Combining technology, scale-up capabilities, and capital to power change

Realizing the strategic importance of batteries, Western governments are aiming to build their own ecosystems, competing (and collaborating) with Asian leaders. So, what will the battery ecosystem of tomorrow look like? To discuss current and future trends, Arthur D. Little (ADL) brought together representatives of established and emerging players. This Viewpoint provides a high-level summary of the discussion.

THE BATTERY ECOSYSTEM AND THE GREEN GAMBIT

Key trends are changing the traditional rules of play as the world shifts to a sustainable, greener future. We are now at the tipping point, where taking risks has become a vital necessity for corporates, startups, and investors. We call this the “Green Gambit,” with transformation being driven by:

- Increased government action, funding, and sustained commitments.

- Greater investor appetite to finance green projects and technologies.

- Wider use of novel financing and partnership methods by corporates to realize their green objectives.

- Rapid evolution of technology and innovation ecosystems, bringing previously disparate players together.

The three fundamental building blocks for change (sustainable capital, winning technology, and scale-up capabilities) are now in place, all facilitated and orchestrated by active, expanding ecosystems.

When it comes to batteries, the market is seeing a seemingly unstoppable increase in the use of Lithium-ion (Li-ion) batteries led by electric vehicles (EVs), and a correspondingly steep drop in price. According to Bloomberg, demand is expected to rise from less than 500 GWh to more than 1,800 GWh by 2030, with the costs of battery packs falling from US $1,100/kWh in 2010 to ~$60/kWh by 2030. This virtuous cycle of demand driving down cost is spreading to other sectors beyond automotive EVs as well, including industrial mobility, energy storage systems, and drones/flying vehicles.

To meet growing needs and deliver on sustainable goals and targets, challenges must be overcome. The clock is ticking — scale-up of battery technology, manufacturing, and ecosystems takes time, meaning that players must act now to guarantee an effective energy transition. To understand the challenges and opportunities, ADL brought together key players from across the battery industry. We would like to thank our panelists for sharing their insights:

- Bob Galyen, founder, Galyen Energy; former CTO, CATL

- Terje Andersen, cofounder and CEO, Morrow Batteries

- Qichao Hu, founder and CEO, SES

- Thomas Jansseune, Senior VP, Umicore

The discussion focused on four key themes:

- The rise of localized ecosystems.

- The need to partner across the value chain to achieve scale.

- Coping with a fragmented technology future.

- Unlocking new sources of funding.

1. THE RISE OF LOCALIZED ECOSYSTEMS

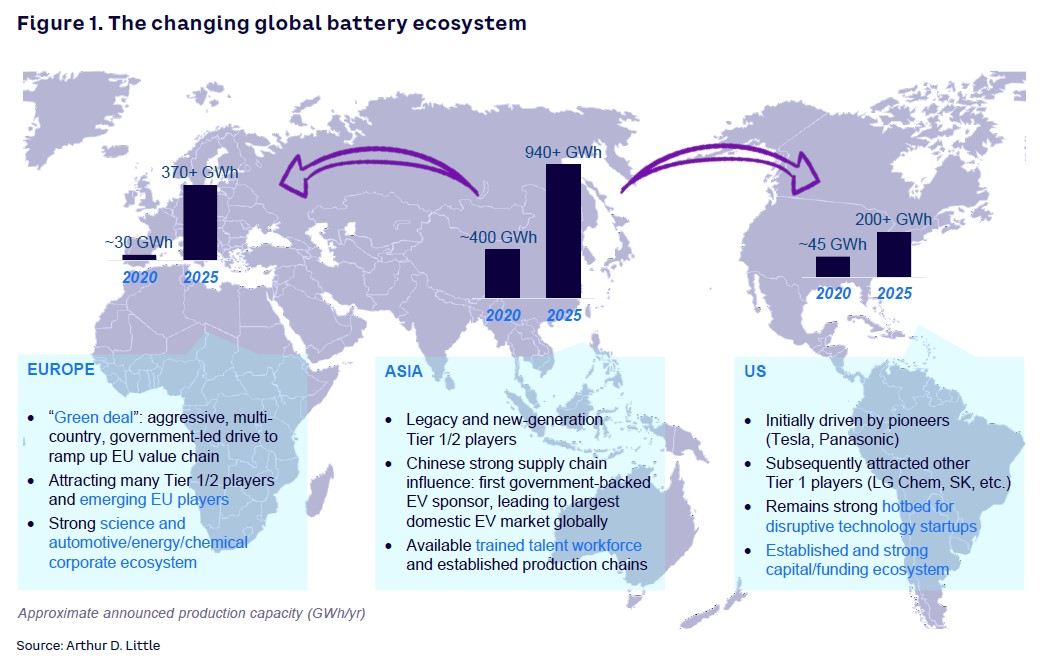

Asia currently dominates battery ecosystems, but Europe and the US are both investing heavily and strategically to catch up, as shown in Figure 1. This has been spurred by increased political concerns about over-reliance on Asian/Chinese suppliers and exacerbated by supply chain disruptions resulting from COVID-19, along with a realization that local battery production creates jobs and is critical to a functioning local industrial base, particularly in the automotive sector.

Europe and the US have different, often complementary, strengths:

- Europe, supported heavily by EU and national government funding, can draw on leading players in the automotive, science, energy/chemicals, and industrial sectors.

- The US is a hotbed for disruptive startups, with a strong ecosystem of venture-based financing and capital players.

Both are aiming to recreate the success of Asian countries, particularly China. China created its battery ecosystem through the following key factors:

- Access to available technology, building on its consumer electronics experience, especially in manufacturing battery-centric devices such as smartphones at scale.

- Available capital via private equity investment.

- The right skills and manufacturing equipment for complex, large-scale battery production; again, built on its consumer electronics manufacturing experience.

- Government support, working in partnership with industry, driven by the need to reduce emissions/improve air quality and backed by long-term plans, investments, and subsidies.

- Access to minerals, building a strong supply chain by guaranteeing key raw materials for battery production.

As Galyen pointed out in the discussion, “You need a complete ecosystem from raw materials to recycling. It takes strategic planning to build a vertical tier with multiple sources as backup.”

Looking at the key factors, Europe and the US are each leaders in specific areas. Players in the US provide technology and capital, while Europe delivers strength in manufacturing and government support. This leaves two major gaps:

- Access to raw materials, although new initiatives around recycling will increase supply of key minerals.

- Developing and retaining trained talent with hands-on experience in batteries, especially as demand becomes extremely high. Unlike China, the EU/US does not have an existing consumer electronics manufacturing base from which to recruit.

2. THE NEED TO PARTNER ACROSS THE VALUE CHAIN TO ACHIEVE SCALE

Partnerships

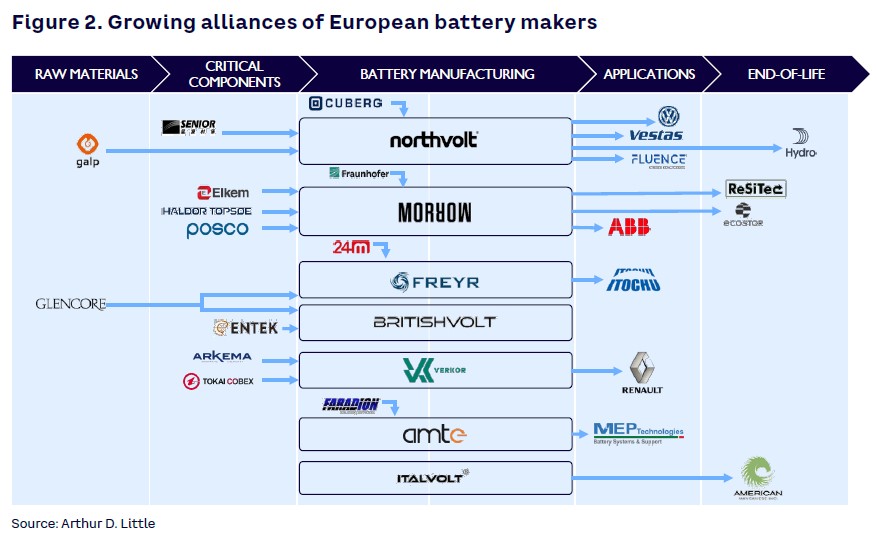

Success requires players to build partnerships across the supply chain — and we are seeing this through the growing alliances between European, US, and Asian companies. A subset of the partnerships of European battery manufacturers is shown in Figure 2.

Andersen explained that “a battery is not just a battery. Supply chain integration is crucial, and sustainability is vital.” In demonstrating this, his company, Morrow, is partnering with multiple players, including POSCO, Haldor Topsoe, and Elkem (on critical battery components) and ReSiTec and ECO STOR (for end-of-life recycling). Emerging EU battery manufacturer FREYR is scaling up technology from US startup 24M.

Additionally, these ecosystems bring together disruptors, battery technologies, energy, and automotive companies, for example:

- US EV player Fisker is partnering with European automotive manufacturer Magna and Taiwanese electronics/battery company Foxconn.

- Swedish battery manufacturer Northvolt, whose biggest shareholder is Volkswagen, has partnered with Portuguese energy company Galp to build Europe’s largest plant for producing lithium hydroxide, a key material for Li-ion batteries.

Scale

Delivering on expected battery demand requires effective scale-up across the battery ecosystem. Hu explained that “having technology is step zero. To get it into a car is a rigorous, long engineering process.” Players within the supply chain will have to be able to create custom solutions for specific uses, based on a wide range of material technologies — all delivered cost-efficiently, quickly, sustainably, and in massive volumes. This requires the whole ecosystem to work together, with many players colocating around the growing number of planned battery gigafactories and EV production facilities recently announced.

Recycling

Ecosystems span the whole battery lifecycle, including covering end-of-life recycling. This emerging part of the ecosystem has already seen multiple partnership agreements, such as those between Italvolt and American Manganese and Northvolt and Hydro. Such partnerships will be on the rise, as manufacturers are required to meet more stringent EU recycling regulations. Current proposals, according to the European Commission, are for 65% of battery weight to be recycled by 2025, with a material recovered rate of 70% for lithium and 95% for nickel, cobalt, and copper by 2030. This should also have a positive effect on the supply of key raw materials. As Jansseune pointed out, “The beauty of metals is that they are infinitely recyclable.”

3. COPING WITH A FRAGMENTED TECHNOLOGY FUTURE

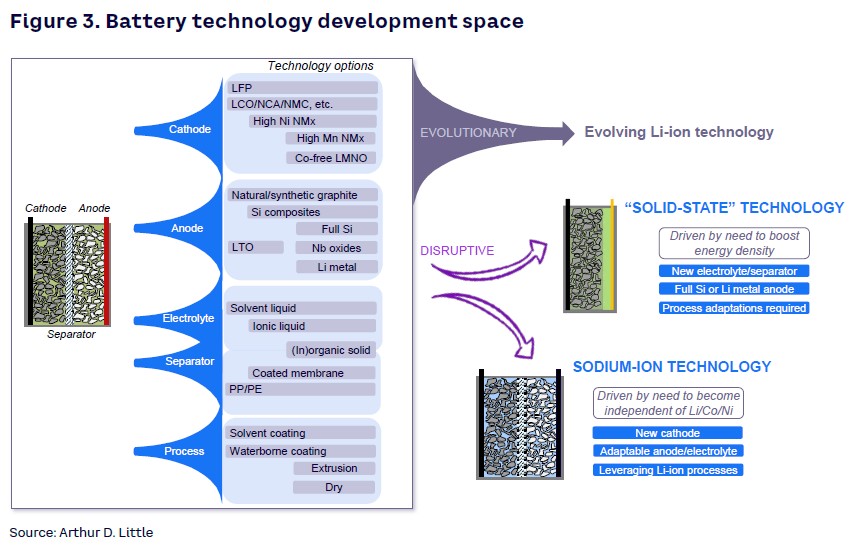

Battery technology is intrinsically complex, with multiple components (cathodes, anodes, coating processes, separators, and electrolytes) that all need to be optimized. New innovations are driving diverging, disruptive technology pathways, both within Li-ion batteries and in new technology areas, such as:

- Solid state, intended to boost energy density.

- Sodium-ion, intended to move away from the use of rarer nickel, cobalt, and lithium while delivering optimal energy density.

There is no consensus on what the future will look like. Galyen noted that “solid state has just been born, so it is very early in the growth curve — other solutions such as liquid and hybrid can currently deliver at lower risk.”

Multiple factors and needs will drive fragmentation and complexity, such as the following

- The availability and cost of raw materials. Ninety percent of Li-ion raw materials currently flow through China, and there are predicted future shortages of nickel, cobalt, and lithium. In contrast, ample reserves of other materials are leading to their planned adoption, such as replacing high-cost nickel or cobalt cathodes with high manganese or lithium iron phosphate (LFP). Technology choices on the chemistry side, therefore, are being made based on both material availability and recycling factors.

- The need to balance innovation and risk. For example, Morrow’s roadmap will see the adoption of high manganese cobalt-free cathodes (LMNO [lithium manganese nickel oxide] in Figure 3, below). According to Andersen, this “aims to de-risk technology development by building a bridge from existing to new technology.”

- Different applications and needs drive different paths. High-performance and heavy-duty vehicles (potentially including flying cars/eVTOL [electric vertical takeoff and landing]) will require high nickel cathodes, while lower-cost automotive segments/energy storage systems can simply use nickel-free technologies.

- The requirement to take a system/solution approach. A working battery cell is a well-balanced system, where each component and process is carefully tuned to deliver performance at acceptable cost levels. Thus, replacing materials in one component impacts other parts of the battery.

4. UNLOCKING NEW SOURCES OF FUNDING

The size and scope of innovative green investment vehicles is expanding rapidly. Issuance of green bonds is at a record high, while development funding from corporates is increasing. For example, Shell recently announced a $1.4 billion fund to invest in businesses accelerating the energy transition.

The largest source of new funding has come from special purpose acquisition companies (SPACs), which provide disruptive young companies with a fast stock market listing. SPAC activity has mostly been focused on energy and technology, with over $100 billion raised in 2020-2021 for these sectors.

The panel agreed that SPACs benefit battery players in two ways:

- They deliver the finance required to scale. Battery technologies require investment in the hundreds of millions; for example, it costs between $50-$200 million per GWh of capacity to set up a gigafactory. These sums can be beyond the reach of normal funding mechanisms.

- They provide collaboration opportunities, gathering allies to build ecosystems:

- Many battery technology startups have partnerships with/investments from automotive players (e.g., Volkswagen and QuantumScape).

- SES’s financial SPAC sponsor Ivanhoe is a major investor in relevant raw materials.

- Umicore is an early investor in Solid Power, which has gone public via SPAC.

However, SPACs are not a foolproof instrument; as discussion participants pointed out, the next few years will be a rollercoaster for investors. Just as with other forms of venture capital, success is not guaranteed, and many investments may not yield long-term results.

CONCLUSION–MEETING THE CHALLENGE THROUGH AN ECOSYSTEM APPROACH

Batteries are at the heart of creating a sustainable future, not just in automotive, but also in sectors such as energy storage and aviation. Innovation may lead in completely new directions. As Hu explained, “Li-ion smartphones drove the rise of the Internet and social media. New batteries will drive new applications that will transform the world.” This could include areas such as battery-powered aircraft enabling urban air mobility.

Expanding capabilities, bringing down costs, and meeting application needs are vital initiatives. As outlined in this Viewpoint, it will take an ecosystem approach to succeed. While the US and Europe can learn lessons from Asia, processes cannot simply be replicated — meaning that areas such as recycling must be a key focus. Summing up the feelings of the panel, Jansseune eloquently concluded: “This is the challenge for a generation. It will take a whole industry working together to ensure sustainable success.”