DOWNLOAD

DATE

Contact

The European public EV charging market is heading for disruption. Although the market is still at an embryonic stage, EV charging is already about to become a commodity and players need to innovate in several directions to stay in business. Some are still hesitating, while others are already investing in collaborations or acquisitions to secure their future market positions. The European market is characterized by high fragmentation and intense competition for market shares and direct customer access. What are the implications for the market in these fast-changing times? What key success factors will drive business models to evolve to cope with the imminent disruption?

Introduction

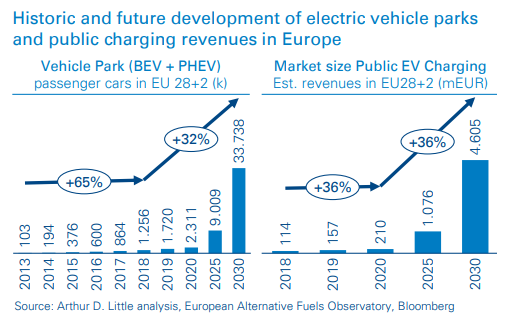

The EV charging market has huge potential growth. EVs and charging stations are not widespread yet, but a significant increase in EV production is expected in the next years. Despite high relative uptake of the electric car park in recent years, absolute growth is still marginal, having only amounted to 400,000 electrified vehicles from 2017 to 2018 in Europe. Applying current vehicle usage patterns and market prices of public charging services to the electric vehicle park would result in total revenues of only 114 €m for 2018.

The expected market uptake is attracting new, eager investors. Today, margins of public EV charging players are low and ROI is negative. However, big oil companies such as Shell and BP have been proactive in securing their shares of the market.

With a rising number of EVs, infrastructure and end-customer solutions are working to keep up. North European countries, in particular, have built up impressive charging infrastructures, and the industry agreed on a European plug standard (CCS). The Netherlands alone is operating more than 40,000 public charging points; this means CPs are found on the road every 3 km, on average. End customers can also select from a big variety of charging cards, which offer access to more than 100,000 charging points all over Europe. Basic electric vehicle charging services are on their way to becoming a commodity; we can already see the first signs of industry consolidation in all value-chain steps. It is clear that small, independent players will only be able to survive if they can offer innovative solutions that distinguish them from the rest of the market.

Still, the European charging market shows high fragmentation, both regionally and along the value chain. However, the expected boost, consolidation and evolution of business models have led to the assumption that the market stands on the threshold of disruption. Some players have started to integrate along the value chain, while others have diversified into adjacent business models to expand their scale, reach and service offerings.

The public EV charging value chain today

Historically, there have been three roles in the public EV value chain:

- Charge point operators (CPOs) run and maintain the charging station. They do not necessarily need to own the charging infrastructure. Their tasks can be separated into technical (deployment, operation, maintenance) and financial CPOs (marketing, pricing), and both parts can be fulfilled by different entities. Unsurprisingly, this business was originally formed and dominated by utilities. A high number of small, regional players are active in this field.

- Mobility service providers (MSPs) offer service contracts to end customers and provide the user interface for access to and usage of charging infrastructure. Today, practical access to charging is mainly through RFID cards and apps. A key success factor is to offer the end customer easy access to as many charging points as possible, regardless of the user’s location. Historically, automotive OEMs were front-runners in enabling long-distance e-mobility for their EV customers and offering additional services via the customer interface (cross-selling of other mobility services). However, as this is a software-intense business, many small, innovative IT start-ups have entered and now directly compete with OEMs (e.g., NewMotion, Plugsurfing, Virta).

- eRoaming platforms act as aggregators of the two other roles, connecting CPOs and MSPs. They release MSPs from the labor-intensive task of directly and individually coordinating with the many CPOs. Currently, the market is divided between just a few platforms. Aggregators such as Hubject and Gireve were put in place by energy and automotive companies. Their key success factor is offering MSPs and CPOs access to as many partners as possible.

The evolution of EV charging business models

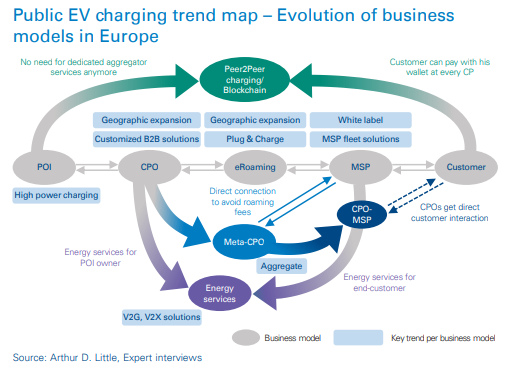

Those value chain roles are still valid today. But value chain integration has started, and only a few pure players are left in the market. Business models are undergoing change, as illustrated in below figure.

Charge point owners (points of interest), such as shopping centers, restaurants and gas stations, need to cope with the improved charging performance of new electric vehicles. They will have to upgrade their infrastructure to higher charging speeds. This is especially true as drivers of battery electric vehicles (BEVs), with battery capacities of 90kWh and more, demand charging speeds of at least 150kW for public charging incidents.

CPOs vertically expand across the value chain

Charge point operators are currently the most active players along the public EV value chain. Because the network of charging points is wide-meshed in most markets, growth potential still comes from improved geographical coverage. Besides building up new locations on their own, CPOs may offer customized turnkey solutions to B2B and B2A customers and operate them as full-service providers (at least technically) after deployment.

Simultaneously, bigger CPOs, in particular, are starting to aggregate other CPOs in order to grow (i.e., in terms of charging network size, customers and revenues) and leverage scale effects. This is a win-win situation for both sides, as operation of additional charging points creates only marginal costs for the aggregating CPO, and the smaller, integrated CPO no longer needs to invest in proprietary costly software solutions.

By reaching a critical size, the CPO becomes more and more attractive to MSPs for direct connection, and both players avoid the fees of eRoaming platforms. In addition, the CPO is in a far better position to negotiate with MSPs, as it can actively decide who to give access to the charging network. Direct CPO-MSP connection via the bilateral OCPI protocol is currently being pushed, especially by Dutch players.

Many CPOs go even further, leveraging their increased size to offer their own MSP services. As a result, they collect the entire margin and get direct access to end customers. Classic examples of this strategic move are big utility CPOs such as EnBW. However, CPOs with unique selling propositions (fast charging), such as Fastned, can also attract the end user’s attention.

CPOs have also expanded their offerings beyond the traditional public EV value chain into the promising field of energy services. They offer smart battery-buffer systems as part of full-service turnkey B2B and B2A solutions to reduce operational costs. The next step is to utilize the battery capacity of B2B fleet vehicles via vehicle-to-grid (V2G/V2X) solutions.

MSPs are trying to diversify outside the public charging value chain

We currently see three major trends in the evolution of business models for mobility service providers:

MSPs have already begun to expand their customer bases from B2C to B2B customers by offering customized B2B fleet solutions that integrate billing for home, work and public charging

Another key trend is for big players, such as Digital Charging Solutions, NewMotion, Plugsurfing and Virta, to offer their charging networks as full-service, white-label solutions to third parties (e.g., DCS to Audi and PSA, NewMotion to Opel). Therefore, it is not an attractive market for new players to enter.

MSPs have understood that offering basic charging services will soon be a commodity, and that they need to distinguish themselves from competitors. Differentiation is achieved by either offering charging as part of an integrated mobility platform (e.g., the NOW family by BMW and Daimler) or adding intelligent energy services that help the end customer save money. OEMs, especially BMW and Volkswagen, have tried to conquer this market with subsidiaries such as Digital Energy Solutions and Elli. IT players such as NewMotion, Virta and eMotorWerks (Enel X), are currently frontrunners in developing V2G/V2X solutions.

Emerging business models for new services

- Vehicle-to-grid service (V2G): The EV battery is used to provide flexibility to the electricity grid, and the EV owner receives a financial contribution for making their EV available. Feasibility and profitability of the technology are related to countries’ regulation and incentive mechanisms.

- Vehicle-to-home service (V2H): The EV battery is used as an energy supplier in case of a blackout, for peak shaving, and as an energy management system that reduces energy costs. V2H technology requires – apart from EVs that manage “reverse flow” – a “smart home” whose main domestic appliances are connected and remotely managed.

eRoaming platforms are stuck in the middle – The historical business model is at risk

The originally favorable, asset-light positioning of eRoaming platforms as aggregators between CPOs and MSPs is being threatened from several sides. CPO aggregators are taking more and more responsibility from eRoaming platforms, and MSPs are aiming for direct connection to avoid fees. Looking into the distant future, blockchain solutions could even make the aggregator business model obsolete. LO3 energy and Share&Charge are currently working on pilot solutions that seamlessly expand beyond geographical borders and the restrictions which come with individual MSPs.

Unfortunately, eRoaming platforms cannot expand vertically into other stages of the value chain. This is because those stages are often already occupied by shareholders which have no interest in such a move. Consequently, eRoaming services are now trying to focus on other services by leveraging their vast technical and market knowledge. Hubject, for example, offers consulting services in the fields of market research, technology, standardization, and calibration law. They help clients implement plug & charge technology. However, this solution will not scale as high as the original business model.

What are the implications on the market?

Electric vehicle charging alone is not yet a profitable business, but margins will increase as business models sharpen and volumes rise. Today’s business model and offerings are very similar and switching between suppliers is easy for customers. In order to become profitable, most players are heading for scale, consolidations, and acquisitions. This process lowers the level of fragmentation, but increases tension and forces all players to evolve beyond their classic roles.

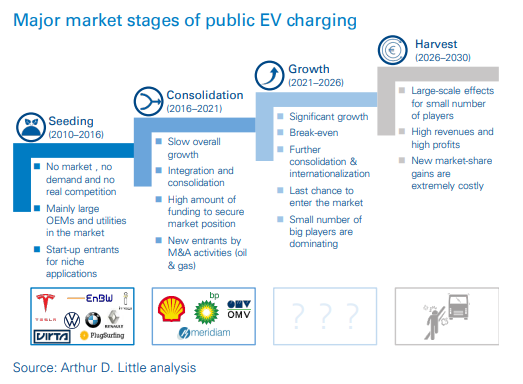

We expect the public electric vehicle charging market to go through four phases. The seeding phase was characterized by no real market demand from customers and no real competition. High initial investments were often publicly funded, and automotive OEMs or large utilities invested to support EV market uptake or mark their ground. Towards the end of this market stage, the expected market uptake triggered a goldrush atmosphere and many start-ups entered the game with innovative niche applications.

Today we are in the consolidation phase. Relevant massmarket EVs are available and we are seeing slow but steady overall market growth. Big players such as Shell and BP are entering the charging market and willing to invest to secure their established positions. Many previously independent niche players have been acquired, and the whole industry is heading towards scale.

In the third phase, which we expect to begin after 2021, significant growth in EV sales will generate revenues from EV charging, which will finally help companies reach or surpass break-even. At this time, we expect integrated players, ongoing consolidation and internationalization. It will be the last chance to enter the market from outside. In the end, we expect to see a small number of pan-European top dogs dominating the market.

After 2026, we will probably know who has won the consolidation game. The remaining top players will have leveraged their high-scale effects to harvest large profits. Additional gains of market share will be extremely costly, and it will be almost impossible to enter the market at this stage.

What are the key success factors for each role?

For CPOs, it is pretty simple: EV charging is a scale game, and the winner takes it all. Besides expanding their networks by aggregating smaller players, CPOs must secure the most attractive charging locations right now – especially for fastcharging services. A strong financial investor is beneficial to provide headroom for organic and inorganic growth.

For MSPs, it is mainly about diversification. Already today, a small number of mostly integrated players are dominating the market, and more competition is unlikely to join. MSPs must either have the most intelligent energy services or offer charging as part of integrated mobility platforms. OEM-related MSPs have the additional advantage of being able to lock EV customers in if plug & charge becomes the market standard.

For eRoaming platforms, it will be extremely difficult to remain in the game. Their core business models will most likely be taken over by CPO aggregators. Hence, it seems reasonable that they must come up with new solutions. For Hubject, plug & charge could be a lifeline. Nonetheless, eRoaming platforms’ biggest threat is losing their current investors due to conflicts of interest.

Conclusion

The public EV charging market is still at an embryonic stage but will offer tremendous growth opportunities in the next years.

However, companies that want to enter this market must choose their strategies wisely. Integration, consolidation and innovation will change the market structure significantly, and first business models are already starting to become obsolete. The consolidation phase, during which competition will intensify, has just begun. Since public EV charging is on the way to becoming a commodity service, size and growth potential are crucial, but so is the uniqueness of a company’s business model. Unique service offerings and innovative technologies are two additional success factors that will determine the future of the EV charging value chain.

It is not possible for investors to simply surf the growth wave without taking risks. To identify the right target, they must analyze charging in a broader sense and look at adjacent industries. Because the window of opportunity will close soon, it is now time to move.