DOWNLOAD

DATE

Contact

VIRTUALIZATION ENTAILS CHANGES IN PROCUREMENT

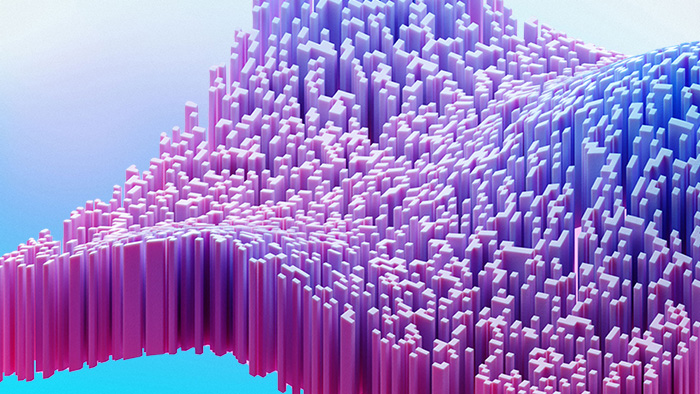

In the 2020 “Virtualizing Mobile Networks” report, Arthur D. Little outlined how technological innovations in both mobile network design and deployment have forced operators to rethink their sourcing and operating models. In order to adapt, operators need to ensure they implement new sourcing strategies that consider the dimensions of higher fragmentation, higher vendor count, increased frequency, and changes to the ecosystem reach (see Figure 1). Such an approach will include the following elements:

- Sourcing lots. Operators source in large lots along key domains (radio access network [RAN], core, transport, and operation/business support system [OSS/BSS]) due to low emphasis from vendors on interoperability. With open interfaces, integration will become simplified and enable operators to pick “best in suite” vendors for different network elements. In this respect, the key financial objective of procurement will shift from “economies of scale” to “supplier competition.”

- Vendor count. The number of vendors will increase significantly. While the current supplier landscape includes one to two vendors per domain, this is expected to increase to as much as one or more per network element. Rakuten Mobile’s virtualized network, for example, lists at least nine distinct network vendors across radio equipment, edge data center hardware, core systems, transport systems, and OSS/BSS, as well as vendors to support system integration and end-to-end orchestration.

- Frequency. Due to software/hardware disaggregation, solution lifecycles will be shortened significantly (down to three to five years), driven by both a faster pace of innovation and easier substitution. It is also expected that exchanging individual network elements, as opposed to large-scale swaps, will become more commonplace.

- Ecosystem. The ecosystem is characterized by new entrants coming with a pure-software play as well as entrenchment from system integrators and hyperscalers, which are starting to compete with conventional network equipment providers (NEPs) that typically dominate the telco vendor space. Operators will need to extend their reach into this new ecosystem and familiarize themselves with the new, viable alternatives.

TELCO PROCUREMENT FACES NEW CHALLENGES

The new sourcing model imposes challenges to procurement, as the incurred changes cannot be easily implemented as modular add-ons to the existing procurement process. Instead, operators need to fundamentally rethink how to conduct sourcing. For example, given the more fragmented nature of sourcing lots, operators need to outline in advance the target architecture and implicit requirements, especially those in relation to ensuring the necessary openness, standardization, and integration/collaboration efforts that may be required. As a result, network architecture and strategy roles will become considerably more important.

Additionally, the increasing vendor count raises the complexity of comparing total cost of ownership (TCO) and performance, requiring more testing/proofs of concepts until industry standardization becomes sufficiently reliable (which can also be driven through operator pushes, with initiatives like the Telecom Infra Project and O-RAN Alliance). From a contractual perspective, agreements will require new mechanisms for vendor management and accountability, along with guarantees on interoperability.

The role of procurement will be to work on an ongoing basis with technical and commercial teams to ensure that the relevant control mechanisms are embedded in sourcing. Additionally, shorter solution lifecycles will require operators to implement mechanisms for the continuous monitoring of market-side demand and available solutions.

On one hand, the new supplier ecosystems require that operators be better informed and more proactive in seeking out specialized providers, with this potentially requiring advanced in-house knowledge of architecture, design, and integration. However, where end-to-end domain vendors were previously the norm, procurement processes need to be designed to enable these new and highly specialized players to compete.

Several major players have launched such initiatives, including NTT DOCOMO in Japan, which has pushed a multi-vendor setup in more than 10,000 base stations (as of December 2021), compliant with O-RAN Alliance guidelines and using two geographically overlapping baseband vendors. In Korea, KT Corporation is collaborating with NTT and Fujitsu in the development and testing of a multi-vendor RAN ecosystem.

European operators Telefonica and Vodafone are also pushing into multi-vendor setups, with initial pilots going live last year. Additionally, in July 2020 several Middle Eastern telcos (e.g., STC, Zain, Mobily, du) signed a memorandum of understanding to support new and innovative entrants in their sourcing of 4G and 5G solutions.

NETWORK’S OPERATING MODEL MUST BE REDESIGNED

Besides rethinking the procurement model, fully leveraging the benefits of network virtualization will also require telco operators to reshape their traditional organizational setups. Here, we outline the key adjustments required to shift toward an operating model that enables and supports virtualized mobile networks.

Converging network and IT

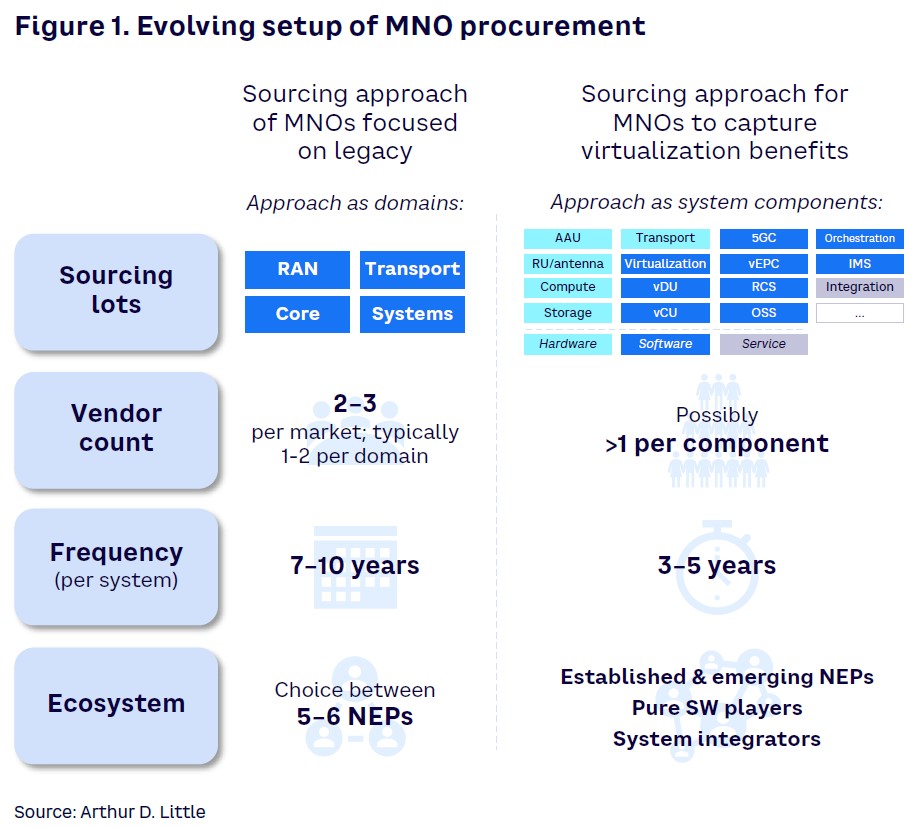

In a traditional setup, telcos have often operated in silos with completely separated network and IT. In this configuration, a network operates in a “waterfall” (plan-build-run) format, with discrete RAN and core operations, while IT operations usually run in a more Agile setup. In contrast, the technological shift toward network virtualization enables the convergent operation of both network and IT (see Figure 2). The combined unit will most likely adopt a DevOps setup rather than following a traditional cascading plan-build-run process.

A virtual network–enabled operating model is driven by holistic strategic planning for both network and IT, with this determining key investment directions and technology roadmaps. In this setup, certain functions such as architecture and design would be allocated to a single unit governing both network and IT roadmaps, with the new and convergent units being the main sites of transformation for both technological areas. Simultaneously, network and IT would move jointly to an Agile DevOps setup, combining build/operation of RAN, core, IT, and any other relevant tools and systems.

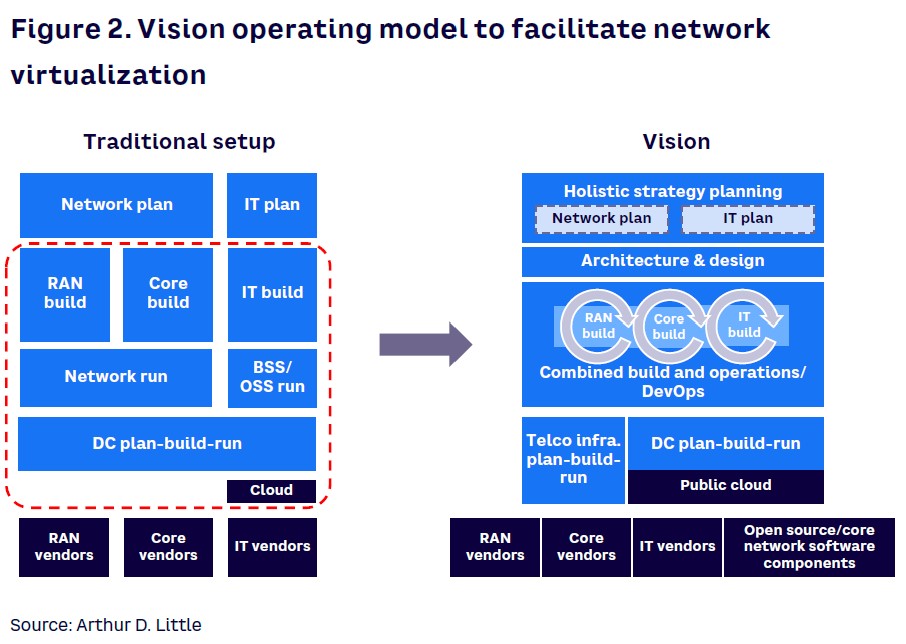

Furthermore, in the new organizational setup shown in Figure 3, infrastructure and cloud are seen as separate domains that can follow different models (e.g., plan-build-run physical network infrastructure, plan-build-run data center infrastructure combined with public cloud), allowing for the traditional operating model to be preserved for the asset types that are significantly unaffected by virtualization.

Combined build and operations/DevOps

In a traditional telco operating model, the key function of a network is equipment configuration and setup. Although OSS/BSS and some network support tools may require different functions, these are often done in either a small, separate “IT for network” team or follow the (physical) infrastructure plan-build-run logic. Overall, the network department typically lacks IT capabilities for vendor integration, software development, and customization.

In the envisioned operating model, all of these functions are shifting to an integrated software solution: a single, 100% cloud-native platform. Together, the respective teams would require new capabilities, focused more on managing and planning virtual, rather than physical, infrastructure and applications.

Cloud-native network functions enable the end-to-end harmonization of OSS/BSS and optimization. A single OSS replaces the traditional disintegrated OSS approach, bringing the benefits of coherent interplay, including increased operational and cost efficiencies. BSS, on the other hand, increasingly assumes the philosophy of automation, ease of integration, and self-service (including customization potential) for business unit users as well as external client users.

Business requirements are embedded on both the strategic planning and DevOps operational levels, with the new vision shifting away from the “business requirement” term, as Agile and DevOps work together in a combined team from the business units and IT. This can result in a “win-win” situation, whereby IT gains by leveraging the experience in achieving stability and resilience from the network, while the network benefits from becoming more agile and flexible.

FUTURE OPERATING MODEL SCENARIOS

One important implication of network virtualization will be the changes in the scope of outsourcing/insourcing. As the new operating model will be implemented to different extents by the various tier players, we expect a variety of outsourcing models and hybrid solutions to emerge.

Tier 1 players are best suited to pursue the virtualized operating model. These operators have the capabilities and scale to potentially shift to mostly insourcing, using solutions developed by their own DevOps teams to compete on differentiation. In this model, only a small share of vendor-sourced components (e.g., 5G) will remain within the outsourcing scope.

In contrast, Tier 2 and Tier 3 players are likely to adopt hybrid models, sourcing a larger share of elements from vendors (e.g., ERP, billing, warehouse systems). However, some solutions will be developed in-house by the DevOps team. Some Tier 2 and Tier 3 telcos will choose combined plan-build operations in cooperation with systems integrators (SIs), where innovation is driven primarily by the SI partner.

Finally, Tier 3 and Tier 4 players will leverage the benefits of network virtualization by implementing off-the-shelf solutions, with technology, including innovation, delivered by vendors in the form of “productized” — or standardized — solutions.

Although the shift to virtualization is already taking place, the speed of adoption among telcos will be different depending on scale and skill. Given that open source solutions are challenging for players with less scale, the key implication for Tier 2 and Tier 3 telcos is an increased requirement for systems integration. The key concern for these players would be the extent of outsourcing to the SI that will be required in order to maximize the benefits of innovation.

Conclusion

MEETING THE CHALLENGE

The new solutions and vendors that operators engage in their technological environment for the purpose of innovation challenge both sourcing and operating models. Sourcing increases the share of software-centric solutions, making the entire process more dynamic and providing new (for the telco space) methodologies for procurement. Consequently, the operating model will have to adapt to the increased complexity of running these solutions at both managerial and operational levels:

- The largest complexity would arise from the need to balance legacy and future-ready technology. Operators such as Rakuten Mobile and Germany’s 1&1 benefit from being greenfield mobile players, with a clean foundation to build on. For established players, the journey will not be as straightforward and will require continuous side-by-side operation of both monolithic legacy telecom assets and new, virtualized network functions. These types of players will need to strategize and prioritize their transformation journey in order to align the introduction of innovation into their networks along with its associated technological maturity and potential for market impact.

- The pace and trajectory at which players transform sourcing and operating models will be diverse. Access of telcos to scale and skills will play a major role in the optimal speed of introducing changes to sourcing and operating models. In this respect, they will need to consider alignment with technology investment cycles, standard release roadmaps, and especially legacy obsolescence and sunset plans. For some operators, the journey’s horizon could be as early as 2024, while for others there will be an overarching roadmap until 2030 based on hybrid operations with a gradual increased presence of the newly envisioned models. In both cases, telcos should now plan how they will navigate the upcoming challenges.

- Adoption of hybrid models of virtualized networks will further change the sourcing landscape. Not all operators will be able to fully adopt virtualized networks due to limitations in scale and skill, thus hybrid models open the opportunity for new players to enter the market in the SI space. This development could have further exciting implications for the sourcing landscape.

Operators will pace themselves in line with the market context, with the maturity of market-facing added value and TCO benefits being the key factors. The customer experience features of mobile network virtualization are increasingly perceived as differentiating for customers. At the same time, vendors can communicate more transparently the TCO of such solutions. By gaining clarity on benefits and costs, we anticipate operators putting more effort into reorganization along new operating and sourcing models.