Recent behavioral and regulatory changes have transformed how customers engage with banks, fundamentally modifying customer expectations and increasing digital transactions. Moreover, competition is intensifying, with new digital players delighting customers while exploiting technology advances and the absence of a physical network. This Viewpoint explores innovative ways incumbent banks can overcome the limitations of their current core banking system as well as how they can define and execute a lasting strategy.

BANKS’ CORE MIGRATION IS FINALLY ON THE GO

In general, banks’ customer-facing systems and many of their peripheral applications like HR are increasingly cloud-native, but the same cannot be said for their core banking architecture. In the back office, many technology systems that process debits and credits and manage payments still sit on mainframes rather than in a cloud infrastructure like that which powers most digital companies.

Bank systems are often decades old, custom-built, and increasingly difficult or costly to maintain. In addition, quick fixes, bug fixes, or workarounds have been applied to keep those core systems working but have led in many cases to severe complexity and slowdown. Banks have invested large sums in robotics to automate outdated, manual processes but have not addressed the core.

They have been reluctant to move away from their legacy technology for two simple reasons: it still works, and the threshold in terms of risk and cost can seem quite high. But resilience and habit may no longer be enough to prevent a wave of core migration to the cloud. Moreover, an increasing number of subsystems have run out of service, and there are fewer and fewer IT specialists able to maintain the aged core banking systems.

After over a decade of inertia where the technology focus has been on enabling microservices and APIs to create agility without touching the core systems, the last few years have seen a sea change. Far more banks are now willing to tackle the complexity and begin moving their core operations to the private or public cloud. This great migration will have setbacks and stumbles but, ultimately, will reshape banks’ (digital) business models and how they serve clients.

A key factor causing “core to the cloud” to reach a tipping point is that cloud-native core banking software applications such as Thought Machine, Mambu, and Finxact are reaching a level of maturity that makes the journey worth the effort. While they cannot yet replicate the functionality of the traditional mainframe systems across all products, the migration benefits can now outweigh the pain of moving thousands of software processes and millions of customer accounts to a completely new environment. At the same time, more traditional core banking software providers such as Temenos, OLYMPIC, and Avaloq are also building up cloud offerings. This gives banks the flexibility to install their core banking software package on-premise or move to a software-as-a-service setup.

In parallel with the maturation of the software, cloud infrastructure providers have continued to upgrade security and resilience to the point where it becomes hard to reject public cloud-based systems due to operational or security risks. Cloud providers now aim to assure bank clients that they can handle even the most extreme spikes in transaction volume and repel the most determined hackers. Moreover, more and more customers trust them because of their reputation, which used to be reserved for banks as “trustworthy partners.”

One impetus for the great “core to cloud” migration may well have come in September of last year when JPMorgan Chase pledged to move its US core consumer systems to the Thought Machine platform. Other incumbent banks have chosen an incremental transformation road. The Spanish financial services company Banco Santander, for instance, is to transition fully to a cloud-based core banking system. To facilitate the full transition, Santander has deployed a bespoke software called Gravity. Developed in-house, the software is set to enable the complete transition of the core banking to the cloud and will play an essential role in modernizing the bank’s core banking system. Santander expects to complete this transition in all its core markets and businesses within two to three years.

Likewise, Belgium-based private and investment bank Degroof Petercam is transitioning its decades-old core banking system to the Avaloq cloud to enable cost efficiencies both in IT and business operations, while at the same time providing a more digitally advanced experience to its customers.

Similarly, Deutsche Apotheker- und Ärztebank (apoBank), a German cooperative bank for pharmacists and physicians, also transitioned from its legacy core banking platform to the Avaloq Core Platform, along with Avaloq’s highly automated business-process-as-a-service model. While the media has been critical of the IT migration — with the release of confidential customer data, system failures, and massive IT conversion costs that have negatively impacted nonpersonal expenses (significantly increasing cost-income ratio) — it will make a significant contribution to the long-term direction and opportunities for the bank.

Others may follow relatively quickly, with numerous banks reportedly planning to move at least part of their core workloads to the cloud within the next several years.

The commitment to the journey by some banks is so strong that they are taking stakes in cloud-native software firms. A case in point is Intesa Sanpaolo, which not only selected Thought Machine to power its digital banking platform but also made a sizeable equity investment. In another interesting development, US challenger bank SoFi decided to buy outright a cloud-based core banking platform Technisys to power its own operations and also improve its banking-as-a-service capability.

The great “core to cloud” migration definitely won’t be an overnight success, but it now has a sense of inevitability to it. In the long run, not only will the bank benefit from the move but customers and shareholders will as well. Moreover, it gives banks the most promising chance to be the innovation drivers themselves again.

WHY IS A LEGACY CORE BANKING SYSTEM AN INNOVATION STOPPER?

A core banking system is essentially the nerve center of a bank. Every transaction — regardless of how, when, or where it is generated — eventually ends up at the core, where reconciliation, reporting, and accounting are finalized.

As the vast majority of banks have been in operation for more than 30 years, they are tied to legacy software and hardware that predates the Internet era. Typically, banks still use hardware systems like z/OS, iSeries AS400, or Hewlett Packard Enterprise Integrity/Superdome OpenVMS. These aged systems are bulletproof and proven — often highly resilient with longstanding and well-understood processes. What they do, they do very well, which has allowed them to endure over time.

Nevertheless, these vintage core systems are struggling to respond to how customers engage with banks in the new era. The legacy systems limit the ability of banks to operate in an agile fashion, react to change effectively, and meet the user experience expectations of a generation raised on rich, interactive, intuitive digital apps.

Legacy processes tend to be in a place where you find legacy systems. They further limit banks’ ability to bring innovation to fruition while the vendor of the platform controls the pace of innovation. If they don’t do it, you can’t have it. Furthermore, legacy systems limit the greatly increased customer expectations and needs, which is probably the main reason to initiate this risky journey.

But there are also some less obvious reasons for the shift. Banking transactions such as paycheck or mortgage payments still depend in part on a tangle of custom-made software connections that only a dwindling number of computer programmers (e.g., COBOL) know how to modify and maintain. As mainframe systems age, the pool of technical talent that understands these systems is shrinking and aging as well. COBOL experts will be retiring in several years. For banks, it is increasingly challenging to find motivated employees that want to be trained on such old systems. This means maintaining and evolving the systems to cope with new regulations, new user needs, or new integrations can quickly become very difficult and costly.

At the same time, cloud talent is multiplying and evolving to embrace innovations such as Web3, a term for a new decentralized version of the Internet based on blockchain. Moving to cloud solutions hence means being able to benefit from this talent and added advanced functionalities.

LATEST TECHNOLOGY BENEFITS

To ensure survival, traditional banks must adapt by replacing legacy systems that aren’t fit for purpose in modern times. Here is where cloud can be a game-changer. A new generation of modern core banking technology providers is surfacing. With the adoption of cloud-native systems, banks can now move away from tiresome upgrade cycles and integration burdens.

A cloud-native core banking platform offers numerous benefits. Apart from flexibility to scale on-demand, savings, and security, banking on the cloud is the next logical step in transforming banks to be both more cost-efficient and more future-proof in terms of digital capabilities. A cloud-native core banking platform must catalyze digital banking transformation, reducing time to market and accelerating the innovation path.

According to Arthur D. Little project experience, banks can reduce IT spend on core banking technology by approximately 10% annually by moving the current technology to cloud. However, when banks move to a modern “next-generation” cloud-native banking platform, this can increase to a more than 40% savings.

All these benefits will make financial institutions more future-ready and improve customer value and revenues. Banks can save the effort of maintaining enormous hardware infrastructure and application monoliths and focus on delivering high-quality customer service and introducing competitive and innovative products to enhance customer satisfaction. Indeed, typically a core migration and its added capabilities and benefits in terms of automation, software evolution, and maintenance mean that a significant portion of the teams within IT, business operations, and sometimes even front-end staff can focus on higher value-add activities.

UNNOTICED ISSUES IN CORE MIGRATION

Traditionally, migrations are viewed as risky multiyear initiatives, which are costly and time-consuming. Incumbent banks face several key challenges when it comes to migration to ensure success:

-

Simplicity. Traditional core banking systems come with a huge number of heavily customized product sets and process functionalities embedded in the monolithic code. An aggressive product and functionality rationalization is required for a successful migration.

-

Spoiled for choice. Diverse options are currently on the market and more are coming. Through a targeted process, banks must understand which system requirements are derived from their status quo and which requirements they need for the future. Once the migration is underway, there is no turning back.

-

Step-by-step. Experience from similar major migration projects in banking and in other industries tells us to avoid a big bang. Segmenting the IT systems and components into logical tranches and migrating step by step is less risky. However, this method might lead to higher costs since interim interfaces must be built.

-

Coexistence. While such a major transformation is taking place — and a program of this nature would take anywhere from two to five years — the bank must continue operating as usual. If the bank avoids a big bang implementation, the legacy core system and the new core banking must coexist, requiring unique reconciliation, reporting, and accounting processes.

-

Digital skills gap. Qualified people with knowledge in COBOL and other assembly languages may be required to understand current processes and functionalities. This gap is a serious problem for many organizations, as it can stop the adoption of cloud technology.

-

Vendor lock-in. The challenge is not to change an incumbent system for another incumbent. It is necessary to invest in platforms that allow for reducing the vendor lock-in, minimizing the use of proprietary technology.

-

Organizational change management. Core banking migration is not a pure technical change but requires a mindset shift that must be managed both on the business (adopting the solution, limiting customization) as well as the IT (change in role of IT with shifting development and operations activities) side.

Financial entities will need to pay attention to these elements to ensure a smoothly implemented core banking transition to the cloud, enabling banks to secure their benefits, meet new customer demands, and create new business opportunities.

MAJOR OPTIONS FOR BANKS

To prepare and define the strategy for core migration, it is important to take the approach that solves the most pressing business challenges. There are normally four routes companies can take:

-

Migrating the core solution to a cloud infrastructure. Lift and shift the existing core banking solution from legacy to the cloud, wherein cloud infrastructure replaces the on-premises data center. This option does not provide the full potential of cloud in terms of savings and functionality but avoids maintaining two infrastructures and opens up the core to the front-end solutions with more modern integration possibilities. However there is more to the term “lift and shift” in this case, as the legacy system will need to be made cloud compatible.

-

Refactor the core. Refactor existing legacy core banking processes and systems, and power APIs via cloud-native solutions to provide scalability and agility. Large banks with in-house and complex core banking systems often prefer this approach, as market (cloud-native) applications do not provide all functionality or do not address all country-specific regulations they have been developing for decades. As the core recoding can last several years, some incumbent banks are considering the lift and shift of their core banking solution as an intermediary step. This approach facilitates the coexistence of the old and the new stack during the refactoring project, as both are on a cloud infrastructure, and provides savings in the short/medium term.

-

Replacing the core. Migrate to a cloud-native core banking system that maximizes the use of new cloud technologies. Leading cloud-native core banking packages can provide a significant step-up in terms of functionalities, user friendliness, and efficiency compared to legacy systems. Cloud-native core banking software applications such as Thought Machine, Mambu, and Finxact cannot yet replicate the functionality of the traditional mainframe systems across all products. As most banks are three or more decades old, with a multitude of product customizations, using cloud core across all products can prove to be difficult. In cases where product simplification is not possible, a parallel core banking system is often required to responds to these uncovered capabilities. The two parallel core banking systems will require unique reconciliation processes for accounting and reporting, resulting in additional implementation and maintenance efforts. Due to changing regulatory reporting demands, these efforts cannot be overlooked. Replacing the core can also be done by installing a package on-premises, although this is inadvisable because the bank remains responsible to update and maintain the software itself, typically leading to a similar situation with an outdated system again in a couple years’ time.

-

Greenfield development. Launch a totally new customer proposition and customer experience that is focused on customer acquisition via innovation, simultaneously developing the core banking platform that supports this new customer proposition. This often means aggressively migrating existing customers, allowing for canceling/re-enrolling or account recreation to gradually move the customer base from the legacy platform to the greenfield platform. This option reduces technology risks, but in some cases these types of initiatives struggle to achieve business success as flanker brand next to the traditional bank brand and can therefore lose customers along the way.

The approach that works best for each bank will depend on its strategic and business imperatives, including budget, risk appetite, user needs, and in-house capabilities. However, moving to a cloud-native core banking platform, if possible, is often advisable, as this provides the greatest benefits in terms of flexibility, new capabilities, and future readiness.

WHAT CONSTITUTES A SUCCESSFUL MIGRATION?

Independent of the migration scenario it chooses, banks should consider a number of critical success factors. Next to the traditional ones such as senior sponsorship, strong governance, and so on, that are relevant for all large transformation programs, special attention to data migration is most critical to obtain a successful transition. This can be a burden, specifically when it comes to cloud adoption, as the process involves taking records from different sources and in different formats. Some of the main challenges are data loss risk and substantial time and human resources, but critical success topics include:

-

Legacy data knowledge. Most core banking developers are less interested in documenting the process than completing it. The majority of banks’ legacy systems thus are poorly documented, and poor documentation of legacy data hinders the effective migration of data. Without a clear understanding of legacy data, the migration can encounter pitfalls that hinder and delay the process. To retain legacy data knowledge, it is essential to keep the critical and relevant employees at least for the duration of the migration.

-

Data quality. Poor data quality is a major reason for project delays and cost overruns. If legacy data is low quality, the data migration will require managing innumerable exceptions, causing delays. Usually, low data quality is not identified until the target system fails. Therefore, it is necessary to analyze the quality of the data to be migrated and take prior decisive action on dirty data in the legacy systems before starting the migration. Cleaning data before migration to avoid poor data quality is a good option.

-

Data redundancy. Banks often have multiple data entries for the same customers. Since redundant data is process-oriented, it is inevitable in the legacy system. Depending on the bank’s requirements and the target system specification, the data should be transformed prior to migration. Data duplication or redundancy is closely related to data quality.

-

Premigration planning. Detailed planning is key, considering the topics mentioned so far, as well as the overall volume of data. The amount of data to be migrated must be determined in the premigration stage itself. High data volumes increase the time required for the process migration.

-

Meeting with high-level decision-making body, and quick fix of glitches. One hopes that things go well, but unfortunately this is not always the case, especially when it comes to technology. It is important to be able to make decisions quickly to minimize turnaround time.

-

Plans for migration rollback in case of migration failure or data reconciliation. It is essential to develop a rollback and data reconciliation plan for each stage of the migration that will allow operations to continue even if some manual work is required.

Ensuring a smooth migration process requires a suited strategy with a clear understanding of the legacy status, well-defined planning, and high involvement of the key people. Such a strategy will minimize risks during data migration and maximize optimal utilization of the new software.

HOW TO MOVE FORWARD

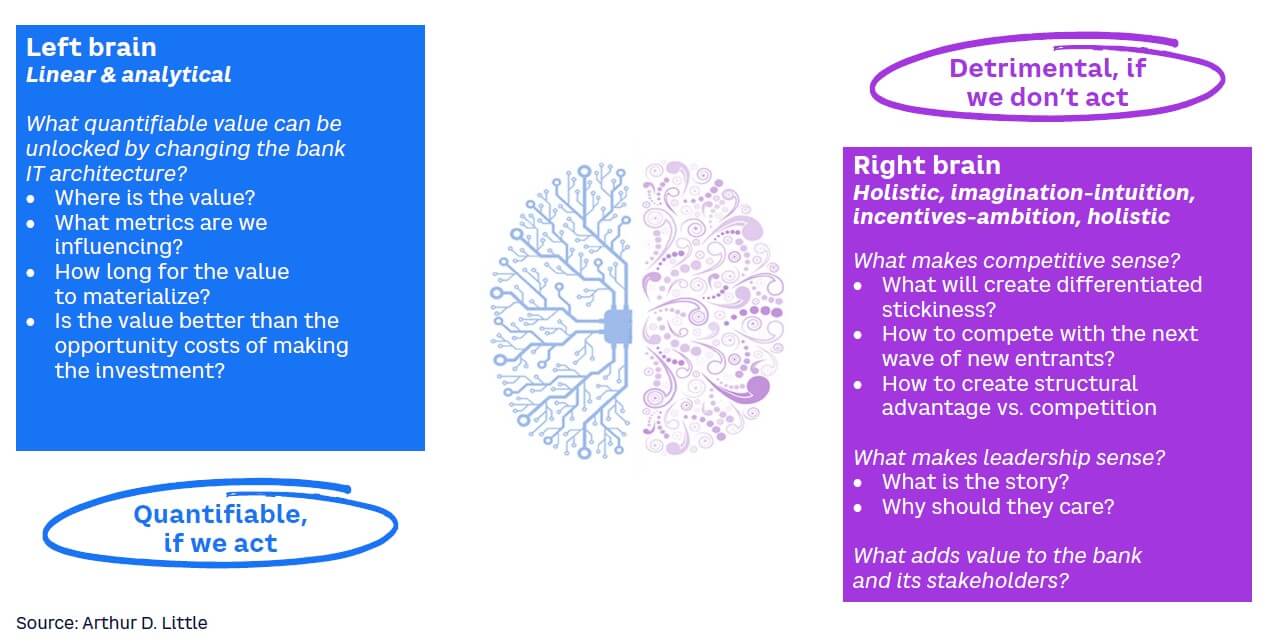

While most banks are still picking the low-hanging fruit in terms of digitally decoupling the core with the front-end solutions, they cannot avoid the core migration journey for long if they want to stay relevant in the market. Some best practices are emerging, and banks need to start to address some questions that will guide decision makers to consider how to launch on this journey. The selection of options requires examining both halves of the equation, using an ambidextrous approach that encompasses both quantifiable and detrimental elements (see Figure 1).

Answering the questions in Figure 1 can clarify a bank’s path. In any case, a core migration does not come without effort and should be considered with the right amount of depth and dedication. Starting this journey typically entails:

-

Determining the right scenario (see options outlined above), aligned to the bank’s business ambition and technical context.

-

Designing the target architecture that fits the bank’s ambition, needs, and selected scenario.

-

Defining the target business and operating model enabled by the new core banking platform, including related product catalog and customer offers.

-

Building the business case, comparing investment and total cost of ownership to one-off and recurring benefits (e.g., risk avoidance, revenue uplift, efficiency gains, hard cost savings).

-

In case of replacement, performing vendor due diligence — moving from a long list to short list through the right set of criteria, eventually picking the right platform provider.

-

Performing a rigorous risk assessment.

-

Defining the roadmap and governance model, including design authority for the program, that will manage definition of to-be customer journeys, workflows and processes, and so on.

-

Setting up a change management program, including training and hiring of employees with the respective expertise, including relevant IT skills.

Conclusion

ON THE RIGHT TRACK

Core banking migrations are incredibly painful and have a high rate of failure. Even technical success can be painful due to feature poverty in the new system or business dissatisfaction and limited adoption. However, doing nothing is not an option in the long run.

A new front end will only fool your customers until a newer, better challenger bank arrives with agility that far outpaces yours or has features you can only dream of with your legacy platforms. Even worse, your direct competitor already will have completed the core migration and will be able to offer new services and innovations similar to fintechs and, at the same time, work more cost-efficiently. Employing a middleware solution only postpones the inevitable and is just delaying the investment required to make the core more future-proof. The only option is to begin this long and risky journey now, developing a detailed playbook that sets you on your way and mitigates the main hazards early on.