11 min read • Strategy, Organization & transformation, Technology & innovation management, Risk

Navigating the sustainability journey

A new scenario-based approach to decision-making

Sustainability is one of the few topics that is high on the agenda across all companies, sectors, and countries. Eighty percent of companies in a recent global ADL study[1] had a sustainability strategy in place, and a further 12 percent were developing one.

Ninety-nine percent of CEOs surveyed by the United Nations said it was important for their business. However, recent economic developments, the COVID-19 pandemic, supply chain disruptions, and the energy crisis have all made it difficult for companies and consumers to prioritize sustainability. In addition, recognizing something as very important does not automatically drive urgent action. In a complex world with multiple players, understanding what to do NOW is not straightforward, particularly as regulations, technology, standards and expectations are still developing or uncertain. For example, just 18 percent of CEOs in the United Nations’ study[2] felt that governments and policymakers had given them the clarity needed to meet their sustainability goals.

All of this means that companies, especially those operating globally, struggle to reach consensus among key stakeholders on what is important and what requires urgent investment to ensure business continuity and capture strategic opportunities. How can CEOs understand what are the most important and urgent actions and “no regret” decisions to take now, irrespective of what will change in the future?

As this article explains and illustrates, one answer is to adopt updated, more data-driven, scenario-based planning methodologies, focusing on complex local and international sustainability factors and their interdependencies (such as technology developments, local and international legislation, or NGO pressure). These give the clarity and confidence business leaders need to take the right short-term decisions, without jeopardizing their mid- to long-term sustainability journey

THE DIFFICULTY OF MAKING SUSTAINABILITY-BASED STRATEGIC CHOICES

While the vast majority of larger companies state that they have a sustainability strategy, far fewer position it as part of the core of their strategy that guides actual investment decisions. Often, change only happens when market and regulatory pressure delivers a “burning platform” moment, such as in the automotive sector, which faces bans on the sale of new internal combustion engine (ICE) vehicles in many countries, beginning in Norway in 2025.

This opens incumbents to the risk of challenges from new, sustainability-first competitors, or even of being driven out of business altogether. For example, Volvo Cars’ former CEO, Håkan Samuelsson, stated in October 2014 that fully electric cars were “not something we believe in.” Less than seven years later, in March 2021, Samuelsson announced that Volvo Cars would only sell electric cars by 2030, significantly behind first mover Tesla.

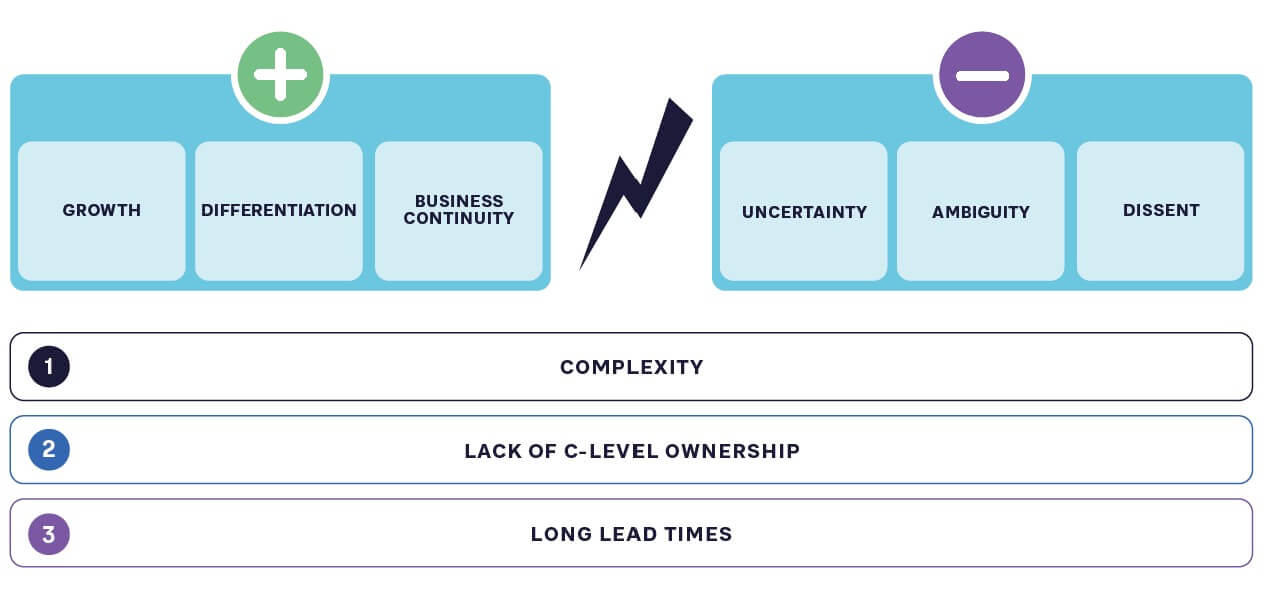

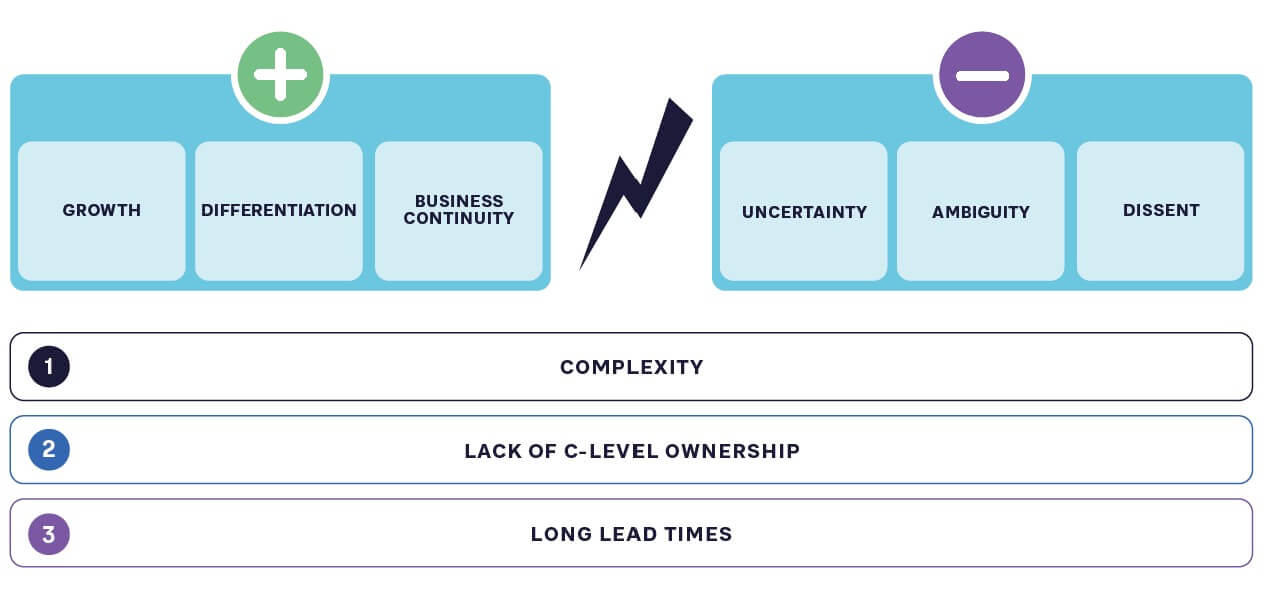

Aside from current economic and geopolitical turmoil, a range of factors act as obstacles to progress on sustainability. (See Figure 1.) These include:

-

Complexity: There are generally very good reasons to “go green”: it can serve as a new growth engine, help differentiate your products, and even be critical for the longer-term survival of the company. However, individual business cases for green initiatives, such as to start a large R&D program, acquire a greener technology, or build a new plant, can be fraught with uncertainty. (For example, will new technology around carbon capture really take off, and can we access enough green raw material at the right price?) Ambiguity can further confuse the case for change: will customers really be paying a green premium, and are we even clear on what we regard as “sustainable”? To make matters worse, there is often a great deal of dissent between internal stakeholders. Some may question the projected pace of change in consumer preferences, or of political willingness to move ahead as economic concerns grow. Others may see proposed green investments as a threat to their own business.

-

Lack of C-level ownership: As any CEO can attest, it is not easy to drive change that truly “moves the needle” in large companies. Innovative products can be launched, and new technologies and ways of working implemented, but without executive decisionmaking and follow-up, a company will remain largely the same tomorrow as it was yesterday. This is why company-critical issues are generally owned by C-suite executives: CEO, CFO, COO, and so on. It is therefore surprising that few companies have a chief sustainability officer or comparable role represented in the boardroom, someone who brings understanding across functional domains and the authority to act across organizational departments. We believe this is a real problem for many companies. It is made clear from the authoritative reports on sustainability (such as those from the International Energy Agency [IEA] and the Intergovernmental Panel on Climate Change [IPCC]) that the world and the business environment will be turned upside down for most industry sectors, and company transformation will need to accelerate significantly. Making the right far-reaching decisions in a highly complicated and dynamic environment is often fiendishly difficult, but in most companies, the accountability for informed decision-making around sustainability is scattered at best.

-

Long lead times: While most business leaders today would agree that sustainability trends are accelerating, they could still take a long time to become truly inescapable. Decarbonizing and circularizing entire supply chains, particularly in globalized industries, is an extremely complex process that will take many years, if not decades. Developing new technologies to the required robustness and economic viability is similarly time consuming, as development of fuel cells, for instance, clearly shows. All this in itself would not be such a problem if not for the fact that most companies are only good at making decisions whose “time to business impact” runs in years, not a decade or more. It takes a high degree of conviction and stakeholder alignment to make far-reaching decisions that will solve issues that have yet to fully materialize and will take many years before fully paying off. As a result, such decisions are all too often postponed or watered down. They are strategically important, but not seen as urgent.

Clearly, companies need to find new ways to address and overcome these challenges if they are to both hit medium- to long-term sustainability targets and ensure competitiveness as they move forward.

A NEW APPROACH TO SCENARIO-BASED PLANNING FOR SUSTAINABILIT Y

Scenario-based thinking and planning have been proven approaches for many decades to manage uncertainties and understand tradeoffs. Through detailed research, they aim to provide a range of realistic, coherent possible future scenarios based on available information, and then use this to drive more informed decision making. They enable organizations to monitor, plan and shape their potential futures, providing actionable insights and timelines for the speed and depth of change.

However, traditional scenario planning has its limitations. Often, it remains solely a research exercise that is not then turned into action. If it is used, general business planning typically picks the mid-case for decision-making and budgeting and ignores the other findings.

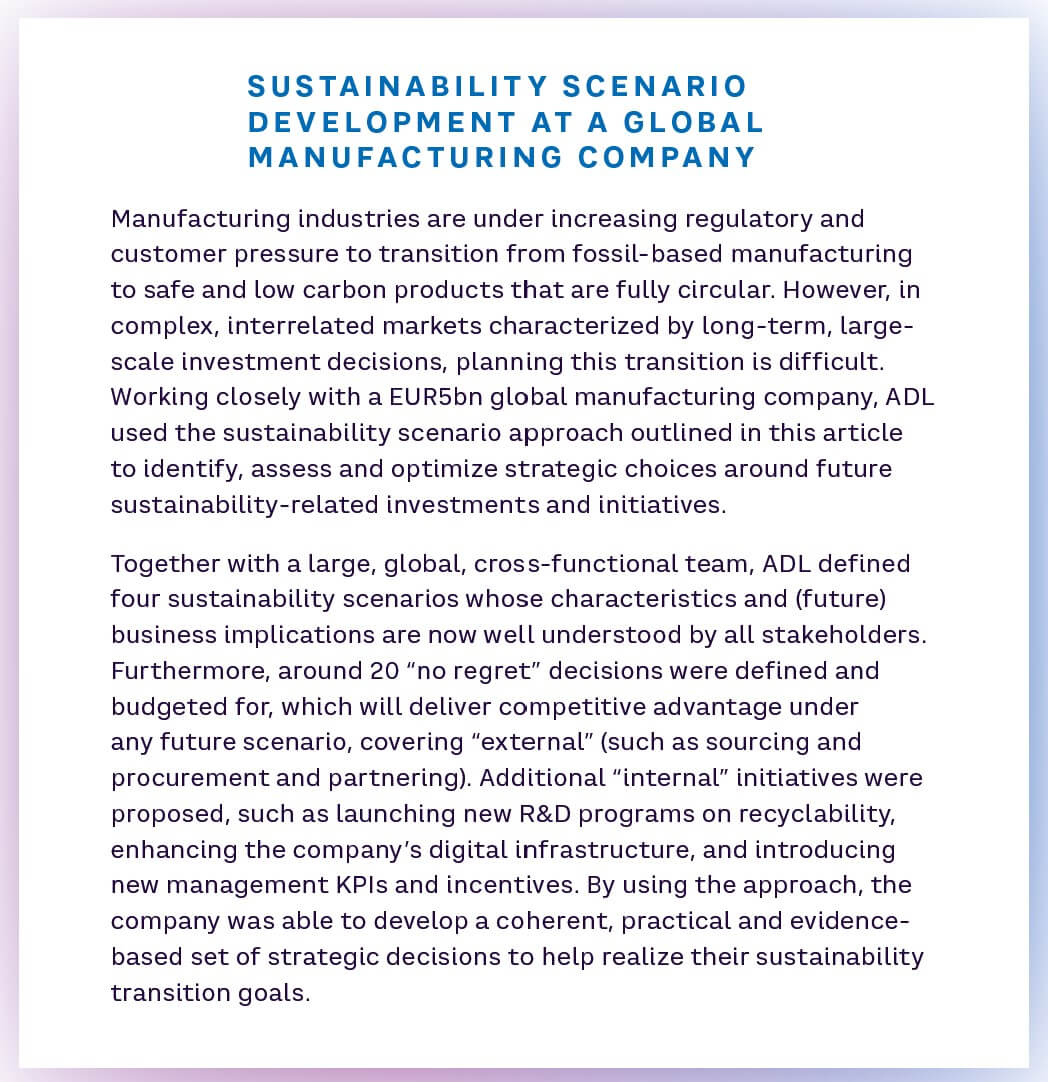

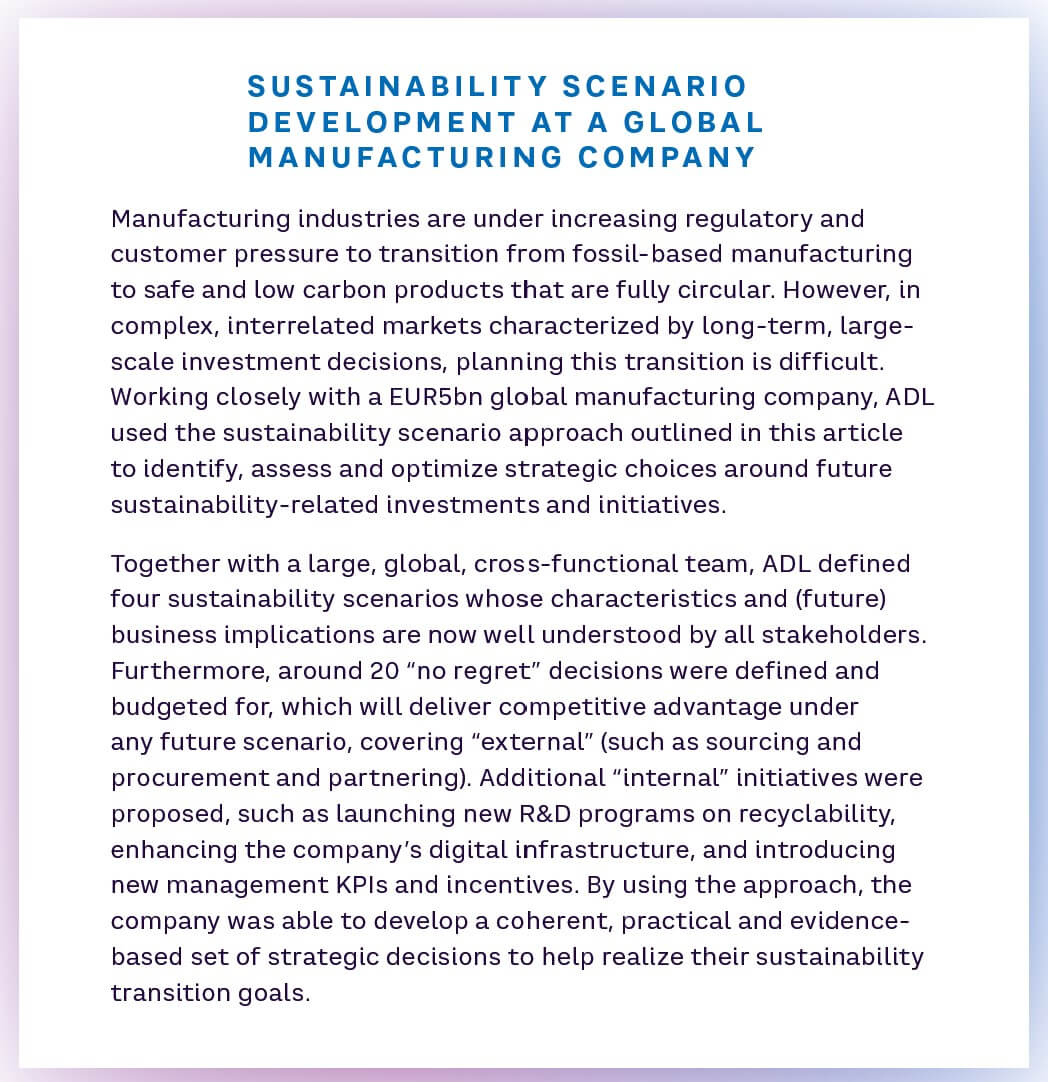

Working with clients, ADL has successfully trialed a new approach that builds on conventional scenario development approaches, but is tailored to the specific requirements around sustainability decision-making.

As shown in Figure 2, the sustainability scenario approach differs from others primarily in its focus on understanding the implications of sustainability drivers for management decision-making at a much more granular business portfolio/regional level, including the question of timing and urgency.

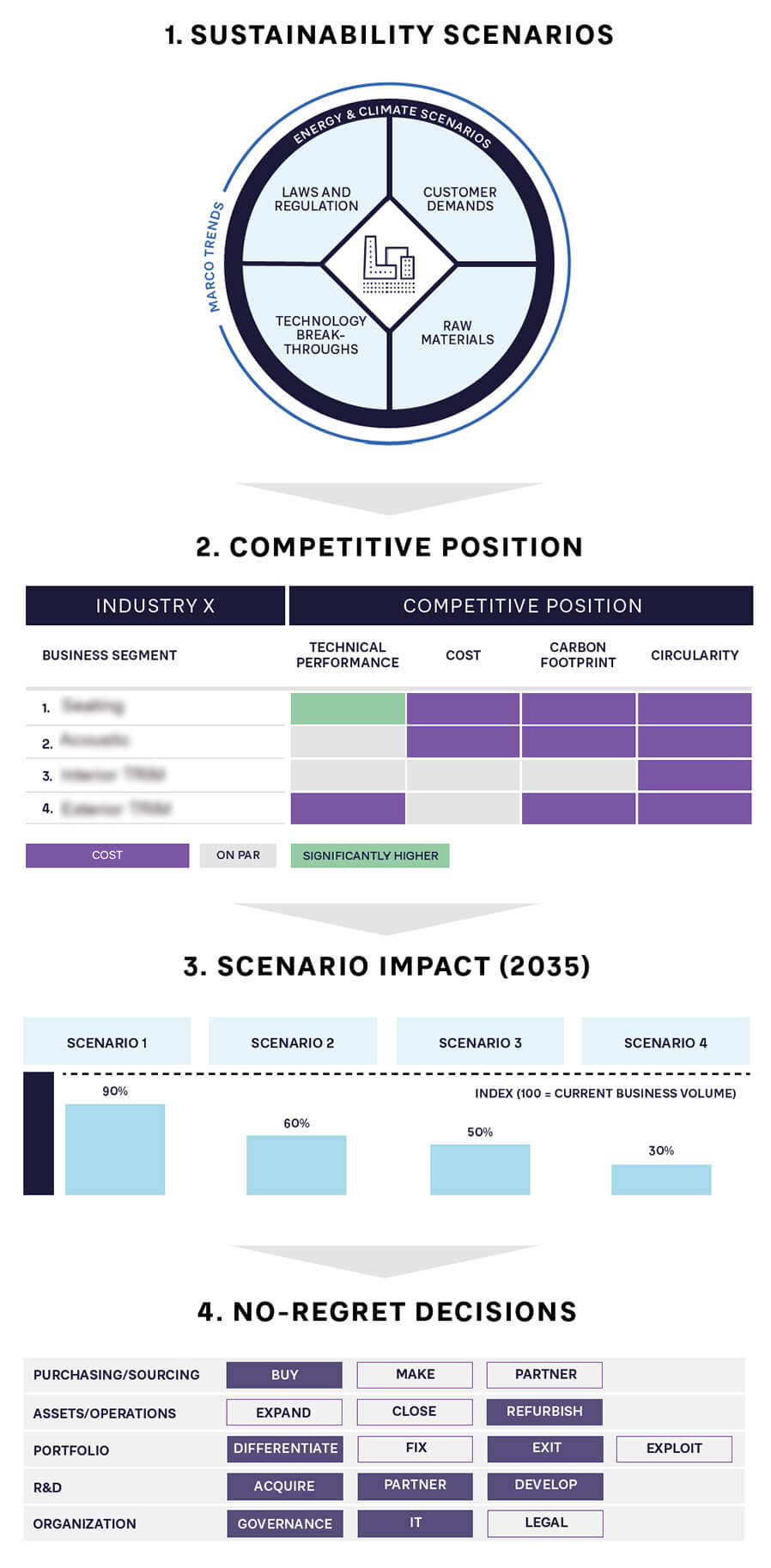

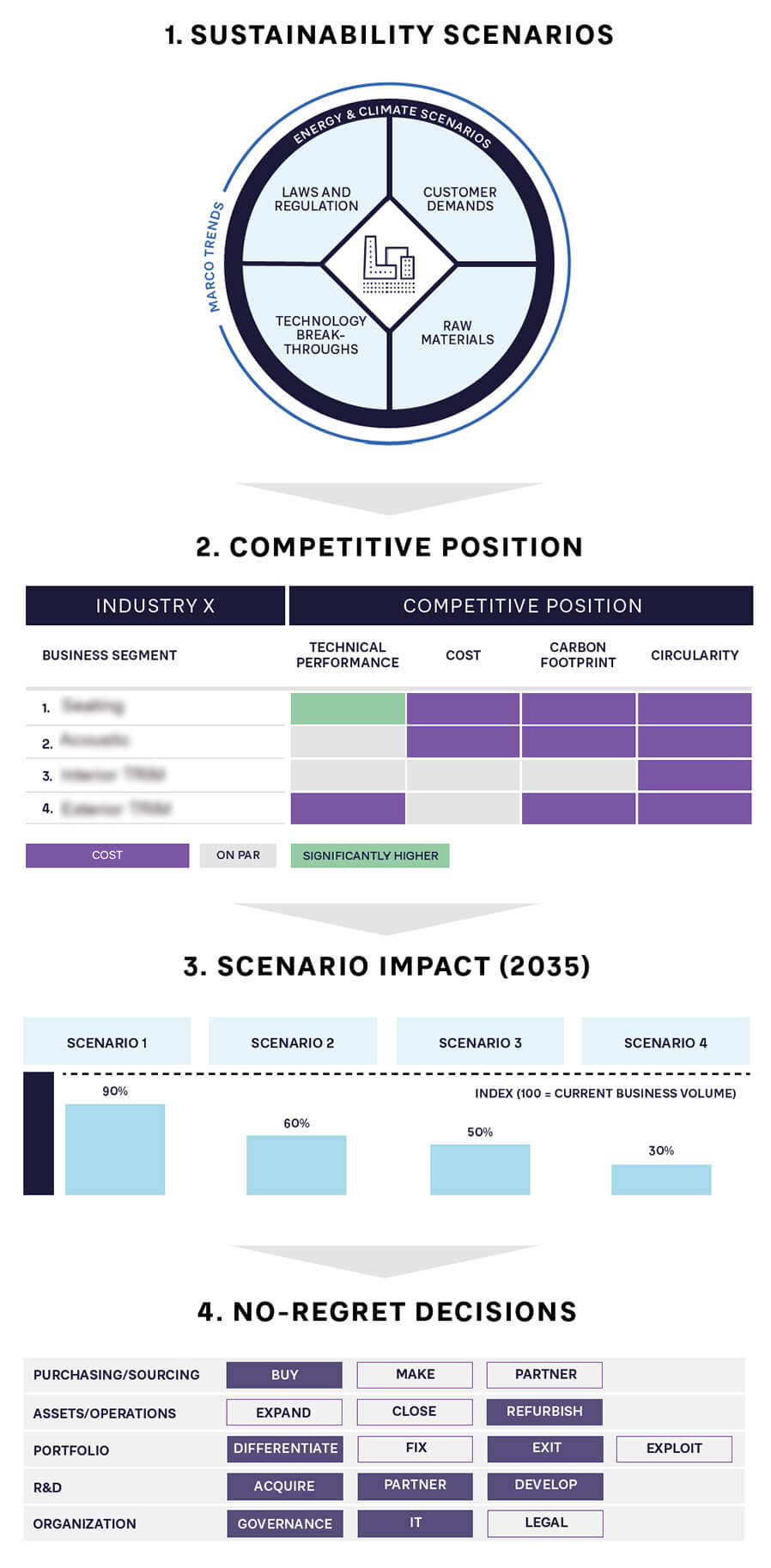

The approach involves four main stages, as shown in Figure 3.

1. SUSTAINABILITY SCENARIOS

The most important requirement in scenario development is for scenarios to be individually meaningful and plausible, as well as collectively exhaustive. Meaningfulness and plausibility can be achieved by starting from wider macro trends (such as global demographics) using reputable sources such as the World Bank and the United Nations. Within those “macro-constraints.” we can then position the wider energy and climate scenarios (such as around the use of renewables and stated government goals) as produced by the IEA and IPCC.

We then consider all sustainability factors and trends that impact specific industry scenarios across different end markets and regions, such as regulation, customer demand, technology breakthroughs, and the availability of required sustainable materials, which is increasingly becoming critical. These factors need to be characterized by defining what might be their credible extreme projections within a relevant, realistic timeframe, such as from today to 2035. For example, costs of CO2 emissions could rise well above today’s levels, but the EIA regards it as unlikely that they will structurally exceed USD 160–170/t by 2035. Similarly, we might expect economically viable breakthrough technologies to emerge, but wide application may still be constrained by economic limitations.

One always-present scenario that deserves specific attention represents continuation of today’s situation (called “Scenario 1” in Figure 3). The point here is that even if sustainability trends stall over the coming years, the world will experience continued and worsening reminders of the importance of fighting climate change. In our view, this means whatever urgency is allocated to sustainability by governments and the market today, the world of tomorrow (for example, by 2035) is bound to be meaningfully different from today from a sustainability perspective, regardless of the scenarios that may unfold. This is an important realization because it underlines that “doing nothing” is also a decision that may have significant consequences.

2. COMPETITIVE POSITION

Once sustainability scenarios have been created, they need to be applied across the company and its portfolio of products/markets. A baseline competitiveness assessment evaluates how products and other offerings currently compare to those of competitors in a company’s key business segments. These are evaluated along three axes: cost, technical performance, and sustainability performance, which, in the client example in Figure 3, is broken down into carbon footprint and circularity performance. This ensures that fact-based and commonly agreed competitive product advantages are considered throughout the analysis and the economic consequences of sustainability actions are transparently considered.

3. SCENARIO IMPACT

Once the sustainability scenarios are defined and described in detail and the company’s current competitive position is known, the impact of each scenario on the relevant product and market segments can be assessed, and even quantitatively estimated. Depending also on the region where a certain product category is sold, the “greenness” of a scenario will change the buying criteria in a market and, hence, determine whether it will win or lose against competing products and potential alternative solutions. For example, a technically superior but fossil-based light-weighting solution in the automotive market may benefit from accelerated penetration of electric vehicles (where weight contribution is especially important), but only in regions where its relatively high carbon footprint is not excessively penalized by either regulators or consumers. Where this is the case, that same product may lose against alternatives made from biomass. Taking the analysis to this level of granularity is key to gauge the real impact of tightening sustainability concerns on margins and market shares.

4. NO-REGRET DECISIONS

Based on this detailed assessment of potential impacts, we can identify decisions that would have positive outcomes regardless of how future events unfolded. Every product group and segment may require highly specific actions, but a handful of decision types generally emerge if we roll up the scenario impacts across the entire business: such as acquiring more sustainable raw materials and components, making changes to the company’s physical (production) assets, modifying its business portfolio (such as by exiting certain segments), starting new R&D programs, and improving supporting competencies and ways of working in the organization. This allows companies to focus on the few “must-win battles” that apply in each scenario, and be clear on which of those require urgent and specific action (how much and what sustainable materials to source by when, for example, or the specific economic context for a new recycling technology to be developed). This clarity is needed to remove the complexity obstacles mentioned above.

Of course, more action is needed besides identifying urgent actions to take today. C-level ownership should be taken, not just for implementation of immediate actions, but certainly also for follow-up over longer periods of time. The higher degree of scenario definition and more precise understanding of which components will be most important to the company’s success help to define these longer-term actions. They make it possible to track just a handful of measurable and meaningful signpost indicators whose values can be used as early warning signals that something is about to happen, requiring urgent specific further action around which executives are already aligned today. Examples could be important regulatory changes on how the EU will deal with recycling and CO2 emissions, or changes in the market prices of green alternatives.

INSIGHTS FOR THE EXECUTIVE – PUTTING SCENARIOS AT THE HEART OF SUSTAINABILITY PLANNING

For executives to have the confidence needed to take the right decisions today that will not jeopardize the longer-term sustainability journey – and gain the consensus of key stakeholders – companies need to adopt a robust, scenario-based approach as outlined in this article. Postponing tough decisions, no matter how important for the company’s future, can seem all too attractive in the face of acute economic challenges, especially given the byzantine workings around sustainability trends, opportunities and threats.

The only smart way for companies to move ahead is to boil all this down to urgent and no-regret actions to take at any given moment, starting from today:

-

Start off by defining commonly accepted principles and wisdom, such as the scenarios developed by the IPCC. Agree on more qualitative assumptions based on experience and common sense.

-

Produce custom scenarios for your business, using digital tools to analyze dependencies between factors or probabilities and analyzing impacts at the business portfolio and regional levels.

-

Involve all relevant business functions (commercial, operations, R&D, finance, etc.) to achieve alignment.

-

Make all conclusions actionable. Monitor, deep dive, and initiate with “if-not-now-then-when” timelines. Define practical signposts linked to key actions.

-

Automate signpost monitoring wherever and to whatever degree possible, and report through customized management dashboards available by business function.

-

Create ownership at the right level. Perhaps most importantly, ensure that findings, actions and future follow-up are all “owned” at the right organizational level. Especially in energy- and materials-intensive industry sectors, such ownership should include a (potentially dedicated) C-level executive.

Notes

- https://www.adlittle.com/en/insights/report/overcoming-challenges-sustainability

- United Nations Global Compact

11 min read • Strategy, Organization & transformation, Technology & innovation management, Risk

Navigating the sustainability journey

A new scenario-based approach to decision-making

DATE

Sustainability is one of the few topics that is high on the agenda across all companies, sectors, and countries. Eighty percent of companies in a recent global ADL study[1] had a sustainability strategy in place, and a further 12 percent were developing one.

Ninety-nine percent of CEOs surveyed by the United Nations said it was important for their business. However, recent economic developments, the COVID-19 pandemic, supply chain disruptions, and the energy crisis have all made it difficult for companies and consumers to prioritize sustainability. In addition, recognizing something as very important does not automatically drive urgent action. In a complex world with multiple players, understanding what to do NOW is not straightforward, particularly as regulations, technology, standards and expectations are still developing or uncertain. For example, just 18 percent of CEOs in the United Nations’ study[2] felt that governments and policymakers had given them the clarity needed to meet their sustainability goals.

All of this means that companies, especially those operating globally, struggle to reach consensus among key stakeholders on what is important and what requires urgent investment to ensure business continuity and capture strategic opportunities. How can CEOs understand what are the most important and urgent actions and “no regret” decisions to take now, irrespective of what will change in the future?

As this article explains and illustrates, one answer is to adopt updated, more data-driven, scenario-based planning methodologies, focusing on complex local and international sustainability factors and their interdependencies (such as technology developments, local and international legislation, or NGO pressure). These give the clarity and confidence business leaders need to take the right short-term decisions, without jeopardizing their mid- to long-term sustainability journey

THE DIFFICULTY OF MAKING SUSTAINABILITY-BASED STRATEGIC CHOICES

While the vast majority of larger companies state that they have a sustainability strategy, far fewer position it as part of the core of their strategy that guides actual investment decisions. Often, change only happens when market and regulatory pressure delivers a “burning platform” moment, such as in the automotive sector, which faces bans on the sale of new internal combustion engine (ICE) vehicles in many countries, beginning in Norway in 2025.

This opens incumbents to the risk of challenges from new, sustainability-first competitors, or even of being driven out of business altogether. For example, Volvo Cars’ former CEO, Håkan Samuelsson, stated in October 2014 that fully electric cars were “not something we believe in.” Less than seven years later, in March 2021, Samuelsson announced that Volvo Cars would only sell electric cars by 2030, significantly behind first mover Tesla.

Aside from current economic and geopolitical turmoil, a range of factors act as obstacles to progress on sustainability. (See Figure 1.) These include:

-

Complexity: There are generally very good reasons to “go green”: it can serve as a new growth engine, help differentiate your products, and even be critical for the longer-term survival of the company. However, individual business cases for green initiatives, such as to start a large R&D program, acquire a greener technology, or build a new plant, can be fraught with uncertainty. (For example, will new technology around carbon capture really take off, and can we access enough green raw material at the right price?) Ambiguity can further confuse the case for change: will customers really be paying a green premium, and are we even clear on what we regard as “sustainable”? To make matters worse, there is often a great deal of dissent between internal stakeholders. Some may question the projected pace of change in consumer preferences, or of political willingness to move ahead as economic concerns grow. Others may see proposed green investments as a threat to their own business.

-

Lack of C-level ownership: As any CEO can attest, it is not easy to drive change that truly “moves the needle” in large companies. Innovative products can be launched, and new technologies and ways of working implemented, but without executive decisionmaking and follow-up, a company will remain largely the same tomorrow as it was yesterday. This is why company-critical issues are generally owned by C-suite executives: CEO, CFO, COO, and so on. It is therefore surprising that few companies have a chief sustainability officer or comparable role represented in the boardroom, someone who brings understanding across functional domains and the authority to act across organizational departments. We believe this is a real problem for many companies. It is made clear from the authoritative reports on sustainability (such as those from the International Energy Agency [IEA] and the Intergovernmental Panel on Climate Change [IPCC]) that the world and the business environment will be turned upside down for most industry sectors, and company transformation will need to accelerate significantly. Making the right far-reaching decisions in a highly complicated and dynamic environment is often fiendishly difficult, but in most companies, the accountability for informed decision-making around sustainability is scattered at best.

-

Long lead times: While most business leaders today would agree that sustainability trends are accelerating, they could still take a long time to become truly inescapable. Decarbonizing and circularizing entire supply chains, particularly in globalized industries, is an extremely complex process that will take many years, if not decades. Developing new technologies to the required robustness and economic viability is similarly time consuming, as development of fuel cells, for instance, clearly shows. All this in itself would not be such a problem if not for the fact that most companies are only good at making decisions whose “time to business impact” runs in years, not a decade or more. It takes a high degree of conviction and stakeholder alignment to make far-reaching decisions that will solve issues that have yet to fully materialize and will take many years before fully paying off. As a result, such decisions are all too often postponed or watered down. They are strategically important, but not seen as urgent.

Clearly, companies need to find new ways to address and overcome these challenges if they are to both hit medium- to long-term sustainability targets and ensure competitiveness as they move forward.

A NEW APPROACH TO SCENARIO-BASED PLANNING FOR SUSTAINABILIT Y

Scenario-based thinking and planning have been proven approaches for many decades to manage uncertainties and understand tradeoffs. Through detailed research, they aim to provide a range of realistic, coherent possible future scenarios based on available information, and then use this to drive more informed decision making. They enable organizations to monitor, plan and shape their potential futures, providing actionable insights and timelines for the speed and depth of change.

However, traditional scenario planning has its limitations. Often, it remains solely a research exercise that is not then turned into action. If it is used, general business planning typically picks the mid-case for decision-making and budgeting and ignores the other findings.

Working with clients, ADL has successfully trialed a new approach that builds on conventional scenario development approaches, but is tailored to the specific requirements around sustainability decision-making.

As shown in Figure 2, the sustainability scenario approach differs from others primarily in its focus on understanding the implications of sustainability drivers for management decision-making at a much more granular business portfolio/regional level, including the question of timing and urgency.

The approach involves four main stages, as shown in Figure 3.

1. SUSTAINABILITY SCENARIOS

The most important requirement in scenario development is for scenarios to be individually meaningful and plausible, as well as collectively exhaustive. Meaningfulness and plausibility can be achieved by starting from wider macro trends (such as global demographics) using reputable sources such as the World Bank and the United Nations. Within those “macro-constraints.” we can then position the wider energy and climate scenarios (such as around the use of renewables and stated government goals) as produced by the IEA and IPCC.

We then consider all sustainability factors and trends that impact specific industry scenarios across different end markets and regions, such as regulation, customer demand, technology breakthroughs, and the availability of required sustainable materials, which is increasingly becoming critical. These factors need to be characterized by defining what might be their credible extreme projections within a relevant, realistic timeframe, such as from today to 2035. For example, costs of CO2 emissions could rise well above today’s levels, but the EIA regards it as unlikely that they will structurally exceed USD 160–170/t by 2035. Similarly, we might expect economically viable breakthrough technologies to emerge, but wide application may still be constrained by economic limitations.

One always-present scenario that deserves specific attention represents continuation of today’s situation (called “Scenario 1” in Figure 3). The point here is that even if sustainability trends stall over the coming years, the world will experience continued and worsening reminders of the importance of fighting climate change. In our view, this means whatever urgency is allocated to sustainability by governments and the market today, the world of tomorrow (for example, by 2035) is bound to be meaningfully different from today from a sustainability perspective, regardless of the scenarios that may unfold. This is an important realization because it underlines that “doing nothing” is also a decision that may have significant consequences.

2. COMPETITIVE POSITION

Once sustainability scenarios have been created, they need to be applied across the company and its portfolio of products/markets. A baseline competitiveness assessment evaluates how products and other offerings currently compare to those of competitors in a company’s key business segments. These are evaluated along three axes: cost, technical performance, and sustainability performance, which, in the client example in Figure 3, is broken down into carbon footprint and circularity performance. This ensures that fact-based and commonly agreed competitive product advantages are considered throughout the analysis and the economic consequences of sustainability actions are transparently considered.

3. SCENARIO IMPACT

Once the sustainability scenarios are defined and described in detail and the company’s current competitive position is known, the impact of each scenario on the relevant product and market segments can be assessed, and even quantitatively estimated. Depending also on the region where a certain product category is sold, the “greenness” of a scenario will change the buying criteria in a market and, hence, determine whether it will win or lose against competing products and potential alternative solutions. For example, a technically superior but fossil-based light-weighting solution in the automotive market may benefit from accelerated penetration of electric vehicles (where weight contribution is especially important), but only in regions where its relatively high carbon footprint is not excessively penalized by either regulators or consumers. Where this is the case, that same product may lose against alternatives made from biomass. Taking the analysis to this level of granularity is key to gauge the real impact of tightening sustainability concerns on margins and market shares.

4. NO-REGRET DECISIONS

Based on this detailed assessment of potential impacts, we can identify decisions that would have positive outcomes regardless of how future events unfolded. Every product group and segment may require highly specific actions, but a handful of decision types generally emerge if we roll up the scenario impacts across the entire business: such as acquiring more sustainable raw materials and components, making changes to the company’s physical (production) assets, modifying its business portfolio (such as by exiting certain segments), starting new R&D programs, and improving supporting competencies and ways of working in the organization. This allows companies to focus on the few “must-win battles” that apply in each scenario, and be clear on which of those require urgent and specific action (how much and what sustainable materials to source by when, for example, or the specific economic context for a new recycling technology to be developed). This clarity is needed to remove the complexity obstacles mentioned above.

Of course, more action is needed besides identifying urgent actions to take today. C-level ownership should be taken, not just for implementation of immediate actions, but certainly also for follow-up over longer periods of time. The higher degree of scenario definition and more precise understanding of which components will be most important to the company’s success help to define these longer-term actions. They make it possible to track just a handful of measurable and meaningful signpost indicators whose values can be used as early warning signals that something is about to happen, requiring urgent specific further action around which executives are already aligned today. Examples could be important regulatory changes on how the EU will deal with recycling and CO2 emissions, or changes in the market prices of green alternatives.

INSIGHTS FOR THE EXECUTIVE – PUTTING SCENARIOS AT THE HEART OF SUSTAINABILITY PLANNING

For executives to have the confidence needed to take the right decisions today that will not jeopardize the longer-term sustainability journey – and gain the consensus of key stakeholders – companies need to adopt a robust, scenario-based approach as outlined in this article. Postponing tough decisions, no matter how important for the company’s future, can seem all too attractive in the face of acute economic challenges, especially given the byzantine workings around sustainability trends, opportunities and threats.

The only smart way for companies to move ahead is to boil all this down to urgent and no-regret actions to take at any given moment, starting from today:

-

Start off by defining commonly accepted principles and wisdom, such as the scenarios developed by the IPCC. Agree on more qualitative assumptions based on experience and common sense.

-

Produce custom scenarios for your business, using digital tools to analyze dependencies between factors or probabilities and analyzing impacts at the business portfolio and regional levels.

-

Involve all relevant business functions (commercial, operations, R&D, finance, etc.) to achieve alignment.

-

Make all conclusions actionable. Monitor, deep dive, and initiate with “if-not-now-then-when” timelines. Define practical signposts linked to key actions.

-

Automate signpost monitoring wherever and to whatever degree possible, and report through customized management dashboards available by business function.

-

Create ownership at the right level. Perhaps most importantly, ensure that findings, actions and future follow-up are all “owned” at the right organizational level. Especially in energy- and materials-intensive industry sectors, such ownership should include a (potentially dedicated) C-level executive.

Notes

- https://www.adlittle.com/en/insights/report/overcoming-challenges-sustainability

- United Nations Global Compact