18 min read • Energy, Utilities & Resources

Offshore wind & hydrogen integration

How sector coupling can support a resilient decarbonization of Europe

Executive Summary

EXPLORING OFFSHORE WIND & HYDROGEN INTEGRATION MODELS

Green hydrogen will be one of the world’s key enablers toward full decarbonization. This sustainable energy source can serve as an energy carrier and offers a carbon-free substitute for fossil fuels, mainly natural gas, thereby providing the heavy industry and heavy-duty transportation sectors with a viable decarbonized alternative. The EU has embraced this renewable energy source as a vehicle to achieve its decarbonization target and has set the target to produce half of its hydrogen demand locally by 2030.

Based on its analysis, Arthur D. Little (ADL) has concluded that a viable, cost-effective method for producing this future hydrogen demand in Europe will be through the use of offshore wind, as this energy source is natural, clean, and abundant. Furthermore, this hybrid model provides many benefits, such as cost savings, effective scaling opportunities, and an additional source of flexibility that can help resolve electricity grid constraints. The most advantageous setup to implement this hybrid model will differ across countries as it is largely dependent on local power market dynamics and geographical characteristics (water depth, distance to shore, etc.), among other things. Further, this shift will impact the entire energy value chain, making meticulous strategic assessment crucial for all affected players.

1

SUSTAINABLE HYDROGEN PRODUCTION: A CORNERSTONE OF EU DECARBONIZATION

MANY COUNTRIES FOCUS ON HYDROGEN, FOR GOOD REASONS

Hydrogen’s popularity is growing all around the world. According to the World Economic Forum, hydrogen could account for up to 12% of global energy use by 2050. China is currently the largest producer (and consumer) of hydrogen worldwide and has recognized hydrogen to be one of six key industries of the future. Alongside China, both the US and the EU have also declared big investment plans to boost clean hydrogen development for both production and consumption. Other countries, however, like Morocco and Namibia in Africa and Gulf countries such as the United Arab Emirates (UAE) and Saudi Arabia, have made the strategic decision to position themselves as net exporters of green hydrogen. These few examples indicate that countries can position themselves very differently with regard to a hydrogen-driven future, which showcases the strategic importance of this new energy source.

OFFSHORE WIND IS A PROMISING RENEWABLE ENERGY SOURCE

In 2022, 96% of Europe’s hydrogen was produced using natural gas (grey hydrogen), resulting in large CO2 emissions. This production process is not sustainable, even if the emitted CO2 is captured (blue hydrogen). So-called green hydrogen is produced through the electrolysis of water using renewable electricity. For this process, Europe requires large quantities of renewable energy on top of what is already being produced to decarbonize its electricity supply. Some countries, such as in the Gulf or Africa, can rely on their abundant sun to produce hydrogen from large-scale solar photovoltaic (PV) fields. However, this is not viable in many parts of Europe. Neither does the European mainland have sufficient hydroelectric or geothermal potential to produce its large hydrogen demand.

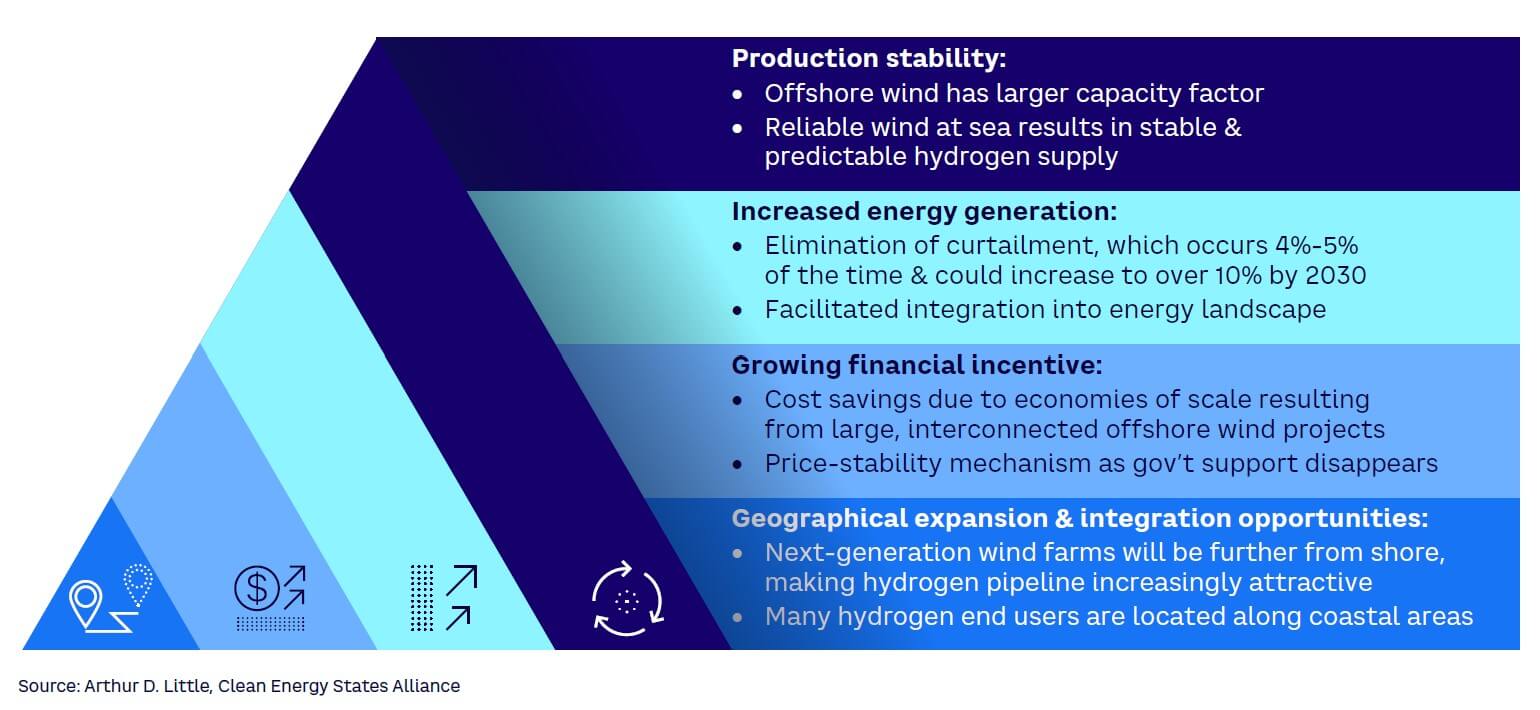

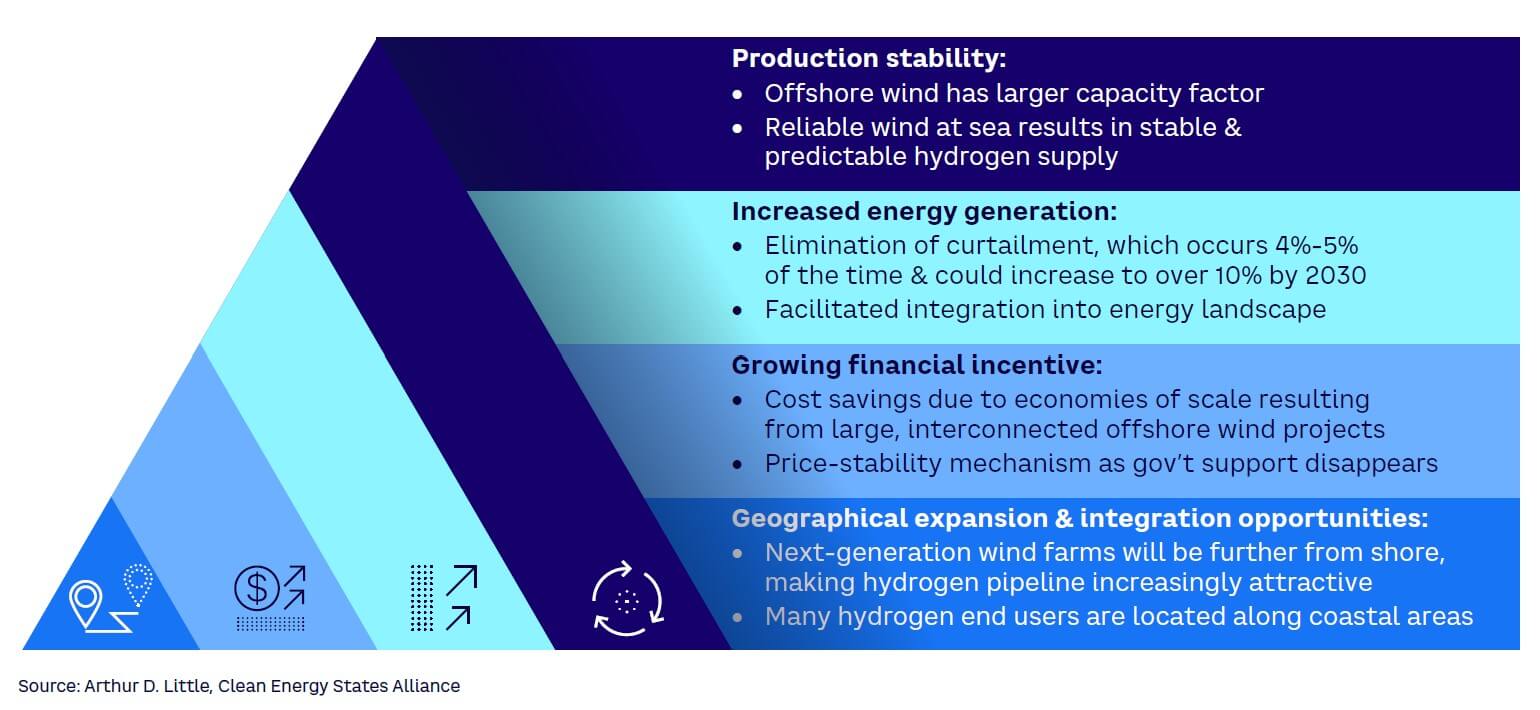

Offshore wind, however, could present a viable solution for Europe, as regions like the North and Baltic Seas have strong winds and shallow coastlines, making them suitable to deploy offshore wind farms in a cost-effective manner. The conditions for offshore wind are overall more favorable than for onshore wind as the continent is densely populated and winds are, in general, stronger and more stable offshore than on land. One key consideration is offshore wind’s levelized cost of energy (LCoE), which, in Europe is still larger than for onshore wind or solar PV. However, as indicated in Figure 1, hydrogen production from offshore wind in Europe presents four main advantages that drive its use case over other renewable energy sources such as onshore wind or solar PV:

-

Production stability

-

Increased energy generation

-

Growing financial incentive

-

Geographical expansion and integration opportunities

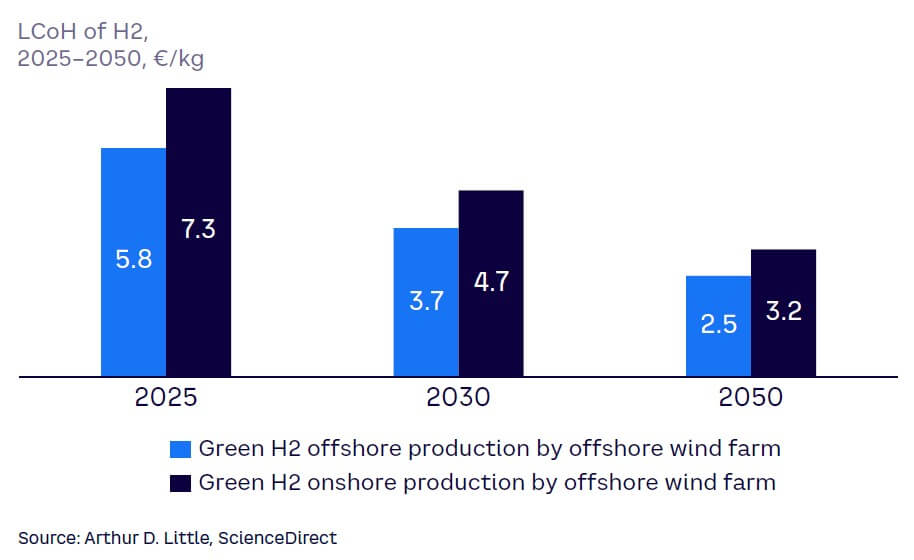

AN ECONOMICALLY VIABLE OPTION IN THE LONG TERM

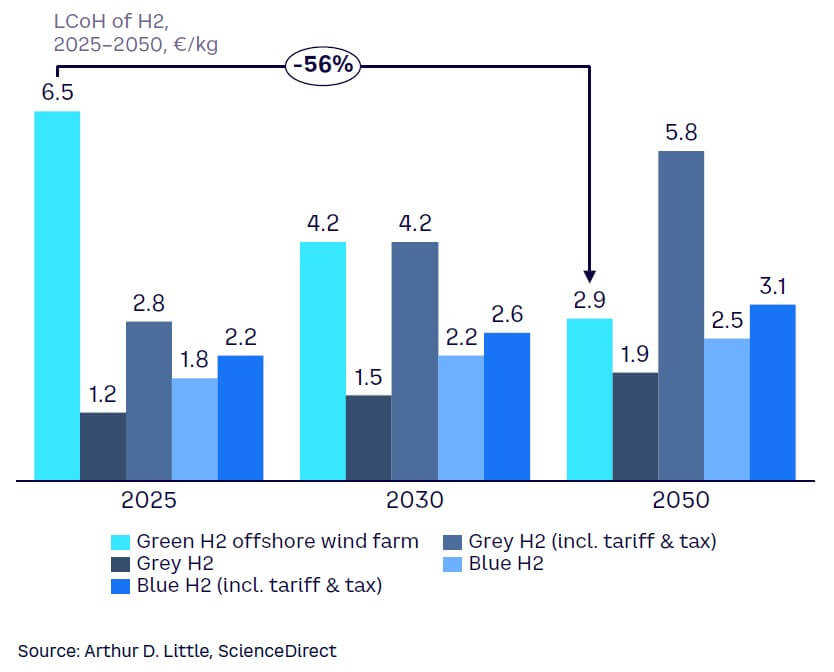

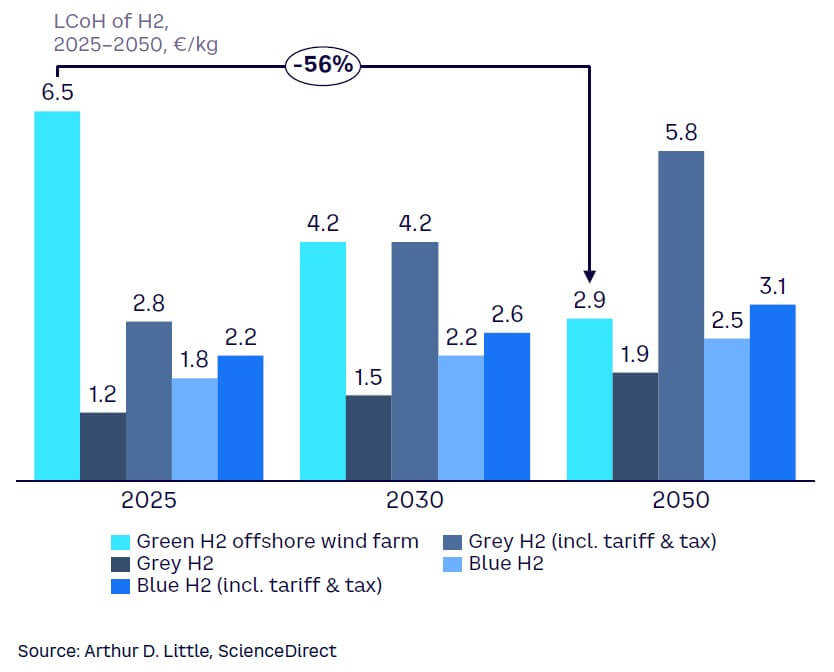

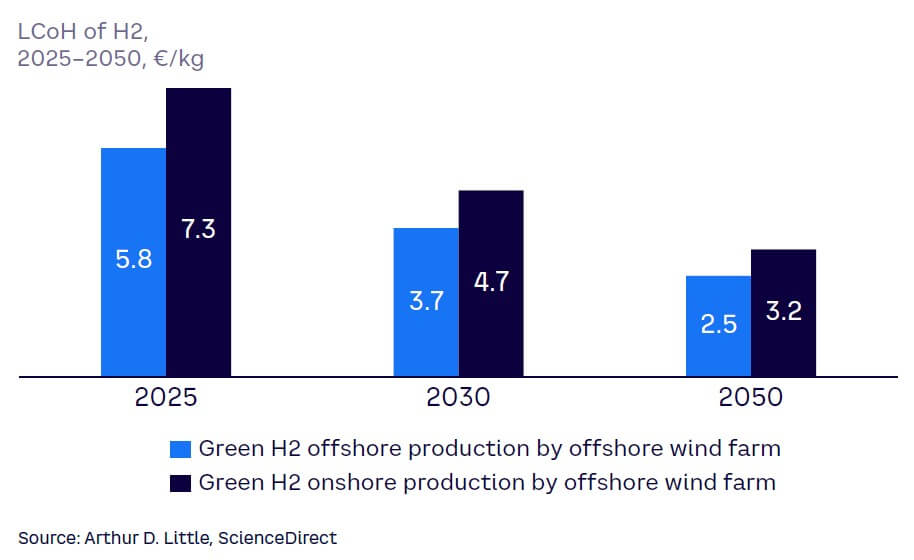

For green hydrogen to be considered for combustion applications, it must be cost-competitive with other forms of hydrogen. To analyze this potential, the levelized cost of hydrogen (LCoH) of the different hydrogen types has been forecasted for the coming decades (see Figure 2). The green hydrogen scenario uses the reference case of a real-life offshore wind farm, Hornsea 2 (a 1,320 MW wind farm at 89 km from shore), taking the average cost of a configuration with an offshore and onshore electrolyzer. The tariffs and taxes imposed on grey and blue hydrogen scenarios follow legislation currently in place by the European Commission. The results indicate that green hydrogen produced from offshore wind farms has the potential to become cost-competitive in the long term.

The main conclusions from the analysis include:

-

Green hydrogen’s LCoH produced from offshore wind farms will see a 56% cost reduction by 2050, resulting mainly from reductions in the offshore wind LCoE and electrolyzer cost (>60% of total cost reduction will take place by 2030).

-

Green hydrogen from offshore wind farms has the potential to become cost-competitive with grey and blue hydrogen in the long term (2050).

-

In the short term, green hydrogen requires additional subsidies and financial incentives to be cost-competitive.

The analysis in Figure 2 relates to hydrogen as a substitute for natural gas in heavy industries and heavy-duty transportation, rather than as a source for energy storage. At this stage, natural gas has not been taken up in the quantitative comparison as European legislation is focused on phasing out its use in industrial processes.

Furthermore, while natural gas price is not expected to increase significantly (as can be derived from the regular grey and blue hydrogen projections in Figure 2), the cost of emitting CO2 (e.g., taxes, offset, capture) will significantly increase in the coming decades. Additionally, while gas prices can be very volatile, producing green hydrogen locally offers a possible method to mitigate potentially damaging price fluctuations. It should be noted that all heavy industry and heavy-duty transportation infrastructure (e.g., pipelines, processes, engines) is currently designed for fossil fuels, and this must be adapted for the eventual use of hydrogen.

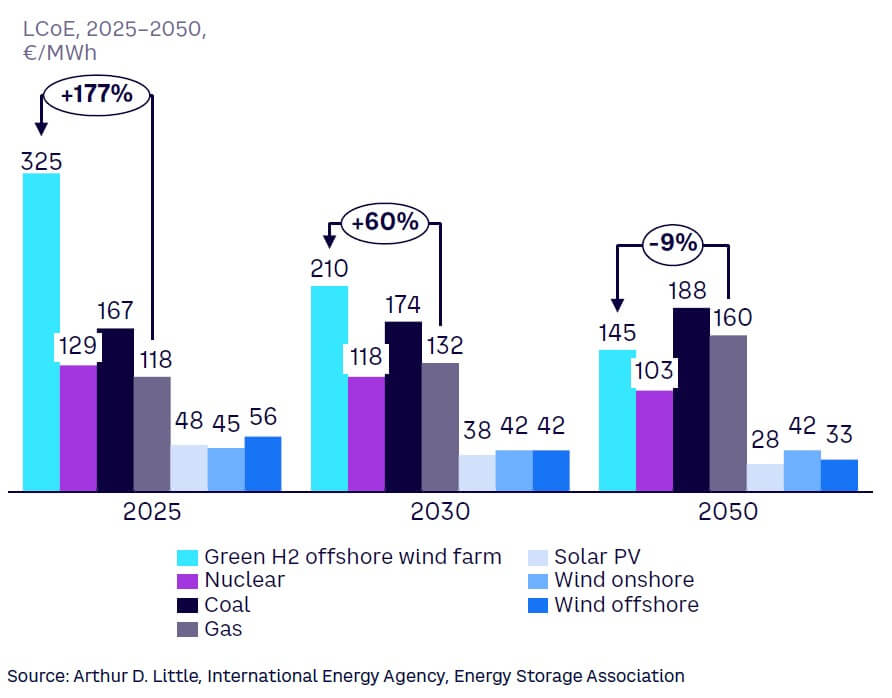

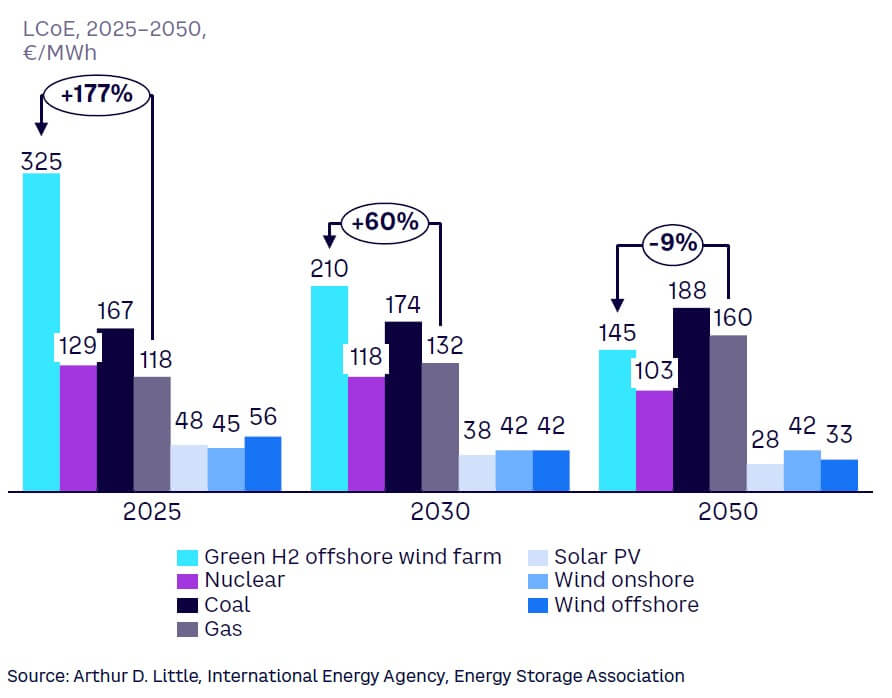

A second use case that green hydrogen presents is the possibility to store energy and provide additional flexibility, which can be leveraged as an electricity grid–balancing mechanism. Therefore, a second analysis required to assess the use case for offshore wind and hydrogen integration is the comparison of green hydrogen with other traditional energy sources for electricity as an end product. An important note here is the limitation of regular renewable energy sources, which cannot serve as flexibility mechanisms as these are themselves intermittent. Therefore, if renewable energy sources are available, their use for electricity production will always be prioritized over hydrogen, making the comparison of hydrogen and natural gas most relevant. Figure 3 illustrates the forecasted LCoE for different electricity sources over time.

The main conclusions from the analysis include:

-

The LCoE of offshore wind currently exceeds onshore wind and solar PV but will become a cost-competitive option in the near future (2030).

-

Electricity produced from green hydrogen (from offshore wind farms) could have a competitive LCoE relative to carbon-emitting alternatives in the future.

Additionally, with the re-electrification of hydrogen, around 40% of the total energy is lost in the process. These large energy losses make hydrogen an inefficient method to produce electricity and should preferably be used as an end product in its gaseous form.

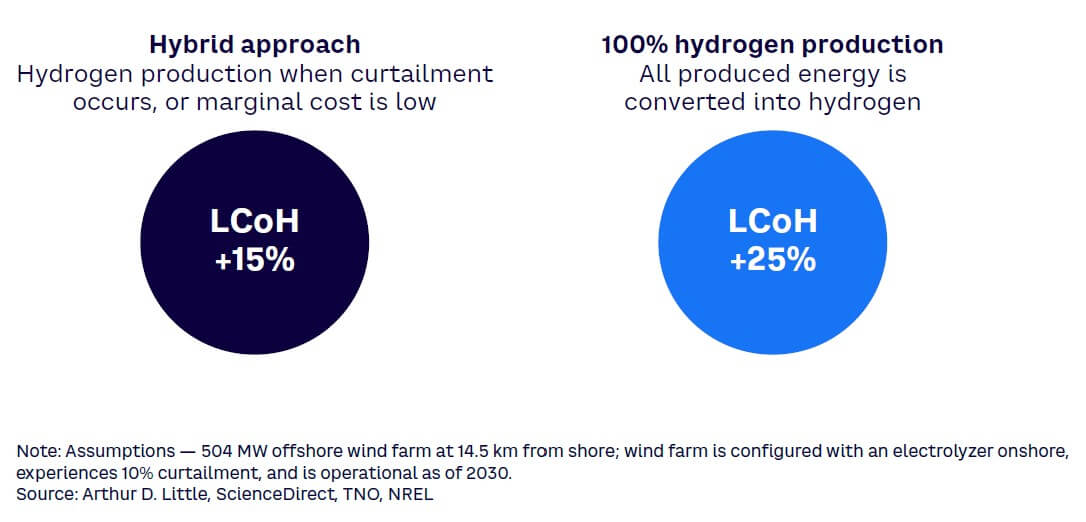

FINANCIAL INCENTIVES NEEDED TO STIMULATE ADOPTION IN THE SHORT TERM

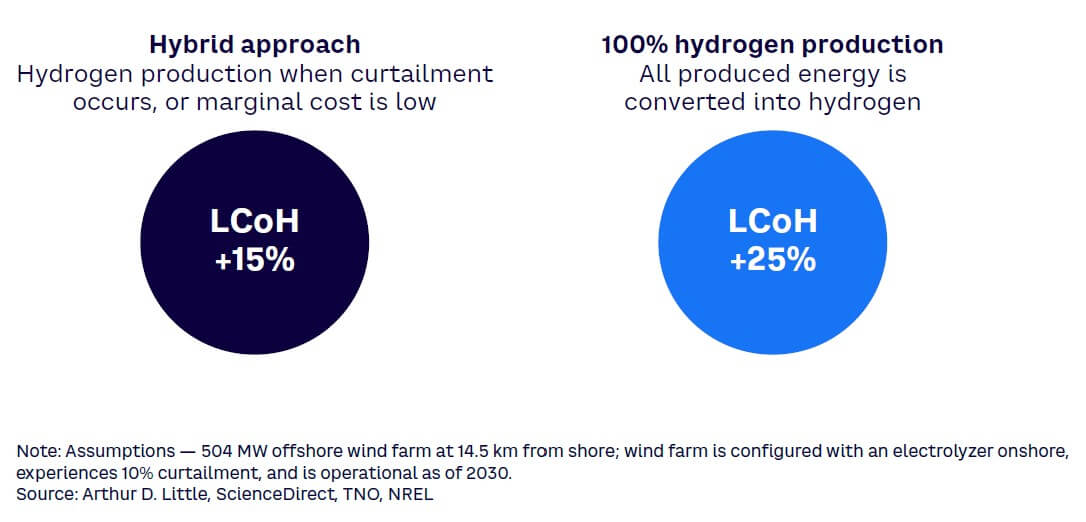

While green hydrogen produced by offshore wind has the potential to become a cost-competitive energy source in the long term, it will still suffer from a higher cost compared to conventional energy sources in the short term. The absence of this financial incentive to reconfigure wind farms into hydrogen-producing hubs is confirmed in the analysis of profitability scenarios for different offshore wind farm configurations. In the short term (2030), a conventional wind farm selling 100% of its produced electricity to the grid would still realize a larger net present value (NPV) than configurations that include hydrogen production. This outcome stems from hydrogen being a product that will be sold through a “cost plus” method and the fact that green hydrogen will still be the molecule’s most expensive form. These elements make the large markups required to match the NPVs of traditional wind farms, as illustrated in Figure 4, seem unrealistic.

2

DIFFERENT COUNTRIES REQUIRE DIFFERENT INTEGRATION MODELS

POTENTIAL FOR OFFSHORE WIND IS COUNTRY-DEPENDENT

Although offshore wind presents a promising prospect for green hydrogen production in Europe, not all countries should act on this opportunity. In addition to the potential to build offshore wind farms, three other factors impact a country’s potential for coupling offshore wind with hydrogen:

-

Decarbonization priority. A country that must further decarbonize its power system would need to sell the largest portion of the electricity generated by offshore wind farms. On the other hand, a country with an already-decarbonized electricity supply that places a larger focus on the decarbonization of heavy-duty transport or heavy industries could make hydrogen production viable. Linked to this, the readiness of a country’s local hydrogen infrastructure and network is also crucial for potential adoption.

-

Geography of the country and its sea(s). Hydrogen pipelines are cheaper per kilometer than electricity cables, and this cost advantage is magnified as the distance from shore increases, making the model more attractive when wind farms are far from shore (when offshore electrolyzers are used). Hydrogen pipelines, therefore, provide expansion opportunities even if the available space close to shore is saturated with existing wind farms (or other infrastructure). Wind farms farther from shore also give countries access to stronger and more stable wind speeds. Furthermore, the type and depth of the seabed also play a role. Additionally, hydrogen production from offshore wind is more attractive from a financial and practical viewpoint when the main usage (in industrial sites) is located close to a country’s coastline.

-

Capacity and cost competitiveness of green hydrogen compared to other renewable sources. A portion of the produced hydrogen could be used as a flexibility mechanism to add electricity to the grid when needed (called P2H2P or “power to hydrogen to power”). Doing so with green hydrogen is currently more expensive than other renewable sources in most parts of Europe. With the evolution of the LCoE of the different sources, as presented in Figure 3, sector coupling of green hydrogen could become cost-competitive in the long term.

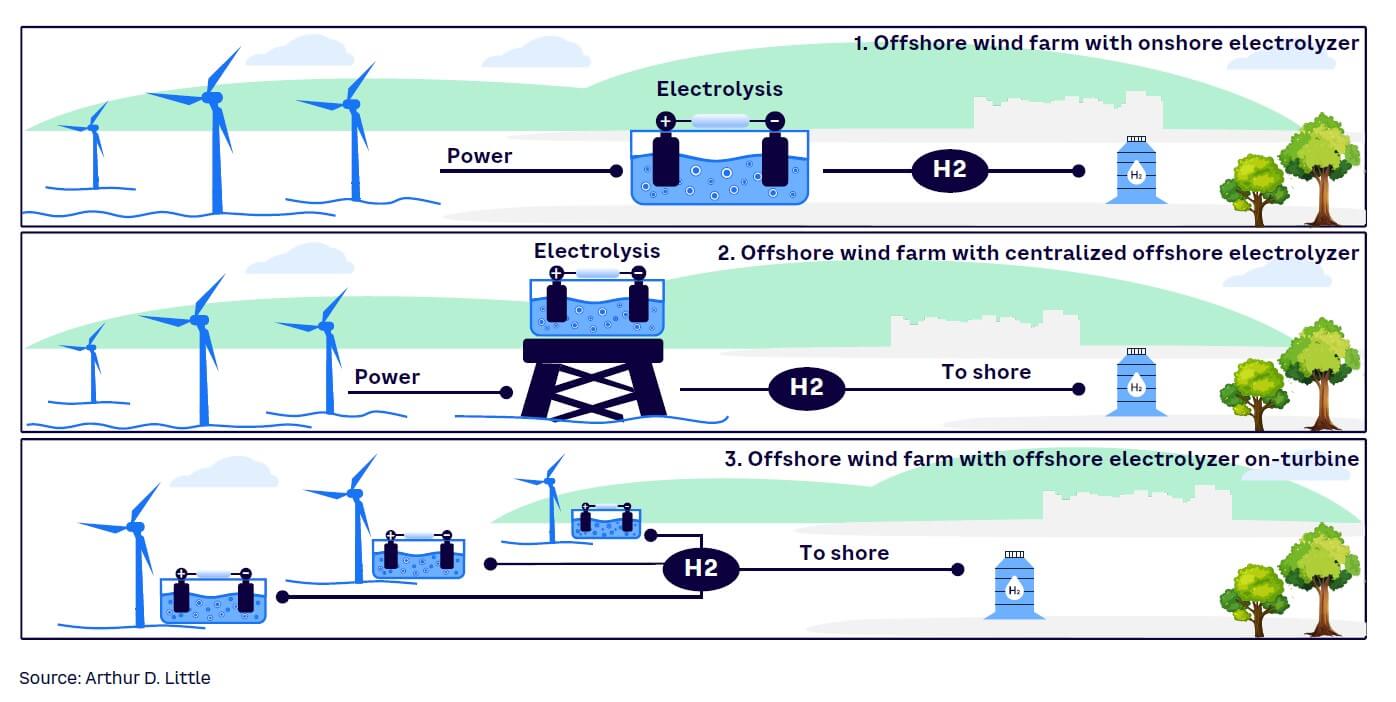

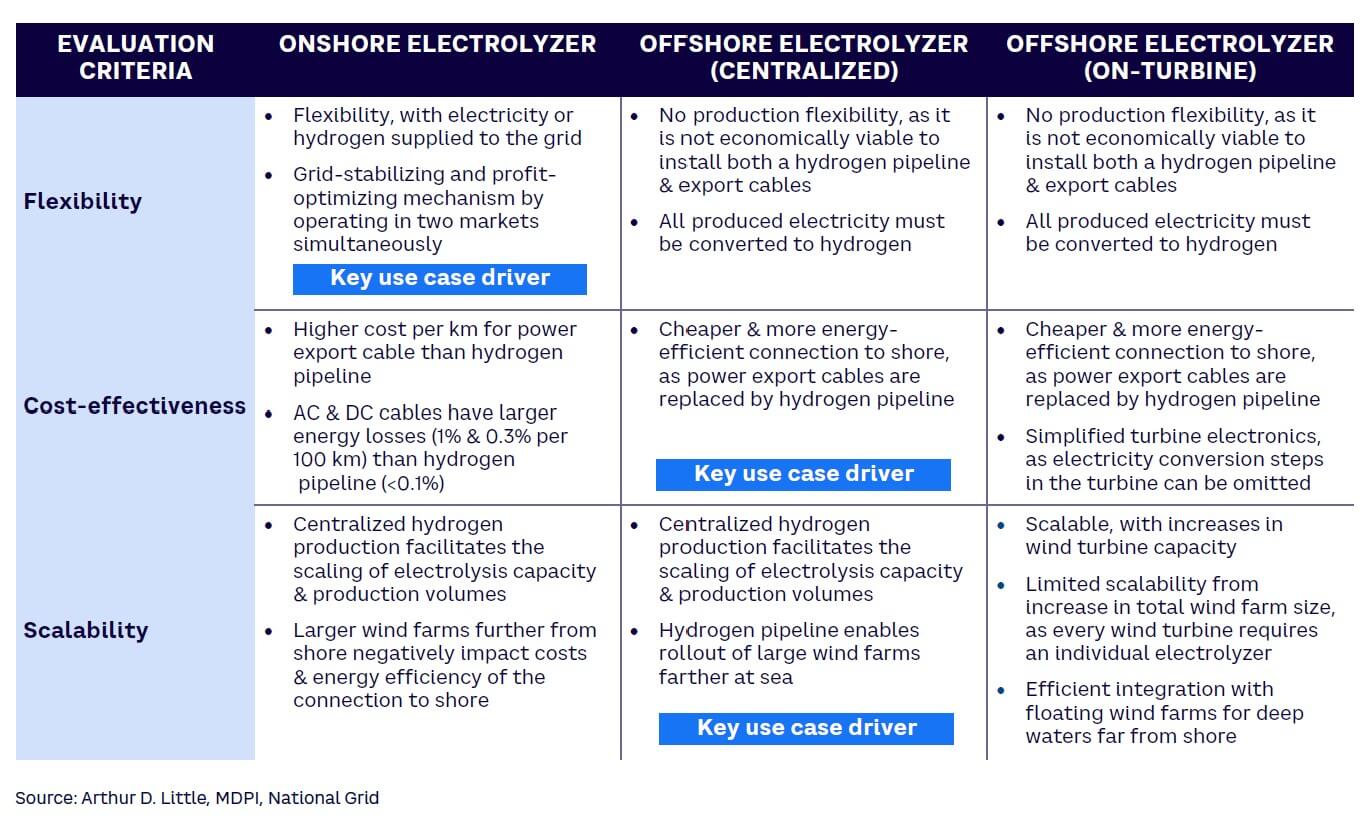

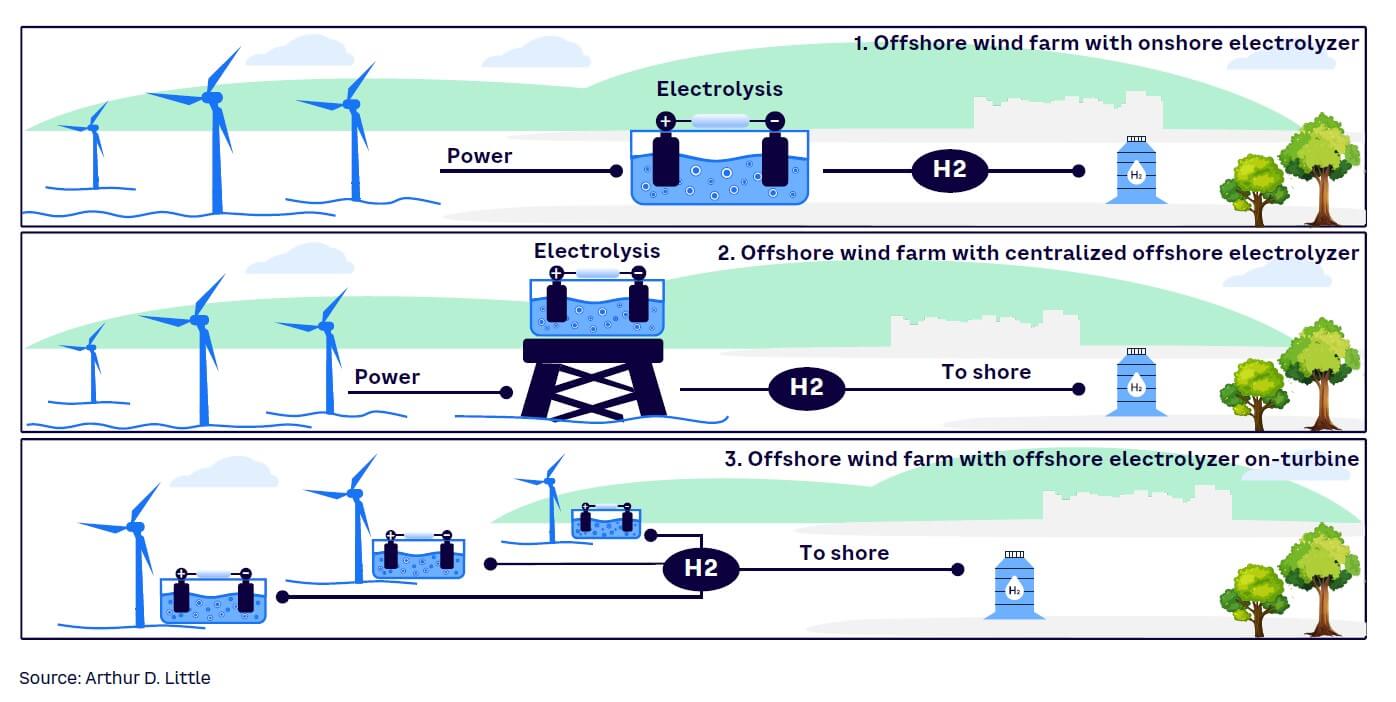

MODELS TO INTEGRATE OFFSHORE WIND WITH HYDROGEN PRODUCTION

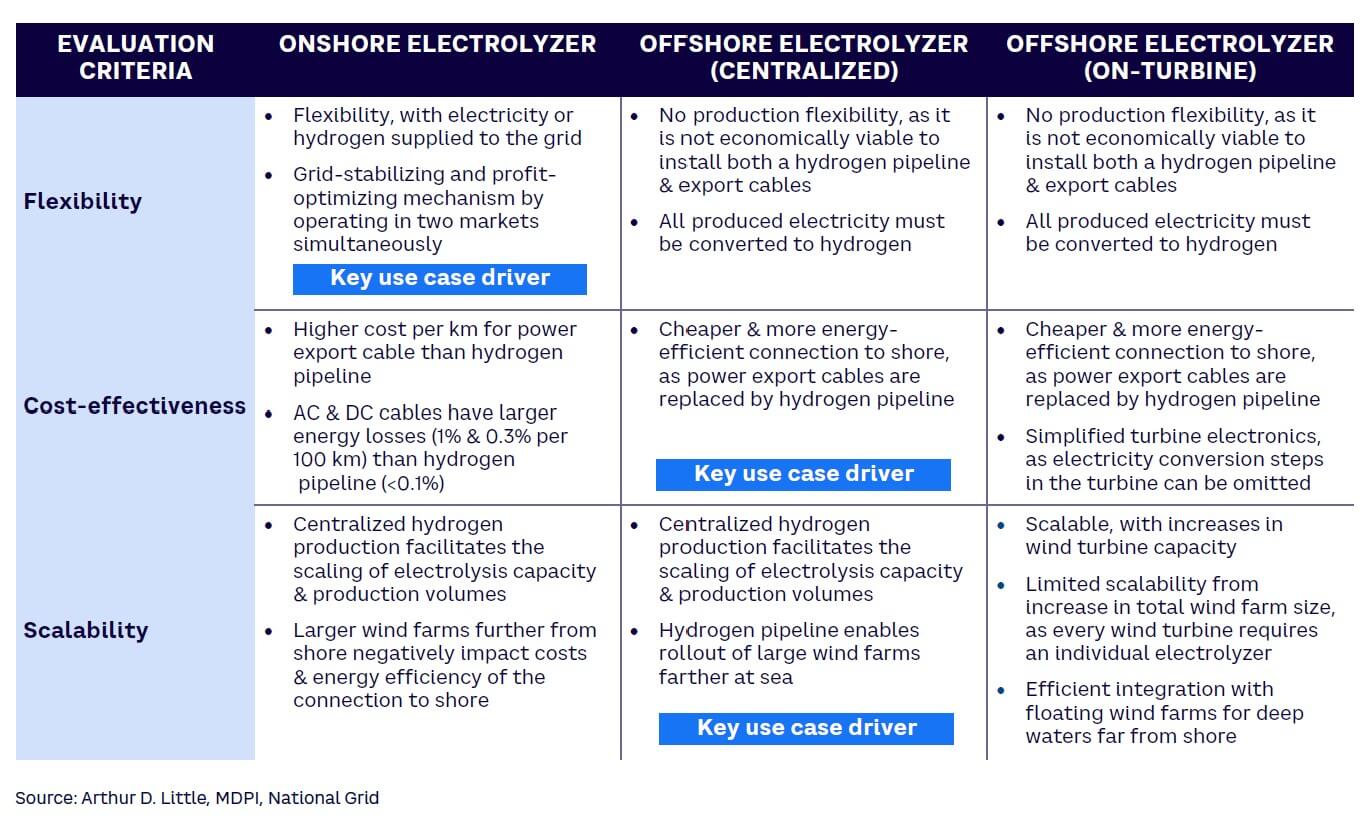

When assessing the economic viability and use cases of hydrogen integration with offshore wind farms, countries must consider different integration models. Three models are possible, which all provide their respective advantages and disadvantages (see Figure 5). Table 1 provides an assessment of these different models. The selection of a model will be very situation- and country-dependent, as there is no one-size-fits-all strategy when it comes to selecting the most suitable model. To evaluate the different models’ attractiveness, three different dimensions were used: cost-effectiveness, flexibility, and scalability.

These three key dimensions are crucial when a country evaluates which integration model best suits its specific archetype:

-

Offshore wind farm with onshore electrolyzer. In this model, power from the offshore wind farms is captured at an offshore substation and is transmitted to shore through traditional power export cables, as with traditional offshore wind farms. Once onshore, the power cables are connected to an onshore substation and hydrogen electrolyzer. Here, the decision is made to either supply electricity to the electricity grid or produce hydrogen for energy storage or hydrogen supply.

-

Offshore wind farm with centralized offshore electrolyzer. The second configuration captures the power produced by the offshore wind farm at a centralized platform offshore. This platform houses a centralized electrolyzer that produces hydrogen and transmits it to shore through a hydrogen pipeline. The configuration resembles the current traditional offshore wind farm setup, but here the offshore substation is replaced by an offshore electrolysis station, and the power export cables are replaced by a hydrogen pipeline.

-

Offshore wind farm with offshore electrolyzer on-turbine. Setup is similar to the centralized offshore model but distinguishes itself by generating hydrogen directly at the turbine through smaller electrolyzers. This configuration is particularly advantageous, as the setup facilitates pilot projects and offers favorable technical specifications. As the technology of floating wind turbines is still evolving, numerous pilot projects are being launched, providing opportunities to test the integration of on-turbine hydrogen production. The on-turbine configuration only requires a limited number of external partners, making it feasible and efficient to launch small-scale pilots. Moreover, as floating wind turbines mature, their technical specifications, which facilitate on-turbine hydrogen production, present a compelling long-term solution. First, floating wind turbines allow for hydrogen production further from the shore, capitalizing on stronger and more reliable winds. Second, the integration of a single large floating electrolyzer for multiple turbines poses challenges due to its weight, which are overcome with on-turbine production. Lastly, floating offshore wind turbines are highly compatible with electrolyzer integration, particularly those equipped with semi-submersible foundations, eliminating the need for modifications to the electrolysis unit or the construction of a separate support structure. In contrast, pilot projects involving on-turbine hydrogen production with fixed-bottom offshore wind turbines have shown the need for a new electrolyzer design prior to integration. However, note that the on-turbine setup faces scalability difficulties as the small individual electrolyzers incur high production and maintenance costs, operational complexity, and limited economies of scale.

COST EVALUATION OF INTEGRATION MODELS

Floating wind farms are still in the pilot phase and their usage at a large scale is expected in the next decade, making the third configuration model possible only in the long term. Therefore, ADL’s analysis deems the options with an onshore or centralized offshore electrolyzer the most viable for large-scale use in the near future.

ADL also investigated the models through a detailed cost assessment. As the CAPEX for an offshore wind farm’s grid connection is a major initial investment, and the cost of the produced electricity represents around 50%-70% of the total cost of the electrolysis process, the cost and efficiency of the energy transmission to shore are crucial factors with a large impact on final LCoH. Therefore, by referring back to the previously investigated real-life wind farm in Figure 2 (Hornsea 2), it is estimated that offshore hydrogen production at a centralized platform presents a 20% discount on the LCoH, compared to the model with an onshore electrolyzer. This difference results from the hydrogen pipeline being cheaper per kilometer and more efficient for energy transmission compared to both AC and DC export cables. This cost difference, as shown in Figure 6, tends to remain stable in the future. It will, however, play a crucial role in determining which integration model should be used at a large scale, as larger wind farms located farther from shore would only magnify this cost difference between the two configuration models.

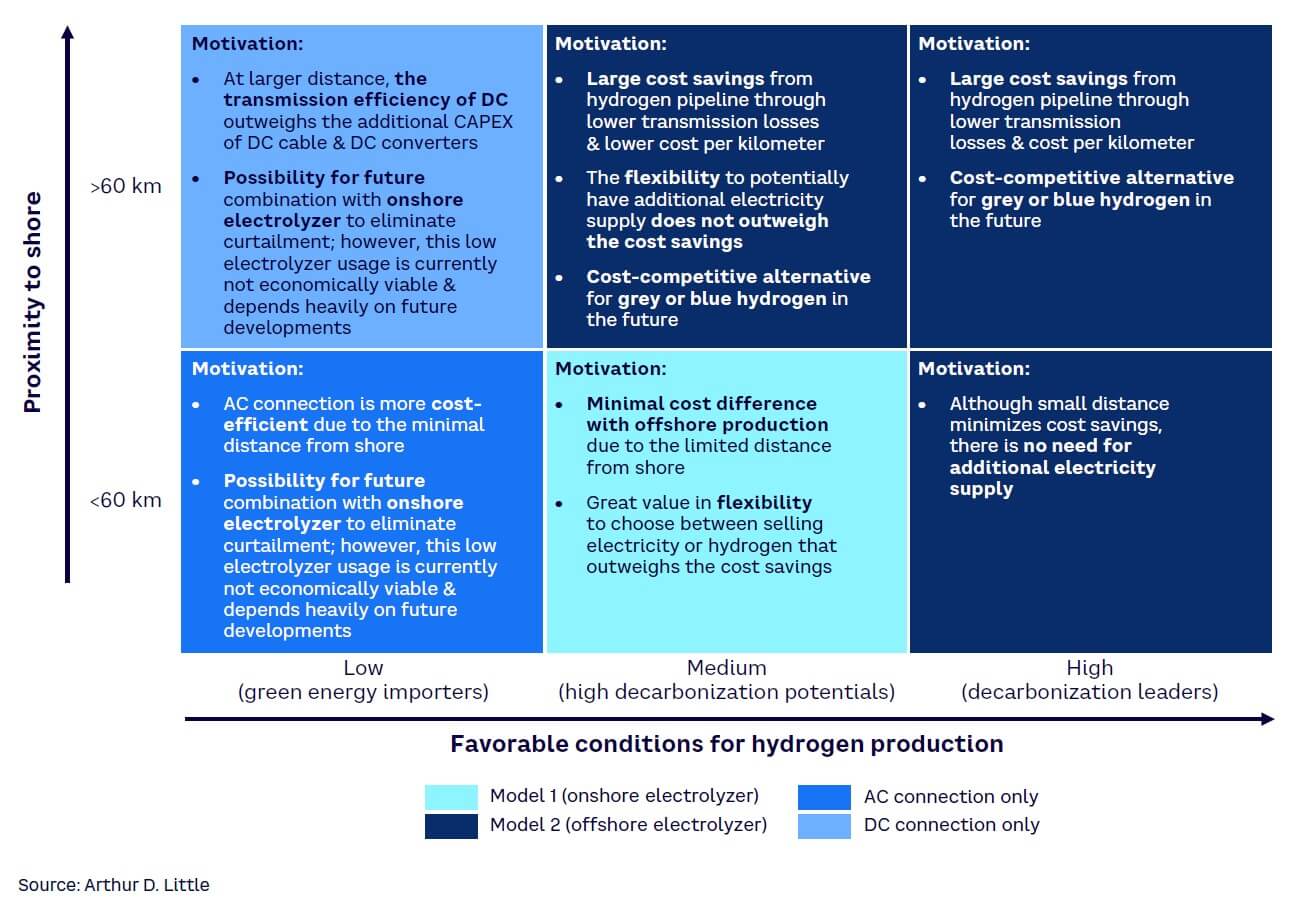

COUNTRY ARCHETYPES & THEIR POTENTIAL FOR HYBRID MODELS

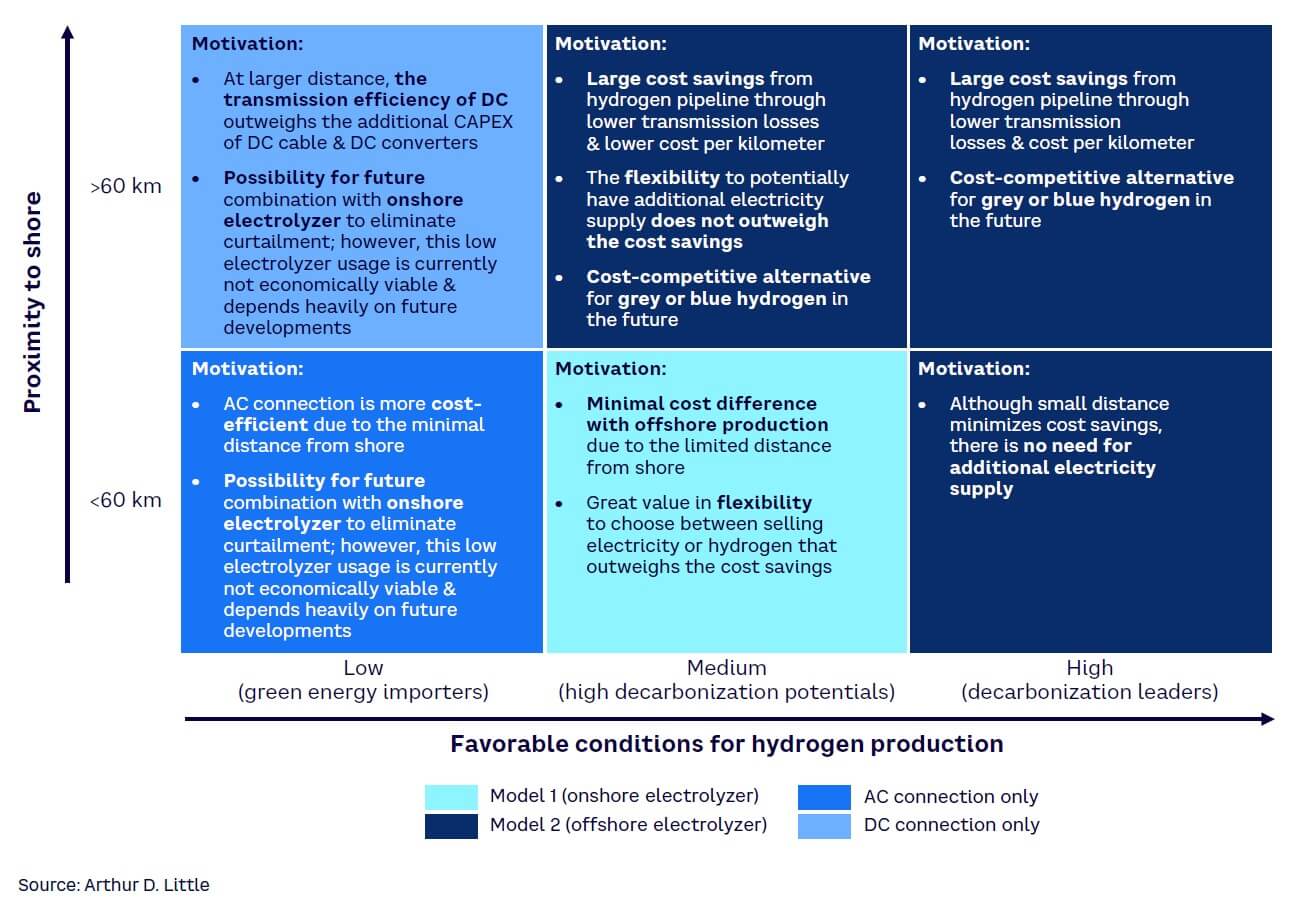

From the identified relevant criteria, European countries can be grouped into three archetypes, each of which has a most suitable model for hydrogen production (Figure 7 represents the three archetypes with their most suitable hybrid model for different scenarios):

-

Decarbonization leaders — countries that typically already have a largely decarbonized electricity supply and are well-equipped to accommodate hydrogen integration, such as Norway, Sweden, and France, among others. These countries have less use for the electricity generated by offshore wind farms than others, but could use the hydrogen for their heavy industry and heavy-duty transportation. Therefore, since flexibility is less of a priority and cost is the largest driver for the use case, hydrogen should be produced at the offshore wind farms and transported to shore through a hydrogen pipeline.

-

High decarbonization potentials — countries that have electricity with moderate carbon concentration and are preparing for hydrogen networks and infrastructure, such as Denmark, Spain, Portugal, and others. These countries have the potential for additional renewable energy capacity and are planning to make use of it. Thereby, they can use some of their offshore wind capacity, when curtailment occurs or when the marginal cost of production is low, to produce hydrogen.

-

Green energy importers — countries that have electricity with high carbon concentration that should use their wind farms primarily to decarbonize their electricity supply, including Belgium, Poland, Germany, and others. They have a relatively low potential to generate renewable energy and will likely need to import their green hydrogen and electricity in the future. Therefore, these countries should first focus on fully selling the electricity generated from their wind farms instead of coupling them to hydrogen production.

3

KEY CHALLENGES PREVENT WIDESPREAD ADOPTION

While there are clear use cases to integrate hydrogen with offshore wind for selected countries in the long term, several obstacles prevent widespread adoption in the short term:

-

High cost of hydrogen and offshore wind integration. There is currently no financial incentive to switch to green hydrogen, as this is not cost-competitive with other forms of hydrogen in the near future. This high cost is not linked to one factor; rather, it is visible across all cost elements from the LCoE of offshore wind to the equipment cost of the electrolyzers and the specialized storage and transportation needs that hydrogen requires.

-

Technical obstacles related to hydrogen production. The limited availability of electrolyzers; the requirement for specialized storage, preferably located close to the end-use application; the need to retrofit existing gas infrastructure; and the large requirement for freshwater or the rollout of desalination technology to purify seawater are four main technical obstacles that prevent widespread adoption of hydrogen production. Further investments and research are necessary to foster improvements.

-

Limited policies and regulation. There is limited legislation in place that supports the integration of hydrogen and offshore wind. Specifically, there is a lack of unanimous and concrete policies that would facilitate widespread production and consumption. Some examples of limits include lack of support to make production financially attractive, no uniform rules across countries regarding blending limits of hydrogen or use of electrolyzers as grid-balancing tools, and no standard design for end-use applications that would facilitate adoption.

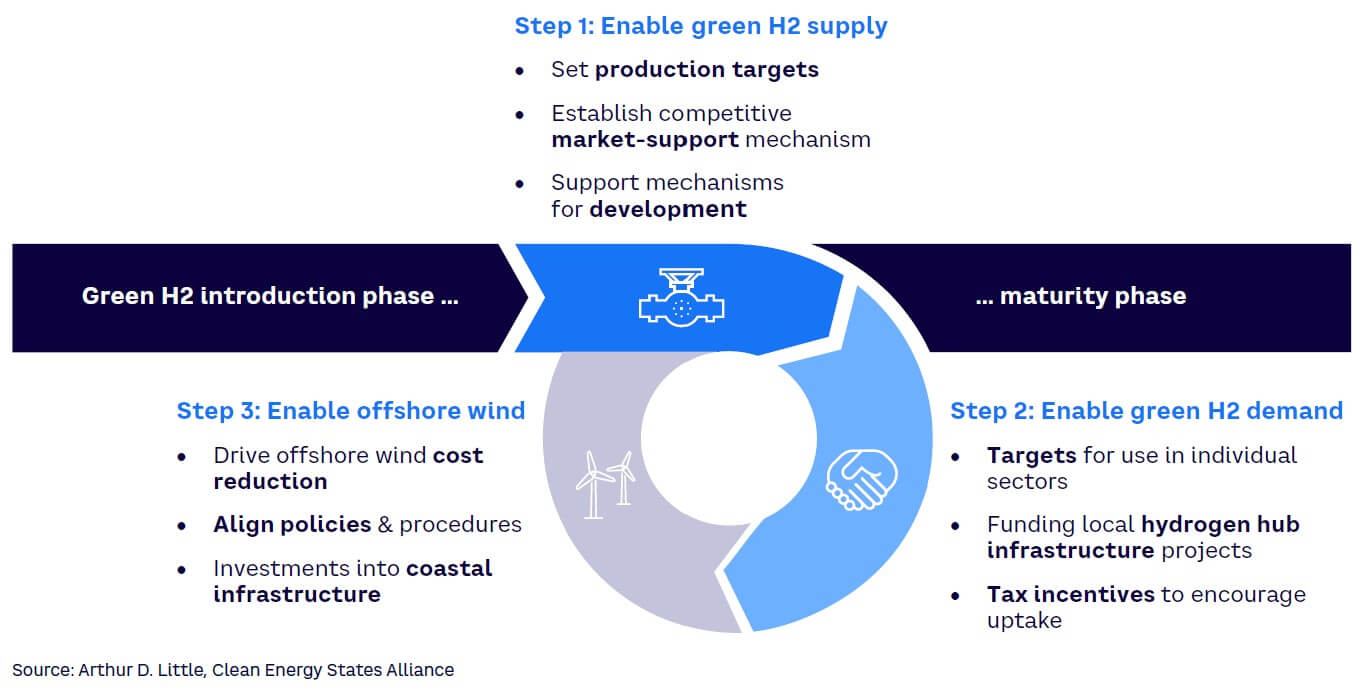

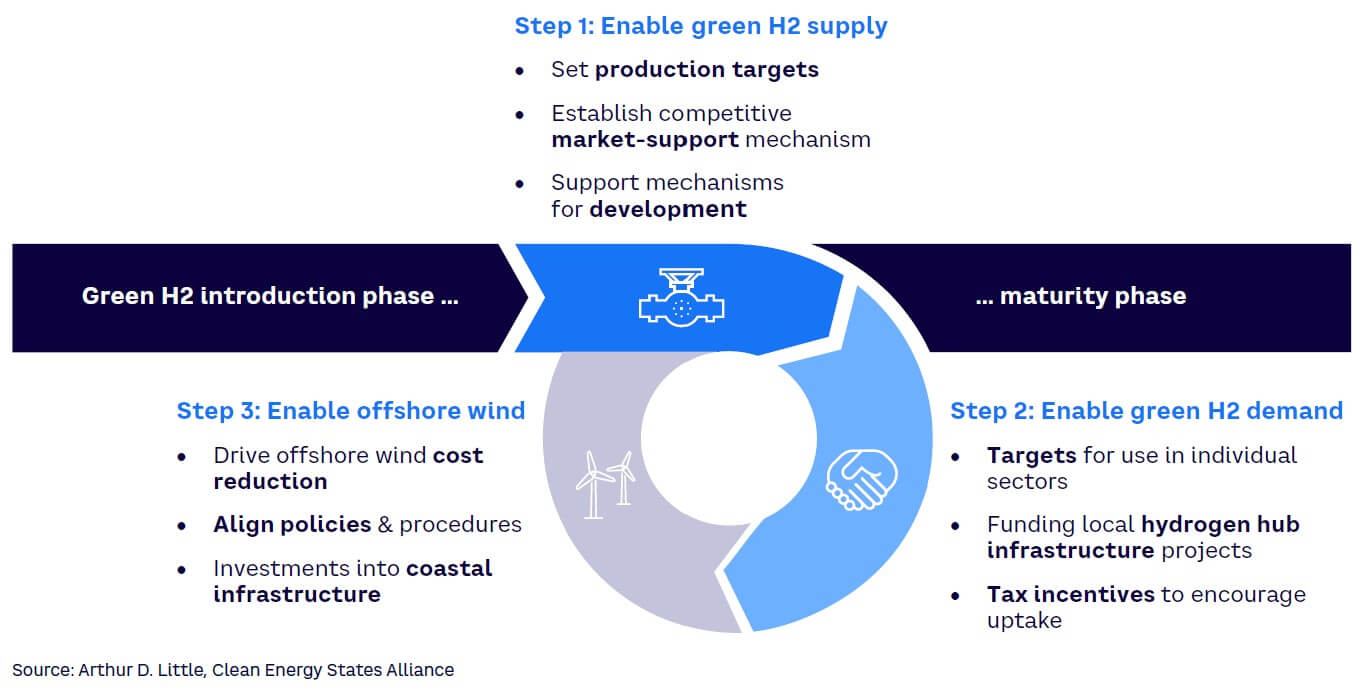

Overcoming these challenges and enabling widespread adoption of green hydrogen from offshore wind farms will require government support, which should be focused on three main levers, as indicated in Figure 8.

4

ENERGY SYSTEM INTEGRATION FOR FUTURE OFFSHORE WIND FARM TENDERS

USE CASE: THE LATEST DUTCH OFFSHORE TENDER

In 2022, the Dutch government released public tenders for offshore wind farms in the Hollandse Kust West sites. One of these two tenders included, for the first time, a qualitative element that was linked to the ease of the offshore wind farm’s integration into the Dutch energy system. Half of this tender’s points for the different evaluation criteria were linked to this qualitative aspect, making it the crucial determining factor for winning this tender. More specifically, to score well in this area, the solution should be innovative and contribute to increasing the scalable flexible demand.

The winning bid for this tender included a solution to combine the offshore wind farm with 600 MW onshore electrolyzers for green hydrogen production. Additionally, the winning party suggested the addition of floating solar panels and integrating e-boilers for heating, battery storage, and charging solutions. These investments are also combined with increased knowledge sharing and close collaboration with partners in the region to stimulate innovation within this market segment.

While this is only one example, tenders all over Europe are increasingly asking for solutions to include flexibility measures in energy production to facilitate integration into the electricity grid.

5

IMPACT FOR PLAYERS ALONG THE VALUE CHAIN

The developments in the integration of hydrogen production with offshore wind farms will have an impact and pose challenges for all players across the entire energy value chain, including:

-

Gas transmission system operators (TSOs). Current gas infrastructure is organized to optimize gas transport from the places of import to end use. These sites are not the same as where hydrogen will be produced, imported, and consumed. In Europe, natural gas typically arrives from the East and the North. In recent years, this has changed quite significantly, as more gas has arrived at ports in the form of liquefied natural gas (LNG). With hydrogen, this will change again as hydrogen will flow in from offshore wind farms, from solar PV fields in the south of Europe, or shipped to designated connection points, which will most likely be placed in locations similar to where LNG is imported. The hydrogen network will need to be designed and optimized accordingly. Furthermore, the existing gas infrastructure must be retrofitted to accommodate transmission of smaller hydrogen molecules. The required investments will be massive and call for thoughtful strategic consideration.

-

Power TSOs. The energy transition, ranging from traditional sources to intermittent renewable ones, will pose a challenge for power TSOs, which need to balance the electricity grid. Like their gas counterparts, the power TSOs will need to adapt their power networks to allow for the infeed of re-electrified green hydrogen. Additionally, the power TSOs must introduce more flexible mechanisms, both on demand and supply side, to keep the grid balanced. Green hydrogen can be a strong asset for power TSOs when used effectively to couple both sectors.

-

Infrastructure funds. Funds focused on infrastructure should explore investments toward new developments. Electrolyzers, pipelines, and fuel cells, will most likely be in high demand in the coming years and will require appropriate investments. The main challenge is that a shift in investor profile will be needed to accommodate investments. The traditional infrastructure investor is a low-risk, low-return investor that prioritizes stability. When these infrastructure funds want to make large investments into an uncertain hydrogen future, they must look for investors willing to take on this uncertainty. Balancing these traditional, safe investments with more speculative hydrogen-focused investments and finding the investor profiles that fit will be crucial to maximizing investments and returns.

-

Engineering companies and renewable energy developers. As discussed previously, different models exist for offshore wind farms’ integration with hydrogen, which have various maturity levels. Model 3 (on-turbine electrolyzer), for example, is a technology that is still very much in the pilot phase, and its effectiveness at large scale is uncertain. Several countries, including the UK and Germany, are conducting tests. Engineering companies must position themselves properly on the different technologies and build the required knowledge and capabilities to execute such projects if they do not want to miss the opportunities related to hydrogen production.

-

End users. Heavy industries and heavy-duty transportation companies will need to adapt to new molecules, including hydrogen. Therefore, even though designing applications to operate on these new molecules requires a large investment, they are of crucial strategic importance for efficient decarbonization. Additionally, being located close to the coastal connection points for these hydrogen pipelines and storage facilities may prove to be a competitive advantage, as plans are already in place to turn certain industrial zones into industrial clusters with “private” hydrogen supply, which gives companies located in these areas access to a stable and secure supply of green hydrogen.

CONCLUSION

Europe’s pursuit of decarbonization hinges on the potential of green hydrogen, with offshore wind emerging as a highly promising source for local production. However, the optimal configuration model for coupling this green hydrogen production with offshore wind is contingent on specific situations and varies among countries, resulting in continuous evolution in the future. As we navigate the short term, it becomes evident that substantial government support is crucial to successfully implement large-scale green hydrogen production. Further, the ongoing developments in this field have far-reaching implications for all stakeholders in the energy value chain. Therefore, making informed strategic decisions will be paramount in positioning a company correctly and reaping the full benefits of this new opportunity. By embracing the potential of green hydrogen and offshore wind, Europe stands poised to achieve significant strides in its decarbonization journey, driving a sustainable and greener future.

DOWNLOAD THE FULL REPORT

18 min read • Energy, Utilities & Resources

Offshore wind & hydrogen integration

How sector coupling can support a resilient decarbonization of Europe

DATE

Executive Summary

EXPLORING OFFSHORE WIND & HYDROGEN INTEGRATION MODELS

Green hydrogen will be one of the world’s key enablers toward full decarbonization. This sustainable energy source can serve as an energy carrier and offers a carbon-free substitute for fossil fuels, mainly natural gas, thereby providing the heavy industry and heavy-duty transportation sectors with a viable decarbonized alternative. The EU has embraced this renewable energy source as a vehicle to achieve its decarbonization target and has set the target to produce half of its hydrogen demand locally by 2030.

Based on its analysis, Arthur D. Little (ADL) has concluded that a viable, cost-effective method for producing this future hydrogen demand in Europe will be through the use of offshore wind, as this energy source is natural, clean, and abundant. Furthermore, this hybrid model provides many benefits, such as cost savings, effective scaling opportunities, and an additional source of flexibility that can help resolve electricity grid constraints. The most advantageous setup to implement this hybrid model will differ across countries as it is largely dependent on local power market dynamics and geographical characteristics (water depth, distance to shore, etc.), among other things. Further, this shift will impact the entire energy value chain, making meticulous strategic assessment crucial for all affected players.

1

SUSTAINABLE HYDROGEN PRODUCTION: A CORNERSTONE OF EU DECARBONIZATION

MANY COUNTRIES FOCUS ON HYDROGEN, FOR GOOD REASONS

Hydrogen’s popularity is growing all around the world. According to the World Economic Forum, hydrogen could account for up to 12% of global energy use by 2050. China is currently the largest producer (and consumer) of hydrogen worldwide and has recognized hydrogen to be one of six key industries of the future. Alongside China, both the US and the EU have also declared big investment plans to boost clean hydrogen development for both production and consumption. Other countries, however, like Morocco and Namibia in Africa and Gulf countries such as the United Arab Emirates (UAE) and Saudi Arabia, have made the strategic decision to position themselves as net exporters of green hydrogen. These few examples indicate that countries can position themselves very differently with regard to a hydrogen-driven future, which showcases the strategic importance of this new energy source.

OFFSHORE WIND IS A PROMISING RENEWABLE ENERGY SOURCE

In 2022, 96% of Europe’s hydrogen was produced using natural gas (grey hydrogen), resulting in large CO2 emissions. This production process is not sustainable, even if the emitted CO2 is captured (blue hydrogen). So-called green hydrogen is produced through the electrolysis of water using renewable electricity. For this process, Europe requires large quantities of renewable energy on top of what is already being produced to decarbonize its electricity supply. Some countries, such as in the Gulf or Africa, can rely on their abundant sun to produce hydrogen from large-scale solar photovoltaic (PV) fields. However, this is not viable in many parts of Europe. Neither does the European mainland have sufficient hydroelectric or geothermal potential to produce its large hydrogen demand.

Offshore wind, however, could present a viable solution for Europe, as regions like the North and Baltic Seas have strong winds and shallow coastlines, making them suitable to deploy offshore wind farms in a cost-effective manner. The conditions for offshore wind are overall more favorable than for onshore wind as the continent is densely populated and winds are, in general, stronger and more stable offshore than on land. One key consideration is offshore wind’s levelized cost of energy (LCoE), which, in Europe is still larger than for onshore wind or solar PV. However, as indicated in Figure 1, hydrogen production from offshore wind in Europe presents four main advantages that drive its use case over other renewable energy sources such as onshore wind or solar PV:

-

Production stability

-

Increased energy generation

-

Growing financial incentive

-

Geographical expansion and integration opportunities

AN ECONOMICALLY VIABLE OPTION IN THE LONG TERM

For green hydrogen to be considered for combustion applications, it must be cost-competitive with other forms of hydrogen. To analyze this potential, the levelized cost of hydrogen (LCoH) of the different hydrogen types has been forecasted for the coming decades (see Figure 2). The green hydrogen scenario uses the reference case of a real-life offshore wind farm, Hornsea 2 (a 1,320 MW wind farm at 89 km from shore), taking the average cost of a configuration with an offshore and onshore electrolyzer. The tariffs and taxes imposed on grey and blue hydrogen scenarios follow legislation currently in place by the European Commission. The results indicate that green hydrogen produced from offshore wind farms has the potential to become cost-competitive in the long term.

The main conclusions from the analysis include:

-

Green hydrogen’s LCoH produced from offshore wind farms will see a 56% cost reduction by 2050, resulting mainly from reductions in the offshore wind LCoE and electrolyzer cost (>60% of total cost reduction will take place by 2030).

-

Green hydrogen from offshore wind farms has the potential to become cost-competitive with grey and blue hydrogen in the long term (2050).

-

In the short term, green hydrogen requires additional subsidies and financial incentives to be cost-competitive.

The analysis in Figure 2 relates to hydrogen as a substitute for natural gas in heavy industries and heavy-duty transportation, rather than as a source for energy storage. At this stage, natural gas has not been taken up in the quantitative comparison as European legislation is focused on phasing out its use in industrial processes.

Furthermore, while natural gas price is not expected to increase significantly (as can be derived from the regular grey and blue hydrogen projections in Figure 2), the cost of emitting CO2 (e.g., taxes, offset, capture) will significantly increase in the coming decades. Additionally, while gas prices can be very volatile, producing green hydrogen locally offers a possible method to mitigate potentially damaging price fluctuations. It should be noted that all heavy industry and heavy-duty transportation infrastructure (e.g., pipelines, processes, engines) is currently designed for fossil fuels, and this must be adapted for the eventual use of hydrogen.

A second use case that green hydrogen presents is the possibility to store energy and provide additional flexibility, which can be leveraged as an electricity grid–balancing mechanism. Therefore, a second analysis required to assess the use case for offshore wind and hydrogen integration is the comparison of green hydrogen with other traditional energy sources for electricity as an end product. An important note here is the limitation of regular renewable energy sources, which cannot serve as flexibility mechanisms as these are themselves intermittent. Therefore, if renewable energy sources are available, their use for electricity production will always be prioritized over hydrogen, making the comparison of hydrogen and natural gas most relevant. Figure 3 illustrates the forecasted LCoE for different electricity sources over time.

The main conclusions from the analysis include:

-

The LCoE of offshore wind currently exceeds onshore wind and solar PV but will become a cost-competitive option in the near future (2030).

-

Electricity produced from green hydrogen (from offshore wind farms) could have a competitive LCoE relative to carbon-emitting alternatives in the future.

Additionally, with the re-electrification of hydrogen, around 40% of the total energy is lost in the process. These large energy losses make hydrogen an inefficient method to produce electricity and should preferably be used as an end product in its gaseous form.

FINANCIAL INCENTIVES NEEDED TO STIMULATE ADOPTION IN THE SHORT TERM

While green hydrogen produced by offshore wind has the potential to become a cost-competitive energy source in the long term, it will still suffer from a higher cost compared to conventional energy sources in the short term. The absence of this financial incentive to reconfigure wind farms into hydrogen-producing hubs is confirmed in the analysis of profitability scenarios for different offshore wind farm configurations. In the short term (2030), a conventional wind farm selling 100% of its produced electricity to the grid would still realize a larger net present value (NPV) than configurations that include hydrogen production. This outcome stems from hydrogen being a product that will be sold through a “cost plus” method and the fact that green hydrogen will still be the molecule’s most expensive form. These elements make the large markups required to match the NPVs of traditional wind farms, as illustrated in Figure 4, seem unrealistic.

2

DIFFERENT COUNTRIES REQUIRE DIFFERENT INTEGRATION MODELS

POTENTIAL FOR OFFSHORE WIND IS COUNTRY-DEPENDENT

Although offshore wind presents a promising prospect for green hydrogen production in Europe, not all countries should act on this opportunity. In addition to the potential to build offshore wind farms, three other factors impact a country’s potential for coupling offshore wind with hydrogen:

-

Decarbonization priority. A country that must further decarbonize its power system would need to sell the largest portion of the electricity generated by offshore wind farms. On the other hand, a country with an already-decarbonized electricity supply that places a larger focus on the decarbonization of heavy-duty transport or heavy industries could make hydrogen production viable. Linked to this, the readiness of a country’s local hydrogen infrastructure and network is also crucial for potential adoption.

-

Geography of the country and its sea(s). Hydrogen pipelines are cheaper per kilometer than electricity cables, and this cost advantage is magnified as the distance from shore increases, making the model more attractive when wind farms are far from shore (when offshore electrolyzers are used). Hydrogen pipelines, therefore, provide expansion opportunities even if the available space close to shore is saturated with existing wind farms (or other infrastructure). Wind farms farther from shore also give countries access to stronger and more stable wind speeds. Furthermore, the type and depth of the seabed also play a role. Additionally, hydrogen production from offshore wind is more attractive from a financial and practical viewpoint when the main usage (in industrial sites) is located close to a country’s coastline.

-

Capacity and cost competitiveness of green hydrogen compared to other renewable sources. A portion of the produced hydrogen could be used as a flexibility mechanism to add electricity to the grid when needed (called P2H2P or “power to hydrogen to power”). Doing so with green hydrogen is currently more expensive than other renewable sources in most parts of Europe. With the evolution of the LCoE of the different sources, as presented in Figure 3, sector coupling of green hydrogen could become cost-competitive in the long term.

MODELS TO INTEGRATE OFFSHORE WIND WITH HYDROGEN PRODUCTION

When assessing the economic viability and use cases of hydrogen integration with offshore wind farms, countries must consider different integration models. Three models are possible, which all provide their respective advantages and disadvantages (see Figure 5). Table 1 provides an assessment of these different models. The selection of a model will be very situation- and country-dependent, as there is no one-size-fits-all strategy when it comes to selecting the most suitable model. To evaluate the different models’ attractiveness, three different dimensions were used: cost-effectiveness, flexibility, and scalability.

These three key dimensions are crucial when a country evaluates which integration model best suits its specific archetype:

-

Offshore wind farm with onshore electrolyzer. In this model, power from the offshore wind farms is captured at an offshore substation and is transmitted to shore through traditional power export cables, as with traditional offshore wind farms. Once onshore, the power cables are connected to an onshore substation and hydrogen electrolyzer. Here, the decision is made to either supply electricity to the electricity grid or produce hydrogen for energy storage or hydrogen supply.

-

Offshore wind farm with centralized offshore electrolyzer. The second configuration captures the power produced by the offshore wind farm at a centralized platform offshore. This platform houses a centralized electrolyzer that produces hydrogen and transmits it to shore through a hydrogen pipeline. The configuration resembles the current traditional offshore wind farm setup, but here the offshore substation is replaced by an offshore electrolysis station, and the power export cables are replaced by a hydrogen pipeline.

-

Offshore wind farm with offshore electrolyzer on-turbine. Setup is similar to the centralized offshore model but distinguishes itself by generating hydrogen directly at the turbine through smaller electrolyzers. This configuration is particularly advantageous, as the setup facilitates pilot projects and offers favorable technical specifications. As the technology of floating wind turbines is still evolving, numerous pilot projects are being launched, providing opportunities to test the integration of on-turbine hydrogen production. The on-turbine configuration only requires a limited number of external partners, making it feasible and efficient to launch small-scale pilots. Moreover, as floating wind turbines mature, their technical specifications, which facilitate on-turbine hydrogen production, present a compelling long-term solution. First, floating wind turbines allow for hydrogen production further from the shore, capitalizing on stronger and more reliable winds. Second, the integration of a single large floating electrolyzer for multiple turbines poses challenges due to its weight, which are overcome with on-turbine production. Lastly, floating offshore wind turbines are highly compatible with electrolyzer integration, particularly those equipped with semi-submersible foundations, eliminating the need for modifications to the electrolysis unit or the construction of a separate support structure. In contrast, pilot projects involving on-turbine hydrogen production with fixed-bottom offshore wind turbines have shown the need for a new electrolyzer design prior to integration. However, note that the on-turbine setup faces scalability difficulties as the small individual electrolyzers incur high production and maintenance costs, operational complexity, and limited economies of scale.

COST EVALUATION OF INTEGRATION MODELS

Floating wind farms are still in the pilot phase and their usage at a large scale is expected in the next decade, making the third configuration model possible only in the long term. Therefore, ADL’s analysis deems the options with an onshore or centralized offshore electrolyzer the most viable for large-scale use in the near future.

ADL also investigated the models through a detailed cost assessment. As the CAPEX for an offshore wind farm’s grid connection is a major initial investment, and the cost of the produced electricity represents around 50%-70% of the total cost of the electrolysis process, the cost and efficiency of the energy transmission to shore are crucial factors with a large impact on final LCoH. Therefore, by referring back to the previously investigated real-life wind farm in Figure 2 (Hornsea 2), it is estimated that offshore hydrogen production at a centralized platform presents a 20% discount on the LCoH, compared to the model with an onshore electrolyzer. This difference results from the hydrogen pipeline being cheaper per kilometer and more efficient for energy transmission compared to both AC and DC export cables. This cost difference, as shown in Figure 6, tends to remain stable in the future. It will, however, play a crucial role in determining which integration model should be used at a large scale, as larger wind farms located farther from shore would only magnify this cost difference between the two configuration models.

COUNTRY ARCHETYPES & THEIR POTENTIAL FOR HYBRID MODELS

From the identified relevant criteria, European countries can be grouped into three archetypes, each of which has a most suitable model for hydrogen production (Figure 7 represents the three archetypes with their most suitable hybrid model for different scenarios):

-

Decarbonization leaders — countries that typically already have a largely decarbonized electricity supply and are well-equipped to accommodate hydrogen integration, such as Norway, Sweden, and France, among others. These countries have less use for the electricity generated by offshore wind farms than others, but could use the hydrogen for their heavy industry and heavy-duty transportation. Therefore, since flexibility is less of a priority and cost is the largest driver for the use case, hydrogen should be produced at the offshore wind farms and transported to shore through a hydrogen pipeline.

-

High decarbonization potentials — countries that have electricity with moderate carbon concentration and are preparing for hydrogen networks and infrastructure, such as Denmark, Spain, Portugal, and others. These countries have the potential for additional renewable energy capacity and are planning to make use of it. Thereby, they can use some of their offshore wind capacity, when curtailment occurs or when the marginal cost of production is low, to produce hydrogen.

-

Green energy importers — countries that have electricity with high carbon concentration that should use their wind farms primarily to decarbonize their electricity supply, including Belgium, Poland, Germany, and others. They have a relatively low potential to generate renewable energy and will likely need to import their green hydrogen and electricity in the future. Therefore, these countries should first focus on fully selling the electricity generated from their wind farms instead of coupling them to hydrogen production.

3

KEY CHALLENGES PREVENT WIDESPREAD ADOPTION

While there are clear use cases to integrate hydrogen with offshore wind for selected countries in the long term, several obstacles prevent widespread adoption in the short term:

-

High cost of hydrogen and offshore wind integration. There is currently no financial incentive to switch to green hydrogen, as this is not cost-competitive with other forms of hydrogen in the near future. This high cost is not linked to one factor; rather, it is visible across all cost elements from the LCoE of offshore wind to the equipment cost of the electrolyzers and the specialized storage and transportation needs that hydrogen requires.

-

Technical obstacles related to hydrogen production. The limited availability of electrolyzers; the requirement for specialized storage, preferably located close to the end-use application; the need to retrofit existing gas infrastructure; and the large requirement for freshwater or the rollout of desalination technology to purify seawater are four main technical obstacles that prevent widespread adoption of hydrogen production. Further investments and research are necessary to foster improvements.

-

Limited policies and regulation. There is limited legislation in place that supports the integration of hydrogen and offshore wind. Specifically, there is a lack of unanimous and concrete policies that would facilitate widespread production and consumption. Some examples of limits include lack of support to make production financially attractive, no uniform rules across countries regarding blending limits of hydrogen or use of electrolyzers as grid-balancing tools, and no standard design for end-use applications that would facilitate adoption.

Overcoming these challenges and enabling widespread adoption of green hydrogen from offshore wind farms will require government support, which should be focused on three main levers, as indicated in Figure 8.

4

ENERGY SYSTEM INTEGRATION FOR FUTURE OFFSHORE WIND FARM TENDERS

USE CASE: THE LATEST DUTCH OFFSHORE TENDER

In 2022, the Dutch government released public tenders for offshore wind farms in the Hollandse Kust West sites. One of these two tenders included, for the first time, a qualitative element that was linked to the ease of the offshore wind farm’s integration into the Dutch energy system. Half of this tender’s points for the different evaluation criteria were linked to this qualitative aspect, making it the crucial determining factor for winning this tender. More specifically, to score well in this area, the solution should be innovative and contribute to increasing the scalable flexible demand.

The winning bid for this tender included a solution to combine the offshore wind farm with 600 MW onshore electrolyzers for green hydrogen production. Additionally, the winning party suggested the addition of floating solar panels and integrating e-boilers for heating, battery storage, and charging solutions. These investments are also combined with increased knowledge sharing and close collaboration with partners in the region to stimulate innovation within this market segment.

While this is only one example, tenders all over Europe are increasingly asking for solutions to include flexibility measures in energy production to facilitate integration into the electricity grid.

5

IMPACT FOR PLAYERS ALONG THE VALUE CHAIN

The developments in the integration of hydrogen production with offshore wind farms will have an impact and pose challenges for all players across the entire energy value chain, including:

-

Gas transmission system operators (TSOs). Current gas infrastructure is organized to optimize gas transport from the places of import to end use. These sites are not the same as where hydrogen will be produced, imported, and consumed. In Europe, natural gas typically arrives from the East and the North. In recent years, this has changed quite significantly, as more gas has arrived at ports in the form of liquefied natural gas (LNG). With hydrogen, this will change again as hydrogen will flow in from offshore wind farms, from solar PV fields in the south of Europe, or shipped to designated connection points, which will most likely be placed in locations similar to where LNG is imported. The hydrogen network will need to be designed and optimized accordingly. Furthermore, the existing gas infrastructure must be retrofitted to accommodate transmission of smaller hydrogen molecules. The required investments will be massive and call for thoughtful strategic consideration.

-

Power TSOs. The energy transition, ranging from traditional sources to intermittent renewable ones, will pose a challenge for power TSOs, which need to balance the electricity grid. Like their gas counterparts, the power TSOs will need to adapt their power networks to allow for the infeed of re-electrified green hydrogen. Additionally, the power TSOs must introduce more flexible mechanisms, both on demand and supply side, to keep the grid balanced. Green hydrogen can be a strong asset for power TSOs when used effectively to couple both sectors.

-

Infrastructure funds. Funds focused on infrastructure should explore investments toward new developments. Electrolyzers, pipelines, and fuel cells, will most likely be in high demand in the coming years and will require appropriate investments. The main challenge is that a shift in investor profile will be needed to accommodate investments. The traditional infrastructure investor is a low-risk, low-return investor that prioritizes stability. When these infrastructure funds want to make large investments into an uncertain hydrogen future, they must look for investors willing to take on this uncertainty. Balancing these traditional, safe investments with more speculative hydrogen-focused investments and finding the investor profiles that fit will be crucial to maximizing investments and returns.

-

Engineering companies and renewable energy developers. As discussed previously, different models exist for offshore wind farms’ integration with hydrogen, which have various maturity levels. Model 3 (on-turbine electrolyzer), for example, is a technology that is still very much in the pilot phase, and its effectiveness at large scale is uncertain. Several countries, including the UK and Germany, are conducting tests. Engineering companies must position themselves properly on the different technologies and build the required knowledge and capabilities to execute such projects if they do not want to miss the opportunities related to hydrogen production.

-

End users. Heavy industries and heavy-duty transportation companies will need to adapt to new molecules, including hydrogen. Therefore, even though designing applications to operate on these new molecules requires a large investment, they are of crucial strategic importance for efficient decarbonization. Additionally, being located close to the coastal connection points for these hydrogen pipelines and storage facilities may prove to be a competitive advantage, as plans are already in place to turn certain industrial zones into industrial clusters with “private” hydrogen supply, which gives companies located in these areas access to a stable and secure supply of green hydrogen.

CONCLUSION

Europe’s pursuit of decarbonization hinges on the potential of green hydrogen, with offshore wind emerging as a highly promising source for local production. However, the optimal configuration model for coupling this green hydrogen production with offshore wind is contingent on specific situations and varies among countries, resulting in continuous evolution in the future. As we navigate the short term, it becomes evident that substantial government support is crucial to successfully implement large-scale green hydrogen production. Further, the ongoing developments in this field have far-reaching implications for all stakeholders in the energy value chain. Therefore, making informed strategic decisions will be paramount in positioning a company correctly and reaping the full benefits of this new opportunity. By embracing the potential of green hydrogen and offshore wind, Europe stands poised to achieve significant strides in its decarbonization journey, driving a sustainable and greener future.

DOWNLOAD THE FULL REPORT