Amidst the uncertainties and challenges of today’s energy market, home energy management systems (HEMS) can offer value to end users by addressing unmet needs and emerging pain points such as energy consumption optimization, automation, and affordability of energy bills, while allowing companies to diversify and/or enhance their value proposition. The latter has already motivated companies within and outside the traditional energy ecosystem to investigate the opportunity. In this Viewpoint, we explain why companies must act now to convince customers of the importance of HEMS and how they can secure their position within the value chain.

GROWTH & IMPORTANCE OF HEMS

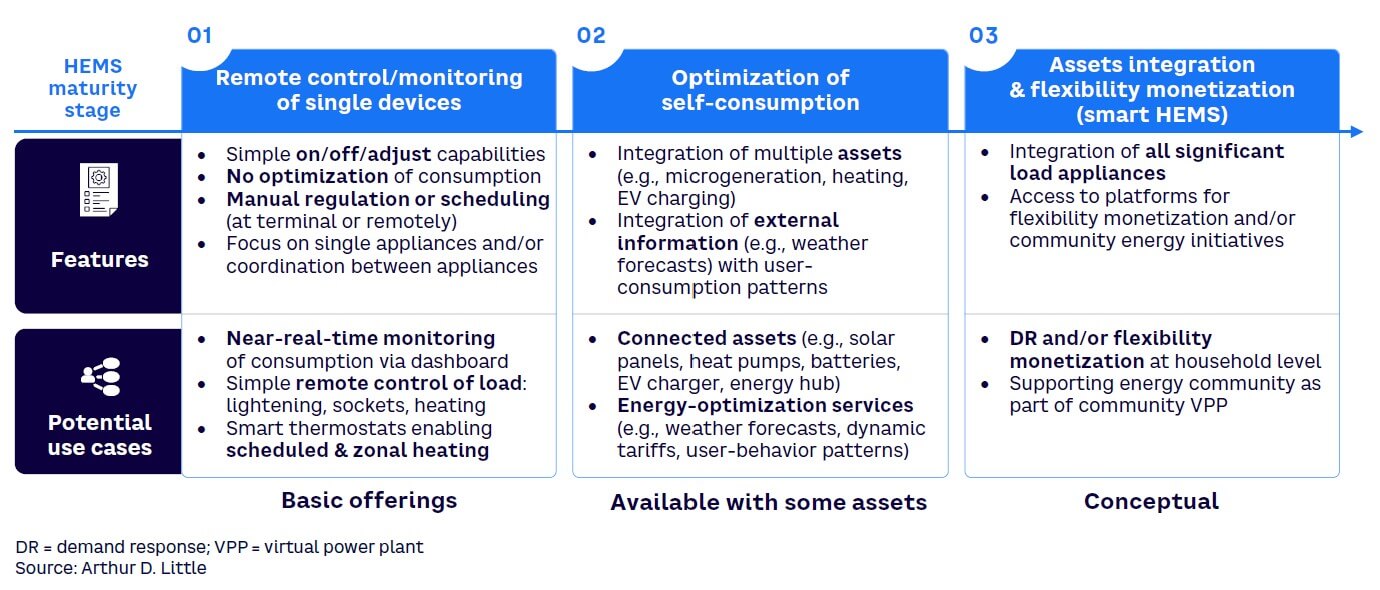

Today’s households are facing a volatile energy market characterized by high and unstable prices, while the adoption of electricity-intensive assets, such as electric vehicles (EVs) and heat pumps, is growing. Even though increased penetration of self-generating assets in homes has enabled customers to partially satisfy their own energy demand, the availability of generation and consumption data and associated systems offers the potential to further optimize their consumption. In this context, HEMS can help end users monitor, control, and optimize their energy generation, storage, and consumption, depending on self-generated energy availability and market prices. Concretely, HEMS solutions and underlying use cases vary based on the degree of automation and integration of the platform with the different energy-related assets and devices within the household, ranging from single device monitoring to automated flexibility monetization (see Figure 1).

Today, most HEMS solutions are quite basic, with use cases generally limited to remotely controlling devices, which leaves the major value pools largely untapped. Evolving to a full optimization of energy-related devices could reduce customers’ monthly energy bill by as much as 30%, according to Arthur D. Little (ADL) analysis.

However, as technology continues the rapid evolution that has characterized the last few years, HEMS are expected to progress through the different maturity stages. Some solutions have grown more sophisticated, as illustrated by developments from the UK and Germany. Players such as OVO Energy (UK), Octopus Energy (UK) and E.ON (Germany) are paving the way toward smart HEMS solutions that could offer opportunities for asset integration and flexibility monetization in the short term. For example, OVO is implementing smart thermostats but is also expanding into vehicle-to-grid trials and ensures EV charging when the energy is the greenest. E.ON combines a smart home application with an interconnected energy ecosystem (i.e., photovoltaic, battery, heating systems, and charge points) to save money, increase energy efficiency, use more green energy, and reduce CO2 emissions.

This Viewpoint focuses on HEMS solutions for households, but similar solutions exist for corporations, especially for those with large vehicle fleets.

UNLOCKING VALUE POOLS FOR SOLUTION PROVIDERS

The end game for HEMS providers is not about monetizing HEMS solutions toward the customer base (via a subscription or a share of cost reduction from energy efficiency), as those solutions should quickly become commoditized and free, offering limited sustainable revenues. Long-term value will likely be generated by monetizing flexibility, while energy trading and imbalance cost avoidance should bring incremental value:

-

Flexibility monetization. Advanced HEMS solutions can unlock flexibility, achieved through energy storage and injection by households, and therefore support transmission system operators (TSOs) and distribution system operators (DSOs) to keep the grid balanced. To avoid supply-and-demand imbalances, TSOs and DSOs have developed multiple mechanisms for the market (e.g., frequency containment reserves and automatic frequency restoration reserves), which allow flexibility providers to sell their power to system operators. HEMS providers can aggregate this energy by combining home energy storage and generation assets from multiple households but also by shifting, increasing, or decreasing energy consumption at certain critical moments of the day.

-

Trading on the wholesale market. Flexibility from aggregated distributed assets (e.g., wall storage) can be traded on wholesale markets to take advantage of price fluctuations.

-

Imbalance cost avoidance. Balancing responsible parties (BRPs), such as energy retailers, must compensate TSOs for any imbalance generated on the grid, resulting from the gap between forecasted energy consumption and supply. By leveraging the flexibility offered by their HEMS customer base, BRPs could partially mitigate imbalance costs.

NOT JUST FOR ENERGY PLAYERS

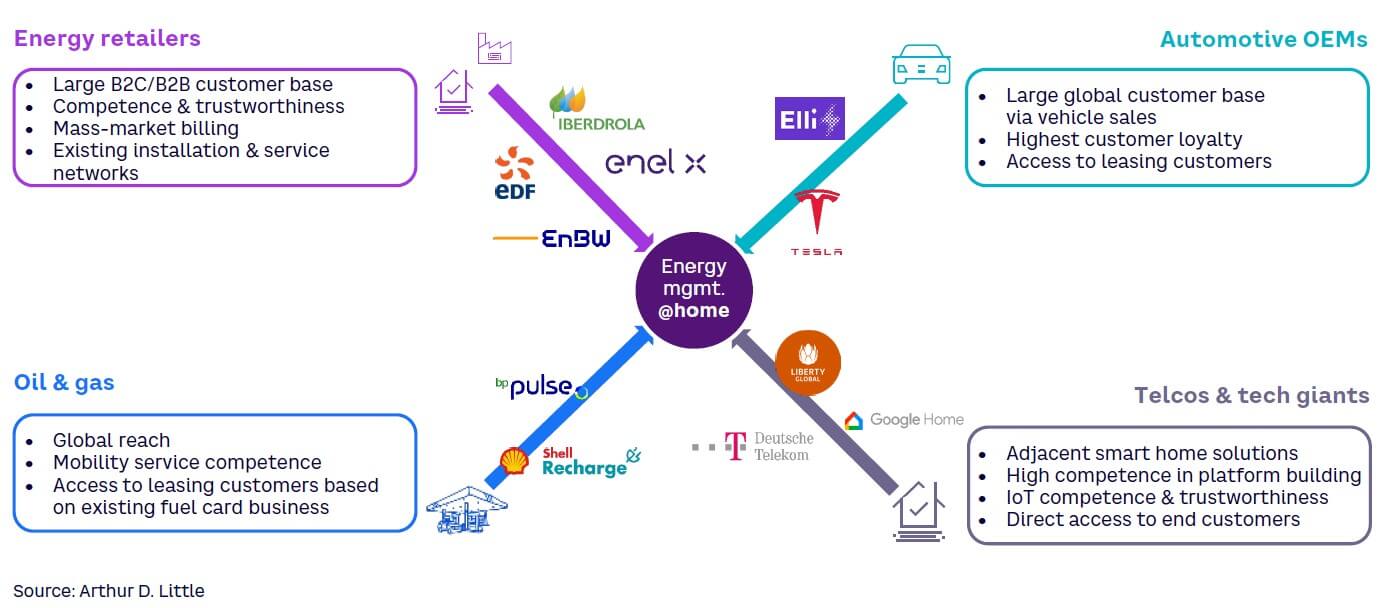

Observers from different industries see the HEMS value chain as a natural extension of their current activities. Their attention arises from HEMS’s location at the crossroads of multiple value chains, including energy retailers, telcos and tech giants, oil and gas companies, and even automotive OEMs (see Figure 2). Consequently, companies from different industries have the legitimacy and interest to enter this market:

-

Energy retailers. Their end goal is to strengthen customer loyalty while diversifying from the commodity business. Energy retailers have a competitive advantage derived from their large B2C and B2B customer bases, which are already accustomed to their practices.

-

Telcos and tech giants. Their objective is to leverage their core business to expand into the energy industry. This trend has come about through the offering of smart home solutions. Illustratively, Amazon found its way into the market through a collaboration with Octopus Energy that allows consumers to use Alexa to adjust energy usage and obtain market information; Octopus Energy’s insights software is built entirely on Amazon Web Services (AWS). Telcos and tech giants have the advantage of direct access to end customers, while their connectivity and platform-building capabilities provide a competitive advantage over energy retailers.

-

Oil and gas companies. They diversify by adding more sustainable products and services. In recent years, they moved into electric mobility, installing charge points at public locations and in households. HEMS provides an extension for the electric charging business by helping optimize and steer the charging. To reach a large HEMS audience, oil and gas companies can try to solicit households via leasing customers of their existing fuel card business.

-

Automotive OEMs. The adoption of EVs and plug-in hybrid vehicles (PHEVs), which often generate lower margins compared to internal combustion engine vehicles, have pushed automotive OEMs to explore additional revenue streams. They have found a value-adding opportunity by offering customers a full experience that encompasses driving and charging, including using HEMS to optimize the energy consumption and charging pattern. Automotive OEMs can reach HEMS end users via their EV and PHEV customer base and leverage their relatively high loyalty from that customer base.

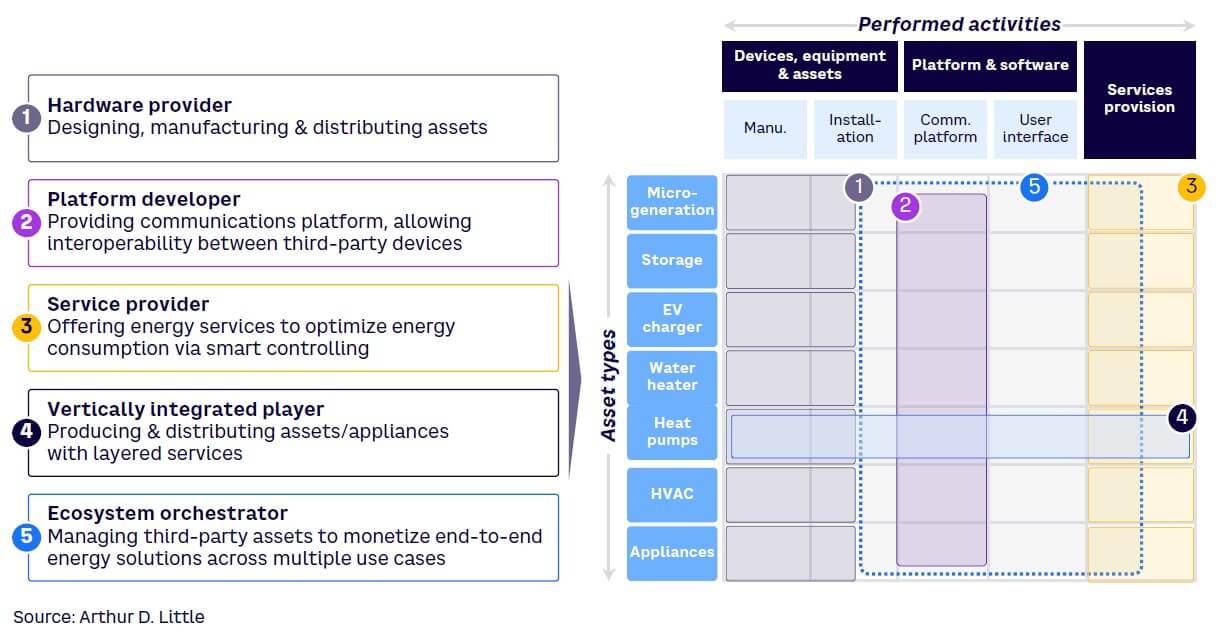

Companies entering the HEMS value chain do not necessarily need to offer the same service. The positioning and value proposition will be determined by their capabilities. Companies can decide to participate in only one part of the value chain, as a hardware provider, platform developer, or service provider (Roles 1, 2, and 3 in Figure 3). They can then choose to address one specific asset type, multiple asset types, or all of them.

An alternative approach is the vertically integrated player, which only focuses on one asset, while covering the entire value chain (Role 4). Finally, the ecosystem orchestrator provides an end-to-end smart HEMS solution to the end customer, across multiple use cases (Role 5). This comes to fruition by creating and managing all stakeholders within the HEMS ecosystem (ranging from manufacturers to service providers) while “owning the home” (i.e., being the central player in the household).

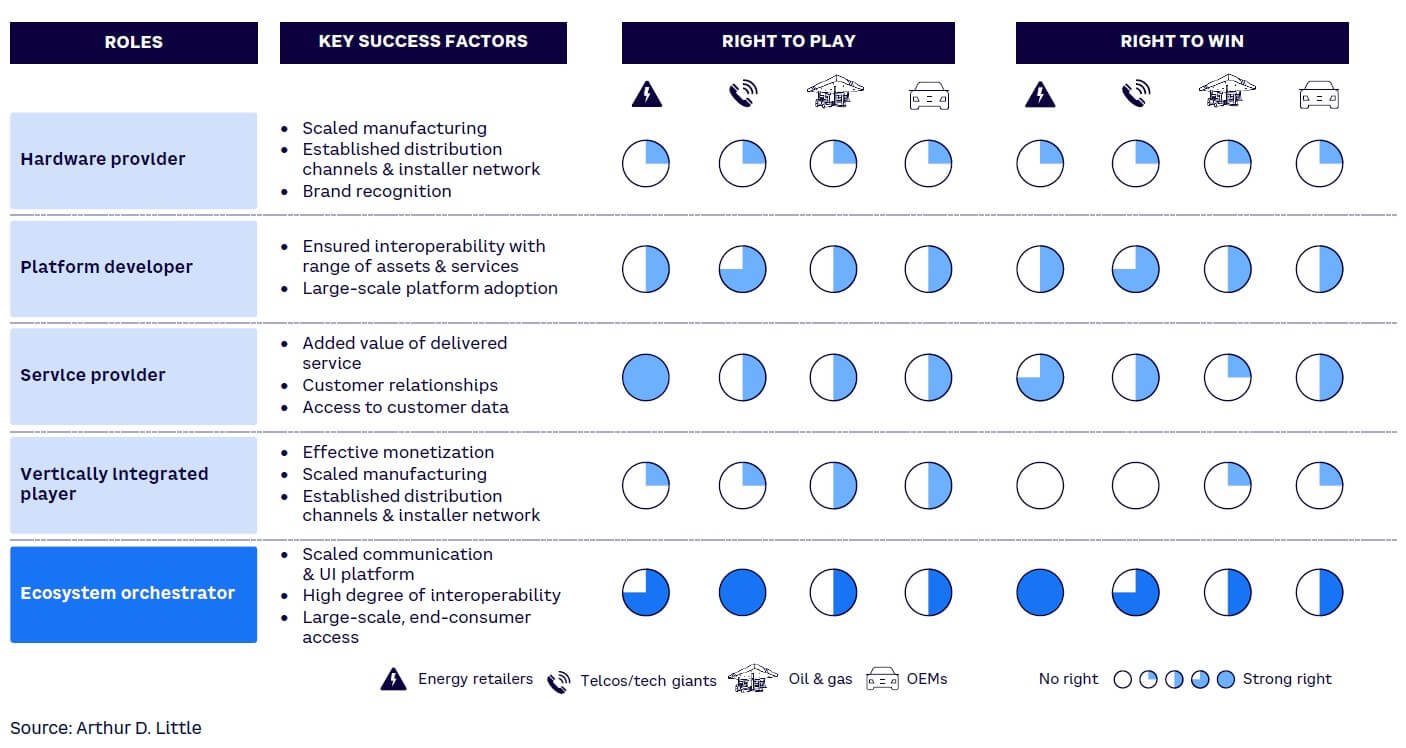

The ecosystem orchestrator role has not fully emerged yet, as only a few specialized companies currently offer a fully functional service, which raises the question of what type of company is best placed to offer it. Looking at the right to play and right to win of each player (see Figure 4), energy retailers and telcos/tech giants seem to be the best placed and most legitimate to take the central role as ecosystem orchestrators, considering their key distinctive capabilities, large customer bases, and strong presence within households. However, energy retailers may have a head start, as they have more to lose and gain and seem the best placed to monetize the entire revenue streams (i.e., flexibility monetization, trading on wholesale market, and imbalance cost avoidance).

Because HEMS likely will become a core service in the home energy ecosystem, failing to offer it could materially deteriorate energy players’ long-term value proposition. Telcos, on the contrary, are less prone to a direct negative impact on their core business. And while trading capabilities might be missing, telcos have serious incentives to enter the market thanks to the opportunity to extend their home services, use flexibility monetization to unlock new sources of revenue, improve their value proposition, and differentiate.

ELECTRIC VEHICLES: THE GAME CHANGER

The main entry point to the HEMS market is through the EV user, independent of which players choose to enter (see Figure 5). EVs are the largest pool of flexible energy. When a car is connected to the grid, it can charge faster or slower, discharge, or postpone its charging session to offer flexibility to the grid. The number of EVs has strongly increased recently and is expected to continue its trajectory in the future:

-

According to Statzon, 5.7 million EVs were on the road in 2022 in the EU.

-

Forecasts from ACEA assume this number will more than double to 15.6 million by 2025 and reach 42.8 million by 2030 (respectively, +40% CAGR between 2022–2025 and +29% CAGR between 2022–2030). The strong growth is mainly driven by mandatory adoption of battery electric vehicles (BEVs) and PHEVs for company cars and stricter emissions norms in some European countries.

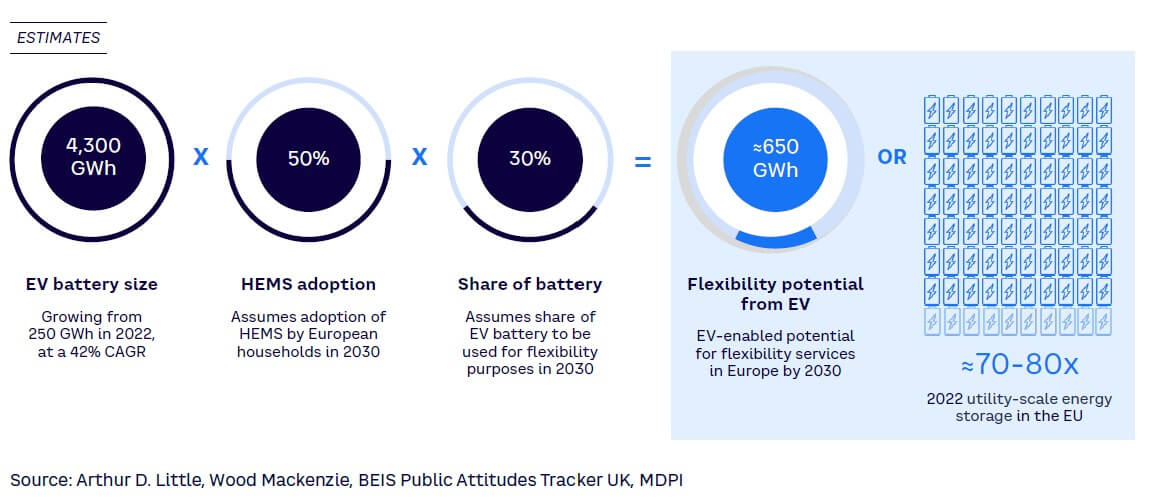

Consequently, data from multiple sources shows EU EV battery size could increase to approximately 4,300 GWh by 2030 (from 250 GWh in 2022), resulting in potentially 650 GWh of EV-enabled potential for flexibility services in the EU. (This assumes 50% of homes are willing to install HEMS and 30% of the battery is available for flexibility purposes.) Comparatively, this would represent about 70-80x the 2022 utility-scale energy storage in the EU.

SPEED TO MARKET IS ESSENTIAL — BUT INSUFFICIENT

Speed is critical for players willing to seize the opportunities presented by HEMS:

-

Due to increasing adoption of EVs and the underlying volume of flexibility, HEMS providers should intensify their marketing campaigns directed at EV users.

-

HEMS uptake is forecasted to grow strongly, driven by energy-consumption efficiency, increased electric mobility and home heating, and the uptake of microgeneration and residential batteries.

-

The current value of flexibility is high, but its future attractiveness is uncertain.

Indeed, the flexibility potential is per definition capped by the maximum energy needed by end users, while the inherent value of flexibility correlates with capacity constraints. In some European countries, current capacity constraints are relatively high due to multiple factors (e.g., nuclear power plants decommissioning). Capacity constraints will probably decrease due to significant investments to secure Europe’s energy supply.

The decrease in capacity constraint would consequently lower the need for flexibility, decreasing its intrinsic value. However, the latter could be mitigated partly by the increasing share of renewables in the energy mix, which requires flexibility, due to their intermittent nature.

First-mover advantage is crucial; increasing competition and high entry barriers will limit the opportunity for late entrants. Therefore, companies must quickly assess whether they want to pursue the HEMS market by analyzing market potential, existing and future competition, and their own capabilities. If companies decide to enter, they should consider additional factors to maximize success:

-

Identify positioning in the value chain to address. Find the right role by considering company strategy and right to win.

-

Identify capabilities. Find the right balance between building in-house, as opposed to hiring outside support through partnerships or M&A (e.g., for trading activities).

-

Keep the value proposition simple:

-

Develop an intuitive customer application.

-

Prioritize software and cloud computing above hardware to limit installation need.

-

Introduce adaptive and simple pricing that can evolve with the maturity of the market.

-

-

Keep end goal in mind. Flexibility monetization is the long-term growth engine toward network operators and energy markets.

Conclusion

FUTURE VALUE POTENTIAL OF HEMS IS CERTAIN, BUT HURRY UP

While HEMS solutions are currently at the basic level, adoption and use case maturity are expected to grow in the near future, unlocking value-creation opportunities for various different players if they act quickly. Important points include:

-

Adoption and maturity of HEMS use cases will unlock multiple value pools for solution providers beyond the monetization of HEMS (e.g., flexibility monetization, energy trading, and imbalance cost avoidance for BRPs).

-

Energy retailers, telcos/tech giants, oil and gas companies, and OEMs have a right to play and win in this market.

-

EVs are the game changer, enabling the flexibility business case, which is the anticipated long-term growth lever.

-

Speed is key, but developing the right capabilities in-house or via partners, keeping the value proposition simple, and targeting the flexibility monetization are also crucial.