Over the last five years, the Kingdom of Saudi Arabia (KSA) has already made great advances in developing fintech into a flourishing industry marked by rapid growth, diversifying services, and increasing contribution to its national economy. However, there are some challenges ahead for KSA to meet its goal of becoming a leading global fintech hub. In this Viewpoint, we look at what has already been achieved and suggest some priorities for KSA’s fintech ecosystem to achieve its ambitious goals.

THE FINTECH JOURNEY SO FAR

Over the past five years, the fintech industry in KSA has undergone substantial growth and innovation. In April 2018, the Saudi Arabian Monetary Authority (SAMA), in collaboration with the Saudi Capital Markets Authority (CMA), kickstarted the nation’s fintech growth journey with the launch of Fintech Saudi, an initiative aimed at cementing KSA’s position as the leading fintech hub in the MENA (Middle East and North Africa) region. Fintech Saudi continuously strives to boost, support, and represent the fintech industry in KSA through initiatives such as its Accelerator program, Career Fair, Fintech Tour, and the Summer Sessions. Since the launch of Fintech Saudi, there has been a 20-fold increase in the number of fintechs operating in the kingdom. Over SAR 4 billion (~US $1 billion) has been invested into fintech companies in KSA, and over 100,000 people have engaged in fintech-related events, training courses, and internships organized by Fintech Saudi.

The development and approval of the national fintech strategy (part of Vision 2030) in May 2022 marked the next stage of fintech development for KSA. The strategy was based on six pillars: (1) developing KSA as the fintech hub for the Middle East, (2) creating a regulatory environment supportive of growth and innovation, (3) funding for start-ups, (4) training and skill enhancement, (5) accelerating support infrastructure, and (6) driving local and international collaboration. KSA’s Vision 2030 plan for fintech has four key objectives, constituting clear milestones toward its aspirations of being a global fintech leader:

-

Establish at least 525 fintech companies (versus 200 in 2023).

-

Open 18,000 fintech job opportunities (versus around 5,400 in 2023).

-

Account for SAR $13.3 billion in direct GDP (versus around $1 billion in 2023).

-

Achieve SAR $12.2 billion in direct venture capital (VC) contributions (versus $1.4 billion in 2023).

The 2022 SAMA “Annual Fintech Report” mentions progress made in a range of areas, including more convenient and accessible payment systems for consumers, new alternative financing platforms with services like debt crowdfunding, and service integration through aggregation platforms, providing a better user experience for the consumer. The number of fintech companies in KSA more than doubled in one year, from 89 in 2022 to ~200 in 2023.

This impressive growth has been catalyzed by a range of measures to stimulate innovation, with three in particular standing out:

-

Fintech Saudi. The establishment of Fintech Saudi was a catalyst for change, leading to such measures as the Fintech Accelerator program, the Fintech Saudi Innovation Hub, an online fintech directory, regulatory enhancements in collaboration with SAMA, and various flagship events (e.g., Fintech Tour and hackathon).

-

Fintech Regulatory Sandbox. The SAMA-established sandbox allowed controlled live testing of fintech innovations, facilitating a smooth transition to the open market.

-

Start-up funding. Various financial-support mechanisms have been deployed in the Saudi fintech ecosystem, some of which are industry-agnostic. For example, the Saudi Venture Capital Company (SVC), supported by CMA and the Financial Sector Development Program (FSDP), launched a SAR 300 million fund focused on fintech start-ups and plans to invest SAR 6 billion more into start-ups and SMEs across other sectors. So far, SVC has invested in 35 VC funds, which have facilitated over 900 deals and SAR 1.9 billion in investments. The Saudi National Technology Development Program (NTDP) has launched the Technology Development Financing initiative that supports start-ups with debt funding.

KEY PROGRESS AREAS

Three key areas illustrate the major progress already made in KSA fintech: digital payments, alternative financing, and financial product aggregation.

Digital payments

KSA has embarked on a journey to transform society to be less dependent on cash transactions. A cornerstone was the FSDP, which played a pivotal role in introducing new players to the financial services landscape. First, regulatory frameworks were established to not only regulate but also to nurture the licensing of payment companies and their service activities within KSA. Vision 2030 set an ambitious aim to escalate the proportion of non-cash transactions to 80% by 2030, a significant leap from its 18% baseline in 2016. In fact, by 2021, non-cash payments were already 62% of all transactions, well ahead of the plan. The fintech landscape has been enriched through collaborative synergies between Saudi Payments and fintech companies. Among the various developments, digital wallets, local transfers, QR code payments, and SADAD system bill payments stand out as the most prominent.

According to data released by SAMA, digital wallet usage has seen an exponential rise from 315,000 in 2018 to 17 million by 2022, representing over half of KSA’s population. In 2018, bank transfers were the primary method for topping up these wallets, accounting for approximately 70% of all top-ups. However, by 2022 around 80% of top-ups were being made via debit or credit cards. Expatriates in KSA have increasingly adopted digital wallets for international transfers, with non-Saudi users up from 17% in 2018 to 45% in 2022. In the thriving digital wallet market, two main contenders have emerged: stc pay (the first fintech unicorn born in KSA) and urpay, linked to Al Rajhi Bank. In particular, stc pay reported a notable 25% year-on-year increase in profits in 2022.

Alternative financing

The alternative financing sector, particularly “buy now, pay later” (BNPL) and debt crowdfunding, has emerged as the second-largest fintech subsector in Saudi Arabia, trailing only behind Saudi Payments. This growth reflects a shift in consumer and business financing preferences, increasingly leaning toward more flexible and accessible options than traditional banking models.

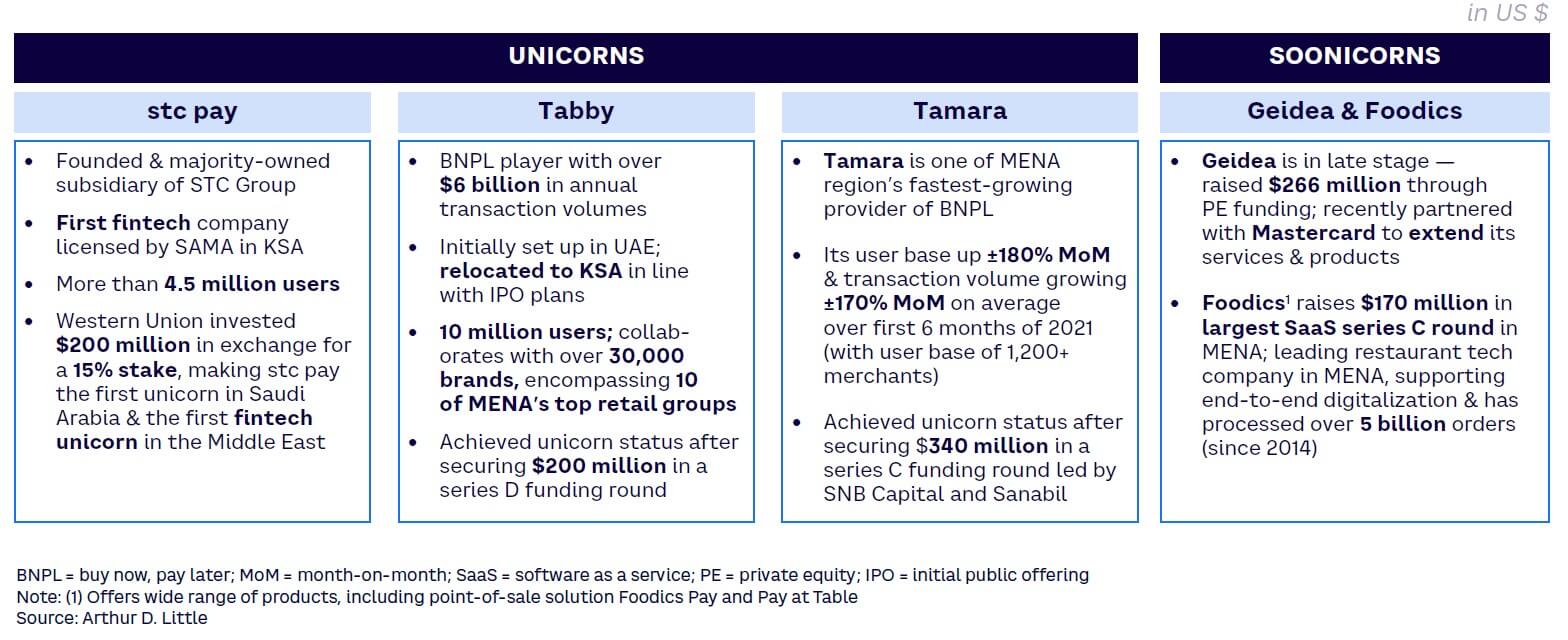

BNPL offers consumers an attractive option to defer online or in-store payments on purchases for weeks or months. According to Statista, BNPL has soared in adoption both on the merchant side (780 in 2020 to 30,000 in 2022) and the customer side (76,000 in 2020 to >10 million in 2022). Indeed, according to the 2022 SAMA report, around 45% customers are between ages 20 and 30. Market dominance in KSA is largely held by Tabby and Tamara, both which have grown substantially and recently graduated to the unicorn league, extending their reach across the Gulf Cooperation Council (GCC).

Debt crowdfunding has become a vital avenue for financing, especially for small and medium-sized enterprises (SMEs) facing challenges in securing traditional bank loans. The platforms operating now in KSA offer a streamlined digital process for businesses to sell invoices and secure funding, alleviating cash flow issues and aiding growth.

As reported by SAMA, the investor base in the KSA crowdfunding market has seen significant growth, from 302 in 2019 to over 92,000 in 2022. These investors have collectively issued over 1,800 loans worth more than SAR 1.1 billion since 2019, with about SAR 770 million in loans disbursed in 2022 alone. Despite the sector’s growth, there are areas ripe for improvement. Interest rates in this market have escalated from 10% in 2019 to over 16% in 2022, and approval rates experienced fluctuations, dropping to 48% in 2021 before recovering to 66% in 2022. Additionally, while the tenure of loans has extended from three to 11 months, the average invoice credit terms have shortened from 80 days to 48 days. A significant portion of borrowers in this market are one-time users (approximately 62%), with only 15% engaging in crowdfunding more than three times.

Financial product aggregation

Financial product aggregation leverages online platforms to act as intermediaries between consumers and multiple financial services providers such as insurers or lenders. The essence of these platforms lies in their ability to simplify the decision-making process for the consumers, offering them an efficient and convenient way to navigate the offerings from different providers and compare them side by side.

In the realm of insurance, aggregation platforms have gained significant traction in KSA. Although only about 375,000 people have downloaded insurance aggregation apps, the websites in this sector recorded an impressive 20.1 million visits in 2022 per SAMA. The products primarily offered through these aggregators are health insurance (10%) and car insurance (90%). Reflecting the sector’s growth, the total value of policies issued through insurance aggregators escalated from SAR 573 million in 2018 to SAR 4.2 billion in 2022, correlating with a rise in policy issuance from 662,000 in 2018 to 4.3 million in 2022. Aggregation leads to significant improvements in operational efficiency: the time taken to issue a policy has been reduced from 836 seconds in 2018 to just 133 seconds in 2022.

The role of financial product and insurance aggregators is expected to become more prominent, fostering a more inclusive, transparent, and consumer-centric financial ecosystem in KSA. There are currently eight companies in the pipeline of SAMA for licensing to operate as a financial services aggregator in KSA, four of which have received initial approval with one in the final licensing stage.

THE CHALLENGES GOING FORWARD

While the future for fintech in KSA looks bright, there are still some important challenges to overcome, including:

-

Enhancing international positioning. While KSA’s fintech growth is impressive, increasing its visibility and distinctiveness will help it stand alongside established global fintech hubs. This involves clarifying its unique ecosystem offerings to global entrepreneurs and investors.

-

Streamlining regulatory frameworks. Efforts to simplify the setup and licensing processes are underway to create a more navigable regulatory environment for fintech entities. Continued enhancements in this area will support both local and international ventures.

-

Broadening funding avenues. The development of more accessible financial mechanisms, including accelerators and grants, is anticipated to stimulate a more dynamic investment climate. A broader and more equitable distribution of resources will empower a diverse range of fintech initiatives.

-

Cultivating talent. Addressing the talent gap is a priority, with strategies aimed at nurturing local expertise while mitigating challenges like turnover and competitive salary demands. This approach aligns with the global trend of fostering homegrown talent.

-

Optimizing infrastructure investment. Initiatives to reduce the cost of essential technology infrastructure are being explored. These efforts aim to balance compliance with local data regulations and the need for advanced application programming interface (API) integration and data accessibility.

-

Fostering international partnerships. Encouraging cross-border collaborations and supporting Saudi fintechs in their international ventures will be instrumental in ensuring their long-term success and adaptability in the global market.

By addressing these areas thoughtfully, KSA can enhance its fintech ecosystem, ensuring robust growth and sustainable development in the years to come.

STRATEGIES FOR ENHANCING KSA’s FINTECH ECOSYSTEM

To meet the national fintech strategy’s ambitious target of more than doubling the number of fintechs to 525 by 2030, a nuanced and multifaceted approach would help enrich the ecosystem, encompassing a diverse mix of fintech company maturities and subsectors. A broader and more diversified fintech ecosystem would expand into diverse domains like regtech and insurtech, thereby fostering comprehensive technological advancement.

International fintech integration is also key, aiming for around 25% of the 525 target to be international ventures. This will enrich the ecosystem and promote global connectivity. Moreover, supporting maturing fintech pioneers in their expansion or initial public offering (IPO) aspirations is vital. This approach could lead to the emergence of more unicorns and “soonicorns” beyond the current three unicorns (stc pay, Tamara, and Tabby), cementing Saudi Arabia’s position in the global fintech arena (see Figure 1).

More specifically, Arthur D. Little (ADL) suggests a number of priorities along the six transformational drivers of the fintech strategy going forward to ensure that the challenges are effectively overcome:

-

Elevating global positioning. KSA aspires to augment its international presence, illustrating its unique value and inviting participation from global fintech innovators. Potential initiatives could include forging international alliances and showcasing the nation’s advancements at global fintech symposiums. KSA’s leadership could significantly influence the fintech narrative within the MENA region and beyond.

-

Regulatory enhancement. By refining regulatory processes and aligning them with international best practices, particularly in emerging sectors like open banking, the KSA fintech ecosystem would be able to streamline the integration of global fintech enterprises into its market as well as supporting growth of local fintechs.

-

Investment ecosystem development. A focus on cultivating a robust investment landscape is essential to ensure that start-ups have ample funding opportunities. This could involve mobilizing VC and broadening investment horizons across various fintech sectors. Collaborative efforts to bolster the angel investor network and fortify public-private partnerships will be instrumental in providing foundational support for early-stage initiatives and reinforcing growth for maturing firms.

-

Educational initiatives. Investment in educational programs tailored to fintech and associated industries will be a priority. Collaborative academic partnerships could aim to nurture a homegrown talent pool, while in the interim, the integration of international expertise will contribute to the sector’s expansion.

-

Infrastructure cost management. Encouraging a competitive tech provider market and local data-hosting solutions is key to mitigating infrastructure expenses. Government incentives for technological advancements could further support fintechs in managing operational costs.

-

Collaborative frameworks. We propose a multifaceted approach to reinforce collaboration. This could include enhancing the role of Fintech Saudi as a pivotal industry facilitator, establishing platforms for domestic and international fintech partnerships, and promoting financial literacy. Additionally, fostering public-private synergies will drive innovation, and expanding regulatory sandbox initiatives will incubate broader fintech advancements.

We anticipate that these initiatives will seamlessly integrate into a refined national fintech strategy that resonates with Vision 2030’s aspirations, acknowledging the progress to date and paving the way for future achievements.

Conclusion

TACKLING KEY CHALLENGES

KSA’s fintech journey thus far has been remarkable, with great progress in sectors like digital payments, alternative financing, and financial product aggregation underscoring its commitment to fostering a dynamic and inclusive financial sector. However, to ensure KSA realizes its goal of becoming a leading global fintech hub, tackling key challenges should be an essential part of its strategy. These challenges are not just obstacles; they also provide great opportunities for innovation and growth. Addressing issues related to global positioning, regulatory frameworks, market and funding, talent acquisition, technology infrastructure, and collaboration is imperative. The KSA fintech ecosystem must continue to innovate and adapt, leveraging its strengths.

The future of fintech in Saudi Arabia is not just about technological advancements or financial products. It is about creating an ecosystem that is resilient, inclusive, and capable of supporting the nation’s broader economic goals and nurturing a culture of innovation where start-ups and established players alike can thrive. Most importantly, it is about empowering consumers and businesses with financial tools and services that are accessible, efficient, and secure.