Claims management is growing increasingly complex, presenting an enormous challenge for insurance companies to identify new opportunities and define solutions. A pragmatic and detailed analysis of a random sample of closed claims enables insurers to identify customer and provider journey pain points, as well as reveal opportunities for the claims management team. In this Viewpoint, we share a tool for pinpointing the root causes of claim errors, quantifying areas for enhancement, and designing new opportunities for boosting insurance companies’ continuous improvement.

UNLEASHING POTENTIAL OF INSURANCE FIRMS

The lifecycle of an insurance claim is the process a claim goes through from the time it is submitted by the provider until it is paid by the insurance carrier. Yet what sounds like a straightforward procedure in fact involves multiple claim situations, various agents with often conflicting priorities, and limited visibility into who is doing what, where, and how. Arthur D. Little (ADL) has found revisiting a random sample of closed claims to be a highly effective tool to uncover potential weaknesses in claims handling.

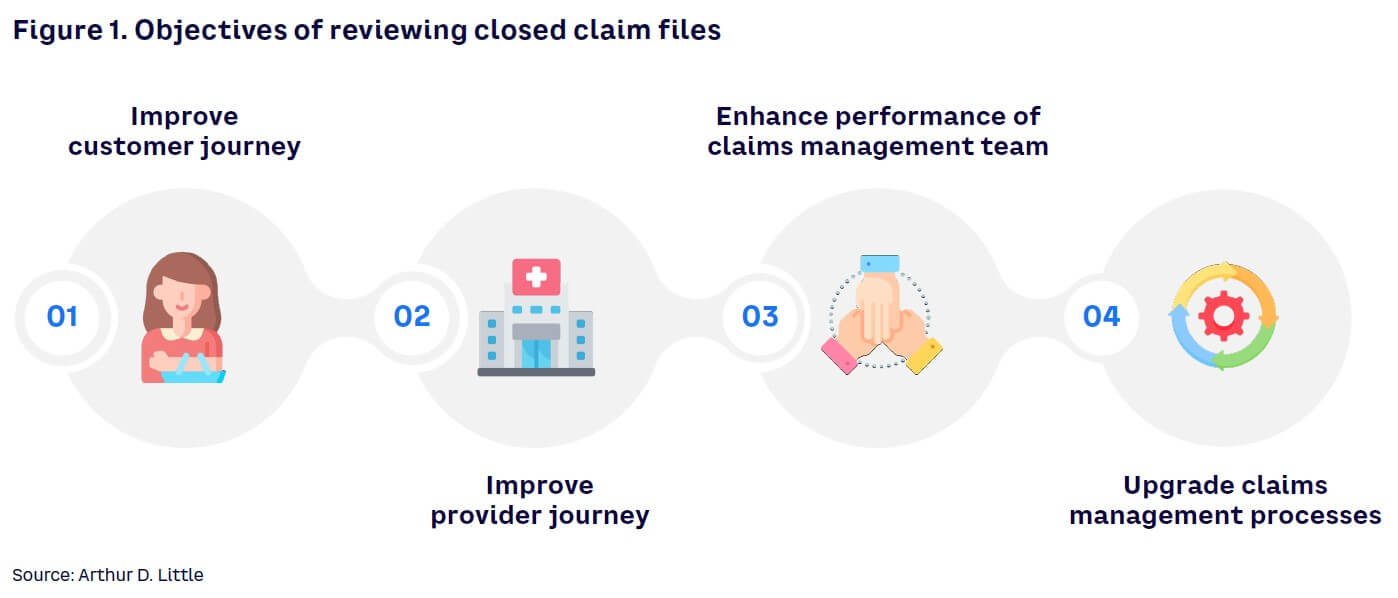

Insurance companies may opt to review and score how processed claims were handled to pursue a variety of objectives (see Figure 1):

- Improve the customer journey. The study of claims will identify areas where the insurance company might be putting in place an unjustified number of barriers and thus generating unnecessary and time-consuming pain points for the customer.

- Improve the provider journey. By having a full understanding of the provider journey, companies can work toward standardizing rules and procedures, ameliorate communication with providers, establish a clear authority matrix, and reduce the burden on the claims reconciliation team.

- Enhance performance of claims management team. A review of closed claims can lead to training opportunities and foster a company culture of continuous improvement.

- Upgrade claims management processes. A comprehensive view of current claims processes can steer the insurance company toward process automation for low-complexity claims and the diversion of claims of higher value to designated specialists.

As promising as the outcomes sound, however, companies must accept inefficiencies as an inevitable part of their operations and delve into their sources with curiosity and a willingness to change.

DEEP DIVING WITH ONE GOAL: SAVINGS OPPORTUNITIES

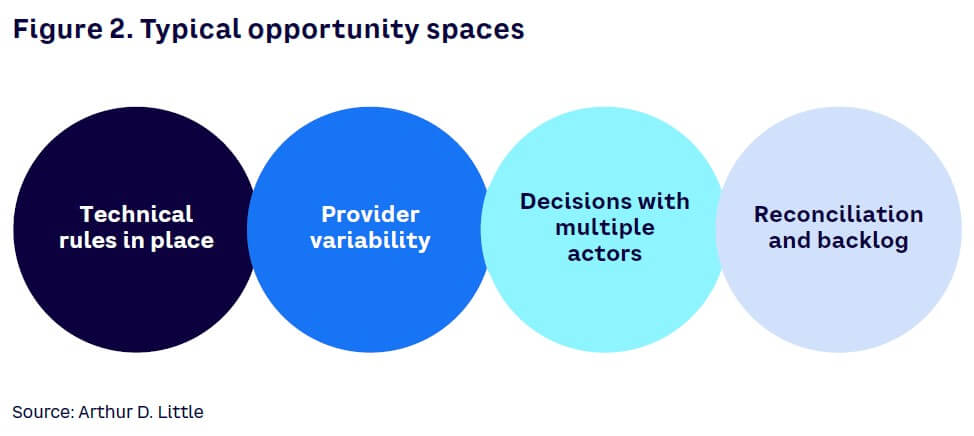

Companies may decide to revisit how claims have been dealt with in the past using different goals. A common objective, however, is to identify the root causes behind inefficiencies that ultimately led to monetary losses. There can be several causes for these monetary losses, including inefficient claims processing, lack of business or technical rules, errors in payments, fraud, and many more (see Figure 2).

Monetary losses are classified as direct or indirect. The former refers to costs incurred by the company that should not have occurred (e.g., duplicate payments or claims sent after the established threshold period). Indirect losses, in contrast, are related to indemnity spend that could have been avoided or reduced through better handling or decision making (e.g., lack of supporting documentation or soft negotiations with providers). Whether direct or indirect, all inefficiencies should be prioritized, identified, and addressed to reduce the loss ratio.

UNDERSTANDING THE METHODOLOGY

Assessing closed claims involves evaluating closed files against end-to-end claims process best practice to identify money that the insurance company should not have paid. A full review of selected claims allows the insurer to identify patterns and root causes of losses and quantify the potential P&L impact. ADL estimates monetary losses after the review of closed files is an average of 5%-15% of the total claims costs.

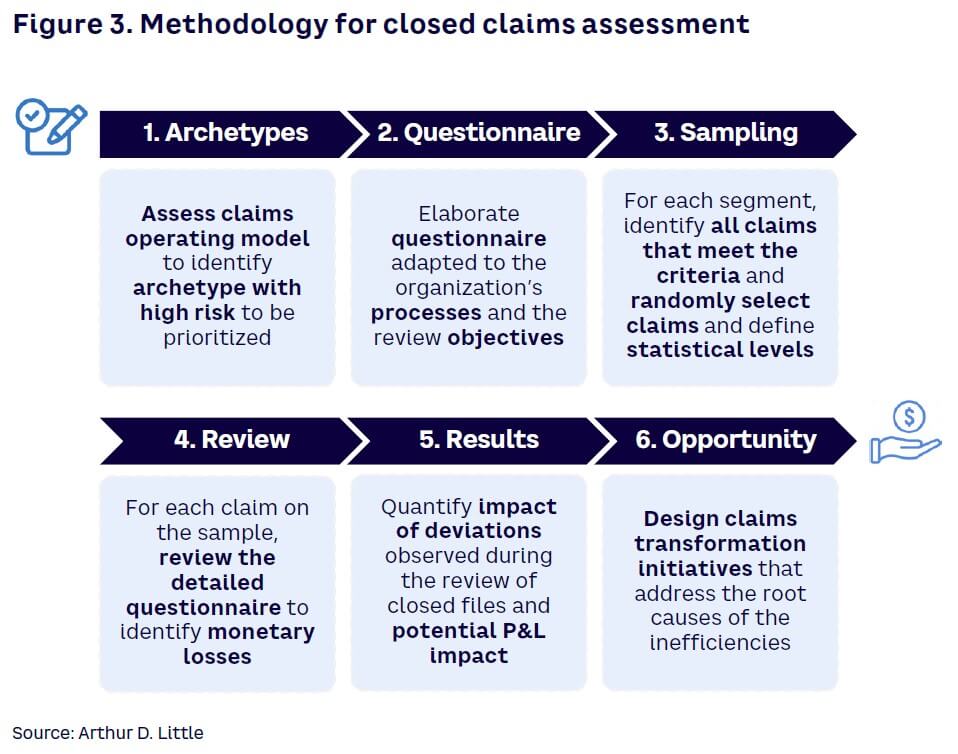

We suggest assessing closed claims by following a pragmatic and structured methodology in the form of sprints (see Figure 3):

- Archetype definition

- Questionnaire elaboration

- Sample preparation

- End-to-end claim revision

- Results extrapolation

- Seizing the opportunity

1. Archetype definition

To begin, insurers establish the different claim archetypes. A claim archetype is a set of claims that share characteristics and are processed in a similar manner. To elaborate archetypes, we diagnose the claims operating model in a top-down manner to identify the archetypes with the greatest potential for improvement, which then can be prioritized for immediate action.

2. Questionnaire elaboration

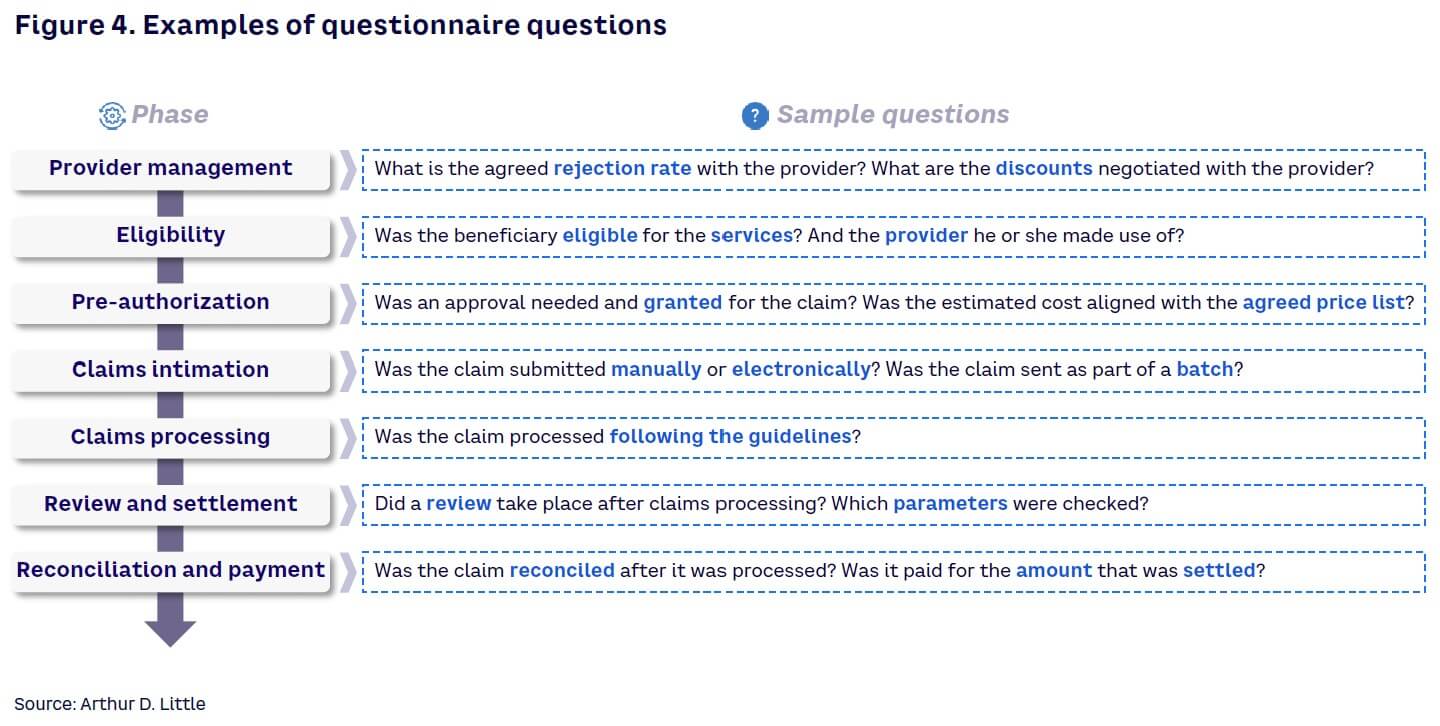

The assessment process must be done in a structured and standardized way, tailored to the specific process of each insurance product. Therefore, first step is to fully map out the different claims management processes to gain a detailed understanding not only of the processes but also the people performing each of the tasks, inputs and outputs, IT support systems, controls, and interdependencies.

With a clear picture of the claims management process, the insurer can draft a specific questionnaire that runs through the steps. The questionnaire must cover all the required steps and facilitate identification of improvement opportunities. A standard questionnaire includes 120-150 questions. The questions should flow logically and align with the end-to-end claims management process to facilitate the assessment (see Figure 4). The questionnaire should also include specific queries that delve into areas where enhancement opportunities are more likely to occur.

3. Sample preparation

Before starting the assessment, we retrieve random samples for all the archetypes that were defined in the archetype definition and group them based on archetype and period of time. This exercise can be done with a data analytics software tool, such as Tableau or Power BI, using the detailed claims register most insurance companies have in their system.

The second step for preparing samples is to set statistical levels that match the sample size. Since the sample size must be statistically significant given the claims population, a common approach is to set as a goal a 90% confidence and 10% margin of error, which implies a total of 90 samples per archetype. A pragmatical rule of thumb is to calculate an average of 10 minutes to review one claim. This translates to around 15 hours to review the claims for a given archetype. Nevertheless, total time will depend on the archetype complexity: an automated outpatient medical claim will most likely be reviewed more quickly than a manually processed inpatient claim, for example.

4. End-to-end claim revision

The core of the exercise takes place at the revision stage when the team is formed. In addition to external consultants, the team should include agents from each step of the claims value chain. With the team assembled, the necessary systems up and running, and supporting documentation for all claims gathered, the real assessment can begin. With the help of a supporting questionnaire to guide the process, each closed claim from the sample is evaluated against the current setup and best practice to identify divergences, focusing on key actions and decisions made at each step of claims processing. During the process, every instance where the claims file shows a deviation of the agreed best practice is documented and quantified in terms of economic value.

5. Results extrapolation

Next, the divergences observed and quantified during the review of the random samples for each claim type are extrapolated to the total archetype population. As an example, if, during the review, two unjustified duplicate payments occurred for a specific archetype (it will be 2.2% over total size of a 90 claims sample), we can extrapolate that ~2.2% of the total claim archetype count will present the same issue. The same logic applies when quantifying the excess money that was paid.

This exercise is performed for all opportunities identified to provide an overall quantification of the major opportunity sources. Then, these opportunities are clustered according to their root cause. If a duplicate payment took place, for example, was it because of a lack of technical rules? Or was it because the authority matrix was overridden without prior controls? All of these reflections will lead to the elaboration of potential solutions.

6. Seizing the opportunity

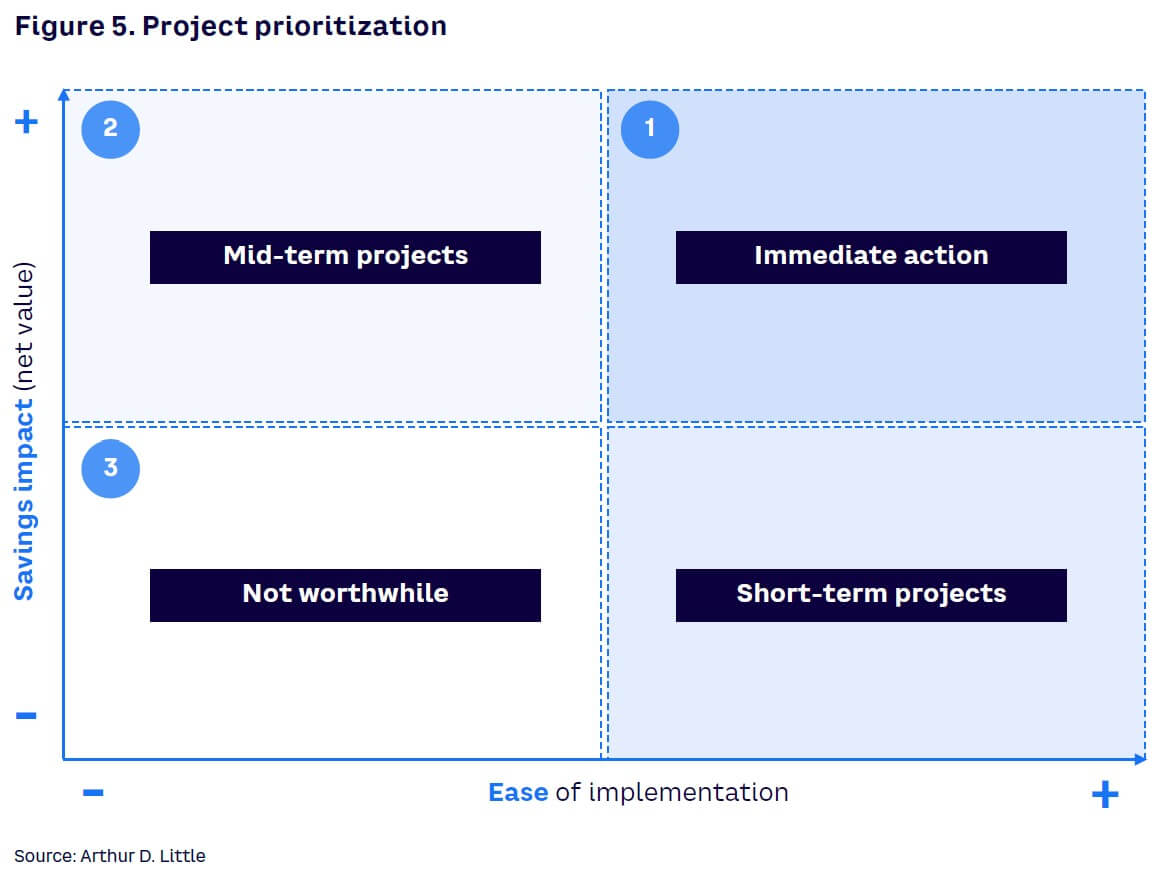

Monetary impact identified during the extrapolation can be translated to potential savings. And to convert potential savings into actual money, insurers must determine the measures that address the root causes behind inefficiencies. Each project requires a defined scope steered by a project leader with a clear understanding of the set of key tasks to be performed, including IT, processes, and people. Moreover, projects must be prioritized taking into consideration factors such as ease of implementation and potential savings impact (see Figure 5).

During the design of solutions, enhancing process automation and leveraging technology solutions can be valuable tools to help the insurance company improve consistency of decisions and the overall claims processing. Moreover, process automation allows firms to focus expensive and specialized resources on high-value tasks.

Conclusion

Call to action

A high-performance claims function is crucial for the success of any modern insurer: claims are the moment of truth for the customer and the biggest cost in the P&L (especially in retail businesses). As claims complexity increases with new products, coverages, and lines of business, it becomes increasingly difficult to identify and quantify improvement opportunities. In our experience, assessing how closed claims were handled is a powerful tool to gain real insights on opportunities, clearly identifying root causes and allowing a robust quantification and prioritization. Closed claims assessment can be an intense and time-consuming activity, but the savings potential clearly outweighs the effort involved. Regular assessment should be considered a key exercise for insurance companies and be integrated into their continuous improvement activities.