Tesla Insurance, the automaker’s insurance division, aims to capture a large share of motor insurance among Tesla owners by providing enhanced customer experience compared to traditional motor insurers. In this Viewpoint, we analyze the extent to which OEM-provided motor insurance can be a game changer and disrupt the industry.

Tesla entered the insurance business with Tesla Insurance in August 2019 and aims to offer 80% of Tesla customers in the US access to car insurance by the end of 2022, as the company reported during their Q1 earnings call. This is a sizeable prize in terms of motor insurance: Tesla sold about 302,000 vehicles in the US market in 2021, and with an average insurance premium on a Tesla vehicle of US $1,496 per year, this represents a potential premium volume of about $362 million in 2021. The company sold 310,000 vehicles just in Q1 of 2022, which shows the dynamic growth of this premium pool.

Tesla aims to enhance the customer experience in an accident by providing claims management and collision repair in-house, paid for by the motor coverage from Tesla Insurance. The company’s premise is that it has unique access to the data the car generates before, during, and after an accident, as well as to all information any other insurer has available. In addition, Tesla expects to digitize the entire claims management process — from first notification of loss all the way to repair and vehicle return — and thus to significantly enhance and accelerate the customer experience in claims. Finally, the company expects to be able to improve the car as core product by using the information from car accidents; for example, by making engineering changes to cars that would accelerate repair or reduce the cost of frequent repairs.

As a result, some expect this disruptive move to change the customer experience and dynamics of motor insurance. Yet there are also voices that caution that motor insurance is a highly competitive business with many regulatory guardrails and that Tesla might find it hard to make money in this business. To better understand the potential implications, we explored three questions:

- Can an integrated OEM insurer expect to create sustainable competitive advantage in motor insurance?

- Where can OEM insurers best position themselves in the motor insurance value chain?

- What would such a move mean for traditional motor insurance companies?

In our thought experiment, we focused on motor insurance operations and did not consider the investment side as a key source of the overall profitability of a motor insurance provider. In essence, we are assuming that the OEM insurer would be able to establish an investment operation equally capable to that of an insurance company.

IS SUSTAINABLE COMPETITIVE ADVANTAGE POSSIBLE?

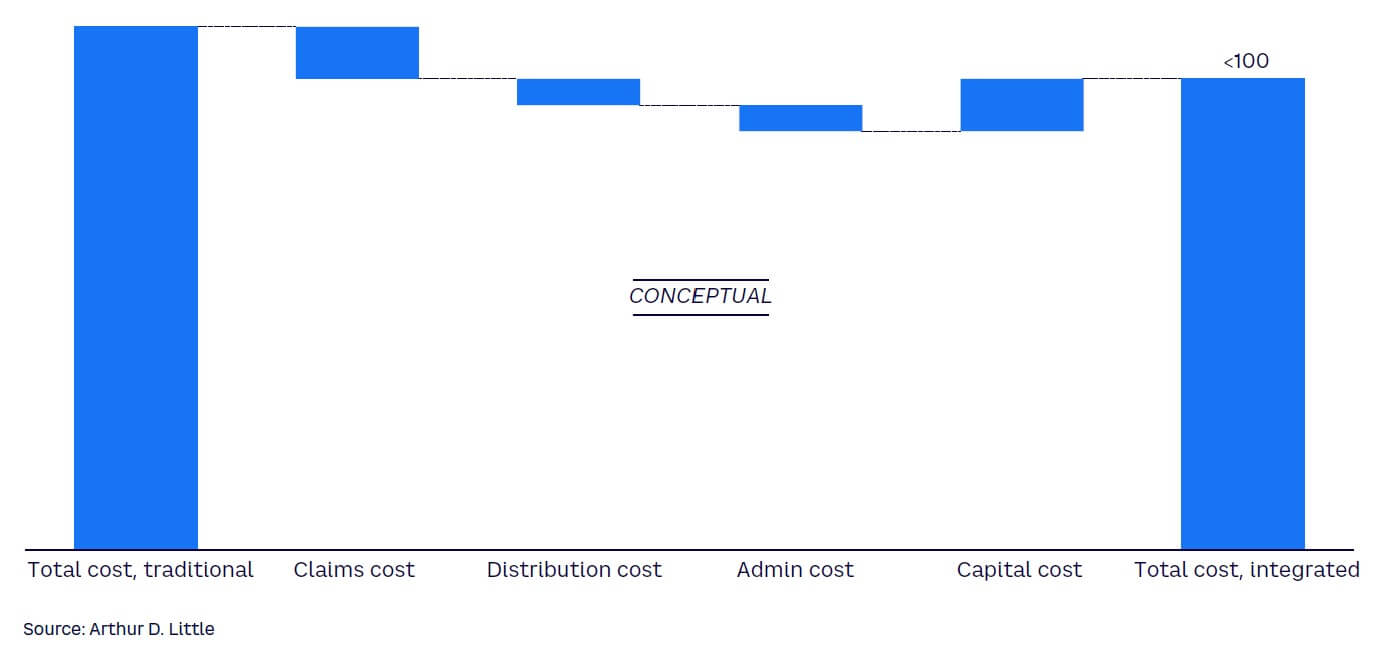

Insurance premiums are a function of expected claims, distribution expenses, the cost of managing claims and administration policies, and the cost of required capital. One potential source of sustainable competitive advantage could be better control over all of these costs and/or the ability to better estimate these costs. For our purposes, we assume the OEM insurer would be able to put the required capabilities for pricing, underwriting, claims management, and policy administration in place. We will revisit these assumptions at the end of the Viewpoint.

Expected claims cost

Claims are the biggest cost element in motor insurance and account for about 65%-70% of the earned premium. Three areas in which the integrated OEM insurer could potentially influence claims cost include:

- Better estimation of accident frequency and severity. OEM insurers would have privileged and instantaneous access to advanced driver assistance systems (ADAS) and other security measures in cars that traditional insurers have only limited access to. This will be even more true when it becomes more common for OEMs to update/activate ADAS remotely. ADAS-related data has already proven a direct correlation with reduced frequency and severity. Additionally, data on driving behavior can help identify risky driving behavior in (near) real time and offers the ability to provide drivers with warnings or to intervene directly by limiting vehicle speed, for example. Finally, data on driving behavior and accidents across the entire fleet can contribute to improving the performance of the fleet’s ADAS to ensure safe driving and prevent accidents (e.g., by improving AI models).

- Reduced accident repair costs. Controlling an end-to-end and automated claims process would allow the OEM insurer to reduce key cost items in the repair process, especially the cost of spare parts and the cost of repair in OEM repair shops (e.g., by positioning repair centers for maximum utilization or reducing labor costs by using better diagnostics). Other costs that depend largely on third parties such as for towing would likely be similar to those for traditional insurers.

- Leveraging data to reduce fraud in accidents. An example of data that can be leveraged is geolocation data, which is key to identifying fraudulent claims, especially when cross-referencing with other data points (e.g., social media posts). The integrated OEM insurer can easily access real-time geolocation information and draw on data analytics to check this data against other data sources to identify potentially fraudulent behavior.

Distribution expenses

Distribution costs typically represent 12%-15% of earned premiums. Motor insurance is already fairly digitized compared to other insurance types, and some players in Europe sell more than 50% of their business through digital channels, for example in Spain according to the Spanish government’s Directorate-General for Insurance and Pension Funds. The integrated OEM insurer could reduce distribution costs by going directly to vehicle owners (e.g., by embedding insurance into the vehicle price or service packages or by using an in-car app as a distribution channel). This approach would likely remove intermediaries (including aggregators) and their commissions for OEM vehicles (at least partially, although some commissions may still be necessary to incentivize vehicle distributors). These effects would help reduce distribution costs when compared to a pure-play insurer. However, the OEM insurer would face the challenge of providing remote advice on the insurance cover each customer would require, as a significant share of customers buying motor insurance through digital channels still require some level of advisory, which is usually provided by agents. And finally, the integrated OEM insurer could increase retention and reduce renewal costs if it manages to enhance the customer experience in the claims process (e.g., due to faster and better quality of repair and/or seamless claims handling).

Claims management costs

OEM insurers might be able to reduce the costs of administrating policies and claims handling with an end-to-end digitized process using an app as the primary engagement channel, thereby reducing the personnel required for these processes. We found that, excluding commissions and paid claims, 45%-50% of the remaining cost is typically linked to policy serving, claims management, and IT and, within this cost bucket, 60%-65% is cost of personnel.

As a monoliner focused on digital distribution, the OEM insurer will also be able to significantly simplify the operating model overall. This same logic also applies to IT operations, as the OEM insurer is not restricted to legacy systems and can build a technology stack and infrastructure that caters specifically to motor insurance and that ties into the OEM’s systems. Thus, the integrated insurer can combine customer service for the vehicle as well as the insurance into one integrated offering, possibly enriched with value-adding services. The OEM insurer could likely reduce the cost required to service the insurance policies as well. To be effective, however, the OEM insurer would have to digitize as many interactions as possible with third parties, such as other insurers, traffic authorities, the police, service providers such as tow trucks, and other stakeholders — or else develop work-arounds for interfaces that cannot be quickly digitalized by the third parties.

Capital costs

Finally, the capital required to run the insurance risks might be higher for the OEM insurer than for a traditional standalone insurer. Drivers of the potentially higher capital requirements compared to a traditional insurer include the much higher concentration of the OEM insurer’s portfolio on motor insurance for essentially one car brand as well as a much more concentrated set of risk factors related to parameters such as autonomous driving systems and driving assistants. Reinsurance might provide some mitigation (lending on structures used by various digital insurance companies) and might in turn give reinsurers access to the behavioral data in the underlying portfolios that is otherwise hard for them to generate.

Overall, there is reason to believe the OEM insurer could reduce the overall cost position below that of standalone insurers (see comparison shown in Figure 1). The caveat is that this is likely true only for the vehicles of the OEM. The key is the near-real-time availability of data coming directly from the vehicle to the OEM’s systems. The integrated OEM insurer would be able to directly collect a richer data set instead of estimating data indirectly from accident reports, customer apps, or other indirect sources. This data set is a critical input into the pricing and opens new possibilities for more accurate risk selection that directly impact underwriting and renewal models. However, this strategy is not easy to implement, as there are still significant challenges in linking a vehicle’s data to risk selection (e.g., different drivers for the same vehicle, driver with risky behavior but no accident history and vice versa, etc.).

Overall, the integrated OEM insurer will have access to data that will allow it to more precisely price the risk of individual cars of its own make, putting the OEM insurer in a better risk position than the standalone insurer, from inception of a policy and for its own vehicles. The OEM insurer could also offer “pay when and as you drive” insurance, allowing vehicle owners (retail or fleet) to pay insurance only when their vehicles move and based on how they are being moved.

In addition to cost-related competitive advantage, the OEM insurer could also try to create switching costs by embedding the insurance into the pricing for the vehicle, whether through the purchase price, leasing rates, a mobility subscription charge, or any other pricing scheme. This is especially powerful if it is combined with stronger customer experience along the insurance journey and offers seamless interactivity on par with other leading digital experiences for the brand’s customers.

The net effect of these cost-reducing factors would be an overall reduction in the absolute amount of the insurance premium and very likely a pricing advantage for the OEM insurer at this lower pricing level, particularly if insurance is considered an ancillary product and not a profit-maximizing business.

Moreover, motor insurance operators typically are not large profit generators, and the OEM insurer might use the opportunity to expand into related insurance lines based on its data and data analytics advantage. For example, data on vehicle-charging behavior (e.g., at home vs. other locations) can provide relevant clues for home insurance, especially when combined with data from other sources such as utilities or telcos.

OEM INSURERS & MOTOR INSURANCE VALUE CHAIN

Generating competitive advantage from lower costs and barriers to switching gives OEM insurers a choice of roles to play across the insurance value chain, depending on their level of commitment. We see three potential high-level models for the OEM-insurer to follow:

- Agent. OEM insurers would leverage direct access to their customer base and the data they collect to sell insurance products customized to individual parameters, offering value to the insurance carrier from a captive, direct distribution channel, and to customers through a larger pool of mass-customized insurance services. The insurance risk would be outsourced to a third-party primary insurance company that aligns its underwriting very closely to the risk models created by the OEM insurer (this could take the form of a managing general agent).

- Insurer. OEM insurers would essentially replace insurance carriers along the entire value chain and offer end-to-end insurance services from underwriting/pricing to claims management for the vehicles they produce. This would provide the OEM insurer with the greatest flexibility, but also the highest capital requirements. Reinsurance will provide OEM insurers with a way to manage their exposure, but this comes at a cost as well and will not reduce capital cost sufficiently.

- Third-party administrator. OEM insurers would become the claims manager for a selected group of direct insurance companies that cover its vehicles, building on the advantage of having access to all claims data from the moment of accident. OEM insurers could offer better customer experience for their own vehicles during and in response to the accident, creating substantial hurdles for other insurers to match, while guaranteeing the lowest cost of vehicle handling and repair.

There will, of course, be challenges along the way for integrated OEM insurers in positioning themselves within the motor insurance value chain. For example, the state of digitalization of the motor ecosystem will be of critical importance, and many elements are outside the insurer’s control. These include but are not limited to the need for subrogation with other insurance companies, interactions with repair garage networks (which affect quality management and customer experience), interaction and competition among vehicle OEMs, and the difficulty in scaling the business within highly regulated markets and across many different regulatory regimes.

This last point specifically will make it challenging for the OEM insurer to offer insurance coverage across all of its markets to ensure a consistent customer experience. Equal coverage will require fast and global expansion, which is costly due to the licensing requirements and difficult due to the speed and magnitude at which coverage needs to expand.

WHAT ABOUT TRADITIONAL MOTOR INSURANCE COMPANIES?

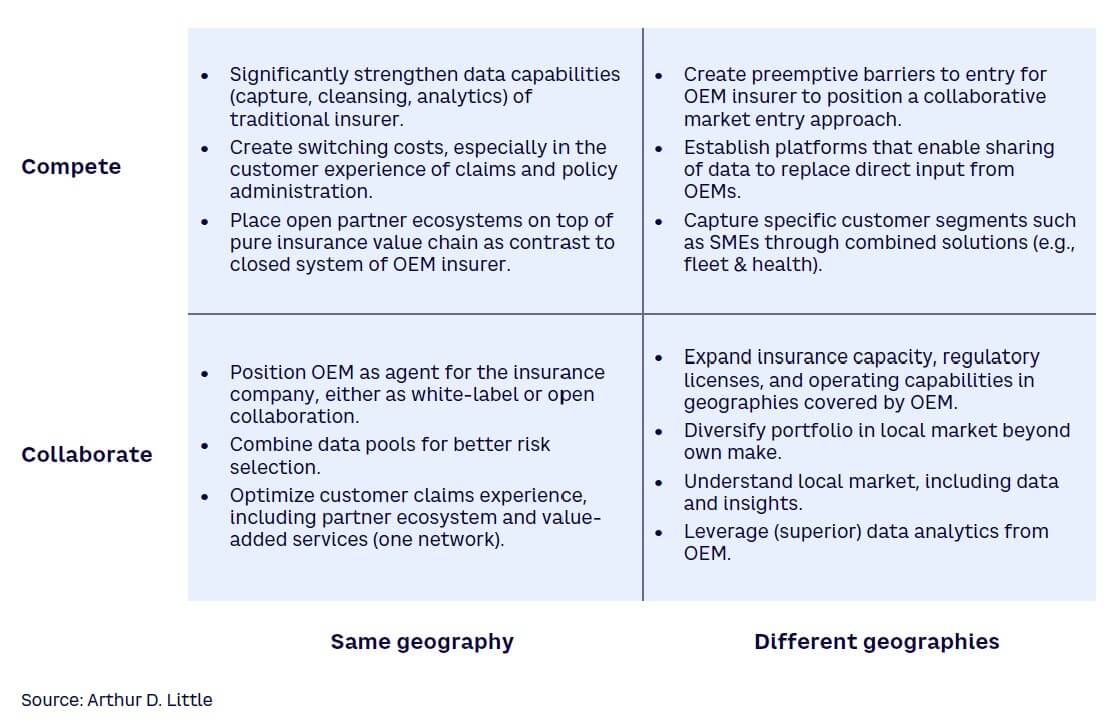

In the final part of our thought experiment, we ask the “so what?” question: what can traditional and new insurers learn from the idea of an integrated OEM insurer? In answering this question, we consider reinsurers to be in a fundamentally different position than primary insurers, and primary insurers that compete directly with OEM insurers to have yet a different problem set than primary insurers in markets without OEM insurer operations. Primary insurers might look at problem set shown in Figure 2.

While primary insurance companies have a choice of whether to compete or collaborate, reinsurance companies would have to develop collaborative models with one or more OEM insurers. The natural starting point is the provisioning of reinsurance capacity as well as underwriting and risk selection know-how using the generally broader market view of a reinsurer. The main advantage for the reinsurer is to move much closer to the behavioral aspects of the individual policyholder, gaining access to data points that are usually out of reach. The reinsurer would likely aim to work with several OEMs through some form of a platform to ensure that this view is as broad as the insurance policy portfolio.

A key takeaway from this thought experiment is that the idea of OEM insurers substantially accelerates convergence of mobility and insurance. In particular, the ability to create an enormous pool of driving behavior data, to relate this data to accidents/near misses, and use this information to price insurance contracts, as well as to be able to provide direct feedback in response to driving behaviors through assistance systems and driver nudging — possibly in real time — could be real game changers. The integrated OEM insurer might have an advantage in contracts involving its own make, although it faces substantial challenges in scaling the business to the global audience of its automotive business, and to the vehicles of other OEMs. Hence, collaboration with traditional insurers will likely make more sense than taking a competitive approach.

In a market where OEM insurers enter the motor insurance segment, traditional insurers have two options:

- Partner with OEM insurers in a complementary manner to fill each other’s gaps and weaknesses (capital requirements, regulatory complexity vs. OEM insurer data, etc.), following to some degree the model of some reinsurers that have already started collaborating with vehicle OEMs (e.g., Swiss Re and Toyota ADAS, Mercedes). These relationships can focus on combining data from a fleet of vehicles with the data from portfolios of motor insurance contracts to provide a more thorough understanding of risks, and therefore more accurate pricing levels. Partners could potentially structure a service for primary insurance companies to help with fleet motor insurance pricing and servicing, leveraging the data and analytics from OEM insurers. Moreover, such relationships would also fit into the likely development of motor insurance from a B2C business into more of a B2B business. As levels of autonomous driving capabilities in cars continue to increase toward levels 4 and 5, liability begins to shift toward the OEM. Fully and largely autonomous cars will likely incur lower frequency and severity of accidents, and this would in turn reduce claims and therefore premiums, especially if those premiums were charged only as the vehicle is being moved. A very interesting aspect of autonomous vehicles is that they enable new models of shared mobility, which reduces the number of vehicles on the road while also increasing utilization of the individual vehicle drastically. These two effects might have both increasing (cars are utilized more) as well as reducing (less cars on the road overall) impacts on motor insurance.

These effects might also make it attractive for OEMs with sizeable financial services operations related to leasing and car financing to consider offering complete mobility packages to their customers (B2C, B2B, and B2B2C). In such a scenario, primary insurers would provide capacity in a local market, leveraging their regulatory presence and their specific understanding of the local market.

- Compete with OEM insurers. With this option, primary insurers should address two dimensions to avoid being overwhelmed by the threat of OEM insurers. First, insurers should participate in the disruption of motor insurance. Data is the key behind OEM insurers’ potential competitive advantage over primary insurers. Improving risk selection by building new ways to acquire data is therefore a must to compete with OEM insurers. Many insurers are already accessing and leveraging new massive customer datasets via partnerships such as bancassurance. Second, primary insurers in direct competition with OEM insurers will likely need to identify key measures that create some level of “inertia” among their customers to keep them from switching. In practice, this will mean working on the customer experience in claims handling as well as finding ways to enhance pricing models to stay competitive in insuring OEM vehicles. Some insurers may even attempt to enter a price war based on existing nation-wide presence to slow OEM insurers’ growth.

Conclusion

COMPETITIVE PRESSURE, ACCELERATED CONVERGENCE & STRATEGIC CHOICES

The rapid convergence of mobility and insurance provides potential opportunities. But along the way, companies will have to decide whether to compete or collaborate in this already highly competitive industry, as well as consider several factors that may have a large impact on their business, including:

- For their own cars, OEM insurers could operate at lower cost levels and increased levels of customer experience than standalone insurers, bringing additional competitive pressure to the industry.

- Expanding the insurance model to all markets with OEM presence will require OEM insurers to enter into partnerships with (re)insurers to optimize capital consumption and time to market.

- The integrated model would accelerate the convergence of insurance and mobility, as the protection services insurance provides is increasingly embedded into the car as a mobility product.

- Insurers will have to consider their response to the OEM insurer competition based on their position in the value chain (primary insurers vs. reinsurers) and their geographic location (core OEM market vs. non-core OEM market).