DOWNLOAD

DATE

Contact

Telcos have long looked to asset reconfiguration as a lever to increase strategic focus and unlock value. While examples often focused on mobile, reconfiguration now reaches fixed assets and is accelerating overall, both in passive and active network components. Rising interest rates, rapid fiber-to-the-premises (FTTP) deployment, and an ever-increasing need for differentiation are forcing integrated telcos toward asset reconfiguration to avoid being outpaced. As we discuss in this Viewpoint, telcos must balance trade-offs on an individual basis, accounting for strategic objectives, local market structure, and company specifics.

TELCO ASSET RECONFIGURATION IS ACCELERATING

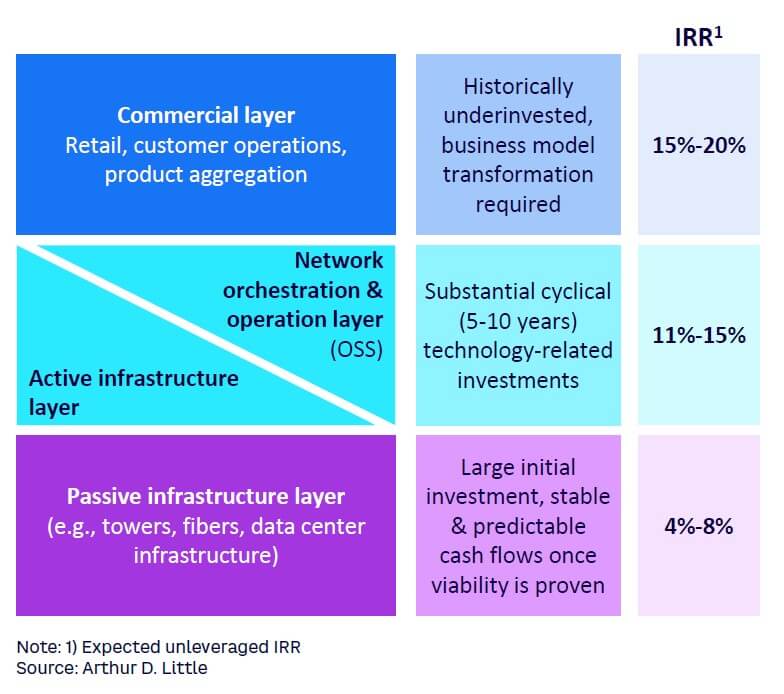

Integrated telcos consist of layers that have fundamentally different business models and capabilities (see Figure 1). These layers, each with their own specific business model and investment profile (i.e., investments horizon, IRR, CAPEX cycles, risk profile), include:

-

Passive infrastructure

-

Active infrastructure, network orchestration, and operation

-

Commercial

Integrated telco assets are being reconfigured to lift the constraints across these layers, unlocking the full business model potential of each layer. This gives rise to new entities, including passive InfraCos (typically consisting of the passive infrastructure layer, and including TowerCos, passive FiberCos, and DatacenterCos) and ComCos (typically including the active infrastructure, network orchestration, and operation layer as well as the commercial layer).[1]

The question at the core of asset reconfiguration is whether a specific asset class creates more value through differentiation (via exclusive access) or mutualization (via economies of scale). Asset reconfiguration gained prevalence in the 1990s when the location of and access to passive infrastructure (i.e., mobile sites) declined as a differentiator in mature markets where multiple operators offered similar coverage. Today, relinquishing ownership of mobile sites has become common for mature mobile operators, as illustrated by the fact that financial players now retain full or partial ownership of more than 50% of European mobile sites through TowerCo investments.

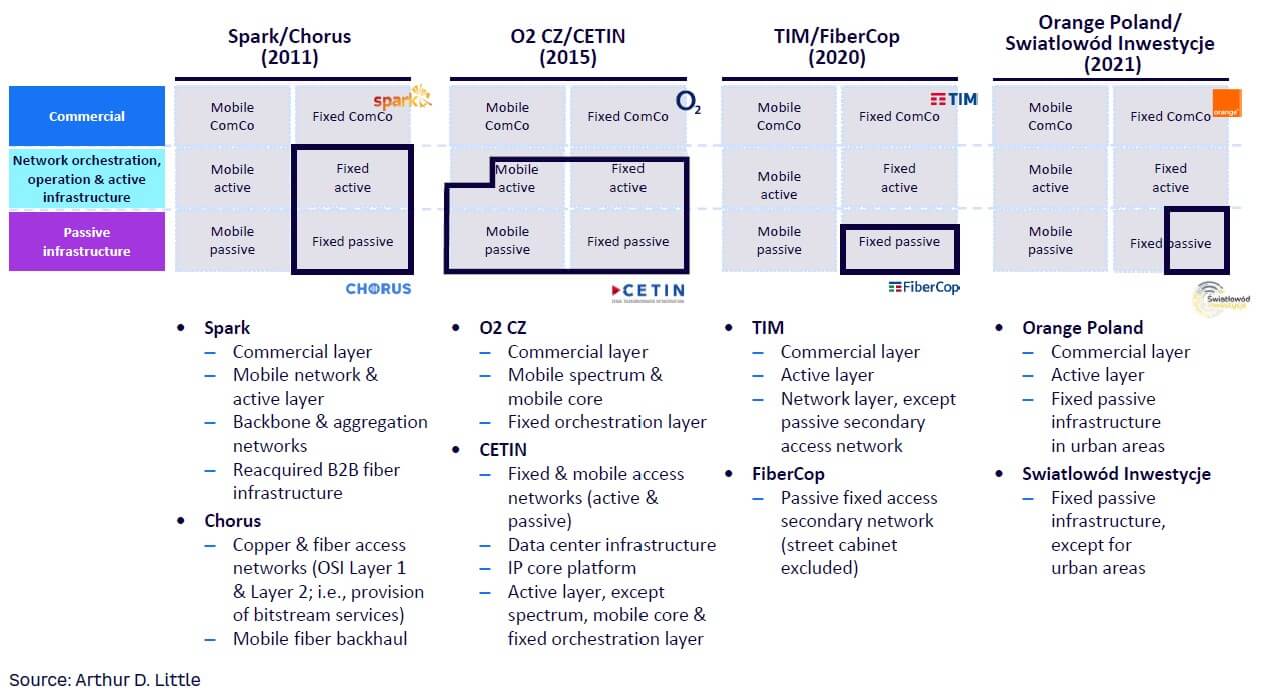

In terms of fixed assets, competition between copper (xDSL) and hybrid fiber coaxial (HFC)-based network technologies allowed for passive technology differentiation to remain value accretive over a longer time frame. Nevertheless, fixed asset reconfiguration started to gain relevance in the early 2010s, as demonstrated by the regulator-driven reconfiguration of Chorus/Spark in New Zealand in 2011, followed by the Arthur D. Little (ADL)-supported first voluntary split of CETIN/O2 in the Czech Republic in 2015.

Although there is no consensus on the timelines and the steps toward full fiberization of access networks, it is widely accepted that both xDSL and HFC will evolve toward full FTTP in the long term, reducing the value of technological differentiation on the passive access layer. Fixed asset reconfiguration is a reality and remains highly complex, even in markets without legacy fixed network technologies.

Four independent market drivers have fueled an acceleration in telco strategic asset reconfiguration over the past decade, including:

-

Infrastructure assets claiming higher valuations in the telco value chain, attracting new investors.

-

Increased pressure on telcos’ CAPEX-to-sales ratio, stimulating new funding structures.

-

Fundamentally different business models (i.e., investment horizon, IRR, CAPEX cycles, risk profile) of InfraCos versus ComCos, leading to internal tensions and misalignment.

-

Challengers on the lookout for attractive anchor tenancy deals to fuel their growth.

The rising interest rates, rapid FTTP deployment, and ever-increasing need for differentiation reinforce these four levers and force integrated telcos to consider asset reconfiguration to avoid being outpaced. As a result, ADL expects financial players to partially or fully own more than 50% of expected FTTP premises in key European markets by 2027.

VALUE CREATION BEYOND FINANCIAL ENGINEERING

Resolving the valuation disconnect

One of the main reasons telecom operators reconfigure or carve out assets is to alleviate pressure from their different stakeholders (i.e., expectations from customers/markets to invest in new technologies and from shareholders to monetize and pay dividends) and refocus it toward more purpose-focused entities with corresponding stakeholder expectations. These expectations, as illustrated in Figure 1, can include longer investment horizons on the passive infrastructure side (4%-8% expected unleveraged IRR) and shorter-term focus on the commercial side (15%-20% IRR). Splitting an integrated telco into an InfraCo and ComCo removes the typical 15%-20% CAPEX-to-sales ratio imposed by shareholders and investors on the integrated telco and enables each entity to invest in the areas its underlying business model calls for.

The fundamentally different business models and investment profiles of the InfraCo and ComCo will also attract different investors with varied expectations. Moreover, carving an integrated telco into a ComCo and an InfraCo will help to remove the valuation disconnect created by the tensions between the shorter-term perspective of public equity markets and the longer-term perspective of private equity markets. Notably, the InfraCo (typically open access) features a lower risk profile stemming from the lifetime value of the asset, its replicability, the reduced risk of major overbuild, and the long-term nature of its contracts compared to retail market dynamics. This lower risk profile leads to a lower cost of equity and corresponding higher leverage potential on the infrastructure side, ultimately leading to higher relative valuations. While to some extent, the inverse effects apply to the ComCo and lead to a higher relative cost of equity, the valuation of the “sum of the parts” is usually bigger than the initial integrated valuation.

Value creation drivers beyond financials

Beyond the financial considerations we have discussed, asset reconfiguration has the potential to create additional value by giving the now distinct entities more strategic freedom to fully embrace their underlying business models without having to balance trade-offs between sometimes conflicting strategic imperatives. For example, when the (passive) network ceases to contribute to differentiation, an InfraCo adopting an open access network model will aim to maximize the network utilization to capitalize on economies of scale. This is unlikely to be a priority in a consolidated context, since even if the ComCo doesn’t rely on exclusive network access to differentiate, it is likely reluctant to “invite” competitors on its network. An independent InfraCo furthermore will be more attractive to wholesale tenants due to its (more) neutral relation toward different wholesale tenants. Finally, its setup enables an InfraCo to use an equity stake as an additional lever to lock in attractive wholesale tenants through favorable wholesale rates and nondiscriminatory open access.

Additionally, telcos may consider setting up commercially driven third-party network access partnerships rather than betting on the outcome of often unpredictable regulatory decisions regarding the conditions and rates of wholesale access to their (fixed) networks.

Telcos failing to shape a market risk facing a market shaped against them

The economics of multiple overbuilt, passive FTTP access networks is complex and only works under specific conditions. This leads to the expectation that market outcomes will tend to converge toward 1.X FTTP network in each market, where the value of “X” must be determined for each case and the result will depend on who succeeds in shaping the market. The telco that shapes the market will, in turn, highly depend on the underlying market structure and dynamics (e.g., the presence or absence of a CableCo, the number of mobile network operators and level of fixed-mobile convergence, and number of infrastructure challengers).

Maximizing the share of 1.X FTTP infrastructures will lead to a win-lose situation unless competition authorities and regulators allow splitting of the created value, effectively trading lower infrastructure competition for lower wasted CAPEX and lower wholesale rates. Additionally, as InfraCo business models are maturing and fixed infrastructure competition is rising, a further consolidation wave is expected in a few years. Scale will be the keyword of this consolidation, both in terms of the InfraCo’s footprint (i.e., a sizeable footprint will be needed to attract anchor tenants) as well as for the InfraCo’s tenants (InfraCos will often require larger tenants to achieve economically viable network penetrations). The combination of these factors urge integrated telecom operators and network owners alike to make decisions about their long-term future today.

MULTIFACETED CHALLENGE WITH NO ONE-SIZE-FITS-ALL SOLUTION

Asset reconfiguration journeys have the potential to unlock substantial value when successful. Due to their transformational nature and far-reaching implications on the organization, they also imply multifaceted challenges requiring a multitude of major and minor trade-offs across all dimensions of the business.

Next to the underlying objectives of the asset reconfiguration journey, balancing business trade-offs demands a consideration of the specific market situation (e.g., regulation, market structure, retail and wholesale competition, labor costs) and company-specific factors (e.g., retail market share, wholesale market share, network upgrade status, network upgrade costs).

Such a wide variety of factors results in a completely unique set of challenges for each asset reconfiguration project. Recent fixed network asset reconfiguration examples (see Figure 2) illustrate that there is no perfect solution, and lessons from case studies (including perceived failures) should be assessed cautiously prior to applying them, considering the local specifics. Nevertheless, the major key questions and underlying trade-offs are broadly similar.

KEY TRADE-OFFS TO NAVIGATE COMPLEXITY & DEFINE STRATEGIC INTENT

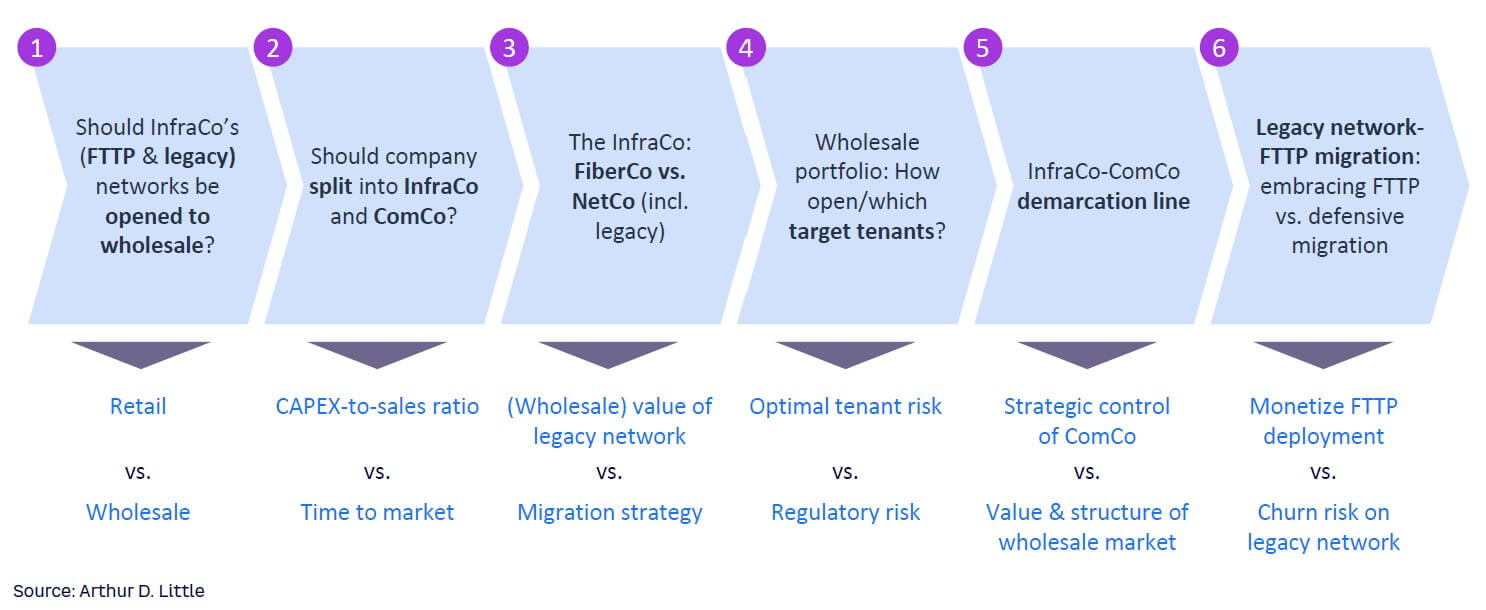

To navigate the initial complexity and define their strategic intent without getting sidetracked, telcos should focus on six key issues and their underlying trade-offs (see Figure 3). Although it is important to keep in mind that there is no perfect solution, it all comes down to crafting a well-balanced setup.

1. Should InfraCo’s (FTTP & legacy) networks be opened to wholesale?

For each of their network technologies, operators must first assess whether to voluntarily open their networks for wholesale to other retail players. Depending on the current implementation of a wholesale offer and the local regulatory environment, the answer to this question may be dictated by the regulator. However, many operators must carefully evaluate whether a closed network still creates more value (typically through technology differentiation or access to unique footprints) than it locks up. While opening the network to third parties will improve asset utilization and allow the operator to leverage economies of scale, it could also fuel competitors’ growth and put pressure on the ComCo. Depending on the retail-wholesale (rate and margin) trade-off, this could prove to be value accretive or destructive from a combined entities’ perspective.

2. Should the company split into InfraCo and ComCo?

Integrated telcos typically embark on asset reconfiguration journeys to unlock value and ensure alignment between business model and asset ownership. Operators must determine whether accelerating FTTP deployment and increasing their share of the 1.X FTTP networks by opening their InfraCo’s capital to third parties is more value accretive than remaining integrated (with more difficult access to funding).

3. The InfraCo: FiberCo vs. NetCo (including legacy)

Operators planning to deploy fiber in an InfraCo-ComCo setup need to define what to do with their legacy network: carve it out and combine it with the to-be-deployed FTTP network (creating a NetCo) or keep it with the retail operations and set up a new dedicated vehicle (FiberCo) to deploy the FTTP network. Although the choice for a FiberCo or NetCo is in part driven by financial considerations due to the drastically different profiles (a NetCo is cash-generative and stable from its inception, while a FiberCo initially does not have meaningful revenues), the factor tilting the scale toward one or the other often proves to be the value potential partners attribute to access to cash flows from the legacy network. NetCos have the added benefit of allowing for monetization of the legacy network and aligning legacy to the FTTP migration-related interests of both entities. NetCos are also less incentivized to push for aggressive legacy to FTTP migration as, unlike FiberCos, they benefit from cash flows on both networks. Carving out a NetCo, however, comes with significantly more complex operational issues to be solved and is less familiar to financial investors.

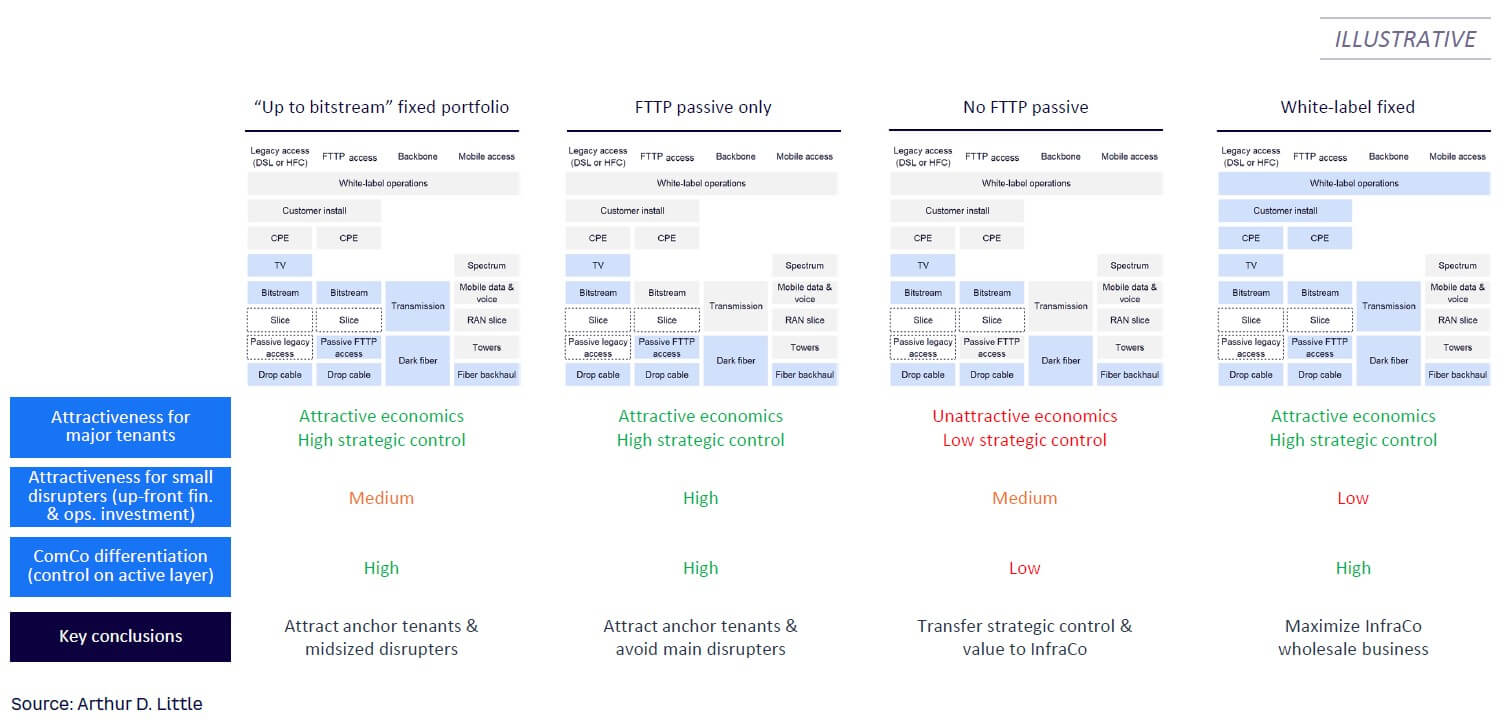

4. Wholesale portfolio: How open/which target tenants?

On the one hand, an InfraCo’s product and service portfolio will drive the type of tenants the InfraCo is most attractive to, while on the other hand, those products and services (which may differ between B2C and B2B) will strongly influence the ComCo’s differentiation. Larger tenants typically will be able to benefit from economies of scale on the active layer and be able to use it to drive product/service–based differentiation, making passive access more desirable. Offering active products allows the InfraCo to attract smaller tenants with white-label products and allows even pure resellers to become wholesale tenants.

Offering both active and passive access, however, creates conflicting incentives for the InfraCo and ComCo(s) and puts them in direct competition with each other (as the latter may also decide to act as an active fixed virtual network enabler). Operators must consciously balance these trade-offs, considering the asset reconfiguration objectives and market context, to strike the intended transfer of value between entities and ensure optimal shareholder value creation. (Figure 4 illustrates some typical InfraCo product and service portfolios as well as key implications for different tenants.)

5. InfraCo-ComCo demarcation line

Although they closely influence each other, the product and service portfolio and the asset demarcation line do not necessarily need to be fully aligned with each other. As an example, it is not necessary for an InfraCo to own the active equipment in order to offer an active service. A multitude of reasons (e.g., strategic control over the product roadmap, minimizing carve-out dis-synergies) can explain such discrepancy between the product and service portfolio and the asset demarcation line, despite the additional operational complexity (mainly at the interfaces) and the seemingly lower InfraCo autonomy this discrepancy typically entails. Finally, the demarcation line will lie at the basis of the governance of future interactions between the InfraCo and the ComCo, especially for matters influencing both entities, such as the rollout plan. This is particularly true for HFC networks, where the active and passive layers are closely interlinked in terms of network upgrade and related costs. In this context, it is crucial that careful attention is paid to designing the master service agreement (MSA) between the two parties.

6. Legacy network-FTTP migration: Embracing FTTP vs. defensive migration

The extent to which operators aggressively push or embrace FTTP and position it as superior compared with the legacy technology is a complex puzzle with multiple pieces. It is thus crucial for telcos to consider both perspectives, as trade-offs will inevitably impact both entities:

-

Should a technology-agnostic retail and/or wholesale approach (marketing, product and service offering, and pricing) be preferred over embracing and promoting technology differentiation? On the one hand, a technology-agnostic approach limits the risk that the perception of the legacy technology will deteriorate and reduces complexity for customers. On the other hand, promoting FTTP allows telcos to adopt a firmer positioning as futureproof via FTTP-based marketing claims and potentially even to increase revenue through average revenue per user (ARPU) uplifts and to accelerate the migration from legacy to FTTP. Furthermore, the latter allows the operator to adopt a faster legacy network decommissioning schedule and realize cost savings, but often at the expense of forced migration-driven customer losses and promotions.

-

Should FTTP deployment focus on capturing first-mover advantages (land-grab strategy) or protecting areas where the legacy network is exposed to competing FTTP (head-on with competition)? On one side, a head-on strategy allows to the operator to limit legacy customer loss and avoid customer lock-in on a competing infrastructure (e.g., once a drop cable is installed, customers may not want to install a second one). And in some cases, head-on deployment can even lead to cost savings through contractor and trench sharing. On the flip side, land-grabbing can lead to a faster FTTP uptake (especially beneficial in a FiberCo situation), higher coverage, and a single infrastructure situation (the latter two when two overbuilt networks are not economically viable). Depending on the market positioning of the ComCo, the land-grab strategy could however lack strategic upsides when limited benefits are expected from proactive legacy network overbuild (given the absence of FTTP-based competition), especially as it can leave the customer base exposed to competing FTTP in other areas.

-

Should the FTTP coverage target maximize the operator’s own coverage or target a (long-term) reciprocal access deal? Passive FTTP infrastructure competition often leads to win-lose situations where the same total market value is divided among the different players. Depending on their underlying strategies, operators will or will not be able to capture value (e.g., through anchor tenancy deals) at the expense of each other. Maximizing own network coverage is typically part of an effort to maximize the share of market value a certain player captures. This will inevitably lead to a certain degree of FTTP-FTTP overbuild, which can be seen as a waste of capital allocation. An alternative in which network owners are allowed to strike a reciprocal network access partnership, minimizing FTTP-FTTP overbuild, has the potential to increase total market value (unless regulatory remedies completely nullify the created value).

-

Should legacy-to-FTTP migration be stimulated or follow natural FTTP market uptake? On the one hand, natural migration limits the risk of forced migration-driven increases in customer churn and adverse effects on ARPU (e.g., resulting from promotions). On the other hand, faster migration enables the InfraCo to accelerate legacy network decommissioning and realize the accompanying cost savings. Additionally, increasing FTTP uptake has the potential to increase customer lock-in by ensuring the drop cable is installed just once.

-

Should the drop cable be deployed during rollout or upon customer demand? On one side, pushing drop cable installation during rollout can help the InfraCo to maximize connections to its network (see above) and lower drop cable installation costs, thanks to a lower number of technician visits. On the flip side, it implies frontloading a significant amount of CAPEX, which is not always justifiable (as the customer might have remained a legacy customer without drop cable) and usually requires close operational alignment with the various tenants.

In all cases, the MSA design should pay close attention to these trade-offs, as it sets the ground rules for both parties.

KEY SUCCESS FACTORS

Based on ADL’s experience in many high-profile cases, the road toward asset reconfiguration is long, iterative, and full of ambushes and hidden traps. The journey only really begins after operators have defined strategic intent. Following a number of key success factors can help reduce organizational friction and improve project efficiency. While some of these factors may seem obvious at first, abiding by them is not always an easy task:

-

Involve all stakeholders from the start and keep them up-to-date. These projects are complex, iterative, and require making a large number of assumptions and balancing many trade-offs. Involving stakeholders only when their approval is needed can slow the process considerably and reopen seemingly long-closed discussions. Early stakeholder involvement enables the identification and management of potential biases and preconceived ideas and worries, smoothing decision-making and the process.

-

Ensure all stakeholders are aligned on the objectives of the strategic asset reconfiguration. Considering the impossibility of maximally extracting value from all value creation drivers and the multitude of trade-offs that impact value transfer from one entity to the other, ensuring full stakeholder alignment (especially from management and shareholders) supports clear direction-setting and enables teams to make the right trade-offs.

-

Don’t rush the process. Asset reconfiguration projects often go hand in hand with transactions, which often puts pressure on timelines. In such cases, it is important to resist the urge to squeeze timelines and avoid the shortcuts this would require. Strategic asset reconfiguration is a drastic measure that will shape the company for decades to come and justifies investing enough time into getting it right.

-

Understand the value and limitations of benchmarks. Each market and company has its own unique characteristics susceptible to tip the balance of one or multiple trade-offs in one or another direction. In addition, different strategic objectives will give rise to significantly varied designs, even when applied within a single market. The added value of precedents and international examples lies primarily in understanding which trade-offs have been made and what factors gave rise to certain choices. They should not be seen as archetypes or solutions that can be widely replicated under a specific set of conditions.

After defining strategic intent, significant time and effort is still required to reach an actual transaction and/or implementation of the reconfigured asset state. The devil is in the details, and multiple iterations are almost a certainty in several key areas, including:

-

Creating and negotiating the shareholder agreement.

-

Creating and negotiating the MSA/wholesale agreement.

-

Negotiating with anchor tenant(s).

-

Preparing transactions: carve-out financials, financing, etc.

-

Creating and implementing the InfraCo target operating model.

-

Defining the business model of the ComCo (which is often underestimated).

Finally, it is important for telcos to understand that reconfiguring the ComCo and its network assets will increase the degree of scrutiny on its business model and its ability to sustainably differentiate and create value without owning the underlying network asset. While business models are starting to reach maturity on the passive InfraCo side and many learnings can be extracted from a handful of successful ComCos, the future dominant ComCo business models remain uncertain.

Conclusion

THE TIME TO EVALUATE TELCO ASSET RECONFIGURATION IS NOW

Passive asset reconfiguration is accelerating, with the potential to be unleashed in many markets, stimulated by the alignment of assets with underlying business models and investment profiles. Rising interest rates, rapid FTTP deployment, and an ever-increasing need for differentiation are forcing integrated telcos toward asset reconfiguration to avoid being outpaced. Future InfraCo value creation will be driven by their potential to optimize network economics and wholesale business through maximization of their share of 1.X FTTP networks and network utilization.

While we expect a further consolidation wave in a few years, current value creation is highly dependent on local market structure, leading to a different endgame for each player. While making decisions on reconfiguration, operators must optimize six major trade-off decisions:

-

Opening the InfraCo’s (FTTP and legacy) networks to wholesale or keeping them closed.

-

Splitting into an InfraCo and a ComCo or remaining integrated.

-

Choosing a FiberCo versus NetCo (including legacy).

-

Defining the wholesale portfolio targeting specific tenants or remaining attractive to anyone.

-

Aligning the InfraCo-ComCo demarcation line with the product portfolio or tweaking its design.

-

Embracing FTTP or migrating defensively.

Note

[1] For more on how disruptive forces are reshaping the integrated telco service provider value chain across these layers, see: Taga, Karim, Gregory Pankert, and Ronan Dunne. “Game Changing: New Players, New Rules!” Arthur D. Little Event Summary, 12 September 2022.