Open insurance — sharing insurer-held data and capabilities within a specialized partner ecosystem — offers benefits to customers and industry players alike. As a key enabler for embedding insurance solutions within product and service purchases, it provides customers greater convenience, flexibility, and personalization. For insurers, it allows for better targeting, efficiency, product/service enhancement, and data accuracy. Yet there are significant barriers hindering progress toward the open insurance model. In this Viewpoint, we examine the building blocks and priorities for overcoming barriers and making open insurance a reality.

WHY OPEN INSURANCE NEEDS INSURTECHS

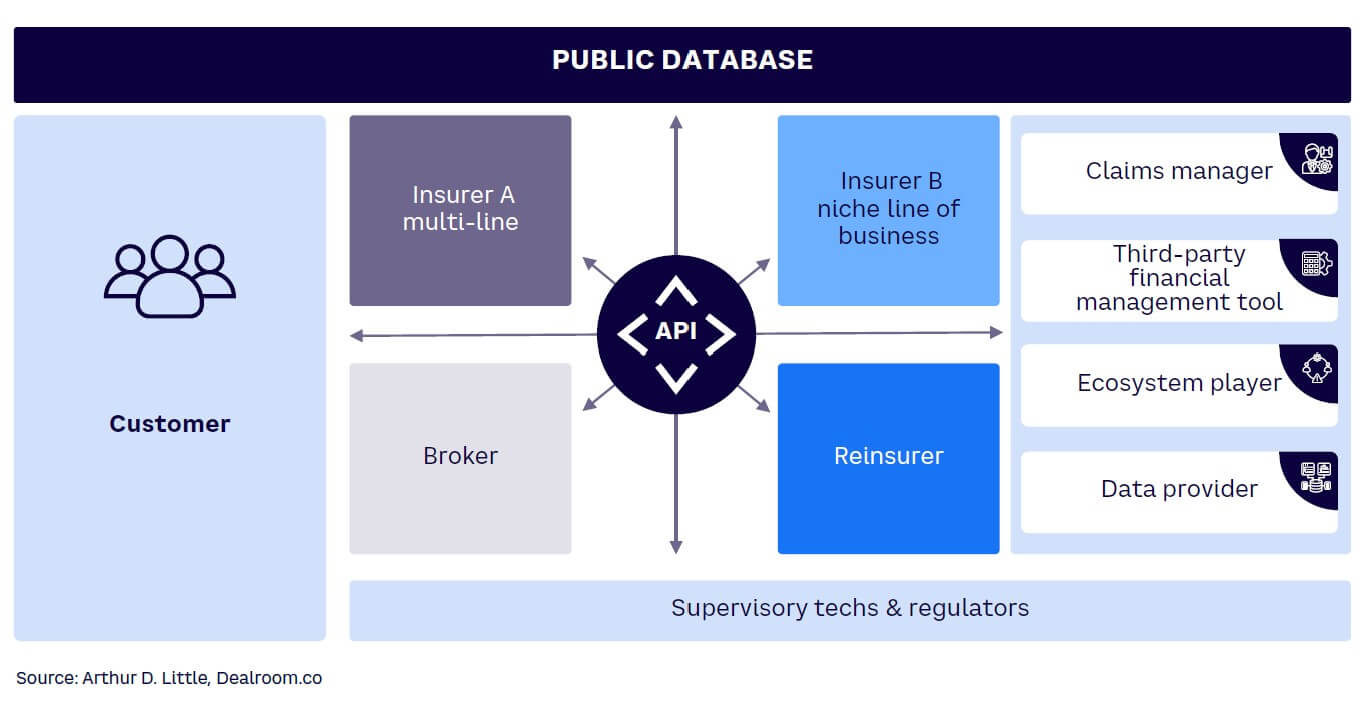

Open insurance refers to sharing insurer-held data and capabilities within a specialized ecosystem (see Figure 1). Similar to the banking sector, which is reshaping its field by enabling third-party developers to create new banking and “beyond banking” products and services, open insurance uses application programming interfaces (APIs) to do the same for the insurance industry in all types of insurance (e.g., life, property, auto, health). The reward for insurers will be twofold, as they will:

-

Become faster, more targeted, and more embedded in their distribution and product development through open insurance and embedded insurance partnerships.

-

Have access to better data and broader partner ecosystems to enhance their distribution width, underwriting, and claims management.

Both points will improve insurers’ total addressable market, lower their customer-acquisition efforts, reduce their claims cost (including fraud), improve their responsiveness to customers, and increase their capacity to manage risk, which will, as a result, generate more value. Technology is crucial to making open insurance a reality, and insurtech start-ups, with their agile frameworks and technology-first approach, play a pivotal role: they can prototype, test, deploy, and adapt solutions at a pace traditional insurers find challenging. Moreover, insurtechs are typically able to engage more frequently with customers than the traditional model allows. Collaborating with insurtechs not only brings technological prowess but also creates a fresh perspective on product development and consumer engagement throughout the insurance cycle.

In addition to technology, open insurance requires a strong ecosystem developed around a specific purpose. Insurance is not a standalone product; rather, it exists only when a consumer satisfies an underlying need or want (e.g., obtaining a house or car) that in turn requires safeguarding in the form of insurance. Many options are already well-defined, often with sophisticated digital structures. Open insurance allows companies to tap into these as partners through existing ecosystems. In return, both expand their business opportunities and drive greater efficiency across their business models.

BENEFITS ACROSS THE VALUE CHAIN

The benefits of open insurance are not just for incumbent or emerging businesses but also for others across the value chain:

-

Insurers. Incumbent providers stand to benefit across all aspects of the value chain, as open insurance will allow them to broaden their product and service offerings, provide more customized protection, and operate in underwriting and claims management with more accurate data. Moreover, open insurance enables insurers to transition from only selling insurance to embedding the insurance product into the underlying needs of the customers (i.e., corporates or consumers); we refer to this as “embedded insurance.”

-

Customers. Today’s customers seek greater personalized and relevant experiences. Open insurance promises just that: better engagement, more tailored products, real-time claims processing, and dynamic pricing models. Access to a wider array of services from third-party ecosystem providers ensures a more seamless, closely integrated, customer-need-focused experience for consumers as well as corporates. In addition, insurers will be better able to understand how needs change over time. Customers stand to acquire substantial value.

-

Insurtechs and other third-party providers. Innovative players will gain permissioned access to the unique capabilities of insurance companies to understand price and carry risk, allowing them to create new and relevant products for customers within a short product development time. These innovators aim to address potential market gaps and enhance and enrich the consumer experience. In doing so, they will add substantial overall value to the value chain.

-

Reinsurers. Reinsurers may gain significantly from the advent of open insurance by leveraging more precise and dynamic risk models developed from granular data. This supports better underwriting and the creation of innovative reinsurance products tailored to emerging market needs. Enhanced operational efficiencies arise from automated and real-time data exchanges, facilitating smoother claims processes and reporting. Additionally, open insurance ecosystems offer strategic partnerships and global expansion opportunities, enriching reinsurers’ portfolios and revenue streams. The resulting transparency aids in regulatory compliance, leading to a more robust and stable reinsurance market.

-

Regulators. An open system fosters transparency. Regulators can leverage open insurance to gain a better view of market developments, consumer reactions, and the performance of individual insurance companies. Moreover, open insurance will allow a specific class of insurtechs to develop solutions to enhance the efficiency and effectiveness of regulatory compliance, thus reducing friction and costs in the overall systems. The regulators will be in control of the speed of the required regulatory changes.

OPEN INSURANCE FUELS EMBEDDED INSURANCE

Open insurance is a catalyst for the growth and evolution of embedded insurance, where insurance is purchased as part of a commercial transaction for another product or service. Embedded insurance opens the way for more innovative, accessible, and personalized insurance solutions. Improved customer experience is a key benefit; customers can use the same channel to arrange insurance at the same time as purchase of the product or service.

The ecosystem nature of open insurance provides an ideal environment for insurers, technology companies, and service providers to collaborate and cocreate tailored embedded insurance solutions. For example, travel platforms use customer data shared in open insurance frameworks to offer on-demand products that only activate during travel periods. As another example, car manufacturers with access to driving-behavior data are already collaborating with insurers to provide tailored embedded policies customized specifically for individual driving profiles to improve the customer experience and provide more accurate risk evaluations and pricing models.

Embedded insurance models are also readily scalable, as they can easily integrate into various platforms. For instance, small business platforms offering tailored coverage can take advantage of open insurance principles to provide automated coverage to precisely address individual businesses’ specific requirements. The synergy between open insurance and embedded insurance is evident in various sectors, from automotive to travel to e-commerce, where embedded insurance is becoming increasingly prevalent.

BARRIERS TO GROWTH

Despite its potential, open insurance has been slow to gain momentum. Insurtech as a market lacks strong funding, which is one reason for its modest growth. In addition to the record decline in investment in the insurtech sector, several other factors have contributed to the slow adoption of open insurance:

-

Mixed interest from incumbent insurers. Despite the significant benefits mentioned above, open insurance also brings potential threats in the form of increased competition, eroded brand value, and greater dependency on third parties. Many insurers operate on older IT infrastructures that aren’t readily compatible with the demands of open insurance. Migrating to new systems is expensive, time-consuming, and fraught with operational risks. Given the significant up-front investment, ROI may not be immediately apparent. Furthermore, open insurance could level the playing field, reducing the competitive edge that larger insurers built over decades. Transitioning to an open model will usually require upskilling and re-skilling staff, restructuring departments, and rethinking business strategies, all of which can slow down the adoption process. And as with any major change, open insurance requires a substantial change of mindset for everyone involved, in what is traditionally a conservative industry. An incumbent’s interest and approach will depend on its strategic goals, current capabilities, and vision for the future.

-

Regulatory and data concerns. Insurance is a heavily regulated industry. Open insurance raises concerns about data protection, consumer rights, and industry stability. Regulators must tread carefully and recognize that the pace of legislative change doesn’t always match the speed of technological evolution. Moreover, for the insurer, data breaches in an open insurance environment could have significant repercussions, impacting brand trust and potentially incurring hefty penalties.

-

Lack of standardization. Open insurance necessitates standard protocols to ensure data compatibility and seamless integrations. Without industry-wide standards, it is hard to roll out protocols, which has led to a fragmented approach across the insurance landscape.

-

Consumer awareness and trust. Though the industry sees the potential, consumers’ current perspective might obscure it. Changing awareness to recognize the value of insurance in an open environment is a slow process.

-

Limited ecosystem. For open insurance to thrive, it needs a robust ecosystem of third-party developers and service providers specializing in specific customer needs. Some of these structures are still in their nascent stages, and many do not currently feature insurers and their ability to de-risk.

BUILDING BLOCKS FOR PROGRESS

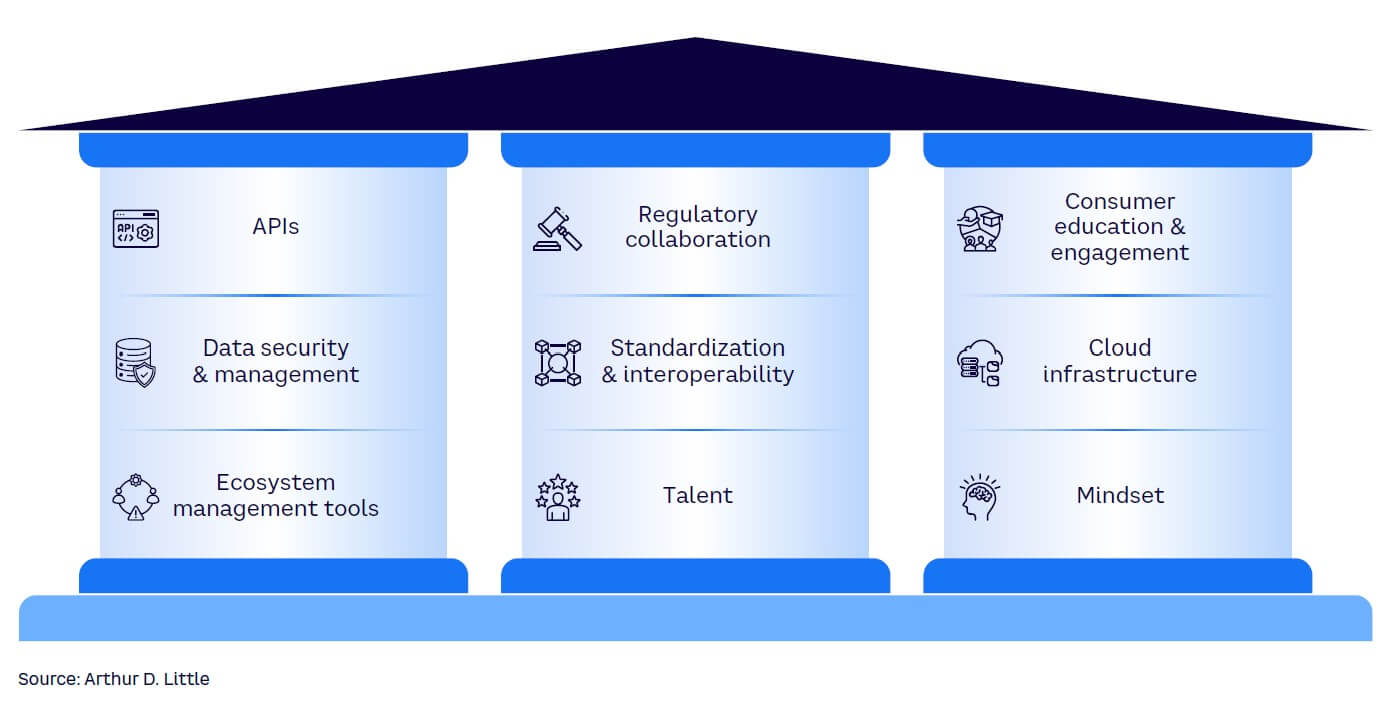

With these barriers to overcome, we cannot expect that the adoption of open insurance will happen overnight. To make progress, a concerted effort will be necessary across insurers, regulators, infrastructure, and service providers. We recognize nine essential building blocks for the industry to pursue (see Figure 2):

-

APIs form the center of open insurance, facilitating seamless data exchange among different systems and stakeholders. They enable insurers to integrate their services with third-party platforms for an enhanced customer experience and to foster an interconnected ecosystem for distributing embedded insurance products. Companies need to explore the increasing range of available insurance APIs.

-

Data security and management practices need to be further developed and enhanced. Effective data-security practices protect sensitive customer data and build trust among customers while meeting regulatory requirements. Data protection is more than a technical necessity; it forms the foundation of customer confidence.

-

Key players need to develop and implement better ecosystem management tools to oversee and manage all components of an open insurance ecosystem, from coordinating partnerships to tracking performance to ensuring consistent operations. When used effectively, ecosystem management tools can enhance operational efficiency and encourage innovation.

-

Industry players need to seek closer collaboration with regulatory bodies. This is essential in a highly regulated market like open insurance. Working in tandem ensures compliance and creates an environment conducive to innovation while shaping policies to protect consumers and simultaneously supporting the expansion of open insurance models.

-

Connected with this, the industry needs to accelerate the development and implementation of standards and interoperability requirements, to ensure smooth integration across platforms and stakeholders, allowing systems to communicate and share data efficiently, while services remain reliable and consistent. Strict regulatory compliance requirements are also vital to building customer trust. Adhering to such standards makes products more reliable and trustworthy; open banking regulations in Europe under the revised Payment Services Directive (PSD2) have inspired similar frameworks in insurance to protect customer data while simultaneously encouraging innovation.

-

Key players, especially traditional insurance incumbents, need to invest in the development of new talent, skills, and experience in areas like data analysis, cybersecurity, and digital marketing. A talented, adaptable workforce of technically knowledgeable and creative thinkers is key to a successful transition.

-

Consumer education and engagement are central to adoption and perhaps one of the most important building blocks of all. Consumers must understand how open insurance works as well as its advantages and risks. An effective consumer-engagement strategy ensures that offerings meet their needs and expectations.

-

A secure and robust cloud infrastructure needs to be deployed and adopted. The cloud offers the scalability, flexibility, and efficiency required for efficiently managing massive data sets and complex operations. The cloud also facilitates rapid deployment of new services while offering robust data analytics capabilities and improving collaboration across its ecosystem.

-

Last but not least, the leadership of key insurance players needs to bring about a new mindset, one that embraces change, innovation, and customer-centricity. Without this, open insurance will not be able to deliver on its huge potential. Open insurance’s viability and successful evolution lie in the interplay among these building blocks. Each one is essential on its own but also contributes to creating an interdependent system that promotes efficiency, innovation, and customer-focused services.

THE KEY ROLES OF VCs & INVESTORS

Transformations of this scale will not happen without adequate investment and funding, and venture capitalists (VCs) and other investors will need to play a critical role. While macroeconomic and geopolitical factors remain key factors in determining levels of investor activity, it is undoubtedly true that success breeds success. There are several ways that investors can help shape the evolution of open insurance in a positive way.

The most obvious investor role is providing the capital required for start-ups and incumbents to research, develop, and implement open insurance solutions. Financial backing will allow companies to hire talent, upgrade infrastructure, and deploy solutions more rapidly. Beyond this, investors can often add considerable value through their expansive networks spanning industries, regions, and expertise. Start-ups can leverage these networks to form partnerships, find clients, and gain regulatory insights. Investors, VCs, and/or corporate venture capitalists (CVCs) can create synergies by fostering relationships between their portfolio companies. For instance, a VC invested in both data analytics and insurtech start-ups could establish a partnership between them, enhancing the open insurance capabilities of the insurtech. Clear exit strategies, whether executed through acquisitions, mergers, or public offerings, can influence the trajectory of open insurance start-ups. Investors can help shape these strategies to ensure sustained growth and industry impact.

Investors can also add their weight and influence in advocacy for overcoming regulatory hurdles and advancing industry policies conducive to open ecosystem development, either directly or by supporting industry consortiums. Focused action can make a real difference where investors are CVC arms of incumbent insurers or participants across an insurance ecosystem.

Ultimately, investment from reputable VCs and/or the CVC arms of existing insurers serves as a stamp of approval, signaling to the market that the venture and the wider concept have real potential. Validation will, without a doubt, enhance credibility, attracting additional partnerships and customers going forward and leading to a virtuous circle of change and transformation.

Conclusion

BRIDGING INNOVATION & REALITY

Though still in a nascent state, open insurance is not merely a trend — it’s here to stay. The benefits are manifold, yet the barriers to realizing these benefits are still very significant. As with most industry transformations, there are no quick solutions, but collectively the key stakeholders can start to bring about the needed shift.

The starting point is to seek wider acceptance of the need for change across the value chain, especially among traditional incumbents who are also the most exposed to the risks involved. Evolving culture and mindset toward one more ambidextrous is fundamental — embrace innovation, creativity, and flexibility while maintaining productivity and operational efficiency. Developing new capabilities/skills and attracting new talent are key to building momentum, as are building flexible business processes and infrastructures to allow for new technologies, market demands, and regulatory shifts. Data is the essential fuel for open insurance, and action to further advance data management infrastructure, standards, regulation, and analytics is a prerequisite for progress. As the line blurs between insurers and tech companies, a collaborative, open, and technology-driven approach will be the hallmark of successful providers. The industry stands at a precipice — its next decisions will determine its evolution for years to come.