Who dares wins!

How access transformation can fast-track evolution of operator production platforms.

Executive Summary

Summary and key ideas

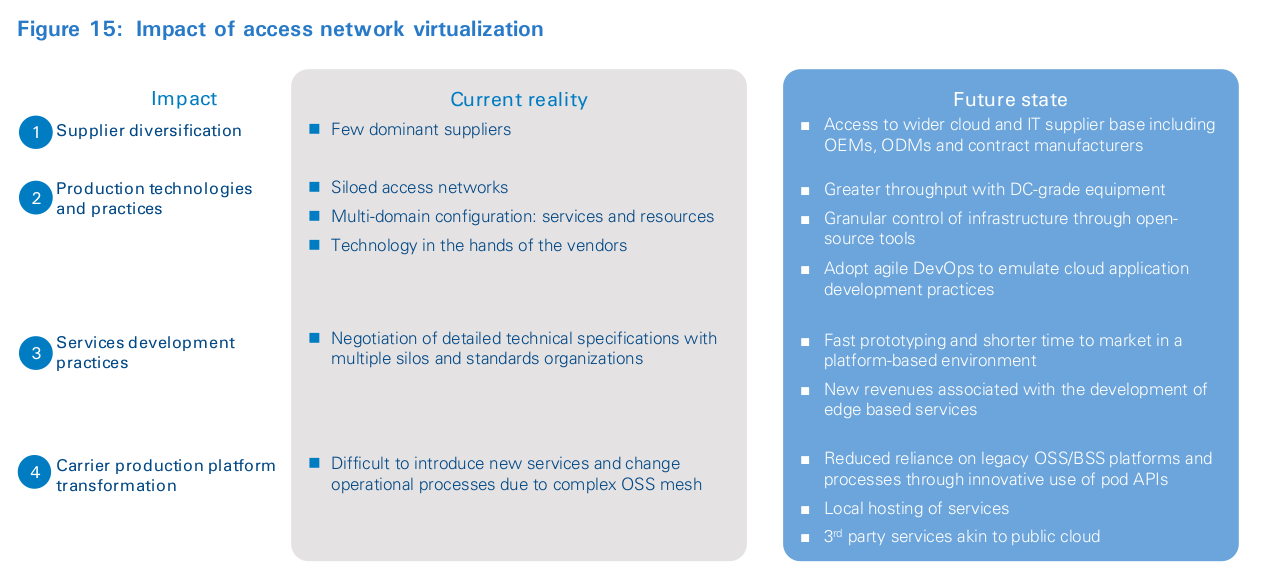

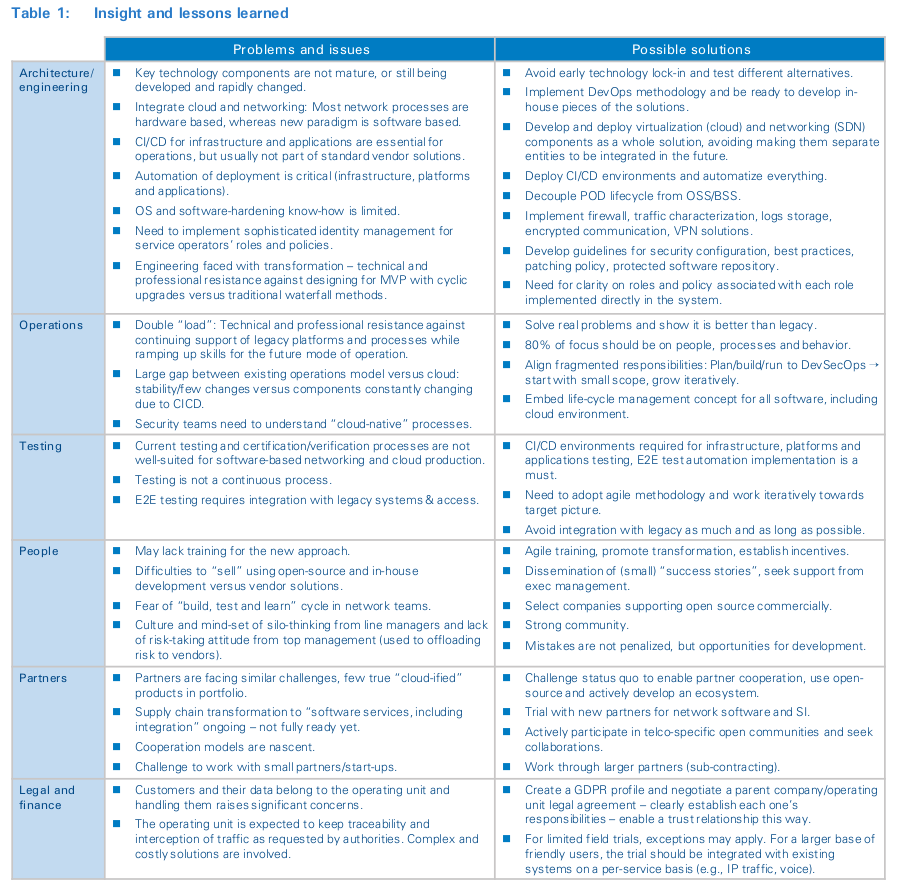

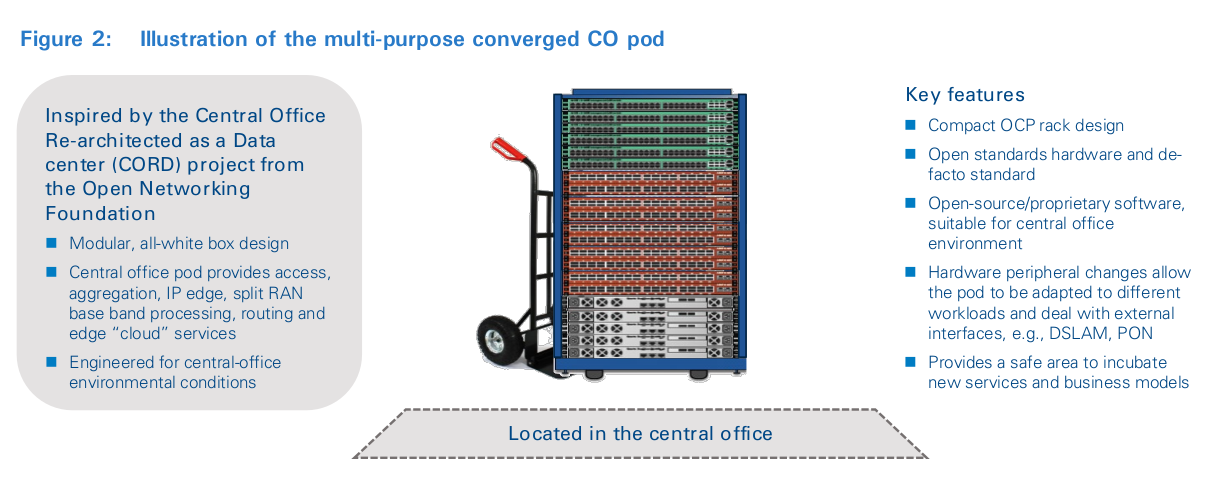

Rapid advances in data center and cloud-based technologies have put the entire operator ecosystem in motion. Operators and their shareholders want to use the automation advantages of deploying and managing infrastructure and services with modern cloud tooling, but have a large, embedded base of legacy OSSs and BSSs to deal with. Not all operators will change, or can adapt, at the same rate as this technological and cultural disruption, so industry norms and standards bodies are struggling to provide timely and usable solutions to the hard problems facing the industry. Traditional telecom equipment vendors are in a predicament. Their customers want solutions with cloud-like simplicity, open interoperability and performance, but shifting to open architectures puts their business models at risk. They’ll need a credible alternative that will allow the industry to modernize, as well as regenerate the supply chain.

Recognizing the challenge, a handful of operators, including AT&T, Deutsche Telekom and Telefónica, are defining an alternate pathway. Their pioneering approach relies on disaggregating and virtualizing the access network to considerably expand the role of the central office, in order to include fixed and mobile aggregation and edge cloud services. This paper describes their ideas and provides insight into their real-life experiences to make the new approach production ready. While numerous execution challenges require further attention, this paper makes the case that, for “those who dare”, access-driven transformation provides an exciting alternative to the status quo.

Key messages of this report

- Operators shouldn’t wait to help themselves transform.

- To remain relevant, the industry must adopt data center technologies and align operating models with cloud-based ways of working.

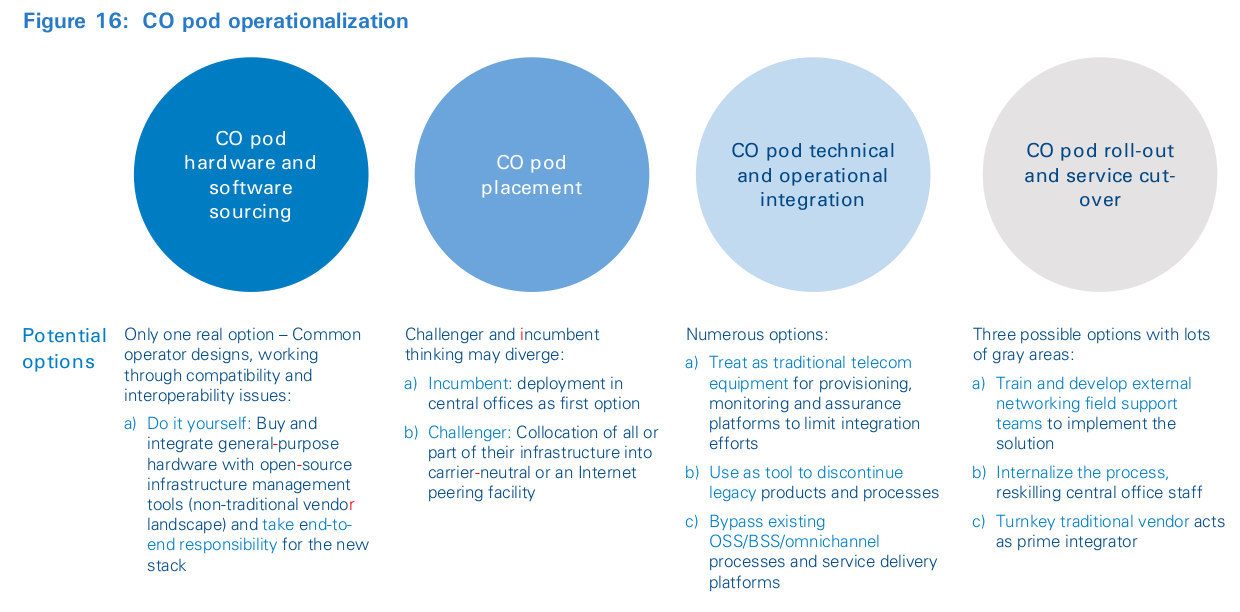

- The “CO pod” provides operators with a new toolbox to virtualize/re-engineer existing services, as well as prototype and test new service ideas, based on cloud-hardened development and operations methodologies.

- Operators must decide if they will lead or follow; for “those who dare”, the prize could be significant.

- Strategic priorities, not technology, must drive access-driven transformation programs.

- Access-driven transformation replaces the traditional central office aggregation function with a leaner and lower-cost design that reduces TTM.

- The CO pod considerably widens choices for operator production platforms.

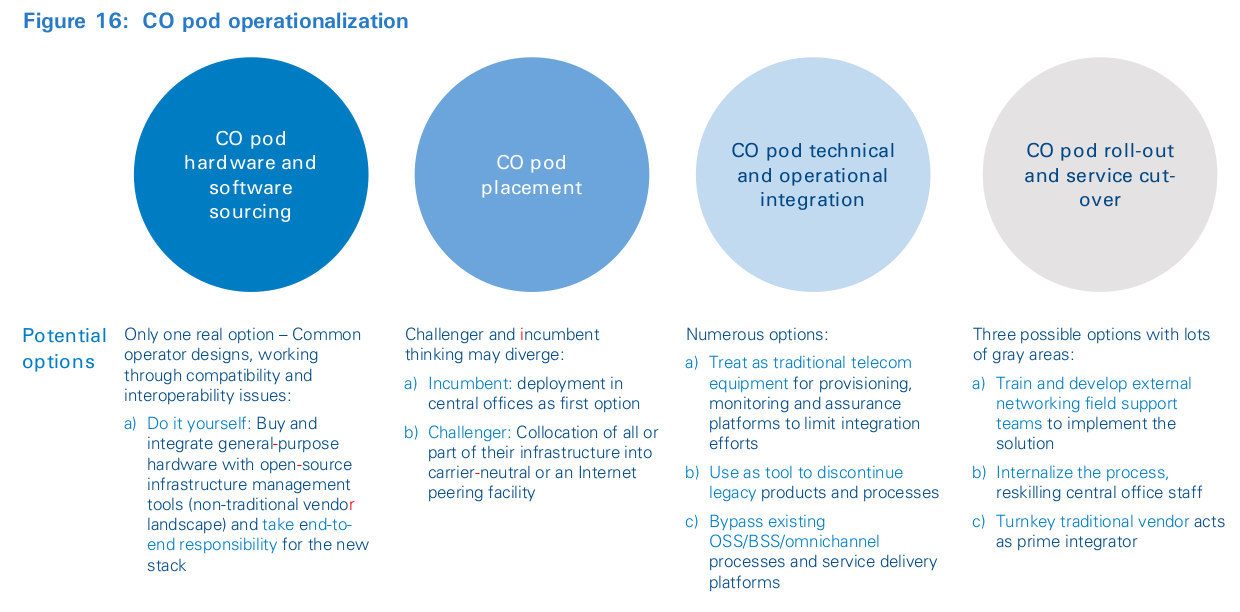

- Making the new design a reality requires operators to address four operationalization challenges.

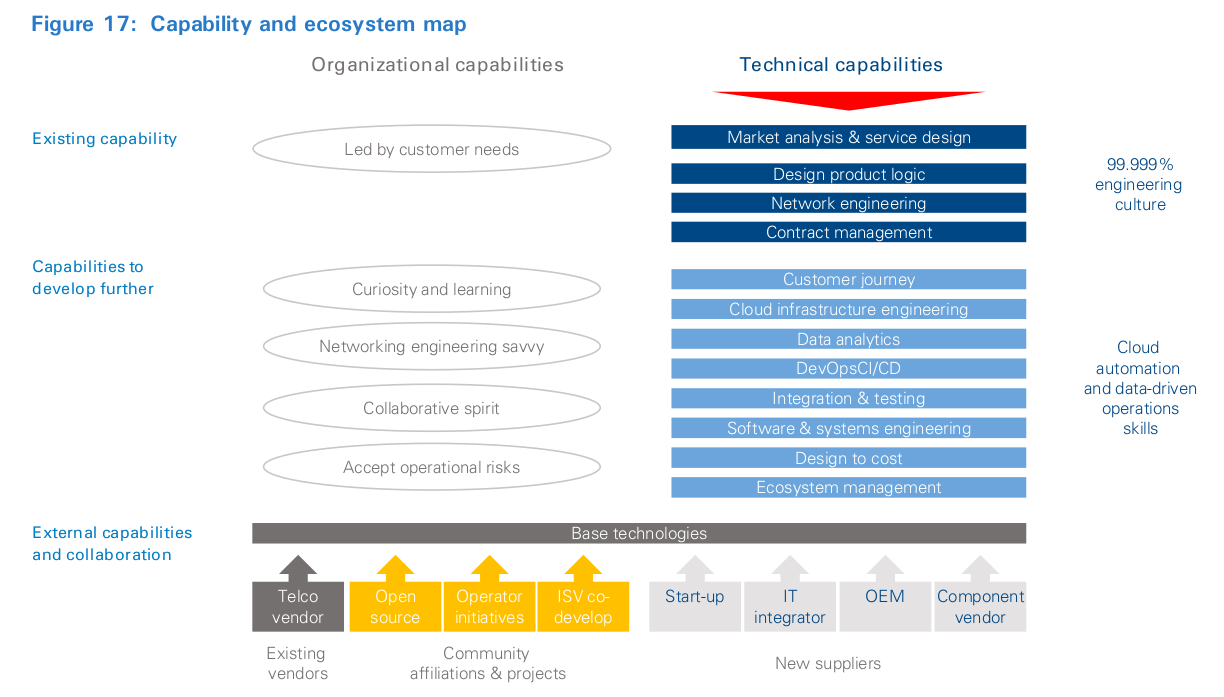

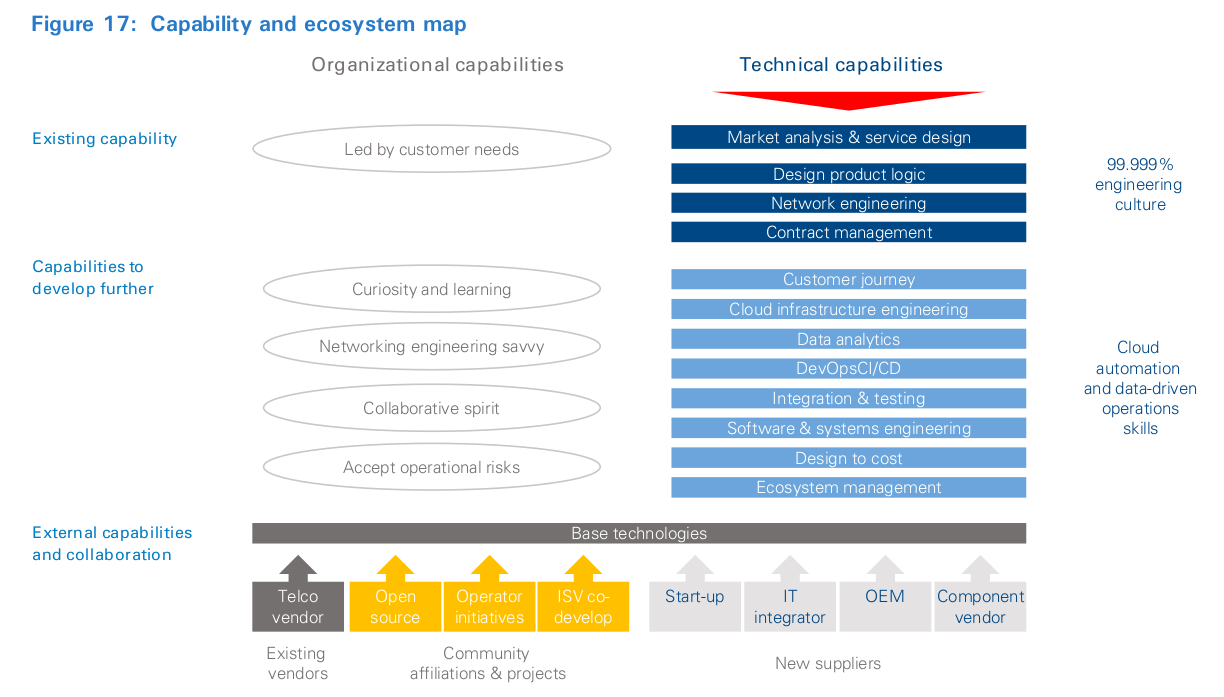

- Success requires operators to acquire new skills in engineering and supply chain, and to rethink investment planning.

- There is no “best approach”: program, design and monitoring must be tightly linked to corporate KPIs.

How to read this document

This document is divided into two modules. The first module is directed at a generalist and technical audience, targeting operator decision-makers from corporate development, as well as product managers, marketers and C-levels. The second module is a deep- dive directed at an operational and technical audience and is intended to encourage greater investment and resource dedication to access-driven transformation, as well as foster community among operators.

The central office pod for generalists

This generalist module is contained in the five sections. The first section outlines why existing operator transformation plans are challenged. The second section describes how access-enabled transformation can enable an alternate production platform and product development pathways. The third section examines the strategic option space enabled by the CO pod, quantifying the key value drivers for change. The fourth section looks at the leadership challenges associated with pivoting toward a cloud-based business and makes the case to upgrade operator skills and expand the supplier ecosystem. Finally, the fifth sections contains insight from AT&T, Deutsche Telekom and Telefónica on how to structure and launch a minimum viable program.

The central office pod for technologists

The technical deep dive module (background in blue) is directed at a technical audience focused on network architecture, operations and supply chain management, as well as existing and prospective operator technology suppliers. It is contained in five additional sections beyond the five generalist sections outlined above. Starting from section six, we outline the design for new edge aggregation and a cloud pod that underpins the CO pod. Section seven examines how the new design creates new options to change the operator production platform. The eighth section examines the operational implications of onboarding the new design. The ninth section looks at how to rebuild core capabilities and supplier ecosystems. Finally, the tenth section contains recommendations for how to get started, drawing on lessons learned from AT&T, Deutsche Telekom and Telefónica.

1

Why business as usual must change

Operators shouldn’t wait to help themselves transform:

- The cloud architectural pattern is the focus of innovation in multiple industries – and drives technological convergence across all of them.

- Operators need to strengthen their technical and operational capabilities to onboard new technologies and innovate; this is evidenced by initial SDN and NFV deployments’ inability to deliver real benefits to operators.

- Operators should not expect standards development organizations (SDOs) or existing vendors to deliver a credible pathway to the cloud.

- Operators must espouse cloud technology, operations and ecosystems, in order to help themselves.

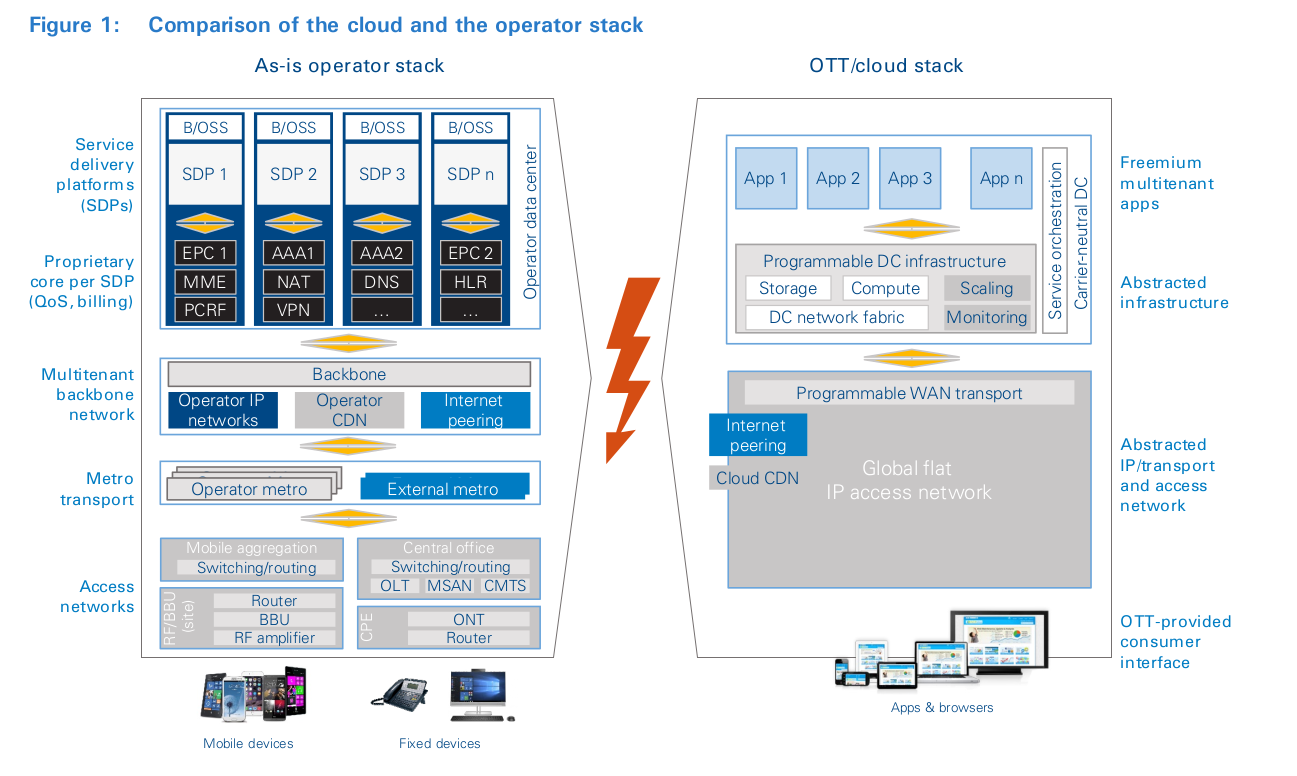

A substantial cloud ecosystem has emerged, which serves both consumer and business users and relies on access connectivity provided by operators around the globe. It consists of a wide range of companies that are described with terms such as “over the top” (OTT), cloud service providers, and web-scale operators. They provide a diverse range of services, from infrastructure to platform and application services. Despite their diversity, they all have one thing in common: they are unlike traditional telecoms operators. As shown in Figure 1, the scope of their activities and operating models is based on a very different technology architecture. OTTs typically provide services built on virtualized, abstracted and programmable compute, storage and networking resource pools whose underlying technology is a multitenant platform, accessible on demand to everyone connected to the World Wide Web. In this ecosystem, the only barriers to entry for a new global OTT are software development skills and a credit card. Success has propelled some cloud companies much further, building hyper-scale infrastructure and ecosystems around search engines, social media, video distribution, infrastructure and devices. Despite the potential regulatory and security shortcomings of this new cloud ecosystem, it has become the force du jour, upending the dominance of the traditional IT and private networking stack. It has attracted services that once were siloed to operate over the global Internet, such as VoIP, IPTV and instant messaging. It has also created many more (myriad) services and capabilities that it would have been inconceivable to create any other way. For operators, sandwiched between OTTs and their customers, the innovation and traffic-growth cycle means operators must continuously upgrade access networks to cope with increasing traffic from customers loyal to their smartphones, tablets and apps. This is because, despite their excitement about cloud services, consumers’ and businesses’ willingness to pay operators for incremental traffic is null or very low.

Few operators would claim mastery of the cloud architectural pattern applied to communications. Beyond internal culture and established architectures and practices, operators are reliant on standards development organizations (SDOs) and a shrinking set of global vendors, which have been slow to provide solutions for operators in order to take advantage of the technologies and business practices in the adjacent cloud markets.

The origin of the problem is how the industry innovates. Future industry offerings are based on the work of SDOs that collectively determine the industry roadmap, setting the overall direction and pace (see inset: “System standards”). Their well- intentioned interoperability- and compatibility-focused work is developed through a gradual process of consensus building among operators and their suppliers. The outcome is often complex and detailed guidelines and specifications that attempt to balance the conflicting interests of the parties, rather than emphasize innovation.

The existing innovation model has allowed the industry to achieve many things, such as xDSL and FTTx, and to go from GSM to 5G. However, there are several unfortunate aspects and effects of this standards-driven process. It is inward-looking and, consequently, often late to adopt new thinking. It’s especially difficult to provide reasonable standards when technology jumps from one adoption curve to the next. To date, few SDOs have been able to internalize cloud technologies and methods or shape the operator service portfolio toward the cloud era.

System standards

The role of standards is not all good or all bad. There is clearly a place for, and benefits from, many types of standards. Much business and technology innovation stems from basic or “component” standards that support global interoperability and reuse of common components across sets of systems, including operator networks. Examples of component standards include ethernet, wi-fi, and TCP/IP. Component standards are useful, not only in telecoms, but also much more broadly: for example, standards for headphone jacks, power receptacles and tires. Problems can arise when standards become too large in scope. Imagine standards that would prescribe the entire headphone, exactly which devices could be attached to power receptacles, or entire cars or trucks. Standards with system-wide scope will, by nature, take longer to establish and react to changes in the marketplace. But carriers typically desire or, in some cases, are regulated, to comply with these standards to provide globally interoperable communications.

In contrast, OTTs can freely determine the system architecture for their services. They do not need to cooperate with their competitors, and their constraints are simply to build on top of existing common infrastructure and interoperate over the Internet.

System standards are typically driven top-down, with specs that efficiently support the use cases that were used to form them. Operators often have siloed 5 networks and operations based on different services that follow different standards (or came from different acquisitions). “Why bother when the vendor knows the standard best?” is a common mindset. Consequently, rather than being a source of innovation, the model has become to develop standards as an industry harmonizer. Despite hiring the brightest engineering minds, the industry has been incapable of reforming SDOs to create real-world, operator-class cloud solutions.

It is not our intent to lay all the industry’s woes at the feet of standards – just to show this as a significant example of how telecoms has matured and ossified, and luckily one that we can do something about.

There are other drivers in the mature telecoms industry that have led to compartmentalization and specialization over time. Some of these include divestment of the industry into manufacturers and operators, separation of regulated and non- regulated services, freezing of service definitions into tariffs, network unbundling regulations, and long-term, negotiated relationships with suppliers of materials and labor. This is the backdrop to the strategic challenge and opportunity facing the industry. All these characteristics are desirable for maximizing efficiency within a status quo. However, gaining access to much more innovation, supplier options, and service options means disaggregating system standards and taking a fresh look at the business from many facets, including technology, interfaces, and component choices.

The change does not come without a cost. Adhering to system standards for networks has allowed operators to reduce their levels of engineering and design skills. However, the flipside is that operators might have also lost their technical and operational capabilities to onboard new technologies and innovate. Sadly, without this skill set, the well-intentioned efforts to advance and adopt SDN and NFV are largely without real benefit to operators. Operators are not getting the technologies they need and are unable to use the ones they get. There is not yet a proven approach or credible supplier to internalize cloud technologies, and one may never emerge if the industry follows its current trajectory.

Recognizing that the industry cannot wait, a few operators, including AT&T, Deutsche Telekom and Telefónica, are working on an alternate approach based on cloud architectural thinking and ways of working. Collectively they believe, if access networking could be rewritten as a cloud-native workload running on COTS infrastructure, it would open three significant and attractive possibilities. First, the increasing traffic demands could be better served using the more efficient cloud technologies and operations. Second, the flexibility offered by programmable, general-purpose, cloud-like infrastructure enables highly targeted elastic approaches without the need to forklift the whole system. Third, access need not be the only workload in such a deployment, and new services, from infrastructure to applications, can be made available to wholesale users and customers. The following section describes this concept and illustrates how this clean-sheet approach can enable operators to experiment with and internalize cloud technologies to positively transform their businesses.

2

The central office pod – A winning cloud design

To remain relevant, the industry must adopt data center technologies and align its operating model with cloud ways of working:

- The CO pod is a cloud platform, built on cloud technologies, and enables cloud ways of working.

- The CO pod uses the same open-source tools, cloud networking, data center technologies, and service mind-set that are used by cloud behemoths, as well as the same DevOps techniques to automate workload and infrastructure management.

- The CO pod design can support multiple mobile and fixed workloads, including edge computing.

- Aligning their technical platforms with hyper-scale architectures allows operators to better address data and network growth, as well as increase the available labor pool.

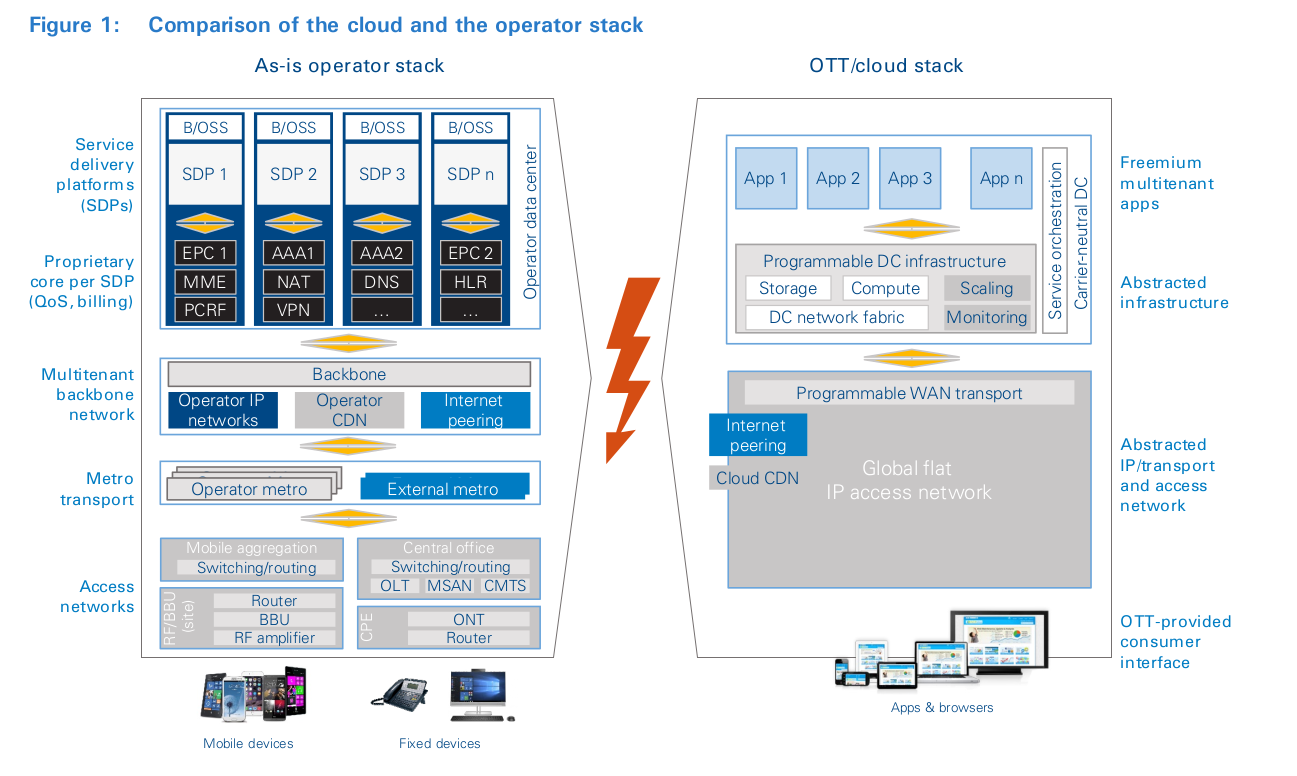

The central office pod, or CO pod, is a new design that takes a different approach to operator transformation. It avoids boiling the ocean with long-lead-time, multi-domain-operator transformation programs. Instead, it focuses on reimagining the operator production platform as a cloud-services platform, starting with the access network. Through clever rearchitecting of industry-standard designs and using CUPS 6 principles, proprietary access equipment is disaggregated and morphed into a small-scale infrastructure cloud platform with specialized access “peripherals”, which provide an “access-as-a-service” software platform (see inset: “Origins of the CO pod”). However, this design is critically different from its proprietary equivalent in three ways. First, the CO pod can run access as well as other application workloads on the same hardware and software stack. This requires a re-think of networking as something that can be dealt with in an IT way. Second, it uses the same open-source tools, cloud networking, data center technologies, and service mind-set that are used by cloud behemoths. Third, it uses the same DevOps techniques to automate workload and infrastructure management. The combined effect of these architectural changes is creation of altogether new possibilities for operator production platform transformation. Access networks and associated IT systems represent a large proportion of industry capital spending, so even small improvements in competitiveness from one operator to the next can boost operator value generation capability and ROI significantly. The CO pod also de-risks potential cloud services and network edge services, because it does not isolate capital investment to only one purpose. Because there is a constant need to invest in network upgrades and expansions, and since there are regular technology advances that increase the data rates in networks, there is a safe business plan to deploy cloud infrastructure solely to support network growth. Additional services on that same cloud are at little or no risk of stranding capital and can be opportunistically explored. In our collective view, because the CO pod provides a safe place that lowers the costs and risks of experimentation and learning cloud concepts in the operator production environment, it is uniquely able to drive service innovation – and therefore, it is a winning design.

Origins of the central office pod

The CO pod design is inspired by Open Network Foundation’s (ONF’s) CORD program, and also by the Open Compute Project (OCP) efforts to drive web-scale technologies into other data centers and adjacent industries, such as telecoms. Mimicking the cloud architectural pattern, it sees central-office infrastructure engineered, provisioned, and orchestrated, just like with web-scale data centers. In this new design, modules of network, compute, storage, and applications work together to deliver networking services in a repeatable design pattern that supports both fixed and mobile applications. It is a single, multipurpose architecture that allows workload pooling, which lowers cost and complexity. It has also been shown to be more capital, energy, and labor efficient. As a result, it has a track record of elastic scalability to handle large numbers of devices and traffic compared with the ability of traditional network and data center platforms. Finally, it has been shown to enable rapid innovation in one of the most competitive marketplaces: the World Wide Web.

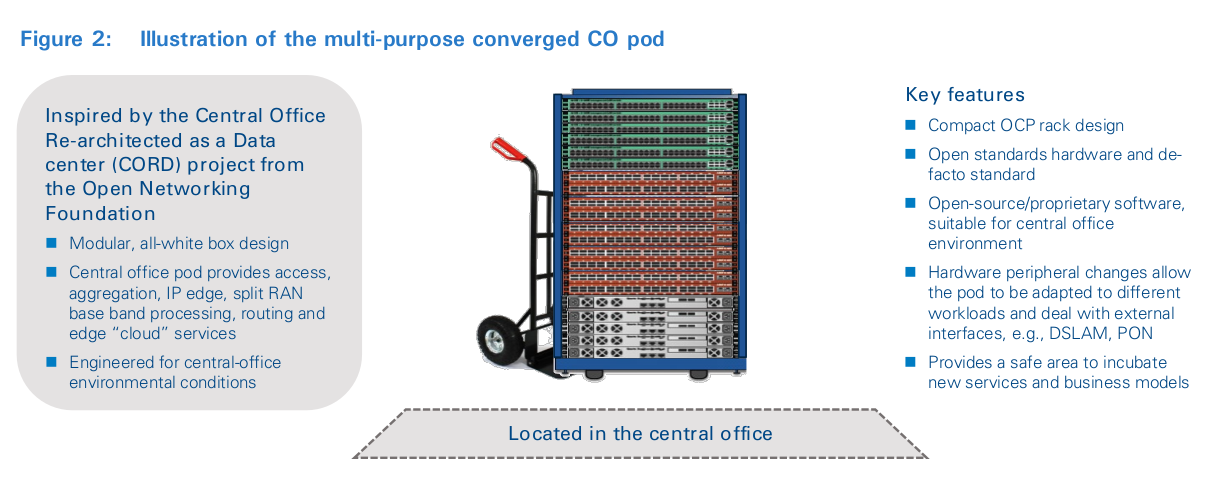

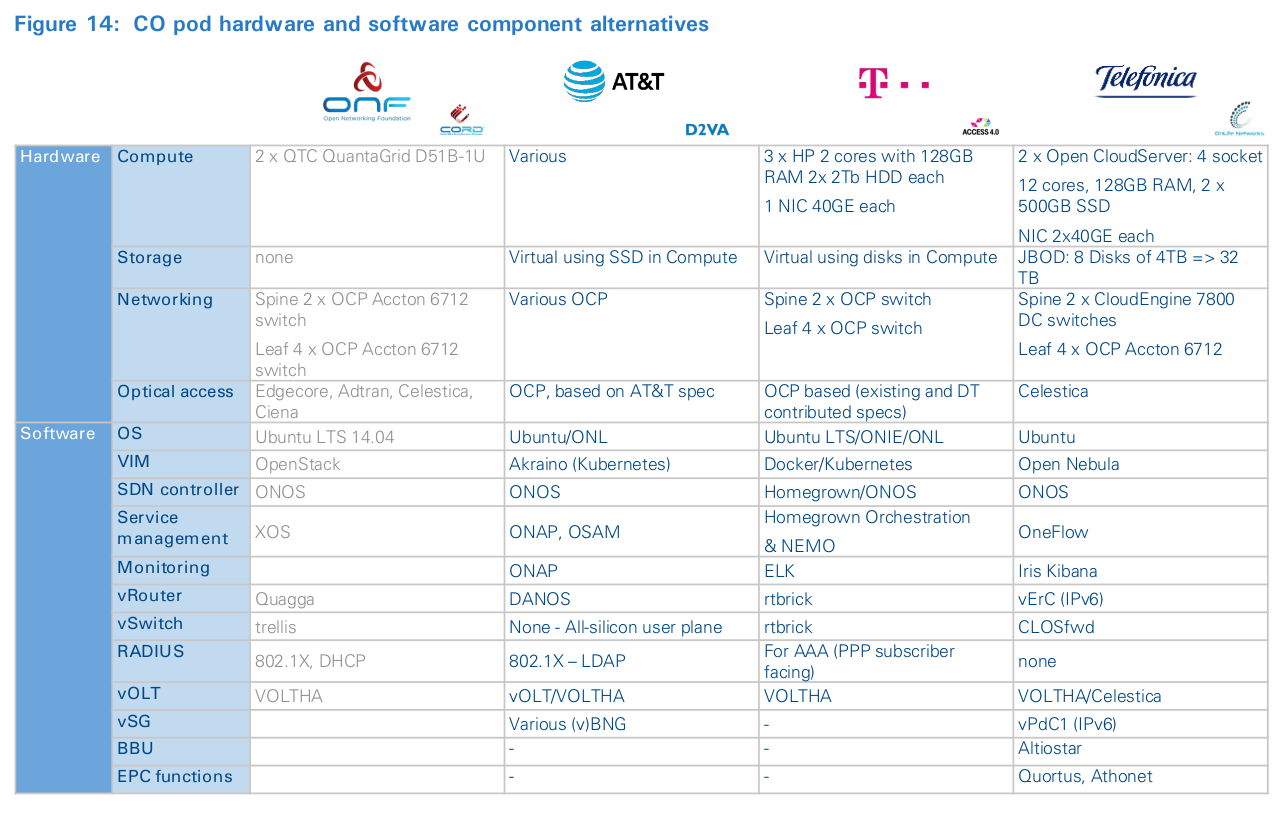

The physical basis of the new design is a modular, multipurpose infrastructure pod engineered for the central-office environment, as shown in Figure 2. The CO pod is not based on one- off hardware designs from telecoms industry vendors or OEMs; rather, it is based on general-purpose OCP hardware specifications, which are supplied by many vendors and used across many industries – with some diligence to ensure they can work in central-office environmental conditions. It consists of a composable rack of compute, storage, high-speed, programmable switching fabric, as well as special-purpose devices to enable FTTx access, called disaggregated OLTs; all of which are supplied by cloud industry vendors or ODMs. Like many cloud systems, there is no need for a complete consensus on several important elements, such as deployment topology and the appropriate software environment. There is room for system differentiation, even though these are constructed from similar or even identical components. The ecosystem enjoys multiple options and approaches, which enables higher levels of technology control. These include both open-source/spec and proprietary components, as well as commercial support options, with varying degrees of system integration provided in-house or by independent suppliers.

Workload convergence

An appropriately equipped CO pod can support multiple workloads. The CO pod can focus (be economically justified) on fixed-network access in FTTx environments, and also serve as an edge production platform for smart home or office and perimeter security services. The CO pod can support stand-alone edge services, future 5G services, and edge cloud applications. Bringing together mobile and fixed workloads in a common pod allows truly converged services, enabling transparent, access-agnostic traffic aggregation and management. The CO pod can also be used for much more than simply hosting operator edge functions, including cloud value pools. With the right security and isolation between internal and third-party workloads, spare capacity can be made available to third-party developers. Leveraging the locational advantage of the pod to provide low-latency infrastructure services, developers can deploy latency-sensitive workloads such as augmented reality and localized, data-intensive workload processing as a precursor to ultra-reliable low-latency services in 5G.

Edge computing services

Redesigning access networks also provides the tools for operators to innovate services and user experiences - emulating cloud players. Just like a public-cloud DC, the pod is a delimited infrastructure resource, which means it can be managed, provisioned, orchestrated and patched in isolation from the rest of the production platform. As a result, it provides a safe place to experiment with new product ideas and software prior to widespread deployment.

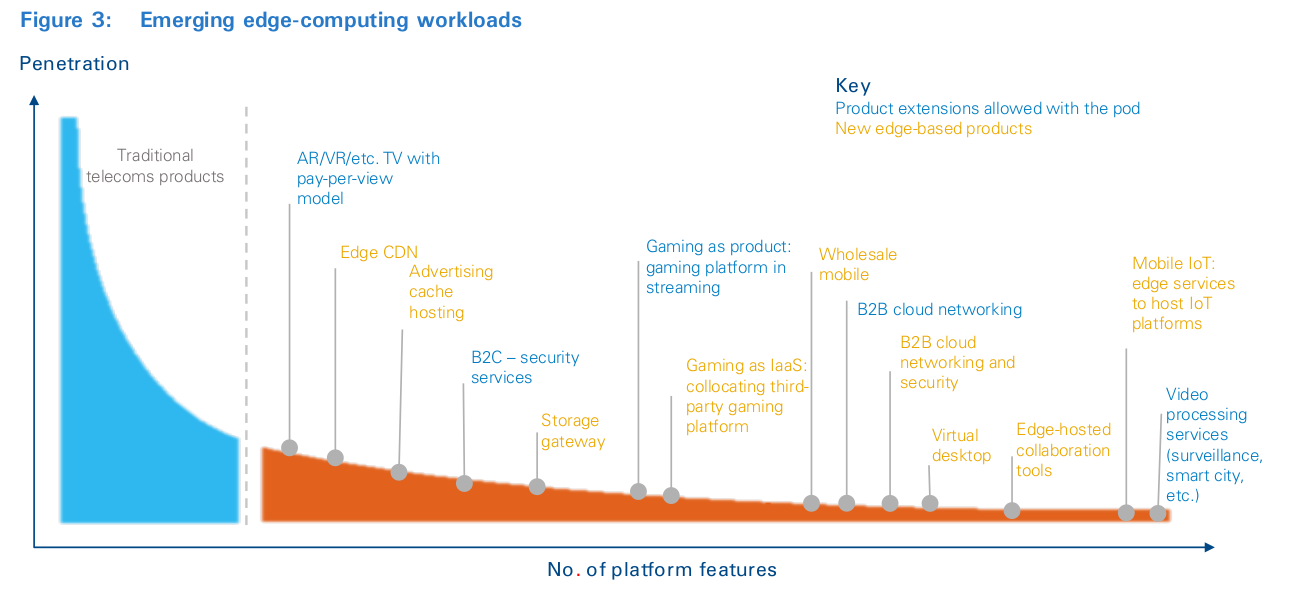

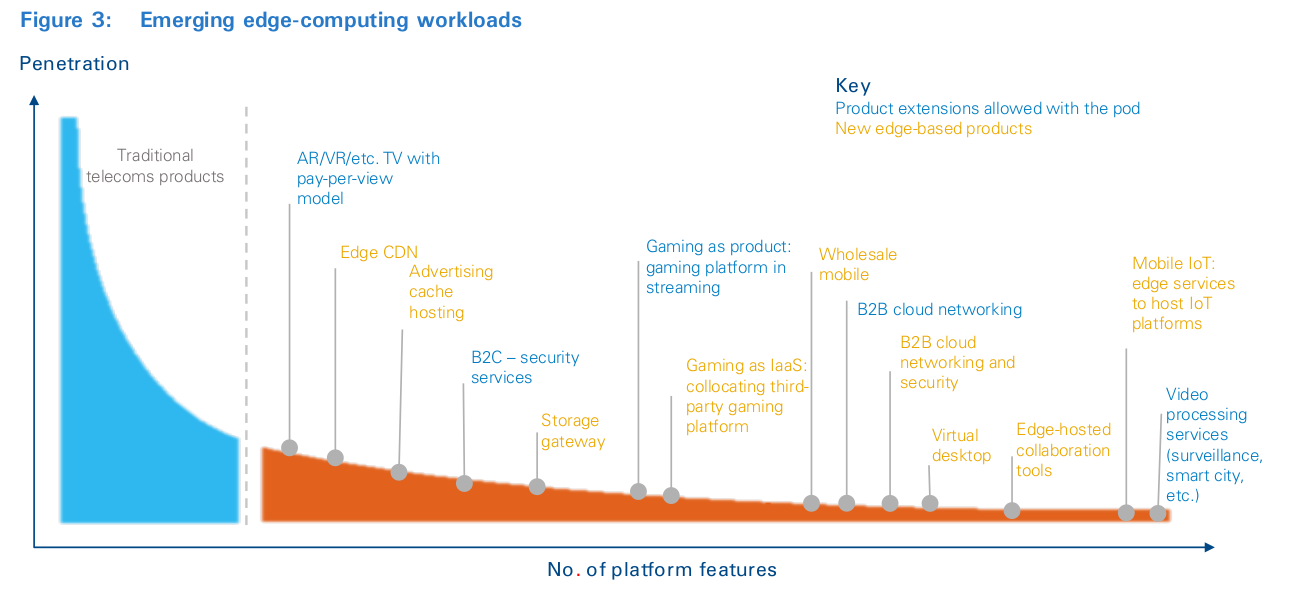

New services might use the CO pod’s locational advantage as a feature to meet the needs of latency-sensitive, massive-edge data or cyber-type workloads, as shown in Figure 3. Alternatively, the ability to locally host services can be used to delocalize centralized service delivery platforms, as well as customer and order management systems 7 . This can enable a new type of quasi-autonomous production model that contains locally hosted application services; subscribers consume most of their services from central-office infrastructure. This new approach to production can provide a transient or permanent solution to the complexities of dealing with dozens of legacy services and platforms. In addition, under the right conditions, local hosting and other local micro-services can be extended to third parties, based on an open-edge infrastructure services model akin to the public cloud, to cement partnerships and capture additional revenues.

Adopting the CO pod allows operators to not only address the forces of change, but also recast themselves as infrastructure- based service companies built for service differentiation, or ultra- lean, low-cost connectivity providers to edge-based applications. Specifically:

- Aligning operator technical platforms with hyper-scale architectures allows operators to better address data and network growth. It also ameliorates changes in technology, suppliers, and generations of equipment and reduces the time to market for these types of changes. The CO pod comes along with disaggregation of vertical equipment architectures and remapping of the resultant capabilities to appropriate cloud-native micro-services, merchant silicon, and cloud infrastructure so the system can be largely supported using typical data center equipment. This helps to bring much-needed competition into the industry supply base. Moreover, softwarization of access networks enables the use of cloud-hardened, open-source software to facilitate continuous innovation, closed-loop automation and services mashups (see inset: “Retooling for automation”). The outcome is a dramatically wider universe of hardware, as well as commercial and open-source software solutions that bring operators closer to the economies of scale enjoyed by web-scale providers.

- Adopting cloud technologies widens the addressable labor pool from which operators can source talent. The cloud paradigm is developing a vast new pool of talent from cloud and security architects, big data engineers, and agile and DevOps specialists. Their tools of choice and skills are vastly different from technical skills previously found at operators. The wider virtualization movement, which caught the industry unprepared as well as under-skilled, provides important lessons. Rather than taking an insular view to talent, the new design recognizes that the industry must pivot towards the same platforms and tooling that are common in the cloud; this will enable the industry to draw on this wider labor pool, which will bring with it vital skills and ways of working to drive individual as well as industry competitiveness.

Bringing cloud technologies and practices inside the telecoms operator allows the industry to align itself with the cloud paradigm. It is not yet apparent whether operators should replicate existing cloud models for innovation and monetization or find other ways. Whatever the direction, the architecture enables operators to fast-track transformation as well as have a go at innovation, creating meaningful differentiation among operators. However, for the CO pod to become reality, it must be industrialized, productized and deployed. In the next section, we make the strategic and economic case to invest in doing just that.

Retooling for automation

It’s critical to drive automation into the design, deployment, and operations lifecycle of the CO pod. Looking at Figure 3 and taking penetration as a factor in determining revenue, it should become clear that developing bespoke approaches to the most popular of services may be possible. However, that approach adds increasing overhead as you move along the long tail and will prevent deploying profitable services at some point.

When developing, using, and reusing common automation across services, the incremental expense needed to support the next service is only in its use of infrastructure resources, not any additional design, deployment and operations cost. In short, the ability to support and monetize long-tail workloads is contingent on the ability to drive end- to-end automation.

3

The case for the central office pod

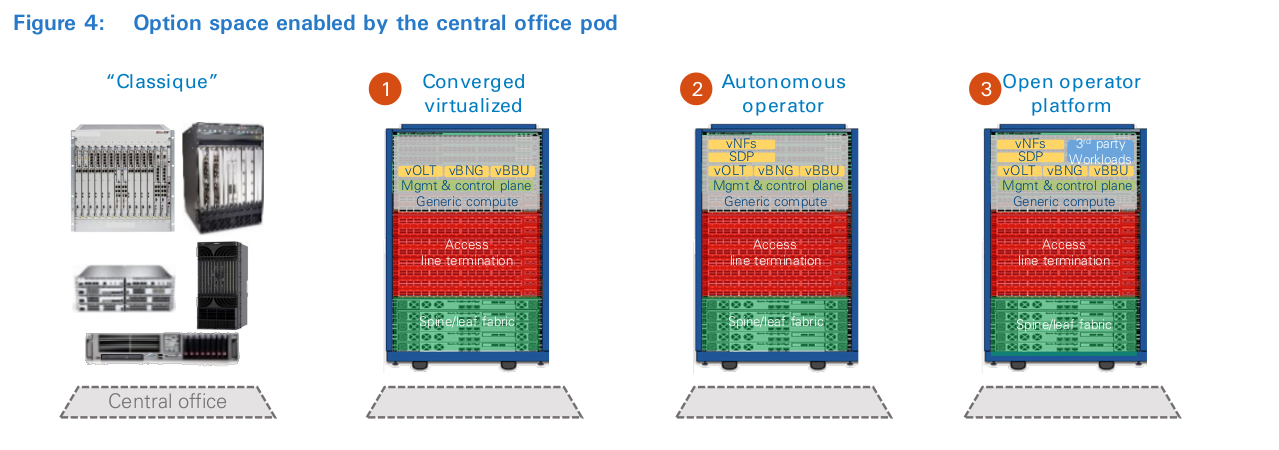

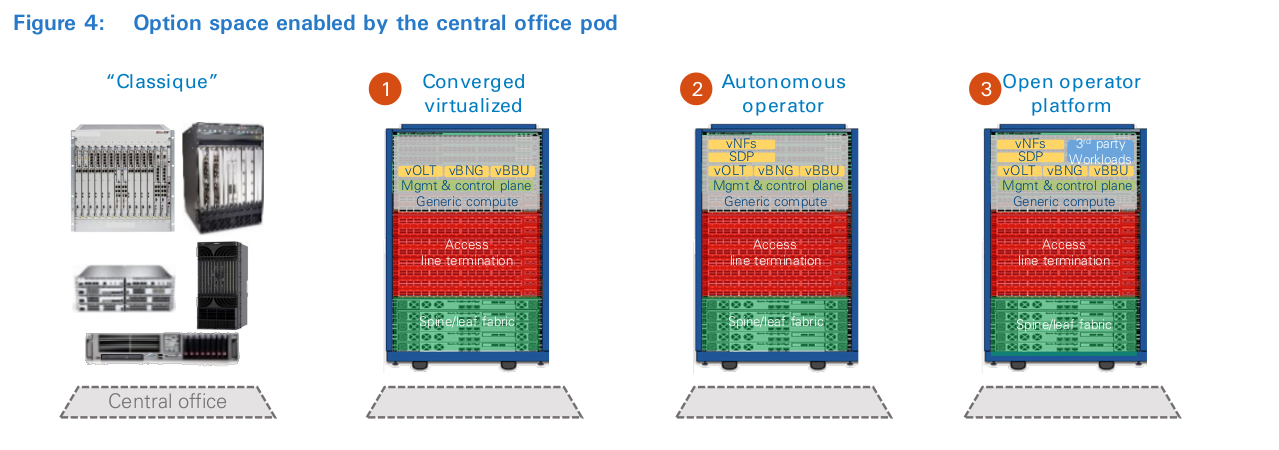

The CO pod provides operators with a safe place to virtualize/re-engineer existing services, as well as prototype and test new service ideas, using cloud-hardened development and operations methodologies. The CO pod gives operators a safe place to start over; we see three options:

- “Converged virtualized access” can encompass both fixed and mobile access, harmonizes the way all traffic is treated at the edge, and provides higher throughput at lower total cost of ownership.

- “Autonomous operator” opens a range of options to deploy complementary, highly-automated edge services using the CO pod.

- “Open operator platform” enables qualified third parties to exploit the edge using pay-per-use models in a model akin to public cloud.

No two operators have the same priorities or starting point, so a thorough economic analysis must consider the specific competition, technology roadmap and debt for each case individually. Nonetheless, to illustrate the logic and benefits of onboarding the CO pod, we describe three pathways for product and production platform development, as shown in Figure 4. The economic logic of each pathway is determined using a side-by-side comparison of proprietary equipment designs with comparable functionality that were built using disaggregated and virtualized data center equipment (i.e., procurement levers only). However, the strategic benefits of the CO pod architecture require a more holistic view of the changes enabled by the new design, such as agility and efficiency in developing new offerings, channels, operations and supply chain value. These changes provide the foundations to drive step-change improvements far beyond procurement, including end-to-end production platform efficiency and innovating the operator business model. Nonetheless, such direct comparisons are valuable because the latter is subjective.

Converged virtualized access

The first approach, also a segue into the other two options, is to use the CO pod for virtualized access as defined today within the existing technology landscape. Virtualized access can encompass both fixed and mobile access and harmonizes the way all traffic is treated at the edge. This saves backhaul cost, reduces interfaces towards the backbone, and enables hybrid access at almost no additional cost. The economic logic behind this choice is that the pod provides higher throughput at lower total cost of ownership compared to classical industry equipment designs. At the same time, it simplifies the process of integrating the technology into an operator network. Because the CO pod is based on commonly available, open hardware and software, there is a great amount of transparency into multiple areas of concern. Hardware BoMs are known and available from multiple suppliers, so design-to-cost, fair pricing, and vendor lock-in can all be managed effectively. Software is also open, so the operator is much more able to manage similar concerns about the value being provided by a software integrator or supplier and, very importantly, vendor lock-in. This first approach has arguably the lowest technical risk of any of the approaches but limits the rewards to efficiency gains for providing broadband access and access convergence. For many, this is a no-regrets rationale to get started on deploying the CO pod, with the next two approaches becoming bonus benefits that can be pursued in the future with little additional investment.

Autonomous operator

As an extension of the virtualized access concept, the second approach utilizes the full set of technical capabilities of the CO pod, expanding the scope to include non-access operator services. The rationale behind the choice is exploiting the platform capabilities of the pod to shift other telco services towards the edge. This is not simple; it requires taking a hard look at existing processes and systems to determine a systematic approach to service and operations transformation. Key to this effort is the creation of marketable, differentiated and/or low-cost edge services, while using the change to reduce dependency on legacy platforms. Operator investment pivots from simply providing bandwidth over long distances to supplying infrastructure that allows applications to consume less bandwidth because there is less distance to their users.

It is important to note the potential benefit of distributing services, in that it can help simplify OSSs, as well as service logic and design complexity (see inset: “New options for distribution”). Many of today’s services are supported with sets of network elements distributed across several offices – like beads on a string. Such services need to be managed as a distributed system, and that pushes a lot of the management and service assurance into the central OSSs that oversee multiple locations. Moreover, fault tolerance often requires geo-redundancy and service state to be duplicated in multiple locations. When a service is largely or completely located at the edge, distributed service assurance and provisioning becomes a local matter and the OSS is simplified at the central tier. This distributes complexity in a more manageable way. Moreover, as for geo-redundancy, in most cases there is little that can be done when the serving office has a systemic failure, since the customers are not connected to any other office, and therefore there is little need to consider redundancy beyond that locality. Note that this argument considers that there is still a highly available WAN IP network attaching to these edges.

New options for distribution

For decades, common sense for operators has been to centralize when they can and distribute when they must. The second approach challenges that logic. Rationale for centralization has been based on aggregating service workloads into larger, more efficient, less fragmented network elements, and it still holds true for legacy box deployments. However, with workloads becoming software in computers or slices projected into merchant silicon switches, it has become possible to distribute fine-grained amounts of service logic without fragmenting the capacity of edge cloud infrastructure. In this environment, a new preferred topology emerges. That topology distributes service capability and logic to the point it’s delivered, and that point is at the edge of the network. However, databases for service entitlements, data lakes to feed automation engines, and principal management and control operations facilities remain central.

Open-operator platform

An independent third approach is to use the CO pod for edge cloud services. This is another logical extension of the first approach. The economics underpinning this choice is the ability to sell excess infrastructure capacity for use by applications that benefit from being local (see inset: “Centralized versus edge cloud workloads”). “Open platform” logic enables qualified third parties to exploit the edge infrastructure using pay-per-use models that are commonplace in the public cloud. This could result in new forms of collaboration with third parties and/or incremental revenues from either rental of the infrastructure or provision of data services. The approach is presented as an add-on because it is seen as having significantly more business risk than a stand-alone approach. On its own it becomes a “build it and they will come” proposition. However, as an add-on to one of the previous approaches, the additional business risk is largely eliminated.

Centralized versus edge cloud workloads

There is not a single broadly accepted definition for edge cloud, so defining how it fits into the existing cloud infrastructure landscape is challenging.

There is also still a lot of uncertainty around the potential benefits of edge-cloud use cases. In particular, the question of how far to the “edge” the compute and storage resources need to be placed is highly controversial and depends on both the workload and the specific deployment situation, e.g., the geographical extent of the network or backhaul delays. While in some scenarios CO pod co-located data centers yield net improvements in user experience, in other scenarios a few centrally located data centers per operator and country would suffice to achieve the same results. For this paper, however, we define the edge cloud as existing in some fraction of serving offices – offices where access technology must be placed. This is for two reasons: 1) it allows sharing capital investment with access, and 2) it reduces the risk of competing against centralized cloud offers from web-scale providers.

The choice of either, or both, of the latter approaches will be driven by factors that will vary from one operator to the next. For example, if an operator just rolled out a new service in the traditional way, it might want to wait for that service’s lifetime to come to an end before moving it to the CO pod.

Similarly, introducing third-party workloads to the CO pod requires operationalizing the infrastructure as a public cloud, with security, billing, and customer management tools that go beyond what’s needed for a private cloud.

Economic impact

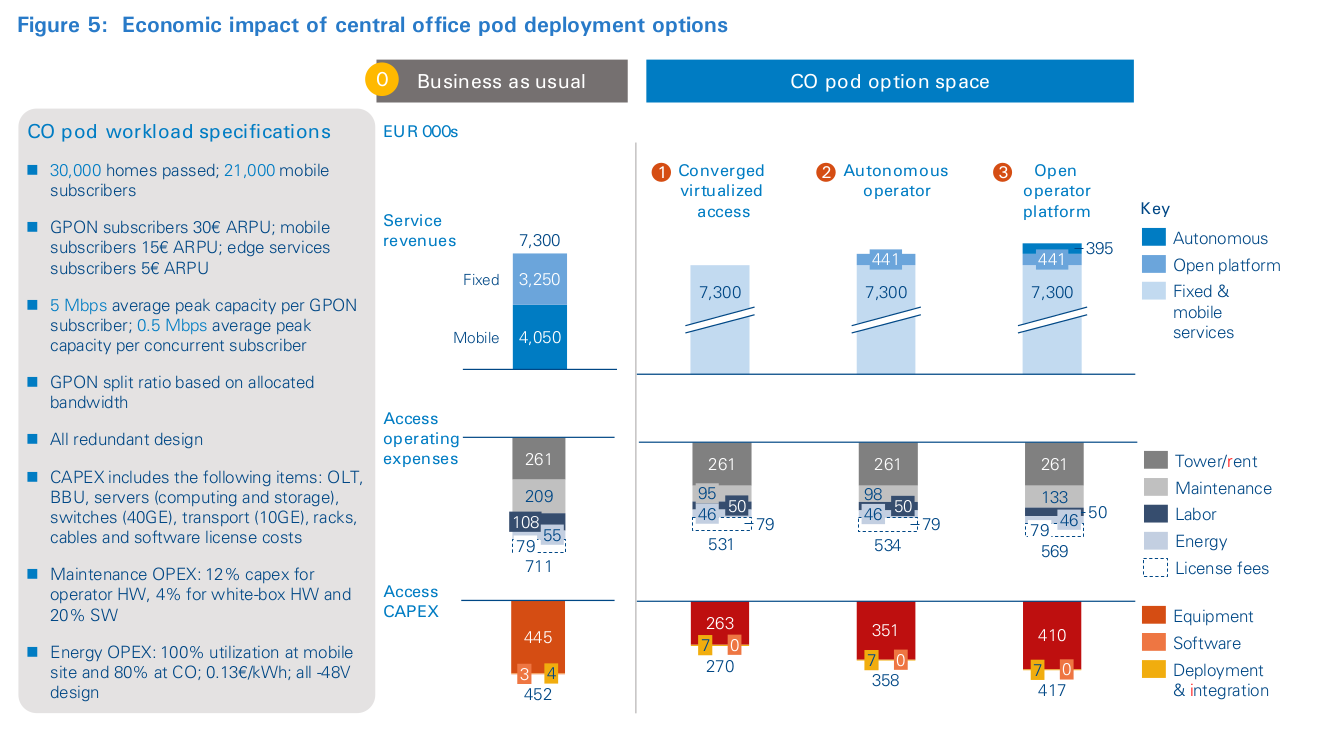

In order to provide a first-order approximation to the sorts of economics associated with the CO pod and the approaches that have just been described, Arthur D. Little has developed a model that compares these approaches based on public information and an exemplar CO pod described in the technical section of this paper. The model is used for all the economic claims in this paper.

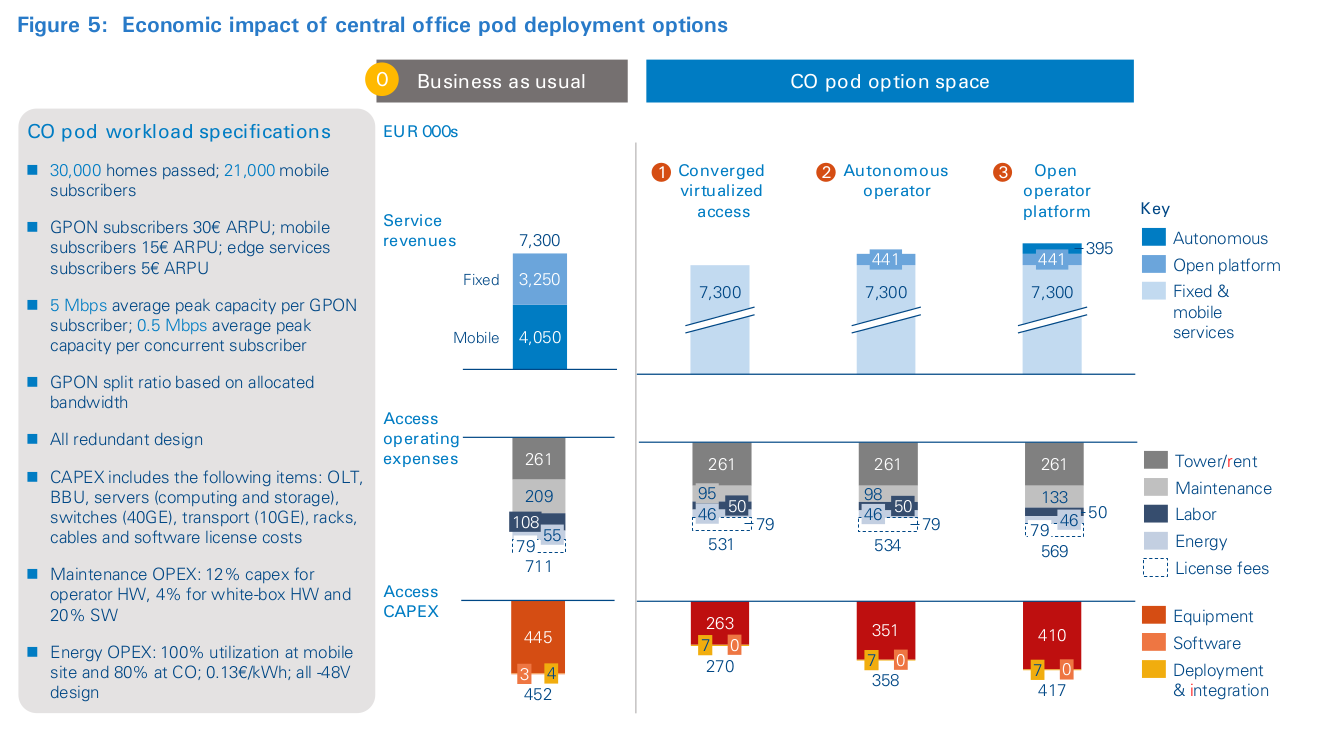

Figure 5 illustrates the link between the different approaches and the addressable value levers, comparing industry-standard design with the corresponding CO pod design. These benefits are contingent on service providers succeeding in creating a viable ecosystem of suppliers that support the technology. The scope of the cost analysis covers network aggregation, subscriber management, and mobile baseband processing, as well as mobile- and fixed-routing functions. The visualization is based on a simple model to illustrate the delta change impact of revenue and cost levers associated with each option. It also illustrates that access platforms represent a small proportion of revenues. The economic case has been built based on bottom- up cost comparison of traditional equipment and virtualized access platform economics, using representative industry costs in a greenfield scenario.

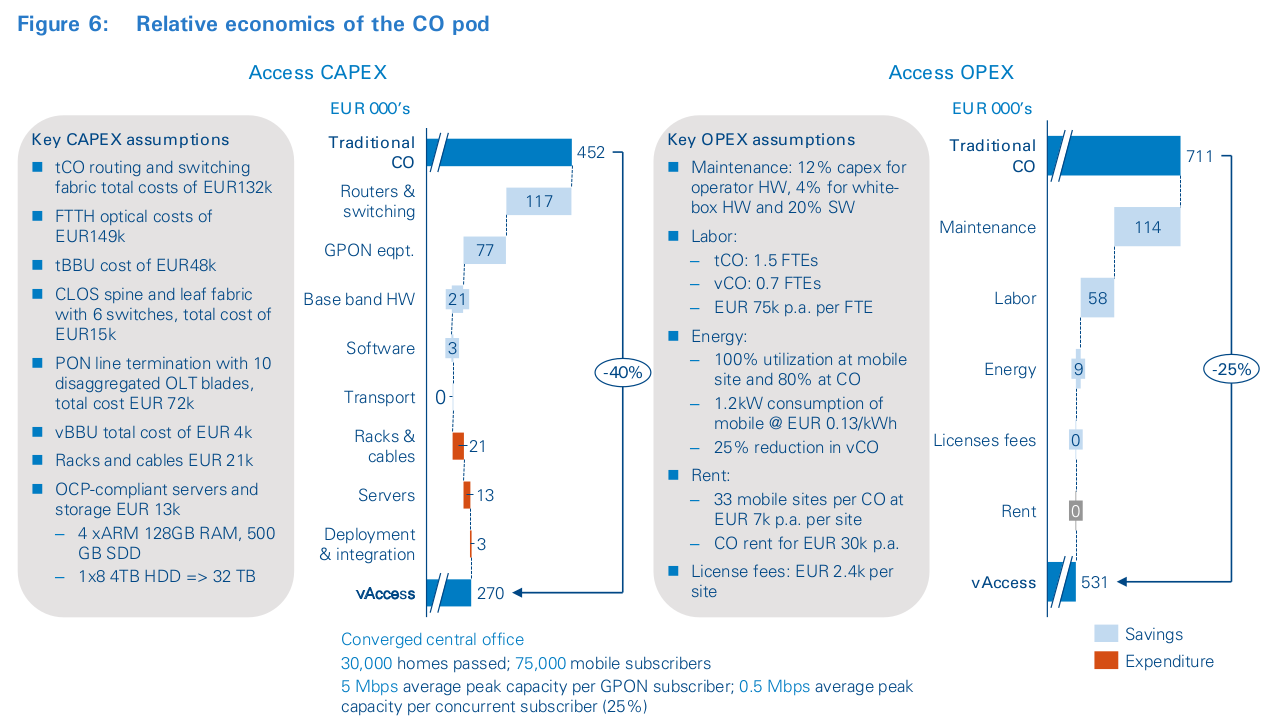

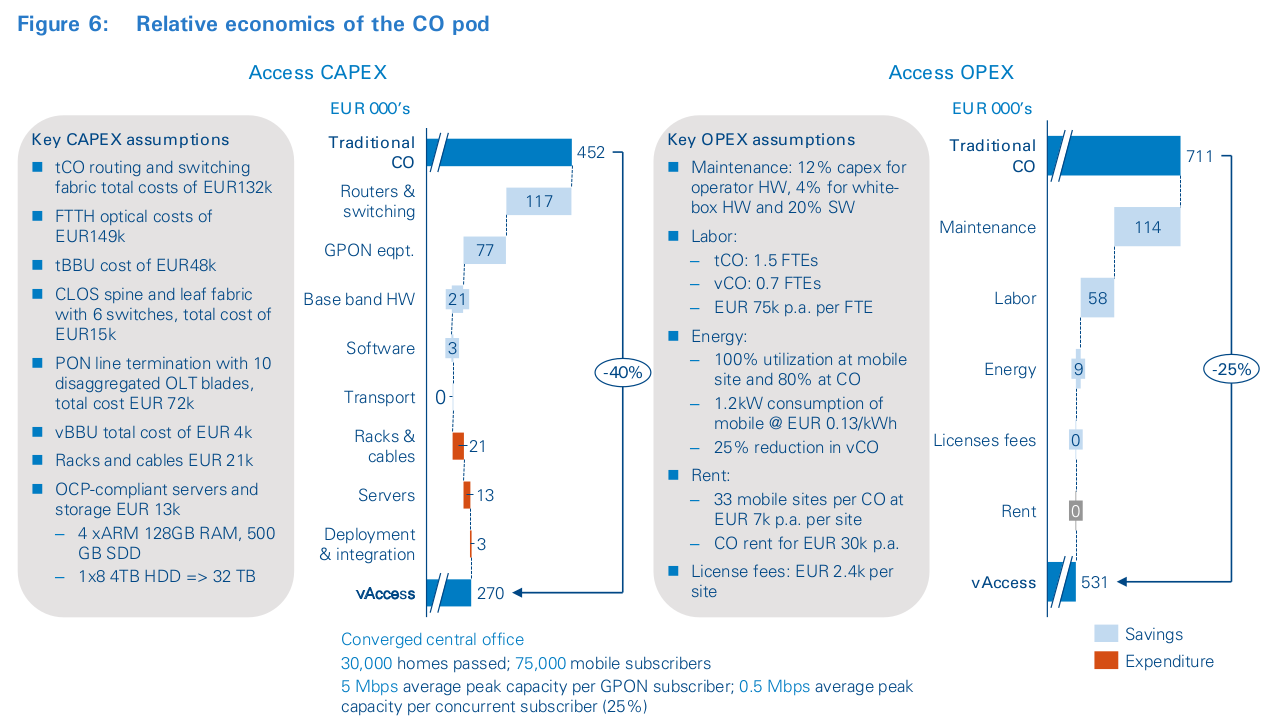

Figure 5 also shows that the impact of virtualized access is mainly operating and capital efficiency. Putting things into the overall context shows that the aggregate results are small and highly dependent on automation benefits derivable from changes in operating practices. As detailed in Figure 6, according to the Arthur D. Little model, the CO pod has circa 40 percent cost advantage in CAPEX, but 25 percent in OPEX. The former is due to its reliance on architectures based on open- source hardware and software, while the latter illustrates the relative importance of central-office non-equipment costs. The largest CAPEX differences are in the relative cost of fixed traffic aggregation and routing, as well as GPON optical equipment (new vs. old cost).

The analysis is based on published price lists and shows that white-box, programmable switches cost one-tenth as much as typical operator routing boxes, whereas commodity optical equipment costs are less than one-half. The model also contemplates virtualizing radio-access processing for mobile networks. Though still emergent, an estimate of marginal cost reductions of 80+ percent is enabled by pooling hardware resources with the pod control functions. Major OPEX differences are more indirect. A large proportion of the savings are based on lower maintenance costs associated with commodity hardware. Further savings are based on greater automation and energy savings. It is important to note that the CO pod does not support all telecoms control functions and protocols; rather, it is a minimalist, software-based design that provides only what is necessary to deliver with carrier-grade reliability.

“Autonomous operator” and “open platform” are revenue plays that use marginal economics to unlock incremental value from the platform. While edge platform services relevant to third parties are a work in progress, numerous spaces linked to video and programmatic networking capabilities are emerging. Figure 7 illustrates numerous sources of incremental revenue gains that could be possible using proximity and low latency. Along both pathways, we expect similar costs to access virtualization; however, we expect higher integration costs associated with the complexity of creating new operations and services platforms, distributed over multiple pods. The upshot is that the CO pod can be used to gain incremental share of wallet, as well as market share. We have attempted to quantify the former, envisaging up to 11 percent gains over and above connectivity revenues based on proxy to comparable cloud services. While these gains will require 5+ years to achieve, they illustrate that such incremental gains could be used to partially self-finance the shift to a CO pod architecture.

The precise economics for incumbent and challenger operators will be different. Incumbents are endowed with greater density of central offices. Challengers, in contrast, rely on regulatory access regimes and new build-outs, so the economic drivers for change will vary. However, this creates new options where challengers may not necessarily be the underdog.

Most incumbents will find they have significant spare capacity in existing central offices; however, significant capital investments may be required to expand or upgrade facilities. On the other hand, challengers will find it prohibitively expensive to match incumbent deployments site-by-site. A more suitable alternative would be collocating all or part of their infrastructure into nearby operator-neutral or operator-peering facilities. In addition to enabling them to access competitively priced, DC-grade space, it puts challengers in prime position for direct peering with tier 1 web-service players, as well as deploying unmodified, high- density standard racks for the CO pod. Moreover, the ability to be a magnet for peering partners could be used to secure ultra-competitive collocation services. As video becomes the dominant form of internet traffic, the impact on transport costs could be substantial.

The new architecture creates new efficiency and revenue opportunities but is contingent on the CO pod becoming a de facto standard. It’s especially important to the third pathway, in which third parties make use of edge-cloud capabilities. If few operators support this capability, it will be less attractive to third parties for developing for the edge cloud. Given this chicken- and-egg situation for edge-cloud demand, it makes sense not to invest in edge-cloud infrastructure without de-risking it by placing the virtual access workload on the same infrastructure. However, getting the CO pod into production will require letting go of industry handrails and accepting new, unfamiliar risks. Additionally, unlearning old habits is hard, and will require leadership that must come, not from technology, but from business decision-makers, as we describe in the next section.

4

Leading the creation of a carrier-cloud mind-set

Operators must decide if they will lead or follow. For “those who dare”, the prize could be significant:

- “Followership” means waiting for a comprehensive alternative supply base to emerge at some unknown future point intime.

- “Leadership” means taking matters into one’s own hands: technology must master engineering and operating cloud infrastructure to provide telco-grade services; sales-marketing-product must evolve in order to exploit capabilities to develop new, exciting products and evolve supplier ecosystems.

- Operators must create an environment that allows teams with the right skills and mindset to experiment (without fear of failure).

Making CO pod-based production a reality will require profound changes for operators. Operator technology organizations must master the details of engineering and operating cloud infrastructure to provide telco-grade services. In parallel, the sales-marketing-product function must evolve in order to exploit the unique capabilities to develop new, exciting products and future platforms for growth. All this is easier said than done because there is no proven roadmap, standard, or large vendor available to help.

The scale of the change associated with access transformation is not unique. Other industries have seen arguably similar shifts that challenge the status quo: the introduction of renewable power into a traditional utility value chain, that of the electric powertrain into conventional vehicles, and the ongoing introduction of blockchain technologies into banking. Therefore, operators should not expect the path to transformation to be smooth or uneventful. However, once the dust settles, the business pay-off can be substantially lower costs, extensions and changes to the business model, and even globalized operations or a “wow” customer experience. Lessons learned include the importance of creating space or labs for experimentation and learning, as well as that of creating oversight mechanisms that encourage technology adoption to solve high-value business challenges.

Adopting the CO pod architecture requires making decisions and accepting their associated risks. The pod is a pre-production technology with a wide but shallow vendor ecosystem to support its development. Therefore, each operator must decide whether it is willing to wait for a specialist supply base to emerge or take matters into its own hands by helping build the platform. Followership may result in missing the boat, but taking control means assuming greater responsibility for the end-to-end engineering. It is not a decision that technologists can make alone; rather, it is a decision regarding operator corporate strategy. Variations such as scope of activities, market position, regulatory constraints and level of control over existing operations will determine the right approach. The operator organization must evolve and redefine what strategists, product marketers, technical managers and operations personnel will do differently, and put structures in place to execute. This requires rebuilding the product development model, as well as the operator technology supply base.

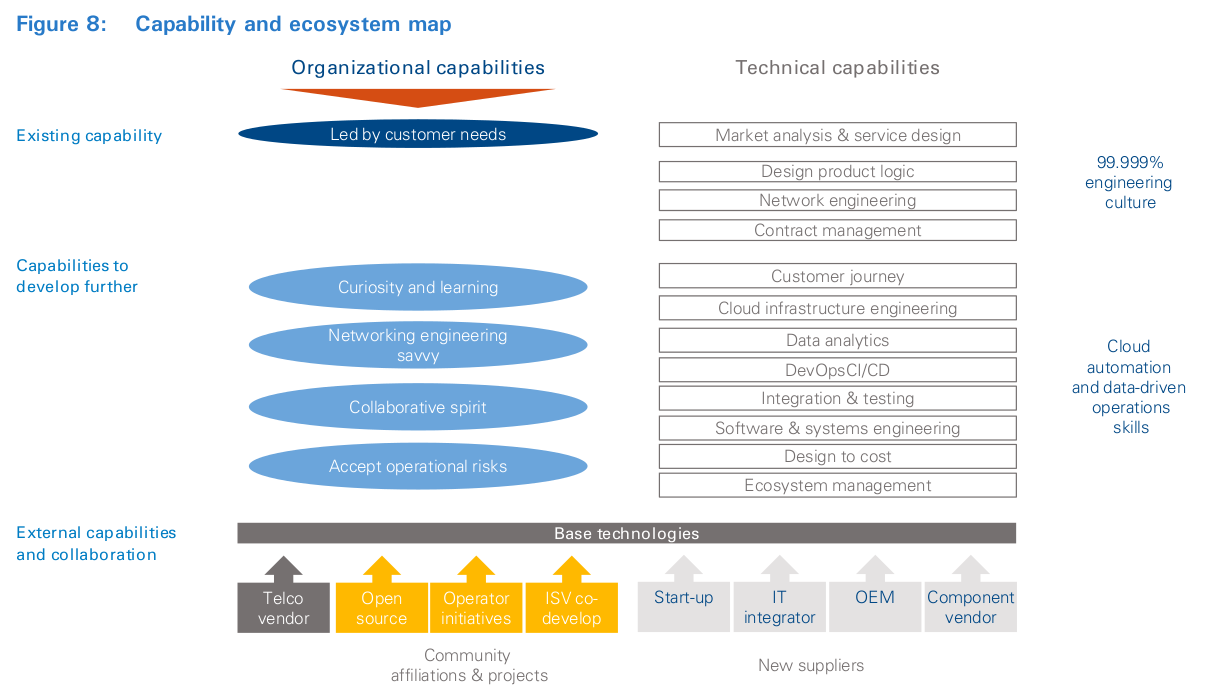

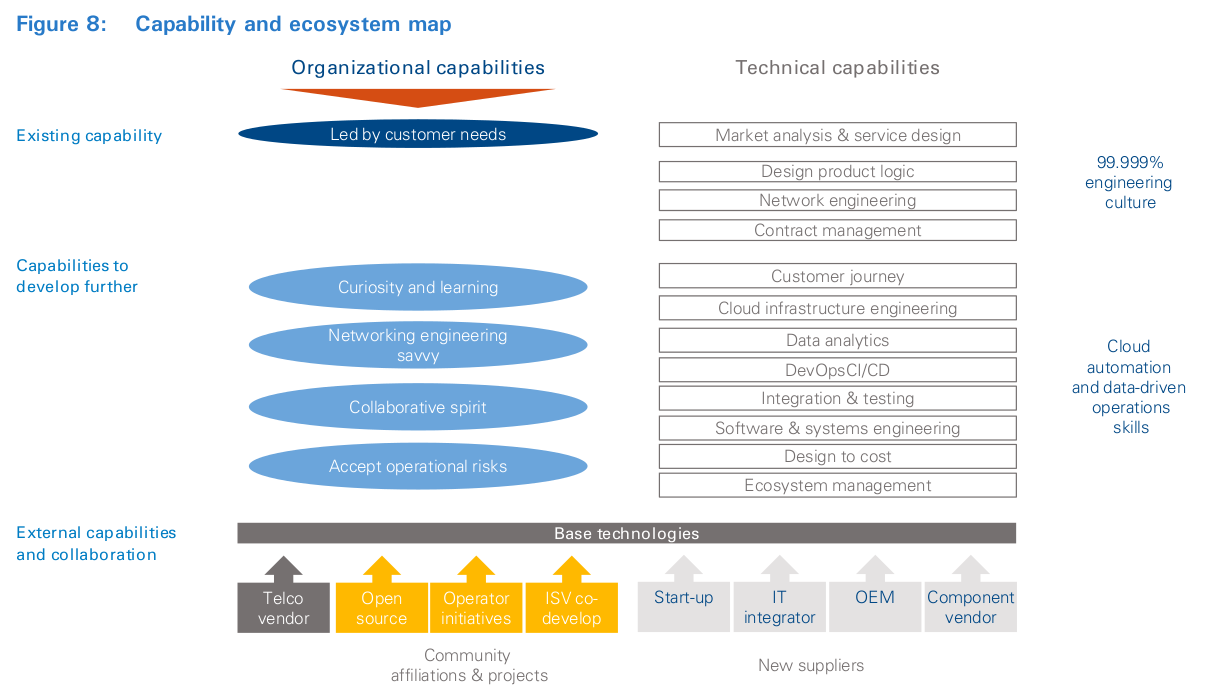

Success requires operators to structure teams with the right skills and mind-set, as well as create a supportive ecosystem of partners and vendors, as shown in Figure 8. This might even require them to reacquire skills lost in the last decades (see inset: “Technology capabilities”).

Technology capabilities

Until the mid-90s, leading operators would often play a key role in the engineering and development of technologies used in their networks. The famous 5ESS electronic switching system, originally developed by AT&T, is a powerful example. Other examples from the co-authors include Deutsche Telekom’s development of ISDN and Telefónica’s co-development with ITT (acquired by Alcatel) of the S12 switch. However, for several reasons the eruption of IP technology has seen operators’ role diminish, with companies relying almost entirely on a handful of vendors for their core technology needs.

Taking advantage of the new platform will require savvy product marketers and service engineering to seize the unique advantages of the new design and mitigate new pitfalls and risks. Operators with narrow focus on access transformation must develop and exploit the new platform within existing network and IT operational environments by developing capabilities to wrapper the platform in order to benefit from the automation tools with the least integration effort for the existing OSS. Operators that see virtualization of the central office as an autonomous edge production or open production platform must rethink their entire operational systems and billing architecture to enable rapid experimentation focused on delighting customers. This will require empowering the CIO, as well as product and network organizations, to find solutions, and asking for results. De-commoditization of operator products and services will require learning to learn again. Rebuilding the product function and platforms, developing cloud architecture engineering, and learning to engage with customers all require patience. All approaches require learning to attract external talent, as well as reactivating internal staff. Attracting external talent will require persistence, a credible story and a space to work. On the other hand, reactivating staff will require dealing head-on with cultural issues to encourage self-development and taking professional risk. Few have attempted to reskill the entire workforce like AT&T, and the company provides a template to emulate (see inset: “Organizational skill upgrading”).

Organizational skill upgrading

Executing in the new landscape requires skills in cloud- based computing, coding, data science, and other technical capabilities – but talent is limited, and everybody is going after it. AT&T is refocusing employee education and professional development on reskilling technical staff. In collaboration with Georgia Tech and numerous online course providers, AT&T is providing opportunities for almost all staff to acquire the skills they and the company will need for the future. It is not optional, because, in effect, every employee is being asked to requalify themselves for the jobs that will be available in the next decade. This is just one element of an overall talent, capability, process and culture change that AT&T has undertaken.

For the new design to become a reality, supplier ecosystems must also be regenerated. Unbundling the technology stack means companies must figure out what components are needed to build, deploy and manage operator-grade virtualized access networks – and how to source them. In this future, operators may not get whole-hearted support from all the traditional vendors, which will be understandably reluctant to erode profit pools and disturb the status quo. This means looking toward the wider cloud landscape with willingness to innovate models of sourcing and collaboration key.

Regenerating the supplier ecosystem will require trial and error rather than an ex-ante decision. It will be an evolutionary process requiring an understanding of existing commercial as well as open-source solutions. Elements will need to be developed by each operator to ensure technology control and differentiation. This will require “learning by doing” and allowing natural selection of players which are trustable and reliable and have staying power in their niches. Operators will need to build the capabilities to shape and orchestrate enhanced sourcing ecosystems, including those developed by cloud service providers.

Cloud hardware and software suppliers are very different from telco suppliers. They are typically smaller, specialized system suppliers whose responsibility is limited to the component. Their limited scope of activities means they are unlikely to be able to match the breadth of services the operators are accustomed to when working with established vendors. This inevitably changes the split of labor and responsibility between in-house teams and third-party vendors. Success requires resolving these issues and managing the diversity to produce a homogenous service. This should not be foreign to operators with long memories – as illustrated in the “Technology capabilities” inset.

Each operator does not have to go its own way. Recognizing the change is a common challenge facing the industry. Operators can pool technical and financial resources and direct them toward creating one or more ecosystems. In these new ecosystems, operators define the rules of engagement, ensure the industry gets what it needs, and create opportunities for others to build new businesses and business models. This is the essence of a community-based approach: a number of operators working collaboratively on a shared ambition, focusing on common elements that do not drive differentiation. In this community effort, success will create the conditions so these common services can be consumed or acquired from third parties.

An issue that must also be dealt with is the role of traditional telecom equipment vendors. What should operators expect from them in this new future? These vendors are the backbone of the industry, and finding new win-wins is important to sustaining existing telecoms’ asset base. Regenerating the existing telco supplier ecosystem will require far more than standards-based cooperativism. It will require technology openness and collaboration to identify new sustainable development options 8 . Such options could include prime integrator, as well as co-development, open-source software support and evolution of legacy equipment to support emerging open-source, de facto standards. The latter requires an entrepreneurial, not a standards mindset on both sides. Given the steep learning curve associated with skills and ecosystem development, we think “wait and see” is not an option. The impact stretches far beyond the network into product features, customer support and the business models used in the industry.

The impact of the new architecture is far-reaching. It requires a concerted effort by decision-makers to create and sustain the conditions for success. Moreover, the new design must necessarily co-exist with business as usual, and they must complement each other in direction, capability and ecosystem development. Creating space for both to coexist will require leadership and cunning to drive eventual convergence. In the next section we share how AT&T, Deutsche Telekom and Telefónica have approached the journey.

5

Launching a minimum viable access transformation program

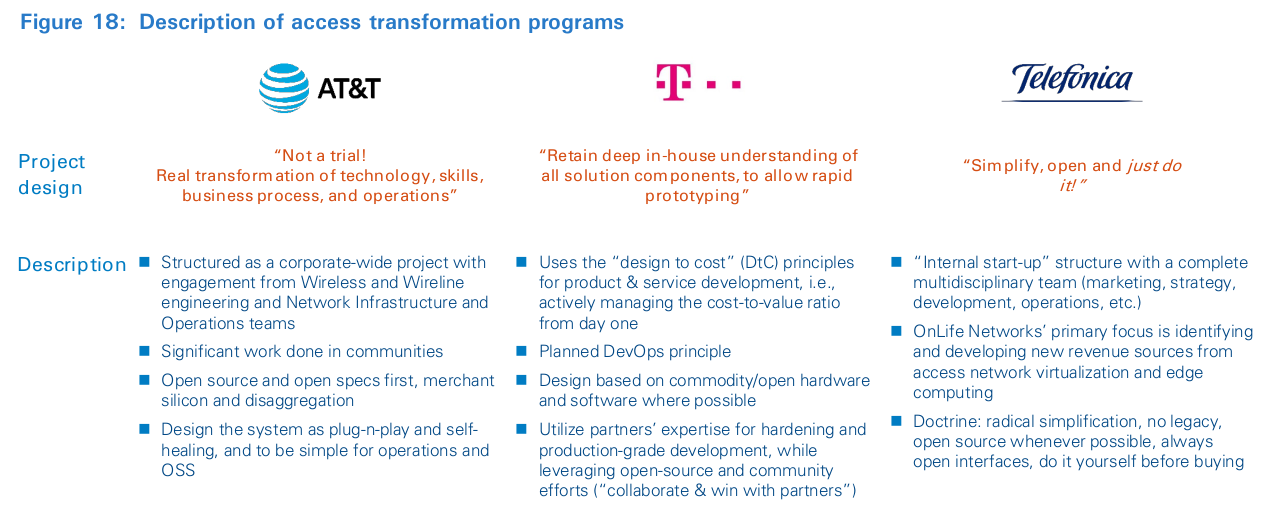

Strategic priorities, not technology, must drive access-driven transformation programs:

- There is not a single overarching approach to framing an access transformation program.

- AT&T wants to systematically embed cloud technologies in all areas of the production platform.

- Deutsche Telekom is focused on bringing down costs of future access platforms, as well as broadening the supplier ecosystem.

- Telefónica is concentrating on using the platform’s edge-cloud features to create new services and revenue streams.

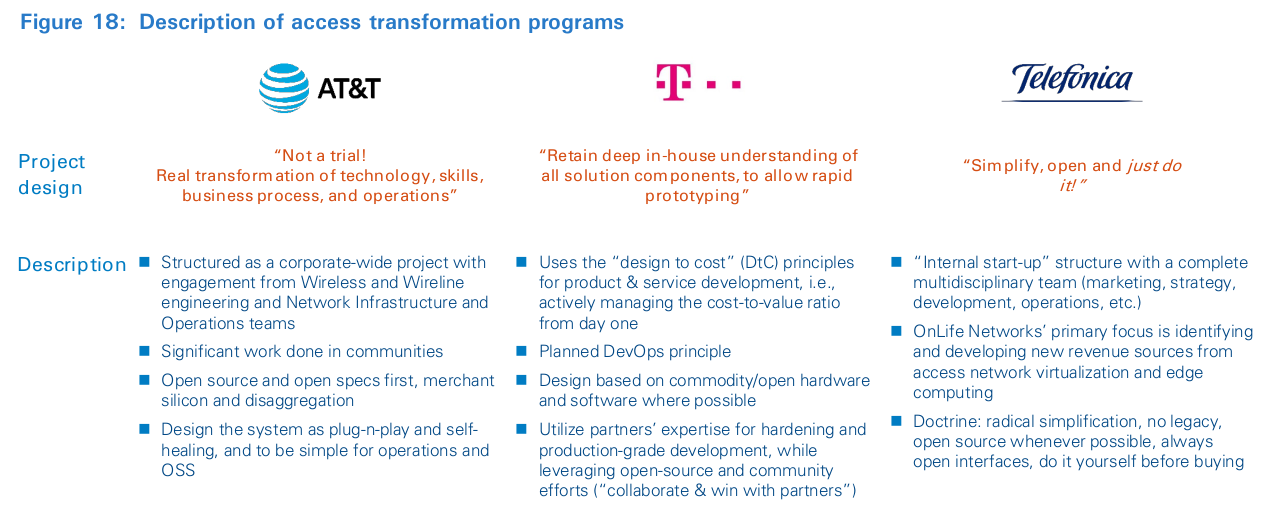

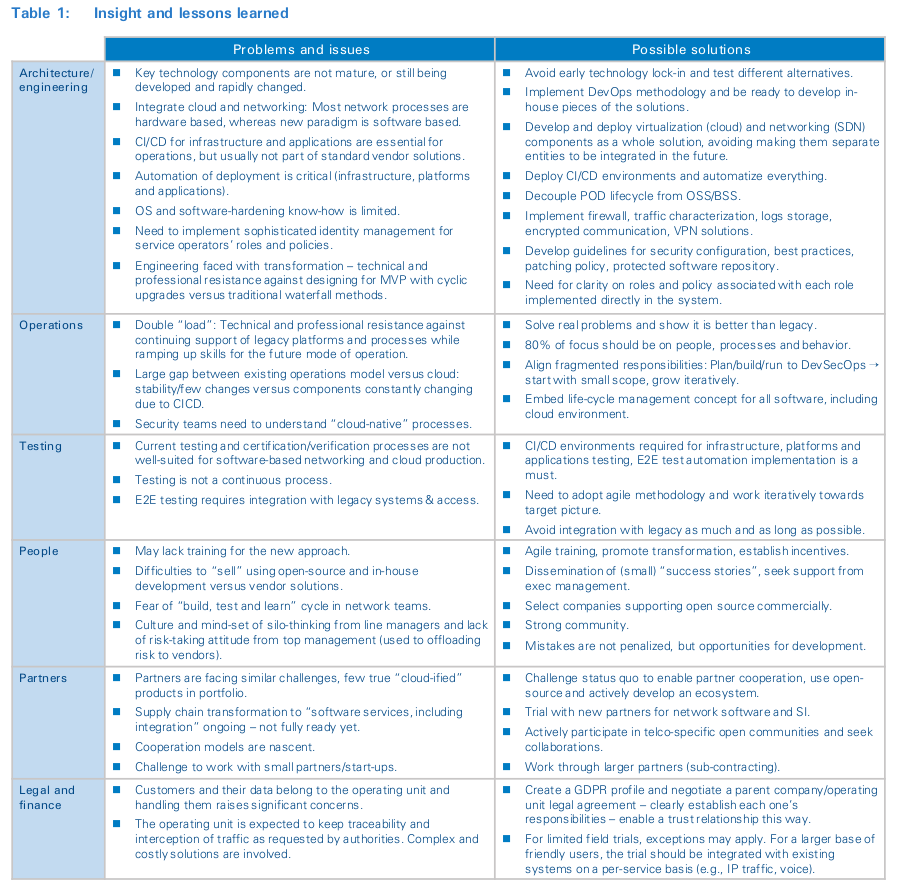

Creating space for radical innovation and breakthrough solutions in traditional environments is not trivial. To encourage community and accelerate industry-wide adoption, this section provides unique insight into the strategic context of the AT&T, Deutsche Telekom and Telefónica programs and how they have approached program design. Their journeys are still being undertaken, but they provide important insight into problem framing and monitoring, as well as guidance on a number of other topics that are important for execution.

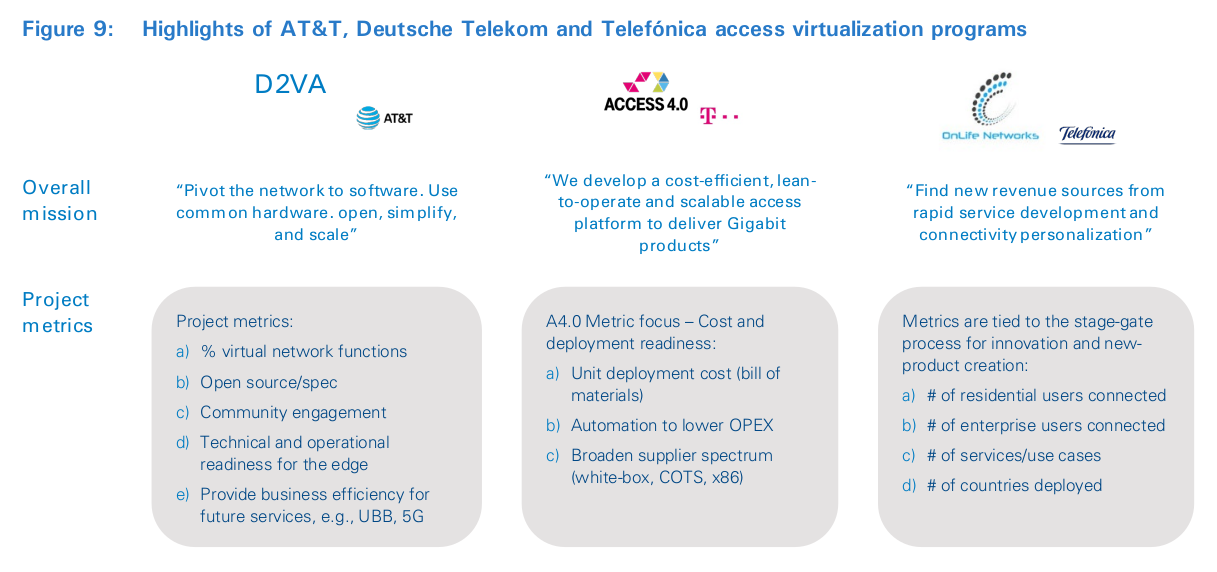

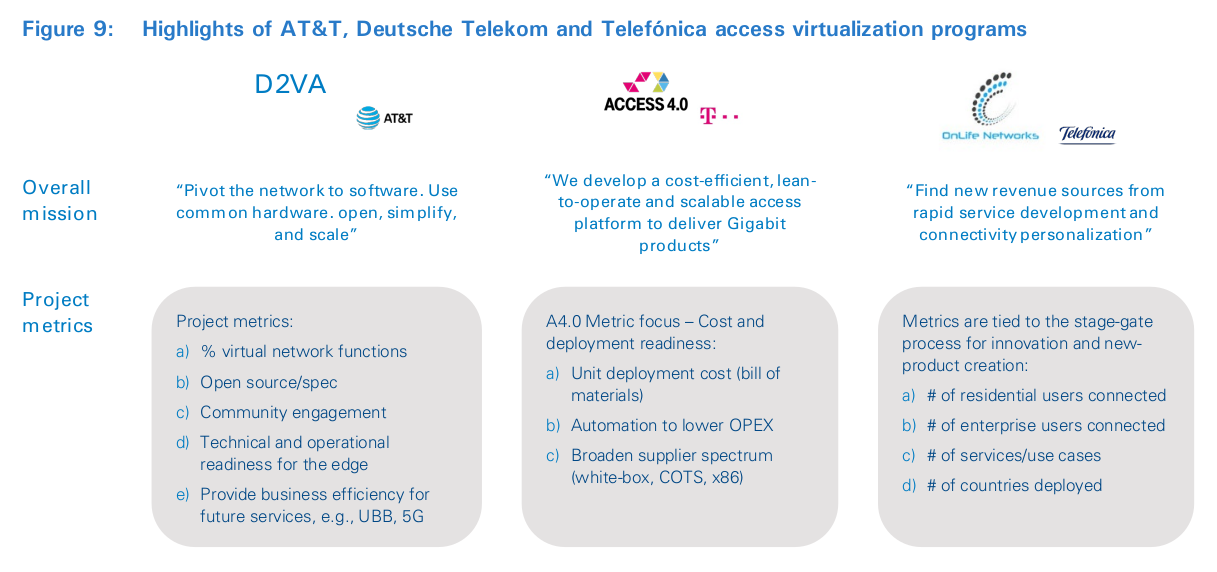

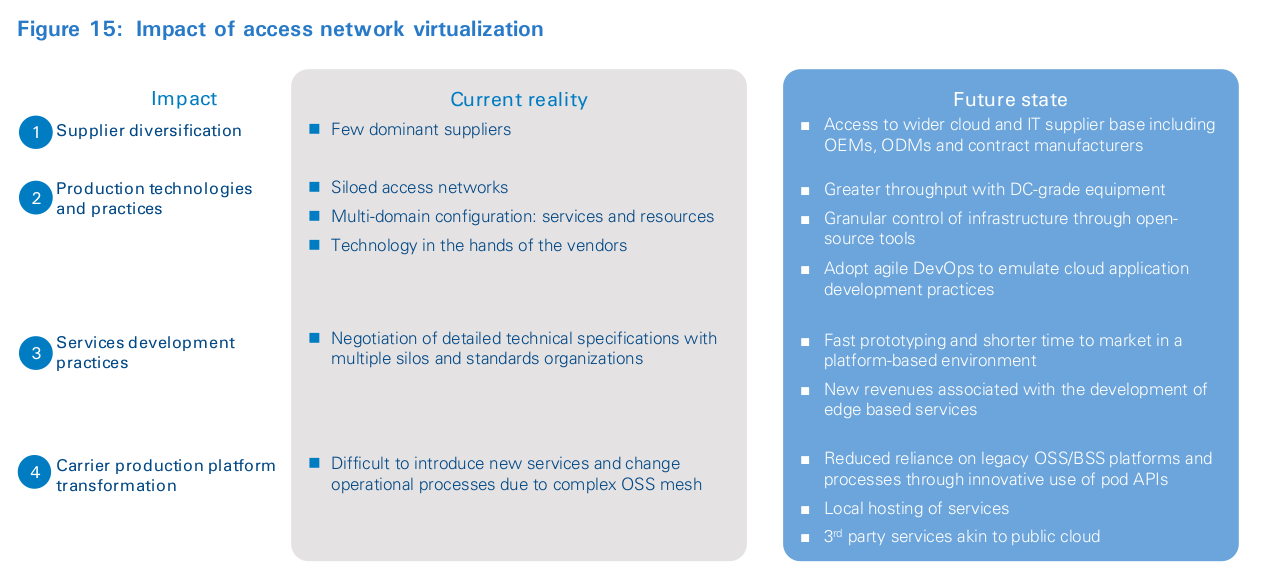

Figure 9 summarizes the differing priorities for access virtualization at AT&T, Deutsche Telekom and Telefónica. In a nutshell, the AT&T approach is part of a larger program focused on systematically embedding cloud technologies in all areas of the business. This means the access team works in concert with the global program to share reusable assets. In contrast, Deutsche Telekom’s approach is focused on bringing down costs of future access platforms, as well as broadening the supplier ecosystem. It sees the cloud as a tool, and not necessarily an end state. Finally, Telefónica is focused on using the platform’s edge-cloud features to create new services and revenue streams. There is no one-size-fits-all approach. Focus is determined by perception of value, market position, network deployment windows and technology prowess.

The remainder of this section describes how AT&T, Deutsche Telekom and Telefónica have structured their minimum viable access-based transformation programs.

In response to an internal business and technology roadmap program, AT&T determined that there would be profound changes in the wider competitive environment. In response, the company’s senior leadership launched a network and IT transformation program that focused on customer self-service and speeding up time to market. Led and funded by the Technology and Operations organization under the heading of “Domain 2.0” (“D2.0”), the transformational initiative was created to pivot the network to software across all network domains and associated operations. With direct oversight from the officers, D2.0 went public in November 2013 when the D2.0 vision white paper 9 was released. The paper describes AT&T’s vision for its future architecture and mode of operation. It triggered several sizable investment programs focused on comprehensive retooling of many aspects of the business. Three business imperatives are pursued by D2.0: Open, Simplify and Scale.

The initial focus was two-fold: to transform a significant portion of networking equipment, typically appliances, into software virtual network functions (VNFs) that would run on data center servers; and to establish a large-scale system automation platform that would plan, deploy, monitor and coordinate functions among many physical locations. This helped to automate and virtualize the existing production model. To advance quickly, RFPs were augmented with short, simple, yet broad market surveys – sent not only to legacy and holistic vendors, but also to start-ups and small suppliers that could only provide components of the overall solutions.

The process is called agile engagement because, like agile development, it follows the pattern of taking small, iterative steps toward a goal. Rather than relying solely on a large waterfall RFP and then instigating only a single interaction with respondents, the agile engagement process allows interacting with many more potential suppliers, and then develops potential solutions through more specific and focused interactions. It also whittles down the field of potential contributors toward a solution. By December 2014, these arrangements were formalized under the D2.0 vendor program, and an ambitious plan was communicated to staff and the outside world for network functions virtualization. Finally, in one of the largest- ever corporate retraining programs, AT&T started to re-educate its entire technical community with critical skills needed for the future. Employees were, and still are, rigorously trained to meet the needs of new job positions through leadership courses, degrees, and “nanodegrees.” To date, D2.0 has resulted in investments worth several billions of dollars in SDN and NFV, as well as numerous large-scale software projects to manage the new landscape, including ECOMP (open sourced as ONAP). This has enabled automated, end-to-end management, and more recently, DANOS, Airship and Akraino.

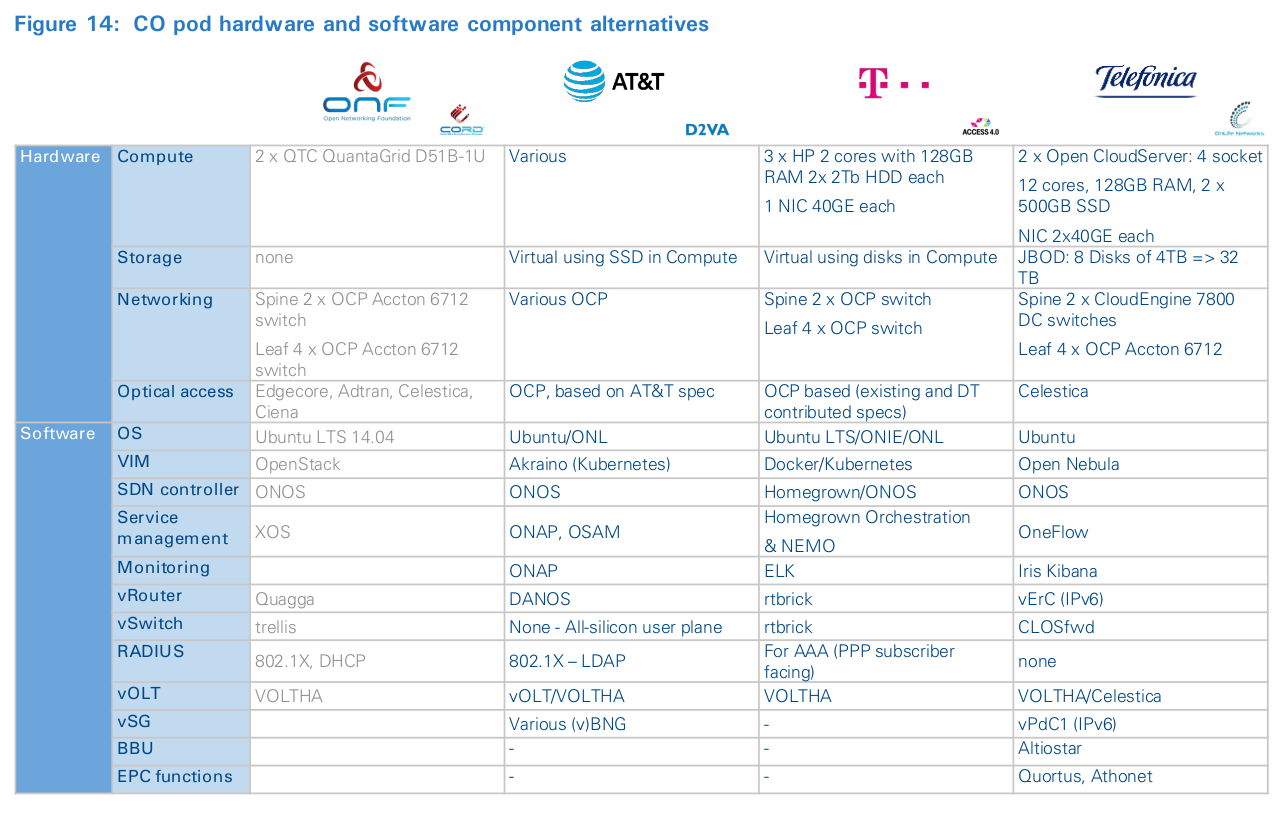

While initially focused on appliances, D2.0 also seeks to open, simplify and scale other network capabilities. Often, this requires breaking apart existing boxes so that they can be disaggregated into their simpler, more reusable subcomponents. Domain 2.0 Virtual Access (“D2VA”) is the access component of the D2.0 program, focused on disaggregation and virtualization of the access network. Access disaggregation was considered a hard problem, so it was not initially a priority; instead, AT&T chose to innovate with an external team from ON.Lab. Based on the learnings from CORD trails, AT&T launched D2VA in 2017 and chose to collaborate with other carriers to create a production-ready design called SDN-Enabled Broadband Access (SEBA). SEBA significantly enhances operations capabilities, interoperates with legacy systems, and provides a path to an all-orchestrated future architecture. D2VA is funded and managed by the wireline and wireless architecture and planning functions at AT&T. The program is organized along three workstreams: infrastructure, wireline and mobile access. The common infrastructure workstream is aligned with other D2.0 infrastructure programs and benefits substantially from existing investments. The wireline stream is where the bulk of staffing is being concentrated. The relative scale of the wireline team is a result of the solution having matured enough to move from PoCs/trials towards deployment. The third work stream, focused on mobility, is currently in trial phase, with the goal of converging with the wireline work as it matures. Most of the team members are existing and retrained staff from within AT&T, complemented by a few externals, college hires and interns to fill specific developer gaps. The success of D2VA is tracked along multiple dimensions, including aspects such as the percentage of open software and the use of white-box hardware based on OCP specifications. While the specific D2VA metrics are focused on relative economics of deployment and operations compared with traditional solutions, the program also builds technical and operational readiness to support future roll-out programs, such as 5G, and builds an ecosystem with community engagement and support. Because of the latter, AT&T spends considerable resources to foster community relationships. The D2VA team closely collaborates with ONF/ On.Lab, OCP and the Linux Foundation (ONAP, Akraino, DANOS).

The long game for AT&T with D2VA and the larger D2.0 initiative includes attracting talent, as well as new capital, into the industry supply chain. AT&T feels that disaggregation, modularization and community collaborations will lower barriers to entry. New entrants can be adjacent providers from Enterprise IT, SI houses, traditional IT suppliers, ODMs, and even VC-funded startups. Similarly, new talent can come from IT and cloud backgrounds in addition to telecoms.

To support the development of the gigabit society in Germany, there are numerous groups focused on disruptive thinking across Deutsche Telekom. Their areas of interest include 5G, mobile edge computing and rethinking access networks. Access 4.0 (“A4.0”) is one such program; its mandate covers fixed and mobile access networks, as well as support for mobile edge-computing infrastructure, but initial focus is on FTTH and FTTN. A4.0’s primary goal is to redesign access networks to reduce vendor lock-in, and drive “step-change” reduction in life-cycle costs through the use of data center hardware, open software and automation. The approach is based on “design to cost” principles, which are commonly employed in product development and manufacturing. It is producing a decoupled design using commodity data center hardware, software and management concepts, with the goal of supporting any existing access service transparently. Focus on transparent access adds some complexity but has allowed the A4.0 team to operate with little involvement from the product or commercial functions.

The program is hosted within the German Engineering organization with strong support from Technology & Innovation (TI) functions and teams. By design, presence within an engineering function provides the right controls and incentives to ensure direct linkage of A4.0 scope to specific business objectives, as well as alignment with Deutsche Telekom’s roadmap. It also provides controlled flexibility to pursue alternate technology pathways, procurement and staff hiring. Direct purview by an operational technology function provides controlled architectural liberty to ensure designs are production ready. Early involvement of procurement has enabled sourcing from non-traditional vendors that are more inclined towards open technologies. Locating the program in the engineering function has also simplified the process of attracting the right talent. Despite being a local program for the domestic BU of Deutsche Telekom, the technical designs are extensible to other geographies across the Deutsche Telekom footprint where applicable.

Rather than building a full set of capabilities in-house, A4.0 prefers to rely on internal staff supported by partners with deep software engineering skills, so it has been critical to select the right individuals and partners to create positive incentives to collaborate. A4.0 was able to transversally win resources from teams specialized in IP networking, OSS, operations, planning, security and software development. It is currently working closely with Reply as main partner, among others, which has been willing to collocate staff at Darmstadt and Berlin and bring in their software engineers with skills in software architecture of large-scale systems, data science and engineering, container networking, and software-defined networking.

A4.0 is targeting production end of year 2020. There is a disciplined approach to monitor progress of three KPIs: (1) unit deployment cost; (2) automation to lower operating costs; (3) broadening of the vendor ecosystem to encourage adoption of commodity elements. Progress is monitored through systematically tracking the quality of the vendor ecosystems willing to support A4.0 roll-out, as well as continuously updating the cost-estimate model to validate direction of efforts.

To encourage a culture of “intrapreneurship”, Telefónica has a systematic process for new-product and -business creation under its digital organization. At least once a year, the Digital Product Innovation Team launches an “Innovation Call” to identify specific research areas of interest that could create new revenue streams from TEF core assets. All TEF staff are invited to participate by proposing innovative products, services and experiences linked to these themes.

In 2016, under the “Customer Centric Networks” theme, an ad-hoc team that combined network architecture, planning and R&D pitched OnLifeTM. Though OnLife TM has many possible development angles, its primary focus is on finding new revenue from rapid service development and personalization of connectivity. The project was selected for initial exploration in May 2016, after successful completion of an initial stage gate. Prototyping was approved in July 2016, and thereafter, OnLifeTM went through the process of technical verification until field trials were authorized in September 2017 and the first Zona Beta clients were connected in June of 2018.

OnLifeTM operates as a “virtual company”, with its own CEO, CTO, and head of architecture, as well as services and technical teams. OnLifeTM execution is organized around four disciplines: Infrastructure, Edge Platform, Use Cases and Access Network. The Infrastructure team is responsible for all aspects related to access, switching and compute infrastructure, as well as the virtualization software or VIM stack. The Platform team defines and develops the APIs for internal use, as well as by third parties, and is responsible for catalogue definition, service orchestration and billing. The Use Case team is responsible for business development and supporting use-case prototyping. As of June 2018, there were 10 staff working on the Infrastructure discipline, five each on Platforms and Use Cases, and two on Mobile Access Networks. The majority were lateral hires from Telefónica. However, in contrast, most of the Use Case teams were external hires. The OnlifeTM team collaborates with other network transformation programs at Telefonica, including Internet para todos 10 and Unic@ 11 , which are focused on low-cost radio access networks and virtualizing the core network, respectively. Collectively, they are trying to figure out how to advance the disaggregation and softwarization agenda at Telefonica and drive network cloudification together with extreme simplification of operational practices.

Lean Elephant TM

The selection process consists of a four-minute stand-up pitch to the top 30 managers of Telefónica, who collectively decide whether to fund the project or not. If selected, the team is given three months to show the technical and economic viability of the solution through consulting with thought leaders at Telefónica and potential partners. If shown to be possible, the team is asked to list its technical and commercial hypothesis and provided with funding for prototyping. Typically, this phase lasts between six and 12 months and consists entirely of validating the key hypothesis. Subsequent steps include either beta testing and development, industrialization, and testing with real clients, which is also called the product phase and when the industrialized product is transferred to an ob. The process is a Telefónica variant on the Lean Startup TM , called Lean Elephant TM , and is funded centrally by the digital team after conceptualization phase. Since the launch of the innovation call, dozens of ideas have been submitted and three have reached the marketplace.

Despite its start-up structure, OnlifeTM is funded 100 percent by the Telefónica group. Funding disbursements are based on progression through a formal stage-gate process. This internal proprietary process, called “Lean Elephant” 12 (see inset: “Lean Elephant”) is based on a Lean Startup TM process in which the three reference pillars of the framework applied to innovation are: (i) Start small and aim high: The level of ambition of the innovation projects must be high. They need to bring the possibility of global reach and the potential to make an impact in everyday life and business. This does not mean they will burn lots of resources to start with, or that they need to show full potential from day one – quite the contrary. Projects, especially at the beginning, work with bare-minimum resources, and investment increases as the project progresses, with validated learnings. The less uncertainty, the more budget. (ii) Iterate fast to achieve efficiency in each of the maturation stages:

This means scaling down initiatives that are too early in time, immature or unfocused, while fueling up ones that show traction. Therefore, product investment decisions conducted along the process rely not only on technological trends, but also on profound understanding of which markets digital customers will participate and spend in, in the upcoming years. Finally, (iii) Fail fast, fail cheap and make sure you learn along the way: Instead of devoting large quantities of energy and resources to increase the individual-success chance of a few projects, Telefonica lowers the overall risk by minimizing the failure cost for each project.

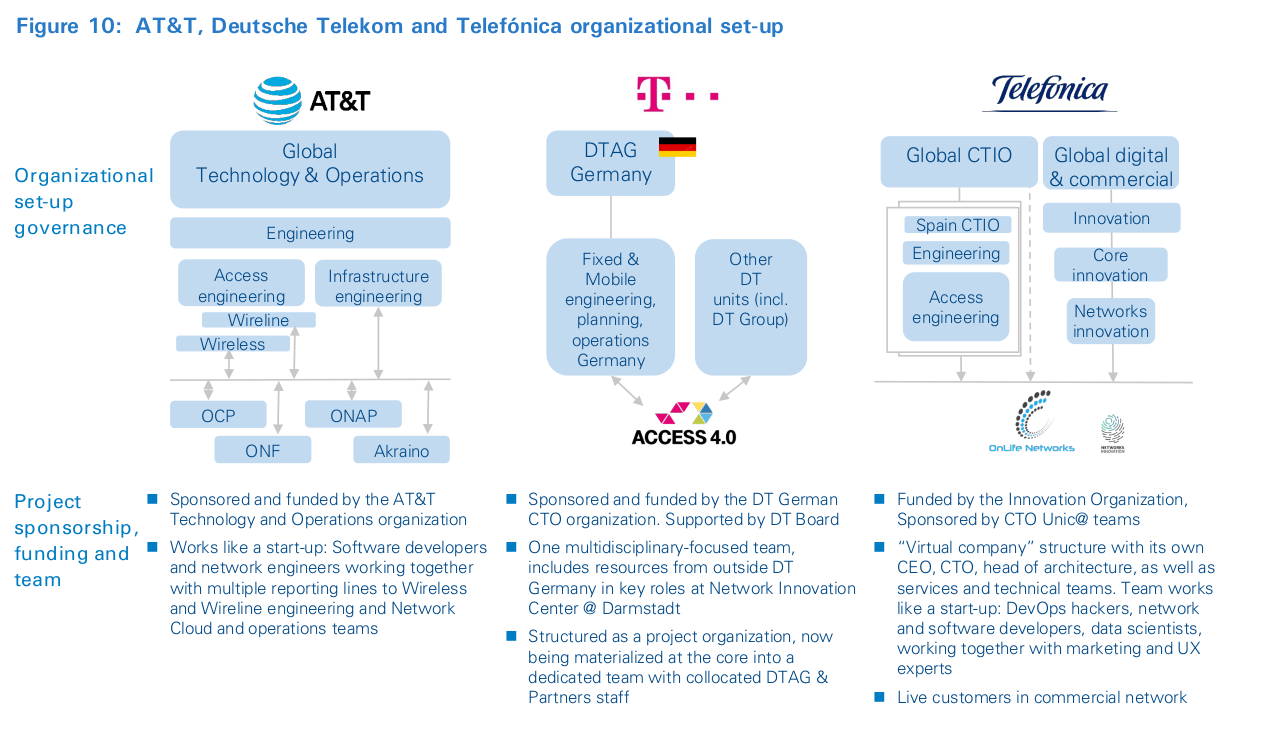

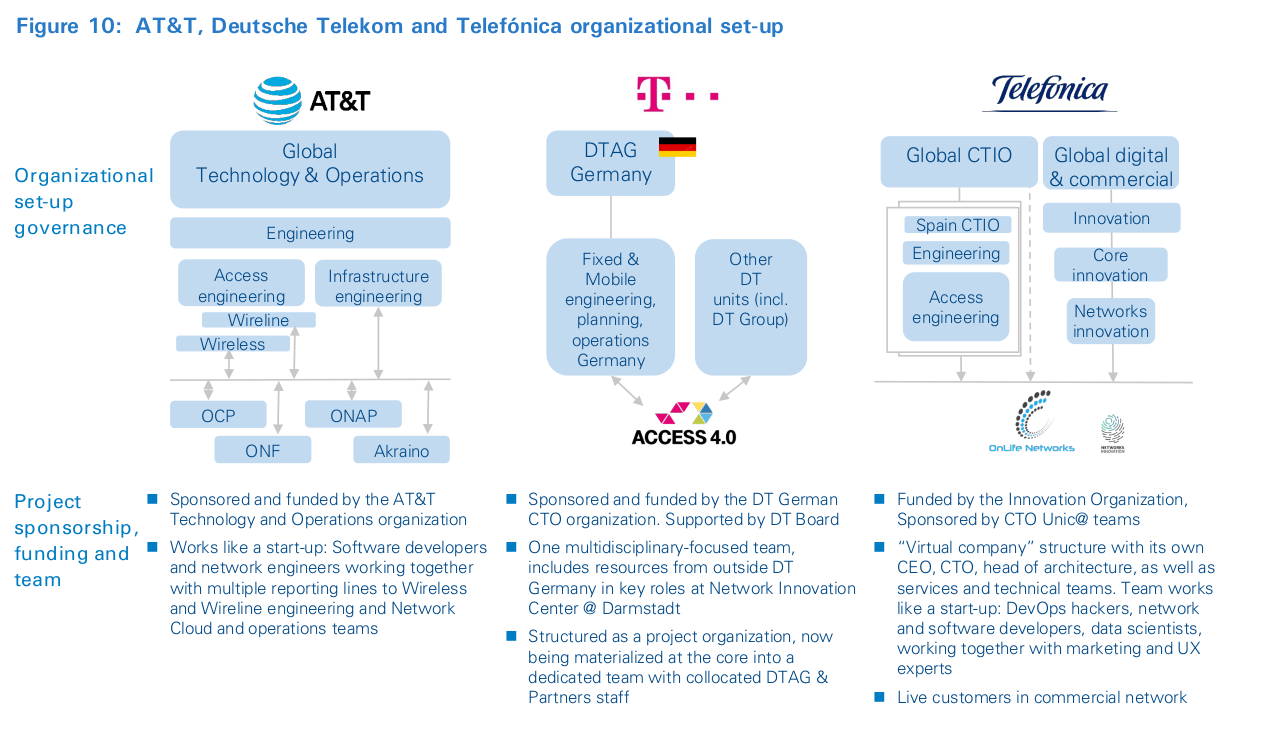

Figure 10 illustrates that there is no single-best appropriate approach to access transformation. AT&T and Deutsche Telekom have collocated the team within their operating-unit engineering organizations, with oversight from their Global CTOs. On the other hand, the Telefónica initiative is structured as a virtual company with funding from the Innovation function and sponsorship from two operating units and the Global CTO teams. The two former allow the team to ensure their efforts are technically sound and draw on the wider technical resource pool, using funding from existing access engineering budgets. With the latter, Telefónica gives full autonomy to the team on technical choices and vendor ecosystem, within an incentive and funding framework that ensures the team stays focused on the program objectives. Note that each of the three companies has involvement from senior leadership within their company or from a new business unit. Because the transformation touches so many aspects of the respective corporations, it requires strong leadership and support from the top in order to be successful.

6

What’s new about the new design

Access-driven transformation replaces traditional central office aggregation function with a leaner and lower-cost design:

- CO pod is a modular pod built using many of the same components you would expect to find in a typical cloud data center, with a software stack designed for extensibility and stability in mind.

- The new design can replace a diverse range of specialist network appliances with software.

- CO pod can support network attachment, traffic aggregation, subscriber, and device management.

- The “secret sauce” of the new design is it allows protocol trimming, elimination of repeated functions and granular configuration to alter functionality to match the operations model desired by the operator.

It is widely accepted that telecoms people – from product marketers and technical managers to customers – want cloud- like agility, but what it entails is much less well-understood. Agility consists of a set of practices related to development, testing, integration, verification and deployment of software, made possible with highly structured and well-thought-out software toolchains and access to programmable and scalable infrastructure. To capture efficiencies derived from reuse, these platforms enable and encourage granular function development and their subsequent API-ization. This combination of agile practices and software reuse dramatically reduces the time it takes to get an idea into production. The result is that developers can create, launch and evolve a broad variety of differentiated services in less time than ever before.

Why the current design is challenged

Traditional telecom platforms were not designed with rapid application development or external developers in mind. These platforms are embedded systems, with proprietary vertical OSSs developed for and by vendor-developers. Their designs are typically driven through lengthy standardization processes and place a premium on service stability, operational resilience and asset life, rather than innovation. Consequently, functionality is rigid, interfaces are brittle, capacity-add is lumpy, and operational design favors operational risk reduction. All of this is far removed from the flexibility associated with the programmable, everything-as-a-service cloud paradigm. Moreover, the standards also tend to preserve the status quo. This ultimately leads to an ossified industry with a small, locked-in set of suppliers. To provide end-to-end services, OSSs are coupled through electronic and manual processes to form the “OSS/BSS mesh”. Often the mesh spans hundreds of individual applications and even spreadsheet-based processes. Tight coupling of business and operational processes with their underlying infrastructure means that despite the complexity, the collective must evolve in tandem. In practice, this means each equipment upgrade, process or service change is conditional on its ability to reliably integrate into the mesh. This design is no accident; it is the consequence of a rational process of domain-based resource allocation in siloed organizations. But siloed responsibilities means low risk, verticalized projects with quick payback are favored, while long-term, transversal and admittedly complex projects are put off indefinitely, left to accumulate technical debt unless a profitable business case can be demonstrated. The outcome is that, as operations mature, operators become increasingly held hostage to their systems and platforms. In this environment, agility requires ingenuity in managing expectations, as well as in getting things done.

Despite the complexities, operators need their technical teams to deliver continuous improvements in customer experience, time to market, and operational efficiency. Recognizing the challenge and desiring to build a community among operators with similar goals, a group of operators funded the creation of ON.Lab to take a fresh look at the problem. Rather than working on theoretical designs, they did what software engineers do – and created a prototype software-centric solution. Building on work in open hardware done by the Open Compute Project (OCP), they positioned the central office in the image of a cloud data center. Using disaggregated routers and servers, combined with open-source software tools such as Kubernetes, Openstack, OpenNebula, ONOS and XOS, they developed a multipurpose central-office platform. Early CORD demo and field trials vetted the architecture, and ON.Lab has now transformed, in both name (now ONF) and mission, to develop production- ready systems defined by operators which are called reference designs (e.g., the broadband wireline access reference design is SEBA). Other organizations have used the same principles to create comparable technical architectures, such as the Broadband Forum with its CloudCO program and OPNFV’s Virtual Central Office project.

The new hardware architecture

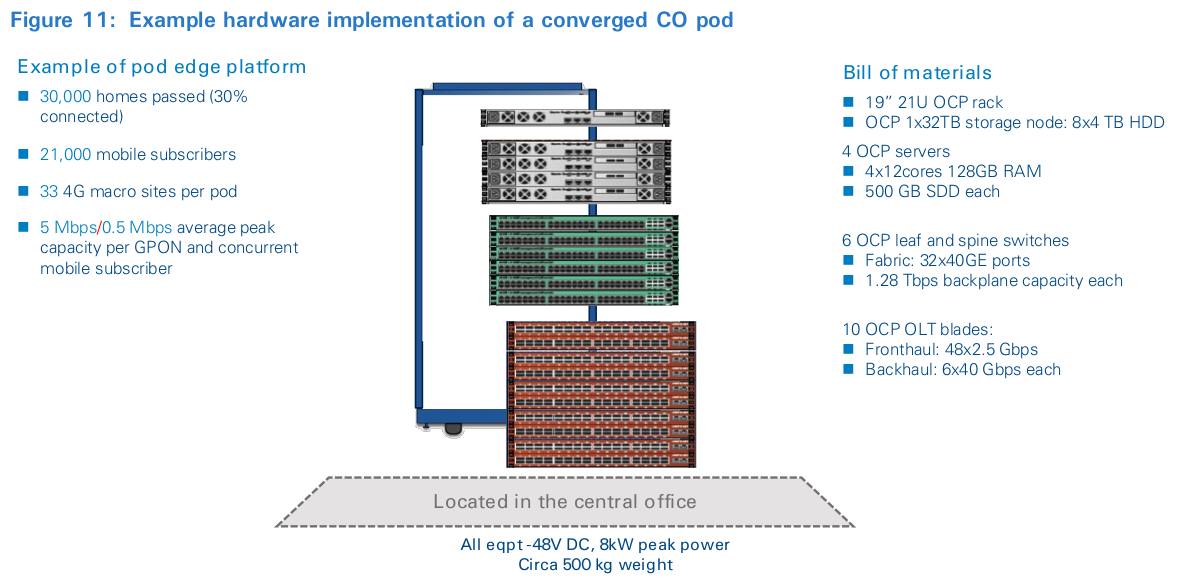

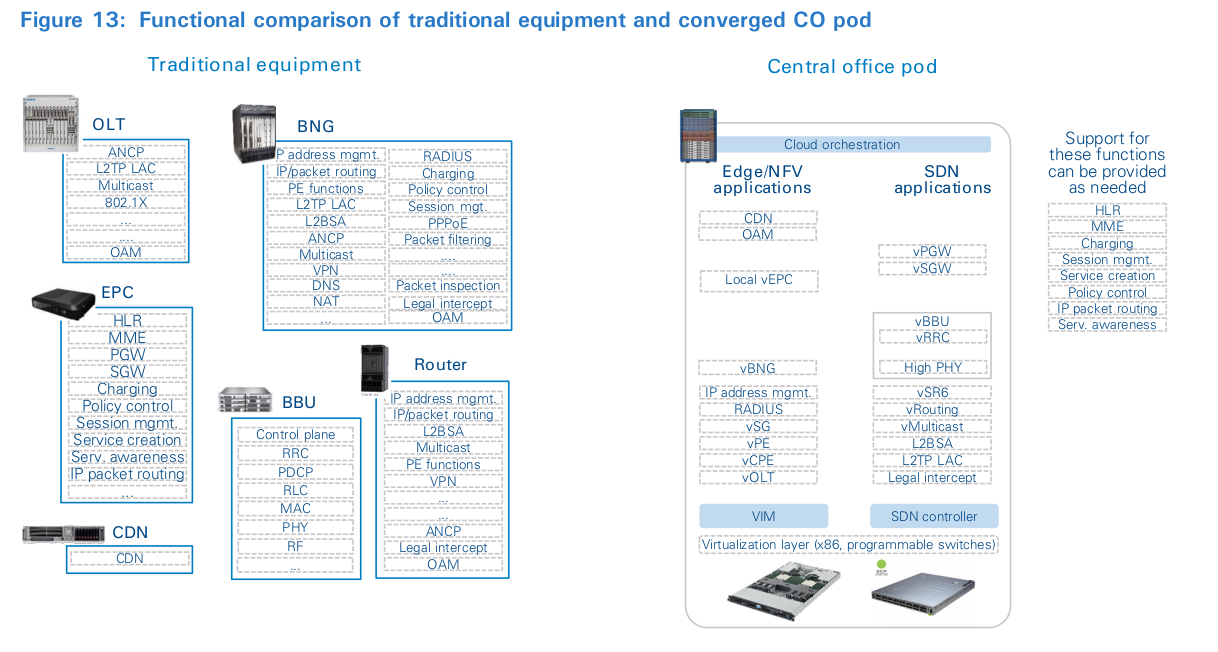

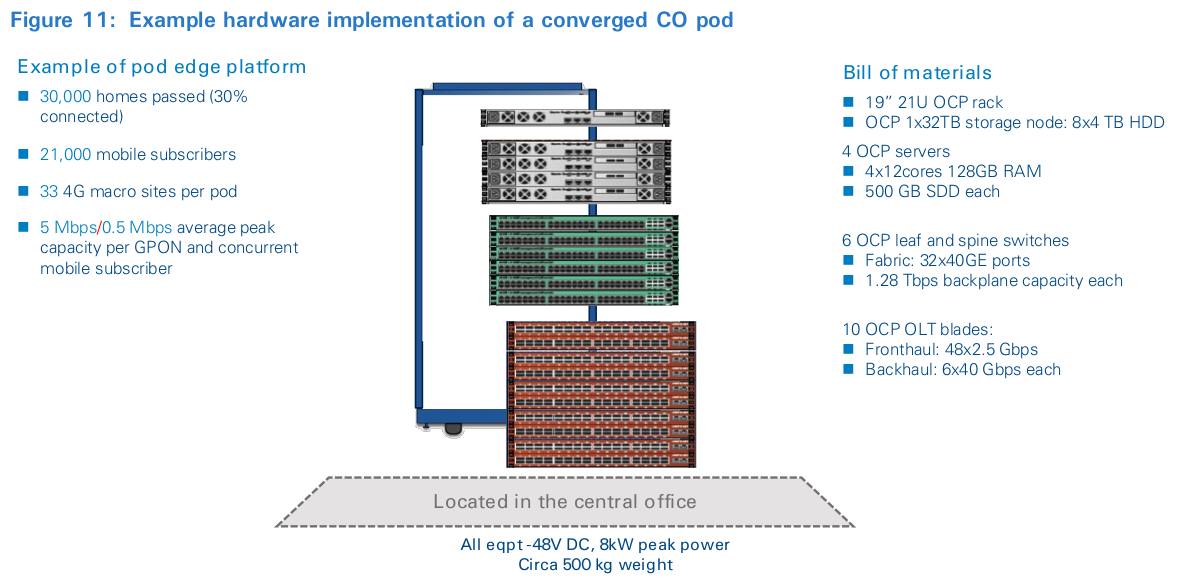

The basic physical unit for the new design is a modular pod built using many of the same components you would expect to find in a typical cloud data center. It consists of a modular, high-density rack of general-purpose compute, storage, high- speed programmable switching, and special-purpose devices to enable different broadband access technologies such as FTTx, xDSL, cable or WTTH and, as of late, radio access. This design allows the pod to provide access, aggregation, edge-routing and computing services. The pod design limits the number of specialized hardware designs and maximizes the use of general-purpose OCP hardware through the disaggregation and refactoring of components that were previously found on the interior of legacy access nodes. Figure 11 shows an example implementation of a half-rack pod dimensioned to serve the fixed and mobile traffic needs of a medium-sized neighborhood of circa 30,000 households.

The new software architecture

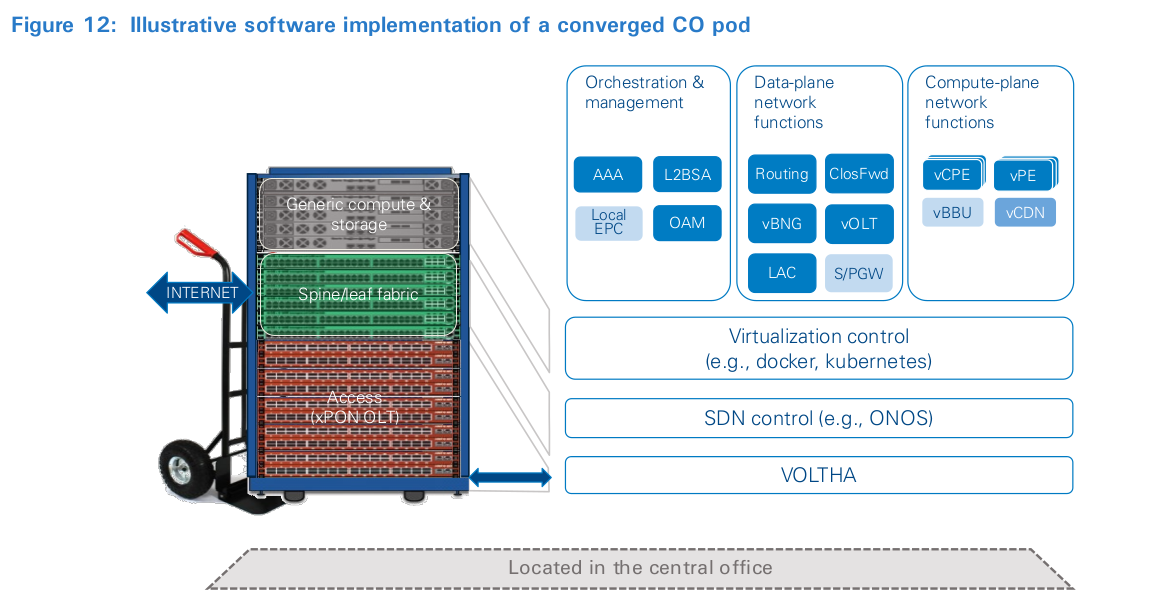

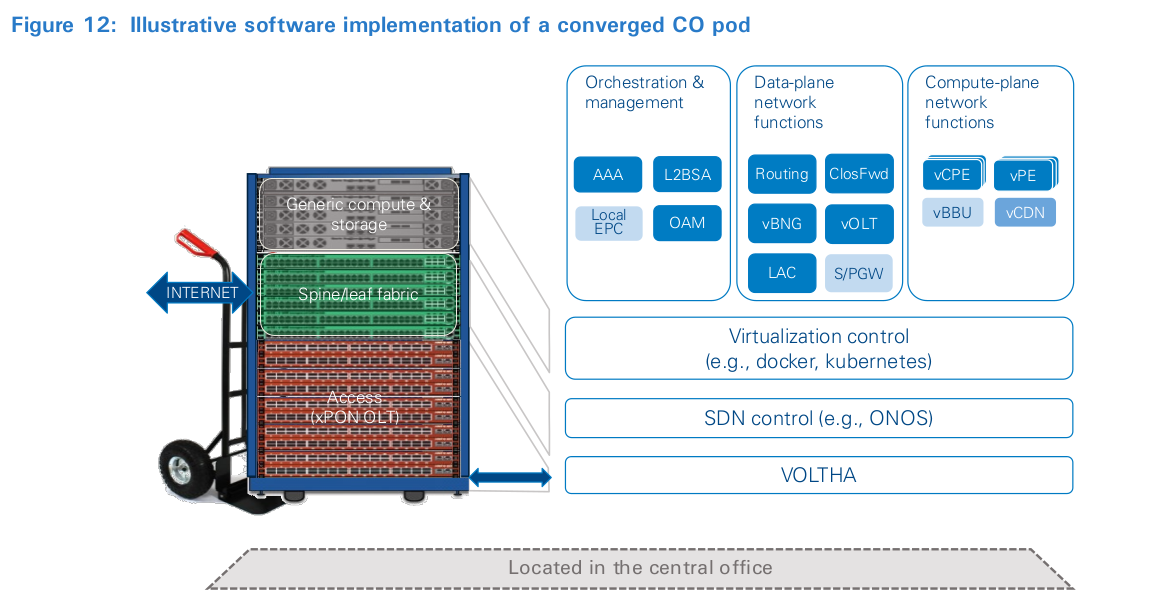

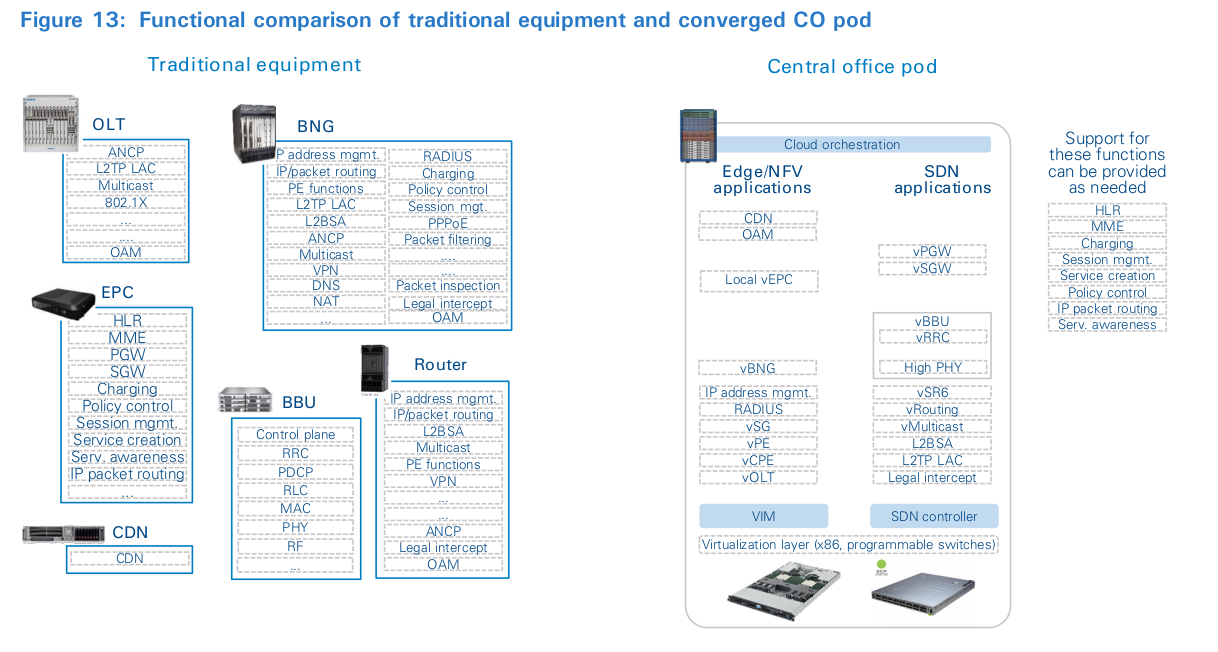

Figure 12 illustrates high-level functional building blocks of the new design. It uses the same technology patterns that have been proven effective in public-cloud data centers. However, unlike the public cloud, the pod is a transit cloud. This means, in addition to running public cloud-like virtualized compute and storage workloads, the pod must forward traffic efficiently to also support communications workloads. This is made possible through an architecture that explicitly enables NFV and SDN applications. The former provides infrastructure services that emulate the public cloud. Meanwhile, the latter allows developers to exploit the programmable networking fabric for data-plane traffic control and processing. This is an important step beyond traditional NFV implementations. Rather than using the compute functions for complex packet switching and forwarding, the programmable network hardware is able to offload a significant part, or even the complete data plane, of a (virtual) network function, which can reduce the amount of compute resource required. This is accomplished by using the white-box fabric switches already in place to interconnect the compute and storage. New elements are not typically needed, and software access to the white-box switches allows controller- based direction to program sophisticated behaviors into the fabric. Using the switching fabric this way creates a great deal of efficiency and cost savings compared with using general- purpose compute for switching workloads. For example, a single fabric elastically supports server interconnect, basic Ethernet switching, IPv4 and IPv6 routing, IP/MPLS switching, and even BNG and SAE gateway functions – as separate network slices – at the same time 13 .

The software elements that make up a complete implementation include both the infrastructure management and network function software. As shown in Figure 12, the former consists of open-source operations and management tooling for virtualization, configuration management, testing, monitoring, logging, analytics and security. While the architecture pattern is the same in most deployments, the specific tools used will vary and depend on the operator’s preference or familiarity from previous traditional data-center deployments. However, the choice of SDN controller has narrowed for the authors. One of the most advanced open-source options targeting a CO deployment is ONOS, in combination with SEBA and OCP design-based OLTs. As part of the CORD project, ONOS can host several other data-plane network functions, such as routing, ClosFwd, vBNG, vOLT/vOLTHA, LAC and S/PGW. The CO pod’s local orchestration or management functions (AAA, L2BSA, Local EPC, OAM) and additional network functions (vCPE, vPE, vBBU, vCDN) could be hosted as either stand-alone containers/VMs or SDN controller-integrated apps. Operator deployment circumstances will drive the specific choice.