Legacy airlines have long struggled with choosing the best strategy to adopt in the era of hyper-competition, having been faced with i) the rise of low-cost carriers, first in the short-to-medium-haul segment, and now also in the long-haul segment; as well as ii) the natural trend of travelers in a maturing industry increasing in sophistication. Legacy airlines (mostly in Europe and Asia) therefore have decided to create “multi-brand airline holdings” to seize the opportunity of new segments and protect their key markets, but this comes with the risk of cannibalization. In this viewpoint, Arthur D. Little explores winning strategies for operating a multi-brand airline portfolio: What is the right trade-off between integration and independence? Which airline product has the best fit with legacy carriers?

Multi-brand airline holdings are key to competing in the hyper-competition era and propose “mass-customization”

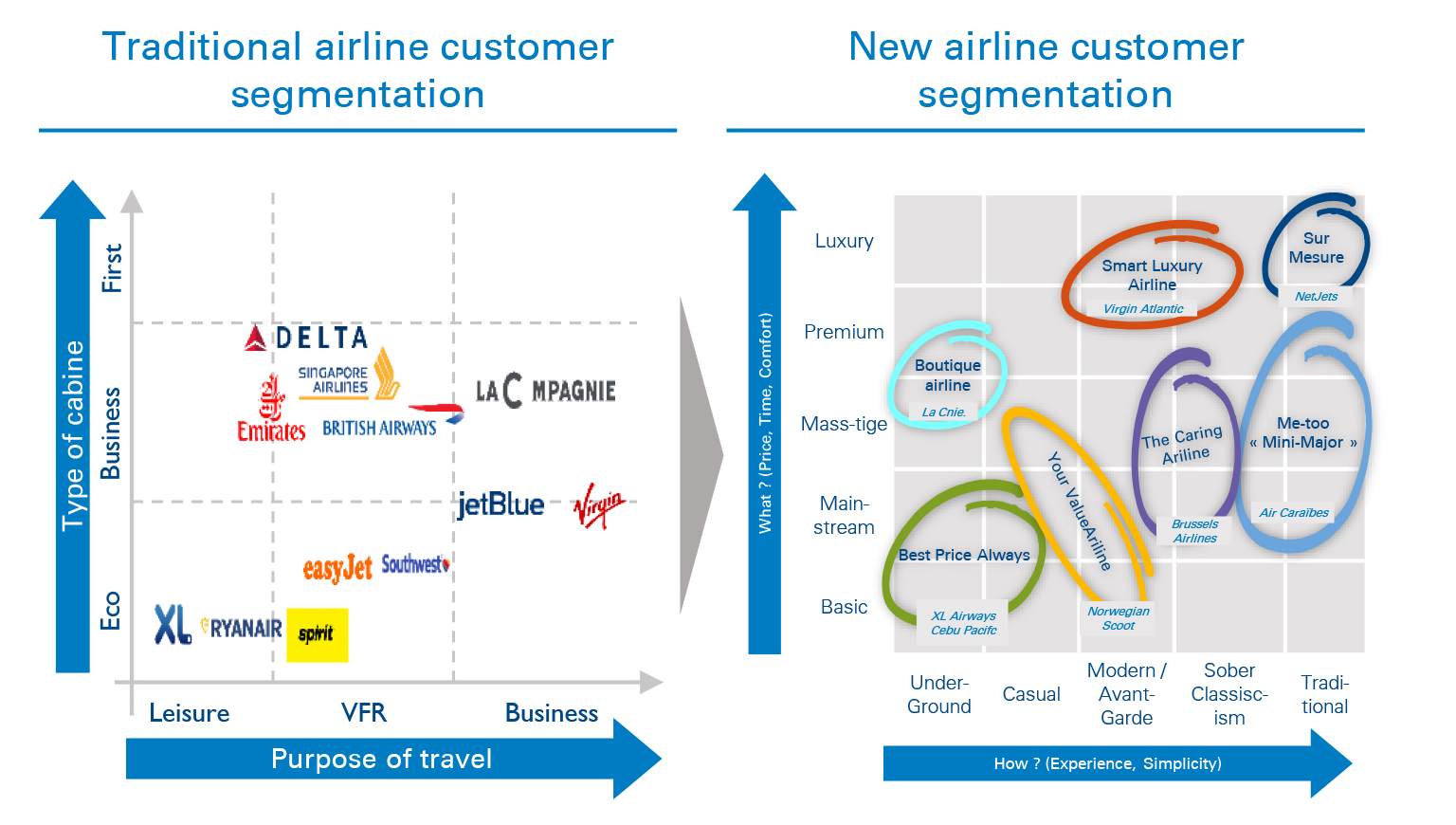

It is critical for legacy carriers to offer a large spectrum of services and experiences to face both the ever-more-competitive environment and customers’ expectations heading towards more customization. Like in the similar hospitality industry, key market segmentation criteria in the aviation industry are evolving from a “socio-demographic” approach to a “behavorial” approach, in which what the travel experience is made of and how it is delivered to customers are key.

The challenge for airlines that achieve profit with efficient utilization of assets, including the aircraft cabin and brand, is that this “mass-customization” dilemma is difficult to overcome using this branding and operating model. Many legacy carriers have thus chosen to go way beyond traditional airline alliances (such as Star Alliance) and consolidate into multi-brand holdings, gathering not just other legacy carriers, but also hybrid and low-cost carriers to address new geographies and customer segments.

The first moves from legacy carriers to address and compete were triggered by the emergence of low-cost carriers in the late 1990s. Legacy carriers adopted various types of strategies to contain the growth of those new entrants and protect their market shares.

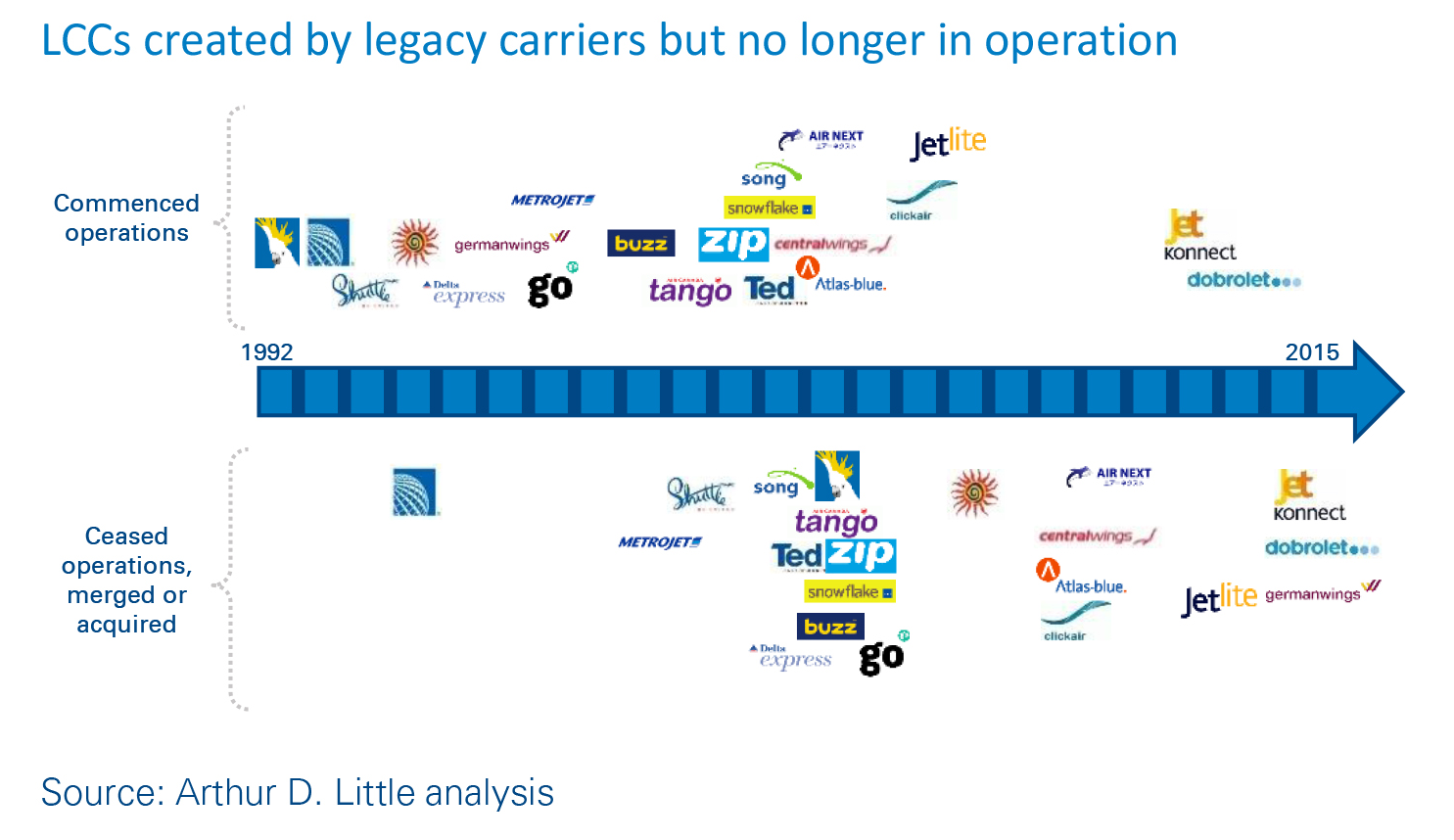

Besides decreases in costs and quality of overall products, as well as large increases in capacity, in order to stop new entrants, a direction many airlines have chosen has been to create (acquire) and operate “LCCs”. Since their emergence, more than 30 LCCs have been created by legacy carriers in Europe, the US and Australia. However, many carriers have learned the hard way that the key success factors for running a low-cost operation are radically different from those for running a parent company. Indeed, more than 20 of the newly created airlines disappeared, sometimes after just a few months of operation.

The strategic moves of legacy carriers seem to have stabilized for the short- and medium-haul segment, but are still active in the long-haul segment. These include the launch of Scoot (SIA), Joon (Air France-KLM group), Level (IAG) and the fleet and network extension of Eurowings (Lufthansa Group).

Figure 2: LCCs created by legacy carriers but no longer in operation

Nowadays, airline groups are using “multi-airline brand holdings” with different profiles, rather than trying to create “carriers within carriers”. The most common profile is to segregate brands according to i) operating model and ability to rotate assets (i.e., medium versus long haul) and ii) level of service to be provided (basic versus premium). Another option is to invest in comparable airline business models that will address different geographies.