The public electric vehicle (EV) charging landscape is rapidly evolving, although key players’ financial performance is uncertain. Arthur D. Little’s (ADL’s) analysis of the industry in the US indicates profitability challenges with first movers as well as opportunities to capture more value through better understanding and targeting of different customer archetypes across all ecosystem players. Such targeted activity will expedite the realization of profitable unit economics across the business.

STATE OF THE MARKET

Today’s automotive industry faces an unprecedented number of “push” and “pull” mechanisms to decarbonize, with EV adoption expected to grow at a CAGR of over 20% through 2030. As this revolution unfolds, there are opportunities for players across the ecosystem to capture value, particularly in the nascent EV charging space. Federal support in the US through the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) has directly allocated US $7 billion and indirectly made eligible a portion of more than $260 billion through 2026 to support public EV infrastructure. At the same time, public charge point operators (CPOs) are scrambling for market share. As in any race, there will be winners and losers.

Poor financial performance

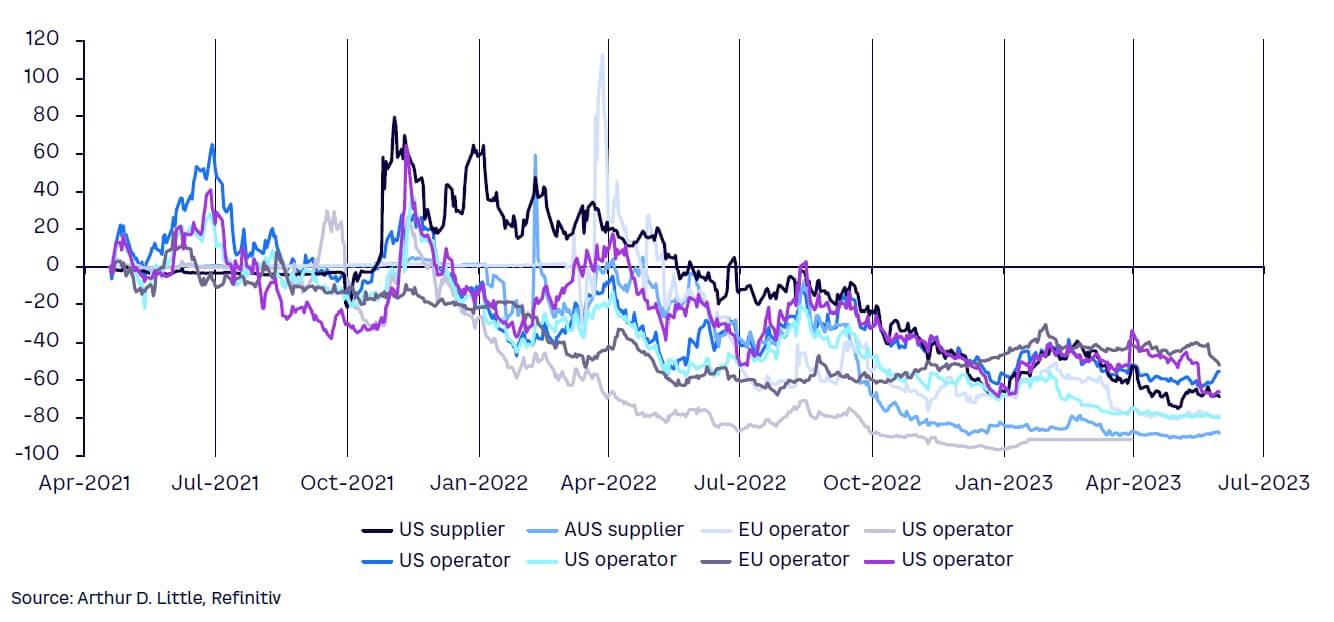

Currently, the market can be characterized by challenged financial performance. Of the eight public CPOs that ADL tracks, most do not expect to reach profitability before 2025. Numerous EV charging companies have gone public during the past few years, looking to take advantage of high public market valuations. However, most have experienced a turbulent journey. Among notable publicly traded companies operating in the EV charging space (with the exception of Tesla), none currently trades higher than its IPO price. In fact, since April 2021, all EV charging companies ADL profiles have faced declines in share price, which have fallen an average 70% through May 2023 (see Figure 1). As an additional example of value deterioration, after going public via special purpose acquisition company (SPAC) in August 2021 at a $1.7 billion valuation, Volta was taken private by Shell in January 2023 in a transaction valued at just ~$170 million.

We anticipate that recently passed legislation in the National Electric Vehicle Infrastructure (NEVI) Formula Program and IRA will lead to an improvement in US CPO financial performance. However, gross margins for publicly traded CPOs average around 20%. Tesla has the highest margins out of the five US public CPO peer set that ADL tracks.

Although most US CPOs are unprofitable at the company level, there is an achievable path to profitability in the near to medium term, with most anticipating reaching a positive EBITDA margin by 2026. Still, margins are expected to be relatively modest in the mid term, ranging from 1% to 8% across publicly traded US CPOs. This implies that meaningful profit generation is unlikely to happen until at least the end of this decade.

Threats from new entrants

The market is evolving and stakeholders across the ecosystem are entering the race. Incumbent oil and gas players are making acquisitions and investing in public charging. BP has committed to investing $1 billion in US EV charging across segments by 2030. Retailers that previously partnered with CPOs to provide charging are now bringing this capability in-house. Both Walmart and 7-Eleven have announced their intention to install, own, and operate EV charging across a portion of their combined 19,000 North American locations. There are also new dedicated platforms emerging as “purpose built” solutions for specific market segments. LNG Electric announced plans to deploy both AC and DC charging across 13,000 hotels (e.g., Marriott, Hilton) and 400 multifamily properties by 2028. In addition, vehicle manufacturers are participating both directly (e.g., Mercedes-Benz-branded network) and through partnerships (Ford adopting Tesla’s charging plug standard). Finally, utilities like Florida Power & Light and Xcel Energy have gained some levels of regulatory approval to develop, own, and operate public charging stations. This increased level of competition will continue to create challenges for those looking to develop new sites and boost utilization across existing stations.

CORE BUSINESS PROFITABILITY LEVERS

Subsidy capture

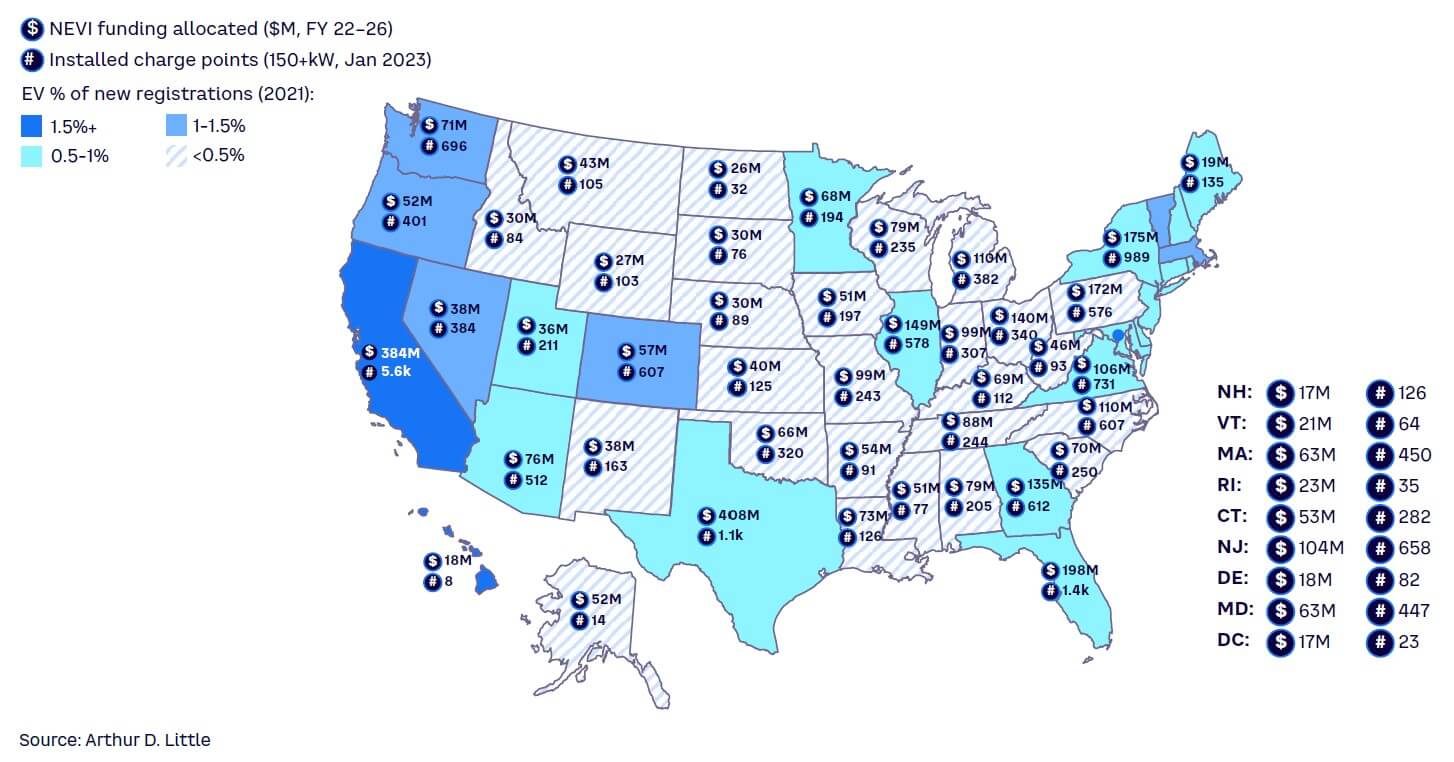

Local, state, and federal governments have recognized the need for charging networks in reaching EV adoption targets. In turn, they have made significant funding available for the development and operation of charging stations. As an example, the NEVI Formula Program directs approximately $5 billion in funding for highway DC EV charging infrastructure, while another $2.5 billion in grants focused on disadvantaged communities will be available for local authorities (see Figure 2). NEVI funds will cover up to 80% of the costs to acquire, install, operate, and maintain charging stations. ADL analysis has shown that for some stations this could accelerate payback periods to under two years and yield return on invested capital (ROIC) ranges above 50% over the lifetime of the assets.

Additional funding will come from a pool of $265 billion from other federal programs that allow for spending on EV charging infrastructure, such as the National Highway Performance Program (NHPP), the Surface Transportation Block Grant (STBG) Program, and the Carbon Reduction Program (CRP). In addition, local and state programs, such as California’s Electric Vehicle Infrastructure Project (CALeVIP) and Energy Infrastructure Incentives for Zero-Emission Commercial Vehicles (EnergIIZE), offer further funding and incentives for EV charging deployment.

It is important to note that many of these programs have specific qualification criteria that will impact EV supply equipment deployment. For example, NEVI requires a minimum station power capability at or above 600kW, comprised of at least four direct current fast charging (DCFC) charge points with combined charging system ports rated over 150kW. All chargers must be compliant with Buy America and Buy American requirements, accept credit cards, and use transparent pricing that does not vary during the charging session. For CPOs to succeed in the short term, they need to maximize subsidies. As such, CPOs must carefully consider funding requirements during procurement, work with compliant hardware suppliers, and pay close attention to developments in local regulations.

Network planning & site selection

For CPOs, the unit economics of each station depend primarily on its utilization rate. These can vary widely based on a number of factors, including type and speed of charger (Level 2-AC, Level 3-DCFC, and Level 4-DC ultra fast), location (high versus low traffic), regional jurisdiction (high versus low EV registrations), and electricity pricing. EV chargers in densely populated areas, areas of interest, and areas with high EV penetration see much higher utilization (10%-25%) versus the national average (roughly 8% across both AC and DC chargers).

CPOs must also weigh the benefits of targeting areas with higher expected EV adoption against real estate costs and utility interconnection considerations. A winning strategy will likely target metropolitan and suburban areas with high EV adoption and leverage partners (e.g., gas stations, real estate owners, large retailers) to cost-effectively deploy charging assets. Partnerships with entities that have national footprints can better inform site selection, expedite station deployment, and lower “soft costs” associated with infrastructure development.

During site development, CPOs must ensure the careful analysis of local utility rate tariffs and diligently take advantage of all possible clean energy incentives and rebates. Additionally, an understanding of interconnection requirements on a site-by-site basis is necessary to accurately estimate installation costs and timelines. If possible, CPOs should work directly with utilities and regulators to develop influence that balances CPO, local authority, and customer objectives.

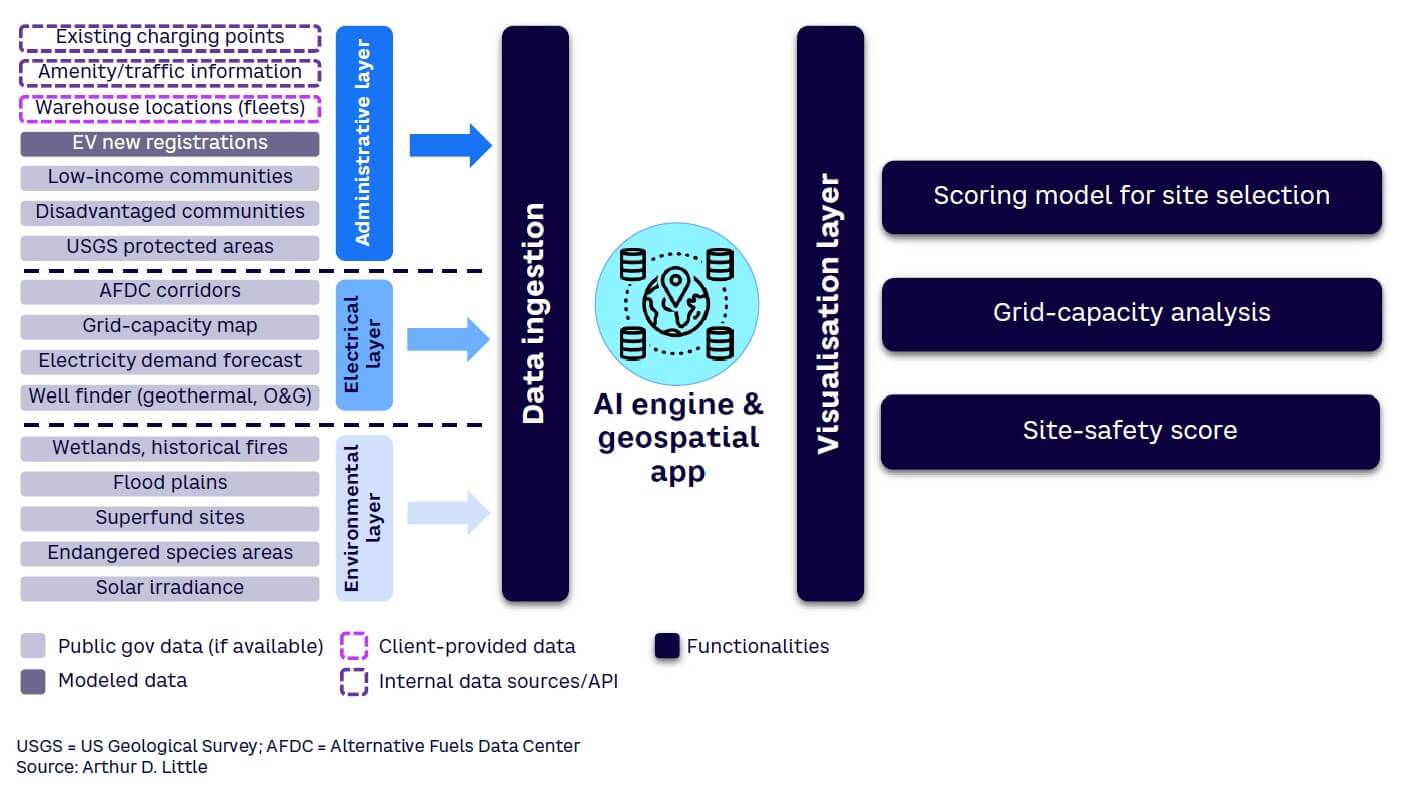

Developing geospatial models that integrate both structured (e.g., current station deployment, new EV registrations, electricity rate tariffs, traffic patterns) and unstructured (e.g., utility distribution plan/filings, social media posts, reviews) data can significantly de-risk network planning. (See Figure 3 for an example from ADL’s EV network-planning analytics tool.)

Customer experience & segmentation

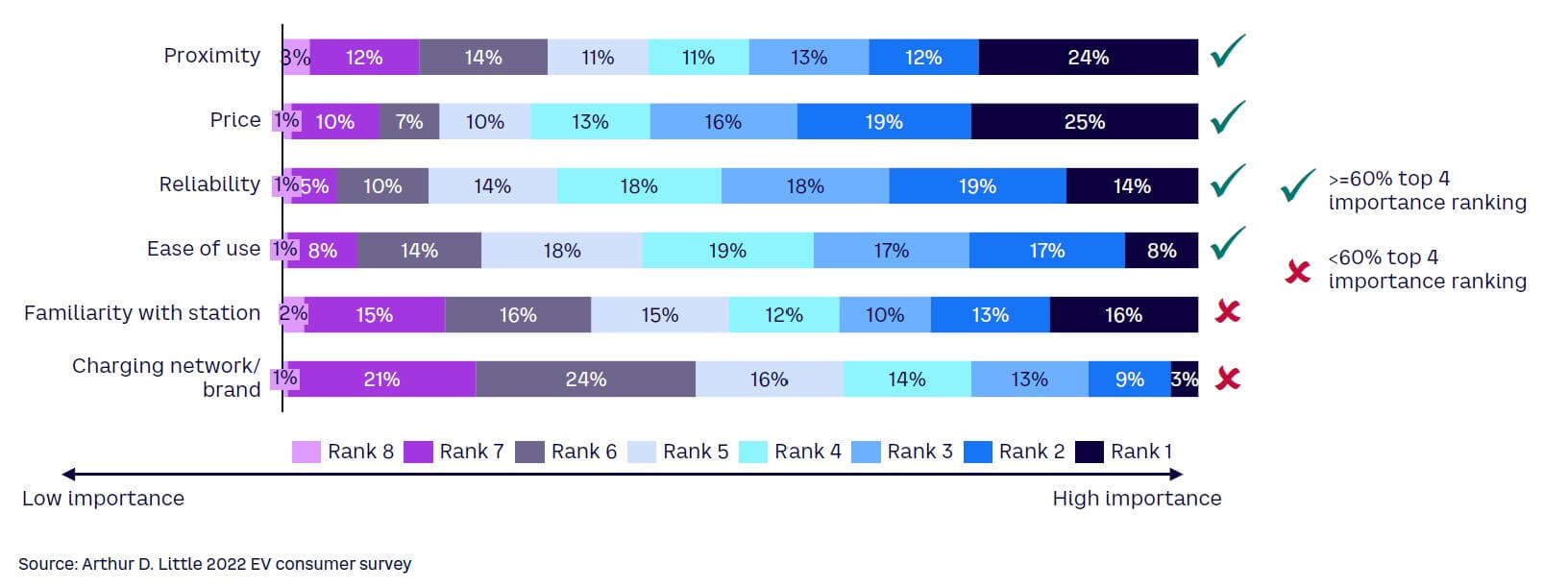

The pain points highlighted in ADL’s charging customer experience survey (see “Customer Experience Drives Value in Public EV Charging”) demonstrate how inconsistent and fragmented the customer experience can be in the US. Tesla is far ahead of the rest of the pack in terms of customer value capture, primarily due to the company’s proprietary ecosystem that seamlessly integrates the Tesla vehicle and charging experience to show charger proximity while ensuring reliability and ease of use, three of the key factors in the customer charging experience (see Figure 4). Due to a significant absence of brand loyalty across the industry, CPOs must focus on providing a superior experience to drive customer lifetime value.

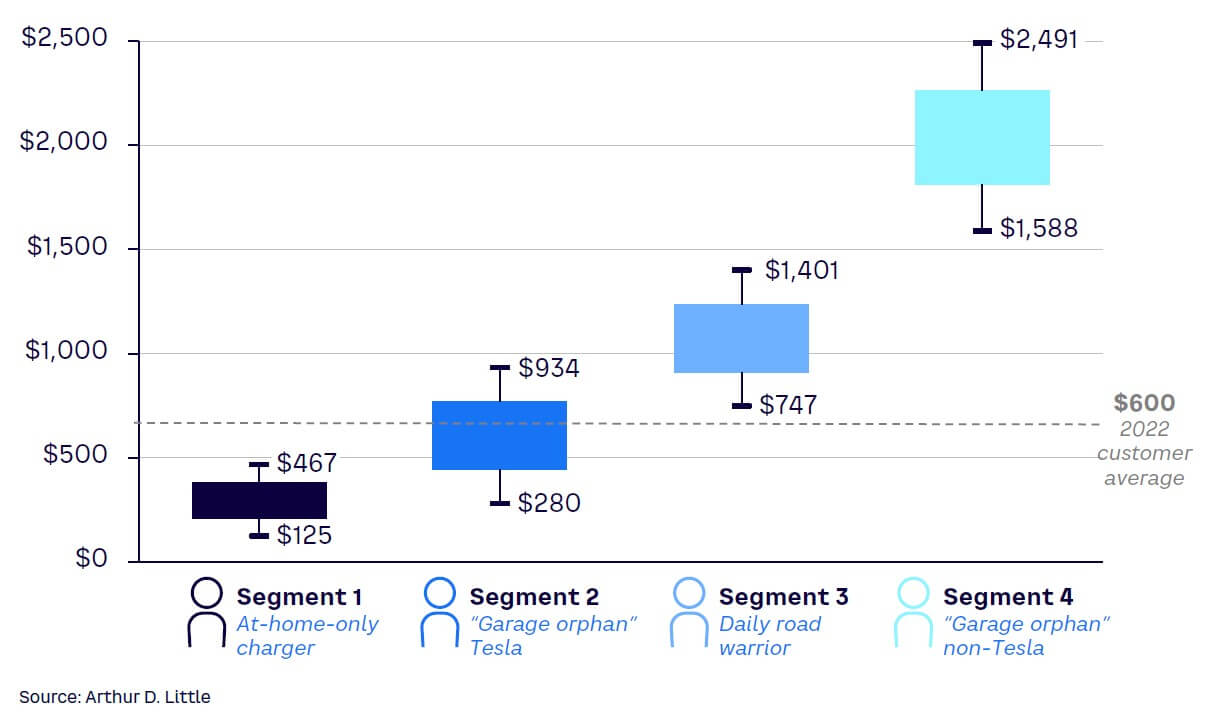

To better understand the market, ADL analyzed annual public charging value from four types of customer profiles (see Figure 5). The archetypes were defined by the customers’ demographics, marital status, residence type, geographic location, and profession, which then informed annual driving mileage, percentage of public charging, retail electricity price, and a set of other inputs to estimate potential annual revenue per customer.

These customer profiles, driven by differences in driving and charging behavior, represent significantly different revenue pools for CPOs.

Currently, most US EV drivers live in urban or suburban areas and own more than one car. Based on ADL analysis, an “average customer” could represent around $600 of annual public charging revenue. When comparing this to actual revenue realized by CPOs, the results are quite disappointing. Publicly available figures suggest that a typical CPO currently captures anywhere from $70-$500 per year from any given customer, with the average being $140. Considering average customer charging spend, we have found that North American operators are capturing only 13%-24% of average customer wallet share, while their European counterparts capture 25%-42%.

This is due not only to the low rates of customer loyalty but also suggests US CPOs’ lack of understanding of their customer. In this industry, as with most others, customer segmentation and tailored engagement are critical to fostering brand loyalty, customer retention, and maximizing customer lifetime value.

Operations & asset management

Charging station reliability, particularly for DCFC, has been a known challenge for CPOs. ADL’s analysis of publicly available data shows charging success rates of only about 64%-80% for leading CPOs in a large US city. This equates to significant loss of revenue and customer trust. A wide range of issues can cause a charging session to fail, including hardware faults, software malfunctions, network issues, defective payment gateways, weather-related challenges, and others. Therefore, it is critical that CPOs design service and asset management functions that are fit for purpose and focus on continuous improvement.

To ensure an acceptable customer experience, CPOs must meticulously vet their hardware, software, installation, and operations and maintenance partners. Strict service-level agreements must be agreed upon (and continuously revisited) to measure performance and hold the right parties accountable to detect and quickly correct issues. Capabilities related to asset monitoring, predictive maintenance, and trouble response should be centralized and brought in-house to continuously improve station uptime. Additionally, proactively addressing pain points in the customer experience can decrease call center volumes and corresponding SG&A cost. For one network operator, 55%-75% of total customer call volumes were found to be related to authorization holds or other avoidable account issues.

ANCILLARY PROFITS THROUGH BUSINESS MODEL INNOVATION

Most of today’s CPOs own their charging stations and generate revenue primarily through the direct sale of electricity to customers. This business model is constrained by high capital costs and fraught with utilization risk. Outside of capital-intensive moves into other parts of the value chain, CPOs should explore how they can extract additional value from their existing assets and customer base. Some strategies for margin enhancement include:

-

Advertising. Although a pure advertising-based model by Volta (now owned by Shell) did not work as a standalone, it did generate respectable revenues (~$38 million through Q3 2022) and attract big-name site partners (e.g., Kroger, Whole Foods, Walgreens). Thoughtfully integrating relevant advertising content into station displays and other customer touchpoints (e.g., mobile app, email receipt) could help CPOs monetize today’s attention economy.

-

Public commercial charging. Either in addition to or in the absence of full-fledged fleet offerings, CPOs could boost utilization rates at existing chargers through targeted commercial fleet offers. These could be for small local fleets or large national delivery and/or rideshare operators.

-

Gamification and rewards. Driving customer loyalty through rewards and incentives is a tried-and-true technique. This creates an additional opportunity to engage with customers and differentiate the brand. These programs must first be piloted and then scaled in targeted phases. As an example, EVgo launched EVgo Rewards in 2021 to allow customers to earn points that are redeemable for free charging.

-

Forecourt extension/retail experiences. When not in conflict with the business of their site host, CPOs should look to create retail experiences for their charging customers. For example, following the success of an initial pilot site in Nuremberg, Germany, Audi plans to scale “charging hubs” with lounge areas and patios. Automated vending machines could offer customer convenience and low-effort incremental revenue.

-

Dynamic pricing. Charging-price flexibility can have the power to improve utilization rates, enhance gross margins, and increase customer retention — if done the right way. For example, in September 2022, the California Independent System Operator sent a Flex Alert to residential customers asking them not to charge their EVs, among other conservation measures, creating a media backlash for EVs and the state. Such scenarios can easily be addressed with price signals, while also optimizing time of use (TOU) tariffs and piloting other arbitrage strategies.

Conclusion

ARRIVING AT THE DESTINATION

The path to profitability in the EV charging space, although fraught with structural challenges, is ultimately navigable. Early movers have struggled to turn a profit as they deploy large amounts of capital (overbuild) to meet anticipated future demand. In the next five years, significant funding at the federal and state levels will be critical to improving early-stage EV charging network economics and decreasing the depth of the J Curve for CPOs. In the meantime, an examination of customer profiles across the EV ecosystem offers players several opportunities to capture value:

-

Charger utilization. The key economic metric for traditional CPOs is charger utilization. Companies should meticulously screen and prioritize potential sites based on key factors (e.g., urban density, traffic patterns, EV penetration, utility interconnection) that correlate to high utilization risk and help de-risk deployments.

-

Focus on the customer. A focus on customer acquisition, retention, and value capture is needed in the near to medium term to drive value as the parc electrifies. CPOs that understand their customers and invest in the customer experience will be best positioned to weather the next few years of suboptimal structural asset utilization.

-

Improved reliability. Improving charger reliability through enhanced operations and maintenance capabilities will yield positive top- and bottom-line impacts.

-

Services and customer offerings. Ancillary services and new customer offerings can create value from the existing customer/asset base while hedging against a reliance on individual charger-utilization rates.