DOWNLOAD

9 min read •

Financial services: Banking on change – Transformation or failure?

The impact on an industry in transition

Prior to COVID-19, banking was already under pressure from technology-enabled disruption, greater regulation and an ultra-low-interest-rate environment. The pandemic accelerates these trends, increasing the need for transformative change. How can banks achieve this? This article outlines the three imperatives for banks moving forward – and the consequences if they fail to transform sufficiently rapidly.

Before the advent of COVID-19, the banking industry was already under pressure from three trends – technology, regulation, and the macroeconomic environment:

- Technology: Accelerating technology adoption and availability has been enabling new market entrants with disruptive business models to reshape the competitive map, and has resulted in massive shifts in profit opportunities, forcing legacy banks to embark on a costly metamorphosis.

- Regulation: Regulators have put additional strain on the sector with open-banking initiatives (PSD2), consumer protection initiatives, and strengthened regulatory capital requirements (Basel IV).

- Macroeconomic environment: The ultra-low interest-rate environment leaves no margin for earning the income necessary for transformation while banking fees are challenged by all political and regulatory entities.

COVID-19 amplifies the impact of all three levers. Every segment of the population has become technology savvier, as they had to learn to use digital channels to remain connected to the outside world in new ways. Banks themselves have had to explore new technology-based operating models to allow their workforces to provide services to their customer bases. Governments are imposing relaxed credit-lending practices and loan repayment moratoria, which is increasing the need for tier 1 capital without additional revenues. And, as the economy contracts, defaults on loans across all business lines (individuals, SMEs and corporate) will dramatically increase, and lead to an unsustainable rise in non-performing loans (NPLs).

Even if banks are not the root cause of this crisis, they could be among the worst hit by it, forced to carry the losses from all industries in the medium term. Banks therefore need to be part of the solution to restart the economy once markets are fully reopened. To achieve this, banks need to shore up their capital structure to withstand the impeding NPL onslaught while transforming to become more virtual and flexible. They need to reshape their revenue and cost models to survive eroding margins and implement long-overdue technology transformation. Speed is paramount because time is running out.

The imperative of a strengthened balance sheet

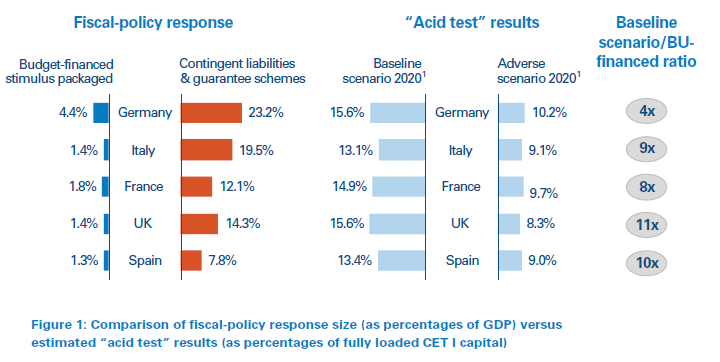

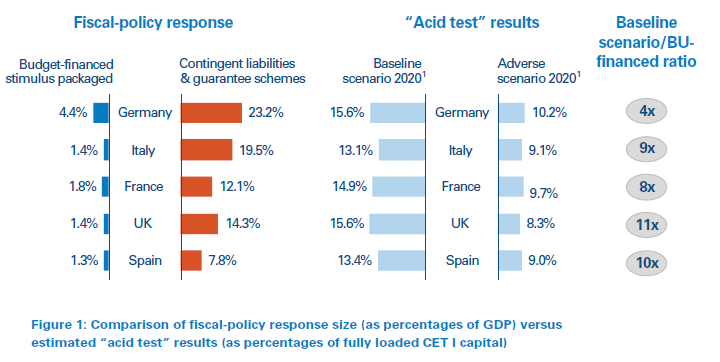

Banks entered the COVID-19 crisis with robust balance sheets. Stress-test scenarios carried out in 2018 expected fully loaded capital ratios to remain well above 8 percent in 2020. (See Figure 1.) However, these estimates did not consider the severe impact of the COVID-19 standstill. The expectation of large losses during Q1 2020 could lead to a significant reduction in banks’ capital ratios, well below even the worst-case scenarios considered.

Although some form of regulatory relief might be possible, the 2008 financial crisis taught regulators (and politicians) a hard lesson. We should therefore expect that banks will be required to strengthen their capital bases to better resist the impact of the crisis. Raising additional capital without excessive shareholder dilution will be a challenge. Many banks, particularly in the west, trade below net tangible book value, and even if they are delivering ROE in excess of 9–10 percent, capital markets are slamming their valuations given their perceived inability to transform quickly. In order to rebase their valuations, banks need to come up with fast and credible transformation roadmaps towards virtual and flexible banking.

COVID-19 accelerates the transformation towards virtual and flexible banking

For several years, digital banking was seen as a solution to the distribution paradigm of delivering client convenience and ease of transactions. Digitalization provided banks with a way of migrating customers to lower-cost channels with the hope of decreasing their costs to acquire and serve them.

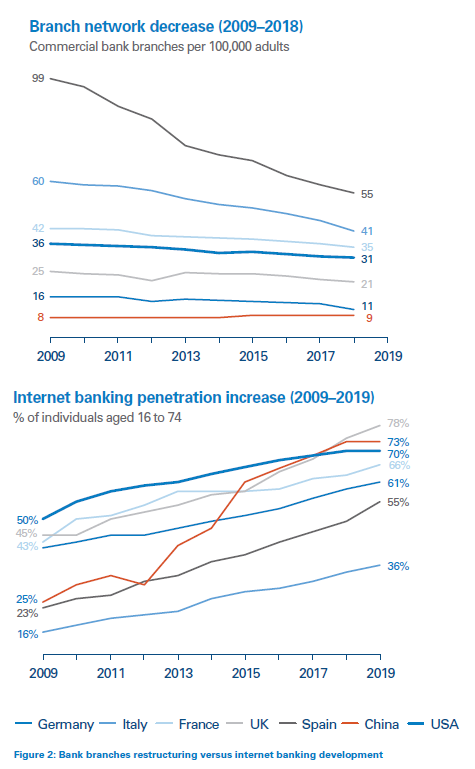

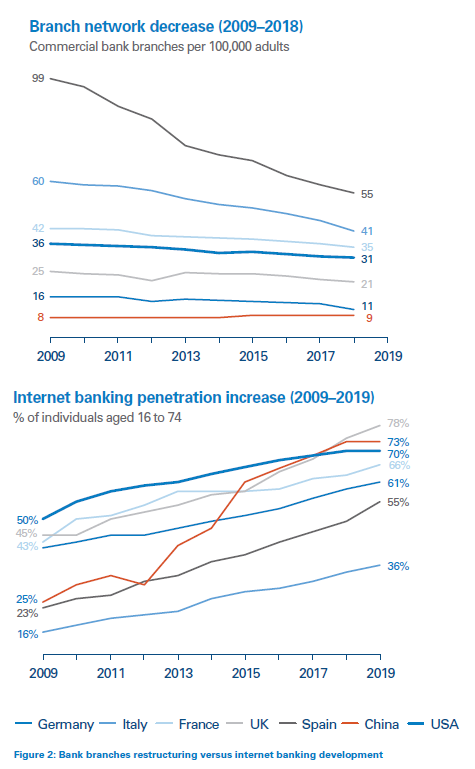

However, banks behaved as though this industry shift would take decades, seeing digital platforms as complementary to their existing branch networks. (See Figure 2) As part of their digital strategies, some banks also converted part of their standard branch networks to new co-working spaces, such as the Santander “Work-Cafés” and Virgin “Money Lounges”, in order to offer broader banking experiences.

The lockdown changed all that. Customer segments that historically would not have considered remote channels their primary form of interaction had no choice but to shift online. Retail banks therefore now have to rush into full digital engagement, as well as review their bank portfolios and service delivery to be more personalized and relevant at all stages of their customers’ life cycles.

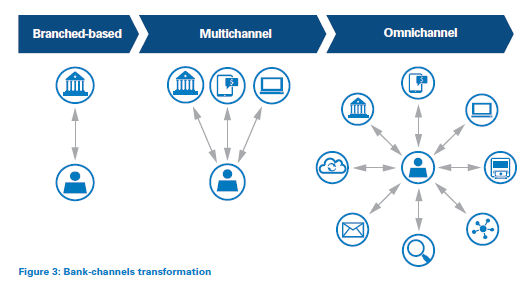

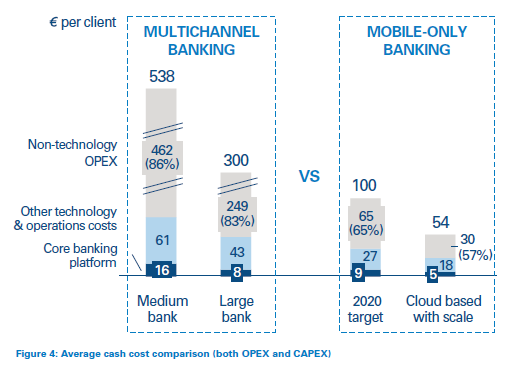

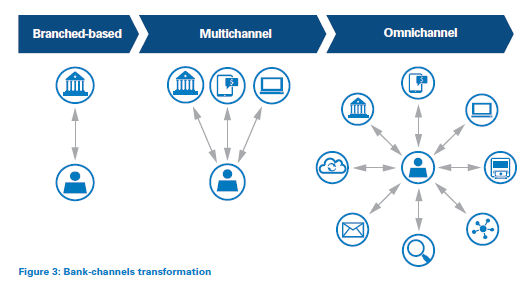

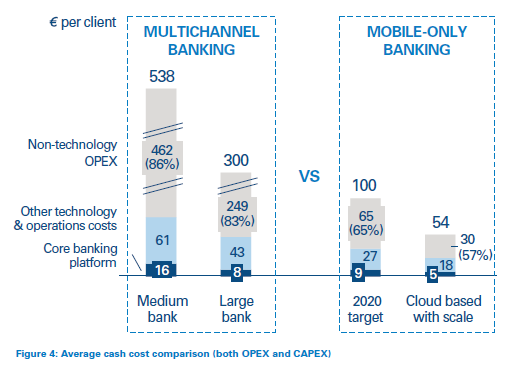

The implication for banks is daunting across all dimensions. There will be an accelerated switch in the omni-distribution channel mix, moving from a branch network supported by digital channels to digital channels supported by a limited branch network (Figure 3). If well implemented, this could pay handsome dividends through significant non-technology cost savings (as shown in Figure 4), accelerated customer onboarding and effective product cross-sell ratios. Unlike traditional rivals, best-in-class neo banks would achieve a cross-sell ratio of almost two products per customer, despite having more limited product ranges.

It’s all about data

When online channels predominate, every step along the customer journey has to be reinvented. Banks will need to improve the way they assess the identities of their customers, engage in a personal manner over digital channels and provide end-to-end digital products. The new customer journey pivots around smart use of data.

i. Identity is the new currency

In a virtual world, digital identity is all that matters. “Know your customer” (KYC) has become a true challenge for all banks as fraud has become more sophisticated and intricate as technology has evolved. Regulators have increased the number of obligations, forcing banks to invest more and more in their KYC systems and expand their infrastructure to store higher amounts of customer data. The solution is not more raw consumer data, but instead, more sophisticated analytics to spot true fraudsters and avoid false positives.

Institutions, particularly medium-size banks, will increasingly have to rely on third-party providers (fintechs) to seamlessly integrate client identity verification into their overall onboarding processes. It will require better data sources and use of AI to accelerate the current cumbersome process and offer speed and convenience to the customer.

ii. Intelligent personalized remote advisory and customercare capabilities are mandatory

Data enables retail banks to tailor services for each customer at the appropriate time. Banks can therefore benefit from data analytics powered by AI to anticipate customer needs before the actual purchase decision. This applies equally to lending and investment decisions.

For example, the Commonwealth Bank of Australia has developed a best-in-class mortgage-sale process using a real-time digital platform solution. Its omnichannel integration enables a faster process throughout, using its mobile app at key milestones in the process while linking property-guide apps to the bank’s mortgage-loan preapproval solution.

Remote robotized advisory is rapidly becoming the norm for the affluent retail segments. A Morgan Stanley study shows that 30 percent of new investments in the US are through such services. These tools allow banks to meet customer-experience expectations, as well as address other lower-wealth segments that would otherwise be unprofitable.

iii. Traditional products do not work on digital channels

Banks need to shift from standard products pushed across all segments to personalized product/service offerings at the appropriate moments in the customer life cycle, focusing on the “moments of truth”. They must start by reducing product complexity, i.e., making their offerings easier to understand and manage through digital channels. Over time, banks need to learn to adapt to more sophisticated product portfolios such as mortgages and investment products. Finally, they should learn to adapt to their clients by offering hyper-personalized products for each customer.

iv. New credit scoring and credit life-cycle management is required

New technologies also allow for improved business decisions based on superior insight. The abnormal situation we are living through now makes credit ratings obsolete, as normally robust businesses and households suddenly have little or no income. AI can evaluate risk more precisely through deeper sectoral analysis for SMEs, or individual financial scanning processes and enhanced pricing models. NPLs can also be better managed along all stages of a bad loan life cycle thanks to data analytics, which allow banks to anticipate short-term client default situations. New entrants such as OakNorth are taking advantage of this opportunity, providing data- and technology-driven solutions that enable smarter decision-making across the loan life cycle.

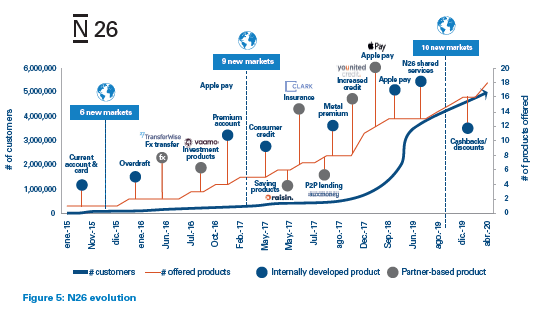

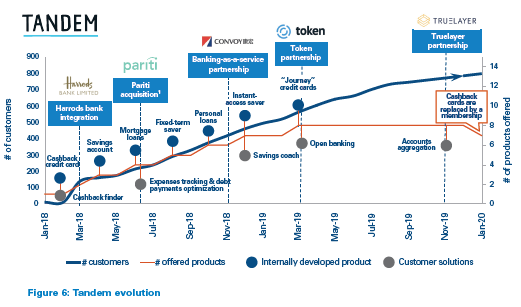

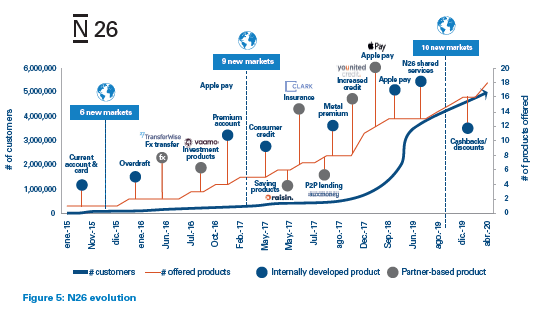

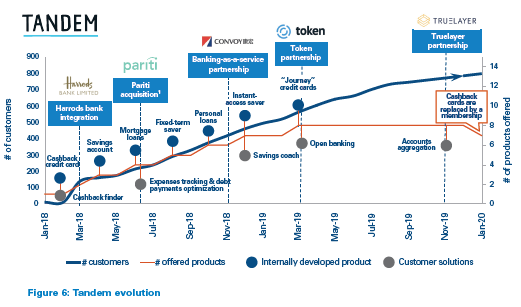

Opting for delaying tactics will not suffice. Adding a simple digital customer interface (balance and payment features) to appear digital – without addressing obsolete cost and revenue models, slow transformation of the branch network and undifferentiated value propositions – is a recipe for failure. In contrast, neobanks such as N26 and Tandem show fast customer growth, increasingly rich product portfolios and accelerated international expansion. (See Figures 5 and 6.)

V. The technology imperative redoubled

Production models need to gain efficiency and flexibility. Transaction costs and the overall cost of serving a customer need to decrease substantially to restore margins. This can only be achieved through next-generation technologies and more skilled workforces.

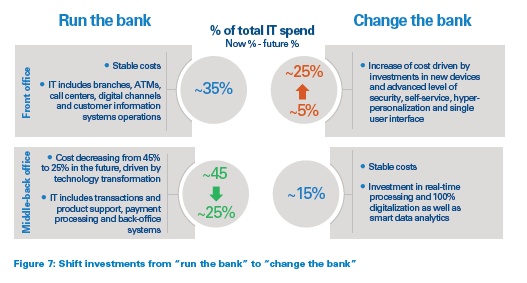

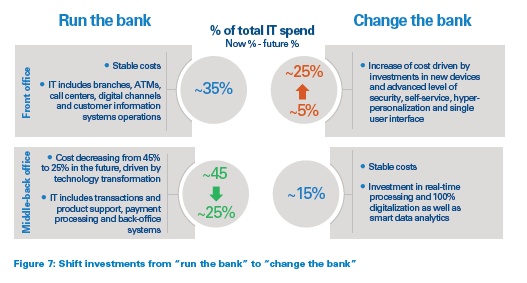

Legacy technology solutions are running out of steam. On average, IT costs in banking have grown at approximately 4 percent CAGR since 2013, wiping out cost reduction efforts in people and real estate. To make matters worse, less than 20 percent of IT spend is devoted to changing the bank. This share tends to be even smaller in times of economic hardship. Banks must exchange run costs for change costs, reducing the run the bank costs in middle-/back-office operations to enable higher investments in technology- and data-driven capabilities. (See Figure 7.)

Next-generation banking architectures are mandatory to compete. A new technological stack will allow banks to lower costs (between 30 and 60 percent) in order to reduce time to deliver functionality changes (up to 10 times less), as well as increase flexibility. Reaching the full potential of new technologies implies revisiting the current back-office format and delivering greater industrialization through end-to-end automation. It also requires bank employees to upgrade their technology competencies to deal with the new tools.

Mutualization of commodity components should allow banks to further reduce costs. This could be the only way out for mid-size and small banks unable to achieve economies of scale. Mutualization also allows them to share the risks of technology innovation and legacy migration, as well as strengthen bargaining power (on costs and lock-in conditions) against technology providers through demand cooperation.

Insight for the executive

In summary, there are three imperatives for banks going forward:

1. Transform or be left behind

If business- and operating-model transformations were key for banks before the crisis, it is now imperative for financial institutions to accelerate the transformation of their business models, operating model costs, delivery capabilities and technology. They must dare to be bold in the choices they make. Marginal or incremental improvements will not be able to save them.

2. Mutualize non-differentiating capabilities

The banking industry has historically been very reluctant to find ways to create scale and economies of scope through mutualization of non-customer-related activities. As a result, value has been transferred to third-party outsourcers that fulfill this role, although banks have so far not fully capitalized on their offshoring. Perhaps the banking industry can learn from its previously successful sectorial initiatives, such as SWIFT in the payment arena, at a time when radical change is required.

3. Engage with the regulator

The financial strain on the banking industry requires a new dialogue with the regulator, with the aim of allowing greater flexibility and enabling banks to better adapt to the new reality. While many regulators have been favoring the rise of fintechs and non-banks, archaic regulations have hampered banks’ ability to compete with new disruptive models. Given their importance to the economy and its recovery, engagement is vital.

Banks will have a critical role to play in the post-COVID-19 economic recovery, but only if they can transform themselves fast enough to meet the economic challenge of cost leadership, capital adequacy and customer engagement. Short of this metamorphosis, as opposed to previous superficial transformation initiatives, banks will not only fail to be the economic lever required for corporate growth and renewed consumer spending, but also simply fail.

9 min read •

Financial services: Banking on change – Transformation or failure?

The impact on an industry in transition

Prior to COVID-19, banking was already under pressure from technology-enabled disruption, greater regulation and an ultra-low-interest-rate environment. The pandemic accelerates these trends, increasing the need for transformative change. How can banks achieve this? This article outlines the three imperatives for banks moving forward – and the consequences if they fail to transform sufficiently rapidly.

Before the advent of COVID-19, the banking industry was already under pressure from three trends – technology, regulation, and the macroeconomic environment:

- Technology: Accelerating technology adoption and availability has been enabling new market entrants with disruptive business models to reshape the competitive map, and has resulted in massive shifts in profit opportunities, forcing legacy banks to embark on a costly metamorphosis.

- Regulation: Regulators have put additional strain on the sector with open-banking initiatives (PSD2), consumer protection initiatives, and strengthened regulatory capital requirements (Basel IV).

- Macroeconomic environment: The ultra-low interest-rate environment leaves no margin for earning the income necessary for transformation while banking fees are challenged by all political and regulatory entities.

COVID-19 amplifies the impact of all three levers. Every segment of the population has become technology savvier, as they had to learn to use digital channels to remain connected to the outside world in new ways. Banks themselves have had to explore new technology-based operating models to allow their workforces to provide services to their customer bases. Governments are imposing relaxed credit-lending practices and loan repayment moratoria, which is increasing the need for tier 1 capital without additional revenues. And, as the economy contracts, defaults on loans across all business lines (individuals, SMEs and corporate) will dramatically increase, and lead to an unsustainable rise in non-performing loans (NPLs).

Even if banks are not the root cause of this crisis, they could be among the worst hit by it, forced to carry the losses from all industries in the medium term. Banks therefore need to be part of the solution to restart the economy once markets are fully reopened. To achieve this, banks need to shore up their capital structure to withstand the impeding NPL onslaught while transforming to become more virtual and flexible. They need to reshape their revenue and cost models to survive eroding margins and implement long-overdue technology transformation. Speed is paramount because time is running out.

The imperative of a strengthened balance sheet

Banks entered the COVID-19 crisis with robust balance sheets. Stress-test scenarios carried out in 2018 expected fully loaded capital ratios to remain well above 8 percent in 2020. (See Figure 1.) However, these estimates did not consider the severe impact of the COVID-19 standstill. The expectation of large losses during Q1 2020 could lead to a significant reduction in banks’ capital ratios, well below even the worst-case scenarios considered.

Although some form of regulatory relief might be possible, the 2008 financial crisis taught regulators (and politicians) a hard lesson. We should therefore expect that banks will be required to strengthen their capital bases to better resist the impact of the crisis. Raising additional capital without excessive shareholder dilution will be a challenge. Many banks, particularly in the west, trade below net tangible book value, and even if they are delivering ROE in excess of 9–10 percent, capital markets are slamming their valuations given their perceived inability to transform quickly. In order to rebase their valuations, banks need to come up with fast and credible transformation roadmaps towards virtual and flexible banking.

COVID-19 accelerates the transformation towards virtual and flexible banking

For several years, digital banking was seen as a solution to the distribution paradigm of delivering client convenience and ease of transactions. Digitalization provided banks with a way of migrating customers to lower-cost channels with the hope of decreasing their costs to acquire and serve them.

However, banks behaved as though this industry shift would take decades, seeing digital platforms as complementary to their existing branch networks. (See Figure 2) As part of their digital strategies, some banks also converted part of their standard branch networks to new co-working spaces, such as the Santander “Work-Cafés” and Virgin “Money Lounges”, in order to offer broader banking experiences.

The lockdown changed all that. Customer segments that historically would not have considered remote channels their primary form of interaction had no choice but to shift online. Retail banks therefore now have to rush into full digital engagement, as well as review their bank portfolios and service delivery to be more personalized and relevant at all stages of their customers’ life cycles.

The implication for banks is daunting across all dimensions. There will be an accelerated switch in the omni-distribution channel mix, moving from a branch network supported by digital channels to digital channels supported by a limited branch network (Figure 3). If well implemented, this could pay handsome dividends through significant non-technology cost savings (as shown in Figure 4), accelerated customer onboarding and effective product cross-sell ratios. Unlike traditional rivals, best-in-class neo banks would achieve a cross-sell ratio of almost two products per customer, despite having more limited product ranges.

It’s all about data

When online channels predominate, every step along the customer journey has to be reinvented. Banks will need to improve the way they assess the identities of their customers, engage in a personal manner over digital channels and provide end-to-end digital products. The new customer journey pivots around smart use of data.

i. Identity is the new currency

In a virtual world, digital identity is all that matters. “Know your customer” (KYC) has become a true challenge for all banks as fraud has become more sophisticated and intricate as technology has evolved. Regulators have increased the number of obligations, forcing banks to invest more and more in their KYC systems and expand their infrastructure to store higher amounts of customer data. The solution is not more raw consumer data, but instead, more sophisticated analytics to spot true fraudsters and avoid false positives.

Institutions, particularly medium-size banks, will increasingly have to rely on third-party providers (fintechs) to seamlessly integrate client identity verification into their overall onboarding processes. It will require better data sources and use of AI to accelerate the current cumbersome process and offer speed and convenience to the customer.

ii. Intelligent personalized remote advisory and customercare capabilities are mandatory

Data enables retail banks to tailor services for each customer at the appropriate time. Banks can therefore benefit from data analytics powered by AI to anticipate customer needs before the actual purchase decision. This applies equally to lending and investment decisions.

For example, the Commonwealth Bank of Australia has developed a best-in-class mortgage-sale process using a real-time digital platform solution. Its omnichannel integration enables a faster process throughout, using its mobile app at key milestones in the process while linking property-guide apps to the bank’s mortgage-loan preapproval solution.

Remote robotized advisory is rapidly becoming the norm for the affluent retail segments. A Morgan Stanley study shows that 30 percent of new investments in the US are through such services. These tools allow banks to meet customer-experience expectations, as well as address other lower-wealth segments that would otherwise be unprofitable.

iii. Traditional products do not work on digital channels

Banks need to shift from standard products pushed across all segments to personalized product/service offerings at the appropriate moments in the customer life cycle, focusing on the “moments of truth”. They must start by reducing product complexity, i.e., making their offerings easier to understand and manage through digital channels. Over time, banks need to learn to adapt to more sophisticated product portfolios such as mortgages and investment products. Finally, they should learn to adapt to their clients by offering hyper-personalized products for each customer.

iv. New credit scoring and credit life-cycle management is required

New technologies also allow for improved business decisions based on superior insight. The abnormal situation we are living through now makes credit ratings obsolete, as normally robust businesses and households suddenly have little or no income. AI can evaluate risk more precisely through deeper sectoral analysis for SMEs, or individual financial scanning processes and enhanced pricing models. NPLs can also be better managed along all stages of a bad loan life cycle thanks to data analytics, which allow banks to anticipate short-term client default situations. New entrants such as OakNorth are taking advantage of this opportunity, providing data- and technology-driven solutions that enable smarter decision-making across the loan life cycle.

Opting for delaying tactics will not suffice. Adding a simple digital customer interface (balance and payment features) to appear digital – without addressing obsolete cost and revenue models, slow transformation of the branch network and undifferentiated value propositions – is a recipe for failure. In contrast, neobanks such as N26 and Tandem show fast customer growth, increasingly rich product portfolios and accelerated international expansion. (See Figures 5 and 6.)

V. The technology imperative redoubled

Production models need to gain efficiency and flexibility. Transaction costs and the overall cost of serving a customer need to decrease substantially to restore margins. This can only be achieved through next-generation technologies and more skilled workforces.

Legacy technology solutions are running out of steam. On average, IT costs in banking have grown at approximately 4 percent CAGR since 2013, wiping out cost reduction efforts in people and real estate. To make matters worse, less than 20 percent of IT spend is devoted to changing the bank. This share tends to be even smaller in times of economic hardship. Banks must exchange run costs for change costs, reducing the run the bank costs in middle-/back-office operations to enable higher investments in technology- and data-driven capabilities. (See Figure 7.)

Next-generation banking architectures are mandatory to compete. A new technological stack will allow banks to lower costs (between 30 and 60 percent) in order to reduce time to deliver functionality changes (up to 10 times less), as well as increase flexibility. Reaching the full potential of new technologies implies revisiting the current back-office format and delivering greater industrialization through end-to-end automation. It also requires bank employees to upgrade their technology competencies to deal with the new tools.

Mutualization of commodity components should allow banks to further reduce costs. This could be the only way out for mid-size and small banks unable to achieve economies of scale. Mutualization also allows them to share the risks of technology innovation and legacy migration, as well as strengthen bargaining power (on costs and lock-in conditions) against technology providers through demand cooperation.

Insight for the executive

In summary, there are three imperatives for banks going forward:

1. Transform or be left behind

If business- and operating-model transformations were key for banks before the crisis, it is now imperative for financial institutions to accelerate the transformation of their business models, operating model costs, delivery capabilities and technology. They must dare to be bold in the choices they make. Marginal or incremental improvements will not be able to save them.

2. Mutualize non-differentiating capabilities

The banking industry has historically been very reluctant to find ways to create scale and economies of scope through mutualization of non-customer-related activities. As a result, value has been transferred to third-party outsourcers that fulfill this role, although banks have so far not fully capitalized on their offshoring. Perhaps the banking industry can learn from its previously successful sectorial initiatives, such as SWIFT in the payment arena, at a time when radical change is required.

3. Engage with the regulator

The financial strain on the banking industry requires a new dialogue with the regulator, with the aim of allowing greater flexibility and enabling banks to better adapt to the new reality. While many regulators have been favoring the rise of fintechs and non-banks, archaic regulations have hampered banks’ ability to compete with new disruptive models. Given their importance to the economy and its recovery, engagement is vital.

Banks will have a critical role to play in the post-COVID-19 economic recovery, but only if they can transform themselves fast enough to meet the economic challenge of cost leadership, capital adequacy and customer engagement. Short of this metamorphosis, as opposed to previous superficial transformation initiatives, banks will not only fail to be the economic lever required for corporate growth and renewed consumer spending, but also simply fail.