DOWNLOAD

DATE

Contact

Web3 is the umbrella term for the next generation of the Internet underpinned by decentralization and token-based economics. Alongside the Metaverse, whose operation it partly enables, Web3 will transform the power structure and way of working of the Internet, providing new opportunities across telecom, media, and other sectors as well as threats to companies that fail to adapt. In this first of a series of Viewpoints on this topic, we provide a brief overview of the Web3 landscape and opportunities.

WHAT IS WEB3 & WHY DOES IT MATTER?

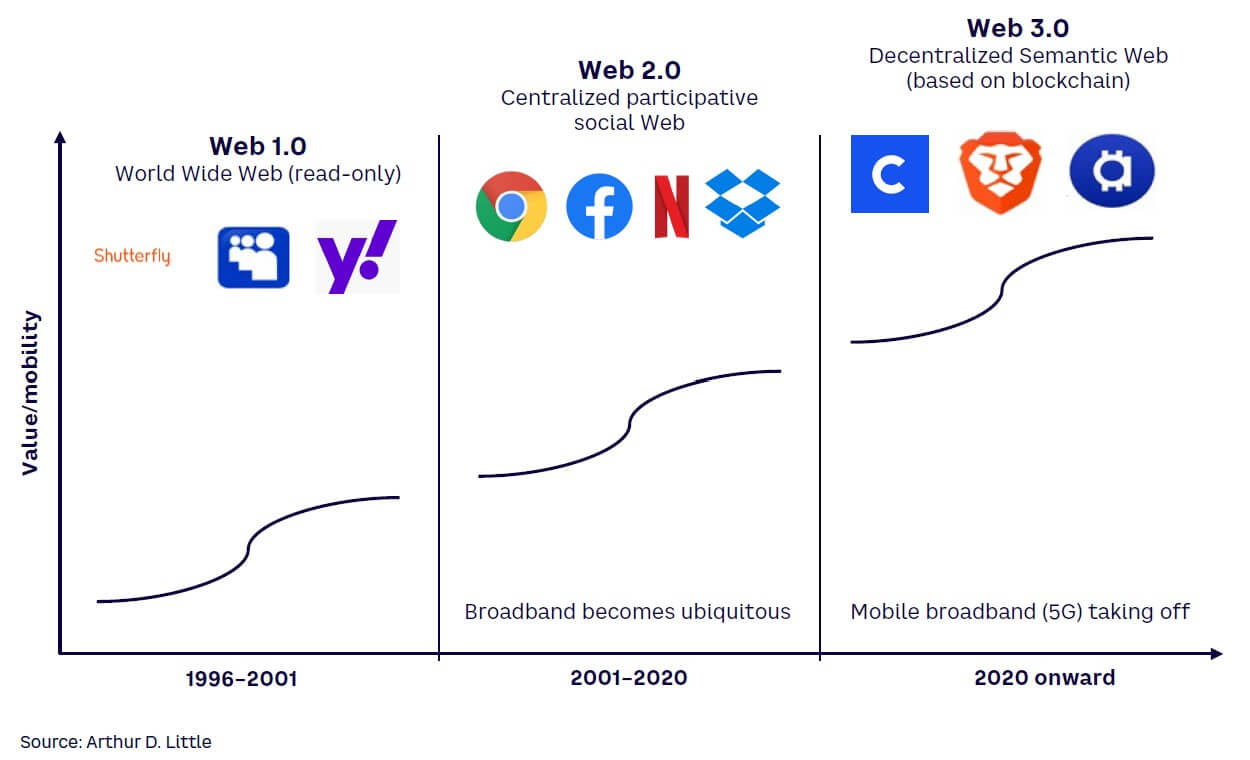

Web3 (aka Web 3.0, Web 3) describes the next major evolution of the Internet, centered on the concepts of decentralization and token-based economics, promising consumers greater privacy, security, and control in their online life. The shift to Web3 offers many interesting opportunities for businesses, especially those in telecom and media. To understand Web3, it is helpful first to look at the evolution of the Web (see Figure 1).

Web 1.0, or the first generation, occurred in the 1990s, when most Internet activity involved navigating static Web pages. When the dot-com bubble burst, the technology landscape dramatically changed. Most Internet-focused firms lost their sky-high valuations. Many firms died out and others lost value for a number of years, but several companies such as Amazon and Google emerged as market leaders in the years that followed.

Web 2.0 saw the rise of interaction and user-generated content, including the advent of social media and large tech player dominance, in which most activity and commerce occurred on a few platforms owned by a small number of mega cap tech players. During Web 2.0, every company effectively became a digital company, with some sort of digital footprint.

The term “Web 3” was first coined in 2014 by Ethereum cofounder Gavin Wood. Web3 promises to force digital evolution further as it pushes for a decentralized Internet, owned and operated by users. Web3 services will run on the blockchain, and no single entity will own users’ information. As such, key topics to consider in relation to Web3 include blockchain, cryptocurrencies, non-fungible tokens (NFTs), smart contract computing, decentralized autonomous organizations (DAOs), and decentralized finance (DeFi).

These technologies didn’t emerge in a vacuum. For example, the emergence of Web 2.0 overlapped with the launch and ubiquitous penetration of broadband. It was the combination of these two seismic events that led to the explosion of streaming content and growth of players like Netflix and YouTube. Similarly, the advent of Web3 is overlapping with the launch and penetration of 5G and mobile broadband. This combination will lead to the next generation of major innovations that will ultimately redefine how we work, live, and socialize. Telecom infrastructure players are integral to any shift, and many are looking for ways to monetize this infrastructure more effectively; in the current state, infrastructure players only get paid for connectivity, not for the services provided on top.

Web3 will irrevocably change the power structure and economics of the Internet. It envisions a massive shift away from centralized platforms toward a new norm of communicating, storing information, and making payments through an uneditable and fail-proof system. Proponents see Web3 technology as ushering in a new era of democratized decentralization, where value is spread across the ecosystem of creators, investors, and owners — instead of most commerce taking place on closed platforms owned by a handful of powerful technology firms. Trust is integral to every real-world transaction, and Web3 in principle increases trust, enabling users to instantly verify the legitimacy of the other party and the validity of any transaction.

However, there are also concerns: for example, currently Internet consumers place trust in a brand or public enterprise that is accountable to regulation and elected authority. With Web3, consumers will be asked to trust the technology itself. As sci-fi movies and apocalyptic literature frequently remind us, people don’t always have positive expectations of new technology. Acceptance and adoption often take time. Moreover, in a fully decentralized structure, it may be more difficult to monitor and regulate illegal activities (although authorities have improved their monitoring capabilities). And some observers worry that Web3 is being overly hyped and could lead to the bursting of a bubble, similar to that of the mortgage-backed security crisis of 2008. The extreme volatility of cryptocurrency only serves to increase these concerns. One important thing to note is that regardless of how some describe Web3 as a complete shift to a new Internet, Web 2.0 and Web3 will coexist for a long period as overlays or complementary networks, just as Web 1.0 and Web 2.0 still coexist today.

BLOCKCHAIN & CRYPTO: THE FOUNDATIONS OF WEB3

The building blocks of Web3 themselves also provide a range of new opportunities for business. The foundation of Web3 is blockchain technology. Cryptocurrency, which relies on blockchain, is also a key part of Web3.

Much has been written about blockchain since its introduction nearly 15 years ago. In summary, a blockchain is a decentralized database distributed across a computer network. It stores information electronically in a linear and chronological fashion, and it cannot be edited. Information is collected in blocks that have certain storage capacities. Once the blocks are filled, they are closed and linked to the previously filled block, forming a chain of data. All new information that follows the last added block is compiled into a new block that will then be added to the chain once filled. This structure creates an irreversible timeline of data. Each block is given an exact stamp when added to the chain. Blockchains can be used to record any number of data points, not just transactions. While blockchain has been around for a long time, investment has accelerated rapidly in recent years — global spend on blockchain solutions rose from less than US $1 billion in 2017 to $6.6 billion in 2021, according to Statista. We can expect to see still more disruptive innovation in the years to come.

Cryptocurrency is a form of decentralized digital currency. It is not reliant on a government or bank; instead, each transaction is verified across a vast network of computers. Cryptocurrencies use blockchain to maintain a secure and decentralized record of transactions, guaranteeing the security of a record of data and generating trust without the need for a trusted third party. While cryptocurrencies have faced headwinds in their adoption due to volatility, distrust, and lack of understanding, the cryptocurrency ecosystem is growing very rapidly. Consumers have increasingly adopted cryptocurrencies, and they will be used more and more as a means of transferring value rather than just as volatile investments. Greater volumes of capital invested in cryptocurrency should lead to less volatility and more stability, particularly when tangible value is being created as opposed to being simply an investment vehicle.

That said, consumer confidence in cryptocurrency is currently very low and an open question remains around how long it will take for adoption to become more widespread. Blockchain has wide application across many sectors, including, for example, goods tracking and verification, food tracking, cybersecurity, trust verification, military logistics, and assurance processes in a wide range of applications such as healthcare, intellectual property, property, and land and government records.

For telecoms, incumbent operators have focused on a few specific areas, including blockchain as a service (BaaS), fraud mitigation, roaming settlement, digital wallets, payments, Metaverse infrastructure services, 5G and Internet of Things (IoT) enablement, data collection, and more.

NFTs: OPPORTUNITY FOR IP OWNERS

NFTs are digital assets that represent real-world objects. Today, NFTs are already used in fields such as art, music, gaming, and videos. They enable private ownership of digital products, conferring tradeable, real-world value to those items. NFTs also use blockchain technology and cannot be broken into component parts. They are always one of a kind, having unique identifiers that indicate ownership of the digital asset encoded within. As well as being considered as an essential Web3 mechanism, they are also a key enabler for the Metaverse, in which digital assets exist within a virtual world.

NFTs are typically bought and sold with cryptocurrency (although sometimes also in US $) in online markets. The most popular of these is OpenSea, which has the main advantage that creators can mint NFTs for free as they do not need to pay transaction fees on the Ethereum network. There is also the option for the original creator to arrange to receive royalty payments for every secondary-market sale of the token in perpetuity. Artists and entertainers find value in NFTs as they can monetize their work, whereas previously, it was difficult to effectively sell any digital work or art. Examples of existing NFTs include:

- National Basketball Association (NBA) Top Shot — an NFT marketplace for users to buy and sell NBA scoring moments.

- Snoop’s Stash Boxes — NFTs with Snoop Dogg music tracks, which sold over $45 million in six days.

- National Football League Super Bowl NFTs — seat-specific NFTs for Super Bowl attendees in 2022.

- Coachella NFTs — NFTs provided to attendees in 2022, some of which unlocked special prizes.

- AC Milan — partnered with Chiliz to list ($ACM) fan tokens on Binance and got $6 million in revenue in a couple of hours.

- FC Barcelona — issued its fan token ($BAR) and got $1.3 million in less than two hours.

However, the NFT space is not without risks. Several marketplaces have cited plagiarism or fraud. Others view the space as a failure so far, as most value is held by a small group of corporations, celebrities, and wealthy individuals, contrary to the goal of a democratized, decentralized ecosystem. Hype is also an issue.

For example, thousands of people have paid thousands of dollars each to buy Bored Ape NFTs — the right to use a jpeg of a Bored Ape. In November 2021, a 500 m2 plot of virtual real estate was sold for a record $2.43 million worth of cryptocurrency. In many ways this is a continuation of the long-standing debate about the value of art and the economics of rarity. These are complex issues. Whatever your view, consumers and businesses need to be aware of the hype and proceed with care.

With a large spike in investment (>$17 billion, according to a report from NonFungible.com) and interest in 2021, the NFT space is expanding further into art, fashion, music, sports, video games, luxury brands, and consumer goods. Traditional media companies are getting less value from Wall Street, while NFT and blockchain companies are receiving large valuations. Studios like Warner Brothers, Disney, and Lionsgate are experimenting with NFTs, releasing NFTs connected to their IP, and moving away from the traditional model in which content is licensed to third-party streaming services. Similarly, video game companies are introducing NFTs to encourage online ecosystems. And media companies are using NFTs to generate interest in projects and to grant exclusive access to digital content. In addition, companies such as Gucci, Marvel, NBA, Coca-Cola, TikTok, Nike, and World Wrestling Entertainment have all entered the NFT space. For its part, Nike has pursued an NFT strategy through its CryptoKicks initiative — someone already paid $130k for one CryptoKicks NFT. Nike also acquired RTFKT, a digital collectible company, to expand on its digital sneaker strategy.

Beyond media, entertainment, and luxury goods, there is much broader potential for use cases in other sectors involving ownership of assets. For example, NFTs have been used to streamline real estate transactions, demonstrate IP ownership, and to verify products and personal identities.

DECENTRALIZED FINANCE, DAOs & SMART CONTRACTS

Web3 also opens up a range of new operational possibilities that could affect almost every business. These include DeFi, DAOs, and smart contracts.

DeFi is a new financial technology based on secure distributed ledgers similar to those used in cryptocurrencies. This decentralization allows for the removal of controls that banks and institutions have on money, financial products, and financial services. Key benefits include the elimination of bank fees, the ability to store money in a wallet rather than a bank, timely transfers, and the lack of any need for approval.

DAOs are Internet collectives that use blockchain technology to distribute ownership and decision-making power among members. People view DAOs as a way to quickly and fairly create groups of people working together for a common goal. They allow for equity stakes to be distributed fairly to investors and workers on a project, skipping the complicated legal barriers and time necessary to spin up new organizations. Increasingly, DAOs are being used for other interesting applications such as sports leagues, allowing fans greater participation in sports while providing teams with additional capital. For example, SailGP, an international sailing league, partnered with NEAR Foundation to create a DAO. NEAR’s platform Astro enables DAOs to coordinate and verify decision making, rules, and governance through smart contracts and voting.

Finally, smart contracts are like real-world contracts, but entirely digital. They are programs stored in a blockchain that run when certain conditions are met. They are immutable and distributed, and thus, impossible to tamper with. Smart contract use cases can include crowdfunding without relying on a third party like Kickstarter, banks issuing loans, or insurance providers processing certain claims.

These operational innovations have potential value almost anywhere across the business world, but are still at an embryonic stage. Embedding them in large established corporations will still require significant change and transformation, with all the costs and risks that this entails.

METAVERSE ENABLER

The Metaverse and Web3 are often mentioned in the same breath. While they are closely connected, they do not mean the same thing. Arthur D. Little (ADL) defines the Metaverse as “the future version of the Internet, blending the frontiers between reality and virtuality, at the convergence of immersive spaces, social and collaborative experiences, and the creator economy” (see ADL’s Blue Shift Report, “The Metaverse, Beyond Fantasy,” which comprehensively covers the structure, technology, and use cases of the Metaverse).

As such, the Metaverse relies heavily on Web3 decentralized digital technologies, such as blockchain and NFTs, to enable transactions to take place in a virtual or augmented reality world. On the other hand, Web3 does not itself depend on a virtual environment or new human-machine interfaces. Web3 users can still interact via today’s two-dimensional screen devices.

What is true is that both the Metaverse and Web3 will be transformative for business, with Web3 likely to impact business ahead of the Metaverse in terms of timescales. Capabilities in Web3 technologies will also be essential for companies not to be left behind if and when the Metaverse starts to grow rapidly. Once the Metaverse is better established, Web 2.0 interactions will seem as dated as phone cords are today.

Many telco operators (e.g., SK Telecom, Telefónica, Vodafone, T-Mobile) have begun investing in the Metaverse at the content and infrastructure level. Many of these opportunities are relatively preliminary, but the potential demand is huge — the infrastructure needs to be an order of magnitude better to achieve the ambitious goals envisaged for the Metaverse.

OPPORTUNITIES FOR TELECOMS & MEDIA

The Web3 (and Metaverse) flywheels have begun to spin. Every industry that deals with some form of data will be impacted by Web3, at least at the operational level. From smart contracts to asset tracking to data storage and encryption, the decentralized nature of Web3 will revolutionize how every company does business — and what consumers expect from them. Some Web3 forces, such as DeFi and DAOs, will transform society’s basic operational and financial underpinnings. No company will be immune.

For telecoms, there is no shortage of investment opportunities, and some companies have not been afraid to pursue more horizontal plays, hoping to capture white space in other verticals/industries. The opportunities include digital wallets, decentralized connectivity, roaming settlements, IP monetization, fraud mitigation, data compilation and analysis, alternative media platforms aimed at reducing take rates, and decentralized 5G. For example:

- Mobile carriers are pursuing new fraud mitigation strategies and roaming transaction settlement techniques.

- Operators like SK Telecom are building digital wallets for crypto management and Web3 access for subscribers, hoping to operate at a horizontal level; SK Telecom is additionally pursuing Metaverse opportunities.

- Operators like Telefónica have invested in many areas, including Metaverse, BaaS, identity, roaming, IoT, NFTs, compute, and storage.

- Broadband cable operators have invested in television data collection and analysis while ensuring user privacy (e.g., Comcast, Charter, Blockgraph).

- Operators such as Verizon and AT&T have launched portfolios of BaaS solutions aimed at enterprise customers.

- Nova Labs’ Helium is aiming to create a fully functional IoT network propagated by end users (Dish will use the Helium 5G network where it makes sense).

- Pollen Mobile is creating a decentralized 5G network.

- Filecoin is building a decentralized data storage alternative to the big players such as Amazon Web Services (AWS), Azure, and Google.

In the media and gaming sectors, incumbents have focused on NFT and Metaverse strategies, while new entrants have focused on disrupting existing content marketplaces or B2C platforms (e.g., ticketing/live music). Web3 is all about transformation, and new entrants have focused on removing intermediaries with the goal of achieving better take rates for content producers and better prices for consumers. For example:

- Studios like Disney, Lionsgate, and Warner Brothers have begun selling NFTs related to their IP, a transition away from the content licensing model that they followed when they licensed content to third-party streaming services.

- Some marketplaces and platforms, including YellowHeart and Audius, are pursuing content engagement opportunities that remove the high take rates of intermediaries, including blockchain-based platforms where creators deliver content directly to fans to earn higher revenues.

- Other browsers and advertising platforms, such as Brave and Permission.io, are introducing opt-in ads that allow consumers to decide whether to participate so they can decide themselves whether and how to monetize their data.

- Mediachain (acquired by Spotify in 2017), among others, are pursuing rights and royalty management opportunities that ensure fair royalty payments via shared databases.

- New entrants like Livepeer are offering decentralized content services aimed at disrupting the centralized streaming giants.

- Gaming players such as Roblox and Epic Games are driving the Metaverse push, focusing on events, branding, advertising, and other monetization opportunities. Through multiple collaborations, they are shifting from gaming toward provisioning of broad-based platforms that allow third parties to cocreate new value chains including entertainment, e-commerce, social interaction, and enterprise services.

Conclusion

THE PATH FORWARD

Web3 is still at an early stage of development, and like most disruptive emerging technologies, big uncertainties and questions remain. Similarly, aspects of the Metaverse have already existed for some time, but there is a long journey ahead before the vision being currently hyped is realized. However, elements are already in place, and the level of development activity and investment is increasing. Many companies, especially those in media, entertainment, and telecoms, have already started identifying and prioritizing opportunities and developing roadmaps. Companies are also actively analyzing the Web3 ecosystem across technologies, use cases, and industries to build potential business models and go-to-market strategies for the most attractive opportunities. And still other companies are leveraging Web3 to cut costs or gain new revenue streams. When Web3 starts to accelerate, it will be transformative, and companies should not be caught unprepared.