24 min read • Healthcare & life sciences

Advancing biotechnology & genomics in Saudi Arabia

Best practice strategies to develop the sector & maximize its impact

Executive Summary

HARNESSING THE BENEFITS OF BIOTECHNOLOGY IN SAUDI ARABIA

Fueled by advances in emerging technologies such as precision medicine,[1] ultra-targeted therapies, “omics,”[2] and many more, the global biotechnology and genomics sector is expected to expand at a double-digit growth rate going forward. Having understood the potential of the sector, governments across the world are making concerted efforts to harness and develop their own biotechnology industries.

Recognizing the opportunity, The Kingdom of Saudi Arabia (KSA) has already launched multiple initiatives to encourage the sector’s growth within the country. While KSA’s biotechnology industry is still at a relatively nascent stage, it is already seeing activity from different players, along with collaboration on projects such as the Saudi Genome Program, which provide a promising foundation for the future.

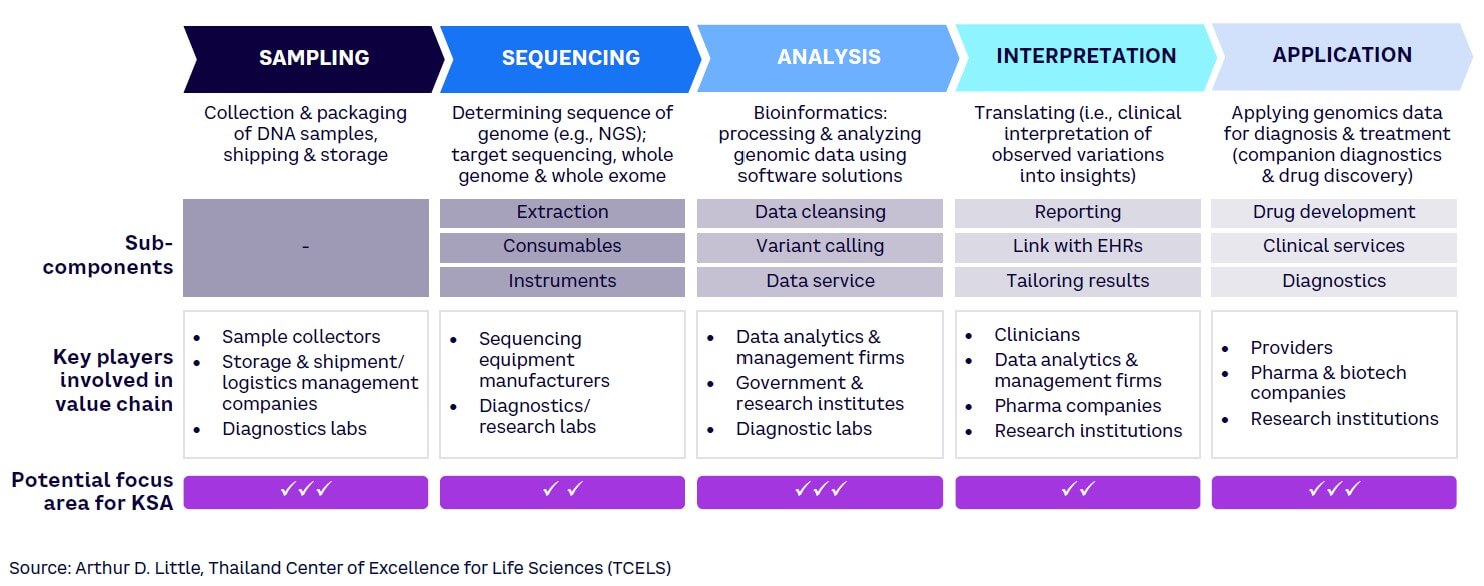

However, while these efforts are a step in the right direction, success requires a clear vision with specific priority areas outlined. This includes identifying and targeting three key segments of the biotechnology value chain (sampling, analysis, and application) as high priorities based on the country’s current capabilities and requirements, as well as developing capacity across a minimum of four thematic areas to further foster growth: (1) genomic data repository set up, (2) widespread genomics adoption, (3) omics and precision medicine research and application, and (4) AI/machine learning (ML) utilization.

Adopting best practices from other countries is an essential approach to catalyze the creation of an indigenous biotechnology and genomics innovation hub. Successful nations have already designed and implemented a range of programs and practices to solve potential challenges and ensure a seamless realization of their visions for biotechnology and genomics. These include: the creation of talent pools through anchoring institutions and innovation hubs; enhanced, active collaboration between the public and private sector; delivering a supportive pro-business environment and regulations, including enhanced intellectual property (IP) protection; the creation of specific innovation-themed environments and ecosystems; setting a clear target picture of all research efforts; and providing start-ups with fast and easy access to public and private funds.

As this Report explains, these best practices are all imperative to helping KSA achieve its objective of becoming a regional leader in the biotechnology and genomics space, delivering clear benefits in terms of public health, economic development, reputation, and overall competitiveness.

1

THE GLOBAL GROWTH OF BIOTECHNOLOGY & GENOMICS

Thanks to ongoing advances, the fields of biotechnology and genomics are set to play a major role in mankind’s future wellness and healthcare journeys. Modern biotechnology provides breakthrough products and technologies to combat debilitating and rare diseases, delivering personalized and more effective treatments often based on genomic data.

Globally, the market is growing rapidly as nations and governments recognize its value for their citizens and tremendous transformative potential for their economies and healthcare systems. As of 2023, the worldwide biotechnology sector was estimated to be worth US $1.5 trillion, with an expectation that it will grow at a double digit CAGR to reach between $3.5-$4 trillion by 2030, according to Grand View Research.[3]

This rapid growth will be driven by both demand-side factors (including rising demand for better and more efficient healthcare diagnostics and treatment services and an increasing focus on wellness and prevention) and supply-side aspects, such as an increasing governmental focus on the sector, along with rising private sector investments and rapid technological advances.

EMERGING TRENDS IN THE SECTOR

Both the public and private sectors are exploring a range of biotechnology use cases along the wellness and healthcare value chain. Demonstrating this, a study of funding patterns for AI/ML-powered digital health companies reflects multiple emerging trends.

These include a shift toward precision healthcare, including the rise of CAR-T cell therapy and companion diagnostics and the growth of ultra-targeted therapies, particularly in oncology, using genomic data, with a consequent focus on more precise patient population segments. The trends are driving new business models based on close collaboration among players across the entire healthcare ecosystem; these models are critical for the successful development and implementation of novel approaches for preventive and curative care.

At the same time, new treatment paradigms have emerged. Advanced therapeutics such as gene editing through CRISPR-Cas9 provide highly personalized and targeted therapies that are curing once-fatal diseases such as cancer and rare genetic disorders, while gene therapy, cell therapy, and immunotherapy are rapidly shifting the focus from mortality to morbidity. This brings implications for all players in the healthcare ecosystem, including developers, payors, providers, and patients.

Thanks to advances in next-generation sequencing (NGS) technologies, we are rapidly moving toward a future where generating and analyzing the whole human genome will be routine for any laboratory.[4] Alongside this, gathering large-scale biological information and data from other pools of molecules (such as proteomics, metabolomics, and transcriptomics) will help generate insights related to disease development and treatment effects. Genome data analysis using sophisticated technologies such as AI and ML is also a major emerging trend with several start-ups focusing on this segment.

GROWTH IN GENOMIC DATABASES TO SUPPORT RESEARCH

Global priorities are shifting toward citizen-centered and patient-friendly genomic collaboration and research. This is leading to countries increasing their investments in biotechnology. In particular, they are actively working to create diverse genome data sets, fostering equitable genomics and driving innovation to address health disparities:

-

The US National Institute of Health (NIH) All of Us Research Program now boasts a data set of nearly 100,000 genome sequences, supplemented by participants’ electronic health records, Fitbit data, and survey responses, all accessible through a cloud-based platform.[5]

-

The EU’s 1+ Million Genomes Initiative, supported by over 25 signatory countries, is dedicated to establishing a European genomic data infrastructure and facilitating federated data access through common national regulation.[6]

-

In the UK, the National Health Service (NHS) is taking steps to integrate genomics into its regular operations by offering whole genomics sequencing as standard to those with rare diseases or cancers.[7]

CRITICALITY OF SECTOR TO NATIONAL GROWTH AGENDA

Changing global geopolitical dynamics and the rise of new diseases and pandemics mean that a strong biotechnology sector is increasingly vital to ensuring a country’s competitiveness, self-sufficiency, and health. Clearly, at a basic level, investing in the sector is essential to providing countries with rapid, immediate access to the latest innovative and cost-effective treatments. Globally, around $162 billion was invested in the biotech sector in 2023, with the US accounting for approximately 35% of total global funding.[8]

A strong biotechnology industry also catalyzes growth in capability development across research and innovation, increasing jobs and investments and boosting the country’s GDP. Demonstrating this, the biosciences sector has outperformed the wider US economy post-COVID, contributing to around 10% of US GDP in 2021. Additionally, the industry generated 2.1 million direct jobs, with employees earning 85% more than the average private sector salary.[9] A strong biotech sector provides a reputational boost that enhances a country’s competitiveness in terms of acquiring talent, innovations, and investment.

2

CURRENT STATUS OF BIOTECHNOLOGY & GENOMICS IN SAUDI ARABIA

While KSA accounts for 1.3% of global GDP, it only currently makes up 0.2% of the global genomics sector.[10] This demonstrates that the industry is still early in its development. Backing this up, the projected growth rate for the genomics sector across MENA (Middle East and North Africa) between 2022–2030 is around 9.5% CAGR, which is much lower than the overall global growth rate of approximately 16.5%. This highlights the opportunity and indicates the potential for the region to direct additional focus and resources toward the sector.

CLEAR TARGETS GIVE IMPETUS & DIRECTION

Globally, multiple countries’ economies have outlined specific goals and targets for their biotechnology and genomics sectors. For example, in the US, the White House Office of Science and Technology Policy report “Bold Goals for US Biotech and Biomanufacturing,” published in March 2023, highlights concrete objectives to strengthen the US bioeconomy, including collaboration with the private sector to advance innovation throughout the full healthcare value chain.

Along similar lines, Saudi Arabia has demonstrated a strong commitment toward developing its R&D agenda. Its “RDI (Research, Development and Innovation) National Aspirations and Priorities” for the next two decades include “Health and Wellness” and “Economies of the Future.”[11] Backing this up, multiple initiatives have been planned and announced in KSA, such as the creation of the National Biotechnology Strategy Committee and Riyadh Biotechnology City.[12] The Saudi Genome Project 2.0 has also set ambitious objectives including enhancing the country’s position as the leader in genomics and genetics within the MENA region.[13]

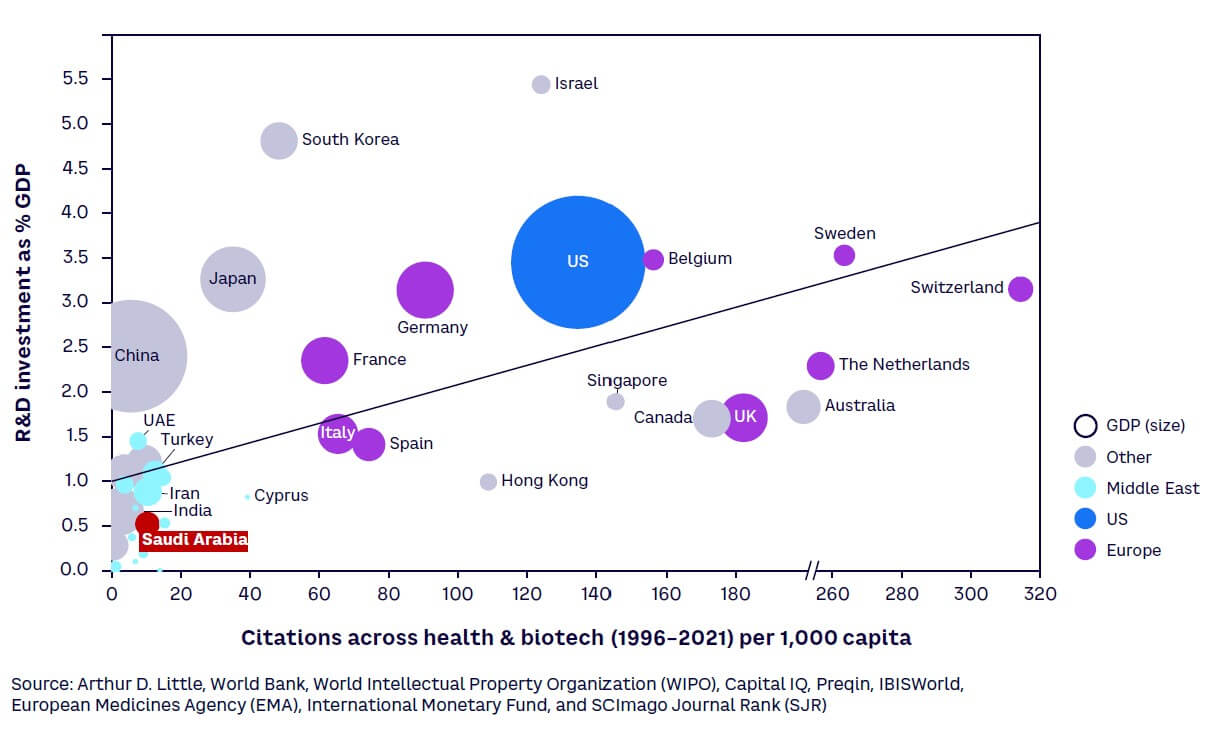

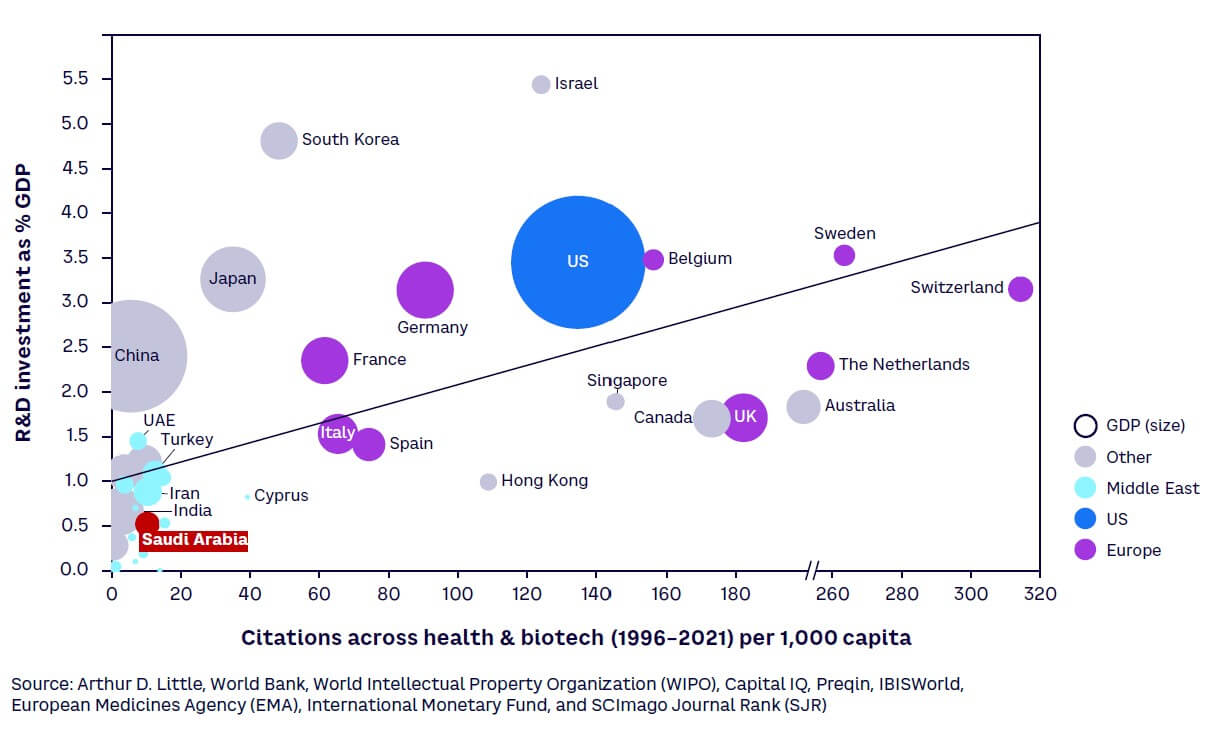

Objectives are being backed by investment in R&D to build a knowledge-based sustainable economy, as part of Saudi Arabia’s National Vision 2030 and National Transformation Program. KSA has dedicated substantial funding for R&D, totaling $3.9 billion in 2021,[14] equivalent to 0.46% of GDP[15] (see Figure 1). While this R&D intensity[16] is currently much lower than the typical 1.5%-3.5% spent by regional and large global economies, this is set to change as Saudi Arabia aims to become a global leader in research, development, and innovation through an annual investment equivalent to 2.5% of GDP by 2040. This is expected to not only add $16 billion to the economy, but also create high-value jobs in science and technology.[17]

SUPPORTIVE REGULATIONS ACCELERATE GROWTH

In the biotechnology sector, major economies have introduced regulations to encourage transparency and expedite clinical trial approvals. For instance, the UK is looking to introduce the Future Clinical Trials Bill,[18] while its Medicines and Healthcare products Regulatory Agency (MHRA) has introduced guidelines to expedite low-risk clinical trials.[19]

Along similar lines, Saudi Arabia is developing and setting up a clear regulatory and governance mechanism for R&D. The Saudi Food and Drug Authority (SFDA) has proposed new guidelines for clinical trials with the aim to regulate, support, and enhance collaboration between the different entities involved in them,[20] while the Research, Development and Innovation Authority (RDIA) is aiming to act as an enabler, legislator, and regulator[21] going forward.

MULTIPLE LARGE-SCALE INITIATIVES ALREADY LAUNCHED

Understanding the opportunity, multiple entities within KSA’s R&D ecosystem are working toward enhancing the biotechnology agenda, launching a range of initiatives. As part of this, there has been an increase in academic research and initiatives by Saudi institutions and a focus on developing the local talent pool in science and technology:

-

Research organizations

-

King Abdullah International Medical Research Center’s (KAIMRC), launched in 2006, focuses on applied sciences research and works with leading academic institutions around the world in areas such as vaccines, genetic research, therapeutics, and drug screening. For example, working with the University of Oxford, KAIMRC led The Kingdom’s first phase I clinical trial of a vaccine into the MERS-CoV virus.[22] The institution is currently focused on multiple initiatives, including the Saudi Biobank, Cord Blood Bank, Research Trauma Project, and Saudi Stem Cell Donor Registry.

-

-

Academic institutions

-

The King Abdullah University of Science and Technology (KAUST) and King Abdulaziz City for Science and Technology (KACST) are fostering research in the fields of genomics and biosciences through memorandums of understanding (MoUs) and collaboration with industry bodies, with a deep focus on biotechnology.

-

The National Biotechnology Center, a joint effort between King Faisal Specialist Hospital and Research Centre (KFSH&RC) and KACST is focused on enhancing medical research and biotechnology. Over 110 projects have been approved, and 67 are ongoing.[23]

-

-

Government initiatives

-

The Saudi National Institute of Health, launched by the Ministry of Health (MOH), is focused on supervision and backing of translational research and clinical trials in the health domain by providing funds and support to research personnel.[24]

-

-

Nonprofit organizations

-

The Hevolution Foundation, a non-profit organization, is focused on longevity medicine and receives up to $1 billion funding per year from the Saudi government.[25]

-

-

Pharmaceutical manufacturing companies

-

Lifera, a Public Investment Fund entity, is a pharmaceutical manufacturing company set up in June 2023 to focus on manufacturing life-saving and essential pharmaceutical products. To date, Lifera has established three platforms: Biologics & Innovation, Manufacturing, and Commercialization.

-

Additionally, Saudi Arabia has built strong partnerships with many global pharmaceutical and biotech companies that are helping grow local capabilities:

-

Partnerships

-

KAUST signed two MoUs in 2023 with multinational firms (Boehringer Ingelheim and Novo Nordisk) focused on enhancing cooperation in the biotechnology and medicine sector.[26]

-

The Ministry of Investment (MISA) has partnered with Novartis to further strengthen Saudi Arabia’s biopharmaceutical capabilities. This partnership involves local investments in cell and gene therapy, technology transfer, and clinical research, aiming to alleviate healthcare budget pressures. Novartis’s involvement is anticipated to contribute approximately $857 million to Saudi Arabia’s GDP by 2024.[27]

-

In 2023, Lifera, Sanofi, and Arabio signed an MoU to manufacture and supply vaccines in Saudi Arabia, boosting local production with a new state-of-the-art manufacturing facility.

-

However, while these agreements are a step in the right direction to bring big pharma and multinational biotech companies to Saudi Arabia, there is a long way to go for developing local capabilities across the value chain. Recognizing this, academic and research institutes have put in place a range of accelerator and incubator programs to train and support entrepreneurs:

-

Research organizations

-

KAIMRC’s Medical Biotechnology Park (MBP) provides a supportive environment to new and emerging medical and biomedical technology ventures and compatible businesses. This environment is designed to assist them during their start-up phase and enhance their prospects for local success.

-

-

Academic institutions

-

KAUST’s accelerator programs include TAQADAM, one of the longest-running accelerator programs in Saudi Arabia. It provides six-month programs to innovators and entrepreneurs offering mentorship, funding, and targeted workshops.

-

KACST has an agreement with King Salman Youth Center to carry out a training project for entrepreneurs. This boosts KSA’s ongoing efforts to fully realize the potential of Saudi youth by promoting their active participation in the development process.

-

In 2022, Dammam Valley, owned by Imam Abdulrahman bin Faisal University, established the Biotech Startups Program, a first-of-its-kind initiative designed to support and incentivize health and biotechnology entrepreneurs. Over 130 projects from various fields of genomics and therapeutics have participated since the program’s inception.

-

Entrepreneurship initiatives have so far primarily come from leading institutions such as KAIMRC, KAUST, and KACST. However, as these institutes and their programs are independent of each other, this can limit collaboration and result in inefficient utilization of resources and facilities.

THE SAUDI GENOME PROGRAM: A BLUEPRINT FOR SUCCESS

Joint efforts and strong collaboration between public and private entities will bolster the development of the Saudi Arabian biotechnology sector. The Saudi Genome Program represents a significant stride in this direction, specifically in the fight against genetic disorders. The program was developed through partnerships with international organizations to establish an extensive genetic repository. To date, 63,000 genetic samples have been gathered, and 7,500 pathogen variants have been detected. This is a result of cross collaboration between institutes, including KACST, KAIMRC, KFSHD, and MOH.[28] However, a stronger coordinated push is critical to ensure rapid innovation and commercialization in The Kingdom.

3

ACCELERATING PROGRESS WITHIN SAUDI ARABIA

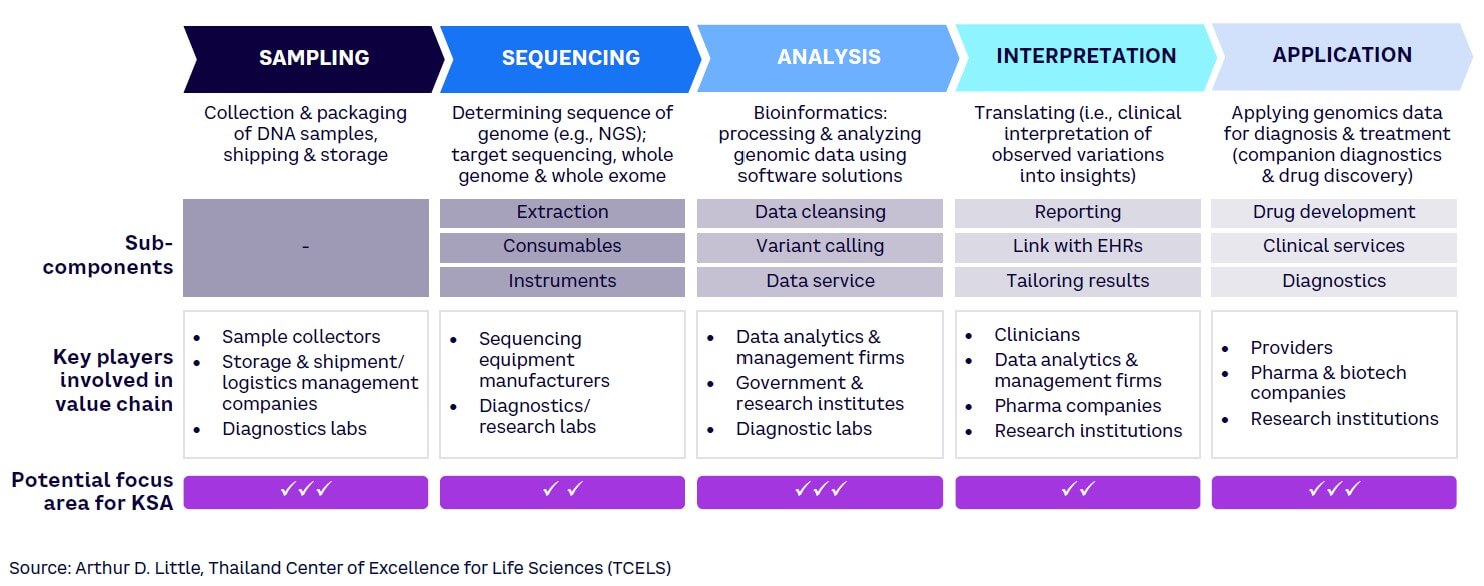

For development of KSA’s biotechnology sector to gather pace, there needs to be a focus on three segments of the value chain (sampling, analysis, and applications) and four thematic growth areas (creating a population-level genomic data repository, the widespread adoption of genomics as a screening/diagnostic tool, omics/precision medicine, and AI/ML-enhanced genomics).

THE VALUE CHAIN: CONCENTRATE ON 3 SEGMENTS

The genomics value chain comprises five steps, each of which requires different capabilities (see Figure 2).[29] To enhance Saudi Arabia’s competitiveness in the biotechnology market, it is vital to identify which of these steps best align with the country’s core capabilities. As highlighted in the figure, KSA should increase its focus particularly across three segments in the value chain: sampling, analysis, and application — due to the following reasons:

-

Sampling. Saudi Arabia can easily develop local capabilities in this area, given that there is a low dependence on highly trained clinicians or existing transportation infrastructure. While this component has a relatively low financial value compared to other steps, developing local capabilities will create a strong foundation for developing presence in more complex processes.

-

Sequencing. Large, high-tech equipment is essential for sequencing work. Developed economies such as the US and UK have already built a strong presence in this area based on their high-tech manufacturing capability, tapping into the high potential for revenues. Establishing competitive equipment manufacturing facilities within KSA would be CAPEX-intensive and technically challenging given a lack of local knowledge and skilled labor. Consequently, Saudi Arabia should focus on importing sequencing machines at this stage.

-

Analysis. Bioinformatics plays a crucial role in processing and analyzing genomic data. Developing software capabilities is a prerequisite for growth in this space; for example, comparison with various phenotypes can reveal meaningful data about diseases and biomarkers. In terms of financial value, this is a lucrative segment where important value can be derived by creating a population database. Marking this as an area of focus, institutes such as KAUST and KACST are already creating academic and industry partnerships to develop AI and data analytics capabilities in KSA.

-

Interpretation. Genetic data interpretation involves identifying clinically relevant genetic variations and their implications for an individual’s health. This segment is expected to significantly increase in size as human genome projects are completed, becoming a central area of research for many countries. However, to enter this area, KSA would need to develop processes and train skilled clinicians who can translate genomic data to predict and diagnose genetic disorders.

-

Applications. Genomic applications across diagnostics, drug development, and precision medicine are relevant for pharmaceutical companies, healthcare systems, and clinicians. This component of the value chain is at a relatively early stage and thus presents opportunities for KSA. The Kingdom should continue to focus on developing the diagnostic services component (i.e., genomics testing services) and maximize value generation from it.

FOCUS ON 4 THEMATIC AREAS TO DRIVE GROWTH

The biotechnology sector has seen crucial advances that are shaping the genetic research and healthcare landscape, including:

-

The increasing utilization of high-throughput sequencing technologies, which are enabling the rapid and cost-effective analysis of entire genomes. This has accelerated our understanding of genetic variation and its implications in health and disease.

-

The integration of genomics into precision medicine, with customized treatments and therapies being developed based on an individual’s genetic profile.

-

The field of epigenomics has grown, shedding light on how environmental factors can influence gene expression and impact health.

-

The emergence of large-scale biobanks and collaborative initiatives worldwide is facilitating the sharing of genetic data, promoting international collaboration, and enhancing our ability to tackle global health challenges.

-

Furthermore, AI/ML are also playing a pivotal role in genomics, aiding in data analysis and the identification of novel genetic associations.

These trends present crucial opportunities that KSA can tap into to develop prevention, monitoring, and treatment technologies that reduce mortality and improve the entire population’s quality of life. Foundations are being established through investment and regulatory framework setup, and now it is imperative to embark on specific actions aimed at fostering the next stage of growth.

Globally, countries are selecting biotechnology and genomics sector priorities based on their population’s healthcare burden and trends, existing capabilities, infrastructure, and the most promising emerging areas. KSA must recognize the fast-evolving landscape and focus on four specific themes going forward to maximize value generation. These include:

-

A population-level genomic data repository. Almost all major economies, including KSA, have been working toward creating a population-level genomic database. This is the first step toward developing precision medicine and is important for understanding how diseases develop so better ways of prevention and management can be devised.

-

Widespread adoption of genomics as a regular tool for screening and diagnostics. It is important to develop a nation-wide underlying infrastructure and service network that facilitates adoption of genomics as a standard clinical diagnostic tool. Currently, due to sociocultural norms, the incidence of birth defects is relatively high.[30] Consequently, genetic risk profiling, genetic screening, and newborn genetic testing could be incorporated as a standard clinical guideline for certain cases. Over time, new clinical indications for genomic testing should be introduced in a phased manner based on the country’s requirements.[31]

-

Omics and precision medicine. Considering the keingdom’s disease burden, it is imperative to focus on this segment, and gather and analyze data to support with diagnosis and management of diseases. The burden of non-communicable diseases (NCDs) such as cardiovascular diseases and diabetes on KSA’s economy is substantial. NCDs accounted for 73% of all deaths in KSA in 2018, higher than the global average of 71%.[32] Approximately 10% of the population is at risk of developing cancer before the age of 75, a figure that is expected to rise going forward.[33] By using biomarkers, omics could support individuals in preventing or effectively treating diseases, thus reducing costs to the healthcare system as well as increasing benefits to patients. In some countries, selected data from omics is being used in certain types of cancer treatments to screen for drug responsiveness and likelihood of adverse effects.

-

AI/ML in genomics. Advanced software and technologies are vital for rapidly and efficiently deriving insights from genetic material. Countries across the globe are utilizing AI and ML for various use cases such as mapping rare mutations or drafting treatment regimes.[34]

Overall, KSA will have to define and initiate focused efforts to develop technologies and platforms for a range of genomics applications. Creating a strong foundation for genomic research and analysis is a prerequisite for successful innovation in the sector. This can be achieved by the development of biobanks and genome databases for the Saudi population while encouraging the use of AI/ML to enable exhaustive research into genotypes and gene variations. It is also important to increase research focus on precision medicine so that tailored solutions based on the country’s population characteristics and disease burden can be created and delivered.

4

KEY SUCCESS FACTORS TO DEVELOP SECTOR IN SAUDI ARABIA

Saudi Arabia has embarked on multiple initiatives aimed at fostering investment in R&D and introducing legislation to support innovation. Nonetheless, development of KSA biotechnology and genomics industry is currently at an early stage, requiring a focus on six key success factors to encourage progress.

CREATE TALENT POOL

The availability of a skilled and diverse talent pool to meet current and future needs across different research areas is arguably the most important success factor for innovation. This makes it imperative for Saudi Arabia to embrace a collaborative approach that bridges the gap between academia and industry to formulate programs aimed at nurturing clinicians, engineers, scientists, and entrepreneurs.

This can be accomplished through the development of internships, apprenticeships, and joint research projects. KSA should work toward building synergies between the talent pipelines of leading institutions such that it serves the current and future needs of the country.

The US, one of the world’s foremost leaders in biotech innovations, employs a multifaceted approach to address this challenge. In addition to establishing innovation hubs anchored around major academic institutes, cooperative agreements such as the one between NIH and the Center for Disease Control and Prevention (CDC) to train public health workers in genetics and genomics to strengthen their Human Genome Program serve as exemplary strategies for building a robust talent pipeline.

ENSURE COLLABORATION BETWEEN PUBLIC & PRIVATE SECTOR

Saudi Arabia has directed substantial investments toward the development of fundamental infrastructure, including laboratories and facilities, which serves as the cornerstone for scientific research. To ensure continued growth, it is imperative to allocate resources to cutting-edge research facilities that cultivate disruptive technologies in intersecting and interdisciplinary fields like AI and data analytics, which play a pivotal role in genomics and bioinformatics. Identifying opportunities for public-private collaboration in these areas is essential to successful patient-centric innovation in KSA.

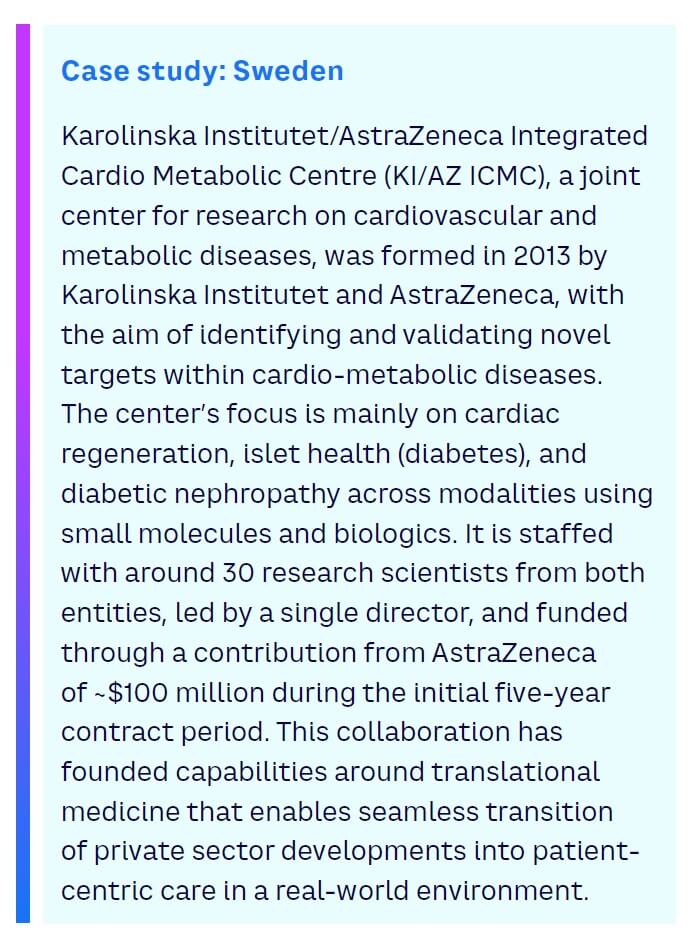

Similarly, the establishment of biotech parks and innovation campuses, designed to promote the collaborative use of workspaces and research facilities, is of paramount importance for fostering interdisciplinary innovation. A notable example of such a hub is the partnership between Karolinska Institutet and AstraZeneca (see “Case study: Sweden”). Other examples are Biohub and Stevenage Bioscience Catalyst in the UK and BioLabs, Johnson & Johnson Innovation’s JLABS, and the Mission Bay Innovation District in the US, all of which are home to renowned research institutions, biotech enterprises, and start-ups, thereby serving as hotbeds of biotech innovation.

DELIVER SUPPORTIVE PRO-BUSINESS ENVIRONMENT & REGULATIONS

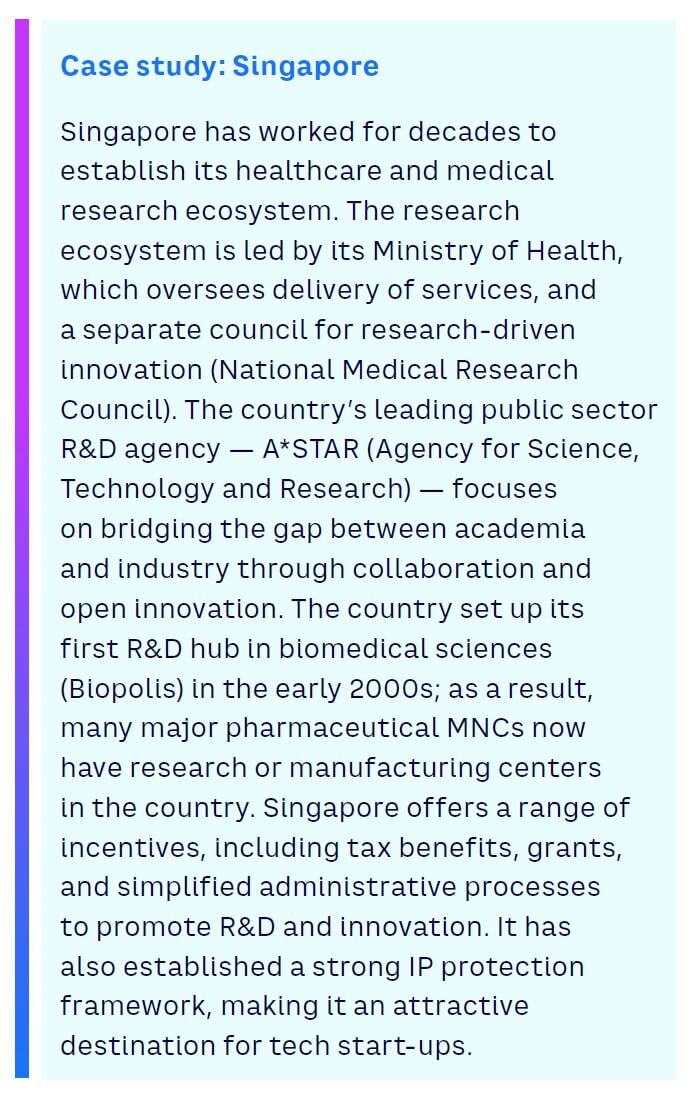

While the launch of the RDIA is a positive step toward creating legislation covering research, development, and innovation, it is imperative to establish a regulatory framework that actively nurtures innovation. Critical components of this regulatory environment include safeguarding IP rights, facilitating market access through international trade agreements, and simplifying bureaucratic procedures to foster a culture of risk-taking.

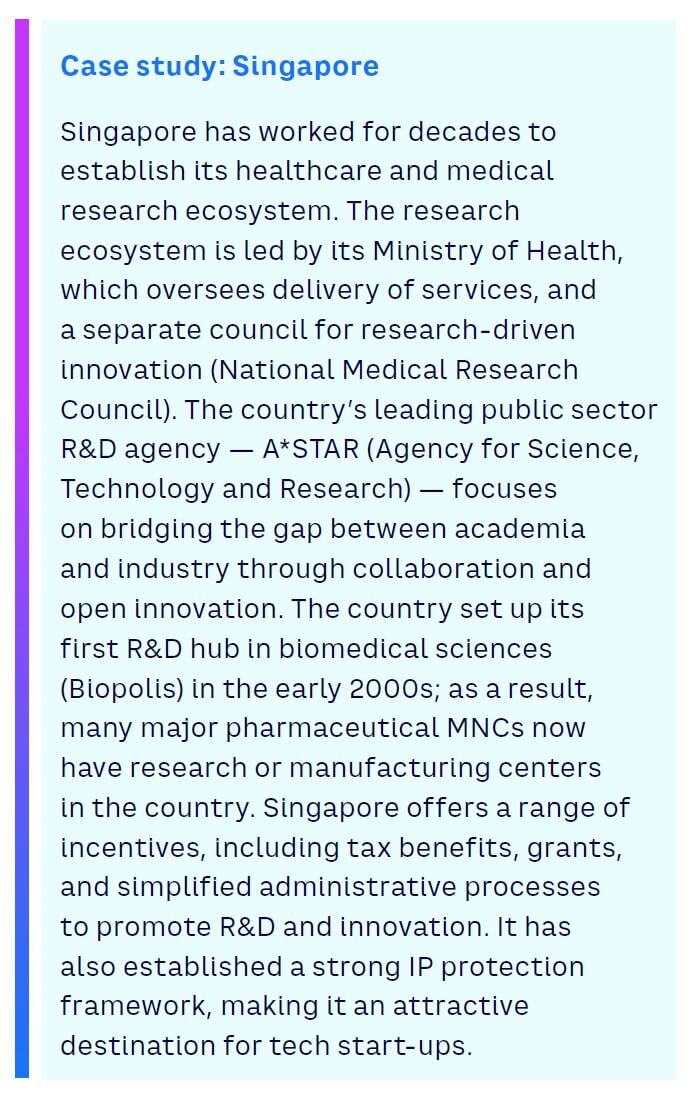

Singapore’s biotech research ecosystem is a good example of this (see “Case study: Singapore”). Led by the country’s Ministry of Health and a council for research, the state is known for its pro-business environment. Using regulation and supportive government infrastructure, as well as centralized government coordination, has made Singapore a regional powerhouse in medical research. To compete, KSA must design and implement appropriate governance arrangements in addition to devising strong underpinning regulations and infrastructure to support and direct efforts toward the country’s chosen biotechnology priorities.

CREATE INNOVATION ENVIRONMENTS & ECOSYSTEMS

As part of its Catapult Network initiative, the UK has set up specific cell and gene therapy–focused research centers, which bring together diverse public and private sector partners to create rapid solutions for key challenges (see “Case study: UK”). KSA can set up a similar network for hereditary disorders, where diverse companies, clinicians, and patients can come together to solve key challenges.

FOCUS ON CLEAR TARGET PICTURE FOR ALL RESEARCH

Delivering biotechnology success requires a clear target picture and the right operating model to centrally coordinate and promote the right research network with academia. This will streamline innovation from research to business. Technology-transfer offices play a pivotal role in the biotech industry by emphasizing the commercialization of research outcomes. They incentivize research and maximize research impact by providing access to markets and industry and protecting the rights of innovators.

The UK’s CGT Catapult (see “Case study: UK”) remains focused on commercialization by focusing both on supporting clinical trials[35] and commercial manufacturing, by ensuring that the country has the necessary infrastructure, skills, and capacity. CGT Catapult’s manufacturing facility aims to accelerate large-scale manufacturing of ATMPs.

Emerging economies such as Lithuania are also investing in the health and biotech arena with a clear focus on driving commercialization. An early integration of commercial functions to prepare for launch can accelerate technology transfer, thereby reducing time to market.

PROVIDE START-UPS ACCESS TO PRIVATE & PUBLIC FUNDING

Adequate sources of funding, including venture capital, angel investors, and public grants, are crucial for start-ups and innovative projects to thrive. Given the complex nature of the R&D and regulatory hurdles for commercialization of any biotechnology product, initial CAPEX and time requirements are significantly higher than other fields. This means that early-stage biotechnology companies almost always require large amounts of capital and resources to fund and fuel their R&D programs, which take years before they reach the market.

Most developed economies have public bodies such as the UKRI (UK Research & Innovation), Innovate UK, and the Biotechnology Innovation Organization (BIO). These catalyze and direct research and innovation funding to start-ups. Similar bodies should be created within KSA.

Conclusion

MOVING FORWARD WITH BIOTECHNOLOGY IN KSA

Given the opportunities and potential benefits it provides, countries across the world are focusing on fostering innovation and setting national targets for the biotechnology and genomics sector. While the sector is at an early stage in KSA, the country understands the large untapped potential that exists and is ramping up its efforts. While various entities such as KAIMRC, Hevolution Foundation, and Lifera are focusing extensively on the sector and forging partnerships to drive growth, a strong and coordinated push is necessary to achieve KSA’s biotechnology potential. Learnings from proven and successful strategies across the globe must be rapidly adapted in KSA to achieve its objective of becoming a regional leader in the genomics and genetics space, benefiting its people, economy, and overall reputation.

Notes

[1] According to the European Federation of Pharmaceutical Industries and Associates (EFPIA), “Precision medicine is a healthcare approach that utilizes molecular information (genomic, transcriptomic, proteomic, metabolomic, etc.), phenotypic and health data from patients to generate care insights to prevent or treat human disease resulting in improved health outcomes”; see: “Precision Medicine.” European Federation of Pharmaceutical Industries and Associates (EFPIA), accessed March 2024.

[2] The term “omics” encompasses the scientific field of collecting, quantifying, and analyzing large pools of biologic molecules, from single cells to whole organisms such as the human body, in both normal health and with disease (e.g., cancer). Molecules can be DNA (genomics), all kinds of RNA (transcriptomics), proteins (proteomics), metabolites (metabolomics), lipids (lipidomics), and sugars (glycomics), as well as their interactions (interactomics).

[3] “Biotechnology Market Size, Share & Trend Analysis by Technology (Nanobiotechnology, DNA Sequencing, Cell-Based Assays), by Application (Health, Bioinformatics), by Region, and Segment Forecasts, 2024–2030.” Grand View Research, accessed March 2024.

[4] Green, Eric D., et al. “Strategic Vision for Improving Human Health at the Forefront of Genomics.” Nature, 28 October 2020.

[5] “NIH’s All of Us Research Program Releases First Genomic Dataset of Nearly 100,000 Whole Genome Sequences.” National Institutes of Health, 17 March 2022.

[6] “European ‘1+ Million Genomes’ Initiative.” European Commission, accessed March 2024.

[7] Floden, Evan. “US Sets Bioeconomy Goals and Confronts Data Challenges.” Genetic Engineering & Biotechnology News, 1 September 2023.

[8] Buntz, Brian. “The Global Biotech Funding Landscape in 2023: US Leads While Europe and China Make Strides.” Drug Discovery & Development, 5 January 2024.

[9] “The US Bioscience Industry: Fostering Innovation and Driving America’s Economy Forward.” TEConomy/BIO, 2022.

[10] “GDP Based on PPP, Share of World.” International Monetary Fund (IMF), accessed March 2024.

[11] “Saudi Crown Prince to Prioritize Research, Development, and Innovation to Address Global Challenges.” The Embassy of The Kingdom of Saudi Arabia, 1 July 2022.

[12] Riyadh Global Medical Technology Summit 2023 website, accessed March 2024.

[13] Objectives also include establishing KSA as a global hub for world-class collaborations on prevalent genetic diseases and ensuring genomics play a vital role in delivering high-quality healthcare to all Saudi citizens; see: “Saudi Genome Project.” Kingdom of Saudi Arabia Vision 2030, accessed March 2024.

[14] “Saudi R&D Spending Tops $3.9bn.” Arabian Business, 8 February 2023.

[15] “Research and Development Expenditure (% of GDP).” The World Bank, 27 November 2023.

[16] “EU Investment in R&D Increased to €328 Billion in 2021.” Eurostat, 29 November 2022.

[17] “Saudi Arabia’s Leap in Research and Development Excellence.” Elsevier/Research, Development, and Innovation Authority (RDIA), 2023.

[18] Eckford, Catherine. “New Bill Could Enhance UK Clinical Trial Regulation.” European Pharmaceutical Review, 27 October 2023.

[19] Medicines and Healthcare Products Regulatory Agency. “New Streamlined Notification Scheme for Lowest-Risk Clinical Trials Marks Start of MHRA Overhaul of Regulation.” Gov.UK, 12 October 2023.

[20] “SFDA’s New Contract Research Organization Draft Guideline.” Al Tamimi & Co., 24 March 2022.

[21] “Saudi Crown Prince to Prioritize Research, Development, and Innovation to Address Global Challenges.” The Embassy of The Kingdom of Saudi Arabia, 1 July 2022.

[22] Nature Research Custom Media. “KAIMRC Leads The Kingdom into the First Phase I Clinical Trial.” Nature Portfolio, accessed March 2024.

[23] “National Biotechnology Center.” King Faisal Specialist Hospital & Research Centre, accessed March 2024.

[24] “Mechanisms and Incentives to Transform the Health Research into Discoveries and Knowledge with Health and Economic Benefits.” Saudi National Institute of Health (NIH), accessed March 2024.

[25] Hevolution website, accessed March 2024.

[26] “Investment Ministry Signs 2 Deals to Enhance Biotechnology, Pharmaceutical Sector in Saudi Arabia.” Arab News, 27 January 2023.

[27] “Novartis Signs Deal to Help Saudi Arabia Expand Its Biopharma Capabilities.” Arab News, 2 June 2022.

[28] “Saudi Genome Project.” Kingdom of Saudi Arabia Vision 2030, accessed March 2024.

[29] “Genomics Value Chain.” Thailand Center of Excellence for Life Sciences (TCELS), accessed March 2024.

[30] Majeed-Saidan, Muhammad Ali. “Effect of Consanguinity on Birth Defects in Saudi Women: Results from a Nested Case-Control Study.” Birth Defects Research Part A: Clinical and Molecular Teratology, Vol. 103, No. 2, February 2015.

[31] “Accelerating Genomic Medicine in the NHS: A Strategy for Embedding Genomics in the NHS Over the Next 5 Years.” National Health Service (NHS) England, 2022.

[32] Alqunaibet, Ada, et al. “Noncommunicable Diseases in Saudi Arabia Toward Effective Interventions for Prevention.” International Bank for Reconstruction and Development/World Bank Group, 2021.

[33] “Global Cancer Observatory.” World Health Organization (WHO), accessed March 2024.

[34] “Genomics and Biotechnology R&D in Singapore.” Government of the Netherlands Ministry of Foreign Affairs, January 2022.

[35] Over 175 ATMP clinical trials were reported as ongoing in the UK in 2023; see: Cameron, Isabel. “UK Maintains Status as an Attractive Destination for Advanced Therapy Clinical Trials.” BioPharmaReporter, 18 January 2024.

DOWNLOAD THE FULL REPORT

24 min read • Healthcare & life sciences

Advancing biotechnology & genomics in Saudi Arabia

Best practice strategies to develop the sector & maximize its impact

DATE

Executive Summary

HARNESSING THE BENEFITS OF BIOTECHNOLOGY IN SAUDI ARABIA

Fueled by advances in emerging technologies such as precision medicine,[1] ultra-targeted therapies, “omics,”[2] and many more, the global biotechnology and genomics sector is expected to expand at a double-digit growth rate going forward. Having understood the potential of the sector, governments across the world are making concerted efforts to harness and develop their own biotechnology industries.

Recognizing the opportunity, The Kingdom of Saudi Arabia (KSA) has already launched multiple initiatives to encourage the sector’s growth within the country. While KSA’s biotechnology industry is still at a relatively nascent stage, it is already seeing activity from different players, along with collaboration on projects such as the Saudi Genome Program, which provide a promising foundation for the future.

However, while these efforts are a step in the right direction, success requires a clear vision with specific priority areas outlined. This includes identifying and targeting three key segments of the biotechnology value chain (sampling, analysis, and application) as high priorities based on the country’s current capabilities and requirements, as well as developing capacity across a minimum of four thematic areas to further foster growth: (1) genomic data repository set up, (2) widespread genomics adoption, (3) omics and precision medicine research and application, and (4) AI/machine learning (ML) utilization.

Adopting best practices from other countries is an essential approach to catalyze the creation of an indigenous biotechnology and genomics innovation hub. Successful nations have already designed and implemented a range of programs and practices to solve potential challenges and ensure a seamless realization of their visions for biotechnology and genomics. These include: the creation of talent pools through anchoring institutions and innovation hubs; enhanced, active collaboration between the public and private sector; delivering a supportive pro-business environment and regulations, including enhanced intellectual property (IP) protection; the creation of specific innovation-themed environments and ecosystems; setting a clear target picture of all research efforts; and providing start-ups with fast and easy access to public and private funds.

As this Report explains, these best practices are all imperative to helping KSA achieve its objective of becoming a regional leader in the biotechnology and genomics space, delivering clear benefits in terms of public health, economic development, reputation, and overall competitiveness.

1

THE GLOBAL GROWTH OF BIOTECHNOLOGY & GENOMICS

Thanks to ongoing advances, the fields of biotechnology and genomics are set to play a major role in mankind’s future wellness and healthcare journeys. Modern biotechnology provides breakthrough products and technologies to combat debilitating and rare diseases, delivering personalized and more effective treatments often based on genomic data.

Globally, the market is growing rapidly as nations and governments recognize its value for their citizens and tremendous transformative potential for their economies and healthcare systems. As of 2023, the worldwide biotechnology sector was estimated to be worth US $1.5 trillion, with an expectation that it will grow at a double digit CAGR to reach between $3.5-$4 trillion by 2030, according to Grand View Research.[3]

This rapid growth will be driven by both demand-side factors (including rising demand for better and more efficient healthcare diagnostics and treatment services and an increasing focus on wellness and prevention) and supply-side aspects, such as an increasing governmental focus on the sector, along with rising private sector investments and rapid technological advances.

EMERGING TRENDS IN THE SECTOR

Both the public and private sectors are exploring a range of biotechnology use cases along the wellness and healthcare value chain. Demonstrating this, a study of funding patterns for AI/ML-powered digital health companies reflects multiple emerging trends.

These include a shift toward precision healthcare, including the rise of CAR-T cell therapy and companion diagnostics and the growth of ultra-targeted therapies, particularly in oncology, using genomic data, with a consequent focus on more precise patient population segments. The trends are driving new business models based on close collaboration among players across the entire healthcare ecosystem; these models are critical for the successful development and implementation of novel approaches for preventive and curative care.

At the same time, new treatment paradigms have emerged. Advanced therapeutics such as gene editing through CRISPR-Cas9 provide highly personalized and targeted therapies that are curing once-fatal diseases such as cancer and rare genetic disorders, while gene therapy, cell therapy, and immunotherapy are rapidly shifting the focus from mortality to morbidity. This brings implications for all players in the healthcare ecosystem, including developers, payors, providers, and patients.

Thanks to advances in next-generation sequencing (NGS) technologies, we are rapidly moving toward a future where generating and analyzing the whole human genome will be routine for any laboratory.[4] Alongside this, gathering large-scale biological information and data from other pools of molecules (such as proteomics, metabolomics, and transcriptomics) will help generate insights related to disease development and treatment effects. Genome data analysis using sophisticated technologies such as AI and ML is also a major emerging trend with several start-ups focusing on this segment.

GROWTH IN GENOMIC DATABASES TO SUPPORT RESEARCH

Global priorities are shifting toward citizen-centered and patient-friendly genomic collaboration and research. This is leading to countries increasing their investments in biotechnology. In particular, they are actively working to create diverse genome data sets, fostering equitable genomics and driving innovation to address health disparities:

-

The US National Institute of Health (NIH) All of Us Research Program now boasts a data set of nearly 100,000 genome sequences, supplemented by participants’ electronic health records, Fitbit data, and survey responses, all accessible through a cloud-based platform.[5]

-

The EU’s 1+ Million Genomes Initiative, supported by over 25 signatory countries, is dedicated to establishing a European genomic data infrastructure and facilitating federated data access through common national regulation.[6]

-

In the UK, the National Health Service (NHS) is taking steps to integrate genomics into its regular operations by offering whole genomics sequencing as standard to those with rare diseases or cancers.[7]

CRITICALITY OF SECTOR TO NATIONAL GROWTH AGENDA

Changing global geopolitical dynamics and the rise of new diseases and pandemics mean that a strong biotechnology sector is increasingly vital to ensuring a country’s competitiveness, self-sufficiency, and health. Clearly, at a basic level, investing in the sector is essential to providing countries with rapid, immediate access to the latest innovative and cost-effective treatments. Globally, around $162 billion was invested in the biotech sector in 2023, with the US accounting for approximately 35% of total global funding.[8]

A strong biotechnology industry also catalyzes growth in capability development across research and innovation, increasing jobs and investments and boosting the country’s GDP. Demonstrating this, the biosciences sector has outperformed the wider US economy post-COVID, contributing to around 10% of US GDP in 2021. Additionally, the industry generated 2.1 million direct jobs, with employees earning 85% more than the average private sector salary.[9] A strong biotech sector provides a reputational boost that enhances a country’s competitiveness in terms of acquiring talent, innovations, and investment.

2

CURRENT STATUS OF BIOTECHNOLOGY & GENOMICS IN SAUDI ARABIA

While KSA accounts for 1.3% of global GDP, it only currently makes up 0.2% of the global genomics sector.[10] This demonstrates that the industry is still early in its development. Backing this up, the projected growth rate for the genomics sector across MENA (Middle East and North Africa) between 2022–2030 is around 9.5% CAGR, which is much lower than the overall global growth rate of approximately 16.5%. This highlights the opportunity and indicates the potential for the region to direct additional focus and resources toward the sector.

CLEAR TARGETS GIVE IMPETUS & DIRECTION

Globally, multiple countries’ economies have outlined specific goals and targets for their biotechnology and genomics sectors. For example, in the US, the White House Office of Science and Technology Policy report “Bold Goals for US Biotech and Biomanufacturing,” published in March 2023, highlights concrete objectives to strengthen the US bioeconomy, including collaboration with the private sector to advance innovation throughout the full healthcare value chain.

Along similar lines, Saudi Arabia has demonstrated a strong commitment toward developing its R&D agenda. Its “RDI (Research, Development and Innovation) National Aspirations and Priorities” for the next two decades include “Health and Wellness” and “Economies of the Future.”[11] Backing this up, multiple initiatives have been planned and announced in KSA, such as the creation of the National Biotechnology Strategy Committee and Riyadh Biotechnology City.[12] The Saudi Genome Project 2.0 has also set ambitious objectives including enhancing the country’s position as the leader in genomics and genetics within the MENA region.[13]

Objectives are being backed by investment in R&D to build a knowledge-based sustainable economy, as part of Saudi Arabia’s National Vision 2030 and National Transformation Program. KSA has dedicated substantial funding for R&D, totaling $3.9 billion in 2021,[14] equivalent to 0.46% of GDP[15] (see Figure 1). While this R&D intensity[16] is currently much lower than the typical 1.5%-3.5% spent by regional and large global economies, this is set to change as Saudi Arabia aims to become a global leader in research, development, and innovation through an annual investment equivalent to 2.5% of GDP by 2040. This is expected to not only add $16 billion to the economy, but also create high-value jobs in science and technology.[17]

SUPPORTIVE REGULATIONS ACCELERATE GROWTH

In the biotechnology sector, major economies have introduced regulations to encourage transparency and expedite clinical trial approvals. For instance, the UK is looking to introduce the Future Clinical Trials Bill,[18] while its Medicines and Healthcare products Regulatory Agency (MHRA) has introduced guidelines to expedite low-risk clinical trials.[19]

Along similar lines, Saudi Arabia is developing and setting up a clear regulatory and governance mechanism for R&D. The Saudi Food and Drug Authority (SFDA) has proposed new guidelines for clinical trials with the aim to regulate, support, and enhance collaboration between the different entities involved in them,[20] while the Research, Development and Innovation Authority (RDIA) is aiming to act as an enabler, legislator, and regulator[21] going forward.

MULTIPLE LARGE-SCALE INITIATIVES ALREADY LAUNCHED

Understanding the opportunity, multiple entities within KSA’s R&D ecosystem are working toward enhancing the biotechnology agenda, launching a range of initiatives. As part of this, there has been an increase in academic research and initiatives by Saudi institutions and a focus on developing the local talent pool in science and technology:

-

Research organizations

-

King Abdullah International Medical Research Center’s (KAIMRC), launched in 2006, focuses on applied sciences research and works with leading academic institutions around the world in areas such as vaccines, genetic research, therapeutics, and drug screening. For example, working with the University of Oxford, KAIMRC led The Kingdom’s first phase I clinical trial of a vaccine into the MERS-CoV virus.[22] The institution is currently focused on multiple initiatives, including the Saudi Biobank, Cord Blood Bank, Research Trauma Project, and Saudi Stem Cell Donor Registry.

-

-

Academic institutions

-

The King Abdullah University of Science and Technology (KAUST) and King Abdulaziz City for Science and Technology (KACST) are fostering research in the fields of genomics and biosciences through memorandums of understanding (MoUs) and collaboration with industry bodies, with a deep focus on biotechnology.

-

The National Biotechnology Center, a joint effort between King Faisal Specialist Hospital and Research Centre (KFSH&RC) and KACST is focused on enhancing medical research and biotechnology. Over 110 projects have been approved, and 67 are ongoing.[23]

-

-

Government initiatives

-

The Saudi National Institute of Health, launched by the Ministry of Health (MOH), is focused on supervision and backing of translational research and clinical trials in the health domain by providing funds and support to research personnel.[24]

-

-

Nonprofit organizations

-

The Hevolution Foundation, a non-profit organization, is focused on longevity medicine and receives up to $1 billion funding per year from the Saudi government.[25]

-

-

Pharmaceutical manufacturing companies

-

Lifera, a Public Investment Fund entity, is a pharmaceutical manufacturing company set up in June 2023 to focus on manufacturing life-saving and essential pharmaceutical products. To date, Lifera has established three platforms: Biologics & Innovation, Manufacturing, and Commercialization.

-

Additionally, Saudi Arabia has built strong partnerships with many global pharmaceutical and biotech companies that are helping grow local capabilities:

-

Partnerships

-

KAUST signed two MoUs in 2023 with multinational firms (Boehringer Ingelheim and Novo Nordisk) focused on enhancing cooperation in the biotechnology and medicine sector.[26]

-

The Ministry of Investment (MISA) has partnered with Novartis to further strengthen Saudi Arabia’s biopharmaceutical capabilities. This partnership involves local investments in cell and gene therapy, technology transfer, and clinical research, aiming to alleviate healthcare budget pressures. Novartis’s involvement is anticipated to contribute approximately $857 million to Saudi Arabia’s GDP by 2024.[27]

-

In 2023, Lifera, Sanofi, and Arabio signed an MoU to manufacture and supply vaccines in Saudi Arabia, boosting local production with a new state-of-the-art manufacturing facility.

-

However, while these agreements are a step in the right direction to bring big pharma and multinational biotech companies to Saudi Arabia, there is a long way to go for developing local capabilities across the value chain. Recognizing this, academic and research institutes have put in place a range of accelerator and incubator programs to train and support entrepreneurs:

-

Research organizations

-

KAIMRC’s Medical Biotechnology Park (MBP) provides a supportive environment to new and emerging medical and biomedical technology ventures and compatible businesses. This environment is designed to assist them during their start-up phase and enhance their prospects for local success.

-

-

Academic institutions

-

KAUST’s accelerator programs include TAQADAM, one of the longest-running accelerator programs in Saudi Arabia. It provides six-month programs to innovators and entrepreneurs offering mentorship, funding, and targeted workshops.

-

KACST has an agreement with King Salman Youth Center to carry out a training project for entrepreneurs. This boosts KSA’s ongoing efforts to fully realize the potential of Saudi youth by promoting their active participation in the development process.

-

In 2022, Dammam Valley, owned by Imam Abdulrahman bin Faisal University, established the Biotech Startups Program, a first-of-its-kind initiative designed to support and incentivize health and biotechnology entrepreneurs. Over 130 projects from various fields of genomics and therapeutics have participated since the program’s inception.

-

Entrepreneurship initiatives have so far primarily come from leading institutions such as KAIMRC, KAUST, and KACST. However, as these institutes and their programs are independent of each other, this can limit collaboration and result in inefficient utilization of resources and facilities.

THE SAUDI GENOME PROGRAM: A BLUEPRINT FOR SUCCESS

Joint efforts and strong collaboration between public and private entities will bolster the development of the Saudi Arabian biotechnology sector. The Saudi Genome Program represents a significant stride in this direction, specifically in the fight against genetic disorders. The program was developed through partnerships with international organizations to establish an extensive genetic repository. To date, 63,000 genetic samples have been gathered, and 7,500 pathogen variants have been detected. This is a result of cross collaboration between institutes, including KACST, KAIMRC, KFSHD, and MOH.[28] However, a stronger coordinated push is critical to ensure rapid innovation and commercialization in The Kingdom.

3

ACCELERATING PROGRESS WITHIN SAUDI ARABIA

For development of KSA’s biotechnology sector to gather pace, there needs to be a focus on three segments of the value chain (sampling, analysis, and applications) and four thematic growth areas (creating a population-level genomic data repository, the widespread adoption of genomics as a screening/diagnostic tool, omics/precision medicine, and AI/ML-enhanced genomics).

THE VALUE CHAIN: CONCENTRATE ON 3 SEGMENTS

The genomics value chain comprises five steps, each of which requires different capabilities (see Figure 2).[29] To enhance Saudi Arabia’s competitiveness in the biotechnology market, it is vital to identify which of these steps best align with the country’s core capabilities. As highlighted in the figure, KSA should increase its focus particularly across three segments in the value chain: sampling, analysis, and application — due to the following reasons:

-

Sampling. Saudi Arabia can easily develop local capabilities in this area, given that there is a low dependence on highly trained clinicians or existing transportation infrastructure. While this component has a relatively low financial value compared to other steps, developing local capabilities will create a strong foundation for developing presence in more complex processes.

-

Sequencing. Large, high-tech equipment is essential for sequencing work. Developed economies such as the US and UK have already built a strong presence in this area based on their high-tech manufacturing capability, tapping into the high potential for revenues. Establishing competitive equipment manufacturing facilities within KSA would be CAPEX-intensive and technically challenging given a lack of local knowledge and skilled labor. Consequently, Saudi Arabia should focus on importing sequencing machines at this stage.

-

Analysis. Bioinformatics plays a crucial role in processing and analyzing genomic data. Developing software capabilities is a prerequisite for growth in this space; for example, comparison with various phenotypes can reveal meaningful data about diseases and biomarkers. In terms of financial value, this is a lucrative segment where important value can be derived by creating a population database. Marking this as an area of focus, institutes such as KAUST and KACST are already creating academic and industry partnerships to develop AI and data analytics capabilities in KSA.

-

Interpretation. Genetic data interpretation involves identifying clinically relevant genetic variations and their implications for an individual’s health. This segment is expected to significantly increase in size as human genome projects are completed, becoming a central area of research for many countries. However, to enter this area, KSA would need to develop processes and train skilled clinicians who can translate genomic data to predict and diagnose genetic disorders.

-

Applications. Genomic applications across diagnostics, drug development, and precision medicine are relevant for pharmaceutical companies, healthcare systems, and clinicians. This component of the value chain is at a relatively early stage and thus presents opportunities for KSA. The Kingdom should continue to focus on developing the diagnostic services component (i.e., genomics testing services) and maximize value generation from it.

FOCUS ON 4 THEMATIC AREAS TO DRIVE GROWTH

The biotechnology sector has seen crucial advances that are shaping the genetic research and healthcare landscape, including:

-

The increasing utilization of high-throughput sequencing technologies, which are enabling the rapid and cost-effective analysis of entire genomes. This has accelerated our understanding of genetic variation and its implications in health and disease.

-

The integration of genomics into precision medicine, with customized treatments and therapies being developed based on an individual’s genetic profile.

-

The field of epigenomics has grown, shedding light on how environmental factors can influence gene expression and impact health.

-

The emergence of large-scale biobanks and collaborative initiatives worldwide is facilitating the sharing of genetic data, promoting international collaboration, and enhancing our ability to tackle global health challenges.

-

Furthermore, AI/ML are also playing a pivotal role in genomics, aiding in data analysis and the identification of novel genetic associations.

These trends present crucial opportunities that KSA can tap into to develop prevention, monitoring, and treatment technologies that reduce mortality and improve the entire population’s quality of life. Foundations are being established through investment and regulatory framework setup, and now it is imperative to embark on specific actions aimed at fostering the next stage of growth.

Globally, countries are selecting biotechnology and genomics sector priorities based on their population’s healthcare burden and trends, existing capabilities, infrastructure, and the most promising emerging areas. KSA must recognize the fast-evolving landscape and focus on four specific themes going forward to maximize value generation. These include:

-

A population-level genomic data repository. Almost all major economies, including KSA, have been working toward creating a population-level genomic database. This is the first step toward developing precision medicine and is important for understanding how diseases develop so better ways of prevention and management can be devised.

-

Widespread adoption of genomics as a regular tool for screening and diagnostics. It is important to develop a nation-wide underlying infrastructure and service network that facilitates adoption of genomics as a standard clinical diagnostic tool. Currently, due to sociocultural norms, the incidence of birth defects is relatively high.[30] Consequently, genetic risk profiling, genetic screening, and newborn genetic testing could be incorporated as a standard clinical guideline for certain cases. Over time, new clinical indications for genomic testing should be introduced in a phased manner based on the country’s requirements.[31]

-

Omics and precision medicine. Considering the keingdom’s disease burden, it is imperative to focus on this segment, and gather and analyze data to support with diagnosis and management of diseases. The burden of non-communicable diseases (NCDs) such as cardiovascular diseases and diabetes on KSA’s economy is substantial. NCDs accounted for 73% of all deaths in KSA in 2018, higher than the global average of 71%.[32] Approximately 10% of the population is at risk of developing cancer before the age of 75, a figure that is expected to rise going forward.[33] By using biomarkers, omics could support individuals in preventing or effectively treating diseases, thus reducing costs to the healthcare system as well as increasing benefits to patients. In some countries, selected data from omics is being used in certain types of cancer treatments to screen for drug responsiveness and likelihood of adverse effects.

-

AI/ML in genomics. Advanced software and technologies are vital for rapidly and efficiently deriving insights from genetic material. Countries across the globe are utilizing AI and ML for various use cases such as mapping rare mutations or drafting treatment regimes.[34]

Overall, KSA will have to define and initiate focused efforts to develop technologies and platforms for a range of genomics applications. Creating a strong foundation for genomic research and analysis is a prerequisite for successful innovation in the sector. This can be achieved by the development of biobanks and genome databases for the Saudi population while encouraging the use of AI/ML to enable exhaustive research into genotypes and gene variations. It is also important to increase research focus on precision medicine so that tailored solutions based on the country’s population characteristics and disease burden can be created and delivered.

4

KEY SUCCESS FACTORS TO DEVELOP SECTOR IN SAUDI ARABIA

Saudi Arabia has embarked on multiple initiatives aimed at fostering investment in R&D and introducing legislation to support innovation. Nonetheless, development of KSA biotechnology and genomics industry is currently at an early stage, requiring a focus on six key success factors to encourage progress.

CREATE TALENT POOL

The availability of a skilled and diverse talent pool to meet current and future needs across different research areas is arguably the most important success factor for innovation. This makes it imperative for Saudi Arabia to embrace a collaborative approach that bridges the gap between academia and industry to formulate programs aimed at nurturing clinicians, engineers, scientists, and entrepreneurs.

This can be accomplished through the development of internships, apprenticeships, and joint research projects. KSA should work toward building synergies between the talent pipelines of leading institutions such that it serves the current and future needs of the country.

The US, one of the world’s foremost leaders in biotech innovations, employs a multifaceted approach to address this challenge. In addition to establishing innovation hubs anchored around major academic institutes, cooperative agreements such as the one between NIH and the Center for Disease Control and Prevention (CDC) to train public health workers in genetics and genomics to strengthen their Human Genome Program serve as exemplary strategies for building a robust talent pipeline.

ENSURE COLLABORATION BETWEEN PUBLIC & PRIVATE SECTOR

Saudi Arabia has directed substantial investments toward the development of fundamental infrastructure, including laboratories and facilities, which serves as the cornerstone for scientific research. To ensure continued growth, it is imperative to allocate resources to cutting-edge research facilities that cultivate disruptive technologies in intersecting and interdisciplinary fields like AI and data analytics, which play a pivotal role in genomics and bioinformatics. Identifying opportunities for public-private collaboration in these areas is essential to successful patient-centric innovation in KSA.

Similarly, the establishment of biotech parks and innovation campuses, designed to promote the collaborative use of workspaces and research facilities, is of paramount importance for fostering interdisciplinary innovation. A notable example of such a hub is the partnership between Karolinska Institutet and AstraZeneca (see “Case study: Sweden”). Other examples are Biohub and Stevenage Bioscience Catalyst in the UK and BioLabs, Johnson & Johnson Innovation’s JLABS, and the Mission Bay Innovation District in the US, all of which are home to renowned research institutions, biotech enterprises, and start-ups, thereby serving as hotbeds of biotech innovation.

DELIVER SUPPORTIVE PRO-BUSINESS ENVIRONMENT & REGULATIONS

While the launch of the RDIA is a positive step toward creating legislation covering research, development, and innovation, it is imperative to establish a regulatory framework that actively nurtures innovation. Critical components of this regulatory environment include safeguarding IP rights, facilitating market access through international trade agreements, and simplifying bureaucratic procedures to foster a culture of risk-taking.

Singapore’s biotech research ecosystem is a good example of this (see “Case study: Singapore”). Led by the country’s Ministry of Health and a council for research, the state is known for its pro-business environment. Using regulation and supportive government infrastructure, as well as centralized government coordination, has made Singapore a regional powerhouse in medical research. To compete, KSA must design and implement appropriate governance arrangements in addition to devising strong underpinning regulations and infrastructure to support and direct efforts toward the country’s chosen biotechnology priorities.

CREATE INNOVATION ENVIRONMENTS & ECOSYSTEMS

As part of its Catapult Network initiative, the UK has set up specific cell and gene therapy–focused research centers, which bring together diverse public and private sector partners to create rapid solutions for key challenges (see “Case study: UK”). KSA can set up a similar network for hereditary disorders, where diverse companies, clinicians, and patients can come together to solve key challenges.

FOCUS ON CLEAR TARGET PICTURE FOR ALL RESEARCH

Delivering biotechnology success requires a clear target picture and the right operating model to centrally coordinate and promote the right research network with academia. This will streamline innovation from research to business. Technology-transfer offices play a pivotal role in the biotech industry by emphasizing the commercialization of research outcomes. They incentivize research and maximize research impact by providing access to markets and industry and protecting the rights of innovators.

The UK’s CGT Catapult (see “Case study: UK”) remains focused on commercialization by focusing both on supporting clinical trials[35] and commercial manufacturing, by ensuring that the country has the necessary infrastructure, skills, and capacity. CGT Catapult’s manufacturing facility aims to accelerate large-scale manufacturing of ATMPs.

Emerging economies such as Lithuania are also investing in the health and biotech arena with a clear focus on driving commercialization. An early integration of commercial functions to prepare for launch can accelerate technology transfer, thereby reducing time to market.

PROVIDE START-UPS ACCESS TO PRIVATE & PUBLIC FUNDING

Adequate sources of funding, including venture capital, angel investors, and public grants, are crucial for start-ups and innovative projects to thrive. Given the complex nature of the R&D and regulatory hurdles for commercialization of any biotechnology product, initial CAPEX and time requirements are significantly higher than other fields. This means that early-stage biotechnology companies almost always require large amounts of capital and resources to fund and fuel their R&D programs, which take years before they reach the market.

Most developed economies have public bodies such as the UKRI (UK Research & Innovation), Innovate UK, and the Biotechnology Innovation Organization (BIO). These catalyze and direct research and innovation funding to start-ups. Similar bodies should be created within KSA.

Conclusion

MOVING FORWARD WITH BIOTECHNOLOGY IN KSA

Given the opportunities and potential benefits it provides, countries across the world are focusing on fostering innovation and setting national targets for the biotechnology and genomics sector. While the sector is at an early stage in KSA, the country understands the large untapped potential that exists and is ramping up its efforts. While various entities such as KAIMRC, Hevolution Foundation, and Lifera are focusing extensively on the sector and forging partnerships to drive growth, a strong and coordinated push is necessary to achieve KSA’s biotechnology potential. Learnings from proven and successful strategies across the globe must be rapidly adapted in KSA to achieve its objective of becoming a regional leader in the genomics and genetics space, benefiting its people, economy, and overall reputation.

Notes

[1] According to the European Federation of Pharmaceutical Industries and Associates (EFPIA), “Precision medicine is a healthcare approach that utilizes molecular information (genomic, transcriptomic, proteomic, metabolomic, etc.), phenotypic and health data from patients to generate care insights to prevent or treat human disease resulting in improved health outcomes”; see: “Precision Medicine.” European Federation of Pharmaceutical Industries and Associates (EFPIA), accessed March 2024.

[2] The term “omics” encompasses the scientific field of collecting, quantifying, and analyzing large pools of biologic molecules, from single cells to whole organisms such as the human body, in both normal health and with disease (e.g., cancer). Molecules can be DNA (genomics), all kinds of RNA (transcriptomics), proteins (proteomics), metabolites (metabolomics), lipids (lipidomics), and sugars (glycomics), as well as their interactions (interactomics).

[3] “Biotechnology Market Size, Share & Trend Analysis by Technology (Nanobiotechnology, DNA Sequencing, Cell-Based Assays), by Application (Health, Bioinformatics), by Region, and Segment Forecasts, 2024–2030.” Grand View Research, accessed March 2024.

[4] Green, Eric D., et al. “Strategic Vision for Improving Human Health at the Forefront of Genomics.” Nature, 28 October 2020.

[5] “NIH’s All of Us Research Program Releases First Genomic Dataset of Nearly 100,000 Whole Genome Sequences.” National Institutes of Health, 17 March 2022.

[6] “European ‘1+ Million Genomes’ Initiative.” European Commission, accessed March 2024.

[7] Floden, Evan. “US Sets Bioeconomy Goals and Confronts Data Challenges.” Genetic Engineering & Biotechnology News, 1 September 2023.

[8] Buntz, Brian. “The Global Biotech Funding Landscape in 2023: US Leads While Europe and China Make Strides.” Drug Discovery & Development, 5 January 2024.

[9] “The US Bioscience Industry: Fostering Innovation and Driving America’s Economy Forward.” TEConomy/BIO, 2022.

[10] “GDP Based on PPP, Share of World.” International Monetary Fund (IMF), accessed March 2024.

[11] “Saudi Crown Prince to Prioritize Research, Development, and Innovation to Address Global Challenges.” The Embassy of The Kingdom of Saudi Arabia, 1 July 2022.

[12] Riyadh Global Medical Technology Summit 2023 website, accessed March 2024.

[13] Objectives also include establishing KSA as a global hub for world-class collaborations on prevalent genetic diseases and ensuring genomics play a vital role in delivering high-quality healthcare to all Saudi citizens; see: “Saudi Genome Project.” Kingdom of Saudi Arabia Vision 2030, accessed March 2024.

[14] “Saudi R&D Spending Tops $3.9bn.” Arabian Business, 8 February 2023.

[15] “Research and Development Expenditure (% of GDP).” The World Bank, 27 November 2023.

[16] “EU Investment in R&D Increased to €328 Billion in 2021.” Eurostat, 29 November 2022.

[17] “Saudi Arabia’s Leap in Research and Development Excellence.” Elsevier/Research, Development, and Innovation Authority (RDIA), 2023.

[18] Eckford, Catherine. “New Bill Could Enhance UK Clinical Trial Regulation.” European Pharmaceutical Review, 27 October 2023.

[19] Medicines and Healthcare Products Regulatory Agency. “New Streamlined Notification Scheme for Lowest-Risk Clinical Trials Marks Start of MHRA Overhaul of Regulation.” Gov.UK, 12 October 2023.

[20] “SFDA’s New Contract Research Organization Draft Guideline.” Al Tamimi & Co., 24 March 2022.

[21] “Saudi Crown Prince to Prioritize Research, Development, and Innovation to Address Global Challenges.” The Embassy of The Kingdom of Saudi Arabia, 1 July 2022.

[22] Nature Research Custom Media. “KAIMRC Leads The Kingdom into the First Phase I Clinical Trial.” Nature Portfolio, accessed March 2024.

[23] “National Biotechnology Center.” King Faisal Specialist Hospital & Research Centre, accessed March 2024.

[24] “Mechanisms and Incentives to Transform the Health Research into Discoveries and Knowledge with Health and Economic Benefits.” Saudi National Institute of Health (NIH), accessed March 2024.

[25] Hevolution website, accessed March 2024.

[26] “Investment Ministry Signs 2 Deals to Enhance Biotechnology, Pharmaceutical Sector in Saudi Arabia.” Arab News, 27 January 2023.

[27] “Novartis Signs Deal to Help Saudi Arabia Expand Its Biopharma Capabilities.” Arab News, 2 June 2022.

[28] “Saudi Genome Project.” Kingdom of Saudi Arabia Vision 2030, accessed March 2024.

[29] “Genomics Value Chain.” Thailand Center of Excellence for Life Sciences (TCELS), accessed March 2024.

[30] Majeed-Saidan, Muhammad Ali. “Effect of Consanguinity on Birth Defects in Saudi Women: Results from a Nested Case-Control Study.” Birth Defects Research Part A: Clinical and Molecular Teratology, Vol. 103, No. 2, February 2015.

[31] “Accelerating Genomic Medicine in the NHS: A Strategy for Embedding Genomics in the NHS Over the Next 5 Years.” National Health Service (NHS) England, 2022.

[32] Alqunaibet, Ada, et al. “Noncommunicable Diseases in Saudi Arabia Toward Effective Interventions for Prevention.” International Bank for Reconstruction and Development/World Bank Group, 2021.

[33] “Global Cancer Observatory.” World Health Organization (WHO), accessed March 2024.

[34] “Genomics and Biotechnology R&D in Singapore.” Government of the Netherlands Ministry of Foreign Affairs, January 2022.

[35] Over 175 ATMP clinical trials were reported as ongoing in the UK in 2023; see: Cameron, Isabel. “UK Maintains Status as an Attractive Destination for Advanced Therapy Clinical Trials.” BioPharmaReporter, 18 January 2024.

DOWNLOAD THE FULL REPORT