CLAIMS MANAGEMENT EXPERIENCE

In today’s mature and hypercompetitive insurance market, insurance companies’ growth within their core business is often limited to winning customers from other insurers. Therefore, as this growth strategy results in high customer acquisition costs, it is critical for insurance companies to boost loyalty to ensure profitability.

Given the nature of the business, customers have little or no interaction with their insurance company until they call for assistance, so customer experience is greatly determined by the way an insurer manages these claims. In fact, recent studies show that more than 80% of customers have considered changing their insurance provider after a negative claim experience. In this scenario, it is clear that managing claims to meet or exceed customer expectations is critical for both retaining customers and winning new customers and thus ensuring profitable growth.

Additionally, there are social and technological trends disrupting the industry model, including the increasing customer inclination toward omnichannel communication, the appearance of automation for customer-facing processes, the growing usage of Internet of Things (IoT), and the availability of data since customers are increasingly willing to provide personal information in return for better service or lower premiums.

Amid this context, Arthur D. Little (ADL) has identified five levers for allowing insurers to build an excellent claims management experience, whether for compensation or repair:

- Creating a unified customer service function.

- Building an efficient and quality-focused service provision model.

- Digitalizing and automating the claims management process.

- Generating a data-based management model.

- Assembling internal capabilities to ensure a continuous improvement cycle.

CREATING A UNIFIED CUSTOMER SERVICE FUNCTION

Customer service is the first contact the customer will have with the insurer and may be considered the “moment of truth.” This contact often takes place during a stressful situation for the customer, such as following an incident that requires assistance, and should be carefully managed.

To ensure excellent customer service, ADL’s experience highlights two critical considerations:

- Success lies in finding the right balance between unification and specialization.

- Full control of the process, whether insourced or outsourced, results in higher satisfaction and valuable feedback.

Find the right balance

First-call resolution results in higher customer satisfaction. In its absence, transfers generate frustration and anxiety when customers feel especially vulnerable. For repair claims, customer service agents should be able to arrange appointments directly with repair technicians, according to the customer’s preferences.

However, claims may be diverse and complex, so customer service agents require appropriate specialization to ensure they are qualified to respond to the customers’ needs. Therefore, customer service should be built upon a partially specialized team that can support the process end to end, eliminating the need for transfers. To fully leverage this team, the technological infrastructure should enable initial screening of each customer contact and then assign the contact to the appropriate agent (specialist). In all cases, customer service agents should be trained to offer adequate and considerate support to claimants.

Control the process

The customer service function should be designed to allow the insurer to oversee its activity in detail, guaranteeing that service meets defined quality standards (e.g., average handle time, script, claims rejection). The design should also allow for gathering precise data about each interaction with customers, which could then be leveraged to improve the process and even adjust the product portfolio.

Building such structures requires careful process design and setting relevant KPIs. Additionally, when case customer service is outsourced, a robust agreement with the provider is critical to enable the same kind of collaboration and reporting.

BUILDING AN EFFICIENT & QUALITY-FOCUSED SERVICE PROVISION MODEL

Insurance customers generally have high expectations regarding quality of assistance, resulting in costly services for insurers. Service providers may also increase costs, as they tend to overdeliver to ensure customer satisfaction (e.g., a healthcare provider might order various diagnostic tests for a patient when a single test could determine the problem). In this context, insurers should carefully design their service delivery model to ensure a consistent quality level while controlling costs.

First, insurers should evaluate their service provision model, identifying which are the core functions and then assessing the outsourcing potential of each function in terms of achieving real cost reductions, boosting operational flexibility, and bringing in innovation capabilities while keeping customers happy.

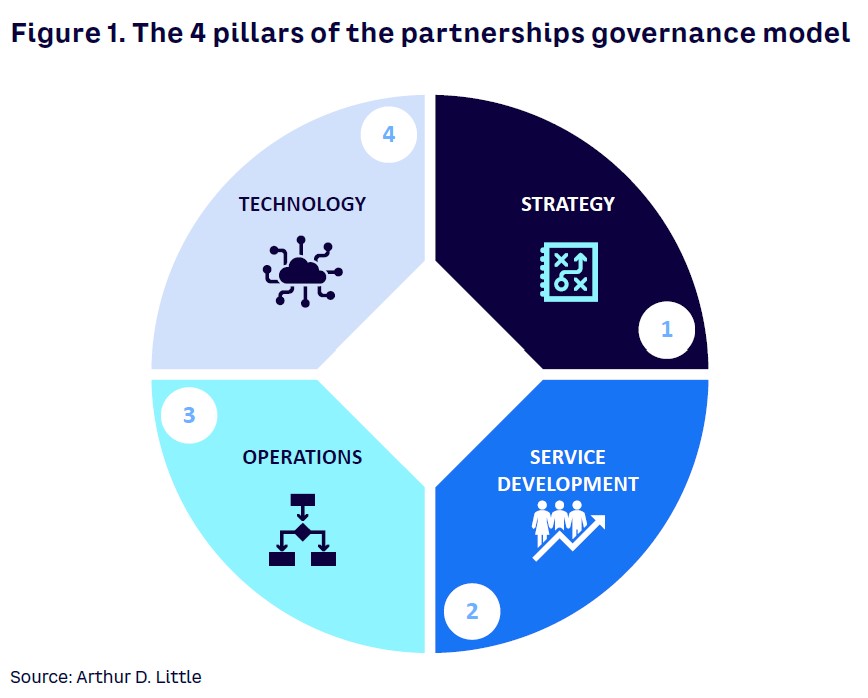

Once insurers have identified the functions suitable for outsourcing, ADL analysis shows that the key for success lies in establishing a partnership with the provider rather than a regular customer-provider relationship. Partnerships should be based on a governance model structured around four pillars that are included in the agreement (see Figure 1):

- Strategy — aligning both the insurer and the provider on a common vision and incentives surrounding the delivery model and the objectives it aims to achieve.

- Service development — ensuring that new ideas and business initiatives are translated into projects with their corresponding resources and management structure.

- Operations — guaranteeing a common operations management model (open books) that enables the insurer to have full visibility over the provider’s operations, so profitability could be prearranged while processes are optimized.

- Technology — agreeing on a common strategy, where both parts aim to build a common IT infrastructure to support the business model (i.e., sharing ideas, resources, and investments) and reduce the burden that otherwise would be assumed by each part.

A partnership agreement only makes sense as a long-term relationship, where the insurer signs a multiyear service contract with the provider. Without such an agreement, the provider might be unwilling to invest in joint technological/business development, rendering the partnership benefits unachievable.

Building on such agreements allows outsourcing providers to focus on delivery rather than profitability or commercial activity, improving customer satisfaction.

DIGITALIZING & AUTOMATING CLAIMS MANAGEMENT PROCESS

Insurance customers have typically used call centers for submitting claims, but in our client work, we are observing customers increasingly moving to digital channels. When contacting their insurer regarding a claim, customers seek real-time status updates and transparent information, which are the key levers to increase NPS.

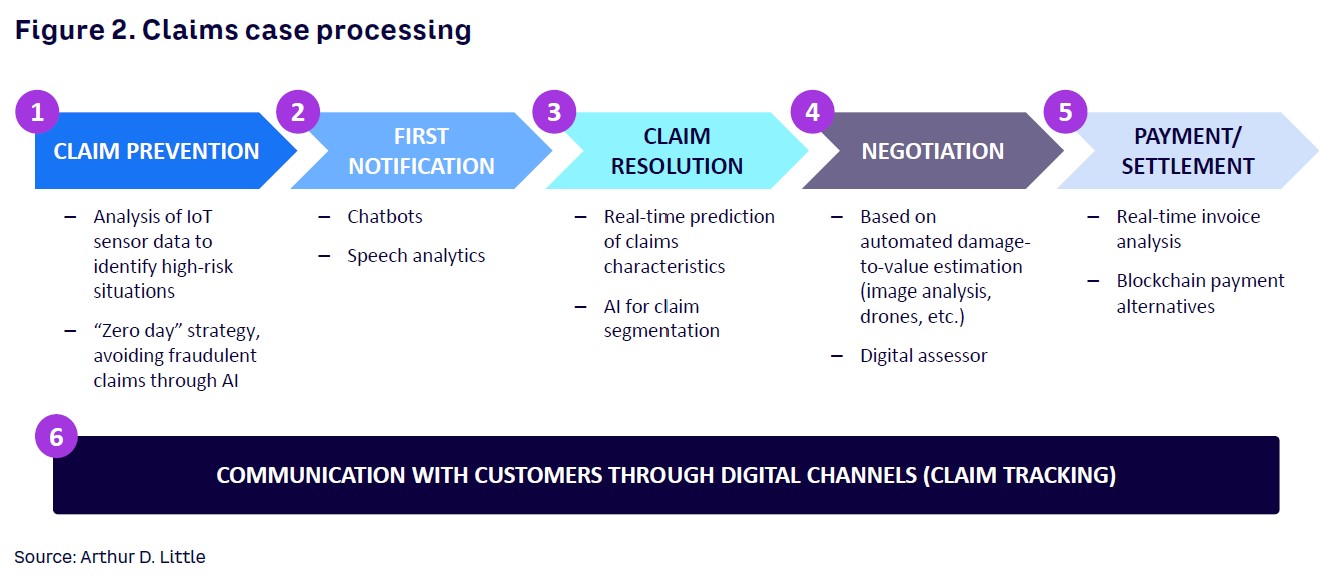

In response to these customer demands, insurers must explore the potential digitalization offers when applied to claims management (see Figure 2).

End-to-end digitalization of the claim’s journey could be difficult to achieve in the short term, especially as the adoption of some technologies could be complex in the absence of previous experience. In this context, ADL suggests a two-step approach, where insurers set quick wins aimed at transforming customer experience in the short term while designing a long-term plan for fully digitalizing the claim’s journey.

ADL has identified three areas of opportunity for short-term digitalization in claims management:

- Claims notification. Allow customers to notify a claim through digital channels (browser or app), including all data and even images/archives in one single procedure through an intuitive and always-available channel. For successful implementation, the process and associated decision trees must be carefully designed, ensuring a streamlined and simple experience. The front end could be based on off-the-shelf (OTS) solutions.

- Claims tracking. Building a digital platform that enables customers to look up their claim’s status in real time is critical for customer satisfaction. This kind of service could be built on OTS technology, as the claims’ notification front, but it relies on the insurer gathering precise and real-time information from service providers. That is a key reason full control over customer service and service delivery is needed. This point is especially relevant for repair claims where various technicians are involved and when the customer needs absolute clarity about when the technicians are going to visit the customer’s home or business.

- Claims negotiation and payment of compensation claims where quick settling and payment have a significant impact on customer satisfaction. For high-frequency and low-severity compensation claims, insurers could automate payment by combining digital notification (the customer uploads all documents including pictures and invoices) with optical character recognition and basic artificial intelligence (AI). Automation should be designed carefully, as insurer-sponsored analysis has shown that poorly designed digital platforms for managing claims leads to higher service costs when compared to the use of call centers. However, well-designed platforms could impact customer experience and drive down service costs, improving an insurer’s combined ratios. These platforms can provide the foundation needed for further optimization of claims with the help of AI technology (e.g., fully automated acceptance and processing of claims based on historical data), avoiding human interaction for noncomplex and repetitive claim situations.

Fraud detection can also benefit substantially from digitalization of claims notification and application of machine learning (ML) algorithms. Using such technology, insurers could improve their fraud detection rate while reducing the resources allocated to the task. Additionally, automated fraud detection is key for successfully implementing automated claims payment.

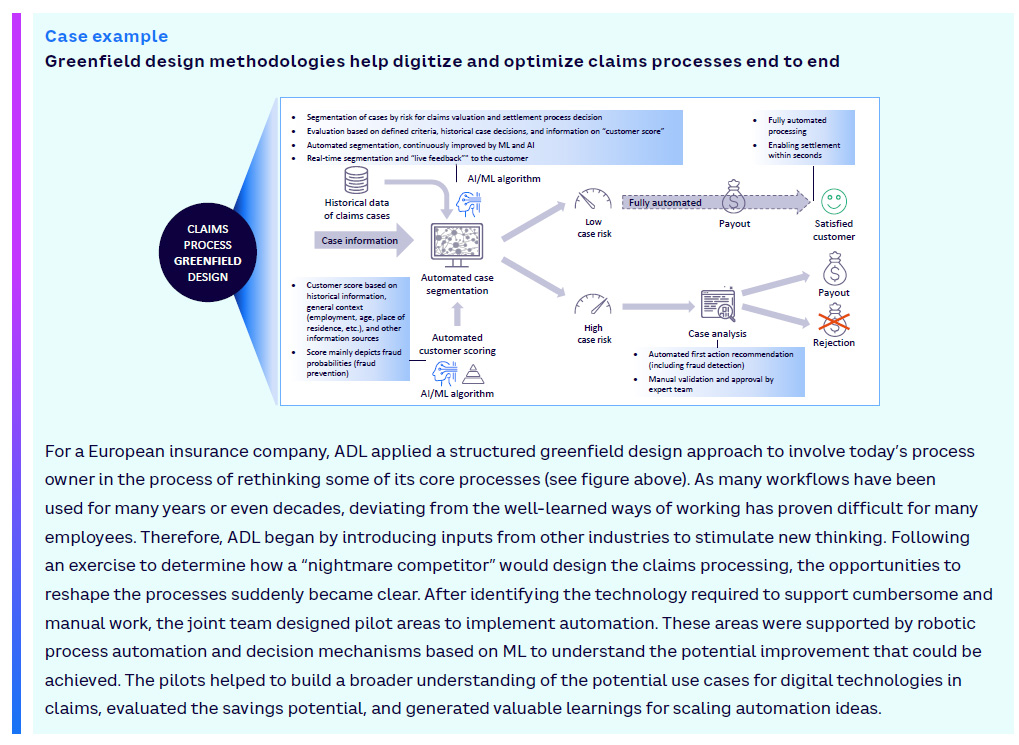

While the initial approach in many cases will be the evolutionary redesign and automation of existing processes in claims management, insurers should consider a selective greenfield methodology to innovate processes end to end and design new workflows that focus on customer experience and process productivity (see case example). This avoids the risk of automating and digitizing an already outdated process.

GENERATING A DATA-BASED MANAGEMENT MODEL

The three levers, when adequately designed and implemented, must allow insurers to collect exhaustive information about service delivery, open claims status, and customer needs. Gathering, processing, storing, and accessing this data requires a flexible and scalable technological infrastructure that can grow in complexity as data becomes available. This infrastructure (usually cloud-based) must also enable the integration of analytical capabilities so operational teams can leverage data to obtain valuable insights.

Building on experience, ADL highlights three ways insurers can leverage this data:

- Driving operational excellence. Precise information about service quality, delivery times, and associated costs allows insurers to closely supervise their partners and set up remediation plans in case any KPI is diverging from the established service levels. This oversight also enables insurers to identify best practices and extend them to the full partners’ network.

- Boosting operational flexibility. If the insurer has complete and consistent information about each claim, reported in real time, decisions about the claim could be insourced even if service delivery is outsourced. This model enables the insurer to control critical decisions regarding claims management despite the chosen service delivery model, so the insurer could change the model and even the partners without losing control or knowledge about the process.

- Improving customer experience. As stated in the digitalization lever, receiving precise and timely information allows the insurer to inform the customer of the claim’s status at any given time and through any channel. This is critical to improve customer satisfaction and even customer trust in the insurer, and to optimize the emotional connection of the customer to the insurer.

ENSURING CONTINUOUS IMPROVEMENT CYCLE

To support implementation on all these levers and extract their full value, insurers must equip themselves with three key internal capabilities:

- Customer experience improvement. Insurers should assemble an internal team dedicated to the continuous improvement of customer experience. This is achieved by building new processes, creating innovative experiences, and designing new products based on the insights obtained through data.

- Service delivery supervision. Creating a team dedicated to overseeing the partners network, with deep knowledge about the network’s internal processes and capabilities, is key to ensure quality and efficiency.

- Data savviness and analytics. As data is key to optimizing claims from the perspectives of customer experience and internal process, a company’s maturity around the handling of data is important for success. Insurers must therefore focus on data quality and processes, a data-sharing culture, and establishing data management roles. Additionally, a dedicated analytics team is needed to leverage the collected data, enabling the data-based management model. At a mature stage, the team should blend different profiles like data engineers (data modeling and ETL processes design), data scientists (analytical algorithms development), visualizers (user interface design), and full stack developers (API development for implementing algorithms).

CONCLUSION

PURSUING EXCELLENCE IN CLAIMS MANAGEMENT

The following points are key elements within an integrated ecosystem covering claims management, underwriting, sales and distribution, and reinsurance. Synergies created by sharing and analyzing data across all key functions and partners will drive performance improvement, particularly in relation to customer retention and reduction of losses and associated handling costs. Thus, insurers should consider:

- Gathering relevant and precise data in real time is the key asset to achieve excellence in claims management. It allows insurers to know their customers’ needs and ensure quality and a timely service delivery. Additionally, full control of data enables insurers to own key decisions regarding the process, reducing dependencies on providers and boosting the flexibility of the model.

- Transforming providers into partners boosts mutual trust, allowing partners to focus on service quality and efficiency. Therefore, it has the potential to significantly improve customer satisfaction, as well as enable insurers to leverage their partners for launching innovative services.

- Digitalization requires a carefully designed strategy with a two-step approach divided into quick wins and long-term goals, focused on good design that includes claims notification, tracking, and settlement as the key areas of opportunity for the short term.