Operations 4.0

The five tech pillars that will make or break telco operators in 2022

Executive Summary

Reaping rewards of new trends without breaking the bank

In all markets, there is an alarming and growing gap between stagnant revenues and the increasing level of investment required to introduce new technologies in the telco sector. The game has changed: supporting soaring data traffic, improving quality of service, and delivering new ways of working are no longer just nice-to-haves, they are operational keystones upon which the future of the entire enterprise depends.

The resulting pressure on margins and cash flow intensifies as the need to deliver growth and better quality of service faces off against increases in OPEX and CAPEX, while management remains unwilling to cut dividends for shareholders. The first action major telco players have taken to fund investment needs is signing network-sharing agreements with TowerCos. As a second step, telcos are even evaluating the creation of NetCos to sell to the market.

As a result of continual technological disruption, such as hypercompetition and sustainability at the global level, the telco value chain is rapidly evolving toward Operations 4.0 as an integrated part of its digital transformation pathway. In this Report, we highlight five emerging tech opportunities that can drive radical performance improvement in future telco operations as well as generate new revenue streams to energize telcos to establish a competitive advantage in the new landscape.

1

The challenge: Monetize investments in tech innovation

The telco industry has been changing rapidly for many years, but the pace of evolution now appears to be faster than ever. Telcos face growing complexity due to technology innovations like 5G and the Internet of Things (IoT), as well as increased competition. They are also experiencing greater pressure on their financial performance. In fact, Capital IQ research has reported that, in the past few years, revenues of the top 50 telco players by turnover have grown by 3.6% CAGR, while EBITDA has increased by only 0.6% CAGR.[1] The point is not whether telcos must transform, but rather how to successfully drive the evolution.

With cooperation from telecom CEOs and C-level executives across continents, Arthur D. Little (ADL) has identified some critical questions that telcos must answer to illuminate the challenge:

- What disruptive forces are enabled by digital technologies in our industry ecosystem?

- What market and client requirements do we need to meet with our operations, and how important are they?

- Which applications of technology will bring real value to our operations, in the short and long term?

- What does the resulting future state of operations look like and what benefits (financial, business model) can we expect?

- How do we get access to know-how and technology to successfully manage this transition?

The need for growth and diversification beyond core business, the demand for a best-in-class customer experience (CX), and higher complexity due to new technologies are pushing executives to look for a higher degree of flexibility and efficiency. Many technology opportunities, including artificial intelligence (AI), advanced analytics, autonomous systems, cloud computing, IoT, 5G, and smart robots, will help drive telco performances along the supply chain. All these new technologies will push far beyond current efficiency targets and will redefine the telcos’ operating model (processes, systems, organization, skill set). We believe they also have the potential to generate new revenue streams and can improve current economics and enable reinvestment in high-potential growth areas.

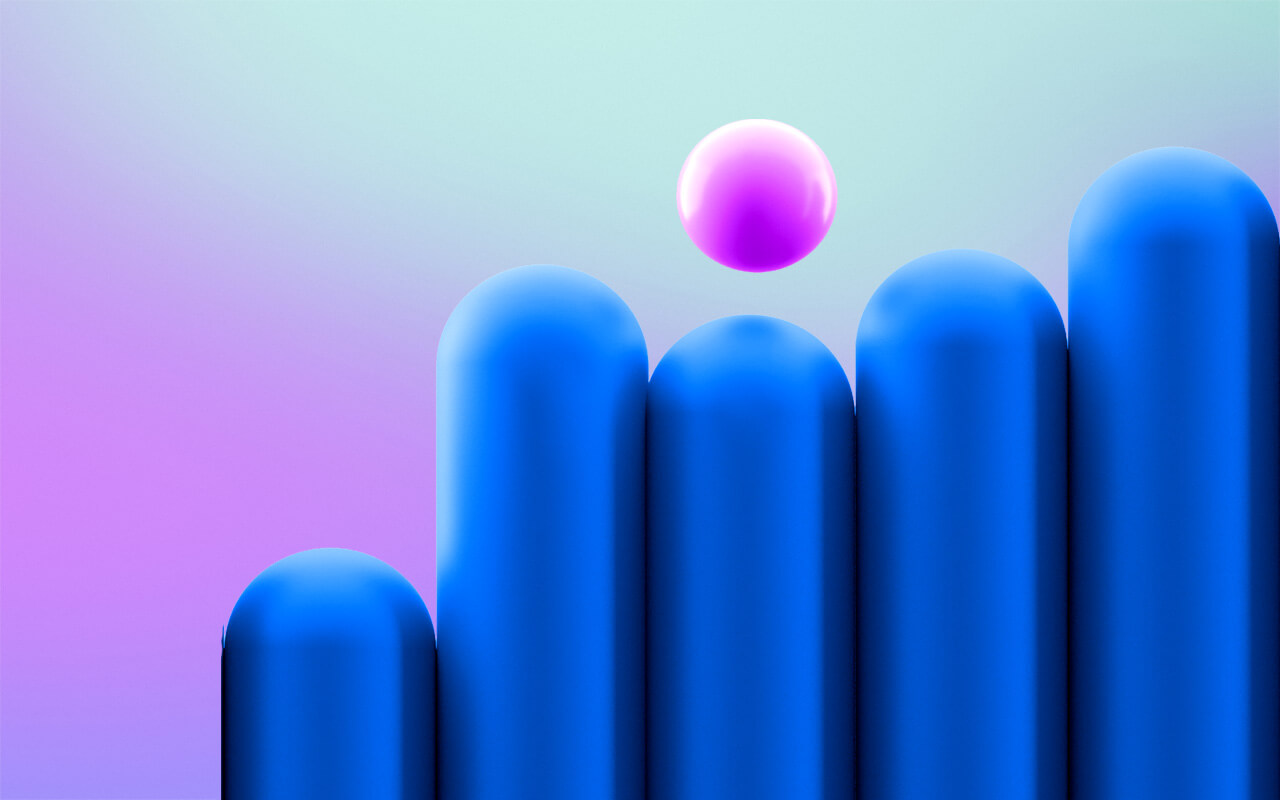

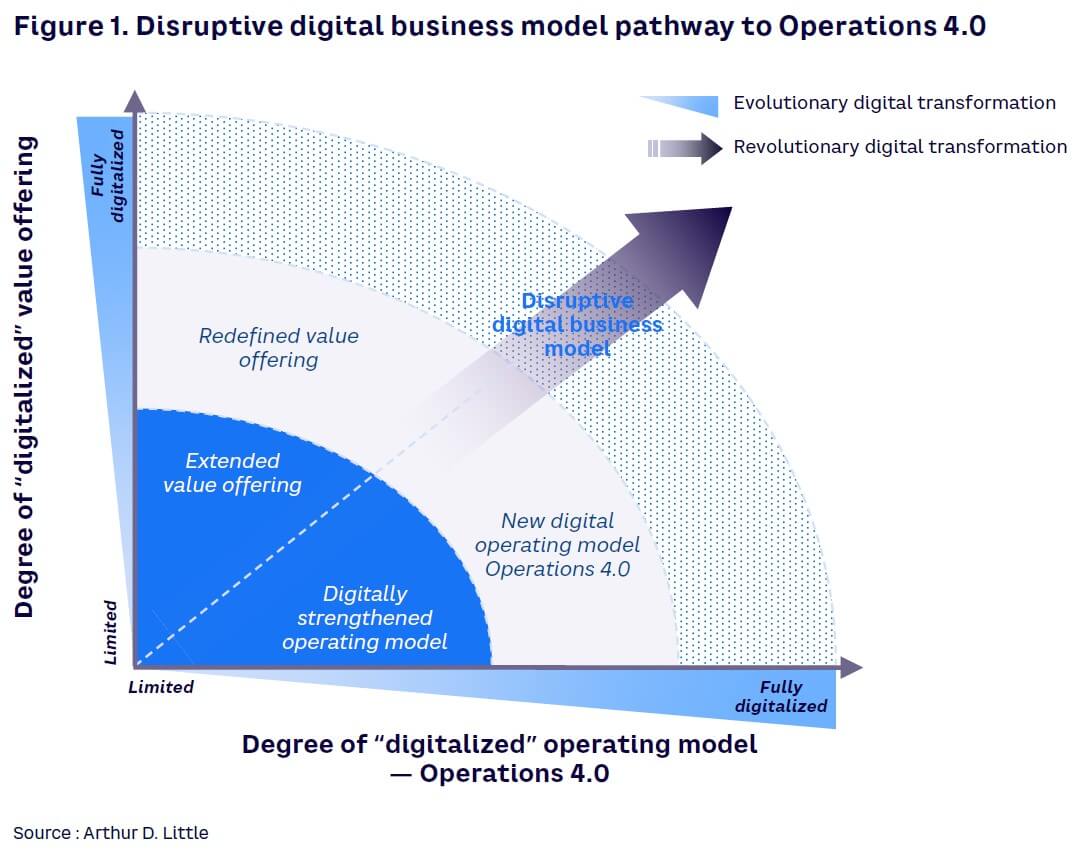

Some telco executives have already started focusing on these topics and are redesigning the telco paradigm by rethinking their business and operating models. Increasing digitalization will redefine value offerings and further adoption of Operations 4.0 (see Figure 1) to manage and surf the disruption, and new trends will overcome the challenges they are facing.

2

Make tech work to enable digital transformation

Mobile network operators across the globe are investing — or will invest soon — in new technologies such as 5G, distributed antenna systems, small and pico cells, IoT, cloud, and AI/machine learning (ML). This will require huge CAPEX (according to ADL analysis, up to 20% of EBITDA, depending on market share, market strategy, and average revenue per user). Investments will enable new services like smart cities, smart homes, eHealth, and autonomous vehicles, allowing customers to fully exploit their experience with better quality of service (e.g., higher downlink and uplink throughput for eHealth and low latency for online gaming).

The main challenge for operators is how to monetize these investments through revenue generation and/or cost efficiencies. Before they can make any strategic decision, telcos must assess and develop use cases to determine the profitability of these new technologies within the entire ecosystem.

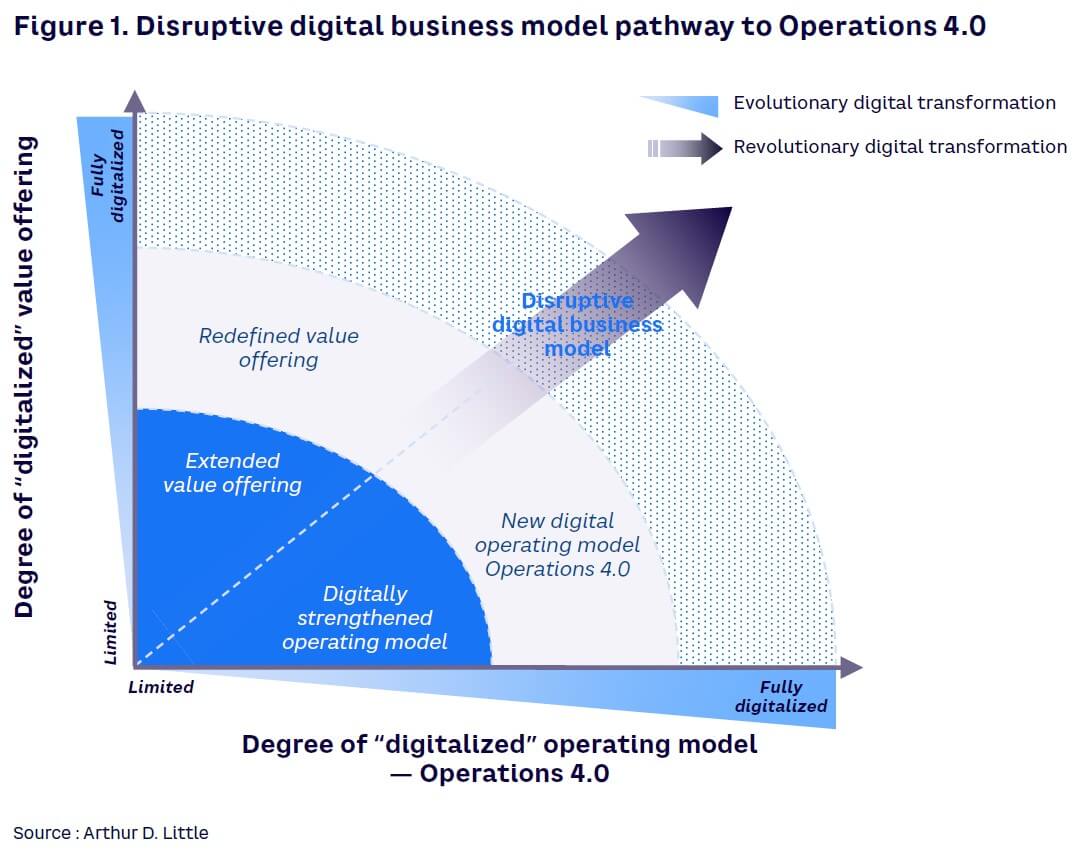

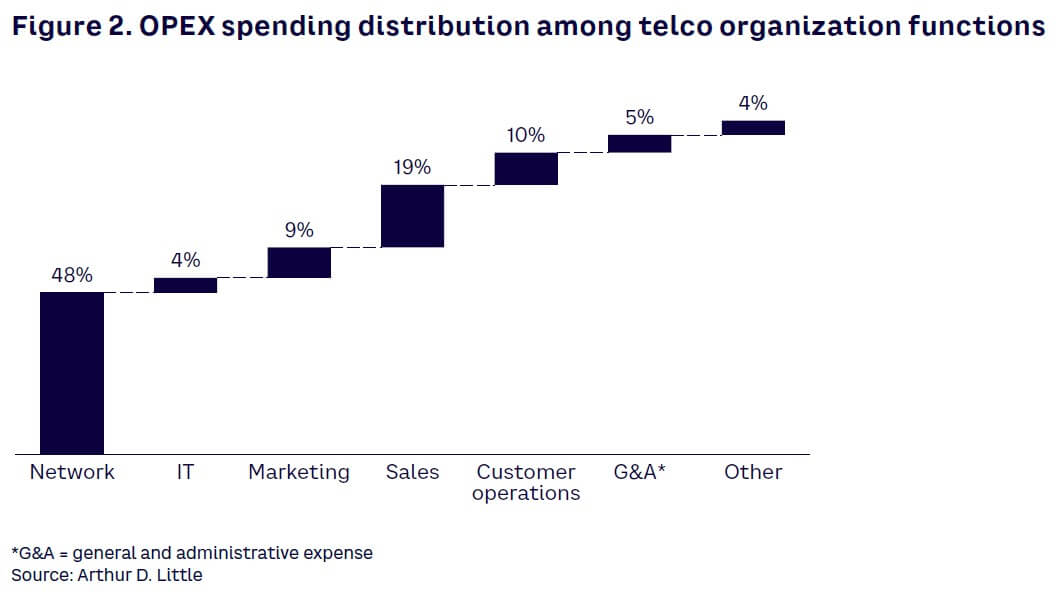

Telcos must also consider how technological trends, especially those involving the network, can enable digital transformation. In this Report, we focus on how new technologies are changing or could impact telco operators from an operational perspective (how technologies are evolving the industry and how players can monetize them) and on the functions that will have the greatest impact on margins. The majority of the OPEX spending is concentrated in network, IT, and customer-facing departments (see Figure 2).

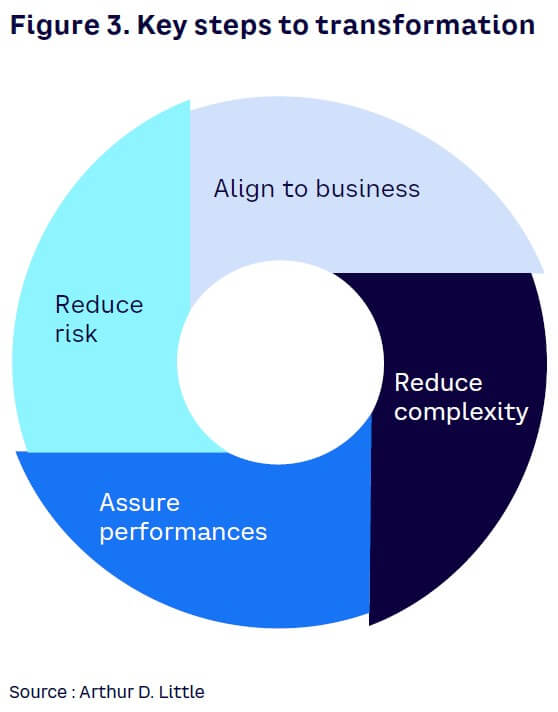

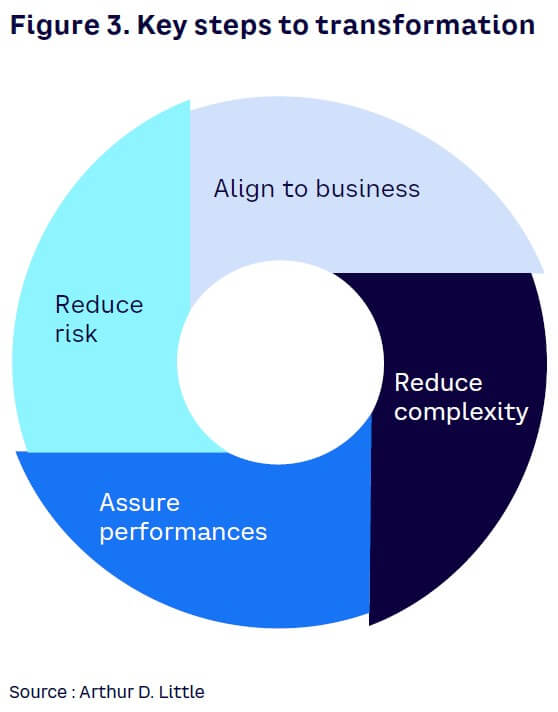

To successfully manage this transformation, we propose a four-step process (see Figure 3). First, align with the business to support the achievement; second, reduce complexity by being lean, efficient, and effective; third, ensure that the performances are aligned to market standards and best practices; fourth, operate to reduce risk during the implementation of new technologies.

In the next chapters, we share our perspectives on how five technology pillars will impact and transform the telco industry and what CxOs should do to maximize their returns from adopting the technologies in these categories:

- AI & advanced analytics

- Cloud & virtualization

- Automation

- Cybersecurity

- Digital workplace

3

AI & advanced analytics: New revenue streams

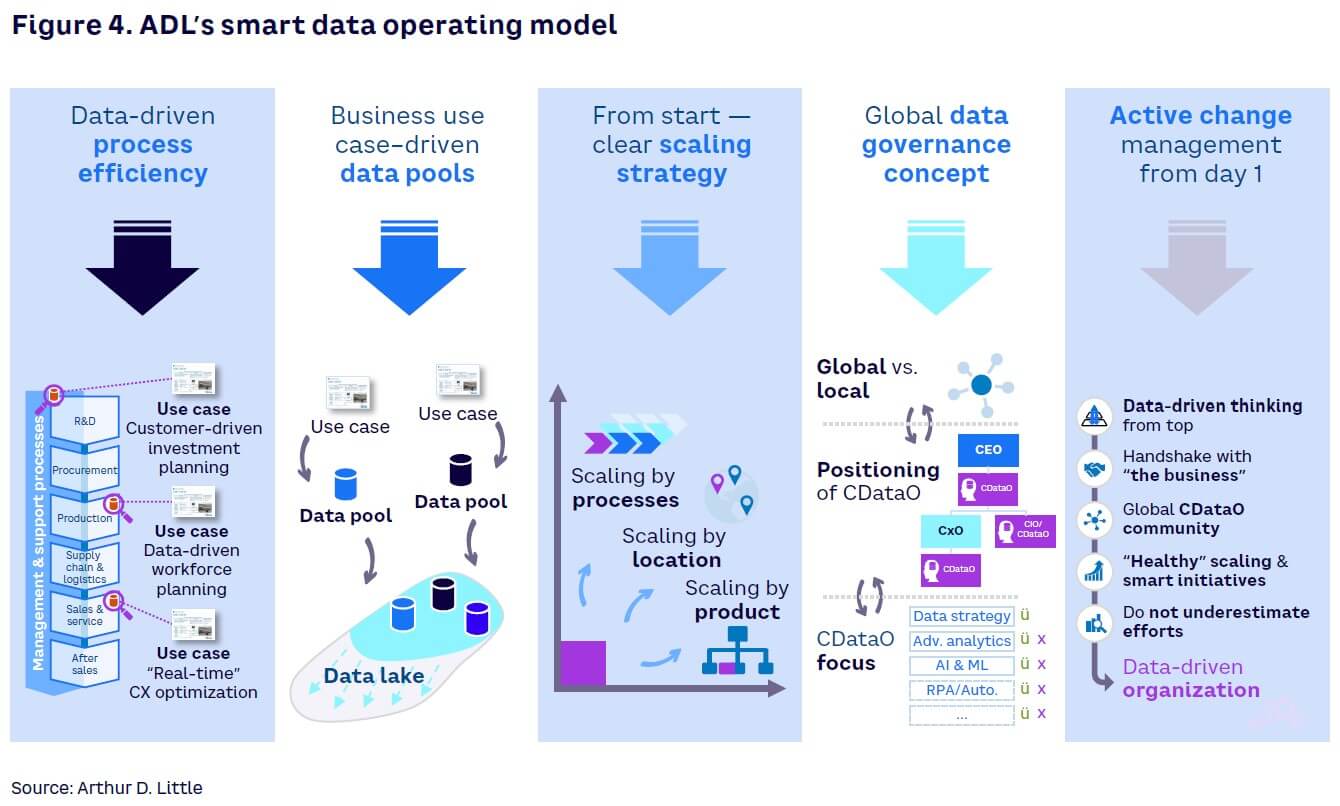

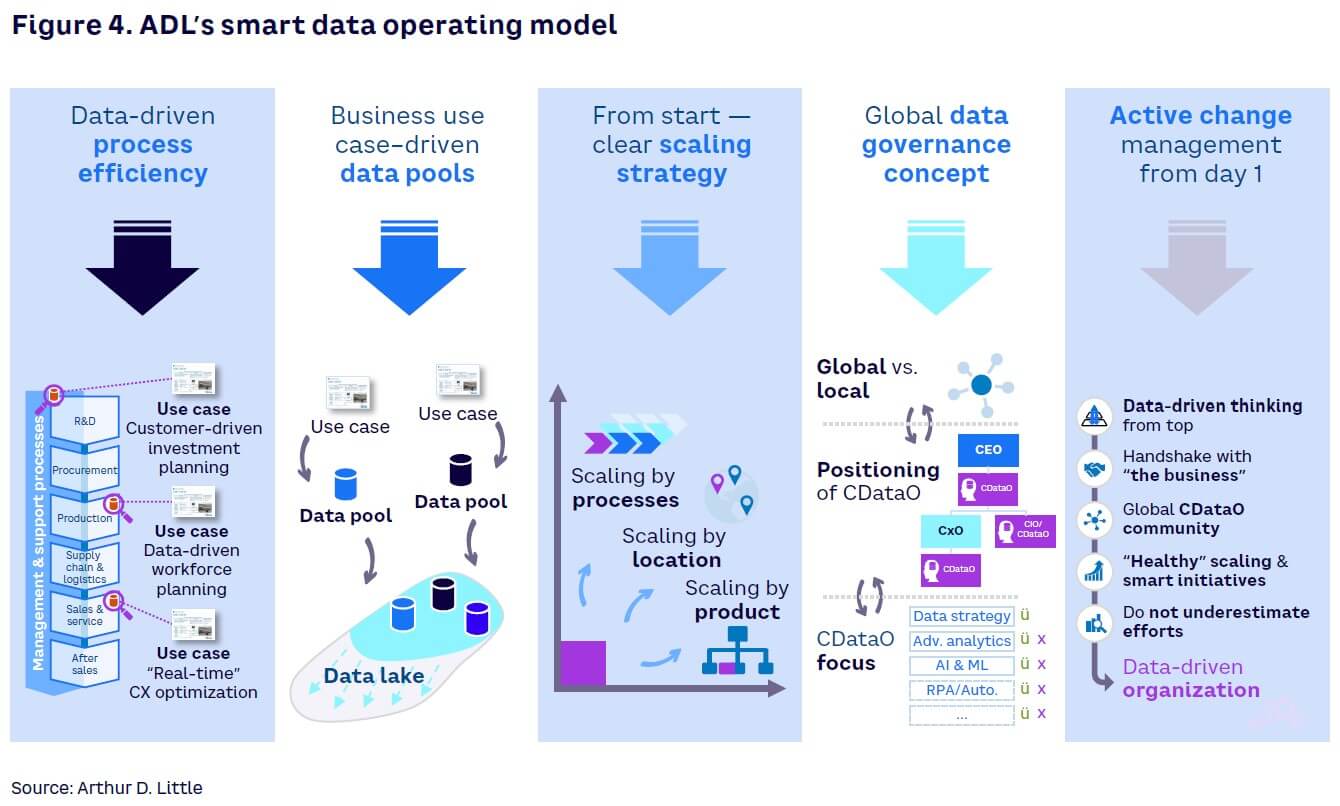

The value of data is clear, and all industries and companies are moving increasingly to data-driven processes, organizations, and applications. Digital native companies like Google, Amazon, and Facebook built their business models around extracting the highest value to improve the operating model and monetize data. Others, including telcos and insurers, are learning how to transform data into an asset they can leverage. ADL recognizes five main areas to assess within any company and around which to build a solid data operating model (see Figure 4).

Data is the key to identifying process improvements, building solid use cases to launch future technologies or maximizing value to extract from existing ones, and scaling up company strategy based on quantitative analysis. The enablers are strong data governance and a clear path to change management.

AI, along with its main components ML and machine reasoning (MR), is an innovation we experience every day and where the technology giants have invested significantly in recent years. Nowadays, this technology is pervasive; we use it in our daily lives to use maps, surf the Web, or call on our home assistant.

The explosive growth in traffic volume, connected devices, interconnected applications, services, and the massive amount of data is overwhelming telcos and operations teams, in particular. These massive amounts of data exceed the ability of human operators alone to perform analysis and take action. AI, ML, and MR allow telcos to explore the complexity and deliver event processing, correlate insights, and guide remediation.

Cisco Fellow JP Vasseur has remarked, “By 2025, AI-enabled network assurance tools will fully automate several well-defined, specific tasks very well. However, the majority of operational tasks that demand more flexible and contextual decision making will still require the expertise and intervention of human operators.”[2] Telco groups worldwide are already using AI to support their network operations to manage the complexity and deliver a higher quality of service, reducing outage periods and related costs. According to Cisco’s “2020 Global Networking Trends Report,” a single network outage in the US costs on average approximately US $400,000. The report found that 22% of telcos surveyed currently use AI for network assurance, 72% are expected to adopt AI for predictive maintenance and remediation, and 50% are considering AI as a top priority for network investments.[3]

We expect AI adoption to become pervasive across many functions, including marketing, customer operations, and networks. In fact, almost everyone we have interviewed is convinced AI in marketing will be crucial to implement next best action initiatives and finally improve CX. The majority also indicate customer operations as an area where AI can be used for complaints resolution and virtual assistance as well as network operations to improve assurance and performance.

Our own experience in running client projects confirms this trend, which involves customer-facing functions such as marketing (launching tailored offers and promotions, potentially in real time, to specific customers — so-called one-to-one marketing) and customer care (real-time assistance to customer inquiries through chatbots). AI also enables “social listening” (reading massive volumes of unstructured data) to generate business opportunities, capture opinions to enhance retention, or form habits influencing customers.

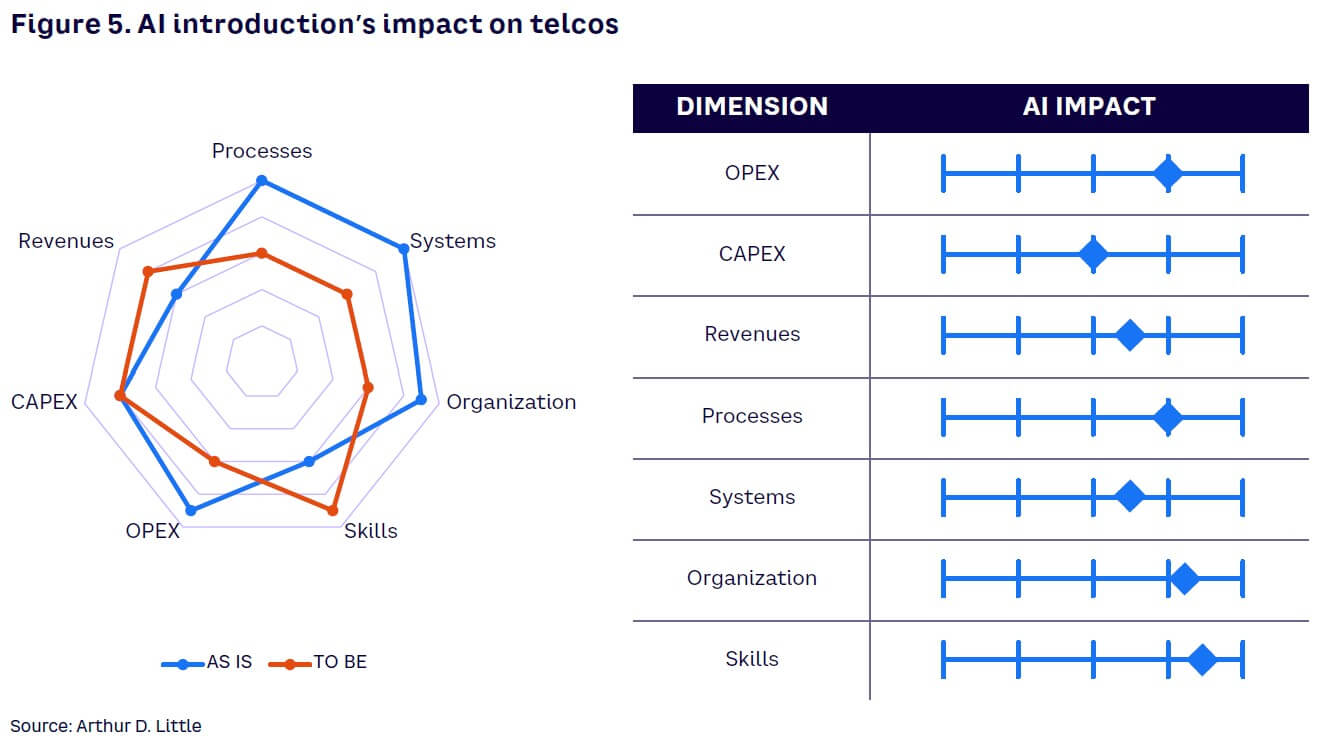

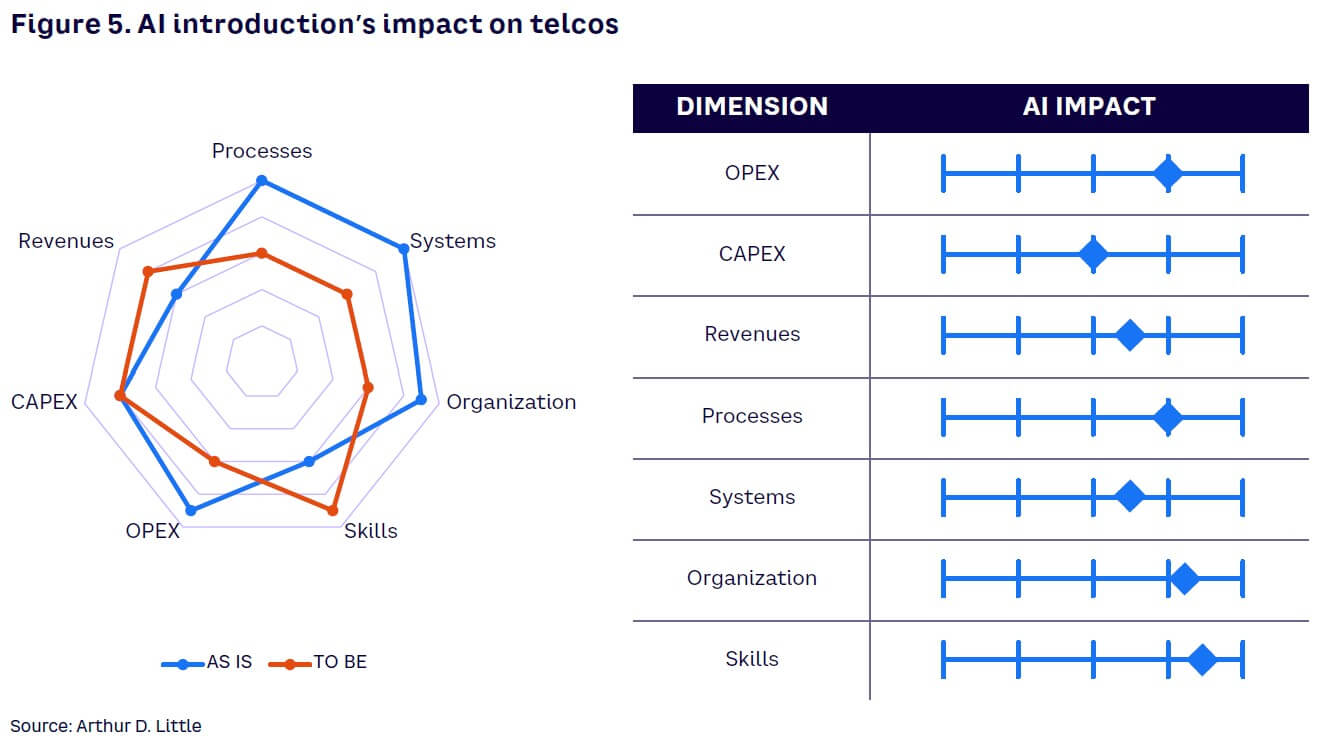

We analyzed AI from several different dimensions to highlight the changes it brings to an organization, looking not only at cost (OPEX and CAPEX) and revenues, but understanding how the operating model (processes, systems, and organization) should be adapted as well as how the required skill set needs to be modified (see Figure 5).

Based on our experience, AI could increase revenues and bring down OPEX and CAPEX (for better utilization of the network assets) but will require a redesign of the operating model. AI requires maintainability, scalability, interpretability, and reliability to move projects beyond proofs of concept and prototypes to full-scale production.

AI stands upon three pillars: DataOps, ModelOps, and DevOps. Organizations must revisit processes, systems, and organization based on these pillars in order to implement new principles across the entire pipeline to sustain high-speed code changes and reap a return on investments. In network operations, for example, where AI may be introduced to correlate alarms, telcos must identify the best potential solutions according to a problem’s root cause and apply algorithms for predictive maintenance. This requires analyzing huge volumes of data for the continuous improvement of ML techniques. The entire organization, from the front office to field maintenance, should be redesigned to ensure AI adoption’s success, including the number and type of engineers, processes, and competencies. Furthermore, telcos should pay additional attention to skills, as AI alone cannot solve network issues. Adopting AI still requires human intervention with highly skilled resources.

Results from AI implementation projects provide a synthesized view of how AI adoption impacts all seven dimensions of our analysis (shown in Figure 5). The benefits from reducing or optimizing OPEX and CAPEX spending are quite straightforward, as is identifying potential revenue upsides. To transform successfully, telcos need to reshape the processes and the organization by leveraging their resources.

Processes must be lean, as simple as possible, and integrated to ensure an end-to-end vision. They must also break down overarching barriers and silos to instill collaboration (i.e., between product development, marketing, and IT). In network operations, for example, which must manage several technologies and new services (each with specific service levels), processes must be redesigned by service and not by platform/technology, despite the reality that monitoring and troubleshooting will remain centered on platforms, to identify the root cause and solve the problem. The organization must also be organized to streamline new roles (for instance, a chief data officer to ensure end-to-end data integrity across different systems, processes, and departments). Telcos should also consider new right-sizing, which is often lower than before and thus may require managing potential overstaffing.

Implemented appropriately, AI can become a real competitive advantage for telco players, not just because it helps executives to rebalance their decreasing EBITDA margins but it also enables the creation of an ecosystem that moves toward a fully digital transformation through the digitization of manual activities. This move can enable telcos to regain some control over overall industry revenues that were lost in past years. In fact, according to the World Economic Forum, carriers’ control of the telecom industry’s profit pool has been shrinking globally in recent years, from 58% in 2010 to 45% in 2018.[4] At the same time, content manufacturers and distributors have started to control more industry profits through digital media experience and are targeting ecosystem growth areas such as cloud to compete with carriers in the fields of emerging technologies.

4

Cloud & virtualization to boost synergies

The $163 billion that operators spend on their networks today is comprised of passive and active mobile and fixed infrastructures, such as radio access network (RAN) equipment, switches and routers, cables, and fiber ducts.[5] Only a small part of CAPEX will ever be a target for cloud investment: the computing elements that can be disaggregated and centralized.

Until now, operators have been reluctant to consider the public cloud for network expenditure, but as mobile operators roll out 5G core networks and push capabilities to the edge, this could change. Virtualization of network functions has increased over recent years, and many operators plan to evolve to fully cloud-native core networks. As applications and workloads migrate to the cloud, operational roles and responsibilities will change and, in some cases, disappear. Overall, the potential for cost savings may be greater in the network than in IT because network spending is so much higher than IT expenditure. However, cost savings in IT may be more tangible and achievable in the short term. (Based on ADL’s project experience, the reduction in the total cost of ownership from moving IT to the cloud is up to 50%.)

Cloud solution providers can achieve 40% cost savings by avoiding operational challenges such as frequent hardware upgrades, time spent on manual deployments, prolonged development and release cycles, and frequent production deployment roll-backs.

We have seen no evidence so far of operators that have moved completely to the public cloud. Some have moved to private cloud leveraging a high degree of virtualization (up to 80%-85%), and others have moved just non-mission-critical applications requiring heavy elaboration time and high volumes of data (depending on privacy law constraints). However, Rakuten Mobile serves as a case study for potential industry cost savings. Rakuten developed a native cloud platform based on open RAN standards, which it now offers to other mobile operators as a service. Rakuten’s claimed results are significant: reduced CAPEX by 40% (mainly in hardware and deployment, which dropped by 60% and 50%, respectively) and OPEX by 30% (reducing rent and electricity [-25%], operations [-50%], and field maintenance [-70%] primarily due to needing fewer resources to manage the network, while doubling data center costs and increasing transmission costs by 50%) compared to a traditional mobile operator.

A Tier 1 efficient operator on average invests 13%-16% of yearly revenues in network CAPEX and OPEX spending. Hence, we estimate an EBITDA margin increase for Rakuten that is somewhere in the range of 4%-5% and CAPEX savings equivalent to 5%-6% of revenues.

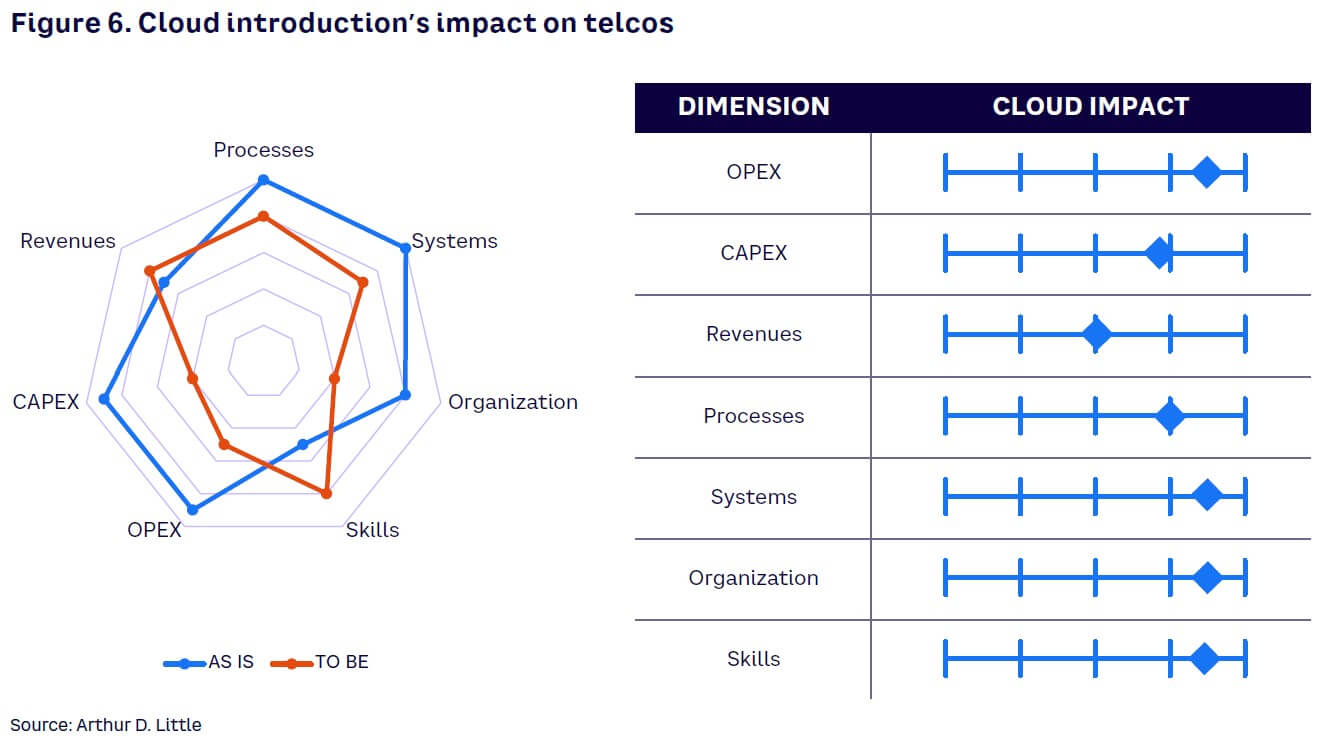

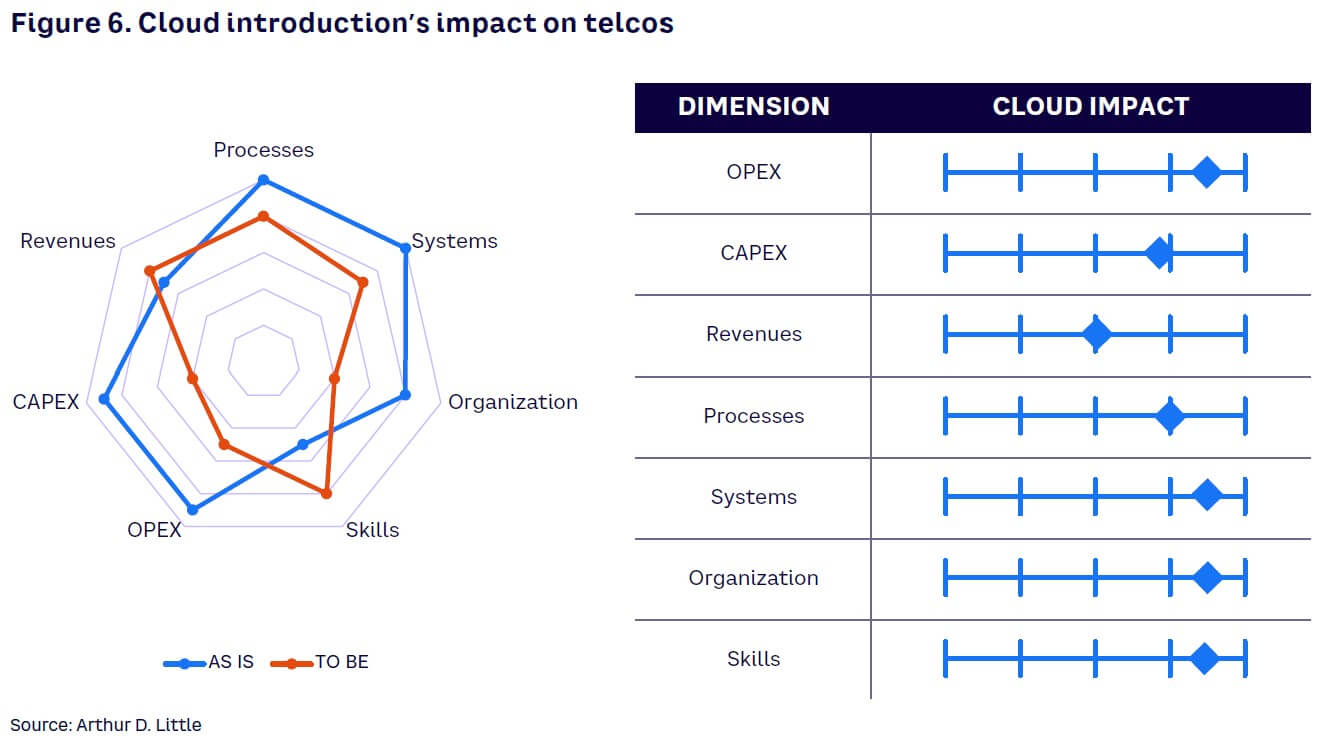

Figure 6 reveals cloud’s impact on a telco organization to be pervasive and significant. Cloud adoption not only impacts cost and margins but also requires the telco operator to completely revisit its operating model. With cloud adoption, entire processes are simplified or even disappear as they become the responsibility of the cloud provider. Resources that previously worked in-house on applications are no longer needed or are reduced to a few, while completely new competencies are required. We have found that cloud, as with any outsourced activity where a vendor has full end-to-end responsibility for activities and performances, requires a strong contract, vendor management, service-level agreements (SLAs), and KPI monitoring competencies in the retained organization. Skill requirements cannot be considered just by analyzing the fit of current skills with the target required. Instead, it requires organizations to manage resource redundancies with reskilling programs and reallocation, while identifying and planning for specific initiatives.

One example of cloud technology adoption’s impact on the business relates to the contact center. Many players across industries are moving to contact center as a service (CCaaS) to support their customers in a more agile way, introducing flexibility, effectively managing volume fluctuation, optimizing utilization of contact center applications, reducing IT dependencies with classic on-premises solutions, and supporting customers potentially from everywhere. According to Grand View Research, the CCaaS market is expected to grow with a 15.7% CAGR from 2021 to 2028.[6] Demand for the CCaaS model has grown, as the model is affordable, adaptable, and always prepared to deliver the newest communication tools. Moreover, the penetration of AI/ML technologies in contact center businesses is expected to create growth opportunities for the market. This phenomenon, together with the demand for remote working, is forcing the shift to cloud-based services to reduce integration, support, and IT costs (e.g., software licenses).

In general, the cloud supports the move to a digital workplace that followed the pandemic as well as the return to the so-called new normal, by enabling operations and deployment of business services across distributed infrastructure located anywhere. The model that enables operations performed anywhere to provide a seamless and scalable digital experience requires changes in technology infrastructure, operating model, employee competencies, customer engagement models, and sometimes underevaluated security policies.

5

Raise efficiency & achieve zero-touch with automation

Enterprises are rapidly automating a wide range of processes that require intensive human intervention, ranging from back-office activities to customer-facing ones, such as customer operations and sales. The market size for robotic process automation (RPA) is estimated to be nearing $3 billion, with many players already in the market, including giants like Microsoft.[7] Introducing automation is a clear ambition for any organization, including within the telco industry. Drivers for adoption relate to a company’s specific objectives.

In collecting clients’ opinions about what drives automation adoption and determining the most relevant and impactful ones, ADL recognizes that each driver is a lever to move to the next level of efficiency, with just one exception: we believe that automation is the killer application to improve the quality of service. Overall CX depends on the coordination and performance of the different network domains that multiply the elements to manage while preserving revenues and OPEX efficiency. In fact, Ericsson estimates that costs for telcos to improve CX will double in the next five years without employing automation, while investing in automation could mitigate or offset these cost increases. Automation, especially on RAN, which according to ADL analysis accounts for about 50% of overall network costs, can enable faster time to market; operational flexibility with automated RAN deployment; operational, optimization, and energy savings; end-to-end integration of operations and service experiences that increase satisfaction; and higher lifetime value for customers. There are several examples of European telco players that have already adopted automation, thus increasing their efficiency by up to 20% and reducing time to correlate alarms and identify the root cause (see ADL Viewpoint, “Extracting Network Operations Efficiency in the Post-COVID-19 Era”[8]).

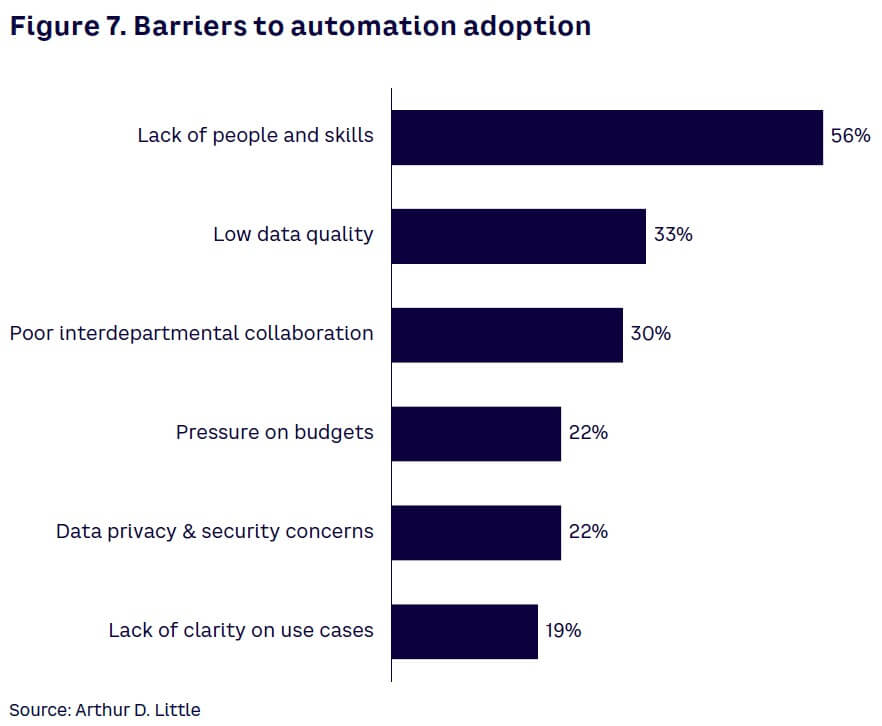

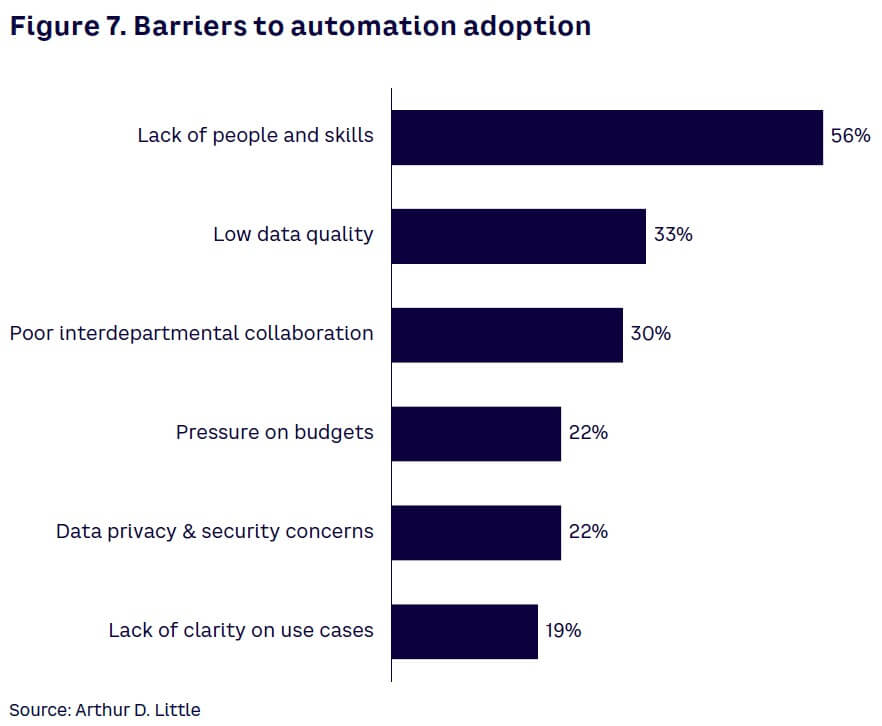

Automation is not straightforward, however. Telcos face a variety of barriers to adopting automation that must be addressed properly, as shown in Figure 7. In our discussions with telco executives, most assert that the most critical roadblock is represented by competencies, while we view two additional issues that are critical: data quality and reliability and automation implementation.

Data for new technologies is as important as a solid foundation is for a building. Without a structured data architecture, integration, and governance among the systems and departments involved, it is very hard to properly implement automation that brings expected results in terms of efficiency and productivity improvement. Not all automation adoptions are implemented properly due to two primary issues: a lack of integration between the front-office and back-office processes and processes digitally automated without a real thought to whether they should be reengineered. Both are a prelude to failure, as the result is merely automated inefficiencies. We suggest starting by highlighting areas for potential efficiency from data analysis and processes redesign to ensure delivering an effective, efficient, and consistent to-be solution.

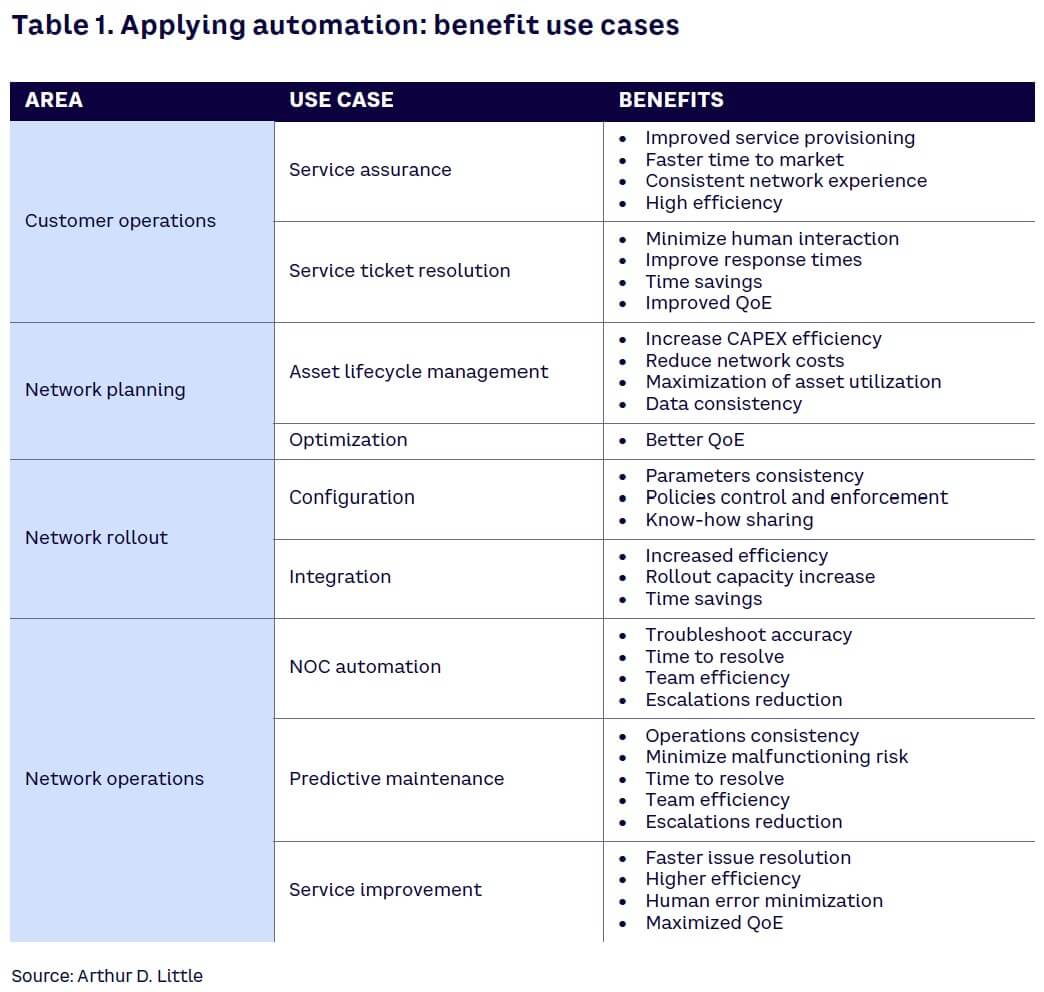

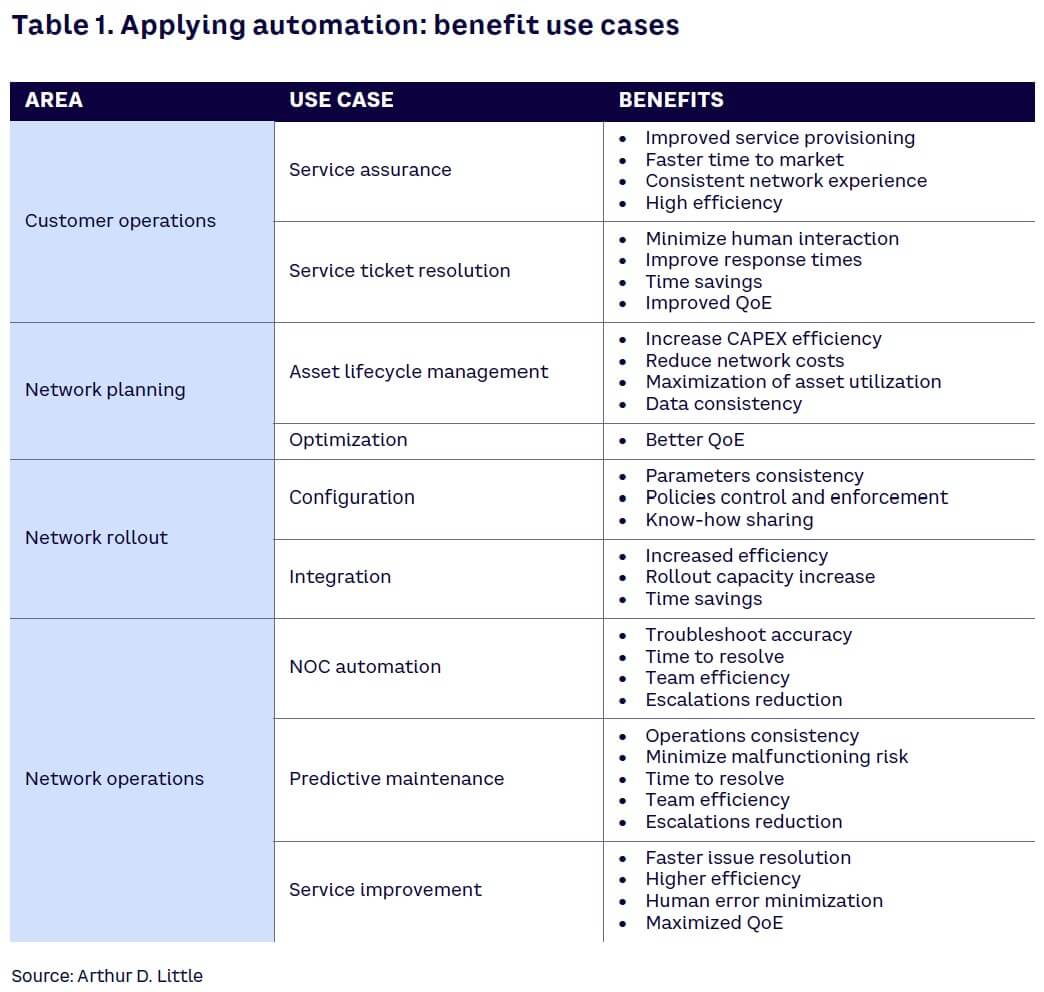

Automation adoption is company-wide. Much has been written on RPA applicability to different departments, and examples include replies to customer inquiries to the contact center provided using chatbots, frequent repetitive tasks in the back office (administration, procurement) performed by software applications, and logistics and sales processes done through Web apps. A full set of use cases in different areas exists to support operators in applying automation to achieve a wide range of benefits (see Table 1).

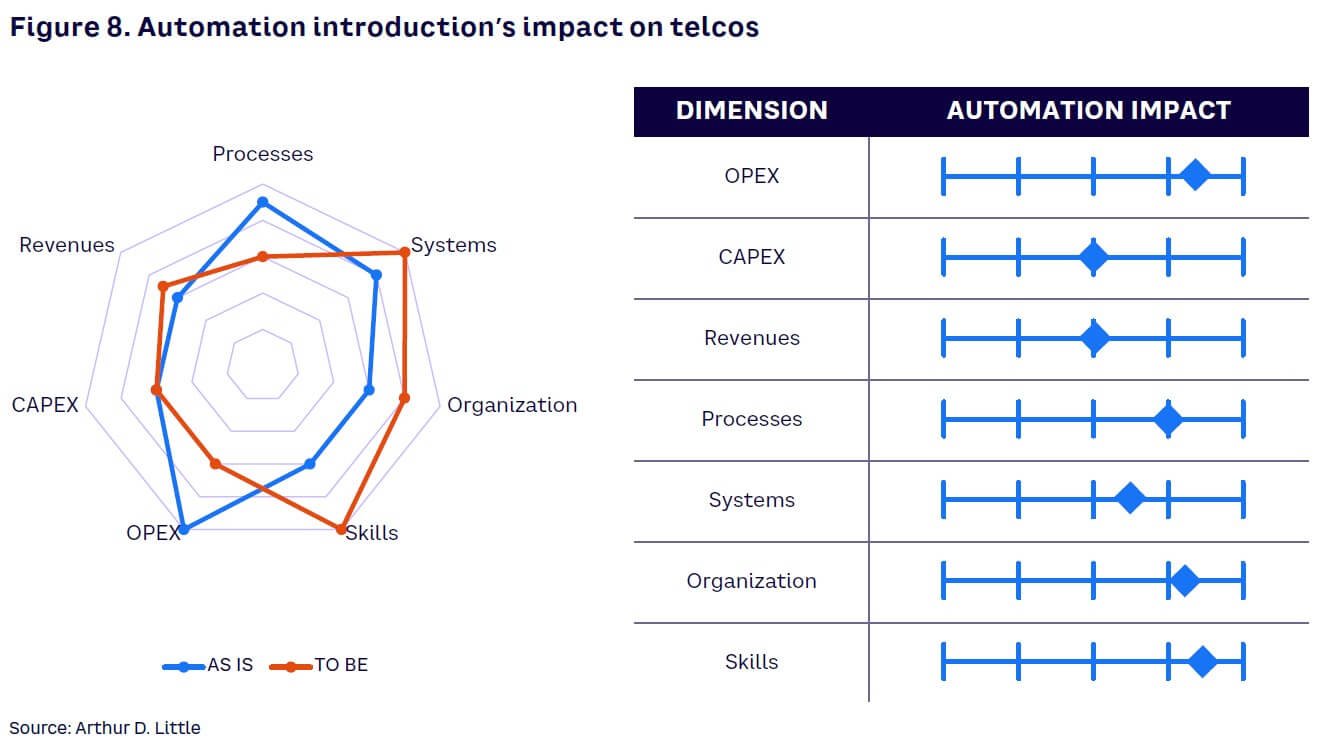

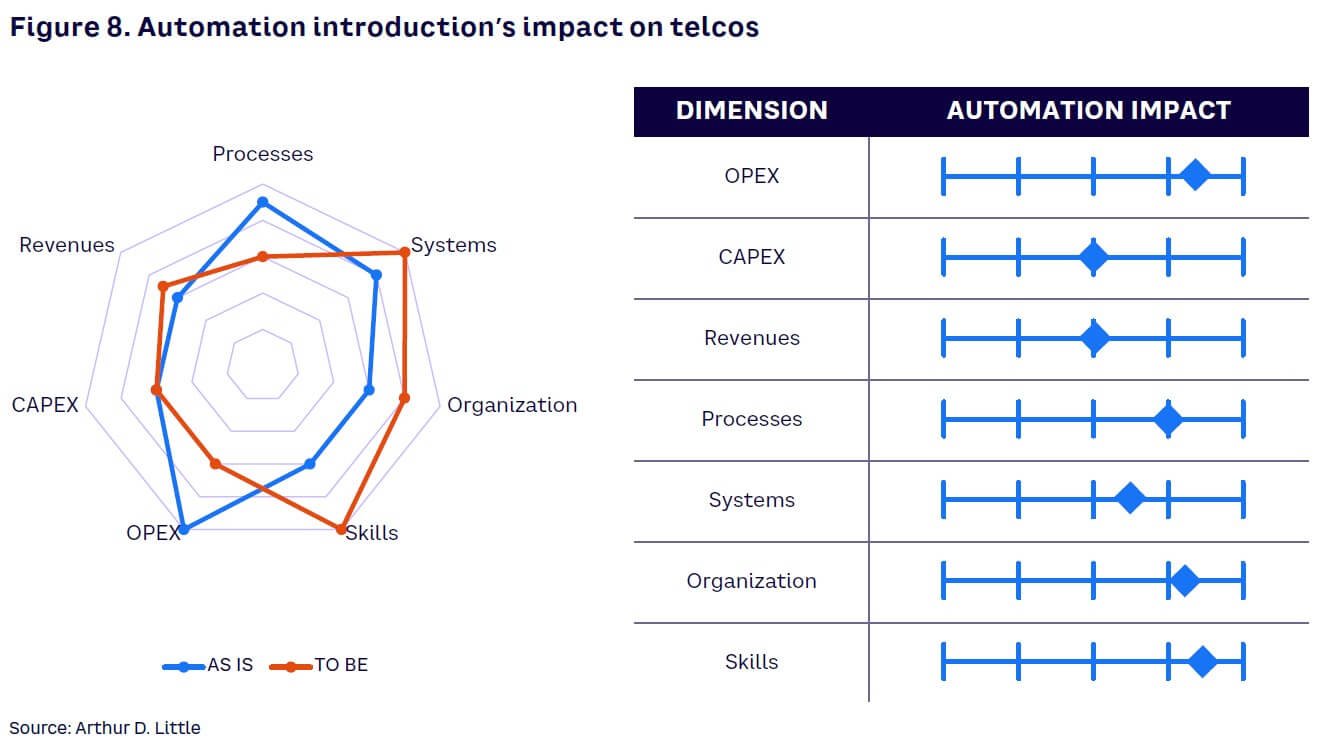

Automation adoption impacts all seven dimensions of our analysis (see Figure 8). The degree of impact likely differs by department, depending on the depth of automation and the operator’s starting point.

We have observed that the average impact of initiatives in the industry varies dramatically, especially in network operations.[9]

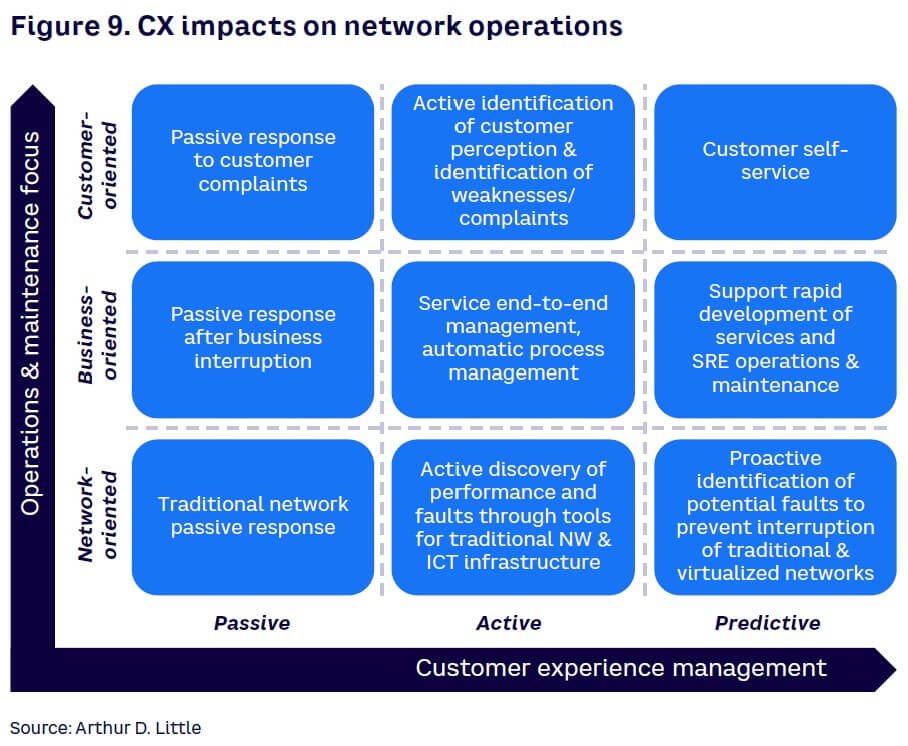

Automation is a prerequisite to moving from reactive to proactive and predictive event management, looking at operations, or provisioning network slices for end-to-end service orchestration. Operators have always built their internal and external processes using the customer as the foundation of any analysis. Well before 2000, for example, Vodafone Italy built a predictive engine to anticipate customer behavior and churn by leveraging a data warehouse system that stored customer information. Nowadays, data is a mantra and big data, advanced analytics, and AI technologies have created the right conditions to employ more sophisticated analysis and achieve more challenging targets. Operations and maintenance are shifting from being network- and business-oriented to paying increasing attention to customers.

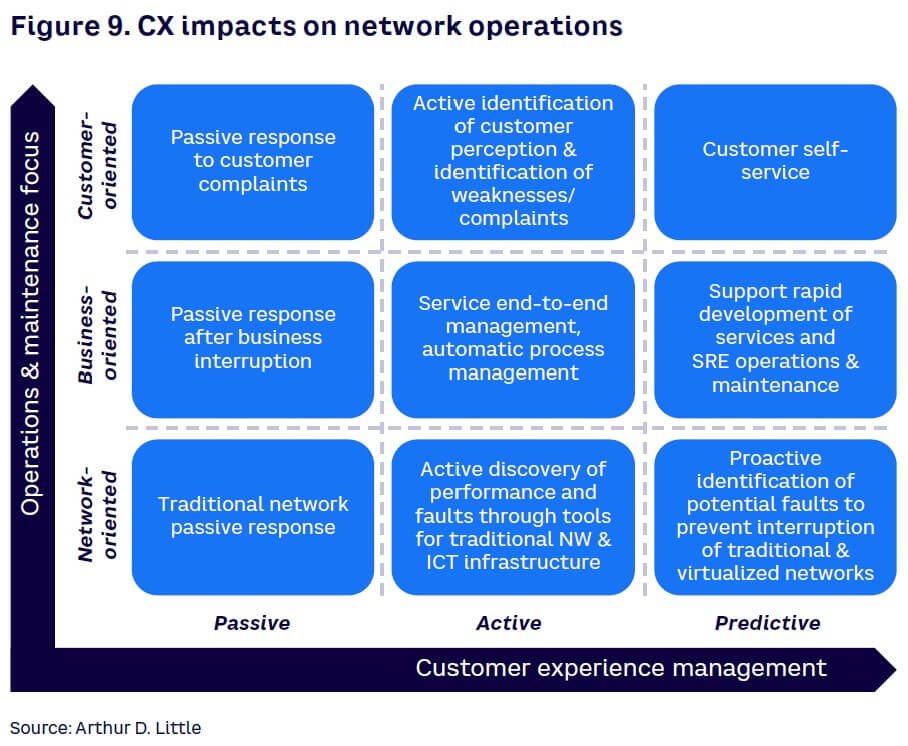

CX management impacts the entire industry, as illustrated in Figure 9. Preventive and predictive tools (e.g., customer self-service) will take the place of more reactive instruments. Thus, even if network environments become more complex, customer-oriented predictive tools will lead to the reduction of network faults, processing time, and operations cost of ownership.

A benefit of automation is increased efficiency across the whole chain that comprises the implementation and provisioning of modern networks. Automation gradually voids numerous costly and time-consuming legacy practices surrounding manual equipment configuration, troubleshooting, and maintenance, greatly reducing OPEX as well as the risk of human error and enabling improvements in network performance, leading to a self-learning, self-improving automated network. According to CTOs’ points of view, repetitive network maintenance activities that can be automated are in the range of 70%-80%, improving consistency and being 100x faster in responding to customers. Initial results from automation are encouraging: up to 80% effort reduction in engineering tasks and just one to three hours to get a site ready for on-air, thanks to automation algorithms. Improved CX, time to market, and efficiency demonstrate that early adopters can envision secure long-term returns; in fact, Cisco clients have reported 383% ROI.[10]

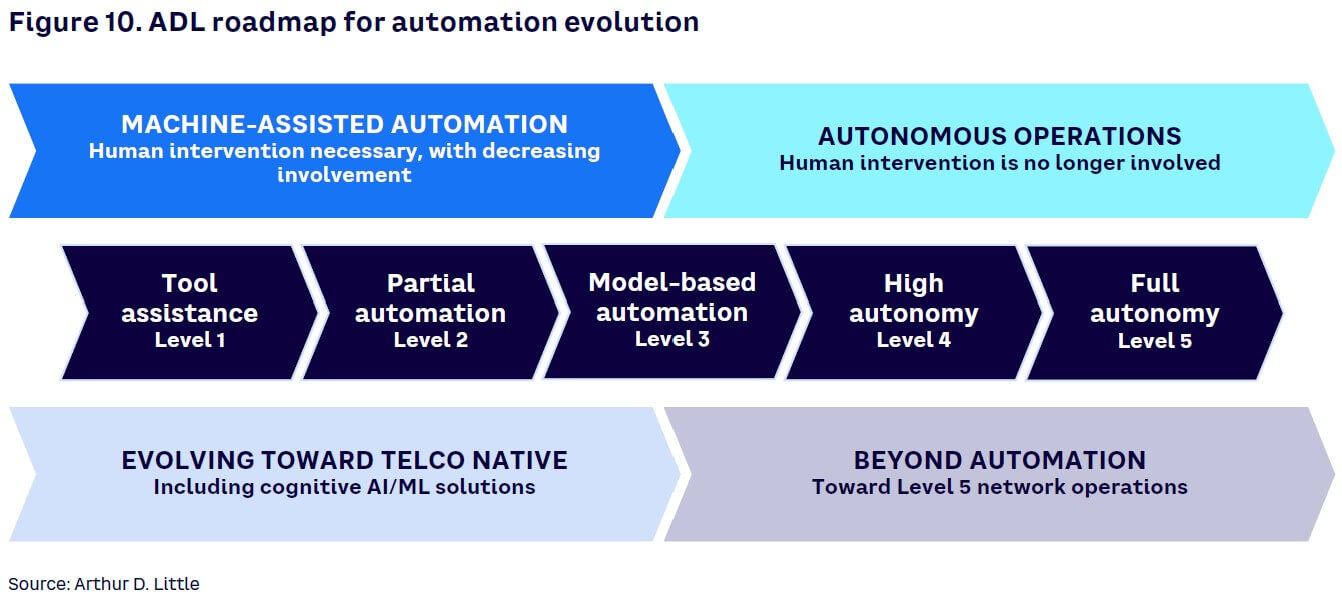

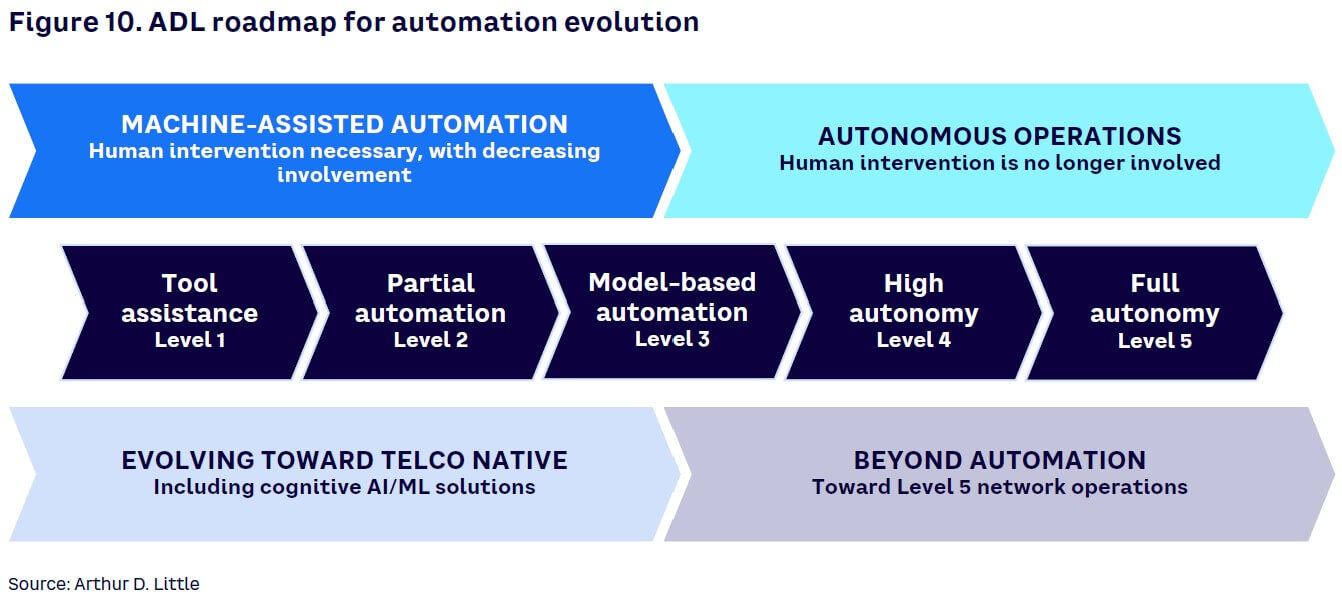

ADL advocates for turning the focus to the next level of automation, which is the starting point of telcos’ evolution toward autonomous networks: moving from zero defects to zero complaints. Thus far, this is an achievable target: although there are no fully autonomous networks deployed as yet, most advanced operators are in the middle of the journey between Level 1 and 3 (see Figure 10). However, some telcos in more advanced and mature markets have already started the so-called zero-touch journey. As an example, the German-based Deutsche Telekom group recently began its zero-touch development journey, aiming at removing any human touch starting with its network management and all the way to the final user experience.

Autonomous networks are fully automated networks supporting self-healing, self-optimizing, and self-evolving infrastructures and operations. There are six main elements characterizing autonomous networks:

- Self-governing — meaning that every action and behavior is controlled within an autonomous domain.

- Programmable — thanks to open APIs and standardized external reference points that support interoperability.

- Explainable — meaning that every action and decision made can always be explained in terms understandable to human beings.

- Composable — which means that smaller functions can build themselves up to create a new, more complex function.

- Business-driven — aiming at reaching business goals and objectives.

- Always run model-driven engineering.

Autonomous networks have the potential, on one hand, to significantly increase revenues and reduce churn by delivering real-time, high-quality services. On the other hand, they can greatly reduce long-term costs. However, there are two key issues to address when implementing such a disruptive and revolutionary system. First, the initial cost of the investment may be significant and thus should be financially managed with proper attention. In addition, operators should also strategically manage the implementation of autonomous networks to avoid a significant impact on the client’s processes and on the business itself.

Telco operators will rely on and adopt automation in general and autonomous networks specifically to manage the complexity behind the deployment of 5G, including private networks and slicing, and strict SLAs for customers that request specific services (e.g., low latency required by companies offering autonomous vehicles). A balance between new technologies deployed and capabilities is imperative to ensure network performance matches demand and expectations. To provide the required and requested level of service with an increased architecture complexity, network executives must guarantee faster response time in case of fault. Autonomous networks provide a means to compete and acquire market share, especially in B2B segments.

6

Anticipate threats by investing in cybersecurity

In a world where the pace of technology advancement keeps increasing rapidly, cyber threats are constantly transforming, becoming more and more sophisticated and dangerous. As the number of devices increases, the attack surface becomes wider and it is thus impossible to contain it in well-defined and safeguarded perimeters. Nowadays, perimeter-based security is no longer able to successfully defend against some of the most advanced cybersecurity threats. Therefore, to effectively identify and contain threats, network and security operations are required to cooperate, share data, and integrate tools and workflows.

The adoption of new technologies, models, and frameworks is generating new testing challenges, which most enterprises’ current security systems are not able to address properly. We believe that there are five primary high-risk challenges that the industry must overcome.

First, the increased scale and complexity of cloud-based and mobile-based systems challenge the solidity of current security frameworks. At the same time, however, ADL’s global benchmarks on telco spending reveal that operators in the past three years have spent much less than 1% of revenues on security. As time passes, those systems, especially the cloud-based ones, will continue to become bigger, more complex, and, therefore, more vulnerable. Setting up adequate security to address those threats requires top-tier competencies and awareness of what exactly those threats are and how they should be managed.

The second, third, and fourth challenges we have spotted concretize themselves as natural consequences of the fast growth of this industry. On one hand, as companies grow they become richer, therefore increasing the potential payoff of a cyberattack. Innovation in attack methods, technology, and modus operandi will continue to develop. On the other hand, a growing industry means more devices, and therefore a continuous increase of attack surfaces. On top of that, the widening of the volume that must be controlled comes inevitably with some lack of visibility: it will always be hard to spot all the threats in a system. All three of these challenges require security systems to be adequately prepared.

Finally, as systems become increasingly complex, the fifth challenge arises: it will be vital for security frameworks to be compliant with the new regulations, continually being monitored and updated.

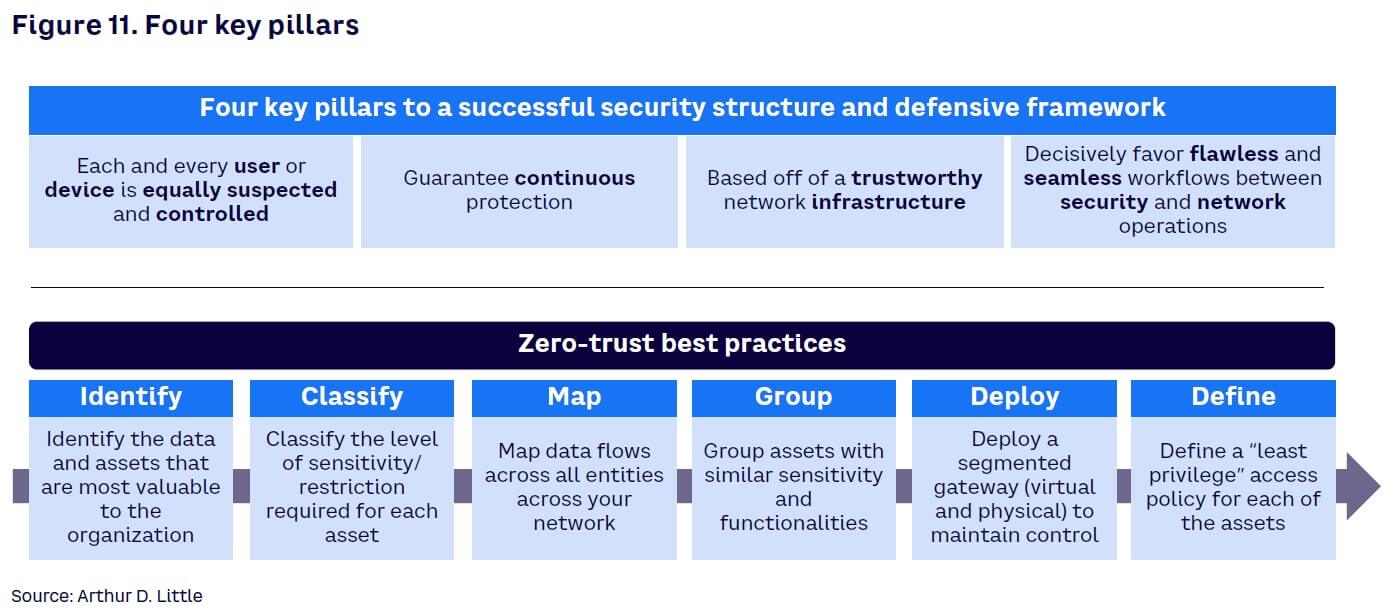

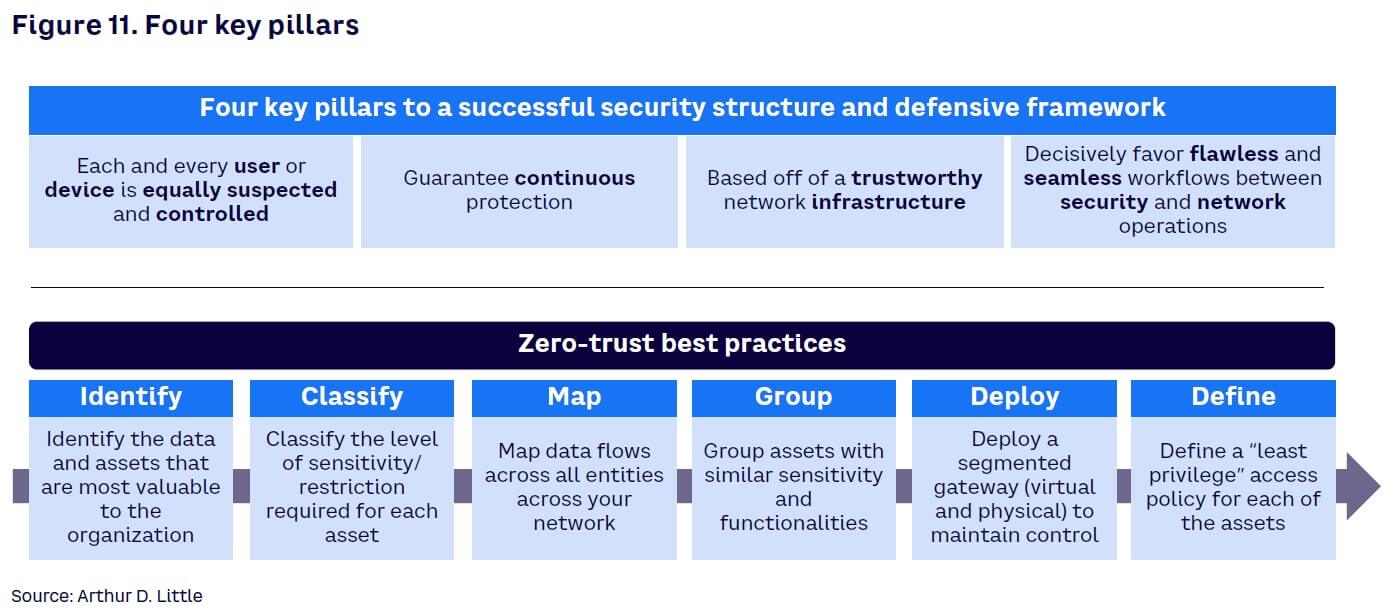

Addressing all these challenges requires a changing role for security. As we said, it is now necessary to deeply integrate security and network in order to effectively tackle these new challenges. Efficiently combining network and security, thus providing flawless communication and interactions between the two, will be vital to build a defensive framework embedded with four key pillars of a successful security structure (see Figure 11):

- It must be a zero-trust network, meaning that every user or device is equally suspected and thus controlled.

- It should guarantee continuous protection.

- It should be based on trustworthy network infrastructure.

- It should decisively favor flawless and seamless workflows between security and network operations.

According to Forrester research, a zero-trust network must embed three main aspects.[11] In the first place, it should apply controls on the network only after it has been appropriately segmented to make these controls more granular, ensuring end-point devices can link with other networks (competitor or suppliers). Second, the output of these controls should be reported with specific visibility for threat detection and response. And finally, a zero-trust network’s foundation should be completely integrated with automation and supported by cryptography algorithms (e.g., International Mobile Equipment Identity number), as data can be used as an entry point for cyber attacks.

Several drivers — such as the increasing number of cyber attacks over time; the more attractive potential payoff for cyber criminals; greater sophistication of attacks (e.g., self-propagating ransomware); and rapidly expanding number of devices (including IoT ones, with few embedded security features) — worry security executives and their implication for customers and business. Cisco’s “2020 Global Networking Trends Report” highlights the importance of managing security in the proper way. According to the report, 48% of network teams recognize the improvement of security capabilities as a priority; network strategists consider it as a top investment area, just after AI; 48% of security C-level executives believe that time to remediation is a key indicator to monitor for performance evaluation; and security operations prioritize dealing with complexity at scale.[12]

ADL sees some critical aspects to be deeply analyzed and addressed to be prepared to potential increase in cyber attacks:

- Security is a process by design (e.g., telco security team should provide requirements to devices’ vendors to reduce risk).

- Avoid “man in the middle” attacks: critical data and processes must be encrypted (e.g., IMEI can be used to simulate a safe user using “post quantum encryption” to follow computational capacity increase).

- Ensure authentication confirmation to all users inside your network.

- Implement a two-level protection (e.g., use two levels of antivirus to reduce probability of success).

- Inform and train employees to potential risks, as a majority of successful attacks derives from behaviors not following proper rules, processes, and procedures due to lack of knowledge.

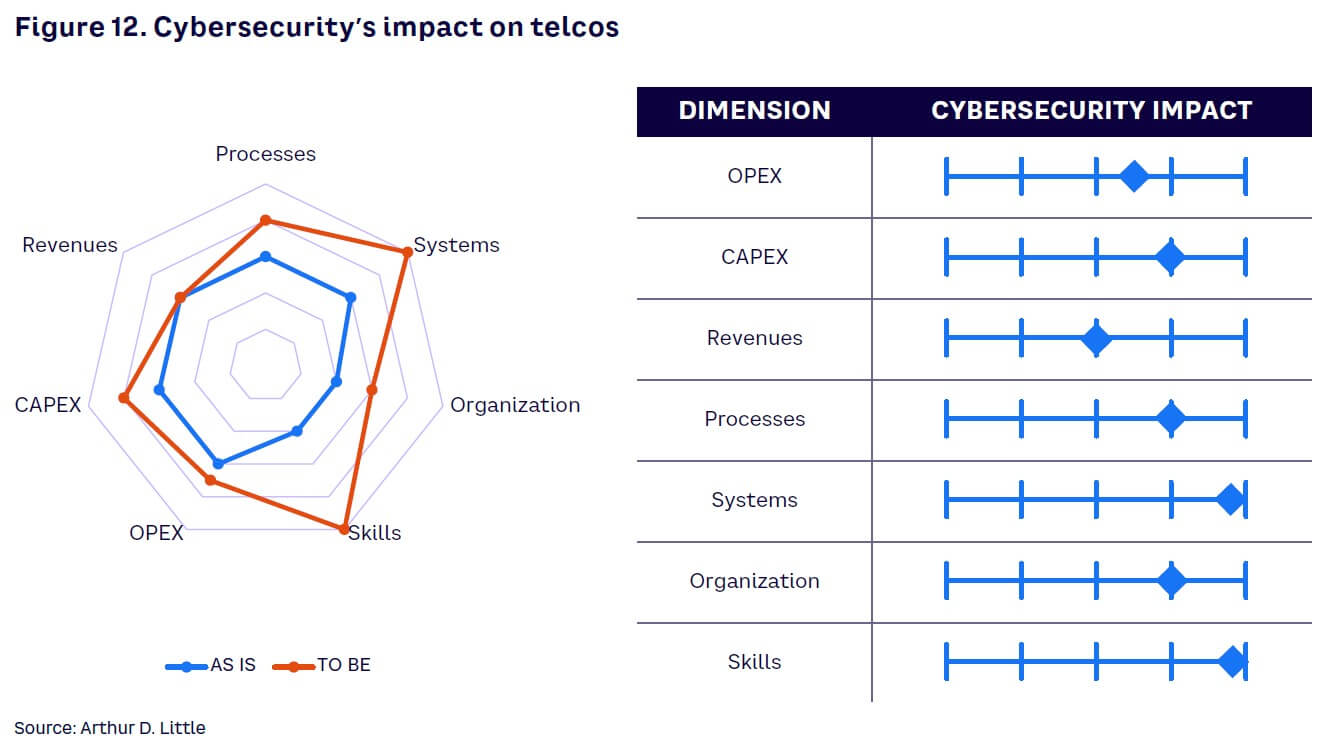

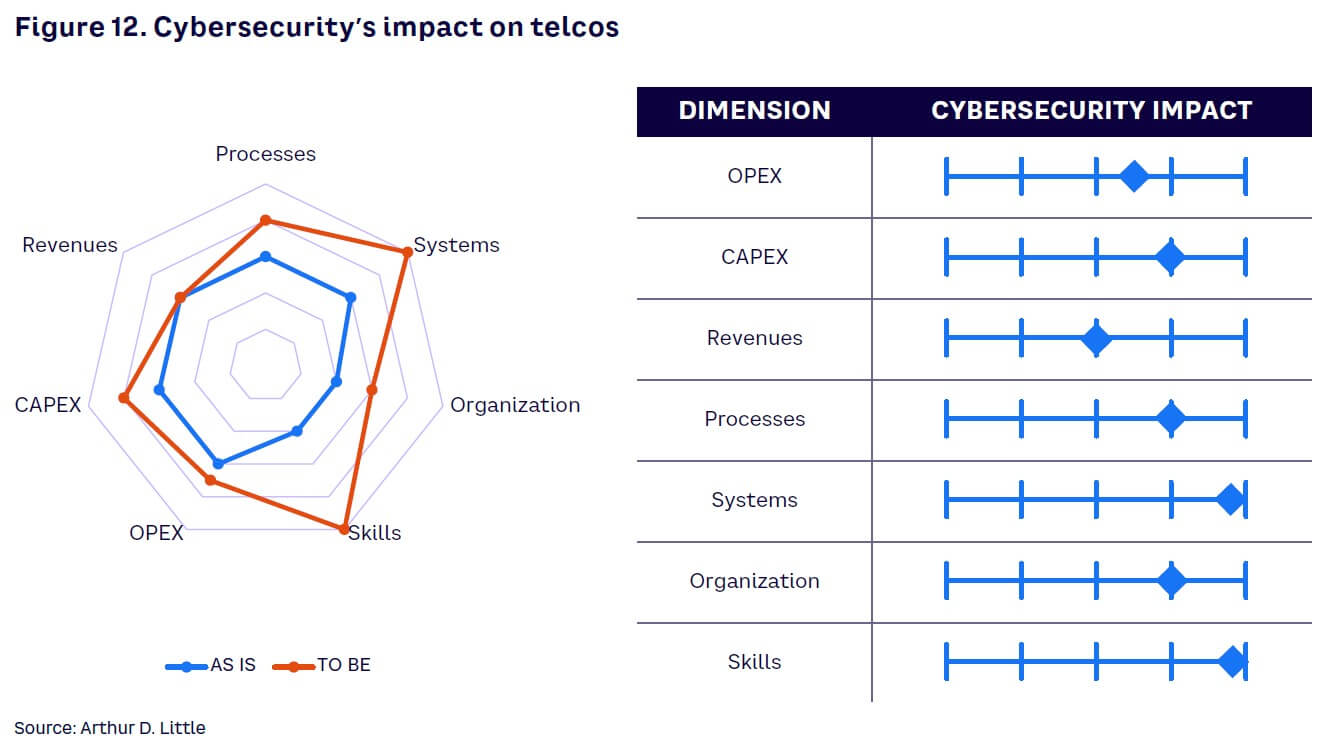

Figures related to security imply that systems, skills, organization, and processes must be adapted to manage such a threat and complexity to avoid loss of revenues and payoff costs (see Figure 12). Access to systems and data also must be secured following the latest laws and policies regarding data protection.

If, in the past, security could be treated with a best-effort approach with appliances overlayed to network equipment, the target in the digital era should consists of an intent-based approach where security is automated and detects emerging potential threats and adapts to changing policies and regulations. To achieve this, operators should invest in skilled resources fully dedicated to adapting systems, processes, and organization (e.g., establish a dedicated structure for security operations) to inspect massive volumes of data, detect and protect access to resources, and act properly in case of suspicious penetration.

In conclusion, cybersecurity is one of the most important and immediate aspects that companies must address. New challenges and new solutions are arising, requiring readiness to act. A flawless security system makes the digital environment a much safer place for customers to actively and willingly store their information.

7

Bring workplaces into the digital world

A digital workplace is crucial when it comes to understanding how new technologies can make companies better. A beautifully integrated digital workplace can significantly raise employee efficiency and engagement, thus reducing costs and increasing work output and profitability. Top companies expect their digital workplace solutions to empower employees, making them able to deliver better outputs faster. When it comes to the digital workplace and its value, two main areas are key: productivity and engagement.

A well-designed and properly structured digital workplace is widely acknowledged to optimize workers’ productivity. A plethora of studies show how much it can boost collaboration, lighten the workload, and reduce employee stress. However, we focus here on a key advantage that setting up an efficient and technologically updated digital workspace can bring to an organization: significantly increasing productivity and reducing wasted time.

An efficient digital workplace can break down technological barriers between people and offices, thus enhancing information flow and contributing to speeding up repetitive tasks. A pair of studies analyzed most of these tasks and found that they can cost as much as $29,000 per employee per year in terms of wasted time and reduced productivity.[13] In 2009, a study commissioned by the Information Overload Research Group discovered that the average employee wastes 25% of their time due to various inefficiencies; reducing wasted time and thus increasing productivity per employee could help companies reduce costs significantly.[14] To put it into perspective, a 500-employee company could save more than $2 million a year. Twelve years later and through a pandemic that forced many to work from home, wasted time remains a huge obstacle. Structuring an adequate digital workplace means addressing some of the most crucial challenges within most industries and providing measurable business value.

Aside from productivity increases, the other main advantage of implementing a proper digital workplace lies in employee engagement. People are quick to acknowledge that today’s workplaces characteristics are changing. Employees now expect a digitally driven work experience that is personal, real-time, mobile-enabled, and collaborative — all exploiting new technologies. Five years ago, a study commissioned by Dell and Intel conducted online interviews with 3,801 people around the world working full-time across seven different industries (education, government, financial services, healthcare, manufacturing, media and entertainment, and retail).[15] The results were convincingly indicative of people’s awareness: 44% of employees surveyed felt that their workspace was not smart enough, while more than 50% expected to be working in a smart office within the next five years. Five years later, the awareness of new technologies’ potential is pushing people to expect highly digital workplaces even more. In addition, another survey of HR professionals conducted by the Society for Human Resource Management found that implementing user-oriented digital workplaces has positive various externalities, such as lower absenteeism, fewer minor health problems, fewer signs of depression, fewer sleep problems, and reduced stress levels.[16]

In light of all this, the reasons to implement a properly designed digital workplace are clear, since it can extensively increase productivity, thus reducing costs and heightening people’s engagement.

Conclusion

Operators face inevitable changes driven by technological advancements that will be key to enabling faster time to market, higher revenues, increased CX, and overall operational efficiency. By taking a decisive strategic shift in transforming the organization so that it can support a future, more customer-centric business, operators make technology transformation a viable and natural option.

Driving a transformation across a multifaceted organization requires challenging the status quo across the areas we have described in this Report:

- AI & advanced analytics

- Invest in AI technology in any function — from marketing to customer operations to network and IT.

- Divert employees’ skills to support fast introduction and proper use of AI as a lever for CX improvement (especially for after-sale and operations) and monetization.

- Incent customers to use digital touchpoints to facilitate AI use and maximize its benefits.

- Cloud & virtualization

- Adopt the cloud as widely as possible to reduce complexity as well as operative costs on IT systems and applications.

- Partner with cloud providers to enrich commercial offerings to customers, especially targeting B2B.

- Explore cloud innovation in the network domain to leverage the technology as early as possible, to reduce the cost to evolve infrastructure and follow market demand.

- Combine IT and network infrastructure to create synergies.

- Automation

- Adopt automation as broadly as possible to enhance efficiency in repetitive tasks for back-office and customer-facing processes.

- Innovate sales and after-sale processes in all customer touchpoints and transition to self-service interactions.

- Move toward zero-touch in network and IT operations domains to minimize human interactions and boost responsiveness in case of fault to maximize the quality of service and CX.

- Cybersecurity

- Increase security investments in the network and IT areas, especially on firewall equipment and software to prevent fraudulent access.

- Adopt zero trust to detect threats and invest in cryptography to defend your environment from cyber attacks.

- Periodically perform vulnerability assessments through penetration testing to identify potential lack of security to be recovered and improve overall security levels.

- Digital workplace

- Invest in digital technologies to enhance productivity and reduce office and travel costs.

- Increase flexibility for employees to work from different locations using technology as support.

- Rethink using KPIs to evaluate employees’ performances, moving instead to a results-based approach.

Operators may find this endeavor demanding, and they may well face barriers such as lack of valuable resources or required skills, among others. To succeed, operators must realize that technology is no longer just a prerequisite but can be a driver of value to enhance CX and support new, innovative services. They must also establish grounded processes and ways of doing business and ensure efficient execution, leveraging technology as a competitive advantage. In this way, operators can effectively navigate the strategic choices that leverage the right support and methodologies. In turn, they will realize their transformation visions and be better prepared for the new landscape of next-generation connectivity.

Notes

[1] “Accelerating the Intelligent Enterprise.” EY Global, 2019.

[2] “2020 Global Networking Trends Report.” Cisco, 2020.

[3] Ibid.

[4] “Digital Transformation Initiative: Telecommunication Industry.” World Economic Forum, January 2017.

[5] Newman, Mark. “Cloud & Automation: Changing CSPs’ Outlook.” TM Forum, April 2021.

[6] “Contact Center as a Service Market Growth & Trends.” Grand View Research, July 2021.

[7] Sutner, Shaun. “RPA Market Booms as Enterprises Automate with Bots.” TechTarget, 26 August 2021.

[8] Basile, Vincenzo, et al. “Extracting Network Operations Efficiency in the Post-COVID-19 Era.” Arthur D. Little, February 2021.

[9] Basile, Vincenzo, et al. “Extracting Network Operations Efficiency in the Post-COVID-19 Era.” Arthur D. Little, February 2021; Basile, Vincenzo, et al. “Beyond the Best Network Operations!” Arthur D. Little, January 2017.

[10] “The Business Benefits of Automation and Orchestration White Paper.” Cisco, 24 January 2022.

[11] Shey, Heidi, et al. “The Zero Trust eXtended Ecosystem: Data.” Forrester, 11 August 2021.

[12] “2022 Global Networking Trends Report: The Rise of NaaS.” Cisco, 2021.

[13] Schubmehl, David, and Dan Vesset. “The Knowledge Quotient: Unlocking the Hidden Value of Information.” IDC, July 2014; “A Study of Trends, Costs, and Attitudes Toward Business Travel and Teleconferencing, and Their Impact on Productivity.” InfoCom, 2018.

[14] Ganz, John, Angele Boyd, and Seana Dowling. “Cutting the Clutter: Tackling Information Overload at the Source.” IDC, March 2009.

[15] “Future Workforce Study, United Kingdom.” Dell/Intel, 2016.

[16] “Workplace Flexibility in the 21st Century.” Society for Human Resource Management, 2008.

DOWNLOAD THE FULL REPORT

Operations 4.0

The five tech pillars that will make or break telco operators in 2022

DATE

Executive Summary

Reaping rewards of new trends without breaking the bank

In all markets, there is an alarming and growing gap between stagnant revenues and the increasing level of investment required to introduce new technologies in the telco sector. The game has changed: supporting soaring data traffic, improving quality of service, and delivering new ways of working are no longer just nice-to-haves, they are operational keystones upon which the future of the entire enterprise depends.

The resulting pressure on margins and cash flow intensifies as the need to deliver growth and better quality of service faces off against increases in OPEX and CAPEX, while management remains unwilling to cut dividends for shareholders. The first action major telco players have taken to fund investment needs is signing network-sharing agreements with TowerCos. As a second step, telcos are even evaluating the creation of NetCos to sell to the market.

As a result of continual technological disruption, such as hypercompetition and sustainability at the global level, the telco value chain is rapidly evolving toward Operations 4.0 as an integrated part of its digital transformation pathway. In this Report, we highlight five emerging tech opportunities that can drive radical performance improvement in future telco operations as well as generate new revenue streams to energize telcos to establish a competitive advantage in the new landscape.

1

The challenge: Monetize investments in tech innovation

The telco industry has been changing rapidly for many years, but the pace of evolution now appears to be faster than ever. Telcos face growing complexity due to technology innovations like 5G and the Internet of Things (IoT), as well as increased competition. They are also experiencing greater pressure on their financial performance. In fact, Capital IQ research has reported that, in the past few years, revenues of the top 50 telco players by turnover have grown by 3.6% CAGR, while EBITDA has increased by only 0.6% CAGR.[1] The point is not whether telcos must transform, but rather how to successfully drive the evolution.

With cooperation from telecom CEOs and C-level executives across continents, Arthur D. Little (ADL) has identified some critical questions that telcos must answer to illuminate the challenge:

- What disruptive forces are enabled by digital technologies in our industry ecosystem?

- What market and client requirements do we need to meet with our operations, and how important are they?

- Which applications of technology will bring real value to our operations, in the short and long term?

- What does the resulting future state of operations look like and what benefits (financial, business model) can we expect?

- How do we get access to know-how and technology to successfully manage this transition?

The need for growth and diversification beyond core business, the demand for a best-in-class customer experience (CX), and higher complexity due to new technologies are pushing executives to look for a higher degree of flexibility and efficiency. Many technology opportunities, including artificial intelligence (AI), advanced analytics, autonomous systems, cloud computing, IoT, 5G, and smart robots, will help drive telco performances along the supply chain. All these new technologies will push far beyond current efficiency targets and will redefine the telcos’ operating model (processes, systems, organization, skill set). We believe they also have the potential to generate new revenue streams and can improve current economics and enable reinvestment in high-potential growth areas.

Some telco executives have already started focusing on these topics and are redesigning the telco paradigm by rethinking their business and operating models. Increasing digitalization will redefine value offerings and further adoption of Operations 4.0 (see Figure 1) to manage and surf the disruption, and new trends will overcome the challenges they are facing.

2

Make tech work to enable digital transformation

Mobile network operators across the globe are investing — or will invest soon — in new technologies such as 5G, distributed antenna systems, small and pico cells, IoT, cloud, and AI/machine learning (ML). This will require huge CAPEX (according to ADL analysis, up to 20% of EBITDA, depending on market share, market strategy, and average revenue per user). Investments will enable new services like smart cities, smart homes, eHealth, and autonomous vehicles, allowing customers to fully exploit their experience with better quality of service (e.g., higher downlink and uplink throughput for eHealth and low latency for online gaming).

The main challenge for operators is how to monetize these investments through revenue generation and/or cost efficiencies. Before they can make any strategic decision, telcos must assess and develop use cases to determine the profitability of these new technologies within the entire ecosystem.

Telcos must also consider how technological trends, especially those involving the network, can enable digital transformation. In this Report, we focus on how new technologies are changing or could impact telco operators from an operational perspective (how technologies are evolving the industry and how players can monetize them) and on the functions that will have the greatest impact on margins. The majority of the OPEX spending is concentrated in network, IT, and customer-facing departments (see Figure 2).

To successfully manage this transformation, we propose a four-step process (see Figure 3). First, align with the business to support the achievement; second, reduce complexity by being lean, efficient, and effective; third, ensure that the performances are aligned to market standards and best practices; fourth, operate to reduce risk during the implementation of new technologies.

In the next chapters, we share our perspectives on how five technology pillars will impact and transform the telco industry and what CxOs should do to maximize their returns from adopting the technologies in these categories:

- AI & advanced analytics

- Cloud & virtualization

- Automation

- Cybersecurity

- Digital workplace

3

AI & advanced analytics: New revenue streams

The value of data is clear, and all industries and companies are moving increasingly to data-driven processes, organizations, and applications. Digital native companies like Google, Amazon, and Facebook built their business models around extracting the highest value to improve the operating model and monetize data. Others, including telcos and insurers, are learning how to transform data into an asset they can leverage. ADL recognizes five main areas to assess within any company and around which to build a solid data operating model (see Figure 4).

Data is the key to identifying process improvements, building solid use cases to launch future technologies or maximizing value to extract from existing ones, and scaling up company strategy based on quantitative analysis. The enablers are strong data governance and a clear path to change management.

AI, along with its main components ML and machine reasoning (MR), is an innovation we experience every day and where the technology giants have invested significantly in recent years. Nowadays, this technology is pervasive; we use it in our daily lives to use maps, surf the Web, or call on our home assistant.

The explosive growth in traffic volume, connected devices, interconnected applications, services, and the massive amount of data is overwhelming telcos and operations teams, in particular. These massive amounts of data exceed the ability of human operators alone to perform analysis and take action. AI, ML, and MR allow telcos to explore the complexity and deliver event processing, correlate insights, and guide remediation.

Cisco Fellow JP Vasseur has remarked, “By 2025, AI-enabled network assurance tools will fully automate several well-defined, specific tasks very well. However, the majority of operational tasks that demand more flexible and contextual decision making will still require the expertise and intervention of human operators.”[2] Telco groups worldwide are already using AI to support their network operations to manage the complexity and deliver a higher quality of service, reducing outage periods and related costs. According to Cisco’s “2020 Global Networking Trends Report,” a single network outage in the US costs on average approximately US $400,000. The report found that 22% of telcos surveyed currently use AI for network assurance, 72% are expected to adopt AI for predictive maintenance and remediation, and 50% are considering AI as a top priority for network investments.[3]

We expect AI adoption to become pervasive across many functions, including marketing, customer operations, and networks. In fact, almost everyone we have interviewed is convinced AI in marketing will be crucial to implement next best action initiatives and finally improve CX. The majority also indicate customer operations as an area where AI can be used for complaints resolution and virtual assistance as well as network operations to improve assurance and performance.

Our own experience in running client projects confirms this trend, which involves customer-facing functions such as marketing (launching tailored offers and promotions, potentially in real time, to specific customers — so-called one-to-one marketing) and customer care (real-time assistance to customer inquiries through chatbots). AI also enables “social listening” (reading massive volumes of unstructured data) to generate business opportunities, capture opinions to enhance retention, or form habits influencing customers.

We analyzed AI from several different dimensions to highlight the changes it brings to an organization, looking not only at cost (OPEX and CAPEX) and revenues, but understanding how the operating model (processes, systems, and organization) should be adapted as well as how the required skill set needs to be modified (see Figure 5).

Based on our experience, AI could increase revenues and bring down OPEX and CAPEX (for better utilization of the network assets) but will require a redesign of the operating model. AI requires maintainability, scalability, interpretability, and reliability to move projects beyond proofs of concept and prototypes to full-scale production.

AI stands upon three pillars: DataOps, ModelOps, and DevOps. Organizations must revisit processes, systems, and organization based on these pillars in order to implement new principles across the entire pipeline to sustain high-speed code changes and reap a return on investments. In network operations, for example, where AI may be introduced to correlate alarms, telcos must identify the best potential solutions according to a problem’s root cause and apply algorithms for predictive maintenance. This requires analyzing huge volumes of data for the continuous improvement of ML techniques. The entire organization, from the front office to field maintenance, should be redesigned to ensure AI adoption’s success, including the number and type of engineers, processes, and competencies. Furthermore, telcos should pay additional attention to skills, as AI alone cannot solve network issues. Adopting AI still requires human intervention with highly skilled resources.

Results from AI implementation projects provide a synthesized view of how AI adoption impacts all seven dimensions of our analysis (shown in Figure 5). The benefits from reducing or optimizing OPEX and CAPEX spending are quite straightforward, as is identifying potential revenue upsides. To transform successfully, telcos need to reshape the processes and the organization by leveraging their resources.

Processes must be lean, as simple as possible, and integrated to ensure an end-to-end vision. They must also break down overarching barriers and silos to instill collaboration (i.e., between product development, marketing, and IT). In network operations, for example, which must manage several technologies and new services (each with specific service levels), processes must be redesigned by service and not by platform/technology, despite the reality that monitoring and troubleshooting will remain centered on platforms, to identify the root cause and solve the problem. The organization must also be organized to streamline new roles (for instance, a chief data officer to ensure end-to-end data integrity across different systems, processes, and departments). Telcos should also consider new right-sizing, which is often lower than before and thus may require managing potential overstaffing.

Implemented appropriately, AI can become a real competitive advantage for telco players, not just because it helps executives to rebalance their decreasing EBITDA margins but it also enables the creation of an ecosystem that moves toward a fully digital transformation through the digitization of manual activities. This move can enable telcos to regain some control over overall industry revenues that were lost in past years. In fact, according to the World Economic Forum, carriers’ control of the telecom industry’s profit pool has been shrinking globally in recent years, from 58% in 2010 to 45% in 2018.[4] At the same time, content manufacturers and distributors have started to control more industry profits through digital media experience and are targeting ecosystem growth areas such as cloud to compete with carriers in the fields of emerging technologies.

4

Cloud & virtualization to boost synergies

The $163 billion that operators spend on their networks today is comprised of passive and active mobile and fixed infrastructures, such as radio access network (RAN) equipment, switches and routers, cables, and fiber ducts.[5] Only a small part of CAPEX will ever be a target for cloud investment: the computing elements that can be disaggregated and centralized.

Until now, operators have been reluctant to consider the public cloud for network expenditure, but as mobile operators roll out 5G core networks and push capabilities to the edge, this could change. Virtualization of network functions has increased over recent years, and many operators plan to evolve to fully cloud-native core networks. As applications and workloads migrate to the cloud, operational roles and responsibilities will change and, in some cases, disappear. Overall, the potential for cost savings may be greater in the network than in IT because network spending is so much higher than IT expenditure. However, cost savings in IT may be more tangible and achievable in the short term. (Based on ADL’s project experience, the reduction in the total cost of ownership from moving IT to the cloud is up to 50%.)

Cloud solution providers can achieve 40% cost savings by avoiding operational challenges such as frequent hardware upgrades, time spent on manual deployments, prolonged development and release cycles, and frequent production deployment roll-backs.

We have seen no evidence so far of operators that have moved completely to the public cloud. Some have moved to private cloud leveraging a high degree of virtualization (up to 80%-85%), and others have moved just non-mission-critical applications requiring heavy elaboration time and high volumes of data (depending on privacy law constraints). However, Rakuten Mobile serves as a case study for potential industry cost savings. Rakuten developed a native cloud platform based on open RAN standards, which it now offers to other mobile operators as a service. Rakuten’s claimed results are significant: reduced CAPEX by 40% (mainly in hardware and deployment, which dropped by 60% and 50%, respectively) and OPEX by 30% (reducing rent and electricity [-25%], operations [-50%], and field maintenance [-70%] primarily due to needing fewer resources to manage the network, while doubling data center costs and increasing transmission costs by 50%) compared to a traditional mobile operator.

A Tier 1 efficient operator on average invests 13%-16% of yearly revenues in network CAPEX and OPEX spending. Hence, we estimate an EBITDA margin increase for Rakuten that is somewhere in the range of 4%-5% and CAPEX savings equivalent to 5%-6% of revenues.

Figure 6 reveals cloud’s impact on a telco organization to be pervasive and significant. Cloud adoption not only impacts cost and margins but also requires the telco operator to completely revisit its operating model. With cloud adoption, entire processes are simplified or even disappear as they become the responsibility of the cloud provider. Resources that previously worked in-house on applications are no longer needed or are reduced to a few, while completely new competencies are required. We have found that cloud, as with any outsourced activity where a vendor has full end-to-end responsibility for activities and performances, requires a strong contract, vendor management, service-level agreements (SLAs), and KPI monitoring competencies in the retained organization. Skill requirements cannot be considered just by analyzing the fit of current skills with the target required. Instead, it requires organizations to manage resource redundancies with reskilling programs and reallocation, while identifying and planning for specific initiatives.

One example of cloud technology adoption’s impact on the business relates to the contact center. Many players across industries are moving to contact center as a service (CCaaS) to support their customers in a more agile way, introducing flexibility, effectively managing volume fluctuation, optimizing utilization of contact center applications, reducing IT dependencies with classic on-premises solutions, and supporting customers potentially from everywhere. According to Grand View Research, the CCaaS market is expected to grow with a 15.7% CAGR from 2021 to 2028.[6] Demand for the CCaaS model has grown, as the model is affordable, adaptable, and always prepared to deliver the newest communication tools. Moreover, the penetration of AI/ML technologies in contact center businesses is expected to create growth opportunities for the market. This phenomenon, together with the demand for remote working, is forcing the shift to cloud-based services to reduce integration, support, and IT costs (e.g., software licenses).

In general, the cloud supports the move to a digital workplace that followed the pandemic as well as the return to the so-called new normal, by enabling operations and deployment of business services across distributed infrastructure located anywhere. The model that enables operations performed anywhere to provide a seamless and scalable digital experience requires changes in technology infrastructure, operating model, employee competencies, customer engagement models, and sometimes underevaluated security policies.

5

Raise efficiency & achieve zero-touch with automation

Enterprises are rapidly automating a wide range of processes that require intensive human intervention, ranging from back-office activities to customer-facing ones, such as customer operations and sales. The market size for robotic process automation (RPA) is estimated to be nearing $3 billion, with many players already in the market, including giants like Microsoft.[7] Introducing automation is a clear ambition for any organization, including within the telco industry. Drivers for adoption relate to a company’s specific objectives.

In collecting clients’ opinions about what drives automation adoption and determining the most relevant and impactful ones, ADL recognizes that each driver is a lever to move to the next level of efficiency, with just one exception: we believe that automation is the killer application to improve the quality of service. Overall CX depends on the coordination and performance of the different network domains that multiply the elements to manage while preserving revenues and OPEX efficiency. In fact, Ericsson estimates that costs for telcos to improve CX will double in the next five years without employing automation, while investing in automation could mitigate or offset these cost increases. Automation, especially on RAN, which according to ADL analysis accounts for about 50% of overall network costs, can enable faster time to market; operational flexibility with automated RAN deployment; operational, optimization, and energy savings; end-to-end integration of operations and service experiences that increase satisfaction; and higher lifetime value for customers. There are several examples of European telco players that have already adopted automation, thus increasing their efficiency by up to 20% and reducing time to correlate alarms and identify the root cause (see ADL Viewpoint, “Extracting Network Operations Efficiency in the Post-COVID-19 Era”[8]).

Automation is not straightforward, however. Telcos face a variety of barriers to adopting automation that must be addressed properly, as shown in Figure 7. In our discussions with telco executives, most assert that the most critical roadblock is represented by competencies, while we view two additional issues that are critical: data quality and reliability and automation implementation.

Data for new technologies is as important as a solid foundation is for a building. Without a structured data architecture, integration, and governance among the systems and departments involved, it is very hard to properly implement automation that brings expected results in terms of efficiency and productivity improvement. Not all automation adoptions are implemented properly due to two primary issues: a lack of integration between the front-office and back-office processes and processes digitally automated without a real thought to whether they should be reengineered. Both are a prelude to failure, as the result is merely automated inefficiencies. We suggest starting by highlighting areas for potential efficiency from data analysis and processes redesign to ensure delivering an effective, efficient, and consistent to-be solution.

Automation adoption is company-wide. Much has been written on RPA applicability to different departments, and examples include replies to customer inquiries to the contact center provided using chatbots, frequent repetitive tasks in the back office (administration, procurement) performed by software applications, and logistics and sales processes done through Web apps. A full set of use cases in different areas exists to support operators in applying automation to achieve a wide range of benefits (see Table 1).

Automation adoption impacts all seven dimensions of our analysis (see Figure 8). The degree of impact likely differs by department, depending on the depth of automation and the operator’s starting point.

We have observed that the average impact of initiatives in the industry varies dramatically, especially in network operations.[9]

Automation is a prerequisite to moving from reactive to proactive and predictive event management, looking at operations, or provisioning network slices for end-to-end service orchestration. Operators have always built their internal and external processes using the customer as the foundation of any analysis. Well before 2000, for example, Vodafone Italy built a predictive engine to anticipate customer behavior and churn by leveraging a data warehouse system that stored customer information. Nowadays, data is a mantra and big data, advanced analytics, and AI technologies have created the right conditions to employ more sophisticated analysis and achieve more challenging targets. Operations and maintenance are shifting from being network- and business-oriented to paying increasing attention to customers.

CX management impacts the entire industry, as illustrated in Figure 9. Preventive and predictive tools (e.g., customer self-service) will take the place of more reactive instruments. Thus, even if network environments become more complex, customer-oriented predictive tools will lead to the reduction of network faults, processing time, and operations cost of ownership.

A benefit of automation is increased efficiency across the whole chain that comprises the implementation and provisioning of modern networks. Automation gradually voids numerous costly and time-consuming legacy practices surrounding manual equipment configuration, troubleshooting, and maintenance, greatly reducing OPEX as well as the risk of human error and enabling improvements in network performance, leading to a self-learning, self-improving automated network. According to CTOs’ points of view, repetitive network maintenance activities that can be automated are in the range of 70%-80%, improving consistency and being 100x faster in responding to customers. Initial results from automation are encouraging: up to 80% effort reduction in engineering tasks and just one to three hours to get a site ready for on-air, thanks to automation algorithms. Improved CX, time to market, and efficiency demonstrate that early adopters can envision secure long-term returns; in fact, Cisco clients have reported 383% ROI.[10]

ADL advocates for turning the focus to the next level of automation, which is the starting point of telcos’ evolution toward autonomous networks: moving from zero defects to zero complaints. Thus far, this is an achievable target: although there are no fully autonomous networks deployed as yet, most advanced operators are in the middle of the journey between Level 1 and 3 (see Figure 10). However, some telcos in more advanced and mature markets have already started the so-called zero-touch journey. As an example, the German-based Deutsche Telekom group recently began its zero-touch development journey, aiming at removing any human touch starting with its network management and all the way to the final user experience.

Autonomous networks are fully automated networks supporting self-healing, self-optimizing, and self-evolving infrastructures and operations. There are six main elements characterizing autonomous networks:

- Self-governing — meaning that every action and behavior is controlled within an autonomous domain.

- Programmable — thanks to open APIs and standardized external reference points that support interoperability.

- Explainable — meaning that every action and decision made can always be explained in terms understandable to human beings.

- Composable — which means that smaller functions can build themselves up to create a new, more complex function.

- Business-driven — aiming at reaching business goals and objectives.

- Always run model-driven engineering.

Autonomous networks have the potential, on one hand, to significantly increase revenues and reduce churn by delivering real-time, high-quality services. On the other hand, they can greatly reduce long-term costs. However, there are two key issues to address when implementing such a disruptive and revolutionary system. First, the initial cost of the investment may be significant and thus should be financially managed with proper attention. In addition, operators should also strategically manage the implementation of autonomous networks to avoid a significant impact on the client’s processes and on the business itself.

Telco operators will rely on and adopt automation in general and autonomous networks specifically to manage the complexity behind the deployment of 5G, including private networks and slicing, and strict SLAs for customers that request specific services (e.g., low latency required by companies offering autonomous vehicles). A balance between new technologies deployed and capabilities is imperative to ensure network performance matches demand and expectations. To provide the required and requested level of service with an increased architecture complexity, network executives must guarantee faster response time in case of fault. Autonomous networks provide a means to compete and acquire market share, especially in B2B segments.

6

Anticipate threats by investing in cybersecurity

In a world where the pace of technology advancement keeps increasing rapidly, cyber threats are constantly transforming, becoming more and more sophisticated and dangerous. As the number of devices increases, the attack surface becomes wider and it is thus impossible to contain it in well-defined and safeguarded perimeters. Nowadays, perimeter-based security is no longer able to successfully defend against some of the most advanced cybersecurity threats. Therefore, to effectively identify and contain threats, network and security operations are required to cooperate, share data, and integrate tools and workflows.

The adoption of new technologies, models, and frameworks is generating new testing challenges, which most enterprises’ current security systems are not able to address properly. We believe that there are five primary high-risk challenges that the industry must overcome.

First, the increased scale and complexity of cloud-based and mobile-based systems challenge the solidity of current security frameworks. At the same time, however, ADL’s global benchmarks on telco spending reveal that operators in the past three years have spent much less than 1% of revenues on security. As time passes, those systems, especially the cloud-based ones, will continue to become bigger, more complex, and, therefore, more vulnerable. Setting up adequate security to address those threats requires top-tier competencies and awareness of what exactly those threats are and how they should be managed.

The second, third, and fourth challenges we have spotted concretize themselves as natural consequences of the fast growth of this industry. On one hand, as companies grow they become richer, therefore increasing the potential payoff of a cyberattack. Innovation in attack methods, technology, and modus operandi will continue to develop. On the other hand, a growing industry means more devices, and therefore a continuous increase of attack surfaces. On top of that, the widening of the volume that must be controlled comes inevitably with some lack of visibility: it will always be hard to spot all the threats in a system. All three of these challenges require security systems to be adequately prepared.

Finally, as systems become increasingly complex, the fifth challenge arises: it will be vital for security frameworks to be compliant with the new regulations, continually being monitored and updated.

Addressing all these challenges requires a changing role for security. As we said, it is now necessary to deeply integrate security and network in order to effectively tackle these new challenges. Efficiently combining network and security, thus providing flawless communication and interactions between the two, will be vital to build a defensive framework embedded with four key pillars of a successful security structure (see Figure 11):

- It must be a zero-trust network, meaning that every user or device is equally suspected and thus controlled.

- It should guarantee continuous protection.

- It should be based on trustworthy network infrastructure.

- It should decisively favor flawless and seamless workflows between security and network operations.

According to Forrester research, a zero-trust network must embed three main aspects.[11] In the first place, it should apply controls on the network only after it has been appropriately segmented to make these controls more granular, ensuring end-point devices can link with other networks (competitor or suppliers). Second, the output of these controls should be reported with specific visibility for threat detection and response. And finally, a zero-trust network’s foundation should be completely integrated with automation and supported by cryptography algorithms (e.g., International Mobile Equipment Identity number), as data can be used as an entry point for cyber attacks.

Several drivers — such as the increasing number of cyber attacks over time; the more attractive potential payoff for cyber criminals; greater sophistication of attacks (e.g., self-propagating ransomware); and rapidly expanding number of devices (including IoT ones, with few embedded security features) — worry security executives and their implication for customers and business. Cisco’s “2020 Global Networking Trends Report” highlights the importance of managing security in the proper way. According to the report, 48% of network teams recognize the improvement of security capabilities as a priority; network strategists consider it as a top investment area, just after AI; 48% of security C-level executives believe that time to remediation is a key indicator to monitor for performance evaluation; and security operations prioritize dealing with complexity at scale.[12]

ADL sees some critical aspects to be deeply analyzed and addressed to be prepared to potential increase in cyber attacks:

- Security is a process by design (e.g., telco security team should provide requirements to devices’ vendors to reduce risk).

- Avoid “man in the middle” attacks: critical data and processes must be encrypted (e.g., IMEI can be used to simulate a safe user using “post quantum encryption” to follow computational capacity increase).

- Ensure authentication confirmation to all users inside your network.

- Implement a two-level protection (e.g., use two levels of antivirus to reduce probability of success).

- Inform and train employees to potential risks, as a majority of successful attacks derives from behaviors not following proper rules, processes, and procedures due to lack of knowledge.

Figures related to security imply that systems, skills, organization, and processes must be adapted to manage such a threat and complexity to avoid loss of revenues and payoff costs (see Figure 12). Access to systems and data also must be secured following the latest laws and policies regarding data protection.

If, in the past, security could be treated with a best-effort approach with appliances overlayed to network equipment, the target in the digital era should consists of an intent-based approach where security is automated and detects emerging potential threats and adapts to changing policies and regulations. To achieve this, operators should invest in skilled resources fully dedicated to adapting systems, processes, and organization (e.g., establish a dedicated structure for security operations) to inspect massive volumes of data, detect and protect access to resources, and act properly in case of suspicious penetration.

In conclusion, cybersecurity is one of the most important and immediate aspects that companies must address. New challenges and new solutions are arising, requiring readiness to act. A flawless security system makes the digital environment a much safer place for customers to actively and willingly store their information.

7

Bring workplaces into the digital world