DOWNLOAD

DATE

Contact

Rising trend in Latin America

Accelerating competition, new technological requirements, and ever-growing data demand have increased CAPEX requirements for MNOs in the Latin America (LATAM) region. Given the necessity of enhancing mobile network reach and capacity, several MNOs have sought cash relief by outsourcing their passive infrastructures to TowerCos, which handle the management of entire networks through built-to-suit (BTS) solutions.

Recently, the presence of TowerCos has strengthened in LATAM, in particular. We see this trend through the number of large portfolio transactions as well as the entry of new TowerCos to the region; nevertheless, there is wide dispersion within the region in terms of overall TowerCo penetration, with countries like Mexico or Brazil nearing 100% and countries like Argentina or Bolivia below the 20% penetration mark.

Surprisingly, despite providing long-term network services to MNOs, TowerCos have yet to fully reach the status of strategic partners, as their dominant business model remains mainly transactional in nature. Service differentiation, if any among TowerCos, depends on asset capillarity, flexible pricing schemes, prompt time to market, and contract flexibility (on already long-term arrangements). Consequently, the current TowerCo-MNO relationship model, where value-added services are unknown, has resulted in diminished entry barriers for new players.

TowerCos at risk for commoditization

Although the market has presented several growth opportunities, with growing numbers of M&As and new build requirements, TowerCos’ value proposition has not evolved and now risks becoming a commoditized business, where pricing and volume are often the only factors appreciated by MNOs in selecting TowerCo partners.

In seeking to understand the key value drivers of this passive infrastructure strategy, Arthur D. Little (ADL) conducted 30+ interviews with regional MNOs in LATAM in order to collect insights regarding MNOs’ needs, their views on TowerCos, and the new opportunities that could emerge soon.

Tower colocation drivers

When it comes to network rollouts, most MNOs aim to improve coverage or offer capacity in the most efficient manner. Thus, site location and fast-paced deployments are fundamental drivers when MNOs decide between partnering with a TowerCo or doing the rollout themselves. Although opinions vary within MNO management teams (e.g., between CFOs and COOs), we found that more than 70% of MNOs interviewed have a stronger preference for colocation versus deploying new sites on their own. Colocation allows for a quick response to market dynamics and captures up-front CAPEX savings. All in all, this offers greater efficiency in allocation of resources in the MNO’s core business and, consequently, the opportunity to maintain a more competitive positioning.

Our analysis also shows that more than 90% of MNOs consider site capillarity as a key decision driver for selecting a TowerCo partner. A detailed colocation portfolio complemented by future rollout plans is a priority, while operational capabilities of the TowerCo, such as on-site maintenance and quick response time when additional colocation is needed, are of importance, too.

Even in the presence of a robust tower portfolio, with sites in strategic locations, pricing remains a critical factor to the extent that more than 60% of MNOs prefer to share sites with competitors in order to enjoy a lower price, thanks to passive infrastructure sharing agreements.

With respect to contractual preferences, 40% of MNOs interviewed mentioned that they had signed master lease agreements (MLAs), which limit pricing and contractual flexibility compared to more agile contractual terms made possible by master service agreements (MSAs). To a certain extent, MNOs give preference to pricing advantages over contractual flexibility, as pricing is often the main driver for selecting a TowerCo in the negotiation process. TowerCos collect extra revenues through contractual flexibility in the form of site amendments and improvements.

Notably, all MNOs interviewed consider that, as colocated tenants, TowerCos should offer more competitive pricing schemes and shorter contractual duration than for anchor tenant agreements. This expectation arises from the fact that most TowerCo expenses are fixed costs (e.g., ground lease rent, site maintenance, security, insurance); thus, revenue generated from additional tenants tends to come at a marginal cost.

Lastly, MNO interviewees mentioned that having optimal service-level agreement (SLA) commitments is a minimum requirement to operate under a TowerCo agreement. An SLA is considered a direct, non-costly consequence of previous colocation experiences and eventually determines future colocation requirements.

Growth opportunities from new site deployments

When it comes to BTS solutions, 65% of MNOs interviewed have considered partnering with a TowerCo only when there is a BTS requirement. Incumbents (market leaders) would lean toward intensifying their positioning by acquiring strategic locations and limiting site-sharing agreements. These types of players typically have relatively low CAPEX limitations. In contrast, market challengers, which often disrupt the market through aggressive value propositions, consider TowerCos as tactical partners to enhance their network coverage, leveraging BTS solutions on unattractive footprints or under cash constraints.

However, market challengers tend to capture transactional value from TowerCos through the deployment of passive infrastructure under their reach. Therefore, market challengers will seek a differentiated value proposition from TowerCos when they wish to seek a partnership deal.

Lastly, when it comes to followers or small players, TowerCos are considered potential financial partners. Given cash constraints due to competition, most operators leverage their current and future passive infrastructure on third parties.

Of those MNOs willing to collaborate with TowerCos on BTS beyond contractual agreements eroded from the MNOs’ financial constraints, ADL has identified three critical levers for selecting a TowerCo on BTS assignments: (1) time to market, (2) risk aversion, and (3) contractual flexibility.

Threats to TowerCo growth

Given deployment speed and financial constraints, RAN sharing agreements stand out as an attractive alternative, particularly for non-incumbent MNOs, because such agreements strengthen their network reach by reducing OPEX and CAPEX.

As part of our interview findings regarding RAN sharing opportunities and their implications on the TowerCo-MNO relationship, we found that price premiums or contractual limitations to RAN sharing agreements are considered drawbacks in negotiations between TowerCos and MNOs, unless they imply the physical modification of a site.

Among reasons that price premiums and contractual limitations are considered drawbacks, MNOs shared the following two key highlights: (1) paying a premium is an additional benefit for TowerCos that requires no effort; and (2) although active sharing doesn’t limit colocation space within existing sites, it does limit TowerCos’ addressable market for colocations. Therefore, MNOs often will accept premiums or additional charges if it involves reallocation or other active equipment within the tower.

When it comes to TowerCos’ operational capabilities, they are perceived as minimum requirements rather than key decision factors in determining TowerCo partnerships. MNOs expect adequate site maintenance, site security (particularly on high-risk areas of vandalism and robbery of MNOs’ active equipment), and quick response to their technical requirements.

Despite a limited appetite for RAN sharing, MNOs foresee it becoming an essential trend in the future since it could improve operational efficiency, particularly in low-density areas where coverage infrastructure is rather complex to deploy.

From ADL’s previous case experience, we have seen that MNOs could reach an average of 20%-35% in-network OPEX savings within the first years of implementing a network sharing agreement (NSA). Although this could erode market growth for infrastructure players, early adopters have approached MNOs to involve a third party within such agreements.

Becoming a strategic partner

TowerCos should focus on creating a customer-centric approach and steer away from the current view of TowerCos as “banks/financial partners.” It will not be enough to deliver infrastructure services under the conventional operational mindset. Instead, TowerCos should pursue a sound effort to excel and innovate the “grass and steel” model.

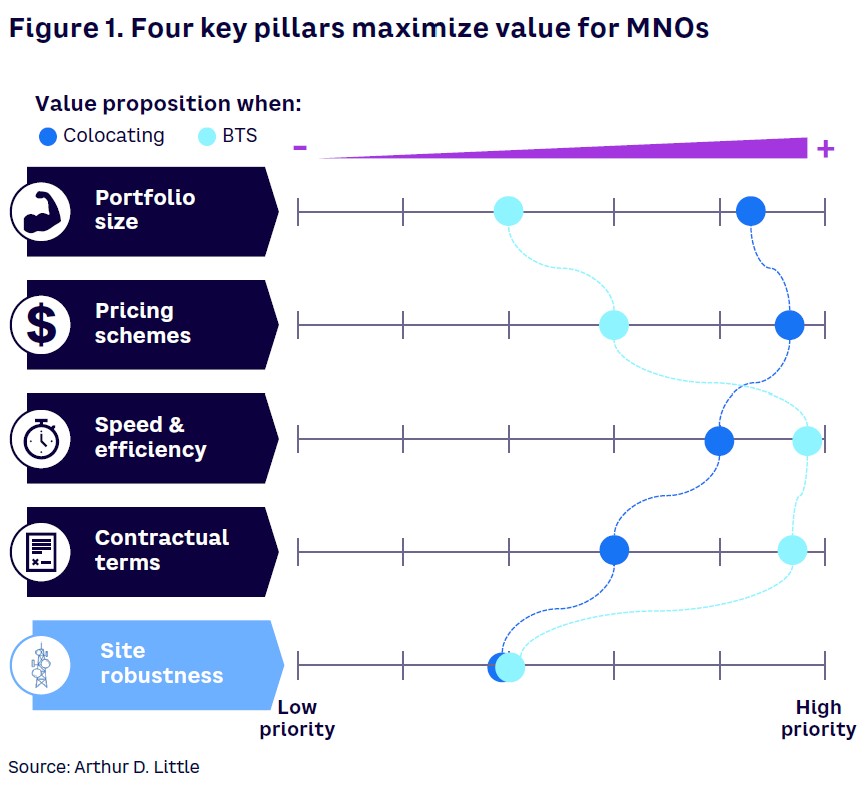

As a result of our interviews with MNOs, we have identified what constitutes a successful TowerCo partner. As illustrated in Figure 1, four key pillars stand out as value maximizers by MNOs:

- Robust portfolio and footprint capillarity. A strong footprint is critical for considering a TowerCo as a strategic partner. About 85% of MNOs interviewed believe location is one of the most critical factors when colocating. A robust portfolio is the starting point for building a value-added proposition as it could also incentivize business model alternatives (e.g., MSAs) if the InfraCo business model allows it.

- Pricing schemes. MNOs have commoditized the colocation business beyond location; there’s little room to differentiate in a more competitive way than pricing. Roughly 40% consider pricing schemes the most important factor for entering a BTS agreement with a TowerCo. It is not only about the lower fee, but there are also several alternatives to be competitive within pricing schemes, such as arrangements in local currency, reasonable escalation index, grace periods, among others.

- Quick time to market. Fully 100% of MNOs interviewed agree that time to market is a top priority when selecting the ideal TowerCo either for colocation or a new BTS. TowerCos’ strong relationships with local municipalities and previous engagement experiences are vital levers when assessing TowerCos’ time to market.

- Ease of contract flexibility. On-site space-utilization flexibility is highly appreciated by MNOs, as are shorter contractual terms when being a colocated tenant. Specifically, 40% of MNOs interviewed consider contract flexibility (e.g., MSA) as a highly attractive value proposition from TowerCos. However, MNOs are aware of the negative implications of on-site capacity given ease of contract flexibility and are willing to invest more resources, if required.

MNOs also seek factors such as site robustness in terms of infrastructure quality, at a bare minimum; beyond infrastructure, robustness is highly appreciated but not a critical differentiator.

Strengthening TowerCo partnerships

When it comes to new business opportunities, TowerCos should formalize new, innovative offerings within their existing sites and adjacent infrastructures — bearing in mind the idea for creating partnership models through understanding customer needs rather than using a transactional approach.

Within the traditional colocation business model, there’s room for TowerCos to move toward adjacent services, such as active equipment maintenance, energy as a service, or even creating lease-up models for active equipment. However, TowerCos should be cognizant of MNOs’ bargaining power with active equipment vendors. Whether from a financial perspective or an operational build-up model, a partnership model could allow TowerCos to differentiate from the traditional sale-and-lease business model. And when assessing potential industry threats like NSAs, TowerCos could act as an operational partner, providing both active and passive equipment. There’s a need for technology sync within MNOs’ dynamic infrastructure or, among others, through inorganic growth by acquiring the joint entity of site-sharing agreements.

Technology evolution and end-customer data consumption have created new business opportunities for network densification within new infrastructure models (e.g., small cells or DAS solutions). Some regional TowerCos have already invested in such opportunities along with their underlying infrastructure by deploying fiber networks — offering new alternatives for MNOs toward network densification. Those initiatives present attractive opportunities that should be assessed on a case-by-case basis, given TowerCos’ capabilities, regional presence, and client appetite.

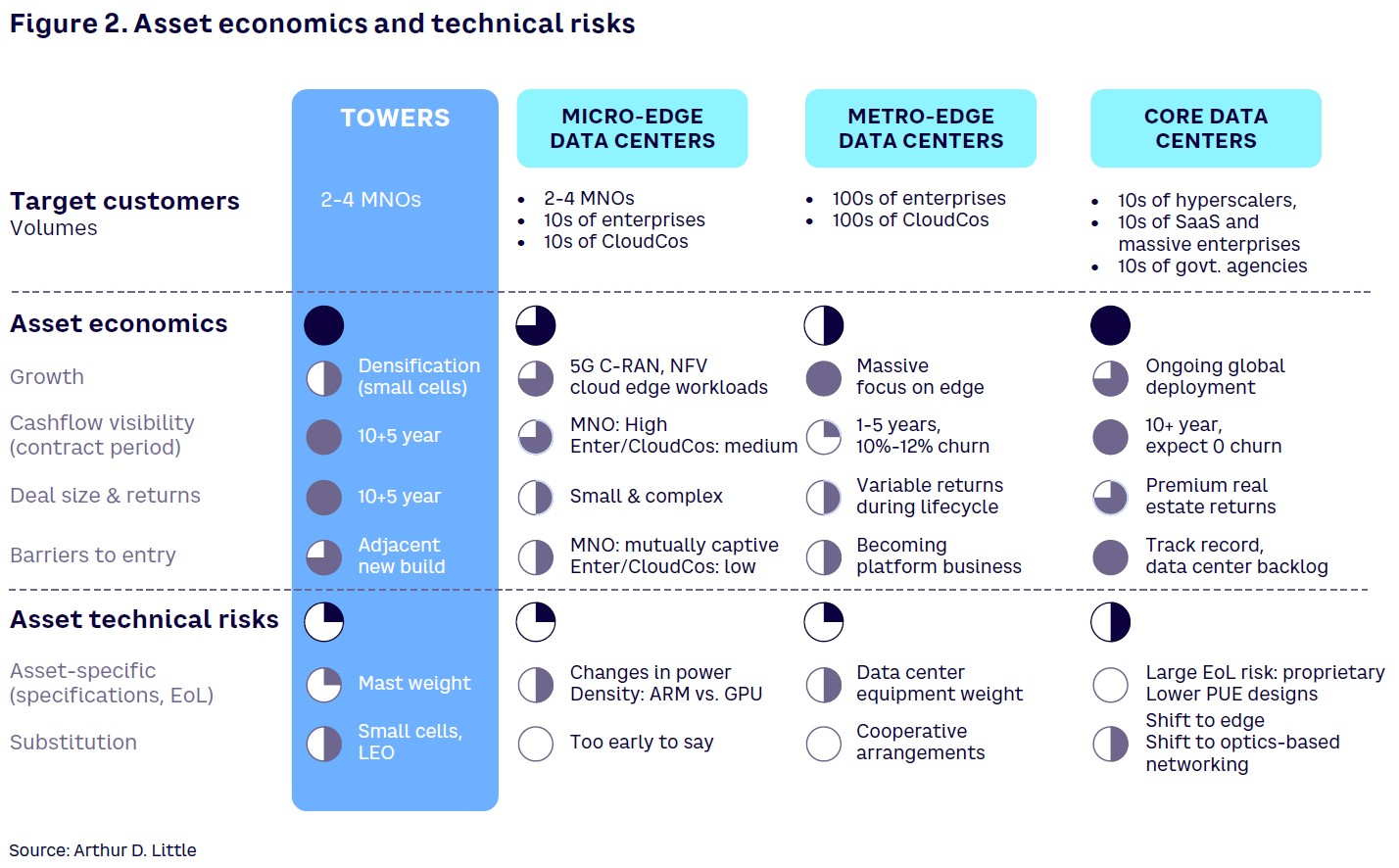

One emerging opportunity that TowerCos have been explored is within the data center ecosystem. Attractiveness varies across investable data center asset classes, from micro-edge data centers to core data centers (see Figure 2).

From a TowerCo perspective, we can look at the data center opportunity in two very different ways: (1) a turnkey connectivity solution for MNOs or other customers or (2) a diversification opportunity. When seen as a diversification opportunity, synergies can be captured and may even act as a hedge against unfavorable changing market dynamics in the MNO’s core business, where shareholders’ interest and investment appetite usually drive the playbook.

Suppose the MNO’s decision criteria revolves around a customer-centric approach. In that case, strong adjacencies should align with the TowerCo’s existing customers and assets portfolio, where addressable opportunities arise within telco workloads, 5G, FTTH (fiber to the home), captive Internet of Things, and, in the near future, MNO edge computing. Although operator edge is a niche and complex opportunity, it could translate into an enhanced customer relationship with MNOs in their network densification journey.

Conclusion

The path toward partnership

Diversification is no longer just an option for TowerCos. Highly competitive pricing schemes in a commoditized market, where pricing and portfolio robustness are the most relevant success factors, can cause TowerCos to fall short in a competitive market. To become a strategic partner, they must follow a customer-centric approach through growth alternatives, developing and offering new, adjacent opportunities. Moreover, TowerCos must carefully select which opportunities fit best according to their capabilities and clients’ needs. We recommend the following action plan:

- Perform an introspection to define your “core” by determining which assets are most strategic (e.g., towers, fiber backhaul, data centers), understanding requirements for the MNO’s future network, and defining the ideal “asset basket” mix.

- Tailor the best strategy by pursuing deals with industrial or financial partners and deciding what sites to include in such deals (e.g., legacy sites, sites with major CAPEX requirements, network extension).

- Define a clear roadmap for moving ahead in the physical asset investment/divestment game.

Depending on needs, strategic orientation, capabilities, and desired involvement level, different options can be proposed, including sales and leasebacks, network management deals, joint ventures, and ad hoc deals.