DOWNLOAD

DATE

Contact

The global public cloud is quickly expanding, with infrastructure needs growing in a decentralized manner. As we explore in this Viewpoint, local data center operators can present themselves to this attractive market segment by aligning their facilities with the needs of hyperscalers, becoming a strategic partner of choice. This opportunity has limited risks, but the window is rapidly closing — cloud giants are already settling into their new homes around the world.

HYPERSCALERS SHIFT AWAY FROM BUILDING DATA CENTERS

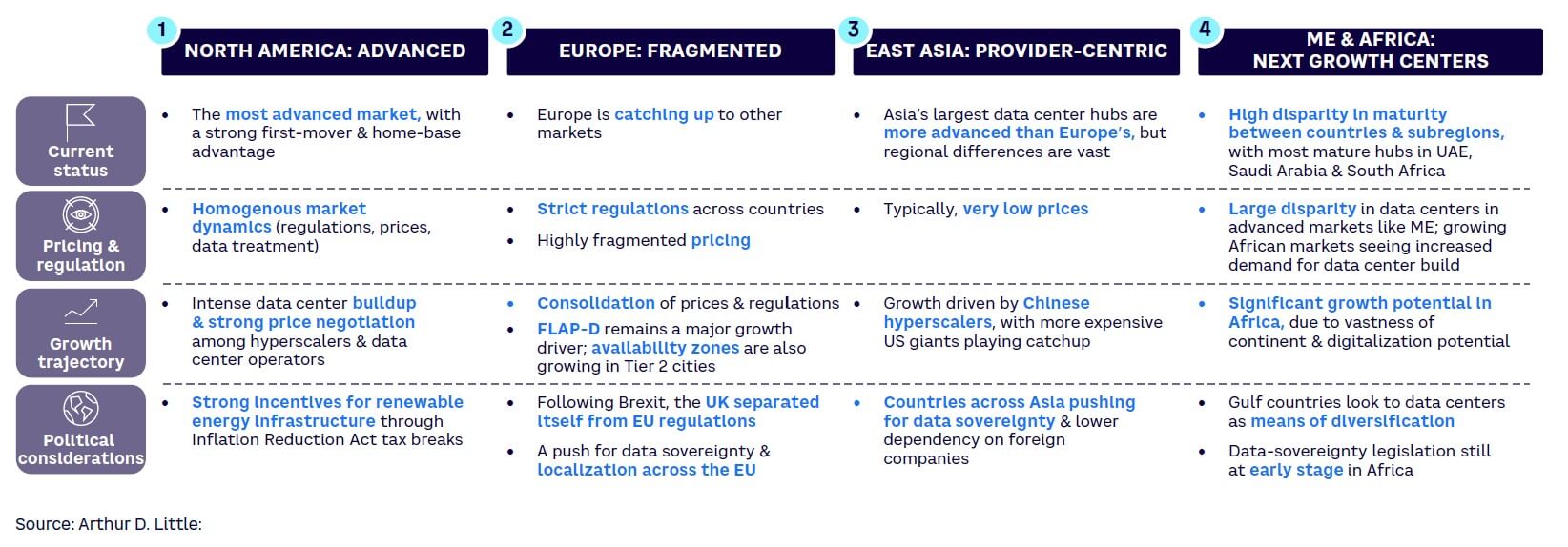

The US market has long been the leading market for hyperscale data centers, thanks to the expansion of the globe’s largest public cloud companies (Amazon Web Services [AWS], Microsoft, and Google). The counterweight to US-centric public cloud providers are Asian-market-focused players like Alibaba and Tencent, which have traditionally stayed closer to home.

As cloud adoption increases globally, hyperscale cloud providers (HCPs) are shifting away from building their own facilities, choosing to contract with external parties instead. The European market, lacking a dominant indigenous public cloud player, has been the first to see this shift. Essentially, Europe is caught between US-centric and Asian-centric players racing to capture market share. This is driving the need for faster time to market, leading to a rethinking of infrastructure business models. The Middle Eastern and African markets will be the next areas of rapid expansion, especially once the European market is consolidated and long-haul connectivity/subsea cables are fully operational (see Figure 1).

Public cloud growing exponentially in Europe

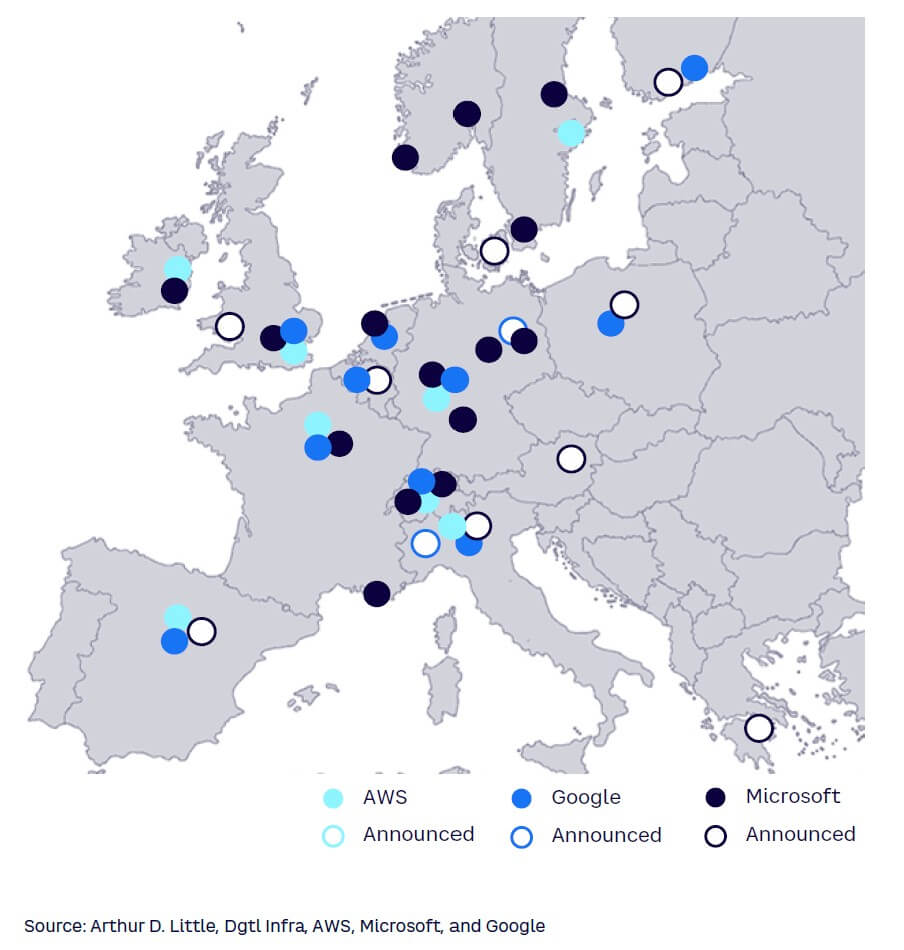

HCPs are announcing new availability zones across Europe beyond the traditional FLAP-D axes (Frankfurt, London, Amsterdam, Paris, and Dublin). Out of a total of 1,000 MW capacity being built across European metro areas, ~270 are targeted for Tier 2 cities like Berlin, Madrid, Zurich, Reykjavik, and Stockholm. The new capacity ensures lower latency in the new computing hubs spreading across Europe (places like the Nordics, Iberia, Italy, and Poland), providing customers with high-quality cloud computing services. Intense competition between HCPs over market share is driving this expansion, with the HCPs mirroring each other’s geographic focus. The rapid expansion has caused HCPs to move away from their US-centric model and consider how best to deploy infrastructure in Europe to support their cloud expansion (see Figure 2).

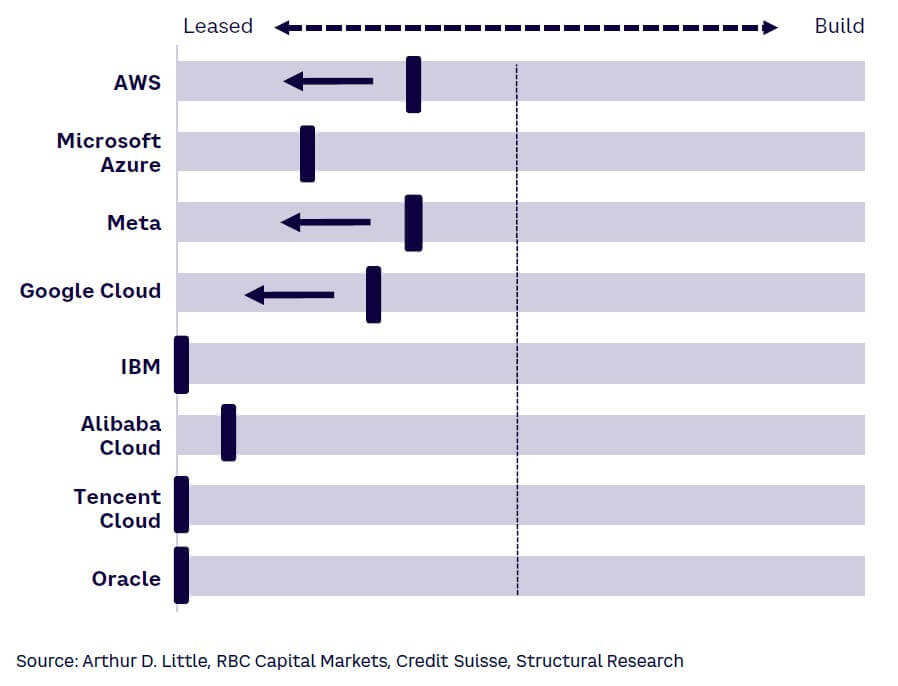

For example, in the US, HCPs usually build and operate their own facilities, including in the data center hub in Ashburn, Virginia, and a cluster of solar-powered facilities in Phoenix, Arizona. Initially, HCPs used that approach in other parts of the world, such as Google’s first European data center (Saint Ghislain, Belgium, 2010) and AWS’s first Asian data center (Singapore, 2011). However, these expansions were driven by a legacy strategic orientation of keeping infrastructure in ownership. The majority of new locations targeted by the HCPs will now deploy in leased build-to-suit modules (see Figure 3).

Initial expansions into European markets beyond the FLAP-D region were limited to existing local capacity to test the market. As full cloud-service offerings move closer to the end user, this approach no longer fits. Local regulations (which are complex compared to the US) are also impacting strategies, making delivery risk higher than in the US. Permit-processing variations, resource pressures, and energy-price differences all play a role in creating an atypical environment for cloud HCPs to invest in. Sunk CAPEX costs involved with owning facilities are becoming a significant pain point for HCPs, with investments in software being prioritized amid rising interest rates.

Regional data center operators can fill the gap

European data center operators that are fully focused on delivering hyperscale colocation services are quickly becoming a vital partner for HCPs. In the past 10 years, regional data center operators saw capturing HCP demand as a way to demonstrate the quality of their facilities. This heightened perception was used to attract enterprises in the area, positioning these operators as “regional champions.” Several US operators like Vantage Data Centers, Iron Mountain, and Yondr recognized that HCPs are moving to a build-to-suit model and capitalized on this trend by acquiring European data center operators with the potential to expand into hyperscale modules. They believe those acquisitions contribute to limiting the local complexities inherent in a self-build approach. European players like Data4, Interxion, and Green Mountain have reacted to the influx by scaling their facilities to meet the HCP demand. A key characteristic for both groups is their emphasis on local knowledge, believing that an understanding of power and land permitting can help businesses scale more rapidly.

Is demand as secure as it seems?

There are a few risks linked to this type of scale-up, ranging from the stability of cloud demand to regulatory and price pressures. More companies are adopting a cloud strategy across public, private, and hybrid cloud solutions, but only a few understand the real cost of such a move leading to enterprises optimizing cloud spend as cost pressures increase. Competition between cloud providers is pushing down the cost of cloud services for enterprises. The regulations on data centers, like those described below in terms of sustainability, will provide a positive influence on the industry as new technologies will keep costs low.

The risk of pricing sinking below current market levels is low, given that capacity remains constrained in most markets (especially Europe). It’s possible that some companies in areas like the Middle East may overextend as they race to build facilities without being sure of demand. Beyond that, the cloud infrastructure has not reached its maturity yet, indicating further room for growth. Also, we do not see any technological advancements that will significantly drive higher densities in the existing facilities, limiting demand.

The opportunity to take advantage of HCP demand in Europe is unprecedented, and the Middle East and Africa are expected to follow a similar trajectory in the near future.

HOW CAN DATA CENTERS MAKE THEMSELVES LOOK ATTRACTIVE?

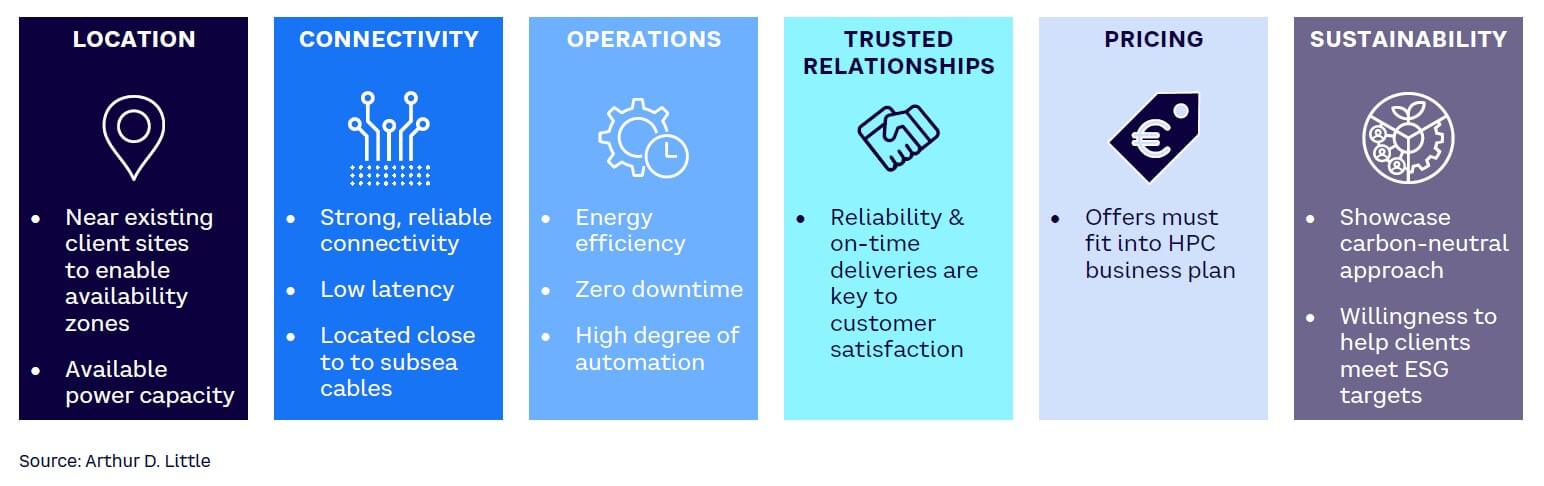

Local data centers focused on providing space for the HCP segment will need funding to support their expansion, requiring them to differentiate themselves and showcase their ability to serve as strategic partners. Potential financiers will closely examine each organization’s potential to meet stringent HCP requirements. The end goal for both operators and financiers is to capitalize on as much of the demand as possible. We see six criteria that local data centers should focus on to ensure they are seen as strategic partners: location, connectivity, DC operations, trusted relationships, pricing, and sustainability (see Figure 4).

1. Location: Tier 2 cities gain momentum

Availability zones are critical to an HCP’s ability to offer reliable, high-quality services to customers. Currently, Tier 1 cities (FLAP-D) remain the most attractive regions for operators because of their high user concentration, with further densification to come. However, the constraints of power and land availability in Tier 1 areas (e.g., areas in Frankfurt, Germany, are constrained until 2028 and 2035), combined with the expansion of cloud zones, are leading to increased development in Tier 2 cities like Berlin, Stockholm, Helsinki, Madrid, and Lyon.

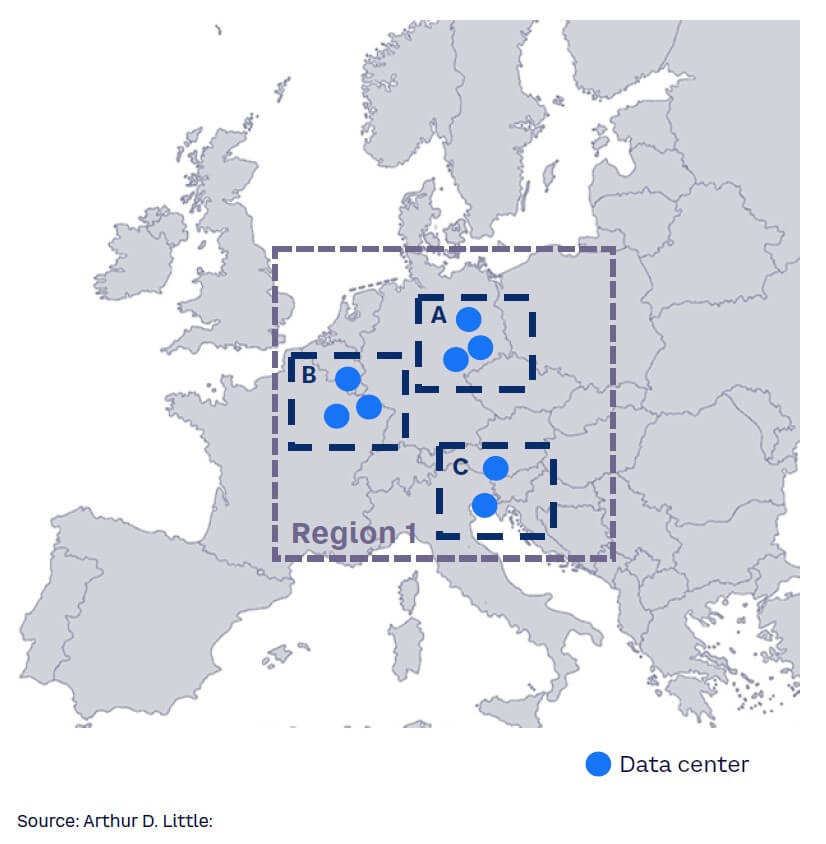

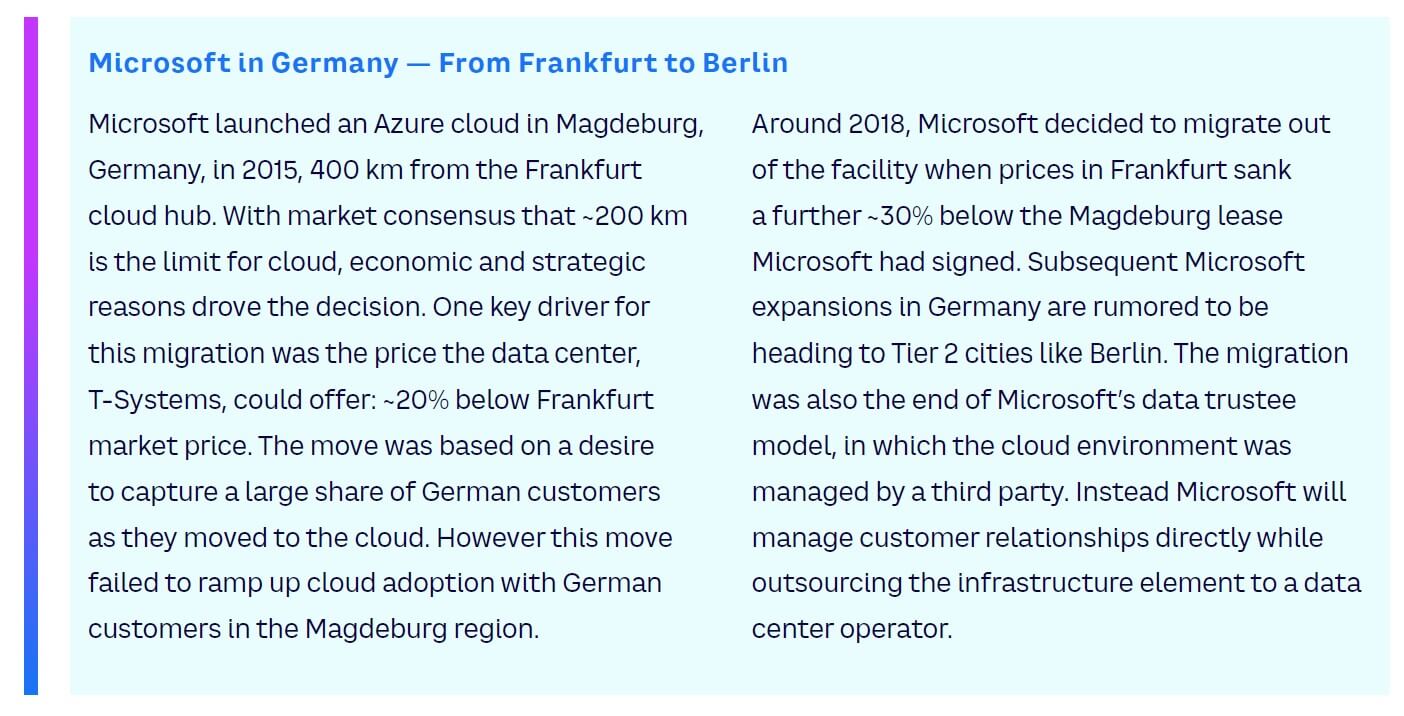

Operators will need to remain agile to ensure the power capacity they’ve achieved remains available to them as the power infrastructure around them changes. We expect availability zones (see Figure 5) to begin overlapping as countries transform into respective metro areas, no longer bound to individual cities. For regional data centers, a two-pronged approach is needed to ensure the wide coverage needed to meet HCP needs. First, they must ensure that regional Tier 1 cities are consolidated to ensure relevance for all HCPs. Second, they must gear up to meet the needs of Tier 2 cities by securing power and land permits for further development. For example, Berlin, Germany, has 70 MW in the development pipeline. This will double its capacity base, which stands at roughly 60 MW today, indicating that the race for Tier 2 cities has begun (see sidebar “Microsoft in Germany — From Frankfurt to Berlin).

2. Connectivity: Access diversity accelerates growth

HCPs operating on a global scale need fully redundant networks in their leased facilities to ensure uninterrupted data traffic. This can be in the form of access to multiple local fiber networks or access to long-haul fiber to cover large distances between regions. Subsea cables have become a key transport component and indicator for HCP build needs (e.g., Cardiff with Vantage Data Centers, Medusa cable with landing points in Portugal, and Marseille granting access to North Africa). Offering access to Internet exchange points further drives the build-out of cloud ecosystems and will be key in securing HCP traffic in the future.

3. Operations: Efficiency in operations drives value

Highly efficient operations don’t just drive down HCP costs, they also benefit data center operators. The more streamlined the offering, the higher the EBITDA margin an operator can capture. However, this streamlining should not be to the detriment of the operational availability of the facility, which is critical to HCPs. The operator that offers the highest level of availability without compromising its cost base will succeed in capturing HCP business. Data centers may choose to offer additional services, something that could impact their margins but in the end drive up revenue.

4. Trusted relationships: Specific needs require a targeted approach

Customer contracts in this market are long term and involve significant amounts of leased MW: HCPs usually demand slots of 10 MW or more. Both characteristics create risk for data centers, binding a chunk of their capacity to one customer. HCPs also have specific demands and long lists of requirements for a facility’s build-out and operation. In fact, they approach leased facilities similarly to how they treat their own buildings. Data center operators must be flexible enough to adjust the planning of their campuses to these requirements, ensuring access to the right suppliers and remaining agile enough to quickly implement requested changes. Data centers should ensure their sales teams have direct access to HCP decision makers, setting up sales teams near HCP headquarters (e.g., the San Francisco Bay area, Google HQ in France) and working to anticipate their needs. Building strong relationships is thus key for operators in guaranteeing their strategic partnership role in the future.

5. Pricing: Avoid “race to the bottom”

Pricing is increasingly becoming a key differentiator due to downward trends in the world economy and the resulting impact on inflation and power prices. These macro conditions, combined with a customer base that understands economics, means pricing is seeing downward pressures. A race to the bottom can be avoided because local operators control the data center capacity that is available to the market (assuming they only build new facilities when capacity has been secured). If local operators limit supply, we expect the pressure of the growing demand in the cloud market to push prices up. Local operators will have to balance these market dynamics and offer services at the most optimal price to align with HCP budget requests.

6. Sustainability: Help balance public perception

The growing public awareness of data center energy consumption is driving industry behavior, even as regulators seek to codify sustainability efforts (e.g., the German Energy Efficiency Act requires facilities to source 100% renewable energy without subsidies from green energy certificates by 2027, with 50% being achieved as of 2024). As HCPs like Meta face public backlash like the one over its proposed facility in Zeewolde, the Netherlands, they will need to convince customers that they are frontrunners in defining sustainable approaches to operations. This includes:

-

District heating approaches in the Nordics (e.g., Fortum in Finland) and Frankfurt (e.g., the Mainova and Interxion announcement).

-

Use of biogas instead of diesel generators for emergency power supply.

-

Wildlife-supporting projects such as a bee-friendly 42-point action plan in Ireland (e.g., planting flowers, reducing mowing).

-

Adopting higher room temperatures to limit cooling requirements.

-

Anticipating the power-generation shift by contributing assets to grid-balancing initiatives (e.g., UPS systems to provide power onto the grid).

Local data centers can differentiate themselves by offering sustainable facilities driven by these types of solutions. The most basic need will be to ensure power used in the facility is 100% green — greenwashed energy through certificates is no longer a viable alternative to reaching HCPs’ sustainability goals.

FUNDS TO BENEFIT

The five-to-seven-year paybacks when HCPs are building themselves are too lengthy, as capital costs increase and colocation space demand will continue to rise. We expect that infrastructure funds will enter this space to aid operators’ cash-flow constraints as it offers a low-risk profile and an ideal way to guarantee long-term returns. Infrastructure funds looking for stable returns for their investments can provide the required liquidity in the market. Contracts between data center operators and HCPs range, on average, from 10-15 years. Exceptions even exceed the 20-year mark, with most including strict renewal clauses to ensure capacity is safeguarded. The long-term nature of these contracts is an attractive proposition for infrastructure funds looking to invest their capital. For data center operators, an influx of liquidity will fuel the ongoing expansion in Europe. Next markets will be Asian Tier 2 cities and the African continent. Already, players are looking to expand to these regions as subsea cables are being laid down to ensure connectivity needs can be met. It is a matter of time before the attention of the HCPs moves to these markets, following a similar strategy that is occurring in Europe.

Conclusion

ACT NOW

HCPs entering the European market recognize that the intrinsic differences across 38+ countries adds complexity to their homegrown business models. The demand for HCP services won’t stall any time soon, and space is needed as soon as possible to cater to this demand. For data centers looking to capitalize on this trend, access to funding and alignment to the six criteria described above will be critical. Points to consider include:

-

Stakeholders should act now.

-

European data centers can set themselves up as strategic partners for HCPs by focusing on: strategically aligned locations; access to a broad connectivity network; highly efficient, robust operations that engender HCP confidence; building deep relationships with HCP stakeholders; competitive prices that match HCP budget estimates; and sustainable facilities.

-

There is limited risk as digital infrastructure becomes even more ubiquitous.

-

Infrastructure and private equity investors can capture value in this high-growth market.

-

The build-to-lease trend is expected to spread to the Middle East and Africa.