26 min read • Healthcare & life sciences

Catalyzing digital health in India

Critical pathways for user adoption & driving the next wave of transformational use cases

FOREWORD

Digital health solutions are shaping the future of healthcare worldwide, driving numerous innovations and trends, including online pharmacies, telemonitoring, personalized medicine, and chronic disease management. The adoption of digital technologies presents opportunities for providers to expand their businesses, enhance profitability, and improve the accessibility and affordability of healthcare services.

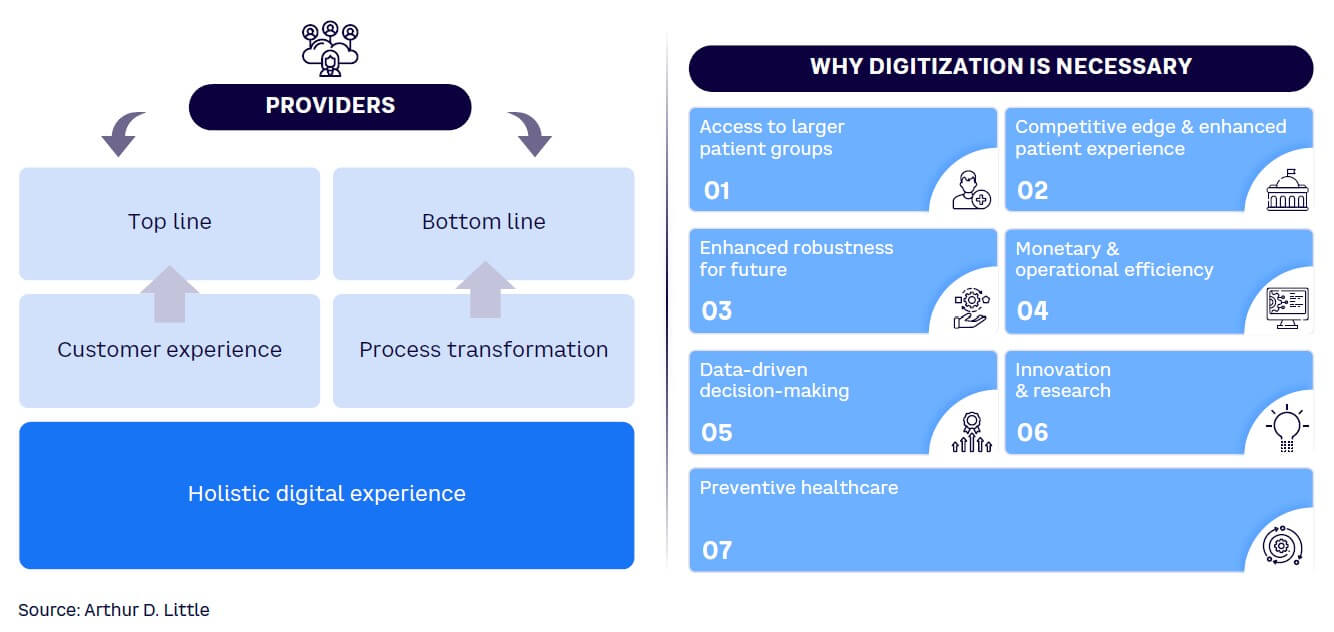

The government’s ambitious Ayushman Bharat Digital Mission (ABDM) is leading the charge in India, aiming to digitize the entire healthcare ecosystem, from patient records to service delivery. Digitalization and ABDM offer several benefits to providers, including improved monetary and operational efficiency, access to larger patient populations, a competitive edge through enhanced patient experiences, future resilience, data-driven decision-making, and better preventive healthcare.

Despite robust demand and a comprehensive rollout plan, healthcare providers, especially private sector, lag in ABDM adoption. This Report deep dives into two key verticals of healthcare providers, hospitals and diagnostics, and seeks to understand the key challenges impeding ABDM adoption in those segments. The Report also provides imperatives and solutions for policy makers, healthcare providers, technology platform providers, and patients. Our findings are based on insights from extensive interviews and a survey. More than 12 in-depth interviews were conducted with relevant industry leaders including founders, medical doctors, CEOs, and CIOs across reputed private hospitals and diagnostics. The survey collected data related to digital health adoption from private and public healthcare providers.

The insights emerging from the interviews and survey can be particularly useful for the entire ecosystem to gain a systemic view of the status of digital adoption and its evolution. The four imperatives identified in this Report will create the impetus for digital health adoption and ABDM integration for private sector hospitals and diagnostics in India.

Brajesh Singh

Associate Director

Arthur D. Little

Siddhartha Bhattacharya

Secretary General

NATHEALTH

EXECUTIVE SUMMARY

The healthcare landscape in India is undergoing a rapid transformation, fueled by technological advancements and evolving patient expectations. Within this dynamic context, the digitization of healthcare has emerged as a pivotal force with the potential to significantly revolutionize healthcare delivery and enhance patient outcomes. The government’s ambitious ABDM is at the forefront of this transformative effort, aiming to digitize the entire healthcare ecosystem and encompassing patient records and service delivery.

A key facet of the digital health mission includes creating the Ayushman Bharat Health Account (ABHA) for individuals and establishing a unique identity (ABHA ID) across healthcare providers. This enables seamless access to unified benefits from public health programs and insurance schemes. Implementing personal health records (PHR) simplifies medical data sharing, reducing patient inconvenience and ensuring continuity of care across different specialists and service providers.

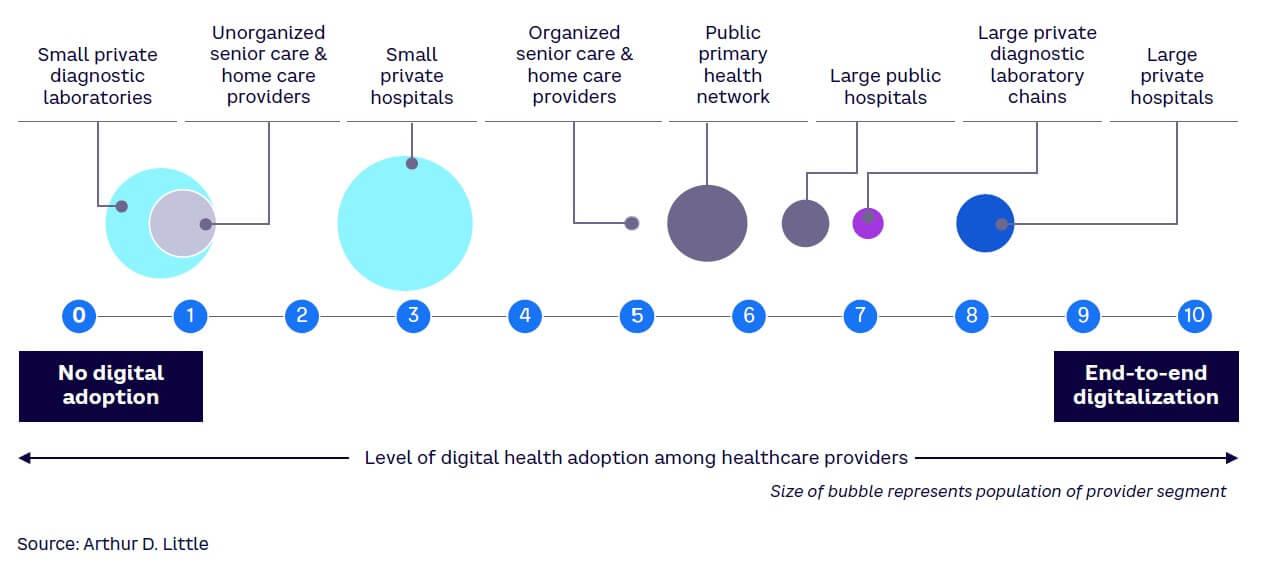

In our earlier exploration of digital health adoption, Arthur D. Little (ADL) revealed additional insights into the current state of digitalization, highlighting its crucial stage.[1],[2] To assess the extent of digitization, we introduced the Digital Health Adoption Index, assigning scores from 0 to 10 to providers based on their digital maturity. The results closely mirrored those obtained in the previous year’s survey. Notably, small private diagnostic laboratories and unorganized senior care and home care providers exhibited limited digital adoption. Conversely, among the participants, large private hospitals showcased the highest degree of digital adoption.

Digitization and ABDM in digital health offer several advantages to the providers, such as improvisation in monetary and operational efficiency, access to larger patient groups, competitive edge through better patient experience, enhanced robustness for the future, data-driven decision-making, and better preventive healthcare.

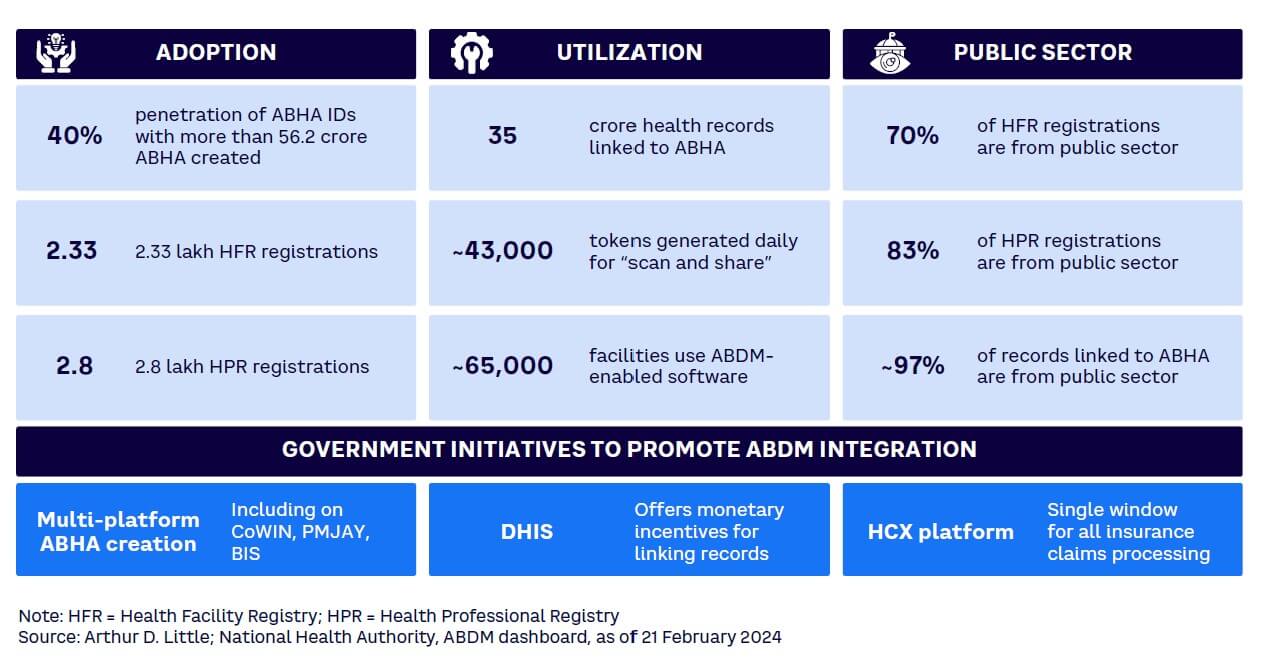

Despite robust demand and a comprehensive rollout plan, healthcare providers, especially in the private sector, lag in adopting digital technologies. Currently, 70% of the Health Facility Registry (HFR) and 83% of the Health Professional Registry (HPR) are populated by information from the public sector. Therefore, this Report deep dives into two key verticals of healthcare providers: hospitals and diagnostics. Through consultations with industry experts, we have identified four key challenges impeding widespread adoption of these critical, enabling digitalization efforts across these verticals, especially in the private sector:

-

Lack of clear guidelines. A significant challenge lies in the lack of clear government guidelines under ABDM. Key issues surround uncertainties regarding the responsibilities associated with data storage, retention, and transfer. Moreover, the current engagement with private players is inadequate, and the guidelines shared are not in-depth or clear. Additionally, there remains confusion among private players over the proper steps for ABDM adoption.

-

Investment required. Adopting the ABDM and making the necessary digital enablement for linking to the NHS requires significant investments in developing technology infrastructure, especially for private players. The business case and rationale for this technology investment are not as simple as was anticipated.

-

Data security concerns. There are very clear apprehensions regarding data security issues. The various stakeholders lack a clear understanding and aligned view of the measures required to guarantee robust data security protocols.

-

Subdued pull from individuals. Since its launch in 2021, only a 40% penetration of ABHA IDs has been observed in India. Individuals are not aware of the benefits provided through health tracking provided by ABDM. Also, currently, there are limited options for ABHA ID usage for people who have already created ABHA; hence, there is a lack of push for individuals to use ABHA.

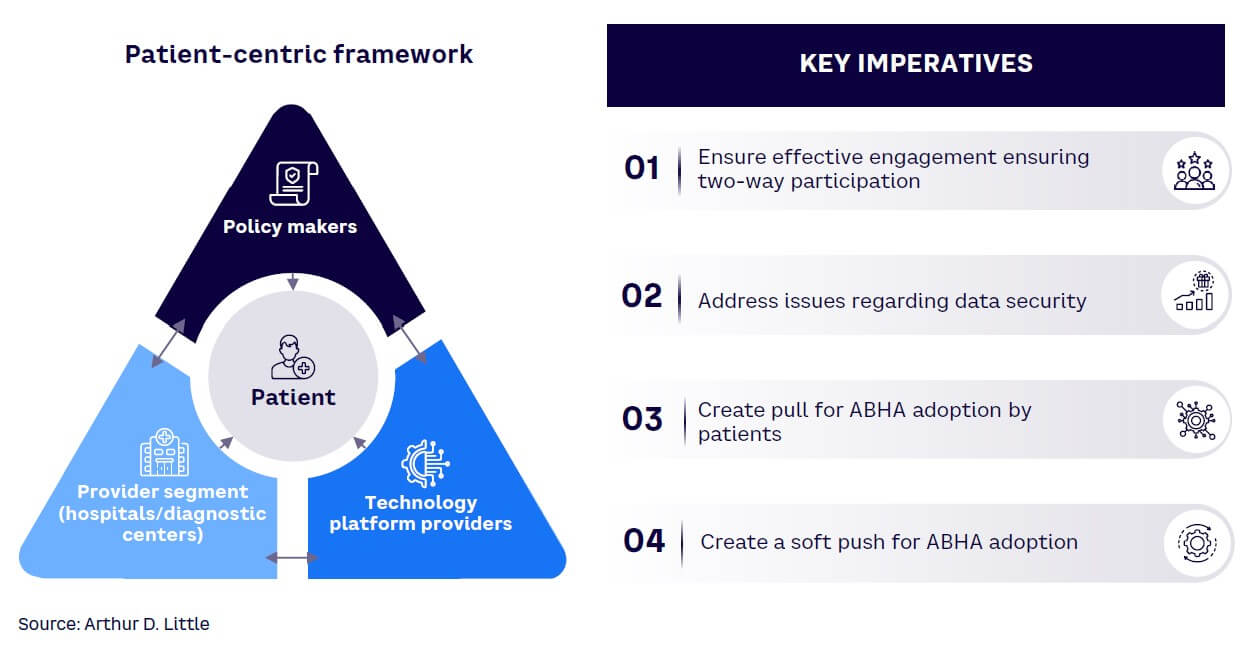

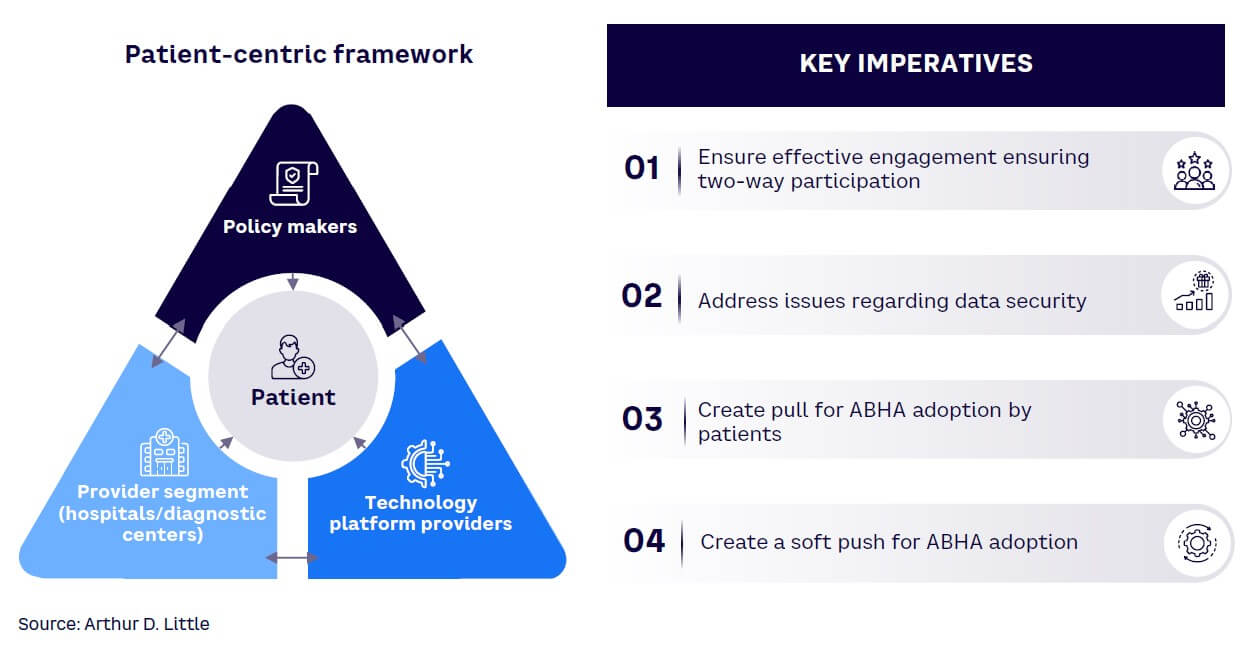

ADL believes the inevitability of digital healthcare underscores the importance of proactive adaptation over reactive compliance. As India embraces the digital landscape, the shift toward digital health not only mandates adjustment but also presents an expansive opportunity for the private sector. The push for deeper penetration of ABDM will require a collective effort on the part of the government, private healthcare providers, technology platform providers, and patients. This Report proposes four imperatives to drive ABDM penetration in the Indian healthcare industry:

-

Ensure effective engagement through two-way participation. The responsibility for ABDM adoption should not rest solely on healthcare providers. Collaboration among policy makers, healthcare providers (including hospitals and diagnostic centers), and technology platform providers is crucial.

-

Policy makers <-> provider segment (hospitals and diagnostic centers):

-

Provide tangible incentives to motivate private sector players to adopt ABDM.

-

Require clear and comprehensive guidelines to ensure a precise understanding of the compliance requirements for ABDM.

-

Highlight the benefits, including easier access to data, efficient operations, and so on, over the cost of digitization, especially for smaller players.

-

Support small and medium-sized players to ensure easier system integration.

-

-

Policy makers <-> technology platform providers:

-

Require clear guidelines on the architecture to ensure easy data integration, data interoperability, and storage.

-

Optimize the process of the sandbox and faster provisioning of technical approvals to expedite the process of ABDM adoption.

-

-

Technology platform providers <-> provider segment (hospitals and diagnostic centers):

-

Provide technical support, especially to medium and small-sized healthcare providers, which are at the initial stages of digitization.

-

Collaborate with providers to ensure a user-friendly and efficient platform that guarantees data interoperability.

-

-

-

Address issues regarding data security. The government needs to play a proactive role in addressing the data security concerns in the following ways:

-

Increase awareness about lower data security issues in HIS and NIS, as they are closed systems.

-

Establish clear government regulations to specify permissible data usage.

-

Provide guidance on encryption and decryption for easier implementation.

-

Educate individuals on authorization, consent management, and data flow to address security concerns.

-

Create awareness and rigorous enforcement of the Digital Personal Data Protection (DPDP) Act 2023.

-

-

Create pull for ABHA adoption by patients. ABDM adoption will take a significant jump if demand is created from individuals across India. Hence, government and providers need to play an active role in creating the pull.

-

Conduct awareness programs (e.g., advertisements) to highlight the benefits of ABDM for individuals:

-

Electronic health records can be used for easy access to health information, reduction of duplication of tests, and reduction in delays of treatment.

-

Health tracking via ABHA ID aids in preventive care, early disease detection, and alleviates the burden of noncommunicable diseases (NCDs), while also enhancing maternal health monitoring and reducing infant and maternal mortality rates.

-

At the population level, health tracking can be used to avoid the spread of epidemics and ensure better governance and management of resources like oxygen cylinders.

-

-

Provide incentives to encourage patients to create and use ABHA ID, such as accelerated CGHS (Central Government Health Scheme)/PMJAY (Pradhan Mantri Jan Arogya Yojana) reimbursements and simplified hospital registration processes.

-

-

Create a soft push for ABHA adoption. Government intervention is needed to create the push from healthcare providers and payers to increase the adoption of ABHA. Mandatory implementation of ABHA ID in specific instances, akin to Aadhaar’s mandatory usage for “know your customer” (KYC) purposes, could be considered.

-

Push from providers. This could include mandating use of ABHA ID for certain healthcare services, such as registration processes.

-

Push from payers. ABHA could be required for issuing and renewal of insurance policies, thereby incentivizing individuals to obtain and utilize their ABHA ID.

-

1

THE STATE OF DIGITAL HEALTH IN INDIA

CURRENT DIGITAL & ABDM ADOPTION LANDSCAPE

India has witnessed rapid digitalization across all sectors, including the healthcare industry. The government’s ambitious ABDM is at the forefront of this transformative effort, aiming to digitize the entire healthcare ecosystem and encompassing patient records and service delivery. Based on our discussion with stakeholders in the provider ecosystem and secondary research, we uncovered critical insights into the present state of digitalization, emphasizing its pivotal role in the healthcare sector.

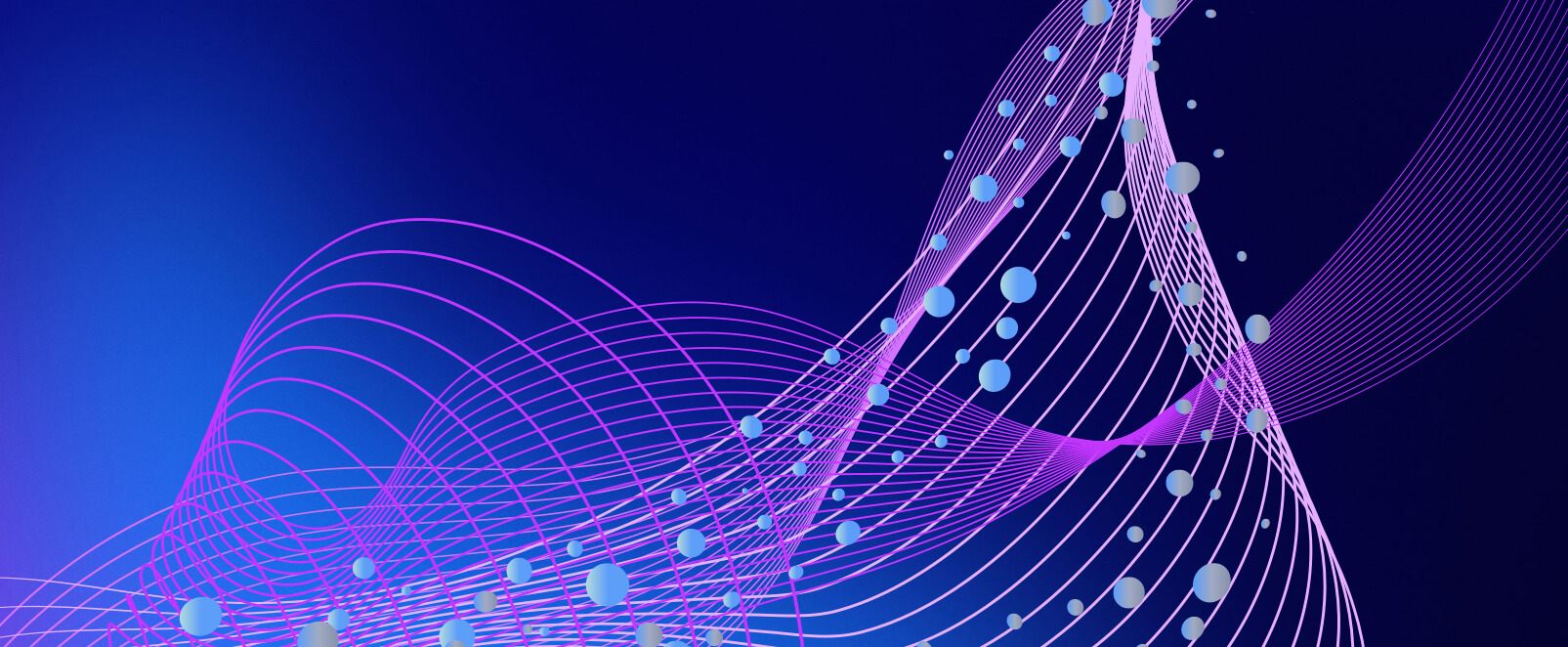

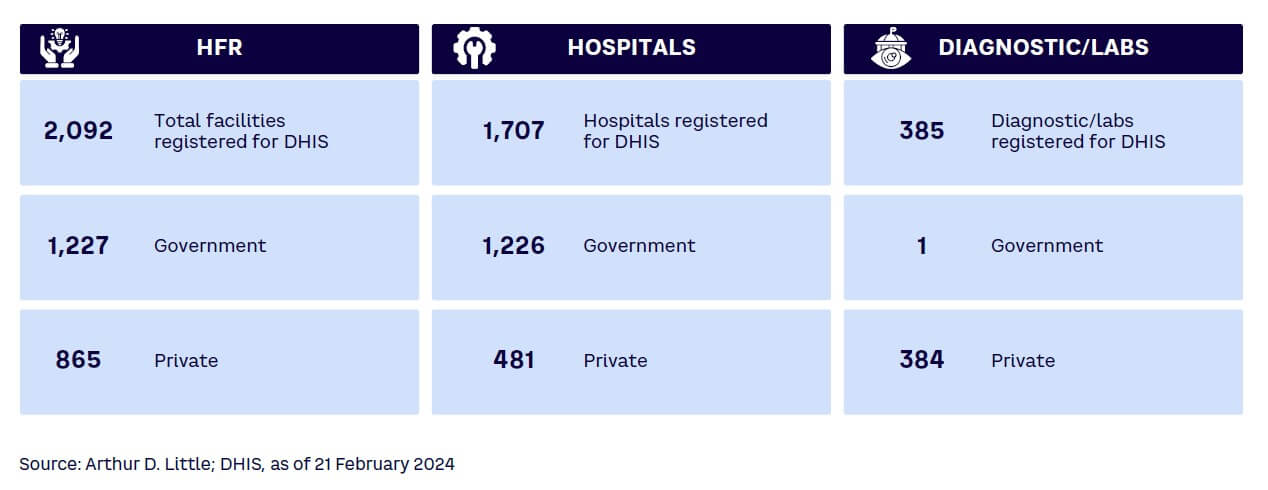

While there are compelling arguments for the digital transformation and adoption of ABDM, private healthcare providers encounter obstacles that impede their transition. An examination of the registered health facilities in India, which total 2,32,091 at the time of this writing, reveals that only 30% of them are privately owned (see Figure 1).[3]

This statistic suggests resistance among private healthcare providers regarding the adoption of ABDM and self-registration. Furthermore, out of the 35 crore reports linked through the registered HFR as of February 2024, a mere 2% (~7 lakh) are shared by private healthcare providers. These figures underscore the limited participation of private providers in the digital healthcare ecosystem and show that, despite a comprehensive rollout plan, the adoption rate among private healthcare providers remains notably constrained.

ABDM: WHAT’S IN IT FOR HEALTHCARE PROVIDERS?

ABDM’s primary objective is to establish the foundational framework required to sustain the integrated digital health infrastructure in India. ABDM endeavors to eliminate the current disparities among various stakeholders in the healthcare ecosystem by establishing digital highways that will enable safer, faster connectivity for all.

The healthcare ecosystem must embrace digital practices to streamline the collection, storage, and retrieval of patient data, thereby enhancing transparency in the system. This transition can improve operational efficiency, resulting in cost optimizations. These benefits can in turn be extended to patients through increased affordability.

The HFR serves as a comprehensive database connecting health facilities to India’s digital health ecosystem. Despite the government’s efforts to promote ABDM adoption, only 30% of total HFR registrations have come from the private sector, despite holding a 70% market share. Public health facilities lead to ABDM adoption, revealing a significant gap between the public and private sectors.

Current ABDM adoption numbers for healthcare providers demonstrate an increasing trend, but the disparity between public and private contributions is evident. Addressing this requires an understanding of the reasons behind low adoption, particularly among private healthcare providers, including concerns related to data security and the sharing of internal digital systems.

DIGITAL HEALTH ADOPTION INDEX

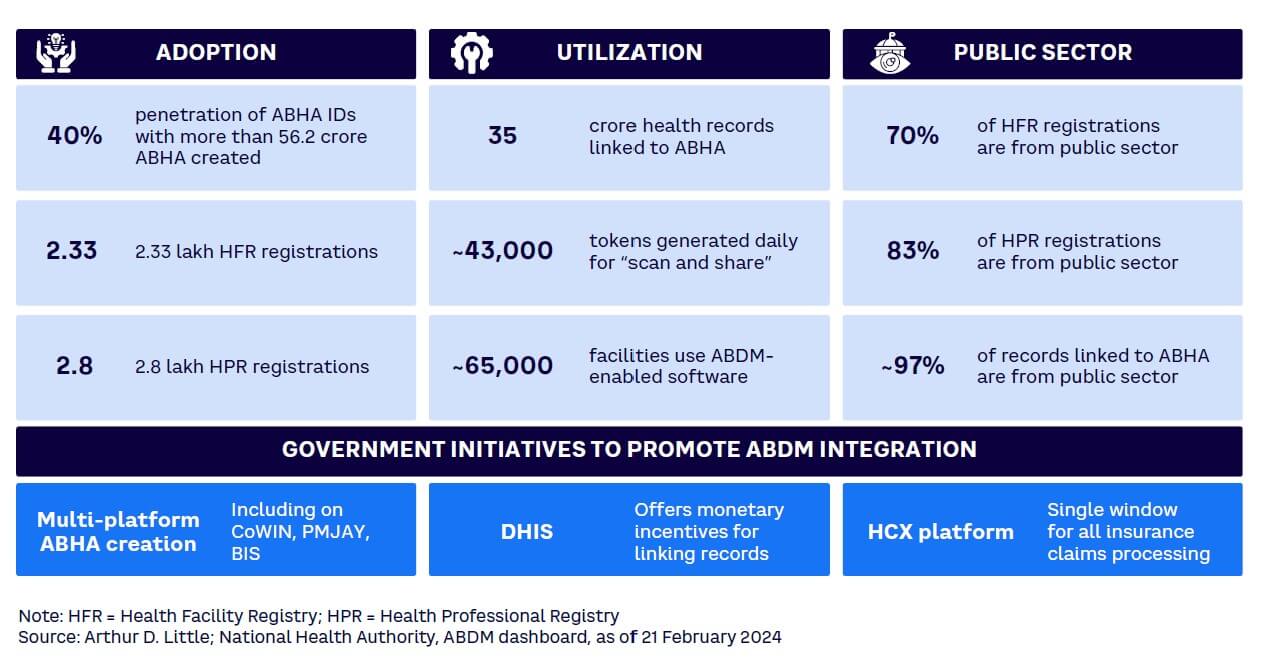

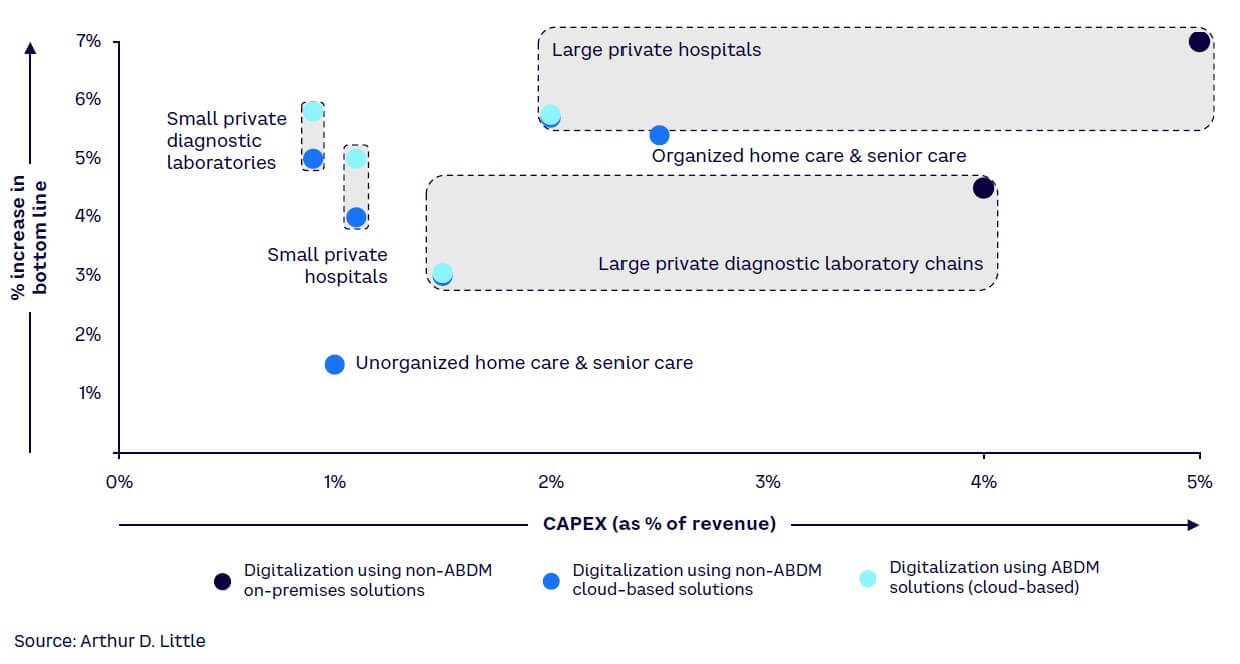

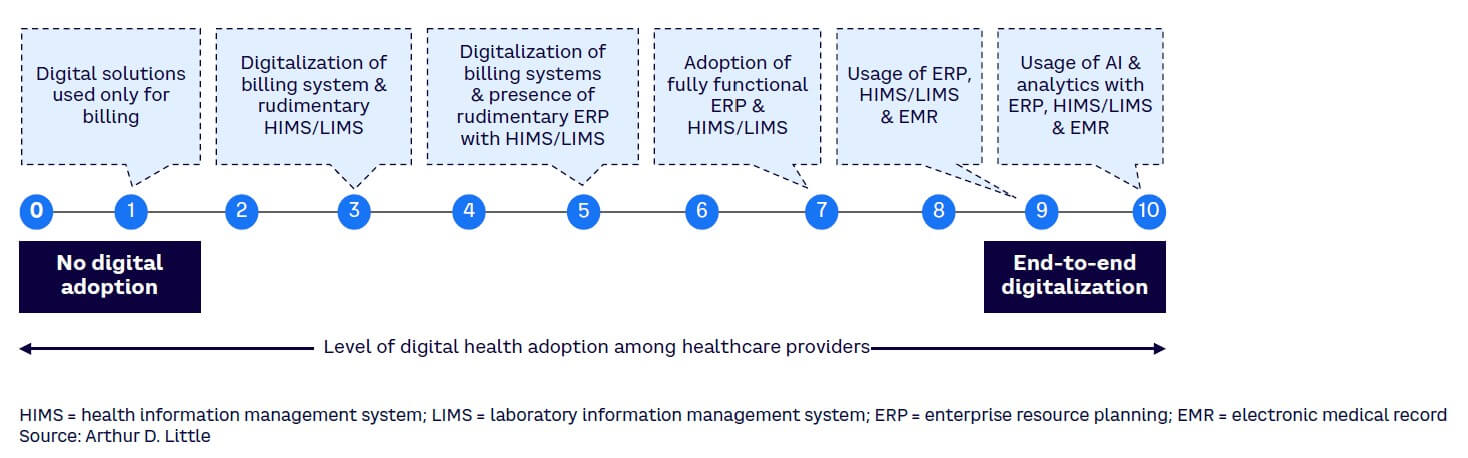

To assess the extent of digitization, we introduced the Digital Health Adoption Index, assigning scores from 0 to 10 to providers based on their digital maturity. Providers with no digital adoption received a score of 0. The score increased based on the degree of digital utilization, ranging from basic billing systems to basic enterprise resource planning (ERP) incorporating health and laboratory information management systems (HIMS/LIMS) and extending to the incorporation of artificial intelligence (AI) and analytics with ERP, HIMS/LIMS, and electronic medical records (EMRs) — see Figure 2.

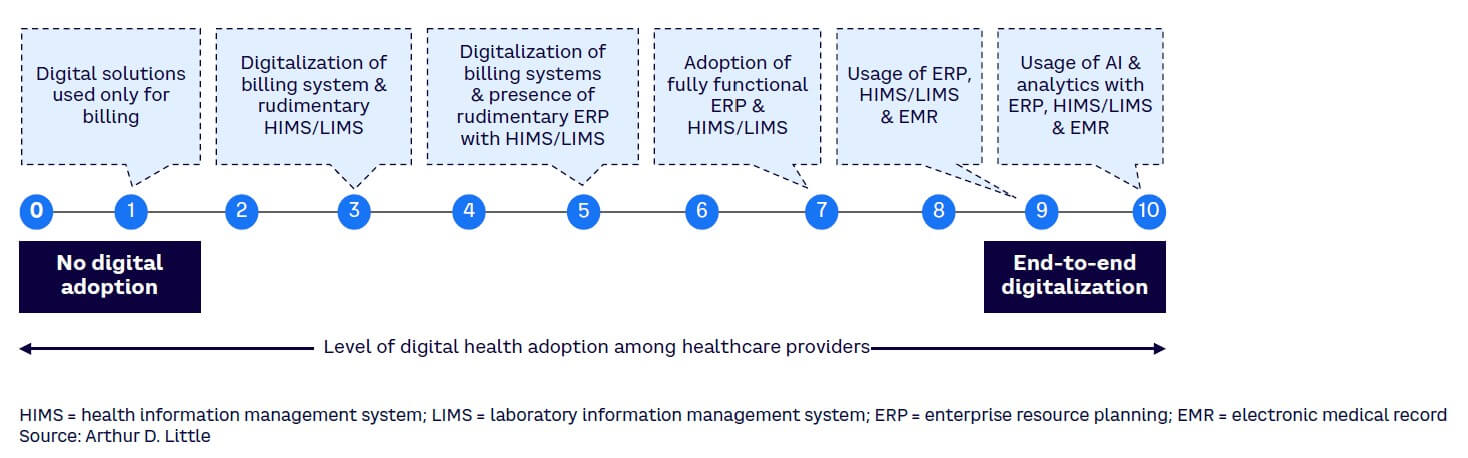

Based on interviews and a survey, we utilized the Digital Health Adoption Index to score different provider segments. The results closely mirrored those obtained in the previous year’s survey.[4] Notably, small private diagnostic laboratories and unorganized senior care and home care providers exhibited limited digital adoption. Conversely, among the participants, large private hospitals displayed the highest degree of digital adoption, as shown in Figure 3.

Notably, large hospitals and diagnostic laboratory chains, despite achieving higher scores on the Digital Health Adoption Index, expressed significant concerns related to data security and the internal sharing of digital systems. This underscores the critical need for a comprehensive strategy that goes beyond mere adoption figures. Addressing these concerns and barriers is essential to ensure the seamless and effective integration of digital technologies into the healthcare sector, allowing for a more robust and secure digital health ecosystem.

GOVERNMENT INITIATIVES FOR ABDM ADOPTION

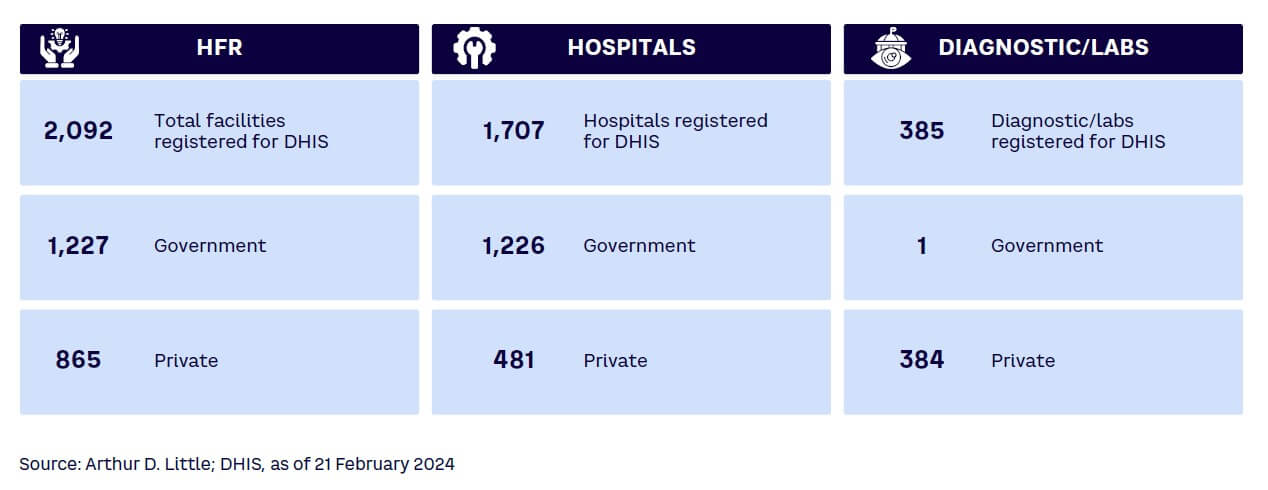

India’s government has designed and implemented several initiatives to push digitalization through ABDM. These incentives focus on increasing ABHA ID creation, incentivizing ABDM utilization, and driving payer-side adoption. ABHA ID creation has been made platform-agnostic to enable a multitude of platforms to create ABHA, reducing technical failures and enabling a large population of grassroots workers, such as accredited social health activists (ASHAs), to create ABHA IDs. Simultaneously, the Digital Health Incentives Scheme (DHIS) aims to reward users of ABDM through financial incentives for crossing certain established thresholds of health record linking with ABHA. The scheme started recently and is expected to be scaled to bring more providers into the benefit pool.

Government initiatives include:

-

Multi-platform ABHA creation. Multiple platforms such as CoWIN (Covid Vaccine Intelligence Network), PMJAY, and Beneficiary Identification System (BIS) support the creation of ABHA ID. Benefits include:

-

Increases ABHA registrations through the involvement of state and central health resources.

-

Multiple platforms reduce the probability of technical failure of ABHA registrations.

-

Improves community adoption in rural areas by engaging ASHA workers.

-

-

DHIS. This scheme aims to use financial incentives to hospitals and diagnostic centers registered on the HFR and to digital solution companies registered on the ABDM Sandbox to improve ABDM adoption. Benefits include:

-

Emphasizes ABDM integration as a lucrative way to kick-start digital adoption by partially offsetting associated costs.

-

Promotes ABDM utilization by incentivizing linking of health records to ABHA IDs.

-

Despite the program’s potential, creating awareness poses a significant challenge, emphasizing the crucial requirement for a robust communication strategy to fully realize its impact (see Figure 4). DHIS registrations have not led to a notable improvement in private healthcare providers’ adoption, primarily due to the perceived inadequacy of financial benefits provided by regulatory authorities to address the operational and capital expenditures (OPEX/CAPEX) required.

-

Health Claims Exchange (HCX) platform. This platform is envisioned as a common platform for facilitating all exchanges of claims-related information between all relevant actors (payers, providers, beneficiaries, regulators, and observers) and processing all health claims. Proposed benefits include:

-

Will drive payer-side digitalization, which, in turn, is expected to increase provider-side digital health and ABDM adoption.

-

Will improve the efficiency and reduce the costs of claims processing through a single platform.

-

-

100 Microsites project. This project aims to address ABDM adoption challenges for small and medium-scale private healthcare facilities nationwide. Its goal is to integrate various health facilities under ABDM, expanding its reach and fostering adoption among private healthcare providers. The state mission directors will spearhead implementation, supported by the National Health Authority. States/union territories may engage an interfacing agency for Microsite setup, receiving incentives tied to ABDM adoption milestones. Proposed benefits include:

-

Targeted outreach efforts within a Microsite can increase awareness about ABDM and highlight the benefits of ABDM for both patients and providers.

-

Will help increase ABDM adoption by private healthcare providers across the country.

-

However, a development partner, aiding Microsite implementation, will not receive financial benefits.

2

CHALLENGES IDENTIFIED: HOSPITALS & DIAGNOSTIC CENTERS

In this chapter, we delve deeper into two pivotal verticals within the healthcare value chain: hospitals and diagnostic centers. Through comprehensive analysis and stakeholder consultations, we have identified key challenges impeding ABDM adoption in these two verticals.

HOSPITALS

Private hospitals dominate the healthcare sector, commanding a substantial 70% market share. Notably, larger private hospitals have embraced digitization, reflected in their commendable Digital Health Adoption Index score of approximately 9. However, the adoption of digital technologies remains notably lacking in smaller and mid-sized hospitals, as shown in Figure 3. This discrepancy is evident in the Digital Health Adoption Index, where these hospitals typically score around 3, highlighting the need for increased digital integration across all healthcare facilities, regardless of size.

Key challenges facing private sector hospitals

We have identified five critical challenges that have hindered the adoption of ABDM among hospitals, impacting not only small private facilities but also large hospital chains:

-

Ambiguities in guidelines from the government. The implementation of ABDM in hospitals encounters notable challenges stemming from unclear government guidelines. Key issues surround uncertainties regarding the responsibilities associated with data storage, retention, and transfer, presenting significant hurdles. The complexity intensifies due to the diverse nature of the data involved, which includes genetic information, family history records, clinical data, and lifestyle-based information. Each of these data types introduces unique challenges, further complicating the seamless adoption of ABDM within hospital settings.

-

Lack of awareness about digitization and ABDM. Small players exhibit a resistance to digitalization, even when resources are available. This resistance is rooted in a desire to avoid heightened regulatory scrutiny resulting from increased transparency brought about by digitalization. Moreover, there is a noticeable lack of awareness regarding the correlation between ABDM adoption and the benefits for smaller hospitals. The advantages, such as increased accessibility for a broader patient base, are not adequately communicated. This awareness gap creates a significant barrier for smaller healthcare facilities, preventing them from realizing the potential advantages and opportunities that ABDM adoption could bring.

-

Technological barriers. Large hospitals encounter challenges when integrating their existing internal systems with common platforms, underscoring the importance of ensuring data interoperability and standardization. Despite a growing number of technology players entering the market, the industry lacks sufficient software and ERP systems tailored specifically for digital health. This scarcity of available technology partners further complicates the adoption process. Furthermore, in the rural areas where approximately 65% of the country’s population resides, there is a notable absence of a robust digital infrastructure despite government initiatives to enhance connectivity. This hinders the adoption of digital health in rural areas.

-

Low penetration of electronic health records. EMRs are the backbone of ABDM. Currently, most large-scale hospitals maintain electronic health records. However, some of them have EMRs as scanned PDFs, which might not be compatible with ABDM systems. Most medium and small-scale hospitals do maintain EMRs.

-

Additional CAPEX/OPEX. Smaller hospitals face a significant challenge because they need to invest a lot in digital infrastructure for ABDM, both in terms of CAPEX and ongoing OPEX. Creating the necessary technology setup is a big challenge, especially for smaller players. It is also unclear how much they will gain from this investment and what tangible benefits they can expect.

DIAGNOSTIC CENTERS

The diagnostic service sector is comprised predominantly of unorganized standalone labs, accounting for 83% of the sector, while organized labs make up only 17%. Notably, there exists a significant disparity in digital adoption between large and small diagnostic service providers. Despite their smaller representation, larger labs exhibit a noticeable trend toward gradual digitization. Large private diagnostic players scored an impressive 8 on the Digital Health Adoption Index, indicating a high level of digital adoption, whereas smaller labs scored a 2, reflecting a low level of digitization. During discussions with senior leaders from leading diagnostic labs in India, we uncovered several challenges hindering the adoption of ABDM.

Key challenges facing diagnostic centers

Large diagnostic players show less resistance to ABDM adoption primarily due to existing digitization, but there are still other concerns that must be addressed:

-

Concern regarding loss of competitive advantage. Large laboratories, which have already embraced digitization, voice apprehension regarding the implementation of standardized platforms, unification of test codes, and the potential diminishment of brand recognition. The preservation of differentiation is deemed crucial, and the shift toward a standardized system is perceived as potentially challenging. Specifically, concerns revolve around the risk of losing a distinctive brand identity within the ABDM platform and the perceived difficulty in standing out on a standardized framework, posing notable challenges for large diagnostic centers.

-

Hesitation with data sharing. Unspoken concerns hover around the sharing of data on shared platforms. There is a need for clear guidance on protocols and standards for data sharing within the industry.

-

Resistance from small and midsized centers. Smaller and midsized diagnostic centers are in the initial stages of transitioning to digital operations. They encounter various challenges, including the considerable cost associated with digitization, which may exceed their financial capacity. Additionally, these centers lack sufficient technical expertise and awareness regarding the advantages of digitalization.

PATIENT-SIDE ISSUES

In addition to the challenges hospitals and diagnostic centers face in ABDM adoption, challenges arise from patients themselves, including:

-

Limited awareness of the benefits of ABHA. Patients often perceive digitization through a narrow lens, primarily associating it with the utilization of applications. However, they may not fully grasp the broader implications and advantages offered by the maintenance of longitudinal digital medical records, as facilitated by ABDM. These advantages span beyond simple app usage and encompass a spectrum of benefits, ranging from better accessibility to healthcare services to personalized health-monitoring capabilities. Particularly significant is the potential for long-term benefits, especially in managing chronic diseases, where such digital records can facilitate more effective disease management strategies and contribute to overall improved health outcomes.

-

Limited opportunities to use ABHA ID. Patients who possess an ABHA ID are not utilizing it adequately, largely due to the limited adoption of ABDM by healthcare providers. This lack of adoption restricts the utility of ABHA IDs, thereby diminishing patient engagement. Without utilizing the ABHA ID multiple times, patients may not fully comprehend the system’s mechanics, including data security through consent management and the potential benefits of health data tracking. Therefore, without proactive efforts from healthcare providers to implement and encourage the use of ABHA IDs on a larger scale, patient willingness to utilize the system will remain low.

-

Concerns regarding data safety. Patients express concerns about sharing their confidential health information due to apprehension regarding potential data breaches and misuse. Their apprehension stems from a lack of understanding about the secure methods involved in data collection, storage, and access, as well as the significance of consent management. This knowledge gap leads to reluctance to share health data, thereby impacting ABDM adoption.

THE BENEFITS OF DIGITIZATION & ADBM ADOPTION FOR PROVIDERS

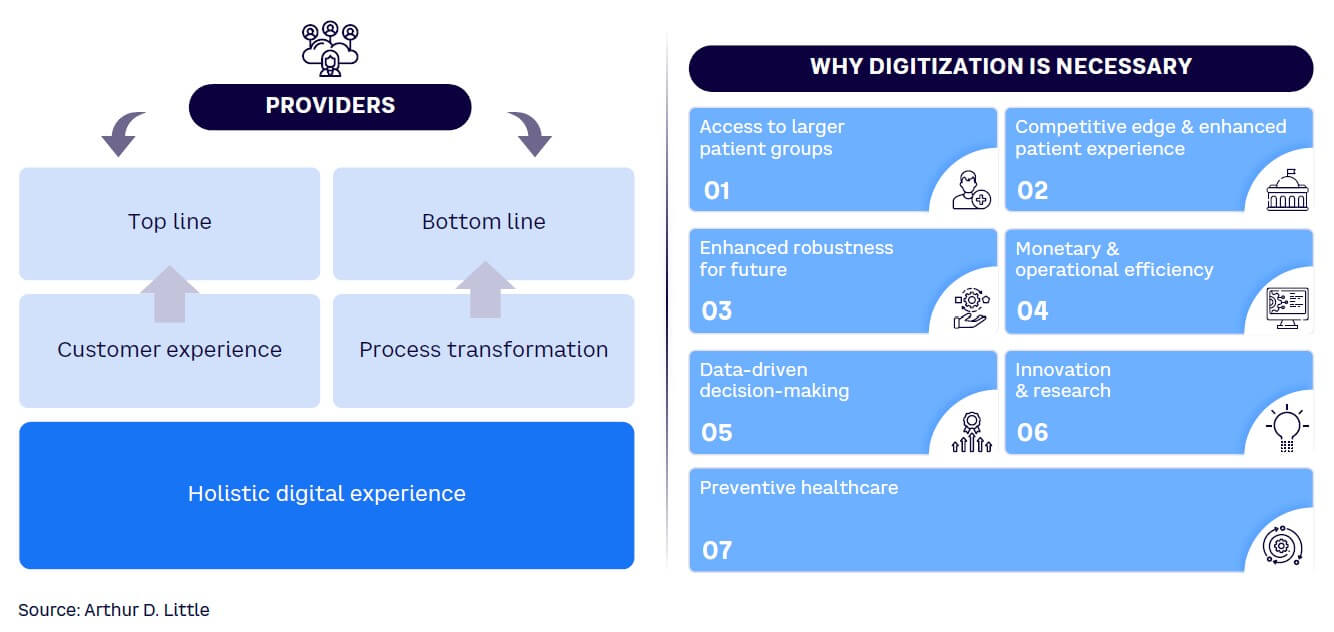

The digitization of healthcare is essential for providers, offering numerous benefits, including (see Figure 5):

-

Access to larger patient groups. Digitization opens doors to a significantly larger patient population. Through digital health records and online services, healthcare providers can extend their reach beyond geographical constraints. This is particularly crucial in a country as diverse and expansive as India, where remote and underserved areas can benefit greatly from improved healthcare access, while the providers would benefit from access to patients across extended regions.

-

Competitive edge and enhanced patient experience. Embracing digital health technologies provides a competitive edge in the healthcare market. Patients increasingly seek healthcare providers that offer advanced and convenient digital services. Digitization enhances the overall patient experience, allowing patients to access their health records online, book appointments digitally, and receive timely reminders for follow-up care. Telemedicine and remote-monitoring solutions enable convenient consultations, which is especially beneficial for patients in rural or remote areas. A positive patient experience contributes to patient satisfaction and loyalty and helps increase the top line.

-

Enhanced robustness for the future. The healthcare landscape is evolving, with emerging technologies such as telemedicine, AI, and data analytics becoming integral to healthcare delivery. Providers that adapt to these changes and invest in digital governance will be better positioned to thrive in the evolving healthcare landscape. With every industry moving toward digitization, healthcare will no longer be an exception. Sooner or later, regulatory compliance will require each provider to be on the digital platform. Providers that join the digital ecosystem from the start will benefit from their early response. Additionally, because the healthcare industry is subject to numerous regulations and compliance requirements, digitization enables providers to adhere to these regulations more efficiently. Digital health records make it easier to maintain and retrieve patient data, ensuring compliance with privacy and security standards.

-

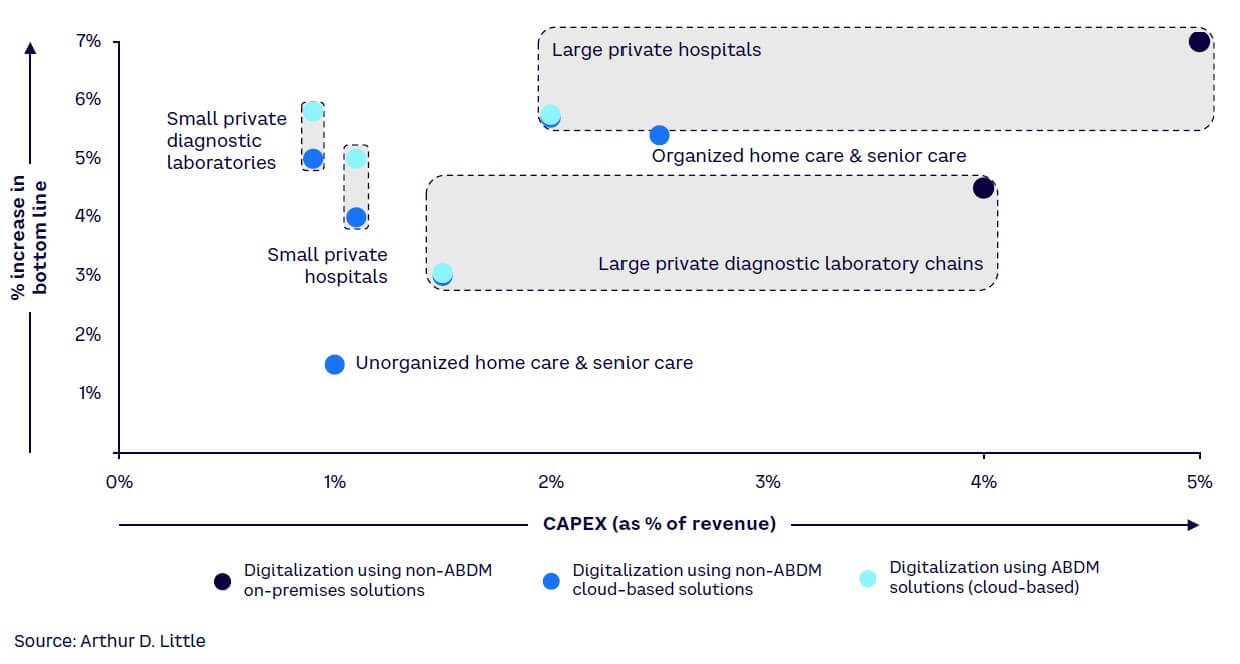

Monetary and operational efficiency. Digitization leads to improved operational efficiency, reducing the burden of paperwork and manual processes. Electronic health records and other digital tools streamline administrative tasks, enabling healthcare providers to focus more on patient care. The cost savings associated with reduced paperwork, improved efficiency, and optimized resource utilization contribute to the financial sustainability of healthcare organizations. In our previous Report, we demonstrated the cost-benefit analysis for private healthcare providers and showed that using cloud-based solutions could add 3%-6% to the provider’s bottom line with a payback period of less than 18-36 months.[5] ABDM-integrated solutions make digitalization feasible even for players with a Digital Health Adoption Index score of 3 or less. ABDM solutions reduce CAPEX by up to 60% as compared to on-premise systems and decrease OPEX by 20%-40% during the initial years in comparison to non-ABDM (cloud) solutions (see Figure 6). Large providers using ABDM-compliant systems from the outset of digitalization can capture more than 80% of the benefits of digitalization with a 60% reduction in CAPEX as compared to an on-premise solution.

-

Data-driven decision-making. Digital health solutions provide valuable data insights that empower healthcare providers to make informed decisions. From patient outcomes to operational efficiency, data analytics can highlight areas for improvement and support evidence-based decision-making. This data-driven approach not only enhances the quality of healthcare services but also contributes to continuous improvement and innovation.

-

Preventive healthcare and population health management. Digital tools support preventive healthcare by enabling proactive interventions based on individual health data. Population health management becomes more effective as providers can identify trends, risk factors, and potential outbreaks, allowing for targeted public health initiatives. Preventive care reduces the burden on the healthcare system and improves overall community well-being.

Digitization is not merely a technological upgrade; it is a fundamental shift in how healthcare is delivered, experienced, and managed. Healthcare providers embracing digital transformation position themselves to provide higher-quality, more accessible, and patient-centric care in an ever-evolving healthcare landscape.

SUGGESTED ABDM USE CASES FOR HOSPITAL & DIAGNOSTIC PROVIDERS

ABDM can be used for various use cases encompassing key areas, including:

-

Integration of ABDM for digital governance of ultrasound devices. Ultrasound technology emerges as a transformative force, offering real-time, high-resolution diagnostics and therapeutic applications. However, its adoption in India faces several hurdles, including limited awareness, regulatory complexities, and inadequate infrastructure. The existing regulations, while well-intentioned, lack proper implementation, resulting in prolonged approval processes and apprehension among healthcare practitioners. A digital governance system for ultrasound devices — a solution aligned with ABDM — has been proposed by a joint collaboration of NATHEALTH and ADL. This digital transformation aims to streamline ultrasound compliance, addressing regulatory inefficiencies and improving transparency. The proposed system functions on a rule-based model comprising four interconnected modules: healthcare providers, equipment suppliers, provider operations, and device registries. A central registry for all ultrasound devices in the country is recommended to monitor their lifecycle status, each linked to a unique device ID. ABDM is pivotal in maintaining this registry and integrating data from the modules.

Furthermore, at diagnostic provider centers, patients can be directly linked to their ABHA ID, seamlessly connecting them to the digital health ecosystem. This streamlines record-keeping and minimizes clerical errors. As an example, pregnancy scan results can be uploaded to an online portal, forming a centralized registry of patient records accessible in real time to authorities. All patient data, including medical history, scans, reports, and interventions, will remain protected under data privacy laws, with access restricted to ABDM.

The envisioned digital governance system aims to revolutionize healthcare accessibility, surmount regulatory hurdles, alleviate the burden of NCDs, enhance maternal and child healthcare, and position India as a frontrunner in health tech innovation.

-

Use of ABDM in organ donation and transplantation process. Organ donation and transplantation are crucial for saving lives, especially given the rise in lifestyle-related health issues today. India recognizes this importance, as evidenced by the prime minister discussing it on “Mann Ki Baat.” With the government’s focus on improving healthcare quality, affordability, and accessibility through digitization, organ donation has become a priority. The establishment of the National Organ and Tissue Transplant Organization in 2014 reflects this commitment. Despite these efforts, India lags behind the global average in organ donation rates, mainly due to manual processes, lack of public awareness, and inefficiencies in governance. A digital transformation is necessary to streamline processes, increase transparency, and improve access to organ donation. This can optimize organ allocation, reduce wastage, and address unethical practices. Leveraging ABHA ID can help check donor pledges and medical fitness, making the organ donation system more efficient and transparent under ABDM.

-

Telehealth. ABDM heralds a new era in healthcare accessibility through telemedicine services. This paradigm shift is not just beneficial; it is crucial for individuals dwelling in remote or rural areas, where access to traditional healthcare facilities is severely limited. Patients with chronic diseases such as diabetes, hypertension, and arthritis are increasingly reliant on telemedicine for ongoing monitoring and management of their health. Even beyond the difficult times of the COVID-19 pandemic, the telehealth market continues to surge with an impressive CAGR of 24%. This statistic speaks volumes about the undeniable impact and sustained demand for telemedicine services across the nation.

In India, a plethora of telemedicine platforms seamlessly connect patients with hospitals and doctors, transcending geographical barriers and revolutionizing healthcare delivery. These platforms empower patients to schedule appointments with specialists across diverse medical fields and engage in remote consultations via video calls or chat functionalities. Moreover, the integration of telemedicine platforms with large healthcare facilities signifies a profound commitment to expanding reach and bolstering patient care. Notably, eSanjeevani, the Government of India’s national telemedicine platform, has served over 10 crore patients with more than 2.3 lakhs healthcare providers enlisted, which signifies the robust demand and positive reception toward telemedicine solutions.

Telemedicine platforms will play a pivotal role in advancing the adoption of ABDM by fostering greater interconnectedness among healthcare provider players. Telemedicine platforms can integrate with ABHA to streamline patient identification and access to health records during virtual consultations. By leveraging ABHA, telemedicine platforms can ensure a secure and seamless exchange of patient information across the healthcare ecosystem, enhancing care coordination and continuity.

CONCLUSION: KEY IMPERATIVES

Our patient-centric framework underlines four key imperatives for all stakeholders to accelerate digital health adoption in the private sector:

-

Ensure effective engagement ensuring two-way participation (see Figure 7). The responsibility for ABDM adoption should not rest solely on healthcare providers. Collaboration between policy makers and healthcare providers (including hospitals and diagnostic centers) is crucial:

-

Policy makers <-> provider segment:

-

Provide tangible incentives to motivate private sector players to adopt ABDM.

-

Require clear and comprehensive guidelines to ensure a precise understanding of the compliance requirements for ABDM.

-

Highlight the benefits, such as easier access to data, efficient operations, and such, over the cost of digitization, especially for smaller players.

-

Support small and medium-sized players to ensure easier system integration.

-

-

Policy makers <-> technology platform providers:

-

Require clear guidelines on the architecture to ensure easy data integration, data interoperability, and storage. These guidelines can act as a roadmap, providing step-by-step directions for creating a digital system that can smoothly handle different types of information while keeping it safe and organized.

-

Optimize the process of the sandbox and faster provisioning of technical approvals to expedite the process of ABDM adoption.

-

-

Technology platform providers <-> provider segment:

-

Provide technical support, especially to medium and small-sized healthcare providers, which are at the initial stages of digitization.

-

Collaborate with providers to ensure a user-friendly and efficient platform that guarantees data can be easily operated.

-

-

-

Address issues regarding data security. The government needs to play an active role in addressing data security issues. The following measures can be helpful:

-

Create awareness that data security issues happen in open systems. HIS and NIS are closed systems. Hence, data security concerns should be lower.

-

Provide rules and regulations on how to use the data. It is crucial to precisely delineate the types of information permissible for storage, ensuring transparency in the process.

-

Provide guidance on data encryption and decryption at all stages for easier understanding and implementation.

-

Provide education on authorization and data flow. Patients should be aware of consent management, data collection, storage, and retrieval to address their hesitation regarding data security.

-

Increase awareness and rigorous enforcement of the DPDP Act, which can play a pivotal role in addressing concerns related to data security. By adhering to the stipulations outlined in this legislation, healthcare entities can bolster their commitment to safeguarding patient information, fostering trust and accountability in the management of sensitive data.

-

-

Create pull for ABHA adoption by patients. Government and healthcare providers need to play an active role in creating the pull from patients:

-

Conduct awareness programs (e.g., advertisements) to highlight the benefits of ABDM for individuals, including:

-

Electronic health records can be used for easy access to health information, reduction of duplication of tests, and reduction in delays of treatment.

-

Health tracking through ABHA ID leads to better preventive care, early tracking of diseases, and reduces the burden of NCDs. Moreover, ABHA can be useful in monitoring maternal health and improving infant and maternal mortality rates.

-

At the population level, health tracking can be used to avoid the spread of epidemics and ensure better governance and management of resources.

-

-

Provide incentives to increase patient willingness to create and use ABHA ID. Examples can be an acceleration of CGHS/PMJAY reimbursements, easier registration at hospitals, and so on.

-

-

Create a soft push for ABHA adoption. Government intervention is needed to create the push from healthcare providers and payers to increase the adoption of ABHA. Mandatory implementation of ABHA ID in specific instances, akin to Aadhaar’s mandatory usage for KYC purposes, could be considered:

-

Push from providers. This could include mandating the use of ABHA ID for certain healthcare services, such as registration processes.

-

Push from payers. ABHA could be required for issuing and renewal of insurance policies, thereby incentivizing individuals to obtain and utilize their ABHA ID.

-

Notes

[1] “Pathways to Scale Adoption of Digital Health in India.” NATHEALTH/Arthur D. Little, March 2023.

[2] “India’s Fast-Evolving Healthcare Industry on the Cusp of a Digital Revolution Driven by the Indian Consumer.” NATHEALTH/Arthur D. Little, March 2022.

[3] “ABDM Dashboard.” India National Health Authority, accessed 21 February 2024.

[4] “Pathways to Scale Adoption of Digital Health in India.” NATHEALTH/Arthur D. Little, March 2023.

[5] “Pathways to Scale Adoption of Digital Health in India.” NATHEALTH/Arthur D. Little, March 2023.

DOWNLOAD THE FULL REPORT

26 min read • Healthcare & life sciences

Catalyzing digital health in India

Critical pathways for user adoption & driving the next wave of transformational use cases

DATE

FOREWORD

Digital health solutions are shaping the future of healthcare worldwide, driving numerous innovations and trends, including online pharmacies, telemonitoring, personalized medicine, and chronic disease management. The adoption of digital technologies presents opportunities for providers to expand their businesses, enhance profitability, and improve the accessibility and affordability of healthcare services.

The government’s ambitious Ayushman Bharat Digital Mission (ABDM) is leading the charge in India, aiming to digitize the entire healthcare ecosystem, from patient records to service delivery. Digitalization and ABDM offer several benefits to providers, including improved monetary and operational efficiency, access to larger patient populations, a competitive edge through enhanced patient experiences, future resilience, data-driven decision-making, and better preventive healthcare.

Despite robust demand and a comprehensive rollout plan, healthcare providers, especially private sector, lag in ABDM adoption. This Report deep dives into two key verticals of healthcare providers, hospitals and diagnostics, and seeks to understand the key challenges impeding ABDM adoption in those segments. The Report also provides imperatives and solutions for policy makers, healthcare providers, technology platform providers, and patients. Our findings are based on insights from extensive interviews and a survey. More than 12 in-depth interviews were conducted with relevant industry leaders including founders, medical doctors, CEOs, and CIOs across reputed private hospitals and diagnostics. The survey collected data related to digital health adoption from private and public healthcare providers.

The insights emerging from the interviews and survey can be particularly useful for the entire ecosystem to gain a systemic view of the status of digital adoption and its evolution. The four imperatives identified in this Report will create the impetus for digital health adoption and ABDM integration for private sector hospitals and diagnostics in India.

Brajesh Singh

Associate Director

Arthur D. Little

Siddhartha Bhattacharya

Secretary General

NATHEALTH

EXECUTIVE SUMMARY

The healthcare landscape in India is undergoing a rapid transformation, fueled by technological advancements and evolving patient expectations. Within this dynamic context, the digitization of healthcare has emerged as a pivotal force with the potential to significantly revolutionize healthcare delivery and enhance patient outcomes. The government’s ambitious ABDM is at the forefront of this transformative effort, aiming to digitize the entire healthcare ecosystem and encompassing patient records and service delivery.

A key facet of the digital health mission includes creating the Ayushman Bharat Health Account (ABHA) for individuals and establishing a unique identity (ABHA ID) across healthcare providers. This enables seamless access to unified benefits from public health programs and insurance schemes. Implementing personal health records (PHR) simplifies medical data sharing, reducing patient inconvenience and ensuring continuity of care across different specialists and service providers.

In our earlier exploration of digital health adoption, Arthur D. Little (ADL) revealed additional insights into the current state of digitalization, highlighting its crucial stage.[1],[2] To assess the extent of digitization, we introduced the Digital Health Adoption Index, assigning scores from 0 to 10 to providers based on their digital maturity. The results closely mirrored those obtained in the previous year’s survey. Notably, small private diagnostic laboratories and unorganized senior care and home care providers exhibited limited digital adoption. Conversely, among the participants, large private hospitals showcased the highest degree of digital adoption.

Digitization and ABDM in digital health offer several advantages to the providers, such as improvisation in monetary and operational efficiency, access to larger patient groups, competitive edge through better patient experience, enhanced robustness for the future, data-driven decision-making, and better preventive healthcare.

Despite robust demand and a comprehensive rollout plan, healthcare providers, especially in the private sector, lag in adopting digital technologies. Currently, 70% of the Health Facility Registry (HFR) and 83% of the Health Professional Registry (HPR) are populated by information from the public sector. Therefore, this Report deep dives into two key verticals of healthcare providers: hospitals and diagnostics. Through consultations with industry experts, we have identified four key challenges impeding widespread adoption of these critical, enabling digitalization efforts across these verticals, especially in the private sector:

-

Lack of clear guidelines. A significant challenge lies in the lack of clear government guidelines under ABDM. Key issues surround uncertainties regarding the responsibilities associated with data storage, retention, and transfer. Moreover, the current engagement with private players is inadequate, and the guidelines shared are not in-depth or clear. Additionally, there remains confusion among private players over the proper steps for ABDM adoption.

-

Investment required. Adopting the ABDM and making the necessary digital enablement for linking to the NHS requires significant investments in developing technology infrastructure, especially for private players. The business case and rationale for this technology investment are not as simple as was anticipated.

-

Data security concerns. There are very clear apprehensions regarding data security issues. The various stakeholders lack a clear understanding and aligned view of the measures required to guarantee robust data security protocols.

-

Subdued pull from individuals. Since its launch in 2021, only a 40% penetration of ABHA IDs has been observed in India. Individuals are not aware of the benefits provided through health tracking provided by ABDM. Also, currently, there are limited options for ABHA ID usage for people who have already created ABHA; hence, there is a lack of push for individuals to use ABHA.

ADL believes the inevitability of digital healthcare underscores the importance of proactive adaptation over reactive compliance. As India embraces the digital landscape, the shift toward digital health not only mandates adjustment but also presents an expansive opportunity for the private sector. The push for deeper penetration of ABDM will require a collective effort on the part of the government, private healthcare providers, technology platform providers, and patients. This Report proposes four imperatives to drive ABDM penetration in the Indian healthcare industry:

-

Ensure effective engagement through two-way participation. The responsibility for ABDM adoption should not rest solely on healthcare providers. Collaboration among policy makers, healthcare providers (including hospitals and diagnostic centers), and technology platform providers is crucial.

-

Policy makers <-> provider segment (hospitals and diagnostic centers):

-

Provide tangible incentives to motivate private sector players to adopt ABDM.

-

Require clear and comprehensive guidelines to ensure a precise understanding of the compliance requirements for ABDM.

-

Highlight the benefits, including easier access to data, efficient operations, and so on, over the cost of digitization, especially for smaller players.

-

Support small and medium-sized players to ensure easier system integration.

-

-

Policy makers <-> technology platform providers:

-

Require clear guidelines on the architecture to ensure easy data integration, data interoperability, and storage.

-

Optimize the process of the sandbox and faster provisioning of technical approvals to expedite the process of ABDM adoption.

-

-

Technology platform providers <-> provider segment (hospitals and diagnostic centers):

-

Provide technical support, especially to medium and small-sized healthcare providers, which are at the initial stages of digitization.

-

Collaborate with providers to ensure a user-friendly and efficient platform that guarantees data interoperability.

-

-

-

Address issues regarding data security. The government needs to play a proactive role in addressing the data security concerns in the following ways:

-

Increase awareness about lower data security issues in HIS and NIS, as they are closed systems.

-

Establish clear government regulations to specify permissible data usage.

-

Provide guidance on encryption and decryption for easier implementation.

-

Educate individuals on authorization, consent management, and data flow to address security concerns.

-

Create awareness and rigorous enforcement of the Digital Personal Data Protection (DPDP) Act 2023.

-

-

Create pull for ABHA adoption by patients. ABDM adoption will take a significant jump if demand is created from individuals across India. Hence, government and providers need to play an active role in creating the pull.

-

Conduct awareness programs (e.g., advertisements) to highlight the benefits of ABDM for individuals:

-

Electronic health records can be used for easy access to health information, reduction of duplication of tests, and reduction in delays of treatment.

-

Health tracking via ABHA ID aids in preventive care, early disease detection, and alleviates the burden of noncommunicable diseases (NCDs), while also enhancing maternal health monitoring and reducing infant and maternal mortality rates.

-

At the population level, health tracking can be used to avoid the spread of epidemics and ensure better governance and management of resources like oxygen cylinders.

-

-

Provide incentives to encourage patients to create and use ABHA ID, such as accelerated CGHS (Central Government Health Scheme)/PMJAY (Pradhan Mantri Jan Arogya Yojana) reimbursements and simplified hospital registration processes.

-

-

Create a soft push for ABHA adoption. Government intervention is needed to create the push from healthcare providers and payers to increase the adoption of ABHA. Mandatory implementation of ABHA ID in specific instances, akin to Aadhaar’s mandatory usage for “know your customer” (KYC) purposes, could be considered.

-

Push from providers. This could include mandating use of ABHA ID for certain healthcare services, such as registration processes.

-

Push from payers. ABHA could be required for issuing and renewal of insurance policies, thereby incentivizing individuals to obtain and utilize their ABHA ID.

-

1

THE STATE OF DIGITAL HEALTH IN INDIA

CURRENT DIGITAL & ABDM ADOPTION LANDSCAPE

India has witnessed rapid digitalization across all sectors, including the healthcare industry. The government’s ambitious ABDM is at the forefront of this transformative effort, aiming to digitize the entire healthcare ecosystem and encompassing patient records and service delivery. Based on our discussion with stakeholders in the provider ecosystem and secondary research, we uncovered critical insights into the present state of digitalization, emphasizing its pivotal role in the healthcare sector.

While there are compelling arguments for the digital transformation and adoption of ABDM, private healthcare providers encounter obstacles that impede their transition. An examination of the registered health facilities in India, which total 2,32,091 at the time of this writing, reveals that only 30% of them are privately owned (see Figure 1).[3]

This statistic suggests resistance among private healthcare providers regarding the adoption of ABDM and self-registration. Furthermore, out of the 35 crore reports linked through the registered HFR as of February 2024, a mere 2% (~7 lakh) are shared by private healthcare providers. These figures underscore the limited participation of private providers in the digital healthcare ecosystem and show that, despite a comprehensive rollout plan, the adoption rate among private healthcare providers remains notably constrained.

ABDM: WHAT’S IN IT FOR HEALTHCARE PROVIDERS?

ABDM’s primary objective is to establish the foundational framework required to sustain the integrated digital health infrastructure in India. ABDM endeavors to eliminate the current disparities among various stakeholders in the healthcare ecosystem by establishing digital highways that will enable safer, faster connectivity for all.

The healthcare ecosystem must embrace digital practices to streamline the collection, storage, and retrieval of patient data, thereby enhancing transparency in the system. This transition can improve operational efficiency, resulting in cost optimizations. These benefits can in turn be extended to patients through increased affordability.

The HFR serves as a comprehensive database connecting health facilities to India’s digital health ecosystem. Despite the government’s efforts to promote ABDM adoption, only 30% of total HFR registrations have come from the private sector, despite holding a 70% market share. Public health facilities lead to ABDM adoption, revealing a significant gap between the public and private sectors.

Current ABDM adoption numbers for healthcare providers demonstrate an increasing trend, but the disparity between public and private contributions is evident. Addressing this requires an understanding of the reasons behind low adoption, particularly among private healthcare providers, including concerns related to data security and the sharing of internal digital systems.

DIGITAL HEALTH ADOPTION INDEX

To assess the extent of digitization, we introduced the Digital Health Adoption Index, assigning scores from 0 to 10 to providers based on their digital maturity. Providers with no digital adoption received a score of 0. The score increased based on the degree of digital utilization, ranging from basic billing systems to basic enterprise resource planning (ERP) incorporating health and laboratory information management systems (HIMS/LIMS) and extending to the incorporation of artificial intelligence (AI) and analytics with ERP, HIMS/LIMS, and electronic medical records (EMRs) — see Figure 2.

Based on interviews and a survey, we utilized the Digital Health Adoption Index to score different provider segments. The results closely mirrored those obtained in the previous year’s survey.[4] Notably, small private diagnostic laboratories and unorganized senior care and home care providers exhibited limited digital adoption. Conversely, among the participants, large private hospitals displayed the highest degree of digital adoption, as shown in Figure 3.

Notably, large hospitals and diagnostic laboratory chains, despite achieving higher scores on the Digital Health Adoption Index, expressed significant concerns related to data security and the internal sharing of digital systems. This underscores the critical need for a comprehensive strategy that goes beyond mere adoption figures. Addressing these concerns and barriers is essential to ensure the seamless and effective integration of digital technologies into the healthcare sector, allowing for a more robust and secure digital health ecosystem.

GOVERNMENT INITIATIVES FOR ABDM ADOPTION

India’s government has designed and implemented several initiatives to push digitalization through ABDM. These incentives focus on increasing ABHA ID creation, incentivizing ABDM utilization, and driving payer-side adoption. ABHA ID creation has been made platform-agnostic to enable a multitude of platforms to create ABHA, reducing technical failures and enabling a large population of grassroots workers, such as accredited social health activists (ASHAs), to create ABHA IDs. Simultaneously, the Digital Health Incentives Scheme (DHIS) aims to reward users of ABDM through financial incentives for crossing certain established thresholds of health record linking with ABHA. The scheme started recently and is expected to be scaled to bring more providers into the benefit pool.

Government initiatives include:

-

Multi-platform ABHA creation. Multiple platforms such as CoWIN (Covid Vaccine Intelligence Network), PMJAY, and Beneficiary Identification System (BIS) support the creation of ABHA ID. Benefits include:

-

Increases ABHA registrations through the involvement of state and central health resources.

-

Multiple platforms reduce the probability of technical failure of ABHA registrations.

-

Improves community adoption in rural areas by engaging ASHA workers.

-

-

DHIS. This scheme aims to use financial incentives to hospitals and diagnostic centers registered on the HFR and to digital solution companies registered on the ABDM Sandbox to improve ABDM adoption. Benefits include:

-

Emphasizes ABDM integration as a lucrative way to kick-start digital adoption by partially offsetting associated costs.

-

Promotes ABDM utilization by incentivizing linking of health records to ABHA IDs.

-

Despite the program’s potential, creating awareness poses a significant challenge, emphasizing the crucial requirement for a robust communication strategy to fully realize its impact (see Figure 4). DHIS registrations have not led to a notable improvement in private healthcare providers’ adoption, primarily due to the perceived inadequacy of financial benefits provided by regulatory authorities to address the operational and capital expenditures (OPEX/CAPEX) required.

-

Health Claims Exchange (HCX) platform. This platform is envisioned as a common platform for facilitating all exchanges of claims-related information between all relevant actors (payers, providers, beneficiaries, regulators, and observers) and processing all health claims. Proposed benefits include:

-

Will drive payer-side digitalization, which, in turn, is expected to increase provider-side digital health and ABDM adoption.

-

Will improve the efficiency and reduce the costs of claims processing through a single platform.

-

-

100 Microsites project. This project aims to address ABDM adoption challenges for small and medium-scale private healthcare facilities nationwide. Its goal is to integrate various health facilities under ABDM, expanding its reach and fostering adoption among private healthcare providers. The state mission directors will spearhead implementation, supported by the National Health Authority. States/union territories may engage an interfacing agency for Microsite setup, receiving incentives tied to ABDM adoption milestones. Proposed benefits include:

-

Targeted outreach efforts within a Microsite can increase awareness about ABDM and highlight the benefits of ABDM for both patients and providers.

-

Will help increase ABDM adoption by private healthcare providers across the country.

-

However, a development partner, aiding Microsite implementation, will not receive financial benefits.

2

CHALLENGES IDENTIFIED: HOSPITALS & DIAGNOSTIC CENTERS

In this chapter, we delve deeper into two pivotal verticals within the healthcare value chain: hospitals and diagnostic centers. Through comprehensive analysis and stakeholder consultations, we have identified key challenges impeding ABDM adoption in these two verticals.

HOSPITALS

Private hospitals dominate the healthcare sector, commanding a substantial 70% market share. Notably, larger private hospitals have embraced digitization, reflected in their commendable Digital Health Adoption Index score of approximately 9. However, the adoption of digital technologies remains notably lacking in smaller and mid-sized hospitals, as shown in Figure 3. This discrepancy is evident in the Digital Health Adoption Index, where these hospitals typically score around 3, highlighting the need for increased digital integration across all healthcare facilities, regardless of size.

Key challenges facing private sector hospitals

We have identified five critical challenges that have hindered the adoption of ABDM among hospitals, impacting not only small private facilities but also large hospital chains:

-

Ambiguities in guidelines from the government. The implementation of ABDM in hospitals encounters notable challenges stemming from unclear government guidelines. Key issues surround uncertainties regarding the responsibilities associated with data storage, retention, and transfer, presenting significant hurdles. The complexity intensifies due to the diverse nature of the data involved, which includes genetic information, family history records, clinical data, and lifestyle-based information. Each of these data types introduces unique challenges, further complicating the seamless adoption of ABDM within hospital settings.

-

Lack of awareness about digitization and ABDM. Small players exhibit a resistance to digitalization, even when resources are available. This resistance is rooted in a desire to avoid heightened regulatory scrutiny resulting from increased transparency brought about by digitalization. Moreover, there is a noticeable lack of awareness regarding the correlation between ABDM adoption and the benefits for smaller hospitals. The advantages, such as increased accessibility for a broader patient base, are not adequately communicated. This awareness gap creates a significant barrier for smaller healthcare facilities, preventing them from realizing the potential advantages and opportunities that ABDM adoption could bring.

-

Technological barriers. Large hospitals encounter challenges when integrating their existing internal systems with common platforms, underscoring the importance of ensuring data interoperability and standardization. Despite a growing number of technology players entering the market, the industry lacks sufficient software and ERP systems tailored specifically for digital health. This scarcity of available technology partners further complicates the adoption process. Furthermore, in the rural areas where approximately 65% of the country’s population resides, there is a notable absence of a robust digital infrastructure despite government initiatives to enhance connectivity. This hinders the adoption of digital health in rural areas.

-

Low penetration of electronic health records. EMRs are the backbone of ABDM. Currently, most large-scale hospitals maintain electronic health records. However, some of them have EMRs as scanned PDFs, which might not be compatible with ABDM systems. Most medium and small-scale hospitals do maintain EMRs.

-

Additional CAPEX/OPEX. Smaller hospitals face a significant challenge because they need to invest a lot in digital infrastructure for ABDM, both in terms of CAPEX and ongoing OPEX. Creating the necessary technology setup is a big challenge, especially for smaller players. It is also unclear how much they will gain from this investment and what tangible benefits they can expect.

DIAGNOSTIC CENTERS

The diagnostic service sector is comprised predominantly of unorganized standalone labs, accounting for 83% of the sector, while organized labs make up only 17%. Notably, there exists a significant disparity in digital adoption between large and small diagnostic service providers. Despite their smaller representation, larger labs exhibit a noticeable trend toward gradual digitization. Large private diagnostic players scored an impressive 8 on the Digital Health Adoption Index, indicating a high level of digital adoption, whereas smaller labs scored a 2, reflecting a low level of digitization. During discussions with senior leaders from leading diagnostic labs in India, we uncovered several challenges hindering the adoption of ABDM.

Key challenges facing diagnostic centers

Large diagnostic players show less resistance to ABDM adoption primarily due to existing digitization, but there are still other concerns that must be addressed:

-

Concern regarding loss of competitive advantage. Large laboratories, which have already embraced digitization, voice apprehension regarding the implementation of standardized platforms, unification of test codes, and the potential diminishment of brand recognition. The preservation of differentiation is deemed crucial, and the shift toward a standardized system is perceived as potentially challenging. Specifically, concerns revolve around the risk of losing a distinctive brand identity within the ABDM platform and the perceived difficulty in standing out on a standardized framework, posing notable challenges for large diagnostic centers.

-

Hesitation with data sharing. Unspoken concerns hover around the sharing of data on shared platforms. There is a need for clear guidance on protocols and standards for data sharing within the industry.

-

Resistance from small and midsized centers. Smaller and midsized diagnostic centers are in the initial stages of transitioning to digital operations. They encounter various challenges, including the considerable cost associated with digitization, which may exceed their financial capacity. Additionally, these centers lack sufficient technical expertise and awareness regarding the advantages of digitalization.

PATIENT-SIDE ISSUES

In addition to the challenges hospitals and diagnostic centers face in ABDM adoption, challenges arise from patients themselves, including:

-

Limited awareness of the benefits of ABHA. Patients often perceive digitization through a narrow lens, primarily associating it with the utilization of applications. However, they may not fully grasp the broader implications and advantages offered by the maintenance of longitudinal digital medical records, as facilitated by ABDM. These advantages span beyond simple app usage and encompass a spectrum of benefits, ranging from better accessibility to healthcare services to personalized health-monitoring capabilities. Particularly significant is the potential for long-term benefits, especially in managing chronic diseases, where such digital records can facilitate more effective disease management strategies and contribute to overall improved health outcomes.

-

Limited opportunities to use ABHA ID. Patients who possess an ABHA ID are not utilizing it adequately, largely due to the limited adoption of ABDM by healthcare providers. This lack of adoption restricts the utility of ABHA IDs, thereby diminishing patient engagement. Without utilizing the ABHA ID multiple times, patients may not fully comprehend the system’s mechanics, including data security through consent management and the potential benefits of health data tracking. Therefore, without proactive efforts from healthcare providers to implement and encourage the use of ABHA IDs on a larger scale, patient willingness to utilize the system will remain low.

-

Concerns regarding data safety. Patients express concerns about sharing their confidential health information due to apprehension regarding potential data breaches and misuse. Their apprehension stems from a lack of understanding about the secure methods involved in data collection, storage, and access, as well as the significance of consent management. This knowledge gap leads to reluctance to share health data, thereby impacting ABDM adoption.

THE BENEFITS OF DIGITIZATION & ADBM ADOPTION FOR PROVIDERS

The digitization of healthcare is essential for providers, offering numerous benefits, including (see Figure 5):

-

Access to larger patient groups. Digitization opens doors to a significantly larger patient population. Through digital health records and online services, healthcare providers can extend their reach beyond geographical constraints. This is particularly crucial in a country as diverse and expansive as India, where remote and underserved areas can benefit greatly from improved healthcare access, while the providers would benefit from access to patients across extended regions.

-

Competitive edge and enhanced patient experience. Embracing digital health technologies provides a competitive edge in the healthcare market. Patients increasingly seek healthcare providers that offer advanced and convenient digital services. Digitization enhances the overall patient experience, allowing patients to access their health records online, book appointments digitally, and receive timely reminders for follow-up care. Telemedicine and remote-monitoring solutions enable convenient consultations, which is especially beneficial for patients in rural or remote areas. A positive patient experience contributes to patient satisfaction and loyalty and helps increase the top line.

-

Enhanced robustness for the future. The healthcare landscape is evolving, with emerging technologies such as telemedicine, AI, and data analytics becoming integral to healthcare delivery. Providers that adapt to these changes and invest in digital governance will be better positioned to thrive in the evolving healthcare landscape. With every industry moving toward digitization, healthcare will no longer be an exception. Sooner or later, regulatory compliance will require each provider to be on the digital platform. Providers that join the digital ecosystem from the start will benefit from their early response. Additionally, because the healthcare industry is subject to numerous regulations and compliance requirements, digitization enables providers to adhere to these regulations more efficiently. Digital health records make it easier to maintain and retrieve patient data, ensuring compliance with privacy and security standards.

-

Monetary and operational efficiency. Digitization leads to improved operational efficiency, reducing the burden of paperwork and manual processes. Electronic health records and other digital tools streamline administrative tasks, enabling healthcare providers to focus more on patient care. The cost savings associated with reduced paperwork, improved efficiency, and optimized resource utilization contribute to the financial sustainability of healthcare organizations. In our previous Report, we demonstrated the cost-benefit analysis for private healthcare providers and showed that using cloud-based solutions could add 3%-6% to the provider’s bottom line with a payback period of less than 18-36 months.[5] ABDM-integrated solutions make digitalization feasible even for players with a Digital Health Adoption Index score of 3 or less. ABDM solutions reduce CAPEX by up to 60% as compared to on-premise systems and decrease OPEX by 20%-40% during the initial years in comparison to non-ABDM (cloud) solutions (see Figure 6). Large providers using ABDM-compliant systems from the outset of digitalization can capture more than 80% of the benefits of digitalization with a 60% reduction in CAPEX as compared to an on-premise solution.

-

Data-driven decision-making. Digital health solutions provide valuable data insights that empower healthcare providers to make informed decisions. From patient outcomes to operational efficiency, data analytics can highlight areas for improvement and support evidence-based decision-making. This data-driven approach not only enhances the quality of healthcare services but also contributes to continuous improvement and innovation.

-

Preventive healthcare and population health management. Digital tools support preventive healthcare by enabling proactive interventions based on individual health data. Population health management becomes more effective as providers can identify trends, risk factors, and potential outbreaks, allowing for targeted public health initiatives. Preventive care reduces the burden on the healthcare system and improves overall community well-being.

Digitization is not merely a technological upgrade; it is a fundamental shift in how healthcare is delivered, experienced, and managed. Healthcare providers embracing digital transformation position themselves to provide higher-quality, more accessible, and patient-centric care in an ever-evolving healthcare landscape.

SUGGESTED ABDM USE CASES FOR HOSPITAL & DIAGNOSTIC PROVIDERS

ABDM can be used for various use cases encompassing key areas, including:

-

Integration of ABDM for digital governance of ultrasound devices. Ultrasound technology emerges as a transformative force, offering real-time, high-resolution diagnostics and therapeutic applications. However, its adoption in India faces several hurdles, including limited awareness, regulatory complexities, and inadequate infrastructure. The existing regulations, while well-intentioned, lack proper implementation, resulting in prolonged approval processes and apprehension among healthcare practitioners. A digital governance system for ultrasound devices — a solution aligned with ABDM — has been proposed by a joint collaboration of NATHEALTH and ADL. This digital transformation aims to streamline ultrasound compliance, addressing regulatory inefficiencies and improving transparency. The proposed system functions on a rule-based model comprising four interconnected modules: healthcare providers, equipment suppliers, provider operations, and device registries. A central registry for all ultrasound devices in the country is recommended to monitor their lifecycle status, each linked to a unique device ID. ABDM is pivotal in maintaining this registry and integrating data from the modules.

Furthermore, at diagnostic provider centers, patients can be directly linked to their ABHA ID, seamlessly connecting them to the digital health ecosystem. This streamlines record-keeping and minimizes clerical errors. As an example, pregnancy scan results can be uploaded to an online portal, forming a centralized registry of patient records accessible in real time to authorities. All patient data, including medical history, scans, reports, and interventions, will remain protected under data privacy laws, with access restricted to ABDM.

The envisioned digital governance system aims to revolutionize healthcare accessibility, surmount regulatory hurdles, alleviate the burden of NCDs, enhance maternal and child healthcare, and position India as a frontrunner in health tech innovation.

-