22 min read • Automotive, Sustainability

The German market for battery-electric light commercial vehicles

The challenge of electrifying urban transport

Executive Summary

German consumers are increasingly embracing electric passenger cars. Driven by longer battery ranges, an expanding lineup of attractive new models and growing charging-station networks, the market for battery-electric cars finally seems to be taking off.

Electric light commercial vehicles (eLCVs) – the centerpiece of urban transport – appear to be the logical next step in Germany’s endeavors to combat traffic-related emissions. In reality, however, eLCVs have struggled to build significant market demand so far. In 2018, less than 2 percent of all newly registered LCVs in Germany were all-electric vehicles. Diesel engines are still dominating this market.

So what has kept German fleet managers from vigorously electrifying their workhorse fleets of diesel vans and transporters so far? How do emission regulation trends affect growth prospects of this market segment? What do potential customers expect from a convincing eLCV market offering? Which vehicle attributes are most crucial in day-to-day operation? Which should be the focal areas of OEMs’ future product development and marketing activities in order to boost the adoption of eLCVs in Germany?

In an effort to find answers to these questions, Arthur D. Little has analyzed the German market for eLCVs, including a survey of more than 100 fleet managers across multiple industry sectors.

Results of the market analysis show that regulatory trends in Germany are increasingly putting pressure on diesel vehicles and supporting an accelerated transition to eLCVs in the upcoming years. Experts predict approximately 30 percent average annual growth of sales volume over the next four to five years.

Our survey has shown that there is a high level of general interest in electric LCVs. Over 70 percent of surveyed fleet managers plan to acquire eLCVs in the near future, mostly driven by their ambition to reduce fleet emissions. However, only a small share of them has actually acquired an electric LCV at this point. In order to develop strong sales arguments for eLCVs, OEMs need to gather a profound understanding of their customers’ reservations against electric vehicles, their main product requirements as well as their key purchasing criteria.

Fleet managers tend to be very rational buyers who prioritize practical “usability” of a vehicle and objective commercial considerations like TCO when making their purchase decisions. Our analysis shows that current generation eLCVs have a hard time competing with diesel vehicles in these categories due to battery range limitations, charging requirements and a significantly higher price tag.

There is a range of issues OEMs need to address in their product development and marketing strategies if they want to convince customers to switch to eLCVs. In our conclusions to this report, we have consolidated our most important findings and provided some guiding principles to eLCV manufacturers and marketers.

2

The regulatory environment in Germany

Emission regulation is a key driver behind the rise of electric vehicles

One of the main forces driving the electric vehicle market in general has been emission regulations at governmental and city level.

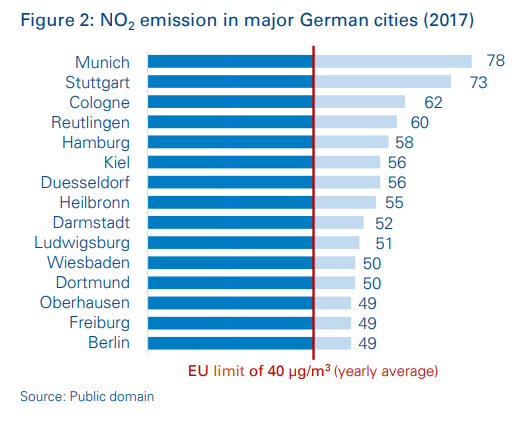

Across Europe, road transport is widely recognized as the single-biggest air polluter. In order to fight air pollution, the EU Council has released its “Directive 96/62/EC on ambient air-quality assessment and management”, which sets emission targets for various hazardous substances in the air. NOx and fine dust (particulate matter – PM) are considered the most relevant emissions generated by vehicles, and currently limited to 40 µg/ m3 p.a. each.

In an effort to comply with EU targets, Germany – like other European countries – has been installing low emission zones (LEZs) in many cities and metropolitan areas since 2008. These zones are limiting access for vehicles with older emission classes. There are currently 58 low emission zones across Germany, with 57 of them “level 3” zones, i.e., prohibiting access for diesel vehicles with Euro 2 & Euro 3 emission class.

Nevertheless, many German cities continue to exceed the NOx limits set by the EU. This has led the German federal court to grant states and cities the right to implement driving bans for diesel cars. In 2018, Hamburg was the first city to install a “diesel ban” in a limited area. Other large cities, such as Munich and Stuttgart, are openly considering bans for the near future.

As emission regulation becomes increasingly strict at governmental and city level, companies operating in urban environments need to reassess their fleet strategies. Upgrading their vehicle fleets to the latest diesel powertrain technology appears to only be a viable solution in the medium term. In order to not risk losing access to their operating environments in the long run, most companies need to think about how long they can maintain their daily business without switching to eLCVs.

Benefits and incentives increase the attractiveness of eLCVs in Germany

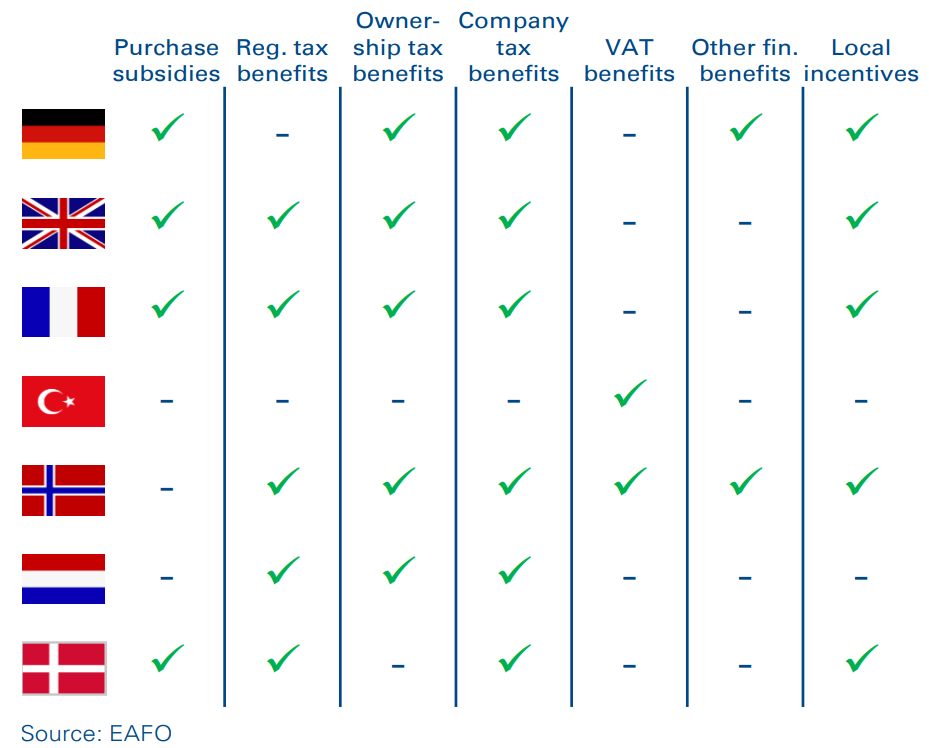

Similar to other European countries, there is a variety of benefits and incentives for EVs in Germany.

Figure 3: EV benefits in major European markets

The most notable financial incentives for EVs at national level are:

- A €4,000 purchase subsidy (covered 50/50 between the German government and the vehicle manufacturer), applicable to eLCVs with net vehicle prices up to €60,000

- Exemption from the motor vehicle tax for 10 years, which thereby significantly reduces operating cost over vehicle lifetime

In addition to nationwide incentives, some major cities, such as Berlin and Munich, have installed local programs to support the adoption of eLCVs.

3

The state of the German eLCV market

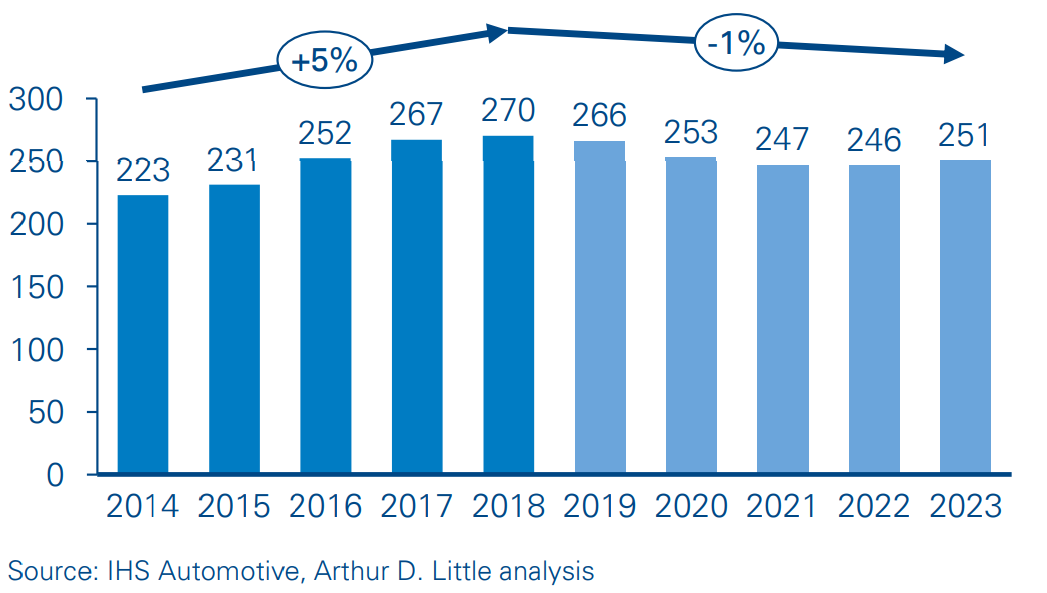

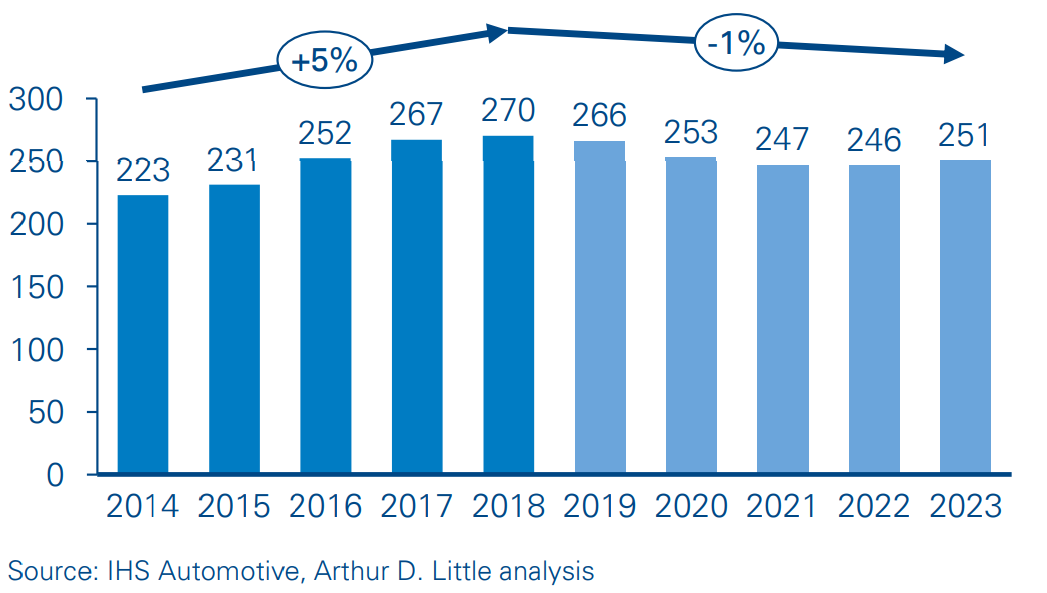

In line with the overall market trend in Europe, the German LCV market is expected to cool down after recent years of solid growth. After it reached its preliminary peak of roughly 270,000 LCVs in 2018, experts predicted the German market to stagnate until 2023.

Figure 4: LCV sales in Germany [k units]

The German eLCV market is small but set for growth

In light of these prospects, eLCVs will have to fight the additional uphill battle of substituting diesel vehicles, because growing in line with the overall market does not appear to be a viable option.

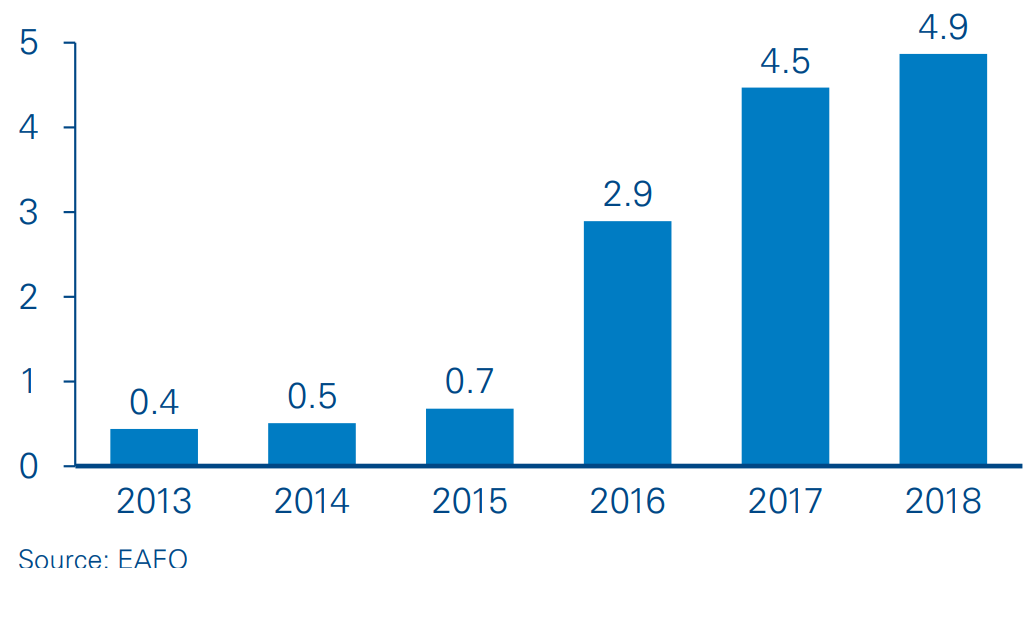

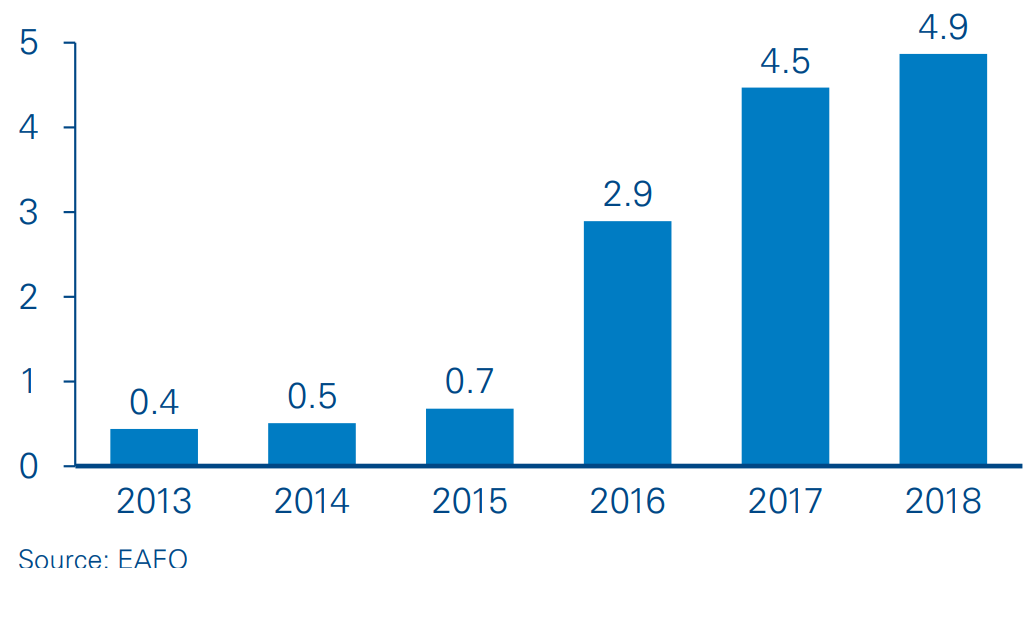

In 2018, some 4,900 eLCVs were newly registered in Germany, up 9 percent from 2017. This accounts for roughly 1.8 percent of the overall LCV market. Looking at the historical trend, these numbers are already quite an achievement.

After the introduction of the first French and Japanese eLCV models in 2013/2014, Germany started seeing 400 to 500 newly registered vehicles per year.

Figure 5: Newly registered eLCVs in GER [k units]

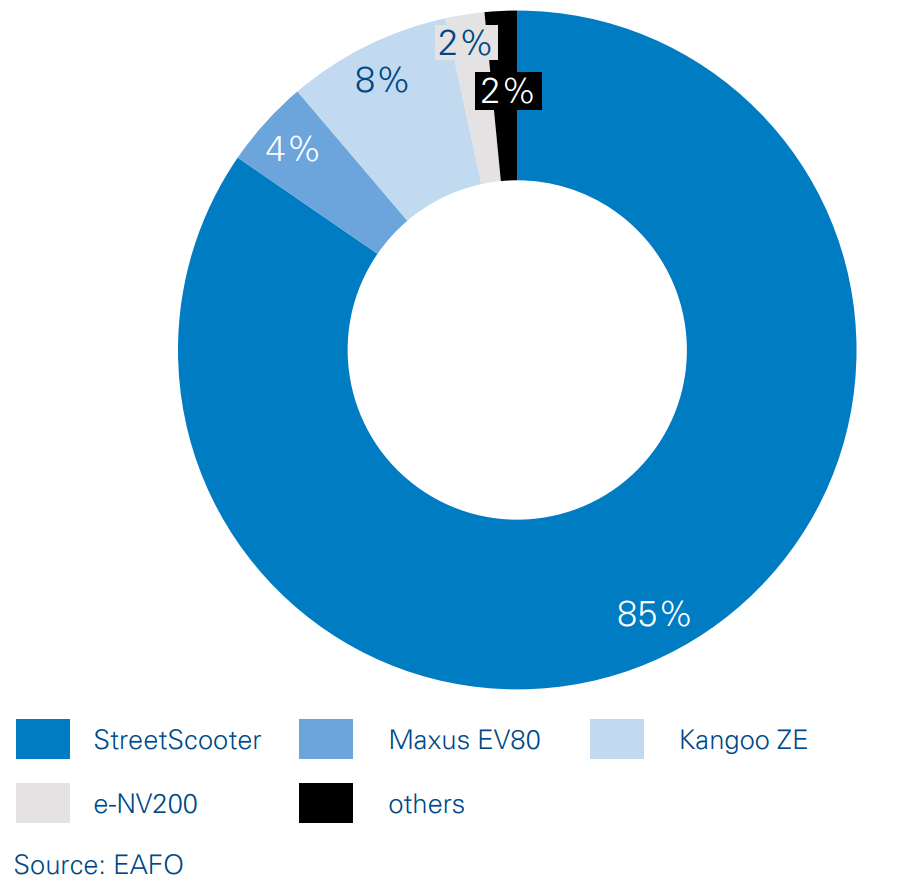

One of the biggest boosts to the German eLCV market came from the introduction of the StreetScooter Work. The StreetScooter is an electric transporter that is developed and produced by Deutsche Post’s wholly owned subsidiary, StreetScooter GmbH. Originally intended for internal use in Deutsche Post’s delivery fleet, StreetScooter launched series production of its Work model in 2016, and has quickly become the market leader in Germany. Due to alleged market demand, StreetScooter has recently started to sell the vehicle to external customers as well, with the first sizable StreetScooter fleets operated by a number of customers in Germany and other European countries.

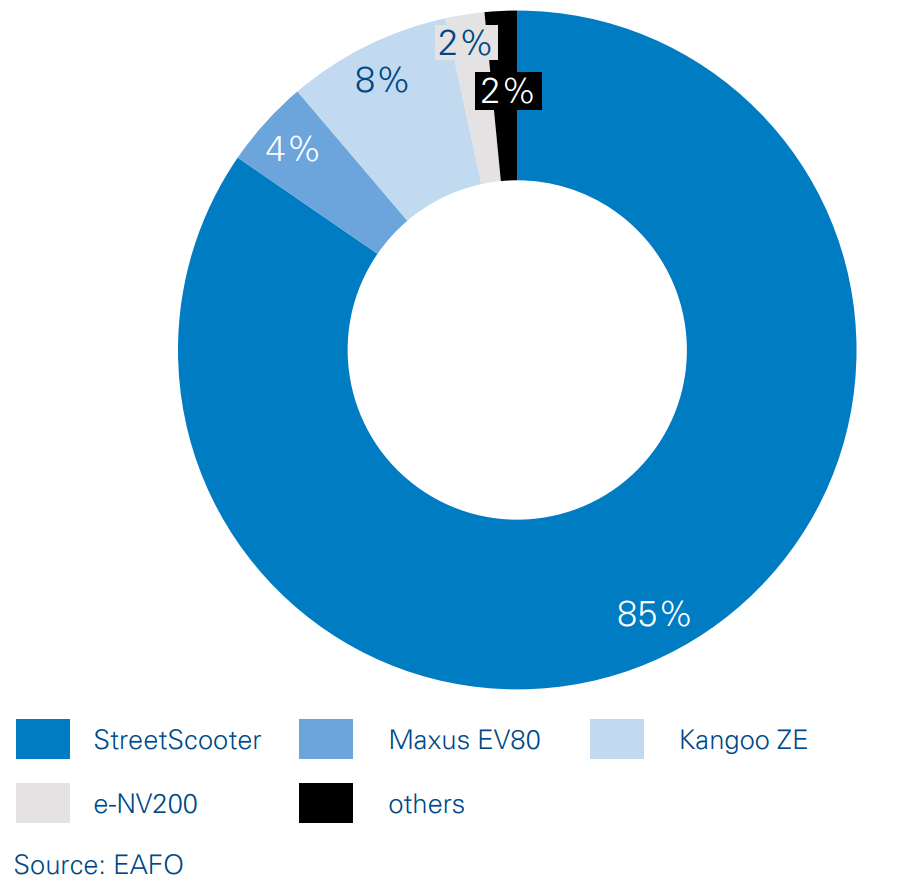

Figure 6: Market share of newly registered German eLCVs (2018)

Other eLCV models, such as Renault’s Kangoo ZE and Nissan’s e-NV200, are struggling to grow their annual sales numbers continuously.

According to many interviews with German fleet managers, one major reason for the lack of momentum in the past was that the big German OEMs had not yet released their electric LCVs. In a market with very strong brand loyalty and considerable brandswitching barriers for customers, this is a huge factor. However, with the recent market launch of Daimler’s eVito and announced introduction of the eSprinter, as well as Volkswagen’s launch of the e-Crafter, some of the highest-selling LCV models in Germany will finally be available as electric vehicles.

As a result, things are about to look much brighter, and experts predict approximately 30 percent annual growth over the next four to five years for Germany

4

The current eLCV lineup in Germany

Figure 7: Overview of eLCVs in Germany, including their base vehicle specs (as of 10/2018)

The eLCV market offering is steadily expanding in Germany

While conducting this study in 2018, many German fleet managers stated a very limited market offering as one of the reasons they had not yet started to electrify their LCV fleets.

With some recent additions by VW, Daimler and Renault, the eLCV lineup in Germany has now grown to 11 vehicle models with varying driving ranges, payloads and load volume specifications.

The small vehicle segment is populated by the StreetScooter Work, as well as electrified versions of the Nissan NV200, the Peugeot Partner, the Citroen Berlingo and the Renault Kangoo. Vehicles in this segment typically provide battery ranges between 170 and 280 km (according to NEDC) and come with payloads between 600 and 700 kg. With load volumes from 3.3 to 4.3 m³, this segment appeals to companies with moderate transport or delivery requirements in urban areas. Despite largely comparable main specs, price points vary significantly: while the Citroen Berlingo is available at roughly €25,000 (including German VAT), customers have to spend almost double that amount, i.e., about €49,000, if they aim to acquire the StreetScooter Work.

The most recent additions to the German eLCV market have been made in the larger vehicle segment, namely, the Mercedes Benz eVito, the VW e-Crafter and the Renault Master Z.E. in 2018. Payloads in this segment range from 700 to 1,100 kg, while load volumes vary between 7 and 11 m³. Similar to the smaller-vehicle segment, larger eLCVs provide driving ranges between 170 and 280 km. Vehicle prices in this segment go up to roughly €83,000 (the VW e-Crafter) for the base model.

Discussions with German fleet managers have revealed that the driving range is often their most crucial factor in considering the electrification of their LCV fleets. Here, it needs to be considered that real-world driving ranges for eLCVs often deviate significantly from driving ranges according to NEDC, due to driving behavior, vehicle load, climate conditions and fleet operation mechanisms.

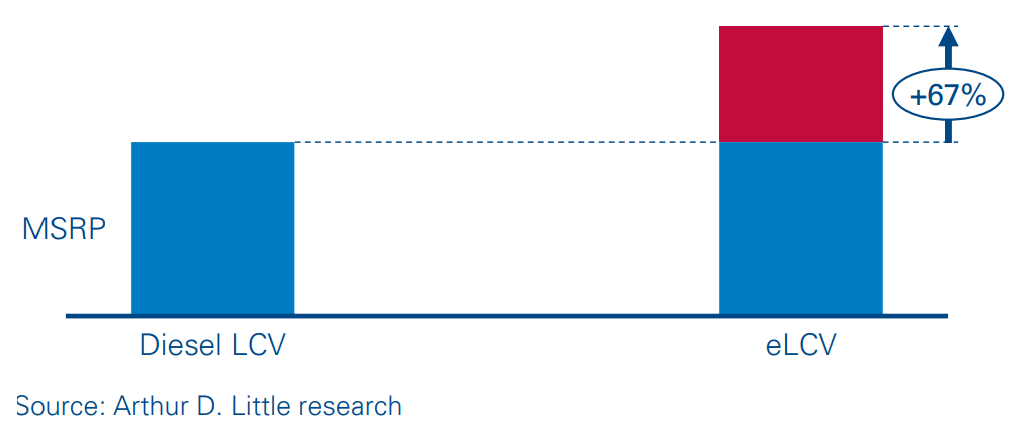

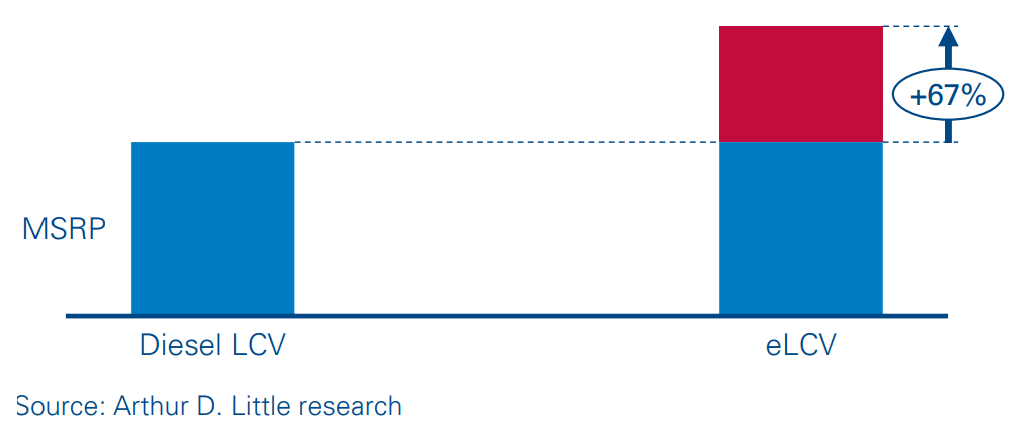

eLCVs come with a significant price premium compared to diesel LCVs

On another note, eLCVs will continue to compete with their diesel equivalents in the foreseeable future. Despite overarching pressure to “go green”, German fleet managers still take a close look at the price tag when making purchase decisions.

Comparing the purchasing prices of eLCVs to similarly equipped diesel vehicles reveals a significant price gap in favor of the diesels. This is best demonstrated by matching an electrified LCV to its diesel brother of the same brand.

Figure 8: Example: MSRP (base vehicle) comparison, eLCV vs. diesel LCV

This gap is not exclusive to this example, but rather, a consistent pattern in the market: fleet managers usually have to be ready to pay a sizable premium when choosing eLCVs over their diesel equivalents. The price-tag difference can mostly be attributed to the cost of the battery pack: with prices for Li-ion batteries currently standing at €150 per kilowatt hour, costs of 40 kWh batteries alone quickly reach €6,000.

To express this in metrics meaningful to fleet managers, customers currently have to pay, on average, €25 per kilogram payload for diesel LCVs, and roughly €45 for the eLCV equivalent.

Some of the initial costs will be outweighed over the course of a vehicle’s life cycle, though. This is primarily due to lower maintenance, repair and energy costs for eLCVs. But the purchase price difference still remains a major factor for fleet managers to only reluctantly substitute their diesel fleets.

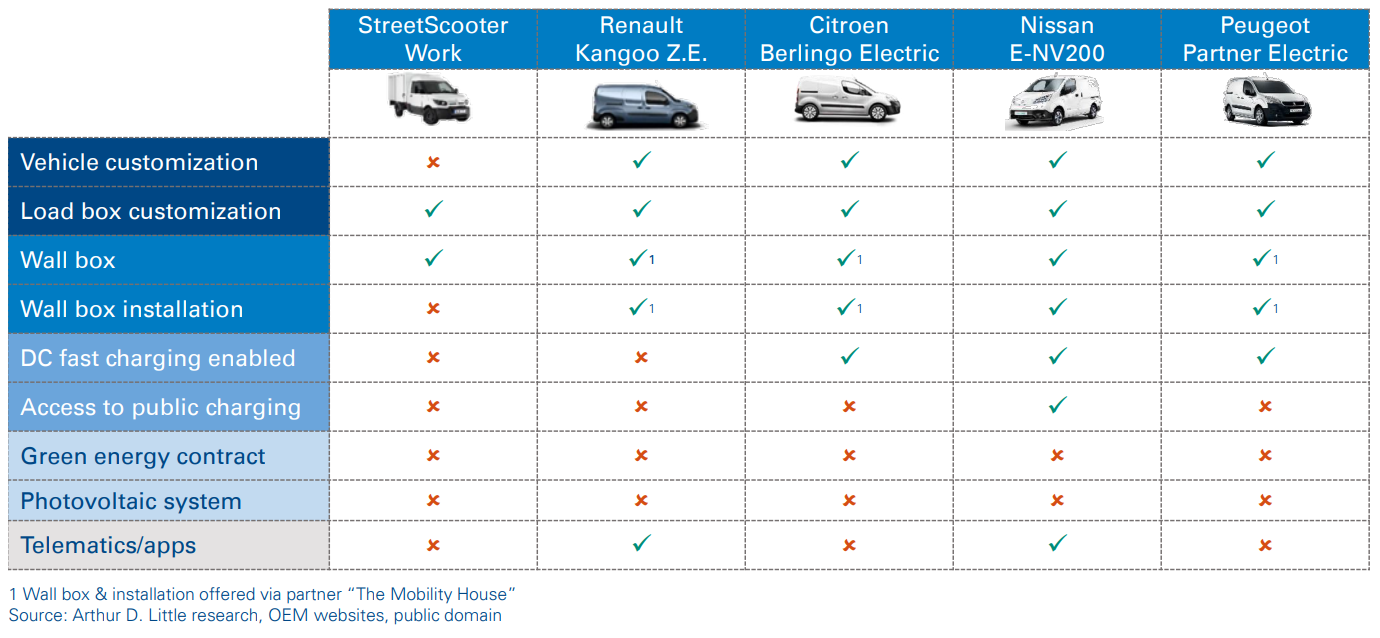

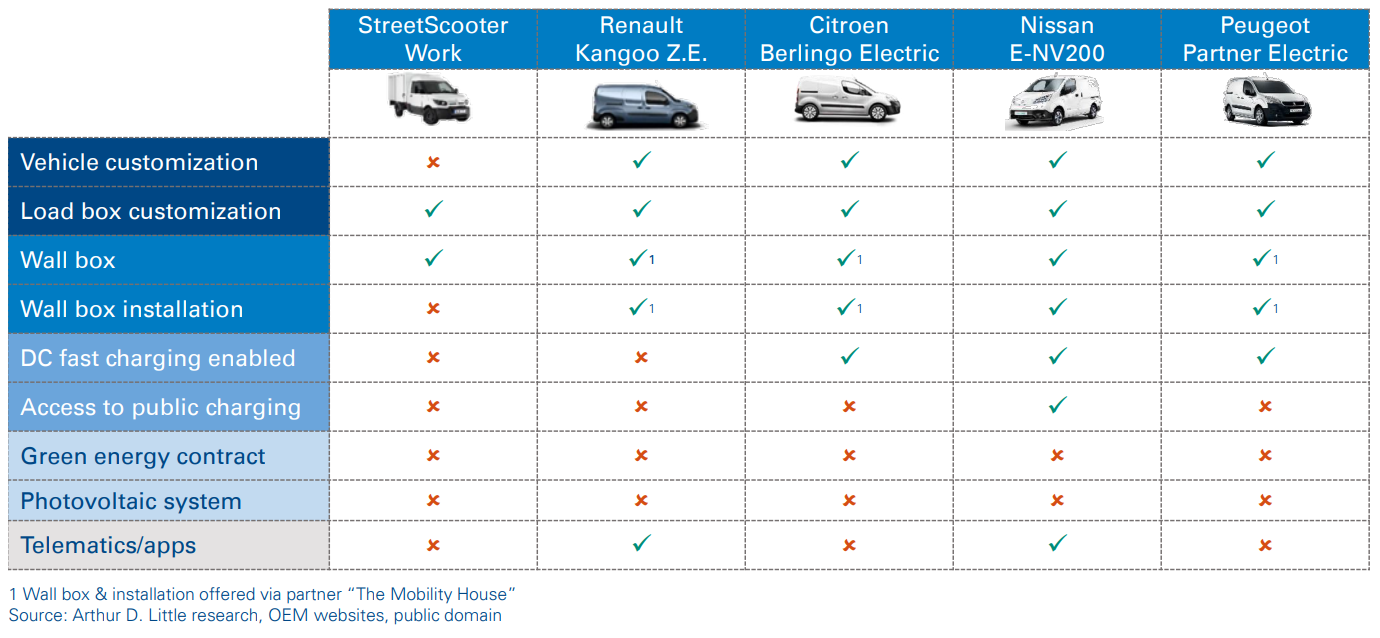

eLCVs are usually marketed together with charging solutions

From analyzing available market offerings in Germany, it quickly becomes apparent that electric LCVs are usually marketed as electric vehicle “system solutions”. Similar to the passengercar market, OEMs typically do not sell customers stand-alone vehicles, but rather, bundles of products and services to facilitate the transition to the new technology.

Among those complementary products, a home or depot charging solution is the most notable component of a standard market offering. All OEMs directly or indirectly (via specialized partners) provide customers with appropriate hardware to recharge the battery at their own premises. Most OEMs also support their customers with charging hardware installation through a network of certified electricians.

Access to public charging networks, unlike with the electric passenger-car market, is not a standard offering in the commercial-vehicle segment. At the time of the analysis, only Nissan was directly marketing public charging products to its eLCV customers. This can probably be attributed to the fact that many current eCLV models are not DC-charging enabled. Hence, on-the-road charging would require too much of the daily operation time of the vehicle.

In the passenger-car market, OEMs are continuously working on enhancing their market offerings by adding “layers” of complimentary “green” products around the vehicle core, e.g., green energy contracts and photovoltaic systems. In the LCV market, however, this is not yet the case. Market offerings tend to stick to the basics: vehicle and charging station.

Figure 9: Components of eLCV market offerings (selected models)

5

Requirements of German fleet managers

In order to develop better insight into potential eLCV customers’ purchase criteria and product requirements, Arthur D. Little conducted a customer study with German fleet managers in 2018. The main purpose of this study was to analyze general fleet managers’ attitudes and concerns regarding eLCVs, as well as to understand what they expected from electric LCVs. The results of the study provide OEMs with guidance for their future product development activities and marketing efforts.

The study was conducted in a two-step approach: the first step was an online survey among more than 100 German fleet managers, followed by a second step in which the results of the survey were further qualified through personal interviews and focus groups.

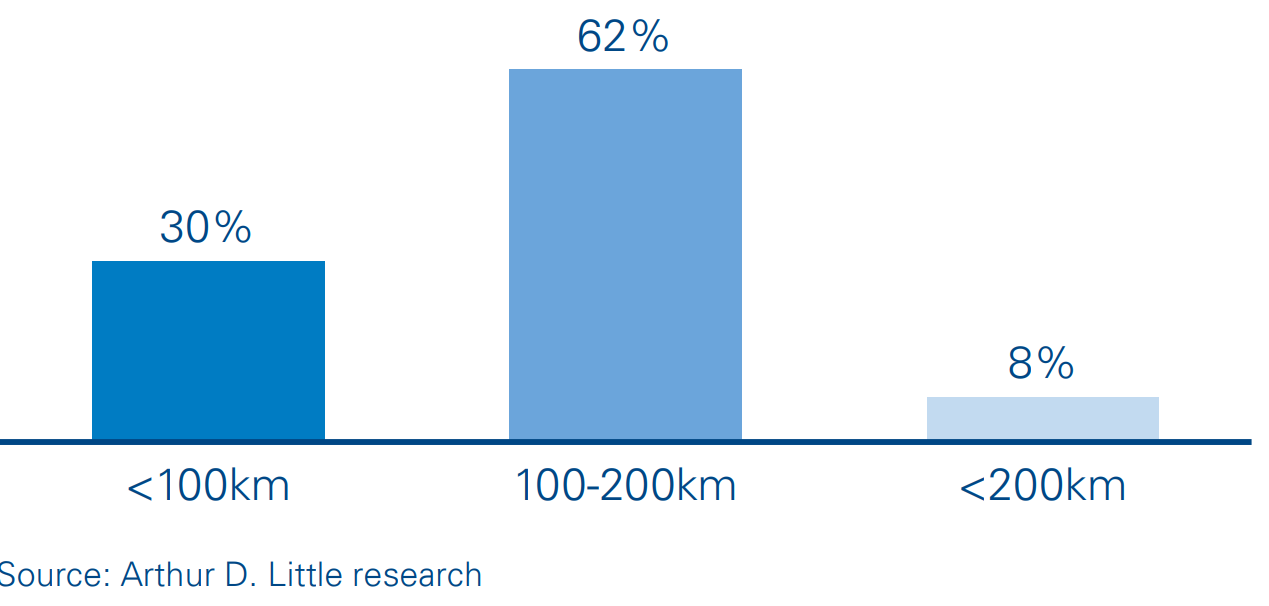

Potential eLCV customers typically operate in urban environments and drive <200 km daily

Initially we identified the most “promising” industry sectors for eLCVs based on current vehicle models’ technical limitations and typical use cases for LCVs.

Due to battery range and load constraints, a viable eLCV use case is characterized by the following factors:

- Short daily driving ranges of 200 km maximum

- Predictable operating routes

- Routing in an urban street environment with no/limited offroad capability requirements

- Daily return to central depot for overnight charging

- Plannable payload and load volume with little special requirements (e.g., towing)

Based on these parameters, we have identified a set of key industry sectors that represent promising target customers for current-era eLCVs:

- Urban distribution and transport companies

- Local/regional craftsmen

- City/municipality fleets

- LCV rental companies

- Energy and utility companies

- Other companies with technical service vehicles (e.g., household appliance manufacturers)

In order to collect meaningful insight regarding the requirements of potential customers that could actually employ eLCVs, we focused our customer survey on these key sectors.

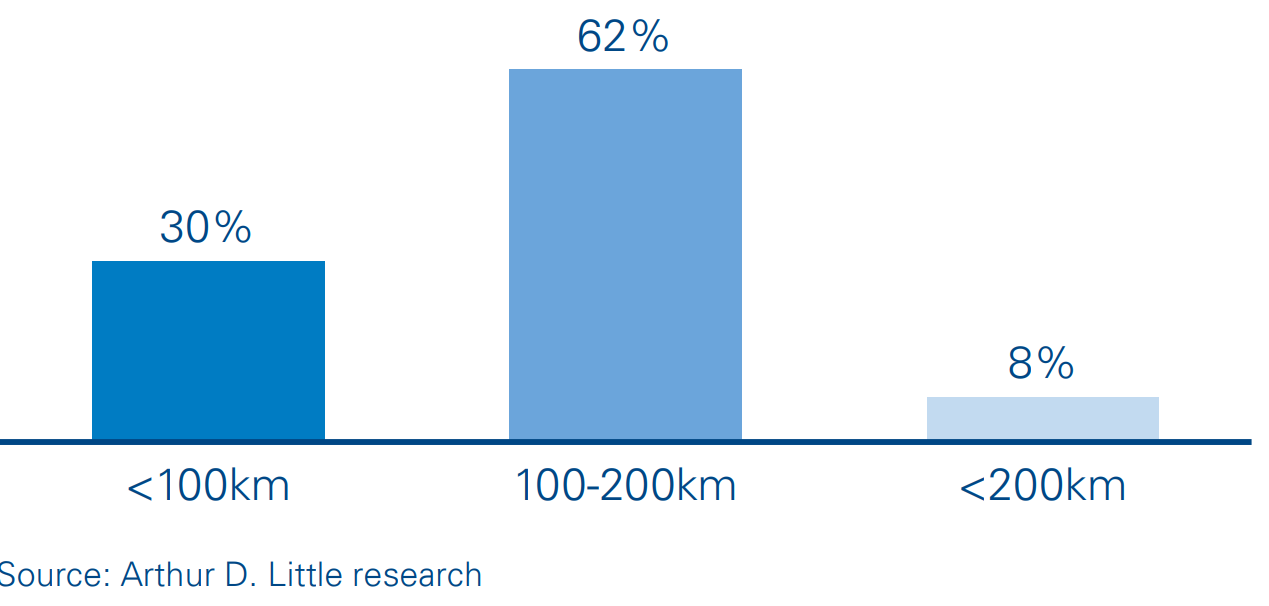

A look at the most restraining factor – the daily driving range – shows that the majority of companies in the survey sample did not require more than 200 km ranges per day:

Figure 10: Survey: Typical daily driving ranges of LCVs in a fleet

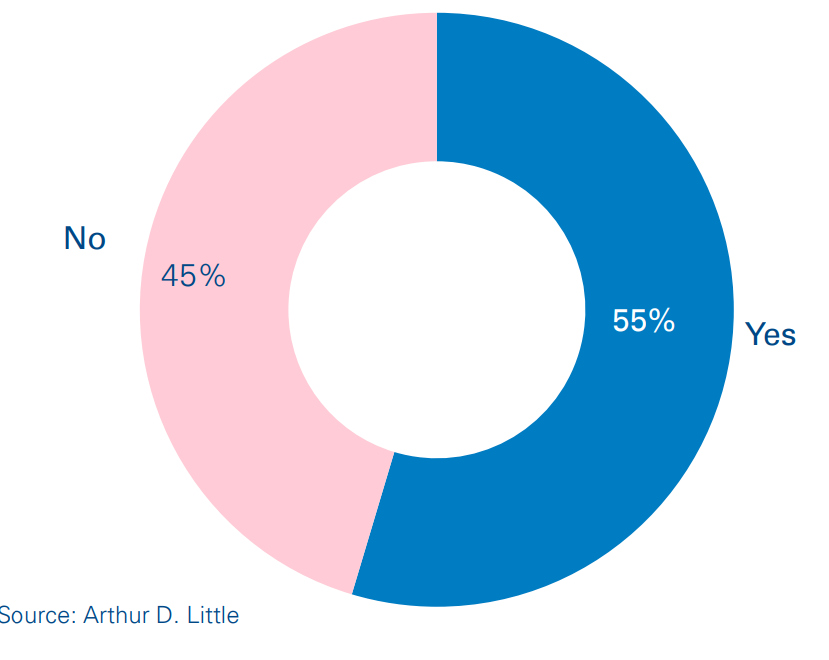

A large share of survey participants planned to acquire eLCVs in the near future

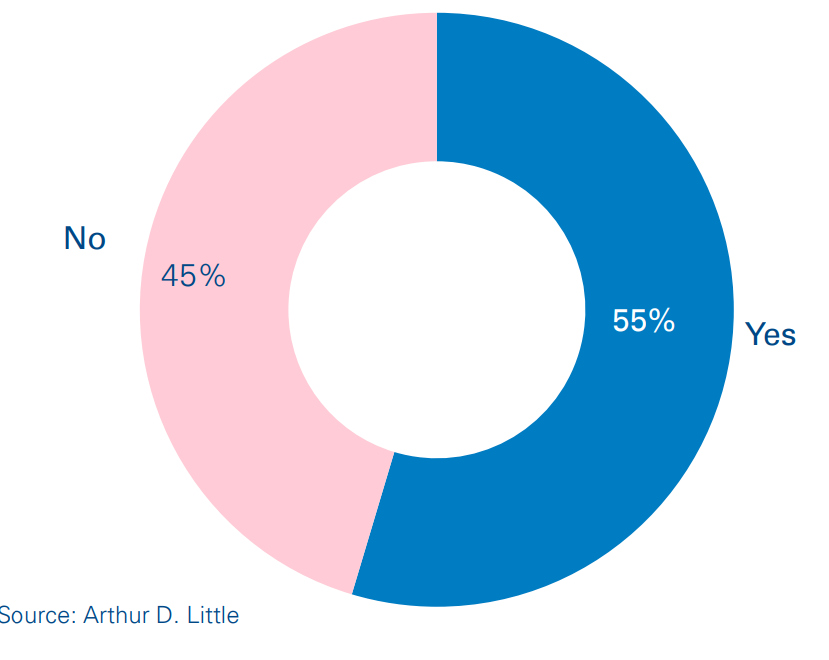

Surprisingly, 55 percent of the fleet managers who participated in our survey stated that they already had eLCVs in their vehicle fleets. However, personal interviews and follow-up discussions revealed that these were mostly single test vehicles. The overall share of eLCVs in these fleets was still miniscule.

Figure 11: Survey: Do you already have eLCVs in your fleet?

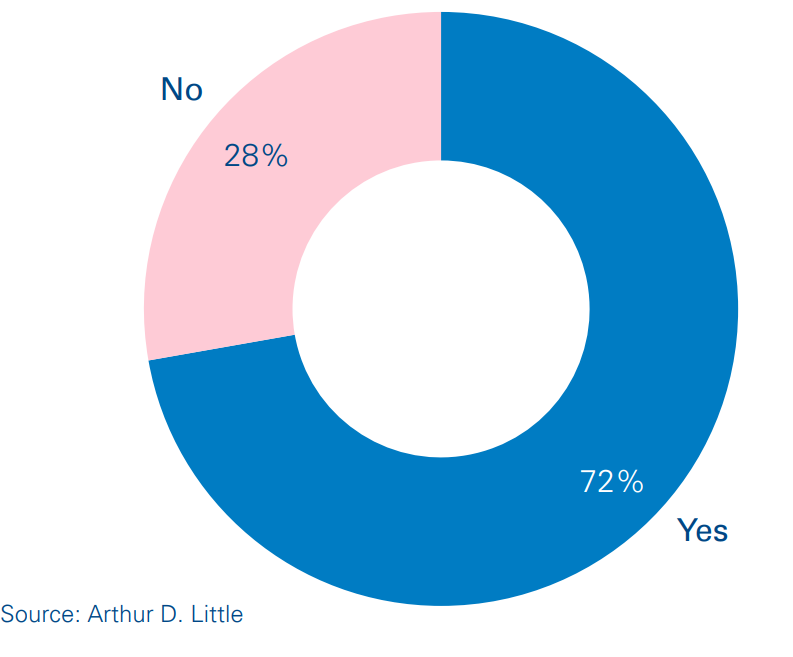

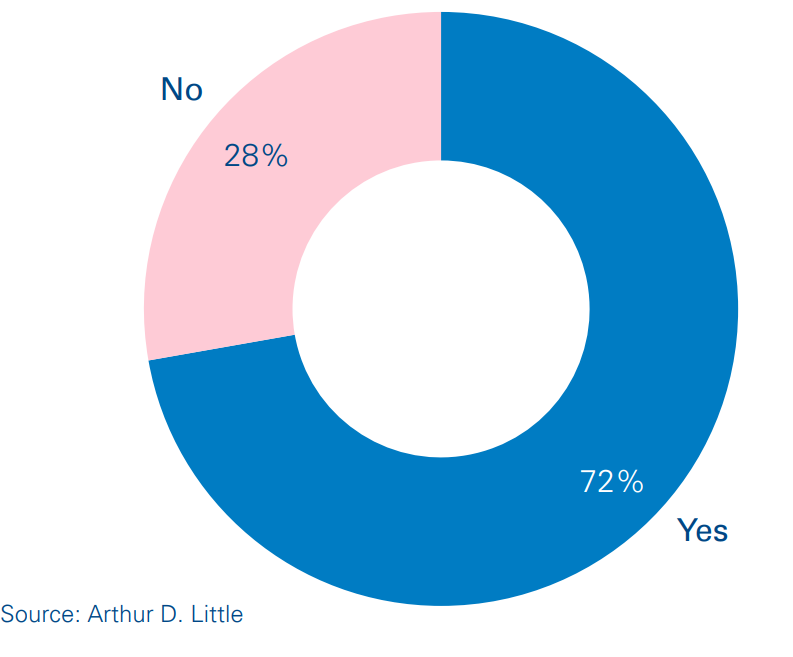

The general interest in acquiring eLCVs among fleets that had not yet employed them was also significant. More than 70 percent of survey participants claimed that they planned to acquire eLCVs in the near future.

Figure 12: Survey: Do you plan to acquire eLCVs in the near future?

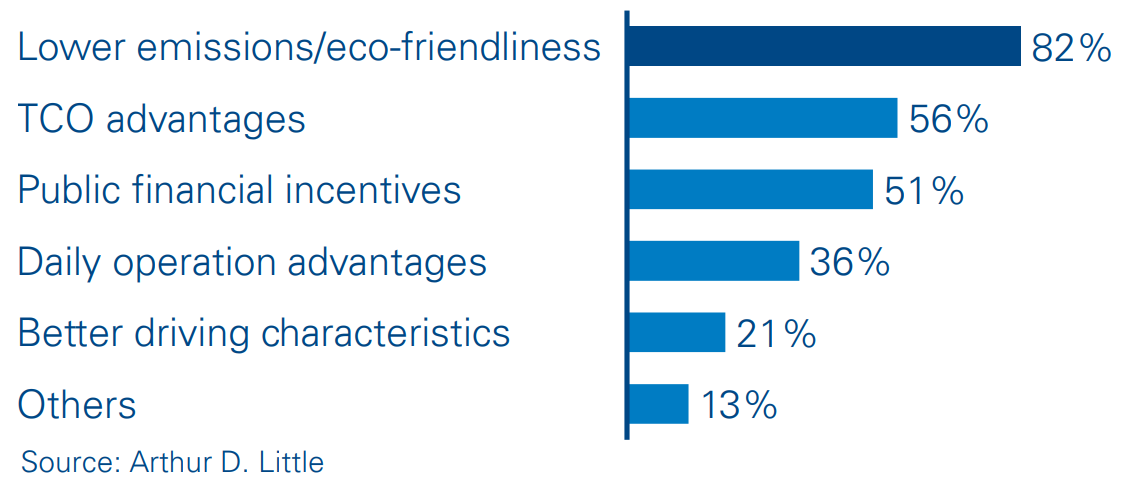

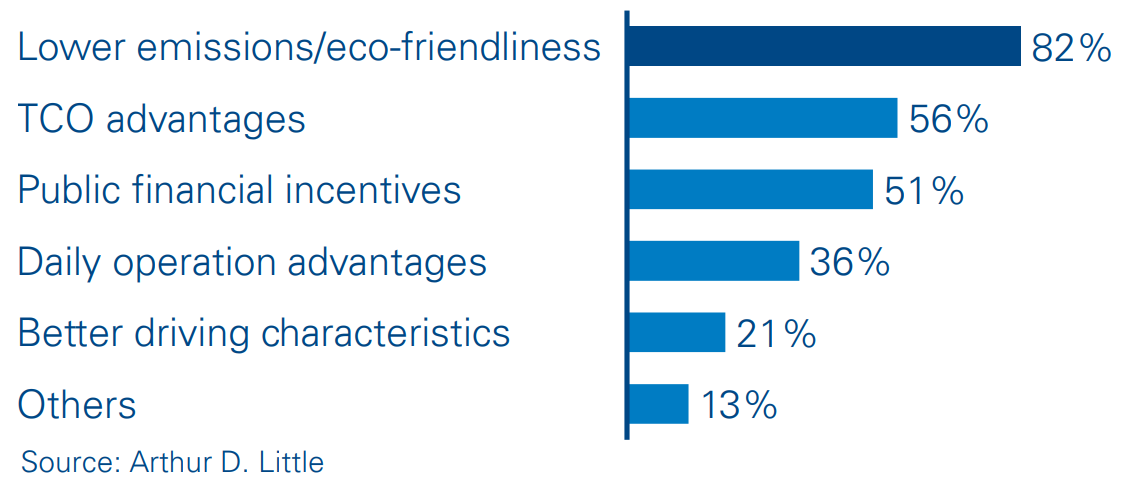

The main motivations behind fleet managers’ plans to switch from diesel to eLCVs were better eco-friendliness, lower expected total cost of ownership, and access to financial incentives for electric vehicles, such as subsidies and tax exemptions.

Figure 13: Survey: Why are you considering switching to eLCVs?

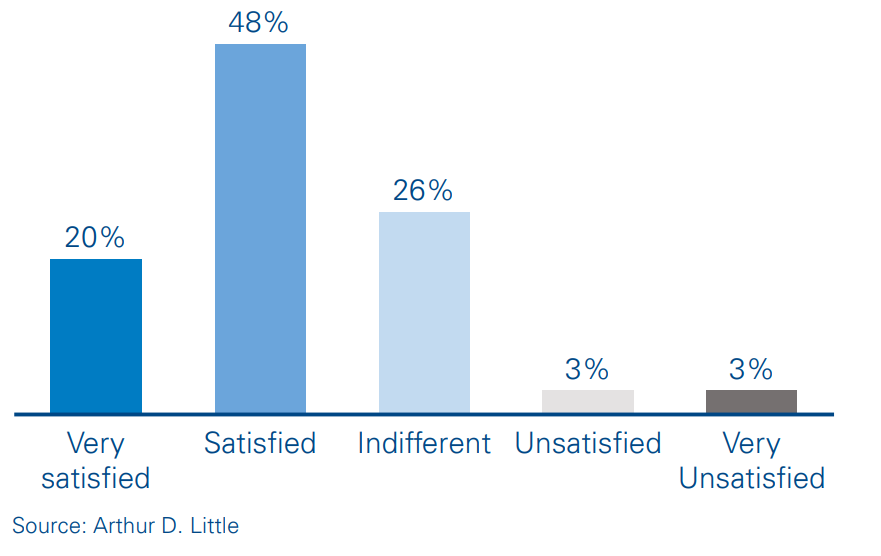

The majority of eLCV owners are satisfied despite compromises in day-to-day operation

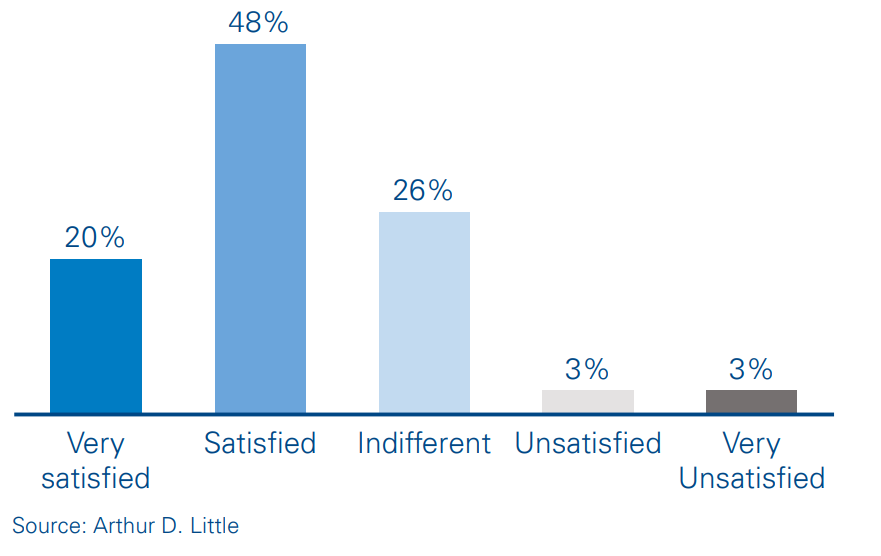

Among fleet managers who had already operated eLCVs as parts of their fleets, the overall level of satisfaction was solid. Over two-thirds of panelists responded that they were either “very satisfied” or “satisfied” with their eLCVs.

Figure 14: Survey: How satisfied are you with your eLCV(s)?

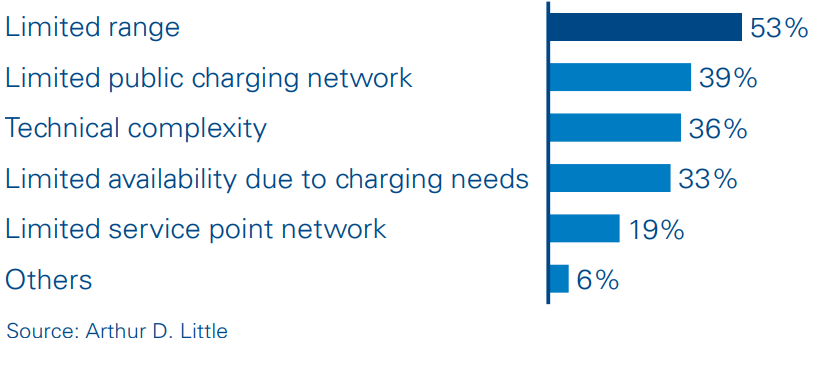

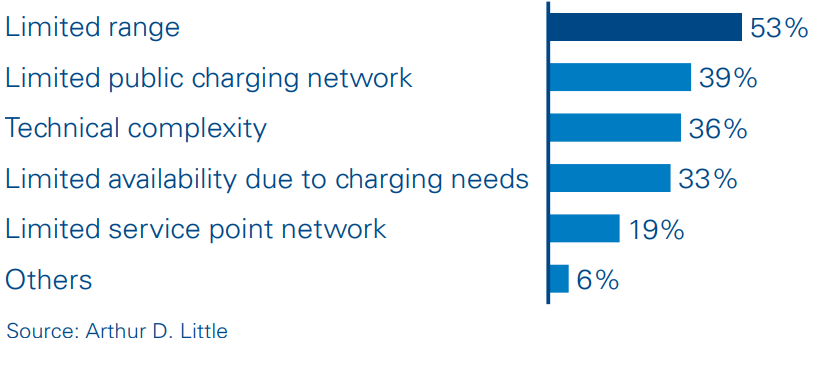

When asked about particular problems in day-to-day operation with their eLCVs, the majority of fleet managers named range-related issues as the most important sources of trouble. Panelists explained that eLCVs fell short when unplanned route changes or spontaneous customer appointments demanded longer driving ranges. The lack of widespread public fastcharging network in Germany further aggravated this issue.

Figure 15: Survey: What were the main issues in day-today operation with your eLCV(s)?

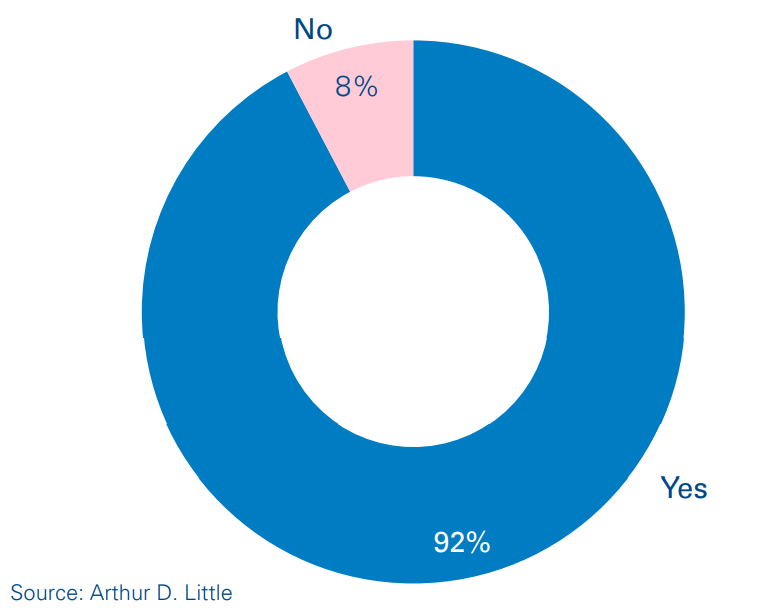

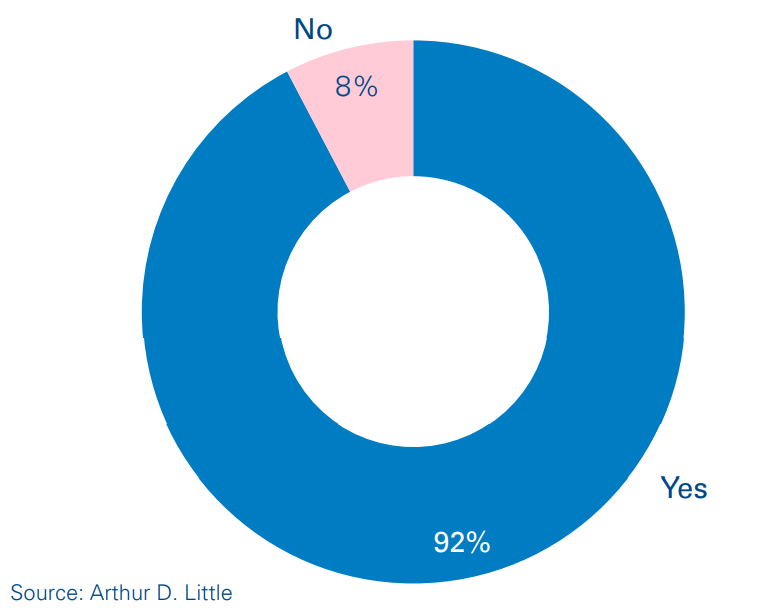

Despite some compromises in everyday use, an overwhelming majority of eLCV users stated that they would definitely buy eLCVs again.

Figure 16: Survey: Would you buy an eLCV again?

Potential customers are often deterred by range limitations

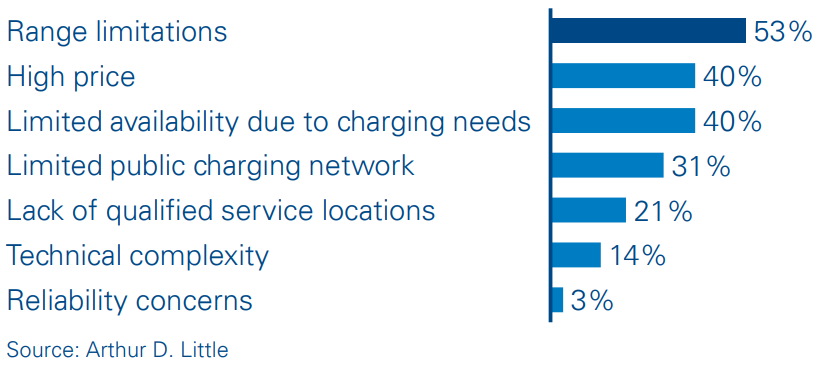

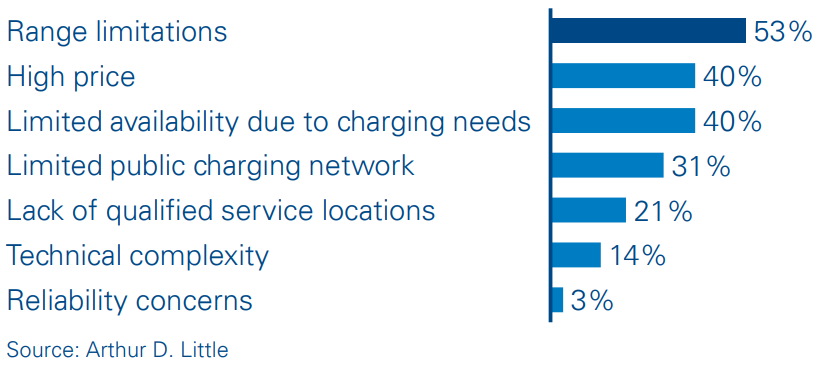

Asked about their past purchasing decisions, about 50 percent of panelists expressed that they had considered acquiring eLCVs before, but then decided against it. In order to explore general pre-conceptions of non-buyers towards eLCVs and identify potential purchasing barriers, we asked these panelists about their main concerns.

Consistent with the compromises in day-to-day operation expressed by actual users, concerns about the battery range were discouraging potential customers from buying eLCVs.

The higher price tag of eLCVs, as well as apprehension that eLCVs need too much idle time to recharge (“time is money”), are the other two main factors prompting potential buyers to reconsider their selection.

Figure 17: Survey: What were your main reasons for deciding against an eLCV?

Purchasing criteria: Quality and price are the most important factors

Fleet managers tend to be rational buyers whose purchase decisions are primarily driven by practical considerations. This is also reflected in the survey responses. When asked about their main purchasing criteria for LCVs (score from 1 – “not important” – to 5 – “very important”), most panelists ranked “vehicle quality”, “price” and “total cost of ownership” as top criteria.

Other factors, such as “local presence of dealer and service locations”, “lease options” and “dedicated fleet services”, were still considered important, but to a lesser extent.

Figure 18: Survey: What are your main purchasing criteria when acquiring a new LCV?

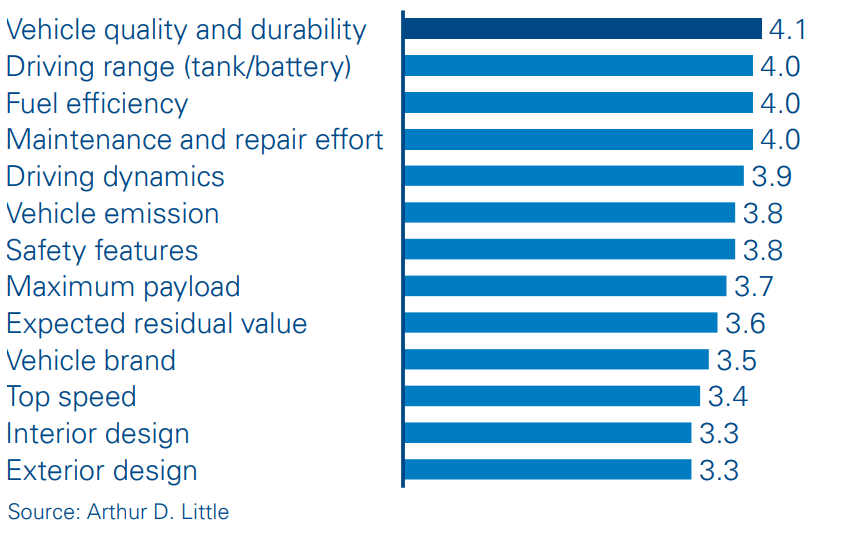

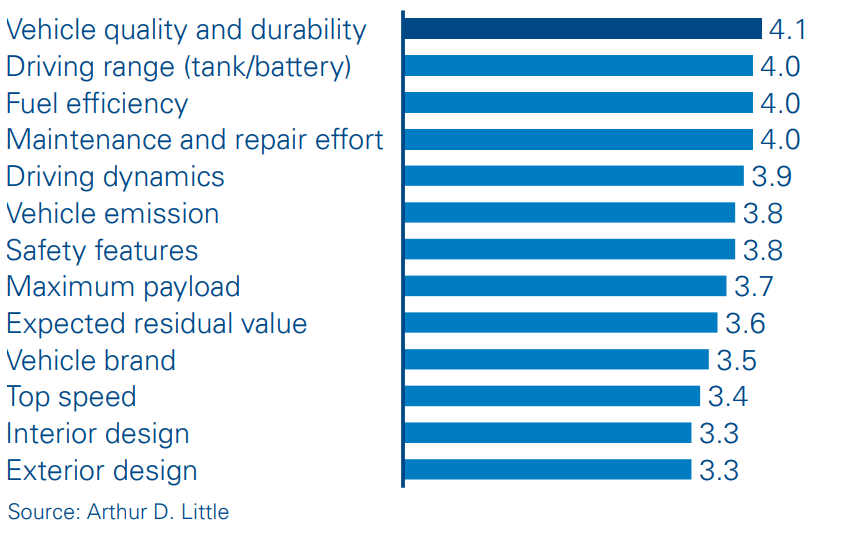

In addition to general purchasing criteria for LCVs, we investigated the relative importance of specific vehicle characteristics and features. Again, panelists were asked to assign an importance score from 1 to 5 to each of the characteristics.

The survey responses confirm that German fleet managers focus on the basics when acquiring new vehicles for their fleets. Practical considerations, such as vehicle “quality and durability”, “driving range” and “fuel efficiency” are the most important factors, while “exterior and interior design”, “vehicle brand” and “top speed” are considered less important.

Figure 19: Survey: What are the most important product characteristics when acquiring a new LCV/eLCV?

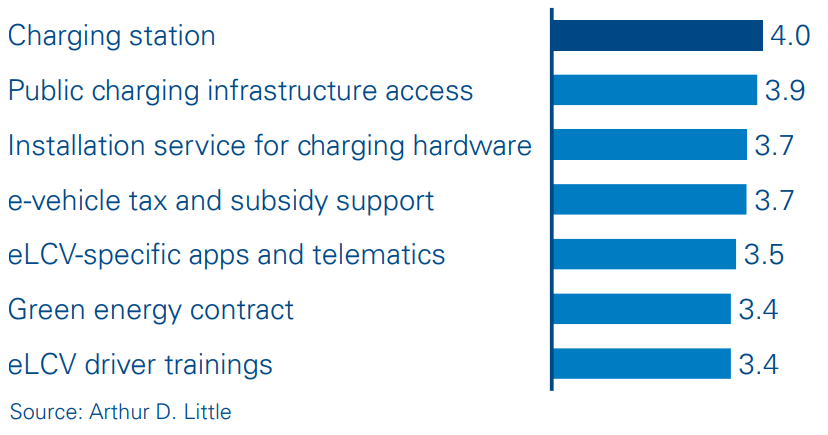

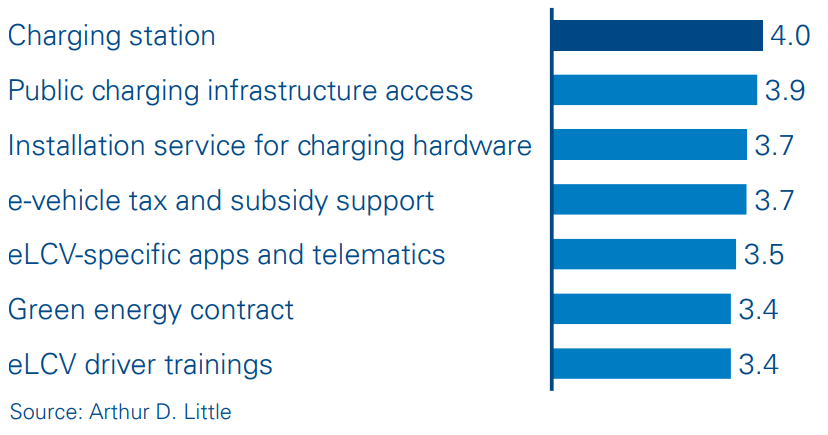

eLCV customers expect charging hardware as part of the system offering

We also asked customers which additional services they would expect in an attractive eLCV “system offering”. By system offering, we refer to electric vehicle-related services offered by the OEM in conjunction with their vehicles. Consistent with other survey responses, charging was their main concern. On-premises “charging stations” were mentioned as the most important element of an eLCV system offering, followed by “access to public charging networks”. More peripheral services, such as “green energy contracts” and “eLCV-specific apps and telematics” were considered “nice to have” but not essentia

Figure 20: Survey: What are the most important elements of an eLCV system offering?

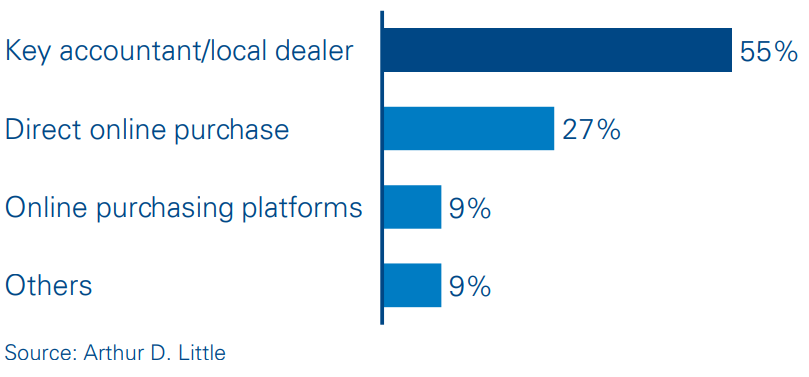

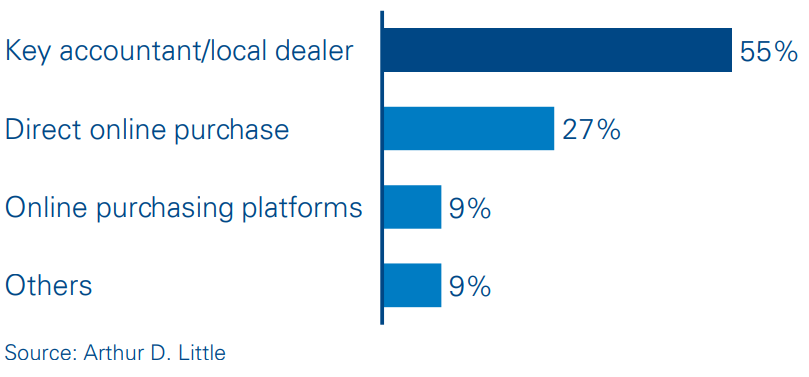

Fleet customers value their personal sales contacts

When investigating purchasing requirements of potential eLCV customers, we also explored their affinity for new, more unusual purchasing channels such as direct online sales platforms. Survey results and personal interviews show that fleet customers value their personal relationships to their key account managers and/or sales reps at their local dealers.

Many fleet customers demonstrate long-lasting brand loyalty when it comes to their LCV fleet compositions. In many cases, loyalty even goes beyond the brand, but is, rather, related to a specific sales representative. Key account managers and dealership sales personnel are often perceived as trusted product advisors – a relationship that online platforms cannot deliver. Discussions with fleet managers revealed that having a trusted personal contact in the purchasing even increases in importance when considering buying eLCVs.

These vehicles come with new, complex technology, as well as different maintenance, repair and operation requirements. eLCVs require extensive product explanation, testing and consulting. This is also true for peripheral topics such as electric vehicle subsidies and tax exemptions.

As a result, the majority of LCV fleet managers prefer to stick to their local dealers or OEM key account managers as their preferred sourcing channels for eLCVs.

Figure 21: Survey: What is your preferred sourcing channel for eLCVs going to be?.

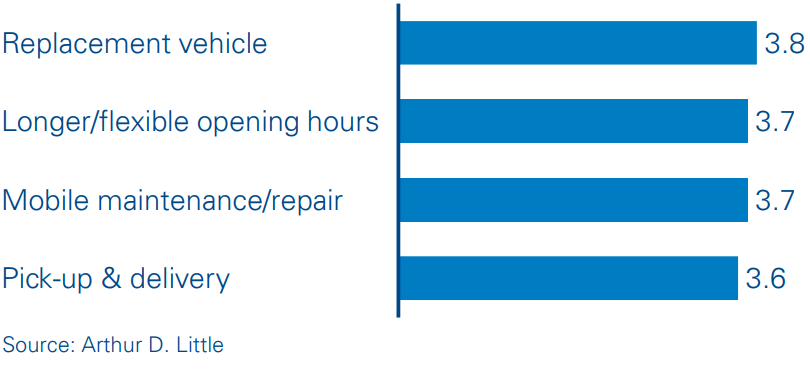

Aftersales: Fleet managers expect state-of-the-art services for eLCVs

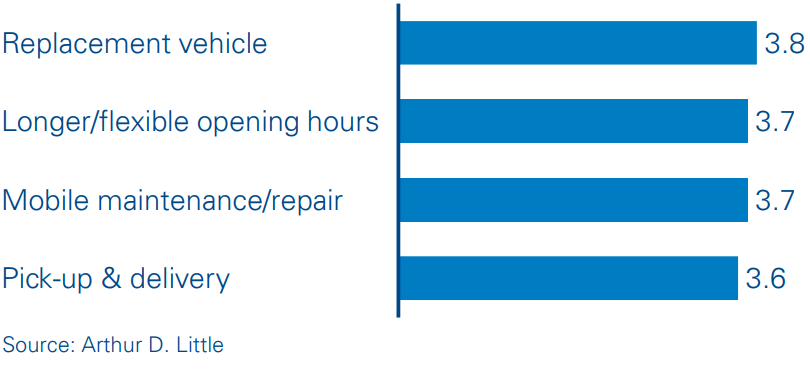

LCV fleet managers are used to receiving special aftersales services as business customers, and not willing to make any sacrifices when switching to eLCVs.

Longer and more flexible workshop opening hours, pick-up and delivery services, and replacement vehicles for the duration of vehicle maintenance are standard in the commercial vehicle sector. In order to maximize their vehicles’ operating time, fleet managers expect the same service offering from eLCV manufacturers.

Our survey shows that all elements of a standard aftersales offering to fleet customers are considered similarly important.

Figure 22: Survey: How important are the following aftersales offerings to you?

In addition, fleet managers expect a dense service and repair network for flexible service and repair arrangements on short notice. Almost 75 percent of panelists would not accept distance to the next workshop of more than 20 km. This certainly represents a challenge for smaller eLCV manufacturers trying to enter the market.

6

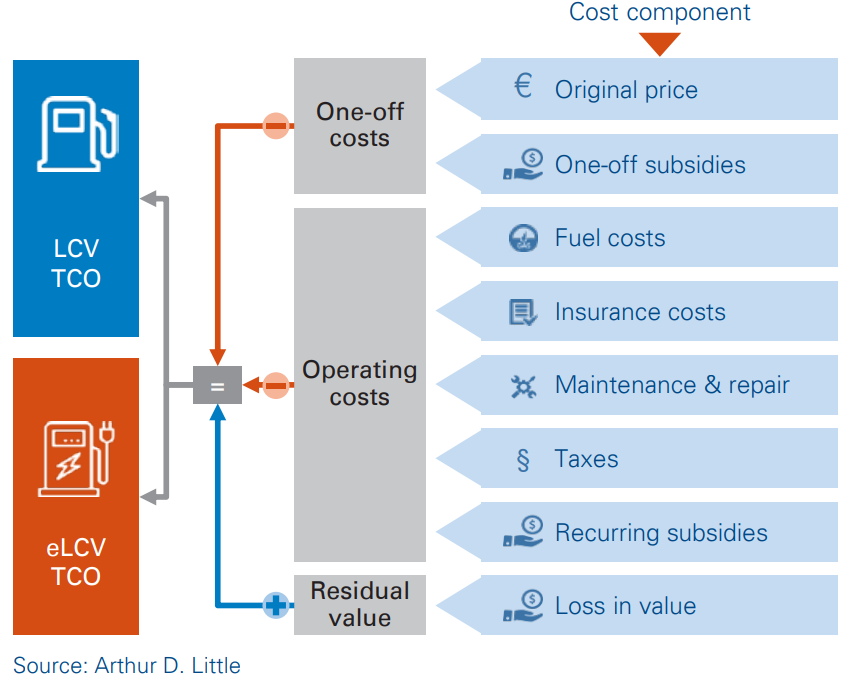

TCO comparison

In addition to leveraging eco-friendliness as a main feature in their marketing efforts, manufacturers consistently advertise their eLCVs’ low operating costs compared to those of combustion engine vehicles. Given their considerably higher average price tag, this operatingcost advantage of eLCVs needs to be sizable in order to compete with diesel vehicles from a “total cost of ownership” (TCO) perspective.

Lower operating costs of eLCVs counter the price gap, but cannot close it

How do eLCVs perform against their diesel counterparts in terms of TCO?

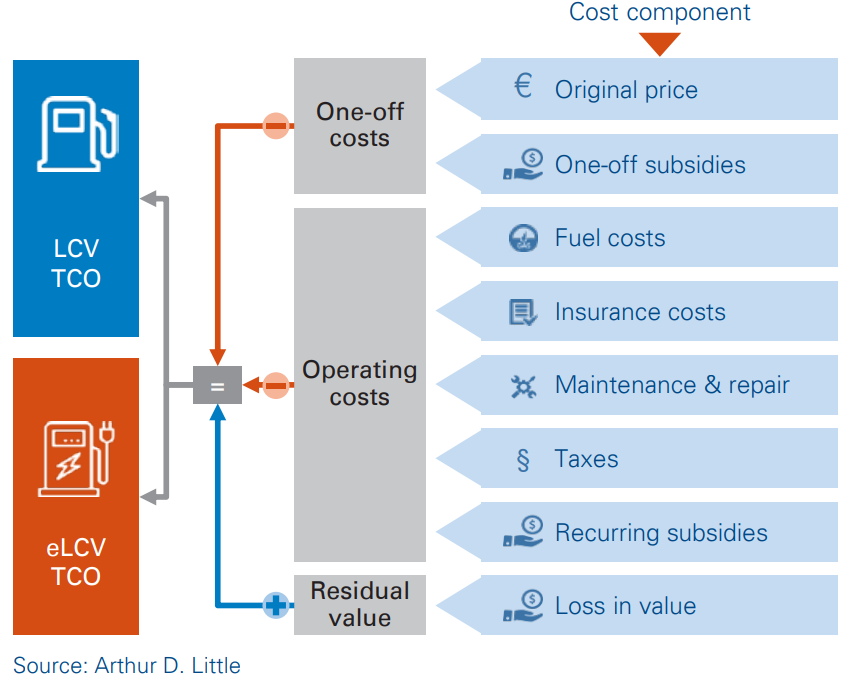

To address this question, Arthur D. Little has developed a TCO model to compare vehicle models. The model includes oneoff costs (e.g., purchase price), operating costs (e.g., energy, insurance, maintenance) and residual values.

Figure 23: TCO model

To make results meaningful we compared the same vehicle models of a given OEM (diesel versus eLCV) against each other and defined a set of main assumptions for the TCO calculation:

- Operating cycle: three years

- Annual mileage: 30,000 km

- eLCV purchasing subsidy: €4,000

- Electricity cost: €0.14 (net)/kWh

- Diesel cost: €1.05 (net)/l

- Current purchasing subsidy: €4,000

Based on commercially and publicly available data, we have also developed specific assumptions for each vehicle model with regard to

- Residual value

- Insurance fees

- Maintenance & repair cost

- Energy consumption rates

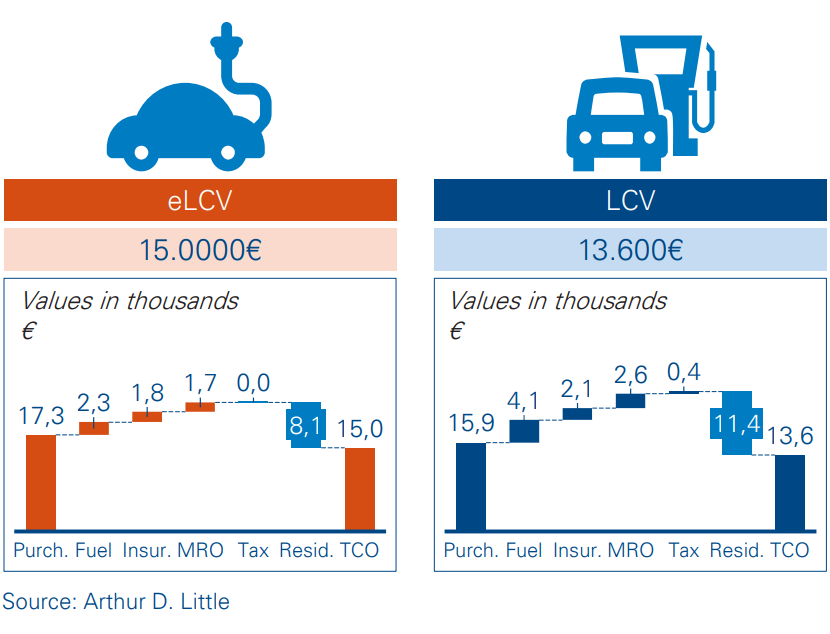

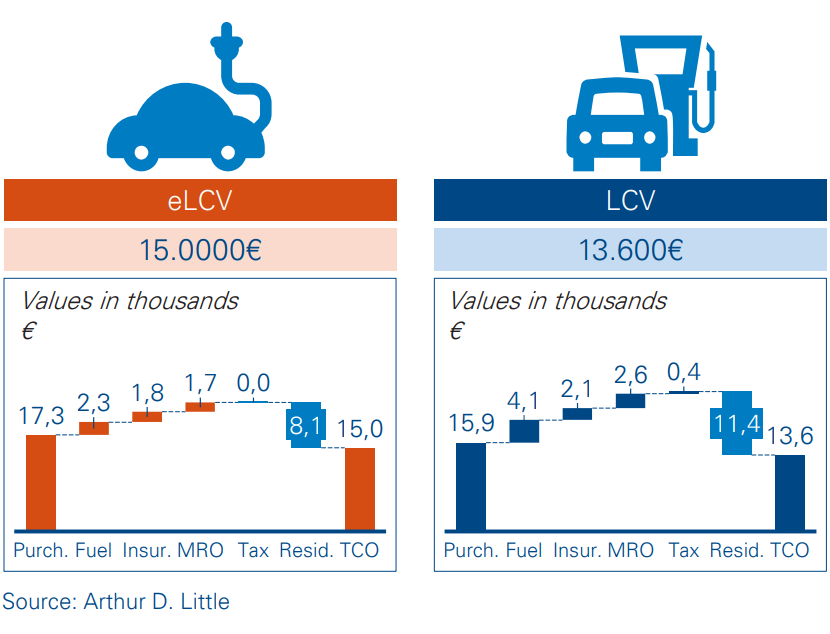

Results of the analysis show that diesel vehicles still have a TCO advantage over a three-year operating cycle.

Despite their significantly lower operating cost, eLCVs’ total cost of ownership is consistently higher than that of their diesel counterparts. The TCO gap between diesel LCVs and eLCVs ranges from 10 to 30 percent.

Figure 24: TCO comparison – diesel versus eLCV (unnamed brand)

As the exemplary calculation shows, residual values are problematic for eLCVs in any TCO comparison to diesels. This is mainly due to the fast progression of battery technology and steep degression of residual values of batteries over time.

Conclusion

Interest among potential customers is high, but concerns often prevail

Our online survey and in-depth discussions with potential customers alike show strong interest in eLCVs among German fleet managers. In practice, however, their lack of experience with this new drivetrain, as well as range and reliability concerns, still leave them reluctant. Professional buyers are less driven by a pioneering spirit than private EV buyers are, since their purchase decisions tend to be more rational. eLCV OEMs should address these concerns in their marketing efforts. Providing field data and real-world driving ranges, as well as actual operating cost of their vehicles, would help significantly in gaining the trust of potential buyers. Many of the concerns of fleet managers mentioned in our study are based on lack of information and transparency about the pros and cons of eLCVs. In order to address the negative myths in the market, OEMs should also leverage positive experiences of current eLCV operators for promotional activities.

Leverage regulation trends for your marketing and sales activities

With a growing number of low emission zones, diesel bans in major cities and governmental incentive programs for EVs, emission regulation in Germany’s urban areas is continuously getting restrictive. Many LCV fleet operators will need to react soon to avoid putting their businesses at risk. Interviews have shown that many fleet operators have not taken current diesel bans in German cities too seriously due to their small regional or local scale. In reality, however, this may just be the beginning if emissions levels in many cities continue to exceed EU limits. Educating customers about the potential impact of regulations on their businesses should be part of any eLCV OEM’s sales advice.

Interviews have also revealed that many fleet managers are only vaguely aware of eLCV subsidy programs or don’t want to deal with the approval process. OEMs need to consult potential customers about available subsidies and their application formalities in order to leverage public EV incentives for their purposes.

Focus on the “usability” of the vehicle

Both preconceptions of non-buyers and feedback from actual users show that eLCVs are still lagging behind diesel vehicles in terms of everyday usability. The major factor here is driving range. Achieving higher driving ranges should be top priority for upcoming vehicle-model generations in order to convince customers to switch. On a similar note, vehicle downtime is always a major concern of business customers. Using public charging stations to recharge during daily operation rarely is a viable option nowadays because most models are only able to use low-speed A/C charging. Equipping eLCVs with D/C-ready onboard chargers could significantly contribute to extending their usable daily driving ranges.

No compromises on aftersales services allowed

Customers’ feedback on aftersales service expectations for eLCVs was unmistakable: fleet managers were neither willing to make any compromises nor concede a “honeymoon period” to eLCVs. As a bare minimum, OEMs need to replicate the experience of a conventional LCV in order to meet customers’ expectations. While larger LCV manufacturers “only” need to make their established service and repair networks “e-ready”, this level of expectation certainly represents a challenge for any new entrant or smaller player.

Be creative to overcome the price gap

Our TCO analysis has shown that lower operating cost of eLCVs only partially covers the significant purchase-price gap in favor of diesel vehicles. In order to be competitive and facilitate stronger market uptake, eLCV OEMs need to employ creative and attractive financing or leasing models to reduce purchase barriers. Subsidized leasing contracts and buy-back arrangements could be options – at least in the current market phase. With battery costs steadily decreasing, the residual-value disadvantage of eLCVs will likely become less severe over time.

DOWNLOAD THE FULL REPORT

22 min read • Automotive, Sustainability

The German market for battery-electric light commercial vehicles

The challenge of electrifying urban transport

DATE

Executive Summary

German consumers are increasingly embracing electric passenger cars. Driven by longer battery ranges, an expanding lineup of attractive new models and growing charging-station networks, the market for battery-electric cars finally seems to be taking off.

Electric light commercial vehicles (eLCVs) – the centerpiece of urban transport – appear to be the logical next step in Germany’s endeavors to combat traffic-related emissions. In reality, however, eLCVs have struggled to build significant market demand so far. In 2018, less than 2 percent of all newly registered LCVs in Germany were all-electric vehicles. Diesel engines are still dominating this market.

So what has kept German fleet managers from vigorously electrifying their workhorse fleets of diesel vans and transporters so far? How do emission regulation trends affect growth prospects of this market segment? What do potential customers expect from a convincing eLCV market offering? Which vehicle attributes are most crucial in day-to-day operation? Which should be the focal areas of OEMs’ future product development and marketing activities in order to boost the adoption of eLCVs in Germany?

In an effort to find answers to these questions, Arthur D. Little has analyzed the German market for eLCVs, including a survey of more than 100 fleet managers across multiple industry sectors.

Results of the market analysis show that regulatory trends in Germany are increasingly putting pressure on diesel vehicles and supporting an accelerated transition to eLCVs in the upcoming years. Experts predict approximately 30 percent average annual growth of sales volume over the next four to five years.

Our survey has shown that there is a high level of general interest in electric LCVs. Over 70 percent of surveyed fleet managers plan to acquire eLCVs in the near future, mostly driven by their ambition to reduce fleet emissions. However, only a small share of them has actually acquired an electric LCV at this point. In order to develop strong sales arguments for eLCVs, OEMs need to gather a profound understanding of their customers’ reservations against electric vehicles, their main product requirements as well as their key purchasing criteria.

Fleet managers tend to be very rational buyers who prioritize practical “usability” of a vehicle and objective commercial considerations like TCO when making their purchase decisions. Our analysis shows that current generation eLCVs have a hard time competing with diesel vehicles in these categories due to battery range limitations, charging requirements and a significantly higher price tag.

There is a range of issues OEMs need to address in their product development and marketing strategies if they want to convince customers to switch to eLCVs. In our conclusions to this report, we have consolidated our most important findings and provided some guiding principles to eLCV manufacturers and marketers.

2

The regulatory environment in Germany

Emission regulation is a key driver behind the rise of electric vehicles

One of the main forces driving the electric vehicle market in general has been emission regulations at governmental and city level.

Across Europe, road transport is widely recognized as the single-biggest air polluter. In order to fight air pollution, the EU Council has released its “Directive 96/62/EC on ambient air-quality assessment and management”, which sets emission targets for various hazardous substances in the air. NOx and fine dust (particulate matter – PM) are considered the most relevant emissions generated by vehicles, and currently limited to 40 µg/ m3 p.a. each.

In an effort to comply with EU targets, Germany – like other European countries – has been installing low emission zones (LEZs) in many cities and metropolitan areas since 2008. These zones are limiting access for vehicles with older emission classes. There are currently 58 low emission zones across Germany, with 57 of them “level 3” zones, i.e., prohibiting access for diesel vehicles with Euro 2 & Euro 3 emission class.

Nevertheless, many German cities continue to exceed the NOx limits set by the EU. This has led the German federal court to grant states and cities the right to implement driving bans for diesel cars. In 2018, Hamburg was the first city to install a “diesel ban” in a limited area. Other large cities, such as Munich and Stuttgart, are openly considering bans for the near future.

As emission regulation becomes increasingly strict at governmental and city level, companies operating in urban environments need to reassess their fleet strategies. Upgrading their vehicle fleets to the latest diesel powertrain technology appears to only be a viable solution in the medium term. In order to not risk losing access to their operating environments in the long run, most companies need to think about how long they can maintain their daily business without switching to eLCVs.

Benefits and incentives increase the attractiveness of eLCVs in Germany

Similar to other European countries, there is a variety of benefits and incentives for EVs in Germany.

Figure 3: EV benefits in major European markets

The most notable financial incentives for EVs at national level are:

- A €4,000 purchase subsidy (covered 50/50 between the German government and the vehicle manufacturer), applicable to eLCVs with net vehicle prices up to €60,000

- Exemption from the motor vehicle tax for 10 years, which thereby significantly reduces operating cost over vehicle lifetime

In addition to nationwide incentives, some major cities, such as Berlin and Munich, have installed local programs to support the adoption of eLCVs.

3

The state of the German eLCV market

In line with the overall market trend in Europe, the German LCV market is expected to cool down after recent years of solid growth. After it reached its preliminary peak of roughly 270,000 LCVs in 2018, experts predicted the German market to stagnate until 2023.

Figure 4: LCV sales in Germany [k units]

The German eLCV market is small but set for growth

In light of these prospects, eLCVs will have to fight the additional uphill battle of substituting diesel vehicles, because growing in line with the overall market does not appear to be a viable option.

In 2018, some 4,900 eLCVs were newly registered in Germany, up 9 percent from 2017. This accounts for roughly 1.8 percent of the overall LCV market. Looking at the historical trend, these numbers are already quite an achievement.

After the introduction of the first French and Japanese eLCV models in 2013/2014, Germany started seeing 400 to 500 newly registered vehicles per year.

Figure 5: Newly registered eLCVs in GER [k units]

One of the biggest boosts to the German eLCV market came from the introduction of the StreetScooter Work. The StreetScooter is an electric transporter that is developed and produced by Deutsche Post’s wholly owned subsidiary, StreetScooter GmbH. Originally intended for internal use in Deutsche Post’s delivery fleet, StreetScooter launched series production of its Work model in 2016, and has quickly become the market leader in Germany. Due to alleged market demand, StreetScooter has recently started to sell the vehicle to external customers as well, with the first sizable StreetScooter fleets operated by a number of customers in Germany and other European countries.

Figure 6: Market share of newly registered German eLCVs (2018)

Other eLCV models, such as Renault’s Kangoo ZE and Nissan’s e-NV200, are struggling to grow their annual sales numbers continuously.

According to many interviews with German fleet managers, one major reason for the lack of momentum in the past was that the big German OEMs had not yet released their electric LCVs. In a market with very strong brand loyalty and considerable brandswitching barriers for customers, this is a huge factor. However, with the recent market launch of Daimler’s eVito and announced introduction of the eSprinter, as well as Volkswagen’s launch of the e-Crafter, some of the highest-selling LCV models in Germany will finally be available as electric vehicles.

As a result, things are about to look much brighter, and experts predict approximately 30 percent annual growth over the next four to five years for Germany

4

The current eLCV lineup in Germany

Figure 7: Overview of eLCVs in Germany, including their base vehicle specs (as of 10/2018)

The eLCV market offering is steadily expanding in Germany

While conducting this study in 2018, many German fleet managers stated a very limited market offering as one of the reasons they had not yet started to electrify their LCV fleets.

With some recent additions by VW, Daimler and Renault, the eLCV lineup in Germany has now grown to 11 vehicle models with varying driving ranges, payloads and load volume specifications.

The small vehicle segment is populated by the StreetScooter Work, as well as electrified versions of the Nissan NV200, the Peugeot Partner, the Citroen Berlingo and the Renault Kangoo. Vehicles in this segment typically provide battery ranges between 170 and 280 km (according to NEDC) and come with payloads between 600 and 700 kg. With load volumes from 3.3 to 4.3 m³, this segment appeals to companies with moderate transport or delivery requirements in urban areas. Despite largely comparable main specs, price points vary significantly: while the Citroen Berlingo is available at roughly €25,000 (including German VAT), customers have to spend almost double that amount, i.e., about €49,000, if they aim to acquire the StreetScooter Work.

The most recent additions to the German eLCV market have been made in the larger vehicle segment, namely, the Mercedes Benz eVito, the VW e-Crafter and the Renault Master Z.E. in 2018. Payloads in this segment range from 700 to 1,100 kg, while load volumes vary between 7 and 11 m³. Similar to the smaller-vehicle segment, larger eLCVs provide driving ranges between 170 and 280 km. Vehicle prices in this segment go up to roughly €83,000 (the VW e-Crafter) for the base model.

Discussions with German fleet managers have revealed that the driving range is often their most crucial factor in considering the electrification of their LCV fleets. Here, it needs to be considered that real-world driving ranges for eLCVs often deviate significantly from driving ranges according to NEDC, due to driving behavior, vehicle load, climate conditions and fleet operation mechanisms.

eLCVs come with a significant price premium compared to diesel LCVs

On another note, eLCVs will continue to compete with their diesel equivalents in the foreseeable future. Despite overarching pressure to “go green”, German fleet managers still take a close look at the price tag when making purchase decisions.

Comparing the purchasing prices of eLCVs to similarly equipped diesel vehicles reveals a significant price gap in favor of the diesels. This is best demonstrated by matching an electrified LCV to its diesel brother of the same brand.

Figure 8: Example: MSRP (base vehicle) comparison, eLCV vs. diesel LCV

This gap is not exclusive to this example, but rather, a consistent pattern in the market: fleet managers usually have to be ready to pay a sizable premium when choosing eLCVs over their diesel equivalents. The price-tag difference can mostly be attributed to the cost of the battery pack: with prices for Li-ion batteries currently standing at €150 per kilowatt hour, costs of 40 kWh batteries alone quickly reach €6,000.

To express this in metrics meaningful to fleet managers, customers currently have to pay, on average, €25 per kilogram payload for diesel LCVs, and roughly €45 for the eLCV equivalent.

Some of the initial costs will be outweighed over the course of a vehicle’s life cycle, though. This is primarily due to lower maintenance, repair and energy costs for eLCVs. But the purchase price difference still remains a major factor for fleet managers to only reluctantly substitute their diesel fleets.

eLCVs are usually marketed together with charging solutions

From analyzing available market offerings in Germany, it quickly becomes apparent that electric LCVs are usually marketed as electric vehicle “system solutions”. Similar to the passengercar market, OEMs typically do not sell customers stand-alone vehicles, but rather, bundles of products and services to facilitate the transition to the new technology.

Among those complementary products, a home or depot charging solution is the most notable component of a standard market offering. All OEMs directly or indirectly (via specialized partners) provide customers with appropriate hardware to recharge the battery at their own premises. Most OEMs also support their customers with charging hardware installation through a network of certified electricians.

Access to public charging networks, unlike with the electric passenger-car market, is not a standard offering in the commercial-vehicle segment. At the time of the analysis, only Nissan was directly marketing public charging products to its eLCV customers. This can probably be attributed to the fact that many current eCLV models are not DC-charging enabled. Hence, on-the-road charging would require too much of the daily operation time of the vehicle.

In the passenger-car market, OEMs are continuously working on enhancing their market offerings by adding “layers” of complimentary “green” products around the vehicle core, e.g., green energy contracts and photovoltaic systems. In the LCV market, however, this is not yet the case. Market offerings tend to stick to the basics: vehicle and charging station.

Figure 9: Components of eLCV market offerings (selected models)

5

Requirements of German fleet managers

In order to develop better insight into potential eLCV customers’ purchase criteria and product requirements, Arthur D. Little conducted a customer study with German fleet managers in 2018. The main purpose of this study was to analyze general fleet managers’ attitudes and concerns regarding eLCVs, as well as to understand what they expected from electric LCVs. The results of the study provide OEMs with guidance for their future product development activities and marketing efforts.

The study was conducted in a two-step approach: the first step was an online survey among more than 100 German fleet managers, followed by a second step in which the results of the survey were further qualified through personal interviews and focus groups.

Potential eLCV customers typically operate in urban environments and drive <200 km daily

Initially we identified the most “promising” industry sectors for eLCVs based on current vehicle models’ technical limitations and typical use cases for LCVs.

Due to battery range and load constraints, a viable eLCV use case is characterized by the following factors:

- Short daily driving ranges of 200 km maximum

- Predictable operating routes

- Routing in an urban street environment with no/limited offroad capability requirements

- Daily return to central depot for overnight charging

- Plannable payload and load volume with little special requirements (e.g., towing)

Based on these parameters, we have identified a set of key industry sectors that represent promising target customers for current-era eLCVs:

- Urban distribution and transport companies

- Local/regional craftsmen

- City/municipality fleets

- LCV rental companies

- Energy and utility companies

- Other companies with technical service vehicles (e.g., household appliance manufacturers)

In order to collect meaningful insight regarding the requirements of potential customers that could actually employ eLCVs, we focused our customer survey on these key sectors.

A look at the most restraining factor – the daily driving range – shows that the majority of companies in the survey sample did not require more than 200 km ranges per day:

Figure 10: Survey: Typical daily driving ranges of LCVs in a fleet

A large share of survey participants planned to acquire eLCVs in the near future

Surprisingly, 55 percent of the fleet managers who participated in our survey stated that they already had eLCVs in their vehicle fleets. However, personal interviews and follow-up discussions revealed that these were mostly single test vehicles. The overall share of eLCVs in these fleets was still miniscule.

Figure 11: Survey: Do you already have eLCVs in your fleet?

The general interest in acquiring eLCVs among fleets that had not yet employed them was also significant. More than 70 percent of survey participants claimed that they planned to acquire eLCVs in the near future.

Figure 12: Survey: Do you plan to acquire eLCVs in the near future?

The main motivations behind fleet managers’ plans to switch from diesel to eLCVs were better eco-friendliness, lower expected total cost of ownership, and access to financial incentives for electric vehicles, such as subsidies and tax exemptions.

Figure 13: Survey: Why are you considering switching to eLCVs?

The majority of eLCV owners are satisfied despite compromises in day-to-day operation

Among fleet managers who had already operated eLCVs as parts of their fleets, the overall level of satisfaction was solid. Over two-thirds of panelists responded that they were either “very satisfied” or “satisfied” with their eLCVs.

Figure 14: Survey: How satisfied are you with your eLCV(s)?

When asked about particular problems in day-to-day operation with their eLCVs, the majority of fleet managers named range-related issues as the most important sources of trouble. Panelists explained that eLCVs fell short when unplanned route changes or spontaneous customer appointments demanded longer driving ranges. The lack of widespread public fastcharging network in Germany further aggravated this issue.

Figure 15: Survey: What were the main issues in day-today operation with your eLCV(s)?

Despite some compromises in everyday use, an overwhelming majority of eLCV users stated that they would definitely buy eLCVs again.

Figure 16: Survey: Would you buy an eLCV again?

Potential customers are often deterred by range limitations

Asked about their past purchasing decisions, about 50 percent of panelists expressed that they had considered acquiring eLCVs before, but then decided against it. In order to explore general pre-conceptions of non-buyers towards eLCVs and identify potential purchasing barriers, we asked these panelists about their main concerns.

Consistent with the compromises in day-to-day operation expressed by actual users, concerns about the battery range were discouraging potential customers from buying eLCVs.

The higher price tag of eLCVs, as well as apprehension that eLCVs need too much idle time to recharge (“time is money”), are the other two main factors prompting potential buyers to reconsider their selection.

Figure 17: Survey: What were your main reasons for deciding against an eLCV?

Purchasing criteria: Quality and price are the most important factors

Fleet managers tend to be rational buyers whose purchase decisions are primarily driven by practical considerations. This is also reflected in the survey responses. When asked about their main purchasing criteria for LCVs (score from 1 – “not important” – to 5 – “very important”), most panelists ranked “vehicle quality”, “price” and “total cost of ownership” as top criteria.

Other factors, such as “local presence of dealer and service locations”, “lease options” and “dedicated fleet services”, were still considered important, but to a lesser extent.

Figure 18: Survey: What are your main purchasing criteria when acquiring a new LCV?

In addition to general purchasing criteria for LCVs, we investigated the relative importance of specific vehicle characteristics and features. Again, panelists were asked to assign an importance score from 1 to 5 to each of the characteristics.

The survey responses confirm that German fleet managers focus on the basics when acquiring new vehicles for their fleets. Practical considerations, such as vehicle “quality and durability”, “driving range” and “fuel efficiency” are the most important factors, while “exterior and interior design”, “vehicle brand” and “top speed” are considered less important.

Figure 19: Survey: What are the most important product characteristics when acquiring a new LCV/eLCV?

eLCV customers expect charging hardware as part of the system offering

We also asked customers which additional services they would expect in an attractive eLCV “system offering”. By system offering, we refer to electric vehicle-related services offered by the OEM in conjunction with their vehicles. Consistent with other survey responses, charging was their main concern. On-premises “charging stations” were mentioned as the most important element of an eLCV system offering, followed by “access to public charging networks”. More peripheral services, such as “green energy contracts” and “eLCV-specific apps and telematics” were considered “nice to have” but not essentia

Figure 20: Survey: What are the most important elements of an eLCV system offering?

Fleet customers value their personal sales contacts

When investigating purchasing requirements of potential eLCV customers, we also explored their affinity for new, more unusual purchasing channels such as direct online sales platforms. Survey results and personal interviews show that fleet customers value their personal relationships to their key account managers and/or sales reps at their local dealers.

Many fleet customers demonstrate long-lasting brand loyalty when it comes to their LCV fleet compositions. In many cases, loyalty even goes beyond the brand, but is, rather, related to a specific sales representative. Key account managers and dealership sales personnel are often perceived as trusted product advisors – a relationship that online platforms cannot deliver. Discussions with fleet managers revealed that having a trusted personal contact in the purchasing even increases in importance when considering buying eLCVs.

These vehicles come with new, complex technology, as well as different maintenance, repair and operation requirements. eLCVs require extensive product explanation, testing and consulting. This is also true for peripheral topics such as electric vehicle subsidies and tax exemptions.

As a result, the majority of LCV fleet managers prefer to stick to their local dealers or OEM key account managers as their preferred sourcing channels for eLCVs.

Figure 21: Survey: What is your preferred sourcing channel for eLCVs going to be?.

Aftersales: Fleet managers expect state-of-the-art services for eLCVs

LCV fleet managers are used to receiving special aftersales services as business customers, and not willing to make any sacrifices when switching to eLCVs.

Longer and more flexible workshop opening hours, pick-up and delivery services, and replacement vehicles for the duration of vehicle maintenance are standard in the commercial vehicle sector. In order to maximize their vehicles’ operating time, fleet managers expect the same service offering from eLCV manufacturers.

Our survey shows that all elements of a standard aftersales offering to fleet customers are considered similarly important.

Figure 22: Survey: How important are the following aftersales offerings to you?

In addition, fleet managers expect a dense service and repair network for flexible service and repair arrangements on short notice. Almost 75 percent of panelists would not accept distance to the next workshop of more than 20 km. This certainly represents a challenge for smaller eLCV manufacturers trying to enter the market.

6

TCO comparison

In addition to leveraging eco-friendliness as a main feature in their marketing efforts, manufacturers consistently advertise their eLCVs’ low operating costs compared to those of combustion engine vehicles. Given their considerably higher average price tag, this operatingcost advantage of eLCVs needs to be sizable in order to compete with diesel vehicles from a “total cost of ownership” (TCO) perspective.

Lower operating costs of eLCVs counter the price gap, but cannot close it

How do eLCVs perform against their diesel counterparts in terms of TCO?

To address this question, Arthur D. Little has developed a TCO model to compare vehicle models. The model includes oneoff costs (e.g., purchase price), operating costs (e.g., energy, insurance, maintenance) and residual values.

Figure 23: TCO model

To make results meaningful we compared the same vehicle models of a given OEM (diesel versus eLCV) against each other and defined a set of main assumptions for the TCO calculation:

- Operating cycle: three years

- Annual mileage: 30,000 km

- eLCV purchasing subsidy: €4,000

- Electricity cost: €0.14 (net)/kWh

- Diesel cost: €1.05 (net)/l

- Current purchasing subsidy: €4,000

Based on commercially and publicly available data, we have also developed specific assumptions for each vehicle model with regard to

- Residual value

- Insurance fees

- Maintenance & repair cost

- Energy consumption rates

Results of the analysis show that diesel vehicles still have a TCO advantage over a three-year operating cycle.

Despite their significantly lower operating cost, eLCVs’ total cost of ownership is consistently higher than that of their diesel counterparts. The TCO gap between diesel LCVs and eLCVs ranges from 10 to 30 percent.

Figure 24: TCO comparison – diesel versus eLCV (unnamed brand)

As the exemplary calculation shows, residual values are problematic for eLCVs in any TCO comparison to diesels. This is mainly due to the fast progression of battery technology and steep degression of residual values of batteries over time.

Conclusion

Interest among potential customers is high, but concerns often prevail

Our online survey and in-depth discussions with potential customers alike show strong interest in eLCVs among German fleet managers. In practice, however, their lack of experience with this new drivetrain, as well as range and reliability concerns, still leave them reluctant. Professional buyers are less driven by a pioneering spirit than private EV buyers are, since their purchase decisions tend to be more rational. eLCV OEMs should address these concerns in their marketing efforts. Providing field data and real-world driving ranges, as well as actual operating cost of their vehicles, would help significantly in gaining the trust of potential buyers. Many of the concerns of fleet managers mentioned in our study are based on lack of information and transparency about the pros and cons of eLCVs. In order to address the negative myths in the market, OEMs should also leverage positive experiences of current eLCV operators for promotional activities.

Leverage regulation trends for your marketing and sales activities

With a growing number of low emission zones, diesel bans in major cities and governmental incentive programs for EVs, emission regulation in Germany’s urban areas is continuously getting restrictive. Many LCV fleet operators will need to react soon to avoid putting their businesses at risk. Interviews have shown that many fleet operators have not taken current diesel bans in German cities too seriously due to their small regional or local scale. In reality, however, this may just be the beginning if emissions levels in many cities continue to exceed EU limits. Educating customers about the potential impact of regulations on their businesses should be part of any eLCV OEM’s sales advice.

Interviews have also revealed that many fleet managers are only vaguely aware of eLCV subsidy programs or don’t want to deal with the approval process. OEMs need to consult potential customers about available subsidies and their application formalities in order to leverage public EV incentives for their purposes.

Focus on the “usability” of the vehicle

Both preconceptions of non-buyers and feedback from actual users show that eLCVs are still lagging behind diesel vehicles in terms of everyday usability. The major factor here is driving range. Achieving higher driving ranges should be top priority for upcoming vehicle-model generations in order to convince customers to switch. On a similar note, vehicle downtime is always a major concern of business customers. Using public charging stations to recharge during daily operation rarely is a viable option nowadays because most models are only able to use low-speed A/C charging. Equipping eLCVs with D/C-ready onboard chargers could significantly contribute to extending their usable daily driving ranges.

No compromises on aftersales services allowed

Customers’ feedback on aftersales service expectations for eLCVs was unmistakable: fleet managers were neither willing to make any compromises nor concede a “honeymoon period” to eLCVs. As a bare minimum, OEMs need to replicate the experience of a conventional LCV in order to meet customers’ expectations. While larger LCV manufacturers “only” need to make their established service and repair networks “e-ready”, this level of expectation certainly represents a challenge for any new entrant or smaller player.

Be creative to overcome the price gap

Our TCO analysis has shown that lower operating cost of eLCVs only partially covers the significant purchase-price gap in favor of diesel vehicles. In order to be competitive and facilitate stronger market uptake, eLCV OEMs need to employ creative and attractive financing or leasing models to reduce purchase barriers. Subsidized leasing contracts and buy-back arrangements could be options – at least in the current market phase. With battery costs steadily decreasing, the residual-value disadvantage of eLCVs will likely become less severe over time.

DOWNLOAD THE FULL REPORT