With interest rates and competition increasing, a value creation model relying on traditional cost-efficiency measures to improve profitability cannot alone maximize an investment portfolio’s value growth. Leading private equity (PE) funds are emphasizing underwriting for top-line growth in parallel, which provides both higher return potential and a more attractive, sustainable story for future investors. In this Viewpoint, we detail the options for achieving growth during turbulent times.

WHAT THE FUTURE MAY HOLD FOR PRIVATE EQUITY

The PE industry, known for its focus on efficiency improvements and EBITDA growth, has expanded dramatically in the past decade, tripling assets under management (AUM) from US $2 trillion to $6 trillion between 2010 and 2020. By 2025, AUM is expected to double again, eclipsing $12 trillion. PE firms control companies that employ millions of people across a range of industries and often have majority control over their portfolio companies. With cooperation from the portfolio company executive team, they can quickly implement change and drive multiple value-growth initiatives. Unlike quarterly driven publicly listed entities, PEs are not hampered by short-term negative developments.

While rapid expansion is likely to continue in the near term, the PE industry faces challenges. A company’s valuation and long-term viability is determined with profitability and growth potential in mind, highlighting the importance of balancing short-term cost-efficiency improvements with efforts to sustain long-term revenue growth.

History has shown that neglecting a portfolio company’s top line may jeopardize value. The 2015 Kraft Heinz deal by Berkshire Hathaway and 3G Capital is a well-known example of a failed cost efficiency–centered PE transaction. The goal was to acquire Kraft Foods and merge it with H.J. Heinz Company, in a deal valued at approximately $50 billion and causing layoffs of roughly 10% of their collective staff. However, layoffs and plant reductions cost the combined entity substantial expertise and human capital. These losses likely contributed to lowering the Kraft Heinz Company’s market position. Controversial legal investigations also destroyed value.

A 2019 Wall Street Journal analysis found that PE managers and company management neglected the potential of existing organic growth opportunities, which compromised the position of strength that existed before the deal. In the weeks following the layoffs, the Kraft Heinz stock price fell significantly. By 2018–2019, the share price of Kraft Heinz had dropped over 40% compared to its value before the PE buyout.

Cost cutting is an important and appropriate tool, but great PE firms combine growth orientation with cost efficiencies and seek to develop sustainable business models.

THE POWER OF THE VALUE CREATION–DRIVEN PE FIRM

We believe a company should take advantage of turbulent times. A more uncertain external environment often offers opportunities for companies with a strong strategic growth plan and, therefore, may be more rewarding than a stable environment. The following three examples outline the mechanics of how prioritizing top-line growth results in the greatest returns.

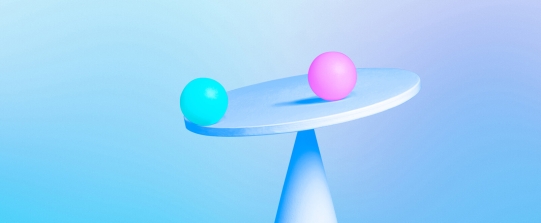

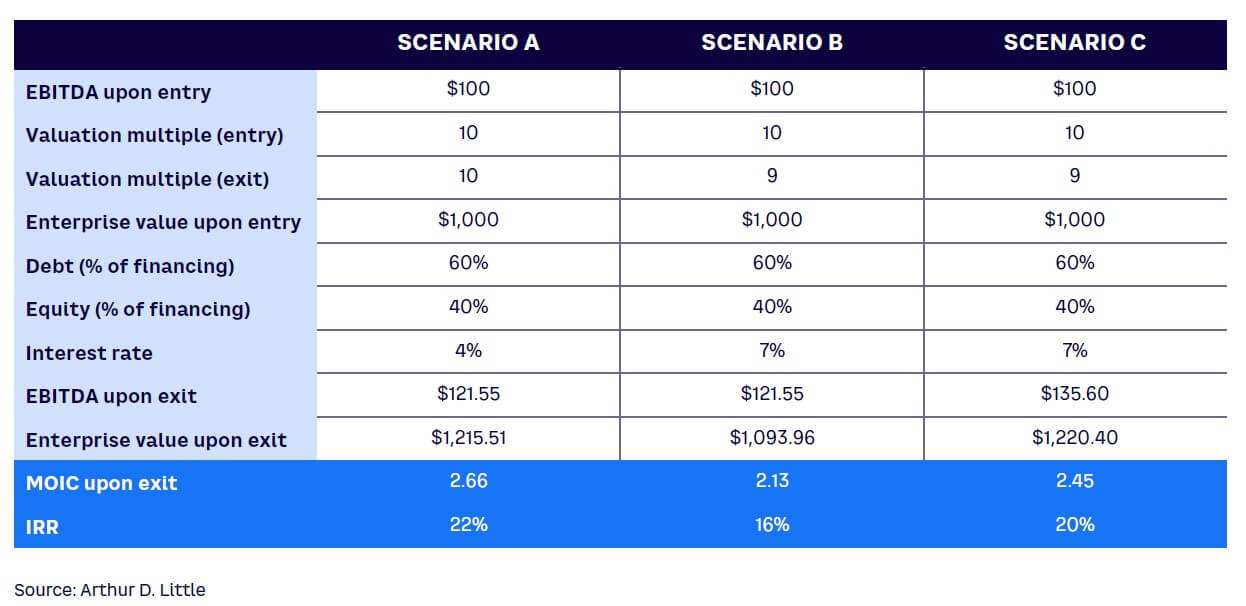

Scenario A: Low interest rates and cost-cutting method

The leveraged buyout (LBO) is a common investment strategy for PE firms. In an LBO, a PE firm uses both debt and equity to acquire a business. For example, a PE firm buys a target company at a valuation of 10x EBITDA of $100 for $1,000, financed by 60% debt and 40% equity. During its ownership, the PE firm first uses cost efficiencies to increase the portfolio company’s annual absolute EBITDA by $9. Later, the results of its new cost efficiencies grow the company’s top line (revenue) by 3% per annum. The cost efficiencies enabled the growth, but the portfolio company did not make further investments in strategic top-line growth initiatives.

Assuming the same entry and exit multiples, the business would be valued at $1,216 upon exit. In a five-year window for exit and a 4% annual interest rate on the loan, the PE firm can complete approximately $450 worth of principal repayments due to available cash at the end of each year, generating an internal rate of return (IRR) of 22% and multiple on invested capital (MOIC) of 2.66 on this deal. Figure 1 illustrates Scenario A.

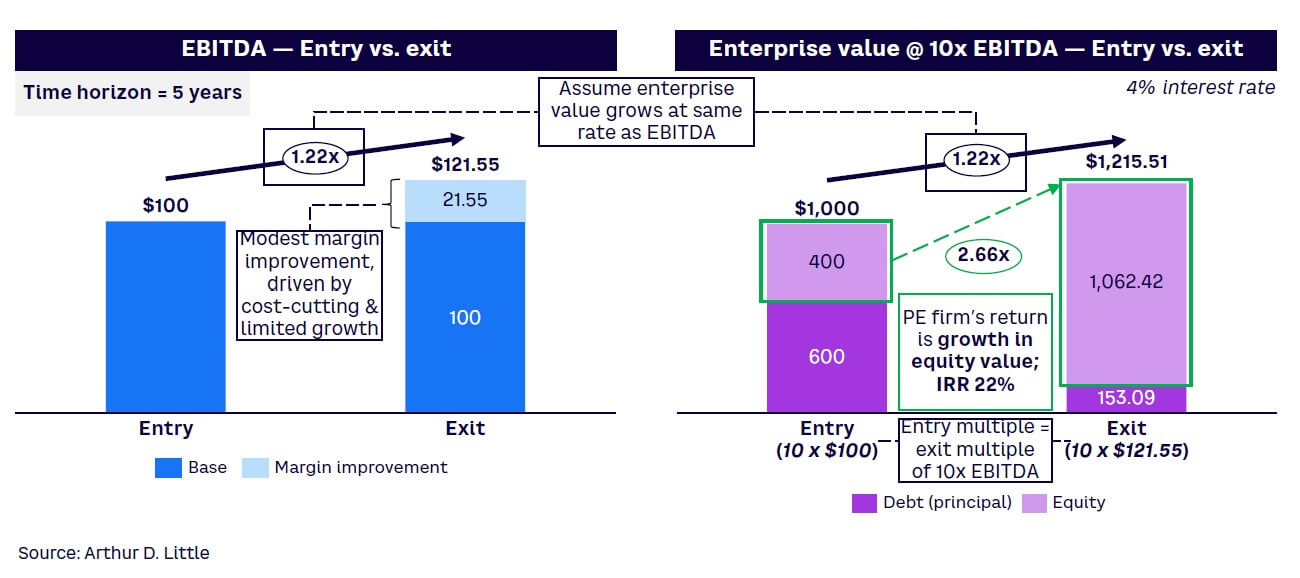

Scenario B: High interest rates and cost-cutting method

But how does this strategy function in a high-interest-rate environment? When rates are high, the approach in Scenario A, which emphasizes cost cutting, is not solid enough to employ.

Assuming the Scenario A elements remain constant, cost cutting here produces an absolute improvement in EBITDA of $9 and opens room for 3% annual revenue growth. In a higher-interest-rate environment, more money must service the debt (with an annual interest rate of 7%) and cannot be used to pay down the principal. Additionally, one must factor in a conservative exit multiple dropping to a point below the entry multiple due to a sustained, high-interest-rate environment, which reflects the increased cost of borrowing and the decreased investor risk appetite. Therefore, in this deal, the PE firm completes roughly $350 of principal repayments on its debt obligation because it has available cash at the end of each year, generating an IRR of 16% and a MOIC of 2.13 (see Figure 2).

Compared to Scenario A, the deal in Scenario B has an equal risk level but generates a lower return due to the challenging macroeconomy. The 16% IRR in Scenario B may be deemed acceptable in some cases. However, it’s crucial to recognize that this represents the base case; investors would likely be dissatisfied if the base case materialized. This is concerning based on the risk associated with this specific transaction.

Additionally, neither Scenario A nor Scenario B exhibits any intentional efforts to drive top-line growth, which highlights the portfolio company’s vulnerability and potential to underperform in a rising-interest-rate environment. Scenario C will demonstrate how strategic investments in top-line growth contribute to resilience and prosperity, even in the face of turbulent economies, preventing the damage seen in Scenario B and positioning the portfolio company for a more compelling exit strategy.

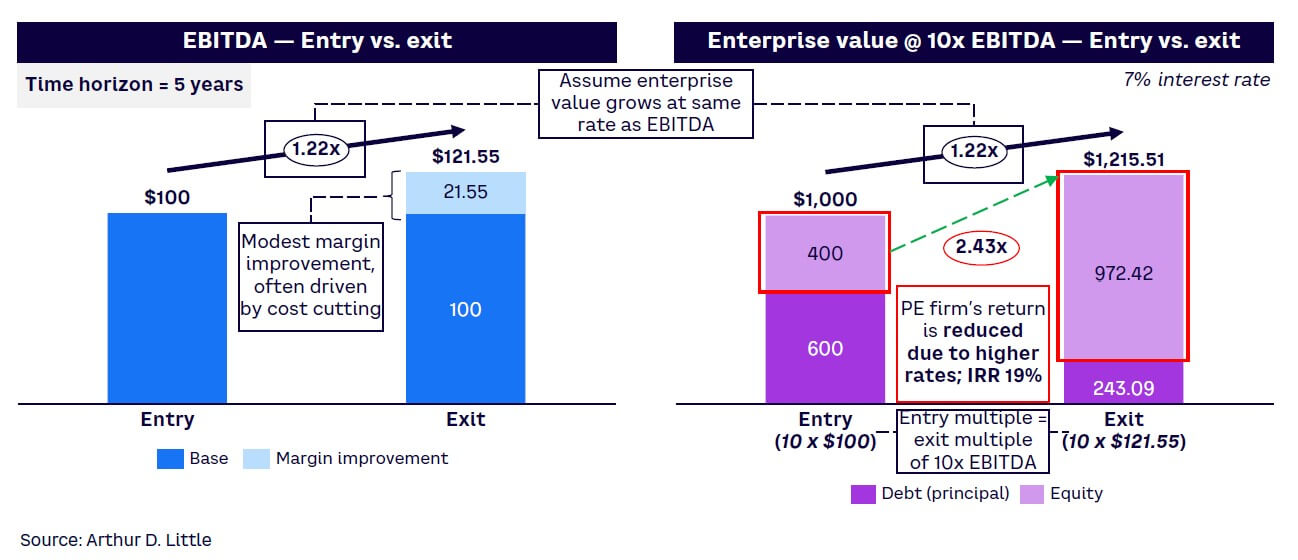

Scenario C: High interest rates and a top-line revenue-growth method

When purchasing a portfolio company, a PE firm’s best option is to develop a strategy centered around reducing costs while purposefully investing some cost savings in top-line growth initiatives.

In this scenario’s high-interest-rate environment, the upside of boosting revenue over the course of the holding period will outweigh the incremental costs of increased interest payments. The PE firm still takes on a cost-cutting program in this scenario, but it focuses on deploying cuts to repurpose company assets toward growth initiatives. During this five-year deal, the PE firm strategically reduces costs by $4.5 per year, enhancing EBITDA through conservative yet tactical cuts. In year 2, the firm achieves revenue growth of 5% and 10% annually for the remaining three years in the holding period, which is driven by growth investments initiated in year 1, with a magnitude of 6% of annual EBITDA (see Figure 3).

Using this method, EBITDA will increase from $100 to $135.60 by the end of year five, resulting in an exit enterprise value of $1220.40, a value larger than Scenario A ($1,215.51) and Scenario B ($1,093.96). The compounding growth in EBITDA gives the portfolio company a higher exit value, and the PE firm can turbocharge its returns, even when faced with challenging high-interest payments. The return on this deal is robust, with an IRR of 20% and a MOIC of 2.45.

In all three scenarios, cost reductions and efficiency improvements factor into the equation as cost cutting and revenue growth are not mutually exclusive; when incorporated, they build a stronger equity story. In any deal, efficiency is vital to position the company for future success, but the focus is the main difference among the three scenarios. Table 1 offers a visual of all three scenarios and their relevant information.

In Scenarios A and B, the PE firm zeros in on cost cutting and identifies relatively few growth opportunities. In Scenario C, the PE firm opens opportunities through cost savings to build momentum, investing savings in growth efforts and placing bets within key strategic areas to turbocharge the company’s exit value. Scenario C also highlights a successful growth story and provides a strong signal to future acquirers, even in a turbulent, high-interest-rate environment. These scenarios and strategies are theoretical and therefore oversimplified. In reality, PE firms are likely to utilize a particular overall strategy over the course of the holding period. However, they can still adjust this strategy when it appears advantageous, while still considering risk factors and the company’s profitability and positioning.

Although a strategy centered around revenue growth may have potential beyond cost savings, this approach may pose a challenge and incur a higher risk, which may discourage PE firms from investing in revenue-growth opportunities. Though this is a valid concern, it should not detract from the opportunity at hand. Rather, the opportunity warrants a more disciplined due diligence effort during the pre-investment phase. This determines the business case viability of the company and identifies a growth-acceleration strategy during the holding period, which ensures sustainable top-line growth and value creation.

A sustainable growth story is crucial for a successful exit, as future investors will be looking to invest in profitable companies that still have room to expand. Striking a balance between current profitability and growth-acceleration potential will communicate strength in the company’s business case and show interested buyers a higher exit valuation.

ENSURING SUSTAINABLE TOP-LINE GROWTH & VALUE CREATION

PE firms can consider several growth levers, both pre- and post-deal, when planning for robust returns. By undertaking growth due diligence, firms can implement plans focused on growth acceleration, sustainability as a lever, and operational-efficiency improvements. With the right execution, these levers can create substantial value.

Growth due diligence: Anticipate the potential

Value creation begins pre-deal, during the due diligence process. In this period, a PE firm must anticipate the future growth potential of their target. This information will allow them to start building the foundation for a pre-investment growth strategy.

There are two crucial points to predict future growth:

-

The relative market share position, both now and over time. The PE firm needs awareness of the industry’s competitive dynamics, market shares, and competitor strengths and weaknesses in order to develop a robust view of how the target fits into this picture.

-

The ability of the target to meet customer purchasing needs relative to its competition. If the target provides something scalable that customers want, the PE firm’s strategic guidance, operational expertise, and capital access will multiply the value the company creates while in the portfolio.

Asking the right questions as part of a successful due diligence process will get to the bottom of the above two points. These questions include:

-

Who is the current customer base, and how does the target’s growth strategy address specific customer segments of opportunity? Do they plan to grow with existing customers, grow share of wallet from existing customers, or grow with new customers?

-

What is the company’s relative market share position, and what are the implications on its ability to build growth momentum?

-

What are the customer base’s purchasing criteria for the company’s products, and how well does the company address these criteria today against its competitors?

-

How scalable is the target’s customer-growth strategy, and does it look beyond their existing customer base?

-

How high are the barriers to entry for competitors to access the company’s existing customer base?

-

Is the target company leveraging advanced technologies and/or software to enable greater growth than the competition?

-

How strong is human capital within the company and its management team?

-

Once the deal closes, what processes can the PE firm monitor to facilitate growth initiatives identified in the deal cycle?

-

What unique growth and development opportunities could the PE firm provide the target company, using the firm’s strategic guidance, operational expertise, and access to capital in the context of the above questions?

It is particularly valuable to assess growth potential through pre-deal due diligence to embed growth into every aspect of the post-deal investment lifecycle. Through this early alignment, the portfolio company management team will understand which levers to pull and create actionable, measurable goals for the investment’s holding period. Defining the growth strategy early is especially important for time-sensitive investments that need to realize a return within a few years.

Growth acceleration of portfolio companies

Implementing a robust growth program immediately is key. During the holding period, this program should build a robust growth story for a value-accretive exit. This challenging task can be simplified by organizing it into three critical activities:

-

Using detailed accounting to understand historic sources of growth.

-

Expanding growth opportunities and tightening the link between innovation and growth objectives.

-

Managing the risk associated with organic growth by:

-

Building sufficient initiative diversification into the plan

-

Taking a portfolio approach to managing growth initiatives

-

Deploying a standardized approach to de-risking growth initiatives

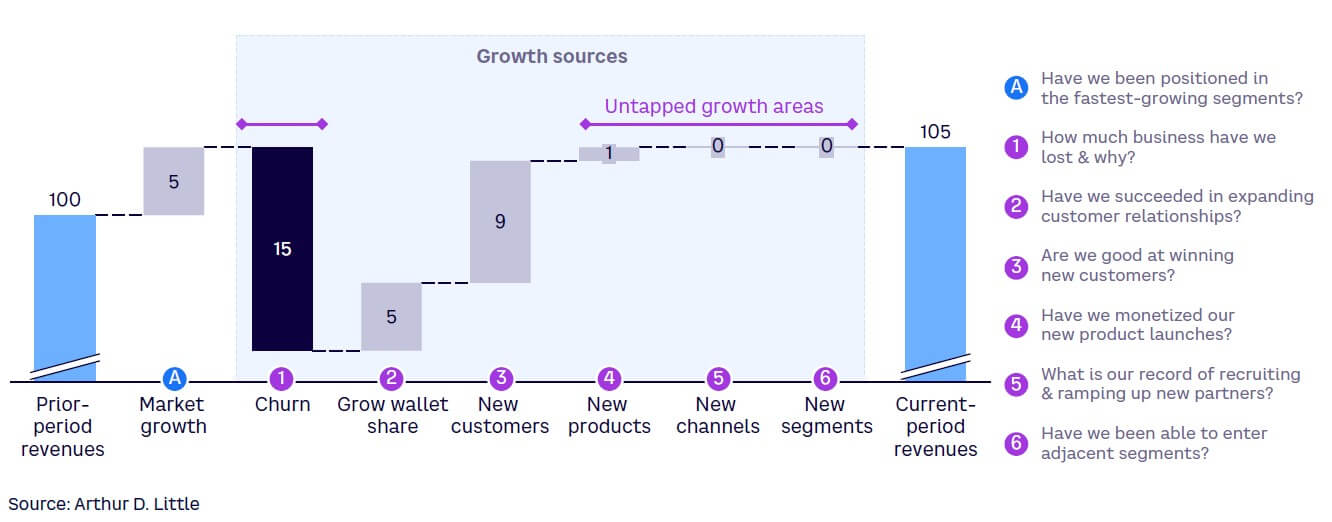

To thoroughly understand the origin of growth, companies should prepare an accounting analysis that lays out the growth profile of the market they operate in and the sources of growth for their business.

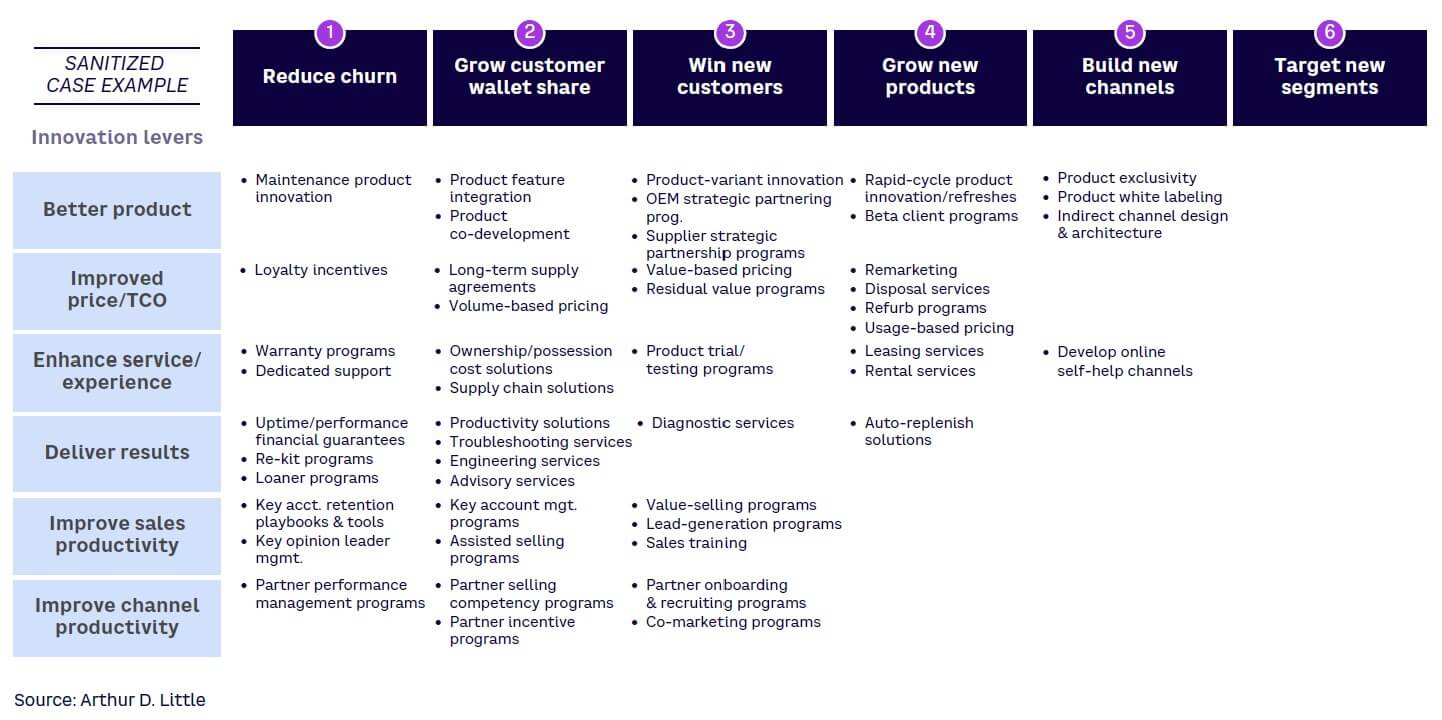

Figure 4 highlights six growth sources. If the company is not constantly innovating its product, channel, and adjacent market strategy, growth accounting will sound the alarm and inspire a shift. Next, map innovation levers to each growth objective. Innovation levers are tangible improvements that have potential to strengthen the business and enable more innovation.

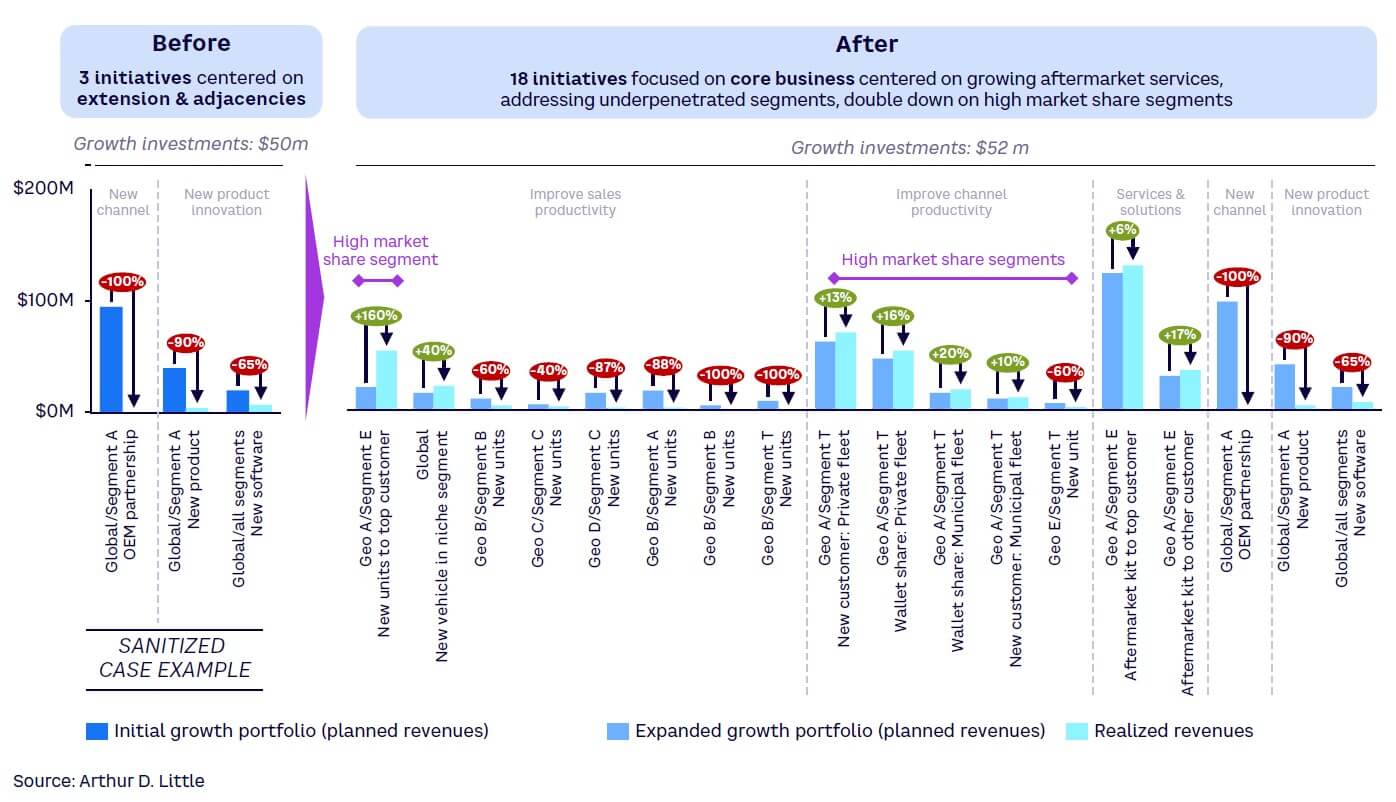

Mapping innovation levers can help identify approximately 50 untapped growth concepts, as seen in Figure 5. The next step is choosing concepts. The success rate is low during execution, and the outcome is often unpredictable with an impact that may vary by 85% or more from its expected result.

PE firms should help their portfolio companies mitigate the risks by diversifying their growth opportunities. They should collaborate to manage the individual risk of their growth initiatives by undertaking about 15-20 new initiatives. These initiatives focus on the core business and double down on high market share segments, while addressing new segments, channels, and products. Figure 6 shows this portfolio approach to innovation.

Some or most of the 15-20 initiatives will fail. But the ones that find immense success will drive the company forward in both core and adjacent areas.

Given the elevated risk of initiative failure, growth plans must chart a path well above the company’s revenue goal — at least 25%. This goal must be set from the top down to ensure teams have enough ambition to achieve it.

Sustainability as a growth lever

In a business context, sustainability is defined as reducing environmental impact and achieving operational efficiencies while considering the needs of all stakeholders. It also acts as a value creation lever, by generating new growth opportunities and making sustainable cost improvements.

Sustainability is often viewed as a compliance issue or a box for a PE general partner to check, rather than a lever that can unlock value. However, research from S&P Global cites the heightened importance of environmental, social, and governance (ESG) evaluations and the advantages and value they provide. Firms that score well on ESG achieve higher exit multiples than less mature peers.

Customer preferences and expectations have changed. General partners (GPs) note that buyers expect the portfolio company to include a sustainability growth story at exit. According to the 2022 New York University (NYU) Stern School of Business Sustainable Market Share Index, sustainably marketed products grew 2x times faster than non-sustainably marketed products and reached a five-year CAGR of 9.43% versus 4.98% for conventional counterparts. NYU’s Stern Center for Sustainable Business also found that sustainability-marketed products enjoy a nearly 28% premium, on average.

Sustainability is linked with increased employee retention and greater ability to attract workers; this trend is especially relevant for younger generations who will soon comprise the majority of the workforce. Companies with sustainability action plans have higher employee-satisfaction ratings than those without. One study, shared as part of a LinkedIn series about the business case for sustainability, found that morale was 55% better in companies with strong sustainability programs.

Climate risk has an impact as well; the US has experienced a dramatic increase in annual disasters costing $1 billion or more. Failing to address sustainability and ESG risks leads to significant losses.

Given the increasing importance of sustainability, GPs would do well to incorporate a sustainability lens within their investment processes, from due diligence to exit. Identifying the most material issues at the start of the holding period shows the asset owner how to define which metrics to track from the beginning. In turn, the asset owner captures the sustainability growth story over the lifetime of the investment, instead of scrambling before a sale to create a credible growth story that retroactively pieces together disparate ESG and sustainability-related initiatives.

We know firms that score well on ESG are typically linked to higher valuations, so why isn’t sustainability a focus at the beginning of the holding period? GPs leave value on the table when viewing ESG and sustainability as risks to be mitigated or boxes to check to satisfy their limited partners. Unlocking sustainability growth levers from the beginning of the holding period can help GPs build value within their portfolio companies.

Operational-efficiency improvements that usher in growth

PE firms should build operational programs to improve the long-term growth prospects of their portfolio companies. These programs often include cost-efficiency measures, particularly in high-interest-rate environments where cash on hand is important. But a value creation strategy should be in effect as the cost-efficiency programs should free up cash for value-creating investments.

According to a release from the company’s newsroom, global car rental agency Hertz filed for Chapter 11 bankruptcy in 2020, citing COVID-19’s impact on the travel industry. Hertz’s 2021 acquisition by Knighthead Capital Management, Certares, and Apollo Capital Management offers an example of a successful operational program built to improve growth prospects despite turbulent times.

This investor group brought in $5.9 billion in capital to help Hertz reduce 80% of its corporate debt and significantly enhance liquidity to fund operations and future growth. Not only did this investment fund future growth, but it also resulted in direct operational improvements. Hertz rightsized its global fleet and location footprint and sold its fleet-leasing business. It also shifted its portfolio to concentrate on growing neighborhood rental locations to meet changing demand. The company emerged from bankruptcy with an improved operating model, well-equipped to capture value in the hot US car rental market.

As PE firms develop their operational programs, they should ask themselves the following three questions:

-

How will this operational program transform the portfolio company into a high-efficiency entity that can execute the growth strategy the PE fund has laid out?

-

If the PE firm looks to cut costs at the portfolio company, how will this decision impact growth and productivity?

-

What is the long-term strategy to improve efficiency? Going forward, what potential roadblocks can be addressed today to enable cost savings and performance improvements tomorrow?

conclusion

NAVIGATING AN UNCERTAIN, CHANGING WORLD

In a world of increasing competition, fewer investment opportunities, and high interest rates, it is vital to focus on growth. Investor requirements and consumer expectations have changed; making growth the core of the investment lifecycle allows the investor to prioritize the correct value drivers and build real long-term value. Here are the primary takeaways:

-

The PE industry’s future includes expansion and several challenges ahead.

-

Macroeconomic pressures often cause turbulent times for PE firms and require a heightened level of awareness and discipline.

-

Three different scenarios reveal how top-line results lead to optimal returns.

-

The view of sustainability and ESG is shifting from an obligation to a means of creating value.

-

Operational improvements are an initial expense, but they improve long-term prospects despite turbulent times.