Financial institutions are increasingly being pushed to tailor their offerings and services to the individual needs of their clients. Behavioral finance (BF) aids in assessing clients’ needs and decision-making processes. It proposes that human biases can cause irrationalities in investment behaviors. Incorporating this concept into an investment approach allows institutions to diverge from traditional approaches and ultimately aims at improving financial health and client satisfaction.

WHAT DOES BF MEAN FOR INVESTMENT MANAGEMENT?

Investment management offerings are increasingly diverging into two categories. The first comprises standardized offerings fostered by increasing regulation, such as the Markets in Financial Instruments Directive (MiFID) and Markets in Financial Instruments Regulation (MiFIR), and the additional cost burden these place on financial institutions. The second category consists of highly tailored services centered around data-driven personalization.

Since standardized offerings provide little opportunity for differentiation in the marketplace, financial institutions looking for competitive advantage would do well to focus on tailoring their services and products to the very specific needs of individual customers.

But, to do that, they must know what makes their customers tick. This is why more and more financial institutions are turning to behavioral finance to help them better understand the hidden psychological motivators that can lead to suboptimal investment decisions and negatively impact the customer relationship. These are factors that most traditional investment approaches do not consider.

On the other hand, by using behavioral finance to explore an individual investor’s ’personality “‘traits”‘ and cognitive biases, relationship managers can cater to their customers’ needs and specific requirements much more precisely. This enables financial services providers to (re)shape their service model to make it ever more relevant to their customers, creating differentiation in the process.

Here, we take a closer look at behavioral finance to better understand its benefits, its mechanisms, and our ability to use it in a business context.

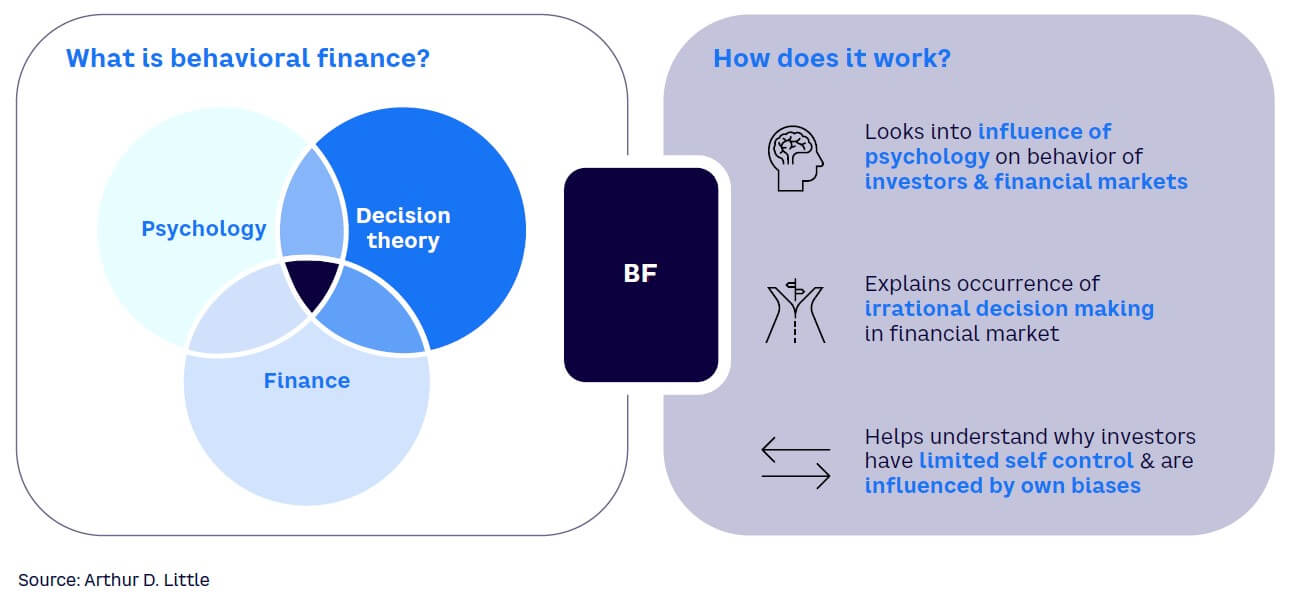

Behavioral finance is a multidisciplinary approach that sits at the center of psychology, decision theory, and finance (see Figure 1). As such, it challenges the established assumptions about the rational nature of investors’ decision making by considering the irrational influences and triggers that affect behaviors and, consequently, what can be done to mitigate their impact.

How does BF benefit financial institutions and investors?

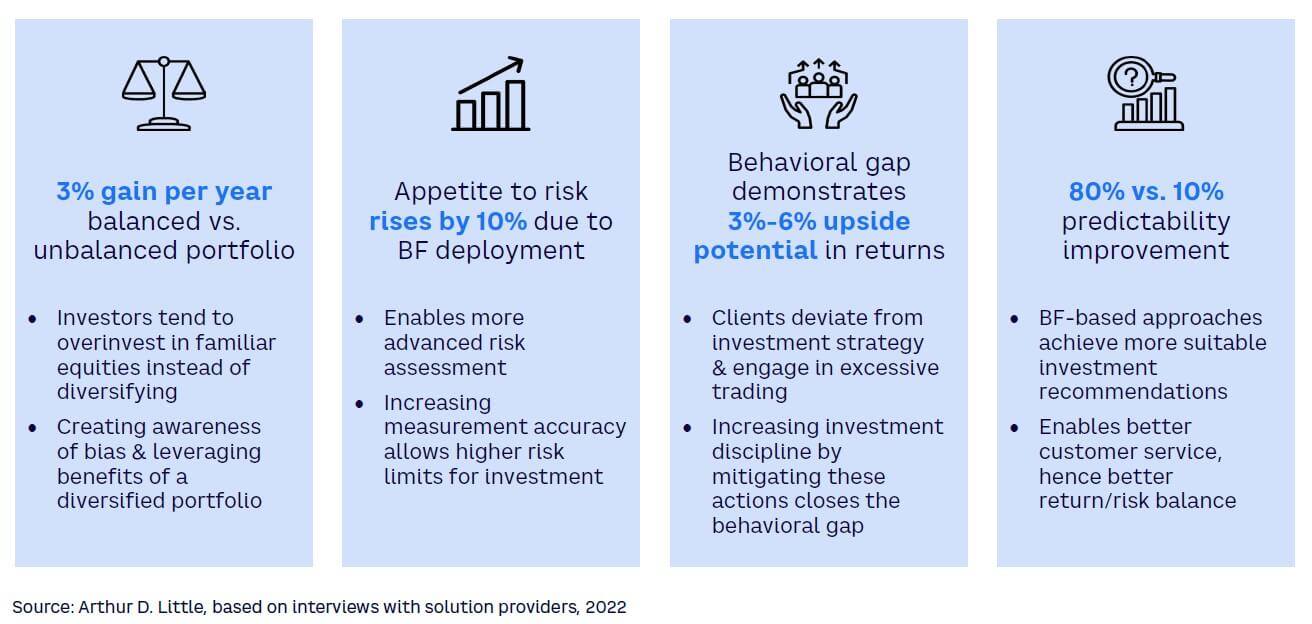

By taking into account their personal preferences and appetite for risk, behavioral finance enables investors to create a more balanced portfolio that not only generates higher returns, but is also much more likely to deliver the financial outcomes they expect and desire (see Figure 2). This in turn builds confidence in the investment choices being made and helps eliminate the “behavior gap” that occurs when investors stray from an agreed strategy.

For a financial services organization, being able to provide such a service is a way to create differentiation. Leading banks are already using behavioral finance to varying degrees, with some now incorporating it into their investment processes. For those yet to adopt it, the question is how best to introduce it into their existing business model.

INTRODUCING BF IN AN EXISTING BUSINESS MODEL

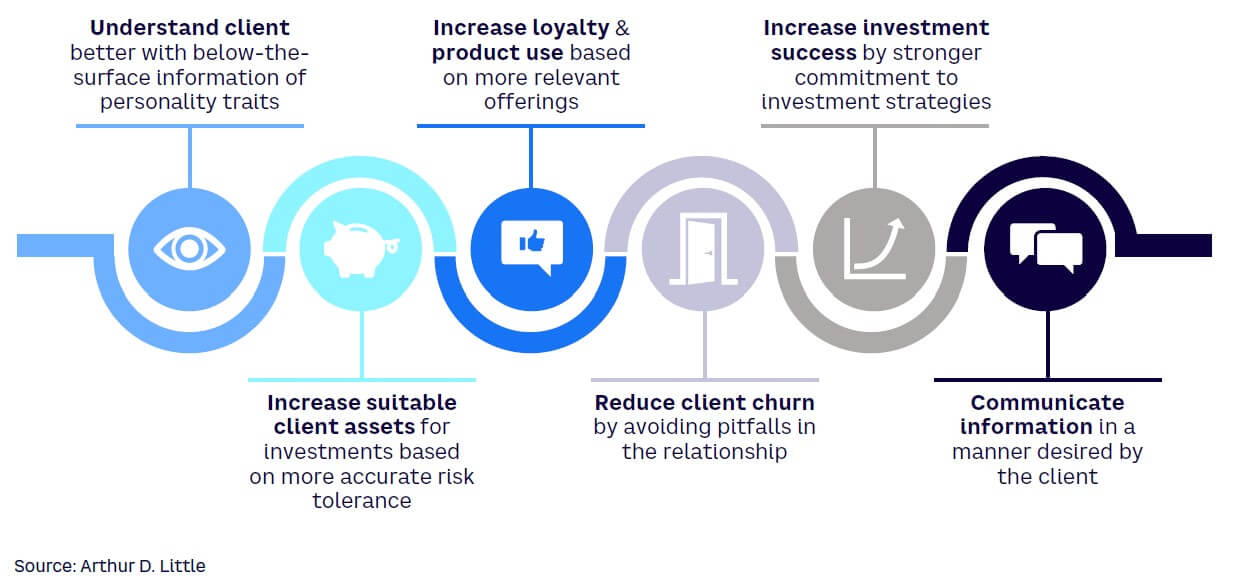

There are many points along the customer journey where behavioral finance can add significant value for either customer or bank, or both (see Figure 3):

-

By better understanding a customer’s needs, banks can fine-tune their investment advice to help investors create a more balanced portfolio. Academic research shows that investors who rid themselves of the tendency to overinvest in familiar equities and diversify instead could be 3% better off each year.

-

By adopting a behavioral finance approach, banks can help their customers extend their “asset comfort zone,” enabling customers to reach their investment goals faster and more efficiently. For example, because it provides a more accurate assessment of a customer’s investment boundaries, using behavioral finance can increase risk appetite by as much as 10%.

-

By providing a better, more personalized service with increasingly “better fit” recommendations, banks can strengthen their relationships with their customers, so investors become more willing to accept an advisor’s guidance. Long-term, this translates into greater customer loyalty and reduced customer churn.

-

By helping to achieve and maintain higher levels of investment success, behavioral finance not only directly benefits customers on an ongoing basis, but also increases their value to the bank, as an enduring relationship will lead to more opportunities to capture a greater share of their wallet by offering additional services.

-

By reinforcing customers’ commitment to an investment strategy, behavioral finance helps prevent early exits and deviation from an agreed investment plan. This is the so-called behavior gap that increases costs and reduces asset performance, which in turn can decrease investor returns by between 3% and 6%.

-

By ensuring only the right communication channels are used, behavioral finance can help ensure customers are receiving advice and knowledge about their investments when and how they want it.

Key to introducing BF: The underlying coverage model

Since behavioral finance approaches use data- and analysis-driven methodologies, they rely on assessing certain characteristics and providing insights based on this. The question is how best to incorporate these insights back into the service offering for maximum effect on the customer and their experience.

At its simplest, this could be done using an automated model that gathers insights directly from information and then shapes the services and products being offered to a customer. Obviously, this will require a predominantly “digital first” client coverage model.

Alternatively, if behavioral finance solutions are to be offered in person, insights must be provided to the relationship manager, who can make recommendations accordingly. With this model, the operational effort required is very low and at the discretion of the relationship manager. However, there is an inherent risk that the insights provided by behavioral finance may not be used systematically across client portfolios.

WHAT BF SOLUTIONS ARE AVAILABLE?

Once a financial institution decides to implement a behavioral finance solution, the next question is how to go about doing so.

The answer is to use one of a growing number of specialist providers, such as Neuroprofiler, Oxford Risk, BehaviorQuant, and Behavioural Finance Solutions GmbH, that have begun offering their expertise to financial institutions (see Figure 4).

Arthur D. Little’s research into these providers indicates a broad spread of value propositions and approaches, variously aimed at rebalancing portfolios, improving financial literacy, bringing a degree of emotion into risk assessment, or introducing new cognitive frameworks to investment decision making.

Initially, most behavioral finance solutions concentrated on the top of the wealth pyramid: (ultra) high-net-wealth customers. However, they have evolved to focus increasingly on lower wealth bands, even including standard retail customer segments.

To make their services as widely consumable as possible, some behavioral finance specialist providers offer integrated services that bring together their behavioral finance solution with regulatory aspects like MiFID and aspects of environmental, social, and governance (ESG). Combining multiple information-gathering and analysis processes allows banks to reduce complexity and improve the customer experience.

This means banks can choose either a more comprehensive solution or a more focused service that they can just drop into their existing portfolio.

Which behavioral finance provider a financial institution chooses to work with will depend on factors such as target segments and geographies and how behavioral finance needs to integrate with other elements of the business. Most of these services are available under annual license or by subscription.

NEXT STEPS FOR BANK MANAGERS

As behavioral finance becomes more widely adopted, leadership teams of financial institutions need to evaluate its benefit to their business by looking at the potential value it adds, the implementation effort involved, and the time frame for completion.

If they choose to incorporate it into their service offerings, they should begin by focusing on the lowest-hanging fruit. In other words, where behavioral finance will make the most difference soonest with the least effort.

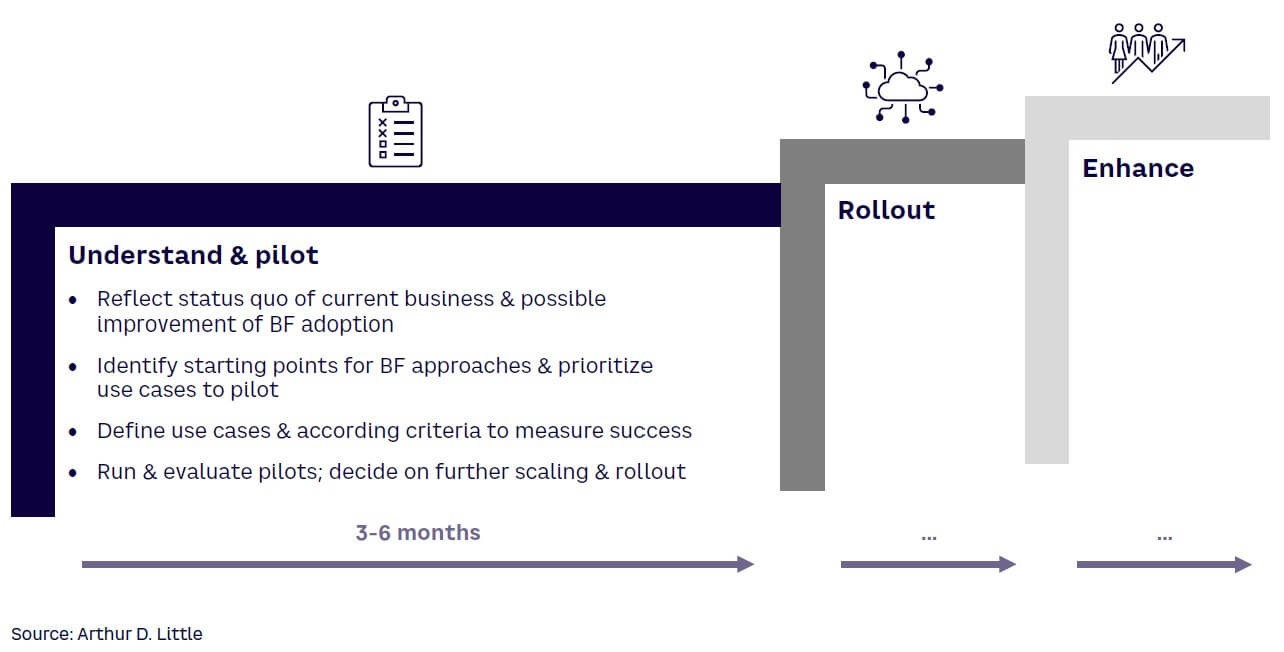

Of course, financial institutions must consider how behavioral finance might fit into current business and operating models, as it needs to sit comfortably with both the organization’s long-term ambitions and the needs of its customers. If this evaluation shows there is potential, then launching a pilot project to test the viability of such a service would be the recommended first step (see Figure 5). This would entail identifying appropriate customers and agreeing on use cases and success criteria, as well as the practicalities of how the service will be delivered.

The complexity of gathering and evaluating the necessary information can be mitigated by using an integrated questionnaire that is not focused on behavioral finance alone but also gathers knowledge about investment attitudes toward, for instance, sustainability, as well as mandatory information to comply with regulations such as MiFID.

A reasonable timeline to determine the suitability of behavioral finance for an individual financial institution and to set up a pilot project would be three to six months, followed by rollout and refinement of the service.

Conclusion

ACCESSING BF BENEFITS

Leading financial services organizations already are using behavioral finance to enable investors to make decisions based on their own appetites for risk. Providing such a service creates differentiation among banks. The benefits of introducing behavioral finance into existing business models can be substantial for a variety of reasons:

- Behavioral finance can be an essential tool to increase personalization in investment management to gain a competitive edge.

- Behavioral finance can be employed to target multiple levers, comprising better financial returns, increased customer experience, and improved relationships.

- These relationships can subsequently translate in an apparent value-add for banks, with greater customer loyalty, differentiation in the marketplace, and an increased share of client wallet.

- Front-running financial institutions have already incorporated elements of behavior finance to various degrees in their offerings.

- Banks should consider the individual scope and use cases of integration depending on their intended value proposition in investment management.