17 min read • Private equity

The insight: State of the European private equity industry

Are we at a turning point?

INTRODUCTION

There has been no let up in pressure in 2023, with persistent inflation, rising interest rates, and ongoing geopolitical issues weighing on Europe’s people, businesses, and economies. While these are conditions that the experienced private equity (PE) and venture capital (VC) industry are used to navigating, they are not ones to which it is immune.

Arthur D. Little (ADL) and Invest Europe’s European PE survey, combined with Invest Europe’s first half activity data, takes a clear look at the evolution of fundraising, investment, and divestment in the first six months of the year and gathers fund manager and investor views on the short- and medium-term outlook for activity. The survey also investigates the challenges and opportunities that have the potential to shape Europe’s PE and VC industry further into the future.

Fundraising, investment, and divestment totals slowed in the first half of 2023, coming off high levels in 2022 — namely, record levels of fundraising and the second-strongest year for investment. The interdependence of all these elements and their relationship to the global economy are evident. As growth slows and uncertainty rises, PE divestments weaken, fundraising turns down, and new investment softens.

Fund manager and investor expectations for the outlook reflect the ongoing challenges from factors such as inflation, interest rates, and economic uncertainty, but also point to some tentative signs of improvement. Higher expectations and preparations than last year for exits could signal a pickup in activity that would stimulate fundraising and investment. Near-record levels of dry powder show an industry prepared to be more cautious and conserve capital in more volatile markets, but also well placed to support companies through new investment and follow-ons.

Also on display is the openness of European PE and VC to new opportunities. General partners (GPs) and limited partners (LPs) are embracing new ideas and offerings, including impact funds. Meanwhile, managers are tailoring products to democratize access to the asset class, appealing not only to high-net-worths but also to the broad “mass affluent” segment, as well as smaller retail clients.

As always, sustainability is a central issue for European private equity. Managers are increasingly embracing environmental, social, and governance (ESG) at a firm and fund level, hiring experts, and targeting “green” funds that comply with the highest levels of Europe’s regulatory framework on sustainability, as well as investor expectations.

While the data and survey highlight the short-term pressures facing the industry, they also demonstrate private equity and venture capital’s evolution. Over the medium and longer term, the industry is positioning itself to be more sustainable, while opening up to a broader investor base — putting it evermore firmly at the heart of Europe’s green transition and bringing the benefits of PE performance to more of Europe’s citizens.

1

FUNDRAISING MOMENTUM WEAKENS

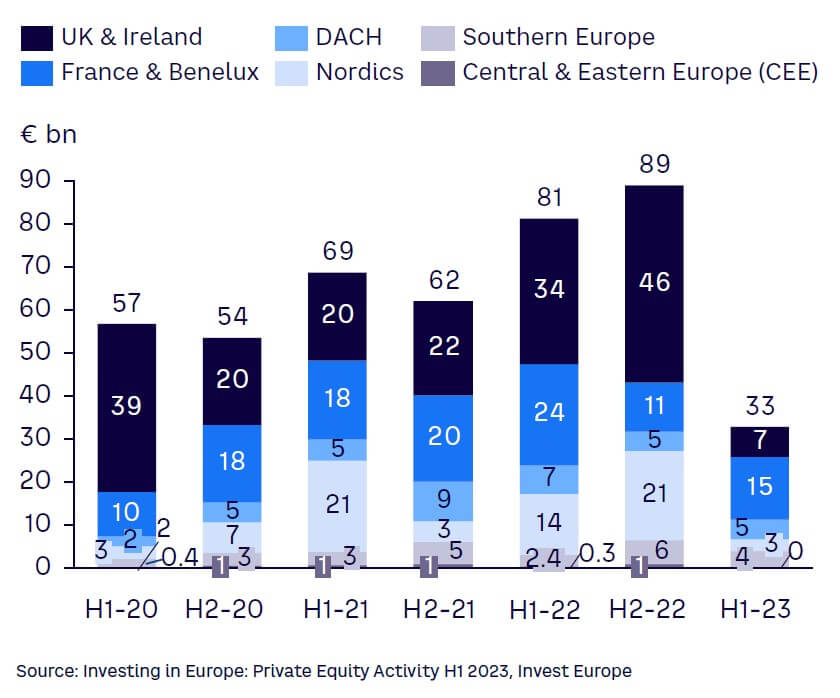

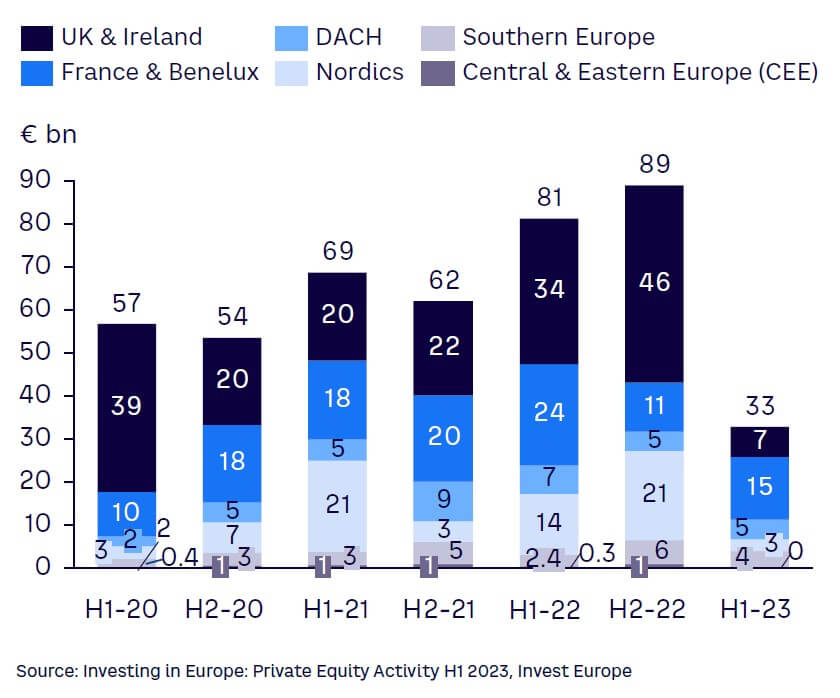

PE fundraising slowed in the first half of 2023, coming off record levels achieved during 2022, as a mix of high inflation, rising interest rates, economic uncertainty, and protracted conflict in Ukraine all weighed on Europe’s economy. Invest Europe’s preliminary data shows that funds raised €33 billion from investors in the first half, a decline of 63% on the prior six months.

There is a degree of cyclicality in fundraising with European PE firms having taken advantage of the recovery in 2021 and momentum into 2022 to raise capital. Furthermore, a reduction in the number of exits and a subsequent weaker distribution of capital back to investors have led to more practical constraints to the redeployment of capital into funds.

That said, it was not an equal picture across Europe (see Figure 1). Fundraising by France & Benelux funds remained resilient, largely in line with recent performance. At a lower level, DACH (Germany [D], Austria [A], and Switzerland [CH]) and Southern Europe fundraising was also solid. In contrast, funds raised by UK and Ireland private equity contracted sharply, illustrating the region’s role as a home for many pan-European managers, and the greater impact of global conditions. Nordic funds’ capital raising also slowed notably, reflecting a natural slow-down after a record year with large commitments to some large fund managers.

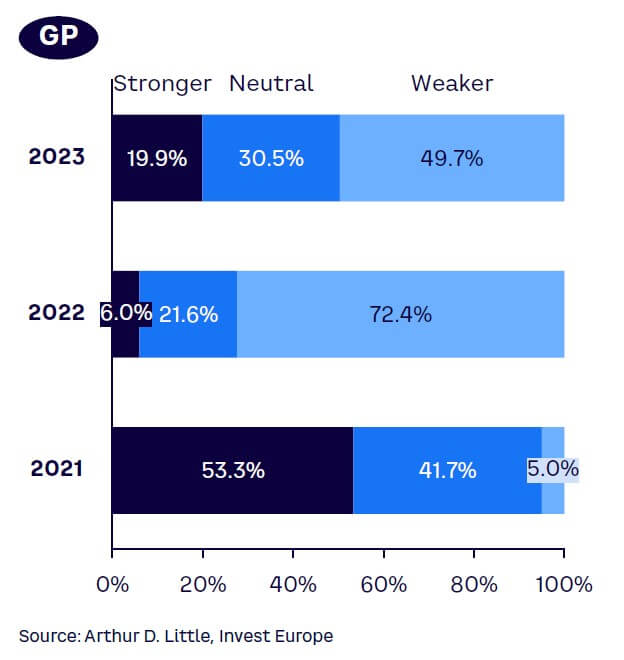

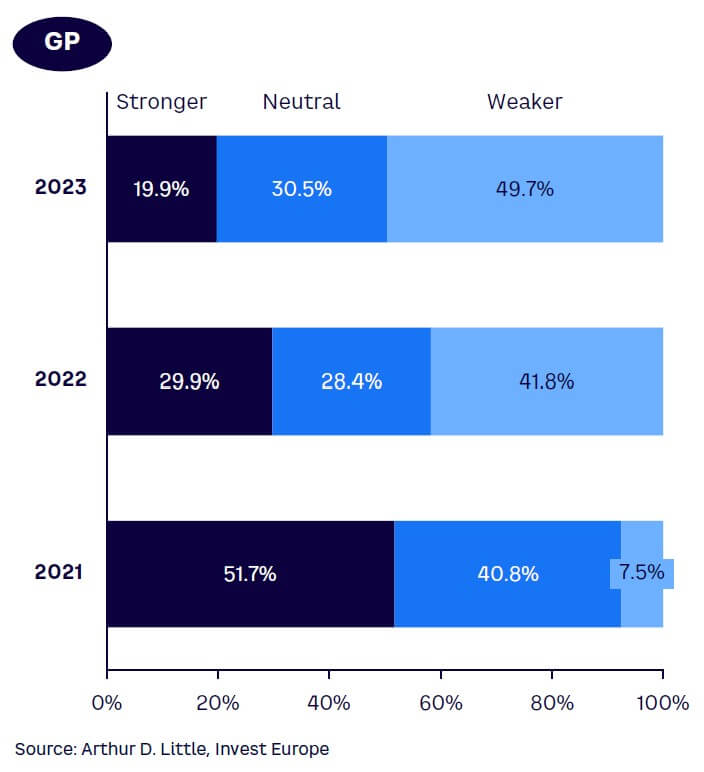

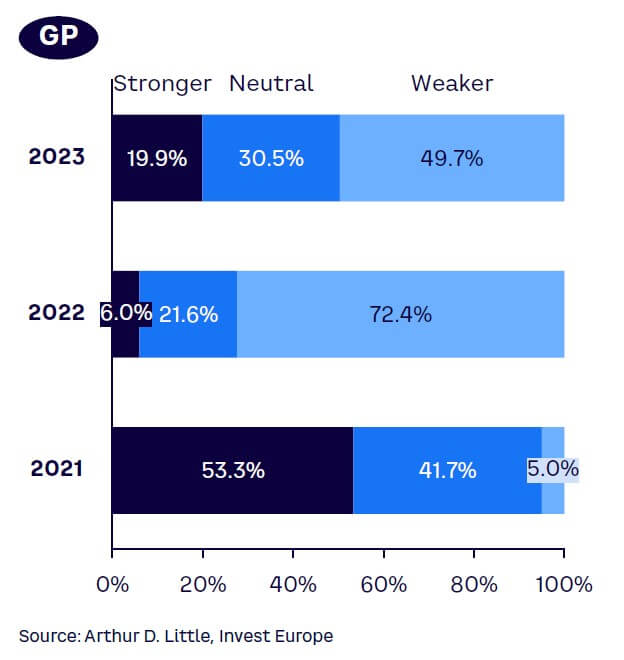

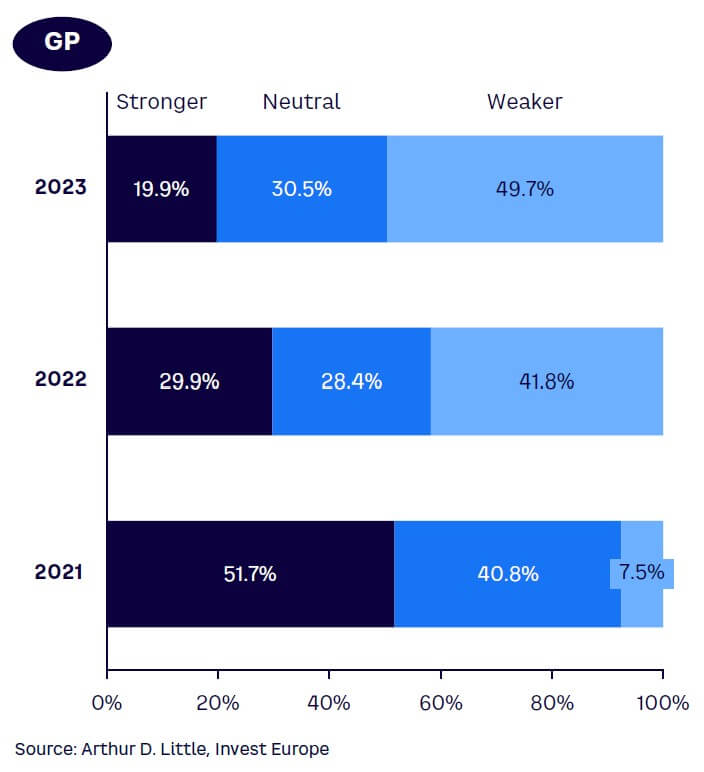

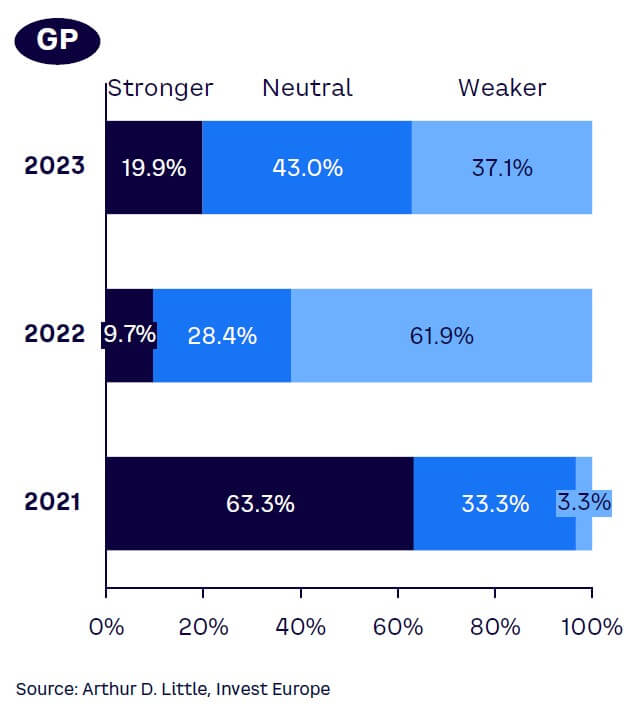

In the midst of a deteriorating macroeconomic outlook, GP and LP expectations point to the continuation of challenging fundraising markets ahead, albeit with several bright spots and opportunities (see Figure 2). While ~80% of GPs surveyed expect weaker or neutral fundraising in the coming 12 months, the remaining 20% see stronger levels in the year to come. Although weak, the sentiment still reflects an improvement on 2022, indicating a bottoming of fundraising conditions.

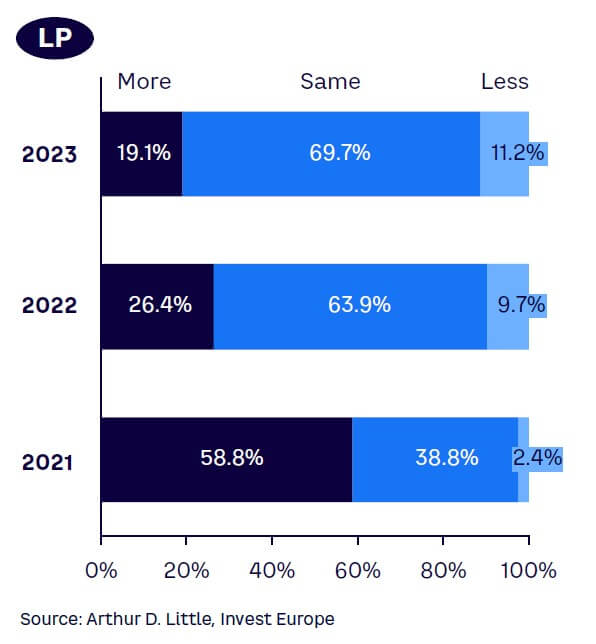

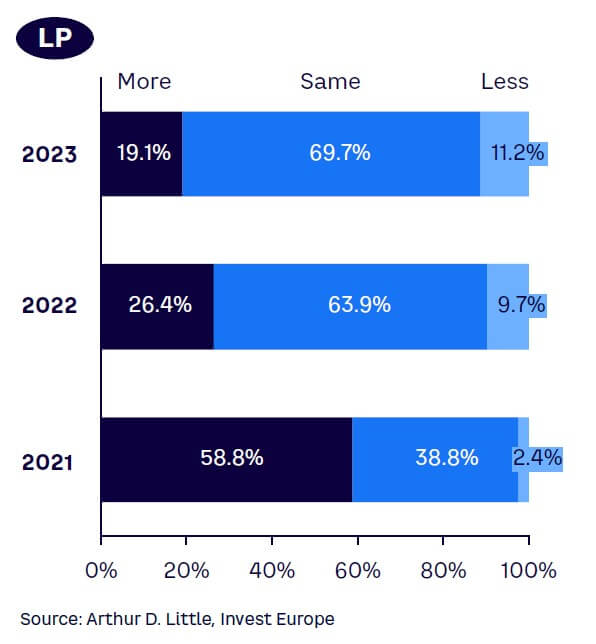

As shown in Figure 3, longer-term expectations on allocations to the asset class have softened modestly from 2022, as the prospect of higher interest rates for longer increases headwinds for companies, while also giving investors other options in their hunt for yield. Nonetheless, almost nine out of 10 LPs expect capital allocations to private equity to stay the same or improve over the next three years, illustrating investors’ belief in the potential for private equity to continue to deliver outperformance.

“Higher interest rates and therefore higher bond yields do give investors new options for yield. However, there will always be a place for private equity in the portfolio simply because few other investments can generate that kind of alpha.”

Frank Amberg, Managing Director, Head of Infrastructure Germany, AltamarCAM

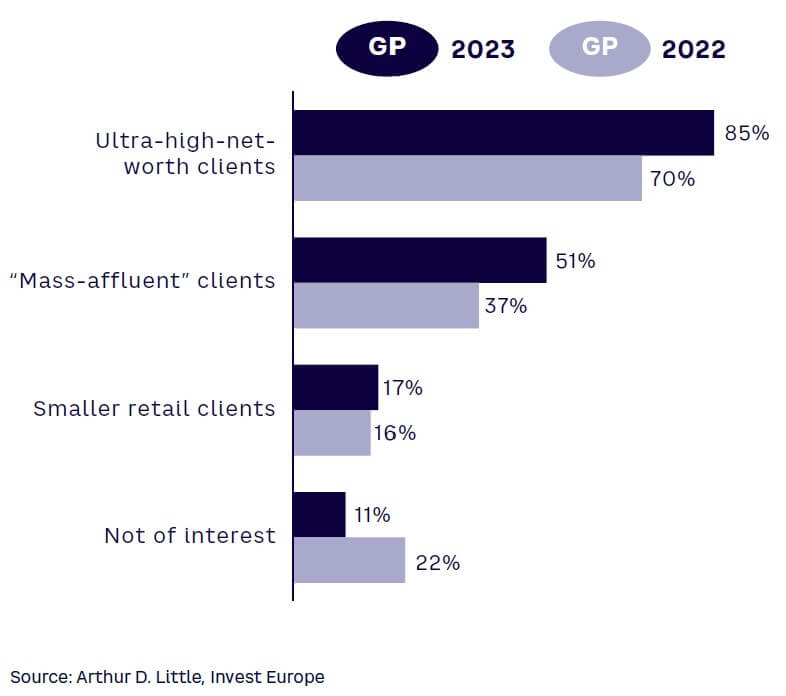

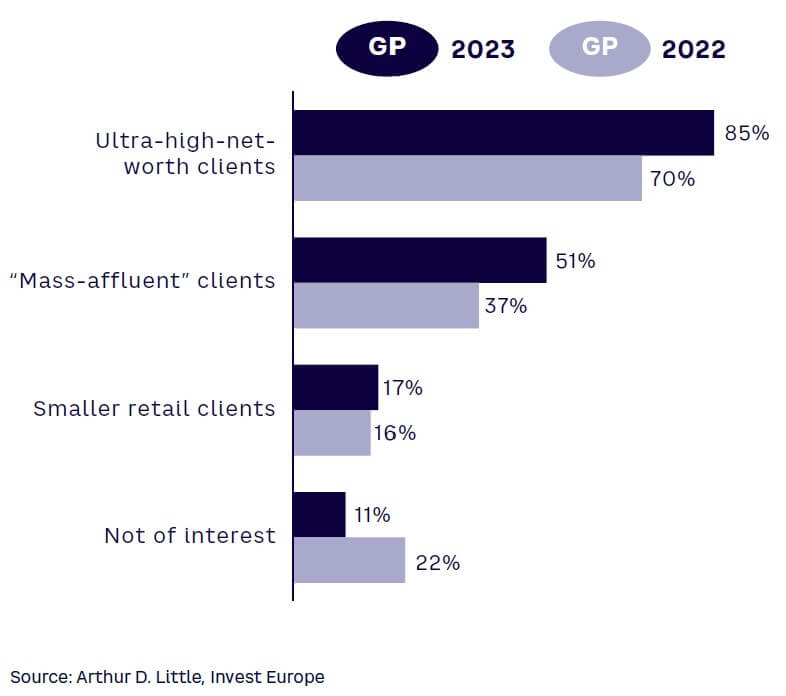

In a shifting fundraising landscape, increasing numbers of GPs are attracted by the opportunity to raise funds from wealthy individuals (see Figure 4). Some 85% of fund managers are interested in raising capital from ultra-high-net-worth individuals, reflecting their sophistication and appetite for illiquid assets, as well as the potential for GPs to cater for a relatively small pool of investors. However, the number of firms also considering “mass affluent” clients with assets in the €100,000 to €500,000 range increased sharply to over half, indicating a desire to tailor products to a broader investor base. Less than one in five are drawn to the smaller retail client space, where challenges include the need for products with more liquidity and potentially different fee structures, as well as greater scrutiny and more regulation.

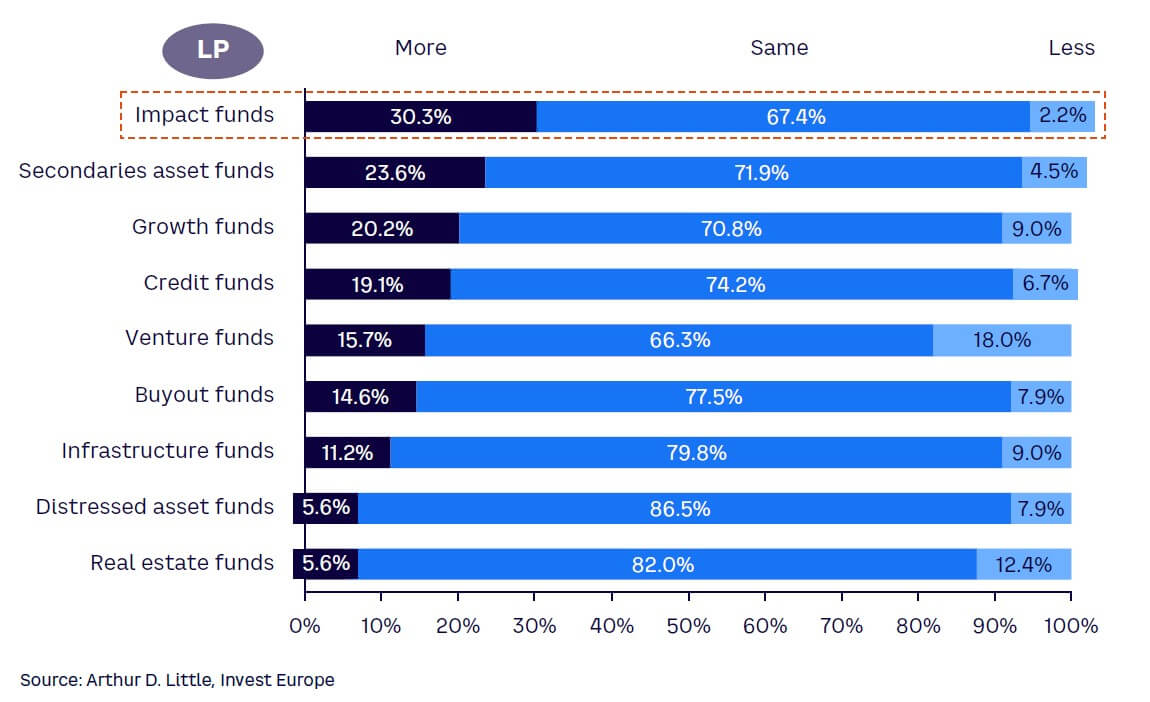

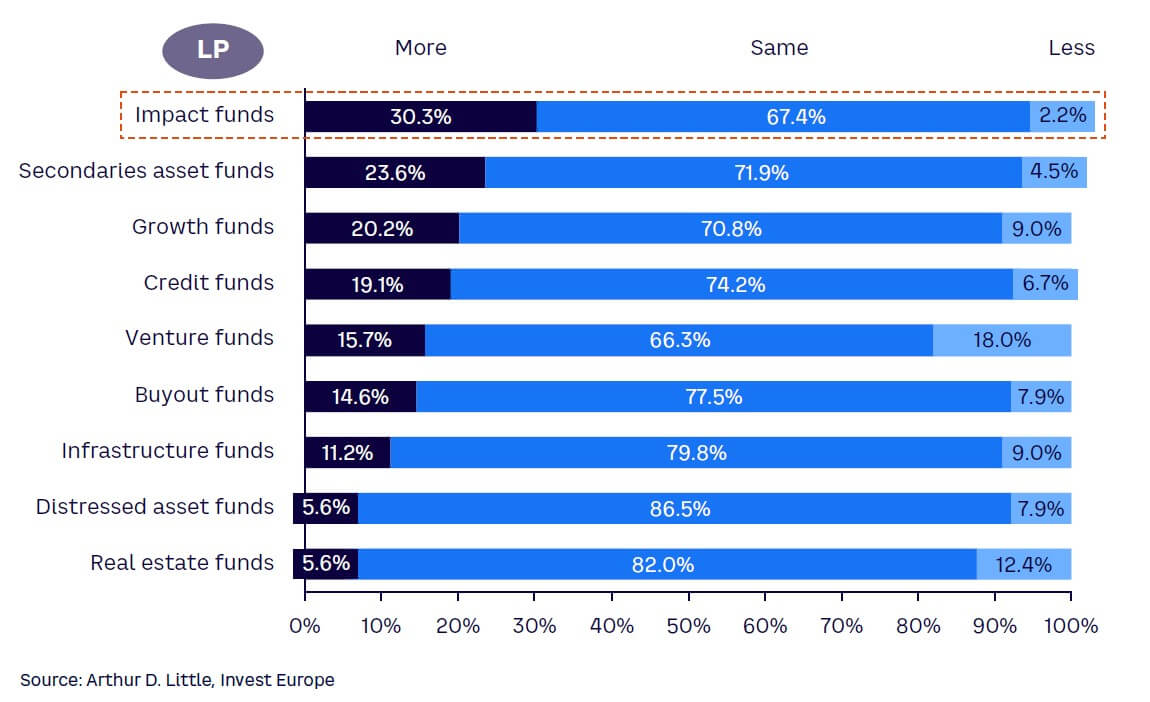

Investors’ increased focus on generating social and environmental value is evident in the funds they intend to back (see Figure 5). Almost a third expect to allocate more resources to impact funds over the coming 12 months versus just 2% that expect to allocate less. The influence of the growing private market funds universe is also evident, giving LPs greater ability to navigate more difficult markets via their commitments. Almost a quarter anticipate allocating more to secondaries funds, while some 20% foresee a higher allocation to both growth and credit funds, as higher interest rates create opportunities for those involved in lending, as well as managers that avoid, or use minimal debt, in their investment models. It is important to note that only a minority of investors expect to allocate less to any private market strategy over the coming 12 months.

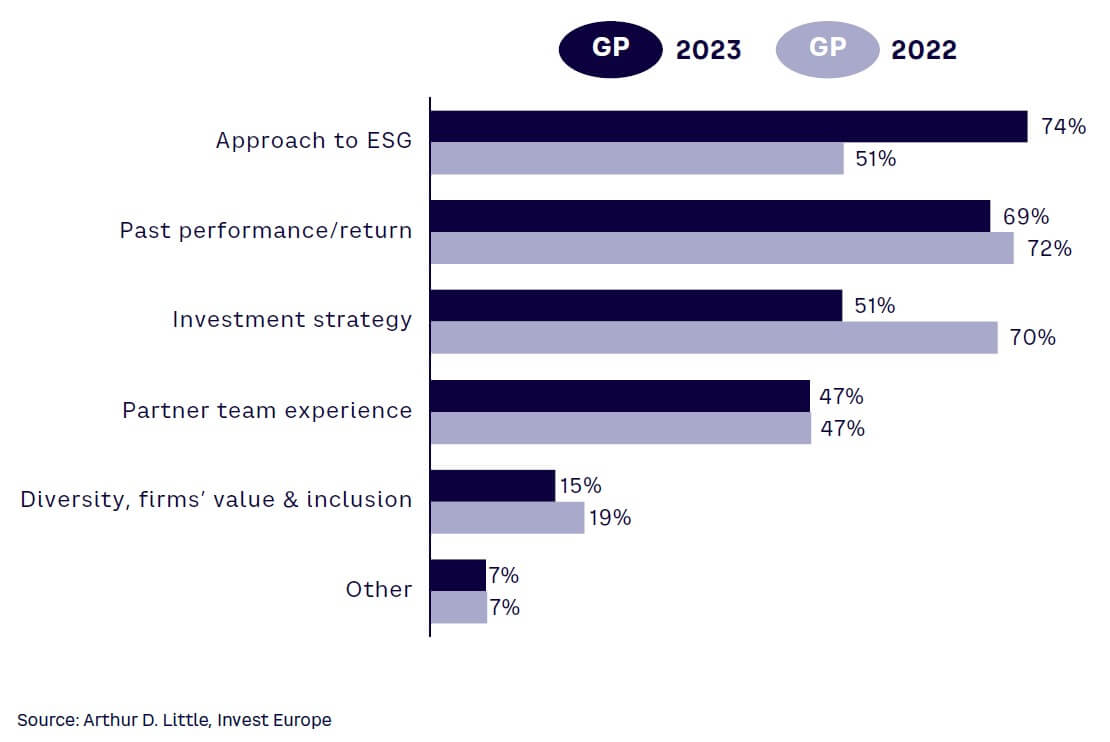

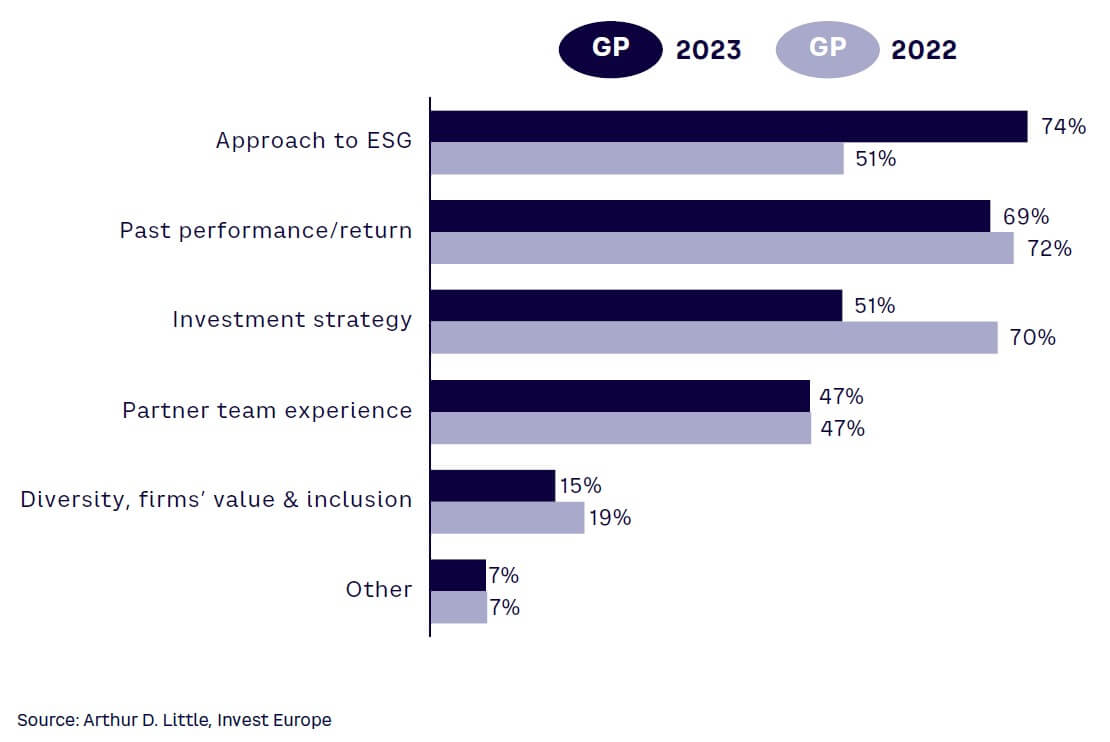

The rapid rise of ESG issues up the agenda is also clear in the differentiating factors that investors will look for in managers (see Figure 6). Three-quarters of GPs believe that a strong approach to ESG will be critical for firms to stand out in their quest to attract capital, also highlighting Europe’s leadership role in sustainable investing and the regulation that shapes it. Importantly, ESG considerations move past a GP’s track record — which remains a strong second differentiator — and investment strategy, which moves down the agenda.

2

CHALLENGING CONDITIONS IMPACT INVESTMENT

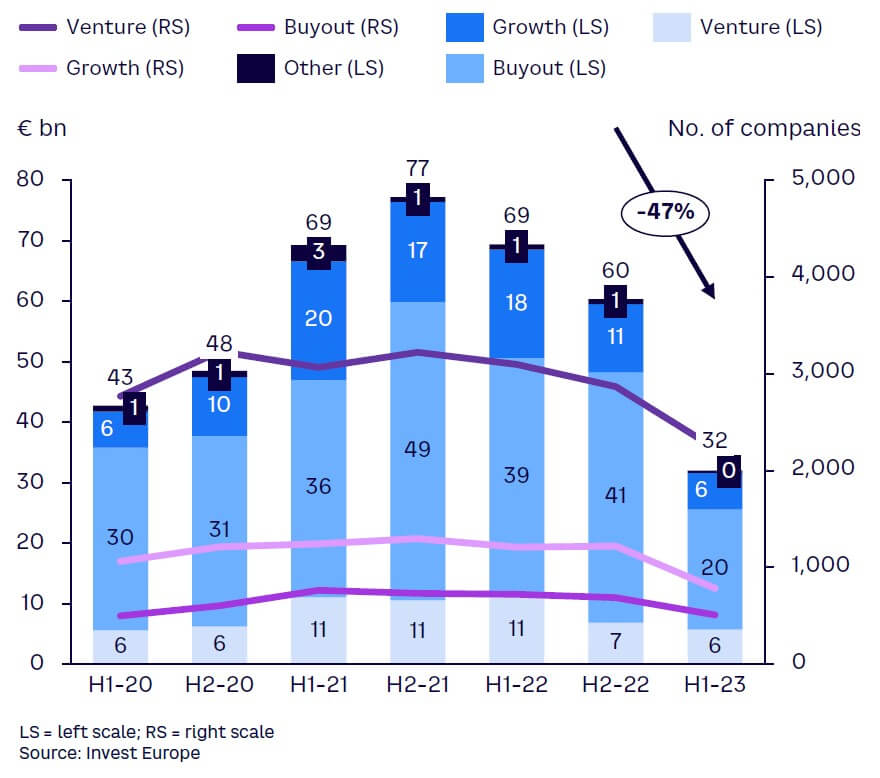

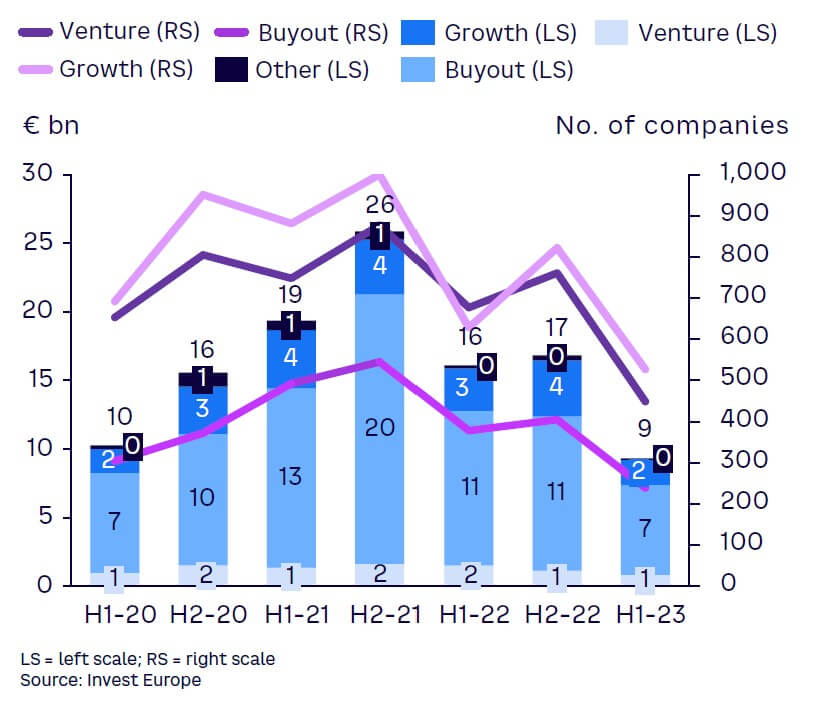

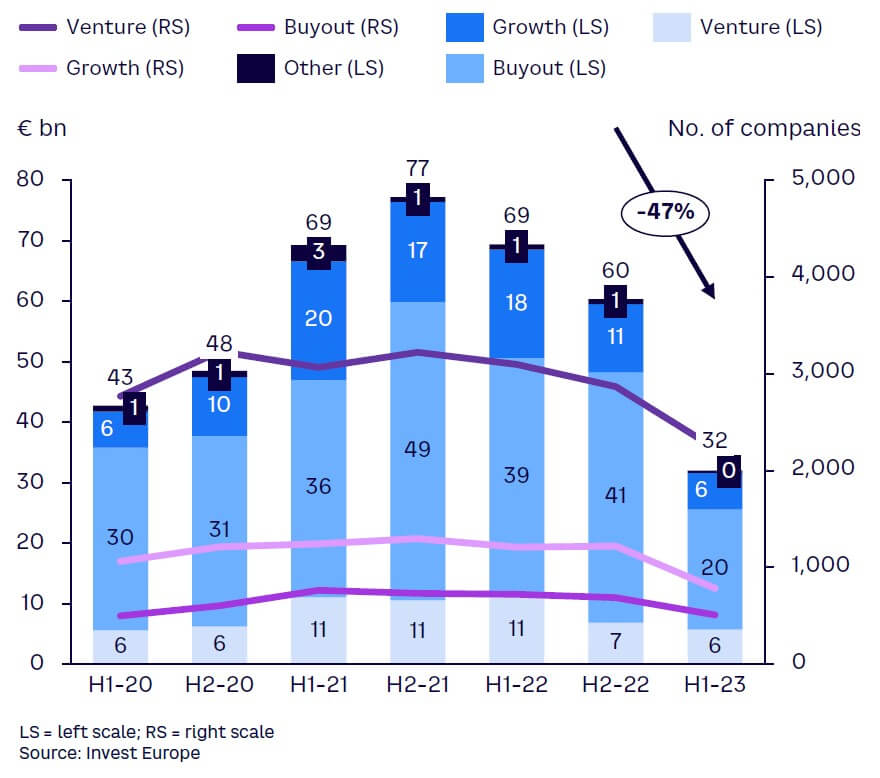

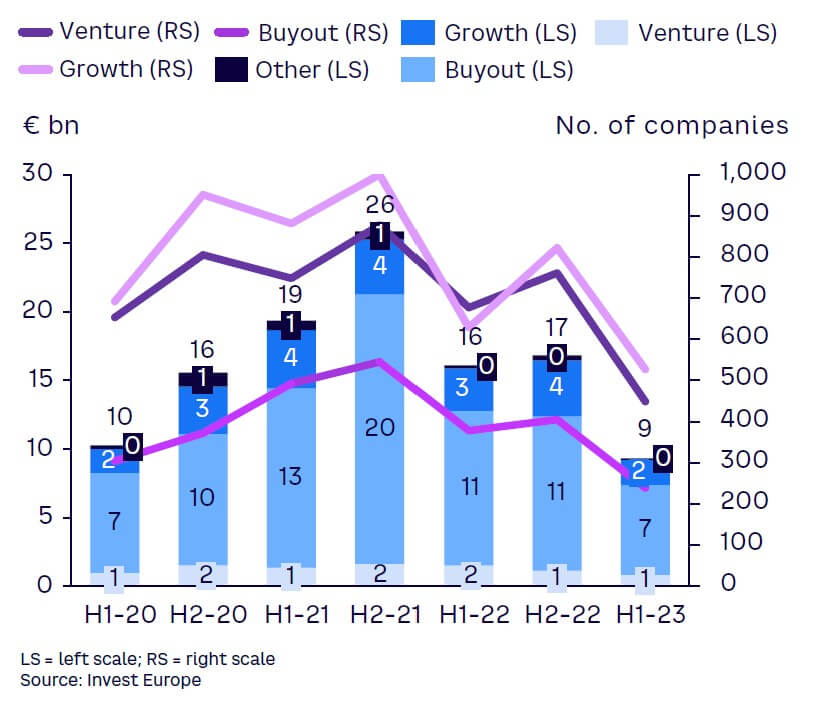

PE investment weakened in the first half of 2023, as difficult financing conditions and uncertainty around valuations weighed on PE and VC deployment. Invest Europe’s preliminary data shows that total investment levels fell by 47% on the previous half year to €32 billion, continuing the downward trend that began in 2022 (see Figure 7). The number of investments fell at a slower rate indicating that larger leveraged buyouts were most affected by the more challenging environment.

Growth investments declined in number, but more so in investment volume, as funds exercised relative caution around some larger funding rounds for fast-growing and scaling businesses. VC funding slowed at the lowest rate in terms of capital invested, underlining Europe’s robust and vibrant start-up scene, which is continuing to produce and fund early-stage success stories across fields, including deep tech, climate tech, and biotech.

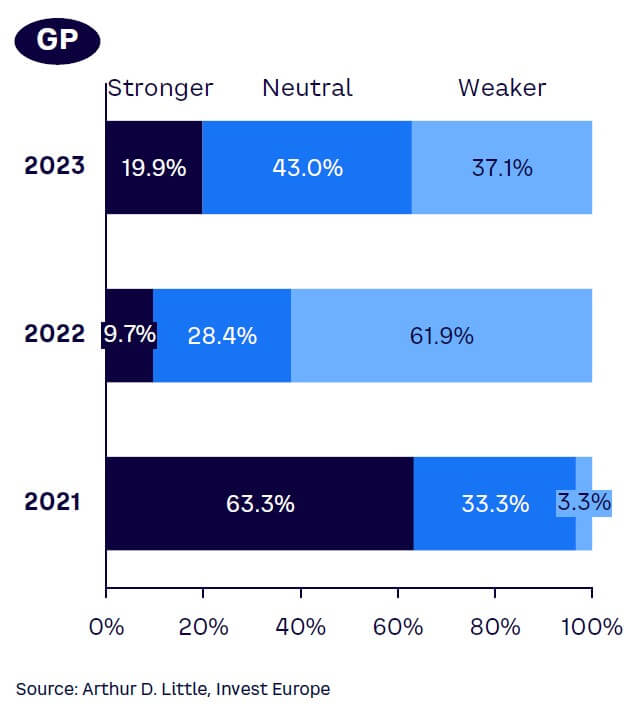

More difficult conditions are impacting GP optimism regarding investment opportunities (see Figure 8). Just one in five anticipate a stronger investment environment over the next 12 months, down 10 percentage points from last year, and more than 30 points below 2021 levels. The corollary is that 50% of managers now see a weaker outlook for investments over the next year.

“The investment outlook is and will remain challenging, until such time as visibility improves and buyer and seller valuation expectations align.”

Dariusz Pietrzak, Partner, Enterprise Investors

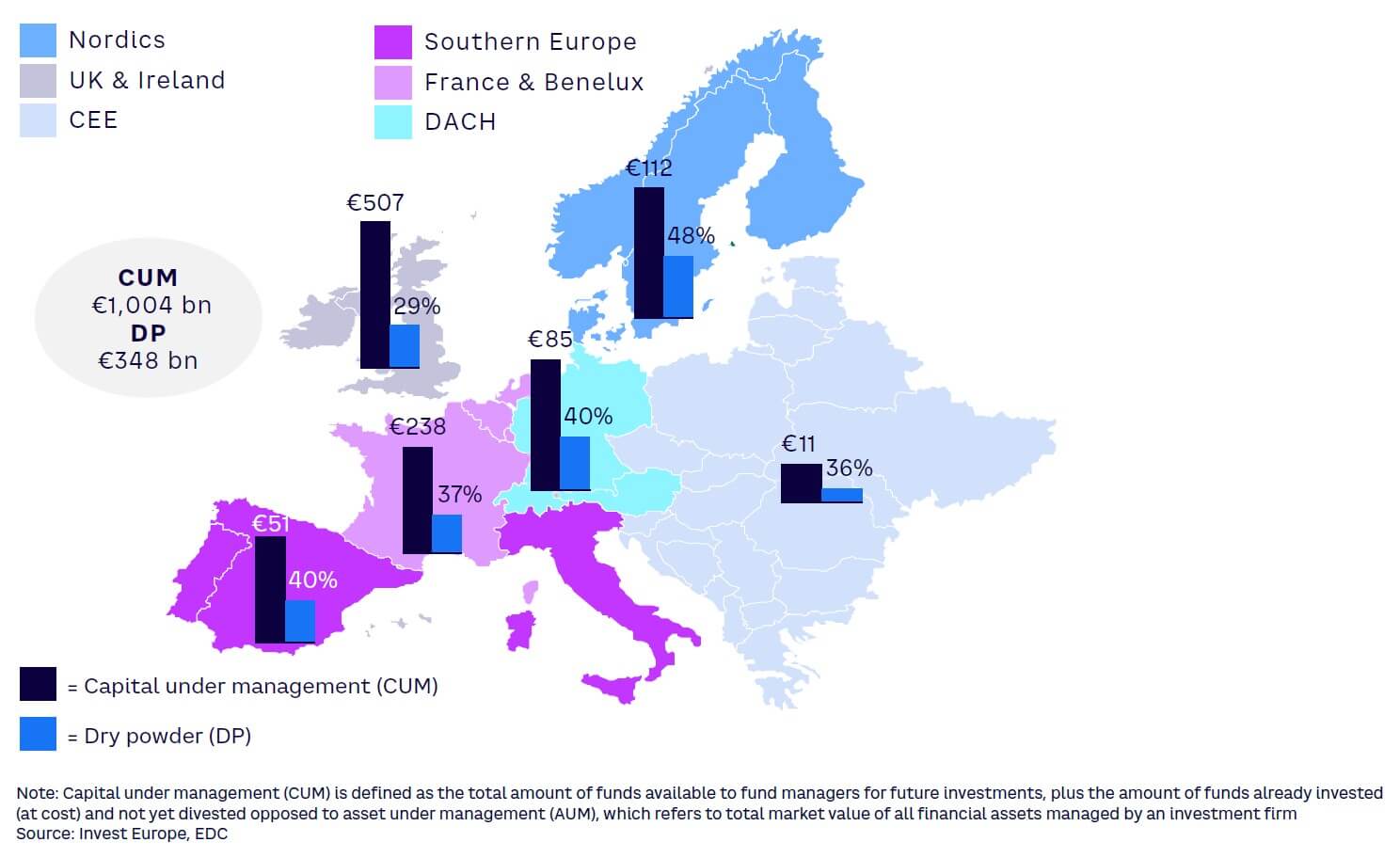

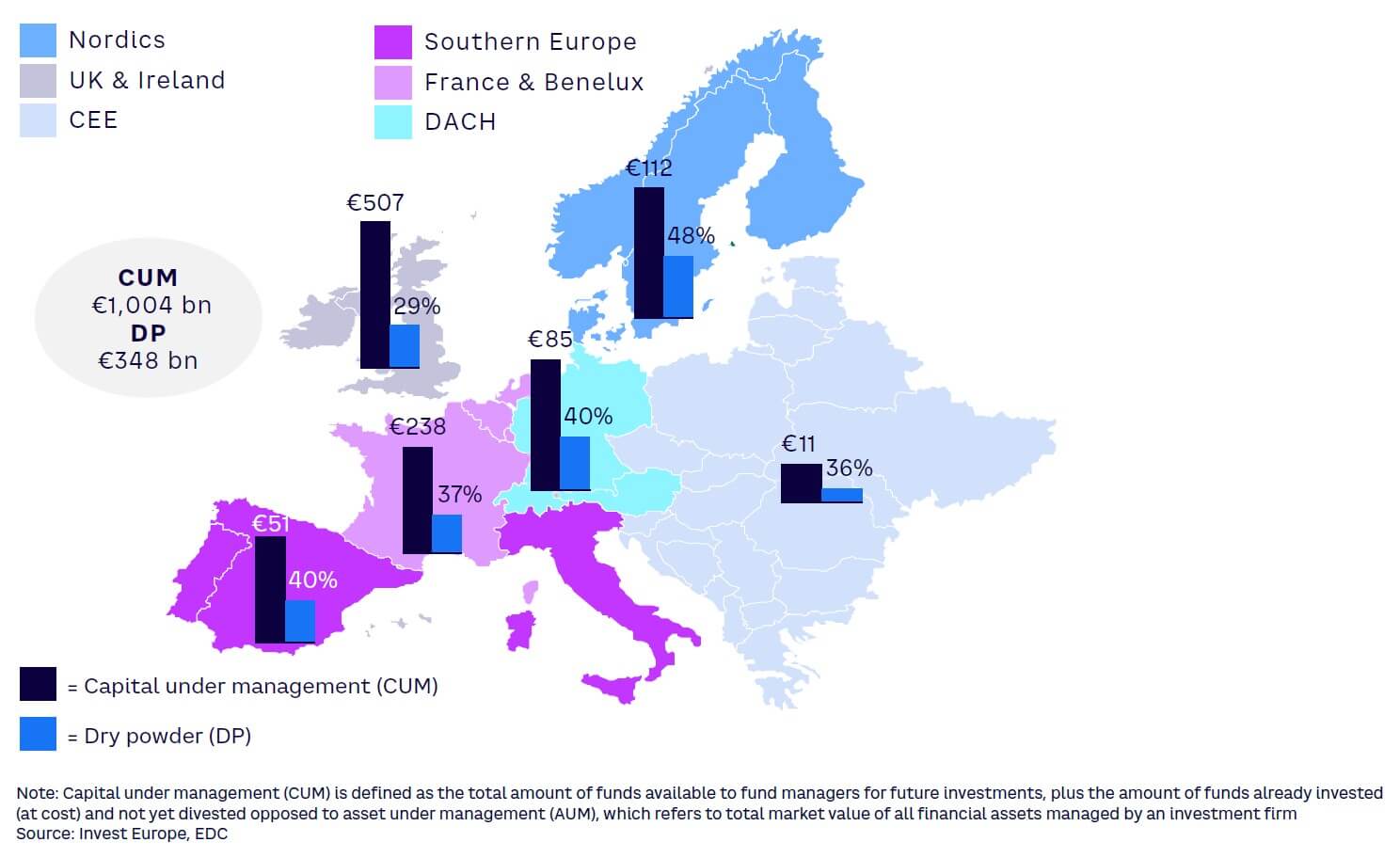

While expectations for near-term activity have weakened, the European PE and VC industry is in a strong position. European capital under management (CUM) stands at a record of more than €1 trillion with dry powder of €348 billion, spread across all regions (see Figure 9). Those reserves may be held until conditions become clearer and there is closer alignment between buyer and seller price expectations. However, they also mean a sizeable war chest for new near-term opportunities, including investment that can support existing companies in their growth.

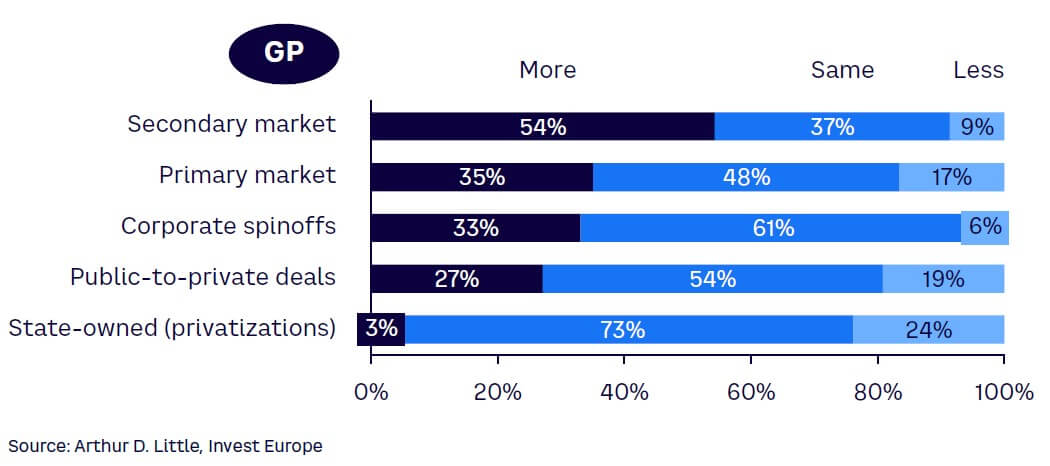

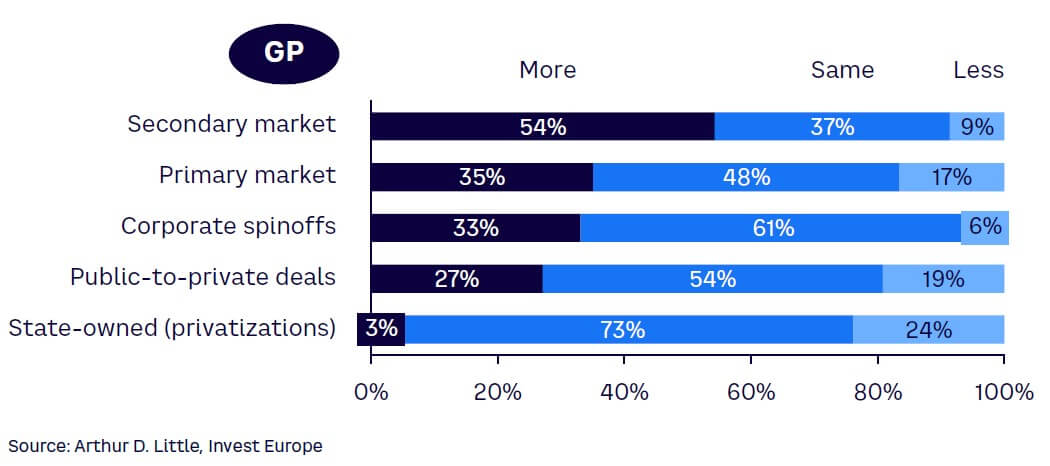

Despite a weak investment outlook, pressure on GPs to return cash to investors that need liquidity will be a key factor shaping activity in the remainder of 2023 and into 2024 (see Figure 10). Over half of GPs expect more secondary buyouts and investments compared to last year. In more challenging markets, GPs have turned to GP-led secondaries to generate liquidity and bring in new capital to invest in portfolio companies — an approach that also enables them to hold businesses for longer, thereby creating greater value and ultimately maximizing returns.

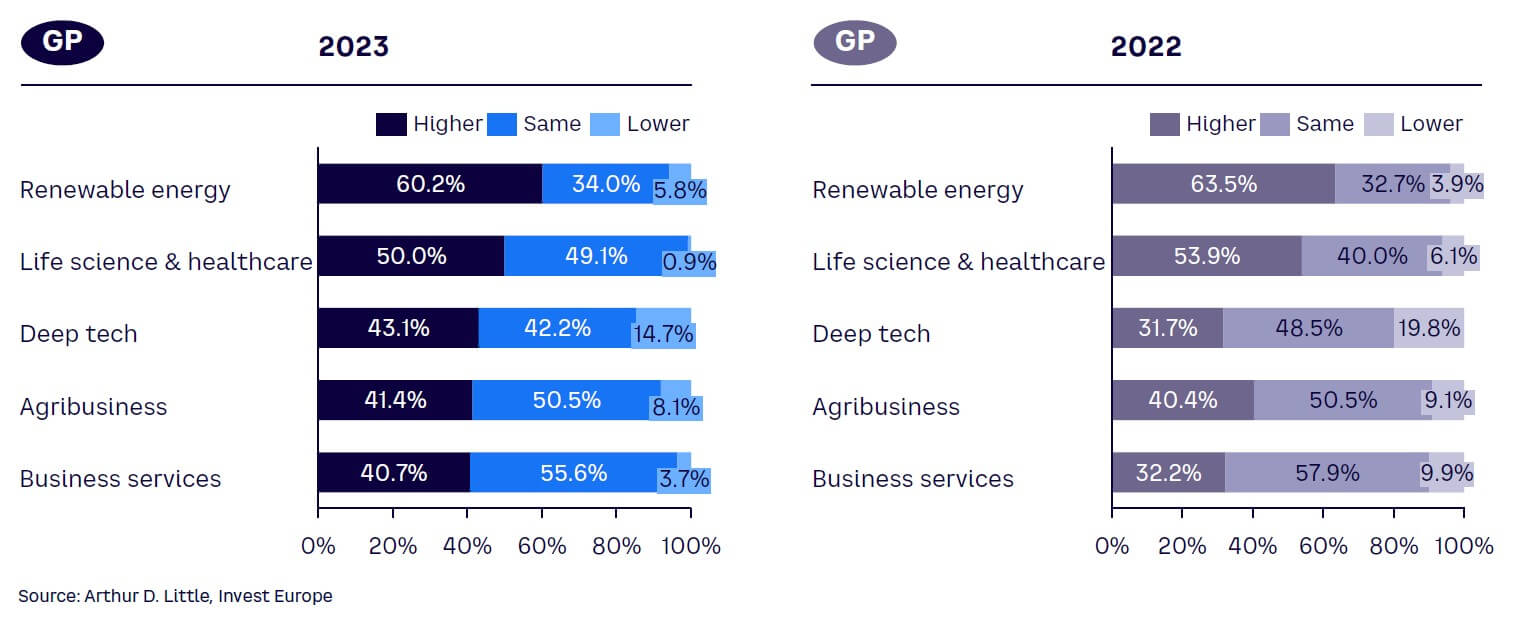

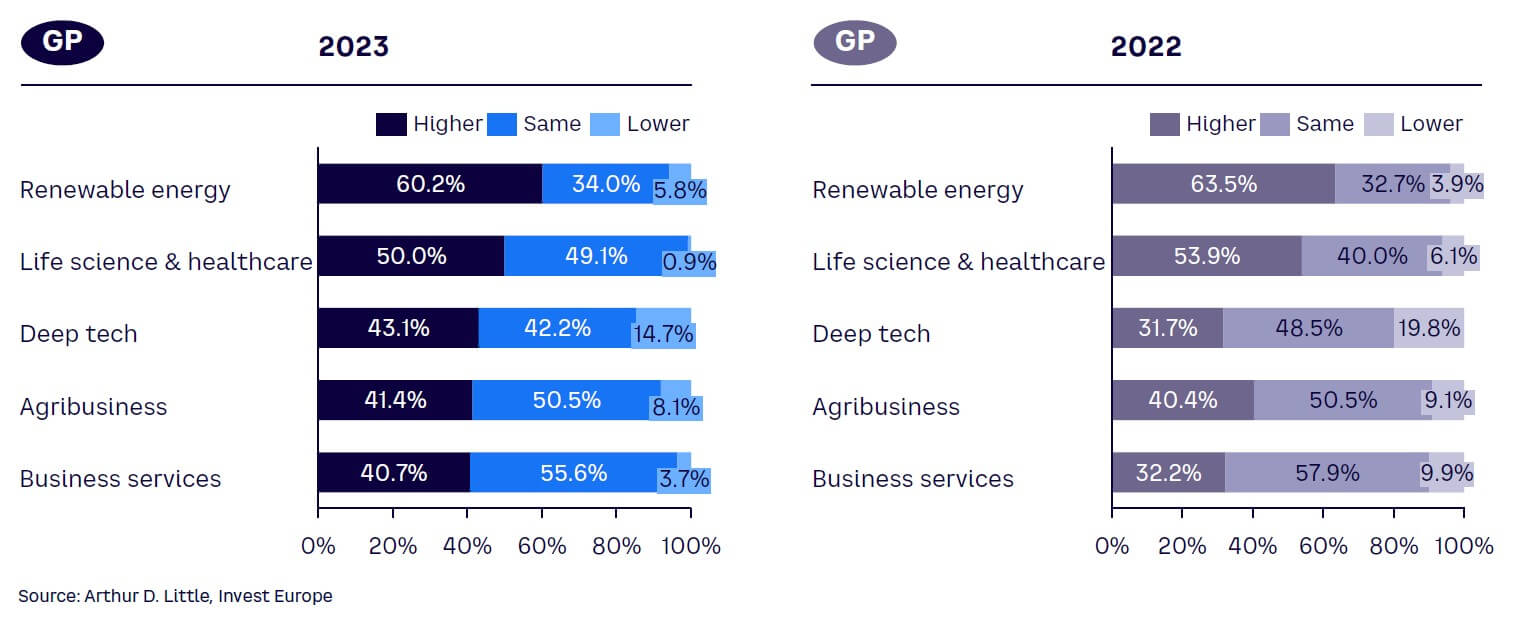

European PE’s focus on sectors that can accelerate the continent’s energy transition and improve citizens’ health is undiminished, in spite of tougher conditions. Renewable energy and life sciences and healthcare continue to top the list of most attractive sectors, with only modest change in their levels of absolute appeal to managers (see Figure 11). At the same time, the attraction of transformative technology and innovative food production techniques are high on rankings, especially deep tech, which has moved up by more than 10 percentage points. Both deep tech and agribusinesses likely are driven by a growing technology content as well as opportunities to automate production processes. Business services is still a hot area as companies are increasingly becoming more reliant on managed services solutions of different sorts.

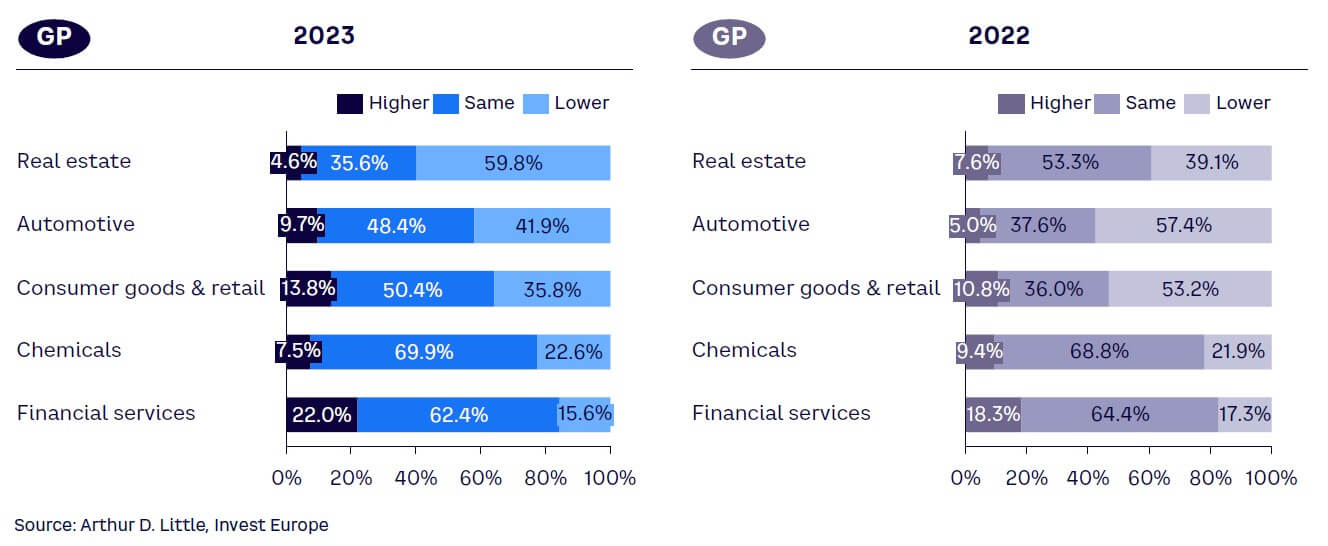

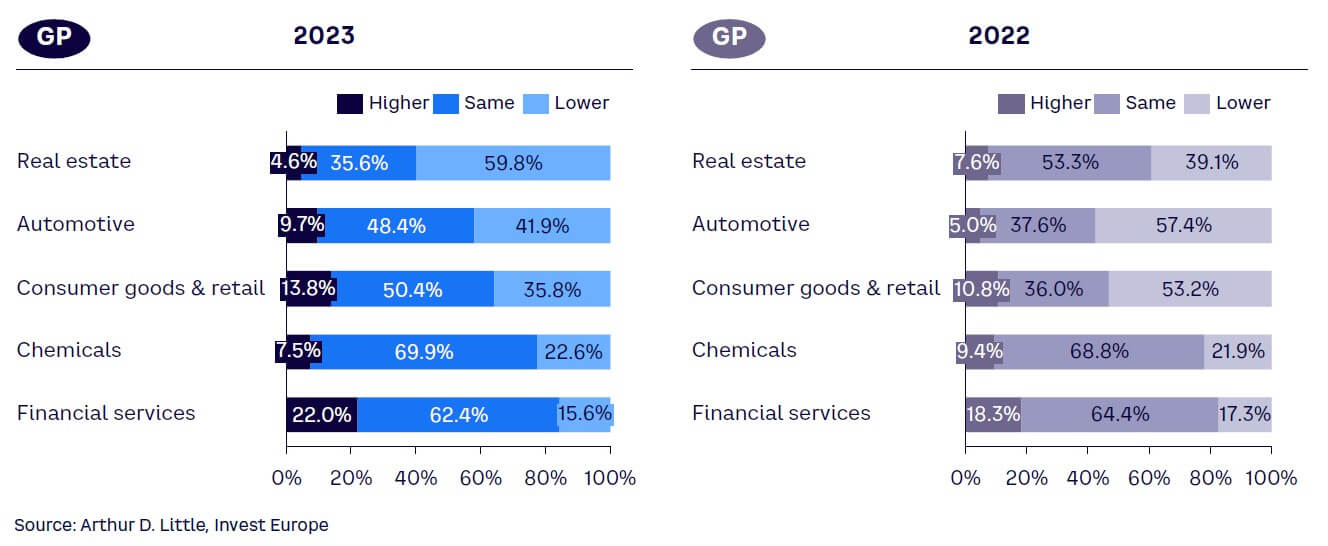

Industries exposed to higher interest rates and cyclicality remain relatively less attractive to PE managers. At the bottom of the list, some 60% of GPs see real estate as less attractive than over the past 12 months, a significantly larger proportion than in 2022’s survey (see Figure 12). In contrast, fewer respondents see the automotive and consumer goods and retail sectors as less attractive than a year ago, although the percentage expecting a higher level of investment remains below one in 10 in both cases.

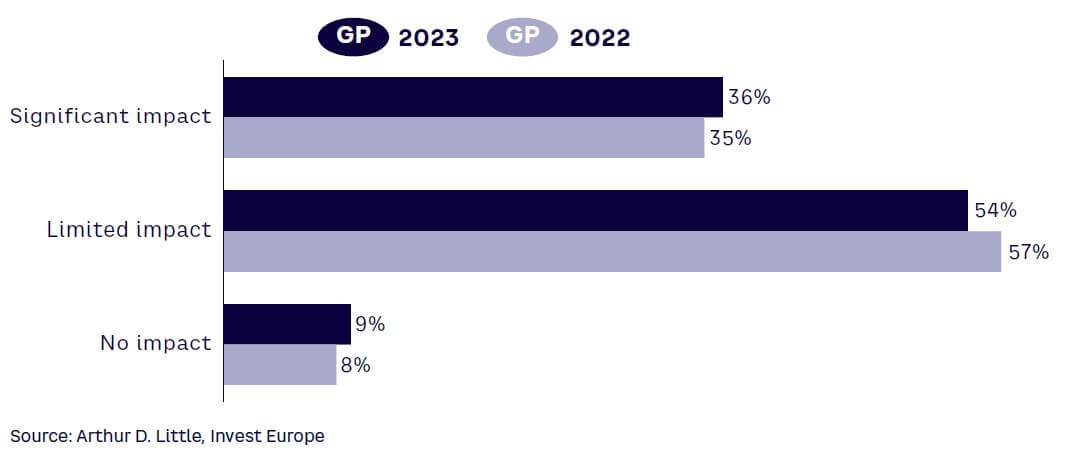

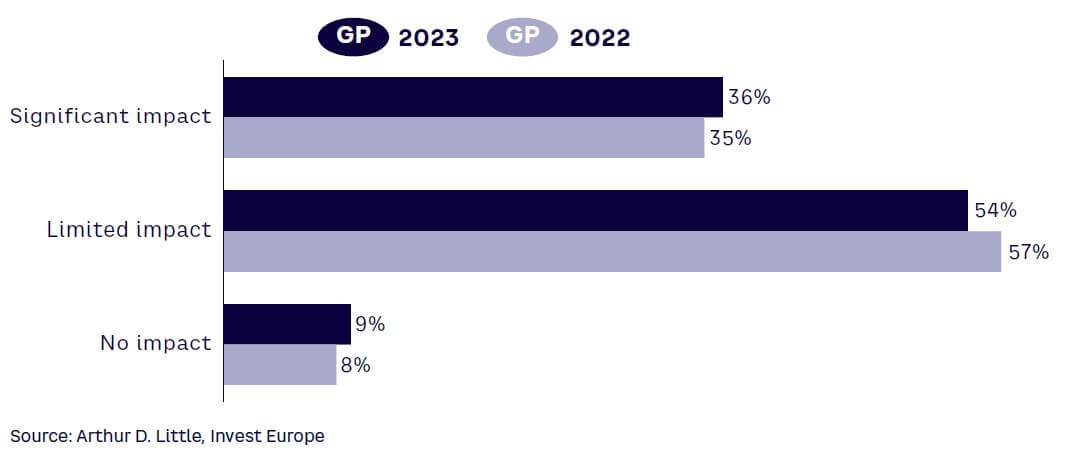

While high interest rates are having a clear dampening effect on the European economy, the majority of respondents believe they will have a limited impact on private equity’s ability to finance new acquisitions (see Figure 13). Just over a third assume that higher borrowing rates will have a significant impact, largely in line with the number of respondents last year.

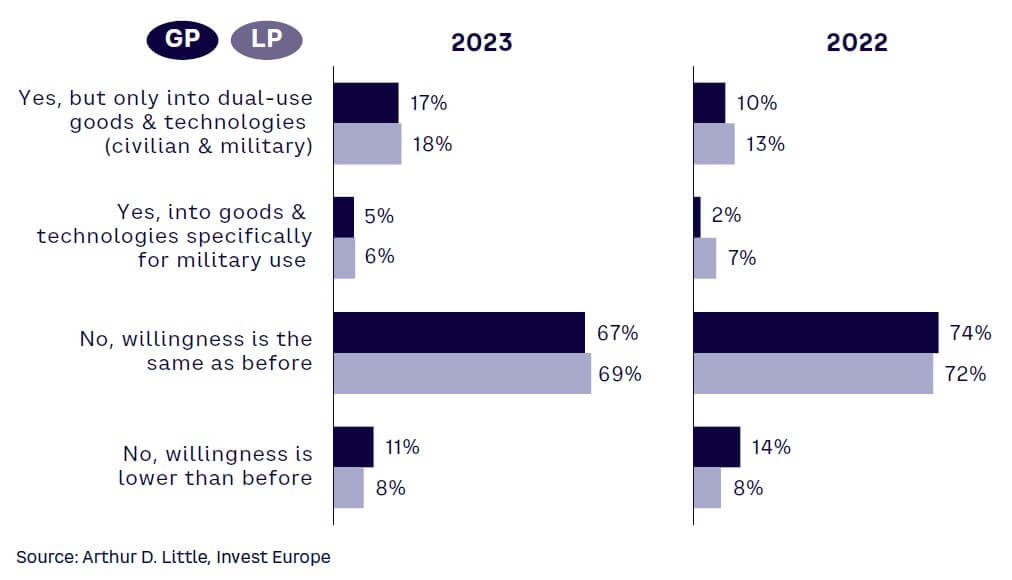

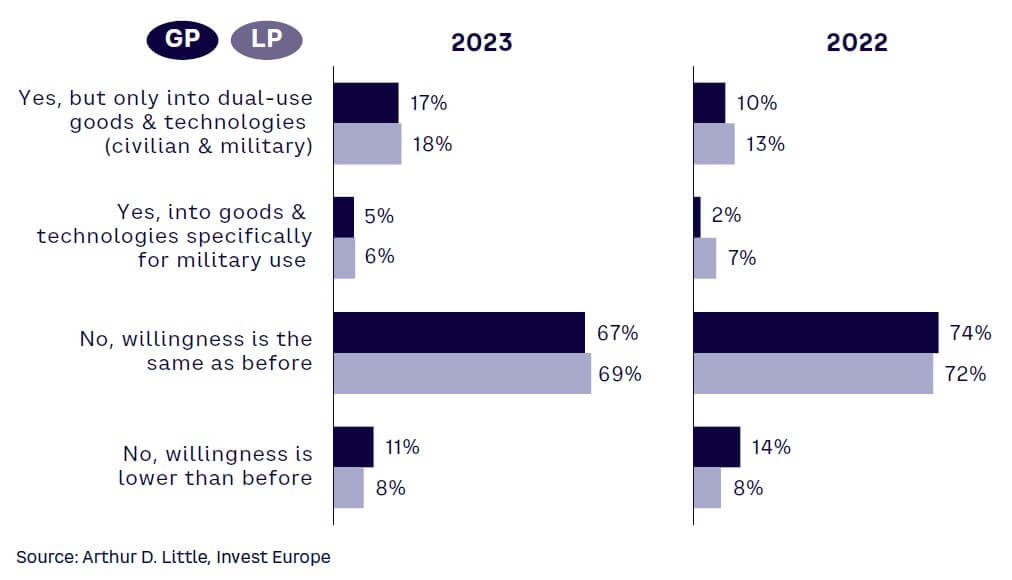

Ongoing geopolitical tension is not only reshaping the landscape in Europe and globally, but also interest and demand in military and defense-related investments. Respondents see more opportunities in that sector, particularly in dual-use technologies that have both military and civilian applications (see Figure 14). Interestingly, LP and GP opinions are in lockstep and indeed even closer than they were last year, as both groups rethink their boundaries on potential ESG exclusions and consider the increased importance of national security and sovereignty.

3

DIVESTMENT ROUTES CHANGING

In parallel with other measures of activity, preliminary data from Invest Europe shows that divestment slowed in the first half, down by 45% on the previous six months to €9 billion. By number of transactions, exits across all segments also fell to lower levels. The uncertain economic outlook, higher interest rates, and geopolitical tensions are all creating pressure on the divestment market, leading to a disconnect between buyer and seller valuations and expectations.

As holding periods lengthen, and it becomes more common for PE firms to own successful businesses for the long term, the data indicates that, for many managers, the best option may be to continue to own the business (see Figure 15). Doing so, they can seek to continue to drive value through operational improvements, while waiting for market conditions to pick up in order to maximize exit value for investors.

GP expectations for the divestment outlook remain low as the threat of economic downturn weighs on companies across the continent (see Figure 16). Only 20% expect a stronger exit environment over the coming 12 months compared to almost double that number expecting a weaker outlook. While sentiment is notably less optimistic than in 2021 in the post-COVID-19 economic recovery, expectations have picked up since last year with those expecting a stronger divestment scene doubling.

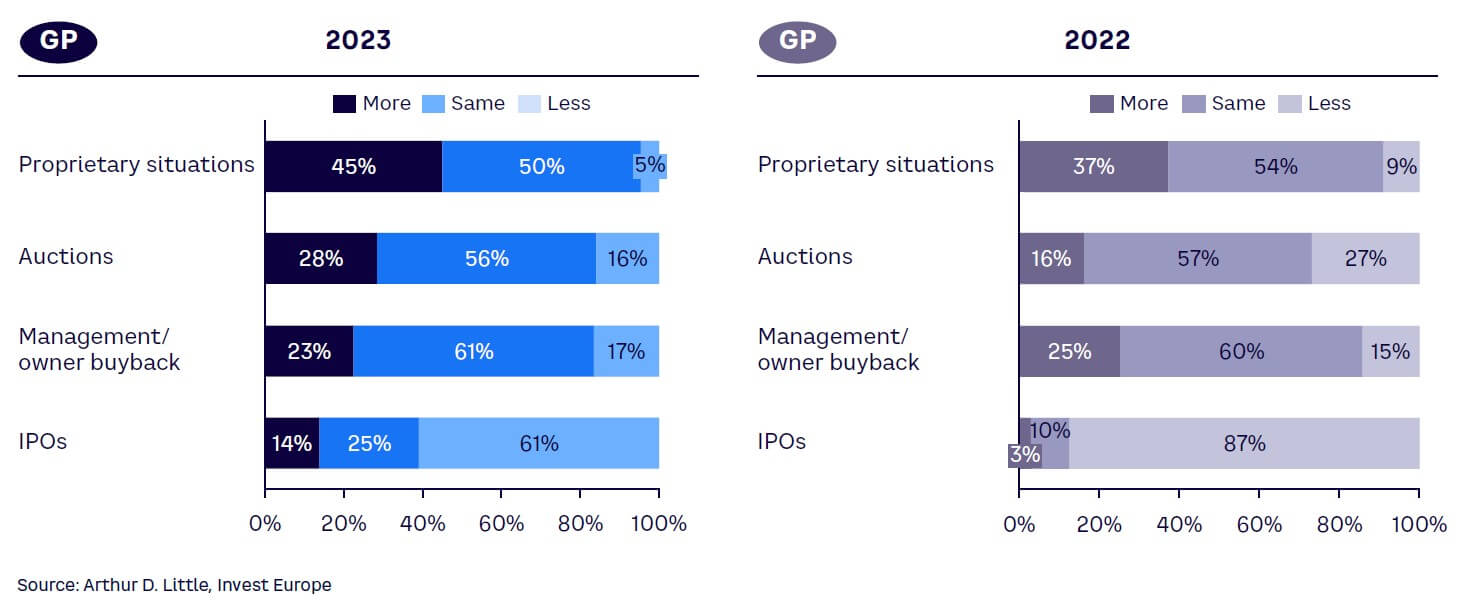

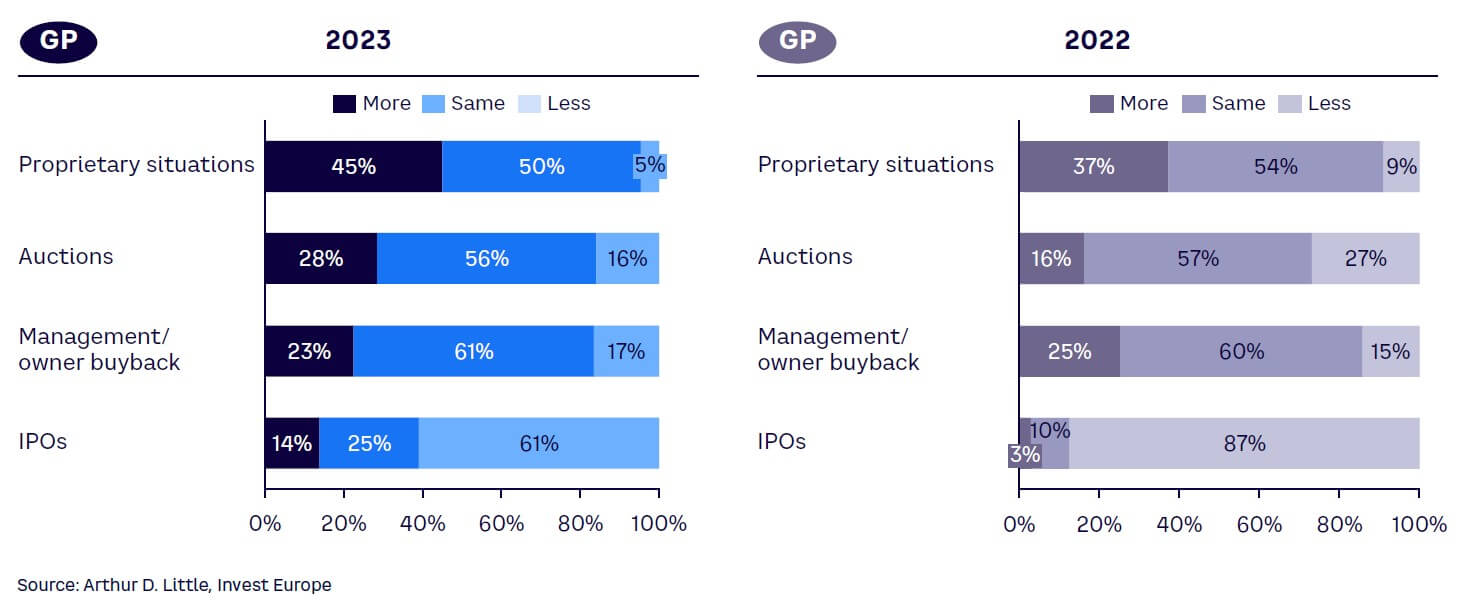

Given weak levels of divestment over the past 12 months, more GPs are expecting an improvement in most exit routes than last year — with the exception of management buyouts and buybacks, on which views are largely unchanged (see Figure 17). While only a minority believe that any of the main divestment options will be more common, the largest number — and a sizeable minority — see more proprietary situations. The challenging conditions mean that many managers will be keen to conclude agreements following preemptive approaches or bilateral off-market discussions, reducing scrutiny on processes while allowing parties more time to conduct due diligence. Nonetheless, the number expecting more divestment activity via auctions and IPOs has also increased, reflecting the relative absence of public listings and large managed asset auction processes over the past year.

Both GPs and LPs are in relative agreement over the prospect for continued valuation declines over the next 12 months, following some resetting of valuations and expectations during the past year. Opinions diverge somewhat over the expected volume of transactions, with GPs notably more optimistic than LPs. However, expectations for all parties are markedly better than last year, potentially pointing to a bottoming of the exit market and an uptick in divestments.

4

INFLATION & INTEREST RATES CREATE LARGEST HEADWINDS FOR PRIVATE EQUITY

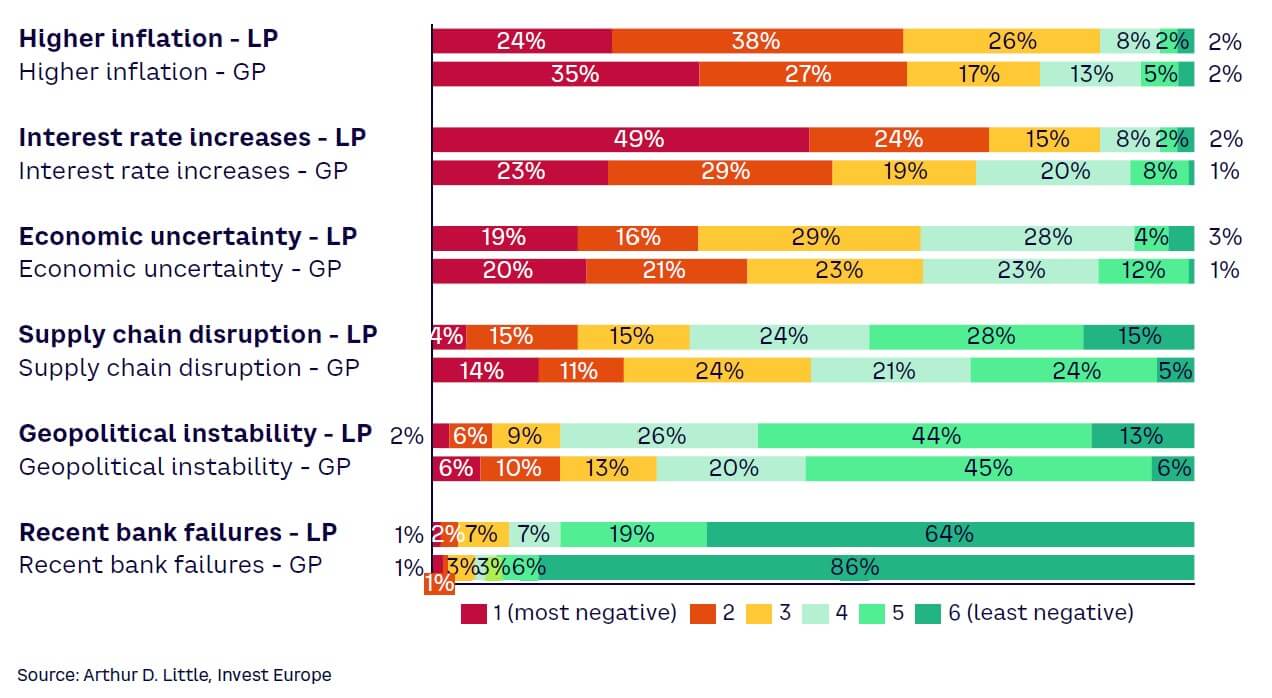

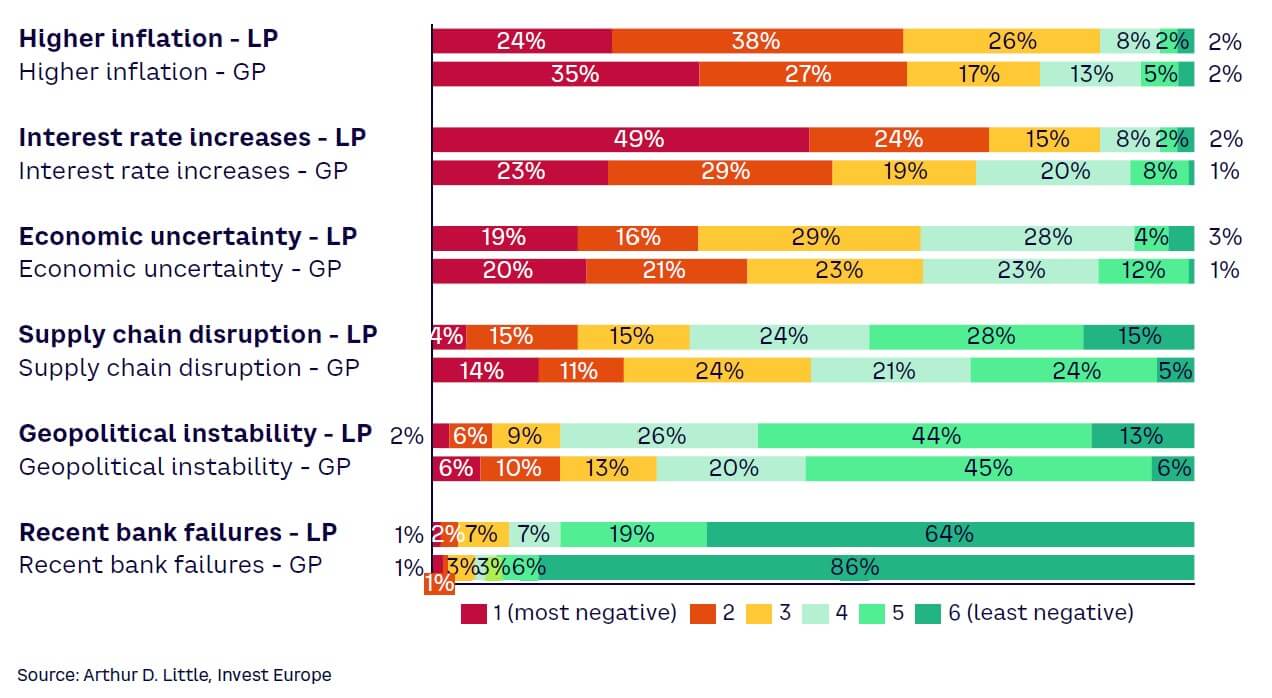

In keeping with last year, inflation is the leading concern for private equity GPs, with over 60% ranking it as the most negative, or second most negative, factor impacting the economic outlook — the same proportion as LPs who view it as strongly negative (see Figure 18).

Opinions diverge on higher interest rates, which about half of LPs rate as the most negative factor versus approximately a quarter of GPs. Both inflation and interest rates are ranked by LPs and GPs as more serious than economic uncertainty — and well ahead of supply chain disruption, which rated as a more severe issue last year, particularly among GPs, as the world contended with supply issues stemming from COVID-19 and the subsequent normalization of production and trade.

Most recently, the impact of banking failures appears to be the least negative factor by far, reflecting the swift action by European governments and regulators, as well as the greater concentration of issues in the US regional banking space.

“Inflation is not going away without a fight. That and high interest rates will be serious headwinds for private equity for the foreseeable future.”

Elias Korosis, Partner, Federated Hermes GPE

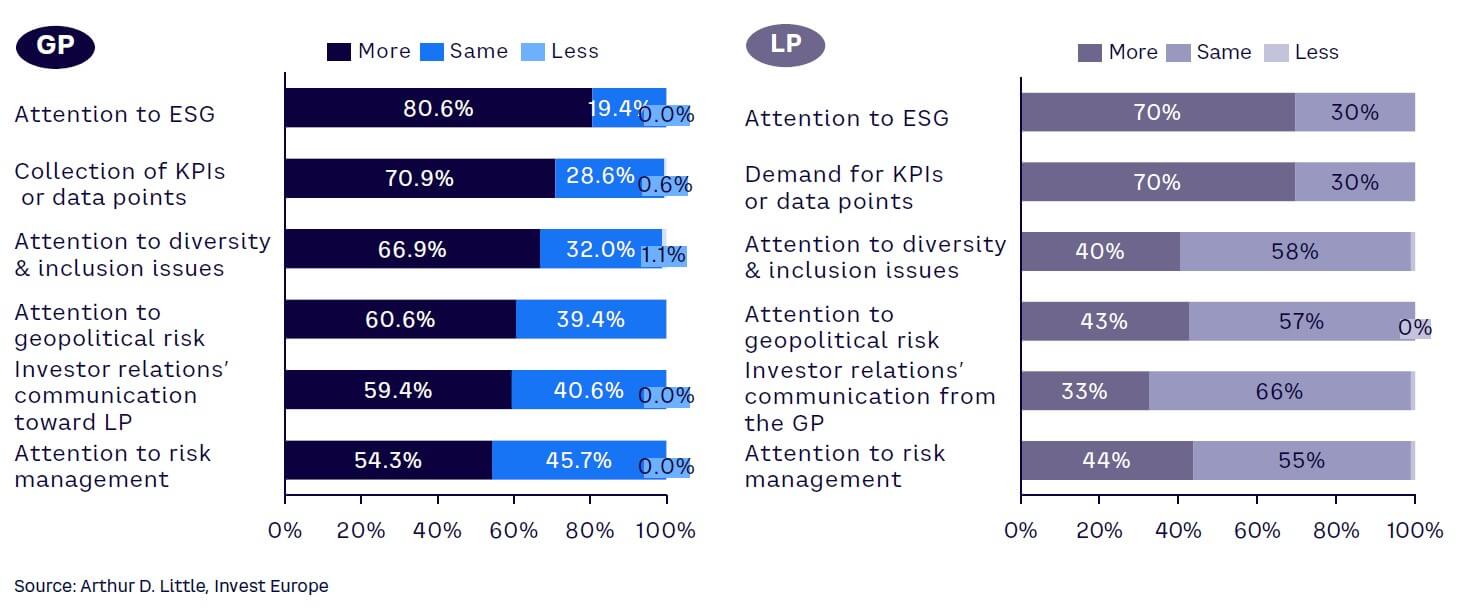

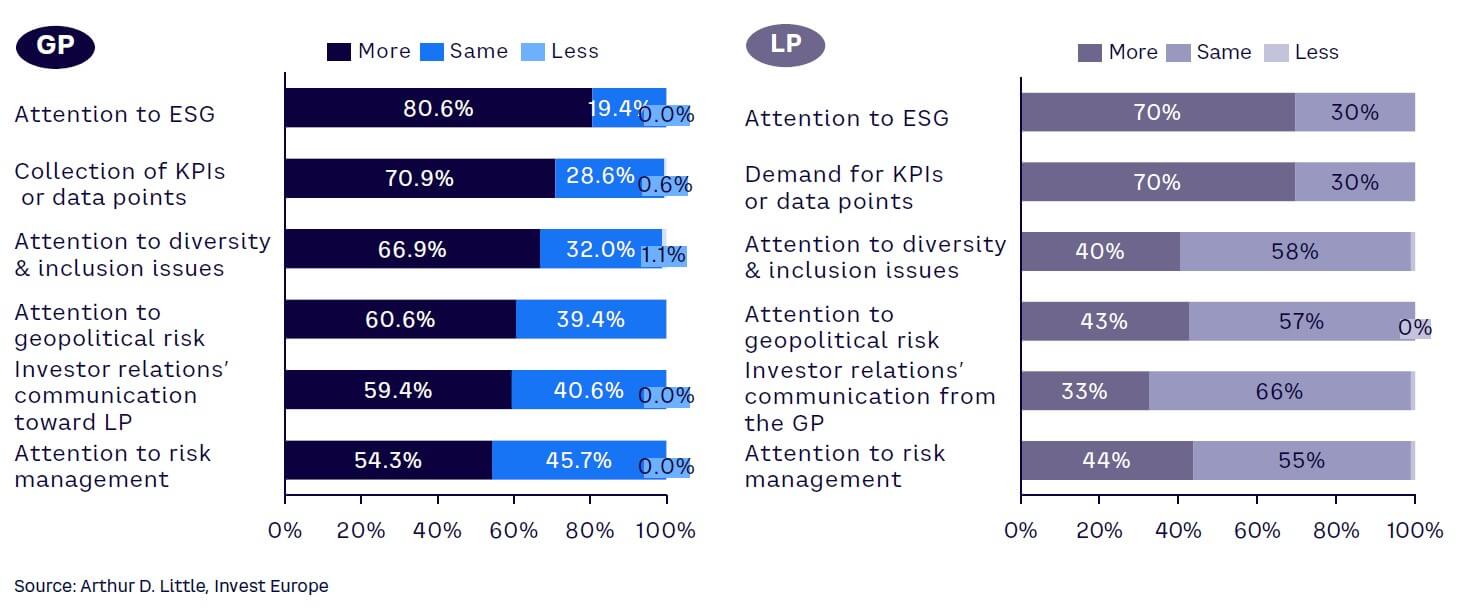

When it comes to factors that are within the PE industry’s control, well over two-thirds of GPs and LPs expect to spend more time on ESG issues and the collection of KPI data points (see Figure 19). More than two-thirds of GPs also anticipate more attention to diversity and inclusion in their near-term operations, ahead of LPs who may have had more focus on the topic in recent times. The majority of GPs expect to have more focus on all issues, demonstrating their attention to navigating challenging markets and conditions, while addressing rising regulatory requirements and investor demands.

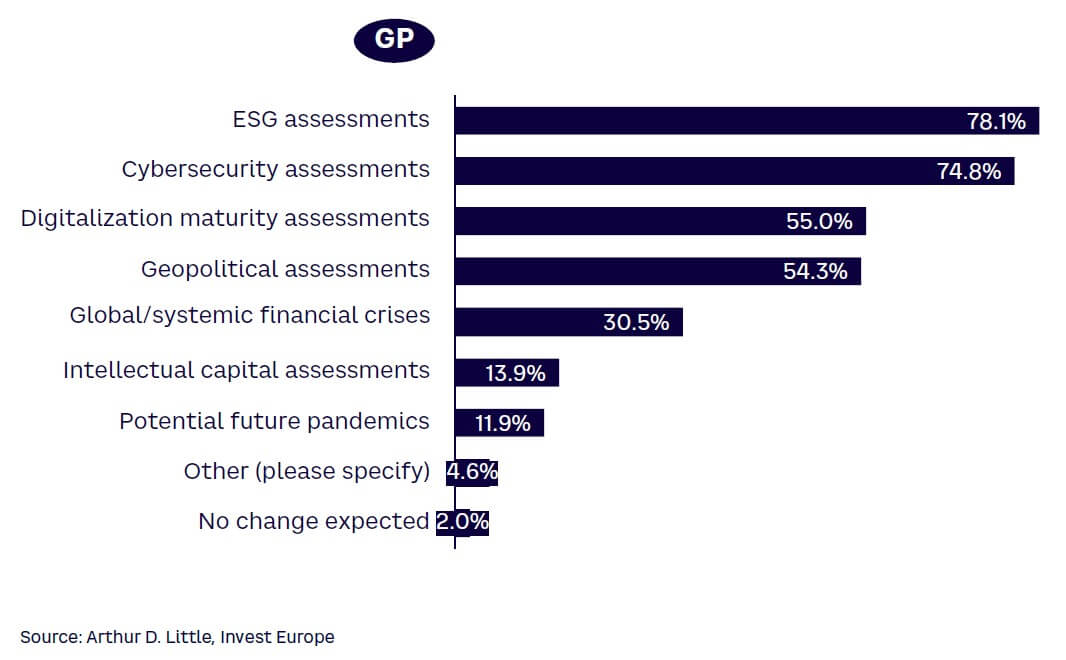

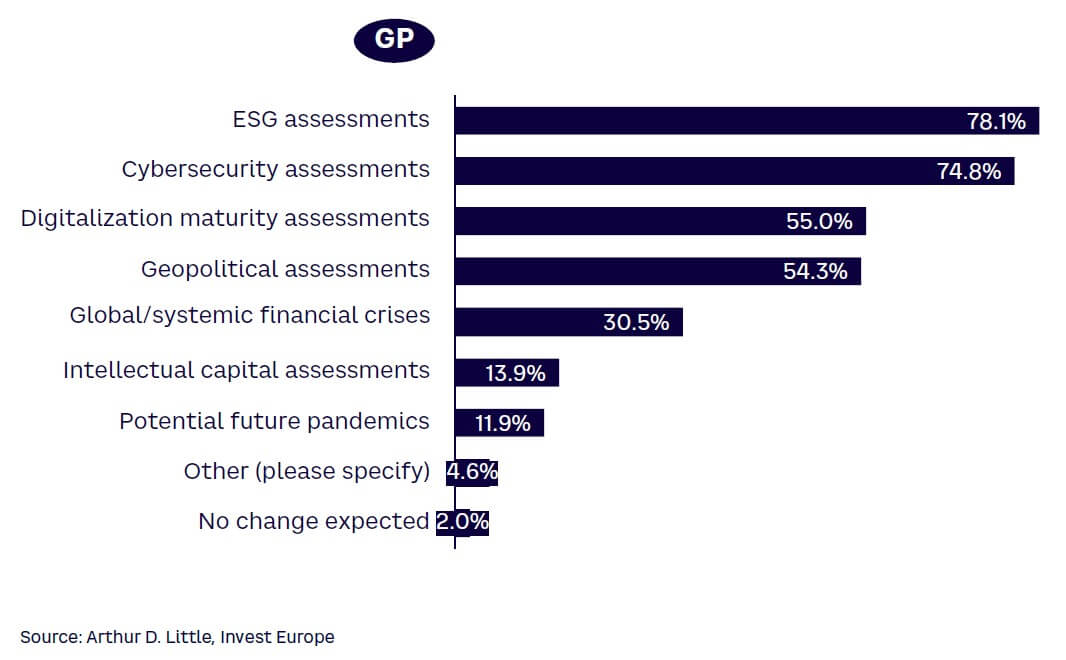

The near-term focus of GPs is also evident in the due diligence fields receiving heightened scrutiny. More than three-quarters of managers expect to do more assessments around ESG and cybersecurity (see Figure 20). Consideration of digital maturity at businesses and geopolitical risks will also receive more attention among over half of GPs, followed by assessments of global financial risks. Less important are intellectual capital considerations and the threat of future pandemics, although 98% of GPs expect some form of change to their due diligence procedures.

“Managing ESG is having a clear impact on our time and resources. Ultimately, it’s an opportunity — as a way of attracting LP capital, generating new investments, and adding value to companies.”

Maaike van der Schoot, Head of Responsible Investment, AlpInvest, a core division of Carlyle

5

REGULATION DRIVES ESG TRENDS & INVESTOR EXPECTATIONS

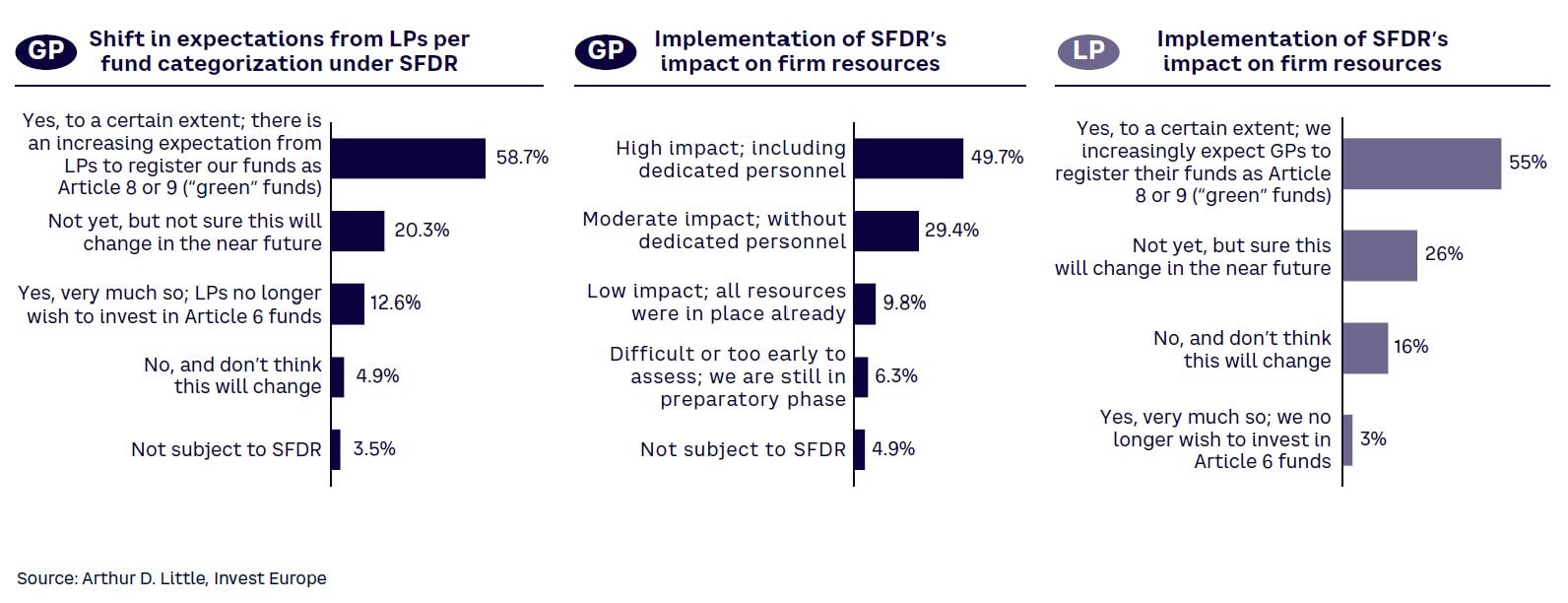

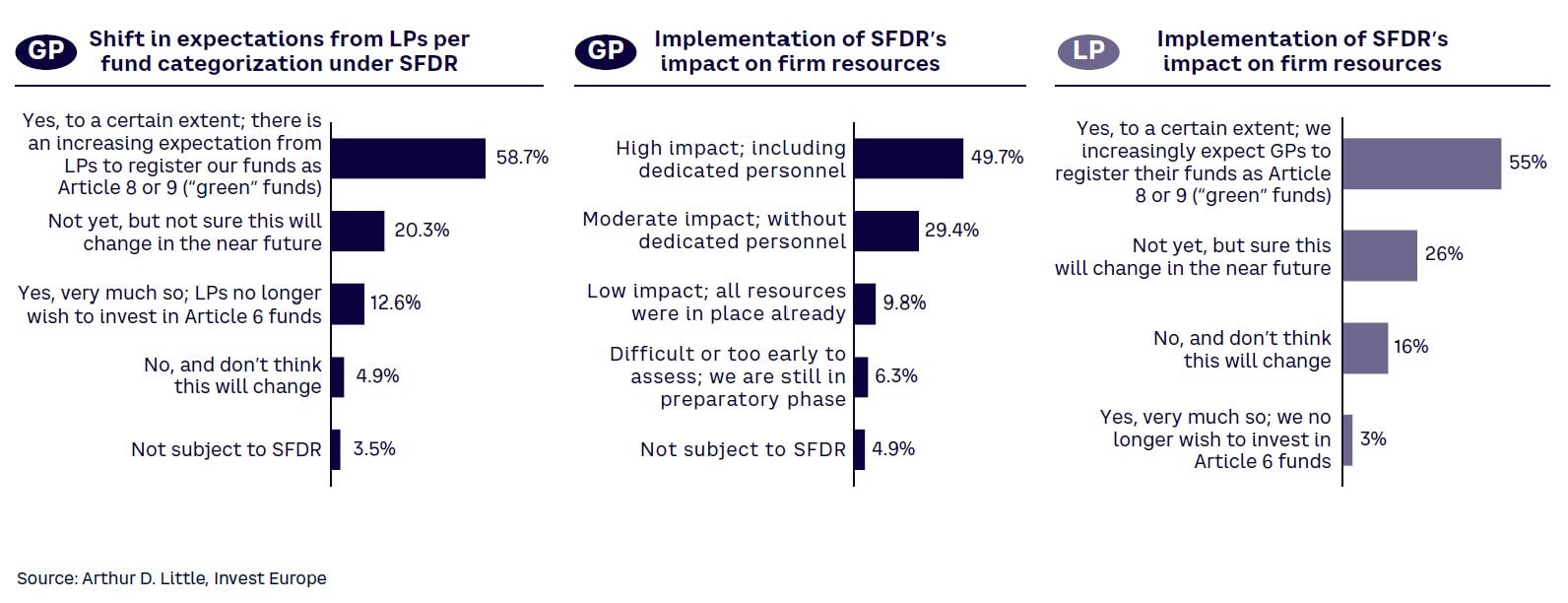

Europe’s lead in developing robust regulation on sustainable investment is creating an important shift in GP positioning and investor expectations. The implementation of the Sustainable Finance Disclosures Regulation (SFDR) has led to the majority of LPs expecting GPs to register their vehicles as Article 8 or 9 green funds, mirrored by the number of GPs who see LPs expecting them to register funds that target higher levels of social or environmental benefit.

The demand for green funds, in combination with the level of measurement and reporting they require, is having a significant impact on fund managers (see Figure 21). About half of GPs anticipate a high impact on firm resources, including the creation of dedicated ESG roles, although around a third expect to be able to fulfil their responsibilities with existing staff. Only a small minority see no change to their positioning as a result of SFDR.

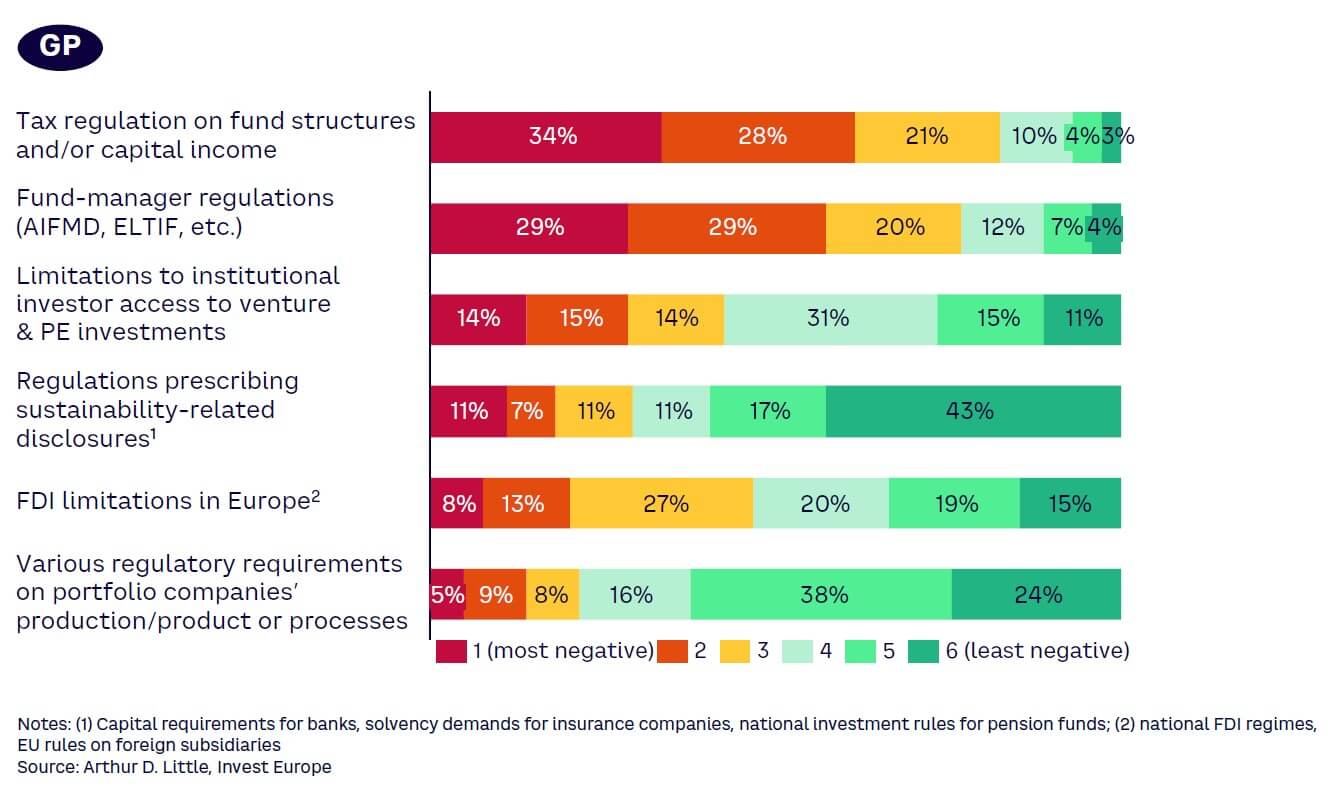

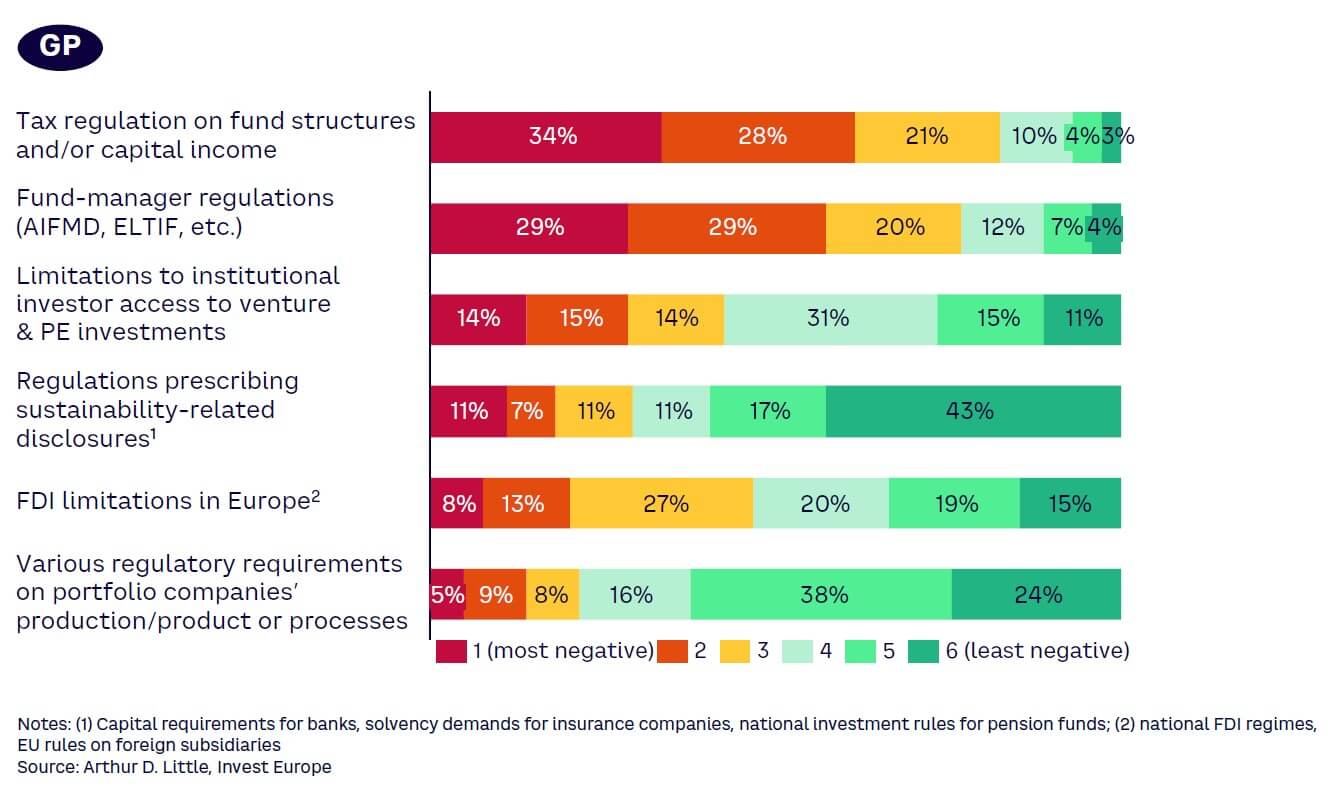

While ESG is perhaps the most significant issue for the European PE industry, other regulatory considerations are having an impact on firms (see Figure 22). Most notable is tax regulation affecting fund structures and capital income, particularly as a looming general election in the UK reignites the debate around carried interest taxation in one of the largest markets. Amendments to fund manager regulation are seen having a significantly negative impact as well, despite Alternative Investment Fund Managers Directive (AIFMD) reforms that should have a relatively benign impact on private equity.

At the bottom of the list, limitations to foreign direct investment (FDI) in Europe and new foreign subsidy rules, along with regulatory requirements on portfolio companies’ production or processes, which may include anticorruption measures and new carbon taxation, are seen having least impact.

6

DIGITALIZATION AT FOREFRONT OF INCREASING OPERATIONAL FOCUS

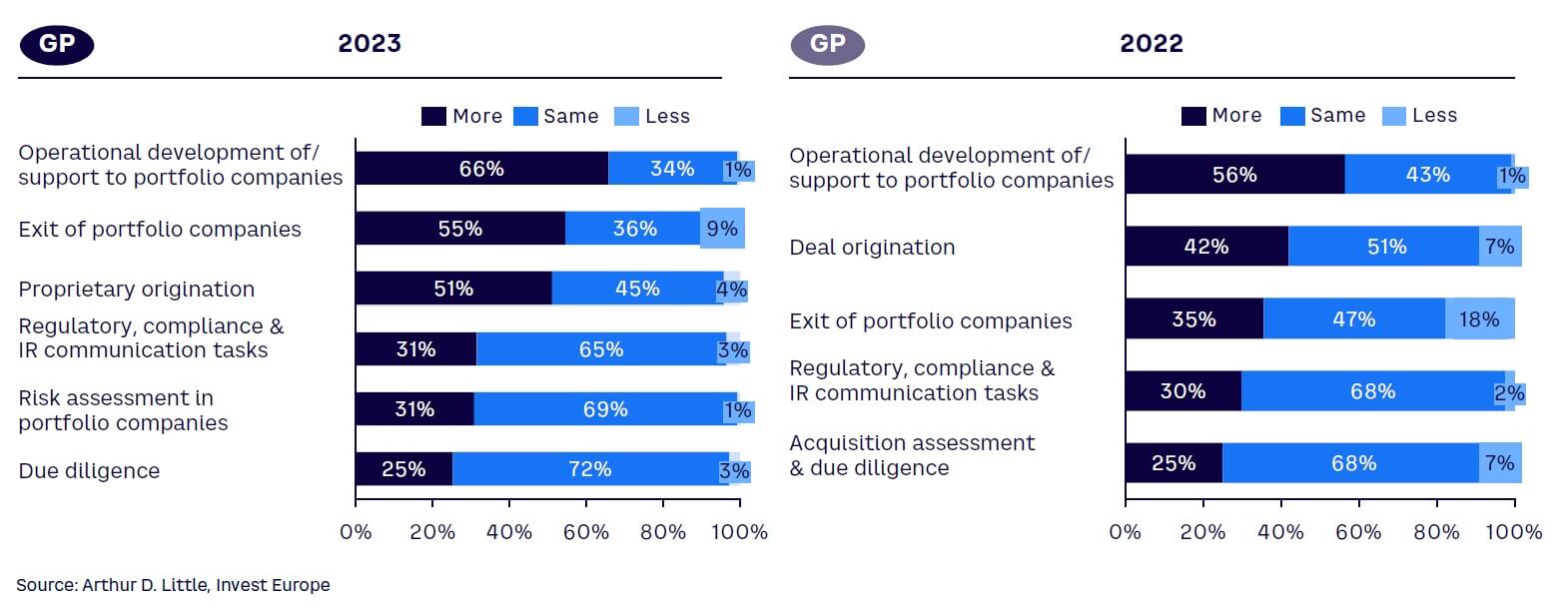

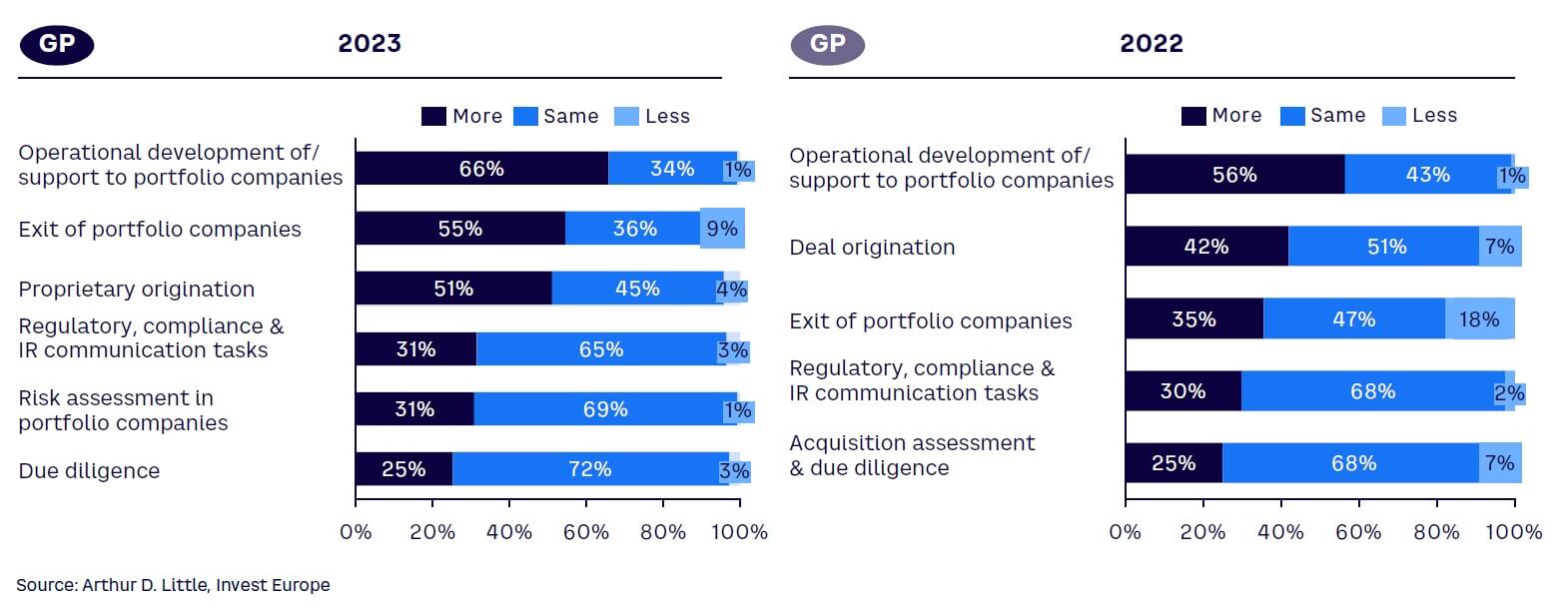

The difficult business backdrop is increasing GPs’ focus on portfolio companies (see Figure 23). Two-thirds of managers expect to enhance operational support and development at their businesses, an uptick over last year’s result. Next, comes a focus on portfolio company exits, another clear signal that GPs see some improvement in the exit environment and that operational activities may be key to getting companies exit ready. Moderately more GPs expect to spend more time on originating proprietary investments over the coming year.

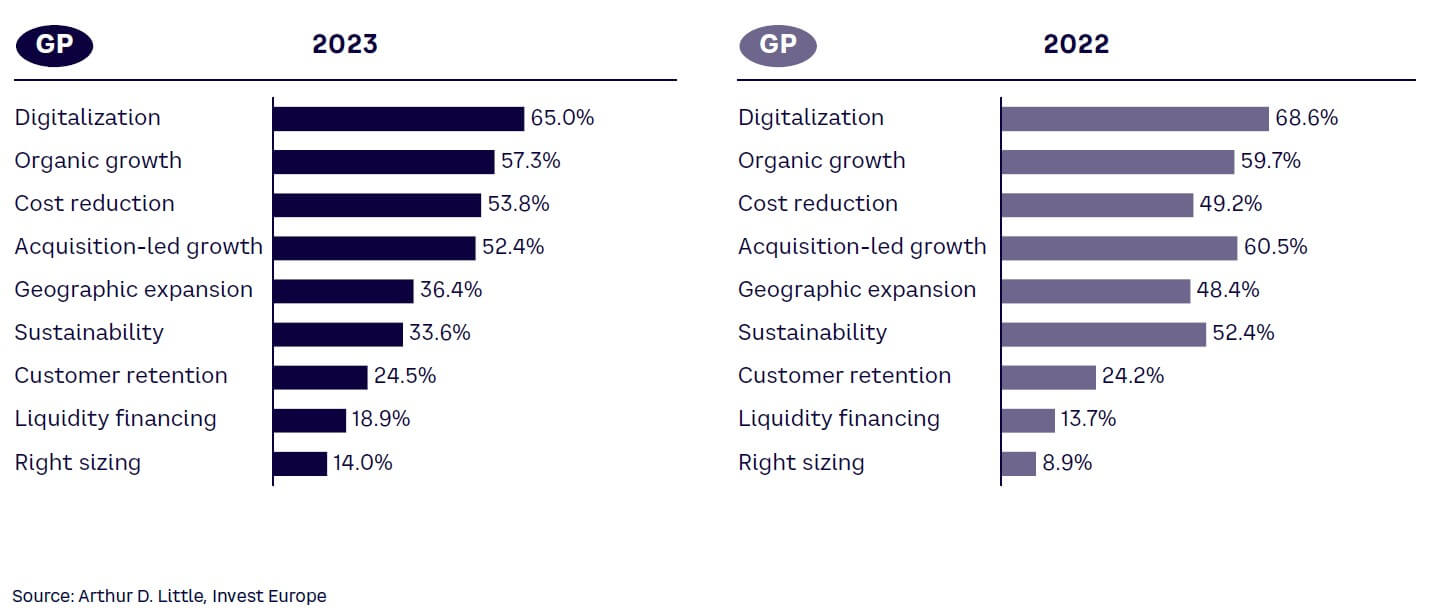

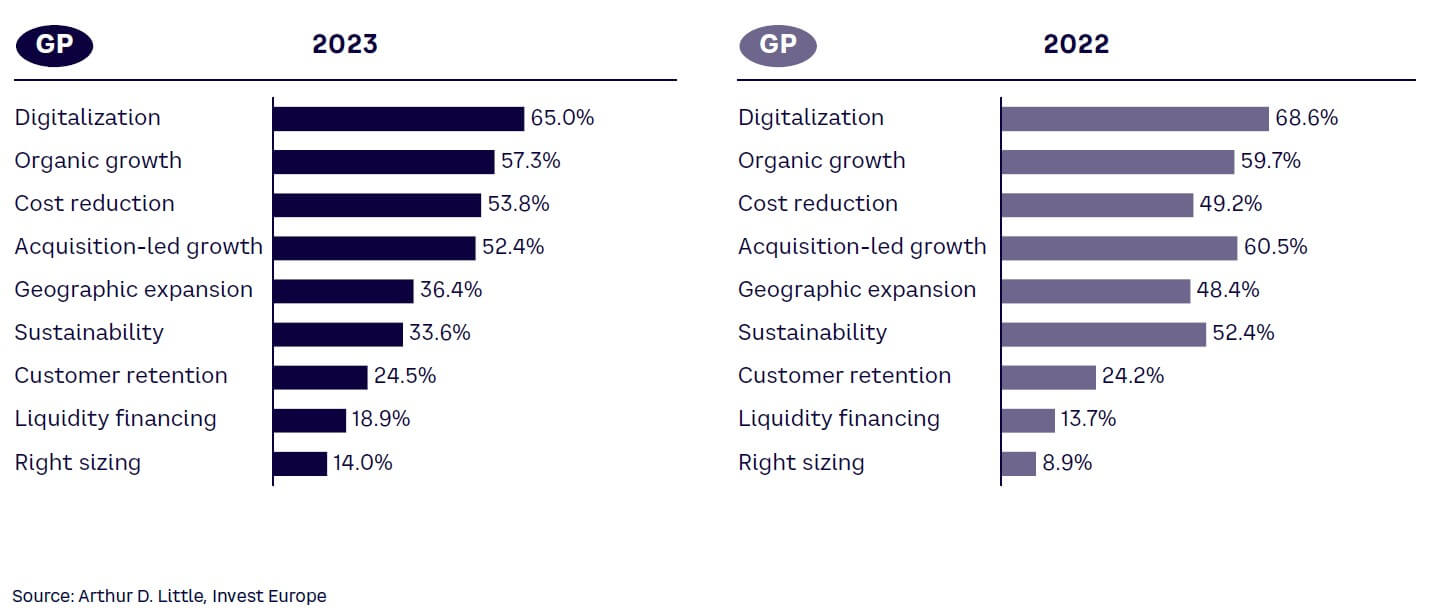

The main improvement initiatives remain largely unchanged from last year (see Figure 24). Two-thirds of GPs see digitalization as the most important initiative to be undertaken at portfolio companies, followed by measures to drive organic growth. Cost-efficiency remains critical, as does acquisition-led growth — albeit at a lower level than last year as firms contend with increased market pressures. Sustainability initiatives have dropped down the list, potentially reflecting the already strong progress made on ESG at portfolio companies, and the relative increase in importance of GP-level measures to comply with regulation and investor expectations.

“Operational improvement has never been more important. There are any number of levers we can pull to drive top-line and bottom-line performance at our companies.”

Bill Watson, Managing Partner, Value4Capital

CONCLUSION

The outlook for Europe’s economy remains challenging with little sign of improvement on the near-term horizon. The message from central bankers that interest rates will stay higher for longer than previously anticipated aims at dampening the remnants of inflation. The almost inevitable consequence will be economic slowdown.

Yet, while the macroeconomic backdrop is weighing on PE and VC activity — as well as GP and LP sentiment — there are plenty of signs for optimism. A short-term decline in investor appetite for private equity does not equate to a reversal. Over time, the European PE industry should continue to grow as long-term investors seek out assets that can generate superior returns to support Europe’s pensioners and savers.

It is not only returns that shape the narrative for private equity’s future, but also the industry’s growing green credentials. GPs and LPs appear in sync with each other, as well as regulation, which is pushing private equity to consider its impact on people and the environment, on top of any purely financial considerations. In this regard, Europe is increasingly standing out from the rest of the world.

A broadening of the PE investor base to individual investors, particularly more mainstream retail clients, will create more practical challenges, such as generating periodic liquidity, as well as more scrutiny. But it will also unlock new capital for which PE firms have clear plans and plentiful opportunities.

Investment in renewable energy infrastructure and technology, life sciences, deep tech, and agribusiness are all top targets. These sectors align with Europe’s broader policy ambitions and play to the deep skillset available among businesses, entrepreneurs, and leading research institutions across the continent. Private equity and venture capital is well positioned and prepared to be catalysts for Europe’s green transition and future economic success.

Previous editions

2020 — “The Insight: Europe’s Private Equity Industry During COVID-19 and Beyond”

2021 — “The Insight: How Europe’s Private Equity Industry Is Anchoring Long-Term Investors”

2022 — “The Insight: Keeping an Eye on the Horizon”

DOWNLOAD THE SURVEY SUMMARY

DOWNLOAD THE FULL REPORT

17 min read • Private equity

The insight: State of the European private equity industry

Are we at a turning point?

DATE

INTRODUCTION

There has been no let up in pressure in 2023, with persistent inflation, rising interest rates, and ongoing geopolitical issues weighing on Europe’s people, businesses, and economies. While these are conditions that the experienced private equity (PE) and venture capital (VC) industry are used to navigating, they are not ones to which it is immune.

Arthur D. Little (ADL) and Invest Europe’s European PE survey, combined with Invest Europe’s first half activity data, takes a clear look at the evolution of fundraising, investment, and divestment in the first six months of the year and gathers fund manager and investor views on the short- and medium-term outlook for activity. The survey also investigates the challenges and opportunities that have the potential to shape Europe’s PE and VC industry further into the future.

Fundraising, investment, and divestment totals slowed in the first half of 2023, coming off high levels in 2022 — namely, record levels of fundraising and the second-strongest year for investment. The interdependence of all these elements and their relationship to the global economy are evident. As growth slows and uncertainty rises, PE divestments weaken, fundraising turns down, and new investment softens.

Fund manager and investor expectations for the outlook reflect the ongoing challenges from factors such as inflation, interest rates, and economic uncertainty, but also point to some tentative signs of improvement. Higher expectations and preparations than last year for exits could signal a pickup in activity that would stimulate fundraising and investment. Near-record levels of dry powder show an industry prepared to be more cautious and conserve capital in more volatile markets, but also well placed to support companies through new investment and follow-ons.

Also on display is the openness of European PE and VC to new opportunities. General partners (GPs) and limited partners (LPs) are embracing new ideas and offerings, including impact funds. Meanwhile, managers are tailoring products to democratize access to the asset class, appealing not only to high-net-worths but also to the broad “mass affluent” segment, as well as smaller retail clients.

As always, sustainability is a central issue for European private equity. Managers are increasingly embracing environmental, social, and governance (ESG) at a firm and fund level, hiring experts, and targeting “green” funds that comply with the highest levels of Europe’s regulatory framework on sustainability, as well as investor expectations.

While the data and survey highlight the short-term pressures facing the industry, they also demonstrate private equity and venture capital’s evolution. Over the medium and longer term, the industry is positioning itself to be more sustainable, while opening up to a broader investor base — putting it evermore firmly at the heart of Europe’s green transition and bringing the benefits of PE performance to more of Europe’s citizens.

1

FUNDRAISING MOMENTUM WEAKENS

PE fundraising slowed in the first half of 2023, coming off record levels achieved during 2022, as a mix of high inflation, rising interest rates, economic uncertainty, and protracted conflict in Ukraine all weighed on Europe’s economy. Invest Europe’s preliminary data shows that funds raised €33 billion from investors in the first half, a decline of 63% on the prior six months.

There is a degree of cyclicality in fundraising with European PE firms having taken advantage of the recovery in 2021 and momentum into 2022 to raise capital. Furthermore, a reduction in the number of exits and a subsequent weaker distribution of capital back to investors have led to more practical constraints to the redeployment of capital into funds.

That said, it was not an equal picture across Europe (see Figure 1). Fundraising by France & Benelux funds remained resilient, largely in line with recent performance. At a lower level, DACH (Germany [D], Austria [A], and Switzerland [CH]) and Southern Europe fundraising was also solid. In contrast, funds raised by UK and Ireland private equity contracted sharply, illustrating the region’s role as a home for many pan-European managers, and the greater impact of global conditions. Nordic funds’ capital raising also slowed notably, reflecting a natural slow-down after a record year with large commitments to some large fund managers.

In the midst of a deteriorating macroeconomic outlook, GP and LP expectations point to the continuation of challenging fundraising markets ahead, albeit with several bright spots and opportunities (see Figure 2). While ~80% of GPs surveyed expect weaker or neutral fundraising in the coming 12 months, the remaining 20% see stronger levels in the year to come. Although weak, the sentiment still reflects an improvement on 2022, indicating a bottoming of fundraising conditions.

As shown in Figure 3, longer-term expectations on allocations to the asset class have softened modestly from 2022, as the prospect of higher interest rates for longer increases headwinds for companies, while also giving investors other options in their hunt for yield. Nonetheless, almost nine out of 10 LPs expect capital allocations to private equity to stay the same or improve over the next three years, illustrating investors’ belief in the potential for private equity to continue to deliver outperformance.

“Higher interest rates and therefore higher bond yields do give investors new options for yield. However, there will always be a place for private equity in the portfolio simply because few other investments can generate that kind of alpha.”

Frank Amberg, Managing Director, Head of Infrastructure Germany, AltamarCAM

In a shifting fundraising landscape, increasing numbers of GPs are attracted by the opportunity to raise funds from wealthy individuals (see Figure 4). Some 85% of fund managers are interested in raising capital from ultra-high-net-worth individuals, reflecting their sophistication and appetite for illiquid assets, as well as the potential for GPs to cater for a relatively small pool of investors. However, the number of firms also considering “mass affluent” clients with assets in the €100,000 to €500,000 range increased sharply to over half, indicating a desire to tailor products to a broader investor base. Less than one in five are drawn to the smaller retail client space, where challenges include the need for products with more liquidity and potentially different fee structures, as well as greater scrutiny and more regulation.

Investors’ increased focus on generating social and environmental value is evident in the funds they intend to back (see Figure 5). Almost a third expect to allocate more resources to impact funds over the coming 12 months versus just 2% that expect to allocate less. The influence of the growing private market funds universe is also evident, giving LPs greater ability to navigate more difficult markets via their commitments. Almost a quarter anticipate allocating more to secondaries funds, while some 20% foresee a higher allocation to both growth and credit funds, as higher interest rates create opportunities for those involved in lending, as well as managers that avoid, or use minimal debt, in their investment models. It is important to note that only a minority of investors expect to allocate less to any private market strategy over the coming 12 months.

The rapid rise of ESG issues up the agenda is also clear in the differentiating factors that investors will look for in managers (see Figure 6). Three-quarters of GPs believe that a strong approach to ESG will be critical for firms to stand out in their quest to attract capital, also highlighting Europe’s leadership role in sustainable investing and the regulation that shapes it. Importantly, ESG considerations move past a GP’s track record — which remains a strong second differentiator — and investment strategy, which moves down the agenda.

2

CHALLENGING CONDITIONS IMPACT INVESTMENT

PE investment weakened in the first half of 2023, as difficult financing conditions and uncertainty around valuations weighed on PE and VC deployment. Invest Europe’s preliminary data shows that total investment levels fell by 47% on the previous half year to €32 billion, continuing the downward trend that began in 2022 (see Figure 7). The number of investments fell at a slower rate indicating that larger leveraged buyouts were most affected by the more challenging environment.

Growth investments declined in number, but more so in investment volume, as funds exercised relative caution around some larger funding rounds for fast-growing and scaling businesses. VC funding slowed at the lowest rate in terms of capital invested, underlining Europe’s robust and vibrant start-up scene, which is continuing to produce and fund early-stage success stories across fields, including deep tech, climate tech, and biotech.

More difficult conditions are impacting GP optimism regarding investment opportunities (see Figure 8). Just one in five anticipate a stronger investment environment over the next 12 months, down 10 percentage points from last year, and more than 30 points below 2021 levels. The corollary is that 50% of managers now see a weaker outlook for investments over the next year.

“The investment outlook is and will remain challenging, until such time as visibility improves and buyer and seller valuation expectations align.”

Dariusz Pietrzak, Partner, Enterprise Investors

While expectations for near-term activity have weakened, the European PE and VC industry is in a strong position. European capital under management (CUM) stands at a record of more than €1 trillion with dry powder of €348 billion, spread across all regions (see Figure 9). Those reserves may be held until conditions become clearer and there is closer alignment between buyer and seller price expectations. However, they also mean a sizeable war chest for new near-term opportunities, including investment that can support existing companies in their growth.

Despite a weak investment outlook, pressure on GPs to return cash to investors that need liquidity will be a key factor shaping activity in the remainder of 2023 and into 2024 (see Figure 10). Over half of GPs expect more secondary buyouts and investments compared to last year. In more challenging markets, GPs have turned to GP-led secondaries to generate liquidity and bring in new capital to invest in portfolio companies — an approach that also enables them to hold businesses for longer, thereby creating greater value and ultimately maximizing returns.

European PE’s focus on sectors that can accelerate the continent’s energy transition and improve citizens’ health is undiminished, in spite of tougher conditions. Renewable energy and life sciences and healthcare continue to top the list of most attractive sectors, with only modest change in their levels of absolute appeal to managers (see Figure 11). At the same time, the attraction of transformative technology and innovative food production techniques are high on rankings, especially deep tech, which has moved up by more than 10 percentage points. Both deep tech and agribusinesses likely are driven by a growing technology content as well as opportunities to automate production processes. Business services is still a hot area as companies are increasingly becoming more reliant on managed services solutions of different sorts.

Industries exposed to higher interest rates and cyclicality remain relatively less attractive to PE managers. At the bottom of the list, some 60% of GPs see real estate as less attractive than over the past 12 months, a significantly larger proportion than in 2022’s survey (see Figure 12). In contrast, fewer respondents see the automotive and consumer goods and retail sectors as less attractive than a year ago, although the percentage expecting a higher level of investment remains below one in 10 in both cases.

While high interest rates are having a clear dampening effect on the European economy, the majority of respondents believe they will have a limited impact on private equity’s ability to finance new acquisitions (see Figure 13). Just over a third assume that higher borrowing rates will have a significant impact, largely in line with the number of respondents last year.

Ongoing geopolitical tension is not only reshaping the landscape in Europe and globally, but also interest and demand in military and defense-related investments. Respondents see more opportunities in that sector, particularly in dual-use technologies that have both military and civilian applications (see Figure 14). Interestingly, LP and GP opinions are in lockstep and indeed even closer than they were last year, as both groups rethink their boundaries on potential ESG exclusions and consider the increased importance of national security and sovereignty.

3

DIVESTMENT ROUTES CHANGING

In parallel with other measures of activity, preliminary data from Invest Europe shows that divestment slowed in the first half, down by 45% on the previous six months to €9 billion. By number of transactions, exits across all segments also fell to lower levels. The uncertain economic outlook, higher interest rates, and geopolitical tensions are all creating pressure on the divestment market, leading to a disconnect between buyer and seller valuations and expectations.

As holding periods lengthen, and it becomes more common for PE firms to own successful businesses for the long term, the data indicates that, for many managers, the best option may be to continue to own the business (see Figure 15). Doing so, they can seek to continue to drive value through operational improvements, while waiting for market conditions to pick up in order to maximize exit value for investors.

GP expectations for the divestment outlook remain low as the threat of economic downturn weighs on companies across the continent (see Figure 16). Only 20% expect a stronger exit environment over the coming 12 months compared to almost double that number expecting a weaker outlook. While sentiment is notably less optimistic than in 2021 in the post-COVID-19 economic recovery, expectations have picked up since last year with those expecting a stronger divestment scene doubling.

Given weak levels of divestment over the past 12 months, more GPs are expecting an improvement in most exit routes than last year — with the exception of management buyouts and buybacks, on which views are largely unchanged (see Figure 17). While only a minority believe that any of the main divestment options will be more common, the largest number — and a sizeable minority — see more proprietary situations. The challenging conditions mean that many managers will be keen to conclude agreements following preemptive approaches or bilateral off-market discussions, reducing scrutiny on processes while allowing parties more time to conduct due diligence. Nonetheless, the number expecting more divestment activity via auctions and IPOs has also increased, reflecting the relative absence of public listings and large managed asset auction processes over the past year.

Both GPs and LPs are in relative agreement over the prospect for continued valuation declines over the next 12 months, following some resetting of valuations and expectations during the past year. Opinions diverge somewhat over the expected volume of transactions, with GPs notably more optimistic than LPs. However, expectations for all parties are markedly better than last year, potentially pointing to a bottoming of the exit market and an uptick in divestments.

4

INFLATION & INTEREST RATES CREATE LARGEST HEADWINDS FOR PRIVATE EQUITY

In keeping with last year, inflation is the leading concern for private equity GPs, with over 60% ranking it as the most negative, or second most negative, factor impacting the economic outlook — the same proportion as LPs who view it as strongly negative (see Figure 18).

Opinions diverge on higher interest rates, which about half of LPs rate as the most negative factor versus approximately a quarter of GPs. Both inflation and interest rates are ranked by LPs and GPs as more serious than economic uncertainty — and well ahead of supply chain disruption, which rated as a more severe issue last year, particularly among GPs, as the world contended with supply issues stemming from COVID-19 and the subsequent normalization of production and trade.

Most recently, the impact of banking failures appears to be the least negative factor by far, reflecting the swift action by European governments and regulators, as well as the greater concentration of issues in the US regional banking space.

“Inflation is not going away without a fight. That and high interest rates will be serious headwinds for private equity for the foreseeable future.”

Elias Korosis, Partner, Federated Hermes GPE

When it comes to factors that are within the PE industry’s control, well over two-thirds of GPs and LPs expect to spend more time on ESG issues and the collection of KPI data points (see Figure 19). More than two-thirds of GPs also anticipate more attention to diversity and inclusion in their near-term operations, ahead of LPs who may have had more focus on the topic in recent times. The majority of GPs expect to have more focus on all issues, demonstrating their attention to navigating challenging markets and conditions, while addressing rising regulatory requirements and investor demands.

The near-term focus of GPs is also evident in the due diligence fields receiving heightened scrutiny. More than three-quarters of managers expect to do more assessments around ESG and cybersecurity (see Figure 20). Consideration of digital maturity at businesses and geopolitical risks will also receive more attention among over half of GPs, followed by assessments of global financial risks. Less important are intellectual capital considerations and the threat of future pandemics, although 98% of GPs expect some form of change to their due diligence procedures.

“Managing ESG is having a clear impact on our time and resources. Ultimately, it’s an opportunity — as a way of attracting LP capital, generating new investments, and adding value to companies.”

Maaike van der Schoot, Head of Responsible Investment, AlpInvest, a core division of Carlyle

5

REGULATION DRIVES ESG TRENDS & INVESTOR EXPECTATIONS

Europe’s lead in developing robust regulation on sustainable investment is creating an important shift in GP positioning and investor expectations. The implementation of the Sustainable Finance Disclosures Regulation (SFDR) has led to the majority of LPs expecting GPs to register their vehicles as Article 8 or 9 green funds, mirrored by the number of GPs who see LPs expecting them to register funds that target higher levels of social or environmental benefit.

The demand for green funds, in combination with the level of measurement and reporting they require, is having a significant impact on fund managers (see Figure 21). About half of GPs anticipate a high impact on firm resources, including the creation of dedicated ESG roles, although around a third expect to be able to fulfil their responsibilities with existing staff. Only a small minority see no change to their positioning as a result of SFDR.

While ESG is perhaps the most significant issue for the European PE industry, other regulatory considerations are having an impact on firms (see Figure 22). Most notable is tax regulation affecting fund structures and capital income, particularly as a looming general election in the UK reignites the debate around carried interest taxation in one of the largest markets. Amendments to fund manager regulation are seen having a significantly negative impact as well, despite Alternative Investment Fund Managers Directive (AIFMD) reforms that should have a relatively benign impact on private equity.

At the bottom of the list, limitations to foreign direct investment (FDI) in Europe and new foreign subsidy rules, along with regulatory requirements on portfolio companies’ production or processes, which may include anticorruption measures and new carbon taxation, are seen having least impact.

6

DIGITALIZATION AT FOREFRONT OF INCREASING OPERATIONAL FOCUS

The difficult business backdrop is increasing GPs’ focus on portfolio companies (see Figure 23). Two-thirds of managers expect to enhance operational support and development at their businesses, an uptick over last year’s result. Next, comes a focus on portfolio company exits, another clear signal that GPs see some improvement in the exit environment and that operational activities may be key to getting companies exit ready. Moderately more GPs expect to spend more time on originating proprietary investments over the coming year.

The main improvement initiatives remain largely unchanged from last year (see Figure 24). Two-thirds of GPs see digitalization as the most important initiative to be undertaken at portfolio companies, followed by measures to drive organic growth. Cost-efficiency remains critical, as does acquisition-led growth — albeit at a lower level than last year as firms contend with increased market pressures. Sustainability initiatives have dropped down the list, potentially reflecting the already strong progress made on ESG at portfolio companies, and the relative increase in importance of GP-level measures to comply with regulation and investor expectations.

“Operational improvement has never been more important. There are any number of levers we can pull to drive top-line and bottom-line performance at our companies.”

Bill Watson, Managing Partner, Value4Capital

CONCLUSION

The outlook for Europe’s economy remains challenging with little sign of improvement on the near-term horizon. The message from central bankers that interest rates will stay higher for longer than previously anticipated aims at dampening the remnants of inflation. The almost inevitable consequence will be economic slowdown.

Yet, while the macroeconomic backdrop is weighing on PE and VC activity — as well as GP and LP sentiment — there are plenty of signs for optimism. A short-term decline in investor appetite for private equity does not equate to a reversal. Over time, the European PE industry should continue to grow as long-term investors seek out assets that can generate superior returns to support Europe’s pensioners and savers.

It is not only returns that shape the narrative for private equity’s future, but also the industry’s growing green credentials. GPs and LPs appear in sync with each other, as well as regulation, which is pushing private equity to consider its impact on people and the environment, on top of any purely financial considerations. In this regard, Europe is increasingly standing out from the rest of the world.

A broadening of the PE investor base to individual investors, particularly more mainstream retail clients, will create more practical challenges, such as generating periodic liquidity, as well as more scrutiny. But it will also unlock new capital for which PE firms have clear plans and plentiful opportunities.

Investment in renewable energy infrastructure and technology, life sciences, deep tech, and agribusiness are all top targets. These sectors align with Europe’s broader policy ambitions and play to the deep skillset available among businesses, entrepreneurs, and leading research institutions across the continent. Private equity and venture capital is well positioned and prepared to be catalysts for Europe’s green transition and future economic success.

Previous editions

2020 — “The Insight: Europe’s Private Equity Industry During COVID-19 and Beyond”

2021 — “The Insight: How Europe’s Private Equity Industry Is Anchoring Long-Term Investors”

2022 — “The Insight: Keeping an Eye on the Horizon”

DOWNLOAD THE SURVEY SUMMARY

DOWNLOAD THE FULL REPORT