87 min read • Automotive

GLOBAL ELECTRIC MOBILITY READINESS INDEX — GEMRIX 2023

Charting the progressive course of e-mobility across the world

FOREWORD

Catastrophic climate change urges global shift toward electric vehicles — but the world needs to establish its readiness

The pressing issue of climate change, which world-renowned naturalist David Attenborough called “the biggest threat to security that modern humans have ever faced,” brought world leaders to a single stage culminating in the landmark Paris Agreement. This resulted in the requirement for countries to submit climate action plans known as Nationally Determined Contributions (NDCs), outlining their emissions-reduction targets and the measures they would undertake to achieve them.

Energy is at the heart of today’s climate challenge and key to the solution, with the inherent need to transition from fossil fuels to clean, sustainable energy. The transport sector, in particular, is responsible for approximately a quarter of greenhouse gas (GHG) emissions, with about 95% of the world’s transport energy coming from fossil fuels. Thus, the electrification of transportation offers a promising solution to climate change — but only if combined with a transition to electric energy generation from renewable resources. In any case, electric vehicles (EVs) beat alternative powertrain technologies with internal combustion engines (ICEs) in efficiency by a wide margin, disregarding the burning of fuel.

Of course, ending the age of the combustion engine is still a challenge for large parts of the planet. However, with 90% of the world GDP now covered with net-zero commitments and pressure on companies to counter climate change through new products, processes, and purpose, e-mobility topics have moved up the strategic agenda for automotive executives around the globe. To assist executives in organizations of all kinds around the world, Arthur D. Little (ADL) has set up a methodology to evaluate the “readiness” of markets for electric mobility and help formulate strategies based on the data. The standardized approach and detailed analysis of key market drivers for EVs enable a solid understanding of the current situation.

ADL’s current analysis covers 35 markets across all continents under varied situations regarding demographics, economics, motorization, energy generation, and so forth. In this Report, we provide an overview of the key results of the 2023 edition of the Global Electric Mobility Readiness Index (GEMRIX), which ADL first carried out in 2018 under the name, “BEV Readiness Study.”

Dr. Andreas Schlosser

Partner, Global Lead, Automotive

EXECUTIVE SUMMARY & KEY FINDINGS

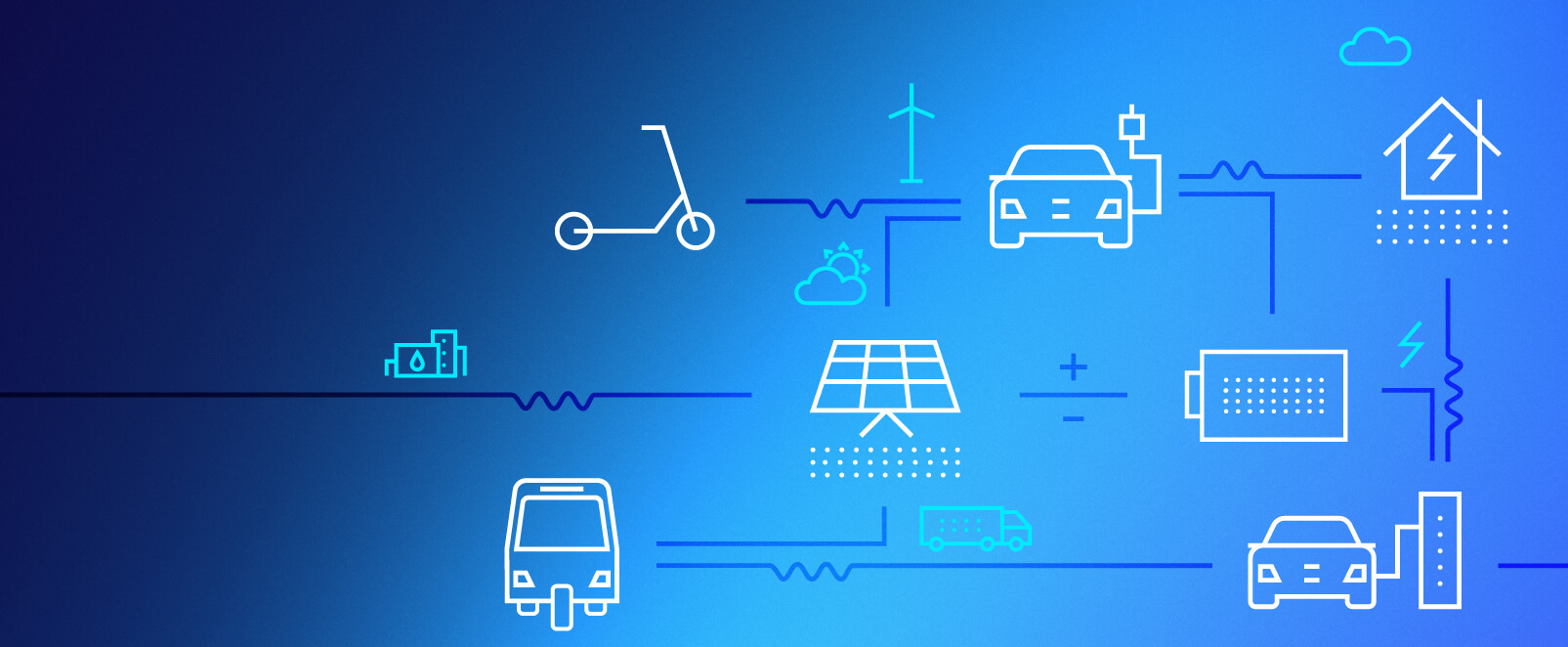

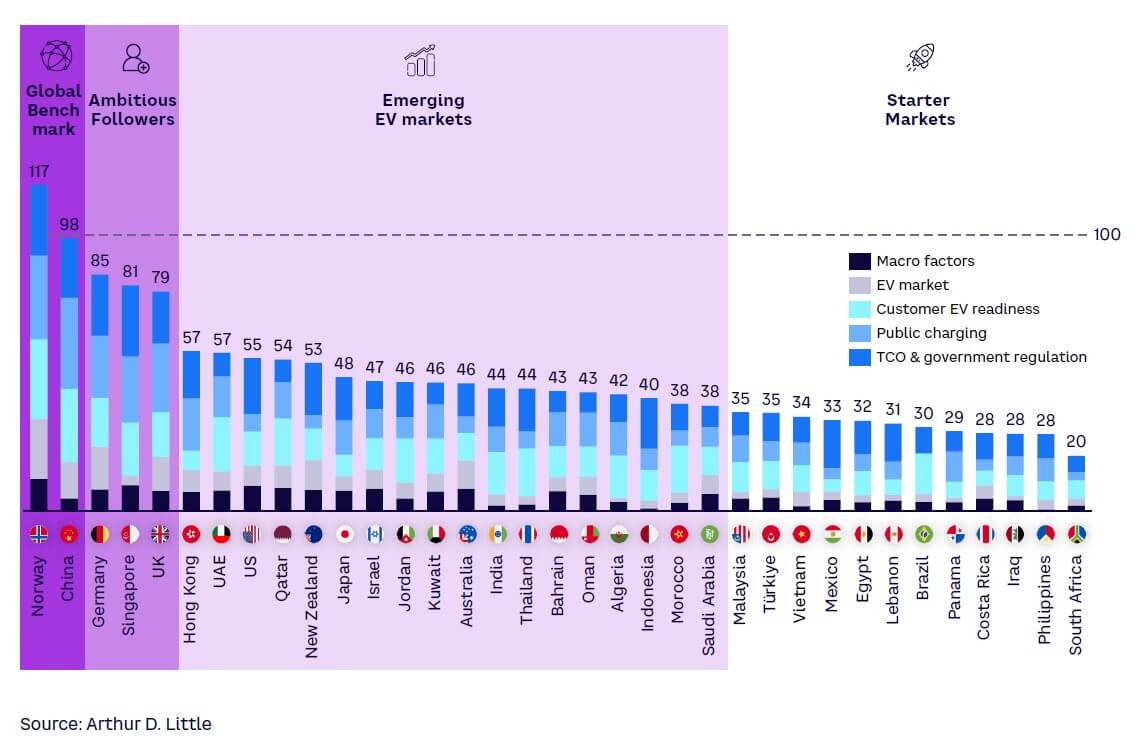

GEMRIX 2023 is the third edition of the study and now includes 35 markets across all continents (see Figure 1). Already since the 2022 edition, there has been a massive jump in EV adoption worldwide. Norway has defended its position as the global leader of the EV readiness ranking, but a new challenger is getting closer, making huge steps: China.

The two markets are followed by three distinct groups of countries. All countries are moving to increase EV adoption, following similar patterns but with differences in time by a few years, as some started earlier than others. We discern differences between global markets primarily in specific legislation and, to a lesser extent, socioeconomic factors. In countries with higher income, for example, environment protection plays a crucial role, while in countries with lower average income, cost is the primary determining factor. The perspective to participate in a new, dynamically growing industry also sets incentives for vehicle electrification in many regions.

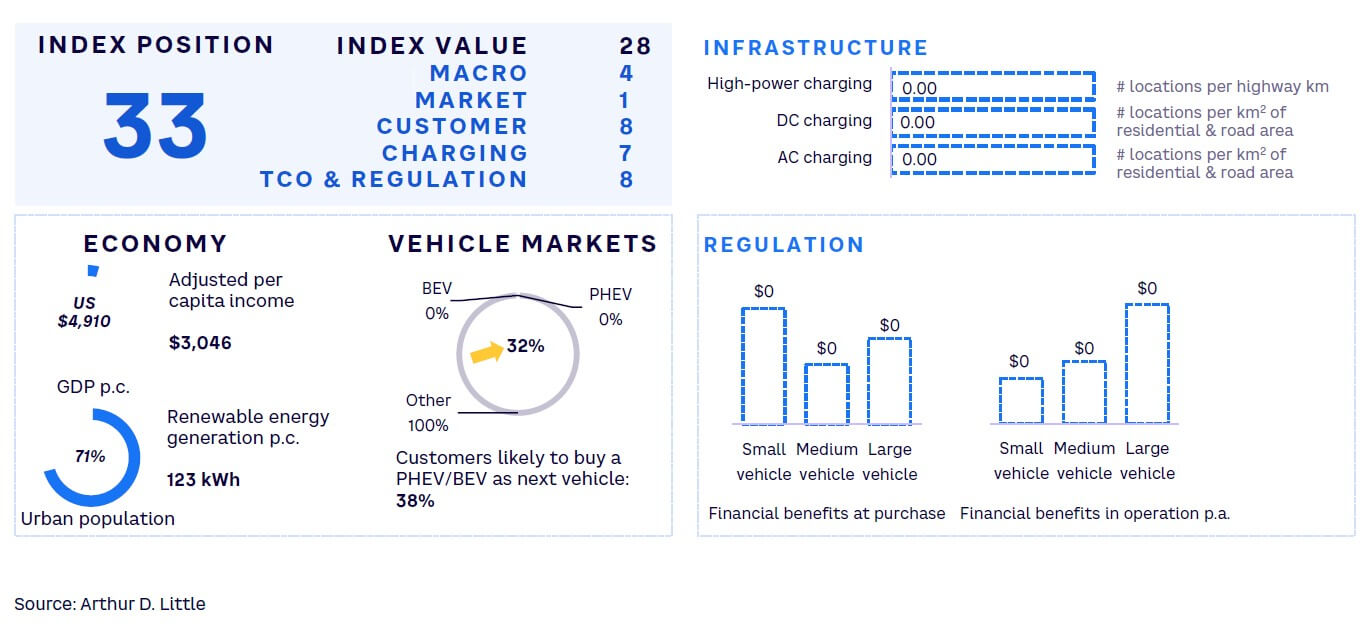

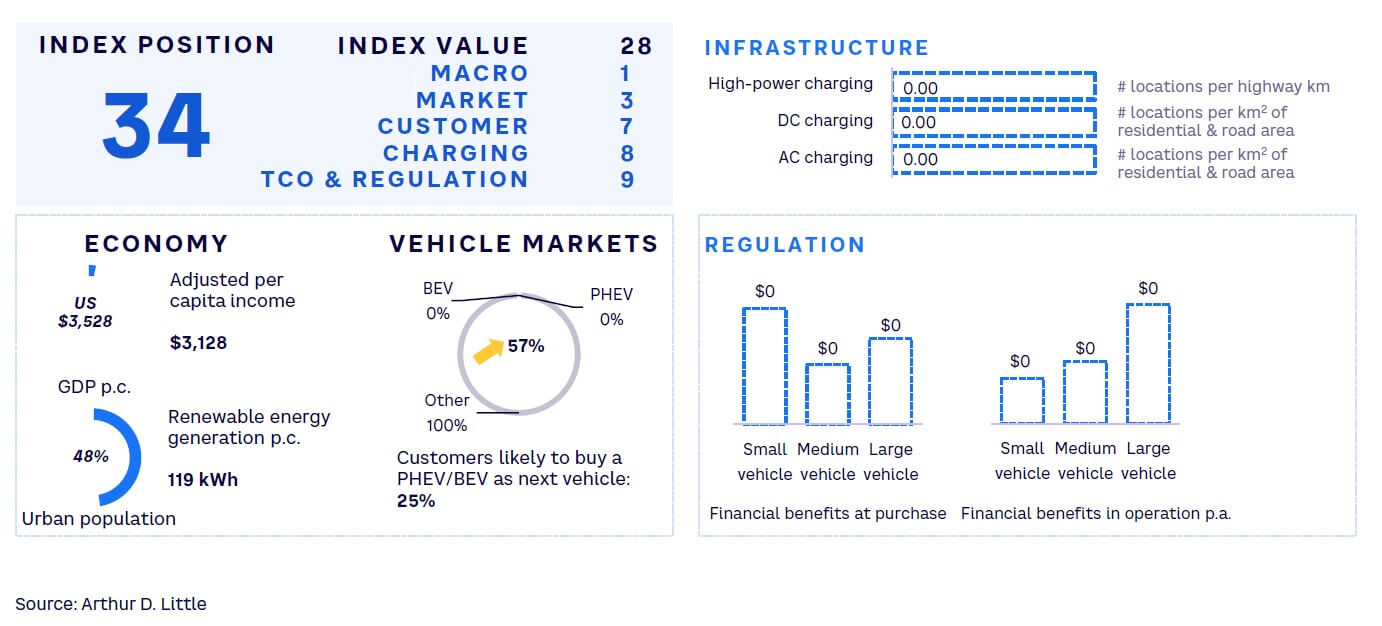

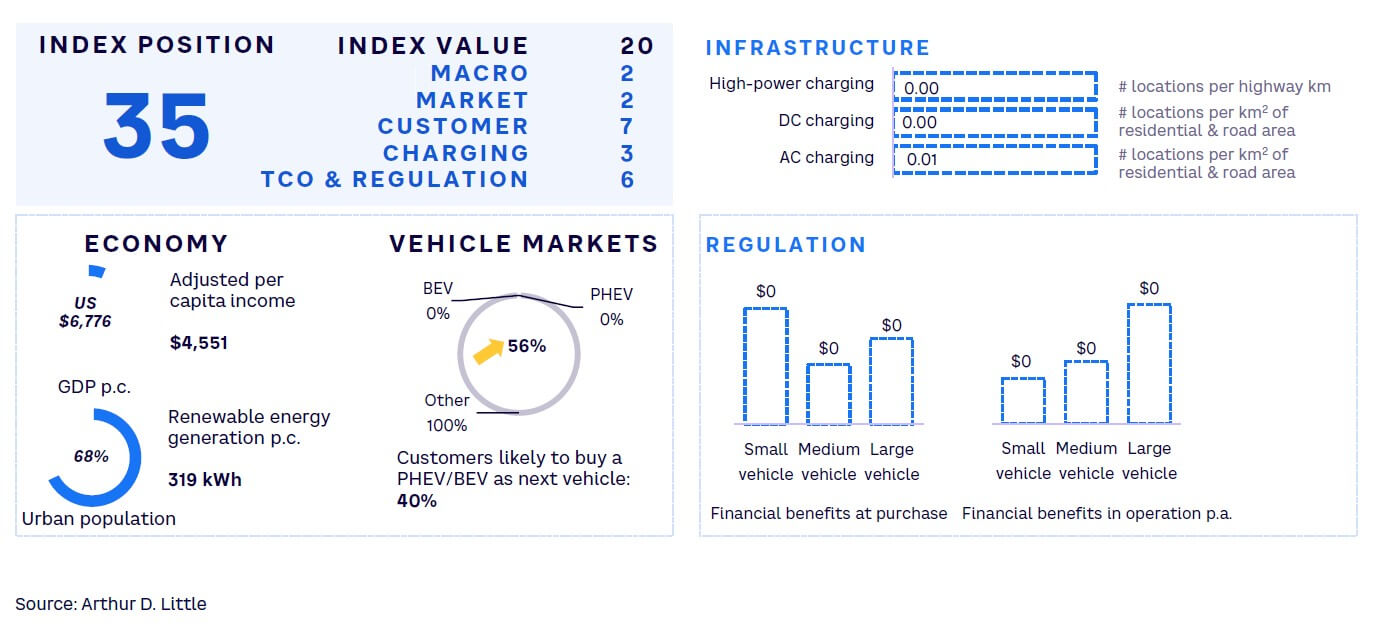

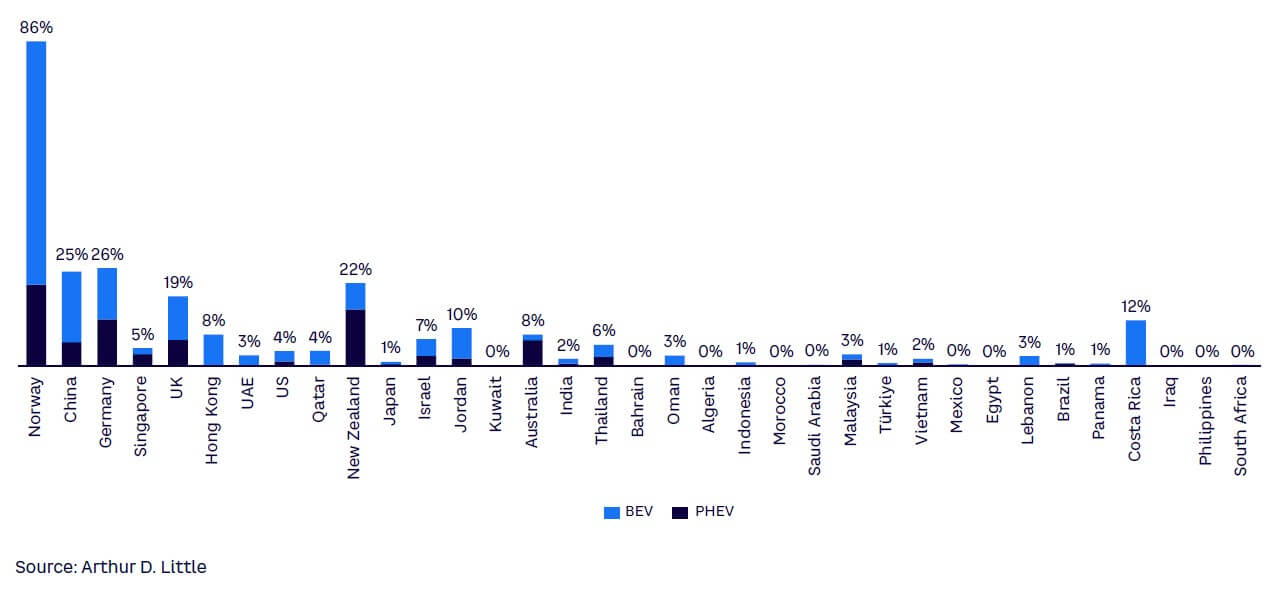

In the 2023 GEMRIX study, the markets are classified into four clusters:

-

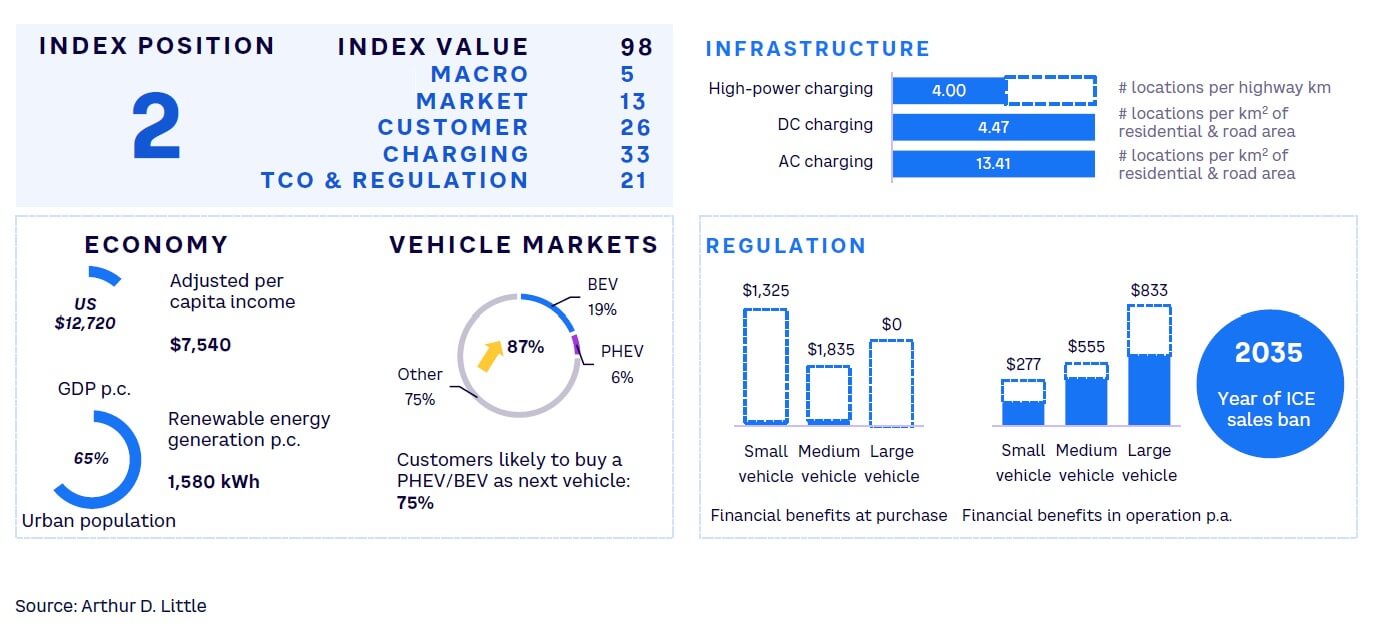

Global Benchmark — markets with a GEMRIX score of 100 or above. In the 2022 edition, only Norway, a lead market for electric mobility, populated this category with more than 110 points. This year, for the first time, a second market has moved closer to the threshold: China scores 98 points. Among the 35 markets, Norway is still the only country with an EV sales share of more than 50%. A stunning 88% of all new cars sold in Norway in 2022 were either battery electric vehicles (BEVs) or plug-in hybrid electric vehicles (PHEVs).

-

Ambitious Followers — where all prerequisites for EV mobility are in place and EVs are on the verge of becoming mainstream. Example markets in this category are Germany, Singapore, and the UK. Among Ambitious Followers, EVs have increased their sales shares to more than 30%. In leading markets, a full range of EV models in different formats and price ranges is available, serving a broad spectrum of client needs. However, even in leading markets, OEMs are still under pressure to expand their EV offerings, especially to the entry market segment.

-

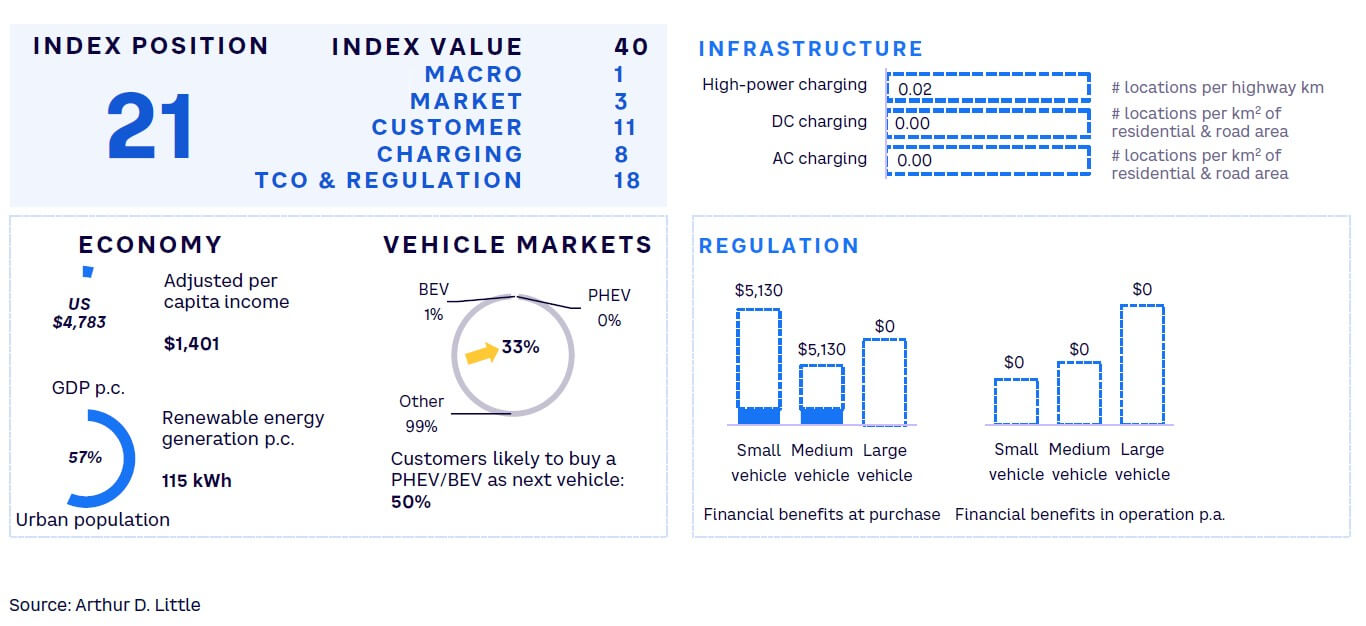

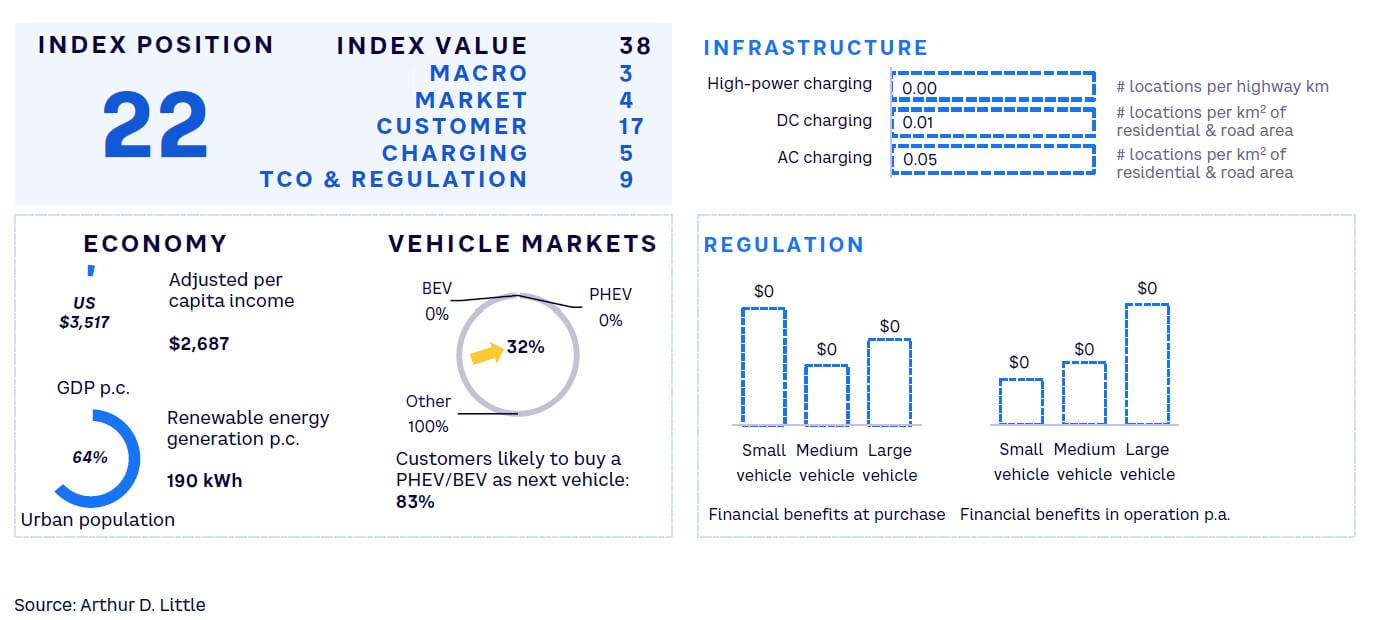

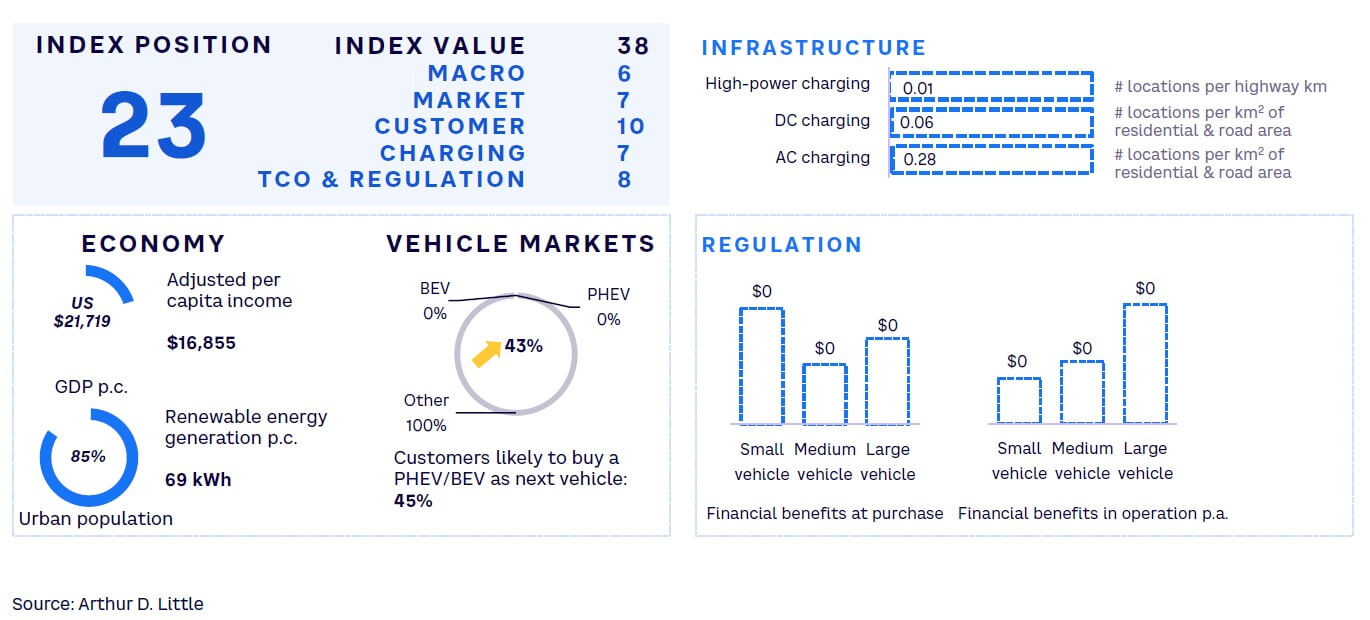

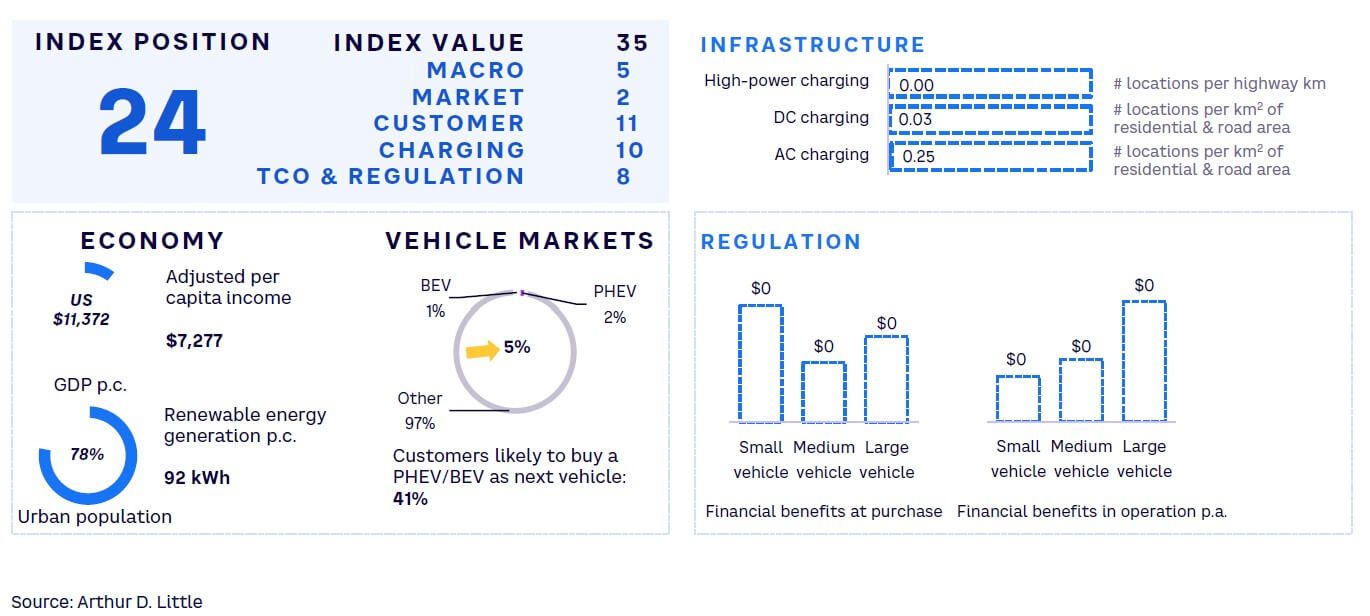

Emerging EV Markets — where conditions for EVs are still inferior to those for ICE vehicles, even though customers are becoming more comfortable with the idea of EVs as infrastructure is ramping up. Example markets are the US, Japan, the UAE, and India. Here, we see mainly scores between 40 and 60, with the UAE and Hong Kong emerging as the front-runners with a score of 57. In these markets, we still see a few operational and financial drawbacks. However, these countries have demonstrated a clear intention to make steady progress toward e-mobility. They are making significant investments to boost the landscape — and will likely catch up soon. For example, an entrepreneurial culture and a start-up ecosystem have played a pivotal role in driving EV innovations in the Americas, Southeast Asia (SEA), and the Middle East. Furthermore, the UAE has experienced an increase in EV charging infrastructure owing to government-led initiatives, a significant catalyst behind the increasing number of consumers willing to buy an EV as their next vehicle.

-

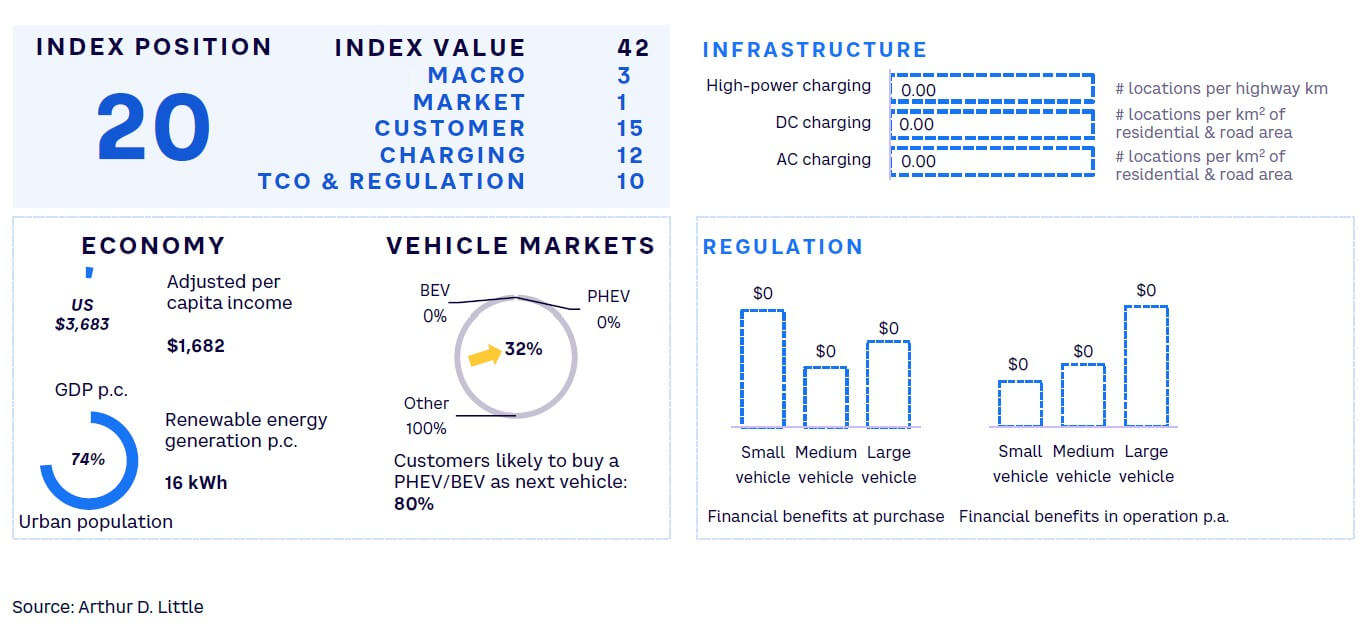

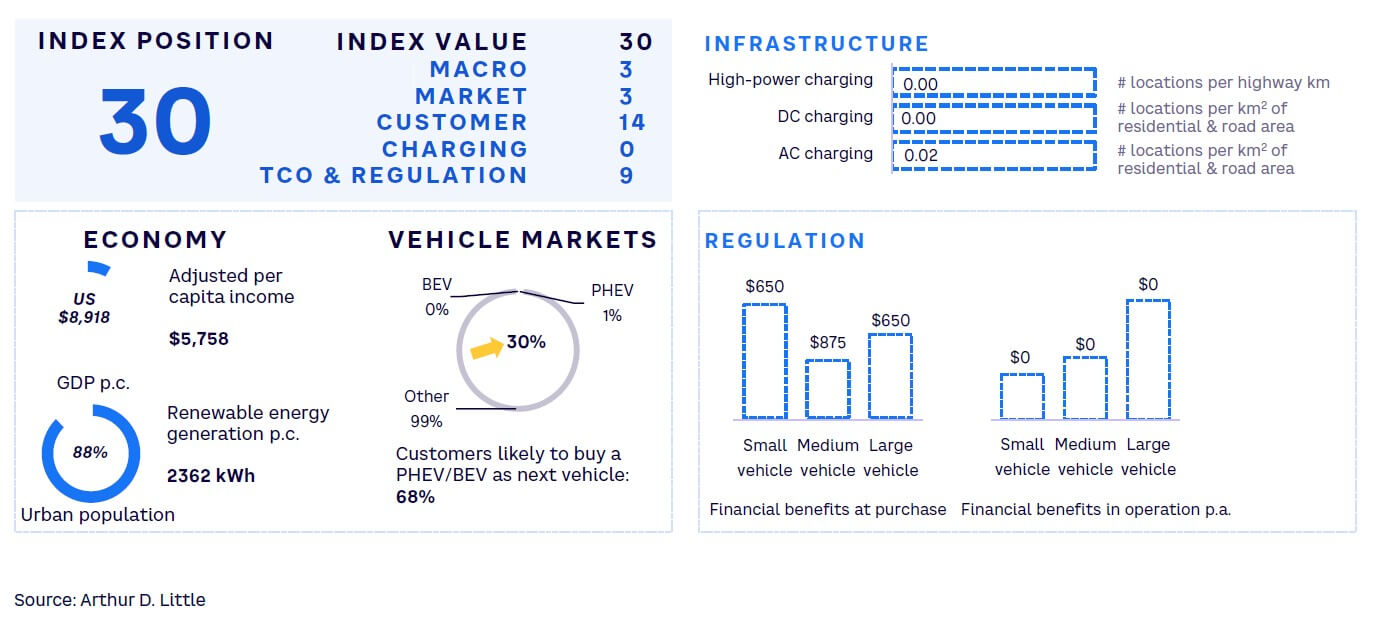

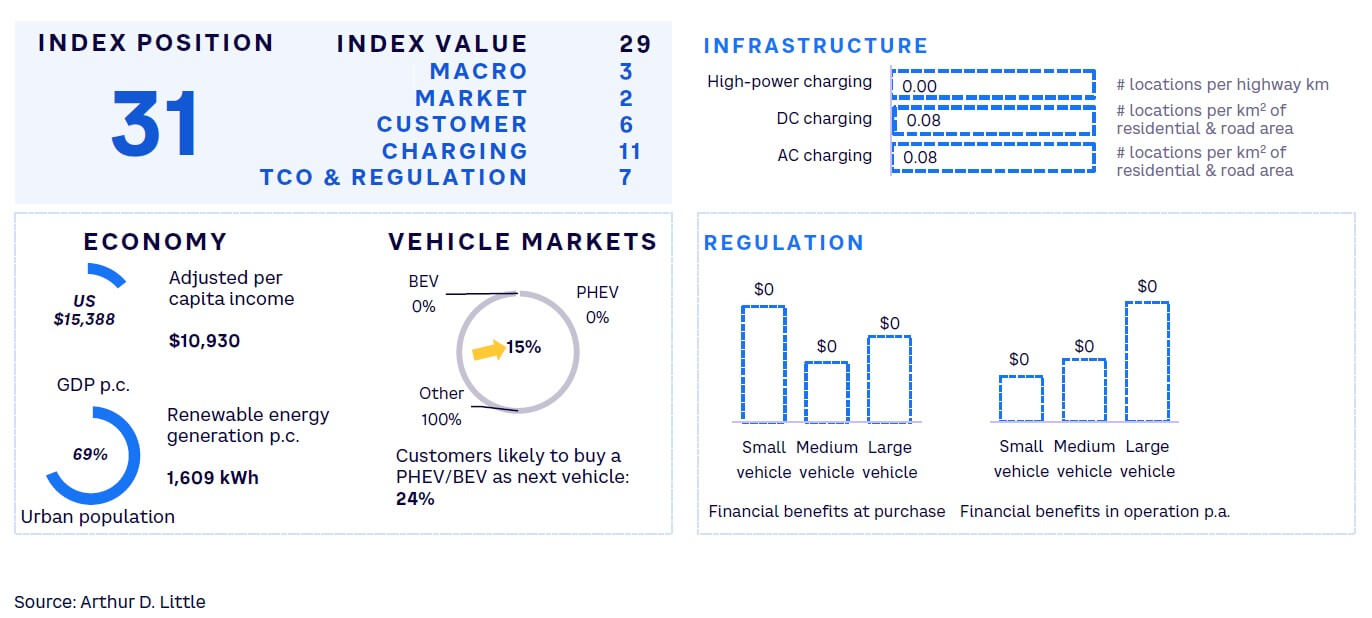

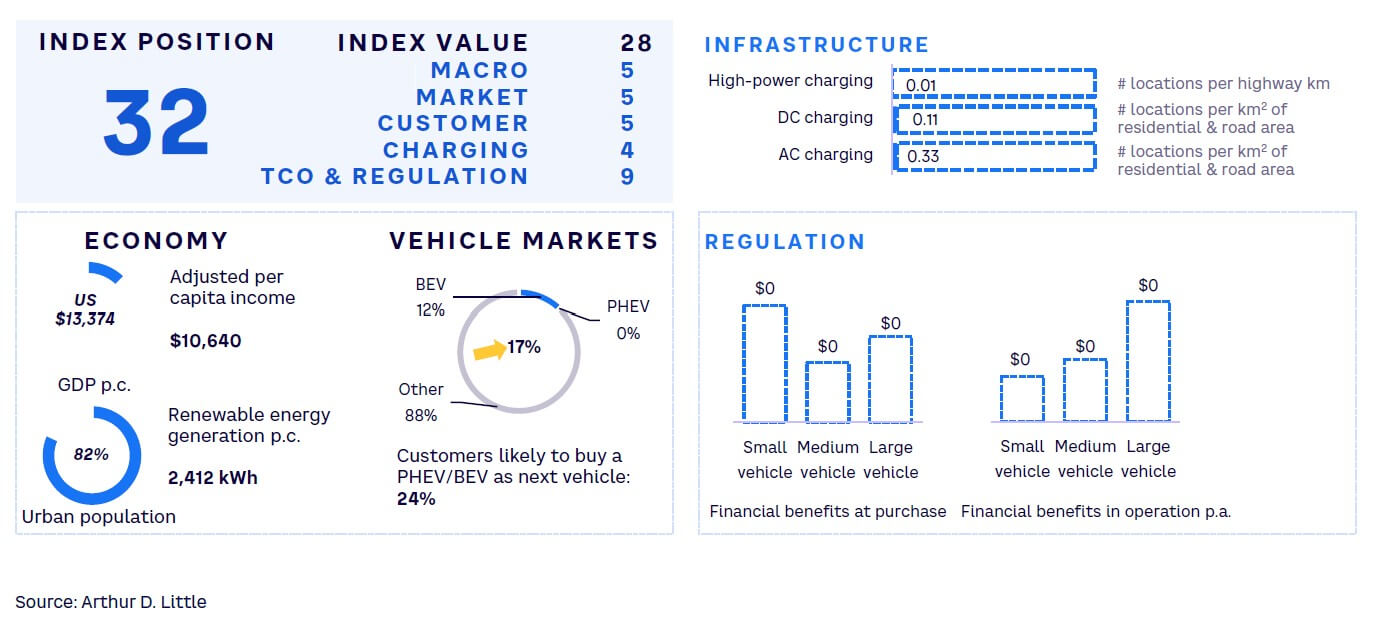

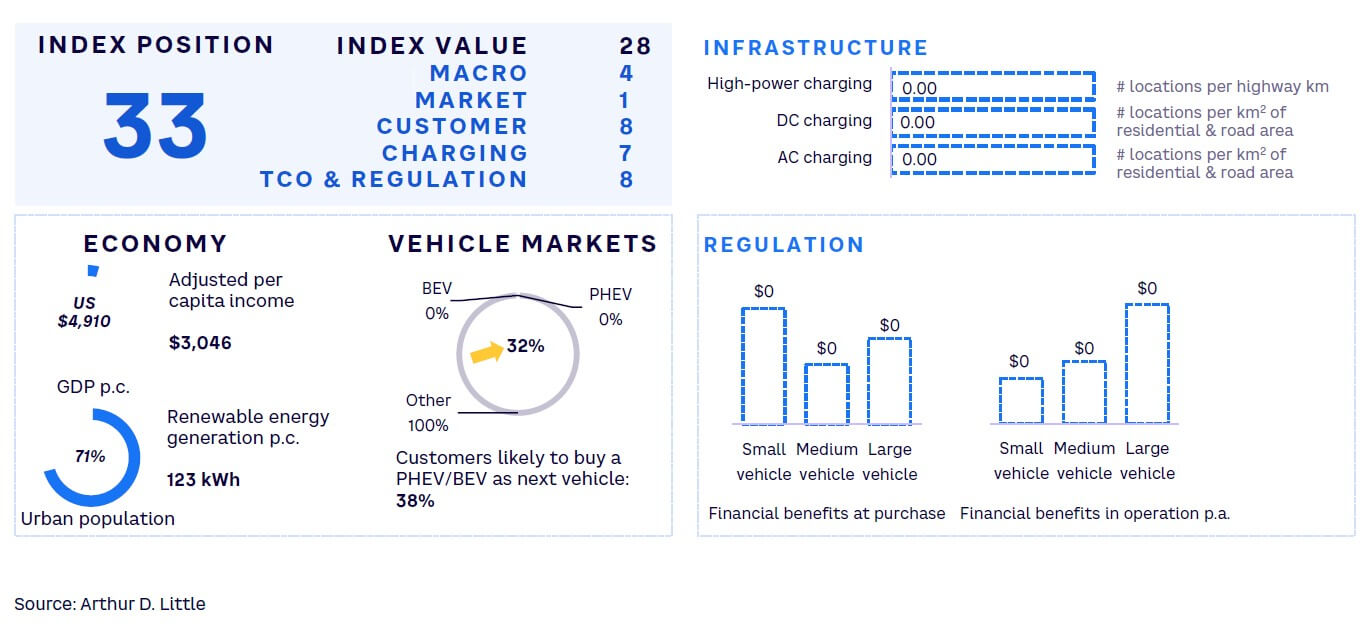

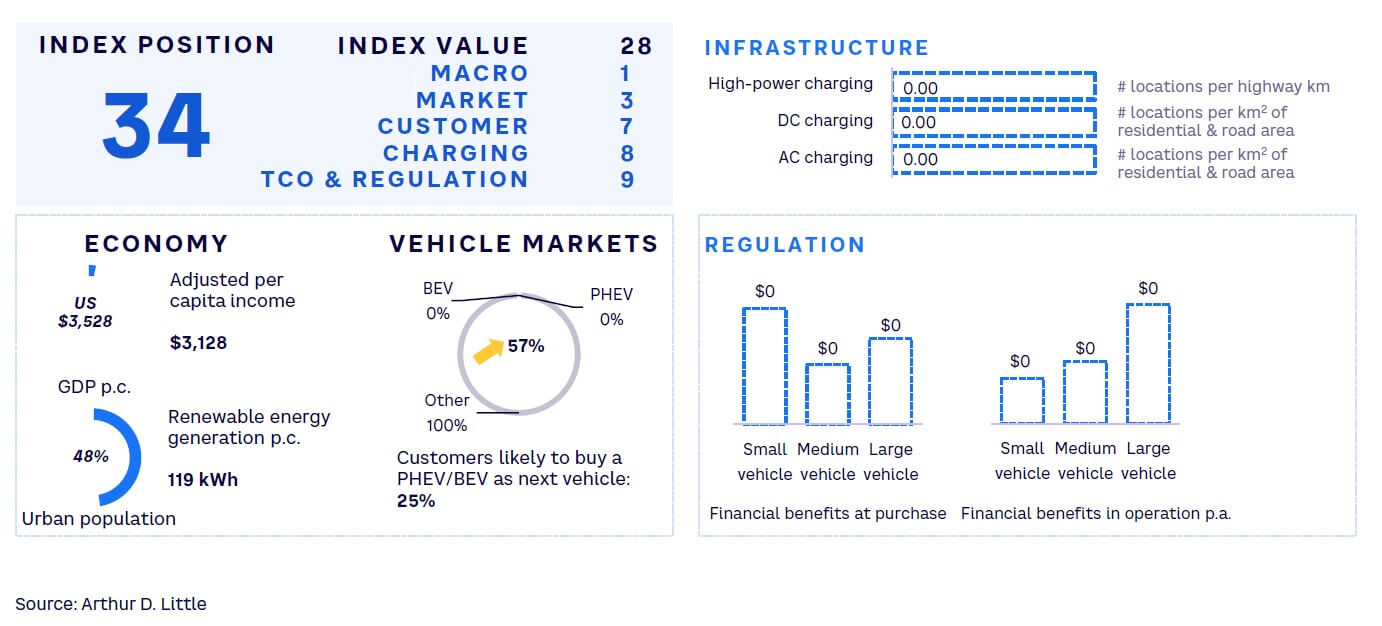

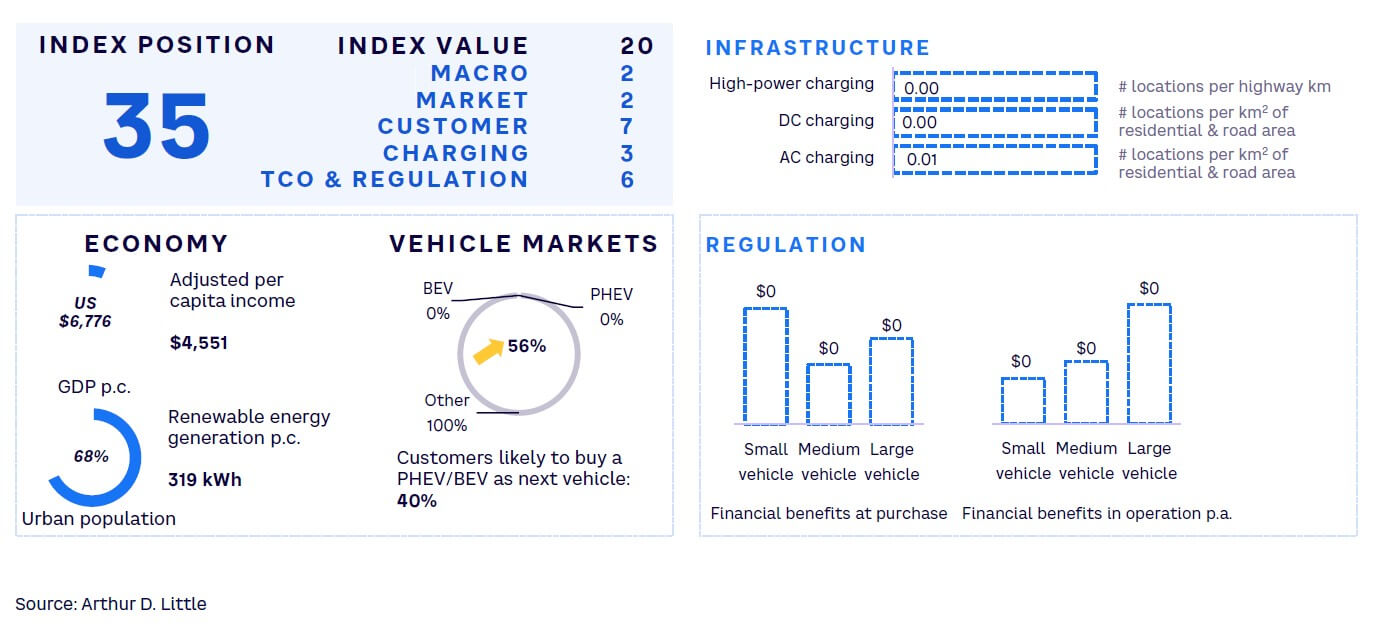

Starter Markets — where EVs have just entered the game and still face major challenges in terms of costs and infrastructure readiness. Example markets are South Africa, Malaysia, and Türkiye. In Starter Markets, electric mobility is just beginning to enter the conversation. Consumers are excited about embracing sustainable technologies, including EVs, as reflected in these countries scoring high in readiness. Given lower fuel costs in these regions, higher total cost of ownership (TCO) of an EV is a deterrent. The limited availability of EV options is yet another major issue. Additionally, given global awareness regarding climate change and a call for sustainability, these regions have ventured into electric mobility and announced initiatives, but execution and implementation at scale remain to be seen. Although the expansion of the EV charging infrastructure is still in its nascent stage, these countries are likely to ascend in the rankings as concerns surrounding charging accessibility are alleviated. Moreover, governments exhibit a strong inclination toward promoting e-mobility in public transportation.

Regarding Customer Readiness, cost is one of the most, if not the most, important drivers of EV adoption. This poses a challenge in developing countries as EV prices are still high and income is comparatively low. Thus, OEMs need to decrease costs, while governments need to create incentives to pave the road to success and allow customers to enjoy electric mobility. Especially in markets with low costs for fossil fuels, there needs to be improvement with TCO for EVs to enable a breakthrough.

In terms of Infrastructure Readiness, battling range anxiety — the fear that a vehicle’s battery will not have sufficient charge to reach the destination — is a key issue. DC chargers are becoming more popular, as they lower charge time, are perfectly suited to highways, and decrease range anxiety. Charging industry players should focus on the Emerging EV Markets — as these countries are about to solve the chicken-and-egg problem (i.e., determining which must be in place first, infrastructure or EVs), if they haven’t already done so, and governments are pushing infrastructure buildup, enabling players to win large-scale contracts. In markets with a quickly rising EV population, the challenge is to keep up with infrastructure installations to avoid creating barriers to adoption.

Government Readiness hinges on government’s willingness to take the first step by introducing wide incentives for purchasing vehicles. Customers should not pay a premium for EVs. Moreover, governments need to reduce TCO by introducing incentives for vehicle usage. Promoting EV adoption in Emerging EV Markets and Starter Markets will give charging infrastructure players the incentive to enter a country, creating a reinforcing spiral of EV adoption.

Betting on EVs is no longer a risky gamble, and the predictability of the EV market is continuing to grow. The only major driver that cannot be predicted fully is government policy. However, making reasonable assumptions about this will give the industry in all countries firm ground on which to base their planning.

1

GEMRIX 2023 METHODOLOGY

GEMRIX evaluates countries’ progress toward e-mobility, providing a comprehensive assessment of their suitability for EV adoption

Index methodology & approach

ADL’s 2023 GEMRIX has been calculated for 35 countries. The index provides a platform to compare countries’ preparedness and progress toward e-mobility. GEMRIX is calibrated between notional scores of 0 and 100. A score of 100 implies that ICE vehicles and EVs are at the same level in terms of acceptability, affordability, and availability. The higher the score, the higher the favorable transition to EVs in the country. Thus, a score beyond 100 shows that EVs are even more beneficial than ICEs.

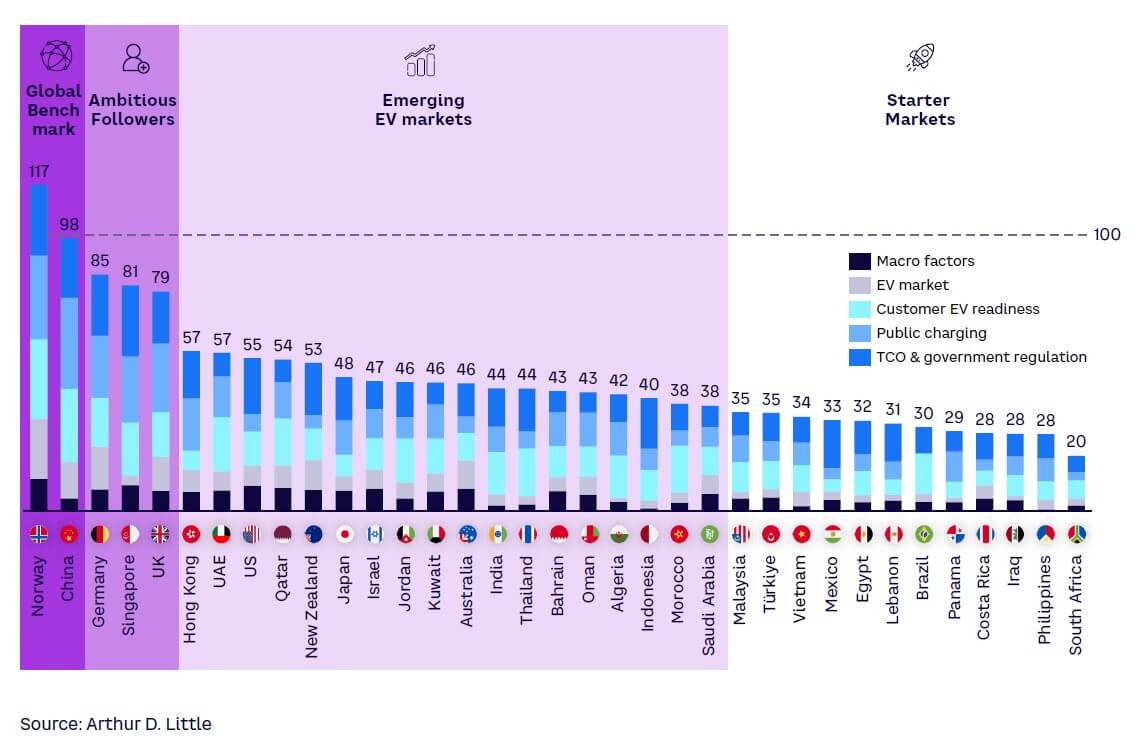

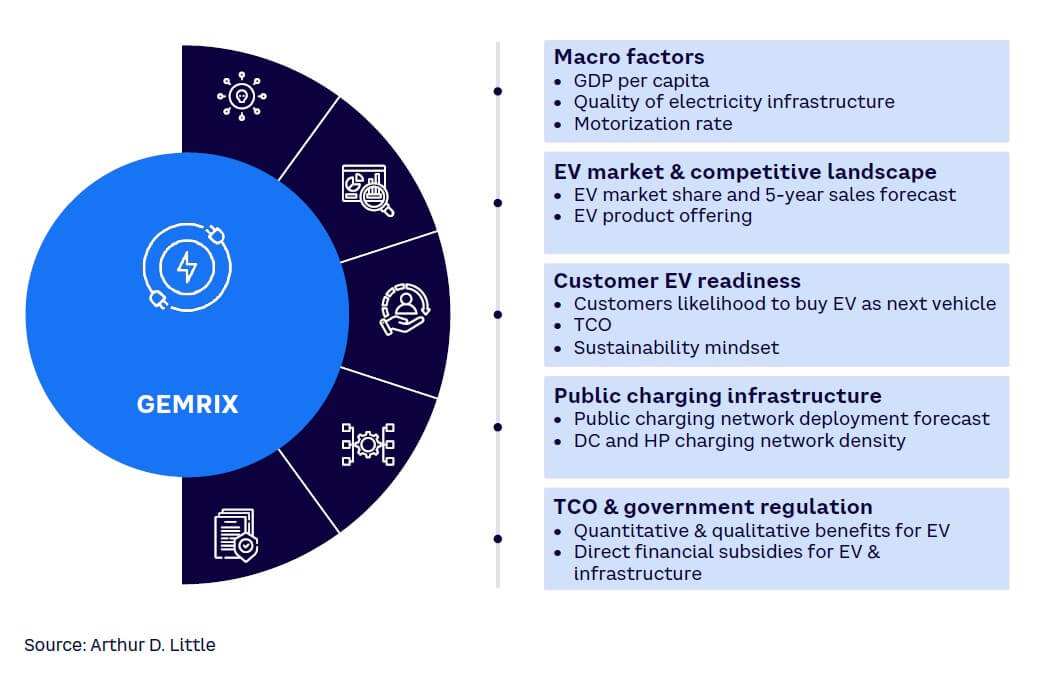

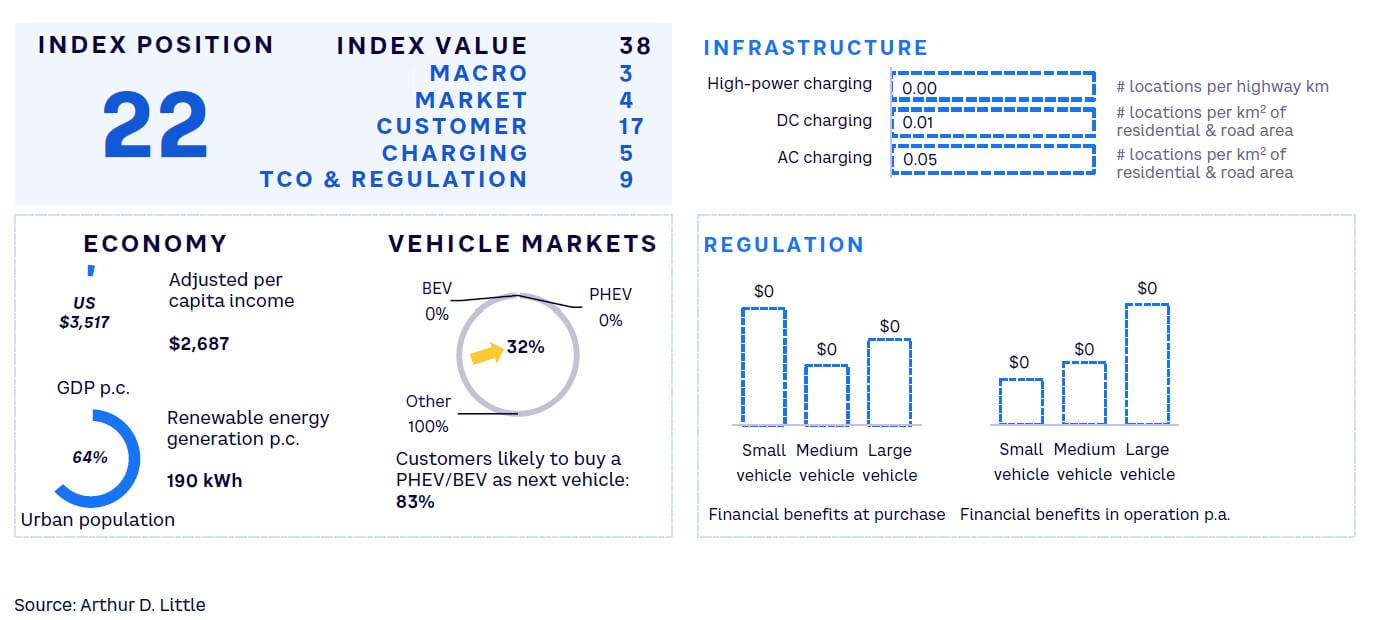

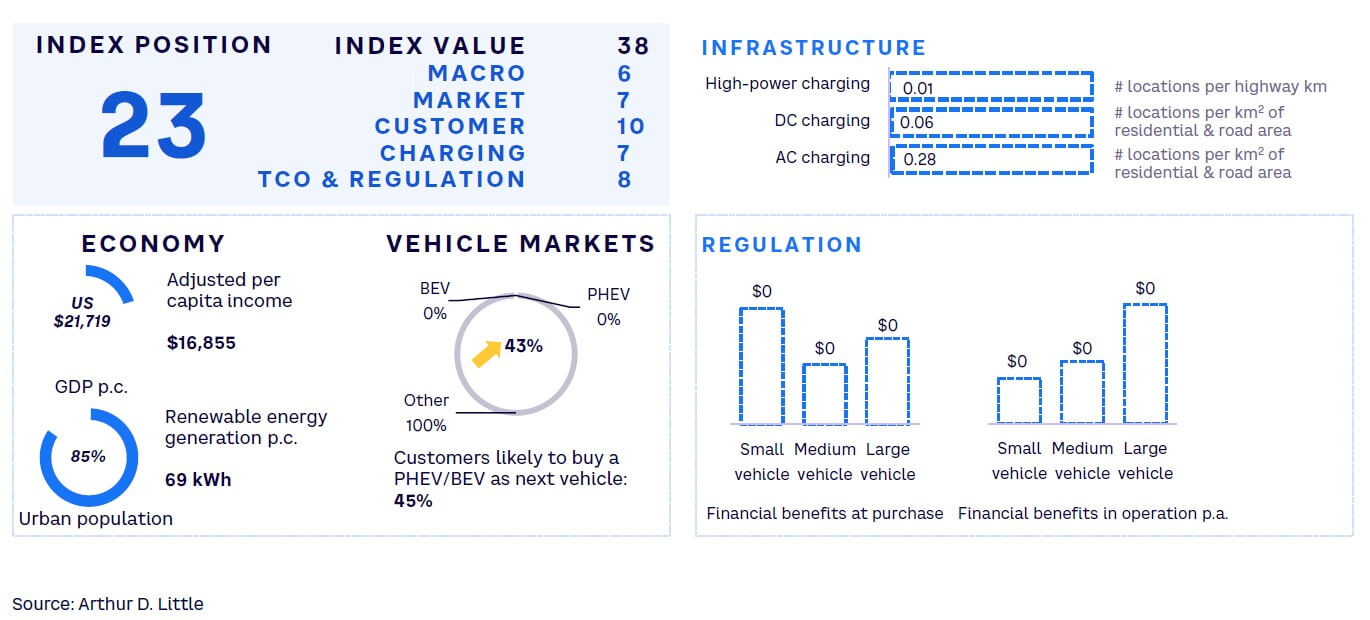

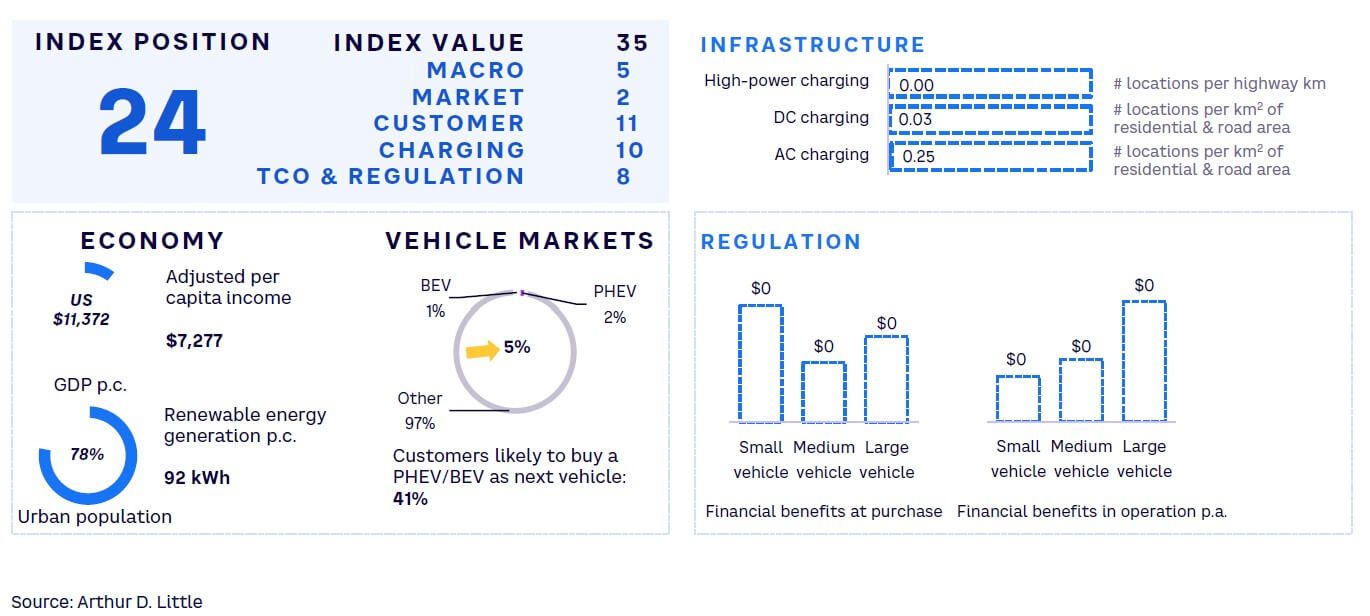

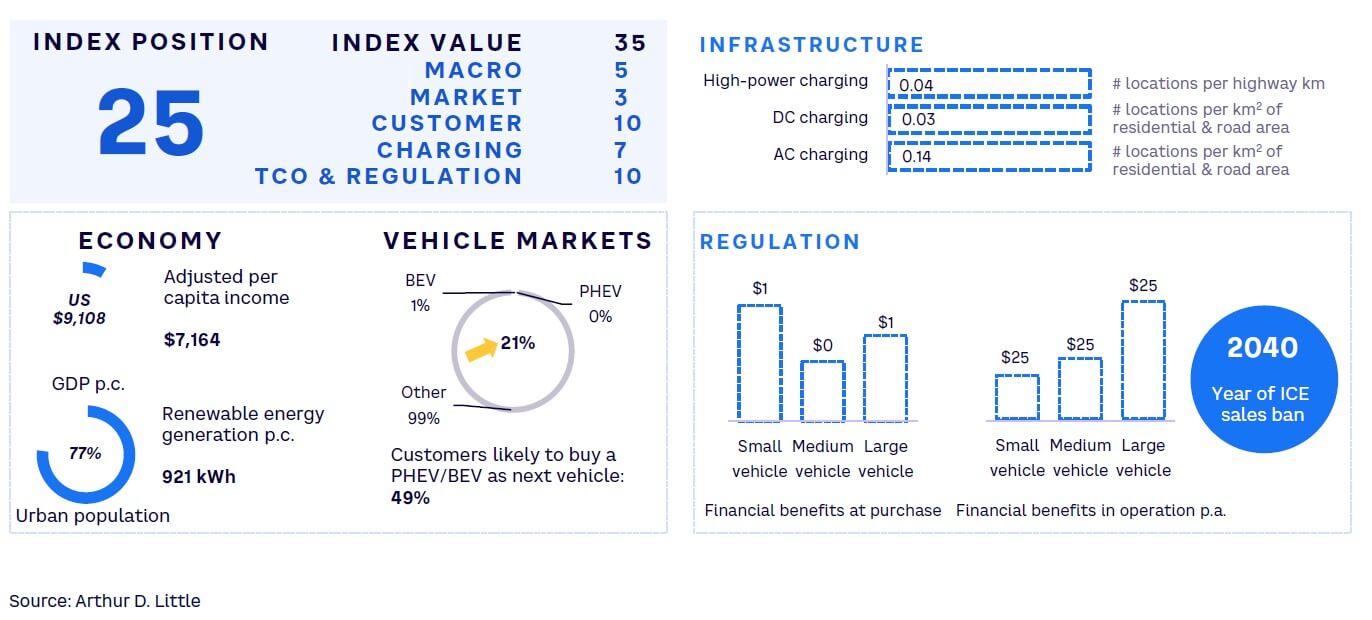

GEMRIX comprises five major categories reflecting EV adoption: (1) macro factors, (2) EV market and competitive landscape, (3) customer EV readiness, (4) public charging infrastructure, and (5) TCO and government regulation (see Figure 2). Each category is further broken down into six to 16 specific data metrics, analyzed with a standardized metric for each country, rendering 47 variables per country.

The five categories are assigned weights according to their relevance for EV adoption. The countries can score different points in each category, with each metric within the categories varying by weight and market data. The individual point score is calculated from analytics that consider relative and absolute performance measures. The final GEMRIX score is the aggregate of performance indicators from the five subcategories, providing a thorough assessment of a country’s suitability for e-mobility.

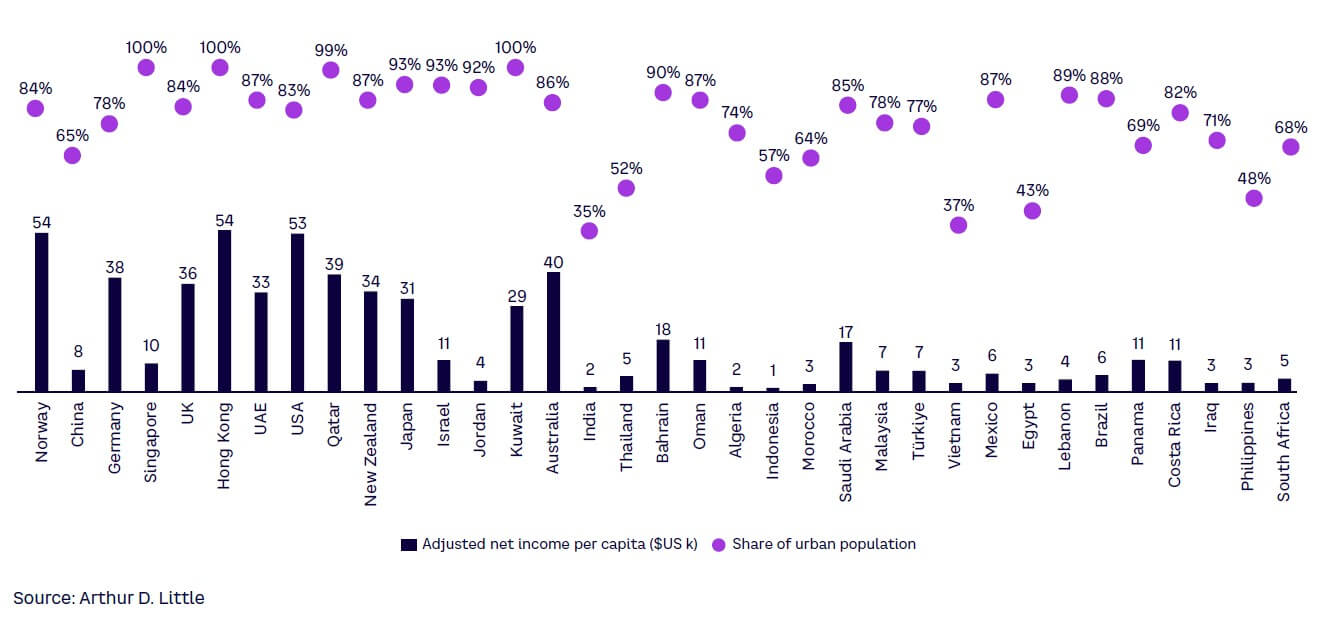

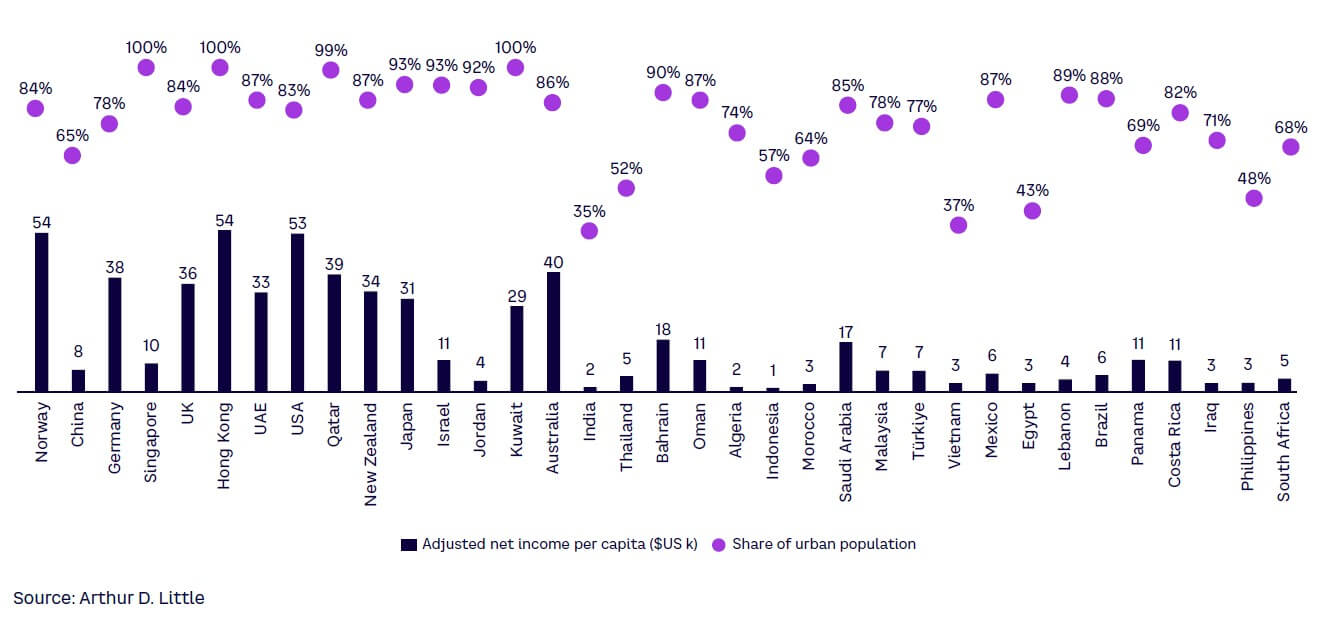

Macro factors

A country’s macroeconomic conditions can substantially impact its readiness for e-mobility solutions. GDP per capita, net income, and growth rate are among key macroeconomic statistics. Higher GDP per capita means more disposable income for emerging technology like EVs; the share of the urban population also paves the way for EV adoption (see Figure 3). As cities typically have higher pollution and congestion levels, EVs are appealing to mitigate these risks in urban cities.

Furthermore, renewable energy production can boost e-mobility preparedness by powering EVs with cleaner, more sustainable energy. Renewable energy production is crucial for EVs to be a truly sustainable alternative to ICE vehicles. Smart grids are also vital as governments pursue ambitious plans to boost their electricity supply and integrate renewable energy into their generation portfolios. Importantly, resilient electrical grid infrastructure can accommodate the growing demand for charging EVs. The availability of a secure and steady electrical supply guarantees EV owners a seamless charging experience, thus easing the transition to electric mobility.

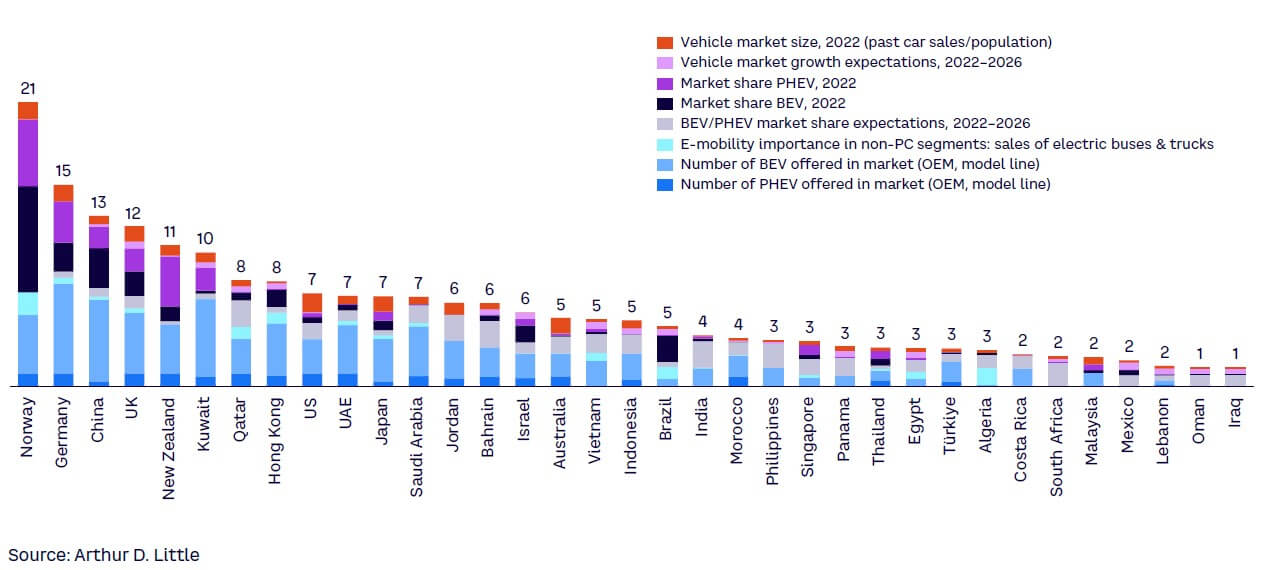

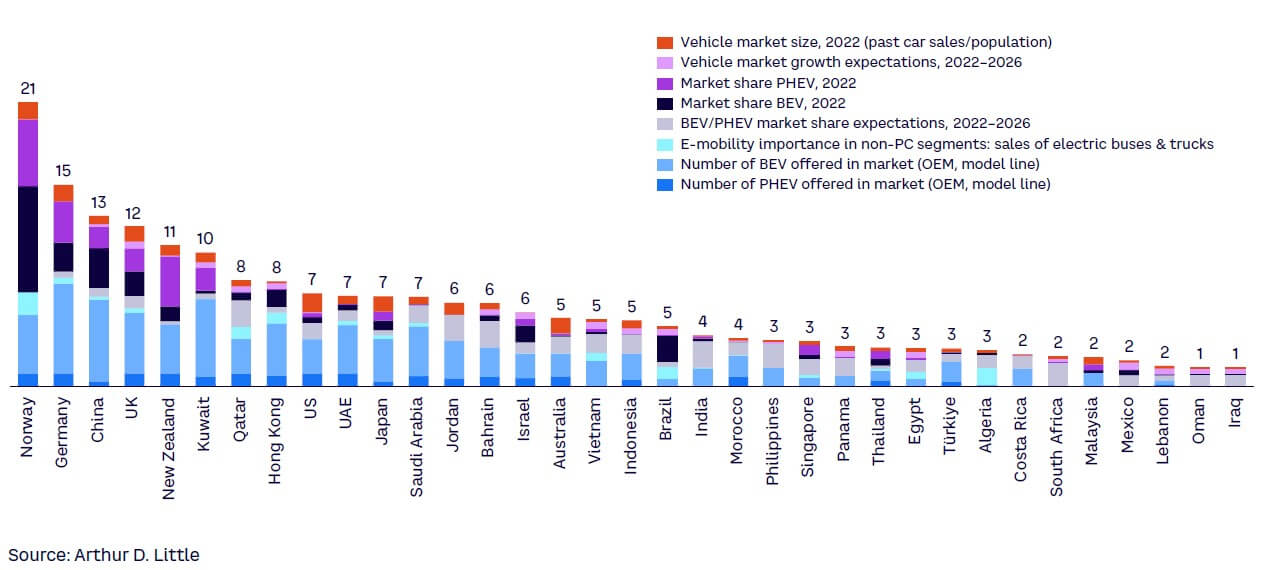

EV market & competitive landscape

The level of competition among OEMs impacts a country’s EV adoption — higher competition results in more innovation, lower prices, and better consumer services (see Figure 4). The number of BEV or PHEV models offered in the market by OEMs also indicates the availability of consumer choices, which drives competition and innovation. This, in turn, can make EVs more accessible and affordable to a broader range of people.

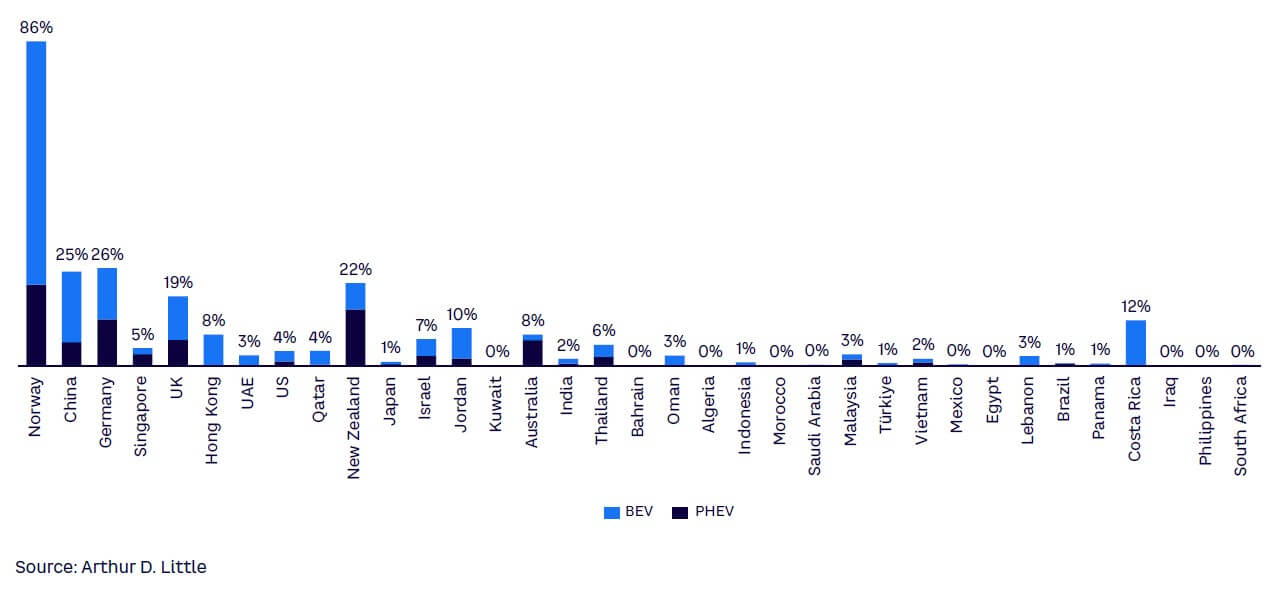

Recently, EV markets globally have proved to be very dynamic (see Figure 5). While it was only two years ago in which the EV market outside China was dominated by emerging players (with Tesla leading the way), many incumbent OEMs have since raced to overtake them. German and US OEMs are a good example of this volatility. Up to 2019, they only reluctantly introduced EVs. Customers interested in electric cars of a new kind largely had to turn to Tesla. Starting in 2020, however, pushed by government initiatives and the pressure of coming late to this important future market, German OEMs rapidly introduced new all-electric lines and models. The US saw a very similar uptake, as major US OEMs — including Ford and GM — also electrified their mainstream model lines.

At the same time, Chinese EV manufacturers are now ready to export their EVs all over the world. Moreover, in many countries, new dedicated EV brands and manufacturers have been installed and are about to start operation, for example, in Vietnam, Türkiye, and Saudi Arabia, among others.

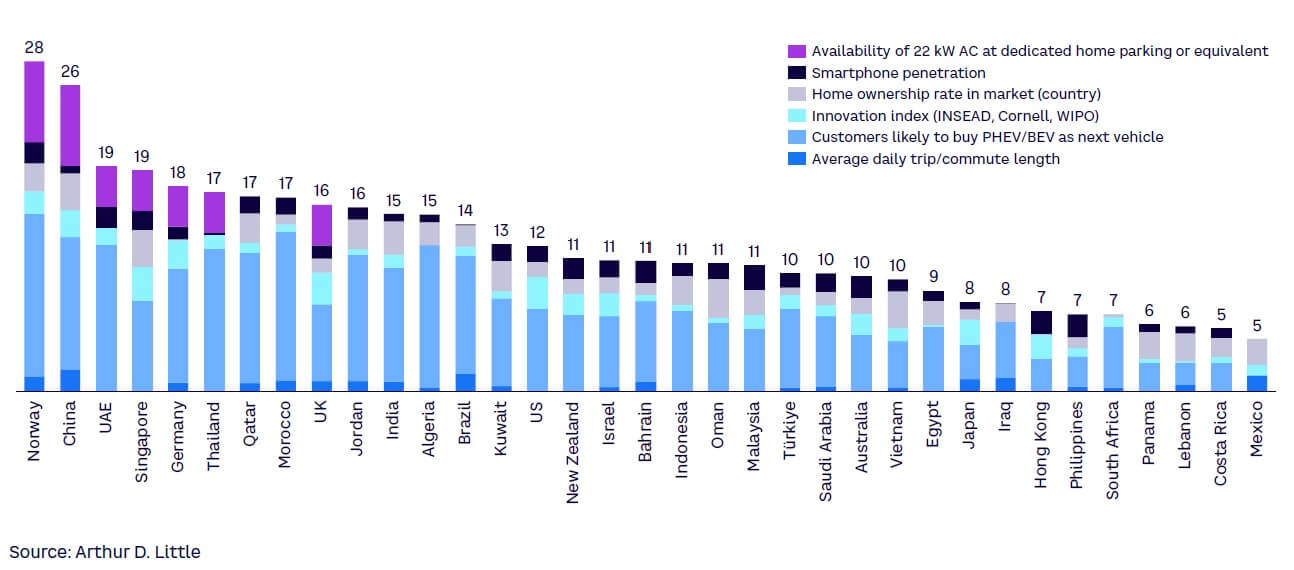

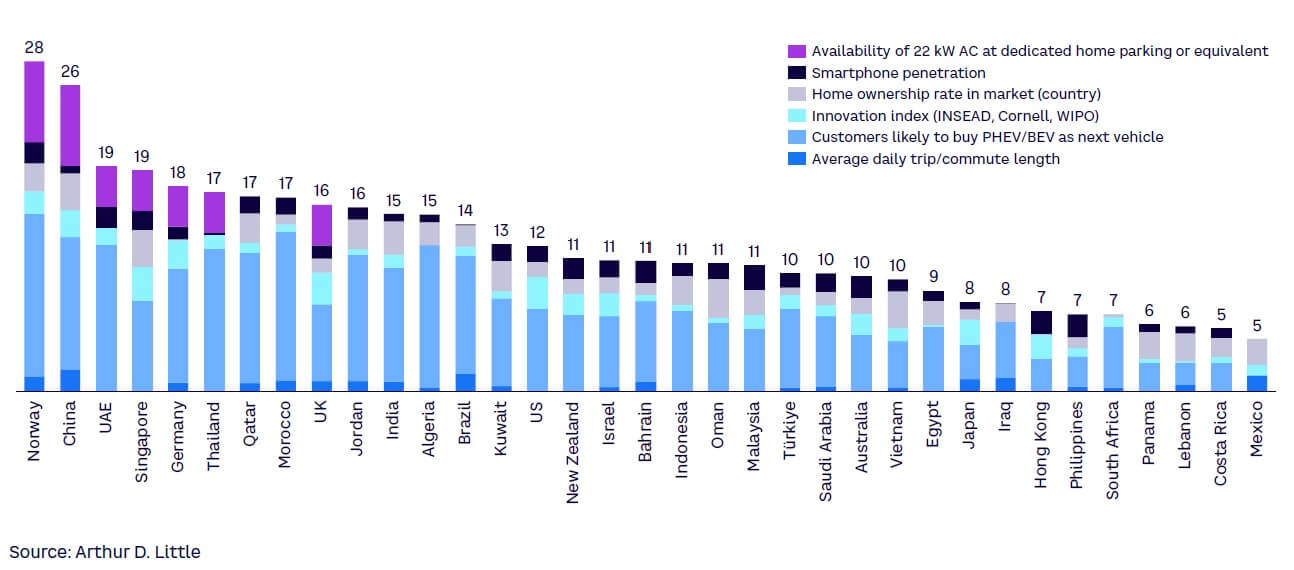

Customer EV readiness

Customer preparedness allows for the acceleration of EV adoption and promotion. This is influenced by such factors as the chance of acquiring an EV, Internet penetration, and EV pricing versus ICE automobiles. A higher incidence of homeownership can create a wider pool of potential EV owners who can readily access and install home-charging infrastructure.

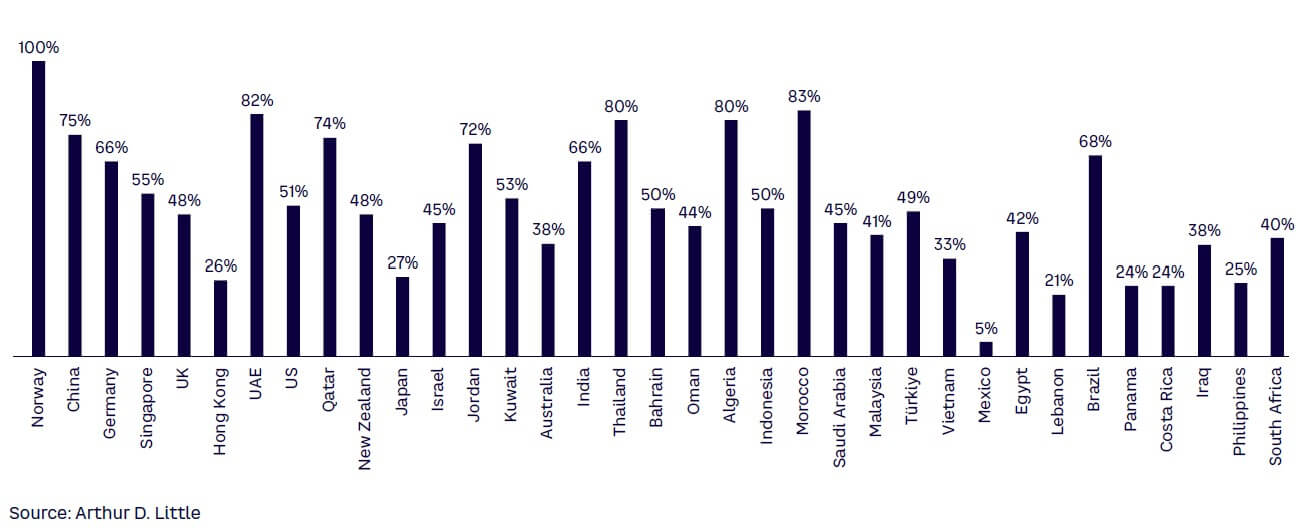

Figure 6 summarizes the factors influencing customer readiness, while Figure 7 zones in on customers likely to buy a PHEV/BEV as their next vehicle.

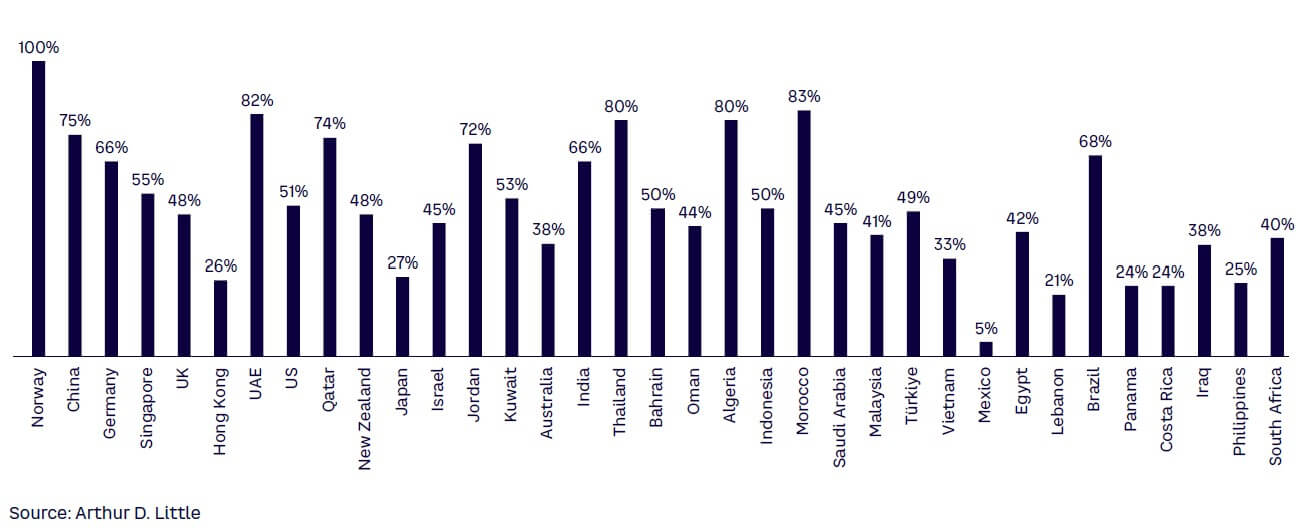

The topic of charging naturally leads to accessibility. We see a correlation between the share of a population living in urban areas and EV readiness. Lack of access to public charging infrastructure is a massive hurdle to the adoption of EVs. Globally, the density of public charging points in rural areas is nowhere near the density of petroleum stations. With most EVs are still of lower range compared to their ICE counterparts, countries with a large rural population have a significant challenge to solve, as is very visible in India and Vietnam. Again, this hurdle is much less pronounced for two-wheelers (2Ws), which can be charged effectively using standard household power lines.

Factors like knowledge and automobile preferences also determine customer readiness. A favorable inclination toward EVs enables greater adoption, as the lucrative demand side will push the supply side, namely, government and OEMs, to enter the EV market. One factor signaling customer preference for EVs is the homeownership rate. Homeowners have the flexibility of charging installation, thereby making e-commutes more feasible. Some countries, such as Oman and Qatar, have fared well in GEMRIX due to upbeat customer readiness, primarily driven by homeownership rates. Range anxiety is another factor that concerns consumers. Thus, a shorter average length of commute bolsters the use of EVs.

Concerns about environmental protection play the second most important role in readiness to buy an EV. We see a clear correlation between EV readiness and environmental awareness, as measured primarily by the number of governmental activities and years since those activities were introduced. While this aspect is very important in Norway and Germany, in a country such as India, it only reaches a very small group of customers. Furthermore, the “coolness” of driving an electric car is a determining factor — again, primarily in Europe and North America.

Additionally, a higher score in the Global Innovation Index (GII)[1] of a country can pave the way for technological advancements in EV technology, including improvements in battery efficiency, range, and charging infrastructure. Customers are more likely to be ready for EV adoption when they see continuous innovation and advancements in these areas.

Public charging infrastructure

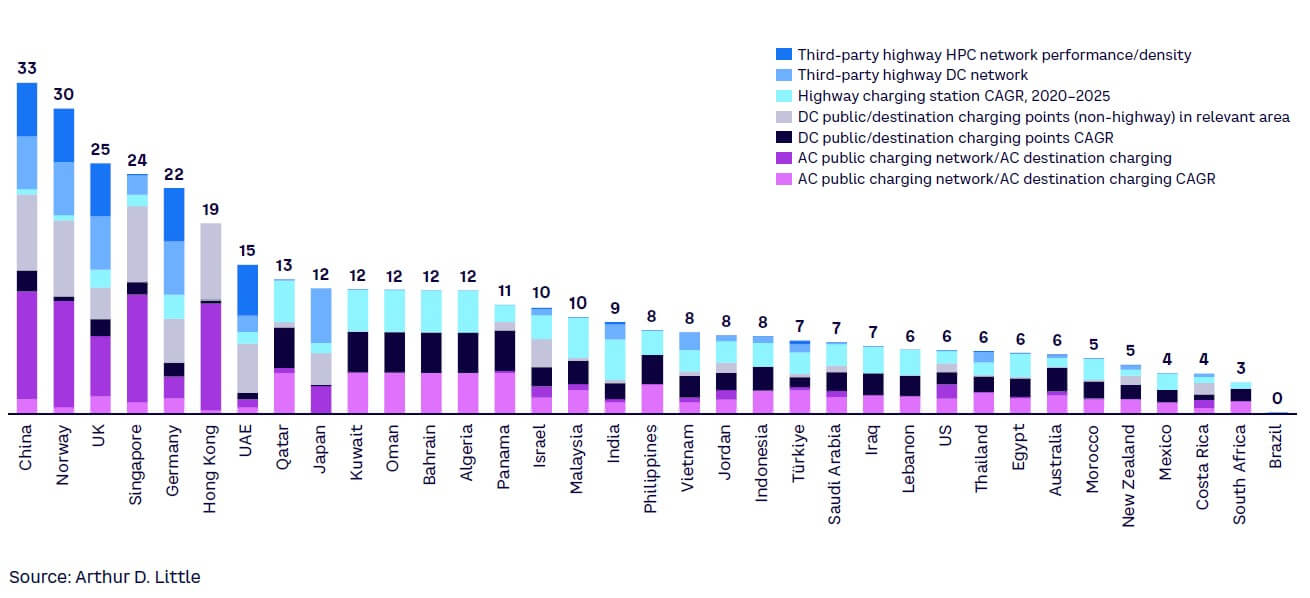

The availability and quality of charging infrastructure are critical variables in a country’s EV industry’s growth and success. Before purchasing an EV, consumers must have faith in the availability and dependability of charging infrastructure. A comprehensive charging infrastructure network, including both AC and DC networks, can improve the convenience and appeal of owning an EV by increasing the number of opportunities for drivers to recharge their vehicles. Furthermore, developing a charging infrastructure network can boost customer trust and encourage EV adoption, increasing demand for EVs and moving the EV sector forward.

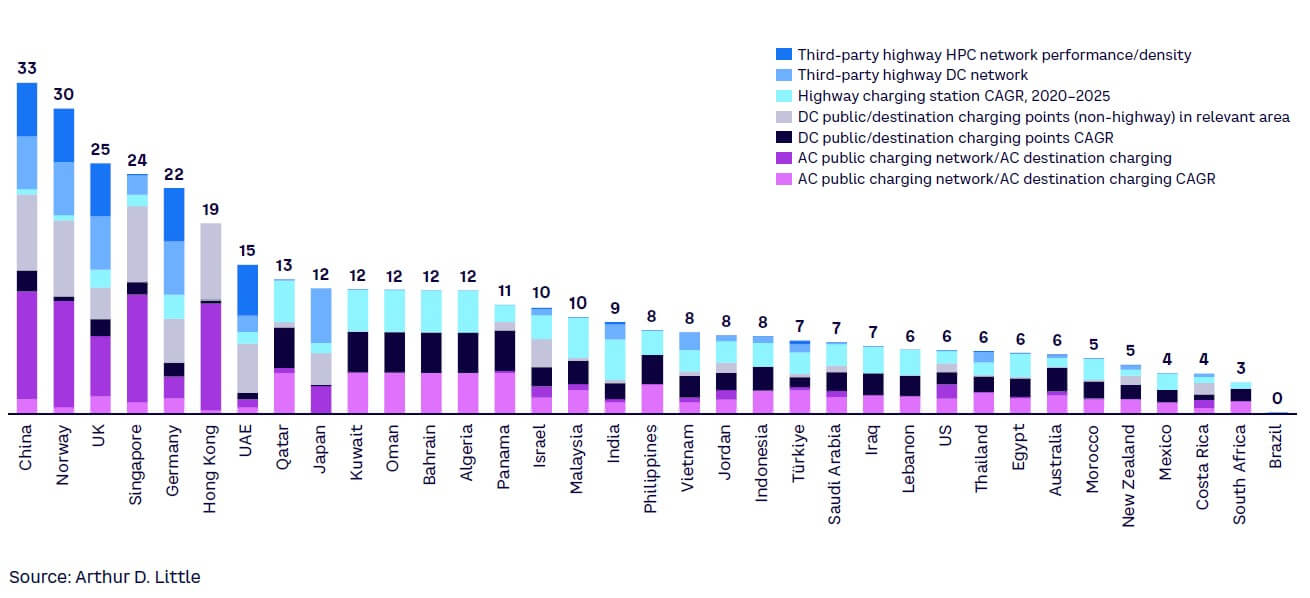

AC charging infrastructure, prevalent in homes, workplaces, and public parking lots, provides slower charging speeds but is appropriate for overnight or extended charging periods. It makes charging convenient and accessible for daily commuting and routine use. DC fast-charging infrastructure, on the other hand, provides considerably faster charging speeds, allowing EVs to recharge their batteries within 30 minutes or less. DC fast chargers are frequently installed along highways and main travel routes to facilitate long-distance travel and reduce charging time during trips. The presence of both AC and DC charging infrastructure demonstrates the EV sector’s comprehensive development (see Figure 8).

The importance of the charging infrastructure category in GEMRIX is established by allocating one of the highest weightages. Some smaller and densely populated countries score high in this category because of high EV charger density on highways, at destinations and in residential areas. EV charging infrastructure is also among the foundations for strengthening the UAE’s position in achieving the highest score in this category. For example, Dubai is investing in making the charging infrastructure robust through various initiatives aligning with its vision toward sustainability. It makes it a lucrative go-to-market for EV charging infrastructure vendors.

When starting EV markets, the availability of private charging at home or workplaces is the key enabler, but every significant step in a market’s EV adoption requires public charging infrastructure. Only dense-enough and easy-to-use public charging infrastructure enables long-distance travel by EV and opens the market to customers who do not have access to private overnight parking with electric power supply.

Because the lack of public charging is the greatest hurdle in starting EV markets, and the costs of infrastructure setup and charging play a major role, AC charging up to 22 kW was the first choice in early EV markets. While these charging speeds are sufficient for small battery packs and charging use cases that allow for several hours of charging, they fail in en route charging and locations with high and continuous charging demand.

We observed that DC charging becomes the preferred choice in a growing number of public charging use cases, including destination, curbside, and en route highway charging, where maximum outputs can reach up to 300 kW currently. Only DC charging powers of around 100 kW and above enable a quick refill for driving distances greater than 50 km in an hour or less.

Leading GEMRIX markets, such as Norway and Singapore, score high in GEMRIX for their public DC charging infrastructures, while the UK, Germany, and the group of Emerging EV Markets are still more AC-heavy beyond the main highway connections. Changing existing infrastructure to DC or creating a sufficient density of DC charge points will require significant investments in those markets in the coming years. Starter Markets preparing for the first wave of EVs can leapfrog to DC charging in public spaces.

TCO and government regulation

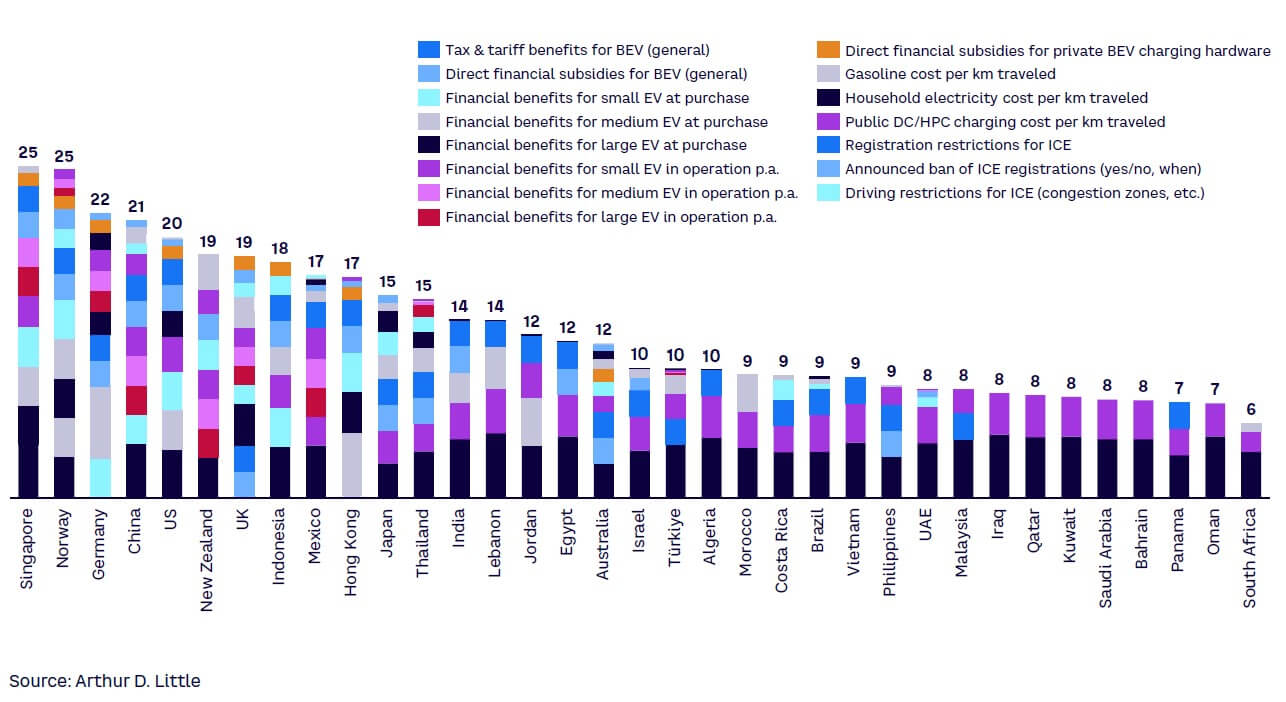

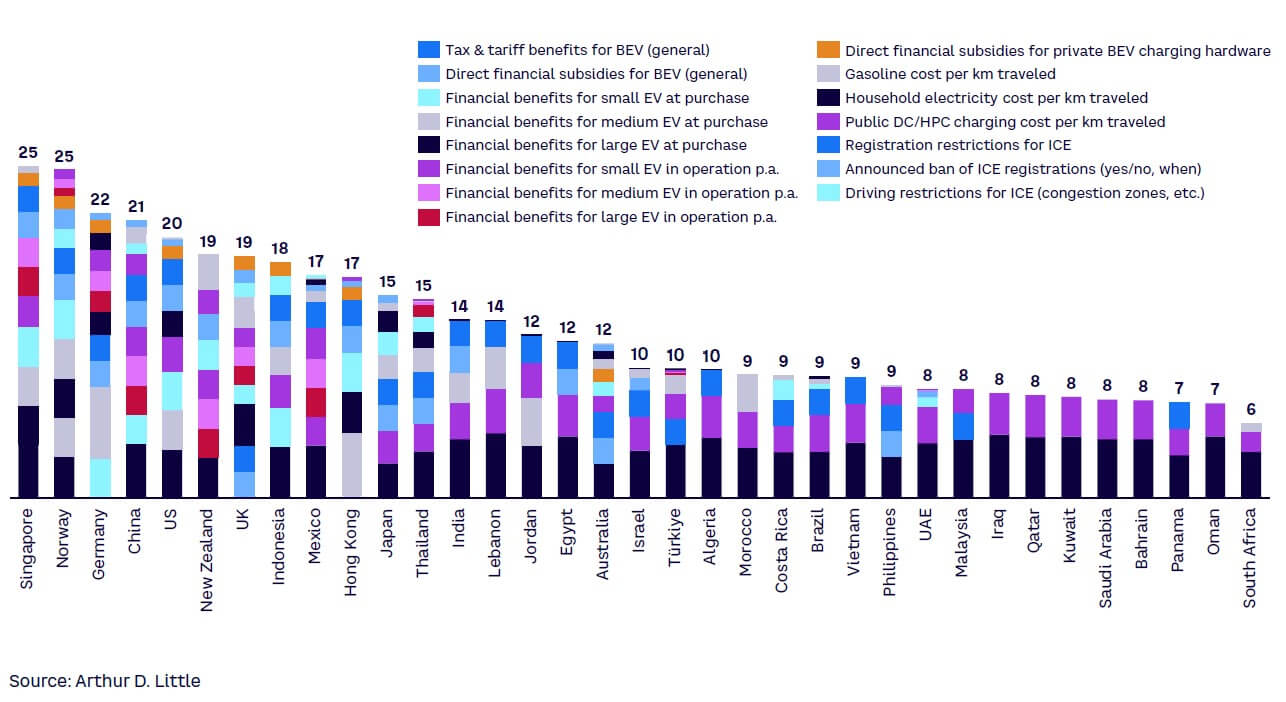

Vehicle price and running costs are the most important factors for customer decisions between ICEs and EVs. ICE vehicles have had a head start of more than a century in optimizing production at scale and building an ecosystem, which has allowed customers to buy and operate vehicles affordably and conveniently. Therefore, legislators have introduced various EV incentives to compensate for economic disadvantages, which are clustered into three broad categories:

-

Sales price — tax reduction or lump sum

-

Ownership — mostly reduction of motor vehicle tax

-

Operations — lower energy prices, reduced tolls, reduced parking prices/exclusive parking

Thus, government regulations can significantly impact the smooth transition to EVs (see Figure 9). Policies like subsidies, tax incentives for EV purchases, and regulations on emissions and fuel-efficiency standards for vehicles can incentivize consumers and manufacturers to adopt EVs. Such schemes help reduce TCO, thereby creating a strong demand pull. Additionally, regulations mandating the installation of charging infrastructure and promoting the use of renewable energy sources for electricity generation can further facilitate the growth of the EV industry.

The classical example for taxation in favor of EVs is Norway. Without the value-added tax (VAT) on EVs, which is 25% in Norway, the end-customer price for a new US $50,000 vehicle effectively falls to US $40,000 for a private customer. As a business, one could deduct the VAT anyway. Thus, EV adoption in Norway has been driven primarily by private customers, which has pushed the market forward and allowed the overall network effects to generate advantages for commercial customers.

Singapore decreased tolls for EVs, making EVs not only more cost-efficient to buy but also to operate. Moreover, in some states of Mexico, EV owners are exempt from the “Tenencia,” an annual vehicle tax based on car value, which amounts to savings of approximately US $850. Additionally, in leading EV countries, the costs of driving 100 km on fuel is nowadays comparatively higher than those of doing so on electricity, also because of taxes.

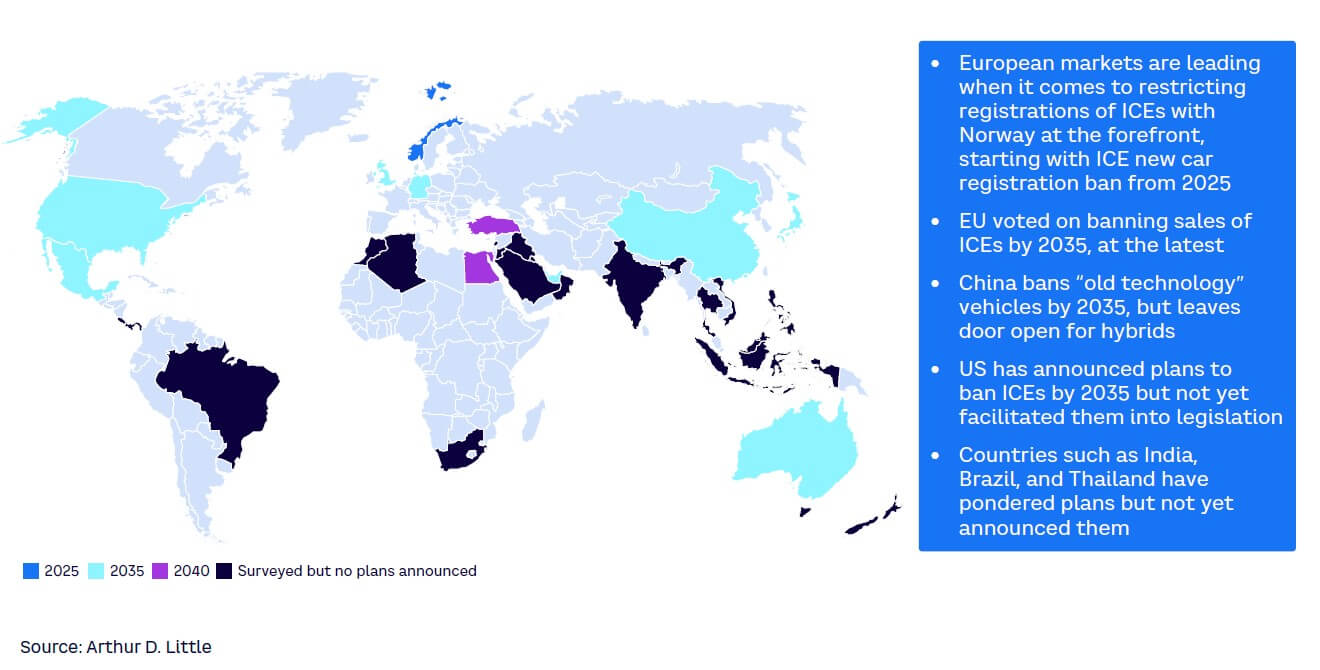

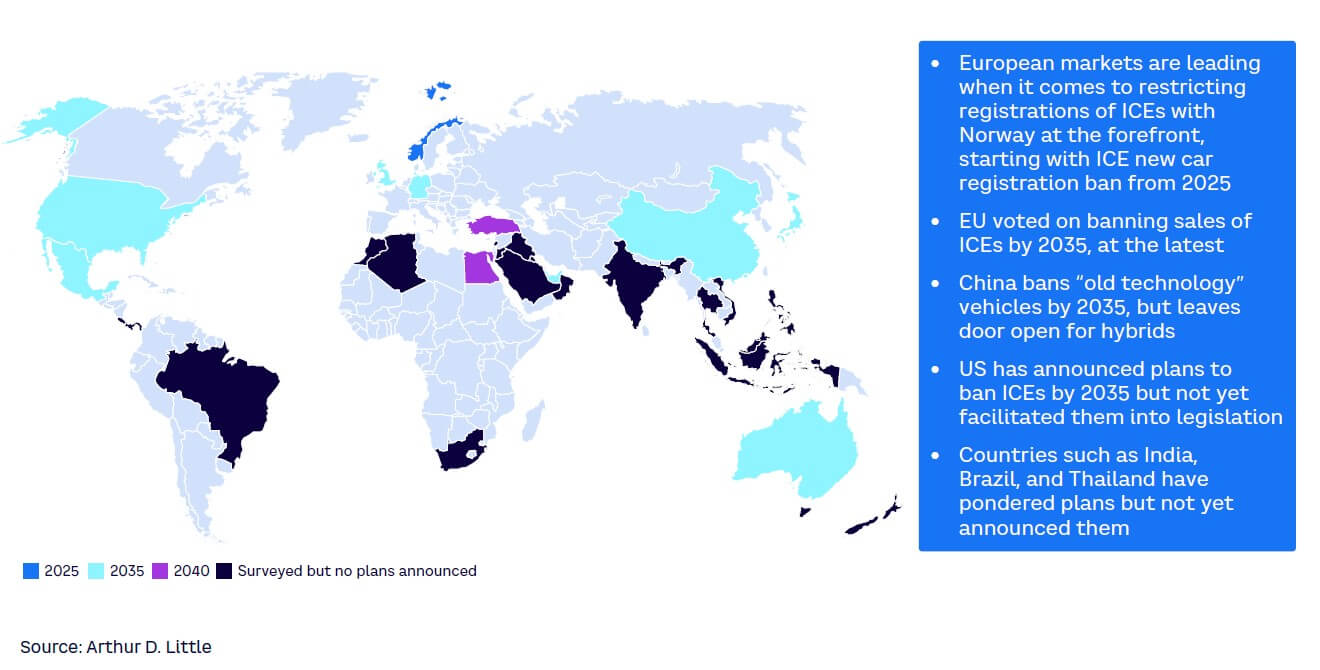

Such policies aim to create a distinction between ICE vehicles and EVs. Customers’ ability to purchase and maintain EVs is a driving force. It includes financial incentives during purchase and when in operation. Beyond these benefits, the government offers incentives like the announced ban on ICE vehicles (see Figure 10) and free parking for EVs. Many markets, such as the EU, Israel, Türkiye, and Egypt, have already announced bans on the registration of ICE vehicles, which will become active in the next decade.

The comparison between gasoline and electricity prices also leads to determining the favored mode of transportation. Some countries are characterized by significant oil reserves, driving oil prices down. As a reaction, for instance, the Lebanese government has reduced subsidies on fuel prices. It indicates a “disincentivization” of gasoline. Thus, the push from the government becomes more crucial in shaping the affordability, demand, and development of the EV sector.

2

GLOBAL BENCHMARKS

What markets can learn from global benchmarks in EV readiness

A consistent trend is that BEV powertrains are key to decarbonizing transport and contribute to decreasing carbon emissions. This is particularly so for passenger vehicles, as well as light commercial trucks, and likely will be the main technology over the next 20-30 years. However, the full value chain, including suppliers, OEMs, and customers, will have a difficult time through the transition.

Norway, still the front-runner in e-mobility, shows how long it may take to turn even a small market and vehicle fleet toward EVs. Norway’s journey began in 2011, when EVs were rare and exotic, and the first Teslas were not yet in series production. Ambitious Followers and Starter Markets will have it easier today, as key market conditions like EV availability, comparative TCO, and environmental awareness have improved on a global scale over the last 10 years.

Financial incentives for EVs and disincentives for ICEs may still be adequate support measures in a starting market, where only pioneers with home-charging ability use EVs. However, to enable true and mainstream transition, all markets require a functioning ecosystem for EVs, which must work hassle free for users. Thus, the stage must be holistically set up by multiple parties and stakeholders.

Infrastructure

Formerly independent industries, such as vehicle OEMs, energy companies, road infrastructure/service providers, and telecom and software companies, need to work together with local and national authorities to provide widely available, easy-to-use, and reliable charging infrastructure for EVs.

Only an integrated approach can ensure cost-effective and customer-oriented infrastructure development without jeopardizing grid stability and macroeconomic feasibility. While this infrastructure was mainly AC-based in the early periods of electric mobility and in starting markets, nowadays the importance of DC fast charging becomes clear. Long-distance mobility with EVs and widespread EV adoption, especially among drivers without home-charging opportunities, can only work with a dense, fast-charging network along all major routes.

Closed-loop EV supply chain

Successful EV markets require a resilient, sustainable, and effective EV supply chain either domestically or in close reach. China is the prime example for setting up a competitively strong EV industry end-to-end in no more than 10 years. This involves the availability of raw materials, key components, and focal capabilities for EVs. It also necessitates a circular approach — reducing and reusing natural resources — to make e-mobility a truly sustainable alternative and ensure supply of scarce inputs. Other examples of this approach can be found in Central and Northern European markets, which have discovered the attraction of domestic battery production and recycling. In addition, SEA, with automotive hubs in Thailand, Malaysia, Vietnam, and others, is already setting up to follow this EV cluster strategy.

Multi-stakeholder orchestration

Governments and regulators have played a central role in supporting e-mobility and will continue to do so. However, they need to change their approach since many markets have reached new levels of maturity. EV infrastructure and supply chains are key prerequisites for successful e-mobility markets of the future. Both require holistic and integrated action from disconnected parties and market actors. Such a “garage band” needs a conductor to become a symphonic orchestra, and markets need more than tax incentives on one hand and restrictions on the other.

Corporate players, too, can assume the role of integrators. Markets in which either entrepreneurs or authorities successfully assume integrative roles in the areas of infrastructure and supply chains will become Ambitious Followers quickly, or even future leaders.

Market readiness differences attract different players

Leaders & Ambitious Followers

Mature EV markets like Norway and China are experiencing increasing competition among market players in the EV sector — for both vehicles and infrastructure. Ambitious Followers are at a stage that enables the entry of all kinds of EV actors, holding potential for established EV OEMs and scaled-up providers of charging infrastructure and ecosystem services. Customers in these markets appreciate a growing and still improving offering and have a rather high willingness and ability to pay — but also hold high expectations. The competition is increasing, especially with new EV OEMs entering the global field. These markets will see further consolidation, and market-entry barriers for new entrants are already high.

Emerging EV Markets

Players that still want to shape an EV market with new and selective vehicle offerings and charging infrastructure solutions will turn to Emerging EV Markets in the Middle East or SEA, such as the UAE or Thailand. These markets are not yet fully divided up among incumbents and growing rather quickly — a very promising environment in which to scale up and create a home base for later expansion, or to enter for increased market share and dynamically growing revenues. Governments in these regions have clear transition plans and support e-mobility with legislative and fiscal action.

Starter Markets

Slightly late to the party, Starter Markets offer huge potential for new start-up-style entrants and early infrastructure development in a “blue ocean environment,” where market shares are not yet divided up. However, profit pools need to be developed first. These markets require some (financial) patience and willingness to invest. Established players would rather wait for others to prepare the ground and make a late market entry with scale and financial power. Many Starter Markets have taken action by establishing local EV manufacturers and full EV ecosystems with component and local energy provider partnerships to set up a charging infrastructure.

How actors can cope

Vehicle manufacturers

Manufacturers must adapt their offerings and supply chain planning to market-readiness levels (e.g., in quantitative sales planning and product management). However, there is no time to lose, and manufacturers that have yet to embark on the EV journey will face more than hard times to survive the industry transition during the coming years.

In markets with higher GEMRIX scores, such as Ambitious Followers, EV sales planning can follow proven methods, considering target segments, pricing, positioning, and product specifications. In addition, sales planners should note that powertrain disruption usually decreases brand loyalty. A convincing EV model offering helps conquer market share and tap into new market segments. Some successful examples show that positive brand repositioning and expansion into new markets can work with electrification.

Starter Markets and markets with lower readiness, however, need special methods of sales planning and market entry. OEMs frequently prefer selective offerings, first targeting the most promising customer segments with lower risk. New sales models and sales channels may help mitigate risks and lower investment requirements. All sales planning must adjust to the fact that a new offering is only one part of the required market preparation. In particular, EV introduction in less mature markets requires a well-planned launch strategy. It may, nevertheless, be more successful than expected due to the lower level of competition. For a brand, gaining market share with new EVs is even easier in a Starter Market than in more mature environments, while lower absolute sales volumes need to be dealt with.

Infrastructure providers

Norway and Ambitious Followers are experiencing consolidation of the charging infrastructure market already. This includes the formation and shift of roles between energy providers, charge-point operators, and asset owners. Players that have not yet pegged their positions — and established partnerships, customer bases, and solid market shares — will face difficulty in keeping up with development. For incumbents, now is the time for scaling and setting up fast public DC charging in attractive locations. Increasing utilization of charge points will be key to improve economics. Public megawatt (MW) charging for trucks and commercial vehicles will be the next big topic in mature EV markets.

Infrastructure players in Starter Markets should avoid copy-and-paste strategies from early EV markets like Norway, and not rely on the rollout of wide AC networks in the public space. Today’s customers in many developing markets require public charging, as they lack private parking and charging possibilities. Leapfrogging to quicker DC charging solutions at destinations and charging parks in fuel station locations is turning out to be the winning strategy to avoid the need for update investments five years from now.

We expect today’s Starter Markets to develop EV readiness quicker than first-benchmark markets, and thus charging needs to catch up sooner rather than later.

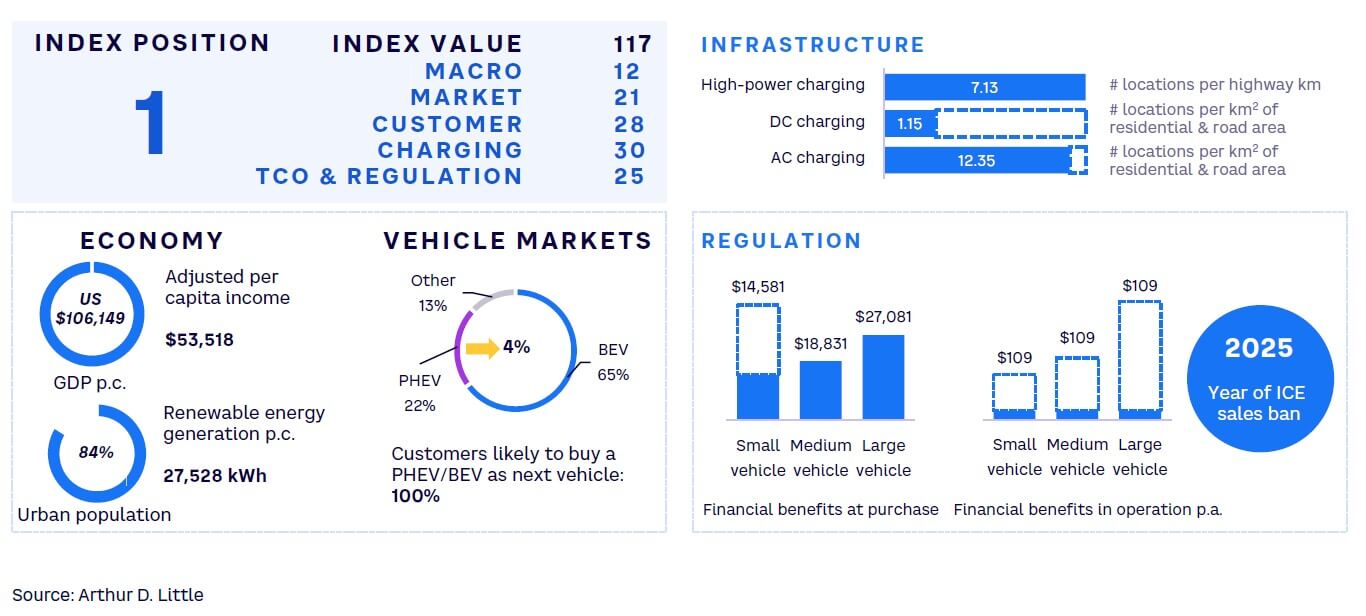

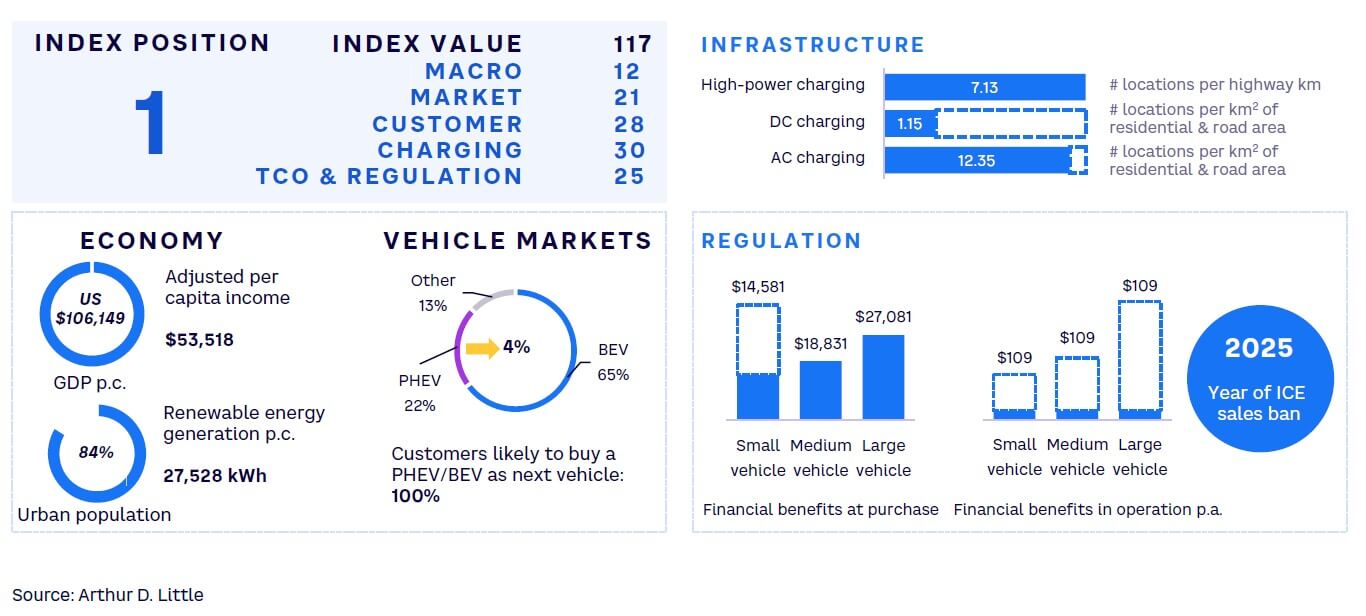

#1 Norway

Still leading in EVs and sustainability due to first-mover advantage

Norway is leading the EV movement across the globe. In 2022, 80% of new vehicle sales were BEVs. This adds to a long history of leadership in many sustainability areas. For example, the country’s utilities sector is built mainly on renewable energy from hydropower, with 45% of its energy mix coming from that source; the first hydropower plant was built in 1892. Moreover, as far back as 2016, 98% of electricity production came from renewables.

One driver for Norway’s EV adoption is its high share of urban population. Of Norway’s inhabitants, 84% live in cities. As a result, typical range anxiety, a major inhibitor of EV adoption, is less relevant, since city driving covers fewer kilometers. However, given that Norway is a vast country, average trip length is high, at close to 15 km per day. The government countered possible range anxiety by launching programs to install charging infrastructure as early as the late 2000s, resulting in about 2,000 charge points by 2011. Today, around 25,000 public charging stations are available in Norway, including around 6,000 fast-charging stations.

As Norway has historically not had a large car industry, a new kind of automotive suppliers are currently flocking to this destination. For example, battery cell manufacturers FREYR AS and Morrow Batteries have set up shop in Norway, and battery recyclers Swedish Northvolt and Canadian Li-Cycle are building plants in the country. The high availability of renewable energy for electricity-intense operations is the key driver of this development.

Norway’s government resolved the previously mentioned economic chicken-and-egg problem through government-funded infrastructure projects and tax breaks for EVs. The first 2,000 charge points were built through a program costing just €7 million. Furthermore, Norway committed to establishing chargers at intervals of at least every 50 km at major roadways, and successfully fulfilled that goal. To further accelerate EV adoption, Norway suspended import taxes on EVs in 1990, decreased annual registration taxes in 2000, and slashed EV VAT to 0% in 2011.

Its focus on cutting taxes paid off as EVs became the major technology in 2019, reaching 50% of sales, and pure BEVs reached 50% of sales in 2020. Conversely, tax burdens on fossil-fueled cars are substantial.

In addition, Norway has set ambitious goals for the future, declaring a target of zero local emissions from passenger vehicles by 2025. Putting this in perspective, the EU aims for the same by 2035. EV adoption has reached levels in Norway that are allowing its government to roll back tax incentives step by step.

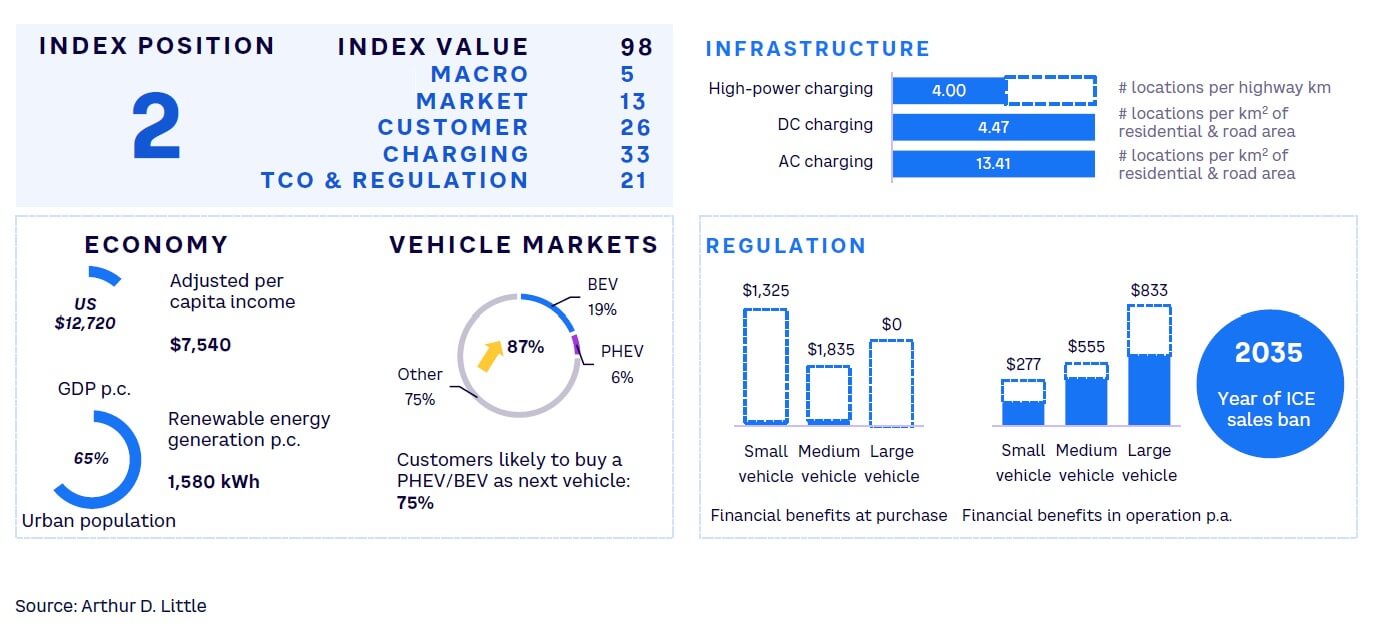

#2 China

Leading industrial BEV ecosystem enables global champion position

The EV industry in China is the largest in the world, accounting for more than half of global production (58%, according to International Energy Association [IEA]), and share of exported EVs from China have increased from 25% in 2021 to 35%. Plug-in electric vehicle (BEV/PHEV) sales amounted to nearly 25% of overall automotive sales in China in 2022, and these sales were increasingly driven by local automotive companies. When it comes to vehicle availability, China is the most developed EV market globally, with more than 90 brands offering over 300 models in all price ranges, from micro car to luxury. Local brands have a market share of more than 80%, among which are BYD, Wuling, Chery, and Changan. From China, there are also internationally active EV start-ups, such as Nio, XPeng, Zeekr, and Aiways. With China representing about 50% of the global BEV market, international OEMs must increase their value to customers and find cost-saving opportunities by designing vehicles to meet local requirements.

While global players are strengthening their technology position, they also need local ties to realize additional opportunities. Chinese OEMs such as XPeng, Nio, Geely, and BYD saw new record growth in EV sales in 2022. These regional companies are providing a superior experience to local consumers. Features such as strong human-machine interfaces and connectivity differentiate them from the competition.

With over 2.5 million charging stations added in 2022 alone throughout the country, China’s EV infrastructure continues to expand at an impressive rate. With the successful transition to EVs so far, China’s charging network has grown in step with other technologies, such as battery-swap stations. As a result, it has established itself as the current leader in EV infrastructure.

The Chinese government is supporting the development of the EV industry through regulation. There are encouraging policies and measures for both EV manufacturers and purchasers, as well as incentives for business operators to engage in and improve charging and other peripheral services. Financial benefits for customers can range from US $1,500-$2,000 per vehicle and US $1,000-$1,500 for manufacturers.

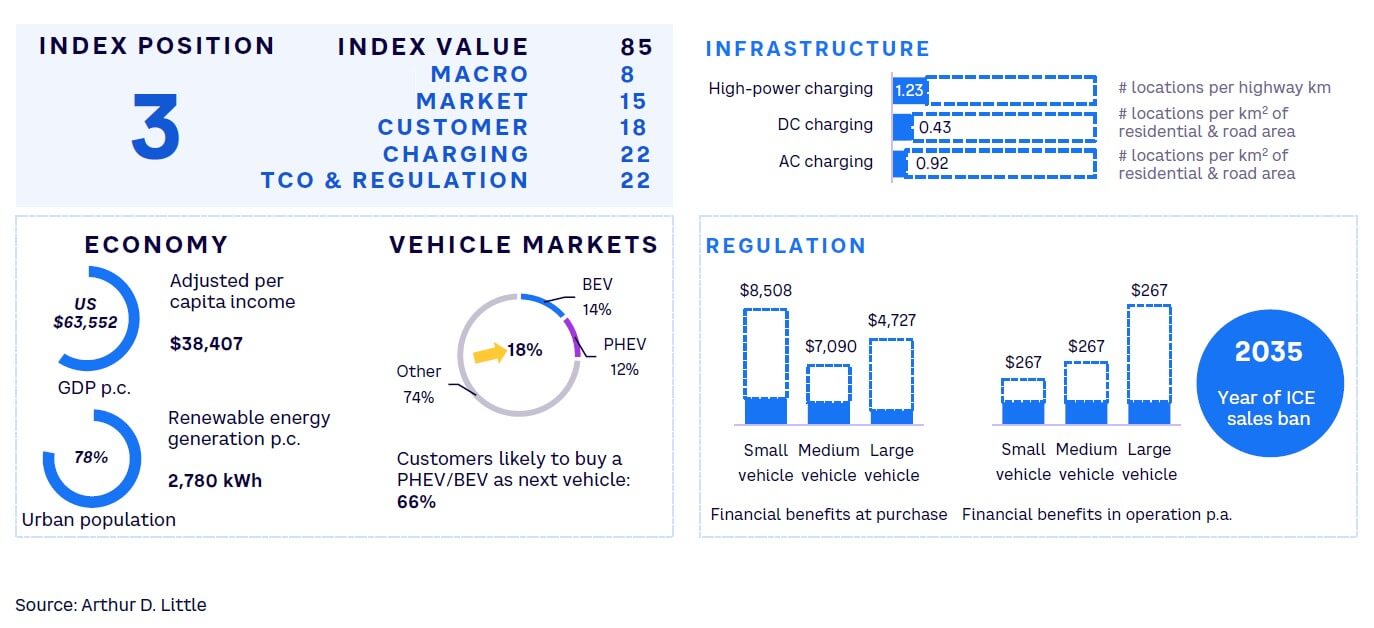

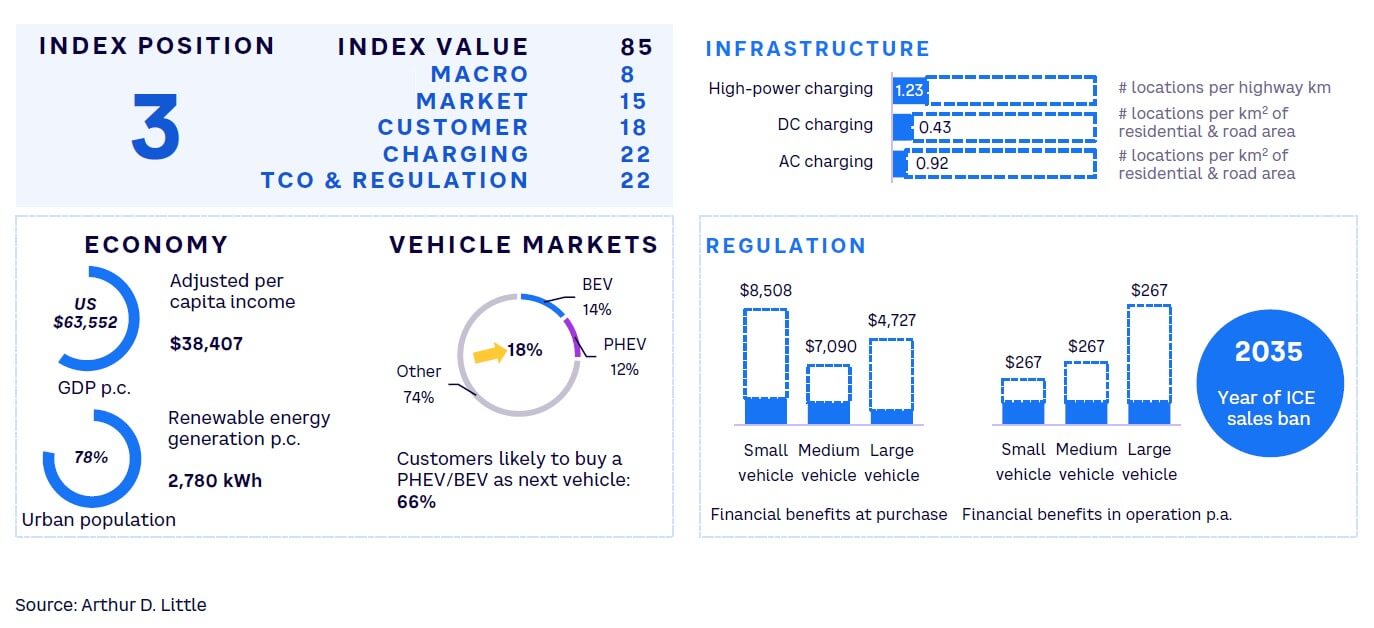

#3 Germany

Transitioning automotive industry and public awareness of sustainability and climate change

Germany has always been a strong automotive market, hosting many of the world’s most renowned brands, especially in the high-end sector. Comparing the number of cars on German roads to the population, statistically more than every second person owns a car in the country.

Additionally, environmental protection has long played a significant role in Germany. The first legislation on the “Energiewende” (energy transition) dates from the late 1970s. Today, about half of the country’s electric energy is generated from renewable sources. The political uncertainties around energy import from Russia have prompted Germany to increase local production of renewable energy even further.

The automotive industry in Germany, however, maintained a strong focus on ICEs for a long time. While the hype around EVs from 2010 to 2013 was already high in countries such as the US and China, German manufacturers only started serious production of EV passenger vehicles around 2019–2020. Despite the late start, German OEMs picked up the pace, and today, more than 120 different BEVs are available in the market, representing a healthy mix of local and international brands.

One of the major barriers to adopting EVs in Germany is the aforementioned chicken-and-egg challenge of consumer unwillingness to buy vehicles due to poor charging infrastructure and industry hesitance to invest in infrastructure due to poor vehicle sales. Germany recently made a new attempt to break this vicious cycle, with many new, attractive EVs coming to market that spanned all price ranges. Many of these vehicles come with a free (or at least well-priced) wall charger, making EVs an attractive offer for the considerable portion of the population living in single-family homes with parking.

German consumers have always tended to spend more for their vehicles (US $45,000 on average for new cars in 2022), and cars are still highly appreciated in parts of the population. Rural Germans often see the car as their only means of transportation. Combined with the substantial financial benefits offered by the federal government in 2022, EV adoption increased significantly. This, in turn, made investment in public charging infrastructure attractive for players from the automotive, oil, and energy industries, as well as start-ups.

Notably, German manufacturers’ sudden increase of vehicle models was also driven by the fact that other global OEMs, for example, from the US and China, are now competing heavily with established European brands. The newfound German appreciation for EVs also benefits from EU regulation like the announcement of banning registration of new ICE vehicles by 2035.

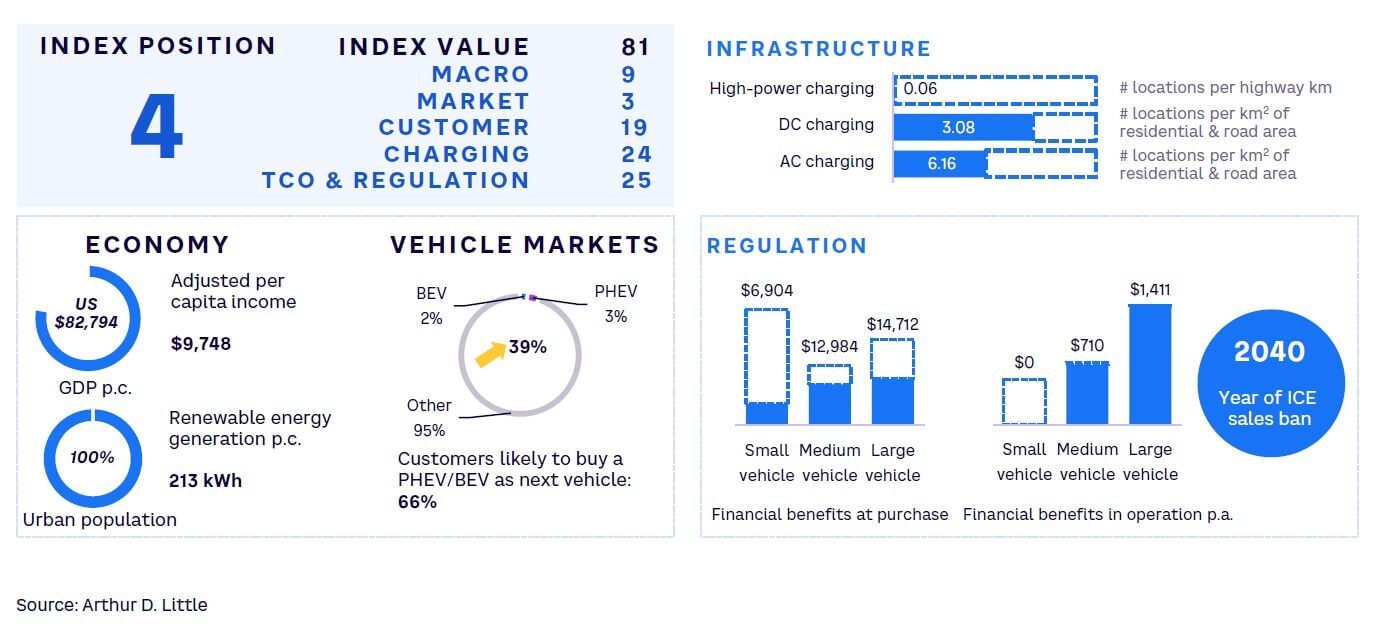

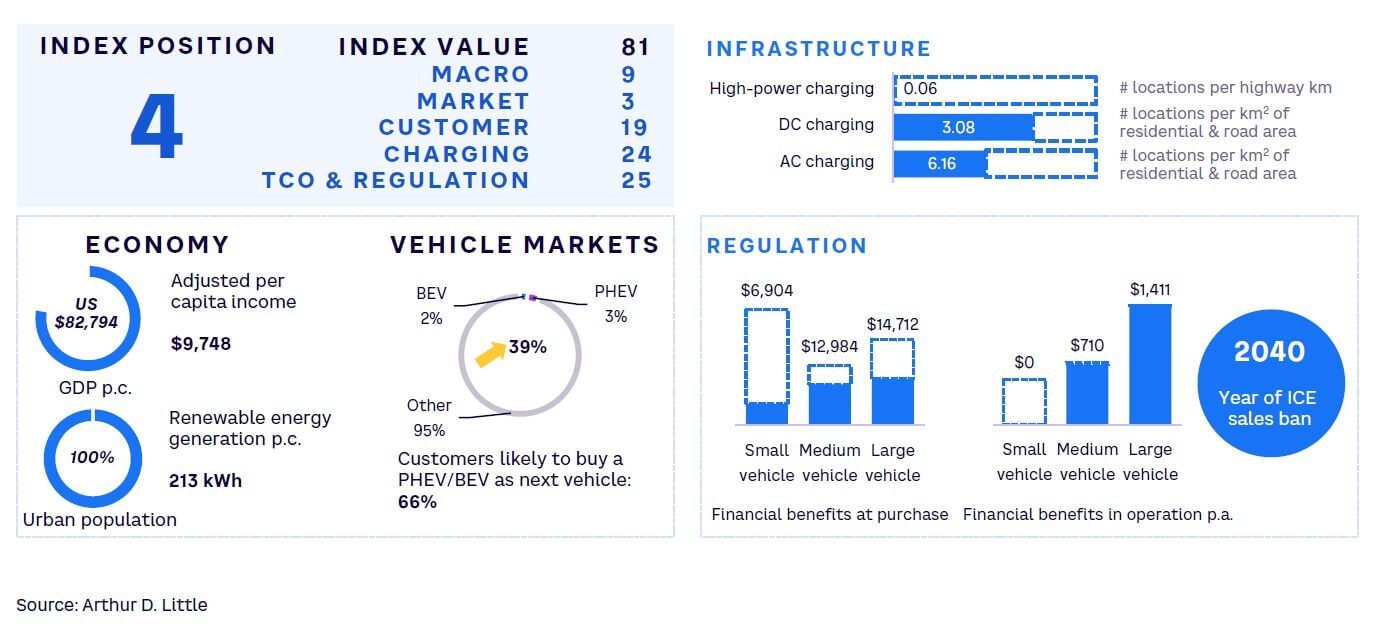

#4 Singapore

EV sales boom in Singapore with new governmental measures

Singapore suffered a setback in EV penetration during the pandemic but has bounced back sharply with new measures to promote EV sales. With a strong economy (a high estimated per capita GDP) and almost 100% urbanization, Singapore consumers are not anxious about driving range and are willing to pay a premium price for EVs, considering the manifold advantages. The government has also been clear about its encouragement of EV adoption through its announcement in March 2021 that all new car and taxi registrations would need to be clean energy models from 2030 onward, and that all vehicles on roads would need to run on clean energy by 2040.

EV sales are expected to continue to grow at an average annual rate of around 40% year-on-year — to reach an annual sales volume of just under 7,000 units by 2030 and an EV penetration rate of around 9.6% of total vehicle sales in the same year. In 2022, about 3,600 EVs were sold, representing about 12% of all new cars registered. Tesla has been the highest-selling EV brand, with a market share of about 24%, followed by BYD.

The Singapore government announced in its 2021 budget speech that US $25 million has been set aside over the next five years for EV-related initiatives entailing public-private partnerships. This could include measures to improve charging availability at private premises. Singapore will also accelerate the development of its charging infrastructure to better support the growth of EVs in the next decade, aiming to enable the rapid growth of EV sales at around 40% year-on-year. The plan is to deploy 60,000 charging points at public car parks and private premises by 2030 — which is more ambitious than the previous target of 28,000 chargers.

Financial regulations in Singapore are quite progressive as well. New policies such as the Vehicular Emissions Scheme, together with the EV Early Adoption Incentive initiatives, provide tax rebates to reduce the prices of some electric cars by up to US $15,000. From May 2022, to support mass-market EVs, those with up to 110 kW of power were grouped in the smaller car category in auctions for certificates of entitlement (COEs), lowering costs for consumers. This threshold was previously at 97 kW.

All these measures are motivating consumers and fleet operators to shift from ICEs to EVs as the transition becomes increasingly user-friendly. They have put Singapore at the forefront of EV adoption across the globe, second only to China in Asia.

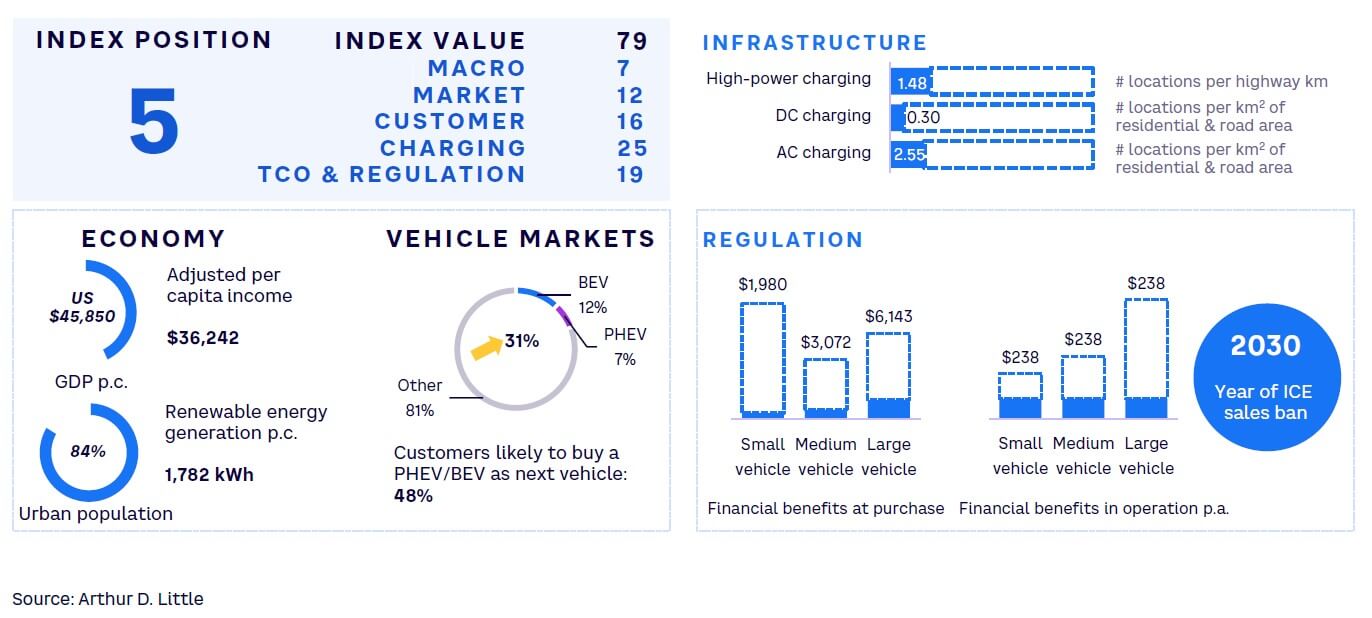

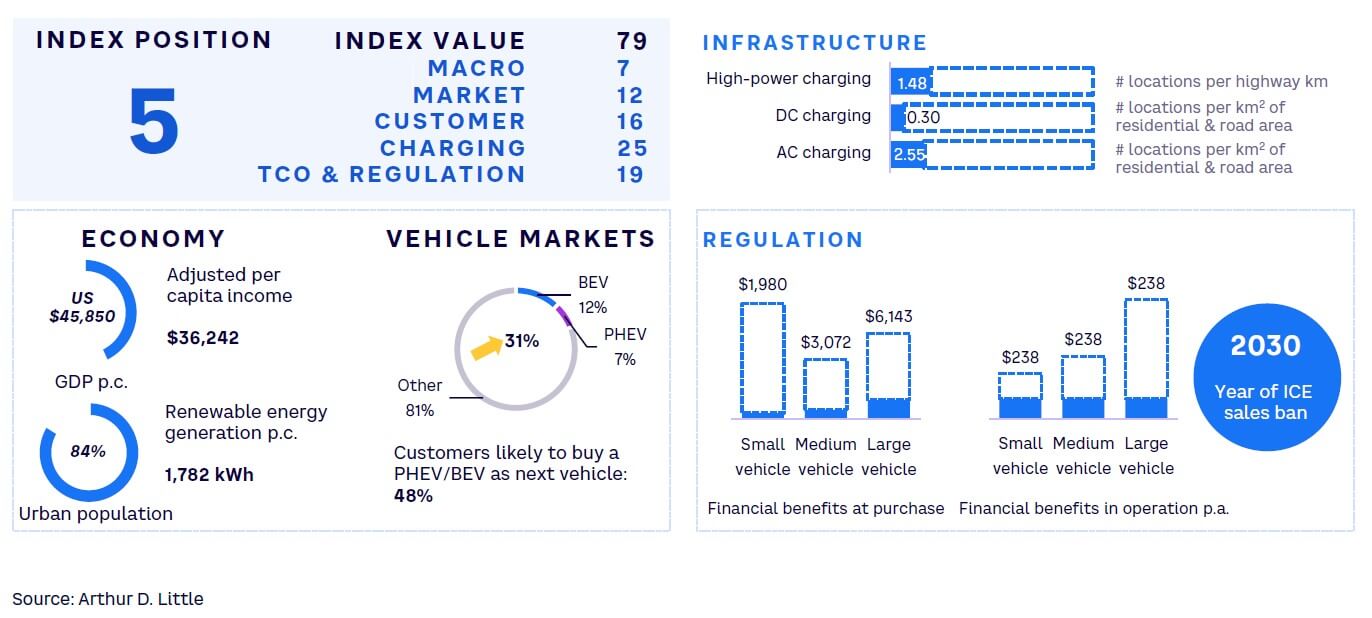

#5 UK

Fast acceleration of EV adoption — Government’s course is becoming unclear but not having a negative effect yet

Electric mobility is slowly becoming a success story in the UK. In 2022, the sales share of electric light vehicles climbed by 40% to 22.8%, while the overall car market suffered. The dominating technology is full BEVs, as nearly 17% of total vehicles sold used a purely electric drivetrain.

The UK government has set ambitious goals for building up its charging infrastructure. In 2022, the public and semi-public charging infrastructure stood at around 39,000 charge points, of which 6,900 were DC fast chargers with more than 100 kW, and a majority of 21,500 were AC with up to 22 kW. The country aims for at least six rapid charge points at every motorway service area by 2023. By 2030, more than 2,500 high-power charge points are scheduled to be added across strategic road networks. In addition to its large public infrastructure program, the UK subsidizes private home charging with a grant of up to £350.

One obstacle to EV uptake in the UK used to be renewable energy supply. The market has increased its speed in the energy transition, and 2022 saw record highs in renewable energy generation: wind contributed 27%, biomass 5%, solar 4.4%, and hydropower 1.8%.

Governments and cities are endorsing EV uptake through bans and regulations on the one hand, and incentives to empower end consumers on the other. The original plan to ban all new registrations of ICE vehicles by 2030 has, however, been postponed by five years. The effects will have to be monitored. Furthermore, parts of cities are regulated through congestion zones in which vehicle operators must pay if emissions and traffic density standards are not met. For example, in London’s Ultra Low Emission Zone, gasoline cars and vans must meet at least Euro 4 standards to avoid charges, whereas in Oxford’s Zero Emission Zone, every vehicle with local emissions is charged — even PHEVs.

Additionally, EV purchase subsidies are in place for up to £1,500, as well as exemptions from road tax and an expensive-car supplementary tax. Further, the UK government also drives corporate promotion of EVs with a capital allowance and a benefit-in-kind tax. In total, we estimate that a BEV company car has an advantage of more than £8,500 spread over three years over a similar ICE car.

In recent years, the UK has started to embrace the change from ICEs to EVs and is accelerating fast to nudge end customers in the direction of the electric powertrain. The steep increase in EV sales and the rapid buildup of infrastructure indicate its success.

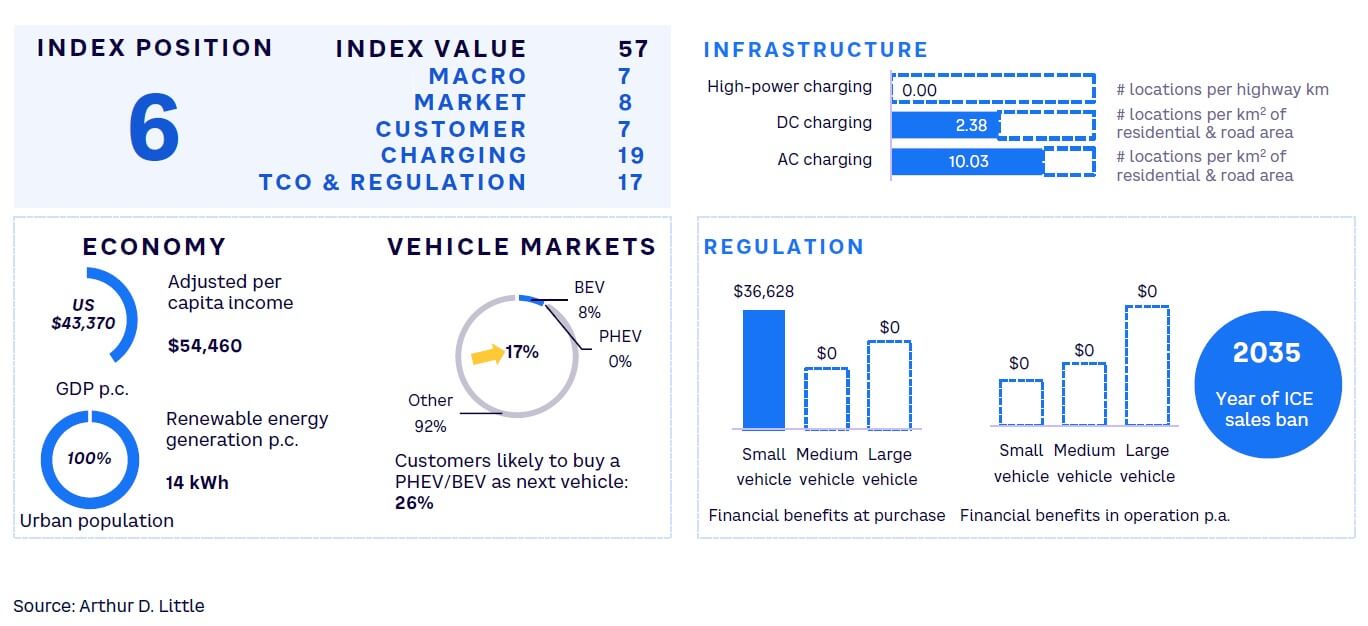

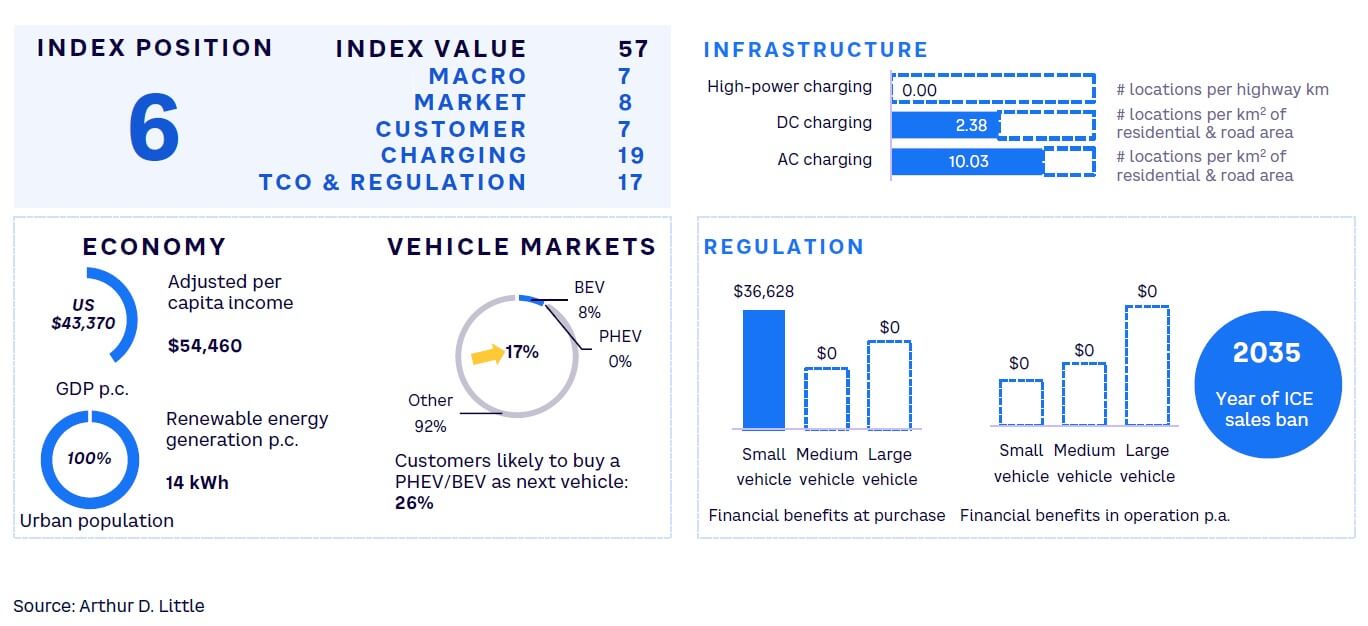

#6 Hong Kong

Charging infrastructure concentrated in residential and commercial buildings

Hong Kong wants to achieve carbon neutrality by 2050 and with the transportation sector being the second largest single producer of carbon emissions, electrification of road transport is an important stepping stone. This region has good overall conditions for an EV transition: an urban, young, tech-savvy population; well-developed electricity infrastructure; and a high smartphone penetration and GII score.

Hong Kong profits from the strong Chinese EV market. The local market for EVs is broad and well developed, as 188 EV passenger cars are available for sale, benefiting from the large offering of Chinese car brands. Unfortunately, only a negligible share of electricity in Hong Kong is generated from renewable sources. Therefore, EVs are not automatically a sustainable alternative, but they help reduce local or tailpipe emissions.

In 2021, the government of the Special Administrative Region implemented a roadmap to support the adoption of EVs, including long-term objectives and policies to reach net-zero vehicle emissions by 2050 (while planning to be carbon neutral overall at the same time). A ban on fossil-fueled cars from 2035 onwards sets a clear agenda, and the government has introduced waivers of first-registration tax (FRT) for EVs, leading to large financial benefits. Enterprises buying EVs can fully deduct the purchase price from their profits in the first year for tax reduction.

The government has also allocated funds for electric buses for public transportation. The EV sales share was 8% in 2022, while the share of fleet is currently around 6%.

Although authorities highlight the importance of charging at home or the workplace, more public charging infrastructure will be required to lower adoption barriers for EVs. A current government plan wants to have a minimum of 5,000 public chargers installed in Hong Kong as early as 2025, in addition to 125,000 chargers in residential and commercial building parking garages. The government has provided funds for installation of EV charging infrastructure at existing residential buildings. For EV users in Hong Kong, an increased transparency about public EV charging locations in the city, along with better accessibility, will make the transition to EV easier.

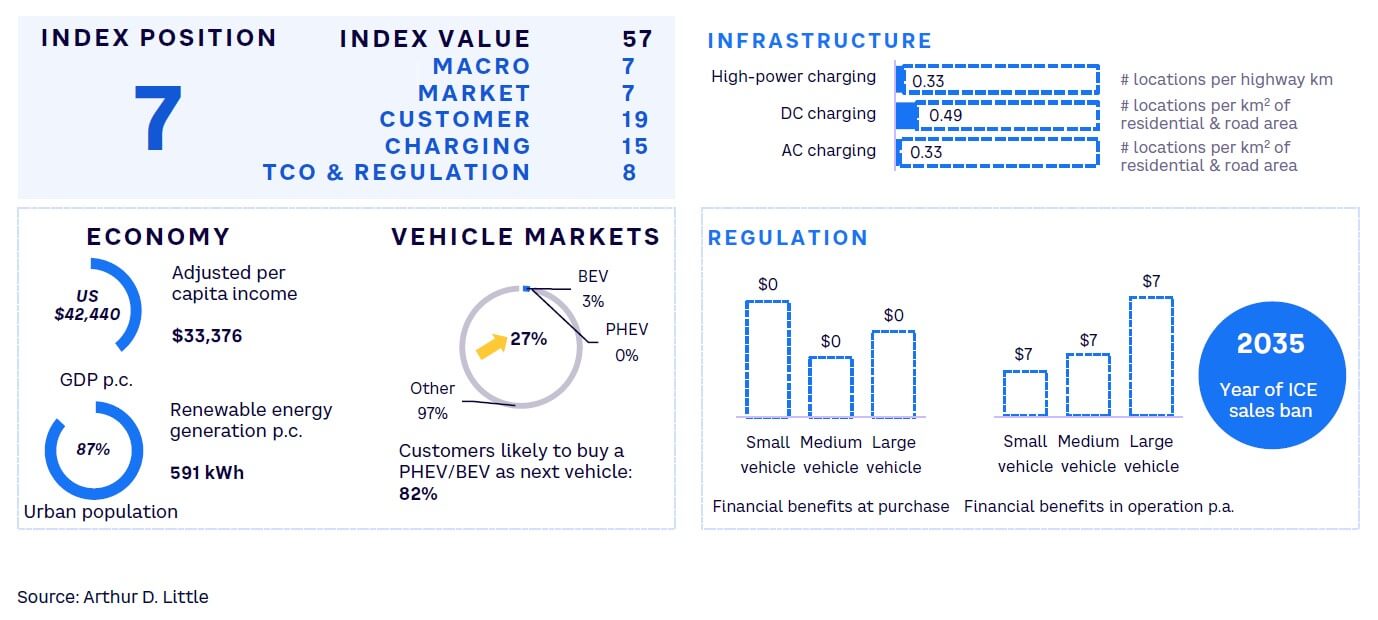

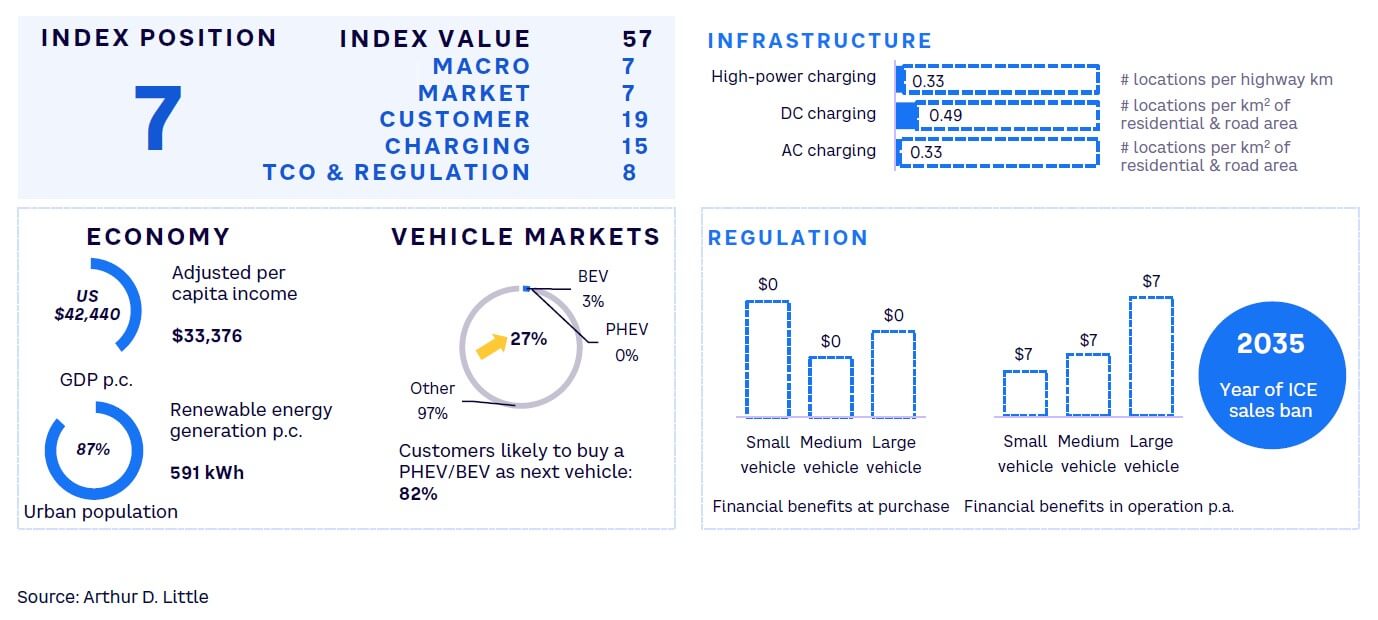

#7 UAE

Incentives support government’s ambitious EV vision; charging infrastructure fuels EV growth

EVs are increasingly visible on the UAE’s roads. This number is set to expand rapidly in the coming years and will interlink the transport and electricity sectors like never before, as the UAE aims to become carbon neutral by 2050. Under UAE Vision 2021, the government has placed a strong emphasis on promoting the adoption of EVs across the country. Dubai, for example, has launched its Green Mobility Strategy 2030, under which it aims to have approximately 42,000 electric cars on the streets of Dubai by 2030.

In 2015, Dubai launched the EV Green Charger initiative to enhance the availability of charging stations for EVs. The overall number of charging stations in the country has grown considerably to approximately 700 stations and is set to expand further. The Dubai Electricity & Water Authority and Road Transport Authority are working jointly to incentivize the use of EVs, with benefits such as free parking and exemption from tolls. By 2050, they aim to make public transportation emissions-free.

The concerted effort of both the government and private sectors in boosting the EV landscape has been met with a promising response from consumers; a staggering 82% are willing to purchase an EV as their next vehicle.

NWTN, a green mobility tech firm, wants to establish an EV assembly plant in Abu Dhabi with a 25,000 square meter facility. It will have an initial capacity of 5,000-10,000 units annually, with potential expansion to 50,000.

Adnoc Distribution, the UAE’s largest fuel and convenience retailer, and Abu Dhabi National Energy Company are coming together to create new joint venture (JV) E2GO. The venture aims to become the primary provider of EV charging points and infrastructure in Abu Dhabi, with plans to deploy a network of fast chargers at key locations, providing associated solutions like parking and tolling services and related digital platforms to enhance EV charging.

By unlocking new revenue streams and catering to the evolving needs of EV customers, the partnership is well placed to promote the adoption of EVs in Abu Dhabi. With the government’s continued support and collaboration with the private sector, the UAE is well on its way to achieving its goal of becoming a leader in e-mobility and sustainable transportation.

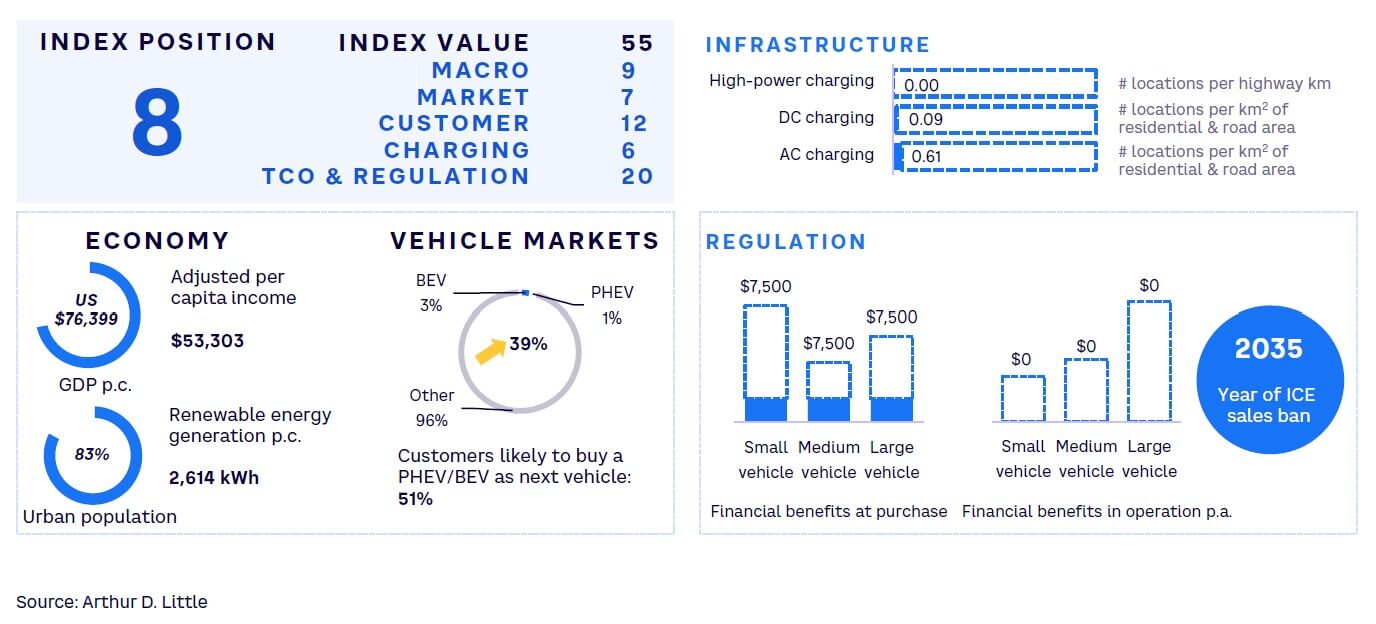

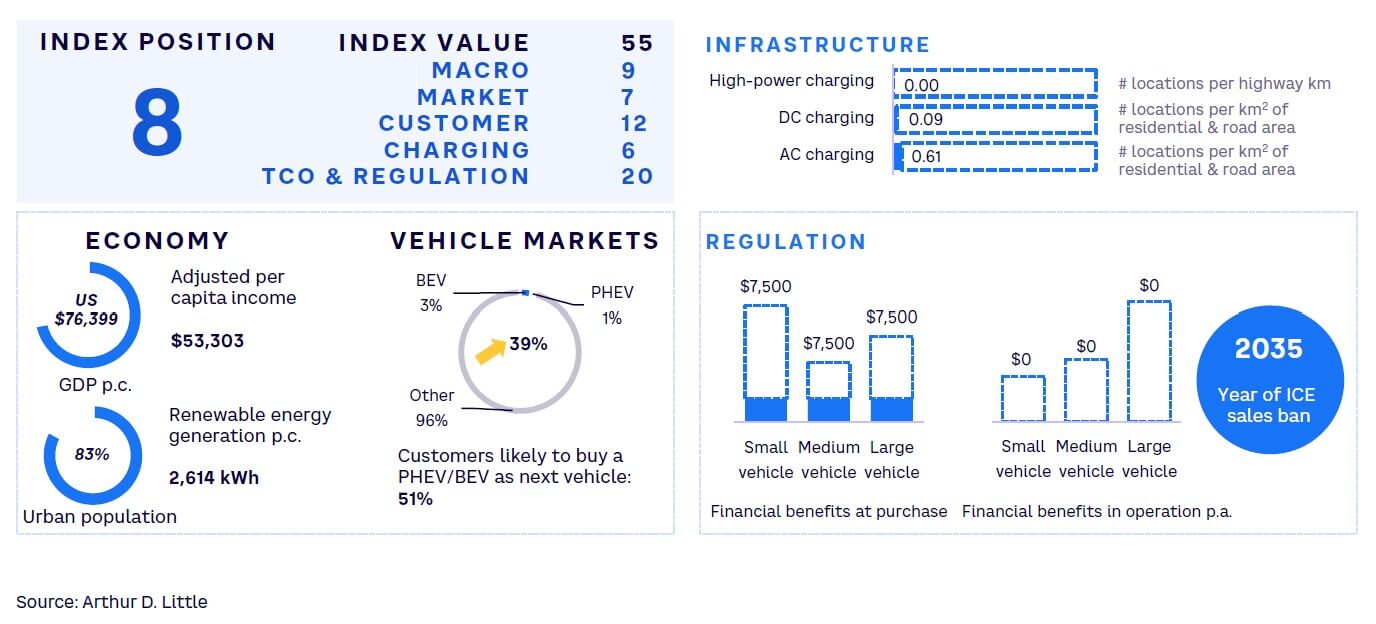

#8 US

Robust government measures continue to create sustainable EV ecosystem — driven also by one of the world’s largest EV OEMs

Until now, EV adoption has been slow in the US, where EVs were roughly 6% of sales in 2022. By the end of the year, only about 1% of the more than 280 million passenger vehicles in the country were electrified. As the US has always been a country of significance for the whole automotive industry, developments will be exciting to monitor over the coming years.

The US has favorable macro factors that are setting a promising framework for EVs: high GDP per capita at more than US $76,000 and 5.6% GDP growth over the last three years indicate adequate disposable income in many cases. One of the highest motorization rates across the globe, with nearly 830 cars per 1,000 inhabitants, establishes the potential of the market. High smartphone penetration of 82% and holding third place in GII rankings also shows the US’s affinity for innovative technologies.

The US automotive industry’s development is now supported by the country’s Inflation Reduction Act policies, including huge clean vehicle tax credits for domestic manufacturers of EVs and EV components such as batteries. The rise of Tesla arguably kicked off the electric mobility movement across the globe and revived the US automotive industry. Tesla’s Model Y and Model 3 are still the most popular EVs within the US. Ford and GM followed up on Tesla’s success by announcing ambitious EV sales plans and introducing electric versions of iconic pickups like the Ford F-150 and the Chevy Silverado. GM aims for 40% of global sales being electric by 2025 and 100% of US passenger EVs by 2035. Ford targets a 50% share of EV sales by 2030. New entrants are also trying to get their share of the market, such as SUV brand Rivian and Lucid Motors.

However, lack of infrastructure is a major inhibitor: charge-point density on highways is very low, at approximately two charge points per 1,000 km. The East and West Coasts boast better infrastructure than the Central and Midwestern states. Additionally, energy infrastructure might pose a problem for home charging, as residential homes are usually served by a single-phase power supply; only commercial sites have the three-phase power required for 22 kW chargers. This creates one of the largest challenges in the US, as range anxiety is the second biggest inhibitor, with more than 25 km traveled per trip per inhabitant.

Encouragingly, the current US government has announced more ambitious plans. It has declared a goal of 50% of sales being EVs by 2030, with the addition of 500,000 new charge points. It backs up these claims by subsidizing EV purchases with tax credits of up to US $7,500 and a fund for infrastructure rollout, including US $7.5 billion for the installation and operation of chargers. Together with the strong tailwind for manufacturers from the IRA, these developments make the US one of the most attractive countries for EV players in the coming years.

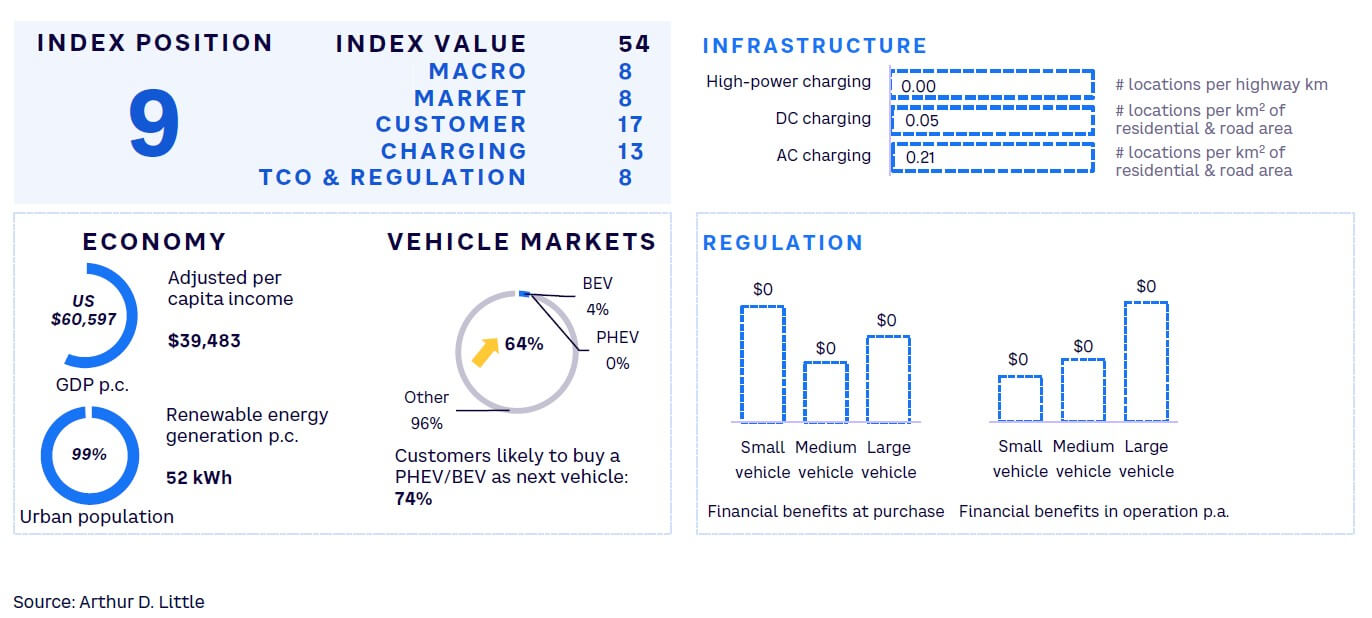

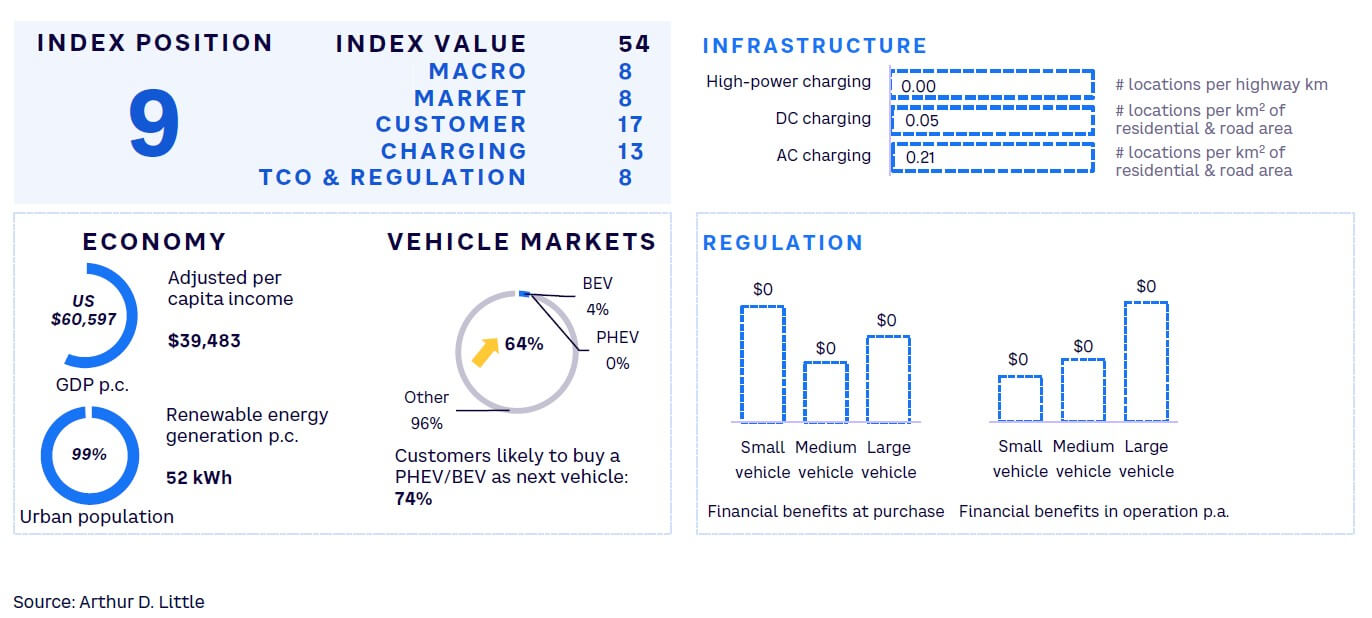

#9 Qatar

Policy frameworks and increased charging infrastructure are required to capitalize on growing customer EV readiness

With one of the world’s highest GDP per capita and a heavily oil-reliant economy, Qatar has set ambitious targets to transition from an industrial-based economic model to a sustainable, innovation-driven one. The country’s EV aspirations align with the vision to facilitate the transition.

According to Qatar National Vision 2030, the nation aimed to achieve 25% of its public transit bus fleet to be electric by 2022 and had successfully reached this milestone by year end. The Ministry of Transport, in line with Qatar’s Vision, aims to switch 35% of total vehicles in its fleet and 100% of its public transport buses to electric by 2030. These strong commitments are a testament to the potential of the EV market in Qatar.

A boost to the EV landscape comes from the recently concluded FIFA World Cup 2022 in Qatar, where the use of electric buses and taxis raised awareness of EVs among tourists and locals alike, while also encouraging consumers to choose EVs. In addition, to bring EVs and hybrid EVs (HEVs) to Qatar, the country is forming partnerships with several international automakers. For example, Qatar Free Zones Authority (QFZA) recently signed a multilateral framework agreement with Yutong, one of the world’s leading bus and coach suppliers, and Mowasalat, Qatar’s major transport services provider, to establish and operate an electric bus factory. Regarding charging infrastructure, Qatar General Electricity and Water Corporation (Kahramaa) and fuel retailer Woqod signed an agreement in late 2022 to supply, install, and operate 37 DC fast-charging units for EVs at Woqod stations.

In addition to the support for public transportation, the government is pushing for higher EV adoption among the consumer segment. The Ministry of Transport is actively promoting the deployment of personal EV charging units for private use, while financial institutions are responding to the growing demand for EVs and hybrids by offering green financing options to facilitate purchases. As a result, it is not surprising that nearly three-quarters of consumers are considering purchasing an EV as their next vehicle.

The government’s strong commitment to promoting green mobility is evident in the active participation of various ministries, offices, and stakeholders in developing robust infrastructure for EV charging and offering a broad range of benefits like free charging. These efforts, combined with a focus on enhancing charging infrastructure and providing incentives for EV purchases, are expected to accelerate the growth of the EV market in Qatar and contribute to achieving the country’s sustainable, innovation-driven economic goals.

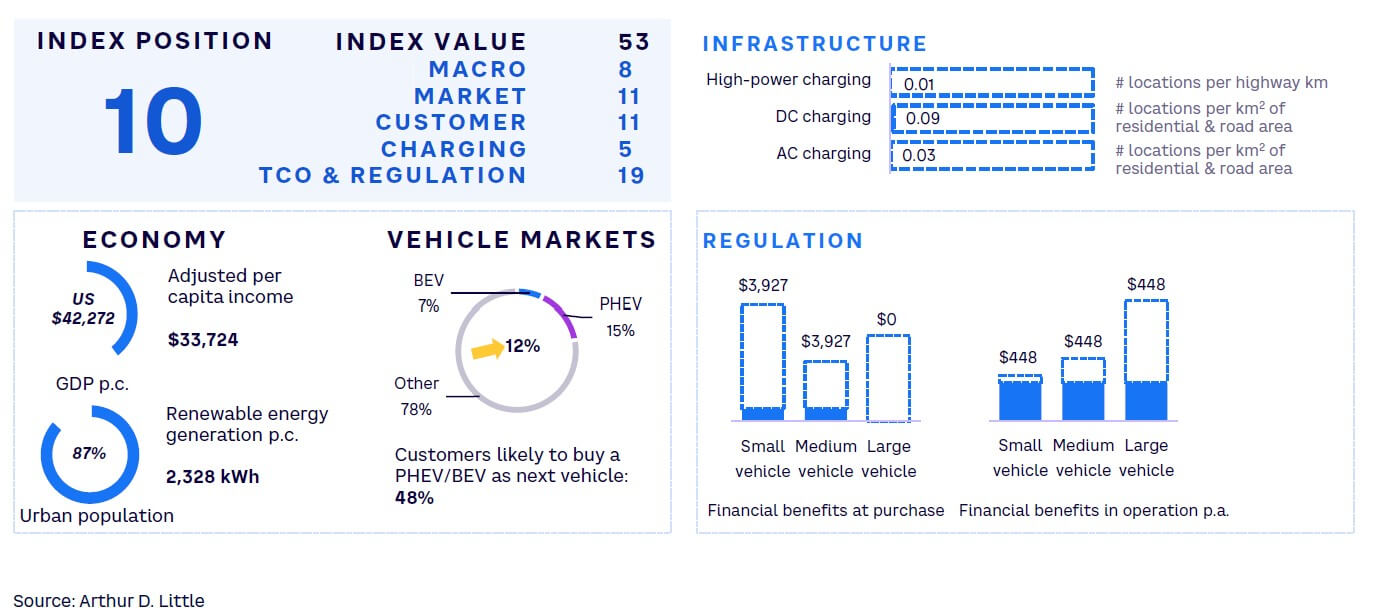

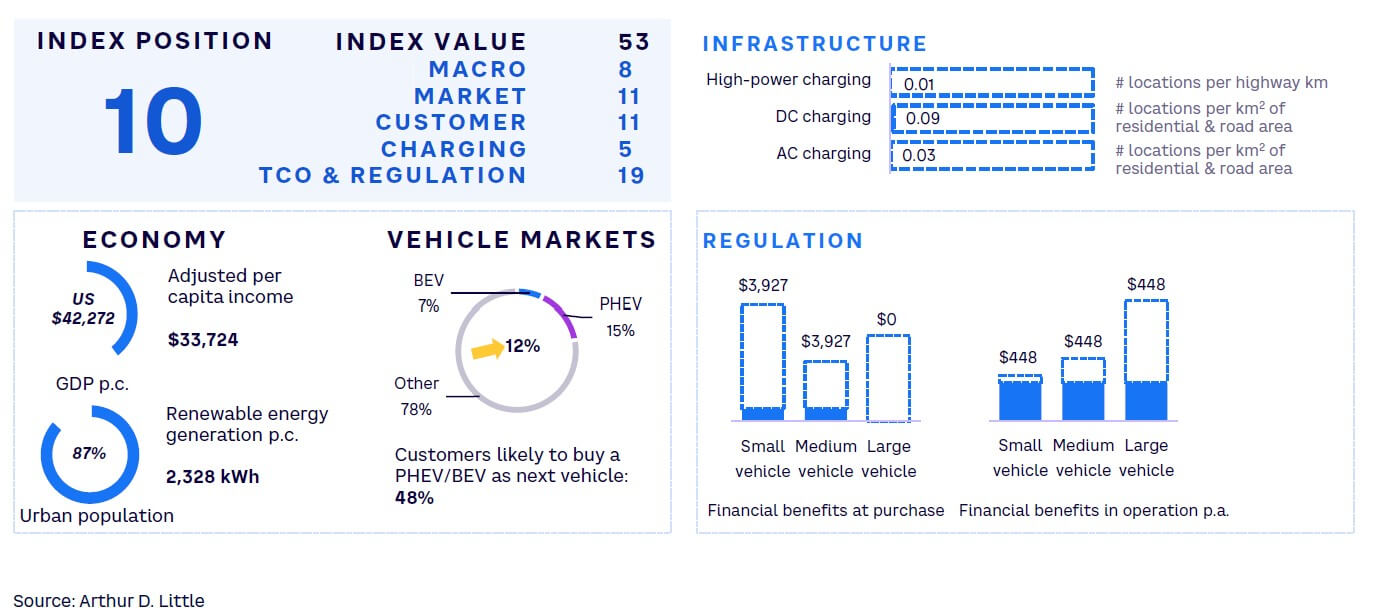

#10 New Zealand

A promising EV market with loads of renewable energy and lack of public charging infrastructure

New Zealand is known for its tourism and beautiful landscapes and shows increasing awareness of the need for a sustainable economy. Climate issues are particularly important to New Zealanders, especially given that the Asia-Pacific region has suffered severely from natural disasters.

New Zealand is likely to ban sales of ICE vehicles by 2040 but has thus far not taken legislative action in that regard. It could improve its GEMRIX position once a ban has been introduced. However, the government has taken action on other ends, such as implementing trade policies that focus on sustainable growth and ceasing fossil-fueled subsidies. For instance, it has introduced an exemption for road user charges that apply exclusively to EVs. These will be in place at least until March 2024. The government is targeting an EV share of 2% of all light vehicles on the nation’s roads by that time. EV sales shares have reached approximately 7% in 2022, and PHEV sales have been at more than 15%. Currently, sales shares are increasing at a high speed.

As a quite wealthy society, with a GDP of more than US $42,000 per capita and a solid economy and political system, New Zealand has good starting conditions for a transition to EVs. Also, it has a high urbanization rate, and strong interest in EVs has been expressed in surveys among consumers.

A large share of renewable electricity generation (around 85%) will help New Zealand not only reduce tailpipe emissions of its local car fleet but also lower overall carbon emissions from the road transport sector by the introduction of EVs. The government has set out to increase this share to fully 100% by 2030, enabling net-zero emissions via use of EVs.

New Zealand is specifically weak in public charging infrastructure, having a very low GEMRIX score and only one charger per 75 km of state streets. As a market of “home chargers” currently, New Zealand could step up to become Ambitious Followers quickly with an improved public charging infrastructure. Some providers have announced plans to install several hundred ultra-fast chargers over the coming years. Thus, a climb up the GEMRIX ranks is probable for New Zealand in the future. Currently, the growth rate of public EV charging infrastructure is more than 30% year-on-year.

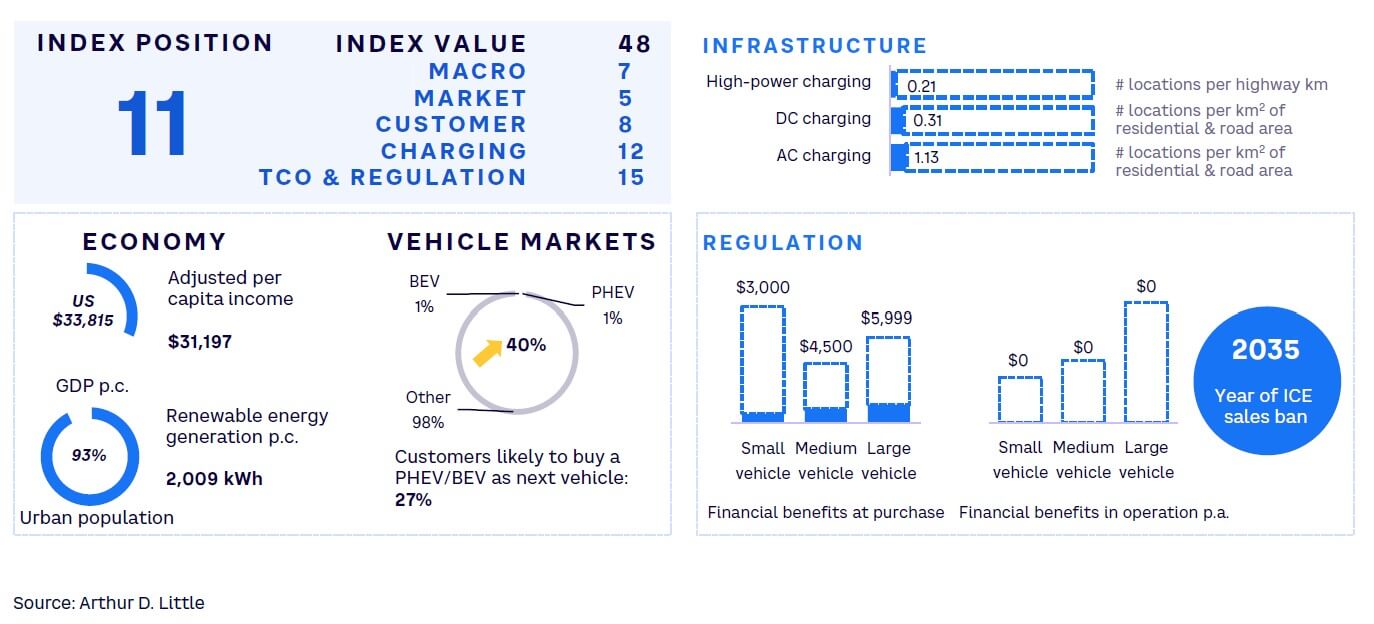

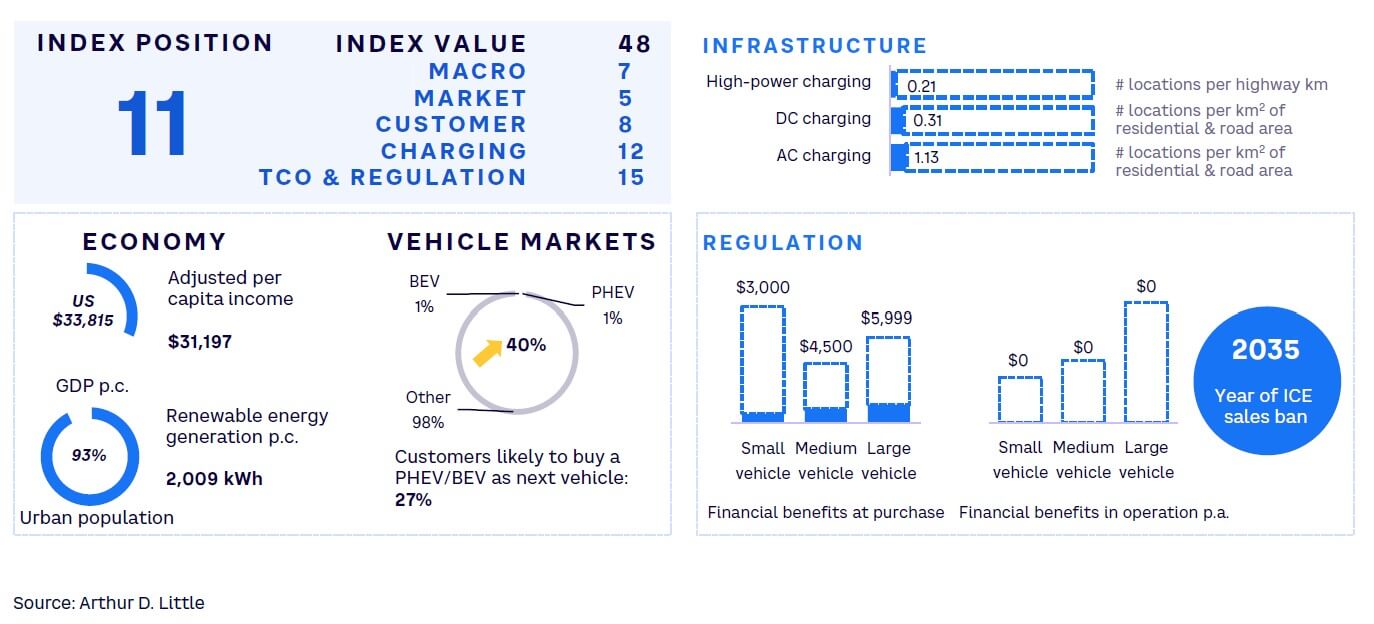

#11 Japan

A huge HEV market prepares for start of full electrification

EV sales as a percentage of total auto sales for Japan were about 2% for 2022, with an estimated annual sales volume of about 77,000 units — a huge jump from around 42,000 units the year before. However, while EV adoption is rising slowly, recent initiatives taken by the government and OEMs are expected to bring a much-needed boost to electrification.

In 2021, the Government of Japan set a target for all new cars sold by 2035 to be environmentally friendly, which will push EV sales. The government has also subsidized part of the cost of purchasing EVs, particularly BEVs, PHEVs, and fuel cell EVs (FCEVs). Local automakers such as Toyota, Suzuki, and Honda expanded their EV offerings in 2022 for the first time, after betting much longer on hybrid and (in small numbers) fuel cell powertrains. For Japanese consumers, 2022 marked the first year of EV model availability from domestic manufacturers.

While PHEVs and BEVs have not seen high adoption in the country, HEVs are still quite popular, reaching a record in sales share of 49% of total auto sales in 2022. Japan also has a strong EV charging infrastructure, with about 30,000 charging stations, and the government plans to increase the number to 150,000 by 2030. With a strong mix of urban population and regulatory push, Japan is slated to become one of the bigger EV markets globally.

Japan’s laggard approach to e-mobility is largely due to its huge investments in gasoline-electric hybrids. For a long time, the Nissan Leaf was the only successful BEV operating in the country. Thus, both the government and Japanese companies have good reason to hold their bets on EVs.

Today, Japan dominates the global market for the current generation of gasoline-electric vehicles. Given customers’ familiarity with this technology, their preference to shift to PHEVs/BEVs is far lower than that of other developed nations. Almost half of all vehicles sold in Japan are HEVs. After incentives provided by the government in 2012, electric charging infrastructure developed rapidly in the country, with more than 30,000 stations already operating.

As demand for HEVs continues to rise, the EV charging infrastructure will further improve. The government provides subsidies at the point of purchase for EVs, but no such incentive is currently provided for operating EVs. The latest changes in the strategy of Japanese OEMs have shown that incumbents like Toyota will surely move quickly to avoid being left behind.

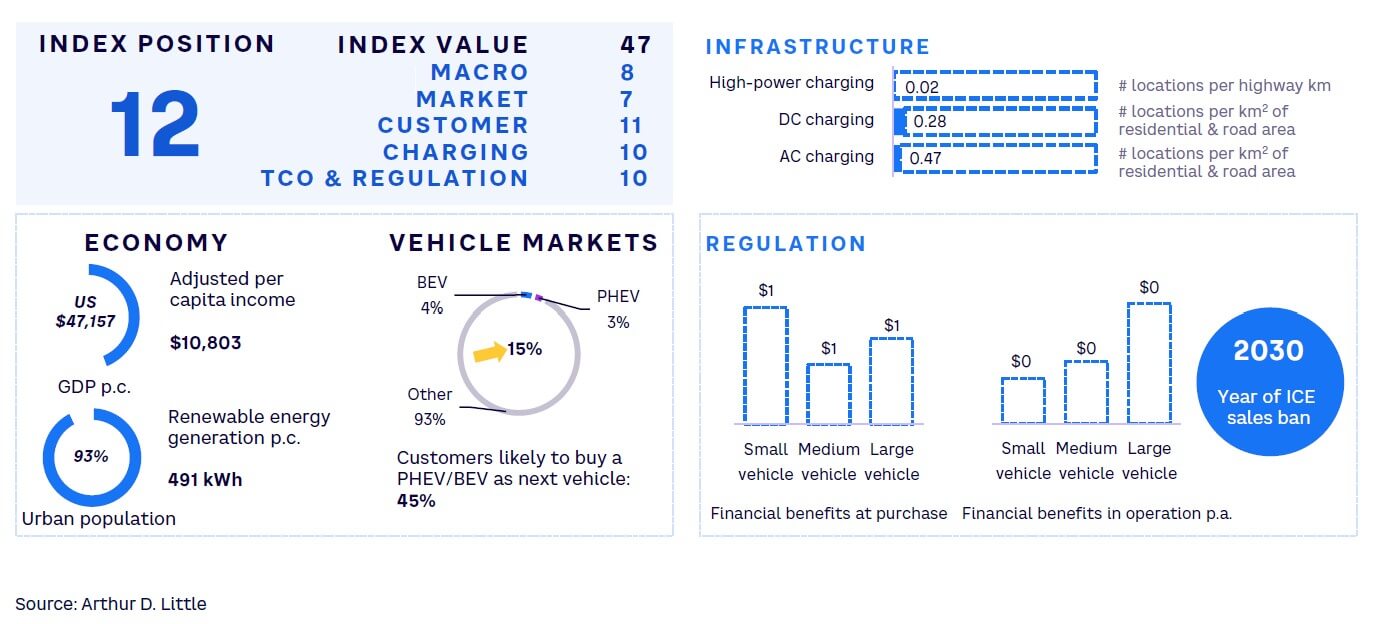

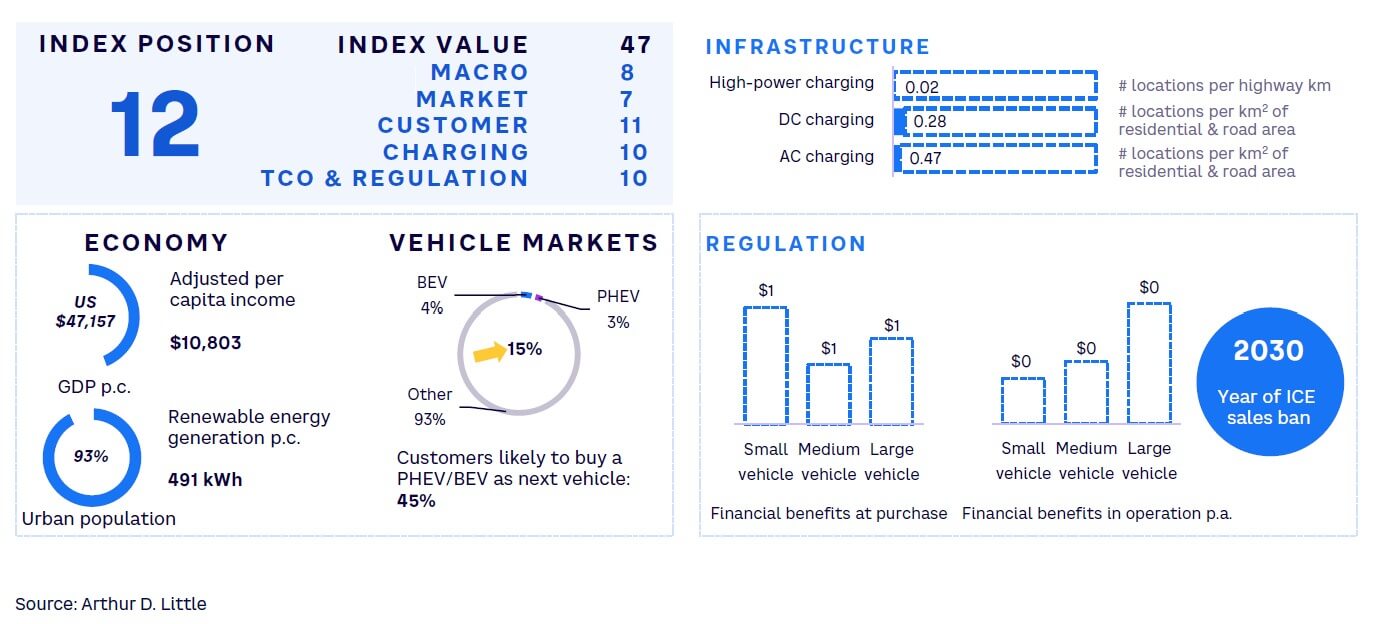

#12 Israel

Propelled by boost in public charging infrastructure and e-mobility innovations

Israel is a highly urbanized, densely populated country with a high dependency on private car commutes. Its commitment to fighting climate change has resulted in an impressive growth story for EVs in the country, which ranks among the top countries in the region in terms of EV readiness. The government’s announcement of making electric cars the only option for purchase from 2030 has further boosted the EV landscape.

Moreover, Israel’s ranking of 16th in GII underscores its affinity for innovative technologies. Although the country’s EV industry is less mature than that of countries like Norway, Sweden, and the Netherlands, Israeli companies have developed some of the best solutions in the industry. Many of the equipment and solutions developed by Israeli companies are highly valued, even in mature markets. For example, StoreDot, an Israeli start-up, has developed a fast-charging battery that can charge an EV in just five minutes, while Electreon Wireless has developed wireless charging technology for EVs, enabling a more convenient charging experience.

A new deal between Toyota and Electreon will yield built-in wireless charging for future Toyota EVs, as well as an easy-to-install kit. With such innovative solutions, Israel is poised to break into the top bracket of countries leading the global EV market.

With one of the highest rates of taxation on ICE vehicles in the world and lower rates for EVs, Israel has incentivized the adoption of EVs. The availability of public charging stations and good electricity infrastructure has also facilitated the EV uptake among customers. As a result, around 45% of consumers will likely buy an EV as their next vehicle. Most current EV purchases in Israel are Chinese imports, with BYD and Geely becoming popular brands and beating legacy players like Hyundai and Kia in sales numbers.

According to Israeli experts and importers, advanced technologies, higher availability, and better configuration are the three main reasons for the success of Chinese EVs in the Israeli market.[2]

However, rapid growth of EVs has put the Israeli government in a conundrum. The government is discussing doubling the purchase tax on EVs from 10% to 20%. The intent is to emphasize public transportation versus massive private EV car usage, as one government official reported saying that the government’s “aim is not to fill the roads, but to encourage travel on public transport.” While this move may cause some confusion in the market regarding emphasis on public and private mobility, the overall EV industry is being bolstered by the government.

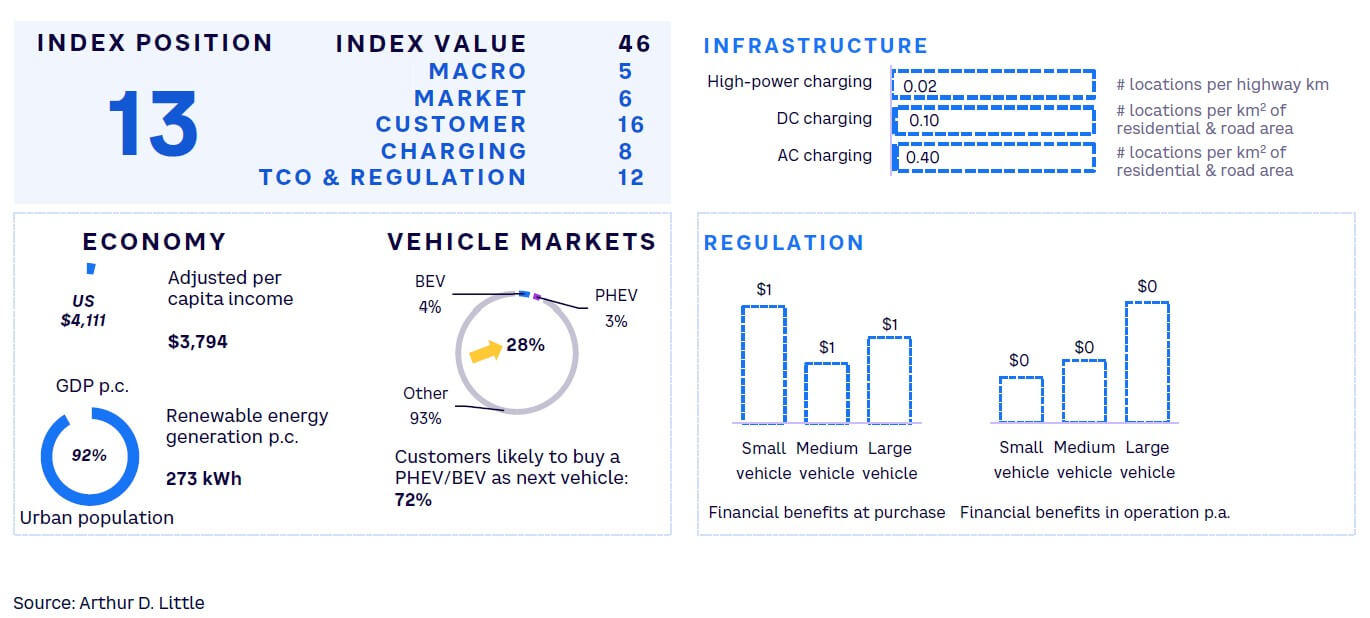

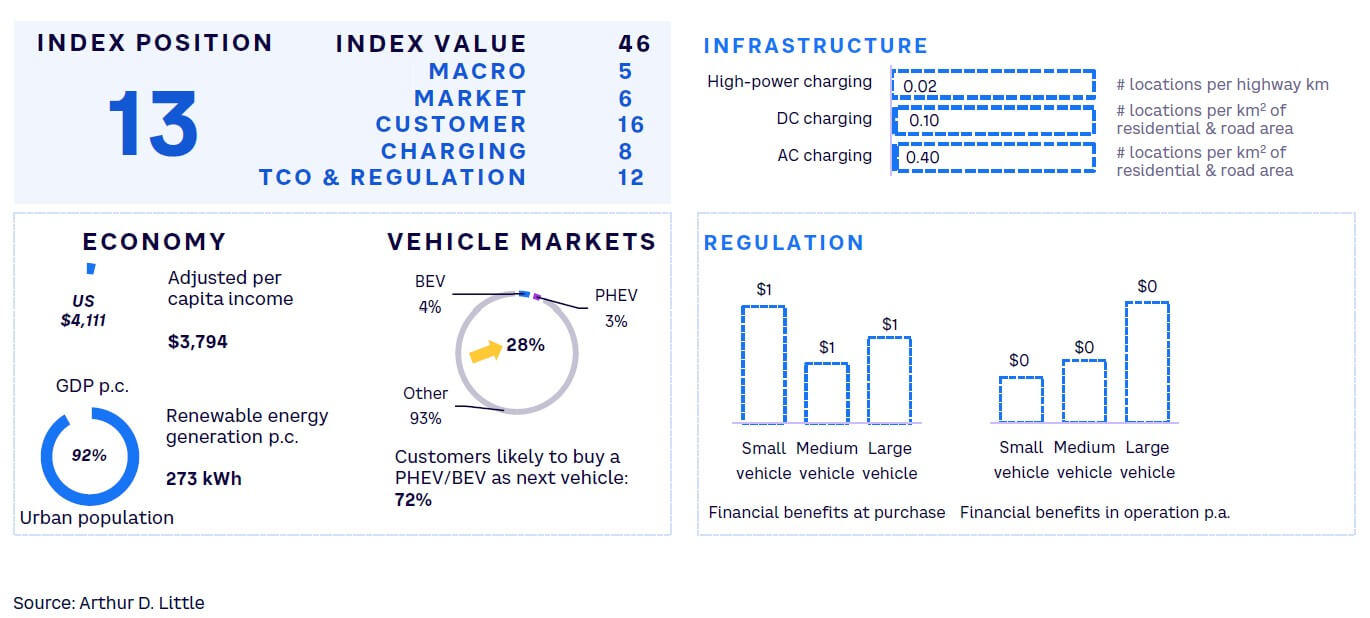

#13 Jordan

Well-developed electric infrastructure; young, urban population; and booming tourism industry bodes well for EV market

In the heart of the Middle East, Jordan is transforming into a sustainable and environmentally friendly nation. The country has shown significant interest in promoting EVs, particularly through government support. In recent studies, more than half of the population shows interest in buying EVs as their next vehicle. Jordan has a significant share of the young and urban population (92%), who are more likely to embrace sustainable technologies like EVs. Additionally, Jordan has a well-developed electric infrastructure, which is a key enabler for robust EV charging infrastructure and opportunities for home charging.

Jordan’s booming tourism industry will have a positive effect on expanding the commercial automotive sector. Intending to build a low-carbon transportation infrastructure, Jordan can capture this boom in commercial transport to enrich electric mobility. The country relies heavily on imported vehicles, focusing on used cars rather than new ones. Affordability is a key consideration for Jordanian car buyers. Thus, cost advantage would be a significant selling point for moving from fuel-based to electric cars. Therefore, the government must invest in charging infrastructure and public transportation to support the transition toward a low-carbon economy.

Jordan’s economic modernization vision aims to promote EV adoption as part of its strategy to reduce dependence on imported fossil fuels and promote sustainable energy solutions. The government has already implemented several initiatives to support EV adoption, including developing a network of electric charging stations. One such initiative is via a partnership with German electric charging station company eCharge to install 10,000 public charging points nationwide.

To meet rising demand, Jordan is also making strides in electrifying public transportation by purchasing up to 15 new battery electric buses (BEBs) in a pilot rollout for the first electric bus transportation network in the city. This project is part of a larger fleet expansion project that involves purchasing 151 buses — 136 diesel Euro V buses and 15 BEBs. Overall, Jordan has favorable conditions for EV adoption. With continued fiscal incentives from the government, such as exempted registration fees and lower customs duties compared to ICE vehicles, the country is well positioned to accelerate its transition toward sustainable transportation.

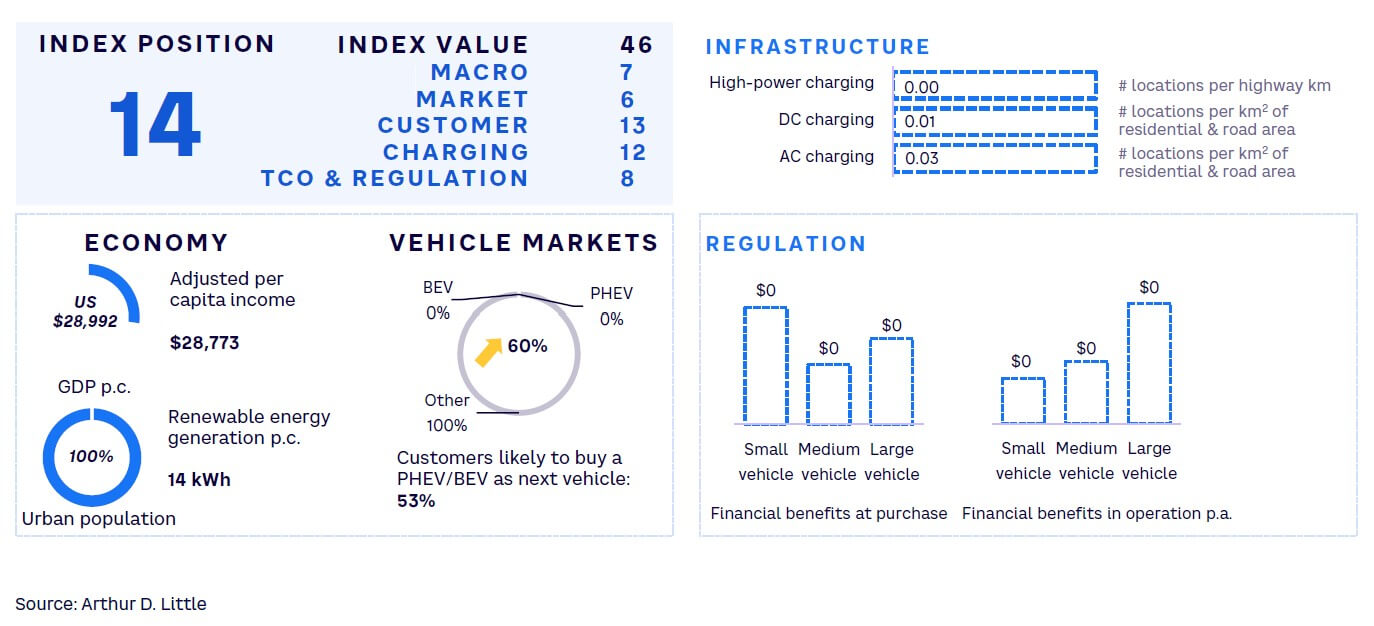

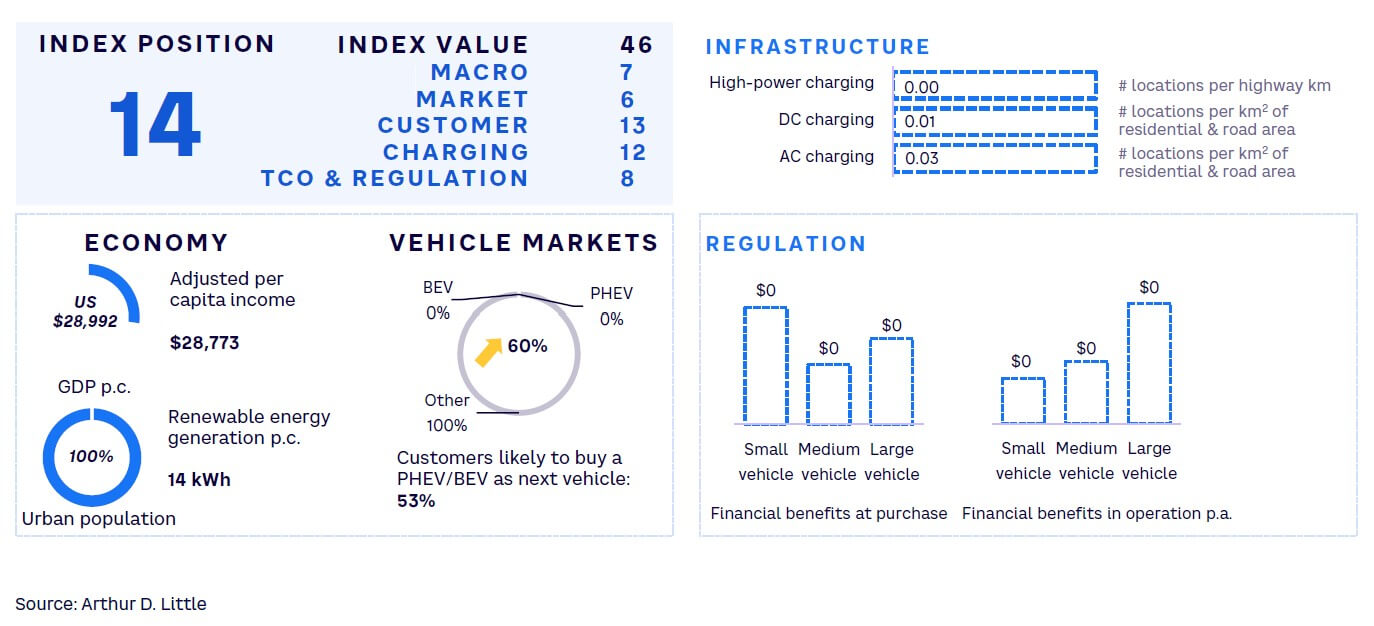

#14 Kuwait

Ambitious infrastructure goals and plans for the Middle East’s first EV manufacturing center indicate potential progress in transition

Kuwait’s e-mobility readiness is gaining momentum, with various initiatives being implemented to encourage the adoption of EVs. With 100% urbanization, there is a high concentration of people and automobiles in densely populated areas, which could make EVs a viable option for reducing air pollution and traffic congestion. In addition, the Internet penetration rate in Kuwait is 100%, which could facilitate simple access to online charging infrastructure, vehicle tracking, and maintenance services. Other potential indicators include Kuwait’s high per capita GDP and the government’s commitment to sustainable development.

However, Kuwait is a highly oil-driven market, with more than 50% of its economy generating output from the industry sector. Such easy and inexpensive availability of fuel poses a hindrance to the evolution of electric mobility.

Customers’ sentiment toward electric transportation is lukewarm, given no substantial value addition over ICE vehicles. On the positive side, the Kuwaiti population owns a high number of cars per 1,000 people. SUVs are Kuwait’s most popular vehicle type, accounting for a little less than half of the market. Kuwait is also an exceptional market for high-end luxury and vintage cars. This reflects that the average Kuwaiti is willing to spend a higher amount on cars. Kuwait also possesses an expansive auto parts supply chain by leading the supply services to Iraq and Afghanistan. These factors can add to positive acceptability of EVs as the transition takes place.

In October 2022, Kuwait-based logistics company Agility announced an investment of US $20 million in Loop Global, a US manufacturer of EV infrastructure. This exhibits the inclination of private players to move ahead in the EV space.

The Kuwaiti government’s infrastructure and environmental objectives are ambitious. Kuwait Ports Authority (KPA) announced intentions to develop EV City, the Middle East’s first EV manufacturing center, in August 2021. In fiscal year 2023/2024, design and construction contracts were to be put out to bid. The decision to create a facility for EV makers aligns with the vision of New Kuwait 2035. This vision strives to recast Kuwait as a trading hub. Strengthening trading relations would pave the way to come to par with other leading economies in transportation development.

Minister of Public Works and Minister of Electricity, Water, and Renewable Energy Ali Al-Mousa said in a statement to Kuwait News Agency (KUNA) that a proposed electric charging rule intends to give electric car chargers to clients.[3] The rule stresses that it establishes a mechanism to enhance the placements of charging points in different areas of Kuwait while taking technical limitations and Kuwait’s environment into account. “Preparing this regulation will encourage many foreign electric car-producing companies to enter the Kuwaiti market, which is one of MEW’s goals,” the minister added.

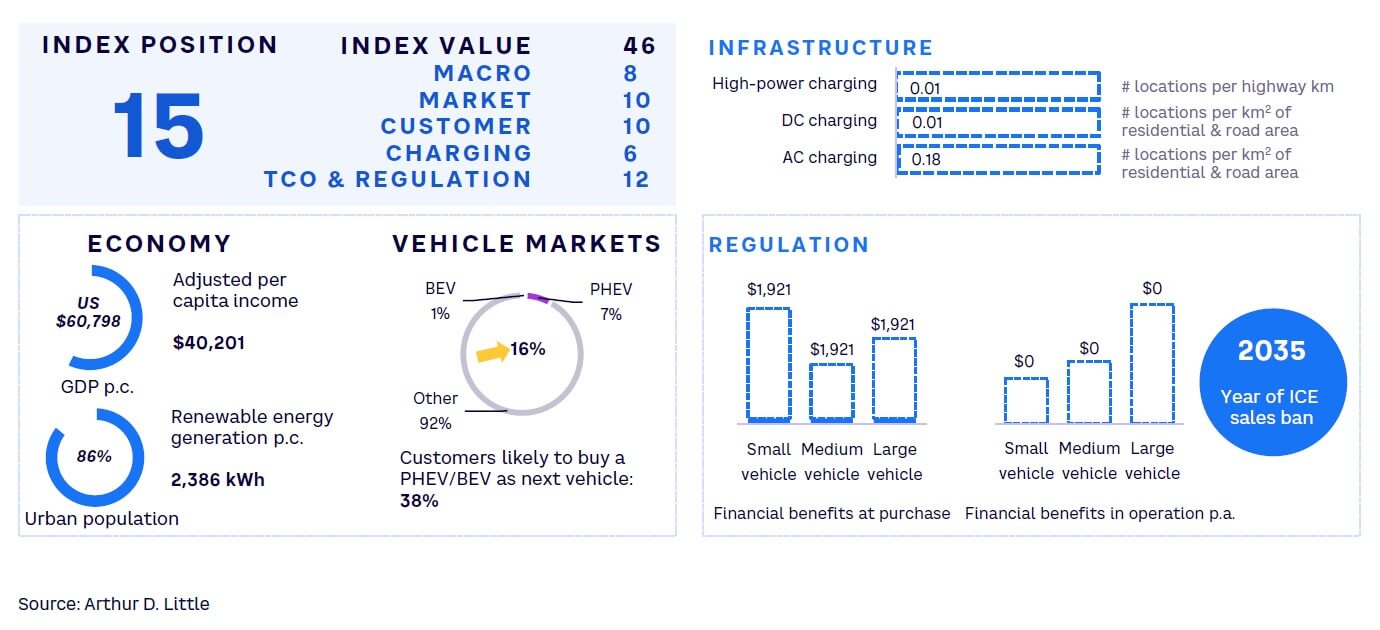

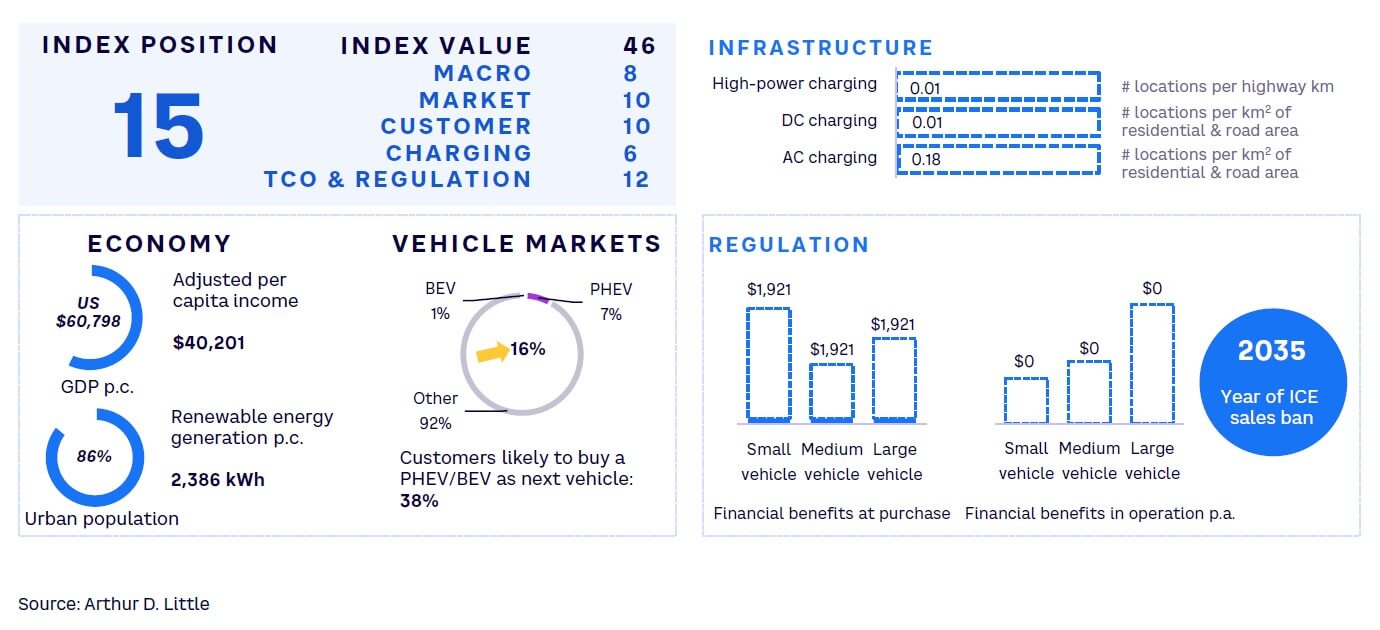

#15 Australia

Government incentives and increasing investments into charging infrastructure support double-digit annual growth of EV market

Like other large territorial states with populations clogging some urban agglomerations, EV shares of vehicle fleets differ greatly in Australia. This share is very low in rural and scarcely populated areas, but higher in large cities with better developed infrastructure and higher awareness of sustainability and climate change issues.

Australia is generally well developed and has a strong economy, with a high GDP of more than US $60,000 per capita. In 2022, its EV sales share was reported at 7% for PHEVs and 1.5% for BEVs. Australia announced that it would ban ICE registrations from 2035 onwards — putting it on tap with the ambition level of the EU.

However, infrastructure is a problem, especially in areas with low population and traffic density. There is a lack of fast-charging stations, especially at interstate connections. Several federal financial incentives are in place; for example, a higher threshold for net-zero-emissions vehicles in luxury car tax (LCT) has been introduced, and all customs duties have been removed for BEVs, PHEVs, and FCEVs. Additionally, zero and low tailpipe emissions vehicles are exempt from fringe benefits tax (FBT). Some territories have introduced additional benefits, such as free registrations for BEVs, direct purchase subsidies, and stamp duty waivers.

Australia’s share of renewable energy in electricity is still low, at below 40%, but growing. The grid is stable and well developed in urban areas.

Consumer interest in EVs has only just begun, as Australia is not a big car market and due to its right-hand traffic style is rarely among the first markets served by new entrants. Still, approximately 150 different EV and PHEV models are now available on the market, and steadily increasing in number. EVs may become more popular as new models are introduced beyond SUVs and sedans (e.g., pick-up trucks and vans).

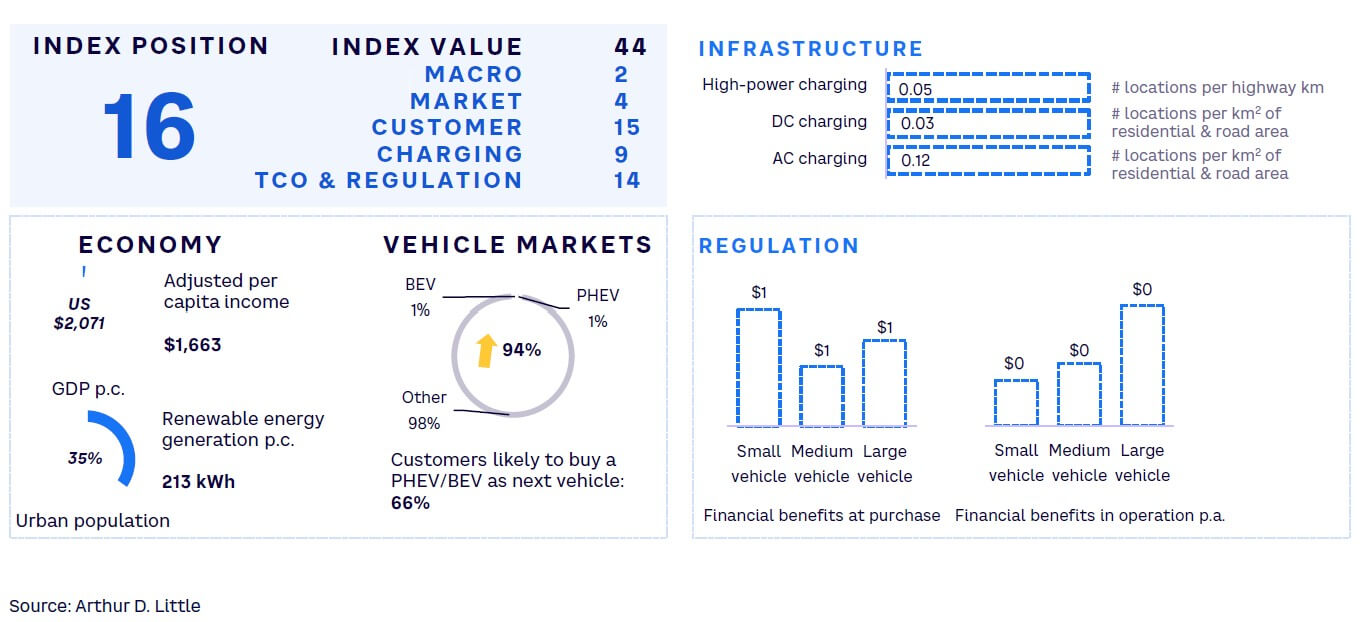

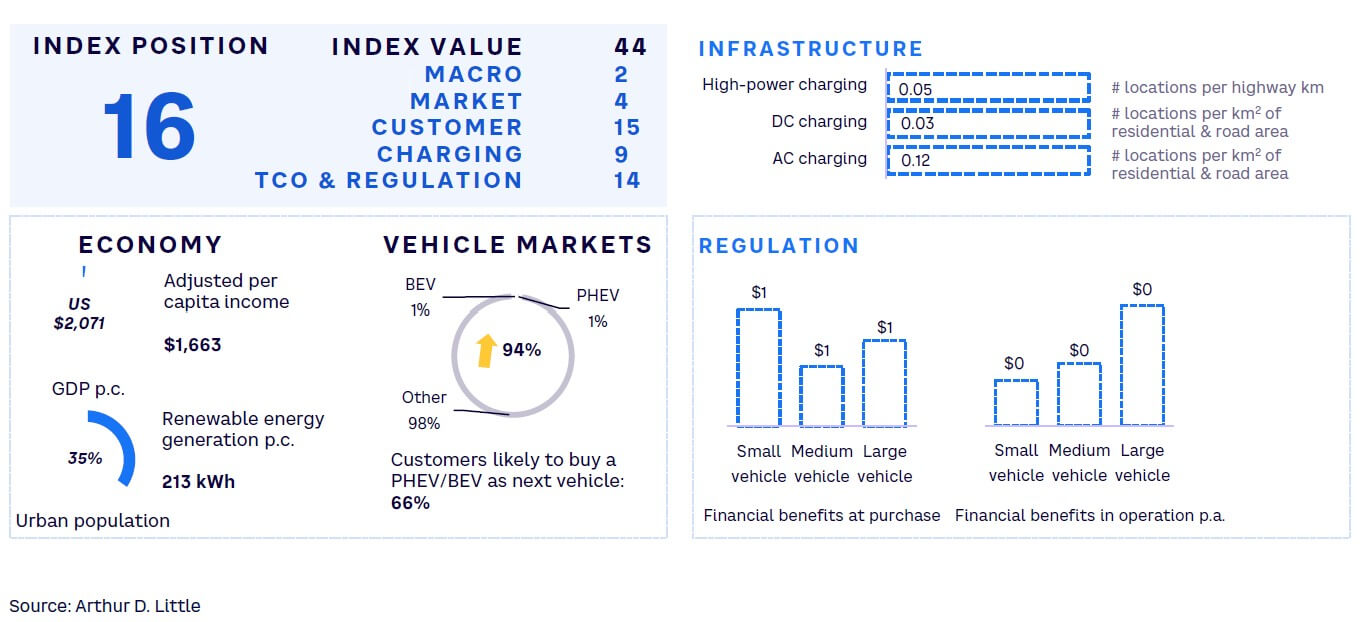

#16 India

Strong government push drives EV adoption

India is uniquely positioned in the EV space, with high customer adoption in a few segments. The current penetration rate of a little more than 1% is not encouraging, but given the country’s ambitions and capacity commitments, it might turn out to be the dark horse in the EV race.

More and more Indian-based manufacturers and local subsidiaries of international OEMs recognize the huge opportunity of the large local vehicle market. Tata Motors currently has a market share of more than 70% in the nascent market but will have to face increasing competition.

However, EV adoption has been higher for 2Ws and 3Ws in India in comparison to passenger cars, which have not had much traction. A lack of proper road connectivity, long charging times, and infrastructure constraints have funneled penetration in favor of 2Ws and 3Ws in the country, which remain the backbone of transport in the large urban centers.

The Indian government’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles II (FAME-II) policy is one of the most important regulatory factors driving the EV push. Although current EV infrastructure is barely present, both local and global players have placed big bets on setting up adequate EV infrastructure in the coming two to three years. A rising middle-class population, the government’s push to reduce carbon emissions, and increasing fuel prices are some other factors driving EV adoption.

The Indian government is providing several financial incentives to OEMs in EV manufacturing, which have been passed down to customers at the point of purchase. However, lack of adequate charging infrastructure has restrained customers from shifting toward EVs, which is still usually a preferred second car choice for aspirational consumers in the country.

A lot of nonfinancial incentives have been provided for EVs, which has further spurred adoption. Given India’s demographics, the shift will, however, be led by the metropolises of Delhi, Mumbai, Bengaluru, and Chennai before it trickles to other parts of the country. The lower cost and customer preference to travel smaller distances on bikes have led to faster adoption of 2Ws. Players like Ola and Ather have already sold out their first batches of EV bikes, and large OEMs like Hero, Honda, and TVS have shifted their focus to 2Ws as well.

India’s prominence in the global space is reflected in its mission to play an important role in the EV space. It remains to be seen if plans put in place materialize soon for the country to achieve its targets.

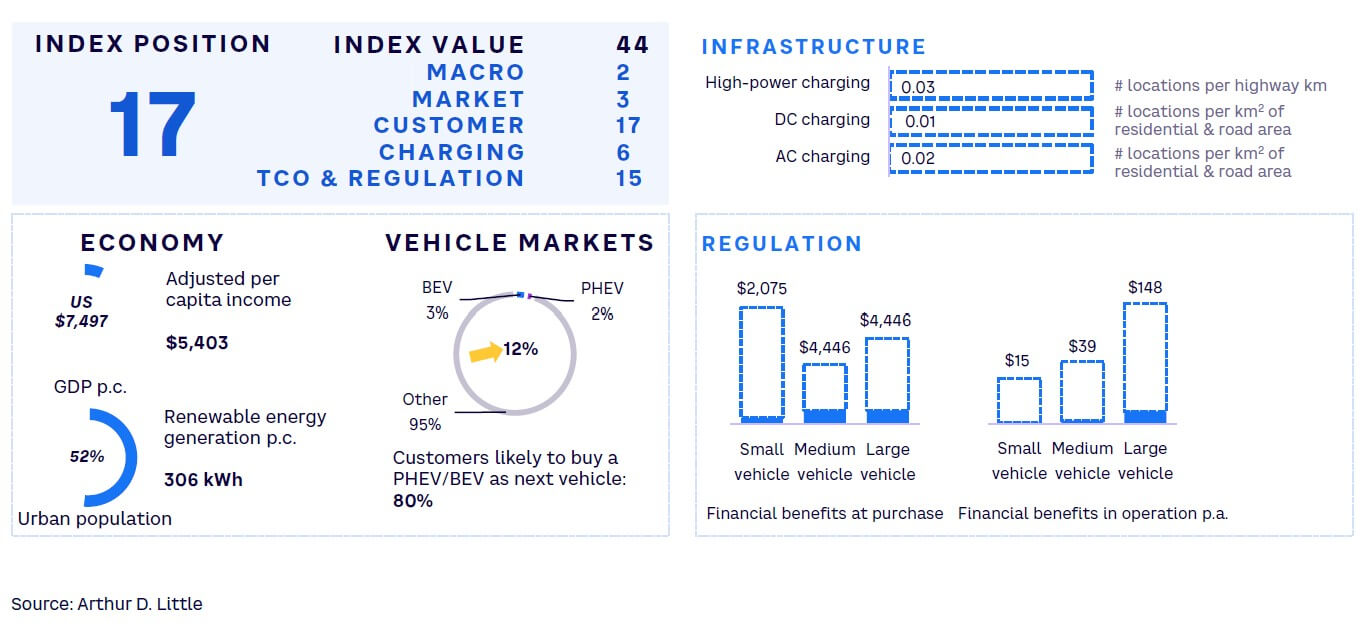

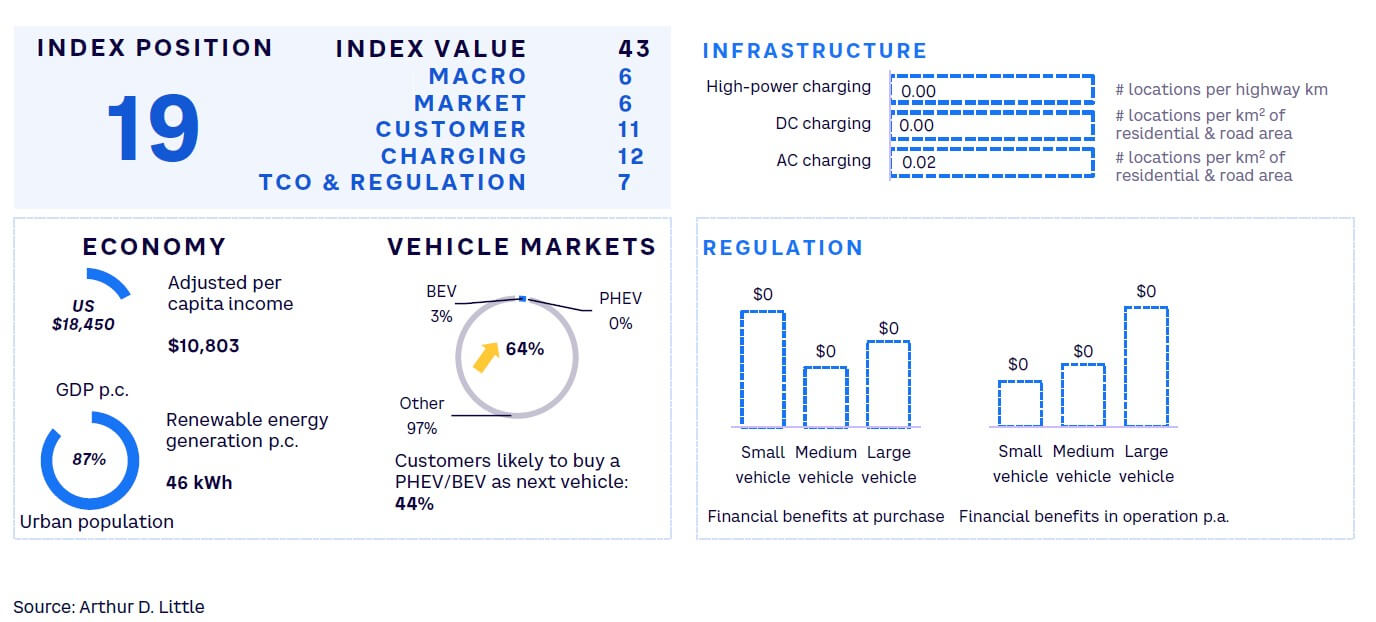

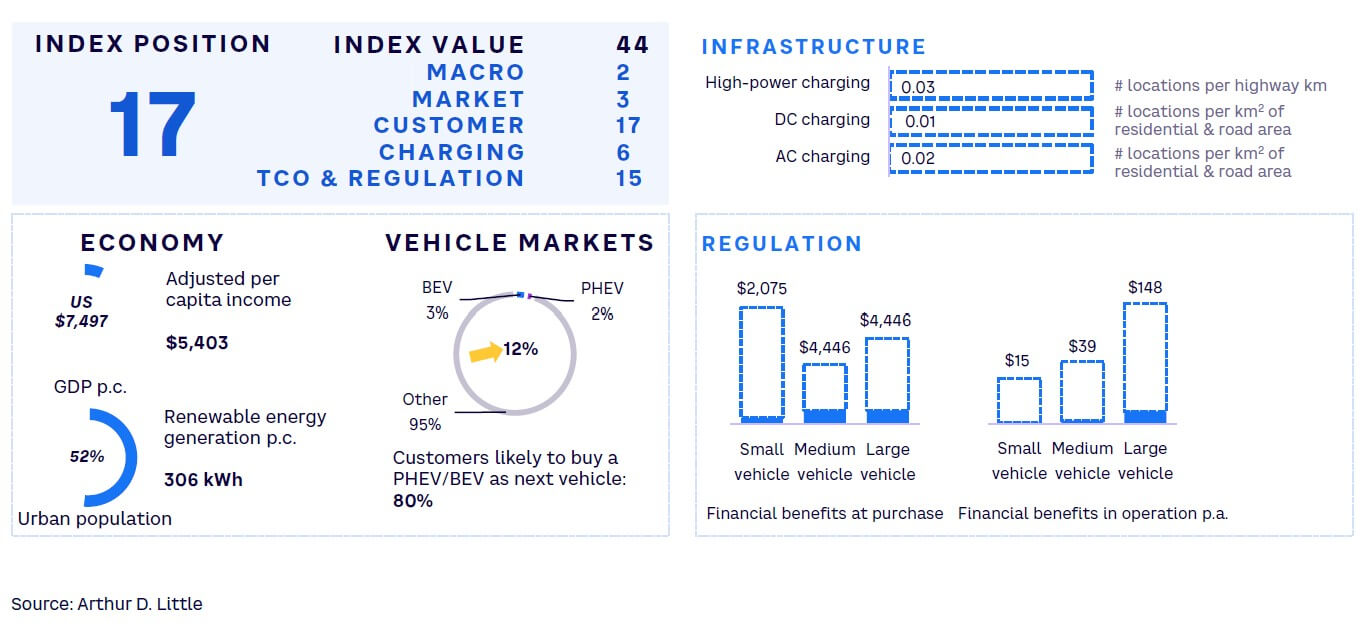

#17 Thailand

Strong stakeholder engagement enhances EV adoption

Often referred to as the “Automotive Hub of Asia,” Thailand has witnessed the flourishing of its automobile industry over the years. The industry contributes significantly to its GDP.

At present, EV penetration is still low, with a fleet share of below 1% and a sales share of 3% of all new cars as of 2022. It is encouraging to note, however, that almost half the population would prefer an EV in the years to come. To sustain this enthusiasm, Thailand will need active government intervention and stakeholder engagement. Recent progress is noteworthy. There has been a concerted push to fast-track EV adoption in the country. State-run companies, academic institutions, government agencies, and automotive associations are taking the lead in electrifying the vehicular fleet, particularly in the area of public transportation.

The Thailand government is supporting EV sales through various demand-side and supply-side incentives, including tax incentives for local EV production and import duties exemption on machinery. They are also offering a five-year corporate income tax exemption for investments in charging stations with at least 40 chargers. The government has set a target of 1.123 million net-zero-emissions vehicles by 2030, with a focus on electrification in the car and pick-up segment.

Also, the government has planned consistent efforts for building the country’s charging infrastructure. The Ministry of Industry, for example, targets the setting up of charging stations within a maximum 50- to 70-km radius in the years to come. To bolster this, three state enterprises — Electricity Generating Authority of Thailand (EGAT), Metropolitan Electricity Authority (MEA), and Provincial Electricity Authority (PEA) — have joined to support investments in EV charging infrastructure.

The Thailand National EV Policy Committee has introduced a roadmap as a framework for EV development from 2021 to 2035, with the aim of developing a well-established supply chain for manufacturing EVs and building the technological capacity for modern mobility.

With EGAT, the Ministry of Higher Education, Science, Research, and Innovation and several academic institutions have collaborated to form the Thailand Energy Storage Technology Alliance (TESTA), which has the objective of revolutionizing local storage technology, a key pillar of electric mobility.

Thailand, therefore, is set for accelerated growth in EVs in the next five to 10 years, with increased investments from local and Thai investors, coupled with government incentives. The government has committed to carbon neutrality by 2050, which will lead to a thrust in EV adoption from 2025 onwards. The government’s National Electric Vehicle Policy Committee has set the target of EV sales penetration at 30% by 2030.

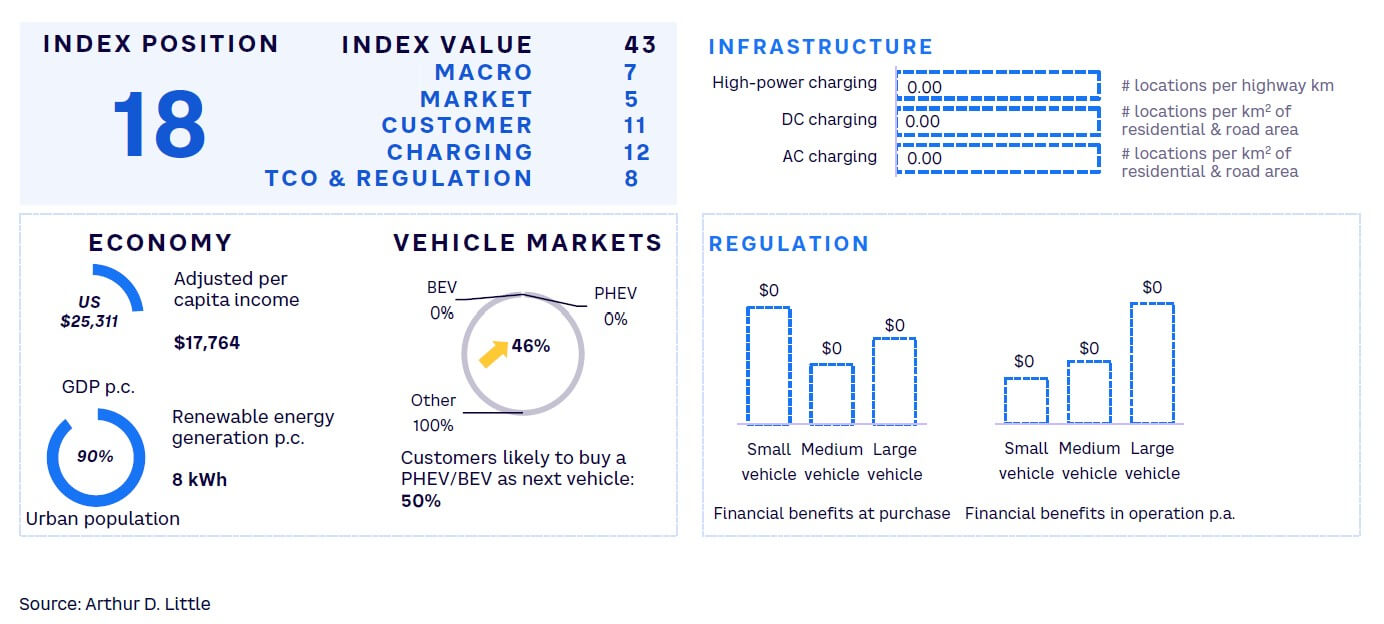

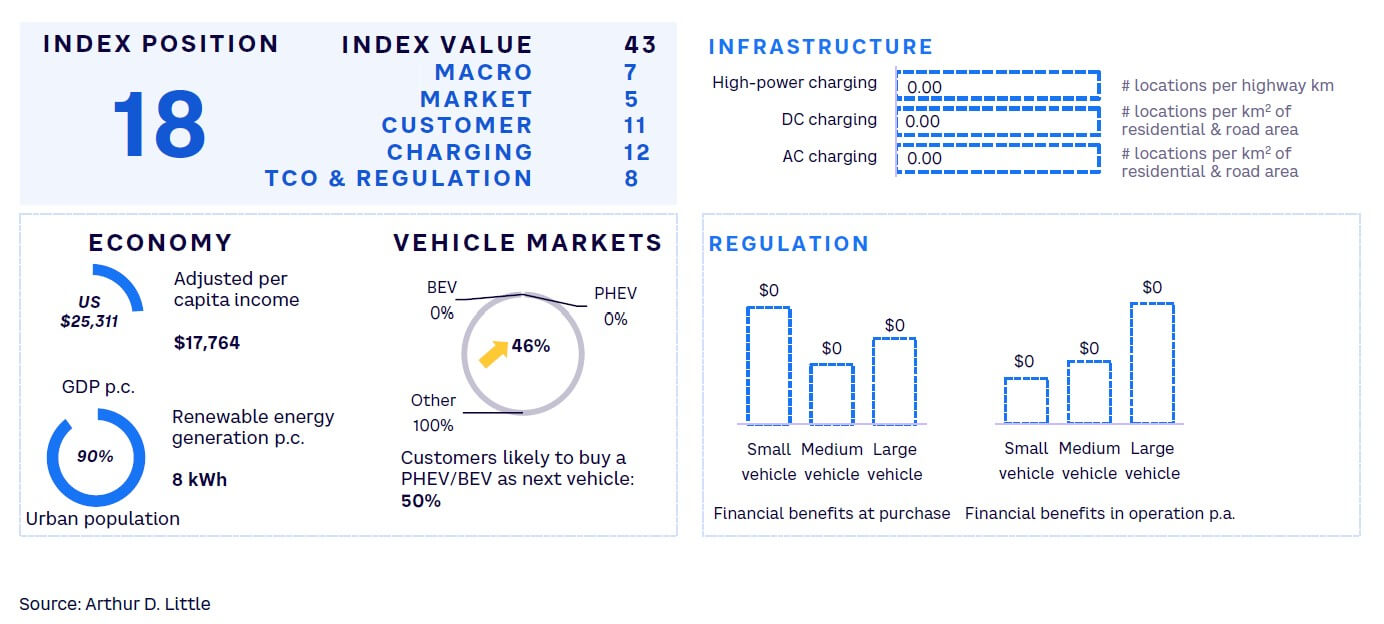

#18 Bahrain

Inauguration of first EV charging station and collaboration with micro-mobility firms paves way for growth

Bahrain has begun its first steps toward embracing EVs with the inauguration of the first EV charging station in 2021, following in the footsteps of other Gulf Corporation Council (GCC) countries aiming to electrify transportation. In addition, Bahrain’s Economic Vision 2030 emphasizes the importance of increasing sustainability. In the future, this vision can pave the road for progressive adoption of e-mobility solutions.

In November 2021, Bahrain launched its Logistics Services Sector Strategy 2022–26 to lift the logistics sector’s contribution to GDP to 10%. This would benefit the country’s commercial transportation in general. Given these broad infrastructural developments, electrification of logistical transit can be considered a future step.

Bahrain hosted a Decarbonization Roundtable Series to enhance understanding of carbon markets and their affect in achieving net-zero emissions, which could have implications for the development of the EV industry in Bahrain.

Furthermore, initial progress comes from collaboration between Bahrain’s Ministry of Transportation and Telecommunications (MTT) and TIER, the leading micro-mobility firm in Europe, to install emissions-free electric scooters and bikes across the city of Manama. Additionally, in 2022, the National Bank of Bahrain (NBB) joined hands with Bahrain National Insurance to offer discounted motor and EV insurance premiums.

This service is provided as part of NBB’s automobile lending program. Customers also will receive up to five years’ complete insurance coverage for agency repairs, as well as additional benefits like battery replacement and electric car recharging. In 2023, Bahraini company Marson Group announced plans to launch Bahrain’s first electric car factory. The organization has partnered with US manufacturing company Gass Auto for implementation. The factory intends to manufacture various EVs, including 2Ws and passenger cars.