12 min read • Chemicals, Operations management

Why the bio-based materials market is finally poised for growth

For decades, the market for bio-based materials[1] has been seen as promising without significantly taking off. Challenges in sourcing affordable and sustainable raw materials, achieving economies of scale, and securing sufficient end-market demand have all prevented the market from growing.

This is now changing rapidly, reinvigorating the market. Demand is growing, driven by increasingly environmentally conscious consumers and governments’ Net Zero targets requiring consumer-focused product companies to achieve sustainability. Finally, technology breakthroughs are bringing down production costs for bio-based materials, while improving their performance to make them comparable or superior to fossil-based counterparts.

At the same time, the increasing volatility within the oil & gas sector is causing traditional petrochemical players to look beyond their fossil-based products for new and more resilient sources of future revenue and growth. All of this is driving interest and investment.

The market is now at an inflection point, with a growth rate that is both steadying and outstripping the wider materials industry. For example, bio-based plastics will see 17 percent CAGR growth between 2020 and 2030, compared to just 3.2 percent for conventional plastics. Several bioplastics will experience major capacity expansions in the next three years (CAGR), such as polyethylene furanoate (PEF) at 163 percent, polyhydroxyalkanoates (PHA) at 50 percent, and bio-polyamide (Bio-PA) at 38 percent.

The opportunities are there for both producers and consumer goods companies. How can players identify and successfully harness compelling areas for growth in the bio-based materials segment?

The trends driving current market expansion and growth

The upsurge of interest in the bio-based materials market is caused by a combination of both demand and supply factors:

1. Demand-side pull

Producers are seeing increasing consumer demand for bio-based alternatives in specific areas. These include premium items (such as in the fashion and automotive sectors), for which higher costs are less of a barrier to purchase, volumes are low, and companies want the increased brand recognition that comes from being a genuine sustainability market leader. Additionally, in some niches bio-based products are the only available or viable option, such as compostable cutlery and tableware for large-scale outdoor catering.

Mass-market consumer goods companies are also dramatically increasing demand. Many have made bold commitments to switch to fully recycled or bio-based packaging as they have looked to differentiate and reduce their carbon footprint. This gives producers confidence in expanding capacity to service this growing need.

Demand is also being stoked by new and planned regulations designed to increase sustainability and grow the circular economy. Many companies are aiming to get ahead of the curve and build resilience into their supply chains by mandating bio-based materials before they are compulsory. For example, in the automotive industry, companies such as Porsche are replacing composites with natural fibers (such as hemp) to enable recyclability while retaining the benefits of materials that are strong and lightweight. Producers that rely on manufacturing materials that are not easily recyclable will have to respond to this regulatory and consumer demand – by exiting the market entirely, developing breakthrough recycling technologies (which may not happen quickly enough), or switching to bio-based materials.

2. Supply-side push

Many bio-based materials are now mature. For example, bio-polyamides (Bio-PA) are now cheaper than most natural fibers while delivering similar levels of quality and durability.

After decades of aborted attempts, capacity and material availability have finally expanded from pilot to commercial-scale activities in many areas as technology barriers have been overcome and investment has increased. Thanks to new finance, capacity for production of furan derivatives is expected to grow by 209 percent CAGR between 2022 and 2025, albeit from a low base.[2] Bio-based material companies such as Newlight Technologies ($107m Series F funding in 2022), RWDC Industries ($263m Series B funding in 2021) and Beijing Phabuilder Biotechnology ($37m Series A funding in 2022) have all attracted significant new investment. Many oil majors are investing heavily in bio-based materials to build future resilience into their portfolios. TotalEnergies Corbion has expanded polylactic acid (PLA) operations in Thailand, for example, using the byproducts of locally grown sugar cane.

The opportunities and challenges for upstream and downstream players

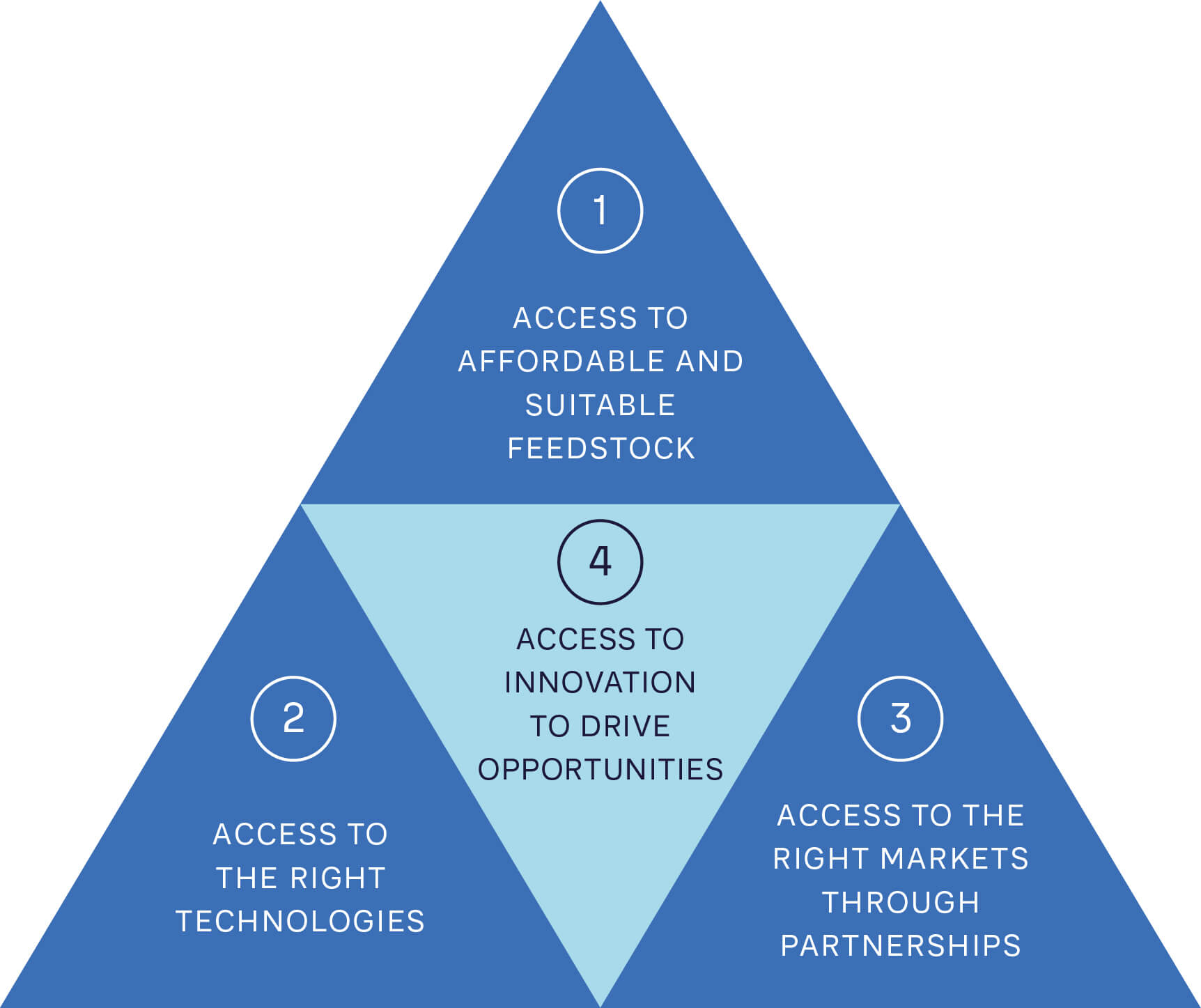

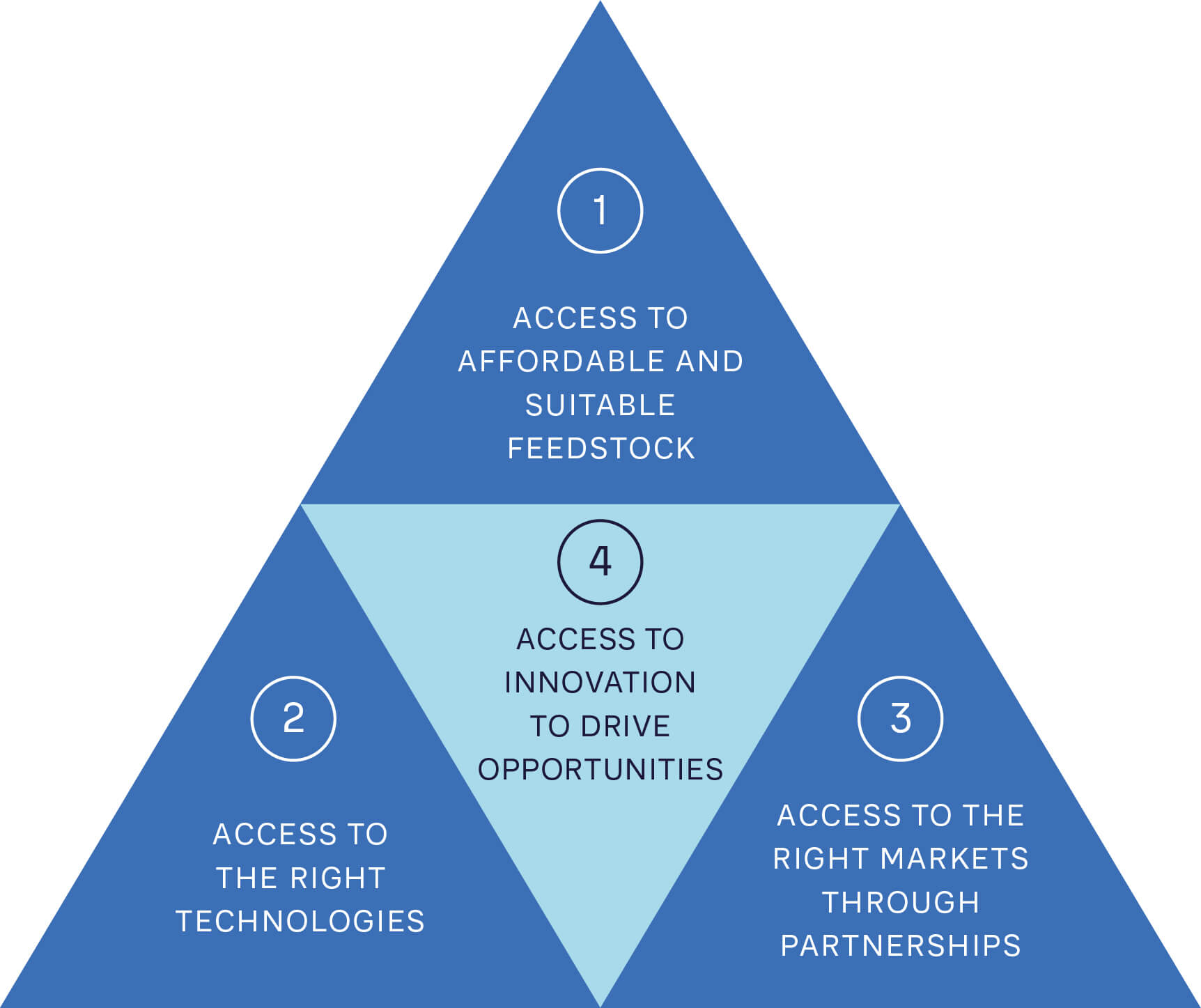

Understanding the market and seizing opportunities requires four key capabilities from businesses seeking to operate in the bio-based materials sector, as shown in Figure 1.

1. Access to affordable and suitable feedstock

The cost of feedstock makes up 60–70 percent of the total production cost of bio-based materials. Therefore, reliable access to available, affordable feedstock of suitable quality and consistency is vital to maintain cost competitiveness against conventional, petroleum-based alternatives.

However, there are natural limits to the amount of biomass that can be created, based on the world’s available land and the need to grow crops for food. This means producers must secure supplies against other players while regulators look to balance a finite supply against increasing demand. For example, the EU has tightened restrictions on the use of edible feedstocks in bio-based material production. Thailand only allows bio-based producers to use the byproducts of sugar cane processing, rather than the crop itself.

Producers can build a resilient supply of feedstock in one of three ways:

- Move production to regions where feedstock costs are lower, such as countries in Asia and Latin America. Arkema has expanded into India and Asian countries to gain access to castor beans, which are used as part of the production process of bio-polyamide. The textiles industry is increasingly adopting this practice.

- Build partnerships to strengthen access to a consistent and high-quality source of feedstock, regardless of geography. HELM and Cargill have partnered to combine their respective strengths in chemicals and corn feedstock to open a $300m commercial facility in the US to produce bio-butanediol (Bio-BDO), a key intermediate for biopolymers. Long-term commitments are essential here.

- Focus on or shift towards sustainably sourced feedstocks and greater recycling. Companies are increasingly relying on agricultural byproducts such as molasses, used kitchen oil, and palm oil waste as feedstocks. As well as increasing supply, this encourages greater recycling and supports the circular economy. LyondellBasell is using bio-naphtha produced from 100 percent waste materials from oil company Neste to create commercial biofuels (bio-polypropylene and bio-polyethylene) with verified renewable content. While bio-based materials and recycling are partly in competition, we ultimately will need both.

2. Access to the right technologies

Technological innovation is vital for achieving satisfactory production yields, building resilience by allowing a range of feedstocks to be used, and enabling overall cost-competitiveness.

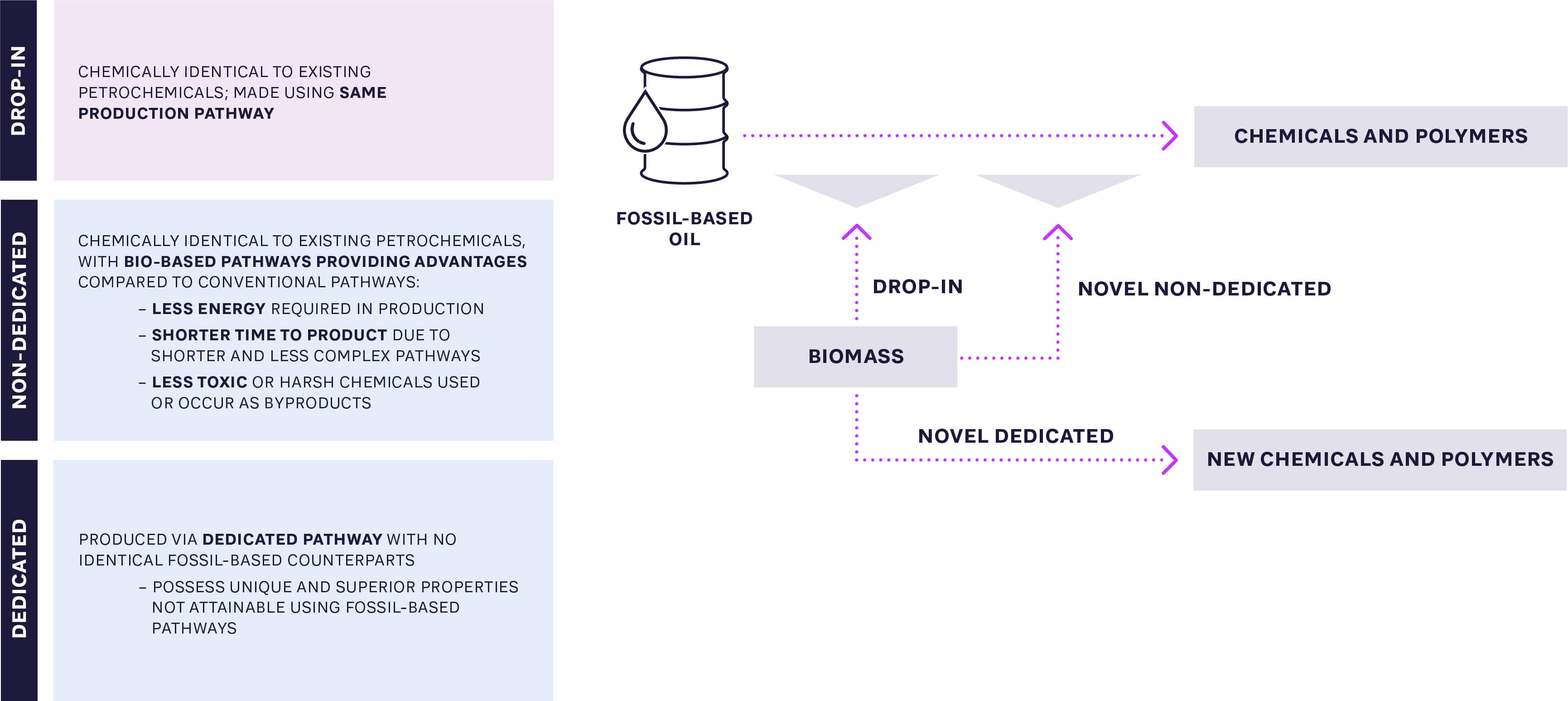

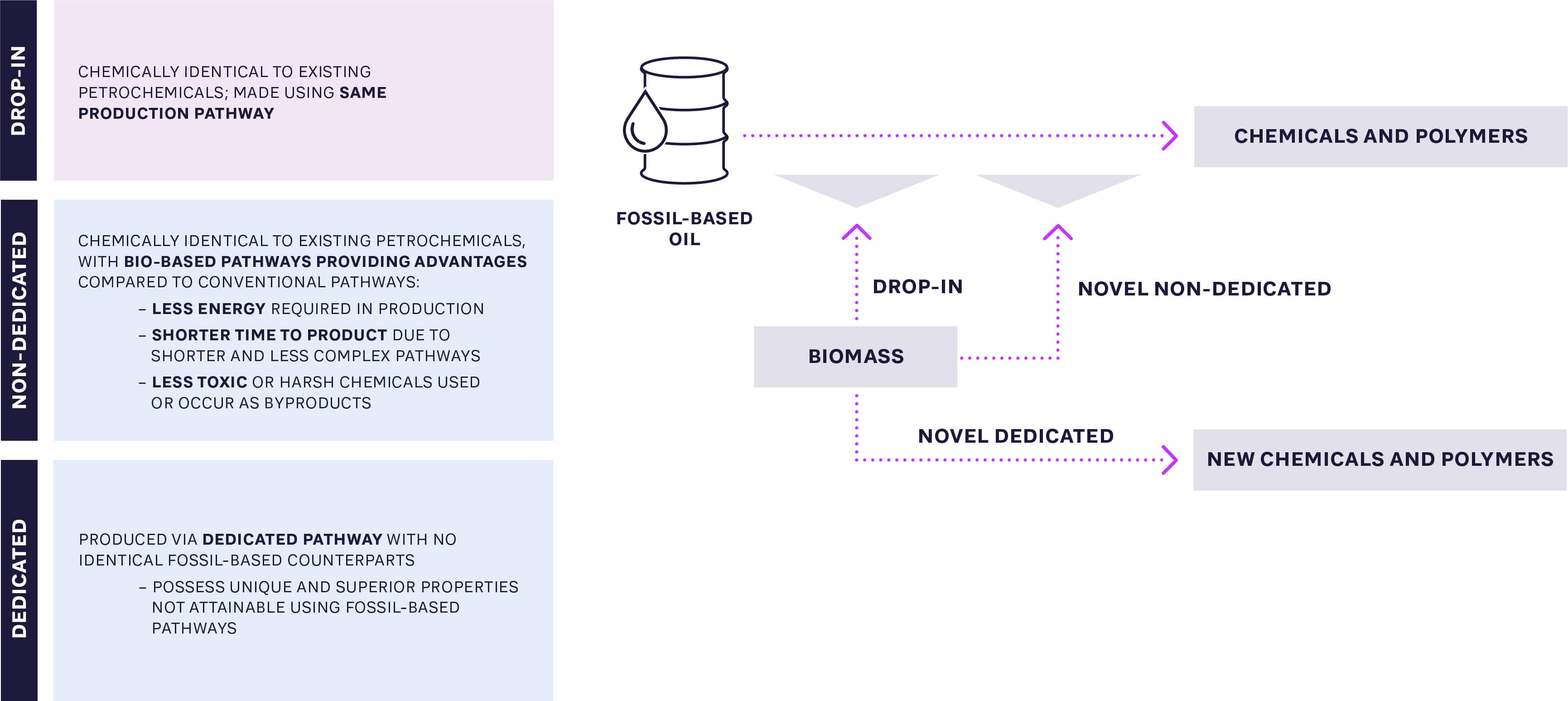

There are three types of products for bio-based production – drop-in, dedicated novel, and non-dedicated novel (as shown in Figure 2). In many cases, novel routes are being explored to find ways to improve production costs and produce bio-based materials with new functionalities.

In particular, producers are looking to use technology to improve feedstock conversion (to lower costs) and improve production capacity, thus increasing economies of scale to cost-effectively meet demand. For example, despite having a range of uses, from food packaging to medical implants, PHA initially struggled as a technology. Significant improvements in production efficiency and scalability have increased fermentation yield to lower unit production cost while driving production growth.

Access to the right technology by developing it internally is capital intensive and has a highly uncertain outcome. Technology licensing is a common model, and removes the need to develop a new technology from scratch while mitigating M&A risks. Genomatica is emerging as a leading technology licensor, offering a wide range of bio-based materials production technologies that are being used by major players such as Novamont, Qore, BASF and DSM.

3. Access to the right markets through partnerships

There is growing demand from consumer product companies looking to differentiate, increase their own supply chain resilience, and meet current and future regulatory requirements.

This is increasingly led by luxury brands, for which price is less of a factor and purchasers expect sustainability and good business practices as a given. For example, both Burberry and Gucci have released products made from Econyl (nylon made from fishing nets, fabric scraps, and industrial plastic).

Matching supply with demand requires close partnerships to ensure bio-based materials meet exact customer needs. This can be achieved through co-development and close collaboration to explore new opportunities and create targeted solutions.

Building strong partnerships with end customers enables:

- Resilience of production and supply for both parties

- The ability to scale production to drive cost efficiencies, based on secure future sales. Dutch-based PEF producer Avantium has established a network of collaborators from multiple industries, including Lego and Carlsberg, to explore the use of PEF in different end products. Consequently, it has successfully achieved offtake commitments representing 50 percent of its upcoming commercial plant capacity, with additional capacity reservations of up to 67 percent

- The ability to improve processes to deliver economies of scale

- The ability for producers to position themselves as a premium or high-quality option, enhancing margins. Genomatica has established a partnership with high-end sportswear brand Lululemon Athletica to integrate bio-based nylons into Lululemon’s sustainability product portfolio

Success may require materials players to move beyond their traditional ecosystems to engage with end customers. Origin Materials is collaborating with a network of global automotive manufacturers on raw materials standards, carbon neutrality, and other key sustainability topics in the automotive supply chain. This enables it to create a market for its own carbon-negative chemicals to be deployed in high-value mobility applications such as fabrics, plasticizers, seat foams, engineered polymers, tires, and hoses.

As well as building collaborative partnerships and ecosystems, producers will require new capabilities, such as around ensuring adherence to international quality standards and being able to certify the credentials of their bio-based materials and demonstrate that they are, in fact, predominantly bio-based.

4. Access to innovation to drive opportunities

As the bio-based materials market expands and matures in many areas, continued innovation is vital. However, materials science has traditionally suffered from under-investment. Producers therefore need to build materials science capabilities that allow them to develop bio-based products such as polymers and plastics that are identical to or better than conventional alternatives. They also need to be able to provide unique solutions that cater to the specific demands of downstream industries, such as through embodied plastics.

Feedstock innovation is also vital in, for example, combining bio-based feedstocks with recycled materials. For example, PTT MCC uses 50 percent bio-based materials when producing polybutylene succinate (PBS). This enables its end customers to meet their required sustainability standards.

Key strategies for success

Producers also need to understand and follow three key strategies when evaluating opportunities to add to their bio-based materials portfolio.

1. Take advantage of a positive and supportive regulatory environment

There is a growing global push for the use of sustainable, recyclable materials, based on environmental and Net Zero considerations. This is leading to legislation in two areas:

- Regulations that aim to increase demand. These can take the form of encouraging or mandating bio-based materials and/or discouraging the use of fossil fuel-based materials, such as through single-use plastic bans.

- Regulations that aim to increase supply. These could be financial and/or non-financial incentives, as have been deployed by the Thai Board of Investment, or bans and taxes on fossil fuel-based goods. The US REDUCE Act has doubled the import tax on fossil-based virgin plastic resins from $0.10 to $0.20 per pound, forcing suppliers to consider bio-based alternatives.

However, legislation is still maturing – for example, in the EU, labeling packaging as “bio-based” only requires 20 percent of the packaging material to be bio-based. This will change, as a current consultation is running around a new legislative framework.

To plan appropriately, producers need to build a deep understanding of the regulatory environment and, in particular, how changes will put pressure on their actual and potential customers to increase their use of bio-based products. Given the long-term time scales producers work to, this planning should be prioritized to position them effectively for the future.

2. Build and leverage the ability to create a technology advantage

Technology advantage is a key driver in the producer’s direct control. It is critical to commercial viability and the wider adoption of bio-based materials in the absence of subsidies/regulations.

Producers should look at three areas to build advantage:

- Feedstock advantage to give flexibility. For example, Bluepha’s fermentation technology allows it to use a wider range of biomass and waste feedstock in the production of PHA compared to rivals.

- Process advantage through fewer inputs and processes. Genomatica’s Geno BDO technology delivers advantages over conventional processes, as it does not require succinic acid as an intermediate.

- Properties advantage to enable the wider use of bio-based materials. Roquette is working with personal care player Syntheon to expand the use of succinic acid, moving beyond its traditional role into high-value cosmetic segments.

By working together with downstream partners, producers can both develop technology advantages and secure complementary expertise to further refine their strengths.

3. Target markets with high growth potential

When identifying significant-size markets, those with high growth potential and little competition are ideal targets. While markets meeting all three criteria might be hard to come by, working in partnership with launch customers will help identify opportunities and provide early revenues, mitigating risk. For example, luxury fashion apparel brand Stella McCartney pioneered the world’s first bio-based faux fur in partnership with DuPont Biomaterials in 2020.

However, high growth potential and a lack of competition does need to be balanced with other drivers (such as technology advantage), as shown in the case of succinic acid, an intermediate for polymer production. Despite significant growth in demand, only four players are currently operating within this space, due to struggles to scale up technology in a cost-effective manner and obtain cheap-enough feedstocks. While technology advancements are now being made, it is not yet clear whether they will lead to large-scale commercialization.

Building a strategy for success

The path to achieving success in the bio-based materials market remains difficult. Market leaders need to align the four capabilities with the three key strategies, starting by securing the right feedstock and building a strong understanding of the product landscape, geography, and technology.

Insights for the executive

Beyond identifying a clear winner, players should retain several key principles throughout their bio-based materials journey:

- Act now to be ready for the future. Suppliers should focus on value chains that are most at risk in the future and/or where a premium is already being paid now.

- Disrupt the market as opposed to playing in the market. Instead of following market trends, players should consistently identify ways to develop a unique proposition and create new market demands to remain relevant. Develop technologies with a protective moat to buy time in the short term to enhance and safeguard your competitive edge.

- View bio-based materials as a future core business. As opposed to seeing bio-based materials as a mere sustainability initiative, players should internalize the potential of bio-based materials as the successor of fossil-based resources.

- Take a partnership approach. Both producers and consumer goods companies should build early partnerships to explore and scale opportunities to reduce risk and build capabilities without over-investment.

- Balance the bio-economy with the circular economy. Beyond the use of bio-based feedstocks, players can consider expanding and integrating recycled materials into their product offering.

- Build scale. As with any process-based industry, you need to be able to grow production. Do you need partners, such as fossil-fuel players with experience of scaling operations?

- Find a focus amidst the white noise. While the opportunities within the bio-based materials space are vast, players should identify key technologies and markets to allocate resources to, rather than spreading themselves too thinly.

Notes

[1] Bio-based materials are defined as chemicals and polymers derived partially or fully from bio-based feedstocks such as biomass, arable crops, and other organic matter.

[2] Source: Arthur D. Little/Nova Institute

12 min read • Chemicals, Operations management

Why the bio-based materials market is finally poised for growth

For decades, the market for bio-based materials[1] has been seen as promising without significantly taking off. Challenges in sourcing affordable and sustainable raw materials, achieving economies of scale, and securing sufficient end-market demand have all prevented the market from growing.

DATE

This is now changing rapidly, reinvigorating the market. Demand is growing, driven by increasingly environmentally conscious consumers and governments’ Net Zero targets requiring consumer-focused product companies to achieve sustainability. Finally, technology breakthroughs are bringing down production costs for bio-based materials, while improving their performance to make them comparable or superior to fossil-based counterparts.

At the same time, the increasing volatility within the oil & gas sector is causing traditional petrochemical players to look beyond their fossil-based products for new and more resilient sources of future revenue and growth. All of this is driving interest and investment.

The market is now at an inflection point, with a growth rate that is both steadying and outstripping the wider materials industry. For example, bio-based plastics will see 17 percent CAGR growth between 2020 and 2030, compared to just 3.2 percent for conventional plastics. Several bioplastics will experience major capacity expansions in the next three years (CAGR), such as polyethylene furanoate (PEF) at 163 percent, polyhydroxyalkanoates (PHA) at 50 percent, and bio-polyamide (Bio-PA) at 38 percent.

The opportunities are there for both producers and consumer goods companies. How can players identify and successfully harness compelling areas for growth in the bio-based materials segment?

The trends driving current market expansion and growth

The upsurge of interest in the bio-based materials market is caused by a combination of both demand and supply factors:

1. Demand-side pull

Producers are seeing increasing consumer demand for bio-based alternatives in specific areas. These include premium items (such as in the fashion and automotive sectors), for which higher costs are less of a barrier to purchase, volumes are low, and companies want the increased brand recognition that comes from being a genuine sustainability market leader. Additionally, in some niches bio-based products are the only available or viable option, such as compostable cutlery and tableware for large-scale outdoor catering.

Mass-market consumer goods companies are also dramatically increasing demand. Many have made bold commitments to switch to fully recycled or bio-based packaging as they have looked to differentiate and reduce their carbon footprint. This gives producers confidence in expanding capacity to service this growing need.

Demand is also being stoked by new and planned regulations designed to increase sustainability and grow the circular economy. Many companies are aiming to get ahead of the curve and build resilience into their supply chains by mandating bio-based materials before they are compulsory. For example, in the automotive industry, companies such as Porsche are replacing composites with natural fibers (such as hemp) to enable recyclability while retaining the benefits of materials that are strong and lightweight. Producers that rely on manufacturing materials that are not easily recyclable will have to respond to this regulatory and consumer demand – by exiting the market entirely, developing breakthrough recycling technologies (which may not happen quickly enough), or switching to bio-based materials.

2. Supply-side push

Many bio-based materials are now mature. For example, bio-polyamides (Bio-PA) are now cheaper than most natural fibers while delivering similar levels of quality and durability.

After decades of aborted attempts, capacity and material availability have finally expanded from pilot to commercial-scale activities in many areas as technology barriers have been overcome and investment has increased. Thanks to new finance, capacity for production of furan derivatives is expected to grow by 209 percent CAGR between 2022 and 2025, albeit from a low base.[2] Bio-based material companies such as Newlight Technologies ($107m Series F funding in 2022), RWDC Industries ($263m Series B funding in 2021) and Beijing Phabuilder Biotechnology ($37m Series A funding in 2022) have all attracted significant new investment. Many oil majors are investing heavily in bio-based materials to build future resilience into their portfolios. TotalEnergies Corbion has expanded polylactic acid (PLA) operations in Thailand, for example, using the byproducts of locally grown sugar cane.

The opportunities and challenges for upstream and downstream players

Understanding the market and seizing opportunities requires four key capabilities from businesses seeking to operate in the bio-based materials sector, as shown in Figure 1.

1. Access to affordable and suitable feedstock

The cost of feedstock makes up 60–70 percent of the total production cost of bio-based materials. Therefore, reliable access to available, affordable feedstock of suitable quality and consistency is vital to maintain cost competitiveness against conventional, petroleum-based alternatives.

However, there are natural limits to the amount of biomass that can be created, based on the world’s available land and the need to grow crops for food. This means producers must secure supplies against other players while regulators look to balance a finite supply against increasing demand. For example, the EU has tightened restrictions on the use of edible feedstocks in bio-based material production. Thailand only allows bio-based producers to use the byproducts of sugar cane processing, rather than the crop itself.

Producers can build a resilient supply of feedstock in one of three ways:

- Move production to regions where feedstock costs are lower, such as countries in Asia and Latin America. Arkema has expanded into India and Asian countries to gain access to castor beans, which are used as part of the production process of bio-polyamide. The textiles industry is increasingly adopting this practice.

- Build partnerships to strengthen access to a consistent and high-quality source of feedstock, regardless of geography. HELM and Cargill have partnered to combine their respective strengths in chemicals and corn feedstock to open a $300m commercial facility in the US to produce bio-butanediol (Bio-BDO), a key intermediate for biopolymers. Long-term commitments are essential here.

- Focus on or shift towards sustainably sourced feedstocks and greater recycling. Companies are increasingly relying on agricultural byproducts such as molasses, used kitchen oil, and palm oil waste as feedstocks. As well as increasing supply, this encourages greater recycling and supports the circular economy. LyondellBasell is using bio-naphtha produced from 100 percent waste materials from oil company Neste to create commercial biofuels (bio-polypropylene and bio-polyethylene) with verified renewable content. While bio-based materials and recycling are partly in competition, we ultimately will need both.

2. Access to the right technologies

Technological innovation is vital for achieving satisfactory production yields, building resilience by allowing a range of feedstocks to be used, and enabling overall cost-competitiveness.

There are three types of products for bio-based production – drop-in, dedicated novel, and non-dedicated novel (as shown in Figure 2). In many cases, novel routes are being explored to find ways to improve production costs and produce bio-based materials with new functionalities.

In particular, producers are looking to use technology to improve feedstock conversion (to lower costs) and improve production capacity, thus increasing economies of scale to cost-effectively meet demand. For example, despite having a range of uses, from food packaging to medical implants, PHA initially struggled as a technology. Significant improvements in production efficiency and scalability have increased fermentation yield to lower unit production cost while driving production growth.

Access to the right technology by developing it internally is capital intensive and has a highly uncertain outcome. Technology licensing is a common model, and removes the need to develop a new technology from scratch while mitigating M&A risks. Genomatica is emerging as a leading technology licensor, offering a wide range of bio-based materials production technologies that are being used by major players such as Novamont, Qore, BASF and DSM.

3. Access to the right markets through partnerships

There is growing demand from consumer product companies looking to differentiate, increase their own supply chain resilience, and meet current and future regulatory requirements.

This is increasingly led by luxury brands, for which price is less of a factor and purchasers expect sustainability and good business practices as a given. For example, both Burberry and Gucci have released products made from Econyl (nylon made from fishing nets, fabric scraps, and industrial plastic).

Matching supply with demand requires close partnerships to ensure bio-based materials meet exact customer needs. This can be achieved through co-development and close collaboration to explore new opportunities and create targeted solutions.

Building strong partnerships with end customers enables:

- Resilience of production and supply for both parties

- The ability to scale production to drive cost efficiencies, based on secure future sales. Dutch-based PEF producer Avantium has established a network of collaborators from multiple industries, including Lego and Carlsberg, to explore the use of PEF in different end products. Consequently, it has successfully achieved offtake commitments representing 50 percent of its upcoming commercial plant capacity, with additional capacity reservations of up to 67 percent

- The ability to improve processes to deliver economies of scale

- The ability for producers to position themselves as a premium or high-quality option, enhancing margins. Genomatica has established a partnership with high-end sportswear brand Lululemon Athletica to integrate bio-based nylons into Lululemon’s sustainability product portfolio

Success may require materials players to move beyond their traditional ecosystems to engage with end customers. Origin Materials is collaborating with a network of global automotive manufacturers on raw materials standards, carbon neutrality, and other key sustainability topics in the automotive supply chain. This enables it to create a market for its own carbon-negative chemicals to be deployed in high-value mobility applications such as fabrics, plasticizers, seat foams, engineered polymers, tires, and hoses.

As well as building collaborative partnerships and ecosystems, producers will require new capabilities, such as around ensuring adherence to international quality standards and being able to certify the credentials of their bio-based materials and demonstrate that they are, in fact, predominantly bio-based.

4. Access to innovation to drive opportunities

As the bio-based materials market expands and matures in many areas, continued innovation is vital. However, materials science has traditionally suffered from under-investment. Producers therefore need to build materials science capabilities that allow them to develop bio-based products such as polymers and plastics that are identical to or better than conventional alternatives. They also need to be able to provide unique solutions that cater to the specific demands of downstream industries, such as through embodied plastics.

Feedstock innovation is also vital in, for example, combining bio-based feedstocks with recycled materials. For example, PTT MCC uses 50 percent bio-based materials when producing polybutylene succinate (PBS). This enables its end customers to meet their required sustainability standards.

Key strategies for success

Producers also need to understand and follow three key strategies when evaluating opportunities to add to their bio-based materials portfolio.

1. Take advantage of a positive and supportive regulatory environment

There is a growing global push for the use of sustainable, recyclable materials, based on environmental and Net Zero considerations. This is leading to legislation in two areas:

- Regulations that aim to increase demand. These can take the form of encouraging or mandating bio-based materials and/or discouraging the use of fossil fuel-based materials, such as through single-use plastic bans.

- Regulations that aim to increase supply. These could be financial and/or non-financial incentives, as have been deployed by the Thai Board of Investment, or bans and taxes on fossil fuel-based goods. The US REDUCE Act has doubled the import tax on fossil-based virgin plastic resins from $0.10 to $0.20 per pound, forcing suppliers to consider bio-based alternatives.

However, legislation is still maturing – for example, in the EU, labeling packaging as “bio-based” only requires 20 percent of the packaging material to be bio-based. This will change, as a current consultation is running around a new legislative framework.

To plan appropriately, producers need to build a deep understanding of the regulatory environment and, in particular, how changes will put pressure on their actual and potential customers to increase their use of bio-based products. Given the long-term time scales producers work to, this planning should be prioritized to position them effectively for the future.

2. Build and leverage the ability to create a technology advantage

Technology advantage is a key driver in the producer’s direct control. It is critical to commercial viability and the wider adoption of bio-based materials in the absence of subsidies/regulations.

Producers should look at three areas to build advantage:

- Feedstock advantage to give flexibility. For example, Bluepha’s fermentation technology allows it to use a wider range of biomass and waste feedstock in the production of PHA compared to rivals.

- Process advantage through fewer inputs and processes. Genomatica’s Geno BDO technology delivers advantages over conventional processes, as it does not require succinic acid as an intermediate.

- Properties advantage to enable the wider use of bio-based materials. Roquette is working with personal care player Syntheon to expand the use of succinic acid, moving beyond its traditional role into high-value cosmetic segments.

By working together with downstream partners, producers can both develop technology advantages and secure complementary expertise to further refine their strengths.

3. Target markets with high growth potential

When identifying significant-size markets, those with high growth potential and little competition are ideal targets. While markets meeting all three criteria might be hard to come by, working in partnership with launch customers will help identify opportunities and provide early revenues, mitigating risk. For example, luxury fashion apparel brand Stella McCartney pioneered the world’s first bio-based faux fur in partnership with DuPont Biomaterials in 2020.

However, high growth potential and a lack of competition does need to be balanced with other drivers (such as technology advantage), as shown in the case of succinic acid, an intermediate for polymer production. Despite significant growth in demand, only four players are currently operating within this space, due to struggles to scale up technology in a cost-effective manner and obtain cheap-enough feedstocks. While technology advancements are now being made, it is not yet clear whether they will lead to large-scale commercialization.

Building a strategy for success

The path to achieving success in the bio-based materials market remains difficult. Market leaders need to align the four capabilities with the three key strategies, starting by securing the right feedstock and building a strong understanding of the product landscape, geography, and technology.

Insights for the executive

Beyond identifying a clear winner, players should retain several key principles throughout their bio-based materials journey:

- Act now to be ready for the future. Suppliers should focus on value chains that are most at risk in the future and/or where a premium is already being paid now.

- Disrupt the market as opposed to playing in the market. Instead of following market trends, players should consistently identify ways to develop a unique proposition and create new market demands to remain relevant. Develop technologies with a protective moat to buy time in the short term to enhance and safeguard your competitive edge.

- View bio-based materials as a future core business. As opposed to seeing bio-based materials as a mere sustainability initiative, players should internalize the potential of bio-based materials as the successor of fossil-based resources.

- Take a partnership approach. Both producers and consumer goods companies should build early partnerships to explore and scale opportunities to reduce risk and build capabilities without over-investment.

- Balance the bio-economy with the circular economy. Beyond the use of bio-based feedstocks, players can consider expanding and integrating recycled materials into their product offering.

- Build scale. As with any process-based industry, you need to be able to grow production. Do you need partners, such as fossil-fuel players with experience of scaling operations?

- Find a focus amidst the white noise. While the opportunities within the bio-based materials space are vast, players should identify key technologies and markets to allocate resources to, rather than spreading themselves too thinly.

Notes

[1] Bio-based materials are defined as chemicals and polymers derived partially or fully from bio-based feedstocks such as biomass, arable crops, and other organic matter.

[2] Source: Arthur D. Little/Nova Institute