DOWNLOAD

13 min read • Information management

Breaking the mold – Using the power of convergence to accelerate growth

Despite an impressive record of value creation and its central importance to meeting mankind’s future “mega-needs”, the chemicals industry is undervalued by investors, which holds back its strategic freedom to grow. Focusing on four key trends to power transformation, this article looks at how this challenge can be overcome by embracing convergence, through lessons that can also be applied to other high- capital-investment, asset-heavy industries.

The chemicals industry has been the world’s most successful in terms of shareholder returns over nearly the last 20 years. However, this excellent performance is not recognized by investors, with company valuations lagging behind other, less successful, sectors. This holds back freedom to invest and take a longerterm, more strategic view. Looking forward, the chemicals industry’s ability to help solve the world’s mega-needs continues to position it well for the future, but to truly obtain industry-leading valuations, the chemicals industry needs to capitalize on the convergence of four independent trends – digital technology, technology transfer from one sector to another, new management approaches and new business models. As this article explains, when these trends are brought together in a holistic way, chemicals firms, as well as those in other asset-heavy industries, can attain the valuations and consequent freedom they deserve, as initial innovators already demonstrate.

The chemicals industry has been the world’s most successful in terms of shareholder returns over nearly the last 20 years. However, this excellent performance is not recognized by investors, with company valuations lagging behind other, less successful, sectors. This holds back freedom to invest and take a longerterm, more strategic view. Looking forward, the chemicals industry’s ability to help solve the world’s mega-needs continues to position it well for the future, but to truly obtain industry-leading valuations, the chemicals industry needs to capitalize on the convergence of four independent trends – digital technology, technology transfer from one sector to another, new management approaches and new business models. As this article explains, when these trends are brought together in a holistic way, chemicals firms, as well as those in other asset-heavy industries, can attain the valuations and consequent freedom they deserve, as initial innovators already demonstrate.

The chemicals industry – What’s not to like?

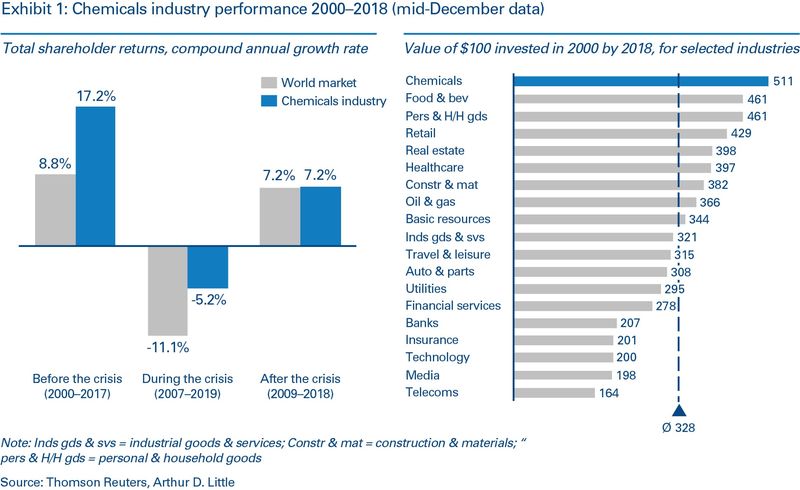

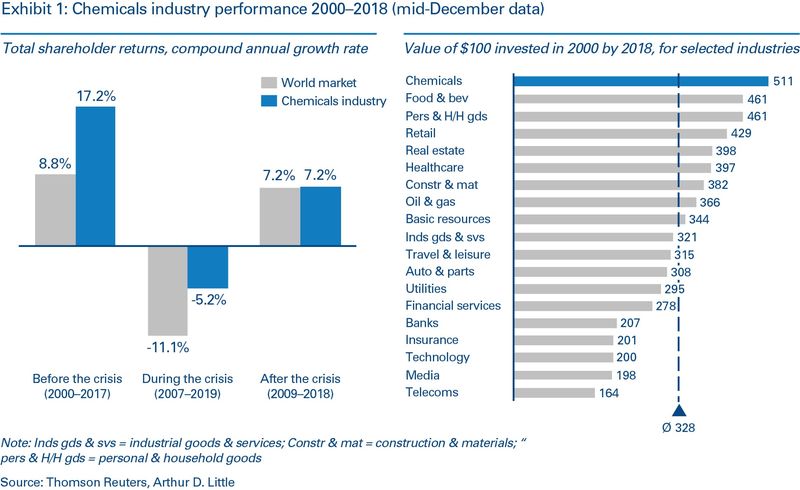

Unbeknownst to many, the chemicals industry has an impressive history of value creation. Even during the financial crisis, the chemicals industry outperformed other industries. (See Figure 1.) And the difference in value creation is substantial: where a $100 investment in telecoms in 2000 would have returned a meager $164 by 2018, the same investment in chemicals would have returned over $500. Clearly, being asset-heavy is no impediment to good returns; this is shown by other industries, such as oil & gas and basic resources, although perhaps to a less stellar extent.

Note: Inds gds & svs = industrial goods & services; Constr & mat = construction & materials; Pers & H/H gds = personal & household goods

Source: Thomson Reuters, Arthur D. Little

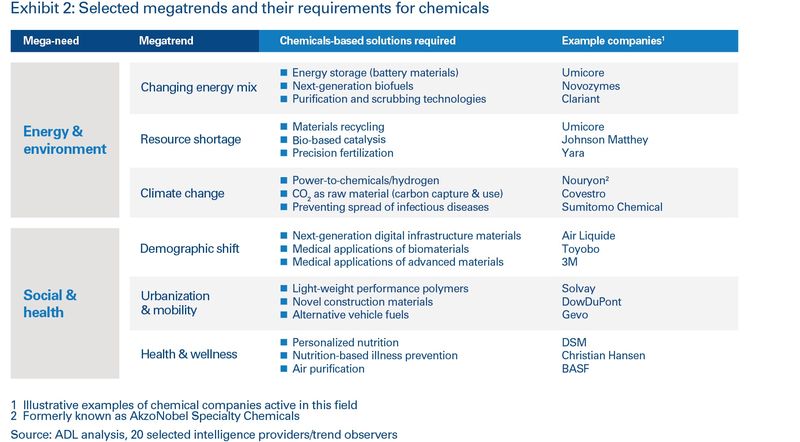

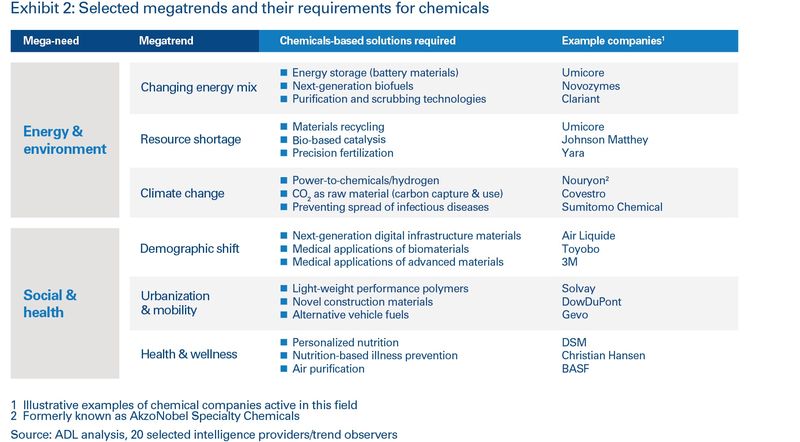

A glance into the future alludes to even more good news for the chemicals industry. Chemicals-based solutions will play a pivotal role in solving the world’s most important challenges, or “mega-needs”. (See Figure 2.)

1. Illustrative examples of chemicals companies active in this field

2. Formerly known as AkzoNobel Speciality Chemicals

Source: Arthur D. Little analysis

This has not escaped the notice of many chemicals companies today, whose websites and investor presentations invariably stress their commitment to these causes and associated growth potential. An industry that consistently creates value and is essential to addressing mankind’s most important “pain and gain points” surely should appeal to everyone.

Investors are not impressed

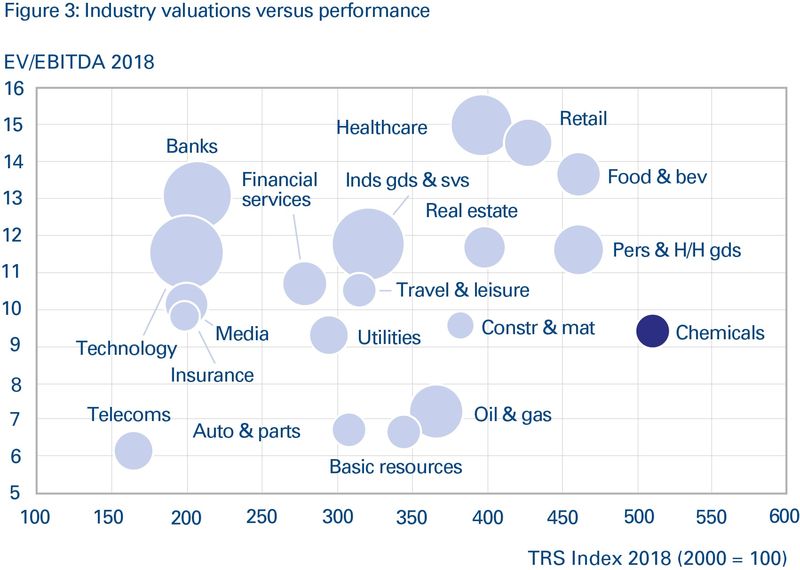

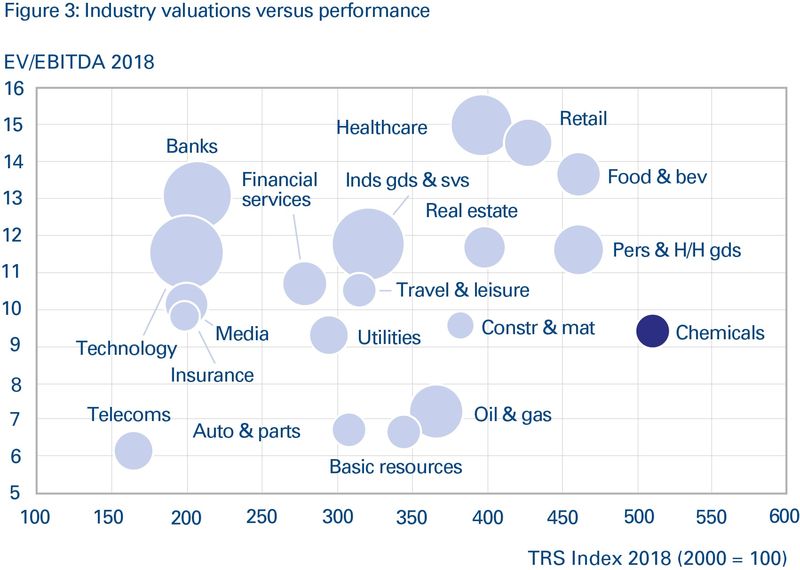

A glance at its valuation suggests that the chemicals industry’s strong performance and potential to solve society’s future challenges do not come across to investors. While the chemicals industry outperforms all others in terms of historical shareholder returns, its perceived future potential (measured in terms of average EV/EBITDA multiple) is underwhelming (Figure 3). Although focused specialty chemicals companies tend to fare slightly better than diversified chemicals commodity businesses, overall, the industry is undervalued. It is important to note that other asset-heavy industries seem to similar fates.

This valuation matters not only financially, but also strategically. For an industry known for long product life cycles, the chemicals sector’s relatively low valuation and “impatient” shareholders decrease the strategic options available to companies looking to grow. Our consulting work offers countless examples of chemicals companies underfunding or even abandoning promising initiatives because they will not “move the needle” in the short term. Furthermore, a casual observer may be forgiven for concluding that there are too many inherent challenges for chemicals firms to change this status quo anyway. Typical chemicals industry issues, such as locked-in assets, long development times, slow adoption of new technology, and low appetite for innovation, may confine the majority of chemicals companies to their current habitat as suppliers of “molecules”. This leaves to others the (profit-generating) creation of ultimate “solutions” to the world’s needs.

Enter convergence

To be clear: there is nothing wrong with the status quo, as Figure 1 clearly shows. While it is difficult to expand beyond “today’s molecules”, it is also hard to get in as an outsider. The complexity of profitably dealing with the technology, safety, and business intricacies of the chemicals industry is very hard to copy.

But remaining as they are seems unattractive to many chemicals firms for a number of reasons. Most chemicals firms aspire to do more than sustain the status quo. And for specialty chemicals firms, the risk of being sucked into “commodity hell”, as one of our clients puts it, is a fate best avoided. Moreover, it would be a missed opportunity if chemicals firms were to stand by and watch as firms from other industries (Amazon, Google and the like) delivered solutions to the world’s most pressing “mega-needs”. There is no law of nature that states today’s technology giants should be the primary beneficiaries of creating tomorrow’s solutions. Instead, given the prevalence of chemicals-based solutions, we believe there is a sizable opportunity for chemicals firms.

Capturing this opportunity would require embracing convergence – the coming together of various independent developments (technological, economic, societal, etc.) to generate a tipping point in, for instance, performance levels, customer acceptance and economic feasibility. We believe the potential for convergence in the chemicals industry is often underestimated, and should receive much more attention than it gets today.

Convergence in the chemicals industry

We believe there are four important trends that enable convergence in the chemicals industry, and indeed, other high-capital-investment, asset-heavy industries.

- Digital technology: Digital technology poses a threat to any company using innovation to command a premium over commodity grades – unless it gets its act together soon enough. For example, what will happen to formulators of coatings, detergents or plastics once Amazon or Google is able to instantly “calculate” the optimal recipe for any customer? The flip side is that even if chemicals companies are unlikely to dominate any particular digital technology, the value of such technologies lies in their application to the “chemicals complexities” that only chemicals firms truly master today. The rewards for such an accomplishment can be enormous; chemicals companies estimate that the success rate of breakthrough innovation projects can be tripled by implementing the right digital solutions, and over 90 percent of companies estimate that digital innovation is transformational (www.adl.com/digitalage). On top of this, digital technology further enables other important trends.

- Technology transfer: We see some very interesting “molecular” technologies coming to fruition in industries adjacent to traditional chemistry. Smart materials are being explored by players such as AkzoNobel, which is looking for enhanced functionalities such as self- cleaning or self-healing surfaces and coatings. Synthetic biology, another example, holds the promise to produce industrial-equivalent products with significantly enhanced benefits in terms of production efficiency, carbon footprint, feedstock flexibility, and replacement of hazardous processes. This was, for example, why Cargill acquired OPX Biotechnologies’ fermentation technology.

- New management approaches: Complementary to technology advances are new approaches to managing innovation, such as start-up collaboration, ecosystem innovation and the use of (external) incubators. We see more and more companies taking a holistic view of all possible “innovation vehicles” (R&D, partnering, corporate venturing, M&A, licensing, etc.) and using whatever best fits their goals. At Arthur D. Little, we have been able to do exciting things for our clients following our Breakthrough Incubator approach – essentially a “build-operate-transfer” model applied to breakthrough innovation opportunities.

- New business models: It is hard to think of true breakthroughs, at least in any recent times, which were not built on new or improved business models. And yet, in the chemicals industry, the concept of business model innovation has long been seen as something more conceptual than of strategic relevance, with the notable exception of a few players, such as Umicore. Umicore is now reaping the returns of years of perfecting its double- revenue business model of spent material recovery in catalysts and battery materials, which allows charging for waste material collection and selling of the recovered products.

Business model innovation is becoming more mainstream, with several interesting approaches being pioneered. One such example is the concept of “molecule leasing”, whereby a chemicals producer retains ownership of its products while they are in use by its customers. This ensures closed-loop economics that will need to become the standard, rather than exception, in a low-carbon world. This model was pioneered in specific niche markets such as the noble metal catalyst industry, but may well become a more widespread practice driven by new or improved technologies, such as chemicals recycling, as was recently announced in initiatives by companies including BASF and SABIC.

Another business model innovation is represented by the “digital twin” concept. This has been exemplified by Dutch technology provider Celsian, which will pilot advanced simulation models later in 2019, using the input of three separate companies and defining the operational settings of a glass furnace that will produce over 3 million bottles a day. Algorithms will continuously recalculate the strategy for the next production hours, outsmarting human operators.

A final example is a first step in the direction of “asset-free” chemicals companies. Honeywell, a process automation company, recently has taken shared operational responsibility for a German manufacturing location that produces chemical and pharmaceutical raw materials. Honeywell will carry out system optimization, parts management, preventative surveillance and other tasks, way beyond just installing process automation software, which will free the plant owner to focus on other activities.

The circular economy for polymers

Circularity thinking typically focuses on the flow of molecules and energy, but tomorrow’s “circular business models” will require more. For example, in addition to intelligent (post- consumer) waste separation and mechanical and chemical recycling technologies, they will certainly need new data exchange and business models, such as certification schemes and blockchain-like technologies, to keep track of carbon content throughout usage cycles. Early examples show how players can work together to optimize the flows of materials, energy, data and finance. For instance, collaborations are beginning between waste management companies (e.g., Suez, HVC), plastic (waste) processors (QCP, Enerkem), chemicals companies (SABIC, Nouryon, Lyondellbasell) and end users (IKEA). Selected investments in this area in north- western Europe alone have amounted to more than $500 million in the last two years.

As in other platform situations, the platform manager will be in the pole position to capture a high share of the value. Chemicals companies, contributing some of the key technologies to the circular economy, will be well placed to take the platform management role.

In isolation, the four trends above might not bring visible results quickly and convincingly enough for shareholders. But when deployed simultaneously in nascent industry intersections and addressing “mega-needs”, they can act as powerful enablers and bring to the chemicals industry what the Internet, cheap computing power and agile software development have brought to so many others.

There are already plenty of examples of companies that have been successful in bringing the above trends together. Chr. Hansen combines megatrend alignment (health & wellness), adjacent technology transfer (enzyme engineering), and a powerful innovation machine (as evidenced by its position in the Forbes Innovation Top 100). Investors are taking note; investment analysts have told us that Chr. Hansen is a good example of a company that has convinced the market it can deliver on its growth projections and capitalize on its technology. It is awarded an EV/EBITDA premium of around 30, comparable to Amazon. Such successes require chemicals companies to bring other industries, companies and capabilities together.

Putting convergence to work

As we have argued, the chemicals industry has a lot going for it. But there are powerful internal and external forces at work that limit chemicals firms’ strategic freedom to meaningfully change the industry’s course. It is tempting to see this as the inevitable fate of any maturing industry, but we believe there are two important reasons to resist this view. First, the chemicals industry’s unique competencies offer a potential gateway to huge future value creation. And second, the power of convergence described above has grown to a point that it may become transformative, even if it does require taking a step back to see the full potential.

Already, most chemicals firms are working at adopting emerging technologies, and many experiment with new business models. Very few companies, however, start with sufficiently holistic reviews of what it would mean to break the mold if the key were to lie in harnessing the power of convergence of several trends, rather than in focusing on just one.

Take artificial intelligence (AI) as an example, which is likely to become an important tool for chemicals firms. Many are building experience, as well as infrastructure, in this new area of research. But AI’s main value could reside in domains that are new to them, such as synthetic biology to find new synthesis routes, or behavioral psychology to promote adoption of new ways of working among developers and users of products (“digital nudging”). Again, for chemicals companies to do this successfully, they need to orchestrate other industries and expertise around their own core capabilities.

“Digital nudging” in innovation

“If HP knew what HP knows, we would be three times as profitable”. This famous quote by a CEO of Hewlett-Packard is as relevant as ever, and accelerated/automated knowledge capture and learning are becoming a real differentiator to companies innovating in a converging world. Today it is not just about what your own company already knows, but your entire ecosystem. Fortunately, digital technology is coming to the rescue. Software company Dassault Systèmes, for instance, offers solutions that support product developers in optimizing new offerings using artificial neural networks which help predict how final product characteristics will be impacted by raw material properties and process conditions. Engineers are encouraged to limit product and process complexity by identifying similar parts used in any other product or system, based on 3D shape, geometrical features and semantic criteria, thanks to machine learning. And, as a final example, advanced modeling and simulation allow for real-time information and coordination, thus enabling optimization of product, process, manufacturing and conditions over the product life cycle.

Business leaders therefore need to understand how all the pieces of the puzzle fit together over time, and be prepared to make decisions surrounded by more ambiguity and uncertainty than they are used to. Notably, in terms of making convergence work in practice, we suggest there are four areas that require the attention of CEOs in the chemicals and other asset-heavy industries (Figure 4):

- Emphasis on broad technology “literacy” across their organizations

- Understanding of the variety of all innovation vehicles available

- A pre-conception that new business models are an integral part of the future

- Widely embedded digital technology

Bringing all this together is no easy task, and chemicals companies cannot afford to spend as lavishly on breakthrough ideas as a company such as Alphabet can on its “moonshot” programs. A chemicals CEO trying to explain how she plans to invest a billion dollars into a breakthrough innovation program, rather than a world-scale production facility, can expect some very nasty questions at her next shareholders’ meeting.

Following the “golden age of chemicals” after the second world war, when one innovation seemed to follow another, access to cheaper feedstock and burgeoning end markets have been the main drivers of chemicals upswings in more recent times.

We believe innovation can once again propel the industry to new heights if it is able to capture the power of convergence: after all, it just takes creativity, the right mind-set, and financial backing to build tomorrow’s winning solutions and business models. The earlier-mentioned Chr. Hansen provides a working illustration with its practice of integrating value- chain data into a digital twin and employing advanced (digital) bioinformatics tools to discover new microorganism strains.

Insight for the executive

In a world where listed company valuation is important for strategic freedom, we have shown that very successful industries such as chemicals are not always rewarded for this success; the impressive track record of the chemicals industry and its importance for solving future “mega-needs” are not expressed in shareholder appreciation.

Fully embracing the convergence of current important technology and business trends will allow chemicals companies to accelerate increases in shareholder appreciation, as is demonstrated already by early adopters of convergence. Embracing convergence will allow chemicals and similar asset-heavy industries to capture more value beyond simply selling specification products.

Our advice to chemicals, and other, industry executives who want to discover the benefits of convergence for their businesses would be to:

- Comprehensively assess options for, and impact of, digital technology in their industries and companies, across business functions.

- Investigate broad possibilities for technology transfer from other industries, either for solving existing problems in new, value-added ways, or for offering new solutions.

- Build deep organizational understanding of available innovation vehicles in their industries and for their companies

- Actively seek out, and rapidly experiment with, new business models.

These four initiatives should be undertaken collectively and not in isolation. CEOs furthermore need to ensure their organizations are streamlined to take on this exciting challenge, and to ready their ways of working and their people for the future. An “ambidextrous” approach to their organizations might be helpful in this respect. (See Prism 2018, issue 1.)

13 min read • Information management

Breaking the mold – Using the power of convergence to accelerate growth

Despite an impressive record of value creation and its central importance to meeting mankind’s future “mega-needs”, the chemicals industry is undervalued by investors, which holds back its strategic freedom to grow. Focusing on four key trends to power transformation, this article looks at how this challenge can be overcome by embracing convergence, through lessons that can also be applied to other high- capital-investment, asset-heavy industries.

The chemicals industry has been the world’s most successful in terms of shareholder returns over nearly the last 20 years. However, this excellent performance is not recognized by investors, with company valuations lagging behind other, less successful, sectors. This holds back freedom to invest and take a longerterm, more strategic view. Looking forward, the chemicals industry’s ability to help solve the world’s mega-needs continues to position it well for the future, but to truly obtain industry-leading valuations, the chemicals industry needs to capitalize on the convergence of four independent trends – digital technology, technology transfer from one sector to another, new management approaches and new business models. As this article explains, when these trends are brought together in a holistic way, chemicals firms, as well as those in other asset-heavy industries, can attain the valuations and consequent freedom they deserve, as initial innovators already demonstrate.

The chemicals industry has been the world’s most successful in terms of shareholder returns over nearly the last 20 years. However, this excellent performance is not recognized by investors, with company valuations lagging behind other, less successful, sectors. This holds back freedom to invest and take a longerterm, more strategic view. Looking forward, the chemicals industry’s ability to help solve the world’s mega-needs continues to position it well for the future, but to truly obtain industry-leading valuations, the chemicals industry needs to capitalize on the convergence of four independent trends – digital technology, technology transfer from one sector to another, new management approaches and new business models. As this article explains, when these trends are brought together in a holistic way, chemicals firms, as well as those in other asset-heavy industries, can attain the valuations and consequent freedom they deserve, as initial innovators already demonstrate.

The chemicals industry – What’s not to like?

Unbeknownst to many, the chemicals industry has an impressive history of value creation. Even during the financial crisis, the chemicals industry outperformed other industries. (See Figure 1.) And the difference in value creation is substantial: where a $100 investment in telecoms in 2000 would have returned a meager $164 by 2018, the same investment in chemicals would have returned over $500. Clearly, being asset-heavy is no impediment to good returns; this is shown by other industries, such as oil & gas and basic resources, although perhaps to a less stellar extent.

Note: Inds gds & svs = industrial goods & services; Constr & mat = construction & materials; Pers & H/H gds = personal & household goods

Source: Thomson Reuters, Arthur D. Little

A glance into the future alludes to even more good news for the chemicals industry. Chemicals-based solutions will play a pivotal role in solving the world’s most important challenges, or “mega-needs”. (See Figure 2.)

1. Illustrative examples of chemicals companies active in this field

2. Formerly known as AkzoNobel Speciality Chemicals

Source: Arthur D. Little analysis

This has not escaped the notice of many chemicals companies today, whose websites and investor presentations invariably stress their commitment to these causes and associated growth potential. An industry that consistently creates value and is essential to addressing mankind’s most important “pain and gain points” surely should appeal to everyone.

Investors are not impressed

A glance at its valuation suggests that the chemicals industry’s strong performance and potential to solve society’s future challenges do not come across to investors. While the chemicals industry outperforms all others in terms of historical shareholder returns, its perceived future potential (measured in terms of average EV/EBITDA multiple) is underwhelming (Figure 3). Although focused specialty chemicals companies tend to fare slightly better than diversified chemicals commodity businesses, overall, the industry is undervalued. It is important to note that other asset-heavy industries seem to similar fates.

This valuation matters not only financially, but also strategically. For an industry known for long product life cycles, the chemicals sector’s relatively low valuation and “impatient” shareholders decrease the strategic options available to companies looking to grow. Our consulting work offers countless examples of chemicals companies underfunding or even abandoning promising initiatives because they will not “move the needle” in the short term. Furthermore, a casual observer may be forgiven for concluding that there are too many inherent challenges for chemicals firms to change this status quo anyway. Typical chemicals industry issues, such as locked-in assets, long development times, slow adoption of new technology, and low appetite for innovation, may confine the majority of chemicals companies to their current habitat as suppliers of “molecules”. This leaves to others the (profit-generating) creation of ultimate “solutions” to the world’s needs.

Enter convergence

To be clear: there is nothing wrong with the status quo, as Figure 1 clearly shows. While it is difficult to expand beyond “today’s molecules”, it is also hard to get in as an outsider. The complexity of profitably dealing with the technology, safety, and business intricacies of the chemicals industry is very hard to copy.

But remaining as they are seems unattractive to many chemicals firms for a number of reasons. Most chemicals firms aspire to do more than sustain the status quo. And for specialty chemicals firms, the risk of being sucked into “commodity hell”, as one of our clients puts it, is a fate best avoided. Moreover, it would be a missed opportunity if chemicals firms were to stand by and watch as firms from other industries (Amazon, Google and the like) delivered solutions to the world’s most pressing “mega-needs”. There is no law of nature that states today’s technology giants should be the primary beneficiaries of creating tomorrow’s solutions. Instead, given the prevalence of chemicals-based solutions, we believe there is a sizable opportunity for chemicals firms.

Capturing this opportunity would require embracing convergence – the coming together of various independent developments (technological, economic, societal, etc.) to generate a tipping point in, for instance, performance levels, customer acceptance and economic feasibility. We believe the potential for convergence in the chemicals industry is often underestimated, and should receive much more attention than it gets today.

Convergence in the chemicals industry

We believe there are four important trends that enable convergence in the chemicals industry, and indeed, other high-capital-investment, asset-heavy industries.

- Digital technology: Digital technology poses a threat to any company using innovation to command a premium over commodity grades – unless it gets its act together soon enough. For example, what will happen to formulators of coatings, detergents or plastics once Amazon or Google is able to instantly “calculate” the optimal recipe for any customer? The flip side is that even if chemicals companies are unlikely to dominate any particular digital technology, the value of such technologies lies in their application to the “chemicals complexities” that only chemicals firms truly master today. The rewards for such an accomplishment can be enormous; chemicals companies estimate that the success rate of breakthrough innovation projects can be tripled by implementing the right digital solutions, and over 90 percent of companies estimate that digital innovation is transformational (www.adl.com/digitalage). On top of this, digital technology further enables other important trends.

- Technology transfer: We see some very interesting “molecular” technologies coming to fruition in industries adjacent to traditional chemistry. Smart materials are being explored by players such as AkzoNobel, which is looking for enhanced functionalities such as self- cleaning or self-healing surfaces and coatings. Synthetic biology, another example, holds the promise to produce industrial-equivalent products with significantly enhanced benefits in terms of production efficiency, carbon footprint, feedstock flexibility, and replacement of hazardous processes. This was, for example, why Cargill acquired OPX Biotechnologies’ fermentation technology.

- New management approaches: Complementary to technology advances are new approaches to managing innovation, such as start-up collaboration, ecosystem innovation and the use of (external) incubators. We see more and more companies taking a holistic view of all possible “innovation vehicles” (R&D, partnering, corporate venturing, M&A, licensing, etc.) and using whatever best fits their goals. At Arthur D. Little, we have been able to do exciting things for our clients following our Breakthrough Incubator approach – essentially a “build-operate-transfer” model applied to breakthrough innovation opportunities.

- New business models: It is hard to think of true breakthroughs, at least in any recent times, which were not built on new or improved business models. And yet, in the chemicals industry, the concept of business model innovation has long been seen as something more conceptual than of strategic relevance, with the notable exception of a few players, such as Umicore. Umicore is now reaping the returns of years of perfecting its double- revenue business model of spent material recovery in catalysts and battery materials, which allows charging for waste material collection and selling of the recovered products.

Business model innovation is becoming more mainstream, with several interesting approaches being pioneered. One such example is the concept of “molecule leasing”, whereby a chemicals producer retains ownership of its products while they are in use by its customers. This ensures closed-loop economics that will need to become the standard, rather than exception, in a low-carbon world. This model was pioneered in specific niche markets such as the noble metal catalyst industry, but may well become a more widespread practice driven by new or improved technologies, such as chemicals recycling, as was recently announced in initiatives by companies including BASF and SABIC.

Another business model innovation is represented by the “digital twin” concept. This has been exemplified by Dutch technology provider Celsian, which will pilot advanced simulation models later in 2019, using the input of three separate companies and defining the operational settings of a glass furnace that will produce over 3 million bottles a day. Algorithms will continuously recalculate the strategy for the next production hours, outsmarting human operators.

A final example is a first step in the direction of “asset-free” chemicals companies. Honeywell, a process automation company, recently has taken shared operational responsibility for a German manufacturing location that produces chemical and pharmaceutical raw materials. Honeywell will carry out system optimization, parts management, preventative surveillance and other tasks, way beyond just installing process automation software, which will free the plant owner to focus on other activities.

The circular economy for polymers

Circularity thinking typically focuses on the flow of molecules and energy, but tomorrow’s “circular business models” will require more. For example, in addition to intelligent (post- consumer) waste separation and mechanical and chemical recycling technologies, they will certainly need new data exchange and business models, such as certification schemes and blockchain-like technologies, to keep track of carbon content throughout usage cycles. Early examples show how players can work together to optimize the flows of materials, energy, data and finance. For instance, collaborations are beginning between waste management companies (e.g., Suez, HVC), plastic (waste) processors (QCP, Enerkem), chemicals companies (SABIC, Nouryon, Lyondellbasell) and end users (IKEA). Selected investments in this area in north- western Europe alone have amounted to more than $500 million in the last two years.

As in other platform situations, the platform manager will be in the pole position to capture a high share of the value. Chemicals companies, contributing some of the key technologies to the circular economy, will be well placed to take the platform management role.

In isolation, the four trends above might not bring visible results quickly and convincingly enough for shareholders. But when deployed simultaneously in nascent industry intersections and addressing “mega-needs”, they can act as powerful enablers and bring to the chemicals industry what the Internet, cheap computing power and agile software development have brought to so many others.

There are already plenty of examples of companies that have been successful in bringing the above trends together. Chr. Hansen combines megatrend alignment (health & wellness), adjacent technology transfer (enzyme engineering), and a powerful innovation machine (as evidenced by its position in the Forbes Innovation Top 100). Investors are taking note; investment analysts have told us that Chr. Hansen is a good example of a company that has convinced the market it can deliver on its growth projections and capitalize on its technology. It is awarded an EV/EBITDA premium of around 30, comparable to Amazon. Such successes require chemicals companies to bring other industries, companies and capabilities together.

Putting convergence to work

As we have argued, the chemicals industry has a lot going for it. But there are powerful internal and external forces at work that limit chemicals firms’ strategic freedom to meaningfully change the industry’s course. It is tempting to see this as the inevitable fate of any maturing industry, but we believe there are two important reasons to resist this view. First, the chemicals industry’s unique competencies offer a potential gateway to huge future value creation. And second, the power of convergence described above has grown to a point that it may become transformative, even if it does require taking a step back to see the full potential.

Already, most chemicals firms are working at adopting emerging technologies, and many experiment with new business models. Very few companies, however, start with sufficiently holistic reviews of what it would mean to break the mold if the key were to lie in harnessing the power of convergence of several trends, rather than in focusing on just one.

Take artificial intelligence (AI) as an example, which is likely to become an important tool for chemicals firms. Many are building experience, as well as infrastructure, in this new area of research. But AI’s main value could reside in domains that are new to them, such as synthetic biology to find new synthesis routes, or behavioral psychology to promote adoption of new ways of working among developers and users of products (“digital nudging”). Again, for chemicals companies to do this successfully, they need to orchestrate other industries and expertise around their own core capabilities.

“Digital nudging” in innovation

“If HP knew what HP knows, we would be three times as profitable”. This famous quote by a CEO of Hewlett-Packard is as relevant as ever, and accelerated/automated knowledge capture and learning are becoming a real differentiator to companies innovating in a converging world. Today it is not just about what your own company already knows, but your entire ecosystem. Fortunately, digital technology is coming to the rescue. Software company Dassault Systèmes, for instance, offers solutions that support product developers in optimizing new offerings using artificial neural networks which help predict how final product characteristics will be impacted by raw material properties and process conditions. Engineers are encouraged to limit product and process complexity by identifying similar parts used in any other product or system, based on 3D shape, geometrical features and semantic criteria, thanks to machine learning. And, as a final example, advanced modeling and simulation allow for real-time information and coordination, thus enabling optimization of product, process, manufacturing and conditions over the product life cycle.

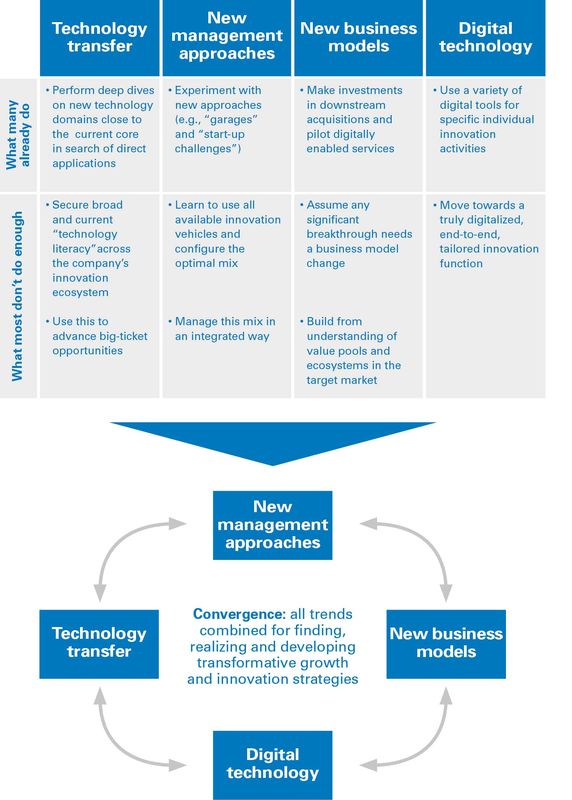

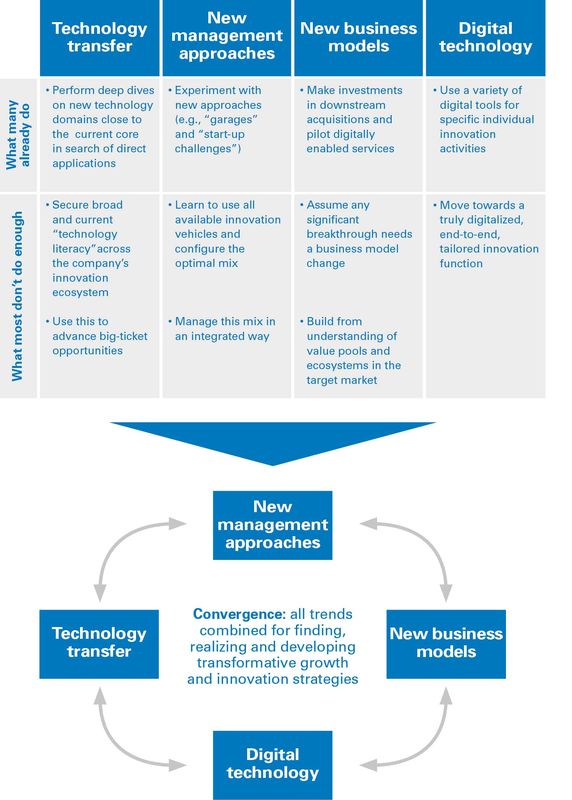

Business leaders therefore need to understand how all the pieces of the puzzle fit together over time, and be prepared to make decisions surrounded by more ambiguity and uncertainty than they are used to. Notably, in terms of making convergence work in practice, we suggest there are four areas that require the attention of CEOs in the chemicals and other asset-heavy industries (Figure 4):

- Emphasis on broad technology “literacy” across their organizations

- Understanding of the variety of all innovation vehicles available

- A pre-conception that new business models are an integral part of the future

- Widely embedded digital technology

Bringing all this together is no easy task, and chemicals companies cannot afford to spend as lavishly on breakthrough ideas as a company such as Alphabet can on its “moonshot” programs. A chemicals CEO trying to explain how she plans to invest a billion dollars into a breakthrough innovation program, rather than a world-scale production facility, can expect some very nasty questions at her next shareholders’ meeting.

Following the “golden age of chemicals” after the second world war, when one innovation seemed to follow another, access to cheaper feedstock and burgeoning end markets have been the main drivers of chemicals upswings in more recent times.

We believe innovation can once again propel the industry to new heights if it is able to capture the power of convergence: after all, it just takes creativity, the right mind-set, and financial backing to build tomorrow’s winning solutions and business models. The earlier-mentioned Chr. Hansen provides a working illustration with its practice of integrating value- chain data into a digital twin and employing advanced (digital) bioinformatics tools to discover new microorganism strains.

Insight for the executive

In a world where listed company valuation is important for strategic freedom, we have shown that very successful industries such as chemicals are not always rewarded for this success; the impressive track record of the chemicals industry and its importance for solving future “mega-needs” are not expressed in shareholder appreciation.

Fully embracing the convergence of current important technology and business trends will allow chemicals companies to accelerate increases in shareholder appreciation, as is demonstrated already by early adopters of convergence. Embracing convergence will allow chemicals and similar asset-heavy industries to capture more value beyond simply selling specification products.

Our advice to chemicals, and other, industry executives who want to discover the benefits of convergence for their businesses would be to:

- Comprehensively assess options for, and impact of, digital technology in their industries and companies, across business functions.

- Investigate broad possibilities for technology transfer from other industries, either for solving existing problems in new, value-added ways, or for offering new solutions.

- Build deep organizational understanding of available innovation vehicles in their industries and for their companies

- Actively seek out, and rapidly experiment with, new business models.

These four initiatives should be undertaken collectively and not in isolation. CEOs furthermore need to ensure their organizations are streamlined to take on this exciting challenge, and to ready their ways of working and their people for the future. An “ambidextrous” approach to their organizations might be helpful in this respect. (See Prism 2018, issue 1.)