The cloud is the playing field of the digital economy. However, most financial services companies have only been able to scratch the surface. Working within its existing operating practices and vendor ecosystem, it seems impossible to look beyond the lowest-hanging fruit. We make the case that it is time to try something new.

A tale of two clouds

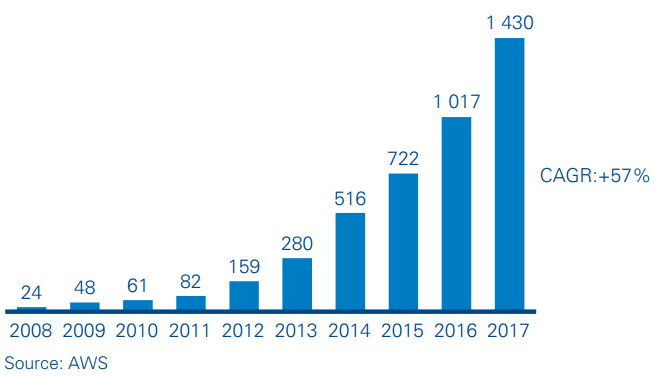

Public cloud technologies underpin the digital economy. They provide scalable infrastructure that is particularly suitable to hosting highly variable consumer workloads. They enable step-change improvements in application development (from months to continuous delivery). The public cloud accommodates data-driven architectures essential to build an impeccable user experience and superior customer knowledge. That is not all – the public cloud innovates constantly. For instance, during 2017 AWS launched 1,400 new features and services, including artificial intelligence, workload placement and advanced security, all features highly valued by the industry. At the same time, the public cloud promises significant running-cost reduction based on scale and automation.

Number of major services and features released by AWS

Financial institutions recognize that cloud technologies are a critical lever for competitiveness. The industry has invested substantially, building cloud sandboxes, tool chains andplatforms. It has retrained staff as cloud architects, product owners, scrum masters and the like to become more agile. Many would claim these efforts have hijacked technology governance. However, despite all of this, the cloud has delivered only superficial impact. For a number of reasons, cloud platforms are either never used in client-facing production platforms or used for only 5–20 percent of total workloads. The outcome is cost containment rather than savings, and marginal gains in overall agility.

New entrants could not be more different. With wind in their sails, often paid for by financial institutions, fintechs talk of advanced customer experience and digital customer interactions, API everything, analytics-centric operating models and artificial intelligence-driven marketing. These players have not built these capabilities on traditional stacks; rather, they have tapped into the massive potential offered by the public cloud. N26, Atom, and Revolut, among others, have demonstrated the scalability of the cloud, onboarding as many as 2,000 customers per day, which is not dissimilar to a regional universal bank or insurance company.

The situation is untenable. Unrealistic expectations have discredited most cloud efforts. This means that more often than not, the approach to the cloud in financial institutions has become opportunistic. The competitive advantage of scale has turned into a scale-driven technology disadvantage. Traditional financial institutions are stuck with their legacy and cloud strategies, while new entrants profit from the innovation advantage built on more agile and efficient platforms. Our analysis shows that the gap between the unit technology cost in a traditional bank versus that of a digital bank at scale could provide new players with a 45–60 percent advantage, in addition to the cost advantage associated with being branchless, ATMless and self-service.