28 min read • Organization & transformation, Strategy

Positive in an uncertain world: Confident CEOs reskill companies for AI-driven growth

CEOs prepare for sustainable future through increased tech adoption, internal talent development

FOREWORD

Across the globe, the last 12 months have seen increased instability, driven by myriad factors, including deepening geopolitical rivalries and conflicts, diverging economic fortunes, and the growing impacts of climate change and artificial intelligence (AI). All of this follows a period when the pandemic accelerated the importance of digitalization, driving wide-scale transformation, which still needs to be completed in many cases. Year-over-year, the range and depth of risks are accelerating, meaning that CEOs truly find themselves and their companies having to navigate in a volatile, uncertain, complex, and ambiguous (VUCA) world.

At Arthur D. Little (ADL), we have been working with CEOs of the world’s leading businesses for more than 137 years, listening to their needs and helping them innovate and transform to thrive in a fast-changing world and successive industrial revolutions.

But changing times called for a new approach in exploring how business leaders of the world’s US $1 billion-plus companies across different industries were reacting to a turbulent present and uncertain future.

Thus, last year, we launched the first in our ongoing series of flagship “CEO Insights” research studies. Through hundreds of conversations and months of research, we looked to answer key questions, such as:

-

How are CEOs reacting to current disruption?

-

How has their outlook changed year-over-year?

-

How are they structuring their strategies and organizations moving forward?

-

Where are they investing for growth?

-

How are they coping with pressing trends, such as AI and environmental, social, and governance (ESG)?

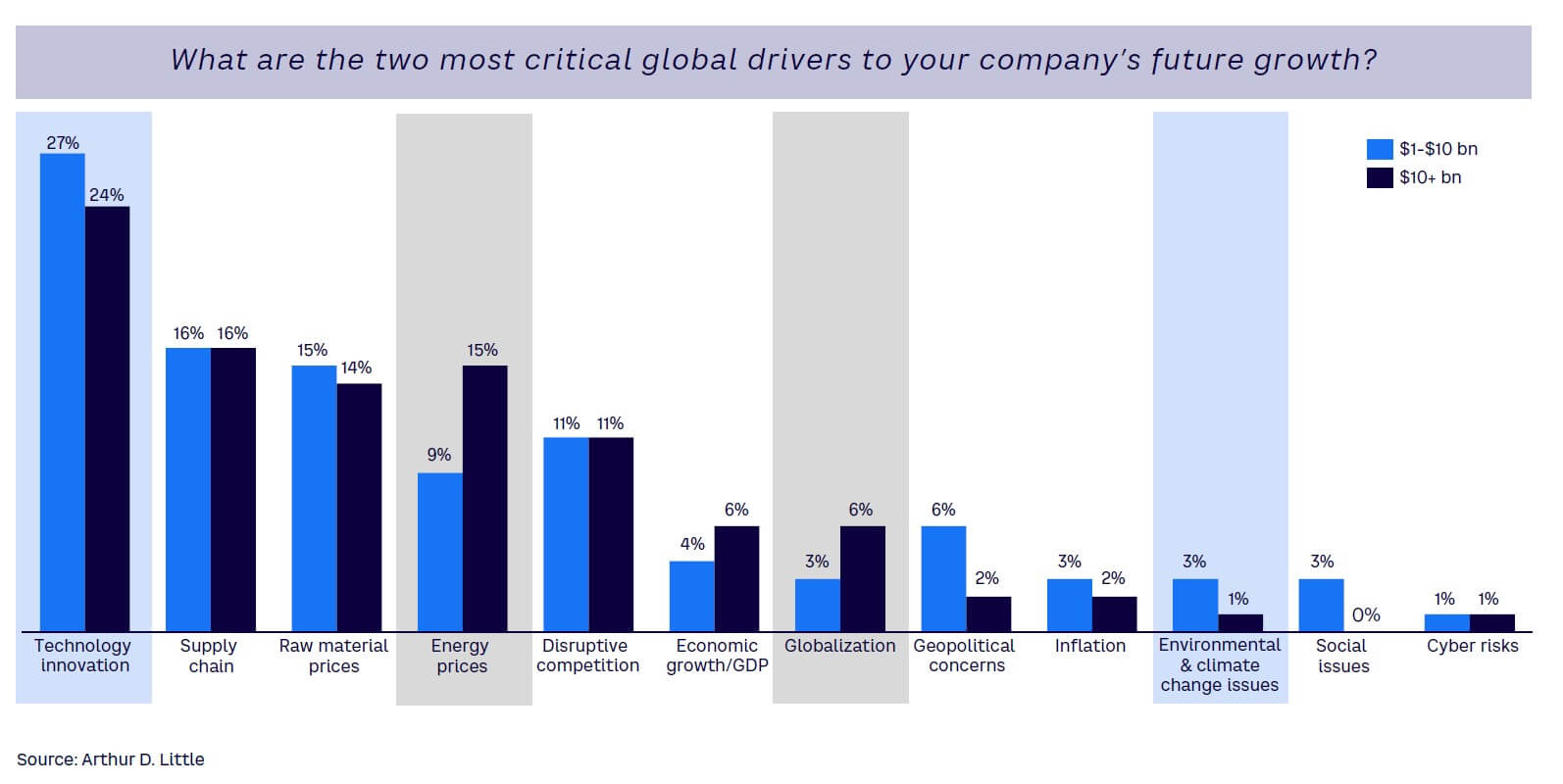

For this 2024 edition of “CEO Insights,” we found strong, positive grounds for optimism. Hearteningly, CEOs of leading businesses are not merely focusing on survival but are increasingly confident about the prospects for their organizations and the wider economy. We found 66% to be highly positive about the global outlook over the next three to five years, a result that has tripled since 2023.

Behind this optimism, CEOs are significantly increasing their growth investments and navigating short-term uncertainty through resilient strategies and organizations built to handle a VUCA world. Moving forward, they are enthusiastically embracing new opportunities like AI, seeing it as a catalyst for growth, and are looking to develop their people to unlock its potential. ESG is becoming a holistic part of strategies as CEOs embed it across their organizations.

At times of disruption, the natural but ultimately flawed approach can be to concentrate only on the short-term volatility and uncertainty of VUCA. Our study shows that today’s global CEOs are truly ambidextrous and are adopting the opposite strategy, looking to deliver on the short term, by transforming short-term uncertainties into opportunities while working on the long term — building a better future for us all.

Ignacio García Alves

Chairman & Chief Executive Officer

Arthur D. Little

EXECUTIVE SUMMARY

THE FUTURE IS BRIGHT & GETTING BRIGHTER DESPITE INSTABILITY

Looking beyond current turbulence, CEOs of the world’s largest companies are increasingly positive about the prospects for growth and are positioning themselves — and their workforces — to seize the opportunities that AI brings, according to the results of our 2024 “CEO Insights” study.

While CEOs are navigating today’s choppy business waters with caution, they are investing for a brighter future, based on the resilient organizational structures they now have in place. As AI impacts their businesses, they are reskilling their workforces and looking internally to develop the talent they need to exploit opportunities moving forward.

Rather than being cowed by uncertainty, CEOs are thriving in a time of turmoil, understanding that volatility is now the new normal in the world of business. They are focusing on ambidexterity,[1] marrying innovation and productivity to enable success in a VUCA world. Combining longer-term vision and innovation with short-term caution, CEOs are committed to driving business growth, centered around a combination of their people and AI working in harmony.

1

ANALYSIS: 4 KEY TRENDS FROM TODAY’S CEOS

In-depth analysis of ADL’s latest “CEO Insights” study enables us to draw four clear conclusions, which apply generally across both geographies and different vertical sectors.

TREND 1: POSITIVE FUTURE OUTLOOK — SIGNIFICANT SHIFT IN CONFIDENCE

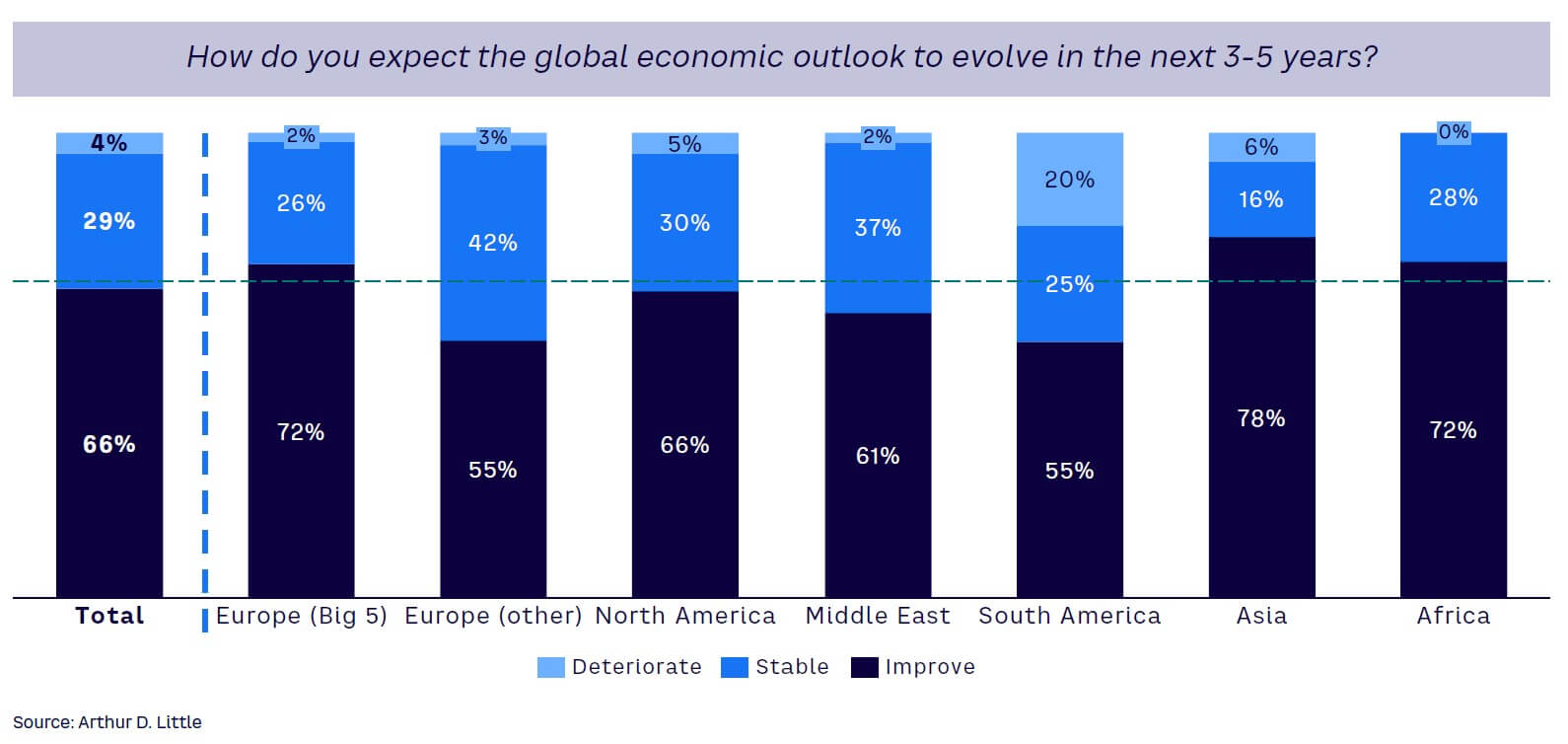

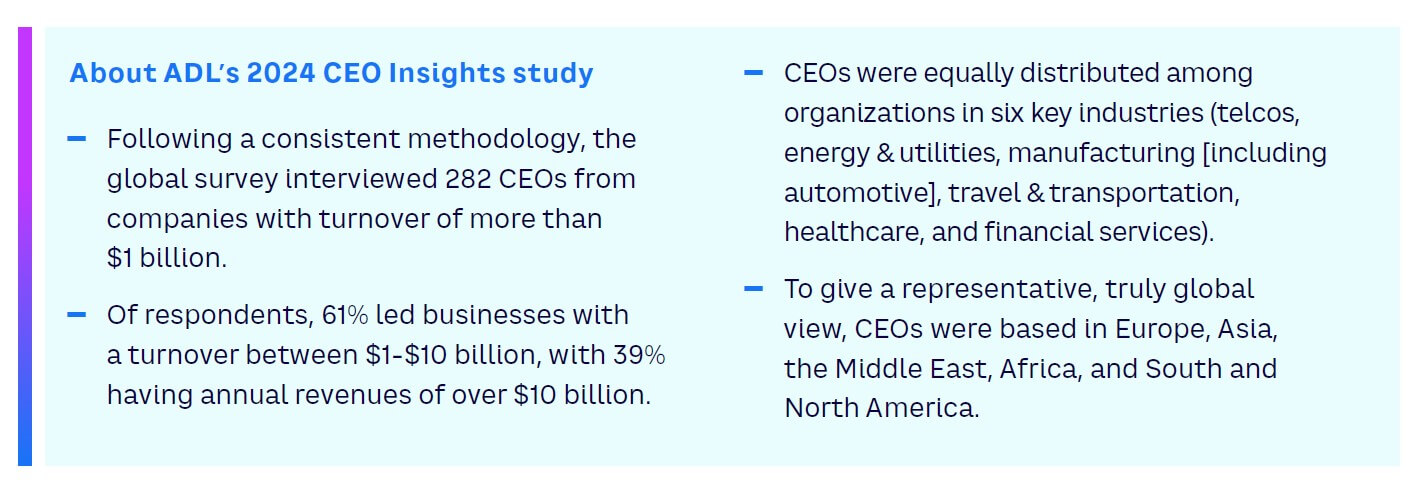

The last 12 months have seen CEOs face an expanding range of challenges, from conflict and geopolitical rivalry to rising costs. Despite this, the headline finding is that CEOs are positive and confident about the medium-term (three to five years) economic outlook (see Figure 1).

Two-thirds (66%) expect a positive global outlook — compared to just 22% in 2022 — implying that they believe the bottom of the market has already been reached or will be reached shortly. Just 4% forecast a deterioration in the global economic outlook, compared to 37% last year. Optimism is even stronger among larger ($10 billion+ revenue) companies, where 84% expect the medium-term outlook to be positive, against 60% of their smaller peers.

Global confidence, regional highlights

This turnaround in optimism is strongest in Asia, where three-quarters (78%) of CEOs forecast positive growth, compared to 10% in 2023. CEOs within the Big Five economies of Europe (France, Germany, Italy, Spain, UK) were equally bullish, with 72% predicting positive global growth, nearly doubling from 38% in 2023. Even in the least positive regions (Latin America and Europe outside the Big Five), a majority of CEOs predict medium-term global growth.

Stable perspective on external growth factors

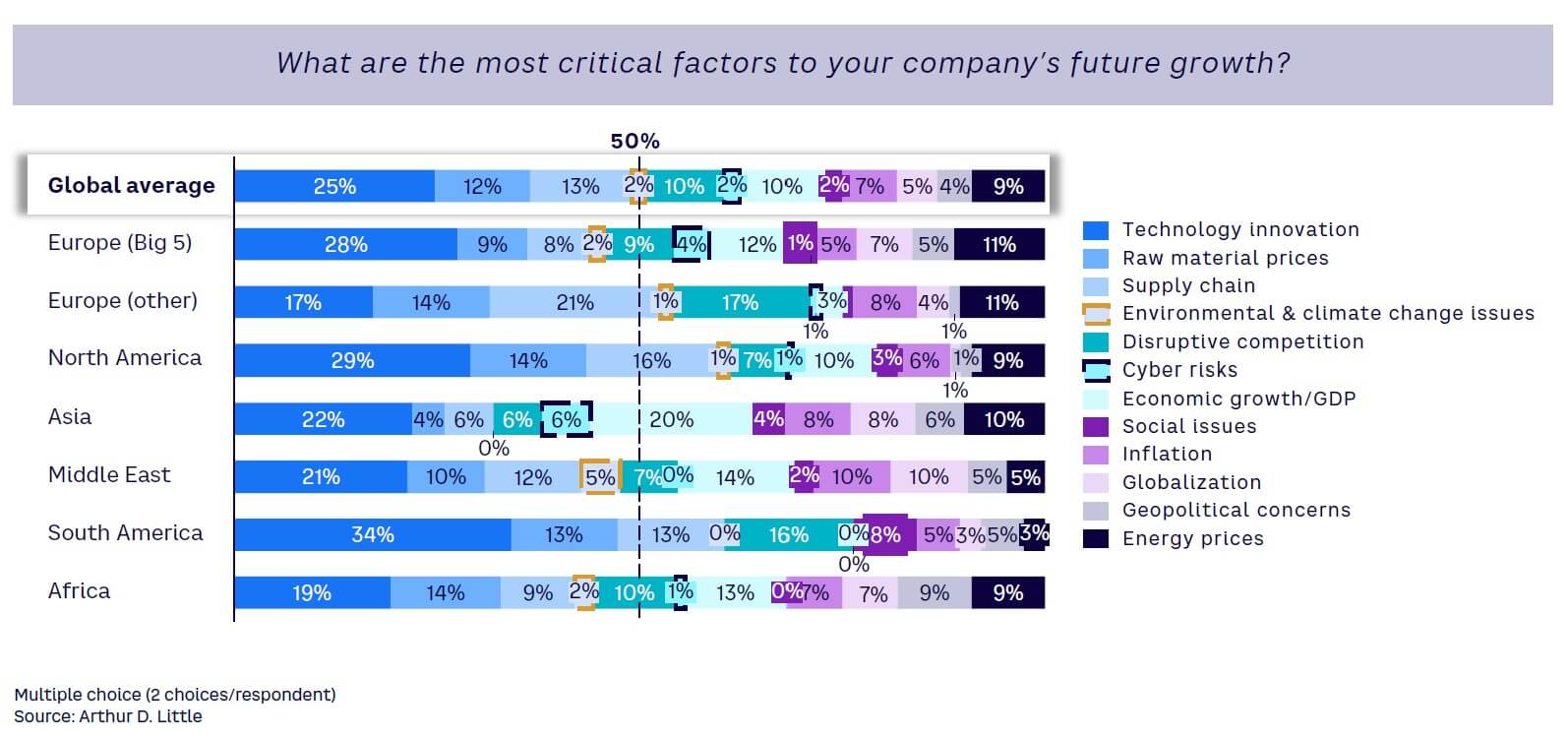

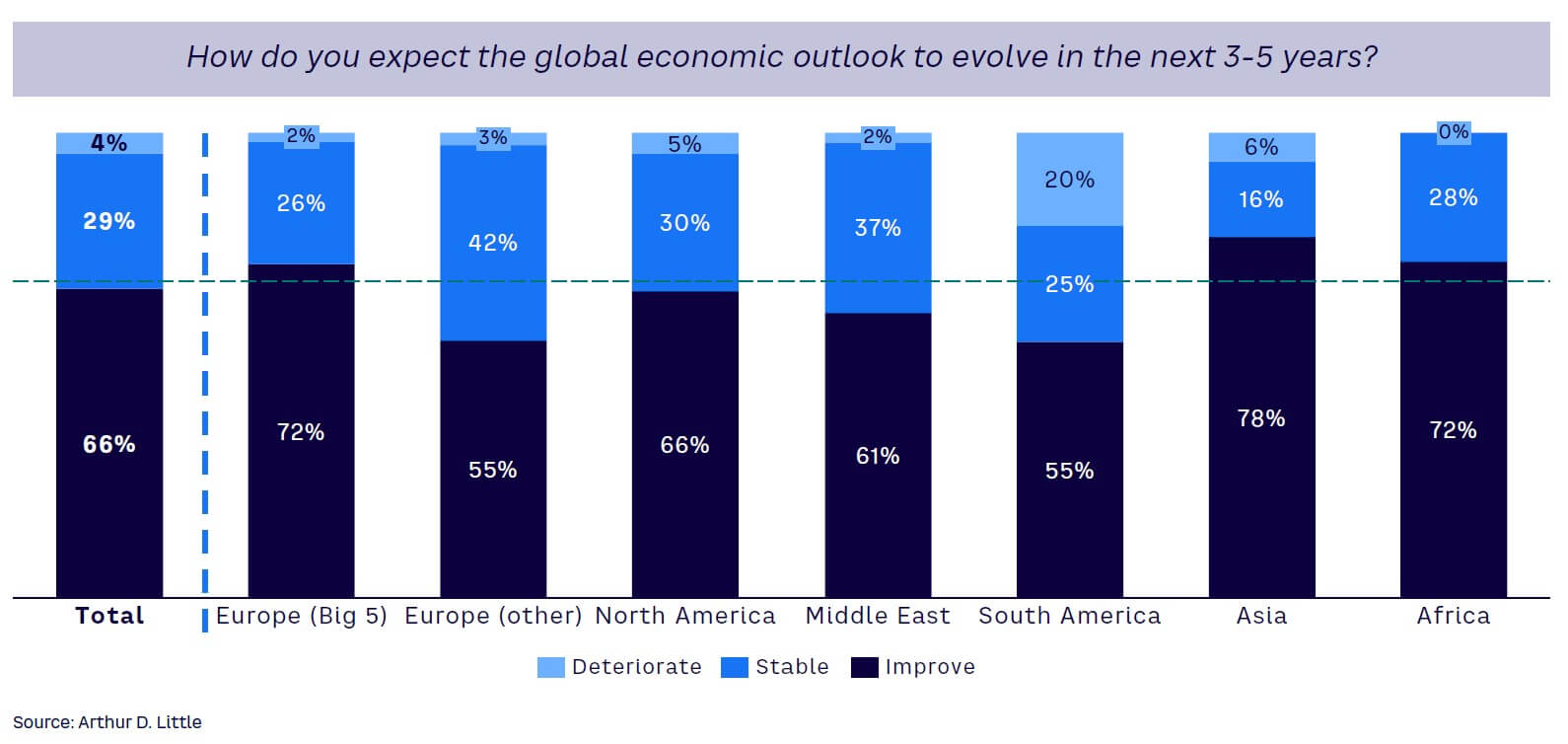

When asked to name the most critical external factors impacting their company’s future growth, CEOs generally focus on the same themes as a year ago (see Figure 2). Technology innovation, including AI, remains the most critical factor globally to drive growth. However, concerns over supply chain stability have been overtaken by a need to cope with rising raw material prices, including energy costs. Globally, this has nearly doubled from 11% to 21% in the past year. This trend is particularly strong in Europe and North America though its importance has dropped in the Middle East, potentially due to easier access to energy resources (e.g., oil and gas).

Over the same period, the perceived criticality of environmental issues has dropped from 10% to 2%, perhaps due to more advanced and integrated ESG strategies being put in place. CEOs highlight social issues as among the least relevant factors to their growth, with just 2% seeing it as critical.

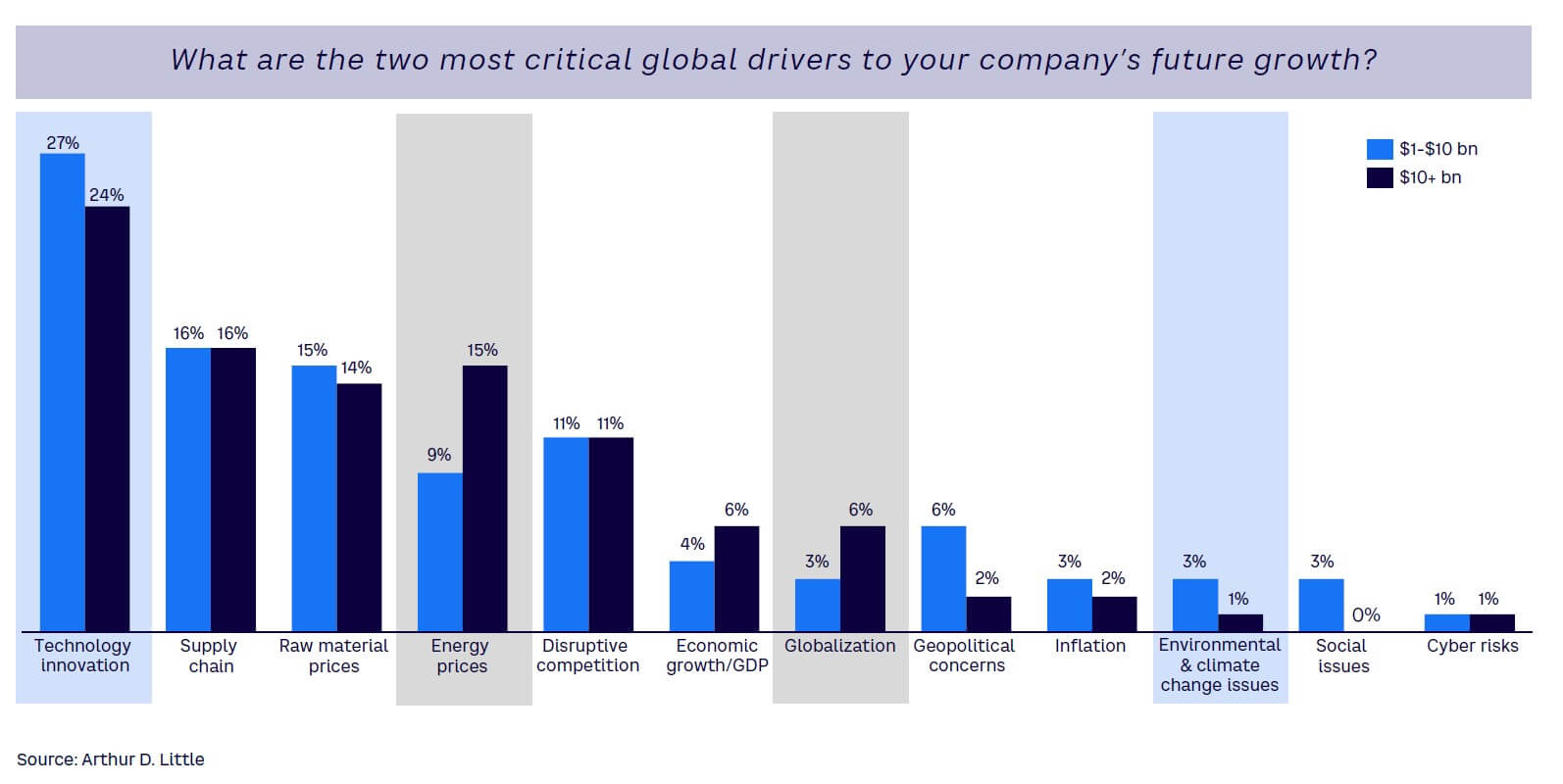

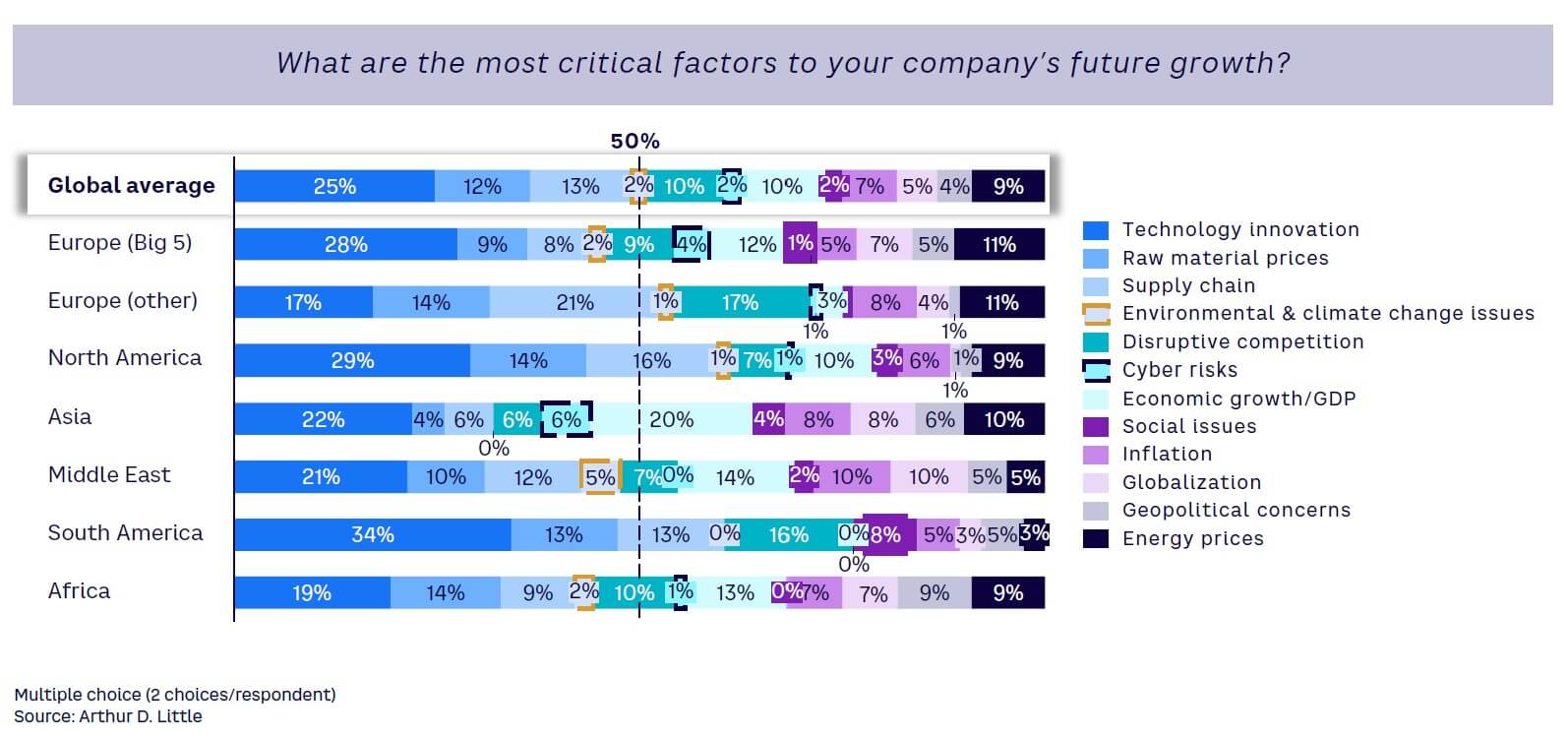

Examining growth factors by company size, CEOs of larger organizations express the greatest concern around energy prices, as well as seeing supply chain and globalization challenges as more critical to growth (see Figure 3). Organizations between $1-$10 billion have a higher focus on technology innovation as a driver but also worry more about geopolitical concerns.

When reporting the drivers that would have the least impact on growth, environmental and climate change issues and social issues were among the bottom three for organizations in both groups.

“Our objective is to leverage technology in order to benefit from increased operational efficiency, data insights, and improved decision-making during periods of high volatility.” — CEO, energy & utilities

Most important trends — past vs. future

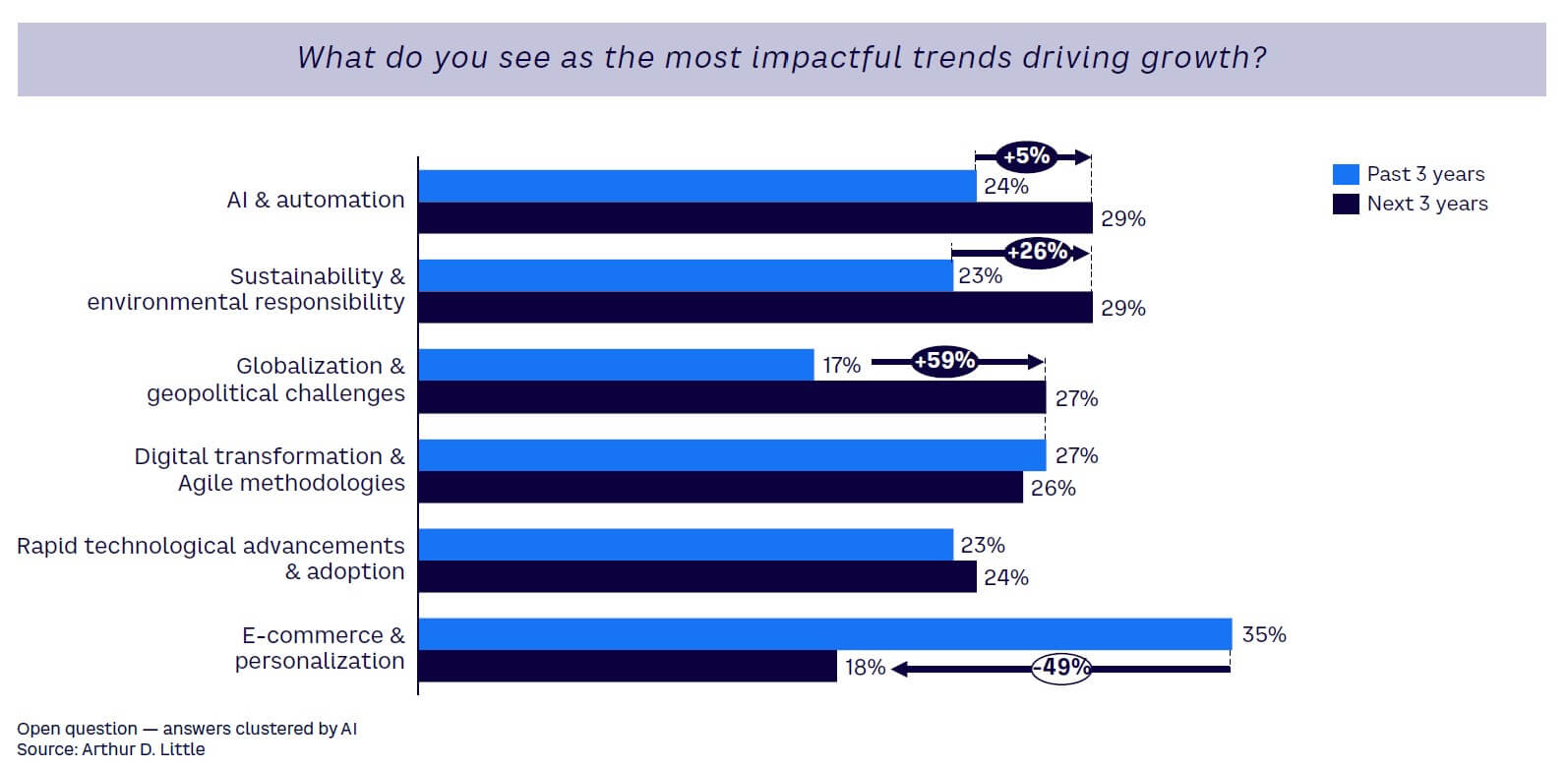

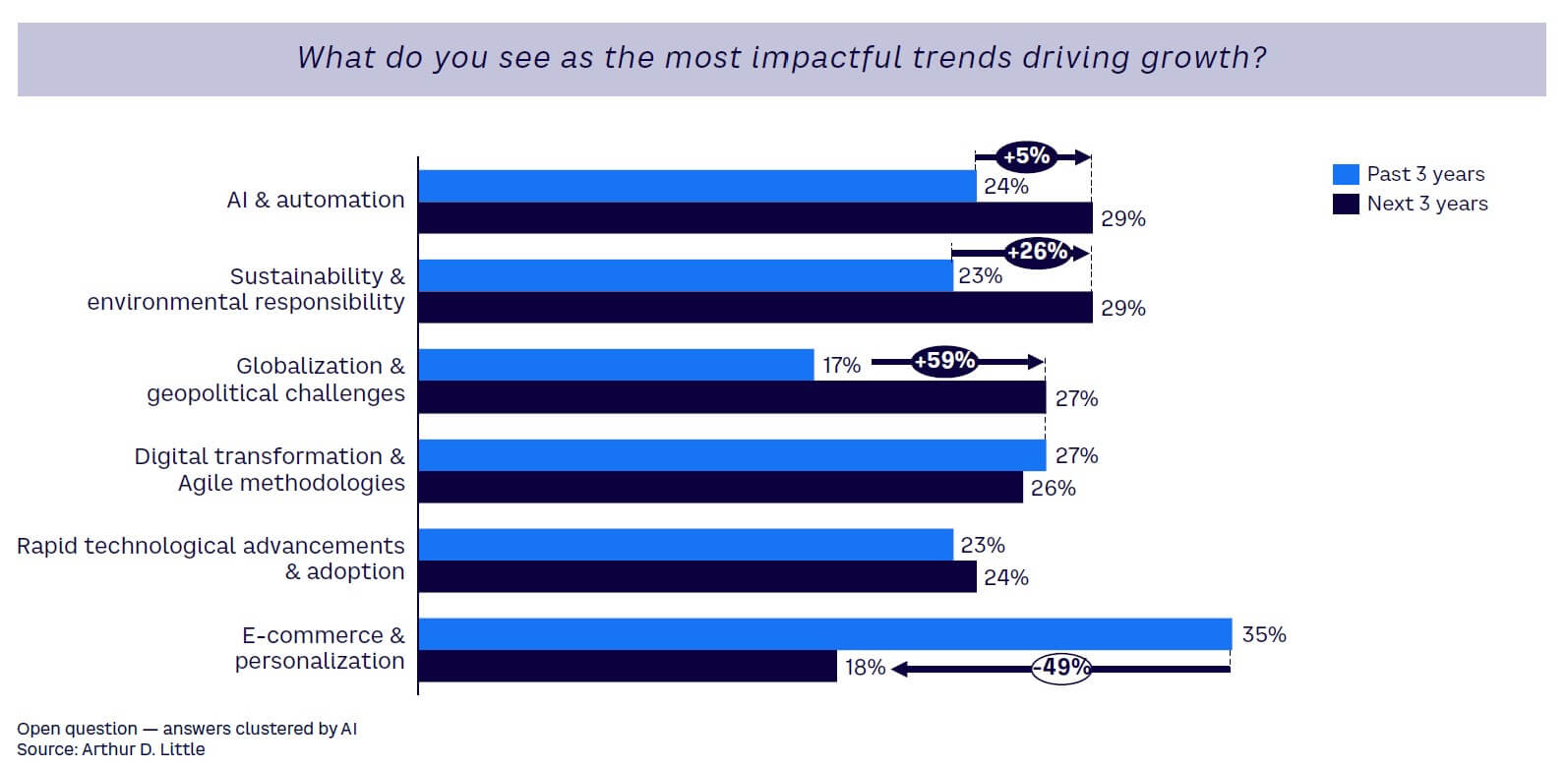

The research also examined how the importance of particular trends has changed over time. We employed AI-based text analysis to understand free text answers comparing trends CEOs felt were important over the last three to five years and which would be of primary importance for the future three to five years (see Figure 4).

The results reveal a clear shift. For example, where e-commerce and digital transformation were the dominant trends listed by CEOs in the past, looking forward they are focusing on AI and automation and sustainability, reducing the importance of e-commerce nearly by half. This reflects the impact of the pandemic and its immediate aftermath, which required every organization to embrace e-commerce and digitalization to operate effectively. Now that businesses are moving out of survival mode, CEOs are putting the onus on AI and sustainability for growth.

By region, the areas of focus for the future include ESG (Asia), AI and automation (North and South America, Europe), advanced technology (Africa), fintech (Middle East), and geopolitical challenges (Europe and South America).

CEOs from different industries are also altering their focus moving forward. For example, automotive CEOs see ESG as having a dramatically increased focus for the future that has outpaced AI, unlike their peers in the wider manufacturing sector. Leaders in the energy and utilities sector are also concentrating on ESG, given their central role in decarbonizing their own operations and those of wider ecosystems. Travel and transportation CEOs have shifted from e-commerce to see digital transformation as the most relevant driver for their industry. Telco CEOs are also focused on digital transformation and AI, moving away from workforce transformation. Healthcare CEOs have shifted their focus from e-commerce to advanced technology. For their part, financial services leaders worry about geopolitical challenges, alongside the threat (and opportunity) of fintech.

When asked what specific technology areas they were focusing on over the next three to five years, CEOs demonstrated a broad range of knowledge and understanding. In addition to AI, they cited advanced technologies like quantum computing, personalized learning platforms, cognitive smart cities, and, in the areas of transport, fully autonomous cars, hyperloop, drone and self-driving deliveries, and urban air transport.

Embracing state intervention to drive growth

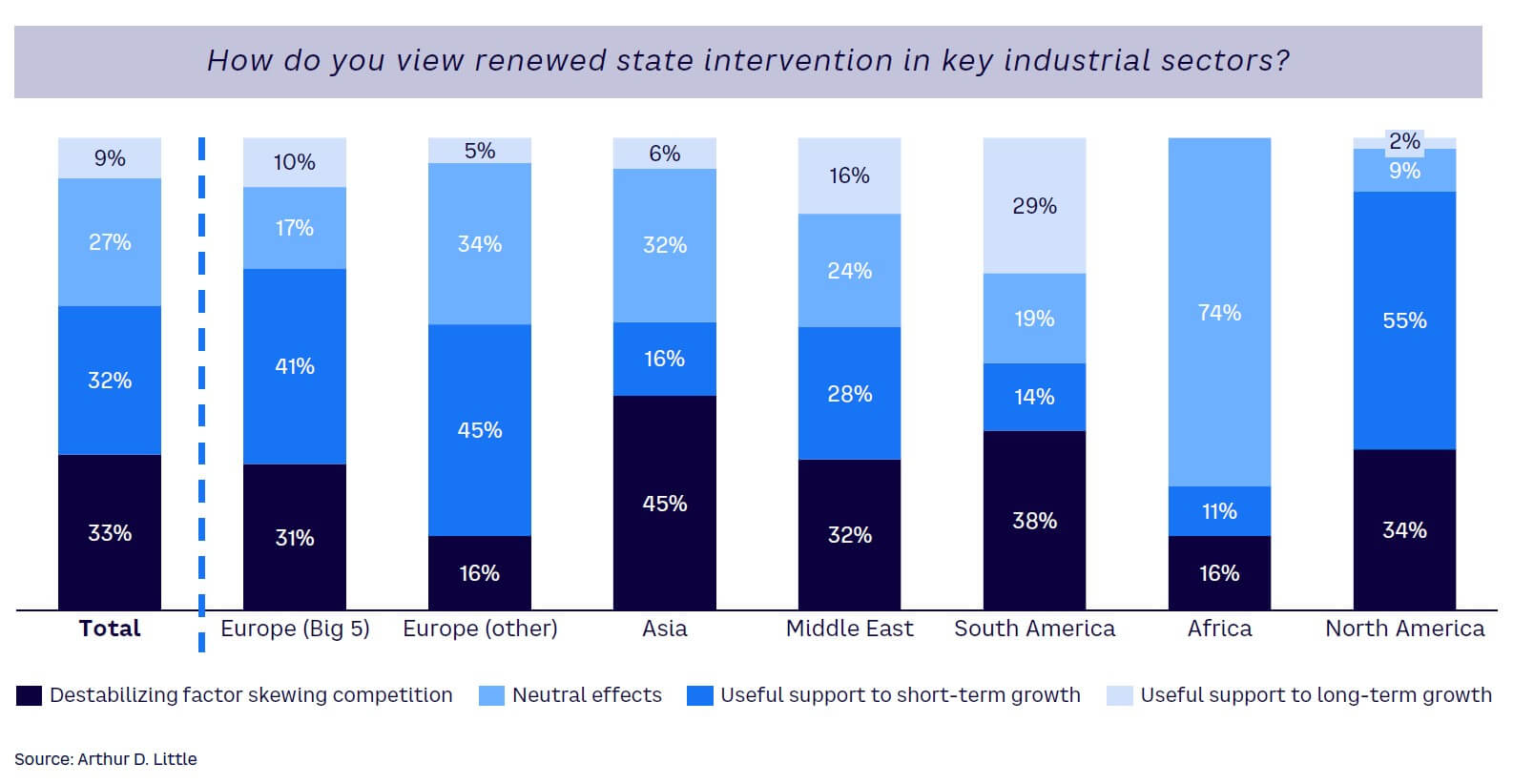

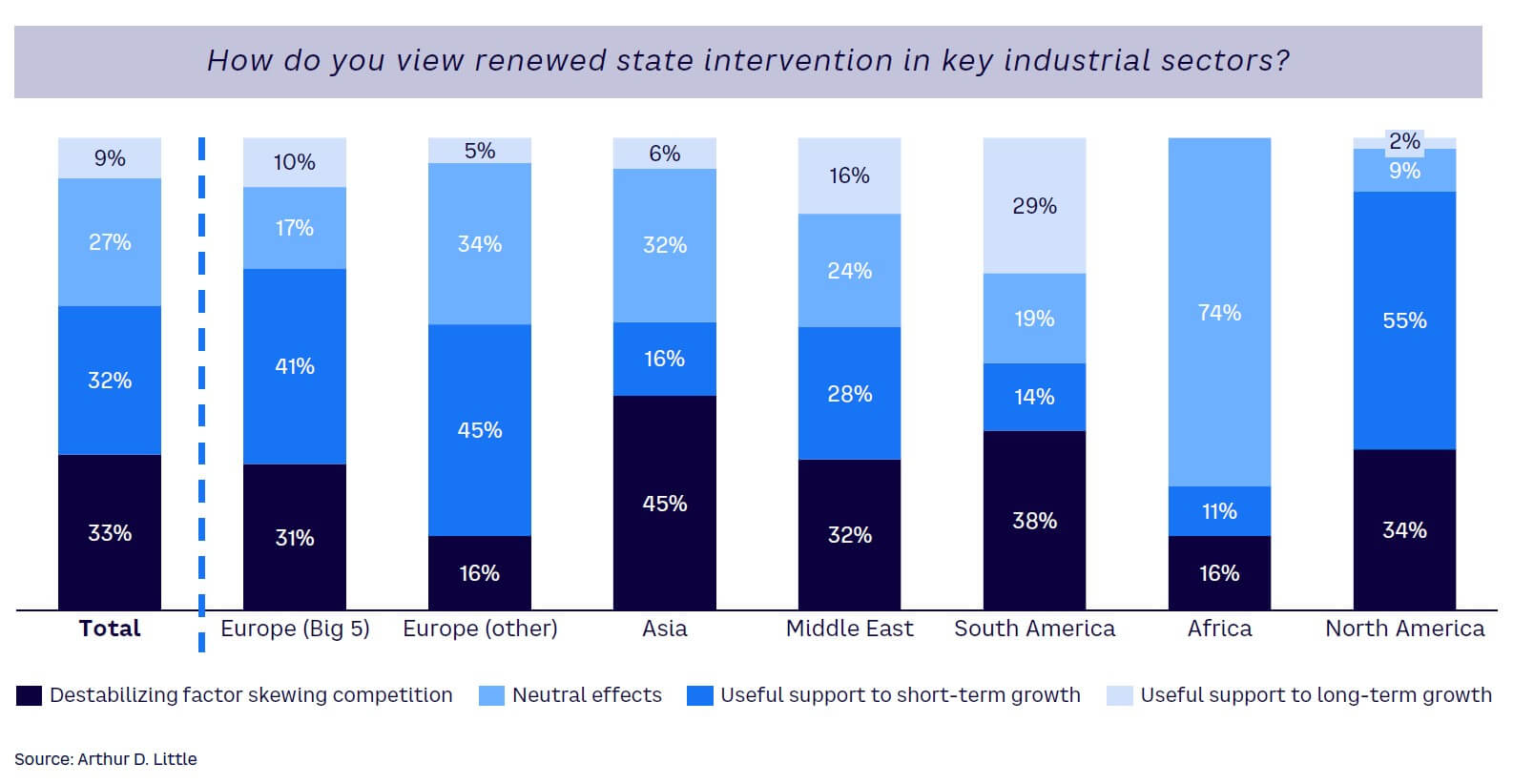

The combination of greater protectionism and increased programs and subsidies around decarbonization and other areas is providing new opportunities and changing CEO attitudes toward state intervention (see Figure 5). A third (33%) globally now see it as a useful driver for long-term growth (up from 21% in 2023), with a similar percentage (32%) viewing it as positive for short-term growth, down from 37% last year. Essentially, CEOs value this access to new investment resources and are factoring it into their overall growth strategies, particularly as they look to embrace new, more sustainable business practices and opportunities.

“We are looking into potential government support initiatives or economic stimulus plans that could offer money during hard times economically.” — CEO, telco

This shift is particularly pronounced in North America and among larger organizations. A clear majority of North American CEOs (55%) see it as a useful support for long-term growth (up 20% from 2023), with 34% viewing it as a short-term growth driver. Just 2% see it as a destabilizing factor that skews competition, compared to 29% of South American CEOs. Of larger ($10 billion+) companies, 41% view state intervention as a useful support to long-term growth, with 33% believing it drove short-term growth.

TREND 2: CURRENT GROWTH STRATEGIES — NAVIGATING UNCERTAINTY WITH CAUTION

A cautious approach to growth strategies

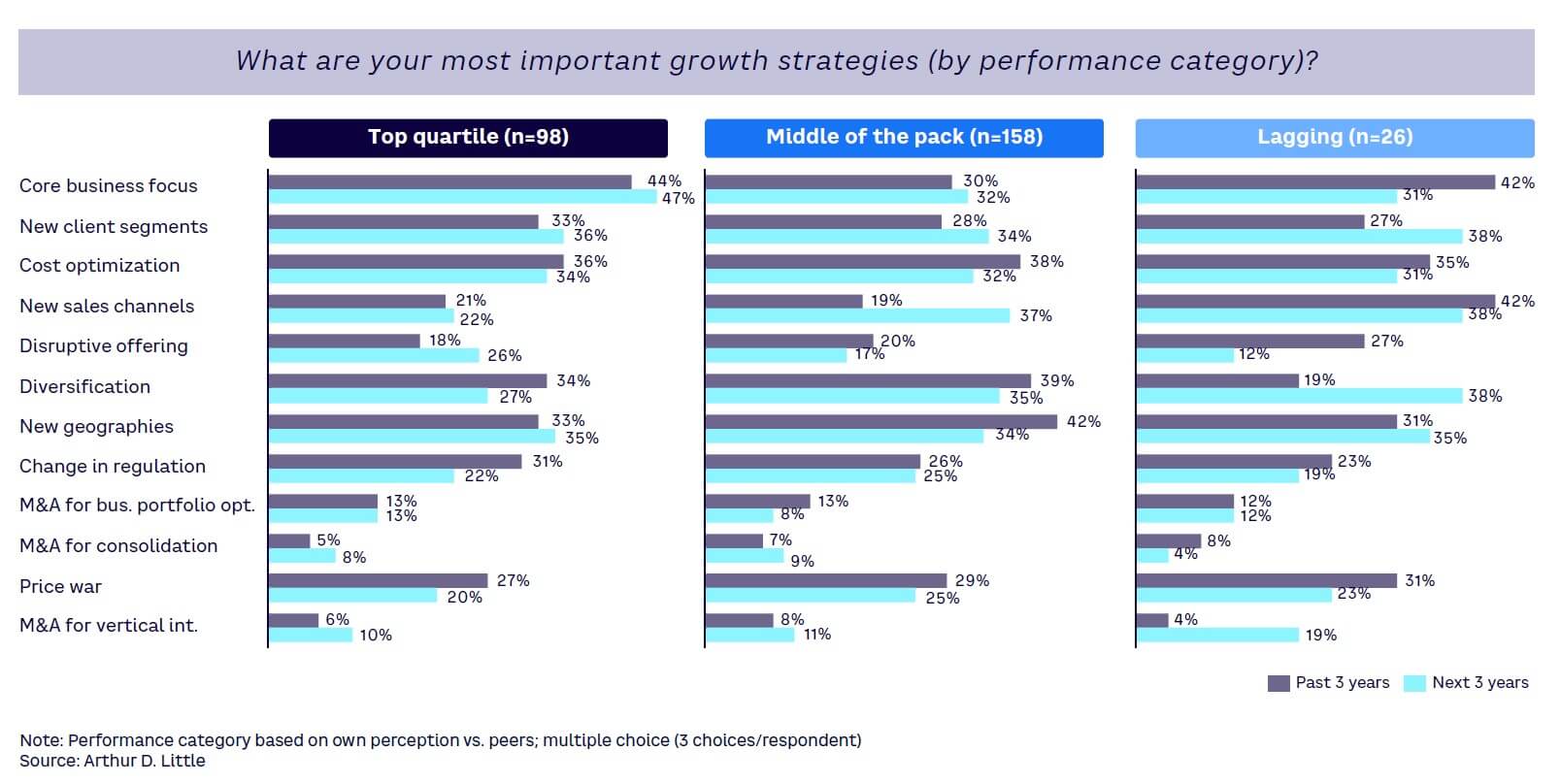

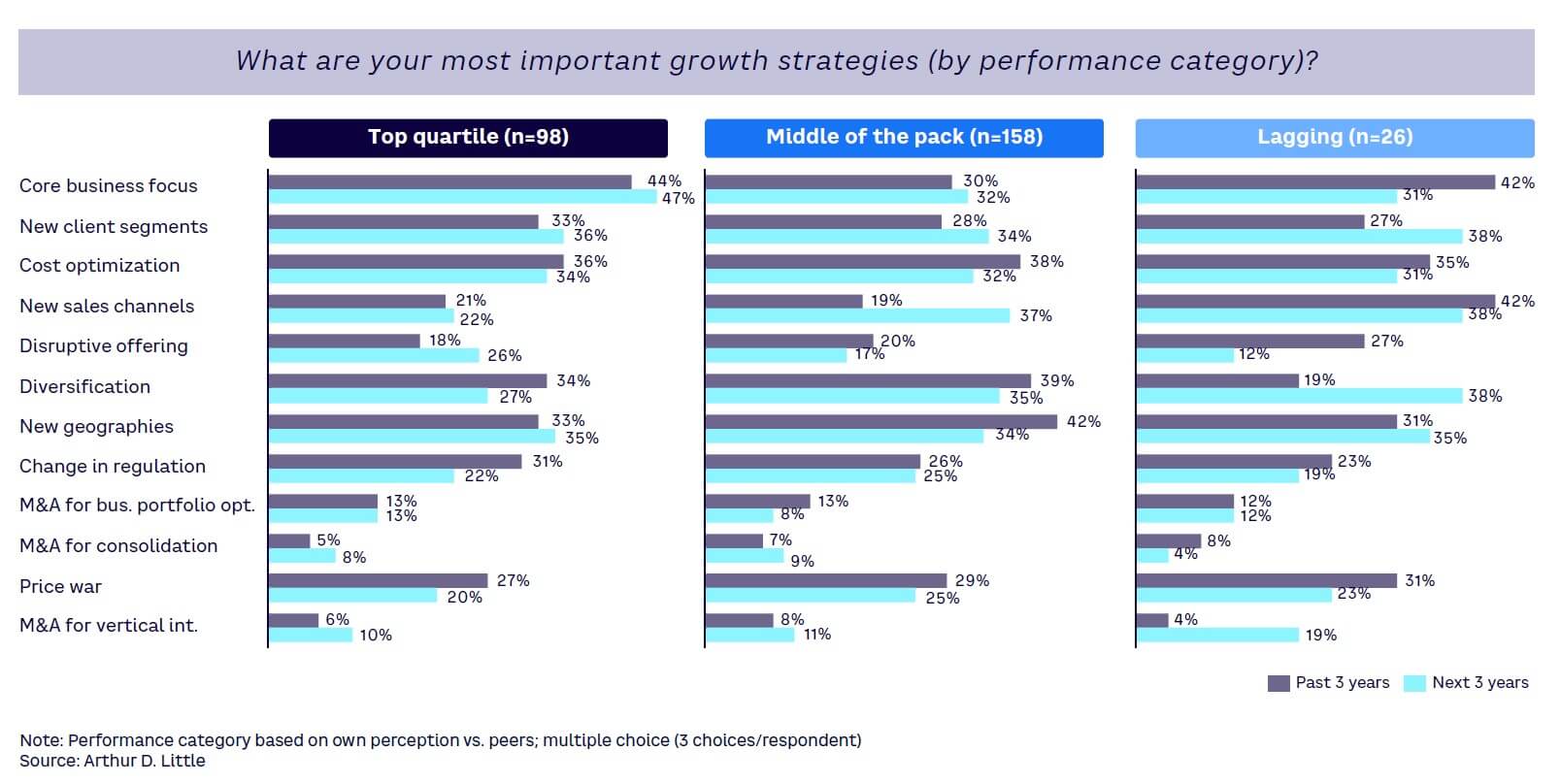

Driven by current market uncertainty, CEOs plan to continue their existing growth strategies, with overall marginal differences between those used for the past three years and the next three years (see Figure 6). The only areas that see a greater focus are diversification (up 14% compared to 2023) and fighting price wars (up 13%), both of which look to be a reaction to economic conditions and more closely fought competition. Providing disruptive offerings (down 9%) and targeting new geographies (down 11%) are being de-prioritized compared to 2023 as CEOs focus on maximizing existing strategies over the short to medium-term.

The future focus on the core business is particularly strong among those companies that see themselves as market leaders, ahead of entering new geographies and cost optimization. For those in the middle of the pack, the focus is shifting to new sales channels (up 18%) and new client segments, showing that they are searching for new opportunities to grow. Among respondents, 38% of laggards are looking to diversify their revenues (doubling from 19% over the past three years), demonstrating a shift away from a core business focus in order to unlock growth.

“Through entering new markets, creating fresh goods and services, and forming clever alliances, we are broadening the scope of our business activities.” — CEO, financial services

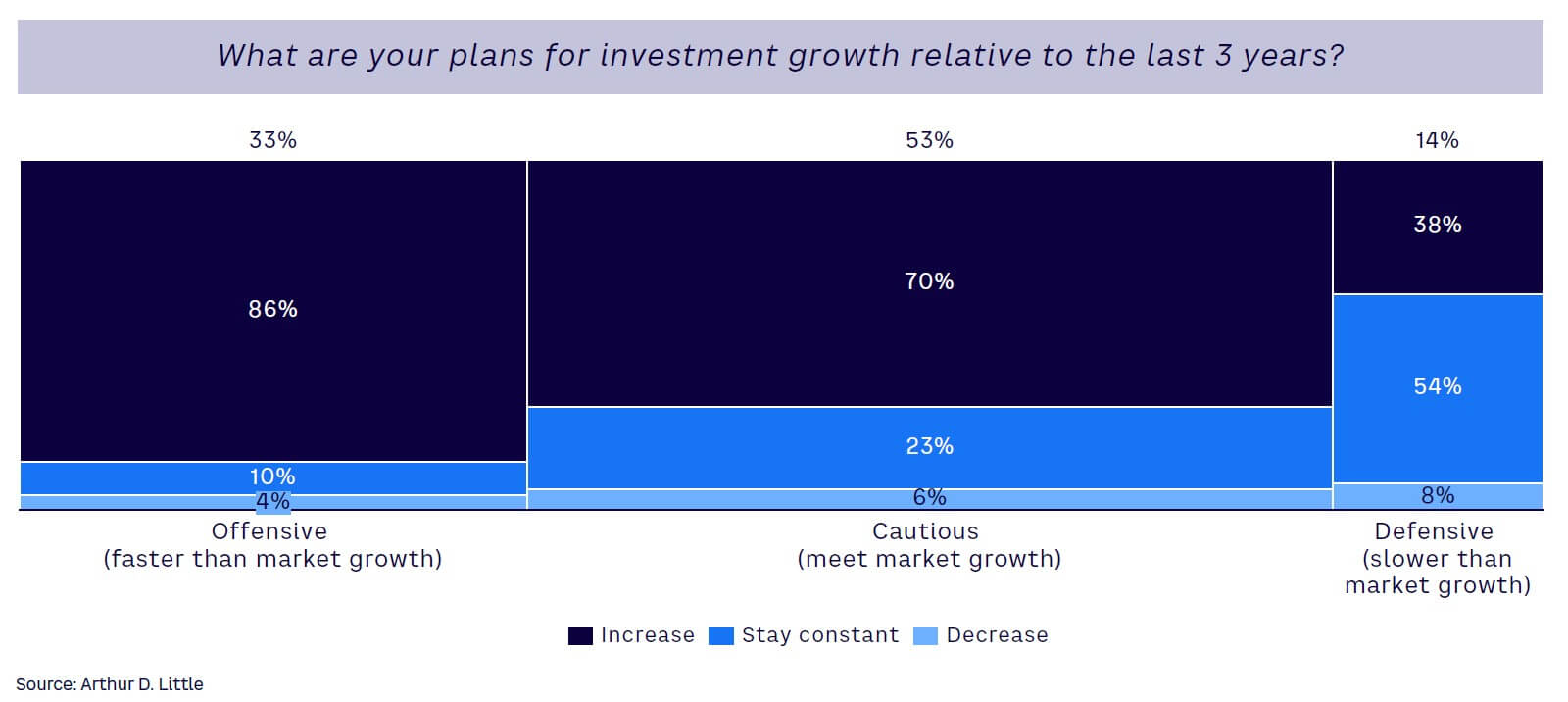

Increasing investments in growth

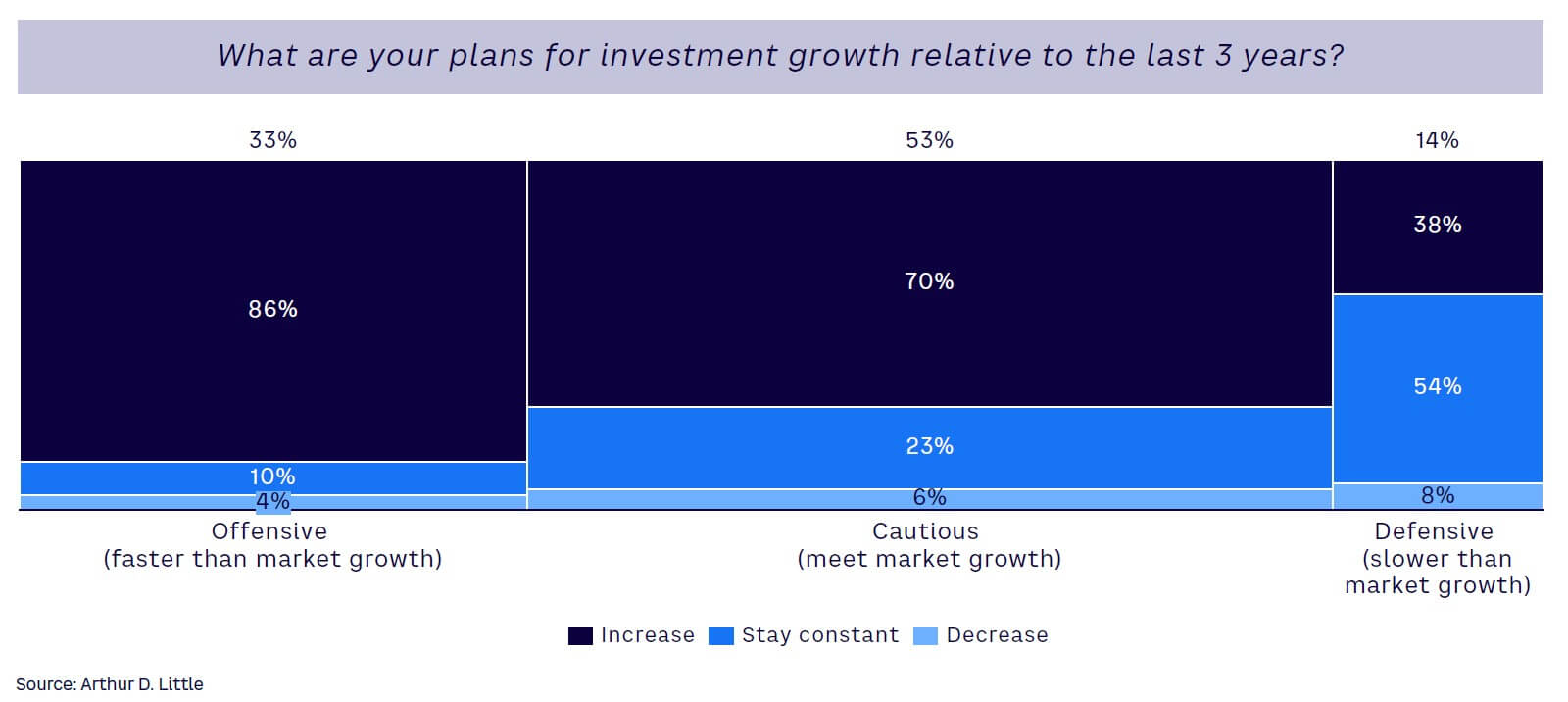

The turmoil of the past 12 months has led some CEOs to recalibrate their growth ambitions (see Figure 7). While a similar percentage (33% versus 30% in 2023) are adopting offensive strategies to achieve faster-than-market growth, the number focusing on cautious strategies (achieve market growth) dropped by 7% as more embraced defensive strategies (aiming for slower-than-market growth). This increase in defensive strategies could also indicate a belief that AI can reduce barriers to entry and bring disruption and new players into existing markets. Larger companies are more likely to be pushing for above-average growth, with 45% adopting offensive strategies compared to 26% of smaller organizations.

What is striking is that across all three groups, CEOs are willing to increase their investments in growth, perhaps pointing to greater funds being required than initially thought necessary to achieve success. For example, 92% of defensive CEOs expect to increase or keep their growth investment constant.

“We recognize the importance of building strong partnerships and collaborations. In times of uncertainty, having a network of reliable partners can provide additional support and resources.” — CEO, healthcare

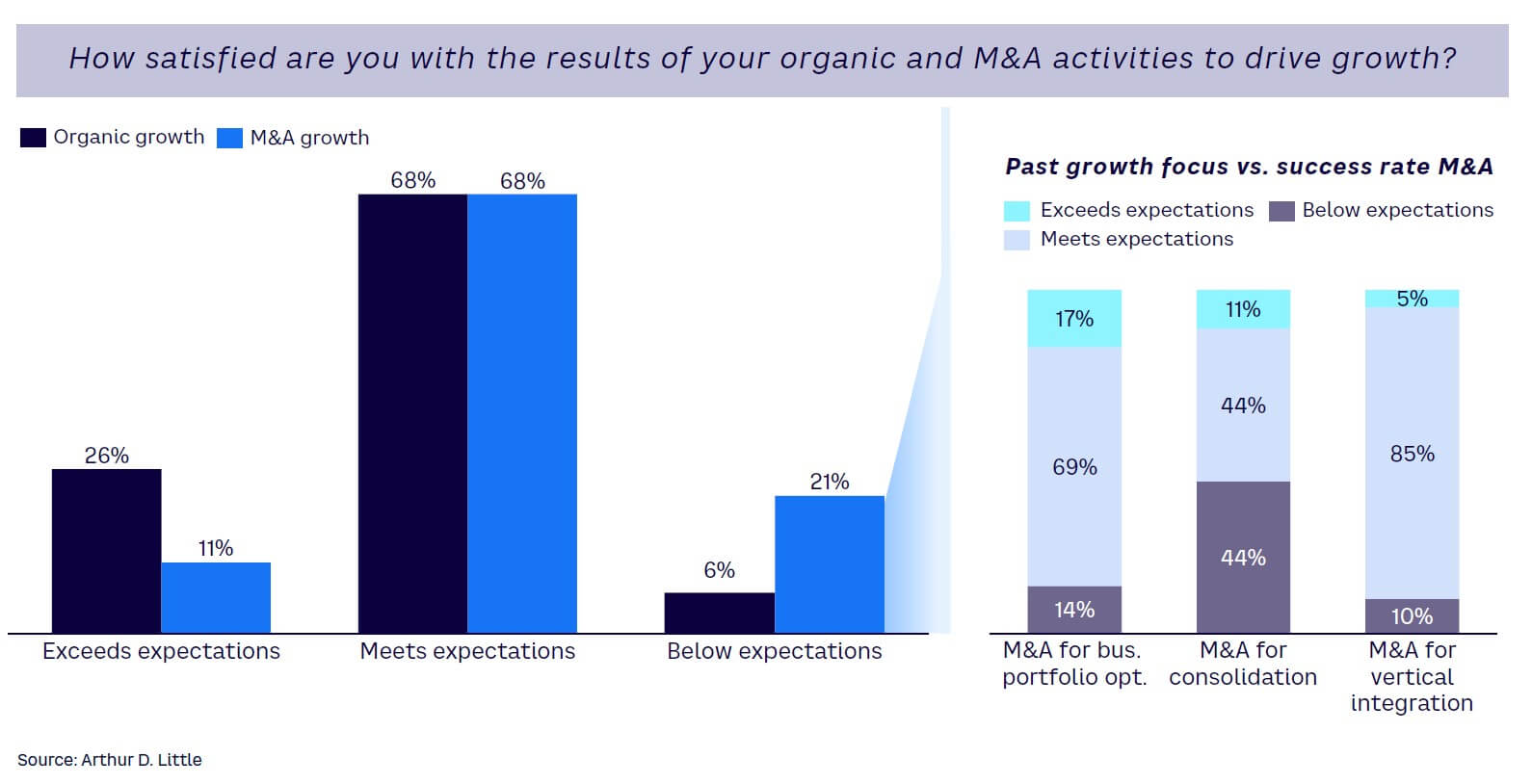

Organic growth outpaces M&A, particularly around consolidation

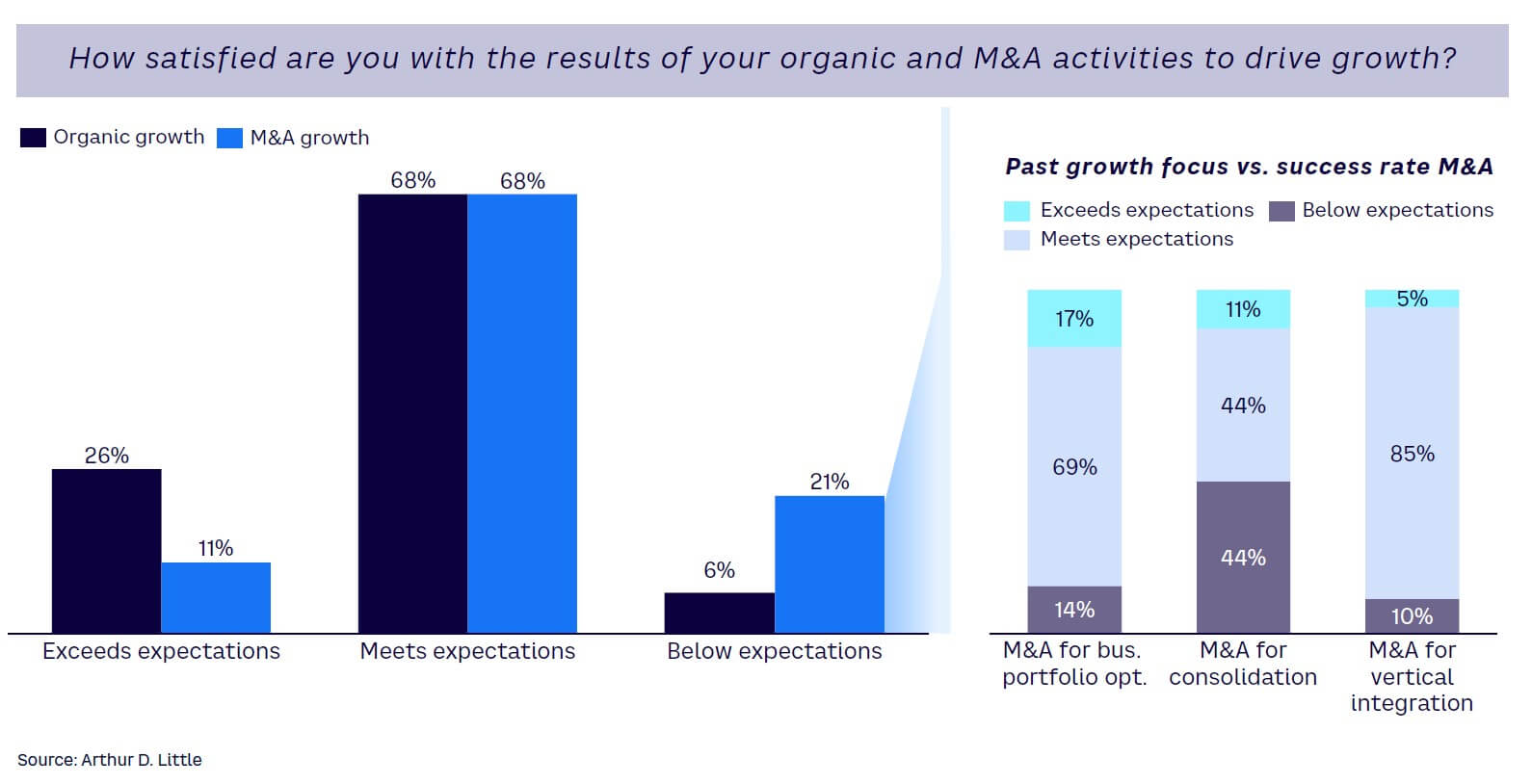

CEOs increasingly understand that while acquisitions can drive growth, they need to be focused and targeted. Overall, two-thirds (68%) of M&A activities met expectations, the same figure as organic growth programs, and up from 2023 (see Figure 8). Yet when it comes to exceeding expectations, organic growth is the clear winner: 26% of CEOs reported that such programs delivered above-expected benefits, with only 6% disappointed with their organic growth strategies.

In contrast, more than a fifth (21%) of CEOs said M&A performed below expectations, particularly around consolidation. Here just 11% of CEOs felt deals had exceeded their expectations, with 44% of CEOs saying they failed to deliver on their potential. This demonstrates the importance of picking the right targets for the right reasons, even at a time of market volatility when more companies may be available at what appears to be the right price. Large-scale consolidation brings key challenges around integrating the acquired business, its people, and product portfolios. At the same time, regulators around the world are increasingly active in reviewing such acquisitions, often demanding large-scale changes to deals that can ultimately reduce or even eliminate the value they bring.

Understanding needs in a VUCA world

Increasing growth investments is part of a wider realization among CEOs that we now live in a world characterized by VUCA. Of CEOs, 80% expect to pay more management attention to VUCA and related topics over the next three to five years, with just 2% believing it will be less important than today.

“Flexibility is one of the most crucial traits a business can have in a volatile industry. Being able to quickly alter course when required can mean the difference between success and failure.” — CEO, financial services

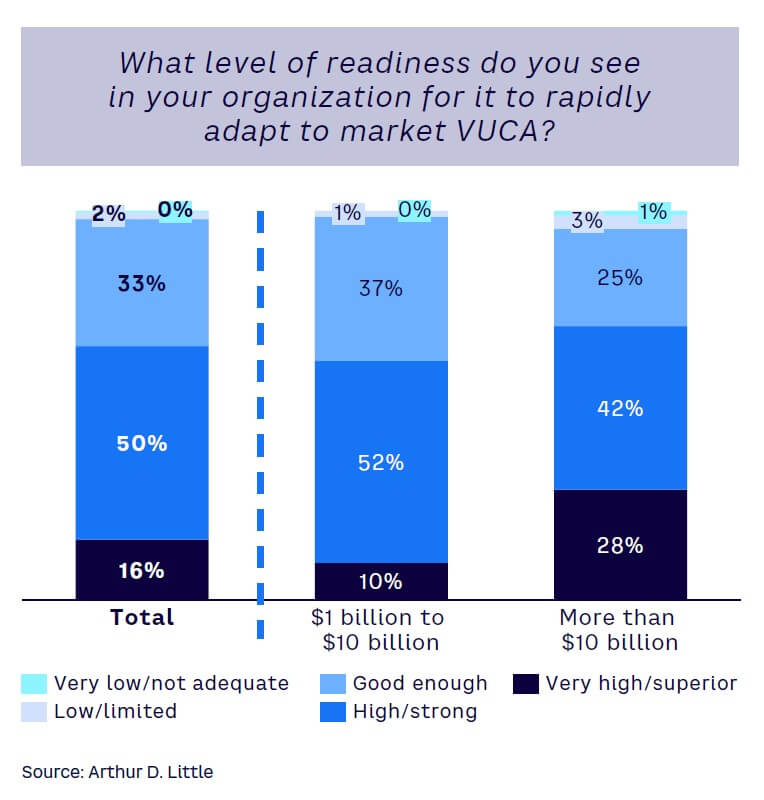

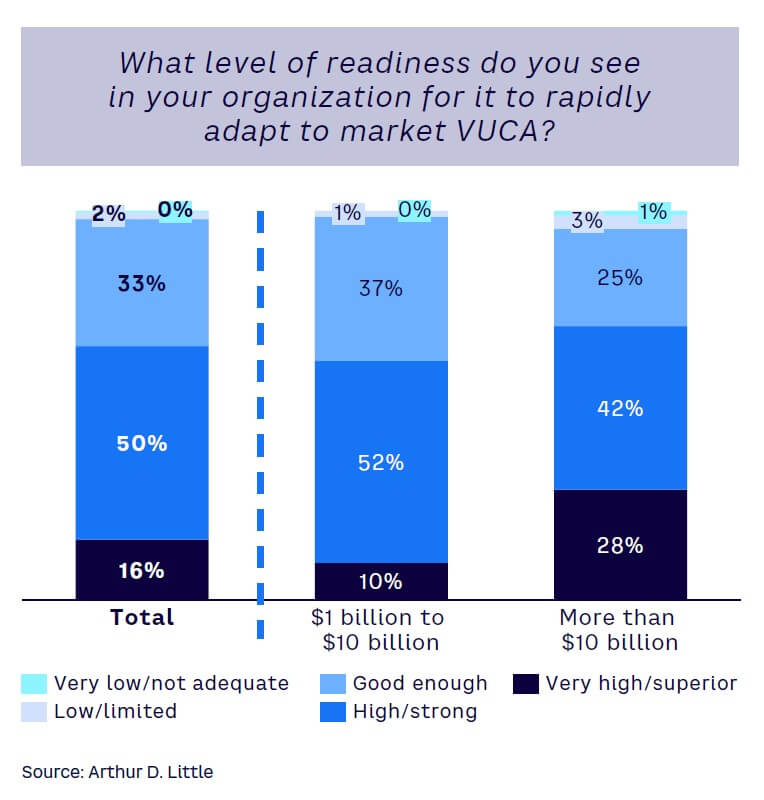

Recognizing VUCA is one thing but adapting the organization to meet its requirements for agility, resilience, and efficiency is more difficult. When asked how they aim to cope with volatility, the most common answers involve greater customer focus, closer links with suppliers, increasing sophisticated risk management, business intelligence, and scenario planning, as well as creating more innovative, flexible organizations that empower their people. As a result of these approaches, half (50%) of CEOs feel that their company has a high level of readiness to adapt to VUCA, and 16% feel their structures are superior to the wider market (see Figure 9).

“The real-time data we are integrating into models that forecast from supply chain disruptions, consumer behavior, and market trends can enable a more adaptable and fluid approach.” — CEO, manufacturing

This shift in adaptation is led by larger organizations, where 28% judge their capabilities as superior. However, 68% of this group feel that they still have a strong/very strong need to reskill staff to adapt to a more volatile environment, compared to 52% of the $1-$10 billion group. On average, 92% of CEOs feel that some reskilling is required for success in the VUCA world.

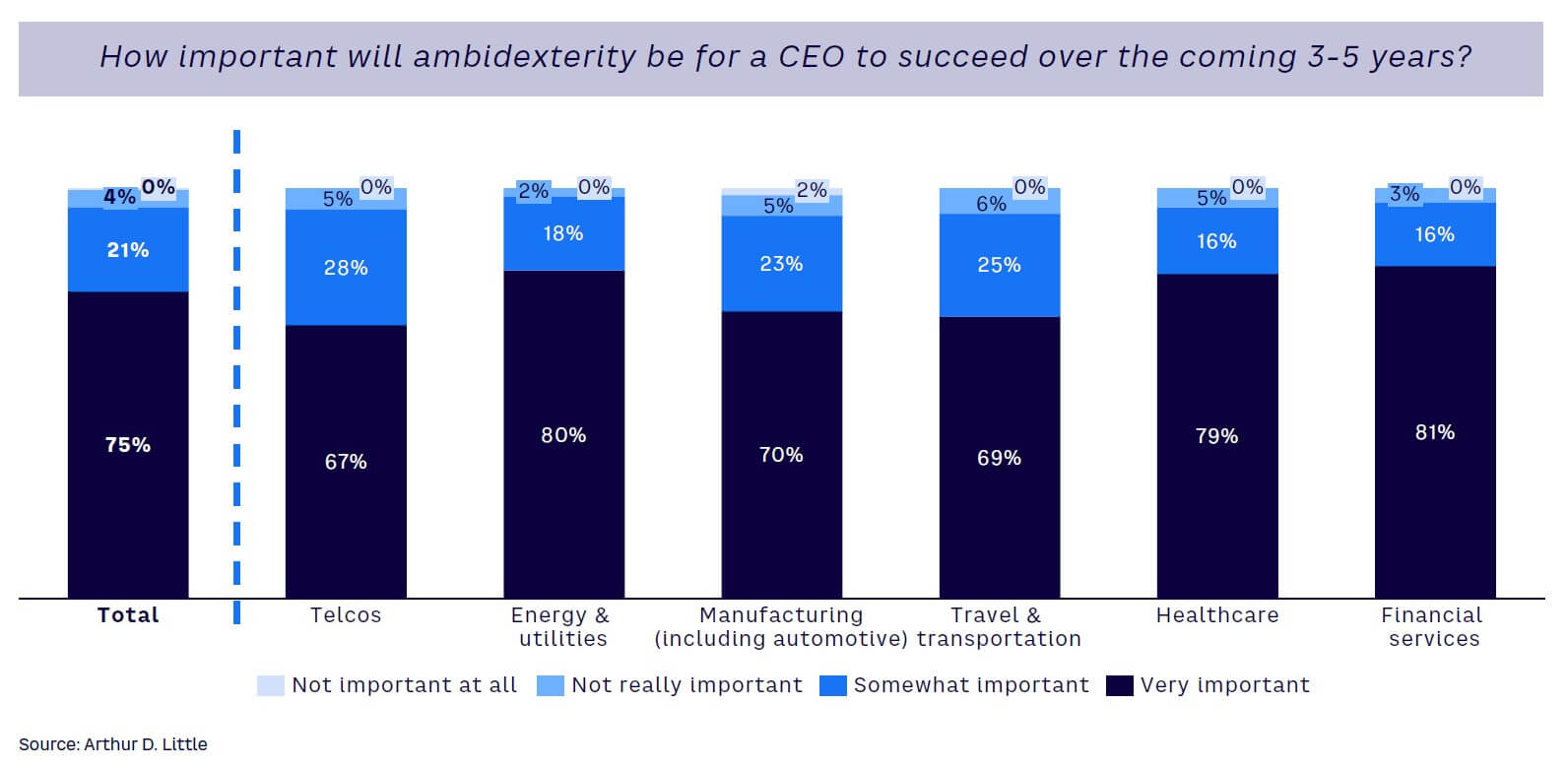

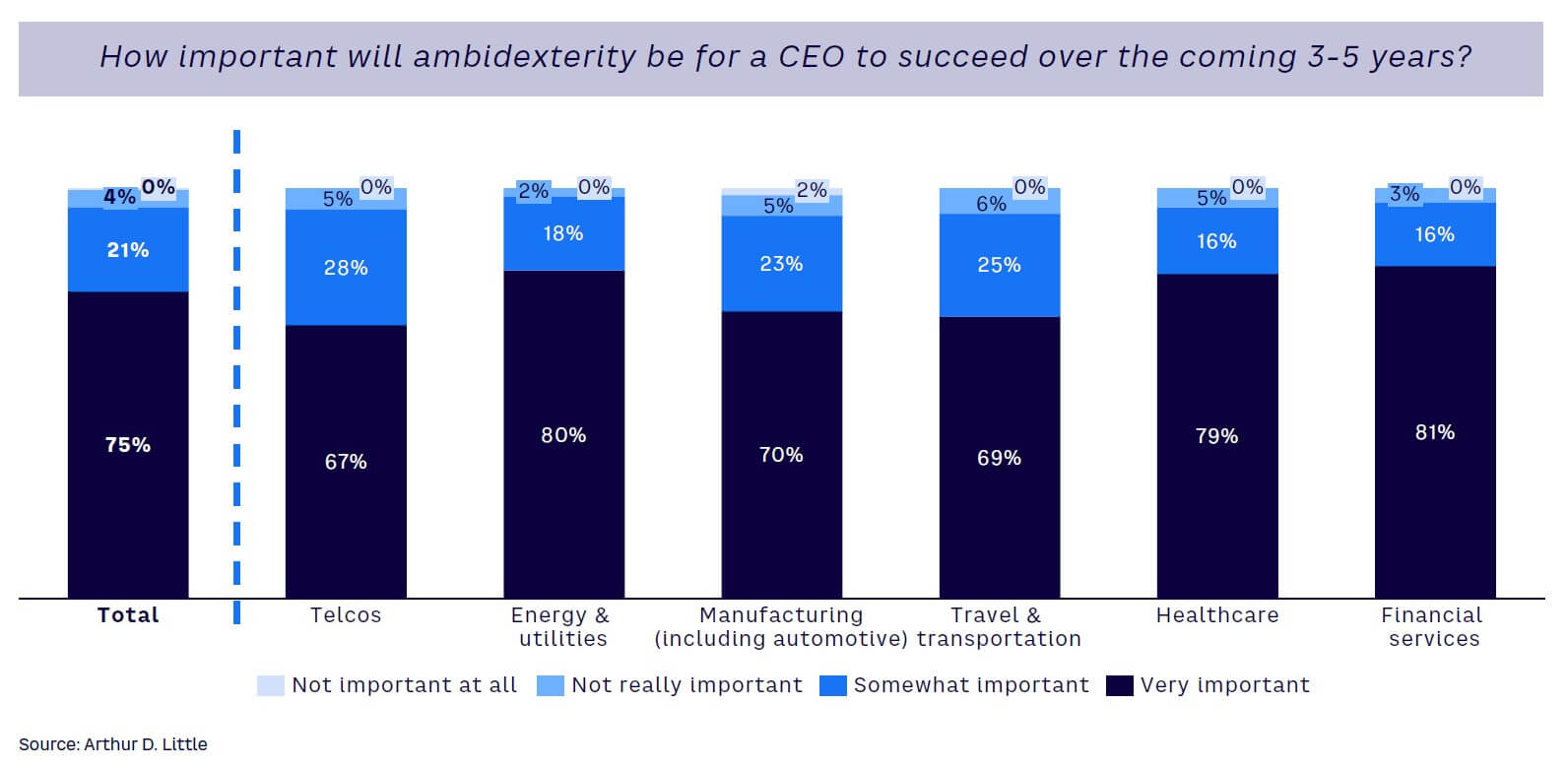

A key to success in a VUCA world is balancing productivity and innovation, creating ambidextrous organizations that succeed in both dimensions of creativity and scale (see Figure 10). CEOs understand this, with 96% believing ambidexterity will be important to their success over the coming three to five years. Among different sectors, more than three-quarters of CEOs in financial services, energy and utilities, and healthcare reported becoming ambidextrous as very important, ahead of manufacturing and travel and transportation, where CEOs feel it will be less of a focus over the medium term.

“We are in a better position to adjust to changes in the market because we consistently invest in R&D and promote an innovative culture.” — CEO, travel & transportation

TREND 3: PREPARING FOR THE FUTURE — AI LEADS TO RESKILLING PARADIGM SHIFT

Organizational structures thrive in testing times

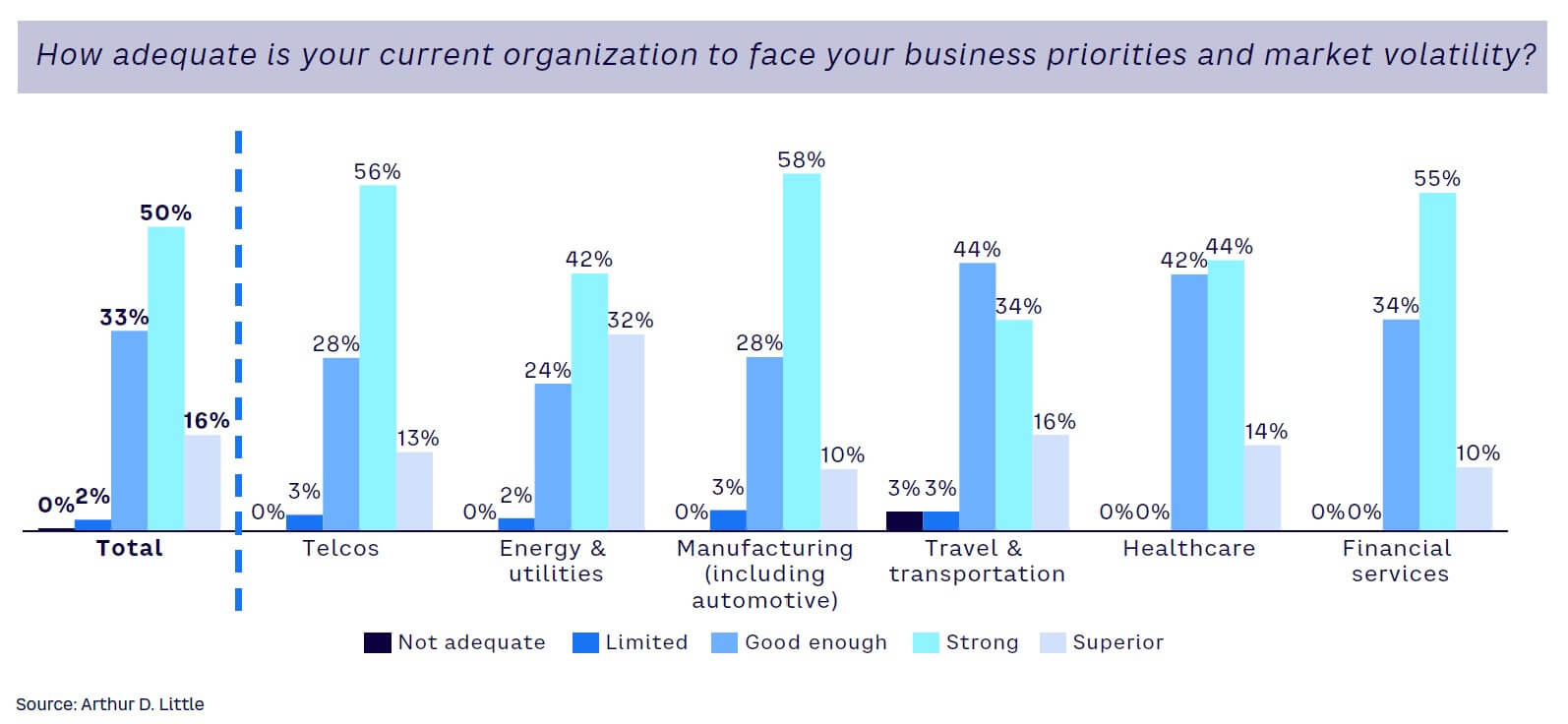

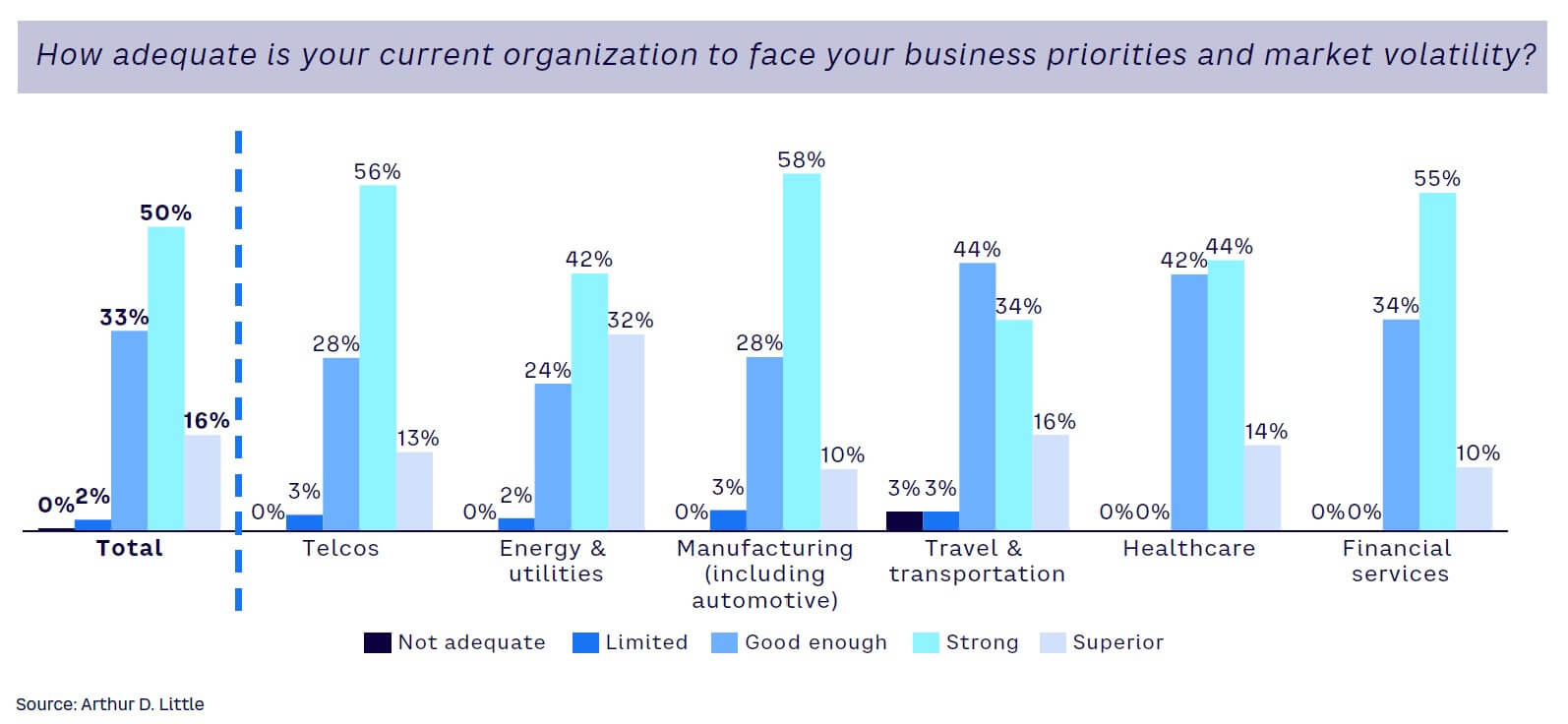

In 2023, half of CEOs expressed confidence that their existing organizational structures were strong enough to navigate business priorities and market volatility, although just 4% classed them as superior.

“To remain competitive in the industry, we will devote more attention to realizing the wants and demands of our customers. Developing a solid rapport with customers might help us through difficult times in the economy.” — CEO, travel & transportation

The testing conditions of the last 12 months demonstrated that CEOs were underselling the benefits of the structures they had put in place; while half still feel their organizations are strong, 16% now see them as superior and none sees them as inadequate (see Figure 11). This improved confidence is visible across all sectors — particularly energy and utilities (with 32% of CEOs feeling structures are superior, compared to 3% in 2023), telcos (from 0% superior to 13%), and financial services (up again, from 0% to 10%). Overall, CEOs are confident that they have strong organizational structures in place to move forward and target their growth goals.

Embrace AI to achieve growth ambitions

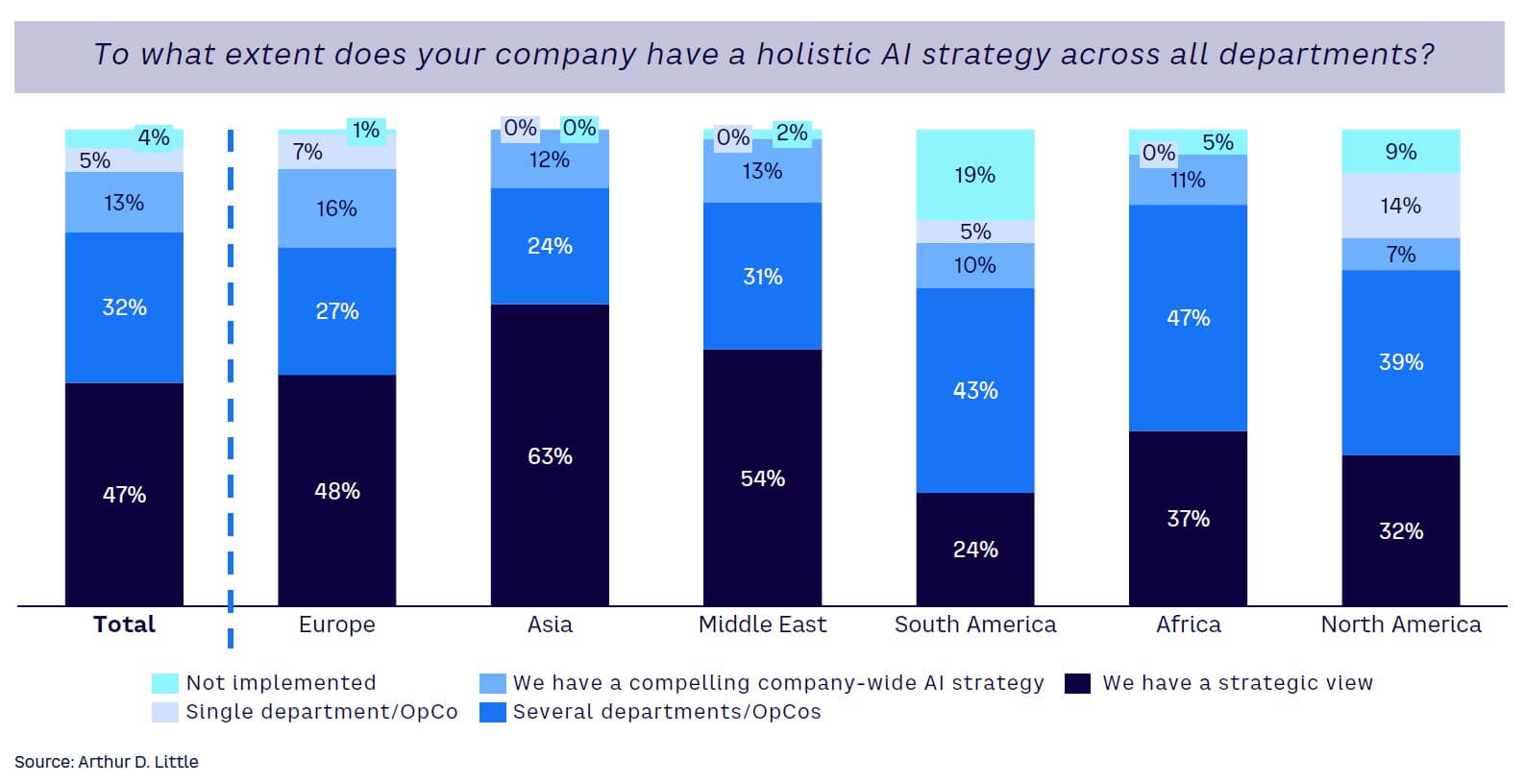

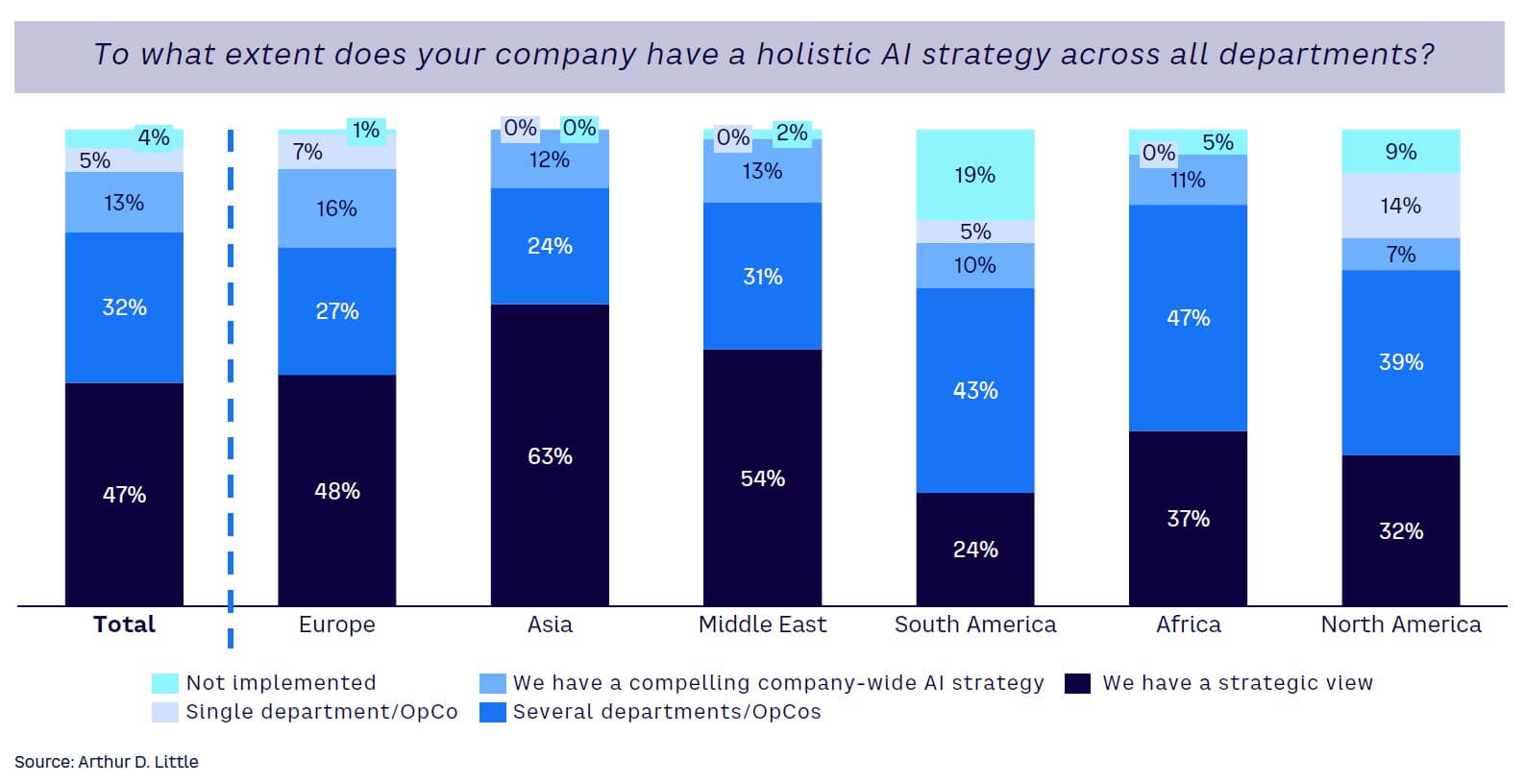

Since 2023, AI usage has accelerated dramatically. To measure CEO attitudes, this year’s study introduced new questions around AI and its adoption. In many ways, progress has been swift — 96% of executives claim to have implemented an AI strategy within at least one department of their organization, with 47% having a strategic view toward AI.

However, just 13% have adopted a comprehensive company-wide AI strategy, demonstrating that they are still on a transformation path to fully understand the impact of AI and integrate it across the organization. In our experience, fully benefiting from AI requires enormous structural and workforce change, which is achievable only with time. There are major challenges to moving from a strategic view to a strategy and then implementing it.

Figure 12 illustrates the strongest performers by region, with 75% of companies within Asia reporting a company-wide strategy or strategic view. The strongest performers by industry and size are those in the financial services (79%) and $10 billion+ organizations (67%). A clear divide also exists between organizations that feel that they are leading their markets, where 24% have a company-wide strategy in place, and laggards, none of which have implemented such a compelling strategy.

AI usage: Efficiency & innovation

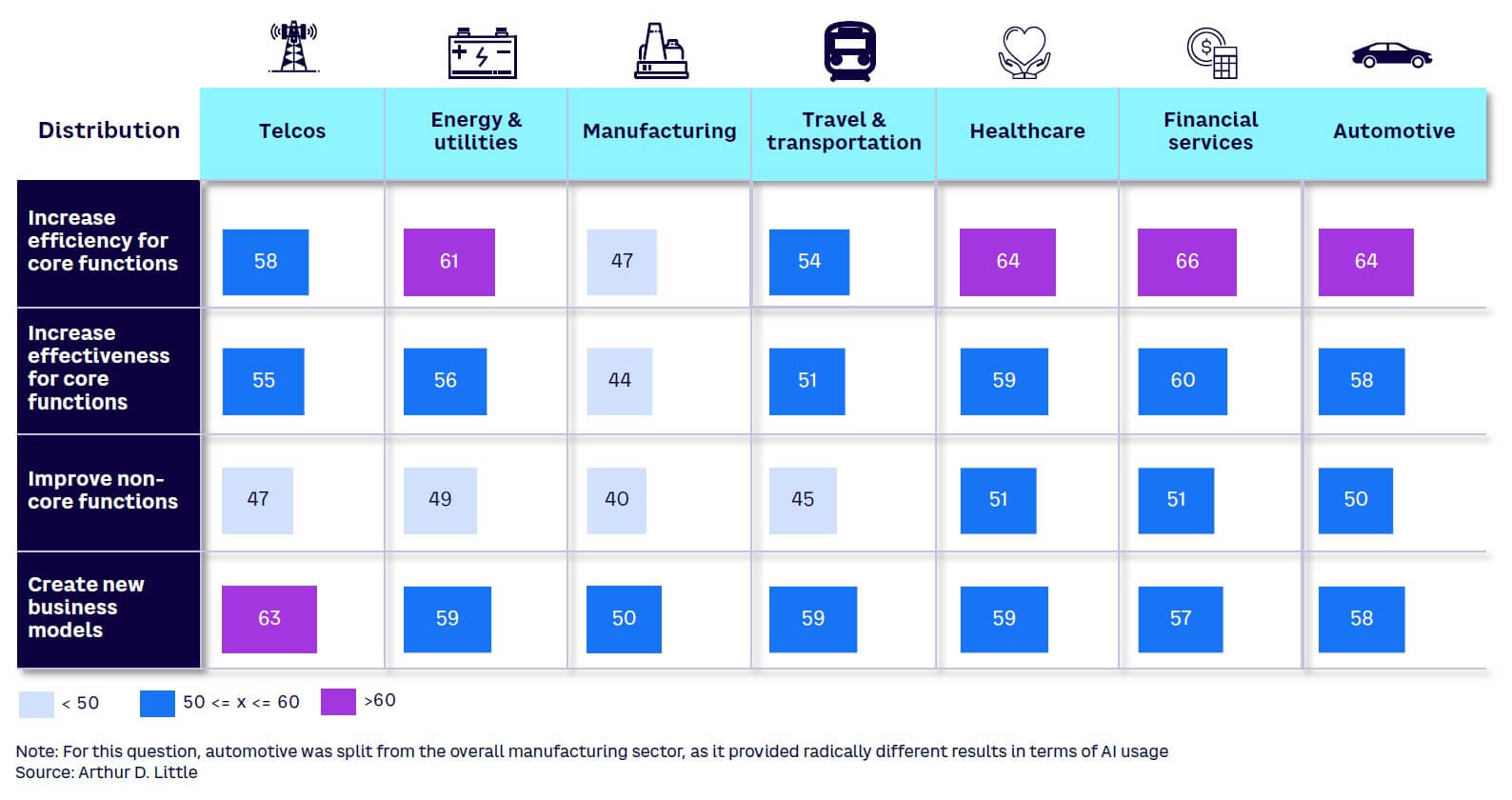

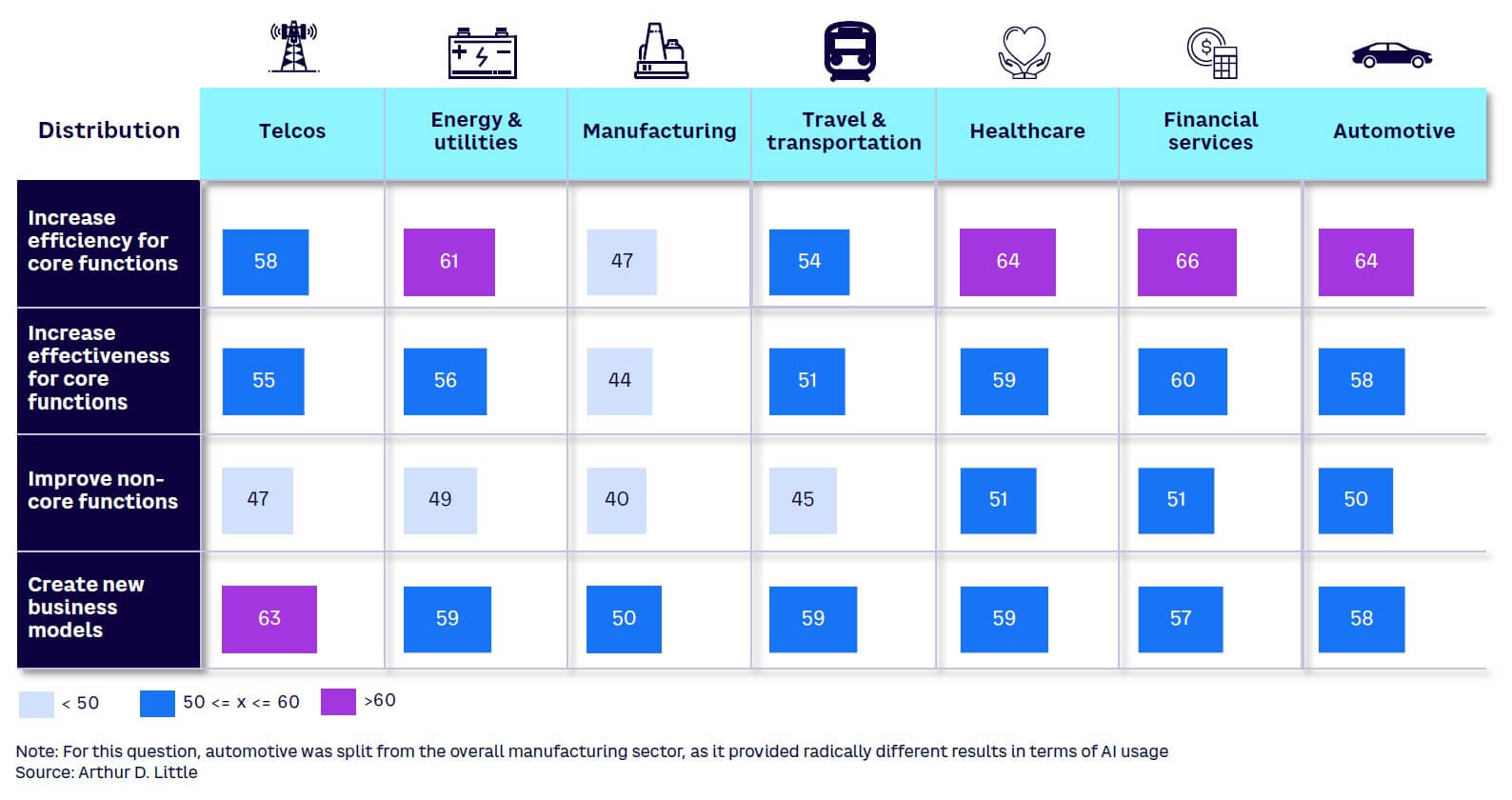

How are CEOs turning their AI strategies into practice? Analysis shows that they are predominantly focused on making core functions better by increasing efficiency and effectiveness, such as through automation (see Figure 13). Efficiency is the leading use case in four out of seven sectors, showing that companies are at a relatively early stage of their AI journey.

The exceptions are telcos, travel and transportation, and manufacturing, which are focusing on using AI to create new business models. However, manufacturing is clearly lagging other sectors on each performance vector, scoring an overall average of less than 50 for AI use. This can be linked to the sector’s pressing need to reskill employees, as we highlight in the next section.

“Our target is to use technology to improve operational effectiveness while cutting expenses.” — CEO, healthcare

“To predict market movements, we are using AI and machine learning, which we are using more and more for scenario analysis and predictive modeling.” — CEO, telco

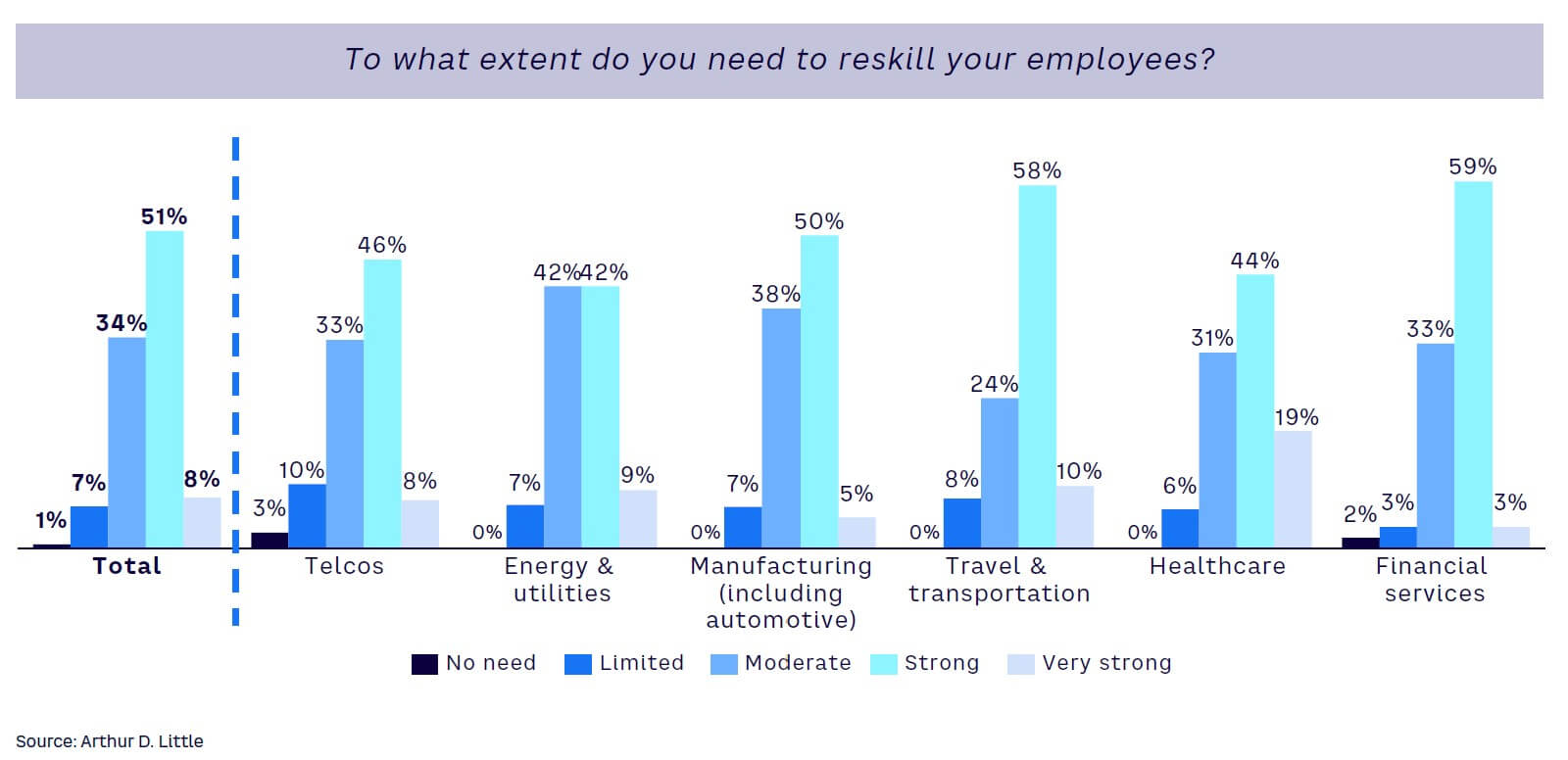

Reskill for AI-driven future

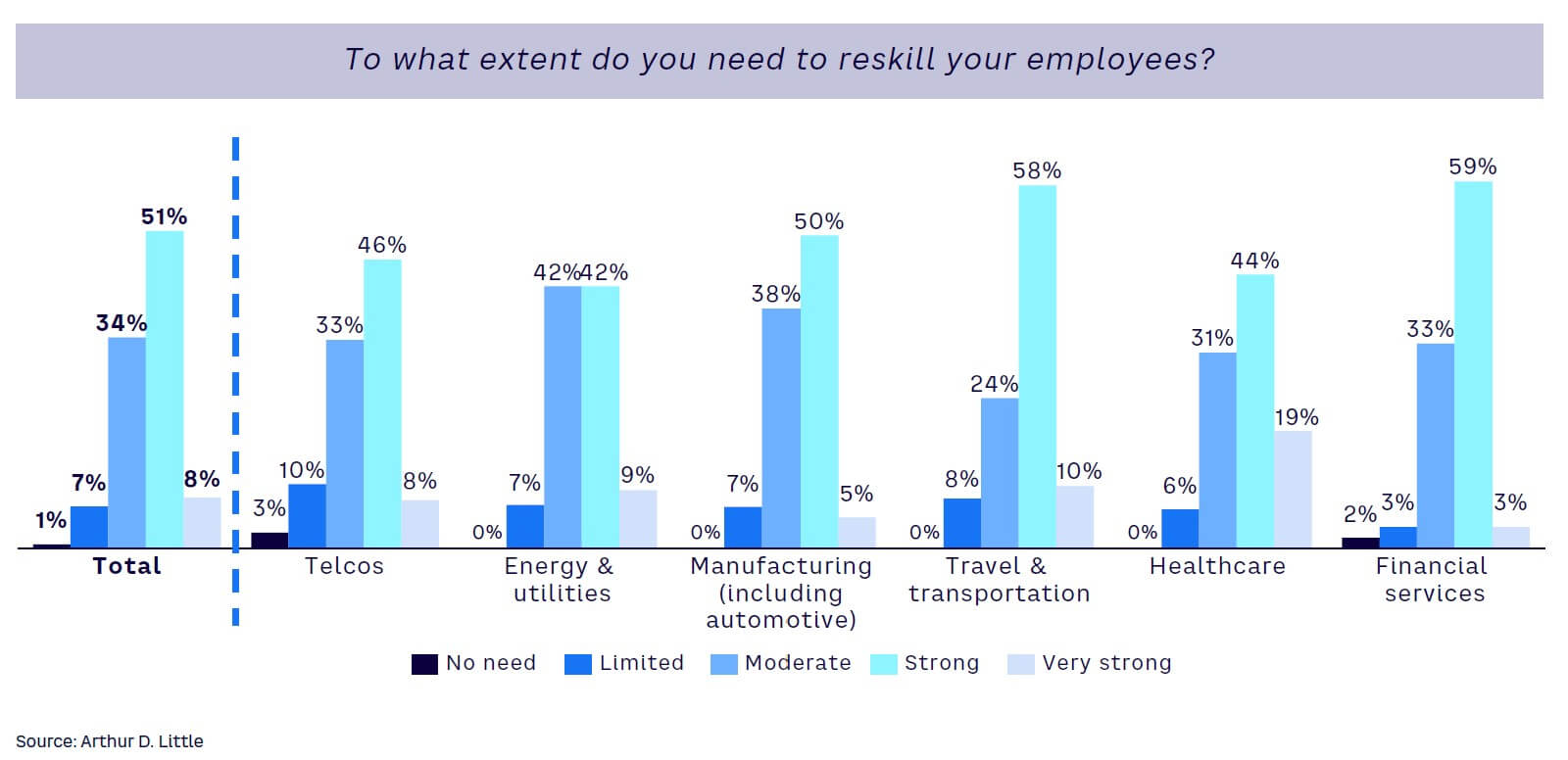

While AI is not yet changing corporate structures, it is having an immediate and enormous impact on the skills required for success. To maximize results from AI, CEOs believe they need to transform their workforces, with 59% seeing a strong or very strong requirement to reskill their employees, up from just 13% in 2023 (see Figure 14). This demonstrates the speed and wide-ranging impact of AI’s rapid rise. For example, 68% of manufacturing CEOs see a strong need to reskill in 2024 compared to 5% in 2023, attesting to the sector’s lack of AI maturity. Across sectors, less than 1% report no need for reskilling, a fall from 11% in 2023.

“We encourage creativity and a willingness to explore novel concepts. A firm with an entrepreneurial atmosphere might be able to develop business strategies that give it an edge over competitors in volatile markets.” — CEO, automotive

Look internally & externally to develop talent

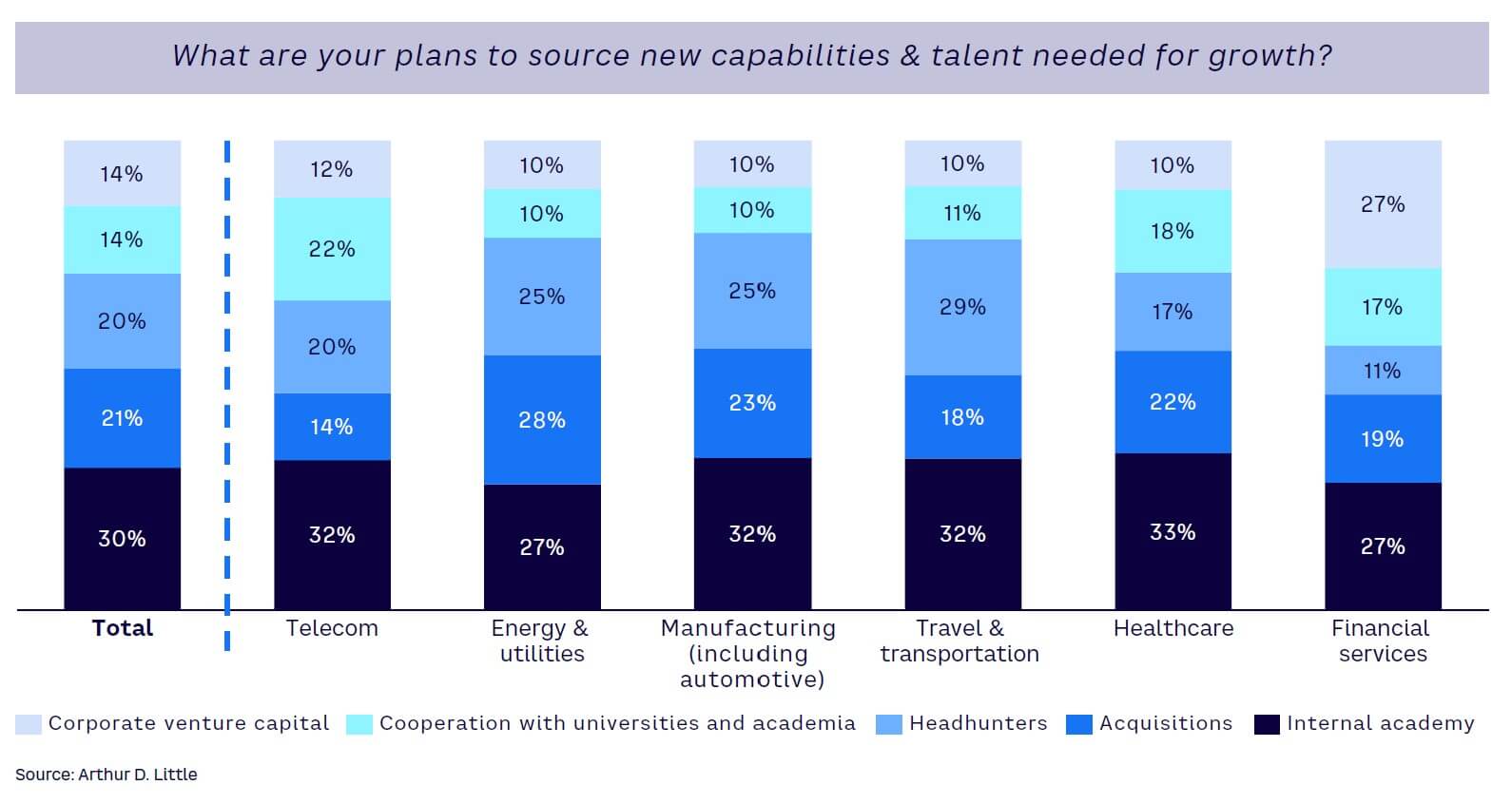

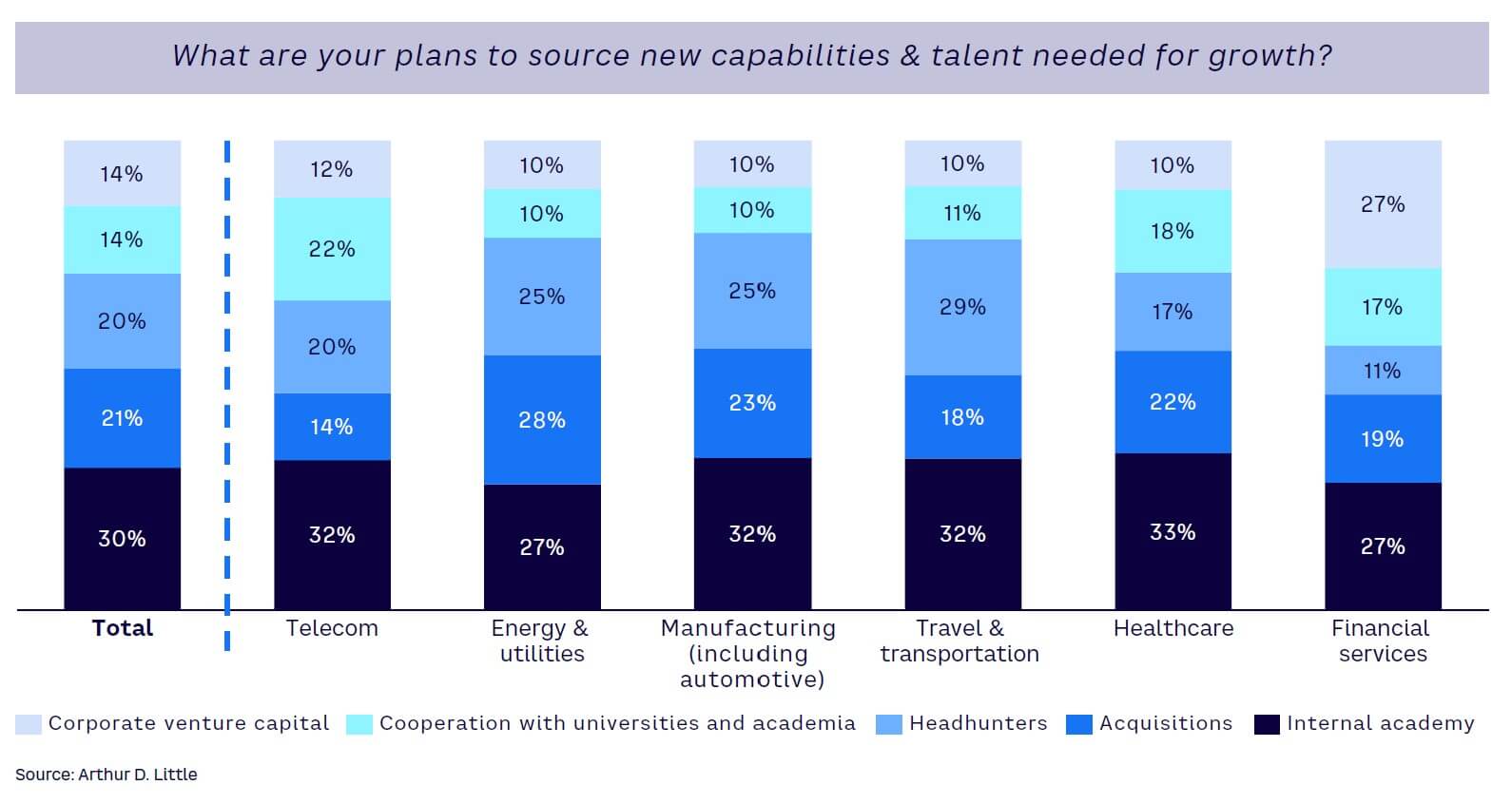

In 2023, CEOs reported relying on external sources, primarily headhunters and cooperation with universities, to provide them with new capabilities and talent to drive growth. In 2024, the focus has shifted, with the largest percentage (30%) looking to internal academies to deliver talent and skills, up from 21% in 2023 (see Figure 15). This trend is potentially driven by multiple factors, including the difficulty of finding AI talent due to global skills shortages and a realization that technical knowledge needs to be married to business understanding to deliver effective results, tailored to the individual company and its objectives.

“In order to identify fresh opportunities for development and build strong business models, we are encouraging creative thinking and entrepreneurial behavior within our company.” — CEO, energy & utilities

TREND 4: A SHIFT IN PRIORITIES AROUND ESG

ESG becomes one of many business priorities

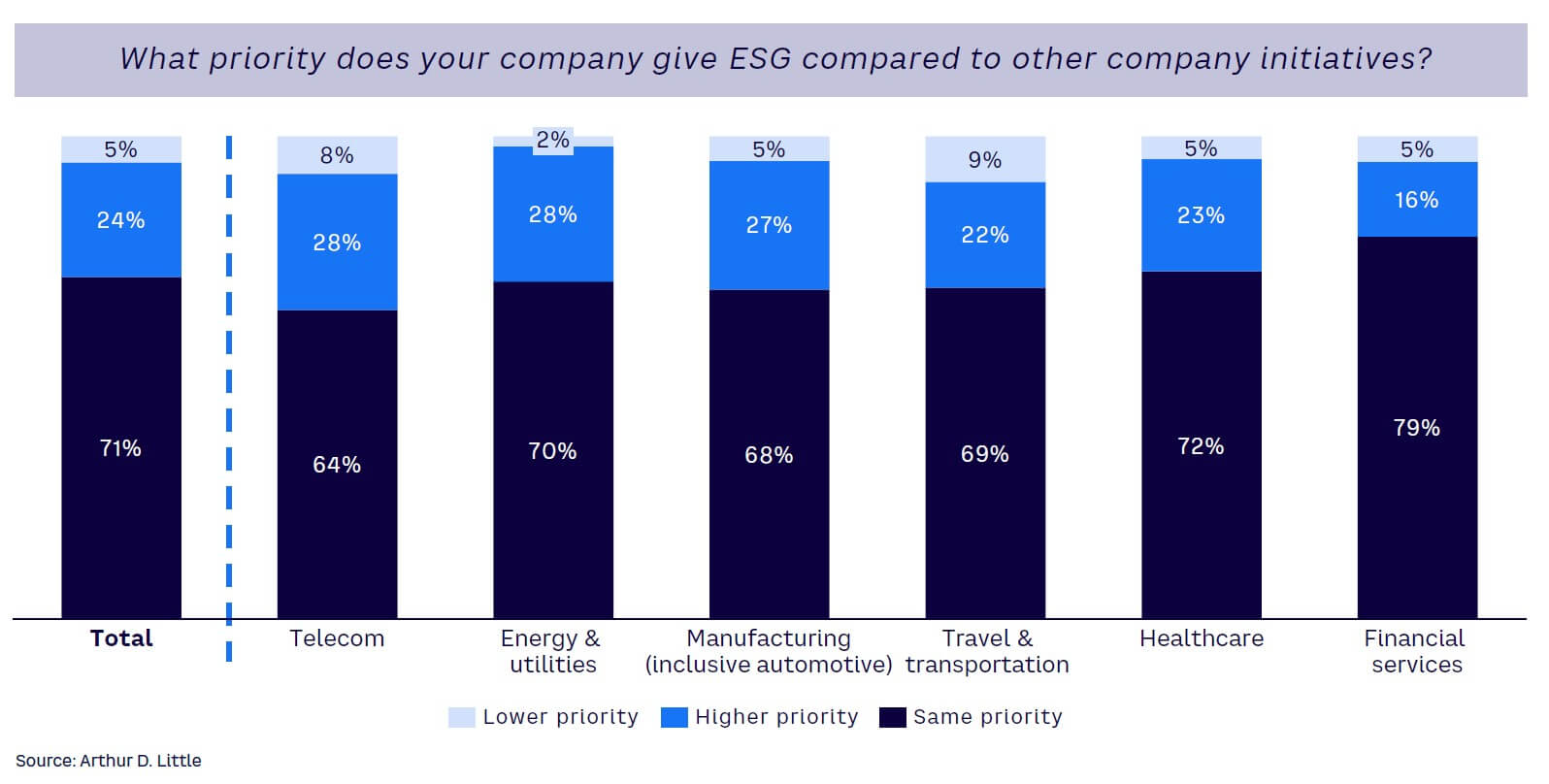

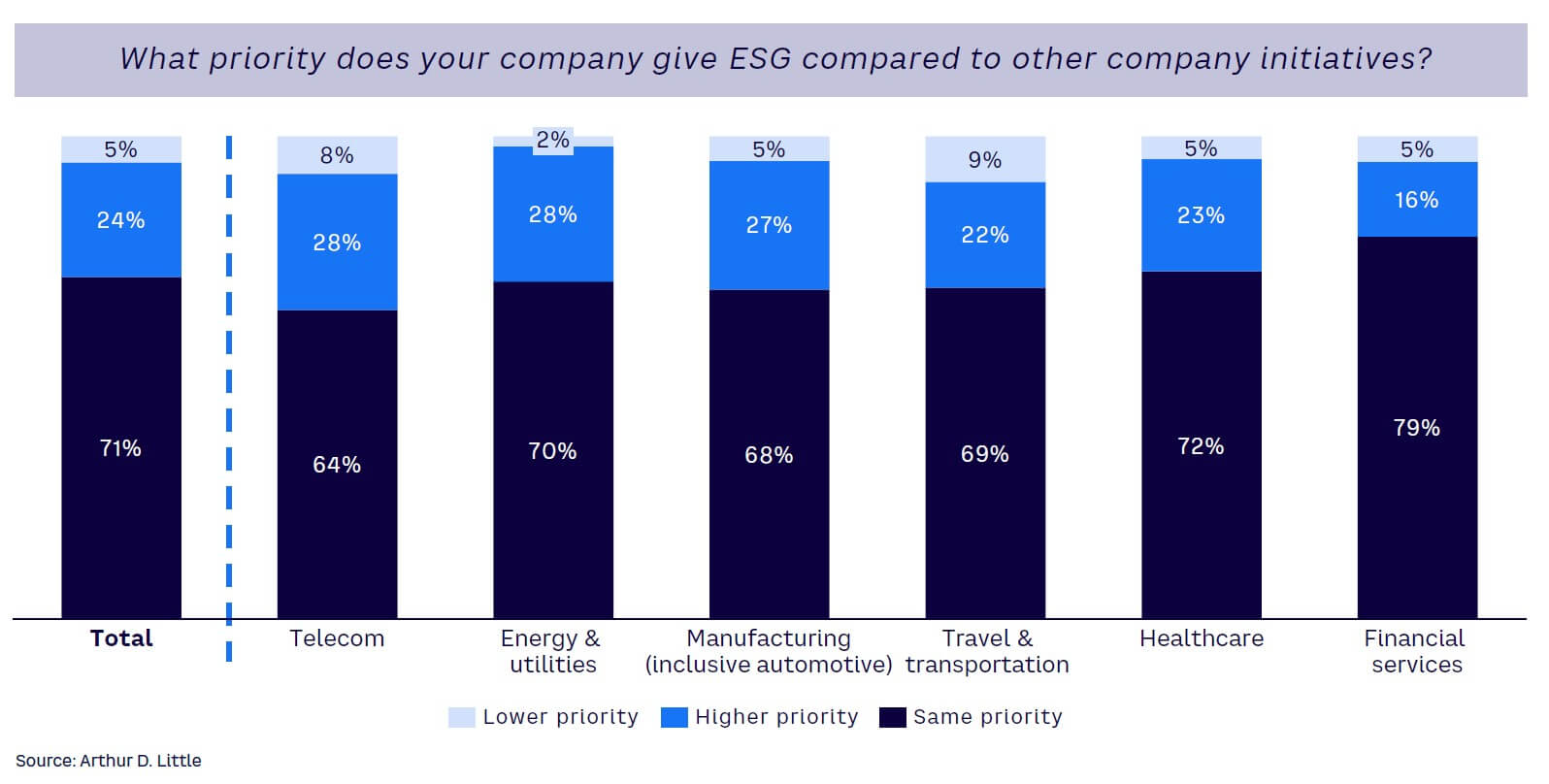

How CEOs approach and prioritize ESG initiatives is undergoing a notable shift as sustainability develops (see Figure 16). Whereas in our 2023 study, 41% gave it a higher priority than other activities, in 2024 this has diminished to just 24%.

Essentially, most CEOs consider ESG as part of “business as usual,” with their approaches maturing over the course of the last 12 months. Clearly, CEOs still see ESG as important, but 71% now rank it on a par with other priorities, up from 58% in 2023.

“As the emphasis on renewable energy sources and ecologically friendly operations grows, we are making long-term investments in and adoption of sustainable practices.” — CEO, energy & utilities

This shift is particularly noticeable in manufacturing, where 35% fewer CEOs see it as a higher priority than in 2023, and travel and transportation, where it has declined by 25%. In fact, 9% of travel and transportation CEOs report that ESG is now less important than other priorities, pointing to either increased maturity (which means it has become an integral part of business operations) or that other more pressing factors have overtaken it in terms of focus. By organizational size, while the overall trend is toward reduced prioritization of ESG, larger organizations are still more likely to focus on it above other activities, with a third (33%) seeing it as more important than other initiatives, compared to 22% of those with revenues between $1-$10 billion.

A divided picture on ESG approaches

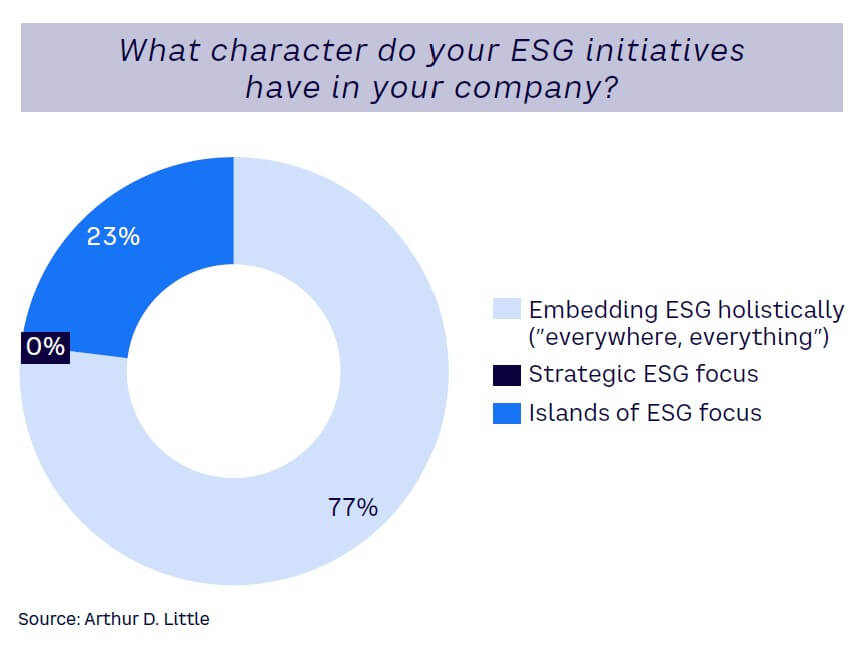

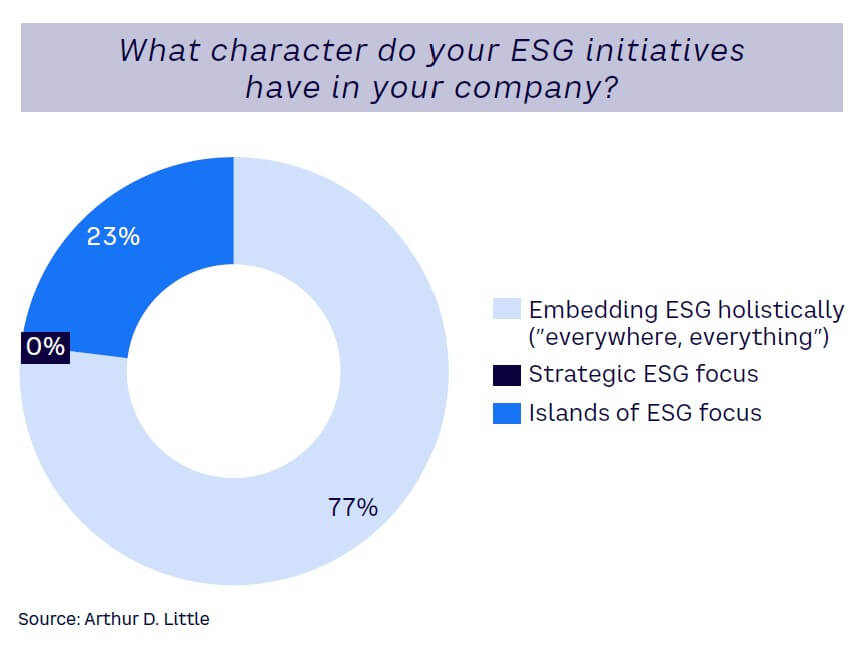

Compared to 2023, the gap between perspectives of CEOs on ESG seems to have widened. Demonstrating its importance to the overall business, Figure 17 shows that 77% of executives have a clear holistic approach that embeds ESG across their organization (up from 24%). Essentially, they are looking at ESG in every activity and department, led from the top, working together to monitor progress and meet sustainability goals.

“Our commitment to corporate social responsibility [CSR] is not just a checkbox; it’s our moral compass.” — CEO, travel & transportation

However, the remaining 23% characterize their approach as creating islands of ESG focus (up from 2% in 2023). Not taking a holistic view may mean that they are concentrating resources and time where it is required most, such as in decarbonizing specific activities or processes, taking a pragmatic approach based on their specific circumstances.

Seeing ESG as a differentiator for long-term success

Large organizations in many regions face regulatory requirements to become more sustainable and to demonstrate transparency and good governance. However, CEOs see the benefits of embracing ESG for multiple reasons, from attracting and retaining customers, staff, and investors to more altruistic desires to protect the planet and leave a positive legacy.

“Our attention is directed toward ESG aspects, which have the potential to draw in a larger pool of investors and foster closer ties with customers who value social responsibility.” — CEO, telco

“It is important to set a good example around CSR initiatives by making meaningful contributions to the communities where the business is located.” — CEO, financial services

CEOs are creating and spreading a sense of purpose and ethical standards across their business, helping to increase financial and reputational strengths. In many cases, focusing on ESG provides a way to cope with volatility, providing a “North Star” for the business to follow.

“The most important thing in a company is its purpose. We want to manufacture the best products while respecting the environment and all other manufacturers. Employees, especially younger ones, are important to us and the future of our company.” — CEO, manufacturing

“We adopt sustainability practices to appeal to environmentally conscious consumers and manage continuous market volatility.” — CEO, healthcare

2

HOW SECTORS COMPARE

While our study demonstrates global trends, there are also considerable variations among the attitudes and actions of CEOs across different geographic regions, company sizes, and sectors. We have covered regional and size variations in the main analysis; in this chapter, we drill down into the notable differences among sectors.

As in 2023, each industry has its own pressing challenges and opportunities that CEOs need to understand and act on. Often these are driven by digitalization and convergence — particularly for traditional industries — and achieving decarbonization in the case of energy suppliers and manufacturing companies:

- Telcos. Telcos face huge pressure on company valuations and stock performance due to increasing costs and the fact that network access is becoming a commodity, particularly as tech/media giants enter the market. This is leading to increased fragmentation (e.g., splitting off infrastructure) and a need for both greater efficiency and hyper-personalization for customers, both of which AI enables.

“In order to streamline processes, boost productivity, and cut expenses, we are embracing automation technologies like AI and machine learning.” — CEO, telco

- Energy & utilities. Energy and utility players must successfully decarbonize and move away from fossil fuels while incorporating changing energy consumption/production patterns, all against a backdrop of market disruption due to geopolitical events. Business models must adapt, while grids must become more agile and resilient to cope with increased demand. AI helps increase network reliability and optimize performance in a fast-changing environment.

“We will incorporate more sustainable practices since they support long-term resilience in addition to being in line with larger societal trends.” — CEO, energy & utilities

- Manufacturing. Manufacturers, particularly in the automotive sector, must master the green transformation, electrifying their operations and creating more circular, sustainable economies — all while digitizing and building stronger direct relationships with customers. AI is at the heart of more digital, autonomous systems, whether it is factory/supply chain digital twins or self-driving cars.

“We intend to increase our investments in customer relationship management, solicit feedback, and modify our products and services in response to evolving consumer demands.” — CEO, manufacturing

- Travel & transportation. The travel and transportation industry was severely impacted by COVID-19 lockdowns, and in many areas demand patterns have changed dramatically. Success requires a focus on more personalized, electrified, and end-to-end mobility solutions, with AI used to optimize transport networks, predict demand, and deliver a more personalized, sustainable experience to customers.

“In order to spot new dangers and possibilities, we keep a close eye on geopolitical developments and market trends. A proactive strategy enables prompt strategy modifications for businesses.” — CEO, travel & transportation

- Healthcare. Increasing global demand is being matched by advances in medical science and drug discovery, accelerating innovation and dramatically reducing time to market. However, development and regulatory costs remain high, requiring greater digitalization and increased use of AI to streamline and accelerate the end-to-end discovery, development, and delivery process.

“We will make an effort to establish strategic alliances with other businesses that will benefit both parties and enable more efficient problem solving.” — CEO, healthcare

- Financial services. The combination of new niche players, convergence, and the rise of tech companies in financial services means that banks must rethink their business models to survive. That requires a greater focus on innovation, ESG, adding value, and increasing efficiency. AI will redefine how financial services operate, optimizing processes, enabling hyper-personalization, and improving pricing and risk management.

“We are embracing ESG considerations in our sustainable banking practices. The bank’s standing and ability to withstand market fluctuations can both be improved by its commitment to sustainability.” — CEO, financial services

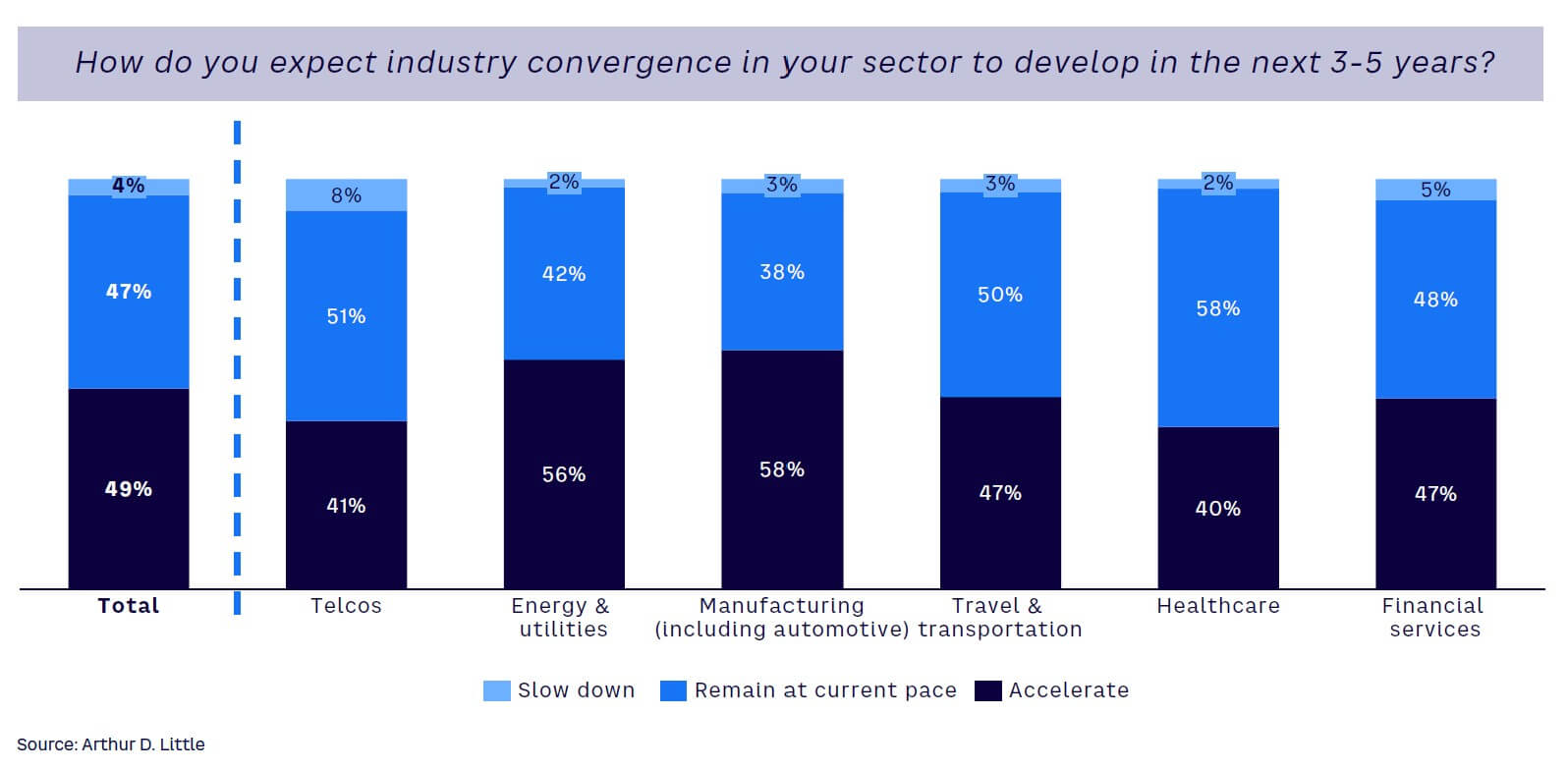

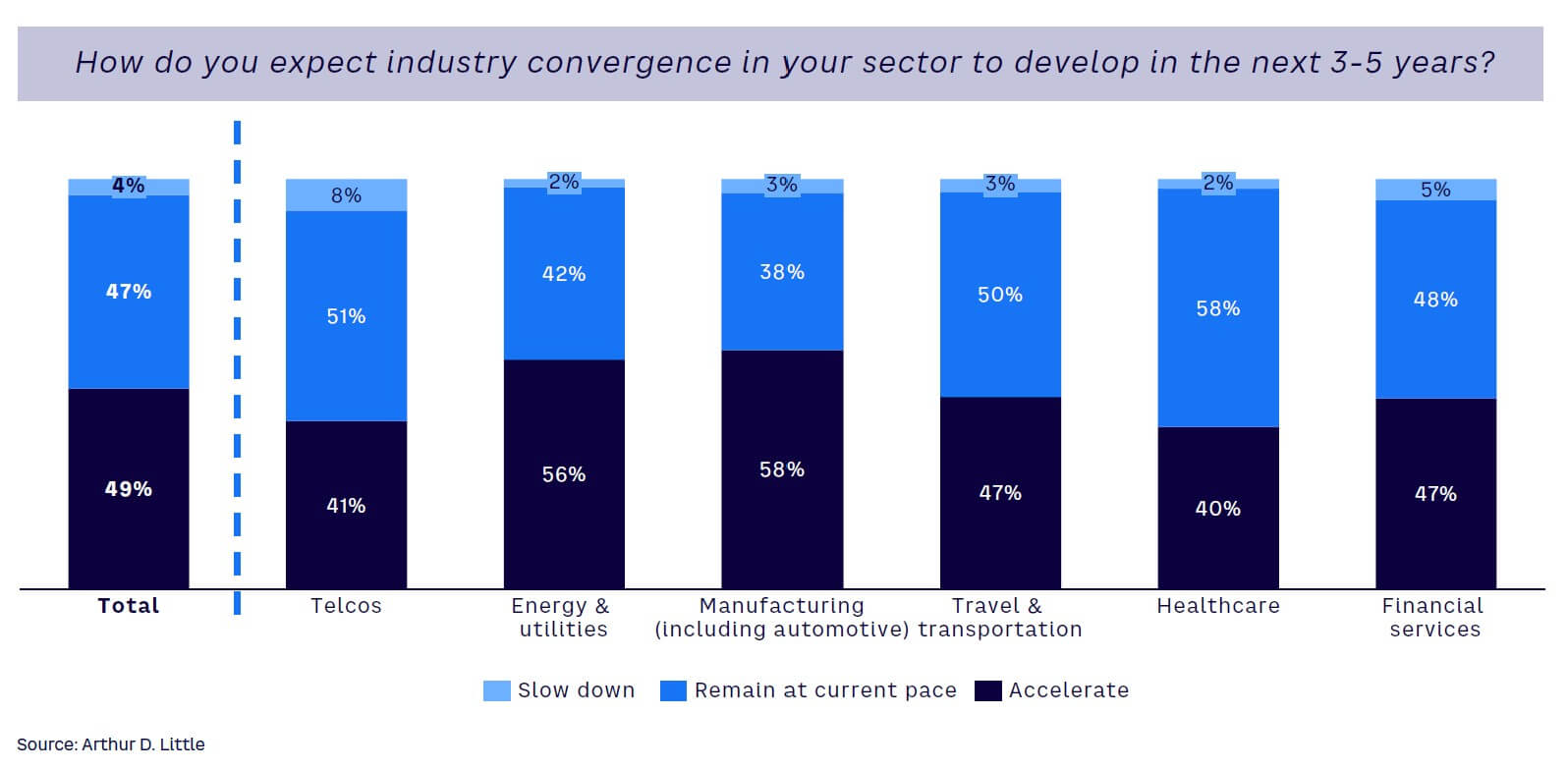

Figure 18 shows that nearly half of all CEOs expect convergence to accelerate over the next three to five years, and just 4% expect it to slow down. CEOs in industries that have already been subject to extensive convergence (e.g., telcos, financial services, healthcare, and travel and transportation) believe it is more likely to remain at its current pace. By contrast, energy and utilities and manufacturing expect convergence to increase over the same period.

These differences between sectors are particularly highlighted in three areas: (1) growth expectations, (2) challenges to growth, and (3) meeting changing talent needs.

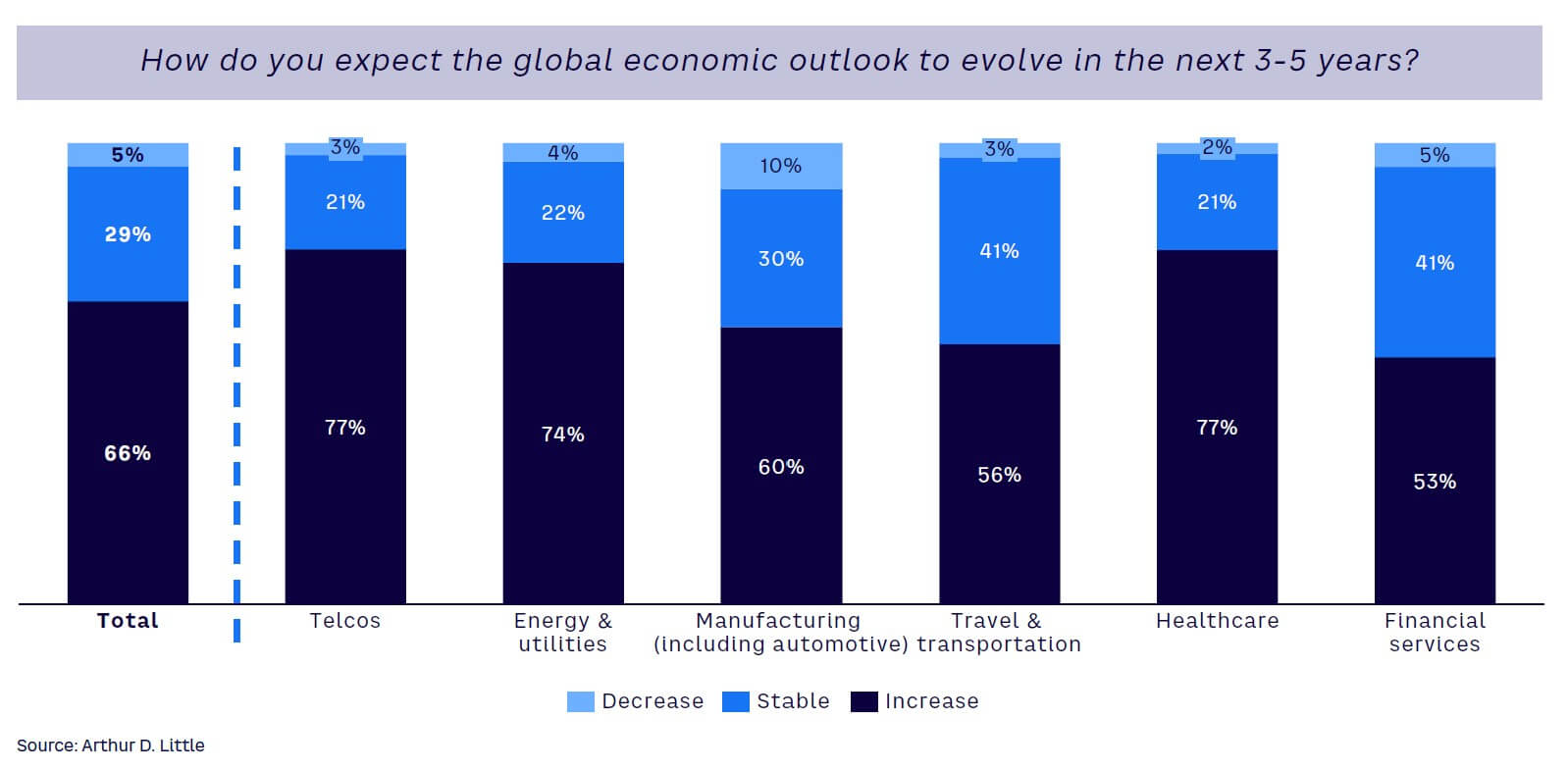

GROWTH EXPECTATIONS

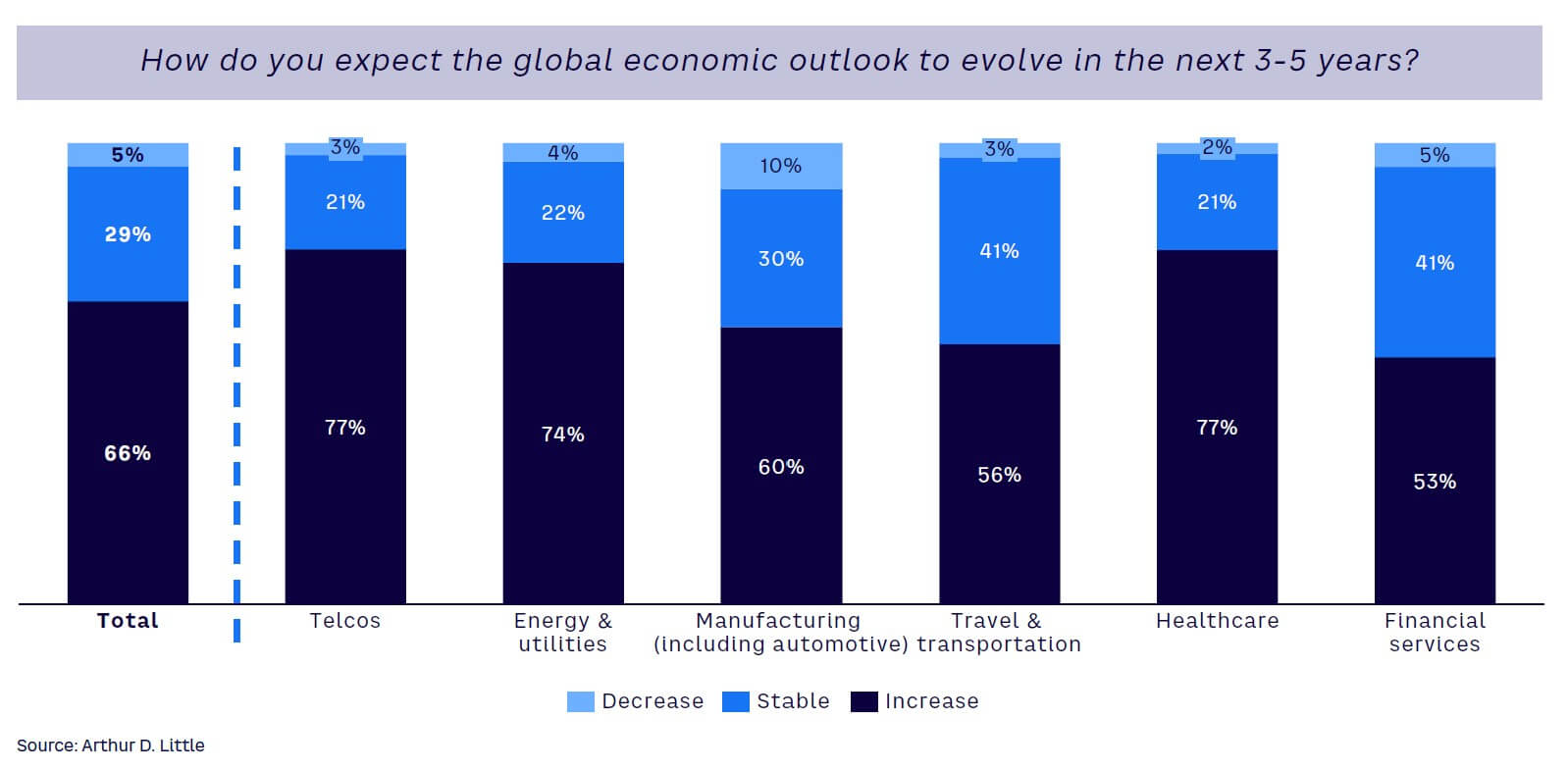

CEOs from every sector share optimism for the future, believing that the global economic outlook will evolve positively over the next three to five years (see Figure 19). For example, 77% of healthcare CEOs predict that the economy will grow, with a further 21% believing it will remain stable. Telco CEOs are equally positive. In contrast, sectors such as manufacturing (where 10% of CEOs see a worsening outlook), travel and transportation, and financial services are more cautious. This aligns with individual sector factors. For example, manufacturers are grappling with rising raw material/energy prices and the need to decarbonize, both of which increase costs and complexity. However, it is important to note that the majority of CEOs in every sector expect a positive future — a major change from the year prior.

“We are utilizing real-time data on market trends, resource availability, and consumer preferences to adjust our product offerings in response to changing demands and to help us make informed production decisions.” — CEO, manufacturing

“We are practicing scenario planning in order to be ready for a range of possible future events. This assists us in determining important factors and formulating plans of action for various circumstances.” — CEO, telco

CHALLENGES TO GROWTH

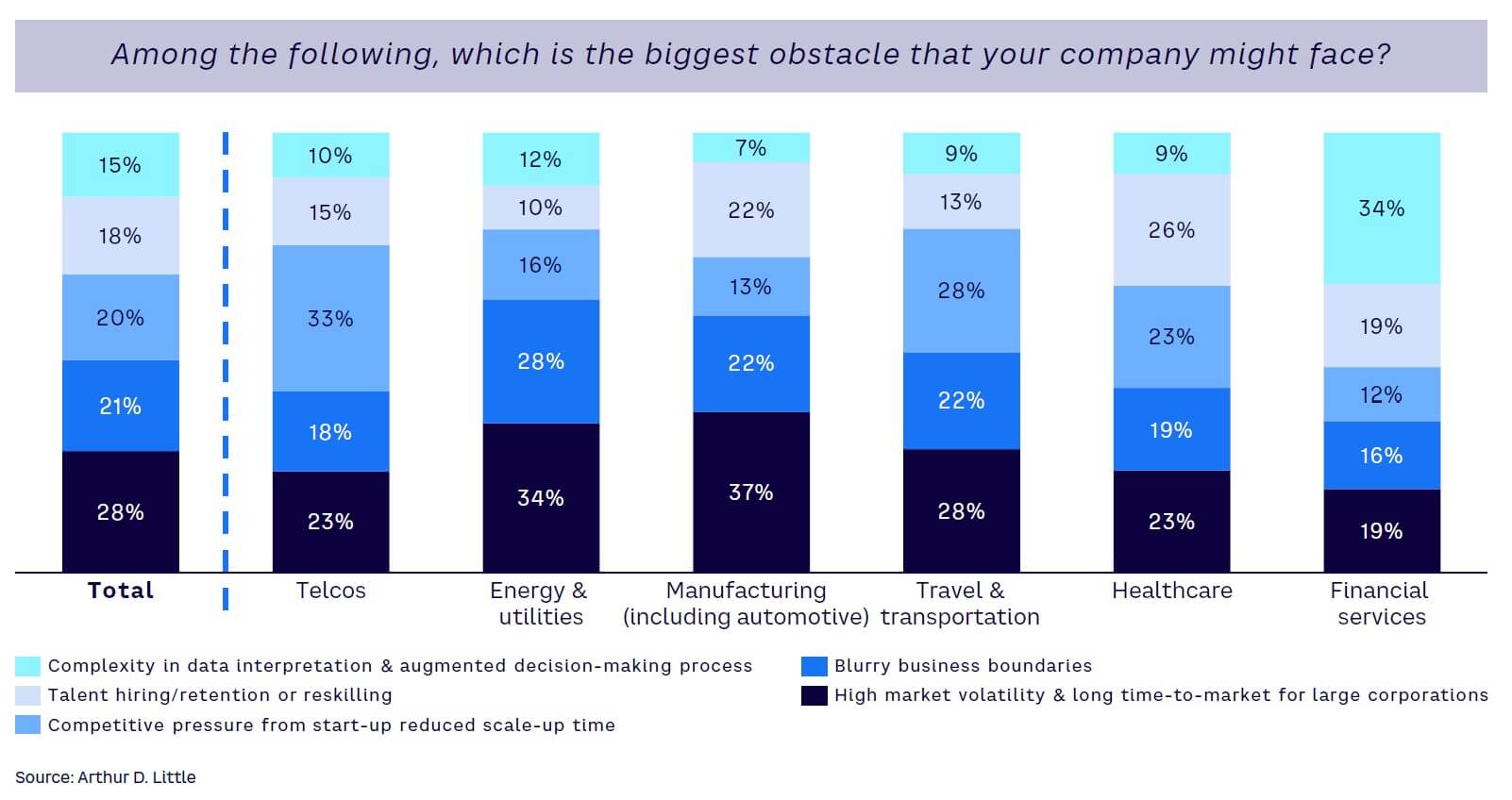

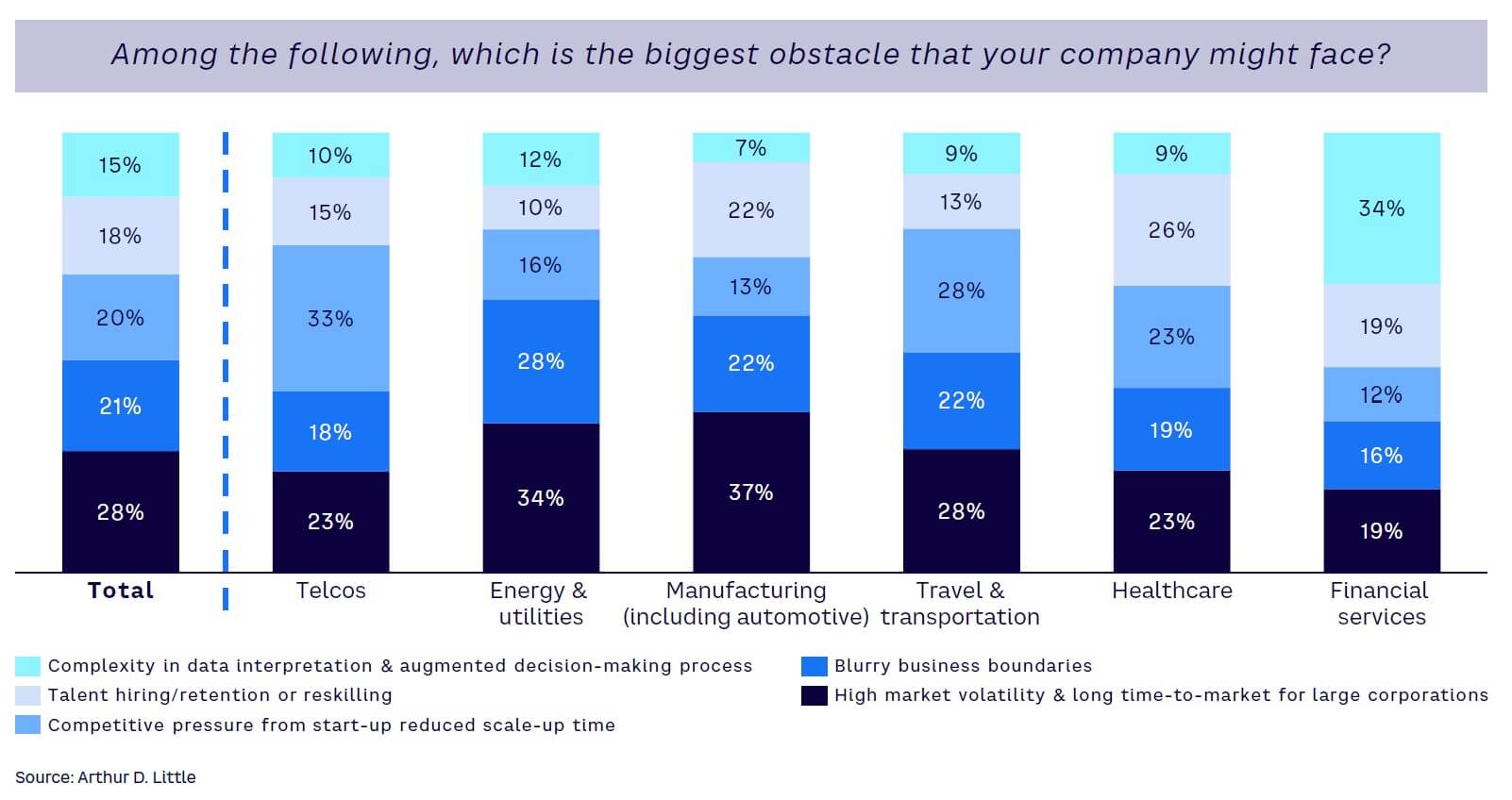

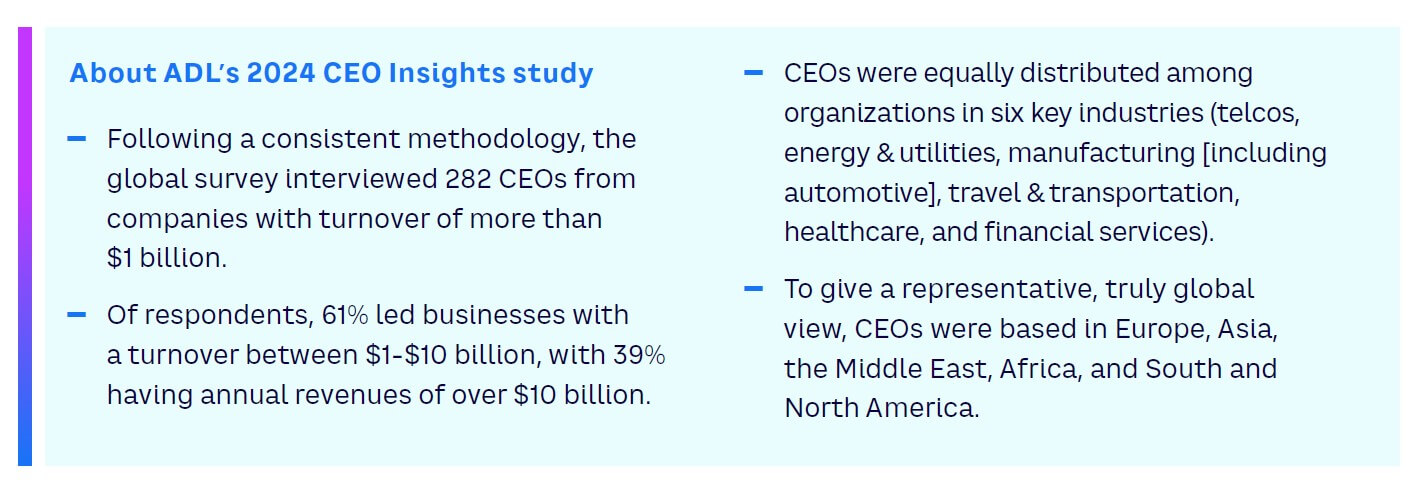

The study also examined the specific challenges that CEOs in different sectors face and how these have changed over the last 12 months (see Figure 20). While overall the obstacles remain constant, there are significant sectoral differences. For example, market volatility has increased in manufacturing (again, likely driven by rising raw material costs), while competitive pressures from start-ups have decreased. CEOs in every other sector are much more concerned about competition from nimble start-ups, especially in telcos, where 33% of leaders named it as their biggest obstacle (doubling from 2023), and travel and transportation (28%). This demonstrates the potential lowering of barriers to entry in these industries thanks to digital disruption, while manufacturing still requires heavy investment to establish and grow operations.

“We are expanding into multiple markets, and diversifying our offerings of goods and services can help us become less dependent on any one source of income or area.” — CEO, travel & transportation

“We are focusing more on ESG factors because they can help us position ourselves more favorably for long-term success.” — CEO, healthcare

MEETING CHANGING TALENT NEEDS

As described earlier, all CEOs understand the need to reskill their workforces to embrace opportunities such as AI. However, how and where they source talent varies considerably (refer back to Figure 15). CEOs in the telco, manufacturing, travel and transportation, and healthcare sectors are looking within the business for skills and are most enthusiastic about internal academies. Healthcare organizations are also increasing their focus on building talents through acquisition at the expense of traditional cooperation with universities and academia, perhaps pointing to the growth in the start-up ecosystem in this area. Energy and utilities CEOs also aim to source new talents via acquisition, while financial services CEOs look to corporate venture capital, investing in fintechs to plug their skills gaps. Travel and transportation is the only sector to increase (slightly) its reliance on headhunters, although they are seen as an integral part of the recruitment mix in most sectors, albeit with a noticeable drop in the financial services sector compared to 2023.

“We support originality and an openness to trying new things. A corporation with an innovative culture may find ways to create business models that offer it a competitive advantage in erratic marketplaces.” — CEO, financial services

“It’s critical to have the flexibility to quickly adjust to changing conditions. This entails establishing an innovative culture, rewarding employee adaptability, and putting procedures in place that facilitate quick decision-making.” — CEO, energy & utilities

CONCLUSION: CEO LESSONS FOR SUCCESS

ADL’s 2024 “CEO Insights” study highlights a positive and heartening vision of the future. Optimistic and confident global CEOs are focused on growth and believe they are well-equipped to operate effectively in a VUCA world, thanks to a combination of strong structures, clear strategies, and a workforce reskilled to make the most of AI.

However, CEOs themselves understand that success is not a given — for them or their companies. Analyzing the research and augmenting it with the many conversations we have had with CEOs, we have defined seven key areas of focus that will help companies to achieve their growth objectives.

1. UNDERSTAND THAT VOLATILITY IS HERE TO STAY

The turmoil caused by the pandemic was not a one-off event. We now live in an interconnected, integrated, and always-on world characterized by constant uncertainty — from geopolitics to climate change. VUCA does not mean the end of strategy, but it does mean that monolithic, long-term strategies must be replaced by more nimble, short-term ones. Successful CEOs understand that this volatility brings opportunity and are focused on creating agile organizations that can respond quickly to change, however it impacts their operations. They need to keep their hands on the corporate steering wheel, driving organizations forward rather than switching to autopilot.

2. BUILD AMBIDEXTERITY INTO THE ORGANIZATION

The companies that will win in the VUCA world are built on strong foundations that enable them to combine scale and productivity with creativity and innovation. These ambidextrous organizations are both efficient and ground-breaking, allowing them both to seize new opportunities and to maximize existing ones.

3. CONCENTRATE ON PEOPLE, SKILLS & CAPABILITIES

Investing in technology alone is not enough to deliver growth. CEOs must ensure that they have the right internal skills and capabilities to deliver an ambidextrous, agile organization. This relies on a fundamental reskilling of the workforce to ensure that they have the correct talent mix to drive the business forward. CEOs are therefore focusing heavily on ensuring they have access to these skills, sourced from multiple areas.

4. EXTEND AI BEYOND EFFICIENCY

CEOs are rapidly adopting AI, not just in departments or pilots, but across the wider business. However, the current focus is on AI for scale and productivity, essentially improving business as usual. The creativity and innovation side of ambidextrous organizations is therefore ripe for the positive impact of AI. CEOs must be bold and explore how AI can transform their strategies across all dimensions to remain competitive in a changing world.

5. KEEP THE FOCUS ON ESG

Extreme weather events and rising global temperatures served as a post-pandemic wake-up call to the entire world. CEOs responded enthusiastically, increasing their focus on ESG priorities in 2023. Moving forward, the majority are taking a more holistic approach, incorporating it into their wider strategy and operations so that it infuses the entire organization. Those that are not, and are instead focusing on specific areas, need to widen their reach to cover the entire business. Otherwise, they risk not only their own competitiveness but also imperil the wider environment.

6. LOOK INTERNALLY & EXTERNALLY FOR SUCCESS

When it comes to growth, CEOs are focusing on maximizing internal strategies around their core business. They are more satisfied with the results of organic growth initiatives compared to acquisitions and are increasingly looking internally to reskill their existing people rather than looking to outside sources for capabilities and talent. However, CEOs must balance this approach with the fact that they operate in complex, interconnected ecosystems and supply chains. They therefore must work openly with others, particularly to achieve ESG goals, meet sustainability targets, and unlock innovation.

7. BE WARY OF ACQUISITIONS

Turmoil brings new opportunities around M&A, both in terms of distressed competitors and cash-strapped start-ups that can provide technology, innovation, and talent. However, CEOs know that despite their alluring promise, many acquisitions disappoint, proving to be a drain on management resources rather than adding value. Careful due diligence is required to ensure that supposed bargains deliver on growth strategies rather than becoming expensive distractions.

Note

[1] We define ambidextrous organizations as those that balance the opposing needs of being agile and creative with being productive and driven by scale. For more background on ambidexterity, see ADL’s Prism article, “Ambidextrous Organizations — How to Embrace Disruption and Create Organizational Advantage.”

DOWNLOAD THE FULL REPORT

28 min read • Organization & transformation, Strategy

Positive in an uncertain world: Confident CEOs reskill companies for AI-driven growth

CEOs prepare for sustainable future through increased tech adoption, internal talent development

DATE

FOREWORD

Across the globe, the last 12 months have seen increased instability, driven by myriad factors, including deepening geopolitical rivalries and conflicts, diverging economic fortunes, and the growing impacts of climate change and artificial intelligence (AI). All of this follows a period when the pandemic accelerated the importance of digitalization, driving wide-scale transformation, which still needs to be completed in many cases. Year-over-year, the range and depth of risks are accelerating, meaning that CEOs truly find themselves and their companies having to navigate in a volatile, uncertain, complex, and ambiguous (VUCA) world.

At Arthur D. Little (ADL), we have been working with CEOs of the world’s leading businesses for more than 137 years, listening to their needs and helping them innovate and transform to thrive in a fast-changing world and successive industrial revolutions.

But changing times called for a new approach in exploring how business leaders of the world’s US $1 billion-plus companies across different industries were reacting to a turbulent present and uncertain future.

Thus, last year, we launched the first in our ongoing series of flagship “CEO Insights” research studies. Through hundreds of conversations and months of research, we looked to answer key questions, such as:

-

How are CEOs reacting to current disruption?

-

How has their outlook changed year-over-year?

-

How are they structuring their strategies and organizations moving forward?

-

Where are they investing for growth?

-

How are they coping with pressing trends, such as AI and environmental, social, and governance (ESG)?

For this 2024 edition of “CEO Insights,” we found strong, positive grounds for optimism. Hearteningly, CEOs of leading businesses are not merely focusing on survival but are increasingly confident about the prospects for their organizations and the wider economy. We found 66% to be highly positive about the global outlook over the next three to five years, a result that has tripled since 2023.

Behind this optimism, CEOs are significantly increasing their growth investments and navigating short-term uncertainty through resilient strategies and organizations built to handle a VUCA world. Moving forward, they are enthusiastically embracing new opportunities like AI, seeing it as a catalyst for growth, and are looking to develop their people to unlock its potential. ESG is becoming a holistic part of strategies as CEOs embed it across their organizations.

At times of disruption, the natural but ultimately flawed approach can be to concentrate only on the short-term volatility and uncertainty of VUCA. Our study shows that today’s global CEOs are truly ambidextrous and are adopting the opposite strategy, looking to deliver on the short term, by transforming short-term uncertainties into opportunities while working on the long term — building a better future for us all.

Ignacio García Alves

Chairman & Chief Executive Officer

Arthur D. Little

EXECUTIVE SUMMARY

THE FUTURE IS BRIGHT & GETTING BRIGHTER DESPITE INSTABILITY

Looking beyond current turbulence, CEOs of the world’s largest companies are increasingly positive about the prospects for growth and are positioning themselves — and their workforces — to seize the opportunities that AI brings, according to the results of our 2024 “CEO Insights” study.

While CEOs are navigating today’s choppy business waters with caution, they are investing for a brighter future, based on the resilient organizational structures they now have in place. As AI impacts their businesses, they are reskilling their workforces and looking internally to develop the talent they need to exploit opportunities moving forward.

Rather than being cowed by uncertainty, CEOs are thriving in a time of turmoil, understanding that volatility is now the new normal in the world of business. They are focusing on ambidexterity,[1] marrying innovation and productivity to enable success in a VUCA world. Combining longer-term vision and innovation with short-term caution, CEOs are committed to driving business growth, centered around a combination of their people and AI working in harmony.

1

ANALYSIS: 4 KEY TRENDS FROM TODAY’S CEOS

In-depth analysis of ADL’s latest “CEO Insights” study enables us to draw four clear conclusions, which apply generally across both geographies and different vertical sectors.

TREND 1: POSITIVE FUTURE OUTLOOK — SIGNIFICANT SHIFT IN CONFIDENCE

The last 12 months have seen CEOs face an expanding range of challenges, from conflict and geopolitical rivalry to rising costs. Despite this, the headline finding is that CEOs are positive and confident about the medium-term (three to five years) economic outlook (see Figure 1).

Two-thirds (66%) expect a positive global outlook — compared to just 22% in 2022 — implying that they believe the bottom of the market has already been reached or will be reached shortly. Just 4% forecast a deterioration in the global economic outlook, compared to 37% last year. Optimism is even stronger among larger ($10 billion+ revenue) companies, where 84% expect the medium-term outlook to be positive, against 60% of their smaller peers.

Global confidence, regional highlights

This turnaround in optimism is strongest in Asia, where three-quarters (78%) of CEOs forecast positive growth, compared to 10% in 2023. CEOs within the Big Five economies of Europe (France, Germany, Italy, Spain, UK) were equally bullish, with 72% predicting positive global growth, nearly doubling from 38% in 2023. Even in the least positive regions (Latin America and Europe outside the Big Five), a majority of CEOs predict medium-term global growth.

Stable perspective on external growth factors

When asked to name the most critical external factors impacting their company’s future growth, CEOs generally focus on the same themes as a year ago (see Figure 2). Technology innovation, including AI, remains the most critical factor globally to drive growth. However, concerns over supply chain stability have been overtaken by a need to cope with rising raw material prices, including energy costs. Globally, this has nearly doubled from 11% to 21% in the past year. This trend is particularly strong in Europe and North America though its importance has dropped in the Middle East, potentially due to easier access to energy resources (e.g., oil and gas).

Over the same period, the perceived criticality of environmental issues has dropped from 10% to 2%, perhaps due to more advanced and integrated ESG strategies being put in place. CEOs highlight social issues as among the least relevant factors to their growth, with just 2% seeing it as critical.

Examining growth factors by company size, CEOs of larger organizations express the greatest concern around energy prices, as well as seeing supply chain and globalization challenges as more critical to growth (see Figure 3). Organizations between $1-$10 billion have a higher focus on technology innovation as a driver but also worry more about geopolitical concerns.

When reporting the drivers that would have the least impact on growth, environmental and climate change issues and social issues were among the bottom three for organizations in both groups.

“Our objective is to leverage technology in order to benefit from increased operational efficiency, data insights, and improved decision-making during periods of high volatility.” — CEO, energy & utilities

Most important trends — past vs. future

The research also examined how the importance of particular trends has changed over time. We employed AI-based text analysis to understand free text answers comparing trends CEOs felt were important over the last three to five years and which would be of primary importance for the future three to five years (see Figure 4).

The results reveal a clear shift. For example, where e-commerce and digital transformation were the dominant trends listed by CEOs in the past, looking forward they are focusing on AI and automation and sustainability, reducing the importance of e-commerce nearly by half. This reflects the impact of the pandemic and its immediate aftermath, which required every organization to embrace e-commerce and digitalization to operate effectively. Now that businesses are moving out of survival mode, CEOs are putting the onus on AI and sustainability for growth.

By region, the areas of focus for the future include ESG (Asia), AI and automation (North and South America, Europe), advanced technology (Africa), fintech (Middle East), and geopolitical challenges (Europe and South America).

CEOs from different industries are also altering their focus moving forward. For example, automotive CEOs see ESG as having a dramatically increased focus for the future that has outpaced AI, unlike their peers in the wider manufacturing sector. Leaders in the energy and utilities sector are also concentrating on ESG, given their central role in decarbonizing their own operations and those of wider ecosystems. Travel and transportation CEOs have shifted from e-commerce to see digital transformation as the most relevant driver for their industry. Telco CEOs are also focused on digital transformation and AI, moving away from workforce transformation. Healthcare CEOs have shifted their focus from e-commerce to advanced technology. For their part, financial services leaders worry about geopolitical challenges, alongside the threat (and opportunity) of fintech.

When asked what specific technology areas they were focusing on over the next three to five years, CEOs demonstrated a broad range of knowledge and understanding. In addition to AI, they cited advanced technologies like quantum computing, personalized learning platforms, cognitive smart cities, and, in the areas of transport, fully autonomous cars, hyperloop, drone and self-driving deliveries, and urban air transport.

Embracing state intervention to drive growth

The combination of greater protectionism and increased programs and subsidies around decarbonization and other areas is providing new opportunities and changing CEO attitudes toward state intervention (see Figure 5). A third (33%) globally now see it as a useful driver for long-term growth (up from 21% in 2023), with a similar percentage (32%) viewing it as positive for short-term growth, down from 37% last year. Essentially, CEOs value this access to new investment resources and are factoring it into their overall growth strategies, particularly as they look to embrace new, more sustainable business practices and opportunities.

“We are looking into potential government support initiatives or economic stimulus plans that could offer money during hard times economically.” — CEO, telco

This shift is particularly pronounced in North America and among larger organizations. A clear majority of North American CEOs (55%) see it as a useful support for long-term growth (up 20% from 2023), with 34% viewing it as a short-term growth driver. Just 2% see it as a destabilizing factor that skews competition, compared to 29% of South American CEOs. Of larger ($10 billion+) companies, 41% view state intervention as a useful support to long-term growth, with 33% believing it drove short-term growth.

TREND 2: CURRENT GROWTH STRATEGIES — NAVIGATING UNCERTAINTY WITH CAUTION

A cautious approach to growth strategies

Driven by current market uncertainty, CEOs plan to continue their existing growth strategies, with overall marginal differences between those used for the past three years and the next three years (see Figure 6). The only areas that see a greater focus are diversification (up 14% compared to 2023) and fighting price wars (up 13%), both of which look to be a reaction to economic conditions and more closely fought competition. Providing disruptive offerings (down 9%) and targeting new geographies (down 11%) are being de-prioritized compared to 2023 as CEOs focus on maximizing existing strategies over the short to medium-term.

The future focus on the core business is particularly strong among those companies that see themselves as market leaders, ahead of entering new geographies and cost optimization. For those in the middle of the pack, the focus is shifting to new sales channels (up 18%) and new client segments, showing that they are searching for new opportunities to grow. Among respondents, 38% of laggards are looking to diversify their revenues (doubling from 19% over the past three years), demonstrating a shift away from a core business focus in order to unlock growth.

“Through entering new markets, creating fresh goods and services, and forming clever alliances, we are broadening the scope of our business activities.” — CEO, financial services

Increasing investments in growth

The turmoil of the past 12 months has led some CEOs to recalibrate their growth ambitions (see Figure 7). While a similar percentage (33% versus 30% in 2023) are adopting offensive strategies to achieve faster-than-market growth, the number focusing on cautious strategies (achieve market growth) dropped by 7% as more embraced defensive strategies (aiming for slower-than-market growth). This increase in defensive strategies could also indicate a belief that AI can reduce barriers to entry and bring disruption and new players into existing markets. Larger companies are more likely to be pushing for above-average growth, with 45% adopting offensive strategies compared to 26% of smaller organizations.

What is striking is that across all three groups, CEOs are willing to increase their investments in growth, perhaps pointing to greater funds being required than initially thought necessary to achieve success. For example, 92% of defensive CEOs expect to increase or keep their growth investment constant.

“We recognize the importance of building strong partnerships and collaborations. In times of uncertainty, having a network of reliable partners can provide additional support and resources.” — CEO, healthcare

Organic growth outpaces M&A, particularly around consolidation

CEOs increasingly understand that while acquisitions can drive growth, they need to be focused and targeted. Overall, two-thirds (68%) of M&A activities met expectations, the same figure as organic growth programs, and up from 2023 (see Figure 8). Yet when it comes to exceeding expectations, organic growth is the clear winner: 26% of CEOs reported that such programs delivered above-expected benefits, with only 6% disappointed with their organic growth strategies.

In contrast, more than a fifth (21%) of CEOs said M&A performed below expectations, particularly around consolidation. Here just 11% of CEOs felt deals had exceeded their expectations, with 44% of CEOs saying they failed to deliver on their potential. This demonstrates the importance of picking the right targets for the right reasons, even at a time of market volatility when more companies may be available at what appears to be the right price. Large-scale consolidation brings key challenges around integrating the acquired business, its people, and product portfolios. At the same time, regulators around the world are increasingly active in reviewing such acquisitions, often demanding large-scale changes to deals that can ultimately reduce or even eliminate the value they bring.

Understanding needs in a VUCA world

Increasing growth investments is part of a wider realization among CEOs that we now live in a world characterized by VUCA. Of CEOs, 80% expect to pay more management attention to VUCA and related topics over the next three to five years, with just 2% believing it will be less important than today.

“Flexibility is one of the most crucial traits a business can have in a volatile industry. Being able to quickly alter course when required can mean the difference between success and failure.” — CEO, financial services

Recognizing VUCA is one thing but adapting the organization to meet its requirements for agility, resilience, and efficiency is more difficult. When asked how they aim to cope with volatility, the most common answers involve greater customer focus, closer links with suppliers, increasing sophisticated risk management, business intelligence, and scenario planning, as well as creating more innovative, flexible organizations that empower their people. As a result of these approaches, half (50%) of CEOs feel that their company has a high level of readiness to adapt to VUCA, and 16% feel their structures are superior to the wider market (see Figure 9).

“The real-time data we are integrating into models that forecast from supply chain disruptions, consumer behavior, and market trends can enable a more adaptable and fluid approach.” — CEO, manufacturing

This shift in adaptation is led by larger organizations, where 28% judge their capabilities as superior. However, 68% of this group feel that they still have a strong/very strong need to reskill staff to adapt to a more volatile environment, compared to 52% of the $1-$10 billion group. On average, 92% of CEOs feel that some reskilling is required for success in the VUCA world.

A key to success in a VUCA world is balancing productivity and innovation, creating ambidextrous organizations that succeed in both dimensions of creativity and scale (see Figure 10). CEOs understand this, with 96% believing ambidexterity will be important to their success over the coming three to five years. Among different sectors, more than three-quarters of CEOs in financial services, energy and utilities, and healthcare reported becoming ambidextrous as very important, ahead of manufacturing and travel and transportation, where CEOs feel it will be less of a focus over the medium term.

“We are in a better position to adjust to changes in the market because we consistently invest in R&D and promote an innovative culture.” — CEO, travel & transportation

TREND 3: PREPARING FOR THE FUTURE — AI LEADS TO RESKILLING PARADIGM SHIFT

Organizational structures thrive in testing times

In 2023, half of CEOs expressed confidence that their existing organizational structures were strong enough to navigate business priorities and market volatility, although just 4% classed them as superior.

“To remain competitive in the industry, we will devote more attention to realizing the wants and demands of our customers. Developing a solid rapport with customers might help us through difficult times in the economy.” — CEO, travel & transportation

The testing conditions of the last 12 months demonstrated that CEOs were underselling the benefits of the structures they had put in place; while half still feel their organizations are strong, 16% now see them as superior and none sees them as inadequate (see Figure 11). This improved confidence is visible across all sectors — particularly energy and utilities (with 32% of CEOs feeling structures are superior, compared to 3% in 2023), telcos (from 0% superior to 13%), and financial services (up again, from 0% to 10%). Overall, CEOs are confident that they have strong organizational structures in place to move forward and target their growth goals.

Embrace AI to achieve growth ambitions

Since 2023, AI usage has accelerated dramatically. To measure CEO attitudes, this year’s study introduced new questions around AI and its adoption. In many ways, progress has been swift — 96% of executives claim to have implemented an AI strategy within at least one department of their organization, with 47% having a strategic view toward AI.

However, just 13% have adopted a comprehensive company-wide AI strategy, demonstrating that they are still on a transformation path to fully understand the impact of AI and integrate it across the organization. In our experience, fully benefiting from AI requires enormous structural and workforce change, which is achievable only with time. There are major challenges to moving from a strategic view to a strategy and then implementing it.

Figure 12 illustrates the strongest performers by region, with 75% of companies within Asia reporting a company-wide strategy or strategic view. The strongest performers by industry and size are those in the financial services (79%) and $10 billion+ organizations (67%). A clear divide also exists between organizations that feel that they are leading their markets, where 24% have a company-wide strategy in place, and laggards, none of which have implemented such a compelling strategy.

AI usage: Efficiency & innovation

How are CEOs turning their AI strategies into practice? Analysis shows that they are predominantly focused on making core functions better by increasing efficiency and effectiveness, such as through automation (see Figure 13). Efficiency is the leading use case in four out of seven sectors, showing that companies are at a relatively early stage of their AI journey.

The exceptions are telcos, travel and transportation, and manufacturing, which are focusing on using AI to create new business models. However, manufacturing is clearly lagging other sectors on each performance vector, scoring an overall average of less than 50 for AI use. This can be linked to the sector’s pressing need to reskill employees, as we highlight in the next section.

“Our target is to use technology to improve operational effectiveness while cutting expenses.” — CEO, healthcare

“To predict market movements, we are using AI and machine learning, which we are using more and more for scenario analysis and predictive modeling.” — CEO, telco

Reskill for AI-driven future

While AI is not yet changing corporate structures, it is having an immediate and enormous impact on the skills required for success. To maximize results from AI, CEOs believe they need to transform their workforces, with 59% seeing a strong or very strong requirement to reskill their employees, up from just 13% in 2023 (see Figure 14). This demonstrates the speed and wide-ranging impact of AI’s rapid rise. For example, 68% of manufacturing CEOs see a strong need to reskill in 2024 compared to 5% in 2023, attesting to the sector’s lack of AI maturity. Across sectors, less than 1% report no need for reskilling, a fall from 11% in 2023.

“We encourage creativity and a willingness to explore novel concepts. A firm with an entrepreneurial atmosphere might be able to develop business strategies that give it an edge over competitors in volatile markets.” — CEO, automotive

Look internally & externally to develop talent

In 2023, CEOs reported relying on external sources, primarily headhunters and cooperation with universities, to provide them with new capabilities and talent to drive growth. In 2024, the focus has shifted, with the largest percentage (30%) looking to internal academies to deliver talent and skills, up from 21% in 2023 (see Figure 15). This trend is potentially driven by multiple factors, including the difficulty of finding AI talent due to global skills shortages and a realization that technical knowledge needs to be married to business understanding to deliver effective results, tailored to the individual company and its objectives.

“In order to identify fresh opportunities for development and build strong business models, we are encouraging creative thinking and entrepreneurial behavior within our company.” — CEO, energy & utilities

TREND 4: A SHIFT IN PRIORITIES AROUND ESG

ESG becomes one of many business priorities

How CEOs approach and prioritize ESG initiatives is undergoing a notable shift as sustainability develops (see Figure 16). Whereas in our 2023 study, 41% gave it a higher priority than other activities, in 2024 this has diminished to just 24%.

Essentially, most CEOs consider ESG as part of “business as usual,” with their approaches maturing over the course of the last 12 months. Clearly, CEOs still see ESG as important, but 71% now rank it on a par with other priorities, up from 58% in 2023.

“As the emphasis on renewable energy sources and ecologically friendly operations grows, we are making long-term investments in and adoption of sustainable practices.” — CEO, energy & utilities

This shift is particularly noticeable in manufacturing, where 35% fewer CEOs see it as a higher priority than in 2023, and travel and transportation, where it has declined by 25%. In fact, 9% of travel and transportation CEOs report that ESG is now less important than other priorities, pointing to either increased maturity (which means it has become an integral part of business operations) or that other more pressing factors have overtaken it in terms of focus. By organizational size, while the overall trend is toward reduced prioritization of ESG, larger organizations are still more likely to focus on it above other activities, with a third (33%) seeing it as more important than other initiatives, compared to 22% of those with revenues between $1-$10 billion.

A divided picture on ESG approaches

Compared to 2023, the gap between perspectives of CEOs on ESG seems to have widened. Demonstrating its importance to the overall business, Figure 17 shows that 77% of executives have a clear holistic approach that embeds ESG across their organization (up from 24%). Essentially, they are looking at ESG in every activity and department, led from the top, working together to monitor progress and meet sustainability goals.

“Our commitment to corporate social responsibility [CSR] is not just a checkbox; it’s our moral compass.” — CEO, travel & transportation

However, the remaining 23% characterize their approach as creating islands of ESG focus (up from 2% in 2023). Not taking a holistic view may mean that they are concentrating resources and time where it is required most, such as in decarbonizing specific activities or processes, taking a pragmatic approach based on their specific circumstances.

Seeing ESG as a differentiator for long-term success

Large organizations in many regions face regulatory requirements to become more sustainable and to demonstrate transparency and good governance. However, CEOs see the benefits of embracing ESG for multiple reasons, from attracting and retaining customers, staff, and investors to more altruistic desires to protect the planet and leave a positive legacy.

“Our attention is directed toward ESG aspects, which have the potential to draw in a larger pool of investors and foster closer ties with customers who value social responsibility.” — CEO, telco

“It is important to set a good example around CSR initiatives by making meaningful contributions to the communities where the business is located.” — CEO, financial services

CEOs are creating and spreading a sense of purpose and ethical standards across their business, helping to increase financial and reputational strengths. In many cases, focusing on ESG provides a way to cope with volatility, providing a “North Star” for the business to follow.

“The most important thing in a company is its purpose. We want to manufacture the best products while respecting the environment and all other manufacturers. Employees, especially younger ones, are important to us and the future of our company.” — CEO, manufacturing

“We adopt sustainability practices to appeal to environmentally conscious consumers and manage continuous market volatility.” — CEO, healthcare

2

HOW SECTORS COMPARE

While our study demonstrates global trends, there are also considerable variations among the attitudes and actions of CEOs across different geographic regions, company sizes, and sectors. We have covered regional and size variations in the main analysis; in this chapter, we drill down into the notable differences among sectors.

As in 2023, each industry has its own pressing challenges and opportunities that CEOs need to understand and act on. Often these are driven by digitalization and convergence — particularly for traditional industries — and achieving decarbonization in the case of energy suppliers and manufacturing companies:

- Telcos. Telcos face huge pressure on company valuations and stock performance due to increasing costs and the fact that network access is becoming a commodity, particularly as tech/media giants enter the market. This is leading to increased fragmentation (e.g., splitting off infrastructure) and a need for both greater efficiency and hyper-personalization for customers, both of which AI enables.

“In order to streamline processes, boost productivity, and cut expenses, we are embracing automation technologies like AI and machine learning.” — CEO, telco

- Energy & utilities. Energy and utility players must successfully decarbonize and move away from fossil fuels while incorporating changing energy consumption/production patterns, all against a backdrop of market disruption due to geopolitical events. Business models must adapt, while grids must become more agile and resilient to cope with increased demand. AI helps increase network reliability and optimize performance in a fast-changing environment.

“We will incorporate more sustainable practices since they support long-term resilience in addition to being in line with larger societal trends.” — CEO, energy & utilities

- Manufacturing. Manufacturers, particularly in the automotive sector, must master the green transformation, electrifying their operations and creating more circular, sustainable economies — all while digitizing and building stronger direct relationships with customers. AI is at the heart of more digital, autonomous systems, whether it is factory/supply chain digital twins or self-driving cars.

“We intend to increase our investments in customer relationship management, solicit feedback, and modify our products and services in response to evolving consumer demands.” — CEO, manufacturing

- Travel & transportation. The travel and transportation industry was severely impacted by COVID-19 lockdowns, and in many areas demand patterns have changed dramatically. Success requires a focus on more personalized, electrified, and end-to-end mobility solutions, with AI used to optimize transport networks, predict demand, and deliver a more personalized, sustainable experience to customers.

“In order to spot new dangers and possibilities, we keep a close eye on geopolitical developments and market trends. A proactive strategy enables prompt strategy modifications for businesses.” — CEO, travel & transportation

- Healthcare. Increasing global demand is being matched by advances in medical science and drug discovery, accelerating innovation and dramatically reducing time to market. However, development and regulatory costs remain high, requiring greater digitalization and increased use of AI to streamline and accelerate the end-to-end discovery, development, and delivery process.

“We will make an effort to establish strategic alliances with other businesses that will benefit both parties and enable more efficient problem solving.” — CEO, healthcare

- Financial services. The combination of new niche players, convergence, and the rise of tech companies in financial services means that banks must rethink their business models to survive. That requires a greater focus on innovation, ESG, adding value, and increasing efficiency. AI will redefine how financial services operate, optimizing processes, enabling hyper-personalization, and improving pricing and risk management.

“We are embracing ESG considerations in our sustainable banking practices. The bank’s standing and ability to withstand market fluctuations can both be improved by its commitment to sustainability.” — CEO, financial services

Figure 18 shows that nearly half of all CEOs expect convergence to accelerate over the next three to five years, and just 4% expect it to slow down. CEOs in industries that have already been subject to extensive convergence (e.g., telcos, financial services, healthcare, and travel and transportation) believe it is more likely to remain at its current pace. By contrast, energy and utilities and manufacturing expect convergence to increase over the same period.

These differences between sectors are particularly highlighted in three areas: (1) growth expectations, (2) challenges to growth, and (3) meeting changing talent needs.

GROWTH EXPECTATIONS

CEOs from every sector share optimism for the future, believing that the global economic outlook will evolve positively over the next three to five years (see Figure 19). For example, 77% of healthcare CEOs predict that the economy will grow, with a further 21% believing it will remain stable. Telco CEOs are equally positive. In contrast, sectors such as manufacturing (where 10% of CEOs see a worsening outlook), travel and transportation, and financial services are more cautious. This aligns with individual sector factors. For example, manufacturers are grappling with rising raw material/energy prices and the need to decarbonize, both of which increase costs and complexity. However, it is important to note that the majority of CEOs in every sector expect a positive future — a major change from the year prior.

“We are utilizing real-time data on market trends, resource availability, and consumer preferences to adjust our product offerings in response to changing demands and to help us make informed production decisions.” — CEO, manufacturing

“We are practicing scenario planning in order to be ready for a range of possible future events. This assists us in determining important factors and formulating plans of action for various circumstances.” — CEO, telco

CHALLENGES TO GROWTH

The study also examined the specific challenges that CEOs in different sectors face and how these have changed over the last 12 months (see Figure 20). While overall the obstacles remain constant, there are significant sectoral differences. For example, market volatility has increased in manufacturing (again, likely driven by rising raw material costs), while competitive pressures from start-ups have decreased. CEOs in every other sector are much more concerned about competition from nimble start-ups, especially in telcos, where 33% of leaders named it as their biggest obstacle (doubling from 2023), and travel and transportation (28%). This demonstrates the potential lowering of barriers to entry in these industries thanks to digital disruption, while manufacturing still requires heavy investment to establish and grow operations.

“We are expanding into multiple markets, and diversifying our offerings of goods and services can help us become less dependent on any one source of income or area.” — CEO, travel & transportation

“We are focusing more on ESG factors because they can help us position ourselves more favorably for long-term success.” — CEO, healthcare

MEETING CHANGING TALENT NEEDS

As described earlier, all CEOs understand the need to reskill their workforces to embrace opportunities such as AI. However, how and where they source talent varies considerably (refer back to Figure 15). CEOs in the telco, manufacturing, travel and transportation, and healthcare sectors are looking within the business for skills and are most enthusiastic about internal academies. Healthcare organizations are also increasing their focus on building talents through acquisition at the expense of traditional cooperation with universities and academia, perhaps pointing to the growth in the start-up ecosystem in this area. Energy and utilities CEOs also aim to source new talents via acquisition, while financial services CEOs look to corporate venture capital, investing in fintechs to plug their skills gaps. Travel and transportation is the only sector to increase (slightly) its reliance on headhunters, although they are seen as an integral part of the recruitment mix in most sectors, albeit with a noticeable drop in the financial services sector compared to 2023.

“We support originality and an openness to trying new things. A corporation with an innovative culture may find ways to create business models that offer it a competitive advantage in erratic marketplaces.” — CEO, financial services

“It’s critical to have the flexibility to quickly adjust to changing conditions. This entails establishing an innovative culture, rewarding employee adaptability, and putting procedures in place that facilitate quick decision-making.” — CEO, energy & utilities

CONCLUSION: CEO LESSONS FOR SUCCESS

ADL’s 2024 “CEO Insights” study highlights a positive and heartening vision of the future. Optimistic and confident global CEOs are focused on growth and believe they are well-equipped to operate effectively in a VUCA world, thanks to a combination of strong structures, clear strategies, and a workforce reskilled to make the most of AI.