DOWNLOAD

Telecoms: Leveraging adversity to leapfrog into the future

The telecoms industry has been able to weather the COVID-19 storm better than many sectors, and has even increased its importance for communicating in a locked-down, socially distanced world. What will be the longer-term impacts for different parts of the sector? This article examines the current environment and explains how CXOs can prepare for the potential challenges and opportunities in a postcrisis world.

Telecoms has been able to weather the storm resulting from COVID-19 more effectively than many other sectors, given its utility-like nature and the specific impact of lockdowns on peoples’ lives and habits. Telecoms has given people the ability to stay connected to family and friends, work remotely, take classes, and be entertained at home.

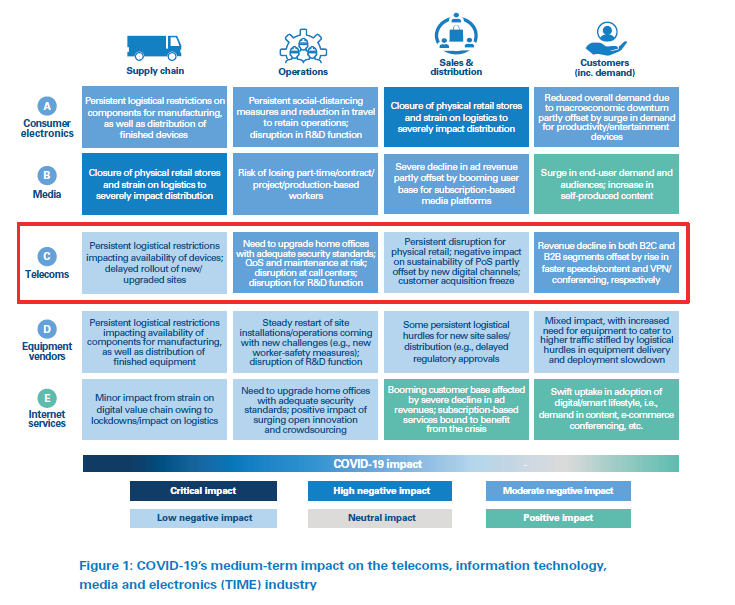

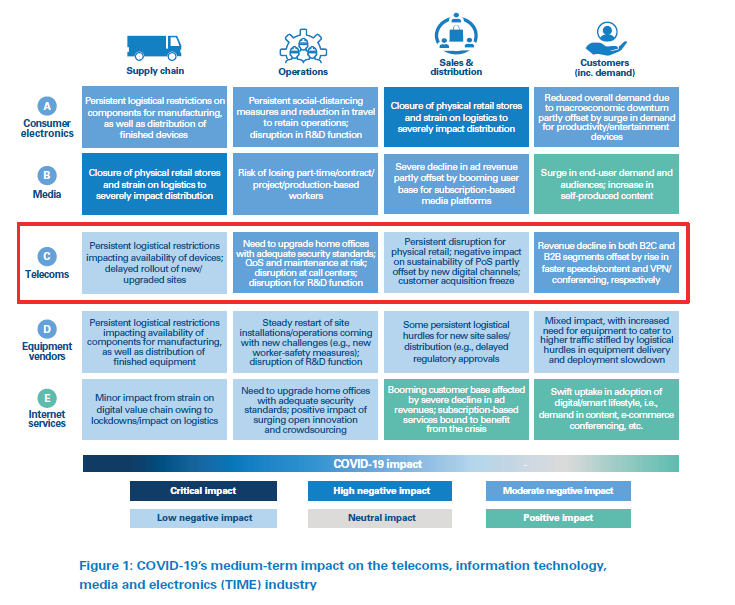

Consequently, when compared to other related sectors, such as media and consumer electronics, we expect the telecom industry’s medium-term (2020) financials to be only moderately impacted.

Consequently, when compared to other related sectors, such as media and consumer electronics, we expect the telecom industry’s medium-term (2020) financials to be only moderately impacted.

Now, with immediate crisis management activities already completed, telecom decisionmakers have a unique opportunity to leverage the disruptive nature of the crisis and take steps to strengthen their competitiveness in the medium to long term.

Although some moves CXOs can make will clearly be dependent on the duration and intensity of lockdowns and the overall pandemic, a strategy focused only on “wait and watch” will not serve them well.

The crisis will potentially lead to the transformation, and even elimination, of both individual companies and wider industries, creating new playing fields and changing the rules for existing ones. Previous competitive advantages might not hold sway in the new world.

Therefore, this is the time to start preparing for the future, particularly as market conditions are conducive to acquisition, including assets available at distressed valuations and talented staff being let go by employers. For example, the satellite firm OneWeb, whose assets are being sold now that it has filed for bankruptcy, could provide synergies and diversification opportunities for telecom players at bargain prices.

Telecom players are well positioned to capitalize on such newly created opportunities, as their core businesses are not as adversely impacted as those of some other industries.

Based on this, in this article we outline five key conclusions around the impact of COVID-19 on the telecoms sector, before sharing our insight and opportunities for sector executives. (See Figure 1.)

1. Networks are broadly able to cope with demand

Network traffic grew at approximately 40–50 percent from the beginning of the outbreak, driven by a surge in demand for fixed subscriptions, higher bandwidth and content offerings, which tested the resilience of existing telecom networks. Vodafone UK, for example, experienced a 30 percent increase in mobile internet traffic and a 42 percent increase in mobile voice traffic.

Although most networks have been able to meet this increased demand, regulators have stepped in with stipulations to ensure network availability for essential basic communications, such as reducing streaming quality in some countries. Additionally, the crisis has exposed weaknesses in the ability of legacy technologies such as xDSL to deliver the required performance, as use cases moved from niceto- haves (video, chat and gaming during the evening) to must-haves (work and education), which require much higher quality of experience (QoE).

2. Developments favor incumbents over challengers

Despite the increased demand for bandwidth, the forced closure of physical channels (kiosks, shops) has had a negative revenue impact on telecom players, although lower sales have been partially offset by less churn to competitors. For example, AT&T closed 40 percent of its retail stores in the US.

However, these developments are likely to be net positive overall for the industry, especially in saturated/developed markets, as they lead to lower customer acquisition and retention costs. Challengers that were growing at the expense of others will be the most negatively impacted.

Advertising and operations are also being impacted in the short term across the industry:

- Companies saw a reduction in roaming and advertising revenues, coupled with a shortage of SIMs, devices and network equipment.

- Mobility disruptions and social-distancing guidelines hit contact-center and network field operations.

3. Top-line revenues to see early-single-digit year-on-year declines

The medium-term impact of COVID-19 on the telecom industry will vary significantly by country, driven by the scale of the country’s health and economic crises. However, the global telecoms industry is likely to demonstrate resilience and perform better than overall GDP trends. This reflects the weak correlation of its utility-like core services with macroeconomic conditions, as was shown in the 2008–09 global downturn. At the same time, social-distancing measures will act as a catalyst for broader and better connectivity, which will be potentially convertible into new revenues through upgraded offers.

However, despite the continuity of these core services and the availability of new opportunities to offset revenues, the net top-line impact of the crisis is unlikely to be positive for most telecom players until well after the global recovery, primarily due to the decline in the B2B segment.

The B2C segment (accounting for approximately 55–70 percent of each company’s revenues) is expected to mostly remain stable. This will balance the impact of reduced prepaid and roaming revenues with the uptake of faster broadband and bigger mobile bundles, increased postpaid usage and reduced churn.

Some challenger players might be impacted more than established leaders due to their business models. For example, reduction in travel is expected to result in a projected USD 25 billion roaming revenue loss in 2020.

Although this will only modestly impact the top lines of the majority of players (for which roaming typically accounts for 5–8 percent of revenues), other players such as Greece’s OTE, which relies heavily on tourists’ use of its network, are expected to take a heavier hit in this area. Additionally, as roaming is often a “pure-margin” service, stronger impact is expected on the net profits of exposed players.

On the B2B side, despite the upside from governments and large corporates seeking higher bandwidth for VPN and conferencing facilities, financial performance will be adversely impacted due to potential bad debts from small and medium enterprises (SMEs), increased unemployment, business closures and the overall decline in economic activity. Few players have taken precautionary measures, although Verizon has set aside a USD 228 million extra reserve for this. Overall, B2B revenues are expected to show a low-single-digit contraction in 2020, bouncing back to growth in 2021 if the global economy recovers.

Based on ADL’s assessment, for mobile operators, global revenues are expected to decline 2–4 percent in 2020 compared to last year. There will be regional differences:

- European players will see a potential decline within a broad range of approximately 2–9 percent.

- In contrast, Asia and Oceania will be affected least, with a probable rough 2 percent decline.

- The Middle East and Africa and the Americas are likely to be between these two poles, with revenue declines of approximately 4 percent and 2–4 percent, respectively.

These estimates assume that the relative geographic impact of the pandemic remains similar to trends seen in April 2020.

4. OPEX to witness a limited decline

A similar evolution can be expected for OPEX. Reduced spending on marketing activities and subscriber acquisition and retention, as well as store closures, is expected to generate OPEX savings of 1–3 percent in 2020.

However, although competition has become moderate as customers’ willingness to churn/port has declined, this trend is expected to reverse as soon as movement restrictions are lifted and retail operations are fully restored. This implies a need to then spend any commercial OPEX allocated for customer acquisition and retention that will have been saved during the lockdown.

Overall labor costs should remain stable as societal and governmental pressures mount to prevent furloughing of staff, especially given the moderate commercial downside the sector faces. For example, Orange has pledged to protect its 87,000 French workers without governmental help as part of an agreement with the economy minister. However, this could lead to persistent loss in flexibility, even as automation increases and makes some areas less labor intensive.

In the medium term, the crisis will also reinforce and accelerate some of the pre-COVID-19 OPEX trends, such as network sharing. Thanks to the pandemic and its economic impact, regulators might adopt a more lenient view of mobile network-sharing agreements, shifting part of their scrutiny from competition to the robustness and economic health of the overall ICT sector.

5. Mixed guidance on CAPEX

Postponing the delivery and deployment of network equipment could lead to a CAPEX reduction of 2–4 percent in 2020. However, CAPEX spend will rebound quickly in 2021 as most telecom players, in the midst of significant 5G network infrastructure capital expenditure, have decided to continue or even expand their plans. Fixed networks, in particular FTTP spend, will also grow to ensure that operators have enough capacity to deliver high-performing services given the increased traffic demand. Heavy expenditure on fixed telecom infrastructure in a downturn was a strategy that several operators adopted successfully during the 2008 financial crisis.

So far, there have been mixed messages on 2020 CAPEX guidance:

- Verizon announced an upward revision (+USD 1 billion) to support its network activity.

- AT&T warned of “downward proclivity” due to logistics issues such as difficult cell-site acquisitions.

The COVID-19 crisis will create situations in which companies will want to invest but not be able to. This risk will be amplified in Europe, where plans for 5G infrastructure are likely to be delayed. Additionally, operator propensity to spend might be hampered by heightened volatility in capital markets, with corresponding implications for the cost of capital.

Insight for the executive

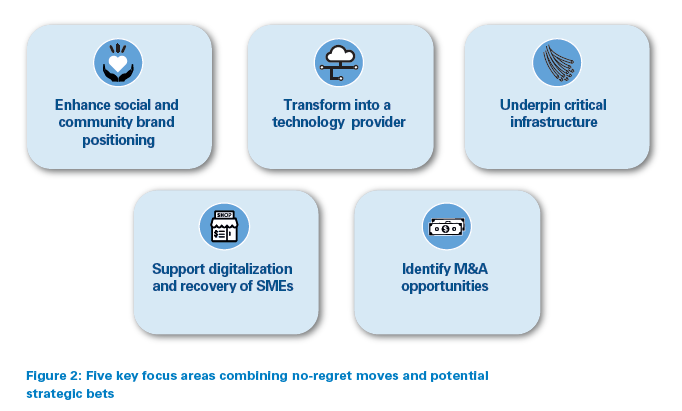

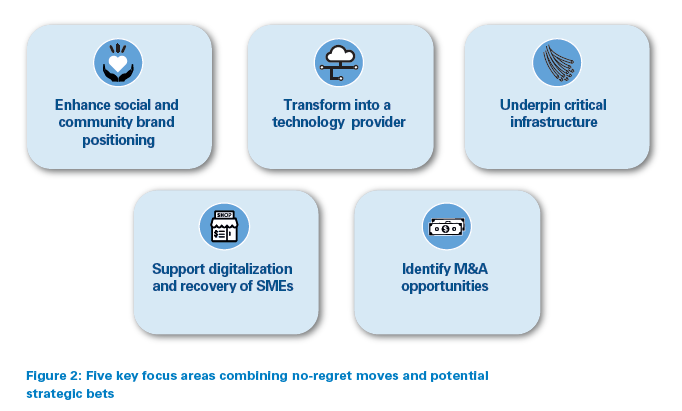

In the longer term, key structural changes that are largely enabled by technological “smartization” are expected to reshape behaviors and societal norms, as well as to redefine value chains and business models. Therefore, appropriate actions need to be taken by CXOs to prepare their organizations for this new world, the establishment of which has only been accelerated by the COVID-19 crisis. We have listed below five key areas for focus. They combine “no-regret” moves that will help telecoms companies, irrespective of which recovery scenario plays out, with potential strategic bets that CXOs can place now to capitalize on any opportunities arising from the impact of the crisis.

Enhance social and community brand positioning:

Enhance social and community brand positioning:

Further strengthen the brand’s positioning and perceptions around supporting its community. For example, Telekom Malaysia deployed 5G base stations at quarantine centers to deliver free Wi-Fi and provided 50 5G FWA terminals.

Transform into a technology provider:

Transform into a technology provider:

Transform self-perception from a telecom services provider to a technology company. Continue with a broader push towards digitalization of functions and develop solutions for emerging trends such as e-learning and telemedicine.

Underpin critical infrastructure:

Underpin critical infrastructure:

Enhance core and transmission network capacity to cater for increased traffic, especially international bandwidth owing to increased two-way traffic for video-conferencing and heavy streaming outside of typical peak traffic hours.

Support digitalization and recovery of SMEs:

Support digitalization and recovery of SMEs:

Play a more active role in digitalization of SMEs by providing cybersecurity support, cloud and business development services, access to training, and tools and capabilities. Devise creative ways to reduce bad-debt risk.

Identify M&A opportunities:

Identify M&A opportunities:

Become aggressive in looking for attractive M&A targets. Take opportunities to expand through acquiring innovative start-ups – as demonstrated by Verizon’s acquisition of videoconferencing company BlueJeans in April 2020.

Overall, CXOs need to leverage the disruptive nature of this crisis and exploit the unique opportunities it creates for transformation of the sector.

Telecoms: Leveraging adversity to leapfrog into the future

The telecoms industry has been able to weather the COVID-19 storm better than many sectors, and has even increased its importance for communicating in a locked-down, socially distanced world. What will be the longer-term impacts for different parts of the sector? This article examines the current environment and explains how CXOs can prepare for the potential challenges and opportunities in a postcrisis world.

Telecoms has been able to weather the storm resulting from COVID-19 more effectively than many other sectors, given its utility-like nature and the specific impact of lockdowns on peoples’ lives and habits. Telecoms has given people the ability to stay connected to family and friends, work remotely, take classes, and be entertained at home.

Consequently, when compared to other related sectors, such as media and consumer electronics, we expect the telecom industry’s medium-term (2020) financials to be only moderately impacted.

Consequently, when compared to other related sectors, such as media and consumer electronics, we expect the telecom industry’s medium-term (2020) financials to be only moderately impacted.

Now, with immediate crisis management activities already completed, telecom decisionmakers have a unique opportunity to leverage the disruptive nature of the crisis and take steps to strengthen their competitiveness in the medium to long term.

Although some moves CXOs can make will clearly be dependent on the duration and intensity of lockdowns and the overall pandemic, a strategy focused only on “wait and watch” will not serve them well.

The crisis will potentially lead to the transformation, and even elimination, of both individual companies and wider industries, creating new playing fields and changing the rules for existing ones. Previous competitive advantages might not hold sway in the new world.

Therefore, this is the time to start preparing for the future, particularly as market conditions are conducive to acquisition, including assets available at distressed valuations and talented staff being let go by employers. For example, the satellite firm OneWeb, whose assets are being sold now that it has filed for bankruptcy, could provide synergies and diversification opportunities for telecom players at bargain prices.

Telecom players are well positioned to capitalize on such newly created opportunities, as their core businesses are not as adversely impacted as those of some other industries.

Based on this, in this article we outline five key conclusions around the impact of COVID-19 on the telecoms sector, before sharing our insight and opportunities for sector executives. (See Figure 1.)

1. Networks are broadly able to cope with demand

Network traffic grew at approximately 40–50 percent from the beginning of the outbreak, driven by a surge in demand for fixed subscriptions, higher bandwidth and content offerings, which tested the resilience of existing telecom networks. Vodafone UK, for example, experienced a 30 percent increase in mobile internet traffic and a 42 percent increase in mobile voice traffic.

Although most networks have been able to meet this increased demand, regulators have stepped in with stipulations to ensure network availability for essential basic communications, such as reducing streaming quality in some countries. Additionally, the crisis has exposed weaknesses in the ability of legacy technologies such as xDSL to deliver the required performance, as use cases moved from niceto- haves (video, chat and gaming during the evening) to must-haves (work and education), which require much higher quality of experience (QoE).

2. Developments favor incumbents over challengers

Despite the increased demand for bandwidth, the forced closure of physical channels (kiosks, shops) has had a negative revenue impact on telecom players, although lower sales have been partially offset by less churn to competitors. For example, AT&T closed 40 percent of its retail stores in the US.

However, these developments are likely to be net positive overall for the industry, especially in saturated/developed markets, as they lead to lower customer acquisition and retention costs. Challengers that were growing at the expense of others will be the most negatively impacted.

Advertising and operations are also being impacted in the short term across the industry:

- Companies saw a reduction in roaming and advertising revenues, coupled with a shortage of SIMs, devices and network equipment.

- Mobility disruptions and social-distancing guidelines hit contact-center and network field operations.

3. Top-line revenues to see early-single-digit year-on-year declines

The medium-term impact of COVID-19 on the telecom industry will vary significantly by country, driven by the scale of the country’s health and economic crises. However, the global telecoms industry is likely to demonstrate resilience and perform better than overall GDP trends. This reflects the weak correlation of its utility-like core services with macroeconomic conditions, as was shown in the 2008–09 global downturn. At the same time, social-distancing measures will act as a catalyst for broader and better connectivity, which will be potentially convertible into new revenues through upgraded offers.

However, despite the continuity of these core services and the availability of new opportunities to offset revenues, the net top-line impact of the crisis is unlikely to be positive for most telecom players until well after the global recovery, primarily due to the decline in the B2B segment.

The B2C segment (accounting for approximately 55–70 percent of each company’s revenues) is expected to mostly remain stable. This will balance the impact of reduced prepaid and roaming revenues with the uptake of faster broadband and bigger mobile bundles, increased postpaid usage and reduced churn.

Some challenger players might be impacted more than established leaders due to their business models. For example, reduction in travel is expected to result in a projected USD 25 billion roaming revenue loss in 2020.

Although this will only modestly impact the top lines of the majority of players (for which roaming typically accounts for 5–8 percent of revenues), other players such as Greece’s OTE, which relies heavily on tourists’ use of its network, are expected to take a heavier hit in this area. Additionally, as roaming is often a “pure-margin” service, stronger impact is expected on the net profits of exposed players.

On the B2B side, despite the upside from governments and large corporates seeking higher bandwidth for VPN and conferencing facilities, financial performance will be adversely impacted due to potential bad debts from small and medium enterprises (SMEs), increased unemployment, business closures and the overall decline in economic activity. Few players have taken precautionary measures, although Verizon has set aside a USD 228 million extra reserve for this. Overall, B2B revenues are expected to show a low-single-digit contraction in 2020, bouncing back to growth in 2021 if the global economy recovers.

Based on ADL’s assessment, for mobile operators, global revenues are expected to decline 2–4 percent in 2020 compared to last year. There will be regional differences:

- European players will see a potential decline within a broad range of approximately 2–9 percent.

- In contrast, Asia and Oceania will be affected least, with a probable rough 2 percent decline.

- The Middle East and Africa and the Americas are likely to be between these two poles, with revenue declines of approximately 4 percent and 2–4 percent, respectively.

These estimates assume that the relative geographic impact of the pandemic remains similar to trends seen in April 2020.

4. OPEX to witness a limited decline

A similar evolution can be expected for OPEX. Reduced spending on marketing activities and subscriber acquisition and retention, as well as store closures, is expected to generate OPEX savings of 1–3 percent in 2020.

However, although competition has become moderate as customers’ willingness to churn/port has declined, this trend is expected to reverse as soon as movement restrictions are lifted and retail operations are fully restored. This implies a need to then spend any commercial OPEX allocated for customer acquisition and retention that will have been saved during the lockdown.

Overall labor costs should remain stable as societal and governmental pressures mount to prevent furloughing of staff, especially given the moderate commercial downside the sector faces. For example, Orange has pledged to protect its 87,000 French workers without governmental help as part of an agreement with the economy minister. However, this could lead to persistent loss in flexibility, even as automation increases and makes some areas less labor intensive.

In the medium term, the crisis will also reinforce and accelerate some of the pre-COVID-19 OPEX trends, such as network sharing. Thanks to the pandemic and its economic impact, regulators might adopt a more lenient view of mobile network-sharing agreements, shifting part of their scrutiny from competition to the robustness and economic health of the overall ICT sector.

5. Mixed guidance on CAPEX

Postponing the delivery and deployment of network equipment could lead to a CAPEX reduction of 2–4 percent in 2020. However, CAPEX spend will rebound quickly in 2021 as most telecom players, in the midst of significant 5G network infrastructure capital expenditure, have decided to continue or even expand their plans. Fixed networks, in particular FTTP spend, will also grow to ensure that operators have enough capacity to deliver high-performing services given the increased traffic demand. Heavy expenditure on fixed telecom infrastructure in a downturn was a strategy that several operators adopted successfully during the 2008 financial crisis.

So far, there have been mixed messages on 2020 CAPEX guidance:

- Verizon announced an upward revision (+USD 1 billion) to support its network activity.

- AT&T warned of “downward proclivity” due to logistics issues such as difficult cell-site acquisitions.

The COVID-19 crisis will create situations in which companies will want to invest but not be able to. This risk will be amplified in Europe, where plans for 5G infrastructure are likely to be delayed. Additionally, operator propensity to spend might be hampered by heightened volatility in capital markets, with corresponding implications for the cost of capital.

Insight for the executive

In the longer term, key structural changes that are largely enabled by technological “smartization” are expected to reshape behaviors and societal norms, as well as to redefine value chains and business models. Therefore, appropriate actions need to be taken by CXOs to prepare their organizations for this new world, the establishment of which has only been accelerated by the COVID-19 crisis. We have listed below five key areas for focus. They combine “no-regret” moves that will help telecoms companies, irrespective of which recovery scenario plays out, with potential strategic bets that CXOs can place now to capitalize on any opportunities arising from the impact of the crisis.

Enhance social and community brand positioning:

Enhance social and community brand positioning:

Further strengthen the brand’s positioning and perceptions around supporting its community. For example, Telekom Malaysia deployed 5G base stations at quarantine centers to deliver free Wi-Fi and provided 50 5G FWA terminals.

Transform into a technology provider:

Transform into a technology provider:

Transform self-perception from a telecom services provider to a technology company. Continue with a broader push towards digitalization of functions and develop solutions for emerging trends such as e-learning and telemedicine.

Underpin critical infrastructure:

Underpin critical infrastructure:

Enhance core and transmission network capacity to cater for increased traffic, especially international bandwidth owing to increased two-way traffic for video-conferencing and heavy streaming outside of typical peak traffic hours.

Support digitalization and recovery of SMEs:

Support digitalization and recovery of SMEs:

Play a more active role in digitalization of SMEs by providing cybersecurity support, cloud and business development services, access to training, and tools and capabilities. Devise creative ways to reduce bad-debt risk.

Identify M&A opportunities:

Identify M&A opportunities:

Become aggressive in looking for attractive M&A targets. Take opportunities to expand through acquiring innovative start-ups – as demonstrated by Verizon’s acquisition of videoconferencing company BlueJeans in April 2020.

Overall, CXOs need to leverage the disruptive nature of this crisis and exploit the unique opportunities it creates for transformation of the sector.