DOWNLOAD

DATE

Contact

The food and beverage industry is experiencing rapid, unpredictable disruptions driven by supply scarcity and commodity price fluctuations. This presents an existential challenge in getting safe, consistent products to market. In this Viewpoint, we identify practical actions to strengthen resilience and build supply chain security through a combination of supply chain innovation and improved product development approaches.

A COMING APOCALYPSE?

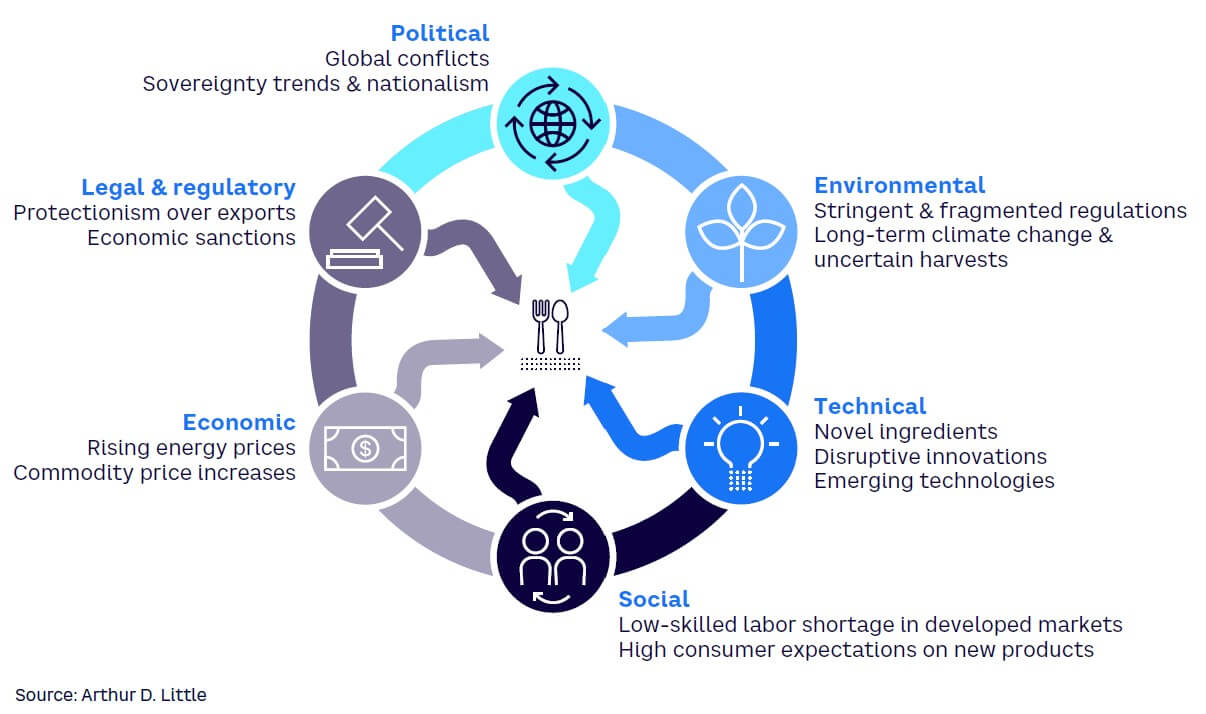

The food and beverage industry is increasingly complex, with a typical processed food product including more than 20 ingredients sourced from around the world. The industry is grappling with a perfect storm of supply chain risk and unpredictability caused by conflicts in Ukraine and the Eastern Mediterranean, skyrocketing energy prices, the after-effects of labor disruption from pandemic, regulatory fragmentation, national protectionism, and uncertain harvests (see Figure 1).

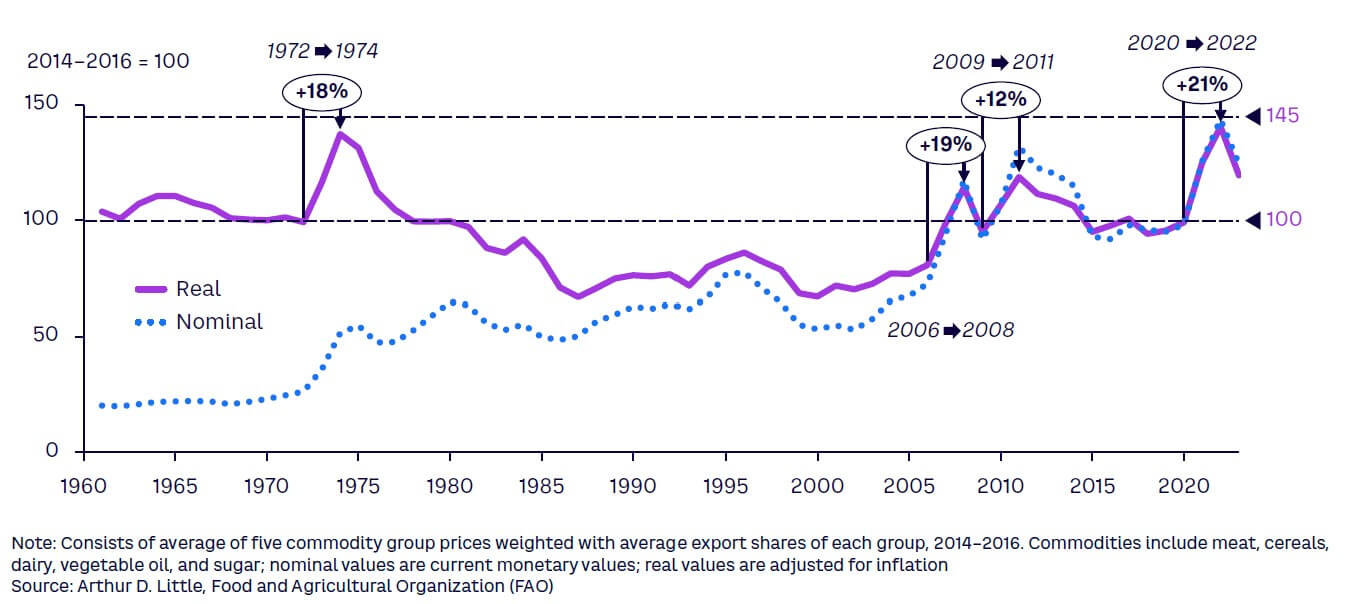

These factors dramatically affect food supply chains: fertilizer production is more expensive, farm labor shortages are increasing, and countries are banning the import/export of certain commodities. Food prices are spiking, most recently rising 21% between 2019 and 2022, faster than at any point in the last 50 years (see Figure 2), a situation described as “apocalyptic” by the governor of the Bank of England.

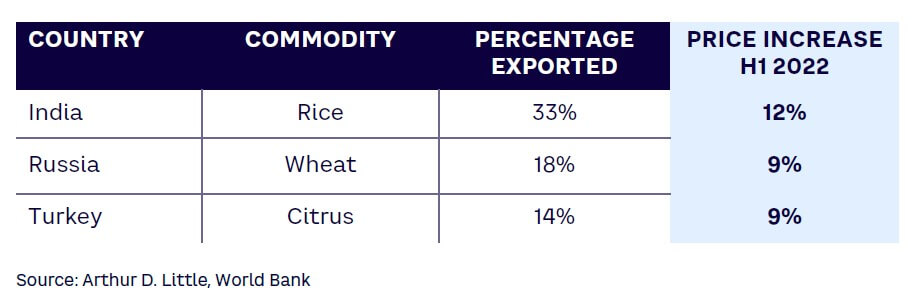

Future spikes and falls are expected to become more frequent and more significant. Sharp, fast increases in many food commodity prices are the result of export bans and restrictions, particularly on rice, wheat, and citrus (see Table 1).

Against this backdrop, food companies must always seek consumer delight by rapidly launching exciting products while ensuring food remains safe, legal, and affordable and enabling a shift toward sustainable, climate-resilient food production. They also must adapt to the availability of novel, natural, and plant-based ingredients and integrate new technologies into products and processes.

BUILDING RESILIENCE

Some think these are impossible times. Others are calmer, believing current headwinds will diminish. Many leaders in this sector have concluded that the trend toward increasing complexity and disruption is not a wait-and-see situation — rather, it’s a new normal in which complicated global value chains will experience more frequent and impactful disruptions, necessitating quick-fire changes in product composition and ingredient choice.

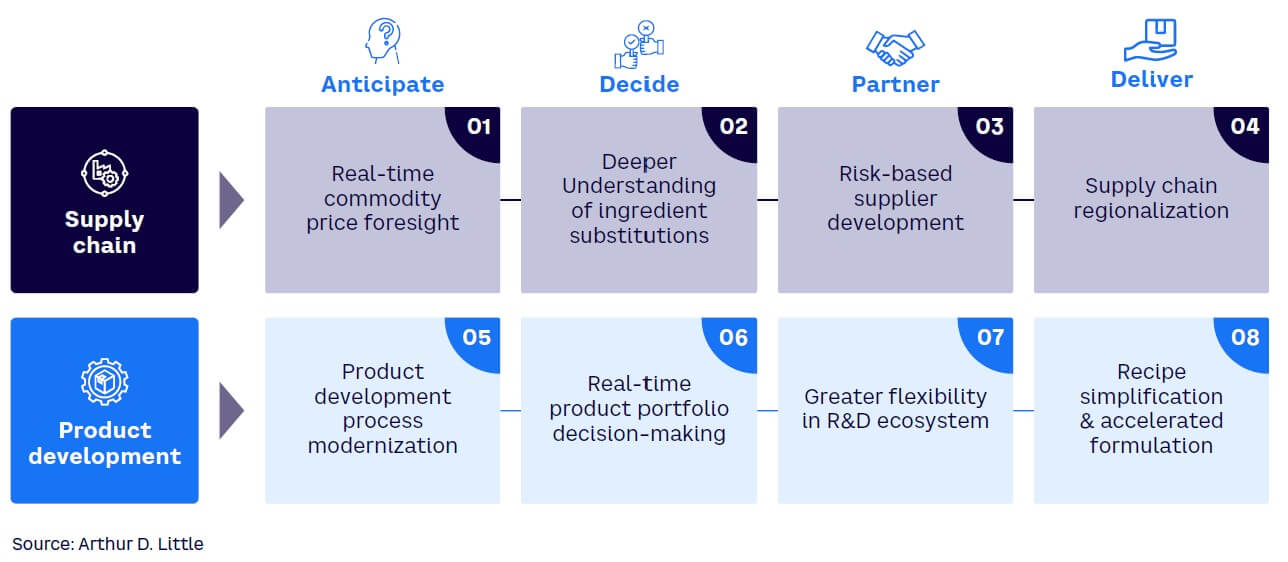

Change must come from two areas: (1) the way agricultural commodities and food ingredients are sourced and (2) how product development takes place. There are a series of levers that organizations in the food, beverage, and wider consumer packaged goods space can pull to build resilience in supply chains and product development. They include anticipating potential issues, making the right decisions, working with the right partners, and delivering the right products and ingredients (see Figure 3). We explore each of these eight levers in detail below.

Building supply chain resilience

Supply chain resilience involves having better visibility into upcoming shocks in the supply chain, developing ways to quickly substitute ingredients when issues arise, and working more closely with increasingly regionalized suppliers to proactively manage risks.

1. Real-time commodity price foresight

The procurement function in large food companies lives and dies by correctly forecasting the price of commodities. Many use sophisticated tools such as Gro Intelligence to model and forecast risks and prices. A remaining challenge is how to convert macro-level intelligence into micro-level insights and foresights, factoring in essential considerations, such as links between commodity prices, food quality and safety, and sustainability credentials of supply chains.

Achieving this requires considering a broader evidence base than conventional price forecasts. Arthur D. Little’s (ADL’s) AI Competence Center recently combined market foresight data with unstructured data from press releases, analyst reports, and social media to predict spikes and troughs in commodity prices in near real time and found error margins of <5%, compared to 16% using conventional market-forecasting techniques. The key difference is the generation of actionable insights for decision-making in near real time.

2. Deeper understanding of ingredient substitutions

In times of scarcity or disruption, ingredients and commodities can be substituted for one another, but this requires a deep understanding of ingredient interactions and what the exchange means for product performance, food safety, and regulatory requirements (e.g., allergens). There is also a huge reputational risk in substituting an ingredient if there’s a chance consumers will feel a well-loved product doesn’t “taste right.”

In response, large food and beverage companies are moving toward more globally consistent material risk assessments and ingredient characterization, and further value can be added by characterizing how ingredients interact with each other (so that it does taste right) and making databases of this information universally available to worldwide product development teams.

3. Risk-based supplier development based on ingredient criticality

Working collaboratively with growers or farmers to, for example, improve farming practices and minimize supply chain losses can help safeguard against disruption and build resilience. Not every supplier can be supported intensively, but those that represent a greater risk in security and continuity of supply (both consumer and reputational risk) can be prioritized.

This is especially important for high-value produce. For example, a large food and beverage company in the premium coffee space identified business continuity and quality risks among its growers in Vietnam and started working with them to ensure consistency and quality of supply. This requires a risk-based approach to supplier assessment, followed by capability development support for key suppliers.

4. Supply chain regionalization

Consumer desires for locally sourced foods present an opportunity to re-localize supply chains to more regional models, although food and beverage production may become more seasonally dependent. This can create a profound shift in how procurement divisions are set up and operate, as well as how ingredient availability informs product launch cycles and feeds into advertising and marketing considerations.

Organizations such as Jeni’s Splendid Ice Creams in Columbus, Ohio, USA, are embracing supply chain regionalization and seasonality as a key differentiator. Summer, spring, and fall flavor collections become a product differentiator, for instance, in addition to making use of locally sourced ingredients at their optimal freshness.

Building product development resilience

Product innovation resilience takes product development a step further by involving a greater understanding of how ingredients interact, simplifying recipes and product portfolios, and making data-driven decisions on how to use a wider ecosystem of co-innovators and partners in the event of a supply chain disruption.

5. Product development process modernization

Product development involves multifunctional teams from within and outside companies involved in ideation, design, and scale-up, often through a series of test-and-learn experiments and decision points. By building resilience-based decisions into each decision gateway during this process and ensuring foresight regarding ingredient availability, the final product can become more resilient.

Key questions to ask include:

-

Does our new product require ingredients available only from a small number of suppliers?

-

Have these ingredients been susceptible to shortages or price fluctuations in the recent past?

-

Does the ingredient or commodity come with any inherent risks or risks associated with how it is produced, farmed, or manufactured?

-

Are there obvious substitutes to ingredients should one become scarce?

6. Real-time product portfolio decision-making

Bringing clear value and margin objectives into product portfolio reviews can help eliminate underperforming products and make scarce or critical commodities more available for the most valuable parts of the product portfolio. Systematically creating ingredient-availability scenarios at the product level can help stress-test these decisions (see sidebar “Reducing the cost of complexity”). The ideal target state involves linking these decisions in real time to consumer insights and, ultimately, to promotions and demand shaping to influence consumers to buy more resilient products. As far as we know, this is yet to be realized.

7. Greater flexibility in R&D ecosystem

Some food and beverage producers are partnering with external manufacturers and product developers to move into new geographies and product categories. This can create resilience by identifying co-developers with similar formulations (rather than changing existing recipes and lines) to safeguard against short-term ingredient shortages.

A rise in contract R&D organizations with specific skill sets that seek to decouple food production from agricultural production is creating new options in areas like alternative protein. For example, Bio Base Europe, a pilot facility in Gent, Belgium, provides process development, scale-up, and custom-manufacturing services for novel bio-based ingredients.

8. Recipe simplification & accelerated formulation

As recipes and stock-keeping units (SKUs) proliferate due to incremental changes to flavors and packaging, different types of ingredients are needed from more places. This increases both time and effort when switching from one recipe to another, as well as knowledge fragmentation across the organization. Recipe simplification, underpinned with a comprehensive understanding of how ingredients interact, can alleviate this complexity. This lets manufacturers quickly test interactions between ingredients and move straight to a new formulation, avoiding extensive testing.

Organizations such as the Materials Innovation Factory at the University of Liverpool, UK, are working with companies like Unilever to developing artificial intelligence and robotics-enabled approaches, applied with a more profound understanding of materials science to enable rapid formulations of cosmetics and home care products.

Conclusion

EXPLORING WHAT’S NEXT

Future consumer goods companies will experience a more uncertain world. To ensure continuity and resilience, we must change the way commodities are sourced and how product development takes place. This requires new thinking in supply chain setup through a more distributed and dynamic approach, along with new ways of developing products with simpler products and more flexibility in the R&D ecosystem. Consider the following as key enablers:

-

Data-driven decisions linking foresight over commodity price fluctuations to deep, proprietary insights about ingredient substitutions and their implications for recipes help companies better understand how to work with suppliers and co-innovators.

-

Strong relationships and seamless data sharing between departments, along with extensive co-innovation between consumer goods companies and the agricultural commodities businesses that supply them, facilitate the invention of more resilient commodities.

-

Clear processes and an institutional appetite for change and transformation within and outside the confines of a single business create enthusiasm to explore “what’s next.”