The claims management process is critical for the success of insurance companies, affecting profitability as well as being a key factor in determining overall customer satisfaction. Building on real experience with top insurers as well as targeted interviews and workshops, this Viewpoint sets out a “best practice” approach for achieving claims management excellence across seven levers, with an emphasis on the interplay between technology and people.

The efficiency and effectiveness of the claims management process is a significant contributor to an insurer’s profitability — insurers typically pay out some 65%-70% of total premiums in claims. According to analysis by Arthur D. Little (ADL), insurers see a value leakage (i.e., the difference between what should have been paid and what was actually paid) of 8%-10%, on average, on casualty and motor insurance claims and 6%-9% on property claims. On the other hand, best-in-class players, with a higher-performing claims organization, can achieve only 4%-7% leakage. The claims management process itself can be both complicated and labor-intensive, and fraud detection and prevention are costly.

What’s more, the claims process is where customers interact most with the insurer, so the quality of the claim experience is a key determining factor for overall customer satisfaction. This is vital for sustained success in an increasingly competitive market. With increasing pressure on bottom lines through rising costs and inflation, excelling at claims management is one of the most important priorities for any insurer.

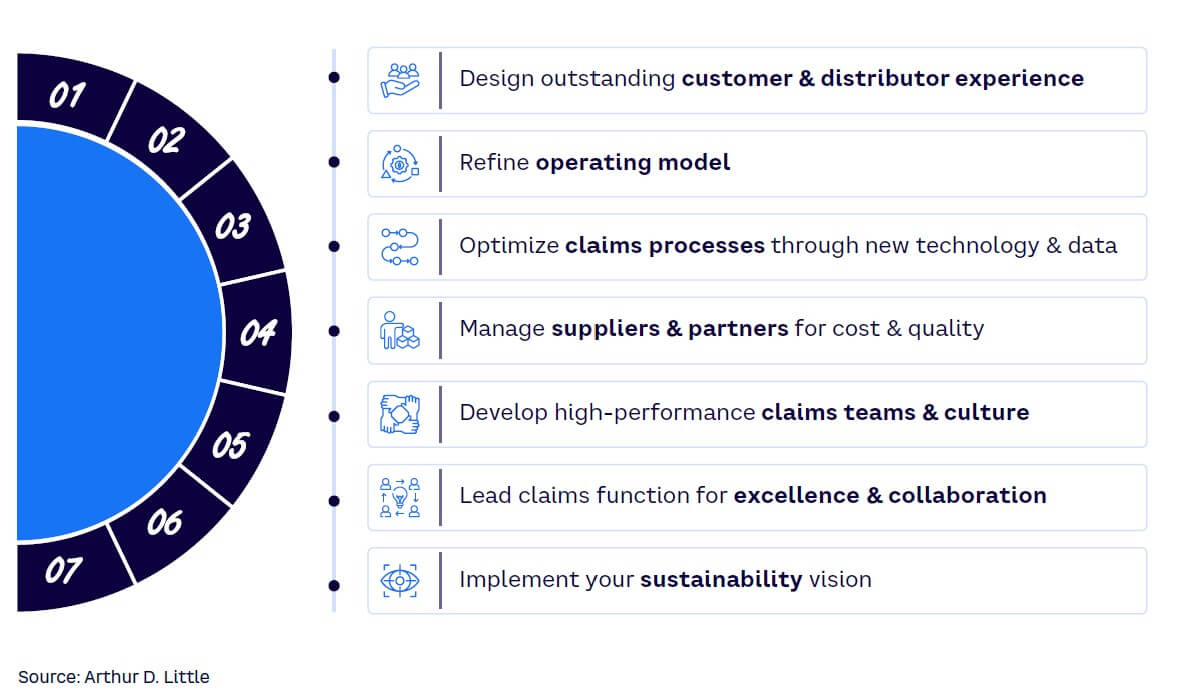

Building on extensive work with insurers to improve the claims management process, along with a set of structured interviews and workshops with CEOs and managers of major insurers, ADL developed a best practice approach for achieving claims management excellence split across seven major levers (see Figure 1).

1. DESIGN OUTSTANDING CUSTOMER & DISTRIBUTOR EXPERIENCE

For customers, the claims process embodies the “moment of truth” that shapes the view of their entire relationship with the insurer. Thus, the starting point for claims management excellence is to develop a customer-centric process that guarantees a high-quality experience. This means, first and foremost, speed and simplicity toward claim resolution, along with transparency and a personalized approach. Evolving digital tools are providing new ways to achieve this. For example, leading insurers have developed digitalized mobile-based first notice of loss (FNOL) processes for auto, home, or e-health insurance and digitalized claims intimation processes (e.g., uploading photos). In health insurance, many firms have implemented a digitalized approval process for medical authorizations, streamlining the service for customers as well as achieving significant cost reductions in contact center support.

Additionally, it is essential to implement an adequate monitoring system of the results obtained through efficient key performance indicators (KPIs) and a net promoter score (NPS) program to understand the effectiveness of the customer experience (CX). Some best-in-class insurers have developed predictive models to identify the customers most likely to initiate complaints, acting proactively with dedicated teams to understand pain points and increase customer satisfaction. If companies deliver exemplary customer service, insurers have more potential opportunities to cross-sell and up-sell, converting satisfied customers into leads for other similar services (e.g., auto to home or health or home to auto).

2. REFINE OPERATING MODEL

Refining the operating model sets the basis for operational efficiency, compliance with regulations, customer satisfaction, and adaptability to changes in the industry. From a claims management perspective, there are four aspects to focus on — claims segmentation, team specialization, repair strategies, and relationships with specialized partners:

-

Having a clear claims-segmentation strategy based on levels of complexity enables the claims team to tailor the approach; for example:

-

Low-complexity/high-frequency claims can be fully automated and digitalized. Teams can start by automating specific coverages or claim types and then progressively move on to the next one, from FNOL to payment/repayment. The selection of coverages with the best trade-offs between benefits (e.g., economics, customer satisfaction) and automation complexity is key.

-

Medium-complexity claims (e.g., involving external experts or higher payments) can be covered by high-performance teams and managed for productivity. Automation can be progressively adopted to support their work until some of these claims are also fully automated.

-

Complex claims may account for only for 1% of total claims, but they can easily require 30% of the overall time and represent 40% of the total costs. The key here is for expert teams to build rules and procedures for recurrent complex claims so they can be managed by medium-complexity claims teams in the future.

-

-

Team specialization is important for tailoring customer service to improve satisfaction. For instance, FNOL activities should be segmented so customers are assisted by specialized personnel in their specific coverage area. Some insurers following this approach have observed an increase of 15 points in the NPS for home claims, for example. Segmenting the claims-handling team by claim domain (e.g., experts in repairment activities, body damage claims, electronic equipment) creates another opportunity.

-

Repair strategies, which increase the percentage of claims that can be repaired, can offer cost and customer satisfaction benefits. Spain’s insurance market is one example, where about 85% of household claims are repaired rather than indemnified, achieving an average savings of 22% versus the payment of the indemnity. Improving repairer network partnerships and educating customers can help increase the proportion of claims repaired.

-

Relationships with specialized partners can help improve and extend service offerings. There is an increasing network of specialists, such as reinsurers, insurtechs, or Internet of Things providers that can provide access to cutting-edge technology and differentiating knowledge. Promoting a culture of collaboration, adopting good ecosystem management practices, and ensuring robust data security and management controls can help drive partner collaboration.

3. OPTIMIZE CLAIMS PROCESSES

Leading insurance companies are optimizing their existing processes by using data and new technology to:

-

Develop data-driven decision-making models.

-

Enhance fraud detection.

-

Improve accuracy and precision.

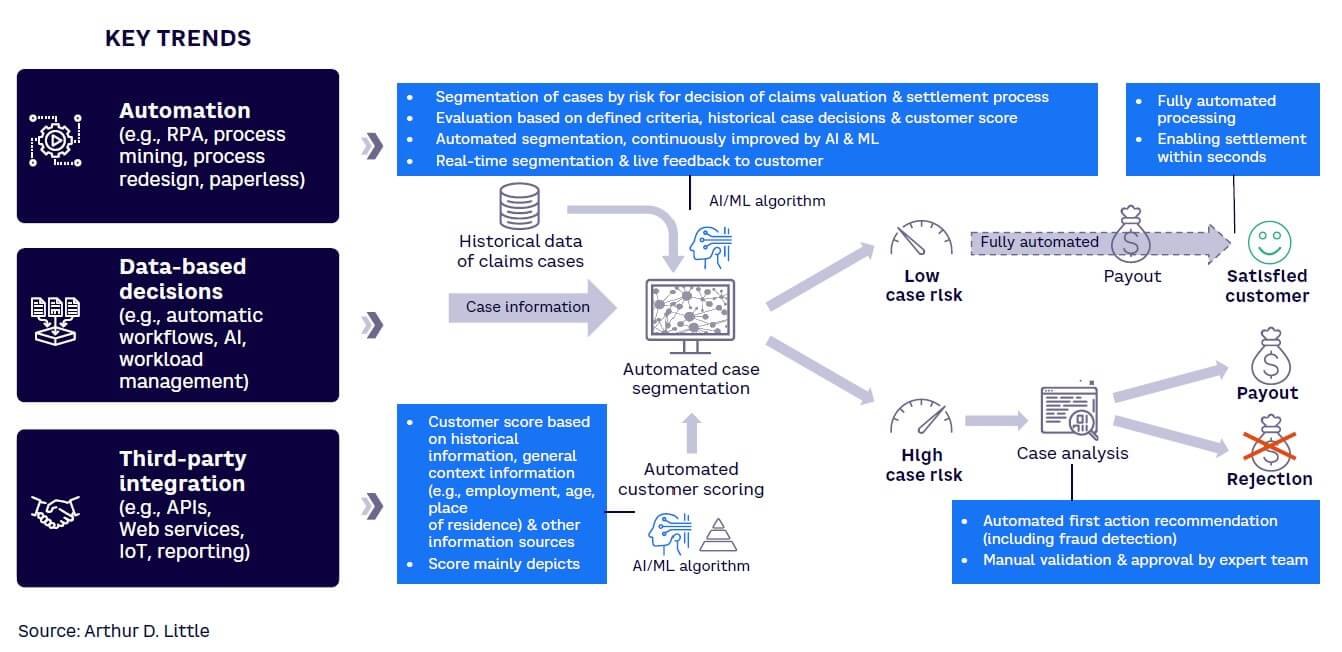

Figure 2 shows a schematic illustration of a claims process optimized through automation and the application of artificial intelligence (AI).

First, technology can automate the case-segmentation stage. AI can be used to interpret a combination of historical claims trend data and customer-profiling outputs, such as account history, current data on work, age, place of residence, and so on. This provides real-time segmentation, as well as rapid “live feedback” to the customer. Systematic customer scoring, enhanced through AI and data analytics, helps predict fraud risk and thus improves fraud prevention. The use of AI ensures continuous learning in the process. As mentioned above, low-risk cases can then be fully automated in terms of further downstream claims processing and settlement. Higher-risk cases will require further manual review, including fraud detection, to ensure robust payment decision-making. The application of automation and AI improves workflows, enhances the quality of decision-making, and minimizes the risk of human error.

4. MANAGE SUPPLIERS & PARTNERS

Optimizing claims operations relies on a clearly defined, adequate ecosystem with specialized third-party suppliers, which improves service quality, reduces costs, manages risks, fosters innovation, and helps ensure compliance with regulatory requirements.

The development of a preferred garage network for motor vehicle insurance is one example. Preferred networks can provide insurers with best-quality service and CX, unlocking opportunities to improve both costs and overall client satisfaction. For example, using a limited number of networks provides the insurer with more negotiation power to secure discounts and process optimizations from service providers, especially if the insurer is responsible for most of the provider’s income. At the same time, with a limited network, the insurer is in a better position to control the value chain, enhancing service quality and consistency for the customer. Clearly, these advantages must be weighed against the risks of supplier dependency and concentration.

Another approach, prevalent in Europe, is to internalize the repair service process (i.e., integrate the garage as part of the insurer’s service offering). By so doing, insurers can further enhance the cost and quality of the repair service, effectively creating a garage “center of excellence.” In other cases, the garage is treated as a profit center, meaning that the repair service is also made available to other insurers, providing benefits of scale, cost optimization, and new revenue streams.

Certain claims require the involvement of multiple specialists, while others only require a single provider. Specialist small and medium-sized enterprises can form a valuable part of the network where this type of expertise is required. Digitalization is an essential enabler for such networks to be effective, allowing for end-to-end data tracking, error/delay detection, and process control. Data transparency and availability are also keys to continuous improvement (e.g., by conducting internal audits on closed claims).

Finally, a strong partner network with a fast and transparent exchange of information is important for streamlining the reconciliation process, especially for health insurance. This results in better control of actual costs while ensuring expected quality.

5. DEVELOP HIGH-PERFORMANCE CLAIMS TEAMS & CULTURE

There is a general tendency in the insurance industry to create large specialist claims management teams, where employee demotivation is one of the main causes of poor team performance. In general, these employees have been in the exact job for a long time, performing the same functions, and sometimes show some resistance to change. In recent years, their roles have evolved due to the greater importance of technology and AI in claims resolution, though the most complex claims are still reviewed and resolved manually.

ADL’s work on claims optimization has shown that, on average, between 10% to 30% of the success of optimization opportunities is tied to the team’s mindset and culture; hence, this is an important dimension to address. We have identified five priorities to develop a high-potential claims team with a strong culture:

-

Understand the team’s capabilities. Understanding each employee’s current and target skills for their respective position helps identify and address gaps and ensure that the team is well-equipped to handle its responsibilities.

-

Develop the team through multiple training methodologies. Providing diverse training opportunities (e.g., workshops, seminars, online courses, and mentorship programs) allows team members to expand their knowledge and skills and foster growth and improvement.

-

Define career paths in both technical and management areas. Clearly outlining career paths for employees helps them understand their potential for growth within the organization, motivating them to excel in their current roles and encouraging them to develop the skills necessary for advancement.

-

Link team development with claims management objectives. A scorecard view, which displays personalized financials, employee efficiency, and CX metrics, is one way to allow team members to see how their individual performance contributes to the overall success of the claims management process.

-

Design an evaluation system. A robust evaluation system objectively informs the HR team about the development needs of the claims team, allowing for targeted incentive programs, training opportunities, and tailored career development plans.

6. LEAD CLAIMS FUNCTION FOR EXCELLENCE & COLLABORATION

To excel in claims management, the claims team needs to deliver high performance and work collaboratively in close alignment with other key functions, such as underwriting, product, distribution, IT, finance, operations, and fraud teams.

Managing performance requires structured diagnosis methodologies that point the way to continuous improvements. For example, conducting closed claims assessments can provide valuable insights into areas that require enhancement. Thorough and actionable KPI scorecards can help track performance across the full range of dimensions, such as product, coverage, segment, and channel. Targets linked to KPI metrics can help ensure teams are working toward the right goals. Simultaneously, collaboration plays a vital role. This can be achieved by establishing periodic committees that involve various stakeholders from other key functions and involving them in creating shared action plans, aligning the parties to work toward common objectives.

7. IMPLEMENT YOUR SUSTAINABILITY VISION

Sustainability, including environmental, social, and governance policies and products, has become an essential concern for all financial institutions. The insurance sector is no exception, with several factors driving its importance. First, emissions that can be attributed to the insurer (claim-linked emissions) are significant in scale (up to 2% of total emissions in developed countries). These stem from many sources, including vehicle emissions, repair and replacement processes, and Scope 3 emissions. Regulatory pressure is also increasing, with bodies such as the European Insurance and Occupational Pensions Authority (EIOPA) emphasizing the need for sustainability integration in the insurance industry. Last but not least, customer preferences are evolving, with an increasing expectation for good sustainability practices to be applied in coverage and claims. For example, leading insurance players are adopting such measures as using electrical repair cranes, increasing the use of recycled spare parts, or opting for motorbikes as surveyors’ vehicles.

ADL recommends four priorities relevant to claims management:

-

Integrate sustainability into the claims strategy. Align the claims strategy with the organization’s broader sustainability vision and services.

-

Measure claims-related emissions. Review the claims value chain and measure the emissions associated with each stage. Adopt a standards-based approach for contractors and suppliers, engage with these stakeholders, and modify underwriting strategies.

-

Digitalize the claims management journey. Embrace digital solutions, such as virtual claim settlements and streamlined processes, minimizing the need for documentation and travel and improving sustainability performance while enhancing customer satisfaction.

-

Reduce emissions and increase recycling and repair rates. Apply the approaches already mentioned, such as better segmentation, use of data analytics, and collaboration with other functions, not just to improve efficiency but also to set and achieve meaningful sustainability targets. Develop monitoring and reporting mechanisms to manage progress.

Conclusion

HARNESSING TECHNOLOGY TO HELP PEOPLE THRIVE

Achieving claims management excellence is a continuous process for all insurers, and those companies that have successfully applied the seven levers outlined in this Viewpoint have moved the furthest along the journey. A dual focus on technology and people is common across all seven levers. The deployment of technologies such as automation, AI, and advanced data analytics is now a major differentiating factor, resulting in better outcomes for both the company and its customers.

At the same time, it is ultimately people who make the difference; without people, the technology is useless, perhaps even more so in an AI-oriented future. Thus, insurers should focus on people-centric business management, nurturing team motivation, upskilling/reskilling, and facilitating collaboration and cooperation. Only by doing this will the power of technological innovation be truly realized.