DATE

11 min read • Private equity

The insight: Europe’s private equity industry during COVID-19 and beyond

1

Fundraising remains resilient

Fundraising in H1 2020 remained relatively resilient, with €49.2 Bn raised during the period (according to Invest Europe’s report, “Investing in Europe: Private Equity Activity H1 2020) — just 4 percent down on 2019.

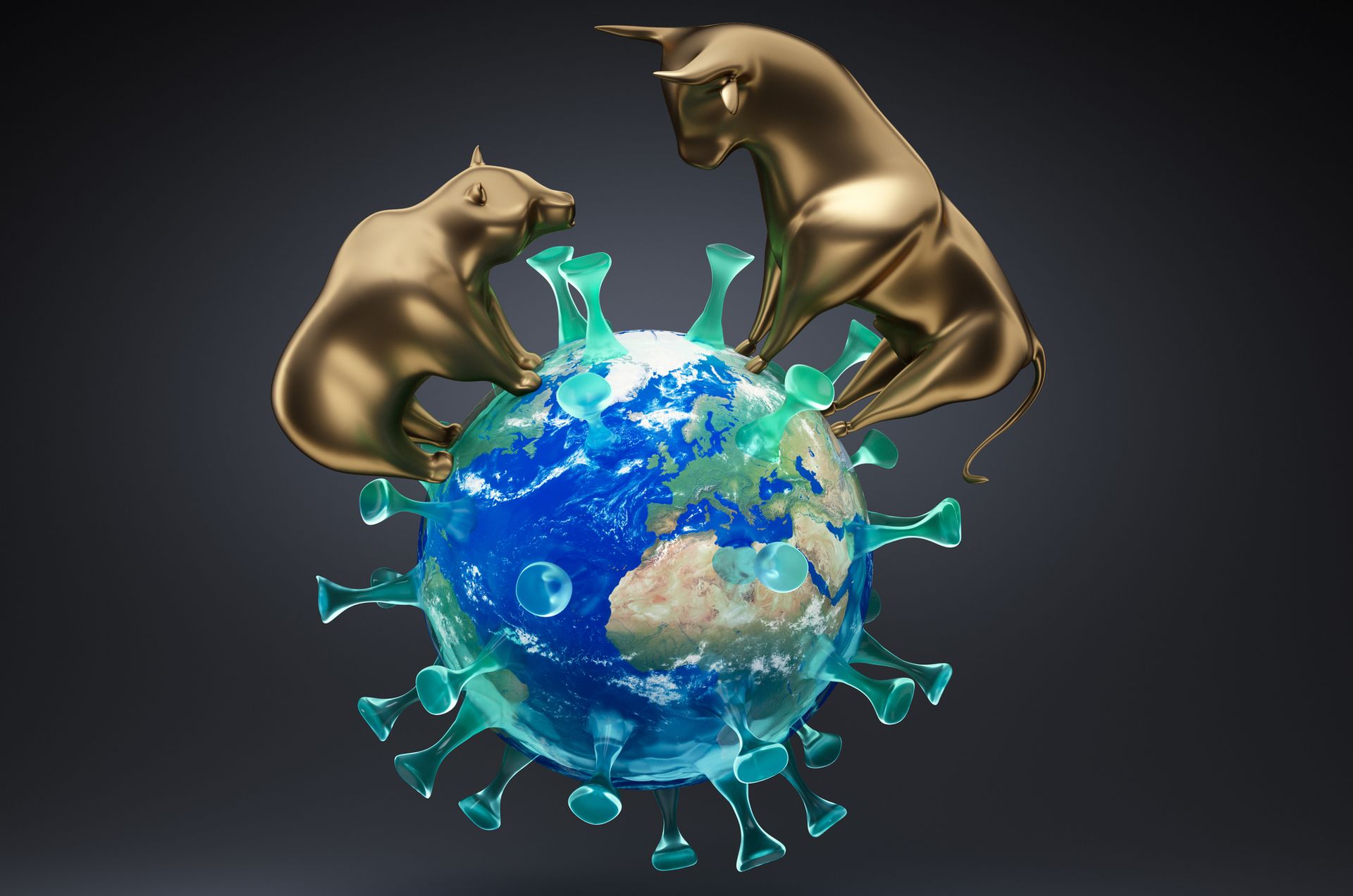

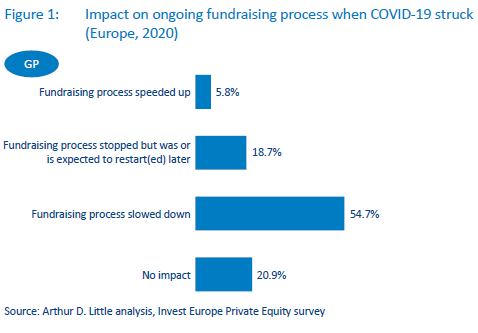

The majority of fundraising processes, approximately 80 percent, continued despite the pandemic (see Figure 1). Even for the 20 percent that did not proceed, this appears to be temporary, with most expected to resume at some point.

2

Investment environment

After a promising first quarter of 2020, the Europe-wide lockdown that lasted from March to the beginning of June not unsurprisingly led to a pause in investment, with reduced transaction volumes leading to levels that were 17 percent less than those of the previous year (€36.2 Bn in H1 2020 compared to €43.4 Bn in H1 2019), according to “Investing in Europe: Private Equity Activity H1 2020”.

Any activity occurring since the mid-summer “restart” has primarily revolved around the conclusion of deals already begun by private equity firms before the first lockdown period in Europe.

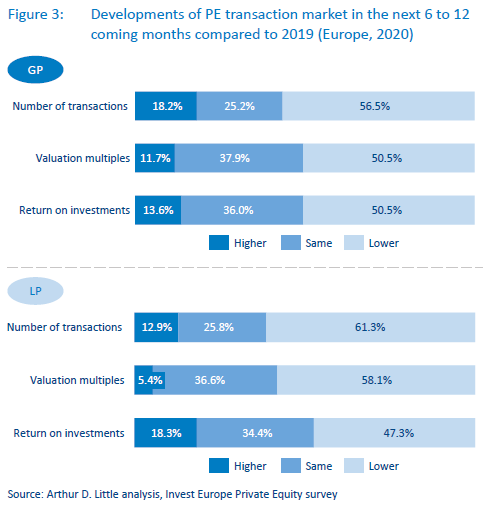

This rather downbeat dynamic is likely to continue over the next six to 12 months in the European private equity market, with 55 percent of GPs and 60 percent of LPs expecting the downward trend in transaction volumes to go on.

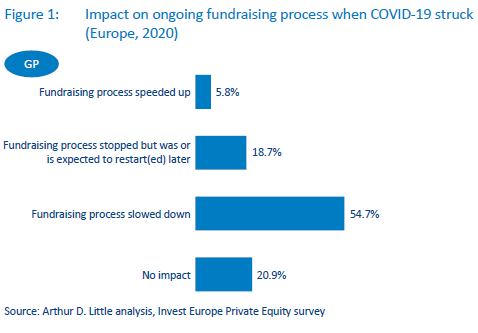

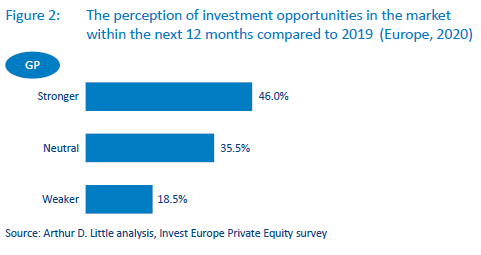

Despite the turbulent context, GPs do see opportunities arising in the market, with 46 percent (see Figure 2) believing that over the next six to 12 months there will be stronger investment opportunities in the market, mainly driven by more corporate spin-offs (43.5 percent) and, to a lesser extent, more primary (37.9 percent) and secondary deals (38.8 percent).

3

Postponement of planned divestments drives lower exit volumes in the market

Divestments have particularly been impacted by the pandemic. Over the first semester, these were down by 49 percent on the same period in 2019. A majority of GPs have postponed exits of portfolio companies and are expected to continue to do so until 2021. That will give private equity firms more time to thoroughly assess the market conditions for a structured exit process when trading numbers have returned to an upward trend.

In the short-term, more than half of GPs expect divestment opportunities to be lower. This is likely to remain the prevailing mood well into 2021.

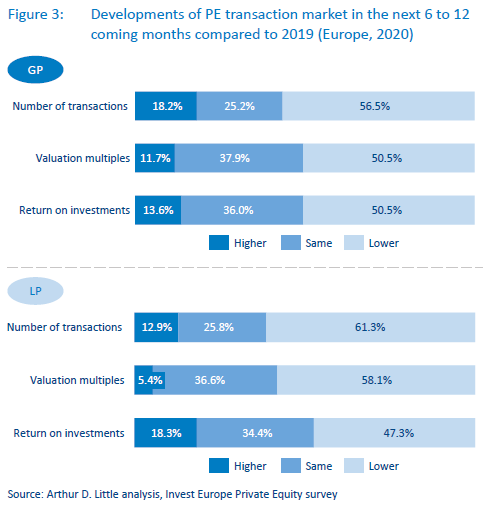

This somewhat negative outlook is also present when looking at valuation multiples, with 50 percent of GPs and 60 percent of LPs taking the view that they will be down on 2019 (see Figure 3).

As a result, short-term returns for the majority of private equity professionals are likely to be lower than the levels achieved in 2019.

4

Operational priorities during and beyond the pandemic

When the pandemic struck, most PE firms rapidly set up various internal teams to provide support to their portfolio companies. These teams were primarily focused on ensuring employee health and safety, securing supply chains, maintaining operations remotely, short-term cashflow planning and the like. As a result of such a different modus operandi, fewer resources were available for new deals or exits, as described above.

We were very quick at setting up ‘war rooms’ for key issues across our portfolio companies. For several weeks, we also held daily telephone conferences with each portfolio company to ensure we were in control of the situation .

Martin Kõdar, Managing Partner, BaltCap

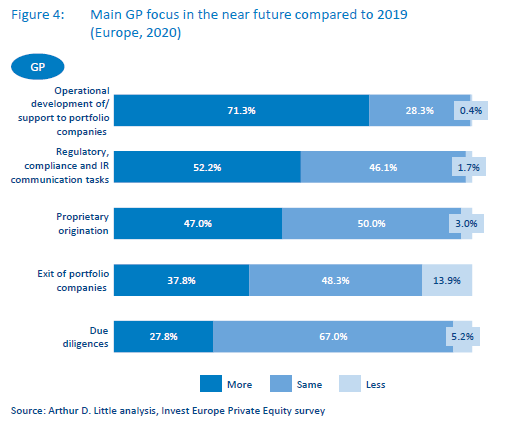

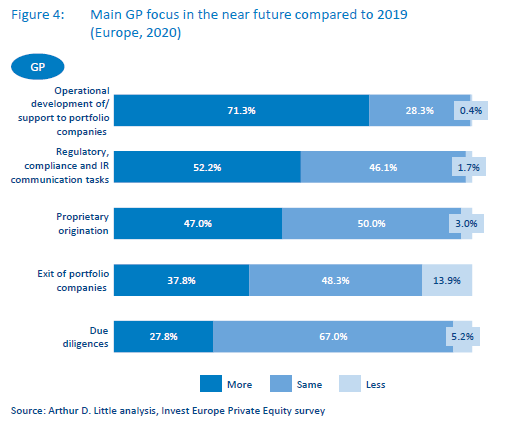

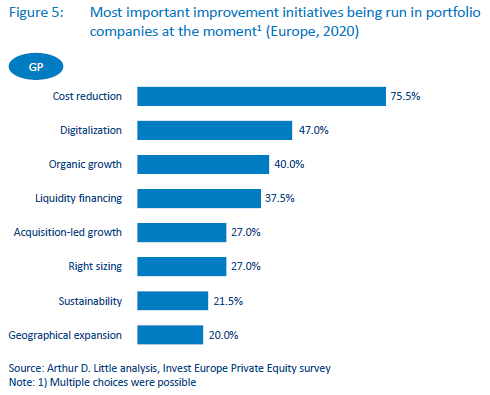

In light of our experience from the pandemic, we also asked what the primary focus of PE firms was now (see Figure 4), and also what would be the most important improvement initiatives for their portfolio companies (see Figure 5). The results depict the reactivity of the firms towards their portfolio companies, as well as their LPs.

Effective portfolio management has risen rapidly up GP teams’ agendas and is likely to remain so for the next six to 12 months. For instance, 70 percent of GPs anticipate allocating more time to operational development and support of their portfolio companies.

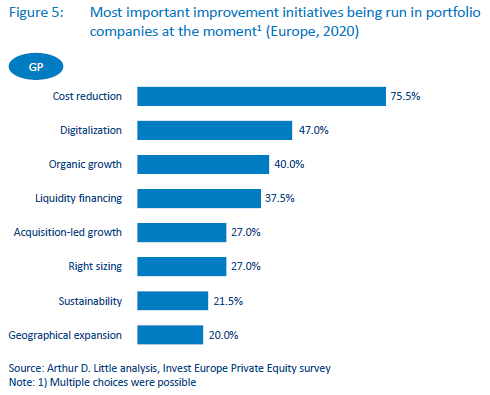

In terms of the most important improvement initiatives, cost reduction comes out as the main focus for value creation, with 75 percent of all respondents stating that it is “very important”. Unsurprisingly, digitalization is a key interest for 47 percent of respondents, which reflects the need to accelerate digitalization as a result of the pandemic.

Liquidity financing remains a key agenda topic for 38 percent of respondents. With a second wave of coronavirus already rolling out across Europe, this figure may well rise in response. Recent lockdowns in Ireland, the UK, France, Germany, Belgium and likely elsewhere very soon are raising the prospect of frontier closures, curfews and even civil disorder, which means many companies may have to rely on their existing reserves to ride out the coming storm — even if that storm is shortened by the arrival of a vaccine for COVID-19, such as the one announced on 9th November by German VC-backed laboratory BioNTech and Pfizer.

During these difficult trading conditions, traditional financing such as loans and credit facilities from banks and shareholders have been used to support portfolio companies. On average 44 percent of portfolio companies have used government unemployment support, and 37 percent have requested and utilized government-backed loans for financing. (This was especially the case for portfolio companies in VC funds and midcap PE funds.) To a large extent, portfolio companies’ requests for government support have been approved, except for VC-fund portfolio companies, for which about one-quarter of requests were rejected. This situation demonstrates the relative resilience of the private equity industry in the current difficult context and will most likely remain the case over the coming months.

5

Private equity asset class remains attractive for LPs, but investment strategies may evolve

Irrespective of the short-term situation, the private equity asset class remains a favorite investment for LPs — 60 percent of LPs and GPs expect there to be greater capital allocation to this area over the coming three years, with only a few (15 percent of LPs) taking a contrary view.

Right now, there’s no other asset-class that can match the PE asset class in terms of risk-reward profile, particularly in the current low interest rate environment .

Eric de Montgolfier, CEO, Invest Europe

However, four out of 10 LPs also say they are looking to capitalize on other investment opportunities arising from the COVID-19 crisis by redirecting their investments into distressed asset or secondary-asset funds.

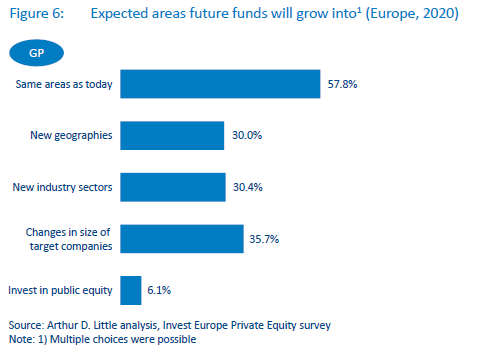

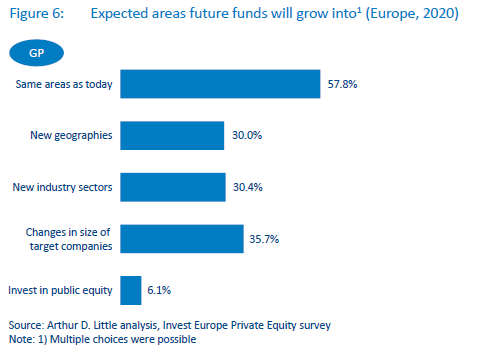

As regards alternative investment strategies, over half of GPs (57 percent - see Figure 6)) see no reason to change tack at the moment, though nearly one in three private equity firms have concluded that the current context may justify looking at investments in new geographies, deal sizes and sectors.

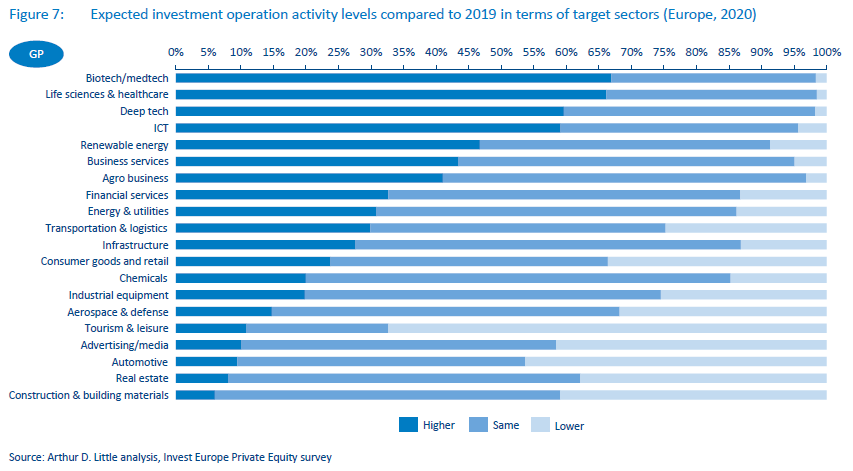

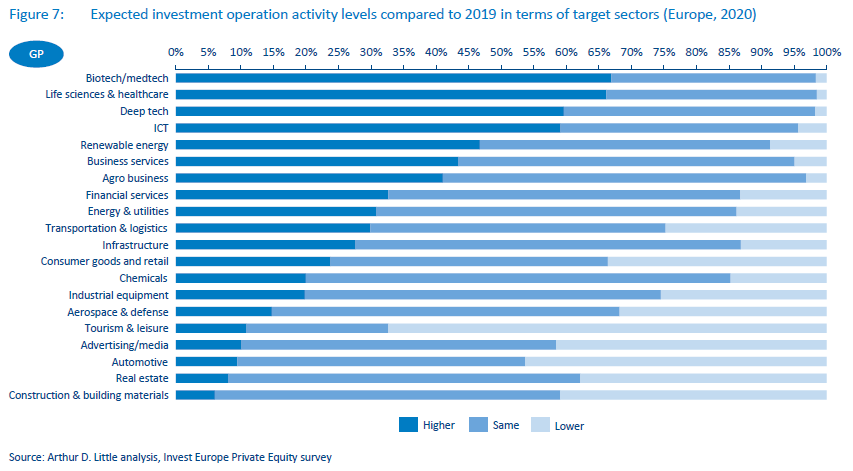

Overall, some sectors are seen as holding the greatest promise: around two-thirds of GPs expect higher investment activity in biotech, medtech, life sciences & healthcare, deep tech and ICT and, to a lesser extent, renewable energy, business services and agribusiness, which about four in 10 respondents regard favorably (see Figure 7).

At the opposite end of the spectrum, COVID-19 has had, and continues to have, a deep and significant impact on major sectors such as tourism and leisure, automotive, real estate (professional) and aerospace and defense (especially the airline industry). Consequently, in the medium term, these will probably be regarded by GPs as offering less investment potential.

6

A changing relationship between LPs and GPs on the horizon?

Among both LPs and GPs, there is an expectation that the “new normal” we have entered into will change the relationship between them in ways that have potential long-term implications for the industry (see Figure 8). Almost half of LPs believe, for instance, that future limited partnership agreements will become more “friendly” towards them. However, the majority of GPs don’t expect any fundamental change in their relationship with LPs.

With continuing widespread volatility in the marketplace, a common view among 40 percent of both LPs and GPs is that the scope of investment will extend further (see Figure 9). If that is the case, then GPs should be able to take advantage of new opportunities. This would enable them to diversify their investments, which would afford some protection when they are faced with future volatile conditions and macro events that create turbulence in the market, COVID-19 related or not.

Because of the uncertainty facing the private equity sector, GPs believe that they should place much greater emphasis in the future on risk management and investor relations (IR) communication activities.

However, when LPs were asked the same question, they did not place as much emphasis on either risk management or IR communication. It seems LPs are more satisfied with the way GPs are working than GPs themselves.

During the early stages of lockdown, we were particularly pleased with the quality and frequency of the information we were getting from most GPs. That was both helpful and reassuring that they were on top of their portfolios

Merrick McKay, Head of Europe - Private Equity, Aberdeen Standard Investments

7

LPs and GPs to remain key partners, though their interests sometimes vary

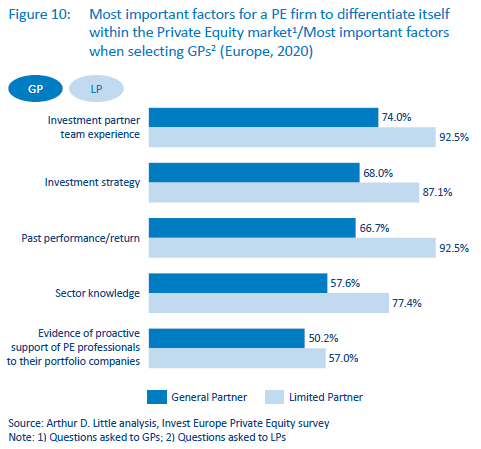

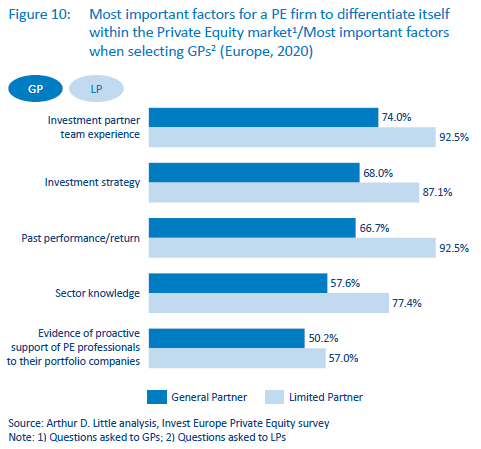

Moving forward, there is still confidence among LPs that GPs will remain key partners; however, they would like to see some changes. So, while they value what might be regarded as the “traditional criteria” (see Figure 10) for judging the relationship, such as the GP team’s experience, track record, investment strategy expertise and sector knowledge, they are also looking for some new attributes that currently are often either absent from GPs or not recognized as important by them.

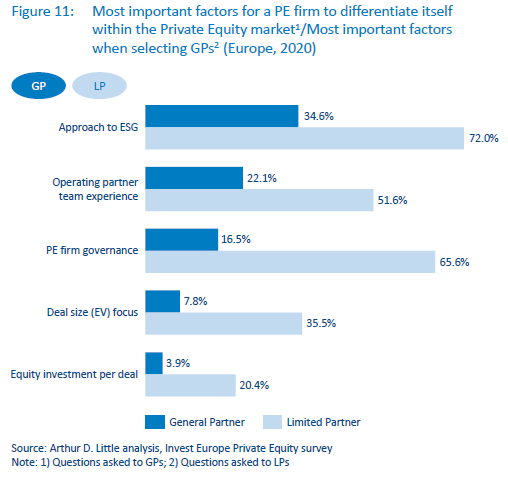

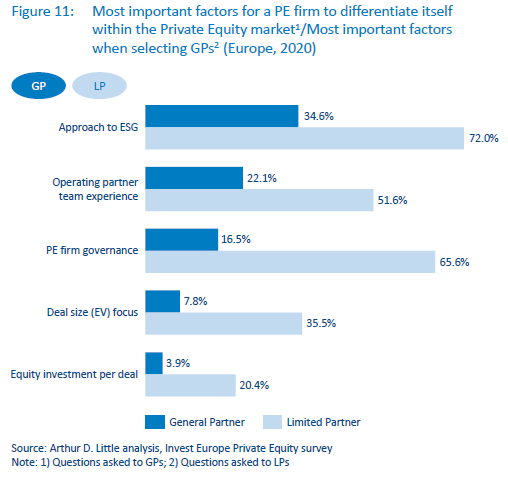

For example, environmental, social and governance (ESG) is clearly something that matters to LPs, since 70 percent define it as one of their key criteria (see Figure 11). However, ESG did not really appear on the radar of GPs; fewer than half indicated that it was something of particular importance to them. The recent Sustainable Finance Disclosure Regulation that is expected to apply from March 2021 will probably increase the need for GPs to put greater emphasis on ESG.

Investing is more than just optimising returns. We have a shared responsibility to make the world a better place. As investors, this means we have to be proactive in making sure our GPs contribute to sustainability.

Jesse de Klerk, Partner, Stafford Private Equity

In two other areas there is a similar mismatch in thinking. The first is the governance of GP firms, something that was an important factor for 65 percent of LPs, while only 15 percent of GPs indicated that it was of value to them. Also, the experience of a GP’s internal operating team was thought important by LPs, but much less so by GPs.

GPs have spent a great deal of time managing companies in their portfolios during the pandemic and are likely to continue to do so. However, for LPs it is important that they see dedicated operational teams “on the ground” that can support portfolio companies and help steer value creation, especially during the current situation.

8

The future of private equity in a “new normal”

Because of COVID-19 and the response to it, we have entered a period of uncertainty, and potentially high volatility. Unfortunately, with the pandemic accelerating across Europe, there is little sign of this crisis bottoming out in the immediate future.

So, it is likely that in the short-term at least, COVID-19 will continue to dampen the private equity transaction market with a lower level of deals and potentially reduced valuation multiples. Given what is likely to be fierce competition in the marketplace as we move out of the pandemic, there is still a higher risk attached to the PE portfolios of today than those of a year ago. So, the private equity industry must adapt to this “new normal” as best it can, and just as it always has in the past.

Despite the many problems it has brought, COVID-19 has highlighted the efficiency of the PE industry’s business model — the high degree of responsiveness from GPs and support from LPs have minimized the impact of the pandemic on exit timing, helped protect portfolio companies and created real value. As a result, private equity has globally remained the favorite asset class of LPs.

However, the COVID-19 crisis is testing PE’s existing business model as investors move towards sustainable, resilient and fastgrowing industry sectors, such as technology, and restructure funds to take advantage of opportunities better suited to our new environment. Underpinning this will also be ever-greater digitalization, which is leading to more streamlined, efficient processes that will accelerate the rationalization of the industry.

The pandemic is also likely to bring about a new era of professionalism. For instance, the setting up of dedicated teams to manage portfolio operations, as many larger firms already have done, will become much more widespread and greater attention will be paid all round to ESG, especially in the wake of recent changes in regulation.

It is also likely that the current relationship between GPs and LPs will move beyond the transactional as better communication and understanding lead to wider recognition that protecting the value of their shared investments is of common interest.

However, the impact of the current crisis will require further assessment if we are not just to limit the negative consequences of COVID-19, but also to anticipate and seize new potential investment opportunities when they appear.

Although there is continuing turbulence in the marketplace, we can presume that at some stage a new equilibrium will be reached as those in the market adjust their approaches to accommodate the new COVID-19 reality. And looking forward, we see that there are some positive fundamentals already in place to build on.

11 min read • Private equity

The insight: Europe’s private equity industry during COVID-19 and beyond

DATE

1

Fundraising remains resilient

Fundraising in H1 2020 remained relatively resilient, with €49.2 Bn raised during the period (according to Invest Europe’s report, “Investing in Europe: Private Equity Activity H1 2020) — just 4 percent down on 2019.

The majority of fundraising processes, approximately 80 percent, continued despite the pandemic (see Figure 1). Even for the 20 percent that did not proceed, this appears to be temporary, with most expected to resume at some point.

2

Investment environment

After a promising first quarter of 2020, the Europe-wide lockdown that lasted from March to the beginning of June not unsurprisingly led to a pause in investment, with reduced transaction volumes leading to levels that were 17 percent less than those of the previous year (€36.2 Bn in H1 2020 compared to €43.4 Bn in H1 2019), according to “Investing in Europe: Private Equity Activity H1 2020”.

Any activity occurring since the mid-summer “restart” has primarily revolved around the conclusion of deals already begun by private equity firms before the first lockdown period in Europe.

This rather downbeat dynamic is likely to continue over the next six to 12 months in the European private equity market, with 55 percent of GPs and 60 percent of LPs expecting the downward trend in transaction volumes to go on.

Despite the turbulent context, GPs do see opportunities arising in the market, with 46 percent (see Figure 2) believing that over the next six to 12 months there will be stronger investment opportunities in the market, mainly driven by more corporate spin-offs (43.5 percent) and, to a lesser extent, more primary (37.9 percent) and secondary deals (38.8 percent).

3

Postponement of planned divestments drives lower exit volumes in the market

Divestments have particularly been impacted by the pandemic. Over the first semester, these were down by 49 percent on the same period in 2019. A majority of GPs have postponed exits of portfolio companies and are expected to continue to do so until 2021. That will give private equity firms more time to thoroughly assess the market conditions for a structured exit process when trading numbers have returned to an upward trend.

In the short-term, more than half of GPs expect divestment opportunities to be lower. This is likely to remain the prevailing mood well into 2021.

This somewhat negative outlook is also present when looking at valuation multiples, with 50 percent of GPs and 60 percent of LPs taking the view that they will be down on 2019 (see Figure 3).

As a result, short-term returns for the majority of private equity professionals are likely to be lower than the levels achieved in 2019.

4

Operational priorities during and beyond the pandemic

When the pandemic struck, most PE firms rapidly set up various internal teams to provide support to their portfolio companies. These teams were primarily focused on ensuring employee health and safety, securing supply chains, maintaining operations remotely, short-term cashflow planning and the like. As a result of such a different modus operandi, fewer resources were available for new deals or exits, as described above.

We were very quick at setting up ‘war rooms’ for key issues across our portfolio companies. For several weeks, we also held daily telephone conferences with each portfolio company to ensure we were in control of the situation .

Martin Kõdar, Managing Partner, BaltCap

In light of our experience from the pandemic, we also asked what the primary focus of PE firms was now (see Figure 4), and also what would be the most important improvement initiatives for their portfolio companies (see Figure 5). The results depict the reactivity of the firms towards their portfolio companies, as well as their LPs.

Effective portfolio management has risen rapidly up GP teams’ agendas and is likely to remain so for the next six to 12 months. For instance, 70 percent of GPs anticipate allocating more time to operational development and support of their portfolio companies.

In terms of the most important improvement initiatives, cost reduction comes out as the main focus for value creation, with 75 percent of all respondents stating that it is “very important”. Unsurprisingly, digitalization is a key interest for 47 percent of respondents, which reflects the need to accelerate digitalization as a result of the pandemic.

Liquidity financing remains a key agenda topic for 38 percent of respondents. With a second wave of coronavirus already rolling out across Europe, this figure may well rise in response. Recent lockdowns in Ireland, the UK, France, Germany, Belgium and likely elsewhere very soon are raising the prospect of frontier closures, curfews and even civil disorder, which means many companies may have to rely on their existing reserves to ride out the coming storm — even if that storm is shortened by the arrival of a vaccine for COVID-19, such as the one announced on 9th November by German VC-backed laboratory BioNTech and Pfizer.

During these difficult trading conditions, traditional financing such as loans and credit facilities from banks and shareholders have been used to support portfolio companies. On average 44 percent of portfolio companies have used government unemployment support, and 37 percent have requested and utilized government-backed loans for financing. (This was especially the case for portfolio companies in VC funds and midcap PE funds.) To a large extent, portfolio companies’ requests for government support have been approved, except for VC-fund portfolio companies, for which about one-quarter of requests were rejected. This situation demonstrates the relative resilience of the private equity industry in the current difficult context and will most likely remain the case over the coming months.

5

Private equity asset class remains attractive for LPs, but investment strategies may evolve

Irrespective of the short-term situation, the private equity asset class remains a favorite investment for LPs — 60 percent of LPs and GPs expect there to be greater capital allocation to this area over the coming three years, with only a few (15 percent of LPs) taking a contrary view.

Right now, there’s no other asset-class that can match the PE asset class in terms of risk-reward profile, particularly in the current low interest rate environment .

Eric de Montgolfier, CEO, Invest Europe

However, four out of 10 LPs also say they are looking to capitalize on other investment opportunities arising from the COVID-19 crisis by redirecting their investments into distressed asset or secondary-asset funds.

As regards alternative investment strategies, over half of GPs (57 percent - see Figure 6)) see no reason to change tack at the moment, though nearly one in three private equity firms have concluded that the current context may justify looking at investments in new geographies, deal sizes and sectors.

Overall, some sectors are seen as holding the greatest promise: around two-thirds of GPs expect higher investment activity in biotech, medtech, life sciences & healthcare, deep tech and ICT and, to a lesser extent, renewable energy, business services and agribusiness, which about four in 10 respondents regard favorably (see Figure 7).

At the opposite end of the spectrum, COVID-19 has had, and continues to have, a deep and significant impact on major sectors such as tourism and leisure, automotive, real estate (professional) and aerospace and defense (especially the airline industry). Consequently, in the medium term, these will probably be regarded by GPs as offering less investment potential.

6

A changing relationship between LPs and GPs on the horizon?

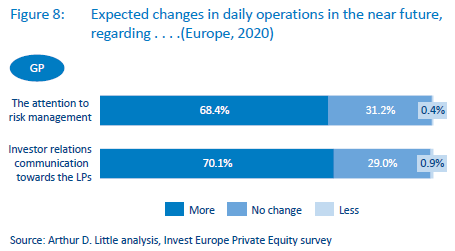

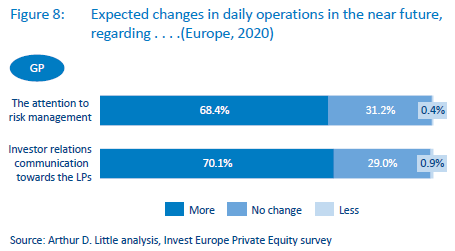

Among both LPs and GPs, there is an expectation that the “new normal” we have entered into will change the relationship between them in ways that have potential long-term implications for the industry (see Figure 8). Almost half of LPs believe, for instance, that future limited partnership agreements will become more “friendly” towards them. However, the majority of GPs don’t expect any fundamental change in their relationship with LPs.

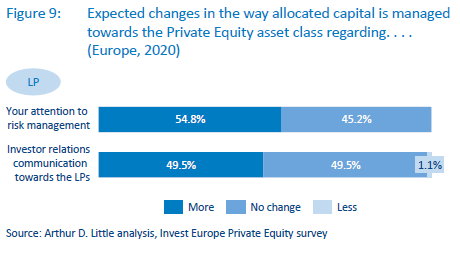

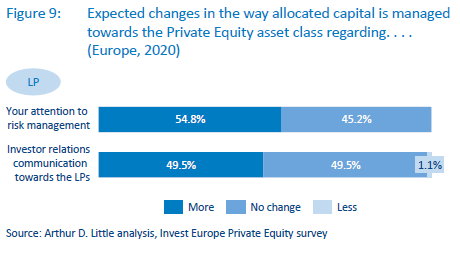

With continuing widespread volatility in the marketplace, a common view among 40 percent of both LPs and GPs is that the scope of investment will extend further (see Figure 9). If that is the case, then GPs should be able to take advantage of new opportunities. This would enable them to diversify their investments, which would afford some protection when they are faced with future volatile conditions and macro events that create turbulence in the market, COVID-19 related or not.

Because of the uncertainty facing the private equity sector, GPs believe that they should place much greater emphasis in the future on risk management and investor relations (IR) communication activities.

However, when LPs were asked the same question, they did not place as much emphasis on either risk management or IR communication. It seems LPs are more satisfied with the way GPs are working than GPs themselves.

During the early stages of lockdown, we were particularly pleased with the quality and frequency of the information we were getting from most GPs. That was both helpful and reassuring that they were on top of their portfolios

Merrick McKay, Head of Europe - Private Equity, Aberdeen Standard Investments

7

LPs and GPs to remain key partners, though their interests sometimes vary

Moving forward, there is still confidence among LPs that GPs will remain key partners; however, they would like to see some changes. So, while they value what might be regarded as the “traditional criteria” (see Figure 10) for judging the relationship, such as the GP team’s experience, track record, investment strategy expertise and sector knowledge, they are also looking for some new attributes that currently are often either absent from GPs or not recognized as important by them.

For example, environmental, social and governance (ESG) is clearly something that matters to LPs, since 70 percent define it as one of their key criteria (see Figure 11). However, ESG did not really appear on the radar of GPs; fewer than half indicated that it was something of particular importance to them. The recent Sustainable Finance Disclosure Regulation that is expected to apply from March 2021 will probably increase the need for GPs to put greater emphasis on ESG.

Investing is more than just optimising returns. We have a shared responsibility to make the world a better place. As investors, this means we have to be proactive in making sure our GPs contribute to sustainability.

Jesse de Klerk, Partner, Stafford Private Equity

In two other areas there is a similar mismatch in thinking. The first is the governance of GP firms, something that was an important factor for 65 percent of LPs, while only 15 percent of GPs indicated that it was of value to them. Also, the experience of a GP’s internal operating team was thought important by LPs, but much less so by GPs.

GPs have spent a great deal of time managing companies in their portfolios during the pandemic and are likely to continue to do so. However, for LPs it is important that they see dedicated operational teams “on the ground” that can support portfolio companies and help steer value creation, especially during the current situation.

8

The future of private equity in a “new normal”

Because of COVID-19 and the response to it, we have entered a period of uncertainty, and potentially high volatility. Unfortunately, with the pandemic accelerating across Europe, there is little sign of this crisis bottoming out in the immediate future.

So, it is likely that in the short-term at least, COVID-19 will continue to dampen the private equity transaction market with a lower level of deals and potentially reduced valuation multiples. Given what is likely to be fierce competition in the marketplace as we move out of the pandemic, there is still a higher risk attached to the PE portfolios of today than those of a year ago. So, the private equity industry must adapt to this “new normal” as best it can, and just as it always has in the past.

Despite the many problems it has brought, COVID-19 has highlighted the efficiency of the PE industry’s business model — the high degree of responsiveness from GPs and support from LPs have minimized the impact of the pandemic on exit timing, helped protect portfolio companies and created real value. As a result, private equity has globally remained the favorite asset class of LPs.

However, the COVID-19 crisis is testing PE’s existing business model as investors move towards sustainable, resilient and fastgrowing industry sectors, such as technology, and restructure funds to take advantage of opportunities better suited to our new environment. Underpinning this will also be ever-greater digitalization, which is leading to more streamlined, efficient processes that will accelerate the rationalization of the industry.

The pandemic is also likely to bring about a new era of professionalism. For instance, the setting up of dedicated teams to manage portfolio operations, as many larger firms already have done, will become much more widespread and greater attention will be paid all round to ESG, especially in the wake of recent changes in regulation.

It is also likely that the current relationship between GPs and LPs will move beyond the transactional as better communication and understanding lead to wider recognition that protecting the value of their shared investments is of common interest.

However, the impact of the current crisis will require further assessment if we are not just to limit the negative consequences of COVID-19, but also to anticipate and seize new potential investment opportunities when they appear.

Although there is continuing turbulence in the marketplace, we can presume that at some stage a new equilibrium will be reached as those in the market adjust their approaches to accommodate the new COVID-19 reality. And looking forward, we see that there are some positive fundamentals already in place to build on.