Countries across the world have set ambitious decarbonization targets. However, despite some progress, the gap between aspirations and reality is growing. Greenhouse gas emissions are rising globally, with industrial emissions proving particularly difficult to reduce. Delivering effective industrial decarbonization therefore requires additional levers, specifically carbon capture, utilization, and storage (CCUS). This Viewpoint explains the opportunities CCUS provides for businesses and its potential to address climate targets.

THE NEED FOR NEW APPROACHES TO DECARBONIZATION

Following the Paris Agreement, a 2015 international treaty on climate change, countries have introduced stringent targets and deadlines to decarbonize in order to limit the rise in global temperature to well below 2°C above preindustrial levels. However, progress on decarbonization has stalled, with three significant factors driving the need for novel approaches:

-

Emissions are actually increasing both globally and in many individual countries. Since 2020, global energy-related CO2 emissions grew by 7.2%, according to the International Energy Agency (IEA).

-

Existing levers are not sufficient. Despite large-scale expansion of renewable energy, growing usage of hydrogen, and increased energy efficiency, there is a gap between policies and stated targets. For example, according to Climate Action Tracker, multiple nations are expected to miss their 2030 reduction targets, including major CO2-emitting countries like the US, the UK, China, and Germany.

-

Key areas are proving hard to decarbonize. Emission reduction is particularly difficult in certain industrial sectors, such as those with energy-intensive processes (e.g., producers of cement and steel), large-scale baseload power generators currently using coal or natural gas, and decentralized combined heat and power generation.

Amidst the rise of renewables and electrification in areas like mobility and heating, the effective decarbonization of energy-intensive industries remains a challenge. Clean hydrogen offers a promising solution, especially for sectors like iron and steel production. However, its full potential depends on the presence of sufficient clean hydrogen supply and the necessary infrastructure, which is unlikely to be in place before the 2030s. Additionally, some industries (e.g., cement) cannot fully adopt hydrogen due to unavoidable emissions from chemical reactions during production.

These challenges require the adoption of new methods alongside existing efforts. Foremost among these is CCUS (see sidebar “What is CCUS?”) as an interim solution in industries that aim to adopt hydrogen in the future but have to meet shorter-term decarbonization needs (e.g., iron and steel) or require a long-term solution in the absence of alternatives (e.g., cement). The United Nations (UN) Intergovernmental Panel on Climate Change (IPCC) highlighted CCUS’s significance, underlining its importance in a 2022 report and emphasizing its role as an essential part of the transition to net zero.

CCUS facilities are currently operational in 11 countries around the globe, including the US, Brazil, Norway, Saudi Arabia, China, and Australia. An additional 14 nations are developing or constructing projects, including France, the UK, the Netherlands, Thailand, and Indonesia. However, due to its size, complexity, high investment requirements, long lead times, and supporting infrastructure (e.g., pipelines and storage facilities), CCUS is not yet widely available for current use.

THE EUROPEAN PERSPECTIVE

Seventeen European countries have either implemented or announced plans for CCUS facilities. Of the EU’s 27 member states, 20 mention CCUS in their national energy and climate plans. In some countries currently without CCUS plans, the situation is changing. Germany, in particular, is seeing a renewed interest in the technology. However, ambitions to ramp up CCUS as part of national decarbonization strategy vary significantly with the UK, the Netherlands, and Norway, which collectively represent approximately 75% of currently planned carbon-capture capacity in Europe by 2030.

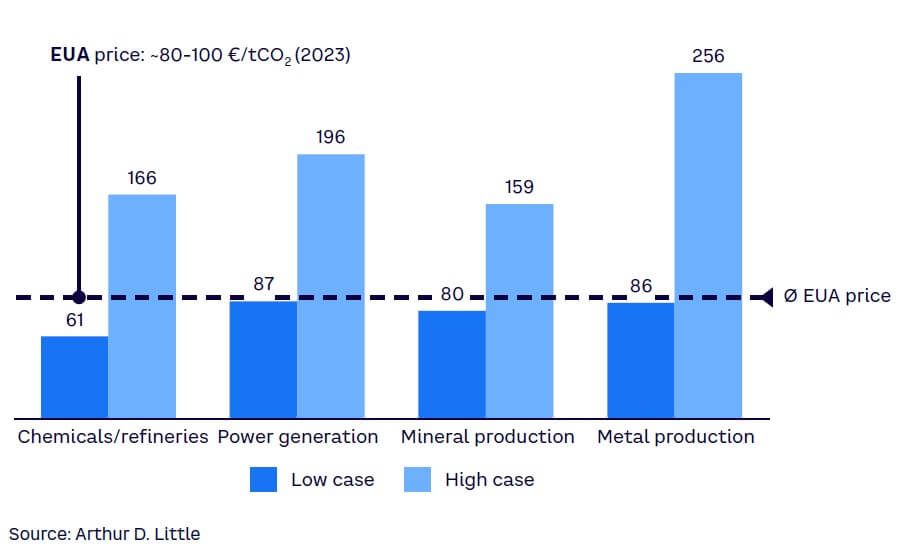

In Europe, CCUS adoption is driven by economic and regulatory costs for emitters. Based on European Energy Exchange (EEX) data, the European Union Allowance (EUA) price for emissions is expected to further increase beyond 100€/tCO2 by the middle of the 2020s, while the levelized cost of CCS is expected to further decline for most industries, as shown in Figure 1. This prediction is based on the realization of potential routes from Central Europe to offshore storage facilities in the North Sea. However, costs are still likely to outweigh potential EUA savings in certain applications for some sectors like metal production, and creating necessary CCUS facilities requires significant long-term investment.

UNDERSTANDING the CCUS value chain

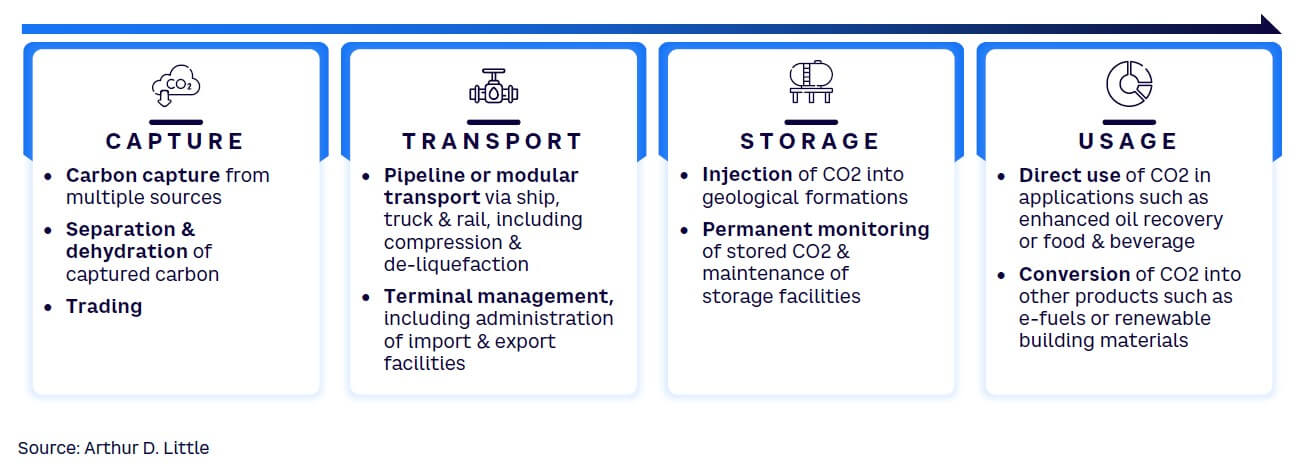

Players exploring opportunities within the CCUS ecosystem should understand the four steps in the value chain from source to sink (see Figure 2).

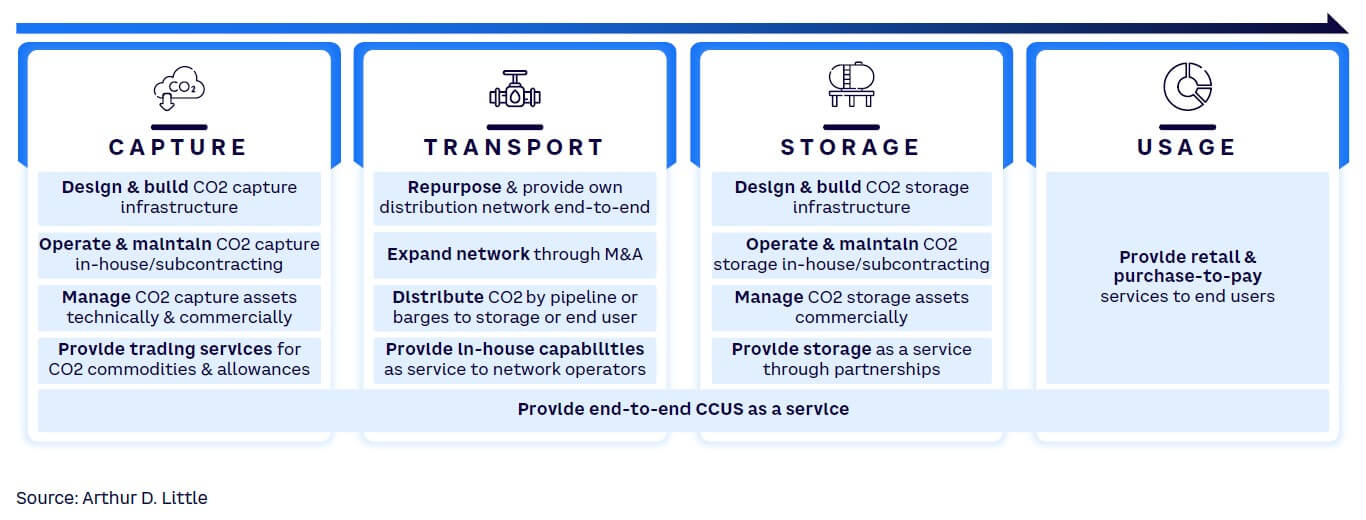

Altogether, the global market for CCUS was worth an estimated €2-€3 EUR billion in 2022, with a growth rate increase of 5% per annum during the previous five years, according to ADL analysis. As shown in Figure 3, the opportunities are:

-

Capture. Capture is the most capital-intensive area, but with the highest revenue potential. It is a strong fit for companies with existing B2B and industrial customer relationships, as they could offer capture as part of an integrated energy strategy.

-

Transport. Transport delivers the smallest relative economic value but requires the lowest capital expenditures. This presents a potential opportunity for gas distribution/transmission system operators to expand their business from adjacent areas.

-

Storage. Higher costs driven by regulatory requirements make offshore storage around three times more expensive than onshore storage. Scale is therefore vital, as is picking countries with the right geology and supportive regulations. Success requires strong customer partnerships; this is especially relevant for oil and gas companies with experience in offshore exploration as well as access to depleted oil and gas fields.

-

Usage. Selling CO2 for utilization by other sectors delivers additional upside potential but requires access to customers with demand for CO2, meaning players will need to compete with incumbent chemical companies and start-ups that are innovating their way into a more sustainable way of living for end users.

-

End-to-end “CCUS as a service.” Managing the entire value chain provides the opportunity to capture significant value; it requires effective partnerships across the ecosystem backed by strong project management expertise.

POSITIONING FOR SUCCESS IN THE MARKET

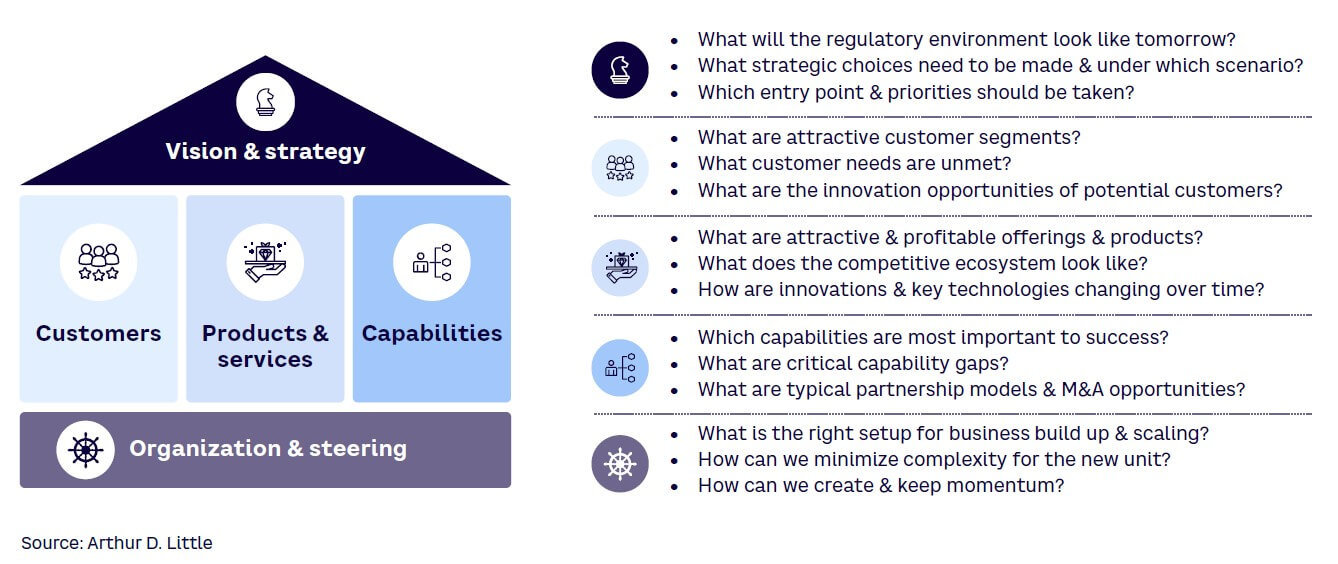

The rapid evolution of the CCUS market means that players need to move quickly to embrace opportunities, form partnerships, create new business models, and adopt innovation and suitable technologies. Success requires a focus on five building blocks, starting by setting a clear vision and strategy and then understanding customer needs, products, and services and developing relevant capabilities. To underpin these building blocks and create an effective strategy and operational plans, companies need to ask and answer key questions (see Figure 4).

However, the CCUS market is in its infancy, with many areas, including regulations, still being developed. For example, existing public subsidy incentives are largely not comparable to those in place to support renewables. There is also a need to address current public concerns around CCUS and promote greater acceptance of its benefits. This is especially the case in countries like Germany, where these worries have led to an effective ban on storing CO2 (see sidebar “The future of CCUS in Germany”).

Given the pace of change and the growing need for CCUS to meet decarbonization targets, waiting for regulations, infrastructure, and public opinion to align is not an option. It is vital for players to act now to harvest the potentials of the growing CCUS market and address the key questions of the building blocks outlined above:

-

Vision and strategy — start with clear target and priority setting. Companies must decide on their growth ambitions and define a clear vision and tangible targets for CCUS. There are multiple options around geographical and business scopes, so clear priority setting is critical to ensure a laser focus on the right opportunities. Review suitable business positioning along the CCUS value chain and identify relevant business models to further pursue and study.

-

Product and services — fast market-testing for CCUS propositions. Understanding which use cases will deliver required value is still unclear. Therefore, organizations need to monitor innovation of necessary technologies while validating and iterating their propositions with industry customers and using feedback to refine their activities in an agile way.

-

Customers — scenario-based market assessments. Understanding both market dynamics and customer needs is crucial when entering the CCUS market. That requires companies to identify attractive customer segments and their unmet needs as well as assessing relevant scenarios and critical signposts determining market developments. This should then serve as a basis to define a balanced market outlook under different scenarios by country, region, and industry.

-

Capabilities — build up of capabilities and ecosystem. While CCUS may share some similarities with existing operations, it also requires new and unique capabilities for the majority of players. These advancements require them to conduct an unbiased review of existing capabilities and identify gaps to fill. The knowledge gained should then be translated into a rapid action plan that covers all areas, such as external hiring, in order to build a complete capability set. Further, as individual companies are likely to just cover one or two steps in the value chain, picking the right type of partner requires market insight and understanding of the competitive ecosystem and the roles within it. Once the partner strategy has been defined, companies need to move quickly to select potential partners that best fit their long-term CCUS needs and positioning.

-

Organization and steering — minimize group internal complexity. Entering the CCUS market means embracing new business models and becoming more agile and flexible. Companies need to reduce internal complexity for project teams and leverage best practices to create effective CCUS businesses. They must take a pragmatic approach, defining CCUS structures in different phases, which could mean embracing a flexible project-like setup during build up and moving to a more formal, process-driven organization when scaling up.

Conclusion

BUILDING AN EFFECTIVE CCUS STRATEGY

Across Europe, CCUS is rapidly moving to center stage, driven by increased activity, clear market need, growing investment, and expected regulatory changes. However, access to CO2 infrastructure is becoming increasingly scarce as demand grows; developing new capacity takes years. Companies must act now to position themselves in the CCUS value chain by:

-

Analyzing scenarios. Assess customers’ future needs using scenario-based planning to understand market dynamics.

-

Defining strategic positioning. Set ambitions, define guiding principles, and short-list business models.

-

Understanding the ecosystem. Identify and build partnerships across the ecosystem and ensure infrastructure access.

-

Detailing business models. Model opportunities through business cases, explore partnering approaches, and define roadmaps.

-

Driving project excellence. Steer business activities through stakeholder engagement, and monitor and track progress through clear KPIs.