Significant opportunities are arising from the trucking industry’s transition to electric drivetrains. The majority of truck chargers will rely on direct current (DC) technology, representing a tremendous opportunity for DC charging manufacturers. By the end of this decade, truck charging in Europe is expected to create a bigger market opportunity than passenger car charging for DC technology. In this Viewpoint, we address existing and potential issues impacting electric truck charging.

MAKING TRANSPORTATION MORE SUSTAINABLE

Road traffic currently contributes to 26% of Europe’s total CO2 emissions. While other sectors such as industry, agriculture, and energy have continuously reduced their CO2 emissions, road transport CO2 emissions have continued to increase. Improving the sustainability of transport in Europe is key to helping address climate change on the continent.

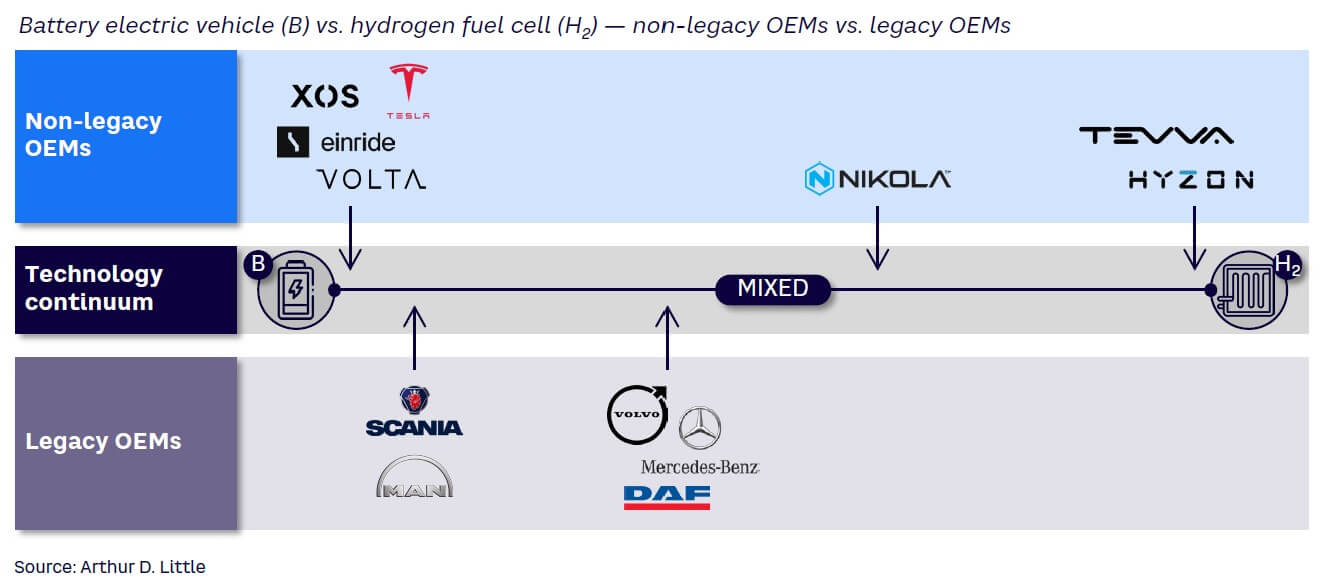

Passenger car electrification is already underway and battery electric vehicle (BEV) sales are breaking records, but movement in the truck segment toward electrification has been very limited. Light vehicle OEMs focused on battery electric passenger cars and light commercial vehicles from the beginning, while truck OEMs have hesitated to make a clear decision about this technology. In the medium- and long-haul sectors, battery electric trucks have considerable disadvantages compared to hydrogen fuel cell trucks, such as shorter distance ranges and reduced payload capacity due to the substantial weight of battery packs. However, BEV technology is comparatively mature and enjoys significant overlaps in R&D with the passenger vehicle industry, which may facilitate the near-term, large-scale rollout of zero-emission (ZE) battery electric trucks.

Hence, it was unsurprising that IAA Transportation 2022 in Hanover, Germany, focused strongly on truck electrification, with several OEMs unveiling new electric trucks during the event. For example, Daimler Truck introduced its new eActros LongHaul, and Scania AB showcased the new generation of its 45 Series, the 45 R electric truck, which will go into production in the fourth quarter of 2023. In addition:

-

Ford Motor Company unveiled an electric truck prototype.

-

DAF Trucks revealed its XD Electric and XF Electric.

-

MAN Truck & Bus SE showcased its new eTruck.

-

Lesser-known manufacturers used this opportunity to introduce their new ZE trucks.

Volvo Trucks, another prominent European truck OEM with five electric truck models already on offer in Europe, attended under the banner “Towards Zero,” referring to both zero emissions and zero accidents. Shortly before the exhibition, Volvo also announced the start of series production of electric versions of its heavy-duty trucks (FH, FM, FMX) on existing production lines at its Tuve plant in Gothenburg, Sweden. It intends to do the same in 2023 at its factory in Ghent, Belgium. The wheels have started turning in the commercial vehicle space.

AMBITIOUS ELECTRIFICATION TARGETS

The truck market is expected to transition rapidly to ZE technologies, which is confirmed by the aggressive alternative powertrain targets announced by Traton Group, Volvo, and Daimler, the three major European truck OEMs, who all foresee at least 50% of new truck sales being ZE vehicles by 2030. However, OEM technology roadmaps differ, despite the three companies uniting over their ambitious targets. While Traton, which owns MAN and Scania, is following an electric-only strategy across its entire portfolio, Volvo and Daimler are pursuing a dual-pronged approach that keeps battery electric and fuel cell electric technologies on their respective technology roadmaps. DAF, Europe’s fourth-largest truck OEM and a subsidiary of the US’s PACCAR is pursuing a strategy similar to Volvo and Daimler, whereas Italy’s Industrial Vehicles Corporation (IVECO), the fifth-largest OEM, is primarily betting on natural gas technologies, in conjunction with its partnership with (and investment in) ZE truck manufacturer OEM Nikola Corporation.

Figure 1 shows a graphical representation of these decisions. Among industry start-ups, Nikola is one of few manufacturers developing both battery electric and fuel cell technology. It is more common for emerging OEMs to focus solely on one.

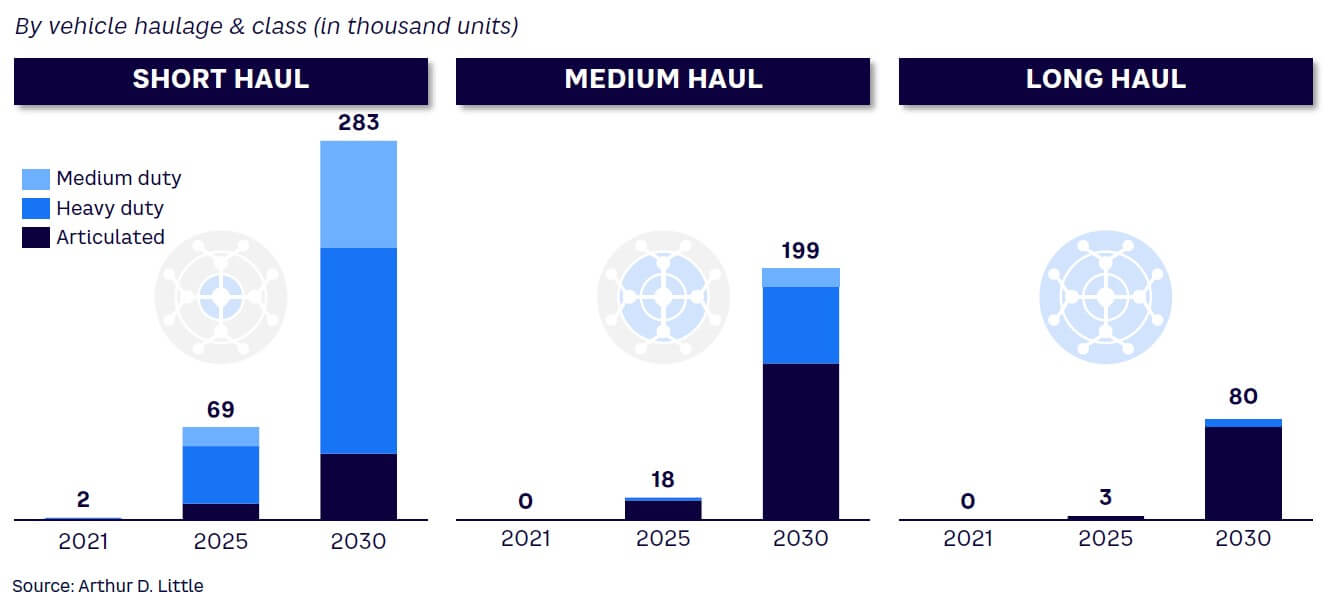

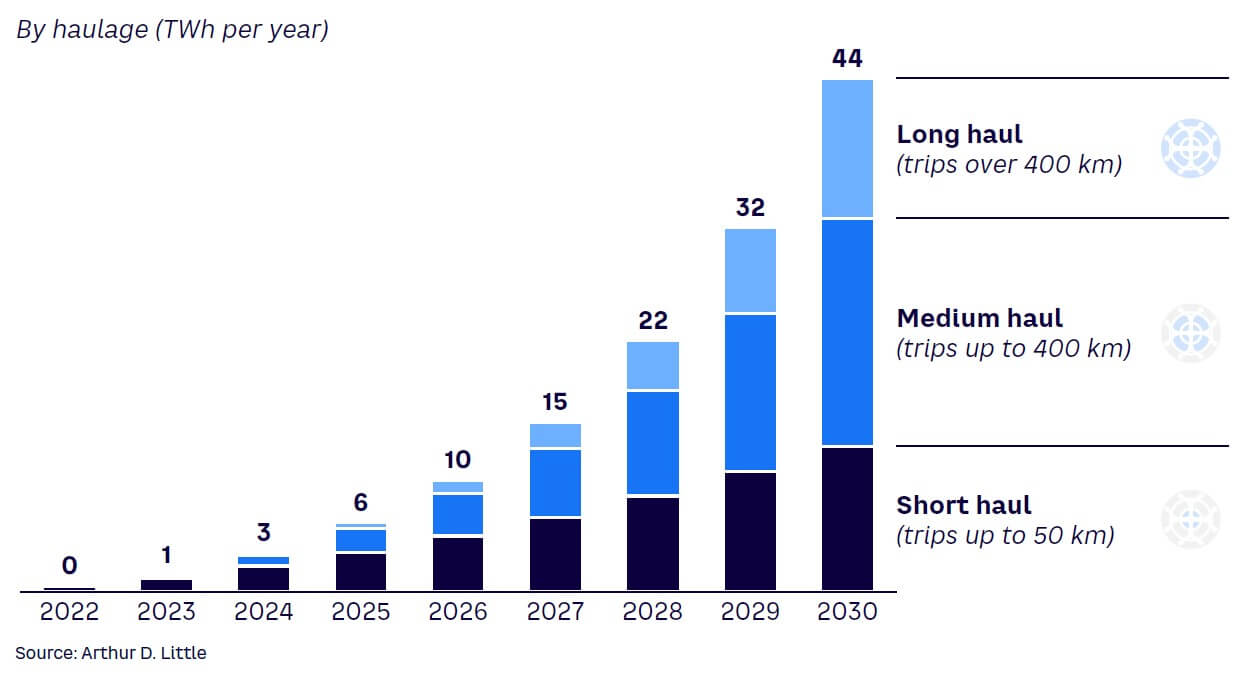

Although it remains to be seen which of the above strategies triumphs in the long run, battery technology has certainly come a longer way than fuel cell technology, despite massive investments in R&D for both technologies. In the near term at least, we believe battery electric trucks will dominate the market for alternative fuel trucks and will have a particularly notable penetration in short- and medium-haul use cases, whereas fuel cell trucks will play a more prominent role in long-haul trucking when they are mature enough for widespread adoption. Figure 2 shows a forecast of the electric fleet, organized by haulage class. On average, we assume that by 2030, 40% of new medium-duty and heavy-duty trucks sold in Europe will be battery electric across use cases.

2030: HALF-MILLION ELECTRIC TRUCKS ON EUROPE’S ROADS

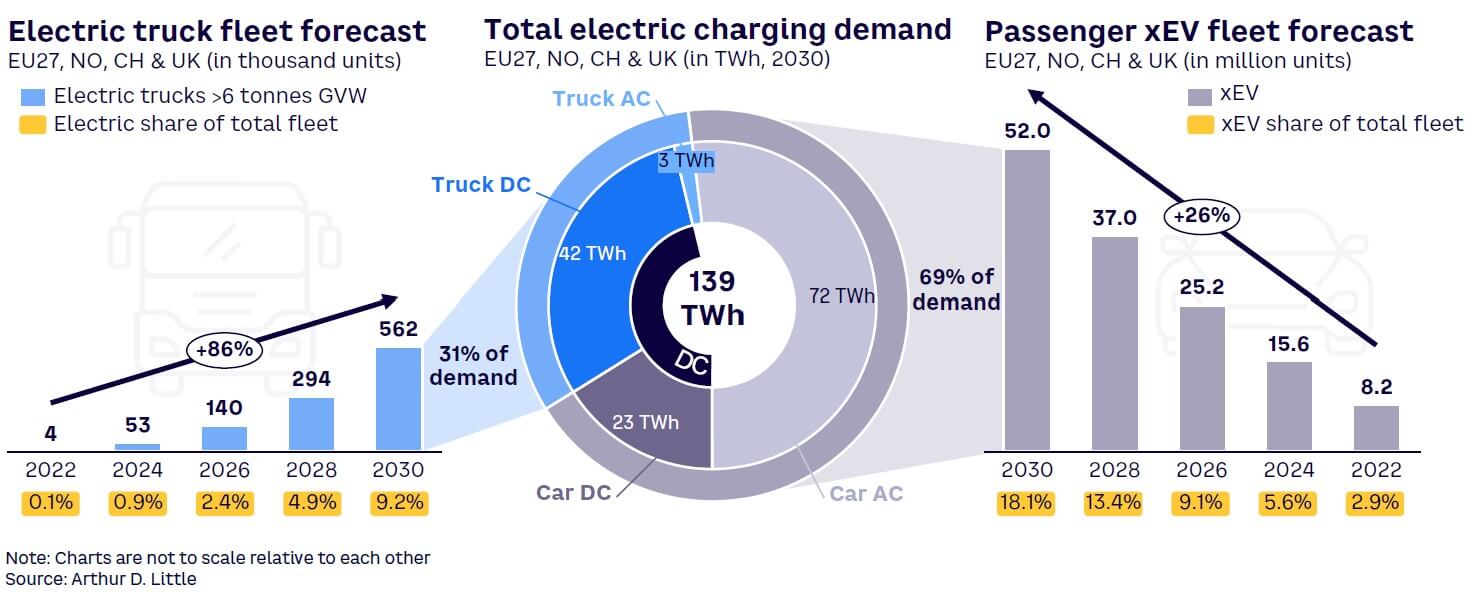

Although plans for truck electrification are ambitious, we are still at the beginning of the journey. For example, Volvo Group, one of the frontrunners in truck electrification, delivered 1,211 fully electric trucks (371 in 2021) and had an order intake of 3,633 units in 2022 (1,062 in 2021), corresponding to a meager 0.2% and 0.4% of total deliveries and orders, respectively. By the end of 2022, only around 4,000 electric trucks were registered in the EU. This number is projected to grow more than twenty-fold until 2025, reaching almost 600,000 units by 2030. By that time, one truck out of every 10 in Europe is expected to be electric. These numbers show the truck segment electrification hockey stick is likely to be much steeper compared to passenger vehicle electrification.

But what types of trucks will come to the market? When assessing the sales plans of the OEMs, we expect that mostly short-haul, heavy-duty trucks with ranges up to 300 kilometers coming to the market until 2025, which will not require public charging infrastructure for everyday operations. From 2024–2025 onward, production and delivery of medium-haul trucks will increase significantly, and by 2027 we expect to see a wider range of long-haul trucks on the market. These developments are in line with the public charging infrastructure plans of the three largest truck OEMs (Daimler, Traton, and Volvo), which formed the joint venture Milence. This collaboration plans to install 1,700 ultra-fast-charging points along the main arteries of the European road network through 2027. We think it might make sense to have a dedicated electricity infrastructure for motorways in some high-traffic areas, similar to the solution for railways. However, these and similar lighthouse projects are often quickly discarded due to strict regulations in distribution network areas and the reluctance of governments to make unpopular decisions.

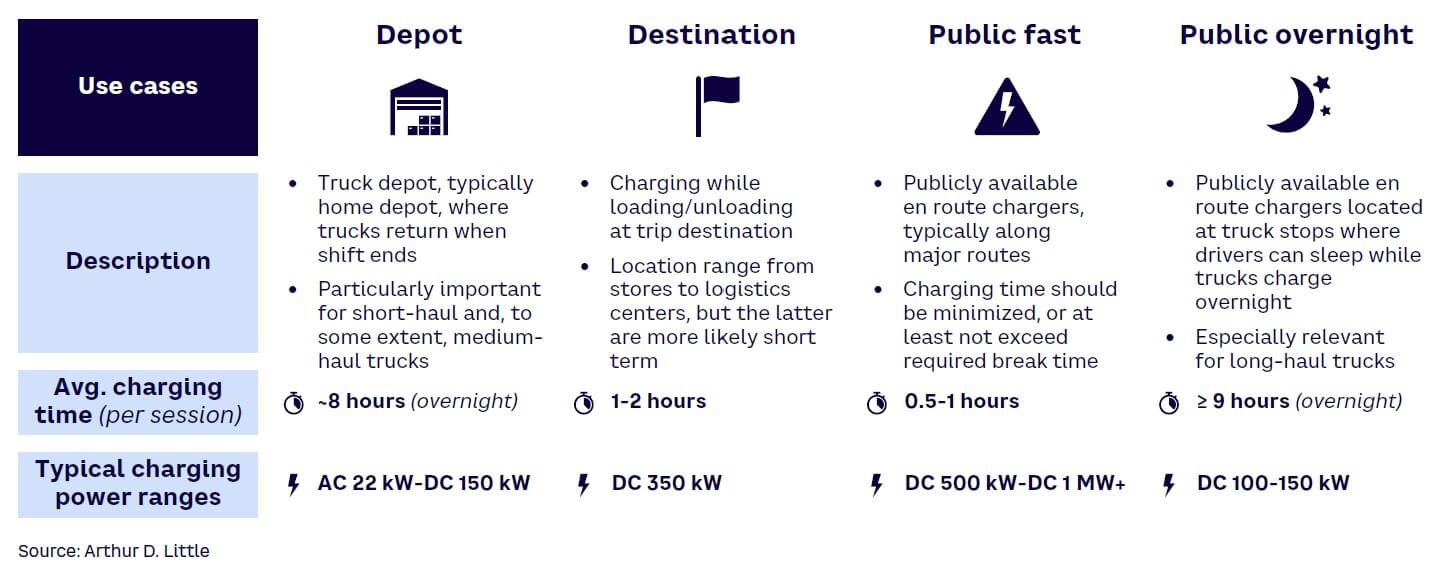

The composition of Europe’s electric truck fleet will determine the necessary charging infrastructure. Until 2025, we will see almost exclusively short-haul electric trucks on the streets of Europe, whereas by 2030 these trucks are predicted to only constitute around 50% of the fleet, with the remaining half consisting of medium-haul (35%) and long-haul trucks (15%). The infrastructure that will be needed to fuel these trucks poses a big, important question. To answer it, we first have to understand the four major use cases for truck charging, which are summarized below in Figure 3.

4 TRUCK-CHARGING USE CASES

Our truck-charging taxonomy distinguishes four different use cases. The time available for a truck to charge is the main differentiator, which in turn determines the power capacity for chargers:

-

Depot charging. This use case is equivalent to the home-charging use case for passenger vehicles, where trucks are charged at their “home depot.” In most cases, depot charging occurs overnight. This leaves plenty of time to generate a full charge, but the actual time spent at the depot can vary greatly. Hence, we expect to see everything from simple alternating current (AC) 22 kW chargers to more advanced DC 150 kW chargers employed for this use case, depending on possible charging time, truck haulage patterns, and battery capacity.

-

Destination charging. Just as trucks can be charged at their home depot when not in use, they can also be charged when stationary; for example, while loading and/or unloading at their stops, be it a grocery store or logistics center. Electric trucks are mainly used for urban deliveries and similar applications, along routes that are typically short in distance, with delivery stops that are short in time; therefore, charging will not be required at each stop. However, trucks used in a hub-to-hub application will have longer distances and stopovers may be longer, so these variables define this use case. We expect the charging opportunity to amount to around one to two hours and use DC 350 kW chargers. Although these characteristics may be over-dimensioned for some trucks, we expect high-powered chargers will be used to increase the overall utilization of chargers installed, as these will be sufficient for all types of trucks in the medium term.

-

Public fast charging. This category of charging happens at publicly available en route charging stations, typically located along major trucking routes, such as the Trans-European Transport Network corridors. As en route charging by definition increases cost, the time spent charging should be kept to a minimum or at least not exceed the statutory driver break time of 45 minutes every 4.5 hours. Chargers should have a very high power rating to provide enough energy in 45 minutes for at least another 4.5 hours of driving. Assuming an average cruising speed between 60 and 80 kWh, this would result in a charging demand of around 400 to 600 kWh, with an average charging power of 550 to 800 kW. As the battery-charging curve is not constant, very high-powered chargers with 1 MW and more are needed for this use case. A new plug standard is required to meet the charging demand and power requirement. The Megawatt Charging System, a connector that meets the standard, was recently presented by the Charging Interface Initiative e.V. (CharIN) and demonstrated by Scania and Alpitronic at the 2022 EVS35 conference in Oslo, Norway.

-

Public overnight charging. Similar to public fast charging, overnight charging takes place at en route charging stations. The key difference is that the allowed charging time is significantly longer (at least nine hours), as drivers are required to take longer breaks for food and rest. Hence, this use case is almost exclusively for long-haul applications, and chargers are likely to be limited to DC 100-150 kW.

CHARGING BEHAVIOR DEVELOPMENT

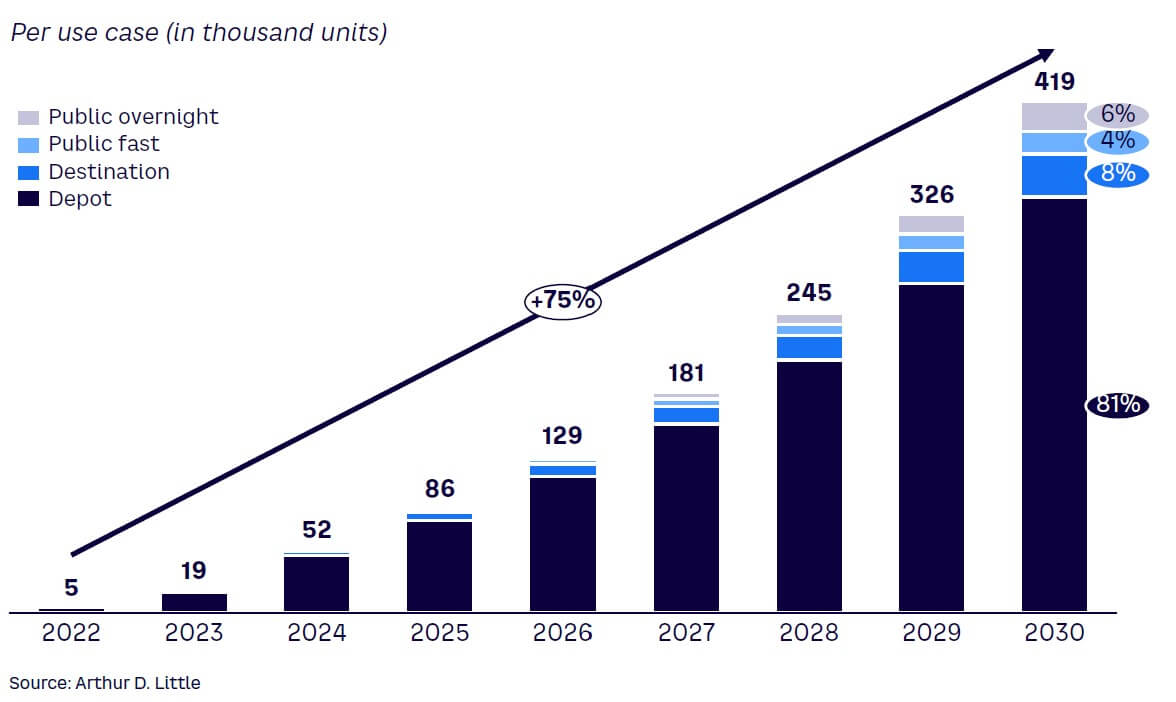

In terms of energy charged, our analysis shows that depot charging will be the dominant use case throughout this decade, as early generations of electric trucks are primarily utilized on shorter routes. The characteristics of these trucking use cases allow for overnight charging at a home depot, where CAPEX can be minimized by using the lowest-powered chargers possible. This dominance manifests itself both in terms of installed units (where the dominance is immense), as well as installed capacity and actual electricity charged (see Figure 4). However, the relative dominance of low-power depot charging diminishes over time, as electric trucks can be equipped with larger batteries and can be increasingly used for medium- and long-haul routes. Electric trucks will have significantly larger batteries than passenger cars and will require significantly higher charging power. The vast majority of these chargers will rely on DC technology, and toward the end of the decade, truck charging will constitute a bigger market than passenger car charging in the European DC segment.

As technological advances prepare electric trucks for more daunting tasks, demand will shift toward higher-powered chargers for other use cases. For example, ultra-high-powered public fast chargers will allow for efficient use of electric trucks on longer routes by not ruining the business case due to longer-than-necessary breaks to recharge the battery.

Similar to passenger EVs, we expect public fast-charging networks for trucks to pop up along the major arteries of the European road network, and in fact, several such initiatives have already been launched on the national and supranational levels. These networks will likely also include an increasing number of lower-powered chargers for public overnight charging, probably concentrated at large, existing truck stops. However, overnight truck-parking capacity is already limited, and truck-charging infrastructure and adjacent energy equipment will occupy significant additional space. These areas will soon become insufficient, generating a high need for additional locations. Support from lawmakers will be important to accelerate the approval of new truck stops in order to remove the space impediment to decarbonizing the transport sector.

Charging demand generated by increasing usage of electric trucks for long- and medium-haul routes will also be fulfilled by an increased number of destination chargers, allowing trucks to top off energy reserves while loading and/or unloading. Initially, however, this only makes sense at highly utilized loading docks, as the limited time spent loading and unloading will call for relatively high-powered chargers, which are still fairly expensive. However, as the costs associated with these chargers decrease and electric trucks become more common, we expect an increase in destination chargers.

The use of electric trucks on longer routes will drive demand for public and destination charging; the correlating increase in battery capacity will drive demand for more powerful chargers across use cases. As power requirements in the depot-charging space increase, DC charging technology will inevitably become more relevant. With power requirements exceeding the capacity of most current-day onboard chargers, the more economically viable option will possibly be the installation of DC chargers (prices for these are expected to decline significantly), instead of developing and installing expensive high-capacity onboard chargers in already-expensive electric trucks, particularly as trucks are high-turnover assets for many companies. Furthermore, many depots may greatly benefit from vehicle-to-everything (V2X) technologies and lower transmission losses, which provide additional arguments in favor of DC chargers in an industry driven by the total cost of ownership (TCO).

THE ENERGY PERSPECTIVE

As electric trucks become increasingly commonplace, the demand for an immense amount of energy will rise. In fact, a comprehensive Arthur D. Little analysis of fleet development, driving patterns, and energy consumption shows that by 2030, electric trucks could require close to half of the energy needed by its passenger vehicle counterparts (45 TWh versus 95 TWh) despite an expected fleet size of only around 1% of that of electric passenger vehicles (battery electric and plug-in hybrids). Figure 5 compares the energy demand for both types of vehicles. In short, this means a single electric truck is expected to have a yearly energy demand amounting to roughly 80 MWh, which is 43 times the annual energy demand created by the average electric passenger vehicle and 20 times more than the average electricity consumption of a single-family home in Germany.

Obviously, this will have a heavy impact on grids and energy generation. Governments, motorway operators, TSOs, DSOs, and utility companies are advised to act swiftly, given the lead times typically associated with this category of infrastructure development. To put it in perspective, the electricity demand expected from 2030’s European fleet of electric trucks amounts to around 1.5% of the total electricity consumption in Europe in pre-pandemic 2019. When the demand expected from electric passenger vehicles is added, we arrive at nearly 5% of the current yearly energy consumption. Truck electrification can only work if we expand renewable energy generation and grid infrastructure capacity. Most operators in Europe are not prepared to meet the vast power requirements by 2040. EU governments must facilitate long-term network planning and accelerate approval processes. Building infrastructure takes years; planning now is crucial.

Of greater interest to the EV charging ecosystem, however, is the astounding difference in demand for DC charging between the two vehicle categories. Our forecasts show passenger EVs accounting for more than two-thirds of 2030’s total energy demand; electric trucks are expected to drive close to 65% of the demand for energy delivered by DC chargers, thereby boosting the relevancy of this technology. According to our forecasts, the sales of DC truck chargers will exceed that of public DC passenger vehicle charging post-2025. With the exception of software offerings, AC chargers are comparatively unsophisticated and difficult to differentiate; for example, DC chargers have the technical characteristics allowing successful companies to charge a premium for performance, quality, and uptime, and the higher potential margins of the DC charging market make it a highly attractive segment.

By extension, and as a result of the synergetic nature of electric passenger vehicles and electric trucks, we expect the truck-charging use case to drive DC technology development, which will inevitably spill over to the passenger vehicle side, which in turn is a prerequisite for many energy-related value pools, such as grid balancing through V2X and bidirectional charging. Hence, beyond gaining access to an attractive charging segment in itself, savvy companies can also use this opportunity to access yet-to-mature, high-value revenue pools in the passenger vehicle market.

GROWING MARKET OPPORTUNITIES

Naturally, the 550,000+ electric truck fleet expected in Europe by 2030 creates an enormous market opportunity for charging companies, as charger demand is expected to soar from fewer than the 10,000 currently installed units to over 400,000 units by 2030, indicating an average yearly growth of the installed base of more than 60%. Compared to the passenger vehicle sector, we expect a more pronounced hockey stick–style development in the future. It will take some time until the vehicle and refueling reliability is on par with conventional trucks, and currently, additional government funding and toll exemptions are needed to make the TCO for electric trucks favorable in comparison to internal combustion engines. Environmentally friendly legislation is on the way, and the passenger car sector is driving technological enhancements to battery and charging technology at a very rapid pace. Megawatt charging along motorways and at important logistic nodes, such as harbors, will often require grid connection in the double-digit MW area that cannot be fulfilled by connections to the existing medium-voltage grid. These conditions represent a tremendous market opportunity for DC charger manufacturers across the globe.

Figure 6 shows the incremental increase in demand for truck chargers. These will predominantly be depot chargers, but as longer-haulage operations become more technically feasible toward the end of the decade, other types of chargers are expected to grow in importance.

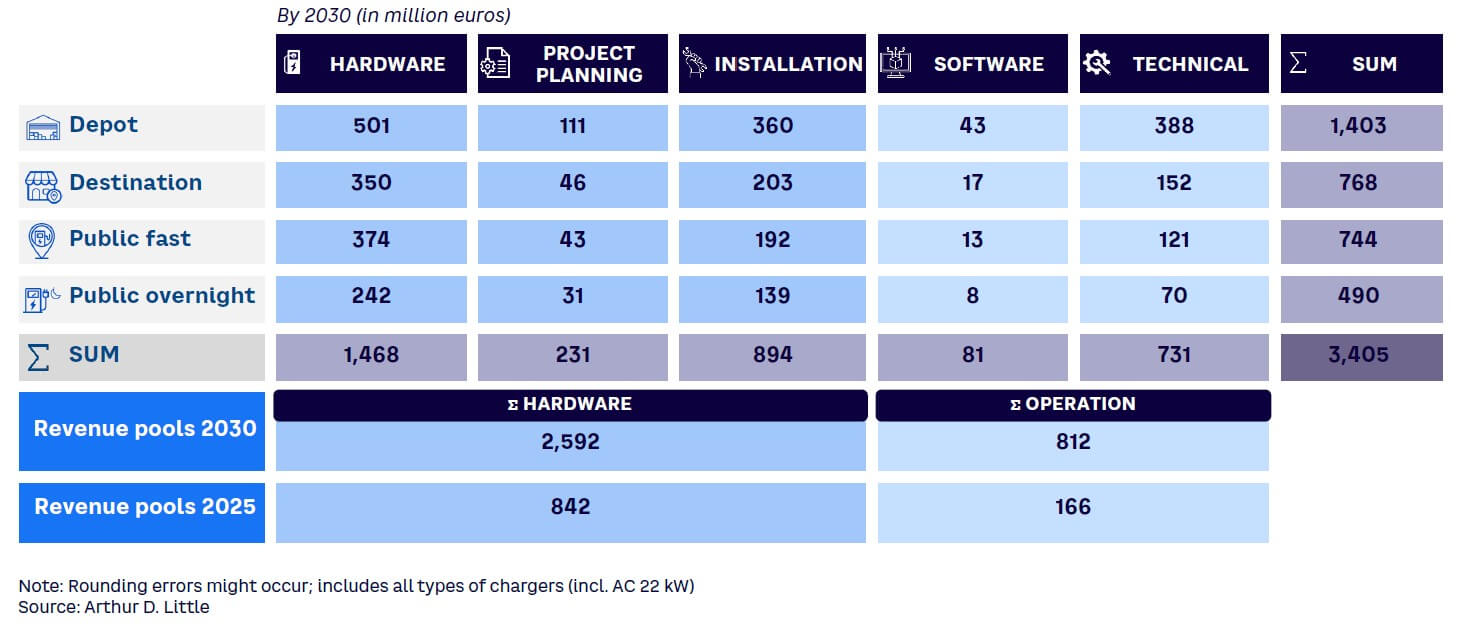

Depot charging is predicted to account for more than 80% of installed chargers by 2030, but it is less dominant from a revenue pool perspective. In fact, our projections show that only around 41% of the total expected revenue pools for truck charging in 2030 will be associated with the depot charging use case, which is primarily due to less costly hardware with significantly lower power requirements (see Figure 7). In general, we see that hardware-related revenue pools will constitute almost a billion-euro business by 2025 and will triple by 2030. An even bigger growth is expected in the recurring operation business that will quintuple from 2025 to 2030 to €800 million (US $870 million). The vast majority of these revenue pools are related to DC charging hardware.

Conclusion

FUTURE FACTORS

Truck electrification is irreversible and may become more important than anticipated. The following factors will impact the future of battery electric trucks:

-

TCO and reliability drive decisions; when these become favorable, potential customers may shift quickly to electric.

-

The heavier duty cycle and shorter usage period of trucks relative to cars will accelerate the shift to electric.

-

Truck charging will boost innovation of DC technology and potentially also accelerate growth of DC charging in the passenger car segment.

-

A small group of players shares most of this market today, but existing reliability problems will not be tolerated by the transportation industry. This could usher in new entrants and new innovations.

Truck charging is among the fastest-growing business opportunities in the wider vehicle electrification space and represents a tremendous market opportunity, particularly for DC hardware manufacturers and CPOs. The high requirements on power output and reliability create a high-value opportunity both for one-time and recurring business models. However, from today’s perspective, it is more a marathon game than a sprint. In particular, public-charging CPOs that want to be part of this game require deep pockets and staying power to come out as winners. With current market participants hesitant to go all-in, the door is open for new market entrants.