DOWNLOAD

DATE

Contact

Phaseout of supply generation assets such as coal, a high demand for gas in Asian markets pushing down European supply, cold weather, and the shortage of Russian gas supply together have led to record energy prices across Europe. Tensions between Ukraine and Russia will likely worsen the already dramatic situation on energy markets. The consequences are dramatic, both for retailers and consumers. On the one hand, there have been a series of electricity and gas retailer bankruptcies, as they have been unable to pass the full cost of the commodity price increase to end consumers. On the other hand, increases in energy bills leave end consumers unable to pay their bills, also impacting financials of retailers.

The gas and electricity crisis has exacerbated retailers’ already well-known struggles, such as low margin, and has added new layers of complexity:

- Rising gas prices in wholesale markets are forcing retailers to buy commodities at high prices to meet customers’ additional energy demands. This additional cost is often borne by retailers if the portfolio consists largely of fixed-price contracts.

- Retailers are accustomed to anticipating and managing the customer churn. In these highly uncertain times, however, when no market offering is significantly more attractive for the end consumer, churn tends to decrease. This diminished turnover has a direct impact on the expected volumes of energy consumed in the retailer customer portfolio, which is not sufficient to respond to the demand. This delta between forecasted and real consumption will also need to be bought on the wholesale markets at a higher price.

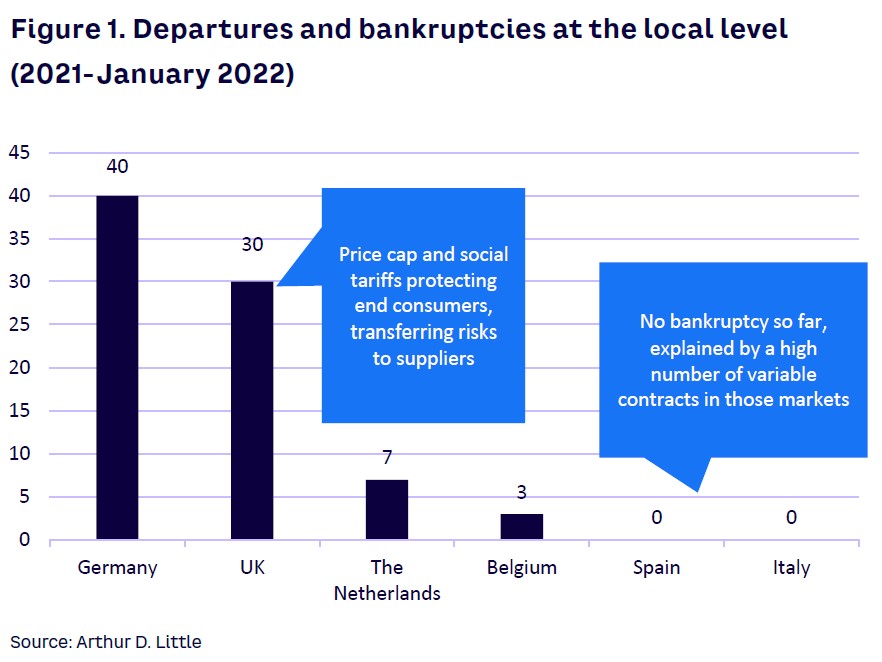

- In some markets, regulators have implemented a price cap or social tariffs to protect end consumers from energy price rises. In the UK, for example, suppliers are not allowed to pass on a price increase to households because of a price cap. In other regions, like in Belgium, an increasing share of households are benefiting from social tariffs (i.e., a specific tariff at a preferential rate).

- Retailers are usually responsible for the expense of unpaid bills, including energy and grid taxes, which significantly impact retailers’ finances. In times of crises, bad debts increase, challenging retailers’ solvency.

The additional complexity unavoidably leads to a high number of retailers that will fail and creates a snowball effect in the markets. Surviving retailers will integrate the customer portfolios of collapsing ones, adding extra costs to retailers that will have to buy the unanticipated volume on wholesale markets. At the same time, however, they will be quite happy to grow their customer portfolio.

The profiles of those electricity and gas retailers that are going bankrupt are typically oriented at lower cost, with a small portfolio of customers and high share of fixed-price contracts. These companies tend to buy electricity on short notice, whereas larger players typically sign long-term contracts or have a generation portfolio and are therefore less affected by rising prices. Nonetheless, larger firms can also be threatened. The placement of the UK’s seventh-largest energy retailer, Bulb Energy, in “special administration” (run by government regulators) demonstrates that insolvency is a challenge for this category of player as well. Since the beginning of the gas crisis, a number of energy retailers have left the market, as illustrated in Figure 1.

An imbalance between supply and demand of gas has meant skyrocketing prices, which is a phenomenon that will likely repeat itself in the coming years considering the increasing uncertainty of supply in many regions of the world. One way to manage the impact of this expected recurring volatility is for retailers to develop additional sources of revenue that would spread the risk related to volatile markets. It is therefore time for energy retailers to reconsider their business model. On one hand, we are convinced their success will not be achieved without a close cooperation with end consumers, whom retailers should stop considering as customers but more as partners, sharing profits in their revised business model. On the other hand, digitalization will be the enabler for retailers to transform their business model beyond commodity selling. These two trends together will give retailers access to new revenue streams.

Shift business model: focus on win-win relationship

At a time when end consumers are aware of clean and sustainable energy and rising energy prices, it is unimaginable to think the future of energy retail will rely solely on the sale of gas and electricity. Instead, retailers’ role will predominantly be to accompany end consumers in their own energy transition, by helping them to become more efficient in the ways they consume energy.

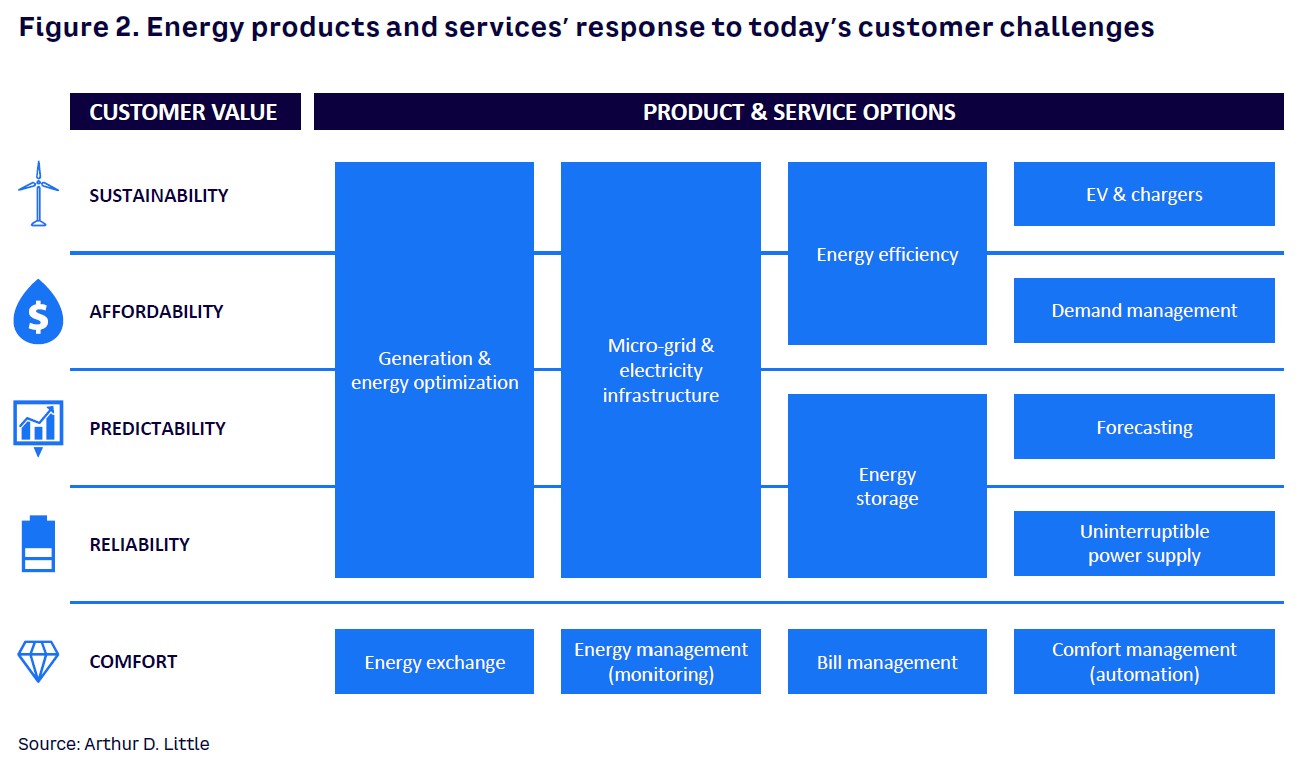

Energy efficiency and management already resonate with many retailers, although some are not exploiting it to their maximum and instead are covering only a limited number of customer segments (typically those with the largest consumption volume). However, all segments are facing similar challenges: engaging in a sustainable approach, accessing affordable energy, forecasting consumption and anticipating costs, gaining access to a reliable flow of energy, and efficiently managing their energy consumption. For all of these ambitions, retailers already offer products and services (see Figure 2).

As consuming locally and more efficiently becomes the new normal, retailers should progressively shift their business model toward a digitalized energy management service model, where technology enables them to respond to evolving customer needs. Indeed, the rollout of smart meters suspends the need for energy retailers’ classical role, pushing the shift toward self-sufficient models where behind-the-meter solutions prevail. This model enables retailers to upsell and lock in customers via a renewed and more profitable set of services composed of, among others:

- Sale of distributed generation assets (e.g., heat pumps/micro-CHPs, solar panels, batteries, geothermal solutions), where the traditional commodity sale would be the back-up solution and included in the asset cost.

- Management of generation output, where share of the energy generated is managed by the retailer on behalf of the end consumer and sold as flexibility to network operators, and the profit for which is shared between the retailer and the end consumer.

- Provision of energy-efficiency services, where different revenue and risk models can be envisioned, including the energy-as-a-service model, the guaranteed, or shared saving models. (More information is available in the Arthur D. Little Viewpoint, “Industrial energy management.”)

- Sale/lease of e-mobility-related services, including sale of electricity, charging poles, fleet management services, and so on.

End consumer as lifetime partner

Retailers’ marketing and sales approach must focus on value creation and not on revenue extraction. The relationship that the retailer will build needs to be a clear win-win, where both the retailer and the consumer see tangible benefits and feel satisfied by their partnership. This is important because such a relationship stimulates strong customer engagement, fostering customer loyalty and sales growth in a time where an increasing number of services are available for sale.

To build a mutually satisfactory relationship, retailers must first establish trust. At a time of high energy prices, retailers must anticipate and prepare for the moment when prices will decrease. They should therefore invest in visibility (in online channels) and communication strategies, regularly updating customers on the evolutions of prices and the impacts on their bills for the coming months, and helping consumers anticipate their energy bills.

In addition to ensuring visibility during the energy crisis, retailers should also commit to providing the best market prices whenever possible. Since consumers see themselves as the victims of this energy crisis and view retailers to be at fault, such a commitment should help illustrate retailers’ loyalty to the consumer. As an example, French energy company TotalEnergies recently took action in France to build loyalty with consumers by announcing that it will support consumers through the crisis by offering a check for €100 for its 200,000 lower-income consumers as well as a €5 discount for each 50-liter refueling in rural areas over a three-month period.

Respond to consumer needs with digitalization

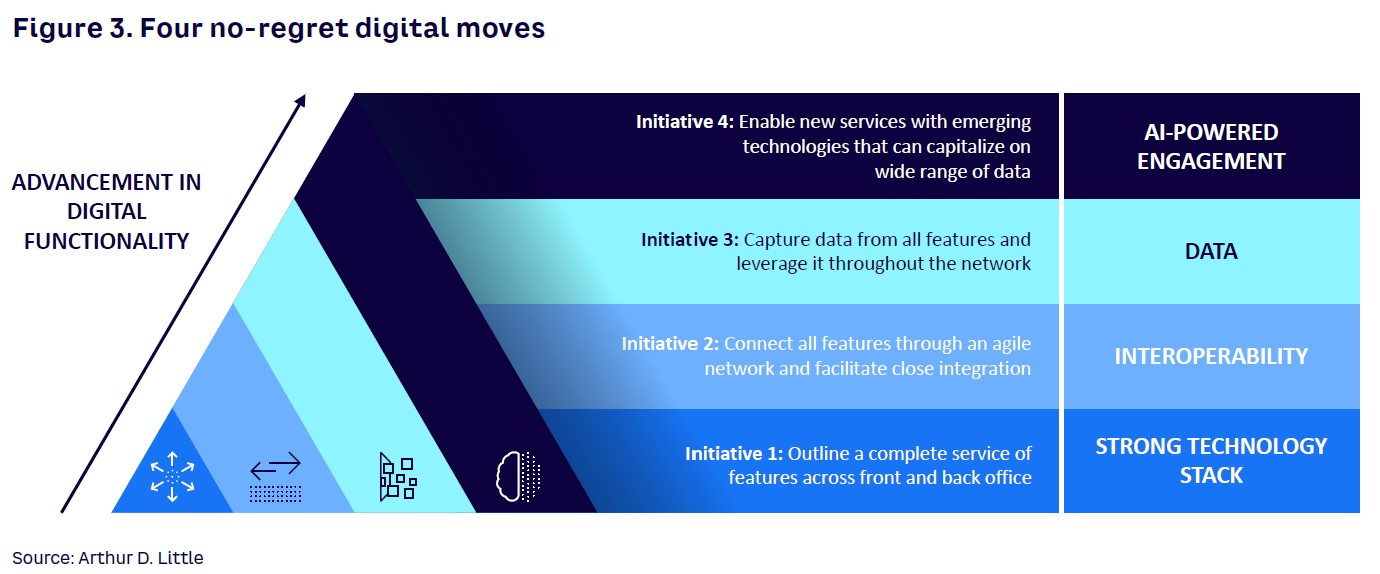

End consumers typically have changing needs and expectations, often leading them to quickly consider differentiating practices as qualifiers rather than satisfiers. Retailers must therefore seek the right balance between staying ahead of the curve in understanding end consumers and proposing new products and services with agility, while at the same time relentlessly pushing down the cost to serve. We have defined four no-regrets digital initiatives to enable this balance (see Figure 3):

- Strong technology stack.

- Interoperability.

- Data.

- Artificial intelligence (AI)-powered engagement.

With the first initiative, retailers should build a strong technology stack to facilitate execution across business models. The front end is all about customer engagement, channels (from telephone to mobile apps to chatbots), customer journey management, the digital experience, and the advanced customer analytics programs critical to operate many business models. On the back end is the system of records for customer relationship management, billing, metering, and enterprise resource planning. Most important, across all layers, modern architectures are cloud- and component-based, modular, integrated by microservices, and loosely coupled to maximize reuse, minimize customization, and optimize total cost of ownership.

In the second initiative, interoperability becomes increasingly critical to connect varied datasets and technology to create value. Approaches such as decoupled data and application programming interface integration are the keys to making these a reality.

With the third initiative, the focus is on prioritizing data. The volume and range of data an energy provider has access to is growing and becoming more diverse. Therefore, retailers should rethink and refocus on relevant customer data points and how these need to be captured along the customer journey. Management and governance of this data, as well as the innovative mechanisms to leverage it across features, are fundamental to analyze changing customer behaviors and anticipate the next ones.

Fourth, sharpen digital customer operations with AI-powered engagement. The commodity business is one of low margins, high volume, and intense competition based on price. With value driven by volume and transaction accuracy at the lowest cost, advanced customer engagement is what enables enhancement in this space. Emerging technology, including process automation and machine learning, can be leveraged in the back office to carry out routine transactions. In the front office, AI agents, virtual assistants, and digital channels could help reduce cost to serve while at the same improve customer satisfaction. Focused messaging and offerings to connect with specific customer segments is crucial, as well as creating digital stickiness by designing, for example, defaulted digital opt-in at sign-up and active opt-out required to go back to traditional channels.

In our recent Viewpoint, “Unleashing innovation in IT,” we describe a clear value-creation journey, setting up a virtuous reinvestment cycle by reinjecting the benefits coming from operational efficiency measures in IT into business alignment and, ultimately, into innovation, to unlock the full potential of the IT assets.

Conclusion

Key thoughts to challenge status quo

To create and develop a partnership relationship with end consumers, we advise retailers to:

- Invest sufficiently in marketing and communication toward end consumers to keep them up to date on the evolution of prices and how this impacts their bills.

- Propose financial solutions to lighten the burden of expensive bills.

- Transform the company business model to propose energy efficiency and decarbonization offerings where risks and savings are shared with end consumers.

- Review the agility of their systems by digitally enabling an integrated set of offerings adapted to consumer needs (based on data capture and analysis).

- Sharpen digital consumer operations (namely via AI) to improve consumer engagement and satisfaction and to reduce cost-to-serve.