In the Gulf Cooperation Council (GCC), assets of corporate banking are three times larger than those of retail. Yet GCC banks focus their corporate external communication primarily on the consumer segment. A number of challenges and opportunities exist today that illustrate the increasing importance of the corporate segment for banks. This Viewpoint reviews the impacts of recent disruptions and explores options for banks to strengthen and grow their corporate and investment banking (CIB) business.

GCC CIB FUNDAMENTALS

Corporate banking assets in the GCC region represent more than three times those of retail banking. Yet banks’ communication and media coverage traditionally focuses on the consumer segment, whether it is fintech, strategy, digital transformation, products, or applications. This is true in part because it is often easier to communicate about a B2C business than a B2B one. Also, corporate banking is often perceived as a specialist area and, as a result, innovation is frequently — and often mistakenly — thought to be focused in the retail banking sector. However, there are a few important reasons for the primary focus to return to corporate banking:

- An inflationary storm is ahead, and CIB will be critically exposed to it. Capital and debt are now rare resources, and banks need to monitor their adequacy ratios and optimize allocation based on diversification, return, and risk targets. At the same time, business is massively driving consolidation in CIB. For example, with a GDP of US $1,040 billion, Saudi Arabia has just 10 major banks. (With a slightly higher cumulated GDP, the five other GCC countries each counts more than 60 active banks.) The pattern in Saudi Arabia is similar to that of France, the UK, Canada, and Switzerland.

So why do other countries feature more banks? Of course, separate licenses for Islamic banking and intra-country territorial divisions play a role. However, CIB is what keeps smaller banks afloat, as it offers relatively high credit spreads with limited fixed costs. For these players, CIB business transformation is often the only option for these players to remain independent and profitable.

- CIB is heavily impacted by environmental, social, and governance (ESG) efforts. Particularly with CIB, ESG represents a new dimension by which investors judge banks, so banks must allocate resources to ESG to improve their performance versus the competition. Additionally, ESG adds to CIB strategic planning uncertainty, as most of the impact of the portfolio allocation by sector and geography depends on the individual strategies of the clients themselves. Eventually, large European CIB players are noting that ESG considerations may cause otherwise stable clients to look closer at prices and sometimes to change banks, leading to shopping-around behavior that is otherwise less common for that segment.

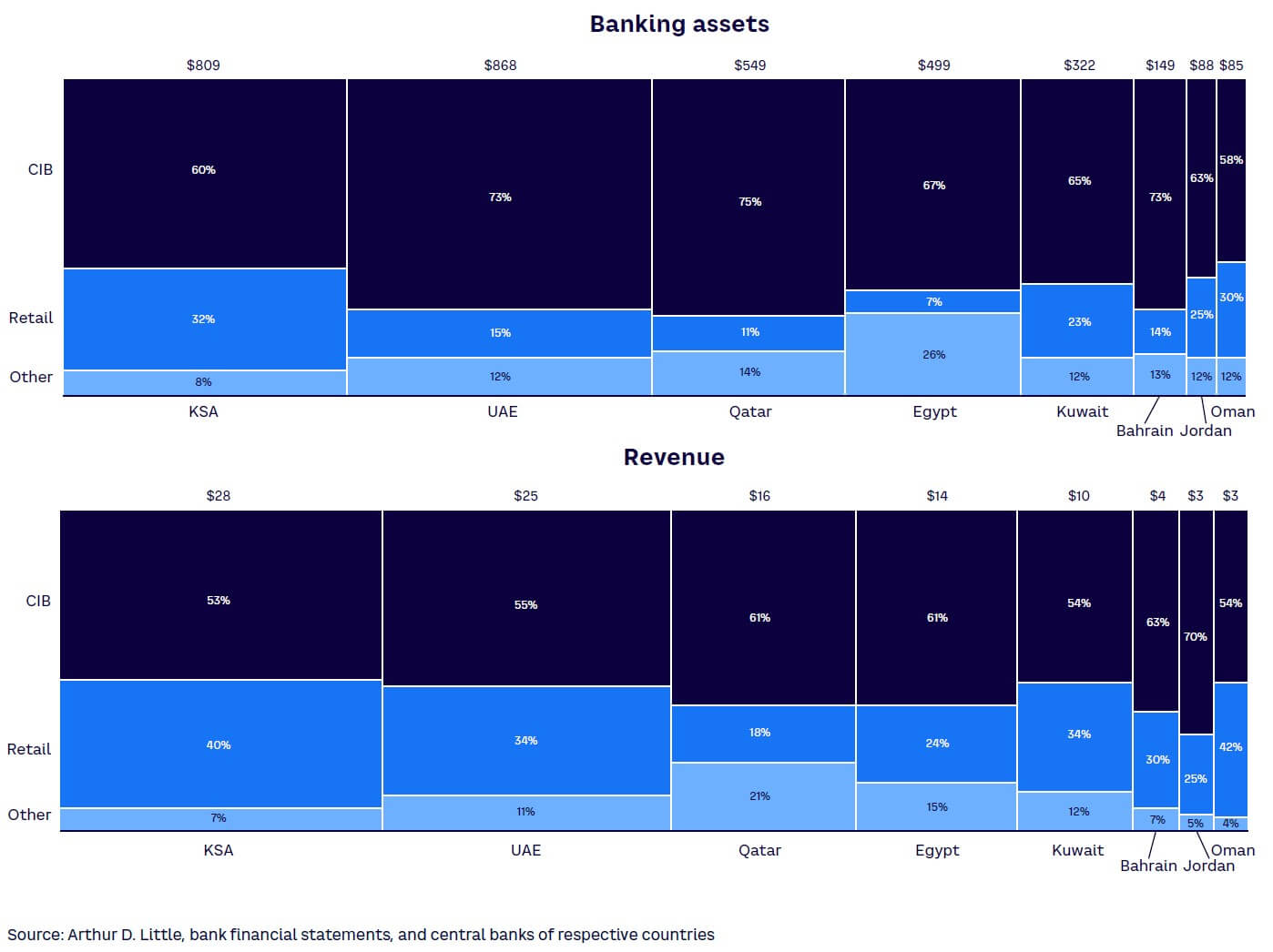

- CIB offers a significant upside potential. While the retail segment is closer to reaching saturation, CIB, which accounts for about 70% of assets in GCC (see Figure 1), benefits from several growth drivers. Clients are facing increasingly complex issues (e.g., in cross-border and transaction businesses) that require new solutions from banks. In addition, the SME segment remains underpenetrated. The potential of digital optimization remains mostly untapped as well, and sizable innovation opportunities exist in the space of blockchain and cryptocurrencies.

These challenges and opportunities are happening in the context of a young banking sector with limited turnaround history, the emergence of a digital business model, and fast-shifting client expectations toward banks.

BANKS UNDER STRESS

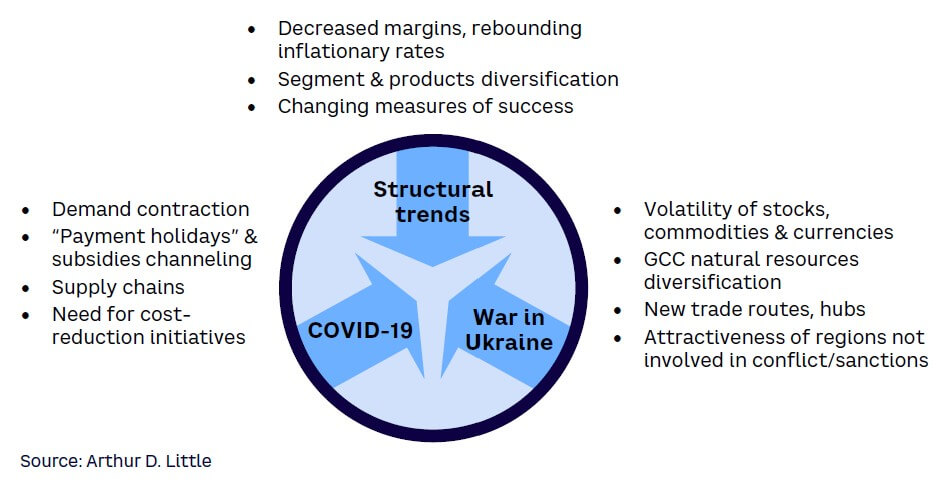

At the same time, CIB businesses are facing an increasingly competitive, fast-evolving, and complex environment that includes a variety of challenges caused by structural trends, COVID-19, and the war in Ukraine (see Figure 2):

- Structural trends. These include a continuous decrease of margins followed by rebounding inflationary rates. There is also increasing competition for larger clients, calling for segment and product diversification. And finally, there are gradually changing measures of success from top line to risk/capital-adjusted bottom line.

- COVID-19 has also created many challenges for banks, including volumes growth that is hampered by demand contraction. Regular commercial activity has also been disrupted by “payment holidays” and subsidies channeling. In addition, the havoc in the supply chain has impacted trade finance and long-term projects. Also as a result of the pandemic, banks are finding that there is an increased need for cost-reduction initiatives to cope with revenue loss.

- The war in Ukraine has added to volatility in stocks, commodities, and currencies, implying additional trading volumes and hedging needs. The war has also meant that GCC natural resources are needed in order to diversify supply, and new trade routes and hubs have been established in “neutral” areas. The conflict makes regions not involved in the conflict and/or sanctions increasingly attractive.

DEVELOPING A SUSTAINABLE BUSINESS MODEL

Since the beginning of COVID-19, Arthur D. Little has spoken with multiple bank CEOs and heads of CIB within and outside of the region. Four common imperatives have emerged from these discussions:

- Capital is now a rare resource and new tumultuous times are ahead, with the return of inflationary pressure and the drying out of the debt market. Banks must rebalance their current portfolios to optimize allocation based on diversification, return, and risk targets, and monitor those at the client level. Banks must also anticipate potential balance sheet cleanup and impact on tier-one capital, and also consider developing treasury and liquidity management capabilities in parallel.

- Revenue growth is constrained by slow recovery. Banks must maximize revenue per customer by spotting all opportunities for (re)activation and retention, cross/upselling, and pricing realization. Banks must also consider implementing, at least partially, variable rates and facility nonusage penalties to reflect the upward rate trends.

- Customers are expecting full support from banks despite dire circumstances. Banks have the opportunity to engage businesses beyond credit, such as with distressed M&As, debt capital market (DCM), or ESG transformation financing. Banks also must be ready to increase their nonperforming loan and restructuring management capabilities. Sectorial specialization will be required for banks to better understand the credit and transaction needs of their clients and risk profiles.

- Unsustainable economics require cost transformation. Banks should simplify business by reducing the complexity of the organization as well as the products and activities they carry out. Reducing their share of fixed costs requires the use of digital tools to optimize, automatize, and/or outsource part of the value chain, either to suppliers or to shared utilities.

Making strategic choices

At the same time, successful CIB strategies must leverage the bank’s core assets and capabilities to create a differentiated and viable positioning. Depending on the starting points, banks can articulate their strategic choices around a few dimensions:

- Ensure risk resilience and capital optimization in a volatile environment. The first lever remains the rebalancing of the portfolio to increase the share of sectors resilient to crisis and economic downturn (e.g., retail, healthcare, or education) and the degree of appetite for the mid-corporate segment that often offers better margins and cross-selling opportunities. Banks can also upgrade their financial restructuring capabilities (e.g., by using specialized providers and augmenting capacity). Measuring client value and potential from a risk-adjusted return on capital perspective is a prerequisite across the board.

- Orchestrate ESG, cost, and digital transformation and ensure bottom-line impact. Corporate banking is facing the complexity of multiple transformation programs led in parallel and the fact that those programs’ goals, actions, resources, and KPIs are not always fully aligned and compatible. Plus, some transformation programs, such as ESG, may entail a strong measure of uncertainty. Of course, the logic of ESG and digital transformations obeys different drivers. However, the same is largely true with the SME and equity capital market business. The best way to handle this conundrum is to adhere to just one strategy for the entire CIB, with a unique set of goals that are related to a set of core transformation activities that enable overall strategy, as well as a few hygiene factors linked to regulatory and compliance requirements. This approach is also a way to avoid transformation resources inflation by managing the activity portfolio on a zero-based budgeting basis, taking into account risk, return, and required resources.

- Use revenue improvement opportunities linked to client journeys optimization. Banks should be on the lookout for opportunities for (re)activation, cross-selling, and retention. They should also increase the volume of high-value transactions, fix revenue leakages, and ensure full pricing realization, creating cross-LoB journeys for affluent clients that own businesses. The choice is between sticking to a simple credit-centered model or pursuing a model that addresses the entirety of client needs. While the answer might be obvious from a revenue perspective, banks must address multiple operational challenges, including sales force enablement; de-bottlenecking silos between corporate, investment, and retail banking; and building new governance and KPIs around cross-selling targets.

Additional challenges

Banks must also address challenges that are common to all lines of business, including:

- Disintermediation. As the share of bank deposits in savings is impacted by fluctuating interest rates, some key issues banks face are keeping a view on actual client creditworthiness, creating an efficient ecosystem of producers and distributors, and managing asset liability management. To accomplish this, banks can:

- Make credit offers conditional on minimal share of wallet for deposits and transactions.

- Develop personal finance managers and aggregator offers to increase touchpoints with clients (particularly for SMEs).

- Develop commission income by cross-selling third-party products.

- Create clear ecosystem governance by defining roles and building a unit to manage cross-entity initiatives and enable tracking and transparency of results

- Consider use of debt capital markets while rates are still low, and possibly IPO. Move from a closed shareholder structure to an open stakeholder one. Stop credits with a low return on capital.

- Strategic cost transformation. Historically, high interest spreads and the need for corporate banking services have triggered the emergence of subscale banks. Key issues for banks to consider are reducing cost to serve clients, simplifying the value proposition, and modifying the organization structure to make it more flexible. To do this, banks can:

- Renegotiate conditions based on credit bargaining power. Establish pricing that deters nonprofitable clients and drives channel migration.

- Reduce product number, options, complexity, and development time. Involve sales force and clients in development process and pilot before rollout.

- Employ a gamification process. Encourage people to suggest initiatives beyond their scope of responsibility and create “implemented or out” deadlines for management.

Conclusion

ANTICIPATING NEW PARADIGM FOR CIB IN GCC

The digital transformation trend has caused widespread disintermediation and the need for scale across industries. As a result, banks must transform in much the same way that car manufacturers — and many other industries — did during the 20th century. This means moving away from an integrated model and outsourcing most value steps except a few strategic ones, such as design, assembly, and control. In response to these disruptive forces, however, banks have an unprecedented chance to broaden their business, reduce costs, and become more reactive. However, as was true with car manufacturing, this can lead to additional challenges.

As we have explored in this Viewpoint, with the strong hindsight of local regulators, the multiplication of banking accelerators for start-ups, and the rapid development of the fintech ecosystem, it is clear that the GCC CIB sector is poised to quickly integrate these new trends and successfully adapt them to the specifics of the local markets. To do so, however, four strategic imperatives need to be kept in mind:

- Maximize revenue per customer:

- Track client value and use commercial actions to improve cross sales.

- Fix revenue leakages and ensure full pricing realization.

- Create a seamless cross-LoB customer journey for affluent clients that own businesses.

- Protect capital and ensure risk resilience:

- Tilt the portfolio toward less cyclical sectors through repricing.

- Upgrade financial restructuring (e.g., use of specialized providers, capacity augmentation).

- Select “prime of risk” (best customers) to become the “house bank.”

- Transform cost base:

- Reduce product complexity and time to market through short-term, self-funded automation and cost initiatives.

- Use pay-as-you-go cost pricing to manage out unprofitable customers.

- Review all projects, investments, and CAPEX on zero-based budget basis.

- Explore inorganic moves:

- Anticipate further sector consolidation due to shrinking margins and high regulatory requirements.

- Develop near-banking businesses and increase product mix.

- Create joint-venture structures for services development (e.g., with tech companies).